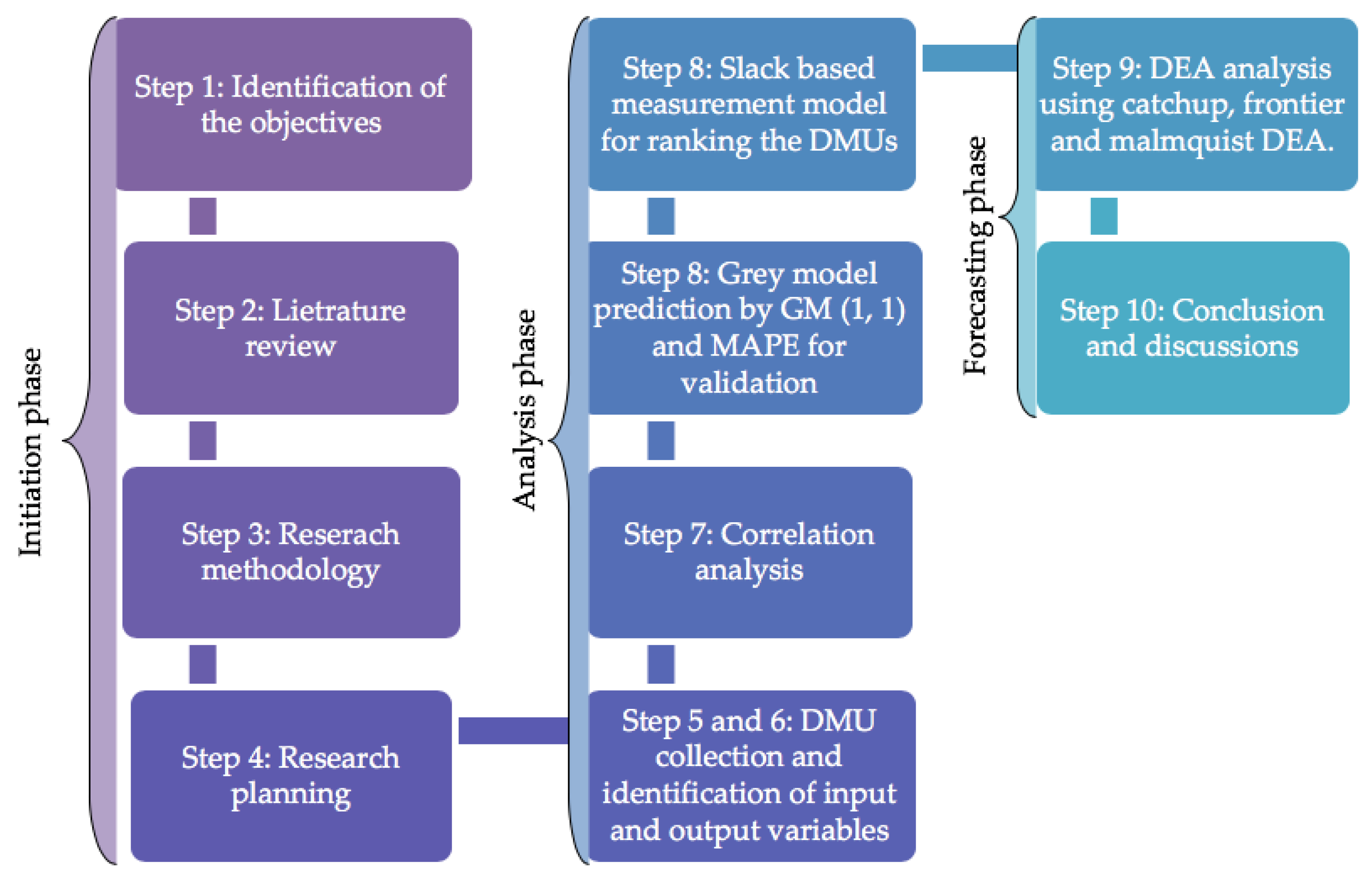

In order to evaluate the efficiency of FDI on the economic growth, the researcher provides the results of the data analysis in this chapter. For this purpose, this chapter presents the descriptive statistics, MAPE and correlation, DEA Malmquist efficiency, super SBM, and GM (1,1) forecasting.

4.2. Pearson Correlation

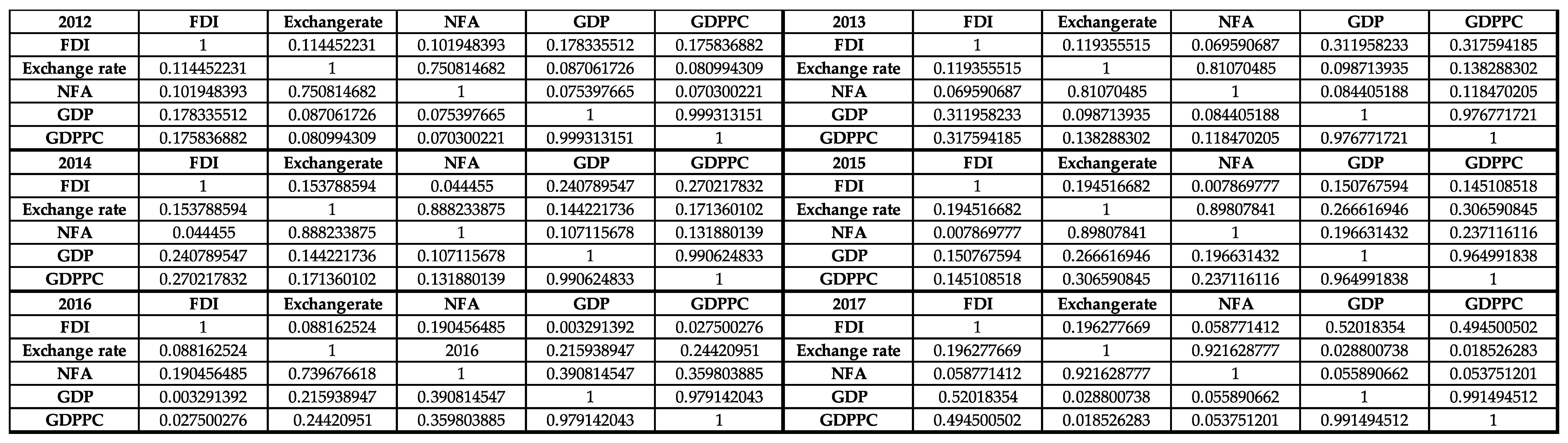

Pearson correlation analysis was utilized to analyze the relationship between inputs and outputs factors. The Pearson relationship coefficient in the analysis was determined throughout the years. Pearson connection coefficient to decide the information was utilized in this analysis, which is inappropriate for the DEA necessities. Connection coefficients are dependable from the dimension of (−1) to (1); if this factor is close to (1), it is an ideal straight connection. After effects of the Pearson connection coefficient from

Table 3 and

Appendix A Figure A2 demonstrate that the elements utilized in this analysis have a solid straight relationship, which is steady with the states of DEA and can be utilized for analysis. In this regard, the study conducted by Tintin [

41] revealed that the relationship between FDI, economic growth, and productivity in developing countries can only be established in the long run. Some of the developing economies, like Nepal and Iraq, face several political and legal barriers in the context of foreign direct investment. In addition to this, the positive impact of FDI on economic growth and productivity is partly verified in developing countries. This is because there is a key element of technology rather than FDI and international trade that play a major role in the economic growth of the developing countries.

The correlation findings indicated that FDI and GDP are positively correlated. This is from the fact that FDI is invested in by a foreign nation, usually a developed nation, to improve the economic conditions of the host nation as well as improve resource utilization. One of the most important facts is that the profit needs to be higher than the costs of communications, transportation, and other barriers due to language, policies, and culture. In this respect, the receiving country remains as the financial inflow and use to improve its resources and financial outflow for the investing country/firm to influence its presence in the receiving country. This helps the receiving country to better utilize its economy and its resources to stabilize the country. Similarly, FDI is also impacted by the CSR policies and activities. CSR activities lead to sustainable utilization of its resources, causing economic and social benefits. This, in turn, helps the receiving country better implement strategies of social, economic, and environmental responsibilities.

4.5. DEA Model

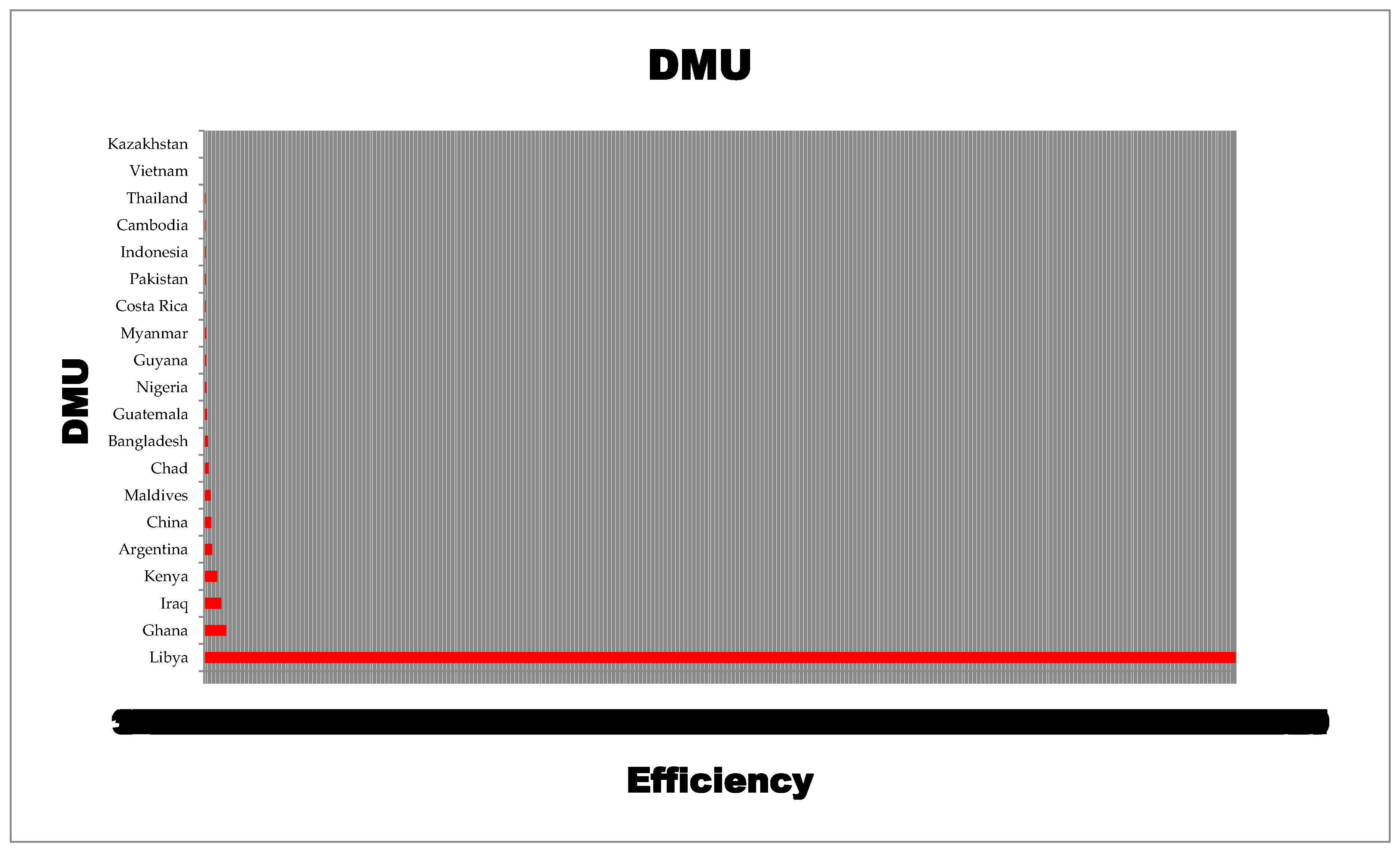

Super SBM Efficiency

The slack-based model has been used in order to improve the existing model that can generate efficiency in the existing model. In the present study, the model evaluates the technical efficiency of the 20 developing countries [

41]. From DEA super SBM model, it is analyzed that Libya is the most efficient amongst the 20 DMUs in 2012–2017. This is from the fact that Libya has an important standing in the world economy and a different political and economic system. Moreover, in Libya, socialist and Islamic factors have impacted on the nature of corporate social responsibility disclosure (CSRD) [

44]. As a result, the level of CSRD has increased in Libya since 2000 due to pressures from stakeholders for information which may influence organizational performance for Libyan companies. Libya has a unique economic, political, and social system. The Libyan economy is neither a classical political economy nor a bourgeois political economy. Studies have indicated that Libyan social environment have influenced CSR and CSRD [

45]. It has also showed the importance of CSRD, and stakeholders’ pressure in particular, after the establishment of a stock market in Libya.

Figure 2 clearly highlights that Libya has shown consistent efficiency among the entire decision-making units. Since the slack-based measure deals directly with the input excesses and the output shortfalls of the decision making unit (DMU), it shows that the inputs are in excess for Libya, in comparison to the output received. Therefore, the country may reduce its inputs to increase its outputs. The measure also indicates that Libya is the only country that shows input excess and output shortfall. The measure of slacks also indicates that the measures of Libya are determined only by consulting the reference set of developing nations and is not affected by analysis for 2012 to 2017.

Table 9 shows the efficiency scores and the ranking of the decision-making units under the super SBM model. The results clearly highlight that Libya has displayed consistently amongst 20 decision-making units 2012–2017 by scoring the score of 1.00. The country has ranked first among all the decision-making units. In addition to this, Ghana also showed consistent progress by achieving the score of 1.00 for 2012–2016 but its efficiency declined in 2017 by displaying a score of about 0.425. Also, Kenya achieved efficiency from the period of 2013 to 2017 by achieving an efficiency score of 1. Lastly, Iraq and China have achieved efficiency until 2016 followed by a decline in 2017. The efficiency score can be seen for only Argentina, Bangladesh, China, Ghana, Guatemala, Guyana, Iraq, Pakistan, Maldives, Libya, and Kenya. Only Libya showed a consistent efficiency value of 1.000. This indicates that the input variables of FDI and CSR spending in Libya have helped in the sustainable economic development. This is evident from the fact that the Greenfield and Brownfield FDI of Libya has increased with respect to the fall in the exchange rate of the country to USD. In addition, reduced exchange rate has caused the increased inflows of FDI and hence helped the corporations to spend more on CSR spending. Thus, this improved the GDP growth of the country, whereas, the FDI and CSR spending of other countries have fluctuated over time and, hence, do not have stable efficiency values.

Efficiency is measured by the examining the production units. In addition to this, it is also essential to identify the inefficient sources that need to be improved to achieve a position in the competitive environment. The DEA technique is widely used for benchmarking in a linear programming model. This technique is widely used by the researcher to measure technical efficiency. This technique uses the input–output variable to measure the amount of output that can be generated with the given level of inputs. This technique acts as a mathematical tool to evaluate the efficiency and deal with a certain set of uncertainties [

46].

Malmquist Efficiency

The Malmquist index is commonly used for measuring the performance of the country in terms of technical efficiency, change in the technology, change in pure technical efficiency, and the change in the total factor productivity [

38]. This index assists the researcher in comparing the productivity change within the groups. Malmquist productivity Index is used for assessing the performance of 20 DMU’s for further analysis. This index identifies the productivity change over time in the context of economic growth. In the present study, performance of the DMUs was measured through Malmquist Productivity Index, catch-up effect, and frontier shift. This helps the DMUs in assessing and improving their performance.

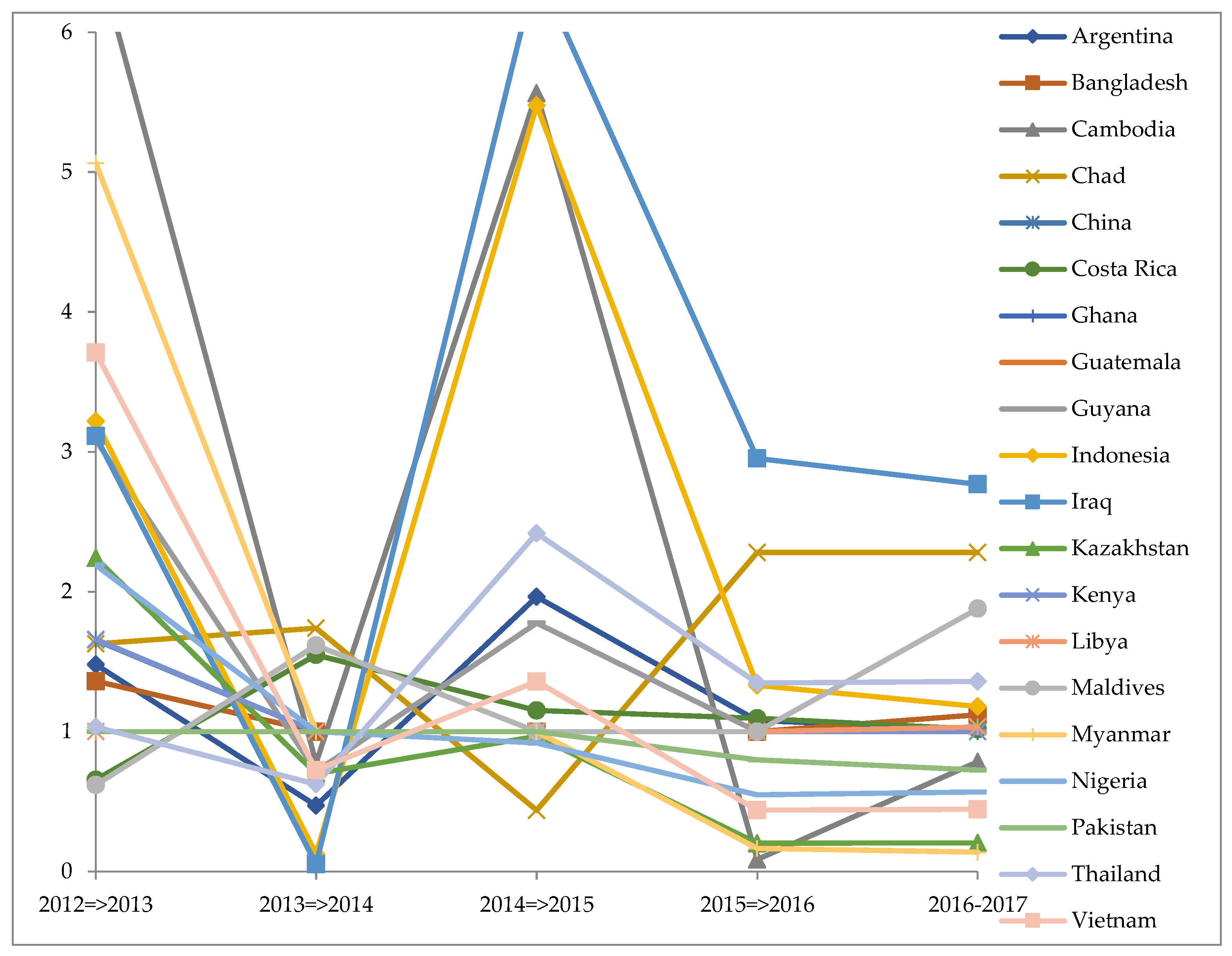

Catch-Up Effect

The catch effect is concerned with the amount of recovery that is obtained under the DMU to increase its efficiency. The catch-up effect represents the efficiency change indicating the extent to which a particular DMU improves or deteriorates its efficiency. If the change in efficiency is greater than 1, it represents the relative efficiency from an initial time period. In addition to this, if the change in efficiency is equal to 1, it represents no change. Further, if the change in efficiency is less than 1, it means that the DMUs have displayed an inefficient behavior [

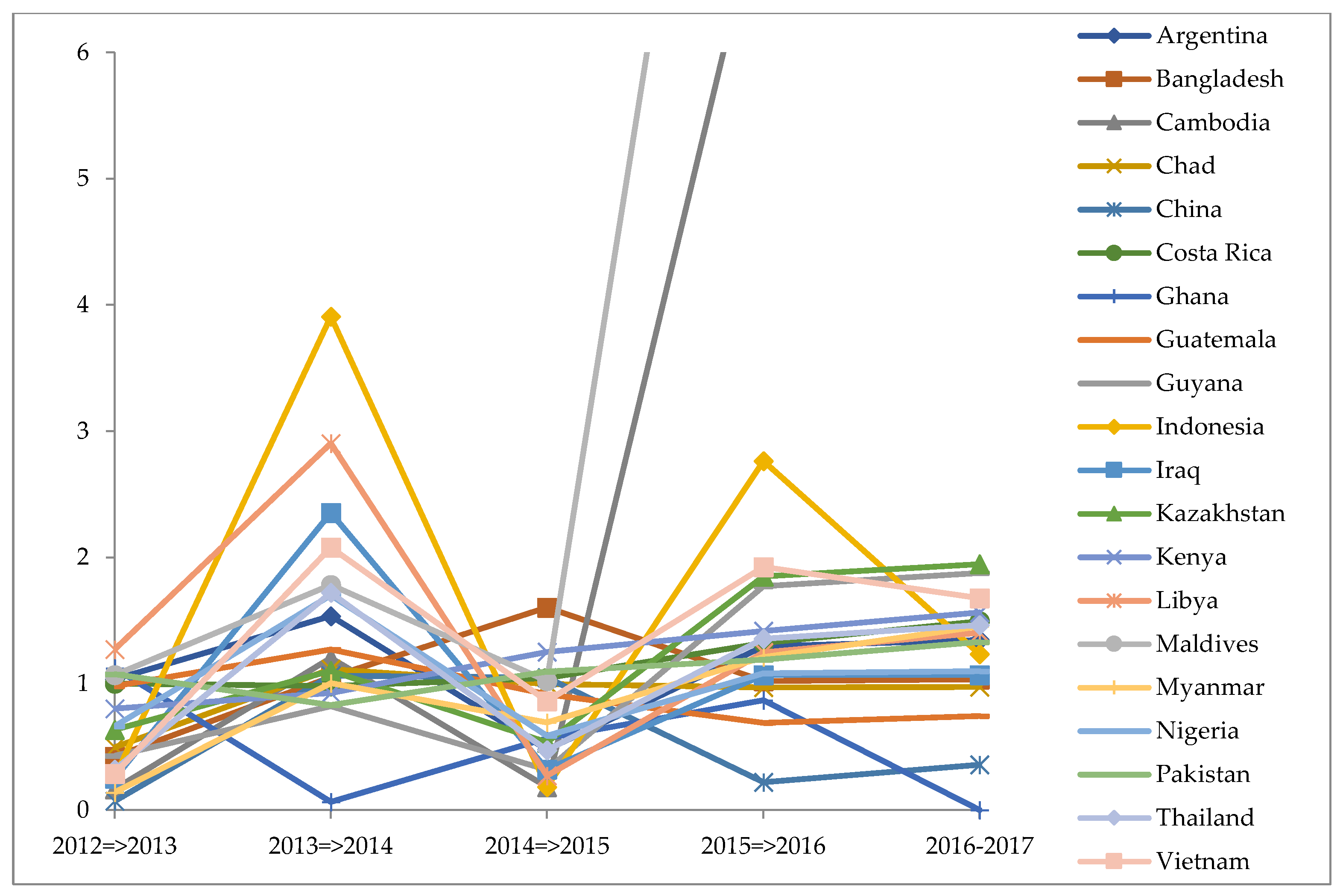

47]. In regard to the efficiency change displayed by different countries, the catch effect indicates the value needed by particular DMU to improve its productivity. The results in

Table 10 indicate that Iraq and Cambodia have displayed a high level of improvement in efficiency as compared to 2012. However, few countries, like Pakistan, need to catch up with the other countries in terms of achieving efficiency.

Figure 3 shows the efficiency change of the 20 DMUs from 2012 to 2016, indicating that the efficiency is improved and reached the highest point for Cambodia, Iraq, and Indonesia for the period of 2014–2015 and displayed a decreasing trend in the following year. These countries have been unstable due to the largest fluctuations and need to focus on their development. This might be from the fact that the multi-criteria FDI and CSR approach increased for Cambodia, Iraq, and Indonesia during the period of 2014–2015. In addition, the exchange rate of Cambodia, Iraq, and Indonesia also decreased in the year 2014–2015. Since the catch-up effect is the amount of recovery that is obtained under the DMU to increase its efficiency, countries like Cambodia, Iraq, and Indonesia indicates the rate of the particular DMU that may have improved or deteriorated its efficiency in the coming years.

Frontier Shift

The frontier effect measures the difference within the efficient frontiers within the two time periods. It is used for measuring the improvement in the technology of the decision-making units. The value of the technological frontier greater than 1 represents the technological progression and a value of less than 1 represents the technological recession [

41]. In this regard, the present study measures the change in technological among the countries.

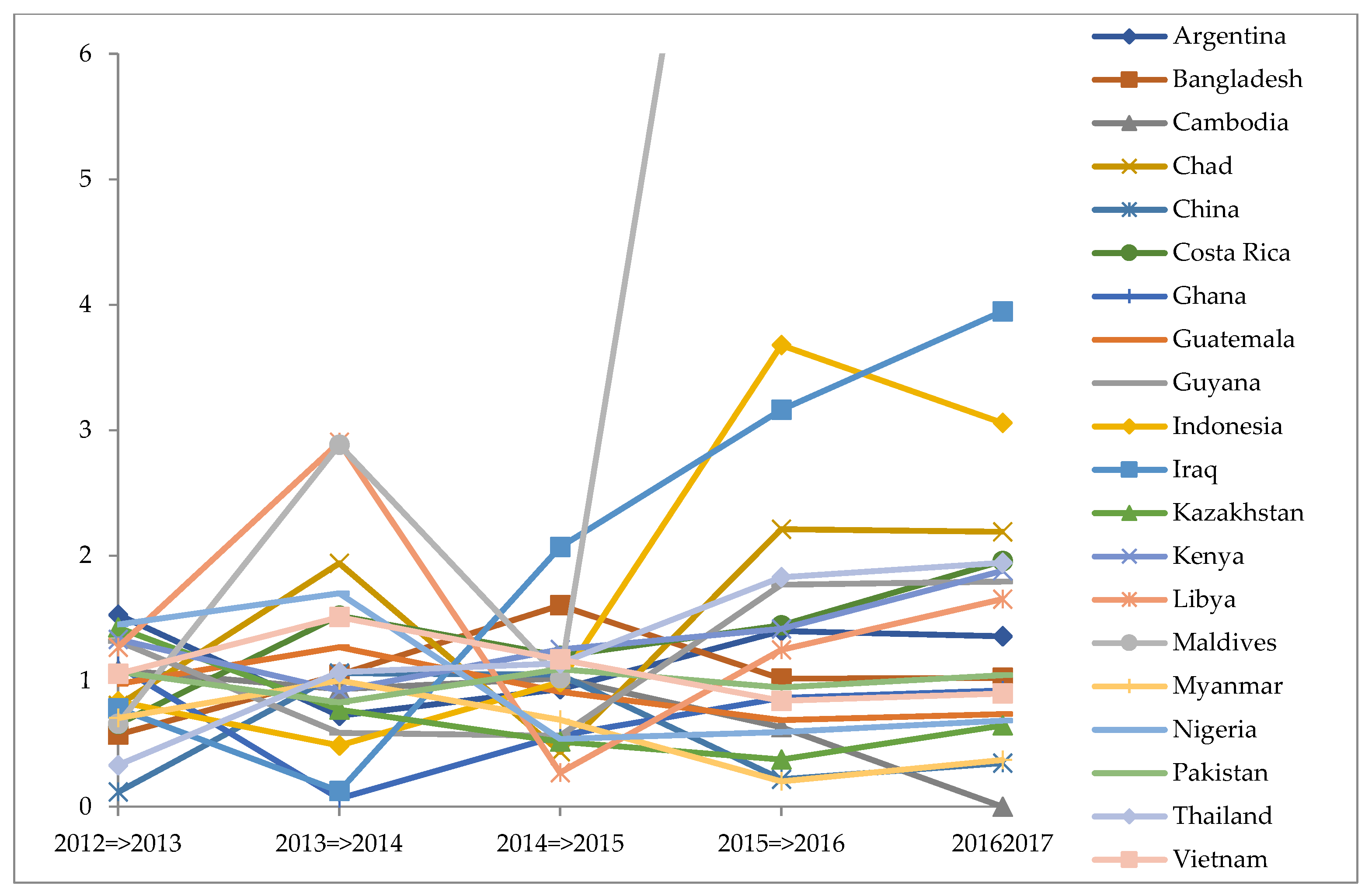

Table 11 represents the technological changes within 20 DMUs during the period of 2012–2017. The results indicate that almost all the countries were enhancing their technology and achieved technological efficiency. Few developing countries, like Maldives and Cambodia, have achieved a frontier effect of greater than 2, indicating these countries have achieved technological progression. However, few countries, like China and Guyana, lacked in comparison to other countries to achieve overall technological efficiency.

The graph in

Figure 4 clearly indicates that, though Cambodia was operating at a very low level of technical efficiency until 2014–2015, the country witnessed a great scale of improvement post-2015. Also, Guyana, which displayed one of the lowest technical efficiencies amongst all the decision-making units until 2014, also displayed a high level of improvement in 2015. However, countries like China, which was operating at a high level of technical efficiency until 2013, have recently witnessed a technological recession. Since this model indicates the difference within the efficient frontiers within the two time periods for Cambodia, Guyana, and China, the values indicate the required improvement in the technology of the decision-making units for multi-criteria FDI and CSR spending. These countries, along with a few others, need to improve their technological efficiency in the years 2015–2016 to become efficient for the years 2016–2017. It may also be indidcated that the difference within the efficient frontiers during 2015–2016 will help Cambodia, Guyana, and China to improve their input variables and exponential outputs.

Malmquist Productivity Index

The Malmquist productivity index is used under the DEA model to measure the productivity in MPI. This measure is used to capture the relative overall performance of the decision-making units within different periods. This measure uses technology for the base period. This measure takes into account the efficiency and technological change in a geometric mean. It measures the overall change in productivity. If the value of the index is greater than 1, it means that there is an improvement in the overall productivity [

42].

Table 12 shows the total productivity of the 20 DMUs from the period 2012–2017. The results clearly indicate that countries like Libya and Maldives have witnessed a long-term upwards trend during the period of 2014–2017. These countries have displayed improvement in their efficiency. However, China’s productivity has fallen since 2015, indicating poor performance in terms of total productivity.

The graph in

Figure 5 reflects that there is a constant improvement in technical efficiency over time in almost all countries. Only Cambodia appears unstable with the largest fluctuations as the country was operating at a low level of efficiency but observed a great improvement in technological efficiency post-2015. Some countries, such as Costa Rica, require improvement in inputs like FDI inflows, CSR, and exchange rate to improve the economic countries. Since, Malmquist DEA indicates the productivity of the input and output variables, the multi-criteria measures of FDI and CSR for Cambodia are used to capture the relative overall performance of the decision-making units within different periods for the years 2014–2017. This also implicates that all other countries may follow the model of FDI usage and CSR expenditure for improved sustainable growth of the country.

The results of the Malmquist productivity index and the frontier effect clearly highlight that Cambodia has witnessed a great improvement in terms of productivity and technological progression post-2015. In this regard, the study conducted by Richardson in 2014 [

48] revealed that Cambodia has witnessed a technological progression in the recent years. In addition to this, the government is imparting training among the students in order to offer them exposure to computers and the internet. Further, the schools and educational institutes have started adopting the latest technological tools and e-learning courses to impart education among the students. The government has shown a favorable attitude in the context of the use of technology by providing the necessary infrastructure of electricity. The study conducted by the government of Cambodia, 2015 (Government of Cambodia, 2015) highlighted that the government has ensured internet availability, human capital, and cellphone coverage across long distances [

49]. An improvement in technological equipment has led to increased productivity and output across all the sectors in the economy. Further, the government has also ensured a stable political system that focuses on the technological assistance and industrial development. Technological assistance has also helped the companies in higher proficiencies and financial performances. CSR spending in Cambodia in the recent years has also grown. However, in developing countries in East Asia, such as Cambodia, CSR is a relatively new concept, and the implications of developments in CSR for local companies are still being explored [

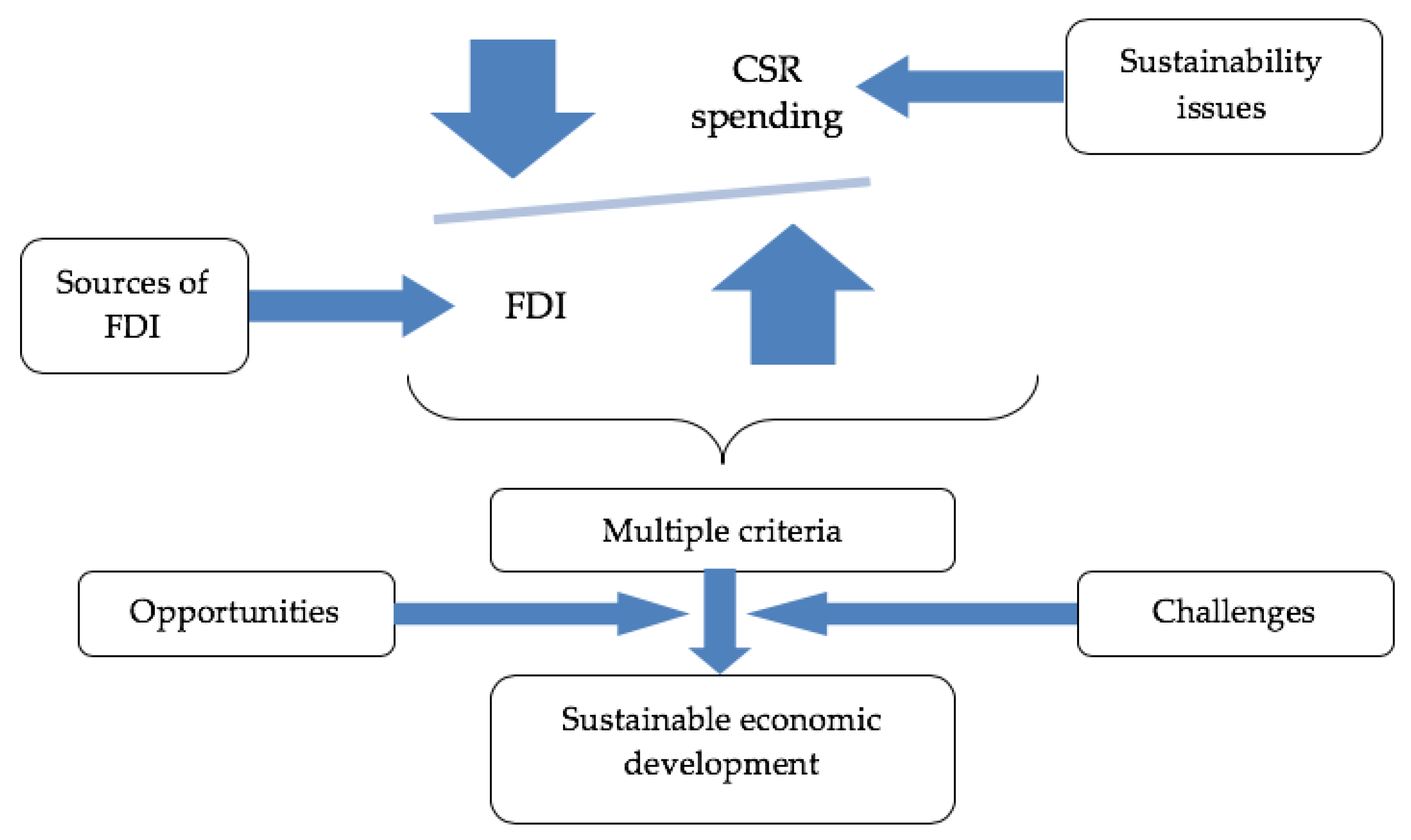

50]. In Cambodia, the size of the industrial base and the extent to which the industrial structure offers potential for CSR activities are limited. However, the spending has increased over the years and is being efficiently used. This must help the decision makers in adopting the strategies of Cambodia so that multiple criteria FDI, exchange rate, and CSR spending can be used efficiently for sustainable development of the nations. In this regard, a conceptual framework may be used by the decision makers for efficient use of multiple criteria FDI and CSR (

Figure 6).

The decision makers are responsible for achieving sustainable economic growth of the nation. Therefore, it is very important the authorities efficiently evaluate the FDI inflows from organizations or international governments. This will help in the effective adoption of technologies and gather knowledge with respect to sustainable development and issues. CSR spending, as found from the literature, is an important method of solving sustainability issues. Therefore, CSR spending and FDI should be in conglomerate and function in a balanced way. The more FDI, the more CSR expenditure can be exerted to resolve the sustainability issues. Thus, these two multiple criteria can be used for the economic growth of the nation. However, during the line, the nation may face challenges and opportunities for sustainability, financial issues, technological changes, and human capital. Henceforth, policy makers must take note of the opportunities and challenges and come up with policies that will help in sustainable economic development.

The study, therefore, hypothesizes the theory of Schumpeterian growth theory. The findings from the study clearly indicated that developing nations have improved the economic conditions and improved growth generated by innovations. As a result, innovations result from FDI investments that are themselves motivated by the prospects. FDI investments, along with CSR spending, allows innovations to replace old policies; in other words, growth involves creative destruction. Therefore, using FDI and CSR will help in positive multi-criteria economic growth of developing nations. Therefore, the decision makers must follow the multi criteria of using FDI and sustainability values efficiently and benchmark the multi criteria models of Libya for sustainable economic development. Thus, for the forecasted years of 2018 to 2020, the decision makers of developing nations must suffice to attract larger inflows of FDI and increased CSR spending. This will have a direct positive impact on the GDP and GDPPC. In addition, the decision makers may view the forecasted values of their respective nations and contract it to the values of Libya for benchmarking and efficient implementation of multiple criteria (FDI and CSR) for sustainable economic developments in the years 2018–2020.