5.1. Data

We obtained our data from the Chinese Industrial Enterprises Database (CIED) which is constructed using firm-level surveys conducted by China’s National Bureau of Statistics (CNBS). The survey included all industrial firms with sales above 5 million RMB, which is called “above scale”. Detailed introduction about CIED could be seen in Nie et al. [

37]. The purpose of this paper is to measure and decompose the productivity of energy supply in China, thus we only focus on energy supply firms. The CIED contains rich information on inputs (such as capital, labor, immediate inputs) and value-added in coal mining firms, and thus could be relied on to measure productivity of energy supply. The empirical analysis is restricted to the coal mining sector for the following reasons:

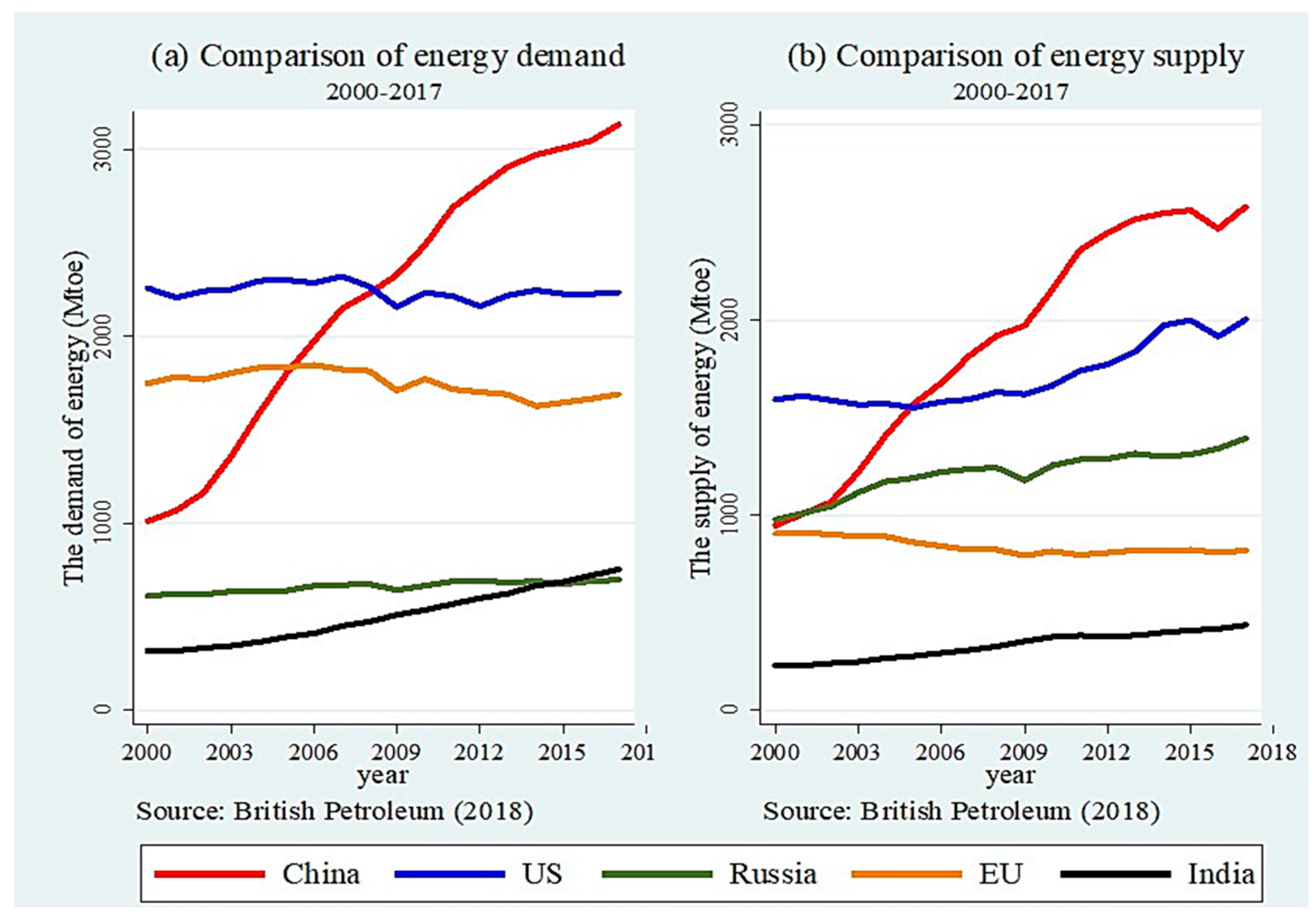

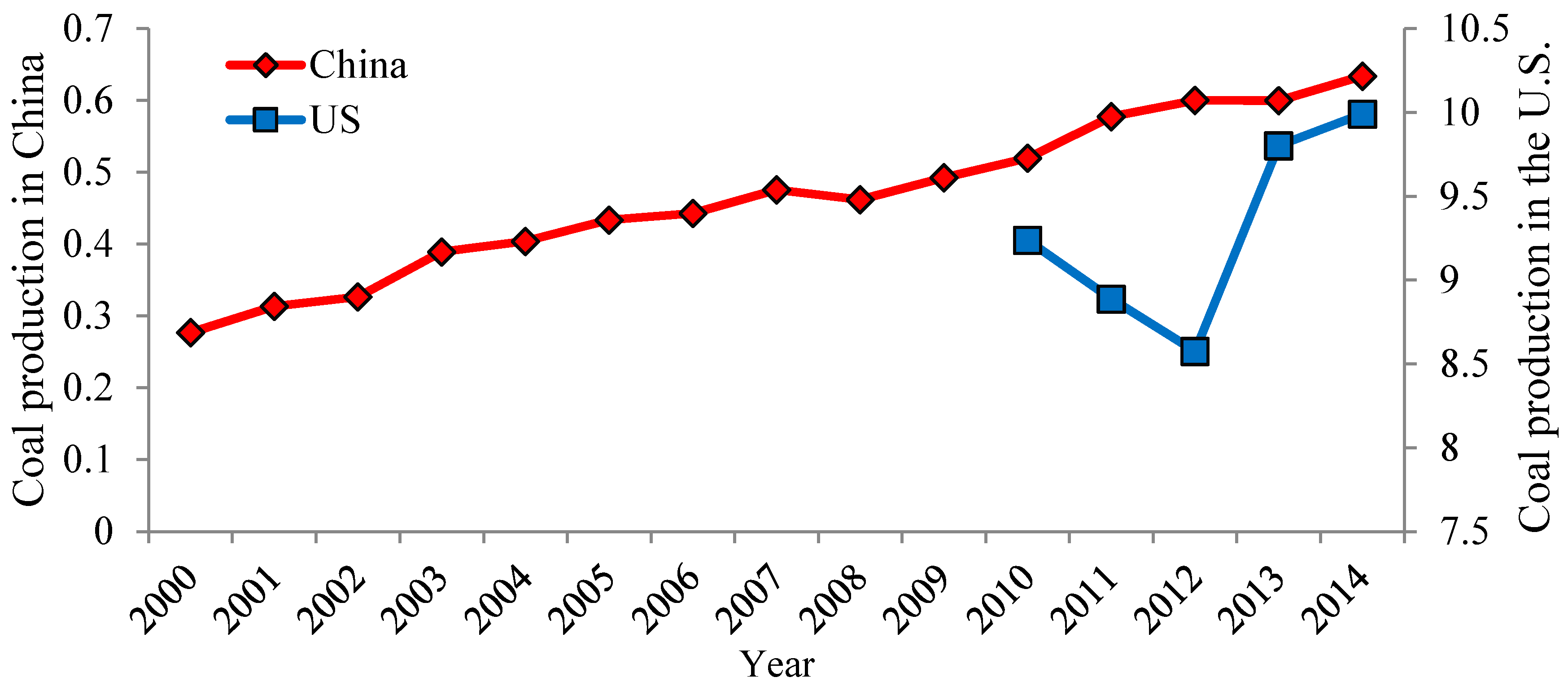

First, as we have shown in

Section 1, coal accounts for more than 70% of China’s energy supply, thus coal mining firms are representative for China’s energy suppliers. Second, there is a large difference between the number of coal mining firms and oil/natural gas producers. Take 2006 as an example, the number of above scale coal mining firms was 5371, while the total number of oil/natural gas producers was only 190. Third, oil and gas industries are much more monopolistic than coal mining industry, so that they are not comparable in empirical analysis.

As most literature using CIED, the sample periods are 1998–2007 [

37], because value-added data is not available after 2007 and the statistical scope of CEID has been changed to “industrial firms with sales above 20 million RMB” since 2007. Between 1998 and 2007, there are 25,627 observations in total.

Some firms have been dropped because their missing or negative observations for fixed-asset, total industrial output value, industrial value added, or intermediate input. Similar to Brandt et al. [

3], we further dropped all firms with less than eight employees. Collectively, 186 observations were eliminated, accounting for 0.7% of all 25,627 observations. The value added of coal mining firms was deflated to 1998’s constant price using the producer price index, the capital stock and investment were deflated using fixed investment price index. Producer price index and fixed investment price index were obtained from the China Premium Database.

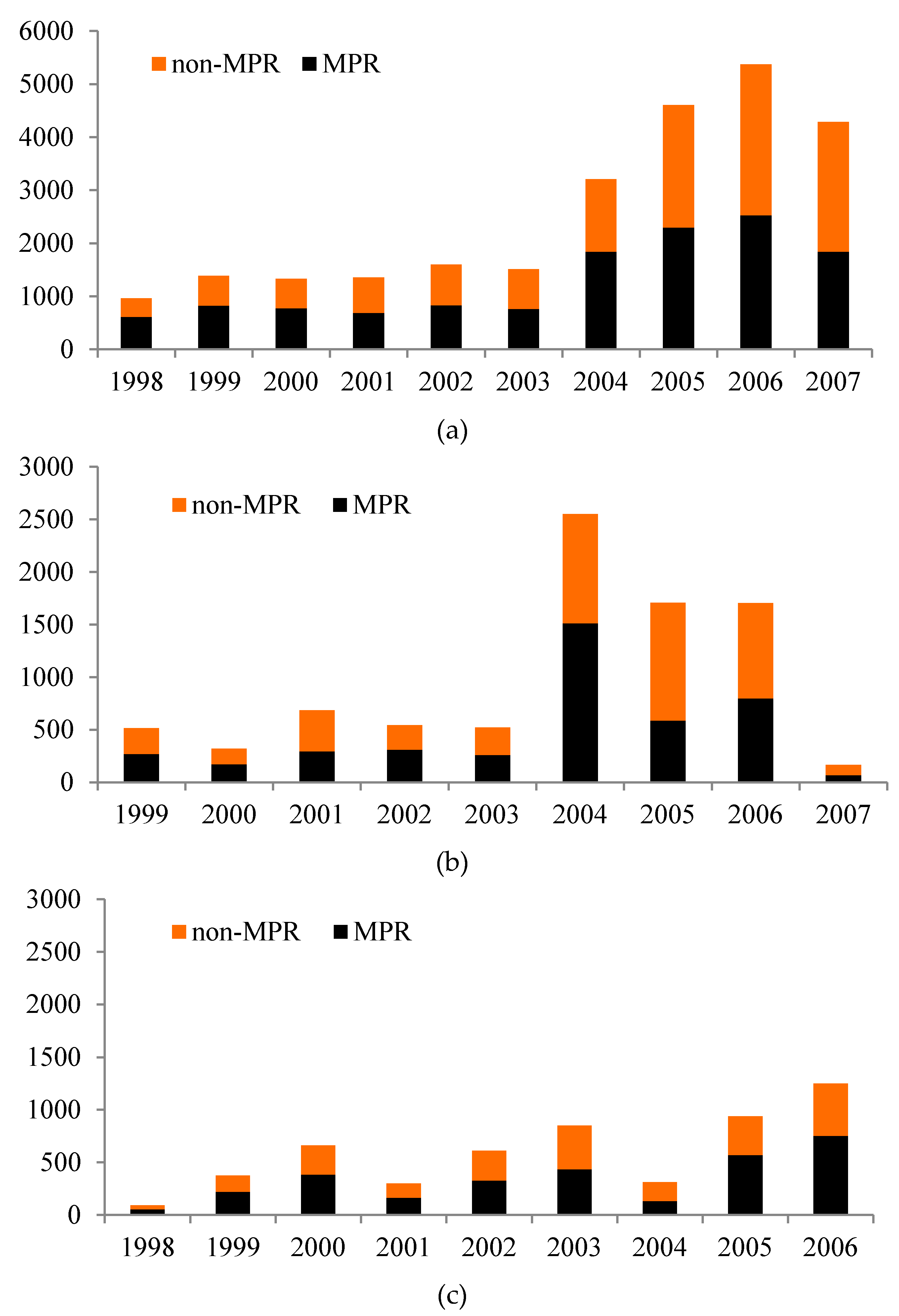

Figure 3 is the number of coal mining firms in China during the sample periods. The number of entrants and exiters are also presented. It should be noted that a substantial part of China’s coal production is concentrated in several provinces, such as Shanxi. In order to incorporate the potential heterogeneity, we divide the observations into two subsamples: (1) main production region (MPR), including Shanxi, Inner-Mongolia, Shandong, Shannxi, and Henan provinces, which accounted for 56.3% of China’s coal production during the sample periods; (2) non-main production region (non-MPR), including the other provinces in China, which supplied the remaining 43.7% of coal production. As shown in

Figure 3a, number of coal mining firms expanded rapidly after 2003, while decreased substantially in 2007 in both MPR and non-MPR.

Figure 3b,c reports entry and exit in MPR and non-MPR. Noteworthy is the sharp increase of coal mining entrants after 2003, which coincides timely with the boom in coal prices. While the number of entrants in 2007 dropped suddenly, which might be induced by the government’s tightening market access since 2007. Correspondingly, exiters of coal mining firms increased substantially in 2007 because of the coal industry’s integration.

5.2. Results and Discussion

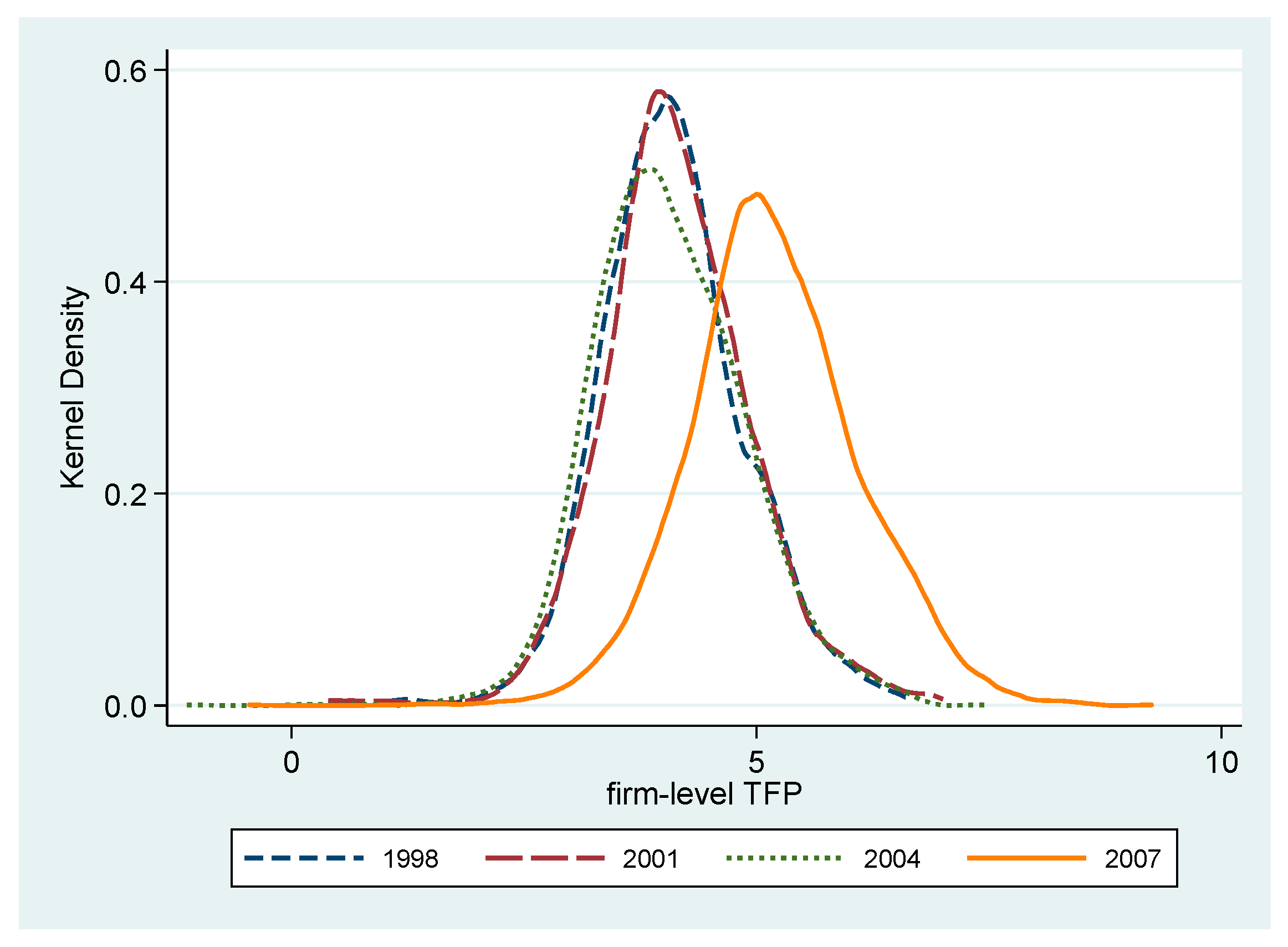

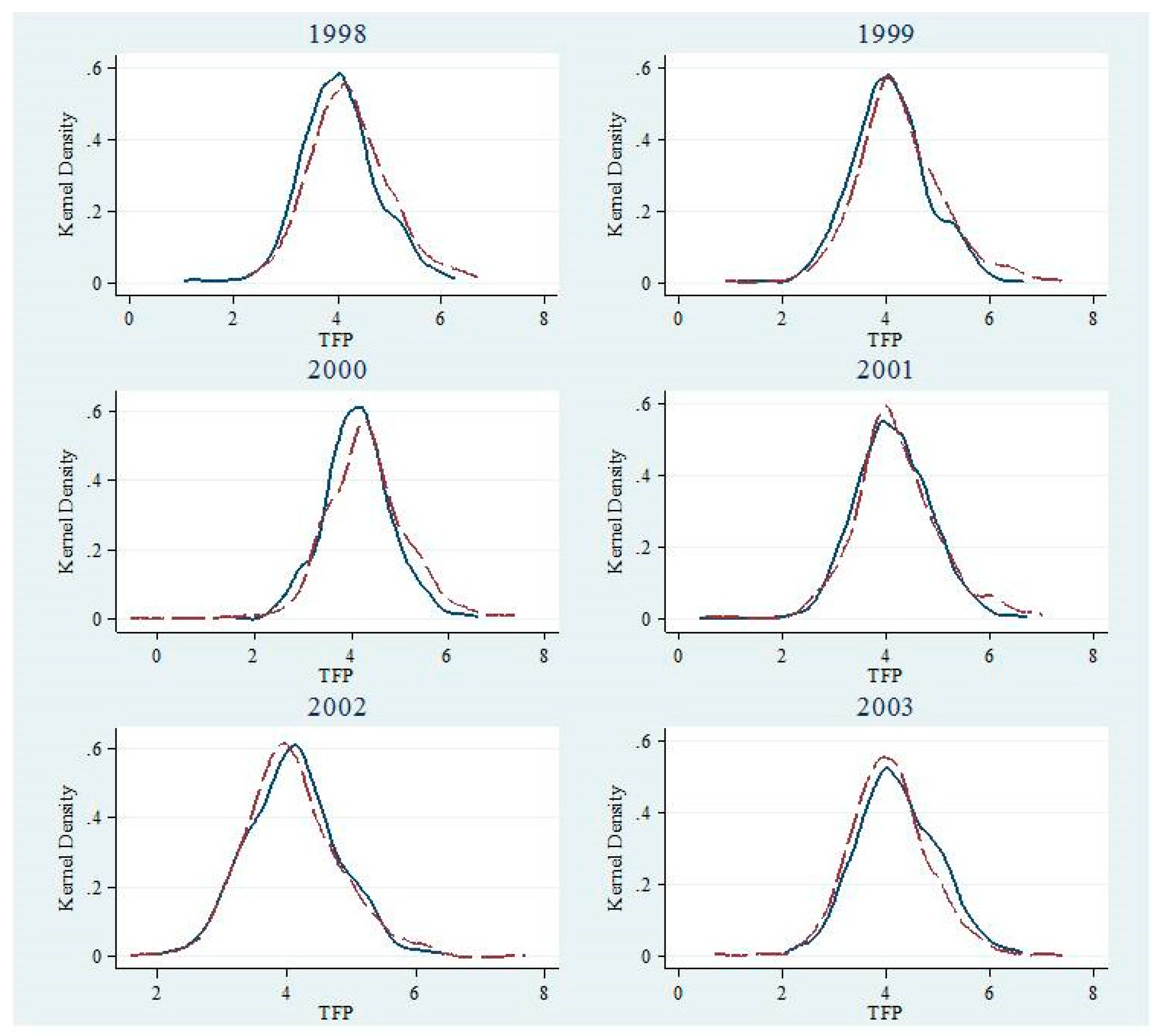

There are thousands of TFPs at firm-level for each year. In order to present the picture about TFP distribution over years in coal mining firms,

Figure 4 shows the kernel distributions of TFP of each firm by year. Compared to 1998 and 2001, TFP in 2004 was slightly left distributed; and the distribution shifted significantly towards the right in 2007.

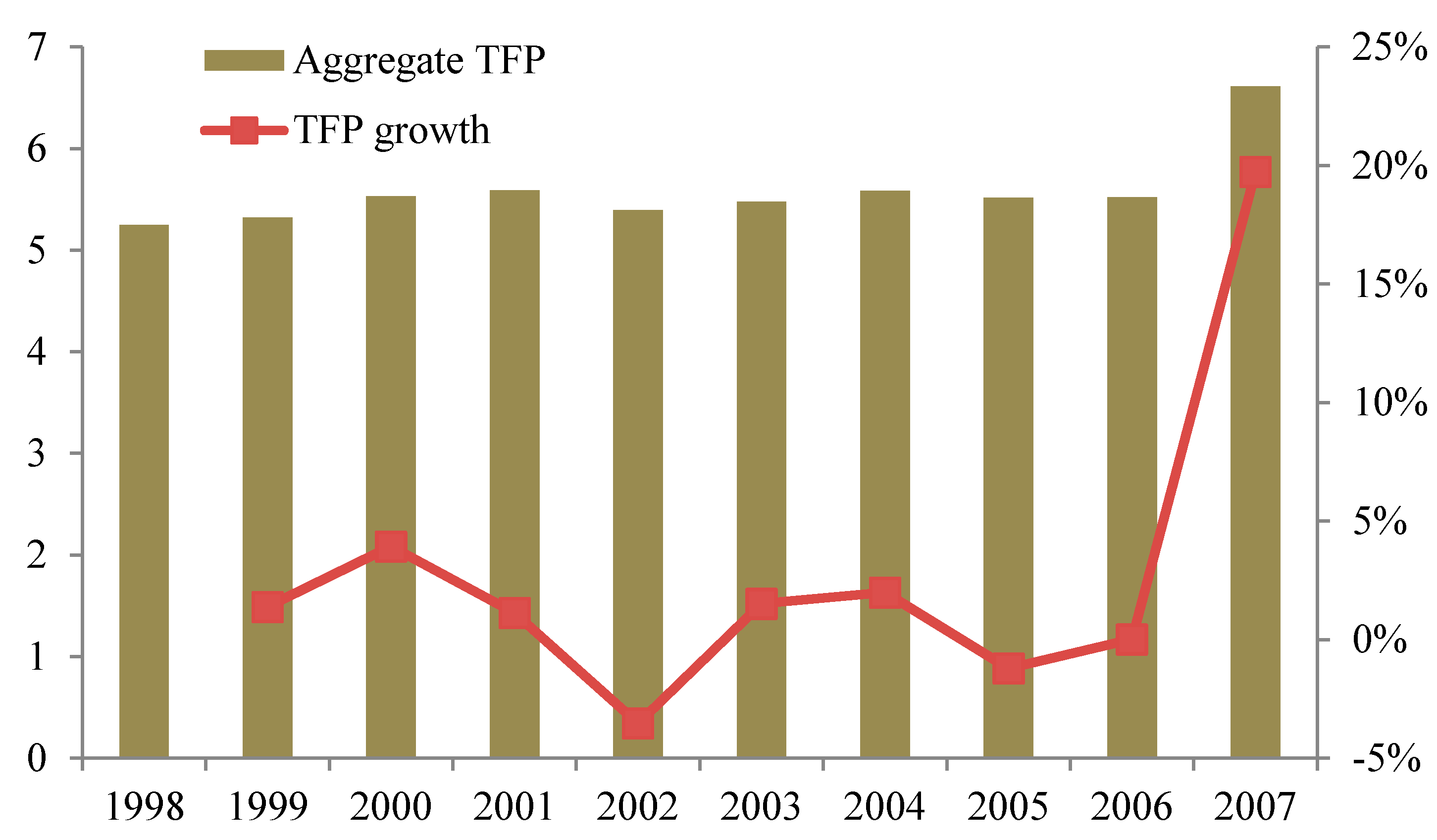

Based on Equation (8), we further calculated the aggregate TFP using value-added weights. The aggregate TFP and its growth rate are depicted in

Figure 5. Physical outputs have been expanded rapidly in coal supply, with annual growth rates of 8.4%. Here we found that the TFP growth of coal supply in China was only 2.6%. This implies that in China more attention should be paid to improving the productivity in energy supply, rather than expanding capital and labor inputs. Noteworthy is the sharp increase of aggregate TFP in 2007, which would be explained explicitly later.

In order to investigate the driving forces of China’s energy supply productivity, aggregate TFP was decomposed. Particularly, we focused on the impacts of entry and exit of coal mining firms on productivity changes, as shown in

Table 3. For comparison, the results from the BHC, GR, FHK, and DOPD decompositions are all reported. For each decomposition, summing the contributions of three groups (surviving, entering, and exiting firms) would obtain the same aggregate TFP change listed in the left column of “All firms”. For BHC decomposition, it was easy to verify the measurement bias that we previously mentioned in the

Appendix A: recall the last two terms of Equation (A1), the effects of entrants in BHC would always be positive, regardless of the productivity of entrants; while the effects of exiters in BHC would always be negative even if the productivity of exiters might be higher. For GR, FHK, and DOPD, the decomposition results are similar. Overall, the decomposition results of GR, FHK, and DOPD suggest that entrants after 2003 have generated negative effects on aggregate TFP changes; while the exiters have had a positive effects.

The dynamic change of aggregate TFP over the years might be explained by the entry and exit of coal mining firms, especially the entry and exit of non-state-owned enterprise (non-SOE).

Table 4 presents the numbers of entrants and exiters of state-owned enterprise (SOE) and non-SOE over the years. Induced by the boom of coal price after 2003, there are 2551 entrants for coal mining in 2004, only 13% (334/2551) of them are state-owned. Similar situation appears in 2005 and 2006. At the same time, more non-SOEs have exited coal production.

The entry and exit of non-SOE generate substantial impact on aggregate TFP changes. Unlike the manufacturing sector, most of non-state-owned entrants are small coal mines employing relatively outdated equipment. This has negative effects on aggregate TFP. Thus, SOE might have higher TFP compared to non-SOE.

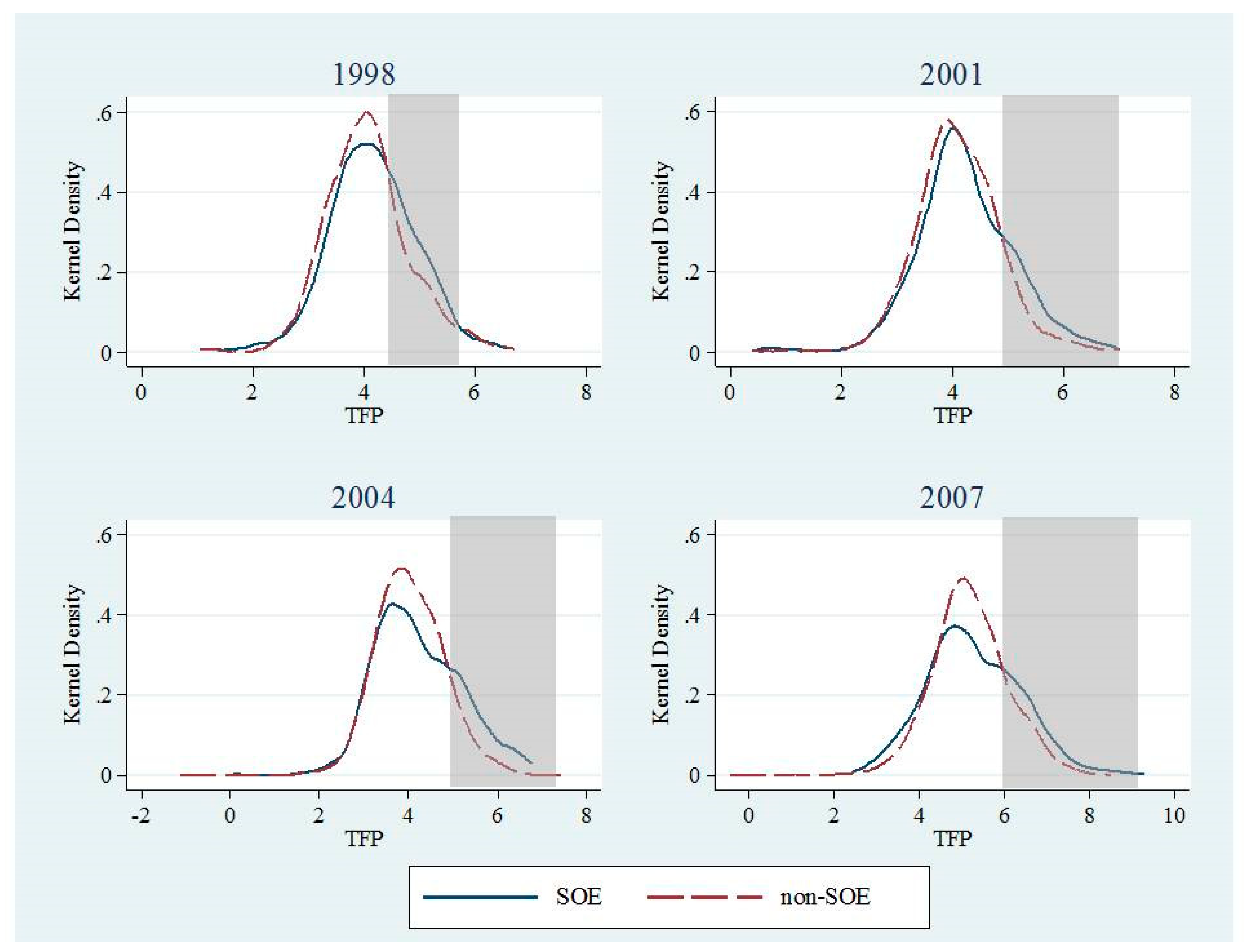

Figure 6 compares the TFP distribution of SOE and non-SOE for coal mining. As shown in

Figure 6, TFP of non-SOE were more left-shifted, indicating lower productivity of non-SOE.

Table 5 provides statistics for TFP differences between SOE and non-SOE using Bonferroni test. The SOE had higher TFP compared to non-SOE, and the differences were statistically significant at 5% level in most cases. Most of entrants induced by the coal price boom after 2003 are non-SOE, and thus the contribution of massive entry after 2003 would be negative.

The year 2007 is noteworthy; the Chinese government became devoted to enhancing coal industrial concentration in 2007, thus many coal mines were forced to exit the market. In 2007, 1249 firms exited, among them only 148 firms were state-owned while the remaining 1101 firms were non-SOE. The effect of the 2007 exit was negative, implying that the integration of coal mining industry in 2007 was not based on productivity, some non-SOE with higher productivity might have been integrated.

Then, how to interpret the rapid increase of productivity in 2007? The results in

Table 3 show that it should be attributed mostly to surviving firms. Thus, we separately present the within and between firm components for surviving firms in

Table 6. There is no clear direction for the contributions of within and between components. Empirically, however,

Table 6 shows that the rapid increase of aggregate TFP in 2007 was mainly induced by within-firm growth, rather than between-firm reallocation. This further supports that coal industry integration in 2007 was not based on productivity, which would result in growth by between-firm reallocation. On the contrary, policy intervention might distort the choice of market integration.

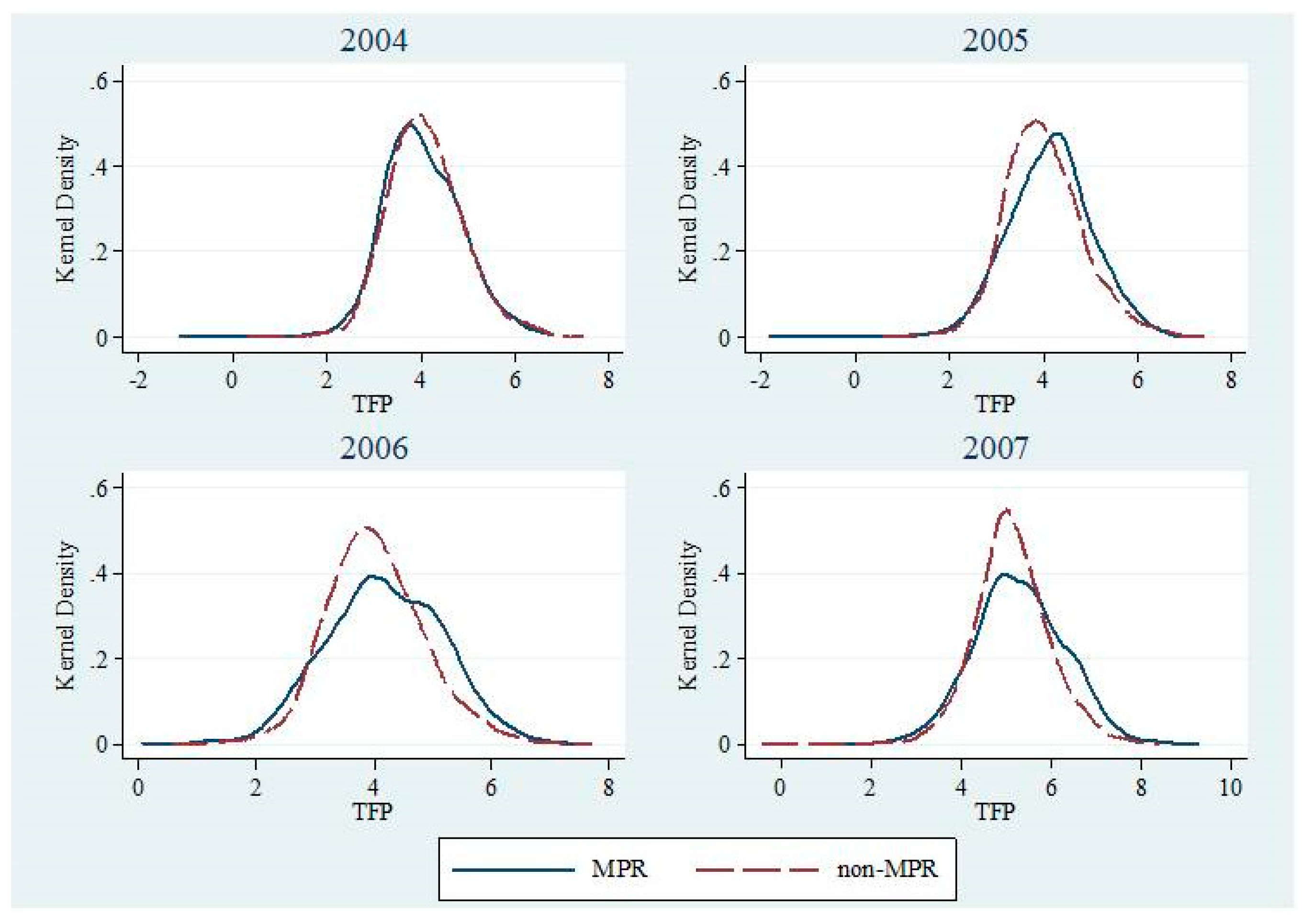

In order to further analyze the contributions of entries and exits by regions, we compared TFP distribution of MPR and non-MPR over the years, as shown in

Figure 7. Interestingly, before 2003 the productivity at firm-level in non-MPR was higher than that in MPR, but the situation reversed after 2004.

We argue that the reversal might also be partly attributed to the differences of entries and exits between MPR and non-MPR.

Table 7 reports the number of entrants and exiters by MPR and non-MPR. First, the data show that there were much more entrants in non-MPR in 2005 and 2006. The massive entrants were small coal mines, which were induced by the increased coal prices. Thus, the TFP of these entrants were lower. These entrants decreased the TFP in non-MPR. Columns (1) and (2) of

Table 8 support this explanation. In non-MPR, the scale of entrants was smaller than those of survivors and exiters (non-entrants) in 2005 and 2006, and the corresponding TFP was also lower. Second, more coal mining firms in MPR exit the market because of policy enforcement, and most exiters are small coal mines with lower productivity. For example, Shanxi, the largest coal production province in China, closed all firms producing less than 30 thousand tons per year in 2004; in 2006, firms producing less than 90 thousand tons per year were further forced to close. TFP in MPR gradually increased due to the exit of low productivity firms. In MPR (columns (3) and (4) of

Table 8), the scale of exiters was smaller than those of entrants and survivors (non-exiters) in 2007, and the average TFP of exiters was also lower.

We further decomposed the aggregate TFP by MPR and non-MPR. The results are reported in

Table 9. As argued by Melitz and Polanec [

4], the effects of entry and exit decomposed by GR and FHK might be biased because neither entrants in period 1 nor exiters in period 2 can be observed. To avoid redundancy, only the DOPD method was used. First, consistent with the former analysis, the contribution of exits in MPR were always positive (except for 2003), while that in non-MPR might be positive or negative. The reason is the elimination of outdated coal production capacity. Second, the integration of coal industry in 2007 generated positive effects on productivity in MPR through between-firm reallocation, but for non-MPR, the effects of between-firm reallocation were negative (between-firm reallocation contributed positively to MPR while contributed negatively to non-MPR. On average, the total effects of between-firm reallocation were negligible according to the results in

Table 6.) Third, the effects of entering in non-MPR were negative in 2004, 2005, and 2006.