1. Introduction

The first extensive survey of corporate governance might be the one conducted by Shleifer and Vishny in 1997 [

1]. They stated that: “Corporate governance deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investment.” [

1]. Academic research regarding this issue has surged significantly over the past several decades. Corporate governance received special attention during the financial crisis in emerging markets since 1998 [

2]. Afterwards, a series of business scandals in the US and the EU took place in the early 21st century, which rendered corporate governance to become the focus of public attention again. The recent financial crisis (2008–2009) further enforced regulators, in the major financial markets, to renovate and devise new guidelines to strengthen corporate governance in multiple aspects; its impact on the global financial systems is apparent.

Before further discussions, we would like to define the concept of “long-term business sustainability” here. We hold a similar view as Dyllick and Hockerts [

3]; they have defined corporate sustainability at the business level. We have transformed their definition and redefined the concept of long-term business sustainability as “meeting the current needs of a company’s stakeholders (e.g., investors, employees, clients, and supervisory authority) without compromising its ability to meet the needs of future stakeholders, in the long-term”.

In this perspective, it could regard corporate governance as the degree of how much a company weighs its stakeholders’ needs at the top managerial level. Because of the importance of corporate governance to long-term business sustainability, several research topics related to this subject have emerged. Examples are equal treatment of shareholders [

4] and the role of stakeholders [

5]. If a competent company cares about corporate governance, the management team should maintain sustainable developments in the business aspect for their clients, employees, and investors. Also, it should earn reasonable profits to share with its shareholders fairly. The long-term business sustainability of the financial industry (such as the banking and life insurance companies) are crucial to the stability of a nation’s economy. Therefore, the present study adopts the financial holding companies as an exemplary case.

The Taiwan Stock Exchange (TWSE) was aware of its crucial role and established a Corporate Governance Evaluation System (CGES) since 2014 [

6], to facilitate the understanding and objective evaluations of the listed companies regarding corporate governance. The key purposes of CGES are twofold: (1) support the listed companies to identify their shortcomings and conduct the associated improvements and (2) increase outside investors’ confidence. To be more specific, the evaluation system’s objectives are to forming the culture of pursuing superior corporate governance among management teams and board members, guiding the sustainable business developments of companies, complying with international standards, and thus improving the Taiwan stock market’s overall efficiency and reputation.

The CGES of Taiwan has attained remarkable results since its debut in 2014. The listed companies refer to various indicators of the CGES to undertake required actions, and the overall awareness of corporate governance—from board members to management teams—has increased significantly ever since. For example, in the dimension of protecting shareholders’ rights and interests, the listed companies that chose the case-by-case vote approach has grown 44% in the past three years (i.e., from 2015 to 2017). The companies that adopted the candidate nomination mechanism to elect all directors and supervisors also increased to 67% until 2017.

In the dimension of enhancing board composition and operation, the proportion of listed companies that have set up audit committees to comply with the TWSE’s regulations has reached 45%. Additionally, the companies that have compiled corporate social responsibility (CSR) reports have also grown year by year, and the number of CSR reports issued has reached 439 in 2017 [

6]. All the aforementioned outcomes suggest that most of the listed companies have shown their willingness and made tangible efforts to pursue corporate governance. The CGES has paved a solid ground for the listed companies to move ahead.

The framework of the CGES referred six principles of corporate governance released by the Organization for Economic Co-operation and Development (OECD) in 2004 [

7]. The TWSE’s current evaluation framework comprises four major dimensions: (1) Protecting shareholder rights and interests and treating shareholders equitably, (2) Enhancing board composition and operation, (3) Increasing information transparency, and (4) Putting CSR into practice. The included number of indicators (or termed as criteria in this study) reached up to 85 in the four dimensions. The TWSE assigned a different weighting for each dimension, and the total weights sum up to 100% from the four dimensions. It is a hierarchical framework that considers multiple aspects is in line with commonly observed multiple criteria decision-making (MCDM) problems; thus, the present study attempts to explore the rationality and fairness of its design of (i.e., the CGES) from the MCDM perspective.

Although the 85 indicators seem to cover a wide spectrum of measures, the system’s design is complicated and inconsistent in its hierarchical design. The TWSE defined five types of indicators, namely A, B, AA, A+, and the EXTRA ones (see

Table 1). Type A applies for all the listed companies where Type B only applies to certain industries. Most of the indicators (i.e., Types A and B) are to be gauged and assigned as either “yes (1)” or “no (0)”, a binary approach to determine a company’s performance outcome on a single indicator. If an indicator can meet the requirement, the system will assign one point for it; zero otherwise.

However, for some other indicators (i.e., Types AA and A+), the scoring mechanism is different. If additional requirements are satisfied, not only one credit will be awarded for the AA or A+ indicator within its dimension, but also another credit will be added to the company’s overall evaluation. The EXTRA Type has two indicators, which can contribute or penalize indefinite scores (e.g., +3 or −5) directly to a company’s final evaluation result. The two EXTRA indicators would cause heterogeneous impacts to a company’s overall evaluation, which is not included in the four dimensions. Its evaluation system seems to be an inadequate design from the perspective of MCDM modeling. The detail numbers of the TWSE’s 2017 corporate governance evaluation dimensions and weightings, the number of indicators and the associated types of indicators of each dimension, are reported in

Table 1.

As mentioned earlier, the CGES exhibits the mission to lead those public listed companies to pursue superior corporate governance, which intends to encourage those front runners and exhort those who are lagging. Therefore, its scoring mechanism should be scrutinized to ensure this goal. The framework of the current CGES (the 2017 version), as shown in

Table 1, has at least four issues that deserve a second thought:

- (1)

The weighting of each dimension seems to have a direct tie with the number of indicators, which might contort the relative importance of each dimension (e.g., in the first dimension, the number of indicators is 17, and reflects its weighting);

- (2)

The “yes (1)” or “no (0)” approach to judge the performance of a company on an indicator would be difficult for experts to express their opinions that consider the different degree or level of satisfaction;

- (3)

The additional credit brought by a Type AA or A+ indicator to the final score (i.e., not just within a dimension) might distort the actual performance of a company compared with the other ones;

- (4)

The two EXTRA indicators that do not belong to the four dimensions are lack of a clear guidance to assign objective scores, and the extra plus indicator might even cause the aggregated score to overpass 100%.

In addition, the CGES model adopts the additive type aggregation approach, which presumes the independence among the dimensions; this seems to be unlikely. For example, the 3rd dimension (increasing information transparency) should have relation with the first dimension (protecting shareholder rights and interests and treating shareholders equitably). As a result, an evaluation system that can model the interdependence or mutual influence relationship among the dimensions would be more realistic in practice.

Therefore, this study attempts to propose a hybrid approach, based on the modeling concept of MCDM, to resolve the issues mentioned above. In the first step, we attempt to distill from the existing 87 (i.e., 85 + 2 EXTRA) indicators, to identify the key factors to forming a concise corporate governance evaluation model. This step may simplify the CGES, which will be helpful to support decision makers (DMs) focusing on manageable numbers of indicators (criteria). According to the renowned theory—bounded rationality—proposed by the Nobel Laureate Herbert A. Simon [

8], DMs would encounter obstacles to make rational judgments while overwhelmed by too many factors. With the help of experienced domain experts on corporate governance, the present study adopts the Delphi method [

9] to eliminate the unnecessary or redundant indicators in each dimension.

In the next step, the decision-making trial and evaluation laboratory (DEMATEL) is adopted to decompose the influential relations among the dimensions; the assumption or limitation of the independence among the dimensions can thus be removed. The DEMATEL technique was proposed to model complex social problems [

10], which presumes that every factor or criterion in a system has more or less influence on the others. The DEMATEL technique also has the capability to analyze the directional influence between dimensions (or criteria), which is often applied to identify the root cause of an under-performed criterion to plan for plausible actions. This technique has been widely applied in many fields, ranging from social science [

11] to engineering [

12], to pursue sustainability in various applications [

13].

In the third step, based on the distilled criteria from the 87 indicators from the first step, we propose a hybrid MCDM approach to explore the relative influence of each criterion, and the consensus of the aggregated influence of each criterion within a dimension, from the knowledge of domain experts, can be reached. This step intends to overcome the previously mentioned issue of how to determine the weighting of each dimension, which should not be solely depended on the number of indicators of a dimension. The hybrid approach applies the DEMATEL technique and the concept of the renowned analytic network process (ANP) [

14], to identify the influential weight of each indicator, termed as DANP [

15]. Additionally, the modified VIKOR [

16,

17] is integrated with the DANP influential weight of each indicator/criterion, to form a novel corporate governance evaluation system. Unlike the conventional simple additive weighting (SAW) aggregation, the modified VIKOR has the advantage of underlining the highest weighted performance gap of a company. The identified gap can be cross-referenced with the cause-effect influences from the DEMATEL analytics, which can support planning actions.

In the present study, considering the critical role of financial holding companies to the stability of economy, five Taiwanese financial holding companies are to be examined by the proposed approach. During the evaluation phase, the study applies the fuzzy measurement technique, which enables experts to denote their linguistic opinions, which is more intuitive. By doing so, we may avoid the problematic “Yes (1)” or “No (0)” scoring approach applied by the CGES; instead, the degree of satisfaction can be expressed.

This study obtained the following outcomes by applying the proposed hybrid model to a group of five financial holding companies in Taiwan: (1) Simplify the complicated and debated CGES model to 13 critical indicators in four dimensions; (2) Explore the interrelations among the included criteria by devising a hybrid MCDM model based on domain experts’ knowledge and their professional judgments; (3) Evaluate the performance of corporate governance of five financial holding companies, and if the ranking outcome (in different experiments ) is consistent with the report of CGES in 2017; (4) Support financial holding companies to pursue business sustainability by identifying their weakness priority on corporate governance with an exemplary case and discussions.

The remainder of the study is organized as follows: In

Section 2, this study reviews the major related studies of corporate governance. In addition, certain MCDM methodologies applied in this model are briefly introduced.

Section 3 proposes a hybrid MCDM to model and evaluate corporate governance.

Section 4 provides an empirical example, ranking three financial holding companies in Taiwan and comparing the result with the one from the CGES.

Section 5 discusses the interrelationships among the assessed dimensions and criteria of the obtained evaluation.

Section 6 provides management implications, research limitations, and the plausible future research direction.

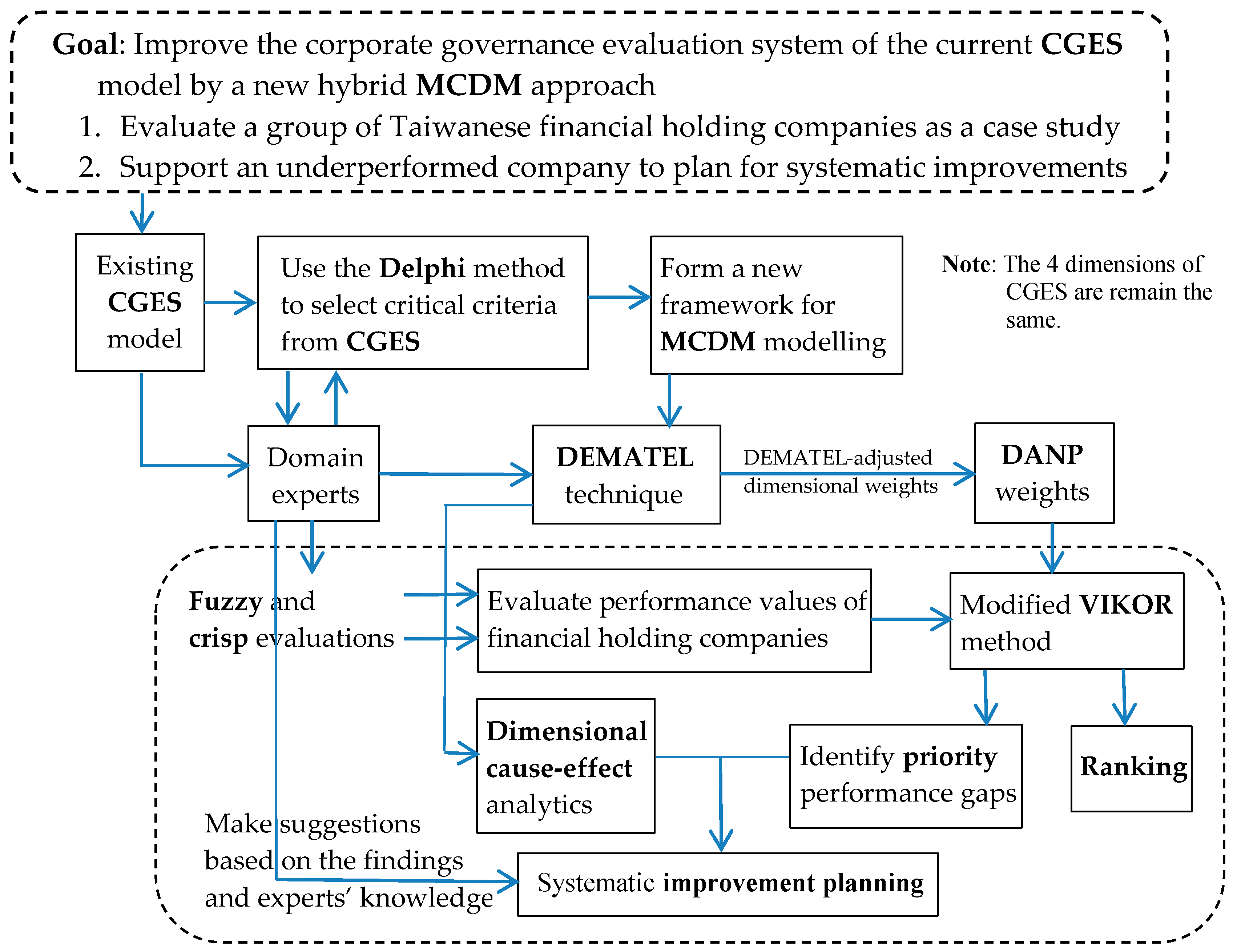

3. Combined VIKOR-DANP Decision Model for Corporate Governance Evaluation

This section introduces the conceptual framework and proposes a hybrid approach to evaluate the performance of the corporate governance of companies, including the DEMATEL technique, the DANP, and the modified VIKOR methods. Additionally, the fuzzy set technique, proposed by Zadeh [

42] is adopted to transform domain experts’ verbal expressions for modeling the impreciseness of their opinions. To construct a hybrid evaluation model for assessing corporate governance comprises four phases as follows in

Figure 1.

In the first phase, as a typical MCDM problem, we have to identify the most relevant dimensions and the associated criteria for forming the framework of an evaluation model. In the present study, we attempt to leverage the existing CGES (devised by the TWSE) and redefine the critical criteria related to each dimension (refer to

Table 1 and

Table 2) by the Delphi method. The involved procedures will be further explained in

Section 4, and the invited experts all have over 30 years’ experience in this domain.

In the next phase, the obtained criteria from the first stage are analyzed to explore the degree of influence of each dimension (criterion) on the other dimensions (criteria). These obtained criteria are applied to form a DEMATEL questionnaire to soliciting domain experts’ opinions. The obtained and averaged opinions from domain experts, forming an initial average matrix

A (refer to Equation (1)), is used to conduct a cause-effect analysis. The outcome of the DEMATEL analytics can be further processed to derive the weight of each criterion by the DANP method. In this phase, the influential weight of each dimension and criteria of the new corporate governance evaluation model can be determined. The mathematical formulae, from the DEMATEL to the DANP, are explained in

Section 3.2.

The third phase involves two steps: (1) Evaluate sample companies’ performance on each criterion and (2) Aggregate the final score of each company by using the modified VIKOR method. The first step requires experts to define their verbal (semantic) expressions in the form of the fuzzy triangular membership function, one of the most widely applied fuzzy membership functions. The second step integrates the DANP influential weights with the evaluated companies’ performance scores from the first step, to determine the final ranking result.

The fourth phase puts emphasis on pursuing business sustainability, by identifying the weighted performance gaps of a company on corporate governance. Since a company has only limited resources to pursue improvements, the identified performance gaps from the third step can be combined with the analytics from the DEMATEL technique, to devise plausible action plans.

The hybrid approach can calculate the weighted performance gaps to the aspiration levels using the modified VIKOR method, also termed as the “aspired-worst” approach, as benchmarks. The four phrases are explained in the following

Section 3.1,

Section 3.2,

Section 3.3 and

Section 3.4 respectively. The conceptual research flows are shown in

Figure 1, and an exemplary case with three financial holding companies in Taiwan are analyzed and illustrated for the proposed hybrid MCDM model.

3.1. Delphi Method

The Delphi method was proposed by the Rand company in the early 1960s, to resolve the issue of different opinions from a group of experts, to reach a consensus anonymously [

44]. Though there are various approaches to conduct the Delphi method, the study adopts the threshold-based approach, by setting a consensus threshold to select the relatively important factors (indicators) from the existing evaluation system of the CGES. In this study, those two EXTRA indicators will not be included.

In the beginning, each expert will be requested to fill in the importance of all the 85 indicators (exclude the two EXTRA ones, refer

Table 1), ranging from 0 (Insignificant) to 10 (Very Important). By setting a threshold, the indicators that are above the threshold (after averaging the scores provided from all the experts) will be reserved for the next round. Since we merely intend to identify the candidates (indicators or criteria) in the first round, the indicators with diverse opinions will not be further investigated.

Similarly, in the second round, each expert provides their opinions about the importance of those selected indicators from the first round. Since the second round involves fewer indicators, if any arguable indicator exists (i.e., with diverse opinions regarding its importance from experts) will be reviewed by requesting the minority to express their reasoning that supports his or her opinion. Then, the minority’s explanations will be provided to other experts to collect their opinions again. In this study, we presume to reserve 12~15 criteria for constructing an MCDM model in the next stage. The details will be provided in

Section 4.

3.2. DEMATEL Technique and DEMATEL-Based ANP (DANP) Method

The DEMATEL technique presumes that each criterion has influence to the other criteria of a system (or model), which is commonly observed in a social problem. The required computational steps are as follows [

15].

Step 1: Form an intial influence matrix A

The initial influence matrix

A can be obtained by asking experts questions such as: “What is the direct influence of criterion

i on criterion

j?” The influencial scale ranges from 4 (very high influence) to 0 ( no influence), and the averaged influence of criterion

i on criterion

j can be denoted as

. The other elements in

A can be obtained follow the same logic (for

in

A), and the averaged influence adopts the arithmetic mean of all experts’ feedbacks, shown in Equation (1):

Matrix A indicates the extent of how each criterion affects the other criteria and the degree of total influences received from the other criteria.

Step 2: Normalize A to form the matrix D

The normalized initial direct influence-relation matrix

D is transformed from the initial average matrix

A. By referring Equation (2) and Equation (3), matrix

D is obtained by multiplying

with

A, and all diagonal elements in

A are equal to zero.

To calculate the total influence-relation matrix

T is similar to the concept of Markov Chain, which can be derived by summing up the matrices with increasing power of

D, as shown in Equation (4).

While increases to infinity, will be very close to a null matrix with elements, and matrix T can be obtained by referring Equation (5).

Equations (6) and (7) are used to obtain each row sum and column sum in the total influence-relation matrix

T, respectively. Here, the superscript denotes the transpose of a vector. Since in the matrix

T is a square matrix, the total number of elements in each vector equals to

n. Therefore, the two column vectors in Equations (6) and (7) can be used to calculate

and

, where

(for

) may divide the involved criteria into two groups: the cause and the effect groups. If

, then criterion

i belong to the cause group; otherwise (e.g.,

), criterion

j the effect group (i.e., receives a net influence from the other criteria).

Step 4: Transform the DEMATEL analytics into a DANP weighting system

Suppose that there are

p dimensions and

n criteria of a total influence-relation matrix

T; in this step, matrix

T can be shown as

to indicate the associated elements within each dimension in Equation (8).

In matrix

, each

denotes a sub-dimensional matrix of

that associates with dimensions

i and

j. By averaging all the elements in each

(

), matrix

can be simplified to become a dimentional influence matrix

, referring Equation (9). Take

for instance, which is the averaged result of all the elements of

in

. As a result,

and

for

and

, which form two dimensional vectors (similar to Equations (6) and (7)).

The dimentional influence matrix

needs to be further normalized. Again, take the first row of

for example, all of the first row’s elements in

should be divided by

. Therefore, the normalized dimentional influence matrix

can be shown in Equation (10). Since

p denotes the number of dimensions, it should be smaller than the total number of criteria.

The transposition of is regarded as an unweighted super-matrix W (i.e., ). Then, the DANP method adopts the normalized dimentional influence matrix to multiply with the unweighted super-matrix W and forms the initial DEMATEL-adjusted initial super-matrix (i.e., ). The influential weight of each criterion, by using the DANP method, can be obtained by multipling with itself multiple times until the the super-matrix becomes stable. After making normalization of the derived stable super-matrix, the sum of the influential weights of all the criteria should equal to one.

3.3. Modified VIKOR Method for Aggregating Performance Scores

While facing multiple criteria, it is usually difficult to compare the overall performance and make a ranking for a group of alternatives (e.g., 10 alternations) precisely. For instance, alternative k might outperform all the others on criterion i; however, it usually performs inferiorly on some other criteria. There are several approaches in conventional MCDM methods that may deal with this ranking problem.

One of the mainstream approaches is to measure the performance gaps that each alternative has on every criterion, and to aggregate the overall performance gaps for all the alternatives. Conventional methods, such as the technique for order preference by similarity to ideal solution (TOPSIS) proposed by Hwang and Yoon [

45], sets an ideal point and the worst point for each criterion to measure the shortest distance to the ideal point and the longest distance toward the worst one. Therefore, by defining a goal in the form of a performance gap function, the best alternative can be selected by identifying the best one with the shortest overall performance gap. The obtained result is also termed as the compromised solution.

Nevertheless, those conventional methods have two potential problems: (1) they do not consider the relative importance of each criterion and (2) the ideal point of each criterion is assigned by using the best performed value from a group of given alternatives. The second issue sometimes may even cause unwanted ranking reversal [

46]. The two mentioned issues can both be resolved by the modified VIKOR method [

16]. In the modified VIKOR method, the suggestion is to set an aspired point to replace the ideal point in those conventional approaches, which may avoid the results being constrained by a group of poorly performing alternatives.

The concept of the modified VIKOR method, begins with a predefined

Lp-metric to serve as an aggregate function by the compromise programming method [

16,

17]. Suppose there are

q alternatives, denoted as

A1,…,

Ak, …,

Az. For alternative

k, its performance on the

jth criterion is denoted as

, and the relative influential weight of criterion

j (i.e.,

) is obtained from the DANP method (

j = 1, 2, …,

n, and

n is the number of the involved criteria of a problem). The

Lp-

metric indicates the aggregated performance gap of alternative

k on all criteria, is shown in Equation (11):

In Equation (11), the aspired and the worst performance values on the jth criterion are denoted as and , respectively. To leverage the advantage of the modified VIKOR mentioned earlier, the aspired and the worst performance values on each criterion are set to be 10 and 0 (i.e., for alternative k on the jth criterion and ) in this study. Therefore, after aggregation, even the best alternative can measure its performance gap to the aspired value (i.e., in here).

Before moving forward, there is one thing that needs to be noticed here; the fuzzy performance evaluation [

13,

15,

39,

47,

48] will be adopted and compared with the crisp evaluation in the next Section. Since the fuzzy linguistic expression is closer to how experts making judgments, the present study adopts a 3-scale linguistic interval (i.e., Bad, Mid, and Good) for the invited experts by using the fuzzy triangular membership function, ranging from 0 to 10.

According to the modified VIKOR method, the following three indices—, , and for alternative k—should be derived based on different settings of a parameter v. The indices and can be obtained by setting (i.e., ) and (i.e., ) for alternative k.

The indices

and

have specific managerial meanings, suggested by a highly cited study [

16]; in which,

stands for the weighted group utility and

the individual regret on a specific criterion. The different combinations of

and

can be applied to forming a compromise ranking index

, based on the choice of a decision maker for alternative

k, is shown in Equation (12).

By setting to the aspired level (i.e., ) and to the worst value (i.e., ), then and . Therefore, Equation (12) can be simplified and rewritten as: .

3.4. The Advantages and Weaknesses of the Combined DEMATEL-Based ANP and Modified VIKOR

The proposed hybrid MCDM model comprises DEMATEL, DANP, and the modified VIKOR methods, which have the following advantages:

- (1)

The DEMATEL technique relaxes the assumption of independence among the dimensions, which can further identify the cause-effect relationship among dimensions;

- (2)

The integration of the influential weights (from the DANP method) with the modified VIKOR method can select and rank alternatives based on putting different emphases on the weighted group utility and the individual regret, to identify the biggest weighted performance gap on a specific dimension or criterion;

- (3)

Once a company adopts this approach to determine its weakness priority on corporate governance, it can identify the source dimension/criterion that may influence the underperformed criterion. Therefore, the board members may discuss the plausible action plans to strengthen its corporate governance.

Despite the advantages brought by this hybrid approach, it also has two weaknesses or limitations. First, it is unlikely for a DM with insufficient knowledge/experience to indicate the degree of influence of one criterion on another criterion regarding corporate governance. Therefore, this approach requires senior experts that are familiar with board operations and have managerial experience in operating or supervising businesses. Second, how to set an adequate v (refer to Equation (12)) is not intuitive; also, the ranking result might change under different settings. Researchers or DMs would need to conduct multiple experiments to ensure the consistency of the obtained findings. A short example will be illustrated in the next Section.

5. Result and Discussions

In this study, the modified VIKOR method adopted 10 as the aspired value and zero the worst one. Thus, take the performance of Company A on C1 for example, the raw score is 8.83, and the weighted performance gap is . The index shows the highest weighted performance gap of Company k. Take Company B for instance, we can find that its highest weighted gap is on C13 (6.90%). Those findings are useful for supporting a diligent company that attempts to improve its overall corporate governance performance by identifying a weakness priority. Even gigantic financial holding companies are constraint by limited resources; an improvement priority list may set a series of goals with a priority for a company to pursue.

Aside from the aforementioned robust test (i.e., not only used by the crisp and fuzzy evaluation approach but also assigned different values of v to examine the ranking by the modified VIKOR method), we also compared our findings with the latest report from the CGES. In 2017, the CGES reported that Company A belongs to the top category, Company B the third one, Company C at the bottom one (the seventh category), Company D also the top one, and Company E the second one; it is fully consistent with our findings (i.e., ); moreover, Company D surpassed Company A, which revealed more details to investors. This consistency implies the validity of the proposed hybrid approach. The original 87 indicators were refined to be the 13 essential criteria, and it also unraveled the relative influence of each dimension and criterion by a scientific and reasonable approach (compared with the CGES evaluation model). This hybrid MCDM model can be regarded as a transparent managerial system, which improves multiple aspects of the existing CGES model.

In

Section 4, this study examined the five financial holding companies’ openly disclosure information on corporate governance, and several robust tests support the validity and consistency of the obtained ranking outcome. The ranking outcome are mainly appealing to external (or potential) investors and supervisors. Once a company that attempts to strengthen its corporate governance to solicit investors’ interests and increases shareholders’ confidence, the proposed hybrid approach could also support board members to plan the plausible actions.

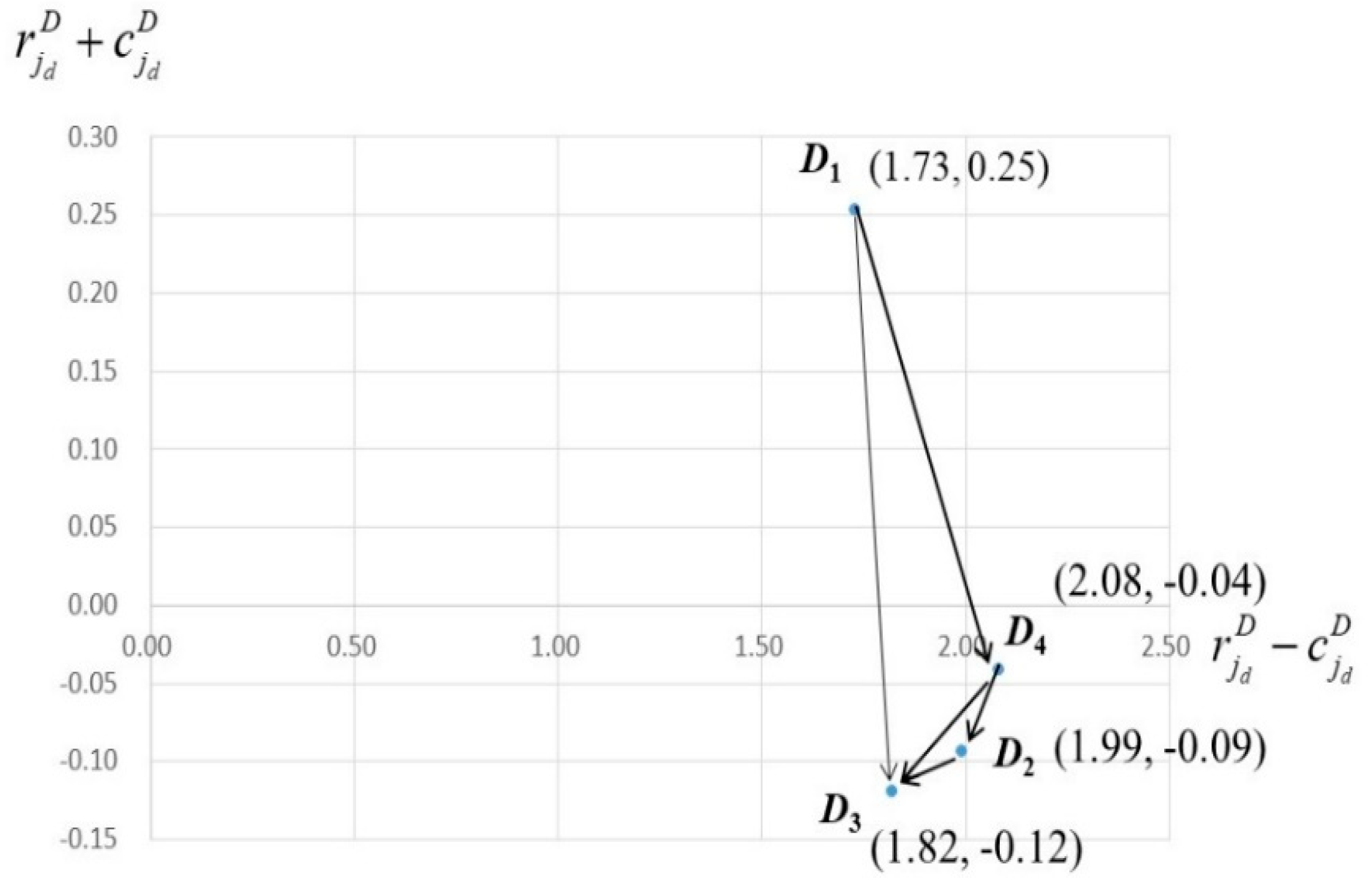

For instance, Company

B (CTBC financial holding company) was ranked beneath Company

A (Cathay financial holding company) in 2017, and its top two weighted performance gaps were

C12 (5.91%) and

C13 (6.90%), all belong to

D4. Company

B should focus on strengthening its performance on

D4 (i.e., Putting CSR into practice). However, if Company

B ignores the source factor (dimension) that influence

D4, it might solve its temporary problem rather than devise a long-term improvement plan. According to the analytics from the DEMATEL and

Figure 2 (i.e., the dimensional INRM),

D1 (Protecting shareholder rights and interests and treating shareholders equitably) should be the source that influences

D4. Therefore, not only the symptoms of its weakness have been identified, the board members can also decipher the root causes that lead to its inferior performance. At the top managerial level, such as among a group of board members, they should suggest a company to use its limited resources on taking the most effective actions. The combination of the DEMATEL analytics and the modified VIKOR method pave a road to reach this goal.

To enrich the practical insights of this illustrated case, the present study conducted additional interviews with several domain experts (from the same pool, refer to

Table 4) regarding how to enhance Company

B based on the obtained findings. The experts suggested that CTBC should reduce its proportion of directors and supervisors’ compensation to net profit, which falls in the category of

D1. The issued cash dividends of Company

B were

$1.08 (NT) per share in 2017. Under this circumstance, it is suggested to reduce its proportion of directors and supervisors’ compensation to net profit, form 0.95% (in 2017) to between 0.3% and 0.1%, to be closer to some other financial holding companies that announced more than NT

$1.08 dividends per share in 2017. Additionally, abusive self-dealing should be prohibited. That is to say, CTBC should reduce its average share pledge ratio of its directors, supervisors, and substantial shareholders significantly (e.g., from 37.64% to less than 10%), not to affect the rights and interests of the company’s shareholders.

From the aspect of C12 (the degree which the company discloses on its website or in its annual report the identities, issues of concern to, channels of communication with, and means for responding to, stakeholders it has identified) in D4, CTBC’s official website already has a “ Center for Stakeholders ”. However, it merely plays a passive role to release important information. To enhance its effectiveness, the experts suggested CTBC to assign a dedicated team (or department) to communicate with stakeholders proactively. Constructive advice or sound (reasonable and influential) questions from stakeholders deserve more attention and direct responses. The board members and the management team of CTBC should have the right to access those questions or suggestions timely. It may even set up a “President’s Contact Window” or an “Internal Communication Network” to encourage the first line staffs to relay customers’ feedbacks to its core management team. Additionally, in C13 (the degree to which the company adopts and disclose on its website a whistleblower system for company insiders and outsiders to report illegal behavior (including corruption) and unethical behavior), the experts suggested CTBC set up a whistleblower system to handling plausible illegal and unethical conducts related to the company. A third party or independent department might be more persuasive to investigate those reported cases. If this mechanism could be implemented stringently, it will not only benefit the company but also fulfill its CSR to the whole of society.

6. Concluding Remarks and Future Research Direction

To conclude, this study reached four significant contributio: (1) Refine the complex and somewhat inadequately designed CGES model, (2) Solicit senior domain experts’ knowledge to form a transparent weighting system regarding the evaluation of corporate governance, (3) Explore the cause-effect influential relationship among the dimensions; (4) Provide a managerial tool—for the sake of business sustainability—for financial holding companies to evaluate their weakness priority.

Once a company identifies it underperformed priority, the analytics from the proposed hybrid model may support the board members to discuss or devise reasonable action plans. For instance, the discussions on Company

B offer managerial insights for its stakeholders (including its management team, shareholders, customers, and authority) in

Section 5. Company

B may evaluate the required resources to carry out the possible plans (e.g., assign a dedicated team to communicate with stakeholders actively or set up an “Internal Communication Network” and make periodic external audits). How to support a company to identify its weakness priority and discuss the reasonable action plans to enhance its corporate governance is the significant implication of this study.

Aside from constructing an evaluation system to monitor listed companies, some other approaches might deliver similar or disparate effects. For instance, CSR-based compensation might be an alternative to motivate CEOs [

31] to pursue higher standards of corporate governance. Or, the mutual monitoring [

49] and both internal and external monitoring mechanisms [

50] could be useful to mitigate agency costs. Those mechanisms require solid support from the board of directors to operate effectively. Because of the importance of corporate governance in business, there are various perspectives to discuss or explore different aspects of it. The present study focuses on enhancing the existing CGES of Taiwan, which mainly covers the evaluation aspect of corporate governance. Some other phenomenon or particularities yielded from different countries can be found in the recent reviews [

51,

52].

Despite the findings and implications obtained by the study, several limitations remain: (1) the effectiveness of the model hinges upon the knowledge and experience of the involved experts; (2) how to balance the cost-effect of the plausible improvement plans is not addressed; (3) the proposed model might not be suitable to compare companies across industries.

The proposed hybrid model is still far from perfect, which requires more samples to test its effectiveness. Therefore, one of the future research directions might be including more industries to enlarge the sample size and comparing the validity of each sector. It’s our hope to contribute our findings for the authorities and the listed companies to refer on how to attain long-term business sustainability through this practical approach.