Sequential Alliance Portfolios, Partner Reconfiguration and Firm Performance

Abstract

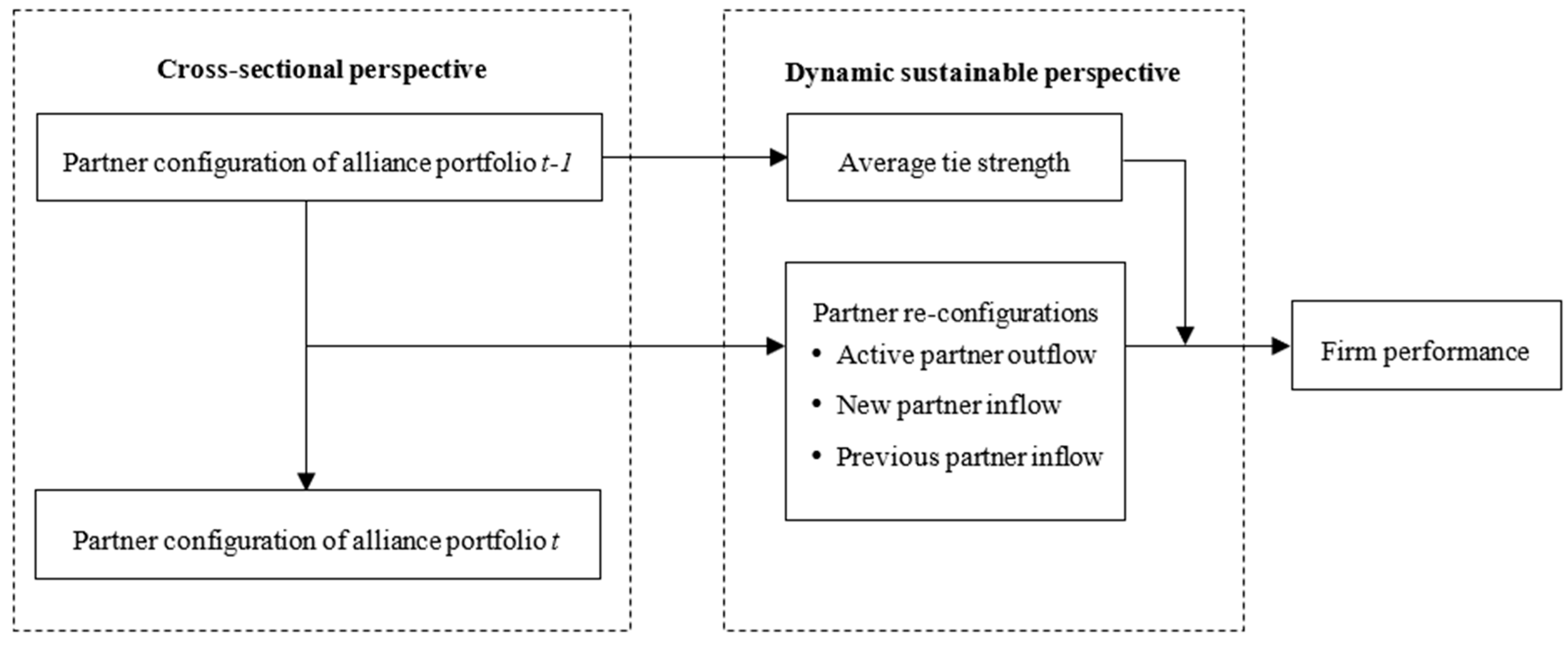

1. Introduction

2. Theoretical Background and Research Hypotheses

2.1. Literature Review: Alliance Partner Selection and Reconfiguration

2.2. The Performance Consequence of Alliance Partner Reconfiguration

2.3. The Moderating Effect of the Average Tie Strength of the Last Alliance Portfolio

3. Methods

3.1. Empirical Setting and Data

3.2. Measures

3.3. Analytical Methods

4. Results

4.1. Main Results

4.2. Robustness Checks

5. Discussion

5.1. Contributions

5.2. Limitations and Further Research Directions

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Trąpczyński, P.; Puślecki, Ł.; Staszków, M. Determinants of Innovation Cooperation Performance: What Do We Know and What Should We Know? Sustainability 2018, 10, 4517. [Google Scholar] [CrossRef]

- Chuang, Y.-T.; Dahlin, K.B.; Thomson, K.; Lai, Y.-C.; Yang, C.-C. Multimarket contact, strategic alliances, and firm performance. J. Manag. 2018, 44, 1551–1572. [Google Scholar] [CrossRef]

- Zhang, S.; Yuan, C.; Wang, Y. The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms. Sustainability 2019, 11, 2321. [Google Scholar] [CrossRef]

- Han, W.; Chen, F.-W.; Deng, Y. Alliance Portfolio Management and Sustainability of Entrepreneurial Firms. Sustainability 2018, 10, 3815. [Google Scholar] [CrossRef]

- Wassmer, U. Alliance Portfolios: A Review and Research Agenda. J. Manag. 2010, 36, 141–171. [Google Scholar] [CrossRef]

- Dzhengiz, T. The relationship of organizational value frames with the configuration of alliance portfolios: Cases from electricity utilities in Great Britain. Sustainability 2018, 10, 4455. [Google Scholar] [CrossRef]

- Hagedoorn, J.; Lokshin, B.; Zobel, A.K. Partner type diversity in alliance portfolios: Multiple dimensions, boundary conditions and firm innovation performance. J. Manag. Stud. 2018, 55, 809–836. [Google Scholar] [CrossRef]

- Bakker, R.M. Stepping in and stepping out: Strategic alliance partner reconfiguration and the unplanned termination of complex projects. Strateg. Manag. J. 2016, 37, 1919–1941. [Google Scholar] [CrossRef]

- Kang, J.; Lee, J.; Jang, D.; Park, S. A Methodology of Partner Selection for Sustainable Industry-University Cooperation Based on LDA Topic Model. Sustainability 2019, 11, 3478. [Google Scholar] [CrossRef]

- Lahiri, N.; Narayanan, S. Vertical integration, innovation, and alliance portfolio size: Implications for firm performance. Strateg. Manag. J. 2013, 34, 1042–1064. [Google Scholar] [CrossRef]

- Asgari, N.; Singh, K.; Mitchell, W. Alliance portfolio reconfiguration following a technological discontinuity. Strateg. Manag. J. 2017, 38, 1062–1081. [Google Scholar] [CrossRef]

- Jiang, H.; Xia, J.; Cannella, A.A.; Xiao, T. Do ongoing networks block out new friends? Reconciling the embeddedness constraint dilemma on new alliance partner addition. Strateg. Manag. J. 2018, 39, 217–241. [Google Scholar] [CrossRef]

- Zhang, X.-J.; Tang, Y.; Xiong, J.; Wang, W.-J.; Zhang, Y.-C. Dynamics of Cooperation in Minority Games in Alliance Networks. Sustainability 2018, 10, 4746. [Google Scholar] [CrossRef]

- Lin, Z.; Yang, H.; Arya, B. Alliance partners and firm performance: Resource complementarity and status association. Strateg. Manag. J. 2009, 30, 921–940. [Google Scholar] [CrossRef]

- Tsai, W. Social capital, strategic relatedness and the formation of intraorganizational linkages. Strateg. Manag. J. 2000, 21, 925–939. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ahlstrom, D.; Dacin, M.T.; Levitas, E.; Svobodina, L. The Institutional Effects on Strategic Alliance Partner Selection in Transition Economies: China vs. Russia. Organ. Sci. 2004, 15, 173–185. [Google Scholar] [CrossRef]

- Häussler, C. When Does Partnering Create Market Value? Eur. Manag. J. 2006, 24, 1–15. [Google Scholar] [CrossRef]

- Greve, H.R.; Mitsuhashi, H.; Baum, J.A.C. Greener Pastures: Outside Options and Strategic Alliance Withdrawal. Organ. Sci. 2013, 24, 79–98. [Google Scholar] [CrossRef]

- Reuer, J.J.; Ragozzino, R. Signals and international alliance formation: The roles of affiliations and international activities. J. Int. Bus. Stud. 2014, 45, 321–337. [Google Scholar] [CrossRef]

- Beckman, C.M.; Haunschild, P.R.; Phillips, D.J. Friends or Strangers? Firm-Specific Uncertainty, Market Uncertainty, and Network Partner Selection. Organ. Sci. 2004, 15, 259–275. [Google Scholar] [CrossRef]

- Haus-Reve, S.; Fitjar, R.D.; Rodríguez-Pose, A. Does combining different types of collaboration always benefit firms? Collaboration, complementarity and product innovation in Norway. Res. Policy 2019, 48, 1476–1486. [Google Scholar] [CrossRef]

- Wassmer, U.; Li, S.; Madhok, A. Resource ambidexterity through alliance portfolios and firm performance. Strateg. Manag. J. 2017, 38, 384–394. [Google Scholar] [CrossRef]

- Heidl, R.A.; Steensma, H.K.; Phelps, C. Divisive Faultlines and the Unplanned Dissolutions of Multipartner Alliances. Organ. Sci. 2014, 25, 1351–1371. [Google Scholar] [CrossRef]

- Andrevski, G.; Brass, D.J.; Walter, W.J. Ferrier Alliance portfolio configurations and competitive action frequency. J. Manag. 2016, 42, 811–837. [Google Scholar]

- Ahuja, G.; Soda, G.; Zaheer, A. The genesis and dynamics of organizational networks. Organ. Sci. 2011, 23, 434–448. [Google Scholar] [CrossRef]

- Castro, I.; Casanueva, C.; Galan, J.L.; Castro-Abancéns, I. Dynamic evolution of alliance portfolios. Eur. Manag. J. 2014, 32, 423–433. [Google Scholar] [CrossRef]

- Zhang, L.; Gupta, A.K.; Hallen, B.L. The Conditional Importance of Prior Ties: A Group-Level Analysis of Venture Capital Syndication. Acad. Manag. J. 2017, 60, 1360–1386. [Google Scholar] [CrossRef]

- Reuer, J.J.; Devarakonda, R. Partner Selection in R&D Collaborations: Effects of Affiliations with Venture Capitalists. Organ. Sci. 2017, 28, 574–595. [Google Scholar]

- Xia, J.; Wang, Y.; Lin, Y.; Yang, H.; Li, S. Alliance formation in the midst of market and network: Insights from resource dependence and network perspectives. J. Manag. 2018, 44, 1899–1925. [Google Scholar] [CrossRef]

- Pangarkar, N. Do Firms Learn from Alliance Terminations? An Empirical Examination. J. Manag. Stud. 2009, 46, 982–1004. [Google Scholar] [CrossRef]

- Rogan, M. Too Close for Comfort? The Effect of Embeddedness and Competitive Overlap on Client Relationship Retention Following an Acquisition. Organ. Sci. 2014, 25, 185–203. [Google Scholar] [CrossRef]

- Reuer, J.J.; Zollo, M.; Singh, H. Post-formation dynamics in strategic alliances. Strateg. Manag. J. 2002, 23, 135–151. [Google Scholar] [CrossRef]

- Greve, H.R.; Baum, J.A.C.; Mitsuhashi, H.; Rowley, T.J. Built to Last but Falling Apart: Cohesion, Friction, and Withdrawal from Interfirm Alliances. Acad. Manag. J. 2010, 53, 302–322. [Google Scholar] [CrossRef]

- Lee, J. “Jay” Dancing with the enemy? Relational hazards and the contingent value of repeat exchanges in m&a markets. Organ. Sci. 2013, 24, 1237–1256. [Google Scholar]

- Noordhoff, C.S.; Kyriakopoulos, K.; Moorman, C.; Pauwels, P.; Dellaert, B.G. The Bright Side and Dark Side of Embedded Ties in Business-to-Business Innovation. J. Mark. 2011, 75, 34–52. [Google Scholar] [CrossRef]

- Clegg, S.; Josserand, E.; Mehra, A.; Pitsis, T.S. The Transformative Power of Network Dynamics: A Research Agenda. Organ. Stud. 2016, 37, 277–291. [Google Scholar] [CrossRef]

- Chung, C.C.; Beamish, P.W. The Trap of Continual Ownership Change in International Equity Joint Ventures. Organ. Sci. 2010, 21, 995–1015. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. A Resource-Based Theory of Strategic Alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Singh, K.; Mitchell, W. Precarious collaboration: Business survival after partners shut down or form new partnerships. Strateg. Manag. J. 1996, 17, 99–115. [Google Scholar] [CrossRef]

- Zhelyazkov, P.I.; Gulati, R. After the Break-Up: The Relational and Reputational Consequences of Withdrawals from Venture Capital Syndicates. Acad. Manag. J. 2016, 59, 277–301. [Google Scholar] [CrossRef]

- Summers, J.K.; Humphrey, S.; Ferris, G.R. Team Member Change, Flux in Coordination, and Performance: Effects of Strategic Core Roles, Information Transfer, and Cognitive Ability. Acad. Manag. J. 2012, 55, 314–338. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Rowley, T.J.; Shipilov, A.V.; Chuang, Y.-T. Dancing with Strangers: Aspiration Performance and the Search for Underwriting Syndicate Partners. Adm. Sci. Q. 2005, 50, 536–575. [Google Scholar] [CrossRef]

- Yamakawa, Y.; Yang, H.; Lin, Z. Exploration versus exploitation in alliance portfolio: Performance implications of organizational, strategic, and environmental fit. Res. Policy 2011, 40, 287–296. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependency Perspective; Harper and Row: New York, NY, USA, 1978. [Google Scholar]

- Xia, J. Mutual dependence, partner substitutability, and repeated partnership: The survival of cross-border alliances. Strateg. Manag. J. 2011, 32, 229–253. [Google Scholar] [CrossRef]

- Levinthal, D.A.; Fichman, M. Dynamics of Interorganizational Attachments: Auditor-Client Relationships. Adm. Sci. Q. 1988, 33, 345. [Google Scholar] [CrossRef]

- Li, D.; Edén, L.; Hitt, M.A.; Ireland, R.D.; Trevor, C.O.; Nyberg, A.J. Friends, Acquaintances, or Strangers? Partner Selection in R&D Alliances. Acad. Manag. J. 2008, 51, 315–334. [Google Scholar]

- Holloway, S.S.; Parmigiani, A. Friends and Profits Don’t Mix: The Performance Implications of Repeated Partnerships. Acad. Manag. J. 2016, 59, 460–478. [Google Scholar] [CrossRef]

- Uzzi, B. Social Structure and Competition in Interfirm Networks: The Paradox of Embeddedness. Adm. Sci. Q. 1997, 42, 35. [Google Scholar] [CrossRef]

- Zheng, Y.; Yang, H. Does Familiarity Foster Innovation? The Impact of Alliance Partner Repeatedness on Breakthrough Innovations. J. Manag. Stud. 2015, 52, 213–230. [Google Scholar] [CrossRef]

- Li, S.X.; Rowley, T.J. inertia and evaluation mechanisms in interorganizational partner selection: Syndicate formation among U.S. investment banks. Acad. Manag. J. 2002, 45, 1104–1119. [Google Scholar]

- Bird, M.; Zellweger, T. Relational Embeddedness and Firm Growth: Comparing Spousal and Sibling Entrepreneurs. Organ. Sci. 2018, 29, 264–283. [Google Scholar] [CrossRef]

- Oliveira, N.; Lumineau, F. The dark side of interorganizational relationships: An integrative review and research agenda. J. Manag. 2019, 45, 231–261. [Google Scholar] [CrossRef]

- Meuleman, M.; Lockett, A.; Manigart, S.; Wright, M. Partner selection decisions in interfirm collaborations: The paradox of relational embeddedness. J. Manag. Stud. 2010, 47, 995–1019. [Google Scholar] [CrossRef]

- Nee, V.; Holm, H.J.; Opper, S. Learning to Trust: From Relational Exchange to Generalized Trust in China. Organ. Sci. 2018, 29, 969–986. [Google Scholar] [CrossRef]

- Lin, Z.; Yang, H.; Demirkan, I. The Performance Consequences of Ambidexterity in Strategic Alliance Formations: Empirical Investigation and Computational Theorizing. Manag. Sci. 2007, 53, 1645–1658. [Google Scholar] [CrossRef]

- Choi, S.; McNamara, G. Repeating a familiar pattern in a new way: The effect of exploitation and exploration on knowledge leverage behaviors in technology acquisitions. Strateg. Manag. J. 2018, 39, 356–378. [Google Scholar] [CrossRef]

- Dai, Y.; Goodale, J.C.; Byun, G.; Ding, F. Strategic flexibility in new High-technology ventures. J. Manag. Stud. 2018, 55, 265–294. [Google Scholar] [CrossRef]

- Hexun Finance. Available online: http://bank.hexun.com/2014-07-15/166624018_1.html (accessed on 15 July 2014).

- Sun, Q.; Tong, W.H. China share issue privatization: The extent of its success. J. Financ. Econ. 2003, 70, 183–222. [Google Scholar] [CrossRef]

- Wang, H.; Qian, C. Corporate Philanthropy and Corporate Financial Performance: The Roles of Stakeholder Response and Political Access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- McFadyen, M.A.; Semadeni, M.; Cannella, A.A. Value of Strong Ties to Disconnected Others: Examining Knowledge Creation in Biomedicine. Organ. Sci. 2009, 20, 552–564. [Google Scholar] [CrossRef]

- Khanna, T.; Gulati, R.; Nohria, N. The dynamics of learning alliances: Competition, cooperation, and relative scope. Strateg. Manag. J. 1998, 19, 193–210. [Google Scholar] [CrossRef]

- Ramaswamy, K. Organizational ownership, competitive intensity, and firm performance: An empirical study of the Indian manufacturing sector. Strateg. Manag. J. 2001, 22, 989–998. [Google Scholar] [CrossRef]

- Bae, J.; Insead, M.G. Partner Substitutability, Alliance Network Structure, and Firm Profitability in the Telecommunications Industry. Acad. Manag. J. 2004, 47, 843–859. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in china: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2017, 62, 375–404. [Google Scholar] [CrossRef]

- Herrmann, P.; Datta, D.K. CEO Experiences: Effects on the Choice of FDI Entry Mode. J. Manag. Stud. 2006, 43, 755–778. [Google Scholar] [CrossRef]

- McDonald, M.L.; Westphal, J.D.; Graebner, M.E. What do they know? The effects of outside director acquisition experience on firm acquisition performance. Strateg. Manag. J. 2008, 29, 1155–1177. [Google Scholar] [CrossRef]

- Li, J.; Tang, Y. CEO Hubris and Firm Risk Taking in China: The Moderating Role of Managerial Discretion. Acad. Manag. J. 2010, 53, 45–68. [Google Scholar] [CrossRef]

- Nielsen, B.B.; Nielsen, S. Top management team nationality diversity and firm performance: A multilevel study. Strateg. Manag. J. 2013, 34, 373–382. [Google Scholar] [CrossRef]

- Kacperczyk, A.; Beckman, C.M.; Moliterno, T.P. Disentangling risk and change: Internal and external social comparison in the mutual fund industry. Adm. Sci. Q. 2015, 60, 228–262. [Google Scholar] [CrossRef]

- Bettencourt, L.M.; Lobo, J.; Strumsky, D. Invention in the city: Increasing returns to patenting as a scaling function of metropolitan size. Res. Policy 2007, 36, 107–120. [Google Scholar] [CrossRef]

- Castilla, E.J. Accounting for the Gap: A Firm Study Manipulating Organizational Accountability and Transparency in Pay Decisions. Organ. Sci. 2015, 26, 311–333. [Google Scholar] [CrossRef]

- Aiken, L.S.; West, S.G. Multiple Regression: Testing and Interpreting Interactions; SAGE Publications: New York, NY, USA, 1991. [Google Scholar]

- Gaur, A.S.; Malhotra, S.; Zhu, P. Acquisition announcements and stock market valuations of acquiring firms’ rivals: A test of the growth probability hypothesis in China. Strateg. Manag. J. 2013, 34, 215–232. [Google Scholar] [CrossRef]

- Shaver, J.M. Accounting for endogeneity when assessing strategy performance: Does entry mode choice affect FDI survival? Manag. Sci. 1998, 44, 571–585. [Google Scholar] [CrossRef]

- Hamilton, B.H.; Nickerson, J.A. Correcting for Endogeneity in Strategic Management Research. Strateg. Organ. 2003, 1, 51–78. [Google Scholar] [CrossRef]

- Peng, M.W. Institutional Transitions and Strategic Choices. Acad. Manag. Rev. 2003, 28, 275–296. [Google Scholar] [CrossRef]

| Main Effects | Dependent Variable | Effect Prediction | |

| H1 | Active partner outflow | Firm performance | Negative |

| H2 | New partner inflow | Firm performance | Negative |

| H3 | Previous partner inflow | Firm performance | Positive |

| Moderating Effects | Dependent Variable | Effect Prediction | |

| H4 | Active partner outflow × Average tie strength of the last alliance portfolio | Firm performance | Negative |

| H5 | New partner inflow × Average tie strength of the last alliance portfolio | Firm performance | Positive |

| H6 | Previous partner inflow × Average tie strength of the last alliance portfolio | Firm performance | Negative |

| Variable | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01 Performance | ||||||||||||||||||||

| 02 Active partner outflow | −0.047 | |||||||||||||||||||

| 03 New partner inflow | 0.091 | −0.028 | ||||||||||||||||||

| 04 Previous partner inflow | 0.083 | 0.088 | −0.081 | |||||||||||||||||

| 05 Market competition | −0.396 | −0.018 | −0.320 | −0.013 | ||||||||||||||||

| 06 Average tie strength | −0.175 | 0.195 | −0.545 | 0.117 | 0.530 | |||||||||||||||

| 07 Last average tie strength | −0.120 | 0.093 | −0.326 | 0.226 | 0.511 | 0.909 | ||||||||||||||

| 08 Partnership size | −0.035 | −0.250 | −0.211 | 0.066 | 0.336 | 0.395 | 0.443 | |||||||||||||

| 09 Bank age | −0.025 | −0.045 | 0.002 | −0.056 | −0.024 | −0.117 | −0.161 | −0.499 | ||||||||||||

| 10 Bank size | −0.198 | 0.138 | −0.228 | −0.051 | 0.286 | 0.235 | 0.129 | −0.446 | 0.601 | |||||||||||

| 11 FMS education | −0.011 | −0.125 | −0.018 | 0.034 | 0.040 | 0.007 | 0.020 | 0.065 | −0.064 | −0.020 | ||||||||||

| 12 FMS working experience | 0.033 | 0.040 | −0.020 | 0.109 | 0.006 | 0.132 | 0.159 | −0.054 | 0.070 | 0.081 | −0.075 | |||||||||

| 13 Firm age | −0.056 | 0.148 | −0.390 | 0.259 | 0.333 | 0.632 | 0.604 | 0.566 | −0.334 | −0.059 | 0.022 | 0.109 | ||||||||

| 14 Firm size | 0.216 | 0.002 | −0.186 | 0.144 | 0.212 | 0.517 | 0.550 | 0.569 | −0.313 | −0.198 | 0.028 | 0.083 | 0.635 | |||||||

| 15 Firm ownership | 0.048 | −0.091 | −0.033 | 0.014 | −0.056 | 0.070 | 0.066 | 0.065 | 0.034 | 0.014 | 0.073 | 0.034 | 0.139 | 0.134 | ||||||

| 16 TMT size | 0.014 | 0.074 | −0.178 | 0.101 | 0.122 | 0.272 | 0.252 | 0.264 | −0.085 | 0.000 | −0.001 | 0.053 | 0.443 | 0.321 | 0.073 | |||||

| 17 CEO international experience | −0.084 | −0.022 | 0.063 | −0.052 | −0.084 | −0.186 | −0.186 | −0.078 | 0.003 | −0.019 | −0.047 | −0.020 | −0.248 | −0.178 | −0.141 | 0.054 | ||||

| 18 CEO education | 0.037 | 0.022 | −0.014 | 0.037 | 0.012 | 0.149 | 0.177 | 0.114 | −0.184 | −0.076 | 0.031 | 0.061 | 0.286 | 0.214 | −0.107 | 0.047 | −0.119 | |||

| 19 CEO origin | −0.082 | 0.001 | 0.156 | −0.023 | −0.090 | −0.206 | −0.189 | −0.212 | 0.048 | −0.038 | 0.099 | 0.027 | −0.130 | −0.306 | −0.048 | −0.021 | −0.003 | −0.031 | ||

| 20 Time effect | −0.413 | 0.127 | −0.460 | 0.022 | 0.799 | 0.695 | 0.639 | 0.322 | −0.011 | 0.393 | 0.016 | 0.012 | 0.395 | 0.116 | −0.101 | 0.154 | −0.084 | 0.016 | −0.095 | |

| Means | 21.074 | 0.157 | 0.142 | 0.114 | 0.963 | 5.260 | 4.834 | 10.864 | 23.744 | 28.864 | 2.050 | 1.373 | 7.025 | 24.158 | 0.712 | 21.627 | 0.256 | 2.229 | 1.596 | 12.434 |

| S.D. | 1.08 | 0.177 | 0.216 | 0.145 | 0.003 | 2.744 | 2.628 | 5.132 | 5.409 | 0.358 | 0.540 | 1.278 | 3.174 | 1.156 | 0.212 | 3.788 | 0.437 | 0.665 | 0.847 | 5.484 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Active partner outflow (AO) | −0.407 (0.182) * | −0.564 (0.219) ** | |||

| New partner inflow (NI) | −1.215 (0.204) *** | −0.733 (0.273) ** | |||

| Previous partner inflow (PI) | 0.497 (0.219) * | 0.663 (0.233) ** | |||

| Last average tie strength (LATS) | −0.032 (0.023) | −0.003 (0.023) | |||

| AO × LATS | −0.188 (0.075) ** | ||||

| NI × LATS | 0.234 (0.095) ** | ||||

| PI × LATS | −0.109 (0.083) † | ||||

| Market competition | −140.956 (23.767) *** | −148.721 (24.403) *** | −113.037 (23.524) *** | −142.303 (24.095) *** | −101.588 (23.860) *** |

| Average tie strength | −0.031 (0.024) | −0.027 (0.024) | −0.052 (0.024) * | ||

| Partnership size | −0.002 (0.011) | −0.015 (0.013) | −0.001 (0.011) | −0.023 (0.014) † | 0.003 (0.011) |

| Bank age | −0.002 (0.008) | −0.003 (0.008) | −0.007 (0.008) | −0.002 (0.009) | −0.007 (0.009) |

| Bank size | 0.093 (0.164) | 0.030 (0.165) | 0.106 (0.162) | −0.083 (0.172) | 0.070 (0.166) |

| FMS education | −0.041 (0.060) | −0.050 (0.059) | −0.049 (0.056) | −0.064 (0.062) | −0.038 (0.057) |

| FMS working experience | 0.009 (0.028) | 0.003 (0.028) | 0.010 (0.027) | −0.002 (0.028) | 0.004 (0.027) |

| Firm age | −0.030 (0.020) | −0.030 (0.020) | −0.037 (0.020) † | −0.019 (0.021) | −0.042 (0.021) * |

| Firm size | 0.342 (0.054) *** | 0.351 (0.056) *** | 0.335 (0.052) *** | 0.373 (0.055) *** | 0.288 (0.054) *** |

| Firm ownership | −0.173 (0.148) | −0.198 (0.142) | −0.309 (0.148) * | −0.187 (0.154) | −0.304 (0.153) * |

| TMT size | 0.015 (0.010) | 0.015 (0.010) | 0.014 (0.010) | 0.015 (0.010) | 0.015 (0.010) |

| CEO international experience | −0.270 (0.079) *** | −0.277 (0.079) *** | −0.345 (0.076) *** | −0.272 (0.079) *** | −0.349 (0.075) *** |

| CEO education | 0.010 (0.052) | 0.002 (0.052) | 0.007 (0.050) | 0.004 (0.052) | −0.017 (0.051) |

| CEO origin | −0.061 (0.042) | −0.068 (0.043) | −0.076 (0.042) | −0.065 (0.043) | −0.068 (0.042) |

| Time effect | −0.023 (0.018) | −0.018 (0.018) | −0.048 (0.017) | −0.014 (0.017) | −0.058 (0.018) |

| Intercept | 21.508 (0.228) *** | 21.458 (0.228) *** | 21.836 (0.225) *** | 21.395 (0.221) *** | 22.033 (0.230) *** |

| Wald R2 | 448.53 *** | 591.88 *** | 2014.48 *** | 369.77 *** | 891.36 *** |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Active partner outflow (AO) | −0.033 (0.020) * | −0.340 (0.207) * | −0.534 (0.257) * | |||

| New partner inflow (NI) | −0.064 (0.025) ** | −0.285 (0.382) | −0.715 (0.273) ** | |||

| Previous partner inflow (PI) | 0.063 (0.024) ** | 0.781 (0.293) ** | 0.646 (0.233) ** | |||

| Last average tie strength (LATS) | −0.025 (0.023) | −0.022 (0.024) | −0.018 (0.019) | 0.008 (0.022) | −0.033 (0.023) | −0.004 (0.024) |

| AO × LATS | −0.013 (0.008) * | −0.247 (0.085) ** | −0.189 (0.076) ** | |||

| NI × LATS | 0.029 (0.009) *** | 0.248 (0.135) * | 0.240 (0.095) ** | |||

| PI × LATS | −0.010 (0.006) † | −0.144 (0.099) † | −0.115 (0.083) † | |||

| Market competition | −141.208 (24.548) *** | −101.536 (23.961) *** | −117.185 (26.304) *** | −98.713 (27.434) *** | −140.690 (24.320) *** | −100.748 (23.874) *** |

| Average tie strength | ||||||

| Partnership size | −0.011 (0.012) | 0.004 (0.012) | −0.017 (0.012) | 0.002 (0.011) | −0.023 (0.014) † | −0.001 (0.012) |

| Bank age | −0.001 (0.009) | −0.004 (0.009) | 0.010 (0.011) | 0.000 (0.012) | −0.002 (0.009) | −0.007 (0.009) |

| Bank size | −0.045 (0.170) | 0.051 (0.164) | −0.226 (0.198) | −0.063 (0.193) | −0.082 (0.172) | 0.054 (0.166) |

| FMS education | −0.061 (0.062) | −0.022 (0.057) | −0.019 (0.069) | −0.006 (0.070) | −0.063 (0.062) | −0.028 (0.057) |

| FMS working experience | −0.004 (0.028) | 0.017 (0.027) | −0.010 (0.003) | 0.007 (0.029) | −0.002 (0.028) | 0.003 (0.027) |

| Firm age | −0.019 (0.021) | −0.040 (0.020) * | −0.023 (0.023) | −0.047 (0.027) † | −0.019 (0.021) | −0.039 (0.021) † |

| Firm size | 0.356 (0.056) *** | 0.329 (0.055) *** | 0.343 (0.061) *** | 0.271 (0.069) *** | 0.370 (0.056) *** | 0.293 (0.054) *** |

| Firm ownership | −0.178 (0.152) | −0.281 (0.150) † | −0.203 (0.201) | −0.262 (0.201) | −0.182 (0.156) | −0.298 (0.152) * |

| TMTs size | 0.015 (0.010) | 0.015 (0.010) | 0.009 (0.017) | 0.011 (0.017) | 0.015 (0.010) | 0.015 (0.010) |

| CEO international experience | −0.279 (0.079) *** | −0.298 (0.074) *** | −0.251 (0.078) ** | −0.305 (0.079) *** | −0.275 (0.079) *** | −0.349 (0.075) *** |

| CEO education | 0.002 (0.053) | −0.014 (0.050) | −0.028 (0.068) | −0.036 (0.070) | 0.009 (0.053) | −0.015 (0.051) |

| CEO origin | −0.059 (0.043) | −0.059 (0.042) | −0.058 (0.047) | −0.053 (0.046) | −0.068 (0.043) | −0.072 (0.042) † |

| Time effect | −0.018 (0.017) | −0.052 (0.017) ** | −0.028 (0.019) | −0.052 (0.019) ** | −0.014 (0.017) | −0.057 (0.018) *** |

| Inverse Mill’s ratio | −0.006 (0.062) | −0.054 (0.050) | ||||

| Intercept | 21.464 (0.225) *** | 21.939 (0.228) *** | 21.184 (0.115) *** | 21.303 (0.129) *** | 21.400 (0.222) *** | 22.025 (0.230) *** |

| Wald R2 | 364.67 *** | 1760.37 *** | 377.15 *** | 2130.45 *** | ||

| Deviance | 1561.149 * | 1551.283 ** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liang, J.; Shao, P. Sequential Alliance Portfolios, Partner Reconfiguration and Firm Performance. Sustainability 2019, 11, 5904. https://doi.org/10.3390/su11215904

Liang J, Shao P. Sequential Alliance Portfolios, Partner Reconfiguration and Firm Performance. Sustainability. 2019; 11(21):5904. https://doi.org/10.3390/su11215904

Chicago/Turabian StyleLiang, Jie, and Peng Shao. 2019. "Sequential Alliance Portfolios, Partner Reconfiguration and Firm Performance" Sustainability 11, no. 21: 5904. https://doi.org/10.3390/su11215904

APA StyleLiang, J., & Shao, P. (2019). Sequential Alliance Portfolios, Partner Reconfiguration and Firm Performance. Sustainability, 11(21), 5904. https://doi.org/10.3390/su11215904