Comparative Analysis of Factors for Supplier Selection and Monitoring: The Case of the Automotive Industry in Thailand

Abstract

1. Introduction

2. Literature review

2.1. Sustainable Supplier Selection

2.2. Sustainable Supplier Monitoring

2.3. SCORs, ISO 9001, and ISO 14001

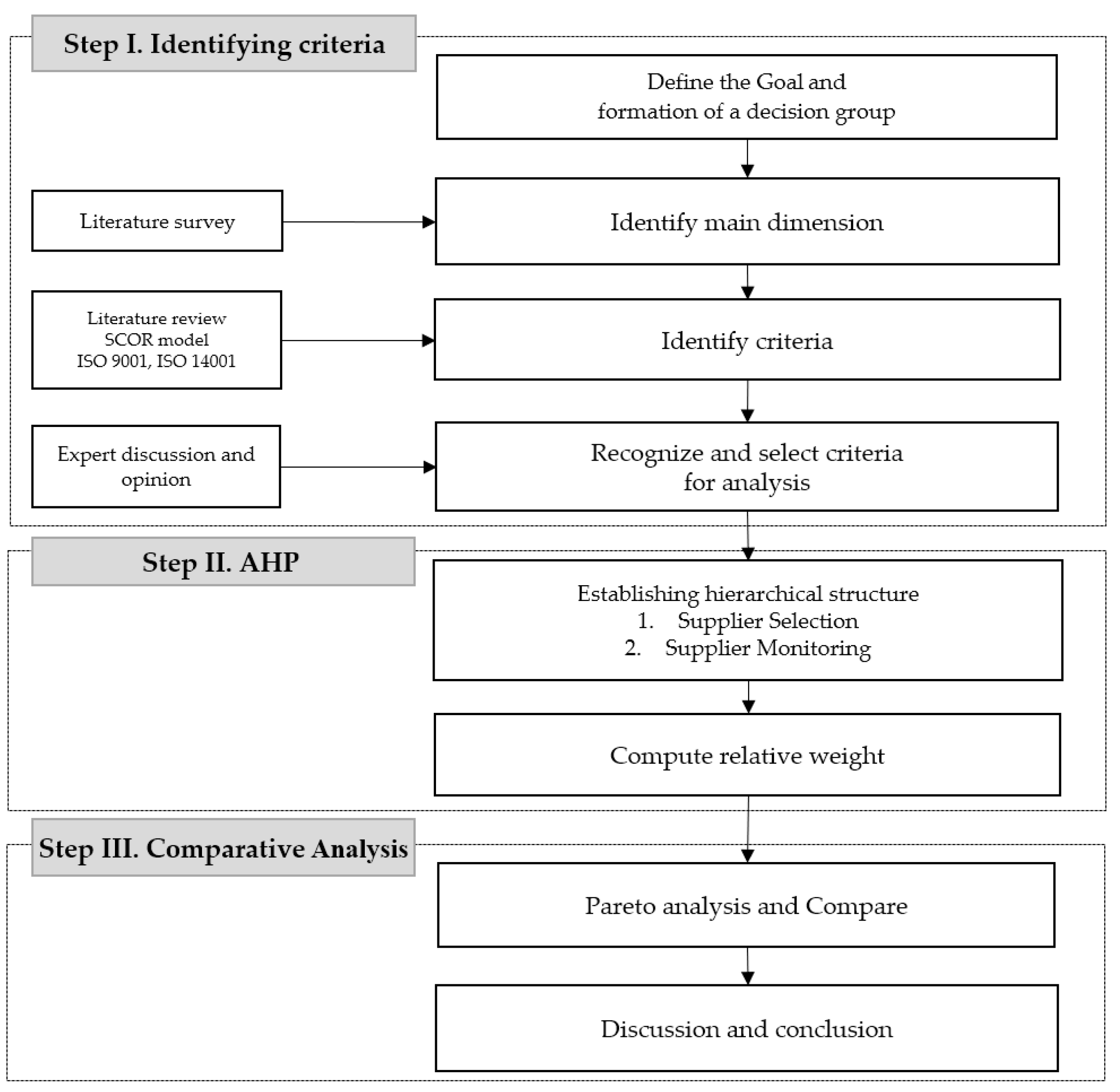

3. Proposed Research Framework

3.1. Step I: Identify the Main Dimension and Criteria

3.2. Step II: Compute Relative Weight for Criteria using AHP

3.3. Step III: Compare and Analyze Different Criteria

4. Results and Discussion

4.1. Identify the Main Dimension and Criteria

4.2. Computing Relative Weight for Criteria using AHP

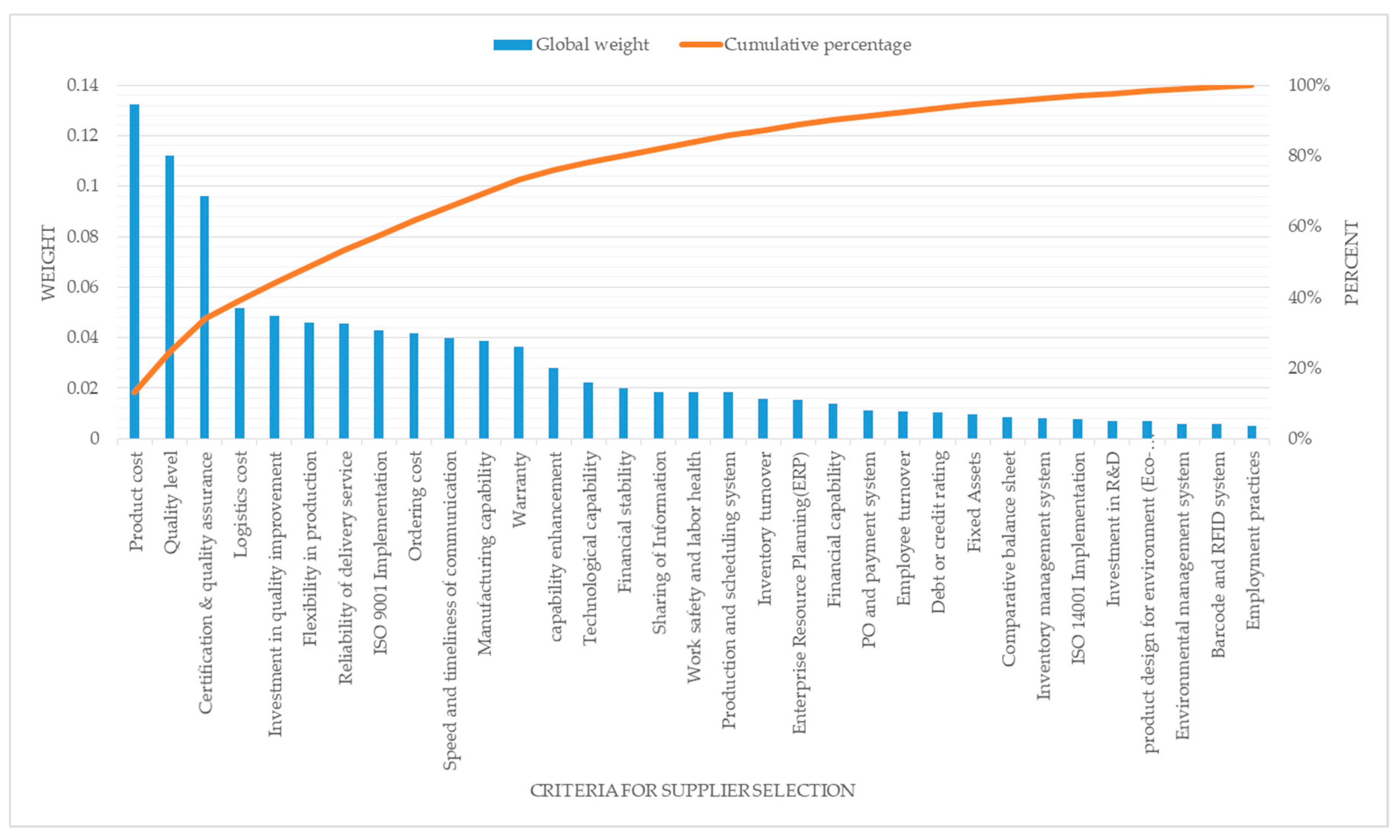

4.2.1. Results of AHP in the Supplier Selection Phase

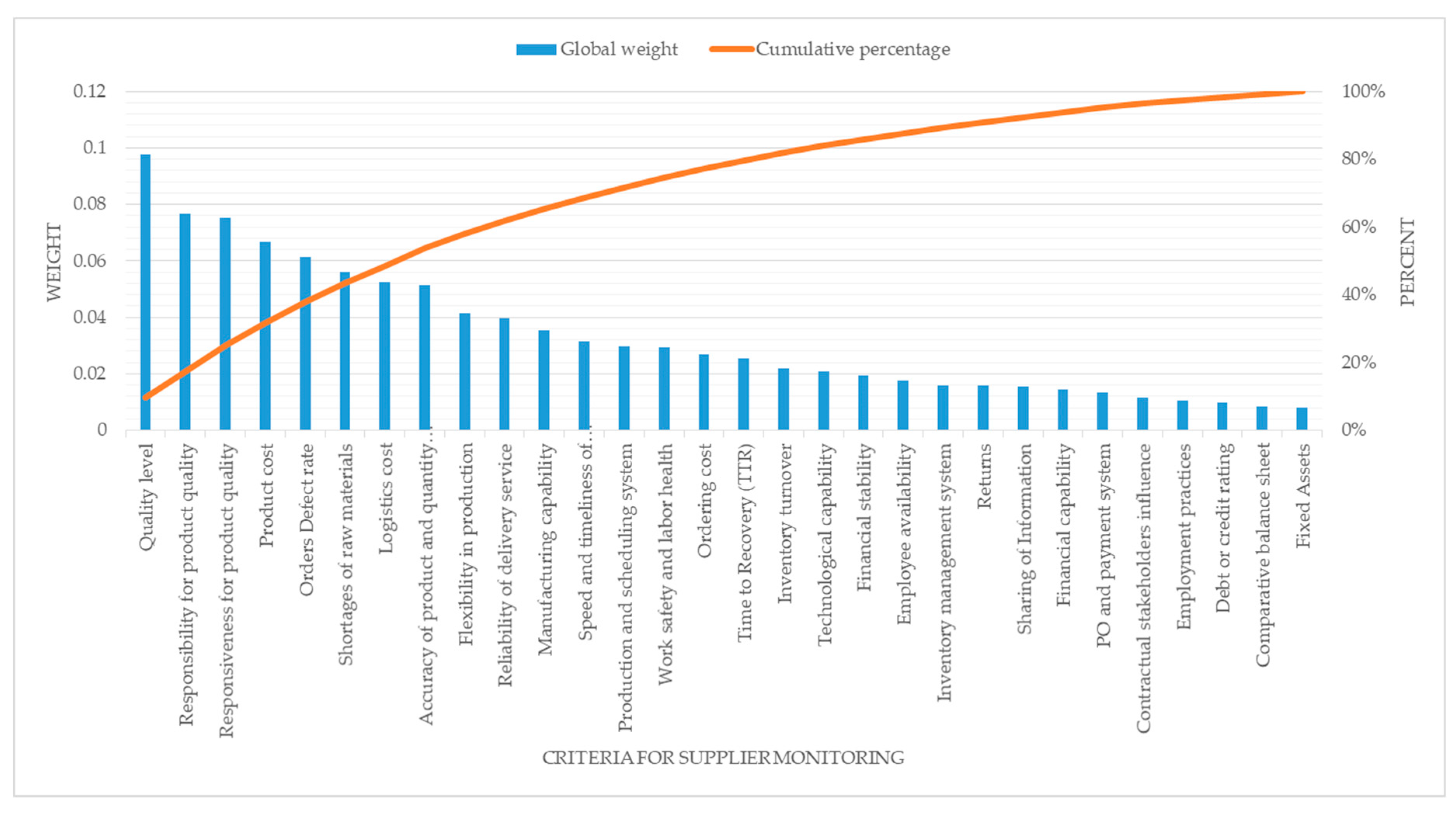

4.2.2. Results of AHP in the Monitoring Phase

4.3. Compare and Analyze Different Criteria

4.3.1. Pareto Analysis

4.3.2. Comparison of criteria

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Omurca, S.I. An intelligent supplier evaluation, selection and development system. Appl. Soft Comput. J. 2013, 13, 690–697. [Google Scholar] [CrossRef]

- Lima-Junior, F.R.; Carpinetti, L.C.R. Combining SCOR® model and fuzzy TOPSIS for supplier evaluation and management. Int. J. Prod. Econ. 2016, 174, 128–141. [Google Scholar] [CrossRef]

- Lee, D.M.; Drake, P.R. A portfolio model for component purchasing strategy and the case study of two South Korean elevator manufacturers. Int. J. Prod. Res. 2010, 48, 6651–6682. [Google Scholar] [CrossRef]

- Ericksen, P. A Look at Purchasing Strategies Part 1: Piece-Price. Available online: https://www.maketime.io/blog/purchasing-strategies-piece-price/ (accessed on 10 December 2018).

- Talluri, S.; Sarkis, J. A model for performance monitoring of suppliers. Int. J. Prod. Res. 2002, 40, 4257–4269. [Google Scholar] [CrossRef]

- Wu, D. Supplier selection: A hybrid model using DEA, decision tree and neural network. Expert Syst. Appl. 2009, 36, 9105–9112. [Google Scholar] [CrossRef]

- Torabi, S.A.; Baghersad, M.; Mansouri, S.A. Resilient supplier selection and order allocation under operational and disruption risks. Transp. Res. Part E 2015, 79, 22–48. [Google Scholar] [CrossRef]

- Vahidi, F.; Torabi, S.A.; Ramezankhani, M.J. Sustainable supplier selection and order allocation under operational and disruption risks. J. Clean. Prod. 2018, 174, 1351–1365. [Google Scholar] [CrossRef]

- Luthra, S.; Govindan, K.; Kannan, D.; Mangla, S.K.; Garg, C.P. An integrated framework for sustainable supplier selection and evaluation in supply chains. J. Clean. Prod. 2017, 140, 1686–1698. [Google Scholar] [CrossRef]

- Zimmer, K.; Fröhling, M.; Schultmann, F. Sustainable supplier management—A review of models supporting sustainable supplier selection, monitoring and development. Int. J. Prod. Res. 2016, 54, 1412–1442. [Google Scholar] [CrossRef]

- Deng, X.; Hu, Y.; Deng, Y.; Mahadevan, S. Supplier selection using AHP methodology extended by D numbers. Expert Syst. Appl. 2014, 41, 156–167. [Google Scholar] [CrossRef]

- Dey, P.K.; Bhattacharya, A.; Ho, W. Strategic supplier performance evaluation: A case-based action research of a UK manufacturing organisation. Int. J. Prod. Econ. 2015, 166, 192–214. [Google Scholar] [CrossRef]

- Thailand Board of Investment. Automotive Industry; Thailand Board of Investment: Bangkok, Thailand, 2017.

- Das, K. Industry Spotlight: Thailand’s Automotive Industry. Available online: https://www.aseanbriefing.com/news/2017/03/17/thailand-automotive-industry.html (accessed on 5 December 2018).

- Hananto, A. Thailand’s Automotive Industry. The Biggest Auto Hub in Southeast Asia. 2017. Available online: https://seasia.co/2017/03/19/thailand-s-automotive-industry-the-biggest-auto-hub-in-southeast-asia (accessed on 18 December 2018).

- Rastogi, V. Thailand’s Automotive Industry: Opportunities and Incentives. Available online: https://www.aseanbriefing.com/news/2018/05/10/thailands-automotive-industry-opportunities-incentives.html (accessed on 9 December 2018).

- Shaw, K.; Shankar, R.; Yadav, S.S.; Thakur, L.S. Supplier selection using fuzzy AHP and fuzzy multi-objective linear programming for developing low carbon supply chain. Expert Syst. Appl. 2012, 39, 8182–8192. [Google Scholar] [CrossRef]

- Akman, G.; Pjgkjn, H. Evaluating green performance of suppliers via analytic network process and TOPSIS. J. Ind. Eng. 2013, 2013, 1–13. [Google Scholar] [CrossRef]

- Lee, T.R.; Le, T.P.N.; Genovese, A.; Koh, L.S.C. Using FAHP to determine the criteria for partner’s selection within a green supply chain: The case of hand tool industry in Taiwan. J. Manuf. Technol. Manag. 2011, 23, 25–55. [Google Scholar] [CrossRef]

- Sagar, M.; Singh, D. Supplier selection criteria: Study of automobile sector in India. Int. J. Eng. Res. Dev. 2012, 4, 34–39. [Google Scholar]

- Muraldiharan, C.; Anantharaman, N.; Deshmukh, S.G. A multi-criteria group decisionmaking model for supplier rating. J. Supply Chain Manag. 2002, 38, 22–35. [Google Scholar] [CrossRef]

- Hou, J.; Su, D. EJB-MVC oriented supplier selection system for mass customization. J. Manuf. Technol. Manag. 2007, 18, 54–71. [Google Scholar] [CrossRef]

- Dweiri, F.; Kumar, S.; Khan, S.A.; Jain, V. Designing an integrated AHP based decision support system for supplier selection in automotive industry. Expert Syst. Appl. 2016, 62, 273–283. [Google Scholar] [CrossRef]

- Shen, L.; Muduli, K.; Barve, A. Developing a sustainable development framework in the context of mining industries: AHP approach. Resour. Policy 2015, 46, 15–26. [Google Scholar] [CrossRef]

- Zhang, Q.; Shah, N.; Wassick, J.; Helling, R.; Van Egerschot, P. Sustainable supply chain optimisation: An industrial case study. Comput. Ind. Eng. 2014, 74, 68–83. [Google Scholar] [CrossRef]

- Dey, P.K.; Cheffi, W. Green supply chain performance measurement using the analytic hierarchy process: A comparative analysis of manufacturing organisations. Prod. Plan. Control 2013, 24, 702–720. [Google Scholar] [CrossRef]

- Yakovleva, N.; Sarkis, J.; Sloan, T. Sustainable benchmarking of supply chains: The case of the food industry. Int. J. Prod. Res. 2012, 50, 1297–1317. [Google Scholar] [CrossRef]

- APICS. Supply Chain Council. Scor Supply Chain Operations Reference Model Ver. 11.0 Quick Reference Quide; APICS SCC Organization: Chicago, IL, USA, 2015; pp. 1–10. [Google Scholar]

- Palma-Mendoza, J.A. Analytical hierarchy process and SCOR model to support supply chain re-design. Int. J. Inf. Manag. 2014, 34, 634–638. [Google Scholar] [CrossRef]

- Gotzamani, K.D.; Tsiotras, G.D.; Nicolaou, M.; Nicolaides, A.; Hadjiadamou, V. The contribution to excellence of ISO 9001: The case of certified organisations in Cyprus. TQM Mag. 2007, 19, 388–402. [Google Scholar] [CrossRef]

- Almeida, D.; Pradhan, N.; Muniz, J., Jr. Assessment of ISO 9001: 2015 implementation factors based on AHP. Int. J. Qual. Reliab. Manag. 2018, 35, 1343–1359. [Google Scholar] [CrossRef]

- International Organization for Standardization. ISO 9001:2015. Available online: https://www.iso.org/standard/62085.html (accessed on 9 December 2018).

- Habidin, N.F.; Hibadullah, S.N.; Mohd Fuzi, N.; Salleh, M.I.; Md Latip, N.A. Lean manufacturing practices, ISO 14001, and environmental performance in Malaysian automotive suppliers. Int. J. Manag. Sci. Eng. Manag. 2018, 13, 45–53. [Google Scholar] [CrossRef]

- Campos, L.M.S.; De Melo Heizen, D.A.; Verdinelli, M.A.; Cauchick Miguel, P.A. environmental performance indicators: a study on ISO 14001 certified companies. J. Clean. Prod. 2015, 99, 286–296. [Google Scholar] [CrossRef]

- Sambasivan, M.; Fei, N.Y. Evaluation of critical success factors of implementation of ISO 14001 using analytic hierarchy process (AHP): A case study from Malaysia. J. Clean. Prod. 2008, 16, 1424–1433. [Google Scholar] [CrossRef]

- Bruno, G.; Esposito, E.; Genovese, A.; Passaro, R. AHP-based approaches for supplier evaluation: Problems and perspectives. J. Purch. Supply Manag. 2012, 18, 159–172. [Google Scholar] [CrossRef]

- Glock, C.H.; Grosse, E.H.; Ries, J.M. Decision support models for supplier development: systematic literature review and research agenda. Int. J. Prod. Econ. 2017, 193, 798–812. [Google Scholar] [CrossRef]

- Fallahpour, A.; Udoncy Olugu, E.; Nurmaya Musa, S.; Yew Wong, K.; Noori, S. A decision support model for sustainable supplier selection in sustainable supply chain management. Comput. Ind. Eng. 2017, 105, 391–410. [Google Scholar] [CrossRef]

- Saaty, T.L. Decision making with the analytic hierarchy process. Int. J. Serv. Sci. 2008, 1, 83. [Google Scholar] [CrossRef]

- Subramanian, N.; Ramanathan, R. A review of applications of analytic hierarchy process in operations management. Int. J. Prod. Econ. 2012, 138, 215–241. [Google Scholar] [CrossRef]

- Goepel, K.D. Implementation of an online software tool for the analytic hierarchy process—Challenges and practical experiences. Int. Symp. Anal. Hierarchy Process 2017, 10, 1–20. [Google Scholar]

- Talib, F.; Rahman, Z.; Qureshi, M.N. Pareto analysis of total quality management factors critical to success for service industries. Int.J. Qual. Res. 2010, 4, 155–168. [Google Scholar]

- Cervone, H. Applied digital library project management: Using pareto analysis to determine task importance rankings. OCLC Syst. Serv. 2009, 25, 76–81. [Google Scholar] [CrossRef]

| Scale. | Meaning |

|---|---|

| 1 | “i” is equally important to “j” |

| 3 | “i” is slightly more important than “j” |

| 5 | “i” is more important than “j” |

| 7 | “i” is very strong important to “j” |

| 9 | “i” is extremely more important to “j” |

| 2,4,6,8 | intermediate values |

| Dimension | Criteria | Selection | Monitoring |

|---|---|---|---|

| Cost | Product cost | ✔ | ✔ |

| Ordering cost | ✔ | ✔ | |

| Logistics cost | ✔ | ✔ | |

| Quality | Quality level | ✔ | ✔ |

| Investment in quality improvement | ✔ | - | |

| Certification & quality assurance | ✔ | - | |

| ISO 9001 Implementation | ✔ | - | |

| Responsibility for product quality | - | ✔ | |

| Responsiveness for product quality | - | ✔ | |

| Orders defect rate | - | ✔ | |

| Capacity | Manufacturing capability | ✔ | ✔ |

| Technological capability | ✔ | ✔ | |

| Flexibility in production | ✔ | ✔ | |

| Inventory turnover | ✔ | ✔ | |

| Employee turnover | ✔ | - | |

| Capability enhancement | ✔ | - | |

| Employee availability | - | ✔ | |

| Time to Recovery (TTR) | - | ✔ | |

| Shortages of raw materials | - | ✔ | |

| Service | Reliability of delivery service | ✔ | ✔ |

| Sharing of information | ✔ | ✔ | |

| Speed and timeliness of communication | ✔ | ✔ | |

| Warranty | ✔ | - | |

| Returns | - | ✔ | |

| Accuracy of product and quantity delivered | - | ✔ | |

| Finance | Fixed Assets | ✔ | ✔ |

| Comparative balance sheet | ✔ | ✔ | |

| Debt or credit rating | ✔ | ✔ | |

| Financial capability | ✔ | ✔ | |

| Financial stability | ✔ | ✔ | |

| ICT | Purchase order (PO) and payment system | ✔ | ✔ |

| Production and scheduling system | ✔ | ✔ | |

| Inventory management system | ✔ | ✔ | |

| Barcode and RFID system | ✔ | - | |

| Enterprise Resource Planning (ERP) | ✔ | - | |

| Sustainability | Work safety and labor health | ✔ | ✔ |

| Employment practices | ✔ | ✔ | |

| Product design for environment (Eco-design) | ✔ | - | |

| Environmental management system | ✔ | - | |

| Investment in Research and Development (R&D) | ✔ | - | |

| ISO 14001 implementation | ✔ | - | |

| Contractual stakeholders influence | - | ✔ |

| Level 0 | Level 1 | Level 2 | Global Priority | Level 0 | Level 1 | Level 2 | Global Priority |

|---|---|---|---|---|---|---|---|

| Supplier Selection | Cost 0.2259 | Product cost (0.5860) | 13.24% | Supplier Monitoring | Cost 0.1463 | Product cost (0.4560) | 6.67% |

| Ordering cost (0.1855) | 4.19% | Ordering cost (0.1846) | 2.70% | ||||

| Logistics cost (0.2285) | 5.16% | Logistics cost (0.3594) | 5.26% | ||||

| Quality 0.2998 | Quality level (0.3739) | 11.21% | Quality 0.3107 | Quality level (0.3145) | 9.77% | ||

| Investment in quality improvement (0.1620) | 4.86% | Responsibility for product quality (0.2464) | 7.66% | ||||

| Certification & quality assurance (0.3204) | 9.61% | Responsiveness for product quality (0.2418) | 7.51% | ||||

| ISO 9001 implementation (0.1437) | 4.31% | Orders defect rate (0.1973) | 6.13% | ||||

| Capacity 0.1613 | Manufacturing capability (0.2389) | 3.85% | Capacity 0.2188 | Manufacturing capability (0.1623) | 3.55% | ||

| Technological capability (0.1371) | 2.21% | Technological capability (0.0947) | 2.07% | ||||

| Flexibility in production (0.2861) | 4.61% | Flexibility in production (0.1898) | 4.15% | ||||

| Inventory turnover (0.0970) | 1.56% | Employee availability (0.0809) | 1.77% | ||||

| Employee turnover (0.0672) | 1.08% | Time to Recovery (TTR) (0.1157) | 2.53% | ||||

| Capability enhancement (0.1736) | 2.80% | Inventory turnover (0.0999) | 2.18% | ||||

| Service 0.1401 | Reliability of delivery service (0.3245) | 4.55% | Shortages of raw materials (0.2568) | 5.62% | |||

| Sharing of information (0.1325) | 1.86% | Service 0.1540 | Reliability of delivery service (0.2579) | 3.97% | |||

| Speed and timeliness of communication (0.2845) | 3.99% | Sharing of Information (0.1016) | 1.56% | ||||

| Warranty (0.2586) | 3.62% | Speed and timeliness of communication (0.2048) | 3.15% | ||||

| Finance 0.0629 | Fixed assets (0.1545) | 0.97% | Accuracy of product and quantity delivered (0.3336) | 5.14% | |||

| Comparative balance sheet (0.1367) | 0.86% | Returns (0.1021) | 1.57% | ||||

| Debt or credit rating (0.1671) | 1.05% | Finance 0.0599 | Fixed assets (0.1345 | 0.81% | |||

| Financial capability (0.2230) | 1.40% | Comparative balance sheet (0.1406) | 0.84% | ||||

| Financial stability (0.3186) | 2.01% | Debt or credit rating (0.1636) | 0.98% | ||||

| ICT 0.0590 | PO and payment system (0.1891) | 1.12% | Financial capability (0.2386) | 1.43% | |||

| Production and scheduling system (0.3098) | 1.83% | Financial stability (0.3226) | 1.93% | ||||

| Inventory management system (0.1398) | 0.83% | ICT 0.0589 | PO and payment system (0.2249) | 1.33% | |||

| Barcode and RFID system (0.0991) | 0.59% | Production and scheduling system (0.5055) | 2.98% | ||||

| Enterprise Resource Planning (ERP) (0.2622) | 1.55% | Inventory management system (0.2696) | 1.59% | ||||

| Sustainability 0.0509 | Work safety and labor health (0.3616) | 1.84% | Sustainability 0.0515 | Work safety and labor health (0.5707) | 2.94% | ||

| Employment practices (0.0996) | 0.51% | Employment practices (0.2014) | 1.04% | ||||

| Product design for environment (Eco-design) (0.1339) | 0.68% | Contractual stakeholders influence (0.2279) | 1.17% | ||||

| Environmental management system (0.1153) | 0.59% | ||||||

| Investment in R&D (0.1347) | 0.69% | ||||||

| ISO 14001 implementation (0.1549) | 0.79% | ||||||

| 1.0 | 1.0 |

| Dimension | Pair-Wise Comparisons | Importance Weight | Ranking | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Cost | Quality | Capacity | Service | Finance | ICT | Sustainability | |||

| Cost | 1 | 0.5807 | 1.5746 | 1.8626 | 3.2571 | 4.8666 | 4.1987 | 0.2259 | 2nd |

| Quality | 1.7220 | 1 | 2.3686 | 2.3631 | 3.4193 | 5.0287 | 4.6544 | 0.2998 | 1st |

| Capacity | 0.6351 | 0.4222 | 1 | 1.3907 | 2.5813 | 3.0428 | 3.7050 | 0.1613 | 3rd |

| Service | 0.5369 | 0.4232 | 0.7190 | 1 | 1.6685 | 3.5463 | 3.6674 | 0.1401 | 4th |

| Finance | 0.3070 | 0.2925 | 0.3874 | 0.5993 | 1 | 0.7387 | 0.8139 | 0.0629 | 5th |

| ICT | 0.2055 | 0.1989 | 0.3286 | 0.2820 | 1.3538 | 1 | 1.5879 | 0.0590 | 6th |

| Sustainability | 0.2382 | 0.2148 | 0.2699 | 0.2727 | 1.2286 | 0.6298 | 1 | 0.0509 | 7th |

| Dimension | Criteria | Relative Weight | Relative Ranking | Global Weight | Global Ranking |

|---|---|---|---|---|---|

| Cost | Product cost | 0.5860 | 1st | 0.1324 | 1st |

| Ordering cost | 0.1855 | 3rd | 0.0419 | 9th | |

| Logistics cost | 0.2285 | 2nd | 0.0516 | 4th | |

| Quality | Quality level | 0.3739 | 1st | 0.1121 | 2nd |

| Investment in quality improvement | 0.1620 | 3rd | 0.0486 | 5th | |

| Certification & quality assurance | 0.3204 | 2nd | 0.0961 | 3rd | |

| ISO 9001 implementation | 0.1437 | 4th | 0.0431 | 8th | |

| Capacity | Manufacturing capability | 0.2389 | 2nd | 0.0385 | 11th |

| Technological capability | 0.1371 | 4th | 0.0221 | 14th | |

| Flexibility in production | 0.2861 | 1st | 0.0461 | 6th | |

| Inventory turnover | 0.0970 | 5th | 0.0156 | 19th | |

| Employee turnover | 0.0672 | 6th | 0.0108 | 23rd | |

| Capability enhancement | 0.1736 | 3rd | 0.0280 | 13th | |

| Service | Reliability of delivery service | 0.3245 | 1st | 0.0455 | 7th |

| Sharing of information | 0.1325 | 4th | 0.0186 | 16th | |

| Speed and timeliness of communication | 0.2845 | 2nd | 0.0399 | 10th | |

| Warranty | 0.2586 | 3rd | 0.0362 | 12th | |

| Finance | Fixed assets | 0.1545 | 5th | 0.0097 | 25th |

| Comparative balance sheet | 0.1367 | 4th | 0.0086 | 26th | |

| Debt or credit rating | 0.1671 | 3rd | 0.0105 | 24th | |

| Financial capability | 0.2230 | 2nd | 0.0140 | 21st | |

| Financial stability | 0.3186 | 1st | 0.0201 | 15th | |

| ICT | PO and payment system | 0.1891 | 3rd | 0.0112 | 22nd |

| Production and scheduling system | 0.3098 | 1st | 0.0183 | 18th | |

| Inventory management system | 0.1398 | 4th | 0.0083 | 27th | |

| Barcode and RFID system | 0.0991 | 5th | 0.0059 | 32th | |

| Enterprise Resource Planning (ERP) | 0.2622 | 2nd | 0.0155 | 20th | |

| Sustainability | Work safety and labor health | 0.3616 | 1st | 0.0184 | 17th |

| Employment practices | 0.0996 | 6th | 0.0051 | 33th | |

| Product design for environment (Eco-design) | 0.1339 | 4th | 0.0068 | 30th | |

| Environmental management system | 0.1153 | 5th | 0.0059 | 31th | |

| Investment in R&D | 0.1347 | 3rd | 0.0069 | 29th | |

| ISO 14001 implementation | 0.1549 | 2nd | 0.0079 | 28th |

| Dimension | Pair-Wise Comparisons | Importance Weight | Ranking | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Cost | Quality | Capacity | Service | Finance | ICT | Sustainability | |||

| Cost | 1 | 0.4679 | 0.5219 | 0.8799 | 2.6008 | 3.0658 | 3.0008 | 0.1463 | 4th |

| Quality | 2.1372 | 1 | 1.6545 | 2.6311 | 4.1060 | 5.2533 | 4.7940 | 0.3107 | 1st |

| Capacity | 1.9162 | 0.6044 | 1 | 1.4792 | 3.3314 | 3.7612 | 4.0423 | 0.2188 | 2nd |

| Service | 1.1365 | 0.3801 | 0.6761 | 1 | 2.8949 | 2.4178 | 3.5856 | 0.1540 | 3rd |

| Finance | 0.3845 | 0.2435 | 0.3002 | 0.3454 | 1 | 0.9245 | 1.1186 | 0.0599 | 5th |

| ICT | 0.3262 | 0.1904 | 0.2659 | 0.4136 | 1.0816 | 1 | 1.2329 | 0.0589 | 6th |

| Sustainability | 0.3332 | 0.2086 | 0.2474 | 0.2789 | 0.8940 | 0.8111 | 1 | 0.0515 | 7th |

| Dimension | Criteria | Relative Weight | Relative Ranking | Global Weight | Global Ranking |

|---|---|---|---|---|---|

| Cost | Product cost | 0.4560 | 1st | 0.0667 | 4th |

| Ordering cost | 0.1846 | 3rd | 0.0270 | 15th | |

| Logistics cost | 0.3594 | 2nd | 0.0526 | 7th | |

| Quality | Quality level | 0.3145 | 1st | 0.0977 | 1st |

| Responsibility for product quality | 0.2464 | 2nd | 0.0766 | 2nd | |

| Responsiveness for product quality | 0.2418 | 3rd | 0.0751 | 3rd | |

| Orders defect rate | 0.1973 | 4th | 0.0613 | 5th | |

| Capacity | Manufacturing capability | 0.1623 | 3rd | 0.0355 | 11th |

| Technological capability | 0.0947 | 6th | 0.0207 | 18th | |

| Flexibility in production | 0.1898 | 2nd | 0.0415 | 9th | |

| Employee availability | 0.0809 | 7th | 0.0177 | 20th | |

| Time to Recovery (TTR) | 0.1157 | 4th | 0.0253 | 16th | |

| Inventory turnover | 0.0999 | 5th | 0.0218 | 17th | |

| Shortages of raw materials | 0.2568 | 1st | 0.0562 | 6th | |

| Service | Reliability of delivery service | 0.2579 | 2nd | 0.0397 | 10th |

| Sharing of Information | 0.1016 | 5th | 0.0156 | 23rd | |

| Speed and timeliness of communication | 0.2048 | 3rd | 0.0315 | 12th | |

| Accuracy of product and quantity delivered | 0.3336 | 1st | 0.0514 | 8th | |

| Returns | 0.1021 | 4th | 0.0157 | 22nd | |

| Finance | Fixed assets | 0.1345 | 5th | 0.0081 | 30th |

| Comparative balance sheet | 0.1406 | 4th | 0.0084 | 29th | |

| Debt or credit rating | 0.1636 | 3rd | 0.0098 | 28th | |

| Financial capability | 0.2386 | 2nd | 0.0143 | 24th | |

| Financial stability | 0.3226 | 1st | 0.0193 | 19th | |

| ICT | PO and payment system | 0.2249 | 3rd | 0.0133 | 25th |

| Production and scheduling system | 0.5055 | 1st | 0.0298 | 13th | |

| Inventory management system | 0.2696 | 2nd | 0.0159 | 21st | |

| Sustainability | Work safety and labor health | 0.5707 | 1st | 0.0294 | 14th |

| Employment practices | 0.2014 | 3rd | 0.0104 | 27th | |

| Contractual stakeholders influence | 0.2279 | 2nd | 0.0117 | 26th |

| Dimension | Important Criteria | Selection Global Weight | Selection Global Ranking | Cumulative % |

|---|---|---|---|---|

| Cost | Product cost | 0.1324 | 1st | 13.24% |

| Quality | Quality level | 0.1121 | 2nd | 24.45% |

| Quality | Certification & quality assurance | 0.0961 | 3rd | 34.05% |

| Cost | Logistics cost | 0.0516 | 4th | 39.22% |

| Quality | Investment in quality improvement | 0.0486 | 5th | 44.07% |

| Capacity | Flexibility in production | 0.0461 | 6th | 48.69% |

| Service | Reliability of delivery service | 0.0455 | 7th | 53.23% |

| Quality | ISO 9001 implementation | 0.0431 | 8th | 57.54% |

| Cost | Ordering cost | 0.0419 | 9th | 61.73% |

| Service | Speed and timeliness of communication | 0.0399 | 10th | 65.72% |

| Capacity | Manufacturing capability | 0.0385 | 11th | 69.57% |

| Service | Warranty | 0.0362 | 12th | 73.20% |

| Capacity | Capability enhancement | 0.0280 | 13th | 76.00% |

| Capacity | Technological capability | 0.0221 | 14th | 78.21% |

| Finance | Financial stability | 0.0201 | 15th | 80.21% |

| Dimension | Important Criteria | Monitoring Global Weight | Monitoring Global Ranking | Cumulative % |

|---|---|---|---|---|

| Quality | Quality level | 0.0977 | 1st | 9.77% |

| Quality | Responsibility for product quality | 0.0766 | 2nd | 17.43% |

| Quality | Responsiveness for product quality | 0.0751 | 3rd | 24.94% |

| Cost | Product cost | 0.0667 | 4th | 31.61% |

| Quality | Orders defect rate | 0.0613 | 5th | 37.74% |

| Capacity | Shortages of raw materials | 0.0562 | 6th | 43.36% |

| Cost | Logistics cost | 0.0526 | 7th | 48.61% |

| Service | Accuracy of product and quantity delivered | 0.0514 | 8th | 53.75% |

| Capacity | Flexibility in production | 0.0415 | 9th | 57.90% |

| Service | Reliability of delivery service | 0.0397 | 10th | 61.87% |

| Capacity | Manufacturing capability | 0.0355 | 11th | 65.42% |

| Service | Speed and timeliness of communication | 0.0315 | 12th | 68.57% |

| ICT | Production and scheduling system | 0.0298 | 13th | 71.55% |

| Sustainability | Work safety and labor health | 0.0294 | 14th | 74.49% |

| Cost | Ordering cost | 0.0270 | 15th | 77.19% |

| Capacity | Time to Recovery (TTR) | 0.0253 | 16th | 79.72% |

| Dimension | Selection Weight | Monitoring Weight | Selection Rank | Monitoring Rank |

|---|---|---|---|---|

| Cost | 0.2259 | 0.1463 | 2nd | 4th |

| Quality | 0.2998 | 0.3107 | 1st | 1st |

| Capacity | 0.1613 | 0.2188 | 3rd | 2nd |

| Service | 0.1401 | 0.1540 | 4th | 3rd |

| Finance | 0.0629 | 0.0599 | 5th | 5th |

| ICT | 0.0590 | 0.0589 | 6th | 6th |

| Sustainability | 0.0509 | 0.0515 | 7th | 7th |

| Dimension | Criteria | Selection | Monitoring | Selection | Monitoring | ||

|---|---|---|---|---|---|---|---|

| Weight | Rank | Weight | Rank | ||||

| Cost | Product cost | ✔ | ✔ | 0.1324 | 1st | 0.0667 | 4th |

| Ordering cost | ✔ | ✔ | 0.0516 | 4th | 0.0526 | 7th | |

| Logistics cost | ✔ | ✔ | 0.0419 | 9th | 0.0270 | 15th | |

| Quality | Quality level | ✔ | ✔ | 0.1121 | 2nd | 0.0977 | 1st |

| Investment in quality improvement | ✔ | - | 0.0961 | 3rd | - | - | |

| Certification & quality assurance | ✔ | - | 0.0486 | 5th | - | - | |

| ISO 9001 implementation | ✔ | - | 0.0431 | 8th | - | - | |

| Responsibility for product quality | - | ✔ | - | - | 0.0766 | 2nd | |

| Responsiveness for product quality | - | ✔ | - | - | 0.0751 | 3rd | |

| Orders defect rate | - | ✔ | - | - | 0.0613 | 5th | |

| Capacity | Flexibility in production | ✔ | ✔ | 0.0461 | 6th | 0.0415 | 9th |

| Manufacturing capability | ✔ | ✔ | 0.0385 | 11th | 0.0355 | 11th | |

| Capability enhancement | ✔ | - | 0.0280 | 13th | - | - | |

| Technological capability | ✔ | - | 0.0221 | 14th | - | - | |

| Shortages of raw materials | - | ✔ | - | - | 0.0562 | 6th | |

| Time to Recovery (TTR) | - | ✔ | - | - | 0.0253 | 16th | |

| Service | Reliability of delivery service | ✔ | ✔ | 0.0455 | 7th | 0.0397 | 10th |

| Speed and timeliness of communication | ✔ | ✔ | 0.0399 | 10th | 0.0315 | 12th | |

| Warranty | ✔ | - | 0.0362 | 12th | - | - | |

| Accuracy of product and quantity delivered | - | ✔ | - | - | 0.0514 | 8th | |

| Finance | Financial stability | ✔ | - | 0.0201 | 15th | - | - |

| ICT | Production and scheduling system | - | ✔ | - | - | 0.0298 | 13th |

| Sustainability | Work safety and labor health | - | ✔ | - | - | 0.0294 | 14th |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suraraksa, J.; Shin, K.S. Comparative Analysis of Factors for Supplier Selection and Monitoring: The Case of the Automotive Industry in Thailand. Sustainability 2019, 11, 981. https://doi.org/10.3390/su11040981

Suraraksa J, Shin KS. Comparative Analysis of Factors for Supplier Selection and Monitoring: The Case of the Automotive Industry in Thailand. Sustainability. 2019; 11(4):981. https://doi.org/10.3390/su11040981

Chicago/Turabian StyleSuraraksa, Juthathip, and Kwang Sup Shin. 2019. "Comparative Analysis of Factors for Supplier Selection and Monitoring: The Case of the Automotive Industry in Thailand" Sustainability 11, no. 4: 981. https://doi.org/10.3390/su11040981

APA StyleSuraraksa, J., & Shin, K. S. (2019). Comparative Analysis of Factors for Supplier Selection and Monitoring: The Case of the Automotive Industry in Thailand. Sustainability, 11(4), 981. https://doi.org/10.3390/su11040981