Changing the Accounting System to Foster Universities’ Financial Sustainability: First Evidence from Italy

Abstract

1. Introduction

2. Italian Higher Education and Quest for Financial Sustainability

- (a)

- Domestic Competition Strategy, i.e., the university adopts the strategic goals defined by the Italian Department of HE, where the reasoning is to increase their performance-related part of the governmental block grants. Currently, the main performance measures cover number of students and researcher productivity. Italian universities are in direct competition with each other.

- (b)

- Financial Autonomy Strategy [23], i.e., tapping into alternative sources of funds to counter changes in income. The main streams of income other than government grants are often competitive research grants and market-oriented/for-profit operations (spin-off companies, contracts with corporations…).

- (c)

- Efficiency Improvement Strategy, i.e., cutting costs while avoiding reductions to the quality and volume of services delivered.

3. Financial Reporting and the Analysis of Financial Sustainability in Universities: Literature Analysis

- (1)

- Financial Viability: The ability of an institution to continue to achieve its operating objectives and fulfil its mission over the long term;

- (2)

- Profitability: The determination of whether an institution receives more or less than it spends in an operating cycle;

- (3)

- Liquidity: The ability of an institution to satisfy its short-term obligations with existing assets;

- (4)

- Ability to Borrow: The ability of an institution to assume additional debt;

- (5)

- Capital Resources: An institution’s financial and physical capital base supporting its operations.

4. Methodology

5. Framework for Financial Analysis in Universities

- Funding from the Ministry of HE contains a performance-related part and this was kept separate so that its trend could be analysed over several financial periods. Universities adopting a ‘domestic competition strategy’ must stress this point.

- Unlike corporations, universities benefit from significant amounts of unearned income. This unearned income can originate from different kinds of transactions, and so this item can include elements with different meanings. The research team identified three different classes of unearned income, deciding to show them separately to improve transparency. The three classes are (a) ‘unearned income on research projects’, corresponding to the financial resources available for future research undertakings; (b) ‘unearned income on funds from government for investments in fixed assets’, which are deferred to future financial periods to balance future depreciation of assets; and (c) ‘other unearned income’.

- The reclassified income statement shows the margin on for-profit activity, as this can be used to assess the level of financial support, if any, for institutional undertakings. This aspect is particularly important for universities which are trying to diversify their sources of income in view of improving their financial sustainability.

- Labour costs for academics and administrative staff have been kept distinct. Moreover, both were detailed in order to highlight the portions pertinent to permanent contract costs and to fixed-term contract costs. The higher the percentage of fixed-term contracts, the more feasible are cost containment strategies (i.e., the third strategy mentioned above).

- The distinction between the most important classes of receivables, i.e., sums owed by the Ministry and by the students. With reference to the latter, their nominal value and the provision for bad debt are presented separately, as universities are expected to manage the problem of unpaid student fees independently.

- (a)

- In HE, financial performance reflects the institutions’ capacity to cover costs or, potentially, to accumulate resources for future growth. A positive bottom line in its income statement indicates that the institution is able to build up resources to be used in future financial periods. On the contrary, a negative margin reflects a reduction in capital retained in previous years, meaning that resources consumed in the given period exceed resources received in the same period. Management should examine these losses and plan to use previously accumulated capital, provided that the quantity/quality of services delivered can be duly measured.

- (b)

- The approach used to assess corporate financial leverage does not fit the model of public institutions. Corporations can benefit from an increase in debts when the return on invested capital exceeds the cost of borrowings. This is never the case for public sector organizations, where investments do not in general produce any profit. In this context, the university’s governing bodies should bear in mind the fact that decisions about increasing interest-bearing liabilities will inevitably reduce their net assets, because income from new investments cannot cover interest expenses. Since borrowings are not a lever for increasing return on investments, taking on the additional financial risk of new debts must have the purpose of pursuing other objectives, i.e., improving research and/or teaching outcomes.

- (c)

- The values of some ratios can indicate that a particular financial strategy has been adopted. When ratios B.1 and/or A.3 are particularly high, this denotes a strategy of revenue diversification and self-sufficiency. Ratio D.2 indicates the willingness to take financial risks in order to develop institutional undertakings, thus, it is reasonable to assume that a high debt to equity ratio is consistent with a strategy of self-sufficiency.

6. Results

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Giddings, B.; Hopwood, B.; O’Brien, G. Environment, Economy and Society: Fitting Them Together into Sustainable Development. Sustain. Dev. 2002, 10, 187–196. [Google Scholar] [CrossRef]

- Boyer, R.H.W.; Peterson, N.D.; Arora, P.; Cladwell, K. Five Approaches to Social Sustainability and an Integrated Way Forward. Sustainability 2016, 8, 878. [Google Scholar] [CrossRef]

- Aupperle, K.; Carroll, A.B.; Hatfield, J. An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Falcone, P.M.; Sica, E. Assessing the opportunities and challenges of green finance in Italy: An analysis of the biomass production sector. Sustainability 2019, 11, 517. [Google Scholar] [CrossRef]

- Höhne, N.; Khosla, S.; Fekete, H.; Gilbert, A. Mapping of Green Finance Delivered by IDFC Members in 2011; Ecofys: Cologne, Germany, 2012. [Google Scholar]

- Owen, R.; Brennan, G.; Lyon, F. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- Mazzucato, M.; Semieniuk, G. Financing renewable energy: Who is financing what and why it matters. Technol. Forecast. Soc. Chang. 2018, 127, 8–22. [Google Scholar] [CrossRef]

- Foray, D.; Mowery, D.C.; Nelson, R.R. Public R&D; and social challenges: What lessons from mission R&D; programs? Res. Policy 2012, 41, 1697–1702. [Google Scholar]

- Mazzucato, M. The Entrepreneurial State; Anthem Press: London, UK, 2013. [Google Scholar]

- Steffen, B. The importance of project finance for renewable energy projects. Energy Econ. 2018, 69, 280–294. [Google Scholar] [CrossRef]

- Borgonovi, E.; Compagni, A. Sustaining Universal Health Coverage: The Interaction of Social, Political and Economic Sustainability. Value Health 2013, 16, S34–S38. [Google Scholar] [CrossRef]

- Pollitt, C.; Bouckaert, G. Public Management Reform: A Comparative Analysis, 2nd ed.; Oxford University Press: Boston, MA, USA, 2004. [Google Scholar]

- Olson, O.; Humphrey, C.; Guthrie, J. International Experiences with “New” Public Financial Management (NPFM) Reforms: New World? Small World? Better World? In Global Warning: Debating International Developments in New Public Financial Management; Olson, O., Humphrey, C., Guthrie, J., Eds.; Capelen Akademisk Forlag As: Oslo, Norway, 1998. [Google Scholar]

- Jansen, E.P. New Public Management: Perspectives on Performance and the Use of Performance Information. Financ. Account. Manag. 2008, 24, 169–191. [Google Scholar] [CrossRef]

- Kohtamäki, V. How do Higher Education Institutions Enhance their Financial Autonomy? Examples from Finnish Polytechnics. High. Educ. Q. 2011, 65, 164–185. [Google Scholar] [CrossRef]

- Caruana, J.; Brusca, I.; Caperchione, E.; Cohen, S.; Manes Rossi, F. (Eds.) Financial Sustainability of Public Sector Entities: The Relevance of Accounting Frameworks; Palgrave Macmillan: London, UK, 2019. [Google Scholar]

- EUA. Impact of the Economic Crisis on European Universities Update: First Semester. 2011. Available online: http://www.eua.be/Libraries/governanceautonomyfunding/NL_June_2011_with_map.pdf (accessed on 24 July 2017).

- Capano, G. Government Continues to Do Its Job: A Comparative Study of Governance Shifts in the Higher Education Sector. Public Adm. 2011, 89, 1622–1642. [Google Scholar] [CrossRef]

- EUA. Public Funding Observatory. 2014. Available online: http://www.eua.be/Libraries/governance-autonomy-funding/PFO_analysis_2014_final.pdf (accessed on 30 July 2017).

- Manes Rossi, F. Massification, Competition and Organizational Diversity in Higher Education: Evidence from Italy. Stud. High. Educ. 2010, 35, 277–300. [Google Scholar] [CrossRef]

- Guthrie, J. Australian Public Business Enterprises: Analysis of Changing Accounting, Auditing and Accountability Regimes. Financ. Account. Manag. 1993, 9, 101–114. [Google Scholar] [CrossRef]

- Parker, L.D.; Guthrie, J. The Australian Public Sector in the 1990s: New Accountability Regimes in Motion. Int. Account. Audit. Tax. 1993, 2, 59–81. [Google Scholar] [CrossRef]

- Mussari, R.; Sostero, U. Il processo di cambiamento del sistema contabile nelle università: Aspettative, difficoltà e contraddizioni. Azienda Pubblica 2014, 2, 121–143. [Google Scholar]

- Cantele, S.; Campedelli, B. Il performance-based funding nel sistema universitario italiano: Un’analisi degli effetti della programmazione triennale. Azienda Pubblica 2013, 3, 309–332. [Google Scholar]

- Parker, L.D. Contemporary University Strategising: The Financial Imperative. Financ. Account. Manag. 2013, 29, 1–25. [Google Scholar] [CrossRef]

- Modugno, G.; Tivan, M. Il Patrimonio vincolato nel bilancio degli atenei: Significato, funzionamento contabile delle poste, implicazioni gestionali. Azienda Pubblica 2015, 4, 359–376. [Google Scholar]

- Coran, G.; Pilonato, S. Criticità e limiti del budget nel nuovo sistema contabile universitario. Azienda Pubblica 2015, 3, 309–331. [Google Scholar]

- Tieghi, M.; Gigli, S. L’introduzione della Contabilità Economico-Patrimoniale negli Atenei: Un commento su alcune opzioni esercitate e alcune possibili proposte di miglioramento. Azienda Pubblica 2015, 1, 13–31. [Google Scholar]

- Agasisti, T.; Catalano, G.; Di Carlo, F.; Erbacci, A. Accrual accounting in Italian universities: A technical perspective. Int. J. Public Sect. Manag. 2015, 28, 494–508. [Google Scholar] [CrossRef]

- Paolini, A.; Soverchia, M. La programmazione delle università italiane si rinnova: Riflessioni e primi riscontri empirici. Azienda Pubblica 2015, 3, 287–308. [Google Scholar]

- Modugno, G.; Di Carlo, F. Financial Sustainability of Higher Education Institutions: A Challenge for the Accounting System. In Financial Sustainability of Public Sector Entities; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 165–184. [Google Scholar]

- Woelfel, C.J. Financial Statement Analysis for Colleges and Universities. J. Educ. Financ. 1987, 12, 86–98. [Google Scholar]

- Sazonov, S.P.; Kharlamova, E.E.; Chekhovskaya, I.A.; Polyanskaya, E. Evaluating Financial Sustainability of Higher Education Institutions. Asian Soc. Sci. 2015, 11, 34–40. [Google Scholar] [CrossRef]

- HEFCE. Financial Health of the Higher Education Sector, 2012–2013 to 2015–16 Forecasts. 2013. Available online: www.hefce.ac.uk (accessed on 26 August 2018).

- KPMG. Financial Ratio Analysis Project, Final Report, 1996, Prepared on Behalf of U.S. Department of Education; KPMG: Amstelveen, The Netherlands, 1996. [Google Scholar]

- Moody’s, U.S. Not-for-Profit Private and Public Higher Education: Rating Methodology; Moody’s Investors Service: New York, NY, USA, 2011. [Google Scholar]

- Fischer, M.; Gordon, T.P.; Greenlee, J.T.; Keating, E.K. Measuring Operations: An Analysis of U.S. Private Colleges and Universities’ Financial Statements. Financ. Account. Manag. 2004, 2, 129–151. [Google Scholar] [CrossRef]

- Fischer, M.; Marsh, T. Two Accounting Standard Setters: Divergence Continues for Nonprofit Organizations, Journal of Public Budgeting. Account. Financ. Manag. 2012, 24, 429–465. [Google Scholar]

- Christiaens, J.; De Wielemaker, E. Financial Accounting Reform in Flemish Universities: An Empirical Study of The Implementation. Financ. Account. Manag. 2003, 19, 267–4424. [Google Scholar] [CrossRef]

- IPASB. IPSAS 1: Presentation of Financial Statements; IPASB: Santa Barbara, CA, USA, 2006. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Using the Balanced Scorecard as a Strategic Management System. Harvard Business Review, January–February; 1996, 75–85.

- Kaplan, R.S. Strategic performance measurement and management in non-profit organizations. Nonprofit Manag. Lead. 2001, 11, 353–370. [Google Scholar] [CrossRef]

- Simons, R. Levers of control: How Managers Use Innovative Control Systems to Drive Strategic Renewal; Harvard Business School Press: Boston, MA, USA, 1995. [Google Scholar]

- Lelo, K.; Monni, S.; Tomassi, F. Urban inequalities in Italy: A comparison between Rome, Milan and Naples. Entrep. Sustain. Issues 2018, 6, 939–957. [Google Scholar] [CrossRef]

| Financial Position | Financial Performance | Other | |

|---|---|---|---|

| Woelfel, 1987 | Expendable fund balance/Debt outstanding related to the financing of assets Net investments in equipment/Debt relating to research equipment where assets are invested in such equipment Expendable fund balance/total current funds expendit. & mandatory funding transfers Nonexpendable fund balances/Total current funds expendit. & mandatory government funding transfers Current fund assets/Current fund obligations | Net total revenue/Total revenue Net educational and general revenue/Total education and general revenue Tuition and fees/Total expenditure and mandatory government funding transfers Net auxiliary enterprise revenue/Total auxiliary enterprise revenue | Major sources of revenue/Tot. educational and general expenditure and mandatory government funding transfers Main sources of non-operating inflows/Total non-operating inflows Major sources of expenditure/Tot. educational and general expenditures and mandatory government funding transfers |

| Moody’s [37], KPMG, 1996 | Expendable fund bal./Debt relating to research equipment (Viability Ratio) | Net Total Revenues/Total revenue (Net Income Ratio) | Expendable fund bal./Total exp. & mand. gov. funding transfers (Primary Reserve Ratio) |

| H. Bunsis, 2010 | Vertical analysis of the Balance Sheet (% on tot. assets) Composition of net assets: % of restricted funds and % of non-restricted funds | Vertical analysis of the “Statement of changes in net assets” % Analysis of revenue % Analysis of expenses, by destination % change in total revenue % change in educational revenue % change in government funding transfers% Analysis of labour cost | % Analysis of sources (uses) of cash |

| Moody’s 2011 | Expendable financial resources/Debt Expendable financial resources/Operations Debts/Operating revenue Monthly days cash on hand Monthly liquidity to demand Debt | Revenue diversity % Operating cash flow/Actual debts Average net income for the past 3 periods/Actual debts | Number of accepted students/Number of applicants Net tuition per student Average grants per student |

| First Plenary Session (March 2015) | Between the First and the Second Session | Second Plenary Session (July 2015) | Between the Second and the Third Plenary Session | Third Plenary Session (October 2015) | |

|---|---|---|---|---|---|

| Objective(s) | To share with practitioners the purposes of the research; To understand what financial information are relevant for universities’ stakeholders. | The research team defined a draft-layout of reclassified Statement of Income and reclassified Balance Sheet. | To share, discuss, and improve the draft of reclassified statements; To discuss the rules for the reclassification of the statements. | Universities reclassified their financial statements; The research team gathered financial data and calculated some ratios. | To share the analysis of the data and to improve the model with new or more relevant ratios suggested also by practitioners. |

| Results | Financial reports prepared according to the new rules cannot provide all relevant information; needed reclassified statements. | Draft of reclassified financial statements prepared and tested in two universities; common rules for the reclassification of the statements are defined. | The definitive layout of Reclassified financial statements for universities is available. | 10 universities could complete the task of reclassification; The research team performs a first analysis of the available data in view of the third session; | The model for the analysis of universities’ financial sustainability is defined: The research team can perform a new analysis. |

| Key Users of Fin. Statements | Key Aspects in Financial Statements Analysis | |

|---|---|---|

| 1 | Central and regional government; other public fund providers |

|

| 2 | Lenders |

|

| 3 | Other external users (students, general public…) |

|

| 4 | Administrators |

|

| 5 | Employees |

|

| (A) Financial Performance and Sustainability | ||

| 1 | Margin on income from non-profit activity | Do current funding transfers from the DHE and local/regional governments ensure the financial sustainability of institutional activities? |

| 2 | Operating Margin from non-profit activity | To what extent does institutional activity contribute to EBIT? |

| EBIT | ||

| 3 | Margin from for-profit activity | To what extent does EBIT arise from for-profit activities? |

| EBIT | ||

| 4 | EBIT | ROA (return on assets): Should be close to 0 in the long term. ROA > 0 preludes future institutional activity developments; a negative ROA is acceptable only if programmed and consequential to improvements in non-financial outcomes |

| Total Assets | ||

| (B) Capability to Attract Funds | ||

| 1 | Self-generated incomes from non-profit activity | What is the value of income generated by the university through competitive research grants, contracts and student fees? (Excluding funding transfers from public entities) |

| Total income from non-profit activity | ||

| 2 | Research grants | What part of income other than funding transfers arises from research undertakings? |

| Self-generated incomes from non-profit activity | ||

| 3 | Performance-related funding transfers | Is the university competitive on the “domestic HE market”? The higher the ratio, the more competitive the university |

| Total funding transfers | ||

| 4 | Performance-related funds allocated to the university | What % in value of total performance-based funds distributed nationally does the university receive? |

| Total value of performance-related funds at national level | ||

| (C) Labour Cost and Productivity | ||

| 1 | Cost of administrative staff | This ratio assumes that universities must reduce their administration costs and expand their research and/or teaching operations as far as possible. The lower the ratio, the more virtuous the university. |

| Cost of teaching & research staff | ||

| 2 | Cost of staff with fixed-term contracts | The cost of labour is the most significant cost for a university, because government funding is shrinking, the inflexibility built into this cost could undermine the university’s financial sustainability. |

| Total cost of labour | ||

| 3 | Self- generated income | Teaching & research staff per capita self-generated income |

| No. of teaching & research staff | ||

| 4 | Revenue from for-profit activity | Teaching & research staff per capita revenue from for-profit activities |

| No. teaching & research staff | ||

| 5 | Research grants | The higher the ratio, the higher the productivity of academic staff |

| Cost of teaching & research staff | ||

| 6 | Self-generated income | The higher the ratio, the more proactive is the university in generating revenue |

| Total cost of labour | ||

| (D) Financial Position | ||

| 1 | Current assets | Current ratio <1 could be a signal of short-term financial distress |

| Current liabilities | ||

| 2 | Net Debt | Debt is net of public funding transfers received for their repayment. The lower the ratio, the safer the university’s capital structure. Universities with a relatively high ratio may be considered less risk-adverse (more ‘entrepreneurial’). |

| Equity | ||

| 3 | EBIT | Interest Coverage Ratio: The lower the ratio, the riskier the university’s capital structure. |

| Interest charge | ||

| (E) Funds Collected for Future Research | ||

| 1 | Unearned income on research projects | Unearned income on research projects represents liquid funds collected but not used in that financial period and so available for future research undertakings |

| Income from research projects | ||

| No. of Students (Small: Less Than 10k; Medium: Between 10k and 30k; Big: More Than 30k) | Age (Old: Established One or More Centuries Ago; Recent: Established Less Than One Century Ago) | Positioning in the HE Market | Geographical Location (North, Centre, South, Islands) | ||

|---|---|---|---|---|---|

| SA | S. Anna Pisa (School of Advanced Studies in applied sciences) | Small | Recent | Specialized | Centre |

| SS | SISSA (International School for Advanced Studies in maths, physics & biosciences) | Small | Recent | Specialized | North |

| PM | Politecnico Milano (Milan) | Big | Old | Technical | North |

| PT | Politecnico Torino (Turin) | Big | Old | Technical | North |

| UV | IUAV (architecture & design) | Small | Old | Specialized | North |

| UB | Univ. Brescia | Medium | Recent | Generalist | North |

| UT | Univ. Trieste | Medium | Old | Generalist | North |

| US | Univ. Sassari | Medium | Very Old | Generalist | Islands |

| UF | Univ. Florence | Big | Very Old | Generalist | Centre |

| UDA | Univ. Aosta | Small | Very Recent | Generalist | North |

| Indicator | UDA | UV | US | SA | UT | PM | PT | SS | UF | UB | AVG. |

|---|---|---|---|---|---|---|---|---|---|---|---|

| A. Margins on Instit. & for-Profit Activities | |||||||||||

| 1. Margin on Institutional Activity * | 4.1% | −1.4% | −4.4% | 6.9% | 2.6% | −0.1% | 11.6% | 7.7% | 0.5% | 2.1% | 3.0% |

| 2. Margin on institutional activity/EBIT | 70.6% | −159.8% | 118.0% | 71.3% | 69.4% | −9.2% | 71.7% | 73.2% | 20.0% | 58.1% | 38.3% |

| 3. Margin on for-profit activity/EBIT | 18.9% | 257.4% | −18.0% | 28.8% | 30.6% | 75.7% | 28.2% | 0.5% | 79.8% | 47.0% | 54.9% |

| 4. ROA (EBIT/Total assets) | 12.0% | 0.5% | −1.8% | 4.0% | 2.0% | 1.0% | 5.7% | 4.1% | 1.0% | 1.6% | 3.0% |

| B. Capability to Attract Funds through Instit. Activities | |||||||||||

| 1. Self-generated institutional incomes/Total income | 16.7% | 19.2% | 16.6% | 39.6% | 18.0% | 27.4% | 26.4% | 18.3% | 12.0% | 20.4% | 21.5% |

| 2. Incomes from research/Self-generated inst. income | 2.0% | 0.0% | 57.0% | 87.3% | 18.3% | 32.2% | 48.3% | 92.0% | N.A. | 25.0% | 36.2% |

| 3. Performance-based transfers/Tot. gov. funding transf. | 0.0% | 17.3% | 20.5% | 17.2% | 18.3% | 20.7% | 18.2% | 15.3% | 18.7% | 20.4% | 16.6% |

| 4. % of Total Performance-based transfers allocated | 0.0% | 0.41% | 1.23% | N.A. | 1.41% | 3.24% | 1.94% | N.A. | 3.77% | 1.14% | N.A. |

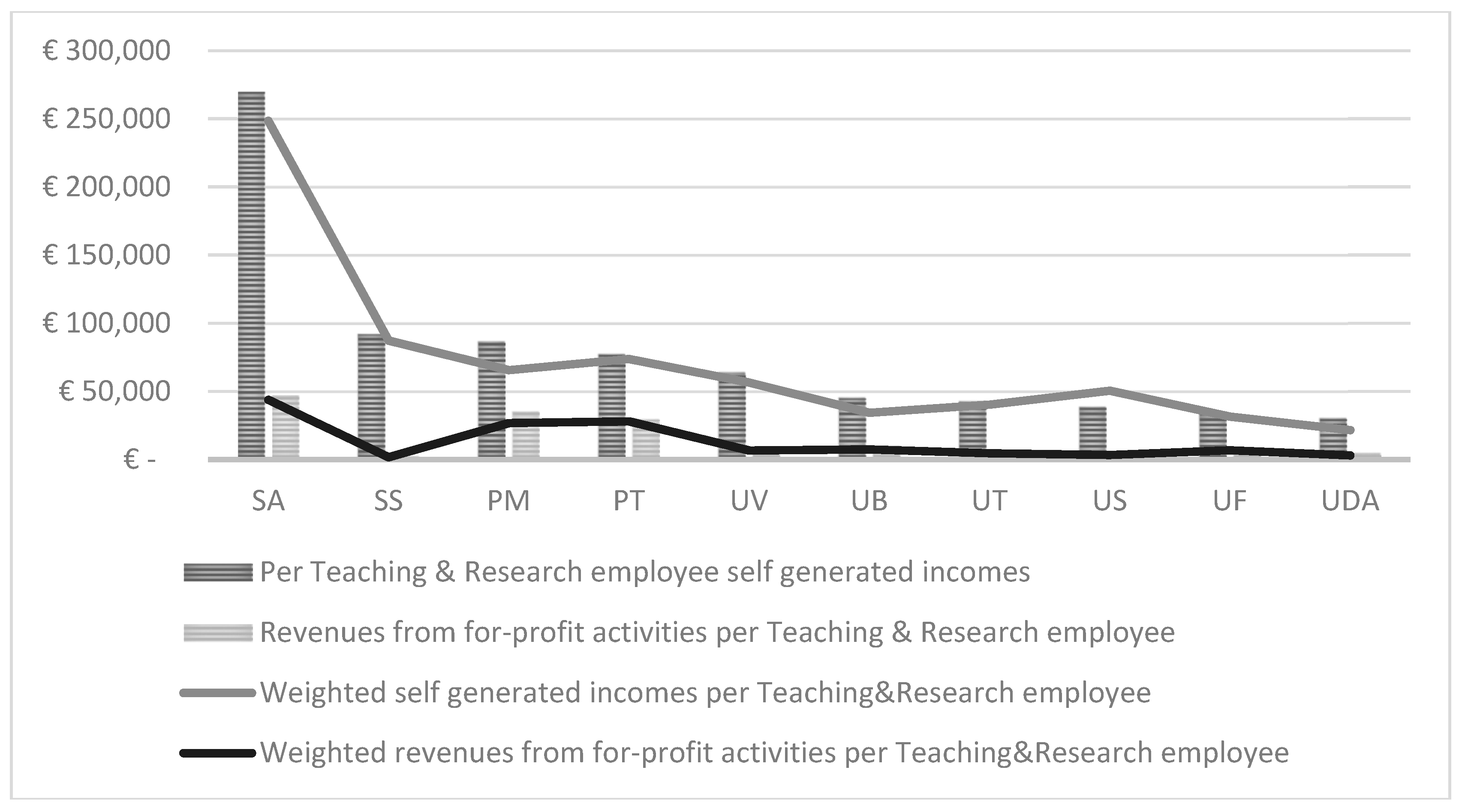

| C. Labour Cost and Productivity | |||||||||||

| 1. Cost of admin. staff/Cost of teaching & res. staff | 59.8% | 57.3% | 36.0% | 38.8% | 40.3% | 37.3% | 39.7% | 32.9% | 31.1% | 32.6% | 40.6% |

| 2. Cost of staff w/fixed-term contracts/Total labour cost | 12.9% | 20.4% | 15.9% | 53.6% | 9.2% | 22.7% | 19.8% | 37.0% | 14.7% | 9.7% | 21.6% |

| 3. Self-generated income/ No. of teach. & research staff | € 29,786 | € 63,567 | € 38,071 | € 269,967 | € 42,243 | € 86,193 | € 76,956 | € 91,727 | € 34,117 | € 44,964 | € 77,760 |

| 4. Revenue from for-profit act./No. teach. & res. staff | € 4114 | € 7472 | € 2498 | € 47,466 | € 4678 | € 35,026 | € 29,127 | € 1644 | € 7319 | € 9569 | € 14,891 |

| 5. Research grants/Cost of teaching & research staff | 0.7% | 0.0% | 19.6% | 109.8% | 8.2% | 24.5% | 35.1% | 52.0% | 0.0% | 11.6% | 26.2% |

| 6. Self-generated institutional incomes/Total labour cost | 22.3% | 28.9% | 54.4% | 90.6% | 28.6% | 55.5% | 52.0% | 42.5% | 20.7% | 35.0% | 43.1% |

| D. Financial Position | |||||||||||

| 1. Current Assets/Current liabilities (net of funding transfers) | 3.48 | 2.64 | 0.95 | 1.80 | 0.92 | 1.59 | 2.28 | 2.32 | 2.39 | 2.19 | 2.06 |

| 2. Debt/Debts + Net assets | 0.0% | 0.0% | 10.1% | 0.0% | 12.5% | 31.1% | 20.9% | 19.1% | 9.9% | 0.3% | 10.4% |

| 3. Interest coverage ratio (EBIT/ interest cost) | 403 | 5 | 30 | 1808 | 39 | 1 | 17 | 3 | 4 | 182 | 249 |

| 4. Total assets/Net assets (i.e.: Equity) | 1.45 | 1.68 | 10.08 | 2.73 | 13.00 | 2.77 | 2.61 | 3.86 | 1.58 | 1.31 | 4.11 |

| E. Funds Available for Future Research | |||||||||||

| 1. Unearned inc. from res./Tot. income from research | 4.07 | N.A. | 5.50 | 1.75 | 19.31 | 5.21 | 2.66 | 1.53 | N.A. | 2.19 | 5.28 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Carlo, F.; Modugno, G.; Agasisti, T.; Catalano, G. Changing the Accounting System to Foster Universities’ Financial Sustainability: First Evidence from Italy. Sustainability 2019, 11, 6151. https://doi.org/10.3390/su11216151

Di Carlo F, Modugno G, Agasisti T, Catalano G. Changing the Accounting System to Foster Universities’ Financial Sustainability: First Evidence from Italy. Sustainability. 2019; 11(21):6151. https://doi.org/10.3390/su11216151

Chicago/Turabian StyleDi Carlo, Ferdinando, Guido Modugno, Tommaso Agasisti, and Giuseppe Catalano. 2019. "Changing the Accounting System to Foster Universities’ Financial Sustainability: First Evidence from Italy" Sustainability 11, no. 21: 6151. https://doi.org/10.3390/su11216151

APA StyleDi Carlo, F., Modugno, G., Agasisti, T., & Catalano, G. (2019). Changing the Accounting System to Foster Universities’ Financial Sustainability: First Evidence from Italy. Sustainability, 11(21), 6151. https://doi.org/10.3390/su11216151