Sustainable Competitive Position of Mobile Communication Companies: Comprehensive Perspectives of Insiders and Outsiders

Abstract

1. Introduction

2. Literature Review

3. Methods

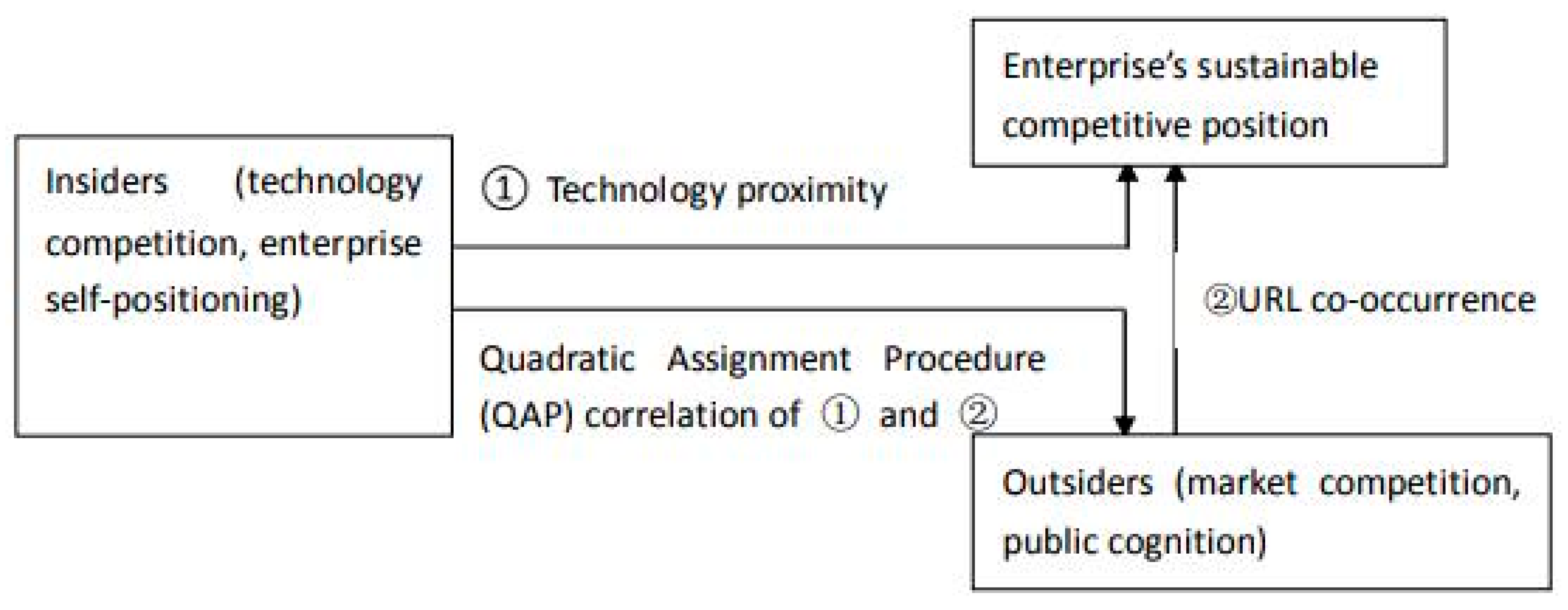

3.1. Conceptual Analysis Framework

3.2. Data Collection

3.3. Analysis of Two Perspectives

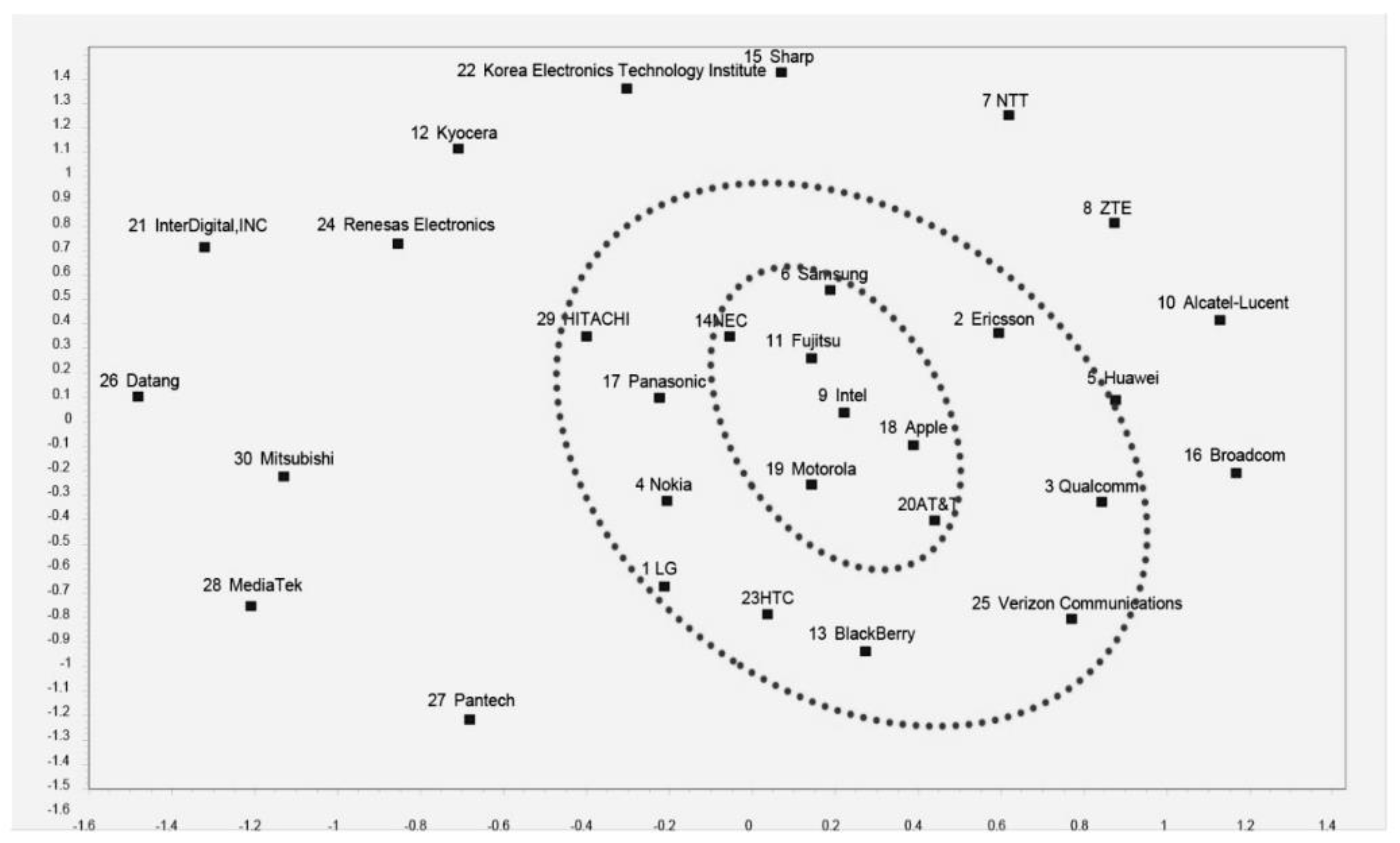

3.3.1. The Perspective of Insiders (Technology Competition, Enterprise Self-Positioning)

3.3.2. The Perspective of Outsiders (Market Competition, Public Cognition)

3.3.3. Panoramic Analysis of Sustainable Competitive Position with Comprehensive Framework Using Huawei as an Example

3.4. Results

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Appleyard, M.M.; Wang, C.Y.; Liddle, J.A.; Carruthers, J. The innovator’s non-dilemma: The case of next-generation lithography. Manag. Decis. Econ. 2008, 29, 407–423. [Google Scholar] [CrossRef]

- Turner, S.F.; Mitchell, W.; Bettis, R.A. Responding to rivals and complements: How market concentration shapes generational product innovation strategy. Organ. Sci. 2010, 21, 854–872. [Google Scholar] [CrossRef]

- Talay, M.B.; Townsend, J.D. Do or die: Competitive effects and red queen dynamics in the product survival race. Ind. Corp. Chang. 2015, 24, 721–738. [Google Scholar] [CrossRef]

- Leiblein, M.J.; Madsen, T.L. Unbundling competitive heterogeneity: Incentive structures and capability influences on technological innovation. Strateg. Manag. J. 2009, 30, 711–735. [Google Scholar] [CrossRef]

- Lerner, J. An empirical exploration of a technology race. Rand J. Econ. 1997, 28, 228–247. [Google Scholar] [CrossRef]

- Kapoor, R.; Adner, R. What firms make vs. what they know: How firms’ production and knowledge boundaries affect competitive advantage in the face of technological change. Organ. Sci. 2012, 23, 1227–1248. [Google Scholar] [CrossRef]

- Barnett, W.P.; Hansen, M.T. The red queen in organizational evolution. Strateg. Manag. J. 1996, 17, 139–157. [Google Scholar] [CrossRef]

- Barnett, W.P.; Sorenson, O. The red queen in organizational creation and development. Ind. Corp. Chang. 2002, 11, 289–325. [Google Scholar] [CrossRef]

- Vaaler, P.M.; McNamara, G. Are technology-intensive industries more dynamically competitive? No and yes. Organ. Sci. 2010, 21, 271–289. [Google Scholar] [CrossRef]

- Costa, L.A.; Cool, K.; Dierickx, I. The competitive implications of the deployment of unique resources. Strateg. Manag. J. 2013, 34, 445–463. [Google Scholar] [CrossRef]

- Peteraf, M.A.; Bergen, M.E. Scanning dynamic competitive landscapes: A market-based and resource-based framework. Strateg. Manag. J. 2003, 24, 1027–1041. [Google Scholar] [CrossRef]

- Bing, L. Research on the competitor scouting & monitoring based on patent information analysis. In Proceedings of the International Conference on Engineering and Business Management, Chengdu, China, 25–27 March 2010; pp. 4992–4996. [Google Scholar]

- Akihiro, L.G.; Inoue, A. Building market structures from consumer references. J. Mark. Res. 1996, 33, 293–306. [Google Scholar]

- Mohammed, I.; Guillet, B.D.; Law, R. Competitor set identification in the hotel industry: A case study of a full-service hotel in Hong Kong. Int. J. Hosp. Manag. 2014, 39, 29–40. [Google Scholar] [CrossRef]

- Vaughan, L.; Gao, Y.J.; Kipp, M. Why are hyperlinks to business websites created? a content analysis. Scientometrics 2006, 67, 291–300. [Google Scholar] [CrossRef]

- Vaughan, L.; You, J. Comparing business competition positions based on web co-link data: The global market vs the Chinese market. Scientometrics 2006, 68, 611–628. [Google Scholar] [CrossRef]

- Thelwall, M.; Sud, P.; Wilkinson, D. Link and co-inlink network diagrams with Url citations or title mentions. J. Am. Soc. Inf. Sci. Technol. 2012, 63, 805–816. [Google Scholar] [CrossRef]

- Chen, M.J. Competitor analysis and interfirm rivalry: Toward a theoretical integration. Acad. Manag. Rev. 1996, 21, 100–134. [Google Scholar] [CrossRef]

- Markman, G.D.; Gianiodis, P.T.; Buchholtz, A.K. Factor-market rivalry. Acad. Manag. Rev. 2009, 34, 423–441. [Google Scholar] [CrossRef]

- Gimeno, J.; Chen, M.J.; Bae, J. Dynamics of competitive repositioning: A multidimensional approach. Adv. Strateg. Manag. 2006, 23, 399–444. [Google Scholar]

- Gimeno, J.; Woo, C.Y. Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation. Organ. Sci. 1996, 7, 322–341. [Google Scholar] [CrossRef]

- Gimeno, J.; Jeong, E. Multimarket contact: Meaning and measurement at multiple levels of analysis. Adv. Strateg. Manag. 2001, 18, 357–408. [Google Scholar]

- Lee, W.S.; Han, E.J.; Sohn, S.Y. Predicting the pattern of technology convergence using big-data technology on large-scale triadic patents. Technol. Forecast. Soc. Chang. 2015, 100, 317–329. [Google Scholar] [CrossRef]

- Barirani, A.; Beaudry, C.; Agard, B. Distant recombination and the creation of basic inventions: An analysis of the diffusion of public and private sector nanotechnology patents in Canada. Technovation 2015, 20, 39–52. [Google Scholar] [CrossRef]

- Ko, N.; Yoon, J.; Seo, W. Analyzing interdisciplinarity of technology fusion using knowledge flows of patents. Expert Syst. Appl. 2014, 41, 1955–1963. [Google Scholar] [CrossRef]

- Jaffe, A.B. Technological opportunity and spillovers of R&D: Evidence from firms’ patents, profits, and market value. Am. Econ. Rev. 1986, 5, 984–1001. [Google Scholar]

- Kwon, S.; Porter, A.; Youtie, J. Navigating the innovation trajectories of technology by combining specialization score analyses for publications and patents: Graphene and nano-enabled drug delivery. Scientometrics 2016, 106, 1057–1071. [Google Scholar] [CrossRef]

- No, H.J.; An, Y.; Park, Y. A structured approach to explore knowledge flows through technology-based business methods by integrating patent citation analysis and text mining. Technol. Forecast. Soc. Chang. 2015, 97, 181–192. [Google Scholar] [CrossRef]

- Caviggioli, F. Technology fusion: Identification and analysis of the drivers of technology convergence using patent data. Technovation 2016, 5, 22–32. [Google Scholar] [CrossRef]

- Jee, S.J.; Sohn, S.Y. Patent network based conjoint analysis for wearable device. Technol. Forecast. Soc. Chang. 2015, 100, 317–329. [Google Scholar] [CrossRef]

- Choi, J.; Hwang, Y.S. Patent keyword network analysis for improving technology development efficiency. Technol. Forecast. Soc. Chang. 2014, 83, 170–182. [Google Scholar] [CrossRef]

- Jeong, Y.; Yoon, B. Development of patent roadmap based on technology roadmap by analyzing patterns of patent development. Technovation 2015, 101, 338–346. [Google Scholar] [CrossRef]

- Yoon, J.; Park, H.; Kim, K. Identifying technological competition trends for R&D planning using dynamic patent maps: SAO-based content analysis. Scientometrics 2013, 94, 313–331. [Google Scholar]

- Momeni, A.; Rost, K. Identification and monitoring of possible disruptive technologies by patent-development paths and topic modeling. Technol. Forecast. Soc. Chang. 2016, 104, 16–29. [Google Scholar] [CrossRef]

- Vaughan, L. Web hyperlinks reflects business performance: A study of US and Chinese IT companies. Can. J. Inf. Libr. Sci. 2004, 28, 17–31. [Google Scholar]

- Thelwall, M.; Sud, P. A comparison of methods for collecting web citation data for academic organizations. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1488–1497. [Google Scholar] [CrossRef]

- Scherer, F.M. Industrial technology flows in the United States. Res. Policy 1982, 11, 227–245. [Google Scholar] [CrossRef]

- Borgatti, S.P.; Everett, M.G.; Freeman, L.C. Ucinet for Windows: Software for Social Network Analysis. 2002. Available online: http://www.citeulike.org/group/11708/article/6031268 (accessed on 1 April 2019).

- Thelwall, M.; Sud, P. Webometric research with the Bing Search API 2.0. J. Inform. 2012, 6, 44–52. [Google Scholar] [CrossRef]

- Farzin, Y.H.; Huisman, K.J.; Kort, P.M. Optimal timing of technology adoption. J. Econ. Dyn. Control 1998, 22, 779–799. [Google Scholar] [CrossRef]

- Eggers, J.P. Competing technologies and industry evolution: The benefits of making mistakes in the flat panel display industry. Strateg. Manag. J. 2014, 35, 159–178. [Google Scholar] [CrossRef]

- Mitchell, W. Whether and when? Probability and timing of incumbents’ entry into emerging industrial subfields. Admin. Sci. Q. 1989, 34, 208–230. [Google Scholar] [CrossRef]

- Qian, L.; Wang, I.K. Competition and innovation: The tango of the market and technology in the competitive landscape. Manag. Decis. Econ. 2017, 38, 1237–1247. [Google Scholar] [CrossRef]

| Serial No. | Number of Patents | Name of Enterprises | Serial No. | Number of Patents | Name of Enterprises | Serial No. | Number of Patents | Name of Enterprises |

|---|---|---|---|---|---|---|---|---|

| 1 | 2898 | LG | 11 | 666 | Fujitsu | 21 | 341 | InterDigital |

| 2 | 2489 | Ericsson | 12 | 655 | Kyocera | 22 | 322 | Electronics and Telecommunications Research Institute |

| 3 | 2542 | Qualcomm | 13 | 617 | BlackBerry | 23 | 297 | HTC |

| 4 | 1805 | Nokia | 14 | 589 | NEC | 24 | 271 | Renesas Electronics |

| 5 | 1574 | Huawei | 15 | 569 | Sharp | 25 | 268 | Verizon Communications |

| 6 | 1560 | Samsung | 16 | 481 | Broadcom | 26 | 263 | Datang |

| 7 | 1335 | NTT | 17 | 389 | Panasonic | 27 | 196 | Pantech |

| 8 | 1227 | ZTE | 18 | 359 | Apple | 28 | 167 | MediaTek |

| 9 | 907 | Intel | 19 | 357 | Motorola | 29 | 113 | Hitachi |

| 10 | 902 | Alcatel | 20 | 350 | AT&T | 30 | 110 | Mitsubishi |

| No. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.00 | 0.88 | 0.93 | 0.83 | 0.84 | 0.98 | 0.89 | 0.87 | 0.974 | 0.85 |

| 2 | 0.88 | 1.00 | 0.99 | 0.99 | 1.00 | 0.94 | 0.93 | 1.00 | 0.957 | 1.00 |

| 3 | 0.93 | 0.99 | 1.00 | 0.97 | 0.97 | 0.97 | 0.95 | 0.98 | 0.984 | 0.98 |

| 4 | 0.83 | 0.99 | 0.97 | 1.00 | 0.99 | 0.91 | 0.92 | 0.98 | 0.927 | 0.99 |

| 5 | 0.84 | 1.00 | 0.97 | 0.99 | 1.00 | 0.92 | 0.92 | 1.00 | 0.932 | 0.99 |

| 6 | 0.98 | 0.94 | 0.97 | 0.91 | 0.92 | 1.00 | 0.91 | 0.94 | 0.994 | 0.92 |

| 7 | 0.89 | 0.93 | 0.95 | 0.92 | 0.92 | 0.91 | 1.00 | 0.93 | 0.928 | 0.92 |

| 8 | 0.87 | 1.00 | 0.98 | 0.98 | 1.00 | 0.94 | 0.93 | 1.00 | 0.947 | 0.99 |

| 9 | 0.974 | 0.957 | 0.984 | 0.927 | 0.932 | 0.994 | 0.928 | 0.947 | 1.00 | 0.943 |

| 10 | 0.85 | 1.00 | 0.98 | 0.99 | 0.99 | 0.92 | 0.92 | 0.99 | 0.943 | 1.00 |

| 11 | 0.89 | 0.98 | 0.98 | 0.97 | 0.97 | 0.94 | 0.98 | 0.98 | 0.954 | 0.98 |

| 12 | 0.847 | 0.909 | 0.919 | 0.9 | 0.896 | 0.869 | 0.987 | 0.907 | 0.887 | 0.9 |

| 13 | 0.87 | 0.99 | 0.98 | 0.99 | 0.99 | 0.94 | 0.94 | 0.99 | 0.953 | 0.99 |

| 14 | 0.89 | 0.97 | 0.975 | 0.959 | 0.96 | 0.929 | 0.989 | 0.967 | 0.945 | 0.963 |

| 15 | 0.941 | 0.915 | 0.956 | 0.881 | 0.886 | 0.937 | 0.974 | 0.902 | 0.95 | 0.901 |

| 16 | 0.926 | 0.872 | 0.905 | 0.846 | 0.839 | 0.941 | 0.802 | 0.859 | 0.943 | 0.853 |

| 17 | 0.952 | 0.957 | 0.985 | 0.927 | 0.934 | 0.967 | 0.969 | 0.946 | 0.979 | 0.945 |

| 18 | 0.927 | 0.97 | 0.974 | 0.958 | 0.957 | 0.974 | 0.896 | 0.964 | 0.978 | 0.959 |

| 19 | 0.916 | 0.994 | 0.996 | 0.978 | 0.983 | 0.965 | 0.941 | 0.987 | 0.978 | 0.989 |

| 20 | 0.753 | 0.89 | 0.883 | 0.931 | 0.883 | 0.815 | 0.861 | 0.875 | 0.849 | 0.909 |

| 21 | 0.90 | 0.98 | 0.97 | 0.96 | 0.97 | 0.96 | 0.89 | 0.97 | 0.962 | 0.97 |

| 22 | 0.961 | 0.923 | 0.944 | 0.887 | 0.9 | 0.985 | 0.852 | 0.923 | 0.974 | 0.898 |

| 23 | 0.82 | 0.981 | 0.965 | 0.98 | 0.976 | 0.886 | 0.941 | 0.978 | 0.914 | 0.982 |

| 24 | 0.777 | 0.958 | 0.933 | 0.963 | 0.962 | 0.849 | 0.937 | 0.962 | 0.869 | 0.957 |

| 25 | 0.727 | 0.888 | 0.879 | 0.936 | 0.882 | 0.8 | 0.808 | 0.87 | 0.834 | 0.909 |

| 26 | 0.82 | 0.99 | 0.96 | 0.98 | 0.99 | 0.89 | 0.92 | 0.99 | 0.909 | 0.98 |

| 27 | 0.989 | 0.802 | 0.87 | 0.744 | 0.757 | 0.948 | 0.844 | 0.791 | 0.931 | 0.767 |

| 28 | 0.897 | 0.989 | 0.985 | 0.975 | 0.98 | 0.949 | 0.951 | 0.99 | 0.959 | 0.979 |

| 29 | 0.918 | 0.966 | 0.983 | 0.947 | 0.943 | 0.945 | 0.967 | 0.955 | 0.97 | 0.962 |

| 30 | 0.9 | 0.922 | 0.943 | 0.901 | 0.906 | 0.912 | 0.998 | 0.915 | 0.926 | 0.91 |

| No. | 1 | 2 | 3 | 30 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 256 | 184 | 99 | 639 | 330 | 498 | 60 | 349 | 288 | 83 |

| 2 | 256 | 0 | 563 | 78 | 554 | 469 | 611 | 126 | 419 | 503 | 468 |

| 3 | 184 | 563 | 0 | 42 | 383 | 423 | 579 | 59 | 210 | 493 | 258 |

| 4 | 639 | 554 | 383 | 151 | 0 | 549 | 191 | 128 | 477 | 492 | 422 |

| 5 | 330 | 469 | 423 | 27 | 549 | 0 | 512 | 141 | 142 | 372 | 384 |

| 6 | 498 | 611 | 579 | 263 | 191 | 512 | 0 | 145 | 522 | 371 | 371 |

| 7 | 60 | 126 | 59 | 15 | 128 | 141 | 145 | 0 | 74 | 193 | 80 |

| 8 | 349 | 419 | 210 | 3 | 477 | 142 | 522 | 74 | 0 | 439 | 226 |

| 9 | 288 | 503 | 493 | 194 | 492 | 372 | 371 | 193 | 439 | 0 | 493 |

| 10 | 83 | 468 | 258 | 7 | 422 | 384 | 371 | 80 | 226 | 493 | 0 |

| 11 | 557 | 522 | 449 | 543 | 509 | 609 | 440 | 252 | 659 | 362 | 557 |

| 12 | 50 | 114 | 98 | 187 | 83 | 336 | 27 | 47 | 200 | 37 | 50 |

| 13 | 528 | 242 | 277 | 322 | 379 | 640 | 50 | 135 | 427 | 155 | 528 |

| 14 | 254 | 518 | 483 | 599 | 451 | 631 | 287 | 216 | 708 | 250 | 254 |

| 15 | 91 | 80 | 45 | 88 | 53 | 361 | 22 | 54 | 137 | 25 | 91 |

| 16 | 118 | 325 | 519 | 367 | 264 | 485 | 50 | 151 | 547 | 167 | 118 |

| 17 | 596 | 455 | 344 | 650 | 409 | 723 | 182 | 166 | 660 | 169 | 596 |

| 18 | 548 | 562 | 406 | 447 | 549 | 142 | 454 | 389 | 635 | 399 | 548 |

| 19 | 660 | 581 | 511 | 568 | 504 | 596 | 125 | 514 | 607 | 380 | 660 |

| 20 | 359 | 475 | 516 | 517 | 397 | 413 | 229 | 208 | 730 | 412 | 359 |

| 21 | 7 | 88 | 79 | 63 | 71 | 66 | 11 | 32 | 84 | 51 | 7 |

| 22 | 17 | 170 | 161 | 182 | 126 | 400 | 20 | 80 | 272 | 78 | 17 |

| 23 | 715 | 189 | 341 | 680 | 229 | 704 | 44 | 337 | 563 | 68 | 715 |

| 24 | 43 | 122 | 168 | 148 | 102 | 372 | 61 | 52 | 424 | 41 | 43 |

| 25 | 257 | 382 | 369 | 100 | 244 | 525 | 106 | 96 | 483 | 263 | 257 |

| 26 | 4 | 31 | 8 | 8 | 31 | 8 | 14 | 44 | 6 | 4 | 4 |

| 27 | 55 | 32 | 19 | 88 | 28 | 119 | 9 | 22 | 22 | 6 | 55 |

| 28 | 1 | 25 | 34 | 35 | 17 | 33 | 6 | 12 | 51 | 3 | 1 |

| 29 | 340 | 337 | 240 | 446 | 246 | 610 | 105 | 125 | 663 | 131 | 340 |

| 30 | 99 | 78 | 42 | 151 | 27 | 263 | 15 | 3 | 194 | 7 | 99 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, J.; Wang, J.; Szmedra, P. Sustainable Competitive Position of Mobile Communication Companies: Comprehensive Perspectives of Insiders and Outsiders. Sustainability 2019, 11, 1981. https://doi.org/10.3390/su11071981

Ma J, Wang J, Szmedra P. Sustainable Competitive Position of Mobile Communication Companies: Comprehensive Perspectives of Insiders and Outsiders. Sustainability. 2019; 11(7):1981. https://doi.org/10.3390/su11071981

Chicago/Turabian StyleMa, Junwei, Jianhua Wang, and Philip Szmedra. 2019. "Sustainable Competitive Position of Mobile Communication Companies: Comprehensive Perspectives of Insiders and Outsiders" Sustainability 11, no. 7: 1981. https://doi.org/10.3390/su11071981

APA StyleMa, J., Wang, J., & Szmedra, P. (2019). Sustainable Competitive Position of Mobile Communication Companies: Comprehensive Perspectives of Insiders and Outsiders. Sustainability, 11(7), 1981. https://doi.org/10.3390/su11071981