1. Introduction

Several management theories (e.g., neoclassical theory) assume that the key objective of an organization is to earn a profit. For this purpose, organizations use different methods and tactics to gain high performance [

1]. However, recent studies have claimed that environmental and economic performance (hereby referred to as sustainability practices) are necessary for getting superior profitability [

2,

3]. In other words, a firm can gain high profit by performing and encouraging sustainability practices [

4]. In its broadest conceptualization, sustainability is defined as meeting the needs of the present without compromising the ability of future generations to meet their own needs [

5]. In management research, it is described from the corporate social responsibility (CSR) perspective and generally indicated through a range of social, political, cultural, legal, economic and natural environmental dimensions [

6]. Research in sustainability is concerned with potential impact on corporate social performance [

7]. Considering its potential contribution to financial performance, achievement of sustainability has become the priority of business [

8] and non-business organizations [

9]. Nevertheless, not all organizations are able to perform sustainability practices [

10,

11]. Some organizations have enough resources and capabilities which enable them to achieve sustainability practices (e.g., [

9]). A plethora of research has discussed the factors that influence sustainably practices such as strategic orientation [

12], organizational change [

13] and organization commitment [

14] etc. At this point, the existing studies have mainly focused on traditional factors while innovative predictors are rarely touched. To put it another way, the influence of Management Innovation (MI) and Technological Innovation (TI) on sustainability. MI and TI are considered crucial for sustainability.

Despite having a broader debate, mixed findings; positive, negative, significant and insignificant have been reported between sustainability and performance [

6,

15]. The present study, on the one hand, is an attempt to explore the relationship between sustainability and firm performance. However, due to globalization, firms have turned to technological practices and have focused on innovative activities [

16]. Recent studies claim that innovation is the best choice for organizations to survive a long run in turbulent markets [

17]. A variety of innovation types have been discussed such as eco-innovation, social innovation, product innovation, marketing innovation and organization innovation [

18] that can impact a firm’s performance. Out of all the innovations, the MI (e.g., [

18]) and TI ([

19]) have been considered the most prominent factors for the survival of organizations. Despite the significant importance of innovation, MI and TI are still rarely touched in terms of firm sustainability. Notwithstanding, existing studies have also examined the direct influence of MI and TI on organizations performance [

20,

21]. However, in fact, the question “Do MI and TI contribute to the organization’s sustainability?” is still unanswered. In other words, this research is an attempt to check if either MI or TI directly influence organization performance or if sustainability mediates the relationship.

The present environmental problems call for more environmentally benign technology. For instance, Kemp (p. 2) [

22] described that “the past two decades witnessed a heightened concern over environmental degradation of the various options open to society to reduce the environmental burden, technology is widely considered as the most attractive”. The theme (that technology is the best option in environmental performance and sustainability) is favored by many recent studies [

21,

23,

24]. However, due to the diverse environmental problems since the 1990s, tensions were inevitably triggered within the firms, encouraging them to formulate internal processes; innovation, technology and non-technology drivers. Especially adequate governance, planning and organizational processes should be integrated within the organization to move in line with environment changes [

2]. We suppose that neither MI nor TI on its own can spur sustainability and performance, but both types of innovation are complementary. As pointed out by Vaccaro et al. [

25], competition has pushed firms towards technological changes and firms need to renew their internal structures. However, the changes are not concerned with offering new products and services, but also altering the nature of management within organizations.

Sustainability is a multidimensional phenomenon. It is often merged with environmental performance and economic performance. It is often described as a measure of a firm’s capability to accomplish its mission and serve its stockholders over a longer period and to have an acknowledged and quantifiable influence. Sustainability when successfully achieved can lead to more extensive sources of funding and configure a firm capacity to provide value in the long run [

26]. In short, a firm that relies on sustainability leads to a greater emphasis on long-term survival. Firms with successfully achieved sustainability can achieve their long-term goal [

27] and can better perform in a resource-constrained environment [

26,

28]. Sustainability is about expanding the financial bottom line into a triple bottom line, which includes environmental and social aspects of corporate performance [

29]. Hence, sustainability should not be restricted to only environment practices to gain environmental objectives but it can also facilitate other advantages (e.g., gaining long-term survival and profitability) in a turbulent market when successfully achieved [

3]. In this study, sustainability is considered an essential practice of a firm that provides environmental, social and economic benefits to configure the firms’ sustainable competitive position. For instance, Nidumolu et al. [

30] described that sustainable development is the only way available for enterprises’ growth, decreasing production costs and generating additional revenues from novel offerings or business expansion. Their empirical study found that (p. 2) “sustainability is a mother lode of organizational and technological innovations that yield both bottom-line and top-line returns.” However, organization performance demonstrates firm objectives to gain high profits, high sales growth and top market share [

31].

The phenomenon of innovation has attracted many management scholars. Beyond the universal product and technological innovation, a variety of innovations have been introduced such as service innovation (e.g., [

32]), business model innovation (e.g., [

33]) and process innovation (e.g., [

34]). But MI and TI are well-known factors in strategic management literature that can configure organizations performance. For instance, Ref. [

35] claims that MI represents one of the most prominent sources of competitive advantage and sustainable performance in the business world. Similarly, it is argued that TI is a necessary tool for a sustainable position in the current era of globalization [

36]. Surprisingly, recent studies still claim a lack of research in term of MI and TI [

21,

20,

37]. Considering the supposition that MI and TI do not always directly contribute to firm performance, we intend that both types of innovation help organizations in acquiring sustainability which in turn provides high profitability.

This research contributes to the existing literature of MI, TI, sustainability and organization performance in several ways. The model of this research is based on empirical evidence collected from an emerging market, Pakistan, which may provide valuable implications because of its location. We test the extent of sustainability that influences the relationship between MI and TI that has ignored in prior studies. In terms of theoretical underpinning, this research tries to clarify the ambiguity about the relationship between sustainability and financial performance. For instance, Yu and Zhao [

38] suggested two competing theories; value creating and value-destroying to examine the influence of sustainability on financial performance. Value creating theory demonstrates that risk is reduced with the adoption of social and environmental responsibility. On the other hand, the destruction theory indicates that firms engaged in social and environmental responsibility lose focus on profitability but please shareholders [

39]. In addition, this research tests the Resource Base View (RBV) theory that demonstrates a prominent role of unique resources (tangible and intangible) in a sustainable competitive position [

40]. Similarly, upper echelon theory also claims that top management activities are the significant factors that influence organizational outcomes and performance [

41]. We as a result of this, we deem MI a new practice that can contribute to corporate sustainability and performance. Alternatively, this research recognizes the most critical factors that can help emerging organizations that face significant challenges; lack of resources, lack of support and lack of capabilities.

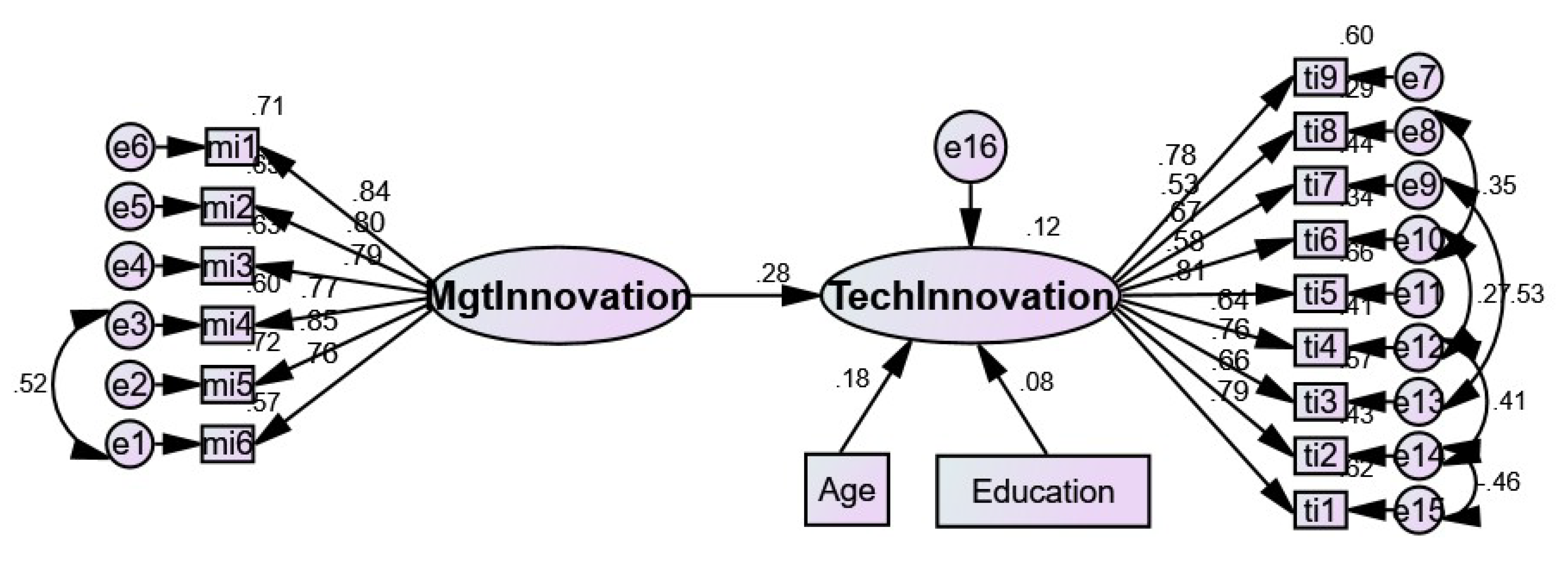

4. Discussion

This study tested the mediating role of sustainability between MI and organization performance as well as between TI and organization performance. Though, several studies have examined the direct relationship between MI and organization performance (e.g., [

20]) and TI and organization performance [

36], especially in developed markets. However, this research is an attempt to test the model based on empirical evidence collected from an emerging economy. We hereby confirmed that sustainability significantly improves financial performance in emerging markets. The confronting theories suggested by Yu and Zhao, [

38] can be properly answered in our research by concluding a significant positive relationship between sustainability and financial performance. Additionally, our findings strongly favor the RBV theory, which demonstrates that a firm with unique and useful resources and capabilities can get a sustainable competitive position and superior performance in a market [

40]. We also confirmed that a firm with innovation capabilities could achieve its goal to make a sustainable position and outperform competitors in a turbulent market. In a similar view (e.g., from an RBV perspective), we argue that TI as a capability, stimulates firm internal structure and process to enhance performance. Moreover, this research also assesses the theme of the upper echelon theory which indicates the role of top management in organizations is critical in outcomes and success [

41]. We argue in this research that senior management through innovative practices can spur organization performance in emerging markets.

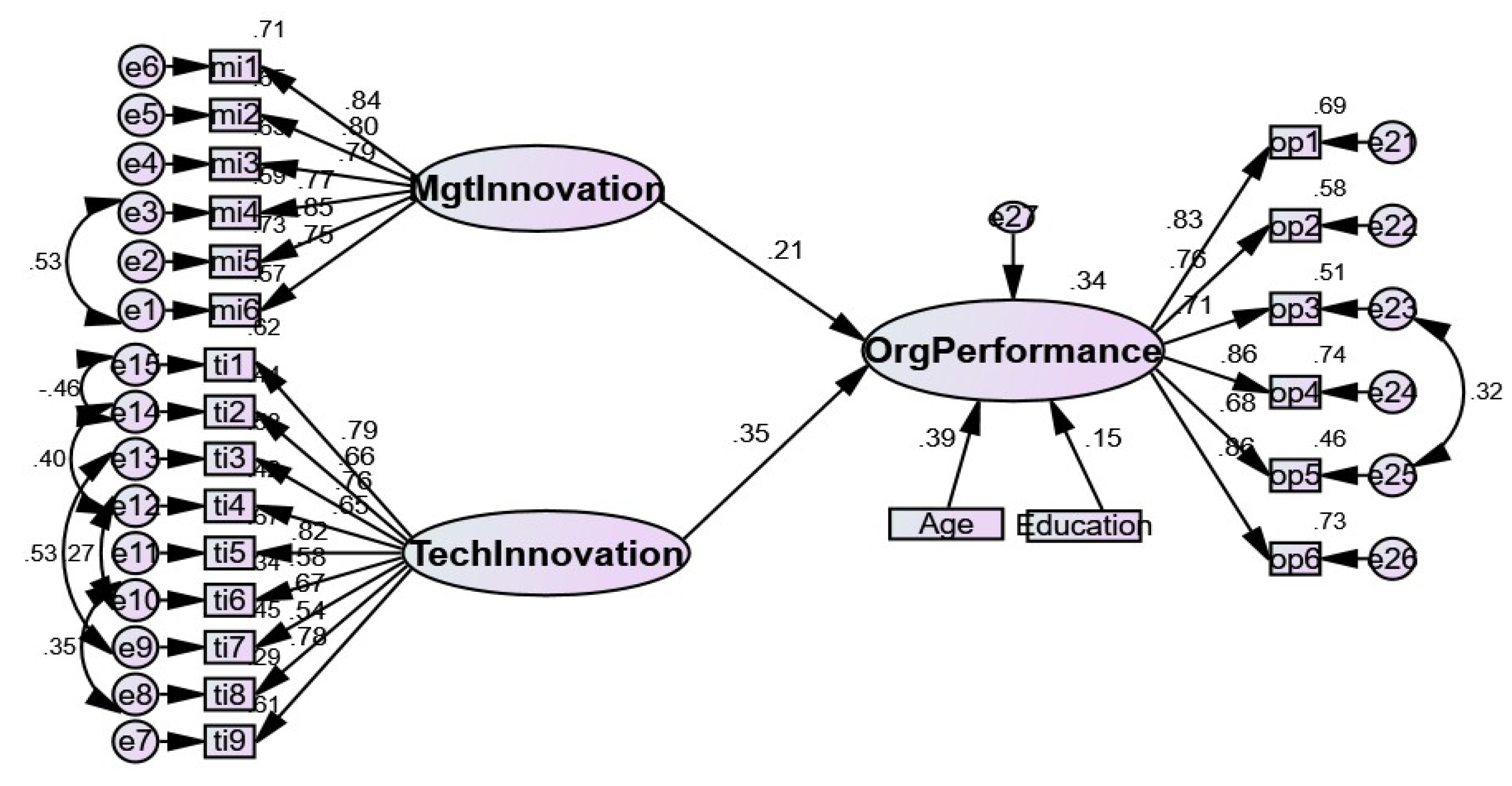

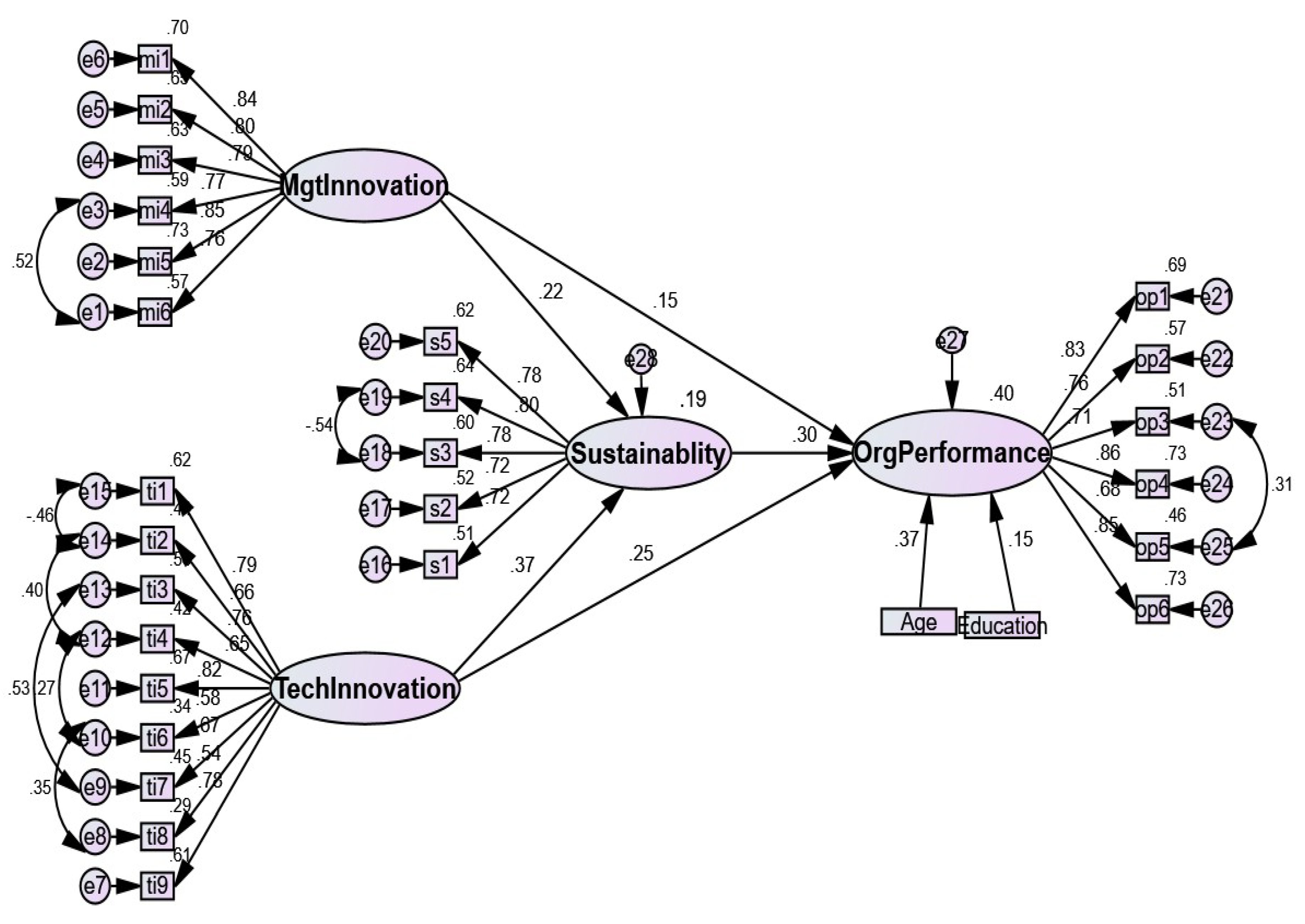

This study confirmed that MI and TI have a significant influence on organization performance that supported H1 and H2 of our research. Consistent with Azar and Ciabuschi [

78] who scrutinized that in the turbulent market, MI and TI are significant predictors that can enhance organizational performance. Moreover, Mol and Birkinshaw [

50] pointed out that MI helps organizations in different ways but it significantly improves its performance and productivity. Additionally, it is indicated that MI innovation helps the organization to achieve high performance by integrating various practices within organizations in novel ways. More preciously, MI is a significant driver of organization performance [

21,

53]. From TI perspective, our findings are consistent with Kim and Choi [

94] who pointed out that any improvement in IT innovation can significantly improve organization efficiency and financial performance.

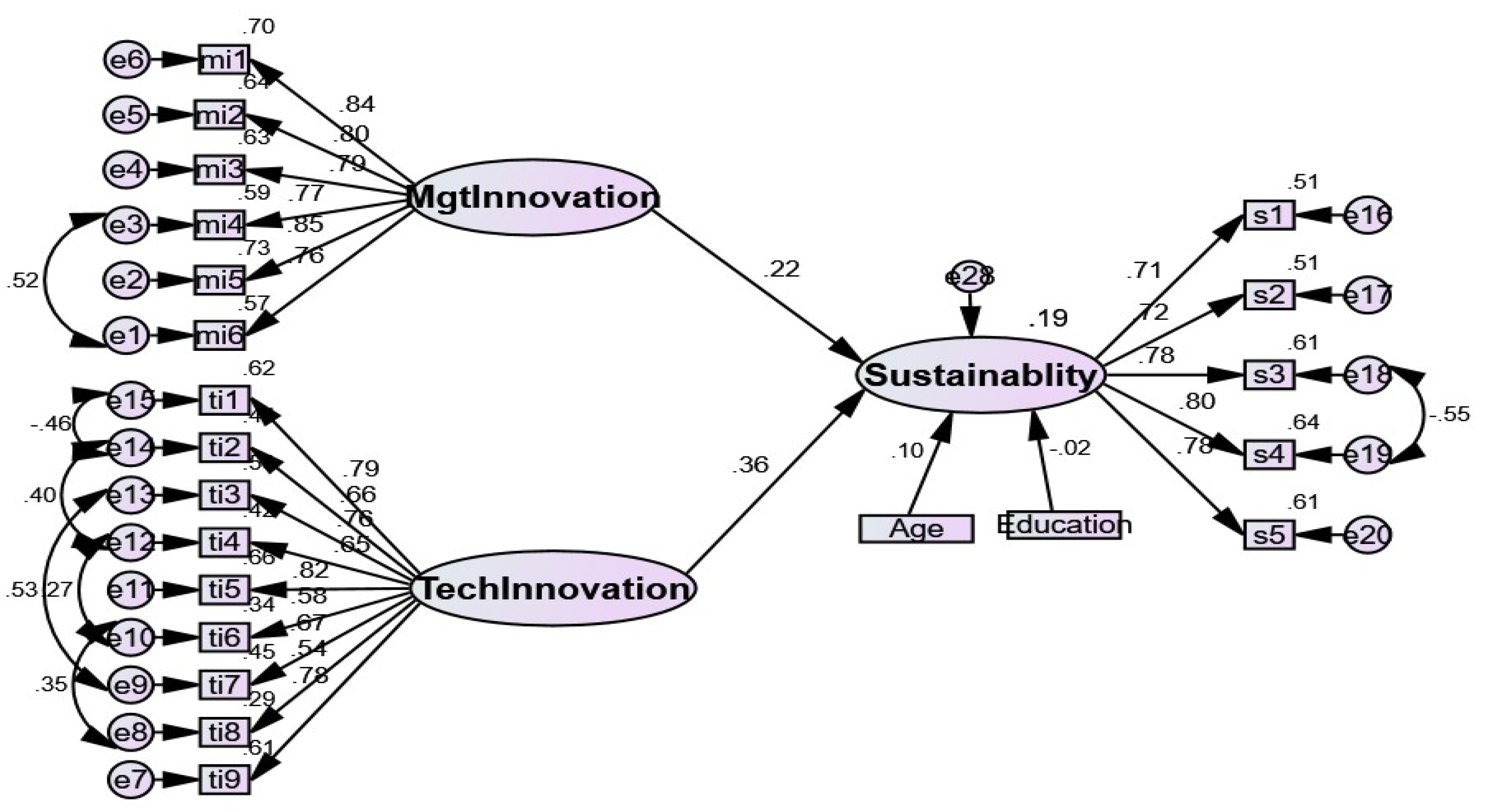

We found that MI and TI significantly positively contribute to organizational sustainability that supported H3 and H4 of our research. In line with Vaccaro et al. [

25], who claimed that MI is slightly tricky to adapt, but in fact it can significantly improve the sustainable competitive advantage. Moreover, to achieve sustainability in the current era of globalization, firms use different approaches. However, out of many paths, MI has been deemed a significant factor especially in emerging markets [

64]. Referring to the role of TI, our results are closed to Yang et al. (2018) who described that TI is a vital factor that enhances enterprises sustainability and competitive advantage. Moreover, Son et al. [

23] said that TI improves different internal and external processes of an organization and systematically significantly improves firm value sustainability.

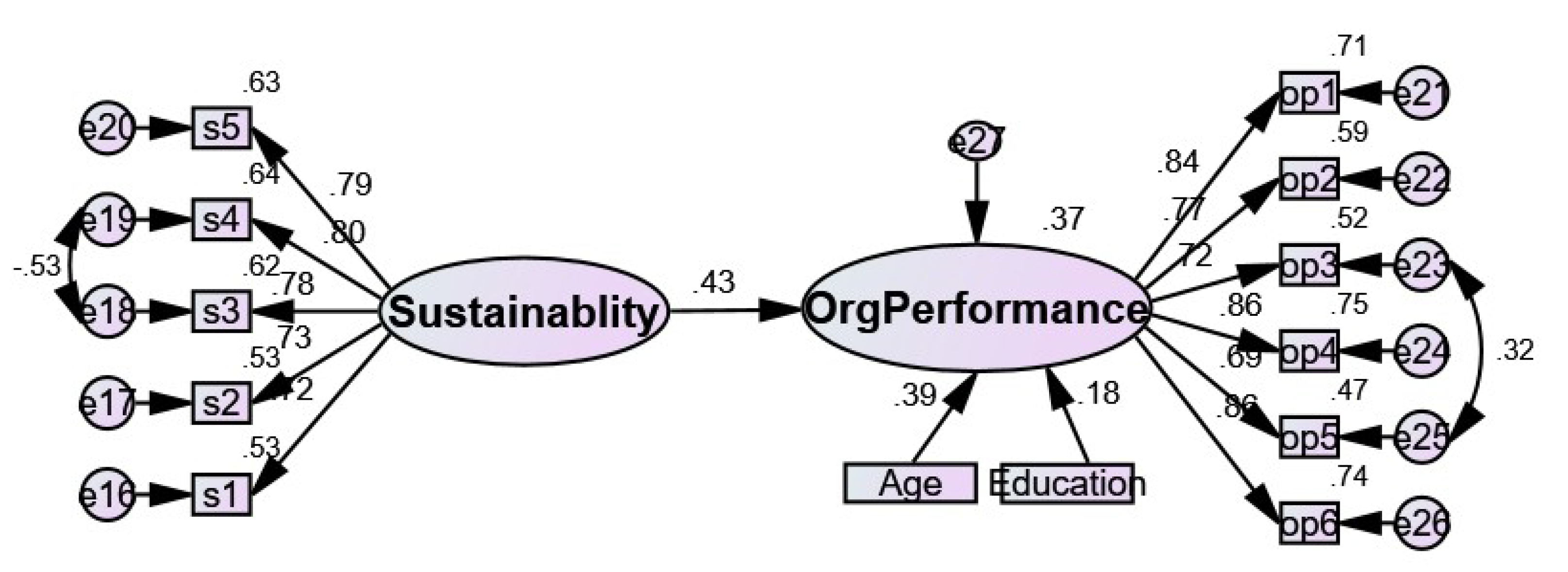

We concluded that sustainability significantly enhances organization performance that supports H5 of our research. In line with Eccles, Ioannou and Serafeim [

4] who found that sustainability facilitates firms to gain high performance in the long run. Moreover, Alonso-Almeida et al. [

75] suggested that sustainability practices spur firms’ performance in a difficult time. Hence, managers are strongly recommended to enhance sustainability as it can significantly contribute to firm competitive performance [

76]. Moreover, sustainability practices lead to high performance in organizations [

8].

We resulted that sustainability partially mediates the relationship MI and organization performance as well as between TI and organization performance that partially supported H6 and H7 of the study. Unlike Smith and Tushman [

79] who claimed that top managers with innovative skills and capabilities first acquire valuable resources that configure sustainability and then lead to high performance. Our findings may endorse the findings of Maletič et al. [

95] who found that innovation performance fully mediates the relationship between sustainability practices and economic performance. To summarize our results confirmed that sustainability is a partial mediator between MI and organization performance as well between TI and organization performance in emerging economies.

4.1. Implications for Practices

To examine the influence of MI and TI on organization performance and the mediating role of sustainability remains the aim of this research. Based on empirical evidence, our model offers several guidelines for top managers, CEOs and practitioners for shaping their policies and strategies for sustainability and superior performance. Sustainability practices boost and the path to high financial performance in emerging economies. We recommend business organizations to emphasize TI and MI to enhance sustainability and performance rather engaged in traditional practices and mass production. Specifically, firms operating in emerging markets such as Pakistan, are advised to focus TI and MI. Organizations that are more likely to acquire a sustainable competitive position and superior performance can promote MI and can adopt TI. Our findings provide valuable insights into the decision-making process and inform managers to make proper decisions e.g., invest in MI and TI, instead of spending lots of resources in risky options for sustainability and high performance. Promotion of TI and MI is vital because of the recent trend of globalization. The traditional approaches may not provide adequate results in the current era. Hence, business organizations, especially in turbulent markets, need innovative practices (technological and non-technological) to survive in the long run. The implications can be equally applied in other emerging and developed economies as Pakistan has many features in common with other countries [

96].

4.2. Limitations and Future Research

Despite having several implications, this research is not free of constraints that should be considered in future studies. In particular, our review is limited to the significant types of innovation (e.g., MI and TI) only. Though, there are several innovations; process innovation, product innovation, organization innovation, and marketing innovation etc. that may influence organizations sustainability and performance. To explore the unique influence of each innovation, there is much to be done to more fully conceptualize, and subsequently empirically examine this area. Similarly, we used only six dimensions to measure organization performance. Other dimensions (non-financial performance, economic performance, customer performance etc.) should be considered in future studies to articulate the results in a better way. Alternatively, Anwar [

57] claimed that business model innovation significantly influences competitive advantage and performance. The question "does sustainability mediate the relationship between business model innovation and performance?" can be answered in future studies. MI and TI may need enough financial capital; we recommend this zone (e.g., financial capital) for future researchers to study in order to acquire better outputs. Moreover, this model can be tested on several data sets; manufacturing, trading, and services separately to explore what type of innovation can significantly enhance sustainability and performance in a particular industry.