Eliciting Weights of Significance of Criteria for a Monitoring Model of Performance of SMEs for Successful Insolvency Administrator’s Intervention

Abstract

1. Introduction

- difficulties arising attempting to access sources of financing;

- SMEs are reliant on internal funds or cash from friends and family;

- lack of management competence, skilled staff, lack of regular training;

- lack of efficiency compared to large firms in screening the regulatory environment and dealing with legal requirements;

- comparably low productivity;

- employees perform multiple roles with unclear boundaries and job responsibilities, which results in rather inefficient flexible internal organizational structures;

- lack of financial safety and high reliance on a low number of customers, thus making finding new customers and sustaining established ones a pressing issue for the majority of SMEs;

- dependence on few suppliers, lack of strong networks and links between businesses;

- lagging to utilize new opportunities, such as new markets, supply chains, or simply gaining support and advice;

- isolation, insufficient connection to ecosystems, where ideas and skills can be shared;

- focus on competition rather than collaboration;

- owner’s permanent fear of bankruptcy.

- out-of-court settlements;

- in-court legal procedures;

- post-bankruptcy treatment of the entrepreneur and creating conditions for a second-chance revival (liquidation or discharge),

2. The set of Criteria Intrinsic to Performance of SMEs, and its Hierarchy Structure

3. Methodology and Results

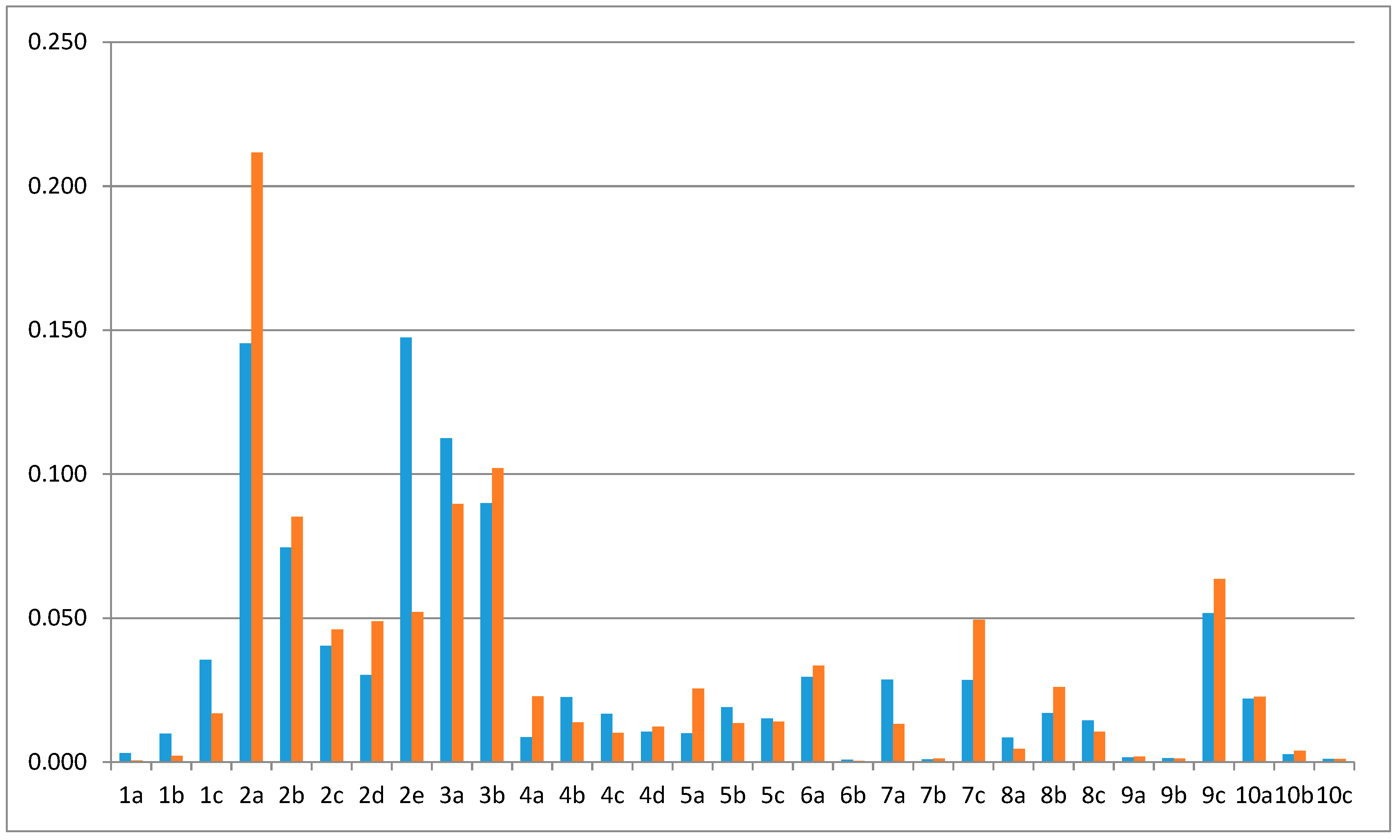

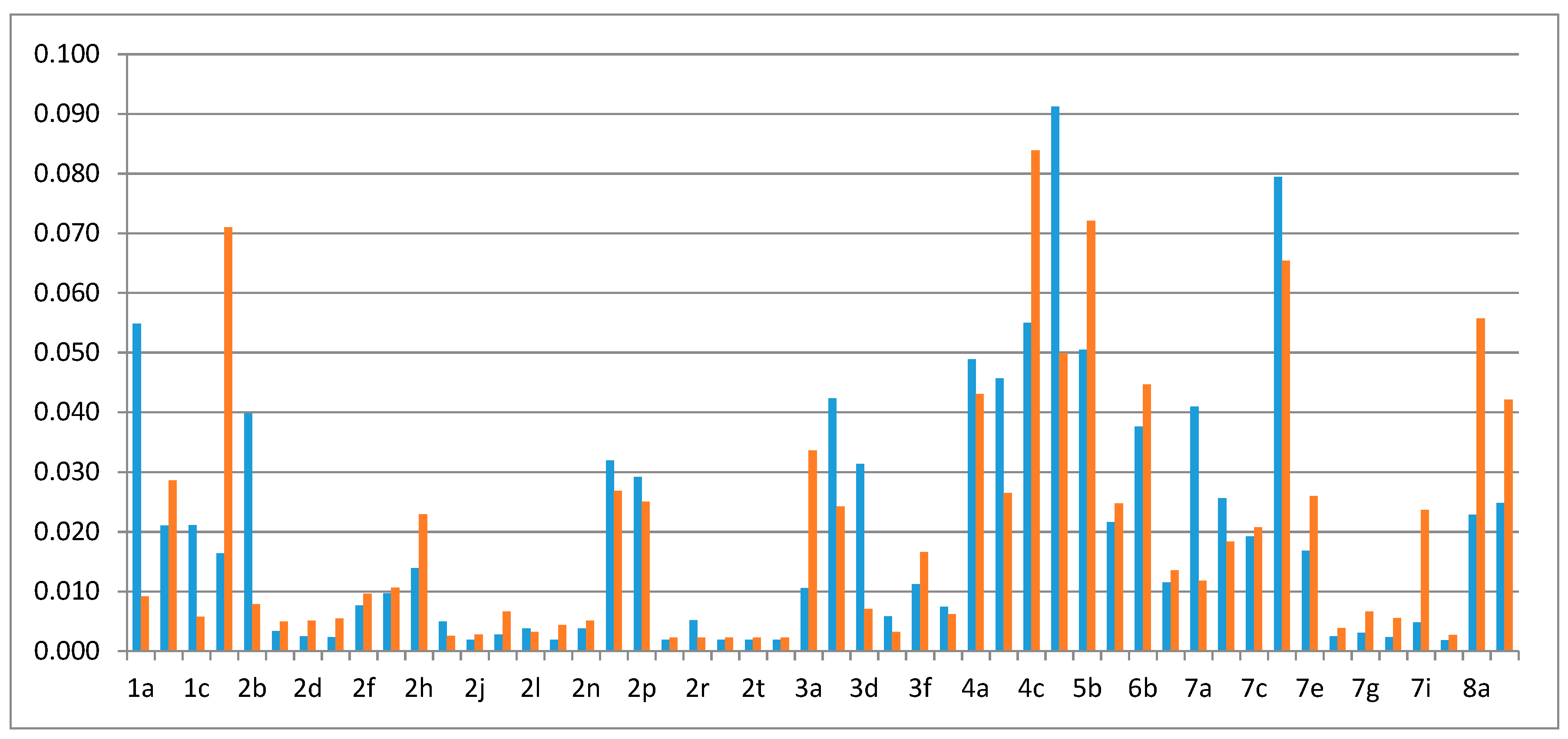

3.1. Eliciting Weights of Criteria

3.2. Statistical Analysis of Correlation

3.3. Nonparametric Statistical Analysis of Concordance of Opinions of Experts

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- European Commission. User Guide to the SME Definition; European Union: Luxembourg, 2015. [Google Scholar]

- OECD. Declaration on Strengthening SMEs and Entrepreneurship for Productivity and Inclusive Growth; OECD Ministerial Conference on SMEs: Mexico City, Mexico, 2018. [Google Scholar]

- European Commission. Annual Report on European SMEs 2016/2017; European Union: Luxembourg, 2017. [Google Scholar]

- Commission of the European Communities. A “Small Business Act” for Europe; Communication from the Commission to the Council, the European Parliament, the European Economic and Social Committee and the Committee of the Regions: Brussels, Belgium, 2008. [Google Scholar]

- Obi, J.; Ibidunni, A.S.; Tolulope, A.; Olokundun, M.A.; Amaihian, A.B.; Borishade, T.T.; Fred, P. Contribution of small and medium enterprises to economic development: Evidence from a transiting economy. Data Brief 2018, 18, 835–839. [Google Scholar] [CrossRef] [PubMed]

- Ayyagari, M.; Beck, T.; Demirguc-Kunt, A. Small and medium enterprises across the Globe. Small Bus. Econ. 2007, 29, 415–434. [Google Scholar] [CrossRef]

- Gupta, J.; Gregoriou, A. Impact of market-based finance on SMEs failure. Econ. Model. 2018, 69, 13–25. [Google Scholar] [CrossRef]

- Ates, A.; Garengo, P.; Cocca, P.; Bititci, U. The development of SME managerial practice for effective performance management. J. Small Bus. Enterp. Dev. 2013, 20, 28–54. [Google Scholar] [CrossRef]

- Chowdhury, S.R. Impact of global crisis on small and medium enterprises. Glob. Bus. Rev. 2011, 12, 377–399. [Google Scholar] [CrossRef]

- Creditreform. Corporate Insolvencies in Europe 2015/2016; Verband der Vereine Creditreform e.V.: Neuss, Germany, 2016. [Google Scholar]

- World Bank. Doing Business: Measuring Business Regulations. Available online: http://www.doingbusiness.org/en/data/exploretopics/resolving-insolvency (accessed on 20 September 2018).

- Flash Eurobarometer. Entrepreneurship in the EU and Beyond: A Survey in the EU, EFTA Countries, Croatia, Turkey, the US, Japan, South Korea and China; Analytical Report; Gallup: Berlin, Germany, 2010. [Google Scholar]

- European Commission. A Second Chance for Entrepreneurs: Prevention of Bankruptcy, Simplification of Bankruptcy Procedures and Support for a Fresh Start; Final Report of the Expert Group, Enterprise & Industry magazine: Luxembourg, 2011. [Google Scholar]

- United States Courts. Bankruptcy Basics. Available online: https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics (accessed on 25 November 2018).

- European Commission. Study on a New Approach to Business Failure and Insolvency Comparative Legal Analysis of the Member States’ Relevant Provisions and Practices Tender No. JUST/2014/JCOO/PR/CIVI/0075; Publications Office of the EU: Brussels, Belgium, 2016. [Google Scholar]

- World Bank. Doing Business 2016: Measuring Regulatory Quality and Efficiency; A World Bank Group Flagship Report; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Hecka, J.; Rittinerb, F.; Steinertb, M.; Meboldta, M. Iteration–based Performance Measurement in the Fuzzy Front End of PDPs. Procedia CIRP 2016, 50, 14–19. [Google Scholar] [CrossRef][Green Version]

- Balfaqih, H.; Nopiah, M.Z.; Saibani, N.; Al-Nory, M.A. Review of supply chain performance measurement systems: 1998–2015. Comput. Ind. 2016, 82, 135–150. [Google Scholar] [CrossRef]

- Akdogan, M.S.; Durak, A. Logistic and Marketing Performances of Logistics Companies: A Comparison between Germany and Turkey. Procedia Soc. Behav. Sci. 2016, 235, 576–586. [Google Scholar] [CrossRef]

- Kotanea, I.; Merlinob, I.K. Analysis of Small and Medium Sized Enterprises’ Business Performance Evaluation Practice at Transportation and Storage Services Sector in Latvia. Procedia Eng. 2017, 178, 182–191. [Google Scholar] [CrossRef]

- Kurschus, R.J.; Sarapovas, T.; Cvilikas, A. The Criteria to Identify Company’s Crisis in SME Sector. Inzinerine Ekonomika–Eng. Econ. 2015, 2, 152–158. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Measures that Drive Performance. Harv. Bus. Rev. 1992, 1–2, 171–179. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Using the Balanced Scorecard as a Strategic Management System. Harv. Bus. Rev. 1996b, 1–2, 75–85. [Google Scholar]

- Ohlson, J.A. Financial Ratios and the Probabilistic Prediction of Bankruptcy. J. Account. Res. 1980, 18, 109–131. [Google Scholar] [CrossRef]

- Grice, J.S.; Ingram, R.W. Tests of the Generalizability of Altman’s Bankruptcy Prediction Model. J. Bus. Res. 2001, 54, 53–61. [Google Scholar] [CrossRef]

- Tian, S.; Yu, Y. Financial ratios and bankruptcy predictions: An international evidence. Int. Rev. Econ. Financ. 2017, 51, 510–526. [Google Scholar] [CrossRef]

- Sabol, A.; Sverer, F. A Review of the Economic Value added Literature and Application. UTMS J. Econ. 2017, 8, 19–27. [Google Scholar]

- Bahri, M.; St-Pierre, J.; Sakka, O. Economic value added: A useful tool for SME performance management. Int. J. Product. Perform. Manag. 2011, 60, 603–621. [Google Scholar] [CrossRef]

- Altman, E.I.; Sabato, G. Modeling credit risk for SMEs: Evidence from the US market. Abacus 2007, 43, 332–357. [Google Scholar] [CrossRef]

- Ausloos, M.; Cerqueti, R.; Bartolacci, F.; Castellano, N.G. SME investment best strategies. Outliers for assessing how to optimize performance. Phys. A Stat. Mech. Appl. 2018, 509, 754–765. [Google Scholar] [CrossRef]

- Popova, V.; Sharpanskykh, A. Modeling organizational performance indicators. Inf. Syst. 2010, 35, 505–527. [Google Scholar] [CrossRef]

- Sanchez, A.A.; Marin, G.S. Orientation Management, Characteristic, and Performance. A Study Spanish SME’s. J. Small Bus. Manag. 2005, 43, 287–306. [Google Scholar] [CrossRef]

- Bianchi, C.; Cosenz, F.; Marinkovic, M. Designing dynamic performance management systems to foster SME competitiveness according to a sustainable development perspective: Empirical evidences from a case-study. Int. J. Bus. Perform. Manag. 2015, 16, 84–108. [Google Scholar] [CrossRef]

- Sarwoko, E.; Armanu, S.; Hadiwidjojo, D. Entrepreneurial characteristics and competency as determinants of business performance in SMEs. J. Bus. Manag. 2013, 7, 31–38. [Google Scholar]

- Hanifzadeh, F.; Talebi, K.; Sajadi, S.M. The Analysis of Effect of Aspiration to Growth of Managers for SMEs Growth Case Study. J. Entrep. Emerg. Econ. 2018, 10, 277–301. [Google Scholar] [CrossRef]

- Hsu, C.H.; Chang, A.C.; Luo, W. Identifying key performance factors for sustainability development of SMEs—Integrating QFD and fuzzy MADM methods. J. Clean. Prod. 2017, 161, 629–645. [Google Scholar] [CrossRef]

- Courrent, J.M.; Chasse, S.; Omri, W. Do entrepreneurial SMEs perform better because they are more responsible? J. Bus. Ethics 2018, 153, 317–336. [Google Scholar] [CrossRef]

- Kloviene, L.; Spezialeb, M.T. Is Performance Measurement System Going Towards Sustainability in SMEs? Procedia Soc. Behav. Sci. 2015, 213, 328–333. [Google Scholar] [CrossRef]

- Seo, Y.W.; Chae, S.W. Market Dynamics and Innovation Management on Performance in SMEs: Multi-agent Simulation Approach. Procedia Comput. Sci. 2016, 91, 707–714. [Google Scholar] [CrossRef]

- Ruiz-Mallorqui, M.V.; Aguiar-Diaz, I. Relationship banking and bankruptcy resolution in Spain: The impact of size. Span. Rev. Financ. Econ. 2017, 15, 21–32. [Google Scholar] [CrossRef]

- Yazdani, M.; Chatterjee, P.; Zavadskas, E.K.; Streimikiene, D. A novel integrated decision-making approach for the evaluation and selection of renewable energy technologies. Clean Technol. Environ. Policy 2018, 20, 403–420. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Antucheviciene, J.; Vilutiene, T.; Adeli, H. Sustainable Decision-Making in Civil Engineering, Construction and Building Technology. Sustainability 2018, 10, 14. [Google Scholar] [CrossRef]

- Keeney, R.L.; Raiffa, H. Decision Making with Multiple Objectives Preferences and Value Tradeoffs; Cambridge University Press: New York, NY, USA, 1993; p. 569. [Google Scholar]

- Kao, C. Weight determination for consistently ranking alternatives in multiple criteria decision analysis. Appl. Math. Model. 2010, 34, 1779–1787. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Podvezko, V. Integrated Determination of Objective Criteria Weights in MCDM. Int. J. Inf. Technol. Decis. Mak. 2016, 15, 267–283. [Google Scholar] [CrossRef]

- Trinkuniene, E.; Podvezko, V.; Zavadskas, E.K.; Joksiene, I.; Vinogradova, I.; Trinkunas, V. Evaluation of quality assurance in contractor contracts by multi-attribute decision-making methods. Econ. Res. Ekon. Istraživanja 2017, 30, 1152–1180. [Google Scholar] [CrossRef]

- Kurschus, R.J.; Sarapovas, T.; Pilinkiene, V. The Concept of Crisis Management by Intervention Model for SMEs. Eng. Econ. 2017, 28, 170–179. [Google Scholar] [CrossRef]

- Stevens, S.S. On the Theory of Scales of Measurement. Science 1946, 103, 677–680. [Google Scholar] [CrossRef] [PubMed]

- Harpe, S.E. How to analyze Likert and other rating scale data. Curr. Pharm. Teach. Learn. 2015, 7, 836–850. [Google Scholar] [CrossRef]

- Lipovetsky, S. Van Westendrop Price Sensitivity in Statistical Modeling. Int. J. Oper. Quant. Manag. 2006, 12, 141–156. [Google Scholar]

- Stookey, J.A.; Baer, M.A. Critique of Guttman scaling: With special attention to its application to the study of collegial bodies. Qual. Quant. 1976, 10, 251–260. [Google Scholar] [CrossRef]

- Saaty, T.L. Decision Making for Leaders: The Analytical Hierarchy Process for Decisions in a Complex World; University of Pittsburgh: Pittsburgh, PA, USA, 1988. [Google Scholar]

- Nunić, Z. Evaluation and Selection of Manufacturer PVC Carpentry Using FUCOM–MABAC Model. Oper. Res. Eng. Sci. Theory Appl. 2018, 1, 13–28. [Google Scholar] [CrossRef]

- Pamučar, D.; Lukovac, V.; Božanić, D.; Komazec, N. Multi-Criteria FUCOM–MAIRCA Model for the Evaluation of Level Crossings: Case Study in the Republic of Serbia. Oper. Res. Eng. Sci. Theory Appl. 2018, 1, 108–129. [Google Scholar] [CrossRef]

- Podviezko, A. Use of multiple criteria decision aid methods in case of large amounts of data. Int. J. Bus. Emerg. Mark. 2015, 7, 155–169. [Google Scholar] [CrossRef]

- Burinskiene, M.; Bielinskas, V.; Podviezko, A.; Gurskiene, V.; Maliene, V. Evaluating the significance of criteria contributing to decision-making on brownfield land redevelopment strategies in urban areas. Sustainability 2017, 9, 759. [Google Scholar] [CrossRef]

- Veskovic, S.; Stevic, Z.; Stojic, G.; Vasiljevic, M.; Milinkovic, S. Evaluation of the Railway Management Model by Using a New Integrated Model DELPHI–SWARA–MABAC. Decis. Mak. Appl. Manag. Eng. 2018, 1, 34–50. [Google Scholar] [CrossRef]

- Kilgour, D.M.; Chen, Y.; Hipel, K.W. Multiple Criteria Approaches to Group Decision and Negotiation. In Trends in Multiple Criteria Decision Analysis; Ehrgott, M., Figueira, J.R., Greco, S., Eds.; International Series in Operations Research & Management Science; Springer: Boston, MA, USA, 2010; Volume 142, pp. 317–338. [Google Scholar]

- Kendall, M.G.; Gibbons, J.D. Rank Correlation Methods, 5th ed.; Oxford University Press: New York, NY, USA, 1990. [Google Scholar]

- Parfenova, L.; Pugachev, A.; Podviezko, A. Comparative analysis of tax capacity in regions of Russia. Technol. Econ. Dev. Econ. 2016, 22, 905–925. [Google Scholar] [CrossRef]

- Palevicius, V.; Grigonis, V.; Podviezko, A.; Barauskaite, G. Developmental analysis of park-and-ride facilities in Vilnius. Promet Traffic Traffico 2016, 28, 163–176. [Google Scholar] [CrossRef]

- Jakimavicius, M.; Burinskiene, M.; Gusaroviene, M.; Podviezko, A. Assessing multiple criteria for rapid bus routes in the public transport system in Vilnius. Public Transp. 2016, 8, 365–385. [Google Scholar] [CrossRef]

- Palevicius, V.; Podviezko, A.; Sivilevicius, H.; Prentkovskis, O. Decision-aiding evaluation of public infrastructure for electric vehicles in cities and resorts of Lithuania. Sustainability 2018, 10, 904. [Google Scholar] [CrossRef]

- Ginevicius, R.; Podvezko, V.; Podviezko, A. Evaluation of Isolated Socio-Economical Processes by a Multi-Criteria Decision Aid Method ESP. In Proceedings of the 7th International Scientific Conference Business and Management’2012, Vilnius, Lithuania, 10–11 May 2012; Selected Papers. Ginevicius, R., Rutkauskas, A.V., Stankeviciene, J., Eds.; Technika: Vilnius, Lithuania, 2012; pp. 1083–1089. [Google Scholar]

- Podviezko, A.; Podvezko, V. Influence of Data Transformation on Multicriteria Evaluation Result. Procedia Eng. 2015, 122, 151–157. [Google Scholar] [CrossRef]

- Podviezko, A.; Parfenova, L.; Pugachev, A. Tax Competitiveness of the New EU Member States. J. Risk Financ. Manag. 2019, 12, 34. [Google Scholar] [CrossRef]

| Category | Soft Sub-Criteria |

|---|---|

| S1. Shareholders/owners |

|

| S2. Management |

|

| S3. Personnel |

|

| S4. Customers |

|

| S5. Suppliers |

|

| S6. Competition |

|

| S7. Finances |

|

| S8. Rehabilitation concept |

|

| Category | Hard Sub-Criteria |

|---|---|

| H1. Adverse balance, negative balance |

|

| H2. Liquidity |

|

| H3. Net sales and profit |

|

| H4. Personnel intensity |

|

| H5. Material intensity |

|

| H6. Funding ratio |

|

| H7. Debt ratio |

|

| H8. Equity ratio |

|

| H9. Yield key figures |

|

| H10. Turnover key figures |

|

| No. Experts | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.52 | 0.42 | 0.39 | 0.41 | 0.56 | 0.49 | 0.74 | 0.33 | 0.41 | 0.44 | 0.19 | 0.42 | 0.44 | 0.74 | 0.61 | 0.70 | 0.63 | 0.39 | 0.59 | 0.67 | 0.67 | 0.58 | 0.45 | 0.53 | 0.44 |

| 2 | – | 0.45 | 0.45 | 0.52 | 0.57 | 0.54 | 0.77 | 0.27 | 0.53 | 0.25 | 0.19 | 0.44 | 0.08 | 0.70 | 0.53 | 0.41 | 0.33 | 0.22 | 0.52 | 0.51 | 0.68 | 0.29 | 0.13 | 0.56 | 0.45 |

| 3 | – | 0.65 | 0.21 | 0.52 | 0.52 | 0.31 | 0.01 | 0.23 | 0.18 | 0.35 | 0.36 | 0.36 | 0.53 | 0.59 | 0.57 | 0.54 | 0.64 | 0.57 | 0.63 | 0.40 | 0.60 | 0.40 | 0.53 | 0.99 | |

| 4 | – | 0.38 | 0.53 | 0.80 | 0.45 | 0.05 | 0.39 | 0.02 | 0.06 | 0.32 | –0.02 | 0.47 | 0.82 | 0.34 | 0.26 | 0.29 | 0.47 | 0.55 | 0.51 | 0.23 | 0.06 | 0.79 | 0.65 | ||

| 5 | – | 0.82 | 0.61 | 0.74 | 0.65 | 1.00 | 0.24 | 0.13 | 0.65 | –0.01 | 0.38 | 0.47 | 0.28 | 0.18 | –0.01 | 0.74 | 0.52 | 0.86 | 0.17 | 0.12 | 0.65 | 0.23 | |||

| 6 | – | 0.74 | 0.74 | 0.50 | 0.82 | 0.36 | 0.49 | 0.74 | 0.23 | 0.57 | 0.69 | 0.57 | 0.45 | 0.33 | 0.82 | 0.83 | 0.87 | 0.43 | 0.34 | 0.77 | 0.53 | ||||

| 7 | – | 0.66 | 0.41 | 0.61 | 0.02 | 0.13 | 0.36 | 0.04 | 0.55 | 0.85 | 0.44 | 0.31 | 0.21 | 0.64 | 0.67 | 0.74 | 0.27 | 0.16 | 0.99 | 0.51 | |||||

| 8 | – | 0.49 | 0.74 | 0.25 | 0.08 | 0.51 | 0.12 | 0.75 | 0.65 | 0.51 | 0.39 | 0.14 | 0.66 | 0.60 | 0.94 | 0.35 | 0.22 | 0.68 | 0.31 | ||||||

| 9 | – | 0.65 | 0.15 | 0.09 | 0.28 | –0.14 | 0.21 | 0.11 | 0.01 | –0.04 | –0.10 | 0.40 | 0.18 | 0.54 | –0.02 | –0.04 | 0.45 | 0.01 | |||||||

| 10 | – | 0.24 | 0.13 | 0.66 | –0.01 | 0.39 | 0.47 | 0.29 | 0.19 | 0.00 | 0.75 | 0.53 | 0.86 | 0.18 | 0.13 | 0.65 | 0.25 | ||||||||

| 11 | – | 0.43 | 0.66 | 0.05 | 0.08 | 0.09 | 0.25 | 0.24 | 0.20 | 0.13 | 0.48 | 0.29 | 0.18 | 0.05 | 0.08 | 0.18 | |||||||||

| 12 | – | 0.55 | 0.35 | 0.25 | 0.13 | 0.28 | 0.29 | 0.56 | 0.34 | 0.52 | 0.18 | 0.34 | 0.35 | 0.13 | 0.35 | ||||||||||

| 13 | – | 0.14 | 0.36 | 0.30 | 0.32 | 0.32 | 0.34 | 0.54 | 0.72 | 0.64 | 0.31 | 0.29 | 0.42 | 0.38 | |||||||||||

| 14 | – | 0.61 | 0.26 | 0.73 | 0.80 | 0.79 | 0.59 | 0.45 | 0.18 | 0.81 | 0.96 | 0.05 | 0.40 | ||||||||||||

| 15 | – | 0.64 | 0.71 | 0.70 | 0.66 | 0.75 | 0.64 | 0.70 | 0.70 | 0.67 | 0.55 | 0.55 | |||||||||||||

| 16 | – | 0.71 | 0.57 | 0.31 | 0.67 | 0.73 | 0.71 | 0.49 | 0.28 | 0.83 | 0.58 | ||||||||||||||

| 17 | – | 0.96 | 0.62 | 0.73 | 0.76 | 0.58 | 0.90 | 0.67 | 0.46 | 0.57 | |||||||||||||||

| 18 | – | 0.75 | 0.70 | 0.72 | 0.48 | 0.97 | 0.75 | 0.35 | 0.54 | ||||||||||||||||

| 19 | – | 0.58 | 0.58 | 0.23 | 0.80 | 0.80 | 0.22 | 0.64 | |||||||||||||||||

| 20 | – | 0.76 | 0.81 | 0.71 | 0.67 | 0.67 | 0.58 | ||||||||||||||||||

| 21 | – | 0.73 | 0.68 | 0.52 | 0.70 | 0.63 | |||||||||||||||||||

| 22 | – | 0.46 | 0.30 | 0.77 | 0.40 | ||||||||||||||||||||

| 23 | – | 0.79 | 0.31 | 0.60 | |||||||||||||||||||||

| 24 | – | 0.17 | 0.45 | ||||||||||||||||||||||

| 25 | – | 0.52 |

| Group of Elicited Weights of Criteria | χ2 Test | χ2 Threshold at α = 0.05 | χ2 Threshold at α = 0.01 |

|---|---|---|---|

| Hard before crisis, 30 degrees of freedom | 481.41 | 43.77 | 50.89 |

| Soft before crisis, 49 degrees of freedom | 669.08 | 66.34 | 74.79 |

| Hard after crisis, 30 degrees of freedom | 502.83 | 43.77 | 50.89 |

| Soft after crisis, 49 degrees of freedom | 677.35 | 66.34 | 74.79 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Podviezko, A.; Kurschus, R.; Lapinskiene, G. Eliciting Weights of Significance of Criteria for a Monitoring Model of Performance of SMEs for Successful Insolvency Administrator’s Intervention. Sustainability 2019, 11, 5667. https://doi.org/10.3390/su11205667

Podviezko A, Kurschus R, Lapinskiene G. Eliciting Weights of Significance of Criteria for a Monitoring Model of Performance of SMEs for Successful Insolvency Administrator’s Intervention. Sustainability. 2019; 11(20):5667. https://doi.org/10.3390/su11205667

Chicago/Turabian StylePodviezko, Askoldas, Ralph Kurschus, and Giedre Lapinskiene. 2019. "Eliciting Weights of Significance of Criteria for a Monitoring Model of Performance of SMEs for Successful Insolvency Administrator’s Intervention" Sustainability 11, no. 20: 5667. https://doi.org/10.3390/su11205667

APA StylePodviezko, A., Kurschus, R., & Lapinskiene, G. (2019). Eliciting Weights of Significance of Criteria for a Monitoring Model of Performance of SMEs for Successful Insolvency Administrator’s Intervention. Sustainability, 11(20), 5667. https://doi.org/10.3390/su11205667