Family Involvement in Management and Product Innovation: The Mediating Role of R&D Strategies

Abstract

1. Introduction

2. Theory Background

2.1. Product Innovation in Family Firms

2.2. R&D Investments and Product Innovation

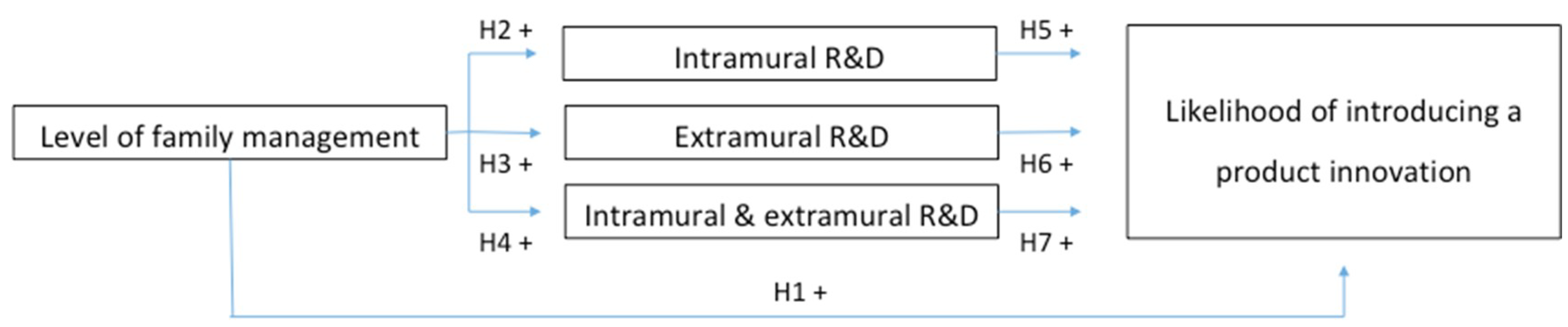

3. Hypotheses Development

3.1. Family Management and the Likelihood of Introducing Product Innovations

3.2. Family Management and Intramural R&D Investments

3.3. Family Management and Extramural R&D Investments

3.4. Level of Family Management and Intramural & Extramural R&D Strategy

3.5. The Likelihood of Introducing Product Innovations and Intramural R&D Investments

3.6. The Likelihood of Introducing Product Innovations and Extramural R&D Investments

3.7. The Likelihood of Introducing Product Innovations and the Combination of Both Intramural and Extramural R&D Investments

4. Methods

4.1. Sample

4.2. Measures

4.2.1. Dependent Variable

4.2.2. Independent Variables

4.2.3. Control Variables

4.3. Data Analysis

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- OCDE. Oslo Manual. Guidelines for Collecting and Interpreting Innovation Data; OCDE: Paris, France, 2005. [Google Scholar]

- D’Aveni, R.; Battista, G.; Smith, K. The age of temporary advantage. Strateg. Manag. J. 2010, 31, 1371–1385. [Google Scholar] [CrossRef]

- Geroski, P.; Machin, S.; Van Reenen, J. The profitability of innovating firms. Rand J. Econ. 1993, 24, 198–211. [Google Scholar] [CrossRef]

- Chen, S.; Xu, K.; Nguyen, L.T.; Yu, G. TMT’s attention towards financial goals and innovation investment: Evidence from China. Sustainability 2018, 10, 4236. [Google Scholar] [CrossRef]

- Shi, C. On the trade-off between the future benefits and riskiness of R&D: A bondholders’ perspective. J. Account. Econ. 2003, 35, 227–254. [Google Scholar]

- Family Firm Institute. Family Firm Institute. Global Data Points. 2018. Available online: https://my.ffi.org/page/globaldatapoints (accessed on 7 March 2019).

- European Commission. Overview of Family-Business-Relevant Issues: Research, Networks, Policy Measures and Existing Studies; Final Report of the Expert Group; European Commission: Brussels, Belgium, 2009; Volume 11, pp. 1–33. [Google Scholar]

- Sirmon, D.G.; Hitt, M.A. Managing Resources: Linking Unique Resources, Management, and Wealth Creation in Family Firms. Entrep. Theory Pract. 2003, 27, 339–358. [Google Scholar] [CrossRef]

- Fama, E.; Jensen, M.C. Agency problems and residual claims. J. Law Econ. 1983, 26, 325–344. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W. Theory of the Firm: Managerial Behaviour, Agency Costs y Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Gedajlovic, E.; Lubatkin, M.H.; Schulze, W.S. Crossing the threshold from founder management to professional management: A governance perspective. J. Manag. Stud. 2004, 41, 899–912. [Google Scholar] [CrossRef]

- Sciascia, S.; Mazzola, P. Family Involvement in Ownership and Management: Exploring Nonlinear Effects on Performance. Fam. Bus. Rev. 2008, 21, 331–345. [Google Scholar] [CrossRef]

- Martínez-Alonso, R.; Martínez-Romero, M.J.; Rojo-Ramírez, A.A. The impact of technological innovation efficiency on firm growth: The moderating role of family involvement in management. Eur. J. Innov. Manag. 2019. forthcoming. [Google Scholar] [CrossRef]

- Mahto, R.; Chen, J.-S.; McDowell, W.; Ahluwalia, S. Shared Identity, Family Influence, and the Transgenerational Intentions in Family Firms. Sustainability 2019, 11, 1130. [Google Scholar] [CrossRef]

- De Massis, A.; Frattini, F.; Pizzurno, E.; Cassia, L. Product Innovation in Family versus Nonfamily Firms: An Exploratory Analysis. J. Small Bus. Manag. 2015, 53, 1–36. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Steier, L.P.; Rau, S.B. Sources of Heterogeneity in Family Firms: An Introduction. Entrep. Theory Pract. 2012, 36, 1103–1113. [Google Scholar] [CrossRef]

- Sharma, P.; Nordqvist, M. A Classification Scheme for Family Firms: From Family Values to Effective Governance to Firm Performance. In Family Values and Value Creation: How Do Family-Owned Businesses Foster Enduring Values; Tapies, J., Ward, J.L., Eds.; Palgrave Macmillan: New York, NY, USA, 2008; pp. 71–101. [Google Scholar]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Klein, S.B.; Astrachan, J.H.; Smyrnios, K.X.T. The F-PEC scale of family influence: Construction, validation, and further implication for theory. Entrep. Theory Pract. 2005, 29, 321–339. [Google Scholar] [CrossRef]

- Upton, N.; Teal, E.J.; Felan, J.T. Strategic and business planning practices of fast growth family firms. J. Small Bus. Manag. 2001, 39, 60–72. [Google Scholar] [CrossRef]

- Sirmon, D.; Hitt, M.; Ireland, R. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Sharma, P.; Salvato, C. Commentary: Exploiting and exploring new opportunities over life cycle stages of family firms. Entrep. Theory Pract. 2011, 35, 1199–1205. [Google Scholar] [CrossRef]

- Matzler, K.; Veider, V.; Hautz, J.; Stadler, C. The impact of family ownership, management, and governance on innovation. J. Prod. Innov. Manag. 2015, 32, 319–333. [Google Scholar] [CrossRef]

- Block, J.; Miller, D.; Jaskiewicz, P.; Spiegel, F. Economic and Technological Importance of Innovations in Large Family and Founder Firms: An Analysis of Patent Data. Fam. Bus. Rev. 2013, 26, 180–199. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaria, L.; Fernandez, Z. Understanding the Innovation Behavior of Family Firms. J. Small Bus. Manag. 2015, 53, 382–399. [Google Scholar] [CrossRef]

- Gómez-Mejia, L.R.; Haynes, K.T.; Núñez Nickel, M.; Jacobson, K.J.L.; Moyano Fuentes, J. Socioemotional Wealth and Business Risks in Family-controlled Firms: Evidence from Spanish Olive Oil Mills. Adm. Sci. Q. 2007, 52, 106–137. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gómez-Mejia, L.R. Socioemotional Wealth in Family Firms: Theoretical Dimensions, Assessment Approaches, and Agenda for Future Research. Fam. Bus. Rev. 2012, 25, 258–279. [Google Scholar] [CrossRef]

- Grimpe, C.; Kaiser, U. Balancing internal and external knowledge acquisition: The gains and pains from R & D outsourcing. J. Manag. Stud. 2010, 47, 1483–1509. [Google Scholar]

- Kotlar, J.; De Massis, A.; Frattini, F.; Bianchi, M.; Fang, H. Technology acquisition in family and nonfamily firms: A longitudinal analysis of Spanish manufacturing firms. J. Prod. Innov. Manag. 2013, 30, 1073–1088. [Google Scholar] [CrossRef]

- Krzeminska, A.; Lucia, S.; Eckert, C. Complementarity of Internal and External R&D: Is There a Difference Between Product Versus Process Innovations? R&D Manag. 2016, 46, 931–944. [Google Scholar]

- De Massis, A.; Frattini, F.; Lichtenthaler, U. Research on Technological Innovation in Family Firms: Present Debates and Future Directions. Fam. Bus. Rev. 2012, 26, 10–31. [Google Scholar] [CrossRef]

- Röd, I. Disentangling the family firm’s innovation process: A systematic review. J. Fam. Bus. Strategy 2016, 7, 185–201. [Google Scholar] [CrossRef]

- Chin, C.; Chen, Y.; Kleinman, G.; Lee, P. Corporate ownership structure and innovation: Evidence from taiwan’s electronics industry. J. Account. Audit. Financ. 2009, 24, 145–175. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Kraft, K. Capital control, debt financing and innovative activity. J. Econ. Behav. Organ. 2009, 71, 372–383. [Google Scholar] [CrossRef]

- Tsao, S.; Lien, C. Family management and internationalization: The impact on firm performance and innovation. Manag. Int. Rev. 2013, 53, 189–213. [Google Scholar] [CrossRef]

- Gudmundson, D.; Tower, C.B.; Hartman, E.A. Innovation in Small Businesses: Culture and Ownership Structure Do Matter. J. Dev. Entrep. 2003, 8, 1–17. [Google Scholar]

- Craigh, J.; Dibrell, C. The Natural Environment, Innovation, and Firm Performance: A Comparative Study. Fam. Bus. Rev. 2006, 19, 275–288. [Google Scholar] [CrossRef]

- Llach, J.; Nordqvist, M. Innovation in family and non-family businesses: A resource perspective. Int. J. Entrep. Ventur. 2010, 2, 381–399. [Google Scholar] [CrossRef]

- Ahuja, G.; Lampert, C.M.; Tandon, V. Moving beyond Schumpeter: Management research on the determinants of technological innovation. Acad. Manag. Ann. 2008, 2, 1–98. [Google Scholar] [CrossRef]

- Bushee, B.J. The influence of institutional investors on myopic R&D investment behavior. Account. Rev. 1998, 73, 305–333. [Google Scholar]

- Palmer, T.B.; Wiseman, R.M. Decoupling Risk Taking from Income Stream Uncertainty: A Holistic Model of Risk. Strateg. Manag. J. 1999, 20, 1037–1062. [Google Scholar] [CrossRef]

- Artz, K.W.; Norman, P.M.; Hatfield, D.E.; Cardinal, L.B. A longitudinal study of the impact of R&D, patents, and product innovation on firm performance. J. Prod. Innov. Manag. 2010, 27, 725–740. [Google Scholar]

- Block, J.H. R&D investments in family and founder firms: An agency perspective. J. Bus. Ventur. 2012, 27, 248–265. [Google Scholar]

- Kotlar, J.; Fang, H.; De Massis, A.; Frattini, F. Profitability Goals, Control Goals, and the R&D Investment Decisions of Family and Nonfamily Firms. J. Prod. Innov. Manag. 2014, 31, 1128–1145. [Google Scholar]

- Cohen, W.M. Fifty years of Empirical Studies of Innovative Activity and Performance. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; Elsevier: Amsterdam, The Netherlands, 2010; pp. 129–213. [Google Scholar]

- Hall, B.H.; Mairesse, J.; Mohnen, P. Measuring the Returns to R&D. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; Elsevier: Amsterdam, The Netherlands, 2010; Volume II, pp. 1033–1082. [Google Scholar]

- Mairesse, J.; Mohnen, P. Accounting for Innovation and Measuring Innovativeness: An Illustrative Framework and an Application. Am. Econ. Rev. 2002, 92, 226–230. [Google Scholar] [CrossRef]

- Hall, B.H.; Lotti, F.; Mairesse, J. Innovation and productivity in SMEs: Empirical evidence for Italy. Small Bus. Econ. 2009, 33, 13–33. [Google Scholar] [CrossRef]

- Peters, B.; Roberts, M.J.; Ahn Vuong, V.; Fryges, H. Estimating Dynamic R&D Demand: An Analysis of Costs and Long-Run Benefits (No. 19374); National Bureau of Economic Research: Cambridge, MA, USA, 2013. [Google Scholar]

- Baumann, J.; Kritikos, A.S. The link between R&D, innovation and productivity: Are micro firms different? Res. Policy 2016, 45, 1263–1274. [Google Scholar]

- Cassiman, B.; Veugelers, R. In Search of Complementarity in Innovation Strategy: Internal R&D and External Knowledge Acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar]

- OECD. Frascati Manual; OECD: Paris, France, 2002. [Google Scholar]

- Griliches, Z. Issues in Assessing the Contribution of Research and Development to Productivity Growth. Bell J. Econ. 1979, 10, 92–116. [Google Scholar] [CrossRef]

- Scherer, F. Intertechnology flows and productivity growth. Rev. Econ. Stat. 1982, 64, 627–634. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation Wesley M Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Bönte, W. R&D and productivity: Internal vs external R&D—Evidence from West German manufacturing industries. Econ. Innov. New Technol. 2003, 12, 343–360. [Google Scholar]

- Howells, J. Regional systems of innovation? In Innovation Policy in a Global Economy; Archibugi, D., Howells, J., Michie, J., Eds.; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Vega-Jurado, J.; Gutiérrez-Gracia, A.; Fernández-De-Lucio, I. Does external knowledge sourcing matter for innovation? Evidence from the Spanish manufacturing industry. Ind. Corp. Chang. 2009, 18, 637–670. [Google Scholar] [CrossRef]

- Barthélemy, J.; Quélin, B.V. Complexity of outsourcing contracts and ex post transaction costs: An empirical investigation. J. Manag. Stud. 2006, 43, 1775–1797. [Google Scholar] [CrossRef]

- DeSarbo, W.S.; Benedetto, C.A.; Song, M.; Sinha, I. Revisiting the miles and snow strategic framework: Uncovering interrelationships between strategic types, capabilities, environmental uncertainty, and firm performance. Strateg. Manag. J. 2005, 26, 47–74. [Google Scholar] [CrossRef]

- Berchicci, L. Towards an open R&D system: Internal R&D investment, external knowledge acquisition and innovative performance. Res. Policy 2013, 42, 117–127. [Google Scholar]

- Greco, M.; Grimaldi, M.; Cricelli, L. Open innovation actions and innovation performance: A literature review of European empirical evidence. Eur. J. Innov. Manag. 2015, 18, 150–171. [Google Scholar] [CrossRef]

- West, J.; Bogers, M. Leveraging external sources of innovation: A reviewof research on open innovation. J. Prod. Innov. Manag. 2014, 31, 814–831. [Google Scholar] [CrossRef]

- Zhao, S.; Sun, Y.; Xu, X. Research on open innovation performance: A review. Inf. Technol. Manag. 2016, 17, 279–287. [Google Scholar] [CrossRef]

- Gomez, J.; Vargas, P. The effect of financial constraints, absorptive capacity and complementarities on the adoption of multiple process technologies. Res. Policy 2009, 38, 106–119. [Google Scholar] [CrossRef]

- Lokshin, B.; Belderbos, R.; Carree, M. The productivity effects of internal and external R&D: Evidence from a dynamic panel data model. Oxf. Bull. Econ. Stat. 2008, 70, 399–413. [Google Scholar]

- Rothaermel, F.T.; Hess, A.M. Building dynamic capabilities: Innovation driven by individual-, firm-, and network-level effects. Organ. Sci. 2007, 18, 898–921. [Google Scholar] [CrossRef]

- Arora, A.; Gambardella, A. Complementarity and external linkages: The strategies of the large firms in biotechnology. J. Ind. Econ. 1990, 38, 361–379. [Google Scholar] [CrossRef]

- Braga, H.; Willmore, L. Technological imports and technological effort: An analysis of their determinants in Brazilian firms. J. Ind. Econ. 1991, 39, 421–432. [Google Scholar] [CrossRef]

- Freeman, C. Networks of innovators: A synthesis of research issues. Res. Policy 1991, 20, 499–514. [Google Scholar] [CrossRef]

- Siddharthan, N.S. Transaction costs, technology transfer and in-house R&D. J. Econ. Behav. Organ. 1992, 18, 265–271. [Google Scholar]

- Hess, A.M.; Rothaermel, F.T. When are assets complementary? Star scientists, strategic alliances, and innovation in the pharmaceutical industry. Strateg. Manag. J. 2011, 32, 895–909. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Classen, N.; Carree, M.; Van Gils, A.; Peters, B. Innovation in family and non-family SMEs: An exploratory analysis. Small Bus. Econ. 2014, 42, 595–609. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Patel, P.C. Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Acad. Manag. J. 2012, 55, 976–997. [Google Scholar]

- Gómez-Mejia, L.R.; Campbell, J.T.; Martin, G.; Hoskisson, R.E.; Makri, M.; Sirmon, D.G. Socioemotional Wealth as a Mixed Gamble: Revisiting Family Firm R&D Investments with the Behavioral Agency Model. Entrep. Theory Pract. 2014, 38, 1351–1374. [Google Scholar]

- Schmid, T.; Achleitner, A.-K.; Ampenberger, M.; Kaserer, C. Family firms and R&D behavior—New evidence from a large-scale survey. Res. Policy 2014, 43, 233–244. [Google Scholar]

- Duran, P.; Kammerlander, N.; van Essen, M.; Zellweger, T.M. Doing more with less: Innovation input and output in family firms. Acad. Manag. J. 2016, 59, 1224–1264. [Google Scholar] [CrossRef]

- Diéguez-Soto, J.; Manzaneque Lizano, M.; Rojo Ramírez, A.A. Technological Innovation Inputs, Outputs and Performance: The Moderating Role of Family Involvement in Management. Fam. Bus. Rev. 2016, 29, 327–346. [Google Scholar] [CrossRef]

- Liang, Q.; Li, X.; Yang, X.; Lin, D.; Zheng, D. How does family involvement affect innovation in China? Asia Pac. J. Manag. 2013, 30, 677–695. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Pearson, A.W.; Barnett, T. Family Involvement, Family Influence, and Family-Centered Non-Economic Goals in Small Firms. Entrep. Theory Pract. 2012, 36, 267–293. [Google Scholar] [CrossRef]

- Patel, P.C.; Chrisman, J.J. Risk abatement as a strategy for R&D investments in family firms. Strateg. Manag. J. 2014, 35, 617–627. [Google Scholar]

- Bertrand, M.; Schoar, A. The role of family in family firms. J. Econ. Perspect. 2006, 20, 73–96. [Google Scholar] [CrossRef]

- Stein, J. Takeover Threats and Managerial Myopia. Ournal Political Econ. 1988, 96, 61–80. [Google Scholar] [CrossRef]

- Stein, J. Efficient Capital Markets, Inefficient Firms: A Model of Myopic Corporate Behavior. Q. J. Econ. 1989, 103, 655–669. [Google Scholar] [CrossRef]

- Lee, P.M.; O’Neil, H.M. Ownership structures and R&D investments of U S. and Japanese firms: Agency and stewardship perspectives. Acad. Manag. J. 2003, 46, 212–225. [Google Scholar]

- Casson, M. The economics of the family firm. Scand. Econ. Hist. Rev. 1999, 47, 10–23. [Google Scholar] [CrossRef]

- Habbershon, T.G.; Williams, M. A resource-based framework for assessing the strategic advantages of family firms. Fam. Bus. Rev. 1999, 12, 1–15. [Google Scholar] [CrossRef]

- Zahra, S.A.; Hayton, J.C.; Neubaum, D.O.; Dibrell, C.; Craig, J. Culture of Family Commitment and Strategic Flexibility: The Moderating Effect of Stewardship. Entrep. Theory Pract. 2008, 32, 1035–1054. [Google Scholar] [CrossRef]

- Levenburg, N.M.; Schwarz, T.V.; Almallah, S. Innovation: A recipe for success among family-owned firms in west Michigan? Seidman Bus. Rev. 2002, 8, 21–22. [Google Scholar]

- Francis, J.; Smith, A. Agency Costs and Innovation: Some Empirical Evidence. J. Account. Econ. 1995, 19, 383–409. [Google Scholar] [CrossRef]

- Ashwin, A.S.; Krishnan, R.T.; George, R. Family firms in India: Family involvement, innovation and agency and stewardship behaviors. Asia Pac. J. Manag. 2015, 32, 869–900. [Google Scholar] [CrossRef]

- Gedajlovic, E.; Carney, M.; Chrisman, J.; Kellermanns, F. The adolescence of family firm research: Taking stock and planning for the future. J. Manag. 2012, 38, 1010–1037. [Google Scholar] [CrossRef]

- Zahra, S.A. Harvesting family firms’ organizational social capital: A relational perspective. J. Manag. Stud. 2010, 47, 345–366. [Google Scholar] [CrossRef]

- Teece, D. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Res. Policy 1986, 15, 285–305. [Google Scholar] [CrossRef]

- Miller, D.; LeBreton-Miller, I. Managing for the Long Run: Lessons in Competitive Advantage from Great Family Businesses; Harvard Business Press: Brighton, MA, USA, 2005. [Google Scholar]

- Patel, P.C.; Fiet, J.O. Knowledge combination and the potential advantages of family firms in searching for opportunities. Entrep. Theory Pract. 2011, 35, 1179–1197. [Google Scholar] [CrossRef]

- Filser, M.; De Massis, A.; Gast, J.; Kraus, S.; Niemand, T. Tracing the Roots of Innovativeness in Family SMEs: The Effect of Family Functionality and Socioemotional Wealth. J. Prod. Innov. Manag. 2018, 35, 609–628. [Google Scholar] [CrossRef]

- Teece, D.J. Reflections on “profiting from innovation”. Res. Policy 2006, 35, 1131–1146. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Diéguez-Soto, J.; Duréndez, A.; García-Pérez-de-Lema, D.; Ruiz-Palomo, D. Technological, management, and persistent innovation in small and medium family firms: The influence of professionalism. Can. J. Adm. Sci. 2016, 33, 332–346. [Google Scholar] [CrossRef]

- Cassia, L.; De Massis, A.; Pizzurno, E. An Exploratory Investigation on NPD in Small Family Businesses from Northern Italy. Int. J. Manag. Soc. Sci. 2011, 2, 1–14. [Google Scholar]

- Chua, J.H.; Chrisman, J.J.; Sharma, P. Defining the family business by behavior. Entrep. Theory Pract. 1999, 23, 19–39. [Google Scholar] [CrossRef]

- Zahra, S.A.; Hayton, J.C.; Salvato, C. Entrepreneurship in family vs. non-family firms: A resource-based analysis of the effect of organizational culture. Entrep. Theory Pract. 2004, 28, 363–381. [Google Scholar] [CrossRef]

- Eberhart, A.C.; Maxwell, W.F.; Siddique, A.R. An examination of long-term abnormal stock returns and operating performance following R&D increases. J. Financ. 2004, 59, 623–650. [Google Scholar]

- Hall, B.H.; Oriani, R. Does the market value R&D investment by European firms? Evidence from a panel of manufacturing firms in France, Germany, and Italy. Int. J. Ind. Organ. 2006, 24, 971–993. [Google Scholar]

- Szulanski, G. Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strateg. Manag. J. 1996, 17, 27–43. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Kahn, E.J. The Problem Solvers; A History of Arthur D. Little, Inc.: Boston, MA, USA, 1986. [Google Scholar]

- Chatterji, D. Accessing external sources of technology. Res. Technol. Manag. 1996, 39, 48–56. [Google Scholar] [CrossRef]

- Calantone, R.J.; Stanko, M.A. Drivers of outsourced innovation: An exploratory study. J. Prod. Innov. Manag. 2007, 24, 230–241. [Google Scholar] [CrossRef]

- Mitchell, W.; Singh, K. Survival of businesses using collaborative relationships to commercialize complex goods. Strateg. Manag. J. 1996, 17, 169–195. [Google Scholar] [CrossRef]

- Steensma, H.K.; Corley, K.G. On the performance of technology-sourcing partnerships: The interaction between partner interdependence and technology attributes. Acad. Manag. J. 2000, 43, 1045–1067. [Google Scholar]

- Eisenhardt, K.M.; Schoonhoven, C.B. Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organ. Sci. 1996, 7, 136–150. [Google Scholar] [CrossRef]

- Eurostat. Innovation in Europe; Results for the EU, Iceland and Norway; Eurostat: Brussels, Belgium, 2004. [Google Scholar]

- Dahlander, L.; Gann, D.M. How open is innovation? Res. Policy 2010, 39, 699–709. [Google Scholar] [CrossRef]

- Radnor, M. Technology acquisition strategies and processes: A reconsideration of the make versus buy decision. Int. J. Technol. Manag. 1991, 7, 113–135. [Google Scholar]

- Hagedoorn, J. Inter-firm R&D partnerships: An overview of major trends and patterns since 1960. Res. Policy 2002, 31, 477–492. [Google Scholar]

- Manzaneque, M.; Ramírez, Y.; Diéguez-Soto, J. Intellectual capital efficiency, technological innovation and family management. Innov. Manag. Policy Pract. 2017, 19, 167–188. [Google Scholar] [CrossRef]

- Mazzelli, A.; Kotlar, J.; De Massis, A. Blending in while standing out: Selective conformity and new product introducion in family firms. Entrep. Theory Pract. 2018, 42. Available online: https://journals.sagepub.com/doi/10.1177/1042258717748651 (accessed on 9 April 2019). [CrossRef]

- Astrachan, J.H.; Shanker, M.C. Family businesses’ contribution to the US economy: A closer look. Fam. Bus. Rev. 2003, 16, 211–219. [Google Scholar] [CrossRef]

- Instituto de la Empresa Familiar. La Empresa Familiar En España; Instituto de Empresa Familiar: Barcelona, Spain, 2015. [Google Scholar]

- Antolín-López, R.; Céspedes-Lorente, J.; García-De-Frutos, N.; Martínez-Del-Río, J.; Pérez-Valls, M. Fostering product innovation: Differences between new ventures and established firms. Technovation 2015, 41, 25–37. [Google Scholar] [CrossRef]

- Martínez-Ros, E.; Labeaga, J.M. Product and process innovation: Persistence and complementarities. Eur. Manag. Rev. 2009, 6, 64–75. [Google Scholar] [CrossRef]

- Qin, X.; Du, D. Do External or Internal Technology Spillovers Have a Stronger Influence on Innovation Efficiency in China? Sustainability 2017, 9, 1574. [Google Scholar]

- Martínez Romero, M.J.; Rojo Ramírez, A.A. Socioemotional wealth’s implications in the calculus of the minimum rate of return required by family businesses’ owners. Rev. Manag. Sci. 2017, 11, 95–118. [Google Scholar] [CrossRef]

- Manzaneque, M.; Rojo-Ramírez, A.A.; Diéguez-Soto, J.; Martínez-Romero, M.J. How negative aspiration performance gaps affect innovation efficiency. Small Bus. Econ. 2018. [Google Scholar] [CrossRef]

- Cruz, C.; Gómez-Mejia, L.R.; Becerra, M. Perceptions of benevolence and the design of agency contracts: CEO-TMT relationships in family firms. Acad. Manag. J. 2010, 53, 69. [Google Scholar] [CrossRef]

- Kelly, D.; Amburgey, T.L. Organizational inertia and momentum: A dynamic model of strategic change. Acad. Manag. J. 1991, 34, 591–612. [Google Scholar]

- De Massis, A.; Kotlar, J.; Mazzola, P.; Minola, T.; Sciascia, S. Conflicting Selves: Family Owners’ Multiple Goals and Self-Control Agency Problems in Private Firms. Entrep. Theory Pract. 2016, 42, 362–389. [Google Scholar] [CrossRef]

- Brinkerink, J.; Bammens, Y. Family Influence and R&D Spending in Dutch Manufacturing SMEs: The Role of Identity and Socioemotional Decision Considerations. J. Prod. Innov. Manag. 2017. [Google Scholar] [CrossRef]

- Kim, H.; Kim, H.; Lee, P.M. Ownership structure and the relationship between financial slack and R&D investments: Evidence from Korean firms. Organ. Sci. 2008, 19, 404–418. [Google Scholar]

- Hagedoorn, J.; Wang, N. Is there complementarity or substitutability between internal and external R&D strategies? Res. Policy 2012, 41, 1072–1083. [Google Scholar]

- Santamaría, L.; Nieto, M.J.; Barge-Gil, A. Beyond formal R&D: Taking advantage of other sources of innovation in low- and medium-technology industries. Res. Policy 2009, 38, 507–517. [Google Scholar]

- Lucena, A.; Roper, S. Absorptive Capacity and Ambidexterity in R&D: Linking Technology Alliance Diversity and Firm Innovation. Eur. Manag. Rev. 2016, 13, 159–178. [Google Scholar]

- Chen, Z.; Kuo, L. A note on the estimation of the mul-tinomial logit model with random effects. Am. Stat. 2001, 55, 89–95. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Selig, J.P.; Preacher, K.J. Monte Carlo method for assessing mediation: An interactive tool for creating confidence intervals for indirect effects. Available online: http://www.quantpsy.org/medmc/medmc111.htm (accessed on 9 April 2019).

- Hayes, A.F. Introduction to Mediation, Moderation and Conditional Process Analysis; Guilford Press: New York, NY, USA, 2013. [Google Scholar]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Agarwal, R.; Campbell, B.A.; Franco, A.M.; Ganco, M. What Do I Take with Me? the Mediating Effect of Spin-Out Team Size and Tenure on the Founder-Firm Performance Relationship. Acad. Manag. J. 2016, 59, 1060–1087. [Google Scholar] [CrossRef]

- Henssen, B.; Voordeckers, W.; Lambrechts, F.; Koiranen, M. The CEO autonomy-stewardship behavior relationship in family firms: The mediating role of psychological ownership. J. Fam. Bus. Strategy 2014, 5, 312–322. [Google Scholar] [CrossRef]

- Zattoni, A.; Gnan, L.; Huse, M. Does Family Involvement Influence Firm Performance? Exploring the Mediating Effects of Board Processes and Tasks. J. Manag. 2015, 41, 1214–1243. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Lockwood, C.M.; Williams, J. Confidence limits for the indirect effect: Distribution of the product and resampling methods. Multivar. Behav. Res. 2004, 39, 99–128. [Google Scholar] [CrossRef]

- Gujarati, D.; Porter, D. Basic Econometrics, 5th ed.; McGraw-Hill Education: Boston, MA, USA, 2008. [Google Scholar]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Analisis Multivariante; Prentice Hall: Madrid, Spain, 1999. [Google Scholar]

- Ramsey, J.B.; Alexander, A. The econometric approach to business-cycle analysis reconsidered. J. Macroecon. 1984, 6, 347–356. [Google Scholar] [CrossRef]

- Cooper, R.G.; Kleinschmidt, E.J. New products: What separates winners from losers? J. Prod. Innov. Manag. 1987, 4, 169–184. [Google Scholar] [CrossRef]

- Di Benedetto, C.A.; Calantone, R.J.; Van Allen, E.; Montoya-Weiss, M.M. Purchasing joins the NPD team. Res. Technol. Manag. 2003, 46, 45–51. [Google Scholar] [CrossRef]

- Hoy, F. The complicating factor of life cycles in corporate venturing. Entrep. Theory Pract. 2006, 30, 831–836. [Google Scholar] [CrossRef]

- Tagiuri, R.; Davis, J.A. On the goals of successful family businesses. Fam. Bus. Rev. 1992, 5, 43–62. [Google Scholar] [CrossRef]

- Westhead, P. Entrepreneurship & Regional Development: An Ambitions, external environment and strategic factor differences between family and non–family companies. Entrep. Reg. Dev. 1997, 9, 127–158. [Google Scholar]

- Thornhill, S. Knowledge, innovation and firm performance in high- and low-technology regimes. J. Bus. Ventur. 2006, 21, 687–703. [Google Scholar] [CrossRef]

- Zahra, S.A. Entrepreneurial risk taking in family firms. Fam. Bus. Rev. 2005, 18, 23–40. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A.; Zellweger, T.M. Extending the Socioemotional Wealth Perspective: A Look at the Dark Side. Entrep. Theory Pract. 2012, 36, 1175–1182. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A. Feuding Families: When Conflit Does a Family Firm Good. Entrep. Theory Pract. 2004, 28, 209–228. [Google Scholar] [CrossRef]

- Hauck, J.; Suess-Reyes, J.; Beck, S.; Prügl, R.; Frank, H. Measuring socioemotional wealth in family-owned and -managed firms: A validation and short form of the {FIBER} Scale. J. Fam. Bus. Strategy 2016, 7, 133–148. [Google Scholar] [CrossRef]

- Berk, J.B.; Stanton, R.; Zechner, J. Human capital, bankruptcy and capital structure. J. Financ. 2010, 65, 891–926. [Google Scholar] [CrossRef]

- Kammerlander, N.; Ganter, M. An Attention-Based View of Family Firm Adaptation to Discontinuous Technological Change: Exploring the Role of Family CEOs’ Noneconomic Goals. J. Prod. Innov. Manag. 2014, 32, 361–383. [Google Scholar] [CrossRef]

- Kotlar, J.; De Massis, A.; Fang, H.; Frattini, F. Strategic reference points in family firms. Small Bus. Econ. 2014, 43, 597–619. [Google Scholar] [CrossRef]

- Munari, F.; Oriani, R.; Sobrero, M. The effects of owner identity and external governance systems on R&D investments: A study of Western European firms. Res. Policy 2010, 39, 1093–1104. [Google Scholar]

- Brinkerink, J. Broad Search, Deep Search, and the Absorptive Capacity Performance of Family and Nonfamily Firm R&D. Fam. Bus. Rev. 2018, 3, 295–317. [Google Scholar]

| Panel A. Number of Observations/Firms by Size (2015) | ||||

|---|---|---|---|---|

| Initial Sample | Final Sample | |||

| Small firms | 591 | 50.29% | 214 | 47.22% |

| Medium-size firms | 320 | 27.23% | 93 | 20.51% |

| Large firms | 261 | 22.21% | 147 | 32.26% |

| Without classification | 3.867 | |||

| Total | 5.040 | 454 | ||

| Variable | Definition | |

|---|---|---|

| 1 | Product Innovation | Dummy variable that takes the value 1 when, in a particular year, the firm has introduced innovations in product functionalities and/or design |

| 2 | Intramural R&D | Ratio of intramural R&D spending to total sales. |

| 3 | Extramural R&D | Ratio of extramural R&D spending to total sales |

| 4 | Intramural&Extramural R&D | The variable is set 0 if neither intramural nor extramural R&D investments are carried out and also when only intramural or exclusively extramural R&D investments are developed; thus, Intramural&Extramural R&D is truncated on the left. If the firm invests in both intramural and extramural R&D simultaneously, then the ratio of total R&D spending (intramural plus extramural R&D) to total sales is coded as a continuous variable. |

| 5 | Family Management | Continuous variable counting the number of family members involved in the top management team of the firm |

| 6 | Firm age | This value is calculated as follows: the record of the years since a firm’s inception. Natural logarithm. |

| 7 | Firms size | This value is calculated as follows: the record of the book value of the total assets of a firm. Natural logarithm. |

| 8 | ROAt−1 | Return on assets of the year t−1 |

| 9 | Firm leverage | This value is calculated as follows: the total liabilities divided by the total assets. |

| 10 | Liquidity | This value is calculated as follows: the working capital divided by the total assets. |

| 11 | Industry | Dummy variables for each two-digit Nomenclature statistique des activités économiques (NACE) codes to capture the subindustry effects. |

| Panel A. Descriptive Statistics | ||||||||||

| Variable | Mean | SD | ||||||||

| Family Management | 0.704 | 0.971 | ||||||||

| Intramural R&D | 0.005 | 0.017 | ||||||||

| Extramural R&D | 0.003 | 0.018 | ||||||||

| Intramural & Extramural R&D | 0.007 | 0.024 | ||||||||

| Firm age | 33.344 | 22.723 | ||||||||

| Firm size | 1.39 × 108 | 7.54 × 108 | ||||||||

| ROA | 0.11 | 0.155 | ||||||||

| Liquidity | 0.352 | 0.555 | ||||||||

| Leverage | 0.51 | 0.229 | ||||||||

| Panel B. Categorical variables: Frequency | ||||||||||

| Value/number of observations | 0 | 1 | Total | |||||||

| Product Innovation | N | % | N | % | N | |||||

| 5651 | 77.79 | 1613 | 22.21 | 7264 | ||||||

| Panel C. Correlations | ||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| 1. Product Innovation | 1 | |||||||||

| 2. Family Management | −0.052 *** | 1 | ||||||||

| 3. Intramural R&D | 0.229 *** | −0.04 *** | 1 | |||||||

| 4. Extramural R&D | 0.109 *** | −0.038 *** | 0.306 *** | 1 | ||||||

| 5. In&Ex R&D | 0.027 | 0.071 *** | 0.884 *** | 0.82 *** | 1 | |||||

| 6. Firm age | 0.077 *** | −0.031 *** | 0.093 *** | 0.067 *** | 0.024 | 1 | ||||

| 7. Firm size | 0.224 *** | −0.312 *** | 0.157 *** | 0.106 *** | −0.132 *** | 0.325 *** | 1 | |||

| 8. ROA | 0.013 | 0.0165 | −0.0236 ** | 0.005 | −0.045 * | −0.053 *** | 0.013 | 1 | ||

| 9. Liquidity | −0.031 *** | 0.053 *** | 0.029 ** | 0.052 *** | 0.08 *** | 0.073 *** | −0.023 * | −0.114 *** | 1 | |

| 10. Leverage | −0.003 | 0.05 | 0.023 ** | 0.044 *** | 0.094 *** | −0.125 *** | 0.027 ** | −0.079 *** | −0.265 *** | 1 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

|---|---|---|---|---|---|---|---|

| Dependent Variable | Product Innovation | Intramural R&D | Extramural R&D | In&Ex R&D | Product Innovation | Product Innovation | Product Innovation |

| Independent variable/Mediator | |||||||

| Family Management | −0.0771 ** (0.0356) | 0.0004 ** (0.0001) | −0.00002 (0.0002) | 0.0004 ** (0.0002) | −0.079 * (0.0435) | −0.0762 * (0.0357) | −0.0808 * (0.0358) |

| Intramural R&D | 9.5616 *** (1.7751) | ||||||

| Extramural R&D | 12.8205 *** (2.575) | ||||||

| In&Ex R&D | 10.2344 *** (1.457) | ||||||

| Control variables | |||||||

| Firm Age | −0.3472 *** (0.077) | 0.0007 ** (0.0003) | 0.0005 * (0.0003) | 0.005 ** (0.0003) | −0.3469 *** (0.0323) | −0.3529 *** (0.0769) | −0.3626 *** (0.0768) |

| Firm Size | 0.1894 *** (0.0591) | 0.005 *** (0.0001) | 0.0003 ** (0.0001) | 0.0002 *** (0.0001) | 0.1795 *** (0.0584) | 0. 1792 *** (0.0327) | 0.189 *** (0.0316) |

| ROAt−1 | 0.3332 * (0.1821) | 0.0004 (0.001) | 0.004 *** (0.0013) | 0.0024 ** (0.0064) | 0.3797 ** (0.1831) | 0.3533 ** (0.1841) | 0.3360 * (0.1835) |

| Liquidity | −0.0548 (0.0528) | 0.0005 * (0.0003) | 0.0023 *** (0.0003) | 0.0005 * (0.0003) | −0.0643 (0.053) | −0.0666 (0.0534) | −0.0681 (0.0533) |

| Leverage | 0.1083 (0.1687) | 0.0003 (0.0009) | 0.0027 *** (0.001) | 0.0007 * (0.0008) | 0.0796 (0.1689) | 0.0654 (0.1696) | 0.0823 (0.1694) |

| Intramural R&D t−1 | 0.173 *** (0.0074) | 2.8372 *** (1.056) | |||||

| Extramural R&D t−1 | 0.2457 *** (0.0063) | 3.0818 ** (1.0763) | |||||

| In&Ex R&Dt-1 | 0.7766 *** (0.007) | ||||||

| Intercept | −2.9948 *** (0.6629) | −0.0098 *** (0.0026) | −0.0084 *** (0.0025) | −0.0071 *** (0.0019) | −2.8188 *** (0.653) | −2.788 *** (0.6617) | −3.36408 *** (0.5581) |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number of Observations | 6.810 | 6.810 | 6.810 | 6.810 | 6.810 | 6.810 | |

| Number of Firms | 454 | 454 | 454 | 454 | 454 | 454 | 454 |

| Wald chi2 | 129.21 *** (25) | 172.96 (27) | 165.55*** (27) | 171.71 *** (19) | |||

| Log likelihood | −2441.511 | −2419.113 | −2419.435 | −2418.742 | |||

| R2: within | 0.058 | 0.004 | 0.119 | ||||

| between | 0.729 | 0.666 | 0.981 | ||||

| overall | 0.462 | 0.189 | 0.673 | ||||

| Mode l1 | Model 2 | Model 3 | |

|---|---|---|---|

| Dependent variable | Product Innovation | ||

| Independent variable | |||

| Intramural R&D | 9.469 *** (2.9293) | ||

| Extramural R&D | 12.7593 *** (3.4323) | ||

| In&Ex R&D | 10.2302 *** (1.4576) | ||

| Control variables | |||

| Firm Age | −0.3478 *** (0.952) | −0.3537 *** (0.1372) | −0.3642 *** (0.0769) |

| Firm Size | 0.1871 *** (0.0361) | 0.1863 *** (0.0367) | 0.1853 *** (0.0325) |

| ROAt−1 | 0.3926 * (0.2319) | 0.3656 * (0.2311) | 0.3511 ** (0.3329) |

| Liquidity | −0.0655 (0.0691) | −0.0678 (0.0753) | −0.0654 (0.0534) |

| Leverage | 0.0716 (0.2061) | 0.0579 (0.2097) | 0.0973 (0.1696) |

| Intramural R&D t−1 | 2.865 *** (1.7284) | ||

| Extramural R&D t−1 | 2.1206 * (1.4374) | ||

| Intercept | −3.0125 *** (0.7196) | −2.9739 *** (0.7316) | −2.9461*** (0.1128) |

| Industry dummies | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes |

| Number of Observations | 6.810 | 6.810 | 6.810 |

| Number of Firms | 454 | 454 | 454 |

| Wald chi2 | 170.08 *** (26) | 162.94 *** (26) | 171.73 *** (25) |

| Log likelihood | −2421.328 | −2421.703 | −2416.664 |

| Product Innovation | c | a | SE_a | b | SE_b | Z | Effect Ratio | MCMAM 95% CI | |

|---|---|---|---|---|---|---|---|---|---|

| Mediator: Intramural R&D | −0.07902 | 0.00040 | 0.00020 | 9.56161 | 1.77506 | 1.89525 | −0.04858 | 0.00012 | 0.00818 |

| Mediator: Extramural R&D | −0.07616 | −0.00003 | 0.00023 | 12.82048 | 2.57502 | −0.11074 | 0.00421 | −0.00618 | 0.00544 |

| Mediator: In&EX R&D | −0.08079 | 0.00044 | 0.00019 | 10.23443 | 1.45704 | 2.18860 | −0.05561 | 0.00064 | 0.00866 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Diéguez-Soto, J.; Martínez-Romero, M.J. Family Involvement in Management and Product Innovation: The Mediating Role of R&D Strategies. Sustainability 2019, 11, 2162. https://doi.org/10.3390/su11072162

Diéguez-Soto J, Martínez-Romero MJ. Family Involvement in Management and Product Innovation: The Mediating Role of R&D Strategies. Sustainability. 2019; 11(7):2162. https://doi.org/10.3390/su11072162

Chicago/Turabian StyleDiéguez-Soto, Julio, and María J. Martínez-Romero. 2019. "Family Involvement in Management and Product Innovation: The Mediating Role of R&D Strategies" Sustainability 11, no. 7: 2162. https://doi.org/10.3390/su11072162

APA StyleDiéguez-Soto, J., & Martínez-Romero, M. J. (2019). Family Involvement in Management and Product Innovation: The Mediating Role of R&D Strategies. Sustainability, 11(7), 2162. https://doi.org/10.3390/su11072162