1. Introduction

The vote with the wallet is a phenomenon of growing relevance in the contemporary economic scenario. We understand the

vote with the wallet as the propensity of consumers to consider social and environmental sellers’ responsibility into consumption and saving choices, in order to stimulate companies to ‘retail’ bundles of private and public goods [

1] which may ultimately be in consumers’ and investors’ own interest (e.g., in terms of healthier food, better job opportunities, and higher corporate fiscal responsibility).

Consumers may interpret their consumption as a voting behaviour [

2] to send general messages to governments and other citizens, increase activism and engagement, and boost sustainable development [

3]. Other consumers who are not aware of their political consumerisms, however, also face purchase decisions between responsible and non-responsible products. In this introduction we describe four examples showing how the vote with the wallet is currently working. These real-life examples document the empirical relevance of the theoretical approach we develop in our paper. The model outlined in the second section explains why the vote with the wallet is a special case of multiplayer Prisoner’s Dilemma (PD): each consumer voting with the wallet for the responsible product produces a positive externality for the other consumers, because her vote contributes to the public good benefit of a higher socially and environmentally responsible stance of sellers. However, voting with the wallet for the responsible product may imply an extra cost vis-à-vis buying a conventional product. This extra cost may or may not be compensated by a third component, that is the intrinsic satisfaction produced by the responsible purchase for those consumers who have other-regarding preferences. These three basic ingredients of the game—the positive externality, the extra cost, and the other-regarding preferences—make free riding (i.e., buying the conventional product) the optimal strategy under a reasonably wide range of parametric conditions, thereby producing a classic coordination failure problem with a pure Nash equilibrium Pareto dominated by the strategy pair where both players vote with the wallet for the responsible product. The paper investigates various potential solutions to this coordination failure problem, in various theoretical frameworks ranging from one-shot two-player to repeated multiplayer games.

A first example of responsible vote with the wallet in action is socially responsible (SR) consumption. The Global Report on Socially Conscious Consumers, one of the most extensive worldwide surveys on consumer choices [

4], observes that 46 percent of interviewed consumers are willing to pay more for socially and environmentally sustainable products. The share grows to 55 percent in the 2014 Nielsen Survey. Even though contingent evaluations as those mentioned above tend to be upward biased [

5], actual market shares of products being traditionally object of responsible vote with the wallet document that the phenomenon exists and is relevant. One of the most interesting examples is Fair Trade (FT). FT is a supply chain in which importers decide to transfer to marginalized raw material producers a higher share of value added than what otherwise would have been the case in order to finance their empowerment, skill upgrading, and provision of public goods to the local community (for the literature on FT see, among others, [

6,

7,

8,

9], and [

10].). Sales of FT products which publicly advertise their extra social and environmental component have considerably grown over the last years despite stagnating consumption in high-income countries after the global financial crisis. They were 33 percent higher in Germany, 26 percent in The Netherlands, 28 percent in Sweden, 25 percent in Switzerland, and 16 percent in the UK in 2012, compared to 2011. Empirical evidence documents that the vote with the wallet for FT products has triggered partial imitation of profit maximizing incumbents. Valuable examples are Nestlé (Wason, E. (2005, October 7th), “Nestle introduces fairtrade coffee, eco-friendly product goes mainstream”,

Mongabay.com. Retrieved from

http://news.mongabay.com/2005/1007-reuters.html.), Tesco, Sainsbury, Ben & Jerry (Unilever) (Gunther, S. (2010, October 25th), “Ben & Jerry announces big move into fair trade”,

Mother Nature Network. Retrieved from

http://www.mnn.com/earth-matters/wilderness-resources/blogs/ben-jerry-announces-big-move-into-fair-trade.), Starbucks, Mars (Mars (2011, September), “Mars and Fairtrade International announce collaboration”. Retrieved from

http://www.mars.com/global/press-center/press-list/news-releases.aspx?SiteId=94&Id=3182.), and Ferrero (Nieburg, O. (2014, March 20th), “Ferrero makes Fairtrade cocoa commitment after rule change”,

Confectionery news. Retrieved from

http://www.confectionerynews.com/Commodities/Ferreromakes- Fairtrade-cocoa-commitment-after-rule-change.), with several institutions acknowledging the potential contagion of the vote with the wallet for FT products (the EU Commission in its communication to the European Parliament on May 2009 acknowledged this contagion potential by declaring that «Fair Trade has played a pioneering role in illuminating issues of responsibility and solidarity, which has impacted other operators and prompted the emergence of other sustainability regimes. Trade-related private sustainability initiatives use various social or environmental auditing standards, which have grown in number and market share» [

11].).

A second channel in which the vote with the wallet is becoming particularly relevant in terms of market shares is professionally managed assets. The 2014 Eurosif SRI study release reports that funds voting with the wallet by picking stocks up above a given SR threshold have grown by 91 percent between 2011 and 2013, up to an estimated 41 percent (€6.9 trillion) market share of European professionally managed assets [

12]. The most common voluntary exclusions are related to Cluster Munitions and Anti-Personnel Landmines (CM & APL) and cover about 30 percent (€5.0 trillion) of the European investment market, while voluntary exclusions not related to CM & APL cover about 23 percent (€4.0 trillion) of the market. In the same year the USSIF report finds that sustainable, responsible, and impact investing assets expanded by 76 percent over two years up to

$6.57 trillion at the start of 2014 (

Report on US Sustainable, Responsible and Impact Investing Trends 2014) accounting for a market share of around 17 percent of all assets under professional management in the United States. A novel and relevant initiative in this direction is the Montreal Pledge (Montréal Pledge, 2014. Retrieved from

http://montrealpledge.org.) signed by a coalition of funds accounting for

$3 trillion of assets under management. The initiative requires signatories “commit to measure and publicly disclose the carbon footprint of their investment portfolios on an annual basis” and to reduce progressively their footprint providing a new frontier of application of the vote with the wallet.

A third relevant example of the vote with the wallet comes from the Oxfam Behind the Brands campaign. In February 2013 Oxfam rated the 10 largest food multinationals by evaluating social and environmental responsibility of their supply chains on different domains (land, women, farmers, workers, climate, transparency, and water) in terms of awareness, knowledge and disclosure, commitment, and supply chain management. Oxfam then asked campaign supporters around the world to take action by voting with the wallet (i.e., buying products of highest rank companies) or sending ad hoc messages to companies expressing their disappointment in case of low scores. At beginning of 2015, nearly 700,000 actions had been taken and 32 major investment funds accounting for around $1.5 trillion joined Oxfam in asking the 10 biggest companies to improve their social and environmental stance. As a result of the campaign, 9 out of the 10 biggest food companies took actions to improve their scores (more specifically Oxfam reports that 9 companies out of 10 improved their scores from February 2013 to October 2014. Advancement concerned among others policies that commit to implementing the principles of Free Prior and Informed Consent, women’s rights, farmers, and environment.).

A fourth vote with the wallet practice is that of “Community supported agriculture”. These small networks commit to buy directly from producers local agricultural products that are socially and environmentally responsible and compete with traditional distributors of traditional product chains with larger geographical extension (at March 2015 around 1600 solidarity-based purchasing groups were present in Italy; for further details see

http://www.retegas.org/index.php?module=pagesetter&func=viewpub&tid=2&pid=10.).

The four examples described above document that millions of people are currently playing the vote with the wallet game, and more so if we consider that also many of those who do not choose ‘responsible’ products face in any case the alternative between conventional and alternative products. Understanding how the vote with the wallet works and how players can be successful in overcoming the related coordination failure problem is an interesting and still partially unexplored field of research.

The literature has analyzed so far in depth the supply side of the vote with the wallet phenomenon with oligopolistic models which investigate how companies compete for attracting socially and environmentally consumers. Ref. [

1] outline a model where producers compete to attract SR consumers by retailing public goods (the industrial organization literature models competition in CSR by considering the latter an additional feature of the product; see, among others, [

13,

14]). Other contributions [

15] document, under reasonable parametric conditions, that the market entry of not-for-profit pioneers triggers (partial) imitation as optimal reaction of profit-maximizing incumbents, thereby identifying in the vote with the wallet one of the originating causes for Corporate Social Responsibility (CSR) and the above described contagion observed in fields such as fair trade. However, the current literature is actually missing a demand side analysis with a more in depth game theoretical inspection of consumers’ interactions when voting with the wallet. On this side, the practise of rewarding ethical firms behaviour through consumption has been analysed by [

3,

16], who respectively discuss the nature and impact of ethical consumer decision making and how buycott and boycott are used as a form of political consumerism. A theory of boycott has also been modelled by [

17]. In his model, individuals can first boycott a firm and then bargain private policy with the latter according to their preferences and available information. The vote with the wallet differs from the boycott in four ways. First, while boycott typically reduces demand, the vote with the wallet is an action aimed at redirecting (and in many cases increasing) consumer demand. Second, the vote with the wallet does not imply a bargaining process since individuals just reveal their preferences by consuming the products of their preferred firms. Third, the vote with the wallet is a practice that individuals do everyday by consuming, while boycotting is in general an extraordinary action that can be chosen under specific circumstances. Fourth, the vote with the wallet is a positive action which aims to reward the most virtuous firms creating emulation, while boycotting is a negative action which penalises the worst firms. For these reasons, even though voting with the wallet for a responsible product implies not buying the alternative conventional product, the vote with the wallet and boycott cannot be considered as symmetric problems.

Our paper provides a contribution to the vote with the wallet phenomenon. In what follows we argue that coordination among consumers voting with the wallet creates a typical multiplayer PD with some qualifying characteristics that make the game unique. We then explore equilibria and potential solutions to the coordination problem from the simplest one-shot two-player up to the one-shot and infinitely repeated multiplayer games. More specifically, we outline conditions under which the PD can be overcome with grim strategies in Folk theorems, Pavlov and proportional tit-for-tat strategies for evolutionary games, and with the identification and creation of coalitions of voters who adopt proper strategies to enforce mutual voting equilibrium in the game.

The paper is divided into six sections (including introduction and conclusion). In the second section we outline the basic characteristics of the two-player one shot version of the game. We then illustrate its multiplayer extension and discuss how the PD can be overcome. In the third section we analytically illustrate how Folk theorems and memory-one strategies in evolutionary games may enforce mutual voting equilibrium in the repeated multiplayer game. In the fourth section examines the power of coordination illustrating how coalitions may enforce strategies which overcome the PD. In the fifth section we discuss how our findings may inform the policy debate on responsible consumerism. The final section concludes.

2. The Simplest Model Representation: A 2-Player Static Game

In the simplest version of the game there are 2 players,

, who can vote with the wallet for the SR product (

) or for the standard product (

). The payoff of player

i is

where

is the strategy profile.

The payoff function (

1) depends on three crucial factors: the public good benefit accruing from the choice of the SR product (

), weighted for the share of players choosing the strategy

, the enjoyment arising from players’ other-regarding preferences (

), and the extra-cost of voting for the SR product (

).

The first factor (

b) is the economic benefit accruing to the individual from company behaviour change due to the vote with the wallet. This element hinges on the assumption that voters’ actions have an impact on companies in proportion to the share of responsible voters and can direct them toward a more responsible behavior. Valuable examples of this benefit are higher chances of getting a job or higher job satisfaction in a more socially responsible company and health benefits or amenities in a more environmentally sustainable company. Other examples may relate to tax or cultural corporate responsibility. According to the former, consumers vote with the wallet for a company abstaining from tax dodging practices that reduce tax financed welfare services in their country. According to the latter, they vote with the wallet for a company that finances local cultural inheritance with its CSR policies. (An example of cultural corporate responsibility comes from Expedia, Inc., a world’s leading online travel company establishing a partnership of the World Heritage Alliance with the UNESCO World Heritage Centre. The World Heritage Alliance includes 59 corporate members and partners (such as the Fairmont Hotels and Resorts and Mandarin Oriental) promoting environmental, cultural and social responsibility, and supporting local community tourism initiatives at World Heritage sites with grants or promotion in favour of responsible tourists contributions. The alliance is currently involved in the protection of 20 World Heritage sites in seven countries including Mexico, Costa Rica, Belize, Jordan, Dominica, Ecuador, and the United States. For other case studies of cultural corporate responsibility see [

18,

19].) In all these cases it is reasonable to assume that the responsible vote with the wallet produces a utility for consumers through a benefit which has public good features since it is clearly non-rivalrous and non-excludable (a socially, environmentally, fiscally, or culturally responsible company cannot limit the enjoyment of its responsible stance to consumers voting for SR products excluding free riders voting for conventional products). (We consider

b as exogenous for simplicity (and not related to oligopolistic models of CSR competition) since we focus on the perspective of consumers, who are reasonably assumed tohave their own approximate idea of the positive externality arising from the vote with the wallet and not to have a sophisticated knowledge of the competition model behind it.).

The second factor (

a) is the contribution, if any, of the responsible purchase to the utility function of the voter if she has some form of other-regarding preferences, an element which has been demonstrated not to be uncommon in the experimental literature. (Empirical findings from Dictator Games [

20], Gift Exchange Games [

21,

22]), Public Good Games [

23,

24,

25], Trust Games [

26,

27], Ultimatum Games [

28,

29], provide ample evidence documenting the existence of other-regarding preferences. Evidence from behavioural studies highlights that individuals have other-regarding elements in their preferences ranging from (positive and negative) reciprocity [

30], inequity aversion [

31,

32], other-regarding preferences [

33], social welfare preferences [

34], and various forms of pure and impure (warm glow) altruism [

35,

36]. A meta study of [

37] examines results from around 328 different Dictator game experiments for a total of 20,813 observations. The result is that only around 36 percent individuals follow Nash rationality and give zero (based on these numbers the author can reject the null hypothesis that the dictator amount of giving is 0 with

) and more than half give no less than 20 percent.)

The third factor (c) (We assume since it represents an extra-cost between a standard products and a SR product, when the former is cheaper than the latter. Alternatively, it could be assumed that . However a negative c makes the problem trivial. Our theoretical analysis hence applies to the more frequent and reasonable cases in which CSR adds extra costs.) measures the cost of voting with the wallet, namely the extra cost, if any, paid by the consumer when choosing a product of a responsible company vis-à-vis a product of comparable quality and lower price of another company which falls below the responsibility standards of the former. We as well assume for simplicity that for all (where is the income of player i), that is, all players’ decisions to vote or not for SR products depend only on utility considerations and are not constrained by lack of income.

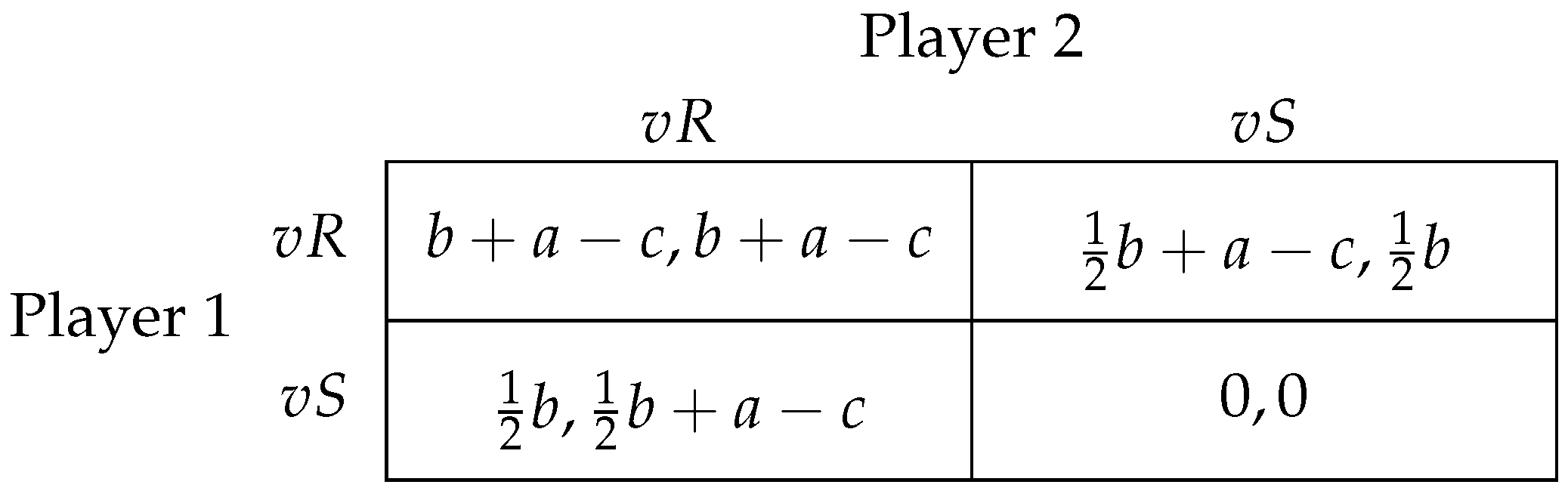

The above described game can be represented by

, where

is the set of players,

is the set of actions, and

is the set of payoffs described in (

1). The payoff matrix writes

The game G has always a unique NE, which is if and otherwise.

The parametric conditions creating a PD in the game are

or

That is, when (

2) holds, the (unique) NE

is Pareto dominated by the strategy pair

which yields the highest payoff for both players.

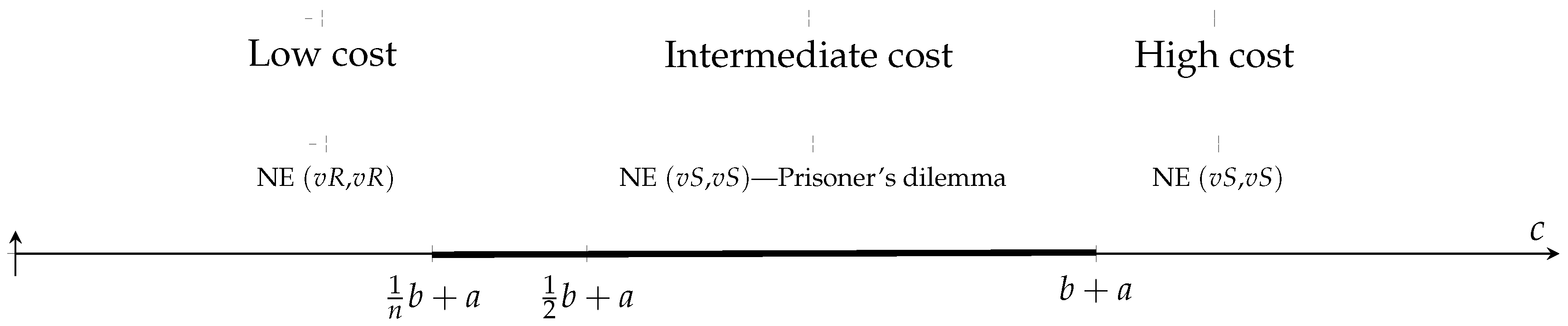

By considering

b and

a as product and individual characteristics respectively, and

c as a parameter which may differ depending on the characteristics of the market, the three regions of equilibria generated by different values of the cost of voting responsibly are illustrated in

Figure 1.

More specifically, given (

2), we are not anymore in the PD area when the cost of voting responsibly is too high (

) or too low (

), which could be the case of products with a relatively low (or zero) cost of voting for socially responsibility (see our discussion in

Section 2.2 which follows). Please note that if

, the NE are

and

, and both are inefficient, while if

, we have that

is efficient and

is inefficient.

Based on the above described features the originality of the game in the PD literature lies in its ‘hybrid’ provision-PD game characteristics ([

38] classify PDs into four categories (provision, commons, altruism, selfish) according to the private/public benefits and costs to players and to the action/inaction choices related to the ‘cooperation’ and ‘defection’ strategies.) where both classical ‘cooperation’ and ‘defection’ strategies require an action. Another difference with respect to standard provision-PD game is given by self-regarding preferences adding a private benefit to the ‘cooperative’ strategy, typically displayed by the vote with the wallet experience. As we will see in what follows these specific features and the framework of the game produce original attempts to overcome the dilemma (

Section 2.2) and original theoretical results vis-à-vis the standard provision-PD game in terms of interval of the PD area (

Section 2.1), Folk theorem threshold patience (

Section 3.1), and renegotiation proofness conditions (

Section 4.2). The specific features of the game also produce an altruism paradox (

Section 4.1) which can be overcome with mechanism designs that are unique to the vote with the wallet framework (

Section 4.3).

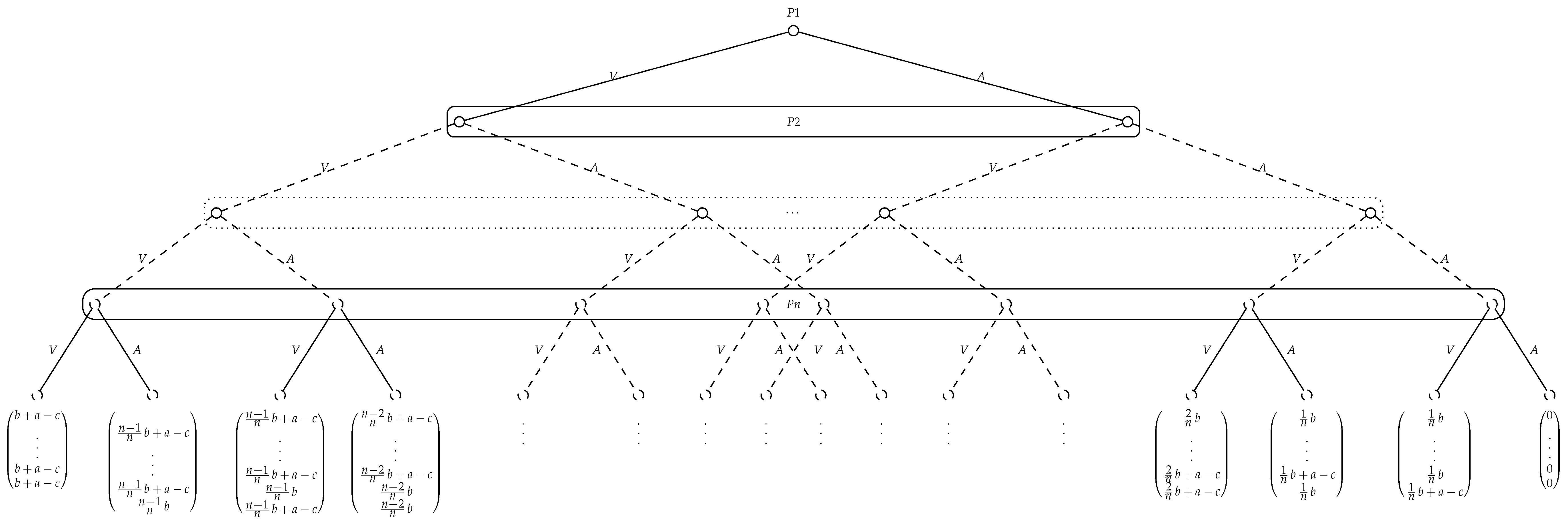

2.1. The Multiplayer Game

When the number of players is

, the game is represented by

, where

for each

, and the payoff function is

with

j being the number of players who play

in

. (

is a

-dimensional vector over

, so

j is a natural number in

.)

The game

has always a unique NE, which is mutual voting for conventional products if

and mutual voting for SR products otherwise (we prove this result in

Appendix A.) However, if

we fall again in the PD and the equilibrium

is not efficient since, for both players, the highest payoff is

, which is obtained with the

strategy pair.

Figure 2 clearly shows that, when the number of players grows, the area of the PD in the voting with the wallet game decreases its infimum. This implies that in standard global consumer markets where the number of players is very large the

equilibrium can be attained only if the other-regarding preference parameter is higher than the cost differential parameter for all players (this is because

). As a result PD is a highly relevant problem in the vote with the wallet game wiht a high number of players and whenever the value of

c is not negligible.

2.2. Discussion and Possible Extensions to Find Solution to the Vote with the Wallet PD

Before looking at formal solutions to the multiplayer PD, we shortly discuss in this section how the dilemma can be practically solved.

A first obvious and simple solution is lowering as much as possible the extra cost of the responsible vote. This is what occurs in two of the four examples we made in the introduction (SR investment funds if the universe of investable funds is large enough to eliminate the cost of missed diversification (The literature highlights that managers of SR investment funds voting with the wallet have three potential additional costs vis-à-vis managers of conventional investment funds (costs of acquiring information on the SR stance of investable stocks, missed diversification opportunities due to the application of their exclusion criteria and cost of disinvesting when a stock enters the exclusion list). Theoretical analysis however shows that the second cost becomes negligible or null as far as the universe of investable stocks is large enough [

39]. Empirical evidence confirms that risk adjusted returns of SR investment funds are not significantly different from those of conventional funds [

40,

41].) and the Oxfam’s

Behind the brand campaign where in some of the proposed actions—such as posting a tweet or a Facebook message to a company—there is no purchase and no extra economic and opportunity cost).

A second type of solution is a government intervention that may facilitate lowering the extra cost in different ways (preferential access to public procurement according to the CSR stance of the bidders/characteristics of the product, ad hoc tax allowances such as green consumption taxes, etc.). If the government aims at providing some public goods, it may find this kind of intervention optimal in order to foster the production of these public goods in the market by companies that internalise the externalities. Some of these interventions are currently pursued by various institutions around the world. (The most relevant example is represented by feed-in tariff schemes for renewable energy adopted in 63 jurisdictions worldwide [

42]. To mention other examples, in many countries dedicated outlets selling FT products have a preferential fiscal treatment and green consumption taxes create fiscal advantages for more environmentally responsible value chains. These fiscal advantages can be directly on consumer prices or, when on producer prices, can be transmitted on consumers prices depending on demand/supply elasticities thereby reducing

c in our model. In addition to it, governments directly vote with the wallet for the responsible product giving preferential treatment to SR products in procurement rules (i.e., Green Public Procurement rules are a relevant example, for their application in the EU see

http://ec.europa.eu/environment/gpp/index_en.htm)).

A third type of solution relies on how individual consumers may solve the coordination problem with their own bottom-up actions, given the extra cost

c. A standard approach consists of applying the class of Folk theorems to the infinitely repeated game. Another interesting approach is the development of zero determinant (ZD) strategies. ZD strategies are memory one strategies (i.e., strategies in which player’s behavior depends only from action in the previous period) unilaterally enforced by a single (focal) player who chooses a linear reaction to other players’ behaviour as a strategy. The literature in this respect documents that the action of the focal player is more important than what may be intuitively thought [

43]. The focal player adopting a ZD strategy can set a linear relationship between her payoff and her co-players’ average payoff. Stewart and Plotkin (2013) [

44] demonstrate that generous ZD strategies have strong power to make population evolve toward cooperation.

A fourth type of solution concerns the action of institutions that may organise coalitions of players that represent an important share of the market in order to enforce mutual cooperation [

43].

In what follows, we discuss these last two types of solutions by providing a contribution on how they can enforce mutual responsible voting equilibria in the repeated game and give rise to new practical solutions of the multiplayer PD.

4. The Power of Coordination

Applications of the Folk theorem in the multiperiod game where players adopt grim strategies as well as of the Pavlov and pTFT strategies in evolutionary games enacted by individual players significantly restrict the area of the PD. However, real world scenarios may fail in two directions: (i) Folk theorems are difficult to enforce with a large number of players and a non-infinite number of rounds due to the well-known endgame problems; (ii) time needed to reach the mutual responsible voting equilibrium in evolutionary games may be too long; (iii) individuals may have higher power in enforcing mutual responsible voting equilibrium if they act as a coalitionslike labor associations, labor unions, or political parties.

Coalitions are particularly useful since we have shown that the power of strategies enacted by individual players to enforce mutual voting is much weaker as far as the number of players increases (

Section 2.1).

Suppose a coalition is composed by

members, with

, who are able to set a strategy

to be played during the game. By applying [

43] results on strategy alliances, we find that a coalition composed by

members can enforce mutual responsible voting if and only if the coalition adopts either a fair strategy, or a generous strategy and (proof in

Appendix A)

We have shown in Proposition 2 that individuals cannot enforce mutual responsible voting by adopting strategies that are generous but not too much. On the other hand, (

9) shows that the higher is the coalition size (high

), the more the strategy can be generous (low

) (as we have seen above, one example of ZD strategy a coalition can apply is the proportional TFT).

4.1. The Coalition of the Willing and the Paradox of Altruism

Here we provide a more intuitive example illustrating how a coalition can work.

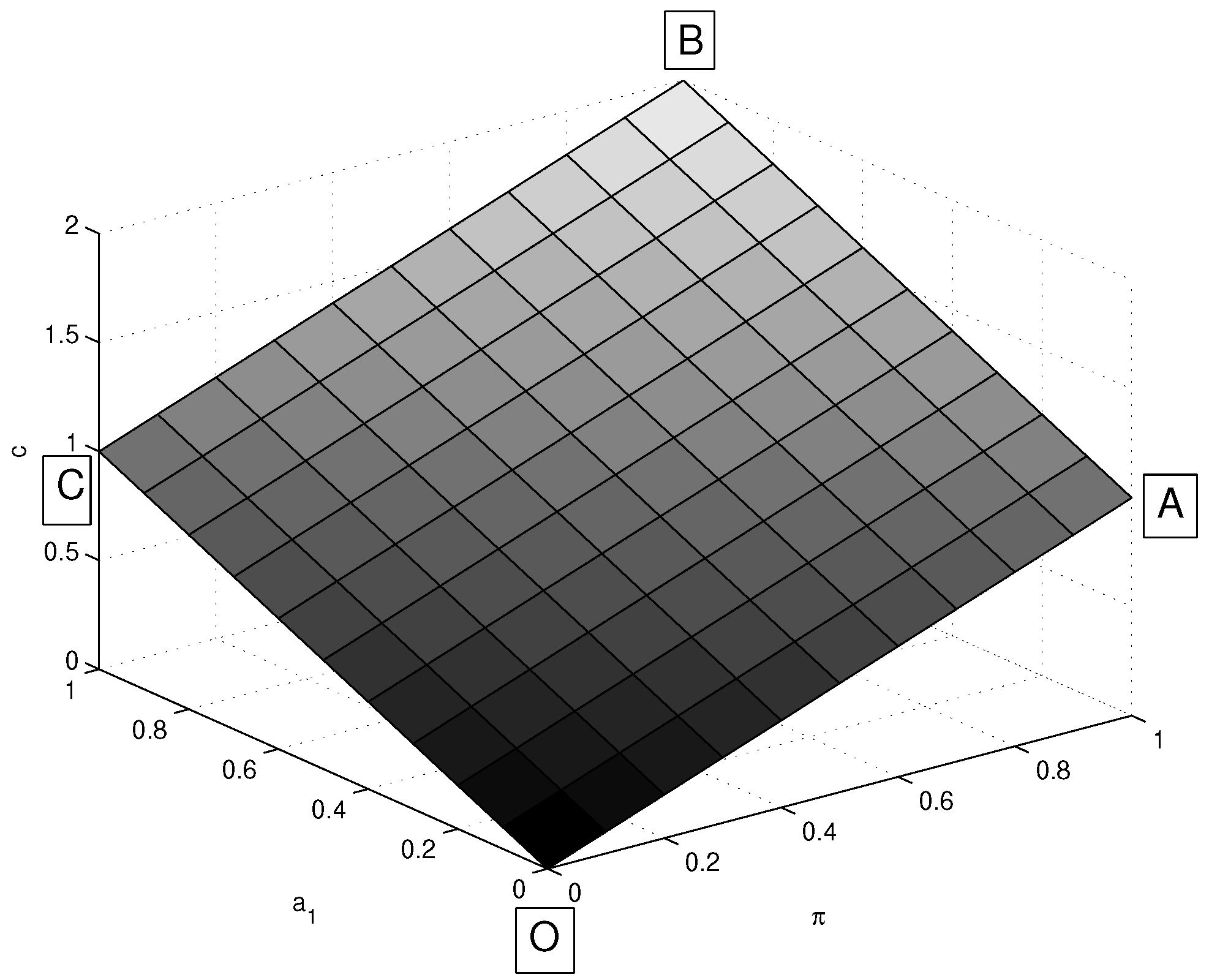

Suppose the existence of a share of non-income constrained individuals with other-regarding preferences of the form where or . These individuals would nonetheless vote with the wallet for the responsible product if they could coordinate and form a coalition of the willing which synchronises their voting choices. Based on the above inequality, can be defined as the minimum responsible vote with the wallet coalition threshold required by individuals with other-regarding preferences higher or equal to .

Figure 4 shows the three-dimensional

threshold of feasible parameters for a ‘coalition of the willing’ when conveniently normalising

. The plane

always belongs to our set because it corresponds to the situation in which the cost of responsible voting is null, and therefore the benefit for each individual of the coalition satisfies

for all

. Hence, when

, we have

. However, when

c increases, the other-regarding preference coefficient

also needs to increase in order to keep

(segment

). This may be interpreted as the higher the cost of voting responsibly, the higher the other-regarding preferences of individuals to ensure compatibility with the lowest coalition threshold. On the other hand, the coalition of the willing must be larger with a higher cost

c in order to convince individuals with other-regarding preferences to vote responsibly. (As an extreme case, when the cost is too high and other-regarding preferences are too small,

, implying that there will always be (at least one) individual(s) with buying the conventional product as a best strategy (segment

). Note as well that when all players are willing to vote responsibly and every individual has a preference to vote responsibly equal to the benefit of the public good component (the numeraire

b), then the extra cost can be up to twice as much the numeraire

b (point

B).).

Suppose now that an organisation can form a coalition of the willing so that a share

(this is a necessary condition to make responsible voting with the wallet strategy nonetheless incentive compatible) of altruists reveal their strategy

at

(regardless the outcome at

). For instance, he strategy can be revealed through a cash mob (Cash mobs are media (video recorded) events where an organised group of sellers gather into a retail outlet to buy a given product and intend to communicate its decision to the general public. For a reference on the US cash mobs see

http://cash-mobs.com/.) where the coalition plays the responsible voting with the wallet strategy and announces her strategy for the future. After the strategy is revealed the remaining players will however vote for standard product if

or because they will fall into the PD if

Assuming that the above inequality holds, in order to avoid the PD the coalition of the willing needs t announce addedits strategy at as , which consists in punishing the free riders at period by not voting with the wallet responsibly.

Given the coalition of the willing’s strategy, the benefit in

for the myopic self-interested individuals who buy the conventional product is

The potential loss for out-of-coalition individuals from the punishment occurring when members of the coalition of the willing deviate from their responsible voting strategy is

where

is the discount rate measuring players’ patience.

The potential conventional buyers will vote responsibly if punishment is higher than temptation, that is

or

Inequality (

10) outlines an altruism paradox since, coeteris paribus, in a (two period) finite number of rounds a larger coalition (generated by a higher number of individuals with enough other-regarding preferences) increases the propensity to free ride given the specific characteristics of the vote with the wallet game. This is because, as it is clear from inequality (

10), with a higher

marginal benefit of free riding (buying the conventional product) will be higher than marginal cost.

To analyse the effect of a coalition on players’ patience, we elaborate a Folk theorem in presence of a coalition action. Suppose a coalition of

k voters vote responsibly at each stage regardless other players’ strategies. In other words, we are now assuming a coalition of players who decide to vote responsibly even if the other players vote for the conventional product. Then each voter solves the problem

Hence, within the PD area, when the paradox of altruism holds the patience parameter is higher than the previous patience parameter measured in the absence of coalition (the altruism paradox does not imply that cash mobs and coalitions are not useful since, when other-regarding preferences of coalition members are not high enough, they produce the effect of triggering the vote with the wallet of coalition members (who would have voted for the standard product if playing the game with any coalition)).

4.2. Renegotiation Proofness

We wonder whether the strategies described above to enforce mutual responsible voting equilibrium are renegotiation proof. The cost of punishing for the punisher (that is, what she loses by executing punishment) is if the alternative is full coordination, or if the alternative is partial coordination. Hence the strategy is renegotiation proof if we reasonably assume that it is not possible to enforce free riders to play cooperatively (i.e., buying the responsible product) in time after they free-rided at time t and if where is the share of punishers. Under such condition the tit-for-tat strategy announced by the coalition of the willing is renegotiation proof, that is, there is no interest for punishers to renegotiate the strategy after the violation of free riders and before the punishment for that violation is enacted, since the PD area in the multiplayer PD is such that .

4.3. The Optimal Cash Mob

Based on what observed above about the power of coalitions and the paradox of responsibility in the vote with the wallet game, we outline the characteristics of a bottom-up mechanism design which can bring to mutual voting equilibrium in the infinitely repeated game.

A coalition of the willing may reveal its existence and strategy by organiszing a cash mob able to

Announce the coalition members number k;

Communicate to the general public the crucial parameters of the game and, more specifically and n;

Communicate the ‘permanent’ commitment of coalition members to play the responsible strategy (to avoid the paradox of altruism documented in

Section 4.1) by subscription a pre-authorised debit for purchase of SR product which is automatically renewed in absence of a cancelation notice;

Define the ‘threat’, that is, the commitment of coalition members to buy the conventional product if other players in the game do not buy the responsible product. As shown above in

Section 4.2 the threat is renegotiation proof as far as parameters are within the PD area since

.

Cash mob plays the role of a reinforced signal. It is more effective than a press conference because the public announcement works together with a credible commitment to enact the strategy. The success of the cash mob depends on the rationality of the non-coalition players and their agreement on the model parameters (the benefit b and the cost c), which is ensured ex ante by assumption in the theoretical model but not in reality. (As stated in the introduction, the perception of b is easier in some specific dimensions of corporate responsibility. For instance, a rise in corporate fiscal responsibility should produce a clearly identifiable increase in domestic fiscal revenues and therefore in resources available for local public goods.).

6. Conclusions

Consumers’ willingness to pay and revealed preferences implicit in the non-negligible market shares of SR consumption and savings document that the vote with the wallet is becoming an increasingly relevant feature of contemporary economics. Growth of FT products and SR investment funds document that non-price demand elasticity (where consumers consider CSR as one of the product characteristics on which they base their choices) plays an important role.

Our paper deals with these novel features of contemporary markets by focusing on the game theoretical demand side characteristics of the vote with the wallet. The paper also investigates the embedded multiplayer PD generated by the public good features of the benefits produced by the vote for the responsible product.

We analyse the vote with the wallet game, its associated PD, and possible solutions, as this game is actually played by millions of consumers. First, we document that the area of the dilemma widens as the number of players increases, as standard in global consumer markets. Second, we apply the Folk theorem and we outline the conditions allowing the PD inefficiency to be overcome with grim strategies. Then, we show that two crucial parameters affect the threshold patient level, that is the number of players and the standardised cost of responsible voting (i.e., the net cost of responsible voting as a proportion of the responsible voting benefit). Third, we investigate how Pavlov and pTFT strategies in evolutionary games enacted by individual players may lead to mutual voting equilibrium. Finally, we show that the formation of stable coalitions of responsible players may lead to larger positive externality generated because of higher CSR but fall into the paradox of altruism because of increasing other players’ propensity to free ride.

Findings presented in this paper through theorems and qualitative mechanisms may inform the policy debate on responsible consumerisms. People do actually vote with the wallet and what we model is the link between key market characteristics, that is the extra cost and the societal benefit of responsible products, consumers’ other-regarding preferences, number of consumers and the role of timing and coalition. Future research can extend our theoretical findings with behavioural components that may react as an additional stimulus to reduce the PD area as well as with empirical evidence showing the link between market components and firms’ CSR.