Abstract

Under the background of the initial completion of Chinese interest rate marketization process, this paper aims to test the actual impact of interest rate marketization on micro-enterprise research and development (R&D) investments financing. Based on the current situation, we put forward the assumption that Chinese enterprises are generally facing financing constraints in R&D investment. The interest rate marketization, which reduced government intervention in fund pricing, helps alleviate financing constraints, especially for non-state-owned enterprises. This paper focuses on the moderating effect of interest rate marketization on financing constraints and R&D investments. The interest rate marketization index is constructed from three indicators: interest rate determination ways, interest rate fluctuation restrictions, and real interest rate level. We use the Euler-equation investment model to test the financing constraints of R&D investment. Based on panel data of listed firms for 2007–2016, we find that R&D investment faces wide financing constraints, and interest rate marketization alleviates financing constraints. More specifically, financing constraints are more significant for non-state-owned firms than for state-owned enterprises, and the deepening marketization of interest rates can effectively alleviate the financing constraints of non-state-owned enterprises.

1. Introduction

This study focuses on the moderating effect of interest rate marketization on the relationship between financial constraints and research and development (R&D) investment. The study tests how the macro-monetary policy of China influences micro-level listed enterprises. Few studies have tested the impact of interest rate marketization in China.

Marketization of interest rate, corresponding to the concept of interest rate regulation (the interest rate of developing countries is not determined by market supply and demand, but by the government) under the “financial suppression” proposed by McKinnon [1], means that the interest rate is determined by market supply and demand, so that the market mechanism can play a leading role in the allocation of financial resources. The core of interest rate marketization reform is to change the pricing mechanism of government intervention in the past, so that the pricing of funds follows the market law, and interest rates become the price signals reflecting the supply and demand of the market, and become the benchmark for resource allocation. To promote and achieve the healthy and sustainable development of the economy, since 1996, China has gradually undertaken market-oriented interest rate reforms. By the end of 2015, China’s RMB interest rate regulation was liberalized. In the current critical period of China’s economic development, liberalizing the interest rate controls can provide more space for financial institutions to screen and support industries and enterprises in accordance with the principle of marketization, which is conducive to stabilizing growth, restructuring, and benefiting people’s livelihoods, thereby achieving sustainable economic development.

The existing research mainly focuses on financial liberalization or financial development, which is a broader topic than interest rate marketization. Martinez et al. [2] found that financial liberalization could lead to more frequent boom-bust cycles and higher GDP growth. Carlson et al. [3] showed that financial liberalization is associated with higher output changes. Yang and Liu [4] found that financial development could better stabilize the economy when combined with interest rate liberalization, and there was a significant positive influence in emerging and developing countries. Love [5] shows that financial development impacts growth by reducing financing. Love and Zicchino [6] emphasize the role of financial development in improving capital allocation and growth. More specifically, financial liberalization can increase the total financial size of an individual start-up entrepreneurial project [7], reduce liquidity constraints [8], relax financial constraints [9], and improve investment efficiency [10,11] and access to external capital [12], which reduce a firm’s reliance on internally generated funds. Even housing price shocks increased along with the advancement of financial liberalization [13]. Some research has shown that financial liberalization is less positive. Financial liberalization may in practice increase fragility and inequality and lead to political backlash against reforms [14]. In addition, financial liberalization resulted in an increase in industrial concentration and a decrease in net firm entry, especially in more finance-dependent sectors [15]. Moreover, some of the financial developments that lead to the expansion of credit may have decreased welfare, rather than increase it [16]. Other research showed that the impacts of financial liberalization are, for instance, two-sided, conflictive, time varying [17,18,19,20]. The effect of financial depth on economic growth has a threshold [21] and an inverted U-shaped relationship between financial development and companies’ investment [22].

We can see only a small number of direct studies on interest rate marketization, and it is even rarer to study China’s interest rate marketization after 2015. Since China’s economy is transitioning from a planned economy, interest rates have been subject to government intervention, and there are various credit programs for state-owned enterprises and large enterprises, which make it difficult to study corporate financing constraints. The current market-based interest rate reforms are aimed at gradually reducing such interventions in order to improve the efficiency of capital allocation and promote sustainable market development [23]. However, it is not clear whether the impact is positive and whether firms with different ownership structures would benefit from interest rate marketization.

In this paper, we construct an interest rate marketization index measured using three indicators: interest rate determination ways, interest rate fluctuation restrictions and real interest rate level. Based on panel data of Chinese A-share listed companies from 2007–2016, we find that R&D investment faces wide financing constraints, and interest rate liberalization will alleviate financing constraints. This conclusion is consistent with most research findings for other developing and emerging-market countries. More specifically, financing constraints are more significant for non-state-owned firms than state-owned enterprises, and the deepening marketization of interest rates can effectively alleviate the financing constraints of non-state-owned enterprises.

2. Literature Review and Research Hypothesis

2.1. Financing Constraints and R&D Investment

Innovation theory, proposed by Schumpeter [24], note that innovation activities could promote the development of enterprises, and generally, technological innovations and corporate performance are closely related. Innovation activities enable the company to increase the impact area, with the achievement of strategic and financial objectives, so modern enterprises that care about their own development systematically engage in the innovation process [25]. Scholars have conducted various kinds of research on innovations, such as innovation in sustainable development from the European approach [26], effects of innovation activity in eastern Poland from a regional approach [25] and innovation activity in transport-related enterprises from a sectoral approach [27]. They proved that innovations are the key to achieving economic growth and an important factor for sustainable global improvement [26,27,28]. In recent years, the Chinese government has taken various measures to ensure sustainable development of the economy. Moreover, the report of the 18th National Congress of Communist Party of China proposed to implement an innovation-driven development strategy. The innovations driving economic development are multi-dimensional, including technological innovation, institutional innovation and business model innovation, among which technological innovation is the core of overall development. R&D investment, which measures innovation inputs, is crucial to the success and quality of enterprise innovation. The classic financial theory proposed by Modigliani and Miller [29] states that in a perfect and frictionless capital market, corporate investment is not affected by external financing conditions. However, in real capital markets, the existence of information asymmetry [30,31] and transaction costs often make external financing costs higher than internal ones, thereby resulting in corporate investment being affected by external financing conditions and relying on internal cash flows.

Compared to other investments, R&D investment has the characteristics of slow effect, high risk, and great uncertainty [32]. Besides the risks and uncertainties inherent to R&D activities, strategic considerations are another factor that may influence R&D investment. Inventors may indeed be reluctant to fully or partly disclose information to the outside world as regards the contents and the objectives of their technological activities since this knowledge could leak out to rivals [33]. Another essential characteristic of R&D that makes it different from ordinary investment is the presence of high adjustment costs and sunk costs [34]. Therefore, we can see that investments in intangible R&D are riskier by essence than ordinary investment [33]. Furthermore, R&D provides less collateral to outsiders since they cannot make accurate appraisals of the values [35]. In general, when corporate resources are limited, R&D investment is more likely to face financing constraints, which could hamper innovation activities [36].

There have been many studies and there is a general agreement that R&D investment is subject to financing constraints. More specifically, R&D investment faces more serious financing constraints than ordinary investment. There is a positive relationship between R&D activities and cash flows for US and German firms [35,37]. By conducting empirical tests using Irish and Chinese manufacturing firms’ respective data, it was found that financing constraints for R&D existed [38,39]. Bond et al. [40] used firm-level panel data from Britain and Germany between 1985 and 1994 and found that, for Britain firms, cash flows determine whether firms engage in R&D, but for Germany this relationship does not exist. Czarnitzki [41] suggested that West German small-and-medium-sized firms are financially constrained in their R&D activities. Studies about Portuguese enterprises proved the existence of financing constraints on their R&D [42]. In addition, many other studies have reached similar conclusions. For example, other studies have found that internal financial constraints are more decisive for R&D [43], financing constraints strongly matter for R&D [44], firms that face financial constraints will have more risk as the strength of R&D increases [45], and financing constraints lead to R&D underinvestment [46], etc.

According to the above analysis, we can see that R&D investment has greater risks and greater information asymmetry than general investment. Therefore, enterprise R&D investment is strongly dependent on internal funding and faces certain financing constraints. Based on that, this paper proposes the following hypothesis:

Hypotheses 1a (H1a):

The R&D investment of Chinese listed companies faces certain financing constraints.

2.2. Interest Rate Marketization and Financial Constraints

The reform practice of interest rate marketization comes from McKinnon [1] and Shaw’s [47] “financial suppression theory” and “financial deepening theory”. Interest rate regulation is the core measure of financial suppression, and interest rate liberalization is the core measure of financial deepening. Under interest rate controls in China, small and medium-sized, private enterprises find it difficult to obtain loans [48] and are nearly squeezed out of formal financial markets, long-term marginalization in the securitization market [49,50]. The core issue here is that, in the case of incomplete markets and given interest rate, the fundamental factor affecting bank credit decision is the bank’s risk rating to enterprises. For banks, private enterprises are relatively new, and there is no independent credit rating agency in the society. Therefore, banks are very cautious about the credit of private enterprise [51,52,53]. State-owned enterprises that obtain loans at low costs [53] often invest low-efficiently under government intervention [54,55,56,57] and have low innovation motivation [58] due to problems such as soft budget constraints. Therefore, the implementation of interest rate marketization reforms, which is undertaken to ensure that the actual interest rate is determined by the demand and supply of market funds, is an important basis for ensuring investment, improving resource allocation efficiency, and promoting economic growth. After interest rate marketization, the unbalanced credit rationing caused by interest rate regulation can be alleviated, and small and medium-sized private innovation enterprises obtain the opportunity to raise funds in the formal financial market, which lowers external financing constraints. Obstfeld [59] believed that after interest rate liberalization, enterprises would share the risks with financial institutions; therefore, the credit increase for risky projects would effectively solve the problem of financial constraints and improve the efficiency of fund allocation.

Many scholars have researched the analysis of financial liberalization (or interest rate marketization) and financing constraints using various methods, including production functions, the classical accelerator models, and the Euler Equation. Most research suggested that financial development or interest rate liberalization could alleviate corporate financing constraints [5,60,61,62]. Some research found that financial liberalization eases financing constraints for small firms, but has adverse effects for large ones [60,63]. In addition, some studies have reached the opposite conclusion. For example, financial reforms raised financing constraints for large firms, and there was no significant change for smaller firms [23].

According to the above analysis, under the environment of interest rate marketization, available external funds will increase, which will alleviate financing constraints, and then R&D investments will increase. Therefore, this paper proposes the following hypothesis:

Hypotheses 1b (H1b):

Interest rate liberalization can alleviate R&D investments financing constraints.

2.3. Ownership Structure

Based on China’s special national conditions, there are state-owned and non-state-owned enterprises. In the current development situation, state-owned enterprises often bear more social responsibility and play a powerful role in stabilizing the economy, promoting development and ensuring employment. Therefore, state-owned enterprises often represent local or central government, and they can always obtain more resources and assistance. Enterprises with different ownership face different financing constraints and, more specifically, non-state-owned enterprises’ R&D investments face more significant financing constraints [64]. Due to China’s imperfect market environment, private enterprises are subject to more institutional discrimination in terms of equity financing and debt financing [65]. Studies have shown that most Chinese financial resources flow to state-owned enterprises. For example, bank loans are mostly loaned to state-owned enterprises, which illustrate the financing difficulties of private enterprises [48,56]. Meantime, the government’s impacts on state-owned enterprises are both direct and indirect. A direct impact is that the government can directly intervene in the allocation of resources so that state-owned enterprises can obtain more and lower-cost financial support. Indirectly, the government provides information security for the operations of state-owned enterprises. When state-owned enterprises face financial problems, they are more likely to receive government assistance [51,53].

With the advancement of interest rate marketization reform, the government’s intervention has reduced, banks’ pricing power is improved, loan interest rate ceiling is liberalized, and banks comprehensively consider income risks in order to provide reasonable pricing. Private enterprises have been progressing towards becoming an important part of China’s economy since 1990s [51]. When the interest rate controls are released, government intervention is reduced and banks are able to pricing the fund according to the demand and supply. Then banks may also provide credit for some non-state-owned enterprises with better prospects and better profit for their own performance considerations. For non-state-owned enterprises, interest rate marketization may alleviate their financing constraints.

Based on the above analysis, we propose the following two hypotheses:

Hypotheses 2a (H2a):

Compared with state-owned firms, non-state-owned enterprises face greater R&D investment financing constraints.

Hypotheses 2b (H2b):

Compared with state-owned firms, interest rate marketization has a greater effect on non-state-owned enterprises’ R&D investment financing constraints.

3. Research Design

3.1. Variable Definitions

3.1.1. Dependent Variable—Enterprise R&D Investment

Enterprise innovation investment is an input for creating and innovating activities, including human resources and financial resources. This paper selects the total R&D investment to measure innovation investment. Generally, there are four methods that measure innovation input intensity: the ratio of R&D investment to revenue, the ratio of R&D investment to total assets, the logarithm of R&D investment, and the ratio of R&D investment to market value. This paper will use the Euler equation investment model for its analysis, which makes it necessary to standardize the data. Therefore, this paper chooses the ratio of R&D investment to total initial assets as the innovation input intensity variable. The strength of R&D investment is the dependent variable of this paper.

3.1.2. Independent Variable—Cash Flow and Sale

Scholars have made many attempts to measure financial constraints, and currently, there are three major categories, including univariate measurement methods [66,67], comprehensive multivariate measurement methods [45,68,69,70,71] and model measurement methods [44,72,73,74]. This paper will use the third method. Learning from investment-cash flow sensitive models and expanding to the R&D investment-cash flow sensitive model in order to measure the financing constraints on R&D, the net cash flow from operating activities is chosen to represent the enterprise cash flow variable.

In the Euler investment equation, the ratio of output to the capital is an essential part [75] if the capital market is imperfect. This paper uses sale, measured by the ratio of revenue to the beginning assets, to represent the variable, ratio of output to the capital.

3.1.3. Moderating Variable—Interest Rate Marketization and Soe

Interest rate marketization means that the generation mechanism, the transmission mechanism and the management of interest rates are all carried out by the market. This paper measured interest rate marketization using three indicators: the interest rate determination ways, the interest rate fluctuation restrictions and the real interest rate level [76], shown in Table 1. Among these indicators, the interest determination ways mainly measures the dynamic changes of the types of interest rates that are controlled by the government or the monetary authorities [77]. The interest rate fluctuation restriction is the extent to which the government or monetary authorities allow the interest rates to fluctuate. It also reflects the control of interest rates, which is measured by constructing the Euler index function [78]. Whether the real interest rate level is negative is an important indicator reflecting the interest rate regulations. The deepening of marketization deregulates interest rates and avoids negative real interest rates, and its measurement calculates the real interest rate and then normalizes it to the range of 0 to 1 [78]. The interest rate marketization index takes the average of the interest rate determination ways index, the interest rate fluctuation restriction index, and the real interest index.

Table 1.

Evaluation index of interest rate marketization.

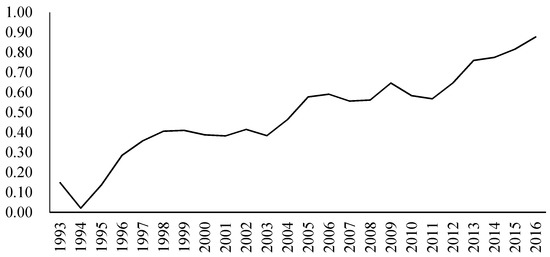

The final calculation in Figure 1 shows the trend of the marketization degree of interest rates from 1993 to 2016. It shows that the interest rate marketization reforms are a gradual process, and there are repetitions during the period. China’s interest rate marketization reform and development are divided into three stages: steady progress, acceleration stage, and basic marketization. This is also consistent with the corresponding policy implementation. The details are as follows.

Figure 1.

Trend of interest rate marketization from 1993 to 2016.

From 1993 to 2006, it was in a steady advancement stage, and the basic idea of interest rate marketization reform was established. The interbank offered the rates and the bond interest rate marketization developed.

2012–2014 was the acceleration stage. The lower limit of the loan interest rate was cancelled in 2013, and the bill discount rate regulation was cancelled.

From 2015 to the present, the market has been fully market-oriented. The central bank has cut the interest rates continuously and the deposit interest rate ceiling has been changed from 1.2 times, 1.3 times and 1.5 times the benchmark, which means that the marketization of interest rates has largely been completed.

Meanwhile, to test whether interest rate marketization has different alleviation effects on financing constraints between different ownership enterprises, this paper uses Soe as another moderating variable. Moreover, we control for the industry and the year (time). All of the variables and their symbols are shown in Table 2.

Table 2.

Variables and their symbols.

3.2. Sample and Data

This study selects Chinese 2007–2016 A-share listed companies as the initial research sample. China implemented new accounting standards in 2007, which stipulate that the R&D expenditures can be capitalized, which makes the disclosure of R&D innovation information increasingly more standardized. Therefore, this paper chose 2007 as the starting year. This paper processed the initial sample in the following steps: (1) Exclude the data of the financial industry; (2) exclude ST listed companies; (3) exclude companies that did not disclose innovative investments for 5 consecutive years in order to ensure that the results are more stable and reliable; (4) exclude listed companies with negative total assets; and (5) conduct 1% Winsorization of the continuous variables in order to eliminate the impacts of outliers.

The R&D investment and financial data of this research are from the CSMAR database. The macro variables for constructing the interest rate marketization index are from the website of the People’s Bank of China, the website of the National Bureau of Statistics, the China Statistical Yearbook and the China Financial Yearbook. This study used Excel and Stata 13.1 for the data processing.

3.3. Model Establishment

Most of the early research used accelerator investment models [60,61,79]. Then later, most researches used the Q-theory [80] of investment to study financing constraints [81]. However, in many cases, the conditions required to equate marginal q to average q do not hold, or stock markets are not strongly efficient. Moreover, several articles emphasize severe problems of this method, including measurement error and identification problems [82,83]. Meantime, in countries where capital market is imperfect, the q-model is likely to be specified incorrectly [63]. The Euler Investment Equation Model proposed by Abel [84] describes the company’s optimal investment behavior, which includes avoiding errors that may occur when using Tobin’s Q, and controlling the impacts of future expected returns on investment expenditures. Fazzari et al. [85], Hubbard and Kashyap [86], and Bond and Meghir [75] further developed the Euler equation investment model in order to study corporate financing constraints.

Moreover, since the Chinese capital market is not a strong effective capital market, the Tobin’s Q model is not strictly applicable in China. Therefore, this paper uses the Euler equation model to research financing constraints of R&D investment. While this method also has its weakness, that is very susceptible to misspecification problems and its small sample properties are poor [61]. Fortunately, the problem is much less severe in this study since we are primarily interested in assessing the effect of interest rate marketization, thereby focusing on changes in the cash flow sensitivities of investment and meantime we construct a large sample to avoid small sample bias.

We state our model as follows:

is the innovation investment intensity of enterprise i in period t, represents the previous period’s R&D, and is the square term. is the cash flow of enterprise i in period t − 1. Meantime, we control the time-specific effects and industry-specific effects for fixed effects.

Model (1) is the baseline specification of Euler Equation model, for verifying Hypothesis 1a. The expected state is that previous investment will promote current investment, but this promotion will decrease along with the increase of the previous investment. Therefore, the expected sign of is positive and that of is negative. represents the sensitivity of R&D investment to operating net cash flows. If the innovation investment is subject to financing constraints, then should be significantly positive. That is, in order to verify Hypothesis 1a, it is necessary to observe , and a larger implies more financing constraints.

Models (2) and (3) test the moderating effect of interest rate marketization on R&D financing constraints. In these two models, the degree of interest rate marketization belongs to external factors, such as politics, the system and natural conditions, and it is therefore exogenous variable. When the R&D investment-cash flow sensitivity changes, it will not affect the degree of interest rate marketization, and so the intersection term in Equation (3) represents the moderating impact. If Hypothesis 1b is proven, needs to be significantly negative, indicating that the advancement of interest rate marketization will significantly reduce the sensitivity of R&D investment-cash flow, alleviate corporate financing constraints, reduce the dependency of R&D investment on cash flow, and promote R&D investment.

Model (4) tests the Hypothesis 2a and 2b, represents the financing constraints for state-owned enterprises. represents the financing constraints for non-state-owned enterprises. That means non-state-owned enterprise face more financing constraints than state-owned firms, if is significantly greater than . Moreover, the coefficient represent the difference of moderating effect of interest rate marketization between different ownership enterprises. The expected sign is significantly negative.

4. Empirical Results

4.1. Descriptive Statistics

From Table 3, the total sample R&D investment has a mean value 2.890% and a standard deviation 2.596%, indicating that there are large differences in R&D investment among different listed companies. The operating cash inflow, which represents the companies’ internal financing ability, 4.823% of the assets, with a large standard deviation, indicates that the ability of different companies to generate cash flows through operating activities is also quite different. The variable sale shows on average, revenues have reach 75.03% of the beginning assets. Moreover, this ratio is largely different between companies and there are many companies with high growth. The average value of ownership is 0.693, thus indicating that most sample companies listed in 2007–2016 of the sample are non-state-owned enterprises.

Table 3.

Summary of Descriptive Statistics.

4.2. Correlation Analysis

This study conducted a correlation analysis. The results in Table 4 show that the correlation coefficient between Rd and Cf is significantly positive at the 1% significance level, which reflects that the R&D investments of enterprises face financing constraints. In addition, except that the correlation between Rd and its lag term is larger than 0.7 and significant, all the correlation coefficients between the other variables are less than 0.3, which shows that to some extent there is no multicollinearity in the model.

Table 4.

Variable Correlation Coefficient Matrix.

4.3. Regression Result

4.3.1. Regression Results Analysis

As the results show in Table 5, Model 1 and Model 3 separately test whether the enterprises face R&D investment financing constraints and whether interest rate marketization promotion can help alleviate the R&D financing constraints. The results show that the coefficient of the lagged term of R&D is positive, the coefficient of the square term is negative, and both are significant at the 1% level, which is in line with the expectation of the Euler equation investment model. The coefficient between Cft−1 and Rdt is 0.02 and is significant at the 1% level, which indicates that, although the magnitude is small, the R&D investments of Chinese enterprises depend on internal cash flows. In other words, the enterprises commonly face relatively financing constraints. Therefore, Hypothesis 1a is verified. The positive and significant coefficient of Salet−1 indicates imperfect competition in the product market, in line with Laeven [63]. The coefficient of the cross term Cft−1 × Imt is −0.001, which is significant at the 10% level. From Table 3, the mean of Im is 72.35, the R&D investment-cash flow sensitivity becomes 0.01765, slightly small than 0.020, equivalent to a fall of 11.75% on average. It means that along with the promotion of interest rate marketization, the dependence of R&D investment on internal funds reduced, and the financing constraints are alleviated to a certain extent. Therefore, Hypothesis 1b is verified.

Table 5.

Total Sample Regression Results.

To test whether enterprises of different ownership face different financing constraints and whether interest rate marketization has different effects on these different enterprises, we regress Model 4. From the last column of Table 5, we can see, for state-owned-enterprises the coefficient is not significant, which means that state-owned enterprises do not face obvious R&D financing constraints. However, for non-state-owned-enterprises, the coefficient is 0.102, significant at 5% level. That indicates that non-state-owned enterprises face more financing constraints. Thus, Hypothesis 2a is verified. Moreover, from the interaction term Cft−1 × Imt, the coefficient is nearly zero, and not significant, while the coefficient of the Cft−1 × Soe × Imt is significantly negative, although the magnitude is relatively small. Interest rate marketization do have a certain degree of mitigation of financing constraints for non-state-owned-enterprises, but for state-owned-enterprise, this effect is not significant. This is in line with the expectation of Hypothesis 2b.

4.3.2. Robustness Test

To assess the reliability, first the sample chooses enterprises that continuously disclose innovative investments in order to make the results relatively stable. Second, this paper uses robust clustering (code) to control for the companies’ sequential autocorrelation in the regressions and avoid the residual sequential autocorrelation that is caused by missing variables. Then, we use robust variables in order to control the heteroscedasticity and ensure that the model is stable. Finally, this paper also selects data from 2012 to 2016, which is the accelerated interest rate marketization period, in order to conduct robustness test, and it verifies the reliability of the results by comparing the accelerated phase regression results with the full sample ones.

Regression results of the interest rate acceleration phase are as follows. From Table 6, the coefficient of the Rd lag term is positive, the coefficient of the square lag term is negative, and both are significant at the 1% level, which is in line with the expectation of the Euler equation investment model. In model 1, the regression coefficient of Cft−1 and Rdt is 0.012, and it is significant at the 1% level. It shows that R&D investment depends on internal cash flows, that is, enterprises also face common financing constraints in the accelerated interest rate marketization period. Therefore, Hypothesis 1a is verified again. The coefficient of Cft−1 × Imt in model 3 is −0.004 and is significant at the 1% level. With the mean of Imt 72.35, the coefficient will be 0.0106 after interest rate marketization, equivalent to a fall of 11.67% on average. This is in line with the results of total sample regression.

Table 6.

2012–2016 Sample Regression Results.

From the last column of Table 6, the coefficient of Cft−1 is not significant for state-owned-enterprises, while the one for non-state-owned firms is 0.364, significant at the 1% level. This result is very similar to the one of total sample regression, which means that non-state-owned enterprises do face more financing constraints. Moreover, the interaction term Cft−1 × Soe × Imt has a significantly negative coefficient 0.003, for non-state-owned-enterprises, the interest rate marketization can alleviate financing constraints of R&D investment, which is consistent with the conclusion we get earlier.

5. Conclusions

Identifying if financial liberalization is effective has received considerable attention, but studies have not reached an agreement. To promote the sustainable development of China’s economy and improve the efficiency of capital allocation, China has also gradually undertaken financial reforms. Interest rate marketization is an important part of financial reforms. However, there are relatively few studies on whether the interest rate marketization is effective, especially after 2012, when China primarily completed its interest rate marketization.

There is a near consensus that the R&D investment of Chinese innovative enterprises faces financing constraint. We also draw consistent conclusions. This paper mainly studies the moderating effect of interest rate marketization on the financing constraints faced by enterprise R&D investment. Through empirical tests, we find that the continuous advancement of interest rate marketization has alleviated innovative financing constraints. Furthermore, compared with state-owned enterprises, the resources and government assistance available to non-state-owned enterprises are limited. That is, non-state-owned enterprises face more financing constraints. The empirical testing finds that interest rate marketization can more effectively alleviate the financing constraints of non-state-owned enterprises. The research results in this paper prove that China’s interest rate marketization is effective. The research in this paper enriches the literature on the practical effects of interest rate marketization. However, there are certain limitations in this paper, such as the construction of interest rate marketization indicators, and the impacts of interest rate marketization on different scales and different sector enterprises. Meantime, limited to the availability of data, we have only studied listed companies, but the impact of interest rate liberalization on non-listed companies remain to be further verified. In addition, we can expand the research scope of research to explore the impact of Chinese entire financial reform on firms’ investment, further, capital market, and overall economic growth, especially for the inconsistent relationship between financial development and investment or economic growth. This provides a reference for future research. In future, we seek to conduct in-depth research to consider whether financial activities under institutional differences have different effects on investment in economic growth and to study whether there is a threshold effect in developing countries and hope to find the scope of the threshold, carrying out financial reform within this scope, and promoting sustainable development of the economy.

China is in a period of economic shifting, transformation, and upgradation. One of the main objectives is to maintain economic sustainability after the 18th National Congress of Communist Party of China. In order to achieve this goal, China’s reforms continue to deepen. The interest rate marketization reform can promote the R&D investments of enterprises by mitigating financing constraints, contribute to the innovation-driven economy, and have positive effects on the economy. The contribution of innovation (mainly refer to technological innovation) to national growth has been well established in the economic literature, both theoretically [87,88,89,90]. Cimoli and Dosi [28] indicate that innovation is key to economy growth. Hong [91], and Li and Zhang [92] also put forward that in China, technological innovation is the core element of economic sustainable growth in The New Normal period.

The significance of the deepening of interest rate marketization and its role are enriched. However, although China’s interest rate marketization has achieved quite fruitful results, the actual interest rate indicator reflects that China’s interest rate marketization reforms are still not complete, and China’s financial reforms still need to be improved and deepened. The research results of this paper provide a theoretical basis for China to continue to promote interest rate marketization reforms in the future. To continue to implement interest rate marketization reforms, the government needs to continuously improve the corresponding supporting measures, eliminate the blockades on different markets, complete the free flow of funds, enhance the efficiency of resource allocation, guide financial institutions and be concerned with supporting the innovative behaviors of enterprises and promoting sustainable economic development. Enterprises should grasp the current opportunities and challenges brought by interest rate liberalization, actively seek financing support for innovative investments, increase R&D investments, and promote enterprise innovation performance.

Author Contributions

Conceiving and designing the model: X.Z. and M.D.; collecting and disposing the data: M.D.; conducting empirical regression: X.Z. and M.D.; guiding and supervision: Z.W.; writing original draft, X.Z.; revising the manuscript: X.Z., Z.W. and M.D.

Funding

Supported by Huazhong University of Science and Technology Special Funds for Development of Humanities and Social Sciences.

Conflicts of Interest

The authors declare no conflict of interest.

References

- McKinnon, R.I. Money and Capital in Economic Development; Brookings Institution Press: Washington, DC, USA, 1973. [Google Scholar]

- Martinez, L.; Tornell, A.; Westermann, F. Globalization, growth and financial crises-Lessons from Mexico and the developing world. Trimest. Econ. 2004, 71, 251–351. [Google Scholar]

- Carlson, J.; Havmöller, R.; Herreros, A.; Platonov, P.; Johansson, R.; Olsson, B. Liberalization, corporate governance and the performance of privatized firms in developing countries. J. Corp. Financ. 2005, 11, 767–790. [Google Scholar]

- Yang, G.; Liu, H. Financial development, interest rate liberalization, and macroeconomic volatility. Emerg. Mark. Financ. Tr. 2016, 52, 1–11. [Google Scholar] [CrossRef]

- Love, I. Financial development and financing constraints: International evidence from the structural investment model. Rev. Financ. Stud. 2003, 16, 765–791. [Google Scholar] [CrossRef]

- Love, I.; Zicchino, L. Financial development and dynamic investment behavior: Evidence from panel VAR. Q. Rev. Eco. Financ. 2006, 46, 190–210. [Google Scholar] [CrossRef]

- Korosteleva, J.; Mickiewicz, T. Start-up financing in the age of globalization. Emerg. Mark. Financ. Tr. 2011, 47, 23–49. [Google Scholar] [CrossRef]

- Habibullah, M.S.; Smith, P.; Azman-Saini, W. Testing liquidity constraints in ten selected Asian countries: An error-correction approach. Appl. Econ. 2006, 38, 2535–2543. [Google Scholar] [CrossRef]

- Guermazi, A. Financial liberalization, credit constraints and collateral: The case of manufacturing industry in Tunisia. Procedia. Econ. Financ. 2014, 13, 82–100. [Google Scholar] [CrossRef]

- Wang, H.J. A stochastic frontier analysis of financing constraints on investment: The case of financial liberalization in Taiwan. J. Bus. Econ. Stat. 2003, 21, 406–419. [Google Scholar] [CrossRef]

- Galindo, A.; Schiantarelli, F.; Weiss, A. Does financial liberalization improve the allocation of investment? micro-evidence from developing countries. J. Dev. Econ. 2007, 83, 562–587. [Google Scholar] [CrossRef]

- Tseng, T.Y. Will both direct financial development and indirect financial development mitigate investment sensitivity to cash flow? The experience of Taiwan. Emerg. Mark. Financ. Tr. 2012, 48, 139–152. [Google Scholar] [CrossRef]

- Iacoviello, M.; Minetti, R. Financial liberalization and the sensitivity of house prices to monetary policy: theory and evidence. Manch. Sch. 2003, 71, 20–34. [Google Scholar] [CrossRef]

- Perotti, E.C. Finance and inequality: Channels and evidence. J. Comp. Econ. 2007, 35, 748–773. [Google Scholar]

- Kabango, G.P.; Paloni, A. Financial liberalization and the industrial response: Concentration and entry in malawi. World. Dev. 2011, 39, 1771–1783. [Google Scholar] [CrossRef]

- Alvarezcuadrado, F.; Japaridze, I. Trickle-down consumption, financial deregulation, inequality, and indebtedness. J. Econ. Behav. Organ. 2016, 5, 163–180. [Google Scholar]

- Kaminsky, G.L.; Schmukler, S.L. Short-run pain, long-run gain: Financial liberalization and stock market cycles. Rev. Financ. 2007, 12, 253–292. [Google Scholar] [CrossRef]

- Giné, X.; Townsend, R.M. Evaluation of financial liberalization: A general equilibrium model with constrained occupation choice. J. Dev. Econ. 2004, 74, 269–307. [Google Scholar] [CrossRef]

- Kikuchi, T.; Vachadze, G. Financial liberalization: Poverty trap or chaos. J. Math. Econ. 2015, 59, 1–9. [Google Scholar] [CrossRef]

- Ferraris, L.; Minetti, R. Foreign banks and the dual effect of financial liberalization. J. Money. Credit. Bank. 2013, 45, 1301–1333. [Google Scholar] [CrossRef]

- Arcand, J.; Berkes, E.; Panizza, U. Too much finance? J. Econ. Growth. 2015, 20, 105–148. [Google Scholar] [CrossRef]

- Tori, D.; Onaran, O. Financialisation, financial development, and investment: Evidence from European non-financial corporations. Soc. Econ. Rev. 2018, 1–43. [Google Scholar]

- Chan, K.S.; Dang, V.Q.T.; Yan, I.K.M. Financial reform and financing constraints: Some evidence from listed Chinese firms. China. Econ. Rev. 2012, 23, 482–497. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Transaction Publishers: Piscataway, NJ, USA, 1912. [Google Scholar]

- Szopik-Depczyńska, K. Effects of Innovation Activity in Industrial Enterprises in Eastern Poland. Oeconomia Copernicana 2015, 6, 53–65. [Google Scholar]

- Szopik-Depczyńska, K.; Kędzierska-Szczepaniak, A.; Szczepaniak, K.; Cheba, K.; Gajda, W.; Ioppolo, G. Innovation in sustainable development: An investigation of the EU context using 2030 Agenda indicators. Land Use Policy 2018, 79, 251–262. [Google Scholar]

- Ioppolo, G.; Szopik-Depczyńska, K.; Stajniak, M.; Konecka, S. Supply chain and innovation activity in transport related enterprises in Eastern Poland. Log. Forum 2016, 12, 227–236. [Google Scholar]

- Cimoli, M.; Dosi, G. Technological paradigms, patterns of learning and development: An introductory roadmap. J. Evol. Econ. 1995, 5, 243–268. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Greenwald, B.; Stiglitz, J.E.; Weiss, A. Informational imperfections in the capital market and Macroeconomic Fluctuations. Am. Econ. Rev. 1984, 74, 194–199. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Holmstrom, B. Agency costs and innovation. J. Econ. Behav. Org. 1989, 12, 305–327. [Google Scholar] [CrossRef]

- Cincera, M. Financing Constraints, Fixed Capital and R&D Investment Decisions of Belgian Firms; National Bank of Belgium: Brussels, Belgium, 2002. [Google Scholar]

- Arrow, K.J. Economic welfare and the allocation of resources for invention. In Readings in Industrial Economics; Palgrave: London, UK, 1972; pp. 219–236. [Google Scholar]

- Himmelberg, C.P.; Petersen, B.C. R&D and internal finance: A panel study of small firms in high-tech industries. Rev. Econ. Stat. 1994, 76, 38–51. [Google Scholar]

- Schneider, C.; Veugelers, R. On young highly innovative companies: Why they matter and how (not) to policy support them. Ind. Corp. Change. 2010, 19, 969–1007. [Google Scholar] [CrossRef]

- Hall, B.H. Investment and Research and Development at the Firm Level: Does the Source of Financing Matter? National Bureau of Economic Research: Cambridge, MA, USA, 1992. [Google Scholar]

- Görg, H.; Strobl, E.A.; Bougheas, S. Is R&D financially constrained? Theory and evidence from Irish manufacturing. Rev. Ind. Org. 2003, 22, 159–174. [Google Scholar]

- Yang, E.; Ma, G.; Chu, J. The impact of financial constraints on firm R&D investments: Empirical evidence from China. Int. J. Technol. Manag. 2014, 65, 172–188. [Google Scholar]

- Bond, S.; Harhoff, D.; Van Reenen, J. Investment, R & D and Financial Constraints in Britain and Germany (No. W99/05); Institute for Fiscal Studies: London, UK, 1999. [Google Scholar]

- Czarnitzki, D. Research and development in small and medium-sized enterprises: The role of financial constraints and public funding. Scot. J. Polit. Econ. 2010, 53, 335–357. [Google Scholar] [CrossRef]

- Silva, F.; Carreira, C. Do financial constraints threat the innovation process? Evidence from Portuguese firms. Econ. Innov. New Technol. 2012, 21, 701–736. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Hottenrott, H. R&D investment and financing constraints of small and medium-sized firms. Small Bus. Econ. 2011, 36, 65–83. [Google Scholar]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Do financing constraints matter for R&D? Eur. Econ. Rev. 2012, 56, 1512–1529. [Google Scholar]

- Li, D. Financial constraints, R&D investment, and stock returns. Rev. Financ. Stud. 2011, 24, 2974–3007. [Google Scholar]

- Lin, Z.J.; Liu, S.; Sun, F. The impact of financing constraints and agency costs on corporate R&D investment: Evidence from China. Int. Rev. Financ. 2017, 17, 3–42. [Google Scholar]

- Shaw, E. Financial Deepening in Economic Development; Oxford University Press: Oxford, UK, 1973. [Google Scholar]

- Li, H.; Meng, L.; Wang, Q.; Zhou, L.A. Political connections, financing and firm performance: Evidence from Chinese private firms. J. Dev. Econ. 2008, 87, 283–299. [Google Scholar] [CrossRef]

- Luo, D.; Liming, Z. Private Control, Political Relationship and Financing Constrain of Private Listed Enterprises. J. Financ. Res. 2008, 12, 164–176. (In Chinese) [Google Scholar]

- Tao, X. Research on the Financing Difficulties of Private Enterprises in China’s Gradual Reform. Stat. Decis. 2012, 15, 173–176. (In Chinese) [Google Scholar]

- Zhang, J. Financial Difficulties and Financing Sequences of Private Economy. Econ. Research. J. 2000, 4, 3–10. (In Chinese) [Google Scholar]

- Xu, C.; Xiuli, G. Research on the financing and financial support of Chinese private enterprise. J. Financ. Res. 2004, 9, 86–91. (In Chinese) [Google Scholar]

- Yin, M.; Zhoujie, W.; Dan, L. A New Framework for Interpreting the Mystery of SME Loan Difficulties. J. Financ. Res. 2008, 5, 99–106. (In Chinese) [Google Scholar]

- Qian, Y.; Xu, C. Innovation and bureaucracy under soft and hard budget constraints. Rev. Econ. Study. 1998, 65, 151–164. [Google Scholar] [CrossRef]

- Huang, H.; Xu, C. Soft budget constraint and the optimal choices of research and development projects financing. J. Comp. Econ. 1998, 26, 62–79. [Google Scholar] [CrossRef]

- Cull, R.; Xu, L.C. Institutions, ownership, and finance: The determinants of profit reinvestment among Chinese firms. J. Financ. Econ. 2005, 77, 117–146. [Google Scholar] [CrossRef]

- Chen, S.; Sun, Z.; Tang, S.; Wu, D. Government intervention and investment efficiency: Evidence from China. J. Corp. Financ. 2011, 17, 259–271. [Google Scholar] [CrossRef]

- Aghion, P.; Van Reenen, J.; Zingales, L. Innovation and institutional ownership. Am. Econ. Rev. 2013, 103, 277–304. [Google Scholar] [CrossRef]

- Obstfeld, M. Risk-taking, global diversification, and growth. Am. Econ. Rev. 1994, 84, 1310–1329. [Google Scholar]

- Harris, J.R.; Schiantarelli, F.; Siregar, M.G. The effect of financial liberalization on the capital structure and investment decisions of Indonesian manufacturing establishments. World bank Econ. Rev. 1994, 8, 17–47. [Google Scholar] [CrossRef]

- Gelos, R.G.; Werner, A.M. Financial liberalization, credit constraints, and collateral: Investment in the Mexican manufacturing sector. J. Dev. Econ. 2002, 67, 1–27. [Google Scholar] [CrossRef]

- Koo, J.; Shin, S. Financial liberalization and corporate investments: Evidence from Korean firm data. Asian Econ. 2004, 18, 277–292. [Google Scholar] [CrossRef]

- Laeven, L. Does financial liberalization reduce financing constraints? Financ. Manag. 2003, 32, 5–34. [Google Scholar] [CrossRef]

- Zhang, J.; Zhe, L.; Wenping, Z. Financing Constraints, Financing Channels and Corporate R&D investment. J. World Econ. 2012, 10, 66–90. (In Chinese) [Google Scholar]

- Li, Z.; Xiangang, X.; Xuhui, Y. The financial development, the debt financing constraint and pyramidal structure. Manag. World 2008, 1, 123–135. (In Chinese) [Google Scholar]

- Fazzari, S.M.; Hubbard, R.G.; Petersen, B.C. Financing Constraints and Corporate Investment. Brook. Pap. Econ. Act. 1988, 19, 141–206. [Google Scholar] [CrossRef]

- Carpenter, R.E.; Guariglia, A. Cash flow, investment, and investment opportunities: New tests using UK panel data. J. Bank. Financ. 2008, 32, 1894–1906. [Google Scholar] [CrossRef]

- Cleary, S. The Relationship between Firm Investment and Financial Status. J. Financ. 1999, 54, 673–692. [Google Scholar] [CrossRef]

- Lamont, O.; Polk, C.; Saá-Requejo, J. Financial Constraints and Stock Returns. Rev. Financ. Stud. 2001, 14, 529–554. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial Constraints Risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Gilchrist, S.; Himmelberg, C.P. Evidence on the role of cash flow for investment. J. Monetary. Econ. 1995, 36, 541–572. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M.; Weisbach, M.S. The Cash Flow Sensitivity of Cash. J. Financ. 2004, 59, 1777–1804. [Google Scholar] [CrossRef]

- Sasidharan, S.; Lukose, P.J.; Komera, S. Financing constraints and investments in R&D: Evidence from Indian manufacturing firms. Quart. Rev. Econ. Financ. 2015, 55, 28–39. [Google Scholar]

- Bond, S.R.; Meghir, C. Dynamic Investment models and the Firm’s financial policy. Rev. Econ. Stud. 1994, 61, 197–222. [Google Scholar] [CrossRef]

- Tao, X.; Mingjue, C. Measure and reform implications of china’s interest rate liberalization. J. Zhongnan Univ. Econ. Law 2013, 3, 74–79. (In Chinese) [Google Scholar]

- Wang, S.; Jiangang, P. The studies on the measurement and performance of china’s interest rate liberalization: Empirical analysis based on the bank credit channel. J. Financ. Econ. 2014, 6, 75–84. (In Chinese) [Google Scholar]

- Zhang, Y.; Qingmei, X. Statistical Measurement of China’s Interest Rate Marketization Process. Stat. Decis. 2016, 11, 154–157. (In Chinese) [Google Scholar]

- Kuh, E.; Meyer, J.R. Correlation and regression estimates when the data are ratios. J. Econ. Soc. 1955, 23, 400–416. [Google Scholar] [CrossRef]

- Tobin, J. A general equilibrium approach to monetary theory. J. Money. Credit. Bank. 1969, 1, 15–29. [Google Scholar] [CrossRef]

- Hubbard, R.G. Capital Market Imperfections and Investment. J. Econ. Lit. 1998, 36, 193–225. [Google Scholar]

- Kaplan, S.N.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Quart. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Gomes, J.F. Financing investment. Am. Econ. Rev. 2001, 91, 1263–1285. [Google Scholar] [CrossRef]

- Abel, A. Empirical investment equations: An integrative framework. Carn. Roch. Conf. Series 1980, 12, 39–91. [Google Scholar]

- Fazzari, S.M.; Hubbard, R.G.; Petersen, B.C. Investment, financing decisions, and tax policy. Am. Econ. Rev. 1988, 78, 200–205. [Google Scholar]

- Hubbard, G.; Kashyap, A. Internal Net Worth and the Investment Process: An Application to US Agriculture. J. Polit. Econ. 1992, 100, 506–534. [Google Scholar] [CrossRef]

- Solow, R.M. A contribution to the theory of economic growth. Quart. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing returns and long-run growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Nadiri, M.I. Innovations and Technological Spillovers 1993. (No. w4423); National Bureau of Economic Research: Cambridge, MA, USA, 1993. [Google Scholar]

- Engelbrecht, H.J. International R&D spillovers amongst OECD economies. Appl. Econ. Lett. 1997, 4, 315–319. [Google Scholar]

- Hong, Y. On the strategy of innovation-driven economic development. Economist 2013, 1, 5–11. [Google Scholar]

- Li, Y.; Xiaojing, Z. The new normal: The logic and perspective of economic development. Econ. Res. J. 2015, 5, 4–19. [Google Scholar]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).