1. Introduction

The stock market trading dilemma is the cumulative reflections of investors’ behavior [

1]. Investors exhibit behavioral irregularities (biases) which potentially influence market efficiency [

2,

3]. Among these biases, herding bias is the most prominent, which is associated with the trading behavior of financial markets’ participants [

4,

5]. It has become a subject of widespread interest in the recent decade [

6,

7,

8]. Herding refers to the situation wherein rational people start behaving irrationally by imitating the judgments of others while making decisions [

3]. Herding theories posit that market participants prefer to follow the financial experts in their trading patterns instead of their own source of information [

9].The study of [

10] believes that the herding of investors is one of the major risk factors that is typically ignored by statistical approaches.

In the past decade, the study of herding documents this diverse behavioral pattern across the globe. In the context of the U.S. markets, Christie and Huang [

5] report the absence of herding bias, even during extreme market movements. Conversely, Choi and Sias [

11] point out the presence of a strong institutional industry herding bias. Likewise, Wang and Zhang [

12] investigate the impact of individual investor trading on the firm value (FV) at the New York Stock Exchange (NYSE), and find the positive impact of investor trading on FV. European evidence [

13] illustrates the presence of herding bias in the “during crises” period. Also, Walter and Moritz Weber [

14] identify the herding bias of mutual fund managers in Germany during extreme market movements. Chinese, Taiwanese and South Korean stock markets also reveal herding behavior [

15,

16,

17,

18]. In the Chinese equity market, Demirer and Kutan [

19] empirically analyze the behavior of return dispersions during periods of unusually large upward and downward changes in the market index of both the SSE and SZSE, and conclude that the Chinese Market is free from herding bias, and a similar approach is used by Demirer et al. [

20]. Conversely, Tan et al. [

21] explore the evidence of herding bias at the SSE and the SZSE, the A-share and B-share markets. They also report the existence of herding bias in both rising and falling market conditions, specifically more pronounced in the A-shares of the Shanghai Market during rising market conditions. Bo et al. [

22] witness the investment herding bias among the corporate board, directors, and CEOs of non-financial firms from 1999 to 2004, and the consequent positive and significant impact on the FV. Similarly, another group of studies [

23,

24,

25] report the mixed results of herding bias at the SSE and SZSE.

The above-mentioned studies highlight herding bias in two ways: First, the evidence of investors herding at market, industry/sector and firm-level during the extreme market conditions [

17,

19]; Second, the evidence of an investment-herding bias of the corporate manager [

14] and their impact on the FV [

22]. For the best of our knowledge, there is not a single study which explains the individual and interactive impact of investor and manager herding (IHR and MHR) biases on the FV. So, motivated by the recent studies [

6,

12,

22] that manager and investor demonstrate herding bias in their investment decision, this study empirically investigates the following questions:

Whether the investor herding bias exists at market-, sectors- and firm-level Chinese equity markets?

Do managers of the firm also exhibit herding bias in Chinese equity markets?

What is the individual and interactive impact of investors’ and managers’ herding bias on the FV?

The Chinese Financial Equity Market is important to be analyzed as it has an influence on integrated markets [

26], while in China there is a need to strengthen the financial resources for sustainable development and poverty reduction [

27]. Based on the literature and the questions stated above, this study adds to the existing literature in the following ways: Firstly, it hypothesizes the presence of herding bias in the Chinese equity markets at the market and industry/sector level, in line with [

8,

15,

19,

28], and later it extends the phenomena at the firm level, which is a unique addition to the behavioral finance literature. Importantly, the market and sector level herding is insufficient to explain the investor’s behavior associated to the firm, as Demirer and Zhang [

17] find that the firm characteristics, their size and the past return has a significant effect on the herding behavior of the investor. Secondly, to the best of our knowledge, this is the first study that examines the impact of IHR and MHR on the FV. Finally, another most interesting contribution is in the form of the interactive impact of both IHR and MHR on the FV, which provides insights into understanding how both stakeholders jointly influence the FV.

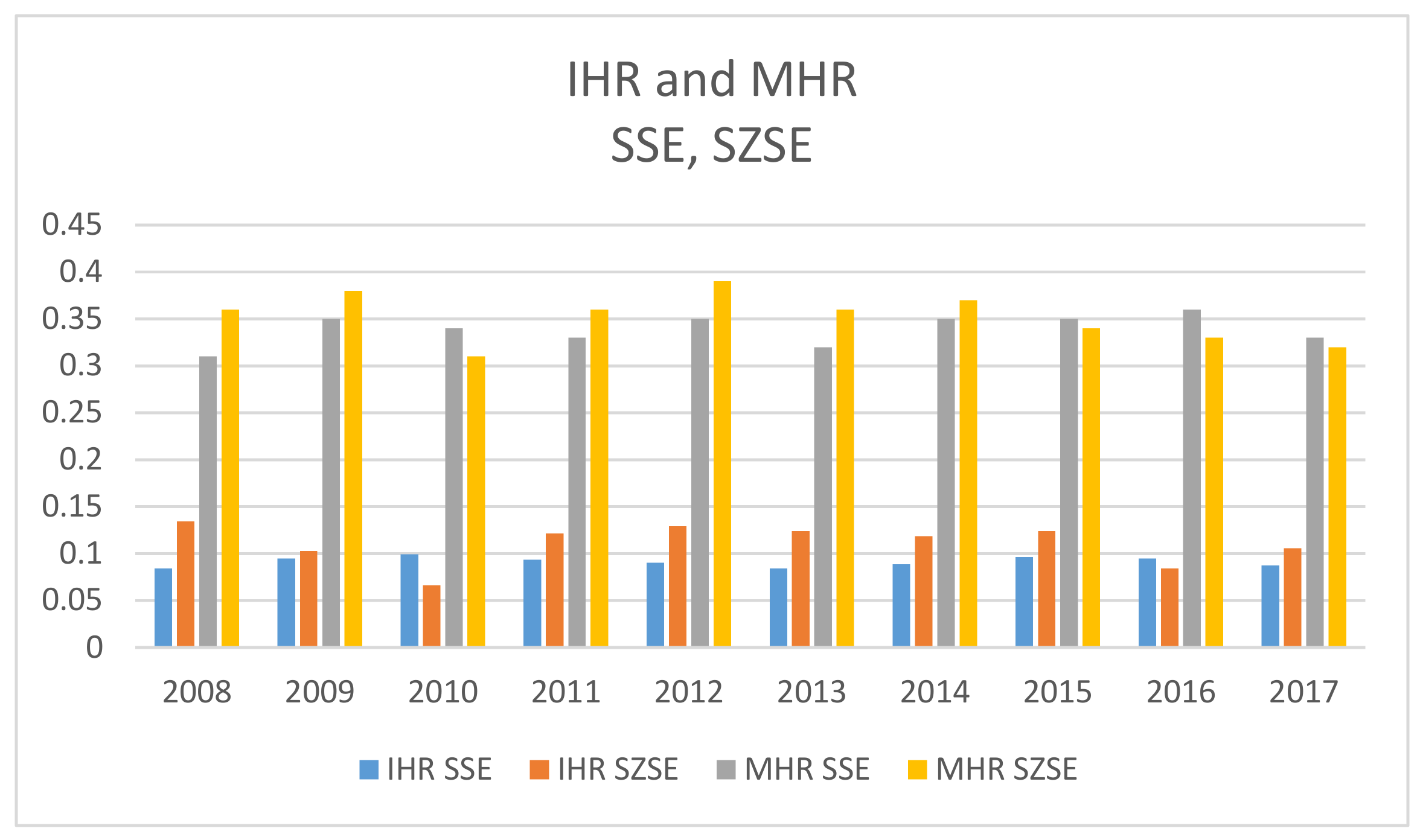

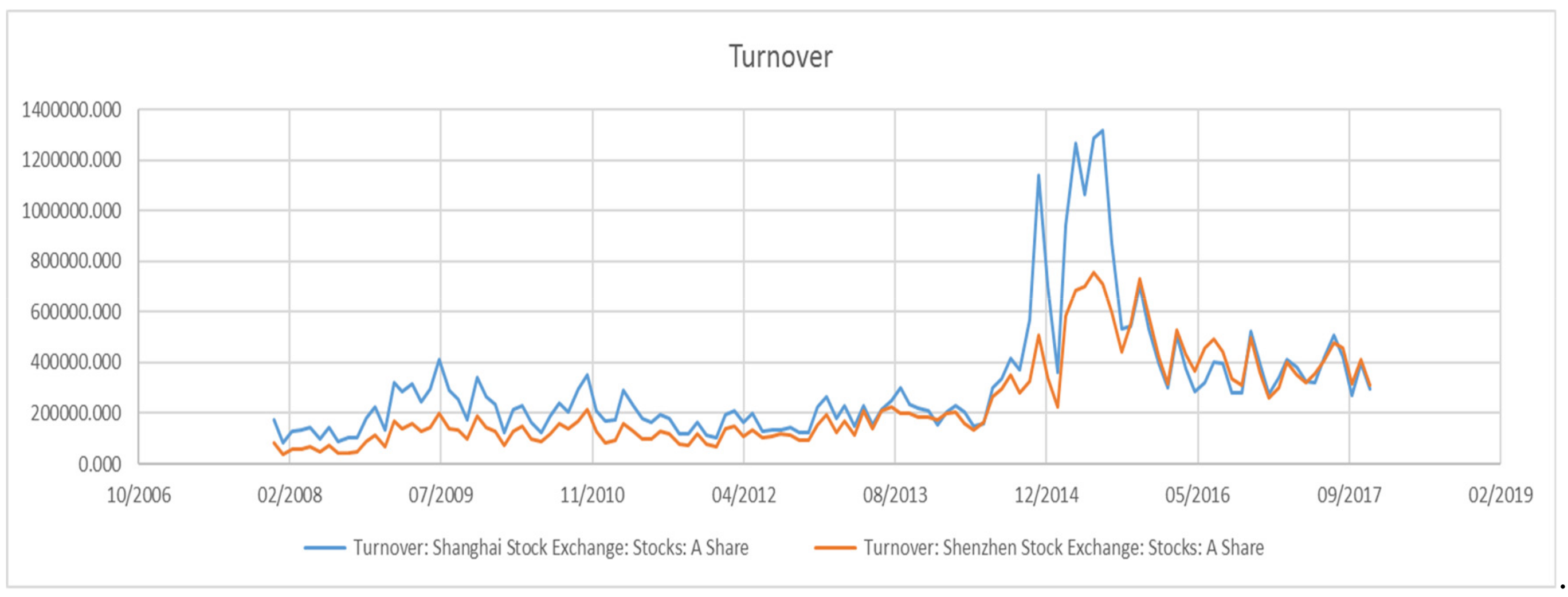

Overall results demonstrate that: (i) Herding behavior exists at market-, sector- and firm-level at the SSE and SZSE, and a non-linear and significant relationship exists between stock return and cross-sectional absolute deviation (CSAD), which seems to be more pronounced in herding bias at all levels at the SZSE. The CSAD model explains 95% and 99% herding bias at the market level, 26% and 32% at sectors level, and 10% and 12% at the firm level at SSE and SZSE, respectively. While an absolute investment deviation model detects 51% and 54% of managers herding bias at SSE and SZSE, respectively.

The empirical results also suggest that IHR and MHR affect the FV significantly during the extreme trading period (2014 to 2015), at both stock exchanges, while the interaction of IHR and MHR reveals the same at the SZSE in 2013. Importantly, the results are robust under different time intervals and industry classification.

The rest of this study is arranged as follows:

Section 2 describes a brief literature and hypotheses development.

Section 3 explains the methodological approach, including variable definitions, data sources and the sample period.

Section 4 states the empirical results and discussion, while the final section concludes the study along with policy recommendations.

2. Literature Review and Hypothesis Development

Prior literature finds a diverse herding bias among participants in various stock markets. Empirical evidence on U.S. and Europeans investors and managers exhibits the presence of herding bias among mutual fund managers [

29], analysts recommendation [

30] and pension fund managers [

31]. The aggregate effect of herding behavior is more prevalent in international markets, especially in emerging markets. Chang et al. [

15] find significant evidence of herding bias in Taiwan and South Korea, alimited bias in Japan, and no bias in the U.S. and Hong Kong.

Later on, the Bueno [

32] document herding bias in both theA-shares and B-shares of theChinese Stock Market. Furthermore, empirical analysis of herding on eighteen international markets by Chiang and Zheng [

33] show the existence of herding in seven Asian and six advanced markets, whereas thenonexistence of herding behavior among both Latin American and U.S. markets, except during a crises period. Recent studies of Balcilar et al. [

34] and Zheng et al. [

35] also document herding behavior in the Gulf Arab and Asian markets. In Pakistan, the study of Javed et al. [

36] and Javaira and Hassan [

37] found no evidence of herding behavior in KSE 100 index companies at the Karachi Stock Exchange (KSE) for the period of 2002 to 2014. Whereas, the study of Yousaf et al. [

38] on investor herding behavior in the Pakistan Stock Market during 2004 to 2014 reports the existence of herding behavior in the market, particularly in 2005 to 2008. Likewise, the empirical work of Shah et al. [

28] for 2004 to 2013 also supports the significant evidence of herding behavior in this Pakistan Stock Market, specifically during the extreme market movements. Additionally, they found more than 50% of sectors at the PSX exhibit herding behavior during the upward market movements.

Demirer and Kutan [

19] examine the presence of herd formation in Chinese markets using both individual firm and sector level data. They analyze the behavior of return dispersions during periods of unusually large upward and downward changes in the market index. They also distinguish sample data between the Shanghai and Shenzhen stock exchanges at the sector-level. Their findings show that herding bias does not exist in Chinese markets. However, comparing return dispersions for upside and downside movements of the market, these return dispersions during extreme downside movements of the market are much lower than those for upside movements, indicating that stock returns behave more similarly during down markets. Munkh-Ulzii et al. [

39] find the presence of significant herding behavior in Chinese and Taiwan stock markets. Tan et al. [

21] explore herding behavior in dual-listed Chinese A-share and B-share stocks. They find evidence of herding within both the Shanghai and Shenzhen A-share markets that are dominated by domestic individual investors, and also within both B-share markets, in which foreign institutional investors are the main participants.

Herding occurs in both rising and falling market conditions. Herding behavior by A-share investors in the Shanghai Market is more pronounced under conditions of rising markets, high trading volumeand high volatility, while no asymmetry is apparent in the B-share market. Lee et al. [

24] document the effect of institutional herding on future stock returns in the China A-share Market at both the market and industry level from 2003 to 2012. Using a unique institutional holding database, they test the herding effect at different time horizons. The results suggest that institutional herding has a significantly positive effect on future excess returns for A shares in the short, medium and long periods of time. In the China A-share market, institutional herding is more significant on the buy-side than the sell-side due to short sell restrictions.

At the industry level, manufacturing and construction sectors experience an institutional herding effect at all time horizons. The financial industry is found to present a significant institutional effect only in the long term.

The institutional herding has a positive and significant impact on the medium-term and long-term excess stock returns in the rest of ten sectors. Yao et al. [

25] report the existence and prevalence of investor herding behavior in a segmented market setting, the Chinese A and B stock markets. The results indicate that investors exhibit different levels of herding behavior, in particular, herding strongly exists in the B-share markets. They also find that across markets, herding behavior is more prevalent at industry-level, is stronger for the largest and smallest stocks, and is stronger for growth stocks relative to value stocks. Herding behavior is also more pronounced under conditions of declining markets. Over the sample period which we are examining, herding behavior diminishes over time. The results provide some indication to the effectiveness of regulatory reforms in China aimed at improving information efficiency and market integration.

Lao and Singh [

23] investigated herding behavior in the Chinese and Indian stock markets. Their results support that although both the Indian and Chinese stock markets are considered inefficient with low information disclosure standards, the Chinese Market exhibits herding behavior greater than the herding behavior in the Indian Market. Nevertheless, in both markets, herding behavior finds itself stronger in large market movements. Asymmetry investigation discovered that the Chinese Stock Market has the most profound herding behavior when the market is low and trading volume is high. Instead, in the Indian Market, herding behavior is observed when the market is high. In the Indian Market, herding behavior also had no association with trading volume. The reasons for herd behavior existing in the Chinese Stock Market, in both up and down states, are analyst forecast, short-term investor horizon, and inclusion of risk in decision making [

40].

Although herding mentioned in the above studies contributesmuch to a better understanding of investor behavior at the SSE and SZSE, their aggregate results are confined at market and sector level, which also explains the mixed results, existence and nonexistence, of herding bias over time. Thus, consistent with the prior literature, we postulate the first hypothesis to test whether herding bias exists at the SSE and the SZSE during the sample period 2008 to 2017.

Hypothes (H1). Stock prices show significant herding behavior at the market and sector level.

Investors usually invest in those stocks with which they are familiar. Study of Huberman [

41] considers the leading example of this phenomena. He explores the higher attention of employees in buying the security of those firms for which they work or are informed about from their peers. Ha [

42] examined the impact of herding on the stock performance, and documentsthe very strong impact of herding on the stock returns and stock returns affect book to the market value of firms [

43]. Also, Van Nieuwerburgh and Veldkamp [

44] found the investors trending in home stock are much higher than the foreign stocks, while careful policy actions are needed to prevent malpractices [

45]. Gebka and Wohar [

46] document stronger irrationality behavior among the investors particularly in the Consumer Services, Oil and Gas and Basic Materials industries in the international equity markets. Following these examples, it can be figured that investors mostly invest in familiar stocks and industries preferably in the national stock market. Focusing on individual stock information for a specific industry may help to explore the herd behavior better rather than at the aggregate industry or market level. To address the answer to this question, we postulate the second hypothesis as below:

Hypothes (H2). Stock prices show significant herding behavior at the firm level in the Chinese stock market.

Detection of herding at any level is not enough to explain the behavior of investors toward the specific firm. Investors usually consider the FV while making their investment decision. The market value of stock reacts on the price momentum based upon the frequency of the investors’ trade. Therefore, investors’ trading patterns show many behavior irregularities and biases which affect the firm’s performance. Among these biases, herding bias is the main behavioral bias [

4], which significantly affects the firm’s performance [

6,

8,

22]. Wang and Zhang [

12] elaborate on the positive impact of investor trading on the FV.

Also, Hilliard and Zhang [

47] find the weaker size and price to book value effect on the herding behavior of the Chinese Stock Market relative to U.S. markets over the period of 1999 to 2012. Our study differs uniquely from the prior studies, and tries to capture the impact of the herding bias of investors, at the individual firm, on the FV listed as A-share at the SSE and SZSE. To examine such a relationship, we construct the following hypothesis.

Hypothes (H3). Ceteris paribus, IHR bias has a positive impact on the FV.H3: Ceteris paribus, IHR bias has a positive impact on the FV.

Effects of herding are not bounded to the investors only. Firms’ managers also exhibit herding behavior in their financial decisions. Theories on herding behavior in standard literature assume that the information set upon which corporate managers are making investment decisions is truly perfect, and informative under a mature market system that guarantees a transparent corporate reporting system, mature laws and regulations, strong shareholders’ protection and effective corporate governance mechanisms. Under such circumstances, the manager should make investment decisions based on the information set relevant to the firm. In contrast, Prendergast and Stole [

48] discuss the herding intention of the managers who make investment decisions over time.Demirer and Zhang [

17] find that small firms with a high level of herding significantly underperform from those small firms that experience low herding. They observe no significant interactions between book-to-market and market beta with herding. Chen and Demirer [

8] point those industries that experience a high level of herding yield higher subsequent returns, regardless of their past performance.

Theories on herding find firms’ managers usually follow their peers in investment decisions, instead of relying on their own source of information [

9]. Garber [

4] elaborates herding behavior as the most prominent bias in the psychology of judgment. In the recent past, the studies on manager investment herding behavior present the diverse behavioral pattern across the world. Fong et al. [

49] demonstrate four general theories, classified into twoparts: Thefirst part belongs to intentional herding, and the second for unintentional herding. The authors state why managers may engage in herding behavior in their investment decisions as such: (1) Firm managers are subject to reputational risk when they behave differently from the crowd. Thus they may ignore private information to trade with the herd. (2) Managers may infer the private information of rival managers (perceived on their prior trades), resulting in the formation of informational cascades. (3) Managers may also receive similar private information because they also examine the same priced factors which caused them to arrive at similar conclusions regarding individual stocks. (4) Managers may exhibit similar aversions to stocks showing characteristics, such as low liquidity or low analyst coverage.

In the U.S. and European markets, herding behavior among managers of different industries is different. Choi and Sias [

11] document strong institutional herding in U.S. corporations. Also, Walter and Moritz Weber [

14] pinpoint the herding behavior of mutual fund managers in Germany. TheSouth Korea, Taiwanand China markets also exhibit herding behavior [

15,

16]. Many scholars examine the relationship between managerial career concerns and herding. Devenow and Welch [

50] analytically illustrate herd behavior in making corporate investment decisions. In light of the above literature, we postulate hypothesis 4:

Hypothes (H4). MHR bias has a positive impact on FV.

Firm financial performance is considered the most important indicator for investors and managers for the evaluation of their financial decisions. It has broad implications for investments, capital allocation and market efficiency of the business. Alabass [

6] and Bo et al. [

22] demonstrate a positive and significant impact of MHR bias on the FV. Theprevious two hypotheses, H3 and H4, are constructed to test the IHR and MHR bias individually. Perhaps it might be more logical to test the combined effect of herding bias to explore the magnitude of firm financial performance during the trading period. To investigate the combined effect of IHR and MHR bias on the FV, we test the following hypothesis:

Hypothes (H5). Interaction of the IHR and MHR has a positive influence on FV.

5. Conclusions

The literature on herding biases is confined to detection at the aggregate firms, sector/industry, and market level. The study adds to the behavioral finance literature by addressing the surprisingly unnoticed phenomena of the behavioral impact of herding bias on FV at the firm level, using the sample of 1,043 A-Shares listed firms at the SSE and SZSE under fixed effect specification. Initially, we detect the existence of IHR and MHR biases at firm-level applying a CSAD model [

15,

35] and an investment model of firms’ investment absolute deviation approach [

6,

22]. After such detection, we deploy the panel fixed-effect model with industry and years dummies to investigate the effect of: (1) IHR on FV, (2) MHR on FV and (3) interaction of IHR, and MHR on the FV respectively.

The empirical results document the presence of IHR and MHR bias at market, sector and firm-level in both equity markets, which potentially drive the FV, while the impact is more pronounced during the extreme trading period i.e., 2014 to 2015. The findings are robust under different time intervals and industry classification, and therefore, offers useful policy implications to understand the behavioral dynamics of investors and managers.

Given the vital role of finance in economic sustainability, the study adds invaluable inputs for policy formulation [

59,

60], specifically, the findings appear to be important for potential investors, as the firm-level financial information is more relevant to their decision, rather relying on an index. Specifically, we infer that the negative interaction of IHR with MHR results in a bullish trend to the stock markets, while the bearish trend is explained by the positive interaction of IHR and MHR. The probability of a market crash may become higher in those circumstances when both negative IHR and MHR interact with each other and cause the FV to decline. Furthermore, this study infersthat at the SSE, if IHR and MHR shift from insignificance to positive significance, it might be the signal of a sudden boom in the market. Whereas, at the SZSE, this suggests that when a positive and significant impact of IHR disappears with the negative impact of MHR, this might be the reason for the sudden decline in trading activity, and vice versa. Thus, the study facilitates to understand the herding biases associated with the investment decisions of investors and managers and their impact on the FV that help corporate stakeholders, financial analysts and stock market regulators to devise their strategic and regulatory policies accordingly.