Exploring Foreign Direct Investment–Economic Growth Nexus—Empirical Evidence from Central and Eastern European Countries

Abstract

1. Introduction

2. Literature Survey

2.1. Earlier Papers Worldwide on FDI–Economic Growth Connection

2.2. Previous Studies in CEECS on FDI–Economic Growth Link

2.3. Preceding Examinations on FDI–Institutional Quality Association

3. Data and Methodology

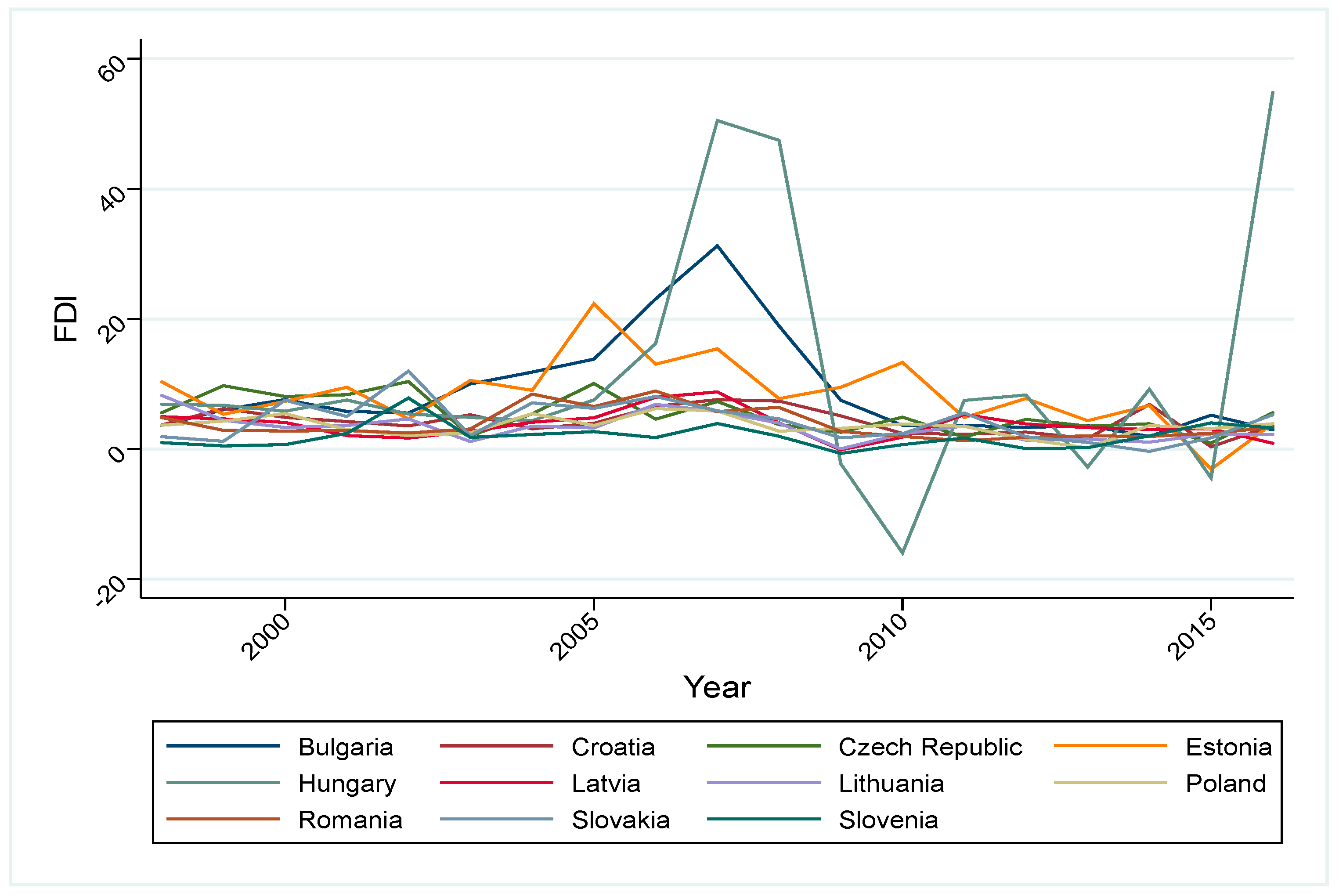

3.1. Sample Selection and Variables

3.2. Quantitative Techniques

4. Empirical Results and Discussion

4.1. Descriptive Statistics and Correlations

4.2. Multivariate Analysis Outcomes

4.3. Causality Analysis

- Model (1): Short-run one-way causal link running from FDI to growth;

- Model (2): One-way causal link running from FDI to growth, along with short-run unidirectional causal link running from government effectiveness to growth;

- Model (3): Short-run one-way causal link running from FDI to growth;

- Model (4): Short-run one-way causal link running from FDI to growth, alongside one-way unidirectional causal link running from growth to regulatory quality;

- Model (5): Short-run one-way causal link running from FDI to growth and one-way unidirectional causal link running from growth to rule of law;

- Model (6): One-way causal link running from FDI to growth, besides short-run unidirectional causal link running from voice and accountability to FDI.

5. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Pegkas, P. The impact of FDI on economic growth in Eurozone countries. J. Econ. Asymmetries 2015, 12, 124–132. [Google Scholar] [CrossRef]

- Buchanan, B.G.; Le, Q.V.; Rishi, M. Foreign direct investment and institutional quality: Some empirical evidence. Int. Rev. Financ. Anal. 2012, 21, 81–89. [Google Scholar] [CrossRef]

- Chan, M.W.L.; Hou, K.; Li, X.; Mountain, D.C. Foreign direct investment and its determinants: A regional panel causality analysis. Q. Rev. Econ. Financ. 2014, 54, 579–589. [Google Scholar] [CrossRef]

- Economou, F. Economic freedom and asymmetric crisis effects on FDI inflows: The case of four South European economies. Res. Int. Bus. Financ. 2019, 49, 114–126. [Google Scholar] [CrossRef]

- Tintin, C. The determinants of foreign direct investment inflows in the Central and Eastern European Countries: The importance of institutions. Communis Post-Commun. Stud. 2013, 46, 287–298. [Google Scholar] [CrossRef]

- Iamsiraroj, S.; Ulubasoglu, M.A. Foreign direct investment and economic growth: A real relationship or wishful thinking? Econ. Model. 2015, 51, 200–213. [Google Scholar] [CrossRef]

- Mahembe, E.E.; Odhiambo, N.M. Does foreign direct investment cause economic growth? A dynamic panel data analysis for SADC countries. Int. J. Emerg. Mark. 2016, 11, 316–332. [Google Scholar] [CrossRef]

- Temiz, D.; Gokmen, A. FDI inflow as an international business operation by MNCs and economic growth: An empirical study on Turkey. Int. Bus. Rev. 2014, 23, 145–154. [Google Scholar] [CrossRef]

- Ketteni, E.; Kottaridi, C. The impact of regulations on the FDI-growth nexus within the institution-based view: A nonlinear specification with varying coefficients. Int. Bus. Rev. 2019, 28, 415–427. [Google Scholar] [CrossRef]

- Giammanco, M.D.; Gitto, L. Health expenditure and FDI in Europe. Econ. Anal. Policy 2019, 62, 255–267. [Google Scholar] [CrossRef]

- Farla, K.; Crombrugghe, D.; Verspagen, B. Institutions, Foreign Direct Investment, and Domestic Investment: Crowding Out or Crowding In? World Dev. 2016, 88, 1–9. [Google Scholar] [CrossRef]

- Vojtovic, S.; Klimaviciene, A.; Pilinkiene, V. The Linkages between Economic Growth and FDI in CEE Countries. Ekon. Cas. 2019, 67, 264–279. [Google Scholar]

- Gohou, G.; Soumare, I. Does Foreign Direct Investment Reduce Poverty in Africa and are There Regional Differences? World Dev. 2012, 40, 75–95. [Google Scholar] [CrossRef]

- Dincer, O. Does corruption slow down innovation? Evidence from a cointegrated panel of US states. Eur. J. Political Econ. 2019, 56, 1–10. [Google Scholar] [CrossRef]

- Brada, J.C.; Drabek, Z.; Mendez, J.A.; Perez, M.F. National levels of corruption and foreign direct investment. J. Comp. Econ. 2019, 47, 31–49. [Google Scholar] [CrossRef]

- Reiter, S.L.; Steensma, H.K. Human Development and Foreign Direct Investment in Developing Countries The Influence of FDI Policy and Corruption. World Dev. 2010, 38, 1678–1691. [Google Scholar] [CrossRef]

- Chen, D.H.; Yu, X.; Zhang, Z. Foreign direct investment comovement and home country institutions. J. Bus. Res. 2019, 95, 220–231. [Google Scholar] [CrossRef]

- Gossel, S.J. FDI, democracy and corruption in Sub-Saharan Africa. J. Policy Model. 2018, 40, 647–662. [Google Scholar] [CrossRef]

- Barassi, M.R.; Zhou, Y. The effect of corruption on FDI: A parametric and non-parametric analysis. Eur. J. Political Econ. 2012, 28, 302–312. [Google Scholar] [CrossRef]

- Egger, P.; Winner, H. Evidence on corruption as an incentive for foreign direct investment. Eur. J. Political Econ. 2005, 21, 932–952. [Google Scholar] [CrossRef]

- Khamfula, Y. Foreign direct investment and economic growth in EP and IS countries: The role of corruption. World Econ. 2007, 30, 1843–1854. [Google Scholar] [CrossRef]

- Gilmore, A.; O’Donnell, A.; Carson, D.; Cummins, D. Factors influencing foreign direct investment and international joint ventures—A comparative study of Northern Ireland and Bahrain. Int. Mark. Rev. 2003, 20, 195–215. [Google Scholar] [CrossRef]

- Kurul, Z. Nonlinear relationship between institutional factors and FDI flows: Dynamic panel threshold analysis. Int. Rev. Econ. Financ. 2017, 48, 148–160. [Google Scholar] [CrossRef]

- Hunya, G. Recent FDI trends, policies and challenges in SEE countriesin comparison with other regions in transition. In Proceedings of the Foreign Direct Investment in South East Europe: Implementing Best Policy Practices Parkhotel Schönbrunn, Vienna, Austria, 8–9 November 2000. [Google Scholar]

- Damijan, J.P.; Rojec, M. Foreign Direct Investment and Catching Up of New EU Member States: Is There a Flying Geese Pattern? Appl. Econ. Q. 2007, 53, 91–118. [Google Scholar]

- Acaravci, A.; Ozturk, I. Foreign Direct Investment, Export and Economic Growth: Empirical Evidence from New Eu Countries. Rom. J. Econ. Forecast. 2012, 15, 52–67. [Google Scholar]

- Popescu, G.H. FDI and Economic Growth in Central and Eastern Europe. Sustainability (Basel) 2014, 6, 8149–8163. [Google Scholar] [CrossRef]

- Kayalvizhi, P.N.; Thenmozhi, M. Does quality of innovation, culture and governance drive FDI?: Evidence from emerging markets. Emerg. Mark. Rev. 2018, 34, 175–191. [Google Scholar] [CrossRef]

- Asiedu, E.; Lien, D. Capital controls and foreign direct investment. World Dev. 2004, 32, 479–490. [Google Scholar] [CrossRef]

- Fawaz, F.; Rahnama, M.; Valcarcel, V.J. A refinement of the relationship between economic growth and income inequality. Appl. Econ. 2014, 46, 3351–3361. [Google Scholar] [CrossRef]

- Lipsey, R.E. Measuring the Impacts of FDI in Central and Eastern Europe; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2006. [Google Scholar]

- Tun, Y.L.; Azman-Saini, W.N.W.; Law, S.H. International Evidence on the link between Foreign Direct Investment and Institutional Quality. Eng. Econ. 2012, 23, 379–386. [Google Scholar] [CrossRef]

- Henderson, V. The urbanization process and economic growth: The so-what question. J. Econ. Growth 2003, 8, 47–71. [Google Scholar] [CrossRef]

- Kottaridi, C.; Louloudi, K.; Karkalakos, S. Human capital, skills and competencies: Varying effects on inward FDI in the EU context. Int. Bus. Rev. 2019, 28, 375–390. [Google Scholar] [CrossRef]

- Krkoska, L. Foreign Direct Investment Financing of Capitalformation in Central and Eastern Europe; European Bank for Reconstruction and Development, Ed.; One Exchange Square: London, UK, 2001. [Google Scholar]

- Paul, A.; Popovici, O.C.; Calin, C.A. The Attractiveness of Cee Countries for Fdi. A Public Policy Approach Using the Topsis Method. Transylv. Rev. Adm. Sci. 2014, 42/E, 156–180. [Google Scholar]

- Nguyen, T.Q.; To, N.K. Threshold Effect in The Relationship Between Foreign Direct Investment and Economic Growth: Evidence from ASEAN Countries. Asia Pac. J. Adv. Bus. Soc. Stud. 2017, 3, 32–45. [Google Scholar]

- Jude, C.; Levieuge, G. Growth Effect of Foreign Direct Investment in Developing Economies: The Role of Institutional Quality. World Econ. 2017, 40, 715–742. [Google Scholar] [CrossRef]

- Freckleton, M.; Wright, A.; Craigwell, R. Economic growth, foreign direct investment and corruption in developed and developing countries. J. Econ. Stud. 2012, 39, 639–652. [Google Scholar] [CrossRef]

- Delgado, M.S.; McCloud, N.; Kumbhakar, S.C. A generalized empirical model of corruption, foreign direct investment, and growth. J. Macroecon. 2014, 42, 298–316. [Google Scholar] [CrossRef]

- Feeny, S.; Iamsiraroj, S.; McGillivray, M. Growth and Foreign Direct Investment in the Pacific Island countries. Econ. Model. 2014, 37, 332–339. [Google Scholar] [CrossRef]

- Awad, A.; Ragab, H. The economic growth and foreign direct investment nexus: Does democracy matter? Evidence from African countries. Thunderbird Int. Bus. Rev. 2018, 60, 565–575. [Google Scholar] [CrossRef]

- Zghidi, N.; Mohamed Sghaier, I.; Abida, Z. Does Economic Freedom Enhance the Impact of Foreign Direct Investment on Economic Growth in North African Countries? A Panel Data Analysis. Afr. Dev. Rev. 2016, 28, 64–74. [Google Scholar] [CrossRef]

- Malikane, C.; Chitambara, P. Foreign Direct Investment, Democracy and Economic Growth in Southern Africa. Afr. Dev. Rev. 2017, 29, 92–102. [Google Scholar] [CrossRef]

- Adams, S.; Opoku, E.E.O. Foreign direct investment, regulations and growth in sub-Saharan Africa. Econ. Anal. Policy 2015, 47, 48–56. [Google Scholar] [CrossRef]

- Iamsiraroj, S. The foreign direct investment–economic growth nexus. Int. Rev. Econ. Financ. 2016, 42, 116–133. [Google Scholar] [CrossRef]

- Estrin, S. Foreign direct investment and employment in transition economies. IZA World Labor 2017. [Google Scholar] [CrossRef]

- Stuart, L. Transforming our World: The 2030 Agenda for Sustainable Development; A/RES/70/1; United Nations Division for Social Policy and Development, Indigenous Peoples: New York, NY, USA, 2017. [Google Scholar]

- Hlavacek, P.; Bal-Domanska, B. Impact of Foreign Direct Investment on Economic Growth in Central and Eastern European Countries. Eng. Econ. 2016, 27, 294–303. [Google Scholar] [CrossRef]

- Yalta, A.Y. Revisiting the FDI-led growth Hypothesis: The case of China. Econ. Model. 2013, 31, 335–343. [Google Scholar] [CrossRef]

- Zhang, K.H. Does foreign direct investment promote economic growth? Evidence from East Asia and Latin America. Contemp. Econ. Policy 2001, 19, 175–185. [Google Scholar] [CrossRef]

- Iamsiraroj, S.; Doucouliagos, H. Does Growth Attract FDI? Economics 2015, 9, 1–35. [Google Scholar] [CrossRef]

- Leitão, N.C.; Rasekhi, S. The impact of foreign direct investment on economic growth: The Portuguese experience. Theor. Appl. Econ. 2013, 20, 51–62. [Google Scholar]

- Mahapatra, R.; Patra, S. Impact of Foreign Direct Investment (FDI) inflow on Gross Domestic Product (GDP) of India—An Empirical study. Int. J. Bus. Manag. Invent. 2014, 3, 12–20. [Google Scholar]

- Saini, A.; Madan, P.; Batra, S.K. Impact of FDI inflow on economic growth of SAARC economies. Int. J. Eng. Bus. Enterp. Appl. 2015, 12, 161–166. [Google Scholar]

- Mahadika, I.N.; Kalayci, S.; Altun, N. Relationship between GDP, Foreign Direct Investment and Export Volume: Evidence from Indonesia. Int. J. Trade Econ. Financ. 2017, 8, 51–54. [Google Scholar] [CrossRef]

- Alshamsi, K.H.; Rasid bin Hussin, M.; Azam, M. The impact of inflation and GDP per capita on foreign direct investment: The case of United Arab Emirates. Invest. Manag. Financ. Innov. 2015, 12, 132–141. [Google Scholar]

- Sunde, T. Foreign direct investment, exports and economic growth: ADRL and causality analysis for South Africa. Res. Int. Bus. Financ. 2017, 41, 434–444. [Google Scholar] [CrossRef]

- Kinuthia, B.K.; Murshed, S.M. FDI determinants: Kenya and Malaysia compared. J. Policy Model. 2015, 37, 388–400. [Google Scholar] [CrossRef]

- Akinlo, A.E. Foreign direct investment and growth in Nigeria—An empirical investigation. J. Policy Model. 2004, 26, 627–639. [Google Scholar] [CrossRef]

- Abdallah, Z.T.; Abdullahi, A. Relationship between Foreign Direct Investment and Per Capita GDPin Nigeria-An Empirical Analysis (1980–2009). Int. J. Bus. Humanit. Technol. 2013, 3, 152–158. [Google Scholar]

- Carbonell, J.B.; Werner, R.A. Does Foreign Direct Investment Generate Economic Growth? A New Empirical Approach Applied to Spain. Econ. Geogr. 2018, 94, 425–456. [Google Scholar] [CrossRef]

- Herzer, D.; Klasen, S.; Nowak-Lehmann, F. In search of FDI-led growth in developing countries: The way forward. Econ. Model. 2008, 25, 793–810. [Google Scholar] [CrossRef]

- Ndiaye, G.; Xu, H. Impact of Foreign Direct Investment (FDI) on Economic Growth in WAEMU from 1990 to 2012. Int. J. Financ. Res. 2016, 7, 33–43. [Google Scholar] [CrossRef]

- Schneider, P.H. International trade, economic growth and intellectual property rights: A panel data study of developed and developing countries. J. Dev. Econ. 2005, 78, 529–547. [Google Scholar] [CrossRef]

- Dutta, N.; Roy, S. Foreign Direct Investment, Financial Development and Political Risks. J. Dev. Areas 2011, 44, 303–327. [Google Scholar] [CrossRef]

- Kottaridi, C.; Stengos, T. Foreign direct investment, human capital and non-linearities in economic growth. J. Macroecon. 2010, 32, 858–871. [Google Scholar] [CrossRef]

- Jyun-Yi, W.; Chih-Chiang, H. Does Foreign Direct Investment Promote Economic Growth?Evidence from a Threshold Regression Analysis. Econ. Bull. 2008, 15, 1–101. [Google Scholar]

- Alvarado, R.; Iñiguez, M.; Ponce, P. Foreign direct investment and economic growth in Latin America. Econ. Anal. Policy 2017, 56, 176–187. [Google Scholar] [CrossRef]

- Mahmoodi, M.; Mahmoodi, E. Foreign direct investment, exports and economic growth: Evidence from two panels of developing countries. Econ. Res. Ekon. Istraz. 2016, 29, 938–949. [Google Scholar] [CrossRef]

- Gui-Diby, S.L. Impact of foreign direct investments on economic growth in Africa: Evidence from three decades of panel data analyses. Res. Econ. 2014, 68, 248–256. [Google Scholar] [CrossRef]

- Omri, A.; kahouli, B. The nexus among foreign investment, domestic capital and economic growth: Empirical evidence from the MENA region. Res. Econ. 2014, 68, 257–263. [Google Scholar] [CrossRef]

- Lee, J.W. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energ. Policy 2013, 55, 483–489. [Google Scholar] [CrossRef]

- Tekin, R.B. Economic growth, exports and foreign direct investment in Least Developed Countries: A panel Granger causality analysis. Econ. Model. 2012, 29, 868–878. [Google Scholar] [CrossRef]

- Belaşcu, L.; Popovici, O.; Horobeţ, A. Foreign Direct Investments and Economic Growth in Central and Eastern Europe: A Panel-Based Analysis. In Emerging Issues in the Global Economy; Mărginean, S.C., Ogrean, C., Orăștean, R., Eds.; Springer: Berlin, Germany, 2018. [Google Scholar]

- Jones, J.; Serwicka, I.; Wren, C. Economic integration, border costs and FDI location: Evidence from the fifth European Union enlargement. Int. Rev. Econ. Financ. 2018, 54, 193–205. [Google Scholar] [CrossRef]

- Campos, N.F.; Kinoshita, Y. Foreign direct investment as technology transferred: Some panel evidence from the transition economies. Manch. Sch. 2002, 70, 398–419. [Google Scholar] [CrossRef]

- Apergis, N.; Lyroudi, K.; Vamvakidis, A. The relationship between foreign direct investment and economic growth: Evidence from transition countries. Transit. Stud. Rev. 2008, 15, 37–51. [Google Scholar] [CrossRef]

- Yormirzoev, M. Influence of foreign Direct Investment on the Economic growth: The case of transitional economies in Central and Eastern Europe and the Commonwealth of Independent States. Bull. Udmurt Univ. Series Econ. Law 2015, 25, 44–52. [Google Scholar]

- Miteski, M.; Stefanova, D.J. The Impact of Sectorial FDI on Economic Growth in Central, Eastern and Southeastern Europe; National Bank of the Republic of Macedonia: Skopje, Macedonia, 2017. [Google Scholar]

- Mencinger, J. Does foreign direct investment always enhance economic growth? Kyklos 2003, 56, 491–508. [Google Scholar] [CrossRef]

- Bačić, K.; Račić, D.; Ahec-Šonje, A. FDI and Economic Growth in Central and Eastern Europe: Is There a Link? Zagreb School of Economics and Management, Institute of Economics Zagreb: Zagreb, 2004. [Google Scholar]

- Kherfi, S.; Soliman, M. FDI And Economic Growth in CEE And MENA Countries: A Tale of Two Regions. Int. Bus. Econ. Res. J. 2005, 4, 113–120. [Google Scholar] [CrossRef]

- Ferencikova, S.; Dudas, T. The impact of foreign direct investment inflows on the economic growth in the new EU member states from central and eastern Europe. Ekon. Cas. 2005, 53, 261–272. [Google Scholar]

- Curwin, K.D.; Mahutga, M.C. Foreign Direct Investment and Economic Growth: New Evidence from Post-Socialist Transition Countries. Soc. Forces 2014, 92, 1159–1187. [Google Scholar] [CrossRef]

- Saglam, Y. FDI and Economic Growth in European Transition Economies: Panel Data Analysis. J. Yaşar Univ. 2017, 12, 123–135. [Google Scholar]

- Comes, C.A.; Bunduchi, E.; Vasile, V.; Stefan, D. The Impact of Foreign Direct Investments and Remittances on Economic Growth: A Case Study in Central and Eastern Europe. Sustainability (Basel) 2018, 10, 238. [Google Scholar] [CrossRef]

- Simionescu, M. What Drives Economic Growth in Some CEE Countries? Studia Univ. “Vasile Goldis” Arad. Econ. Ser. 2018, 28, 46–56. [Google Scholar] [CrossRef]

- Bayar, Y. Greenfield and Brownfield Investments and Economic Growth: Evidence from Central and Eastern European Union Countries. Naše Gospod. Our Econ. 2017, 63, 19–26. [Google Scholar] [CrossRef]

- Silajdzic, S.; Mehic, E. Absorptive Capabilities, FDI, and Economic Growth in Transition Economies. Emerg. Mark. Financ. Trade 2016, 52, 904–922. [Google Scholar] [CrossRef]

- Silajdzic, S.; Mehic, E. Knowledge spillovers, absorptive capacities and the impact of FDI on economic growth: Empirical evidence from transition economies. Procedia Soc. Behav. Sci. 2015, 195, 614–623. [Google Scholar] [CrossRef]

- Albulescu, C.T. Do Foreign Direct and Portfolio Investments Affect Long-Term Economic Growth in Central and Eastern Europe? Procedia Econ. Financ. 2015, 23, 507–512. [Google Scholar] [CrossRef]

- Pharjiani, S. Foreign Direct Investment on Economic Growth by Industries in Central and Eastern European Countries. Int. J. Econ. Manag. Eng. 2015, 9, 3988–3996. [Google Scholar]

- Sârbu, M.-R.; Carp, L. The Impact of Foreign Direct Investment on Economic Growth: The Case of Romania. Acta Univ. Danub. Œcon. 2015, 11, 127–137. [Google Scholar]

- Nistor, P. FDI and economic growth, the case of Romania. Procedia Econ. Financ. 2014, 15, 577–582. [Google Scholar] [CrossRef]

- Mehic, E.; Silajdzic, S.; Babic-Hodovic, V. The Impact of FDI on Economic Growth: Some Evidence from Southeast Europe. Emerg. Mark. Financ. Trade 2013, 49, 5–20. [Google Scholar] [CrossRef]

- Bailey, N. Exploring the relationship between institutional factors and FDI attractiveness: A meta-analytic review. Int. Bus. Rev. 2018, 27, 139–148. [Google Scholar] [CrossRef]

- Dunning, J.H. The Eclectic Paradigm of International Production—A Restatement and Some Possible Extensions. J. Int. Bus. Stud. 1988, 19, 1–31. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Mengistu, A.A.; Adhikary, B.K. Does good governance matter for FDI inflows? Evidence from Asian economies. Asia Pac. Bus. Rev. 2011, 17, 281–299. [Google Scholar] [CrossRef]

- Harms, P.; Ursprung, H.W. Do civil and political repression really boost foreign direct investments? Econ. Inq. 2002, 40, 651–663. [Google Scholar] [CrossRef]

- Sabir, S.; Rafique, A.; Abbas, K. Institutions and FDI: Evidence from developed and developing countries. Financ. Innov. 2019, 5, 1–20. [Google Scholar] [CrossRef]

- Xu, T. Economic freedom and bilateral direct investment. Econ. Model. 2019, 78, 172–179. [Google Scholar] [CrossRef]

- Daniele, V.; Marani, U. Organized crime, the quality of local institutions and FDI in Italy: A panel data analysis. Eur. J. Political Econ. 2011, 27, 132–142. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M.; Berg, N.; Hajzler, C. Expropriation risk and FDI in developing countries: Does return of capital dominate return on capital? Eur. J. Political Econ. 2017, 49, 84–107. [Google Scholar] [CrossRef]

- Peres, M.; Ameer, W.; Xu, H.L. The impact of institutional quality on foreign direct investment inflows: Evidence for developed and developing countries. Econ. Res. Ekon. Istraz. 2018, 31, 626–644. [Google Scholar] [CrossRef]

- Zakharov, N. Does corruption hinder investment? Evidence from Russian regions. Eur. J. Political Econ. 2019, 56, 39–61. [Google Scholar] [CrossRef]

- Kato, A.; Sato, T. Greasing the wheels? The effect of corruption in regulated manufacturing sectors of India. Can. J. Dev. Stud. 2015, 36, 459–483. [Google Scholar] [CrossRef]

- Elheddad, M.M. What determines FDI inflow to MENA countries? Empirical study on Gulf countries: Sectoral level analysis. Res. Int. Bus. Financ. 2018, 44, 332–339. [Google Scholar] [CrossRef]

- Meon, P.G.; Sekkat, K. Does corruption grease or sand the wheels of growth? Public Choice 2005, 122, 69–97. [Google Scholar] [CrossRef]

- Cooray, A.; Schneider, F. Does corruption throw sand into or grease the wheels of financial sector development? Public Choice 2018, 177, 111–133. [Google Scholar] [CrossRef]

- Dang, D.A. How foreign direct investment promote institutional quality: Evidence from Vietnam. J. Comp. Econ. 2013, 41, 1054–1072. [Google Scholar] [CrossRef]

- Asamoah, M.E.; Adjasi, C.K.D.; Alhassan, A.L. Macroeconomic uncertainty, foreign direct investment and institutional quality: Evidence from Sub-Saharan Africa. Econ. Syst. 2016, 40, 612–621. [Google Scholar] [CrossRef]

- Kuzmina, O.; Volchkova, N.; Zueva, T. Foreign direct investment and governance quality in Russia. J. Comp. Econ. 2014, 42, 874–891. [Google Scholar] [CrossRef]

- Busse, M.; Hefeker, C. Political risk, institutions and foreign direct investment. Eur. J. Political Econ. 2007, 23, 397–415. [Google Scholar] [CrossRef]

- Wisniewski, T.P.; Pathan, S.K. Political environment and foreign direct investment: Evidence from OECD countries. Eur. J. Political Econ. 2014, 36, 13–23. [Google Scholar] [CrossRef]

- Asiedu, E.; Lien, D. Democracy, foreign direct investment and natural resources. J. Int. Econ. 2011, 84, 99–111. [Google Scholar] [CrossRef]

- Aziz, O.G. Institutional quality and FDI inflows in Arab economies. Financ. Res. Lett. 2018, 25, 111–123. [Google Scholar] [CrossRef]

- Uddin, M.; Chowdhury, A.; Zafar, S.; Shafique, S.; Liu, J. Institutional determinants of inward FDI: Evidence from Pakistan. Int. Bus. Rev. 2019, 28, 344–358. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. B Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S.W. A comparative study of unit root tests with panel data and a new simple test. Oxf. B Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and Hypothesis-Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

| Author(s) | Time Span | Database | Empirical Methods | Outcomes |

|---|---|---|---|---|

| Awad and Ragab [42] | 1989–2014 | 53 African nations | Linear dynamic panel data model | Positive effect of FDI on growth |

| Alvarado, et al. [69] | 1980–2014 | 19 Latin American states | Panel data fixed-effects models | FDI does not have a positive influence on growth except high-income countries (Chile and Uruguay) |

| Malikane and Chitambara [44] | 1980–2014 | 8 Southern African states | General Methods of Moments (GMM) | FDI has a direct positive influence on economic growth |

| Iamsiraroj [46] | 1971–2010 | 124 cross-country data | Simultaneous system of equations | Bidirectional relationship between FDI and economic growth |

| Mahmoodi and Mahmoodi [70] | 1986–2013 | 8 European developing nations and 8 Asian developing states | Panel-VECM | Two-way causality between GDP and FDI for the European developing panel |

| Gui-Diby [71] | 1980–2009 | 50 African nations | SYS-GMM | Negative link among FDI inflows and economic growth from 1980–1994 Positive link between FDI influxes and economic growth from 1995–2009 |

| Omri and kahouli [72] | 1990–2010 | 13 Middle East and North Africa states | GMM | Two-way causal relationship between foreign investment and economic growth |

| Feeny, Iamsiraroj and McGillivray [41] | 1971–2010 | 209 states | Ordinary Least Squares and GMM | FDI is related with higher rates of economic growth in the Pacific |

| Lee [73] | 1971–2009 | 19 nations of the G20 | Co-integration tests and fixed-effects models | FDI influxes drive economic growth |

| Freckleton, Wright and Craigwell [39] | 1998–2008 | 42 developing nations and 28 developed states | Panel dynamic ordinary least squares | In both the short-run and the long-run, FDI has a significant impact on economic growth |

| Tekin [74] | 1970–2009 | 18 least developed countries | Panel Granger-causality | FDI Granger-cause GDP in Benin and Togo GDP Granger-cause FDI in Burkina Faso, Gambia, Madagascar, and Malawi |

| Pegkas [1] | 2002–2012 | 18 Eurozone nations | Fully Modified OLS (FMOLS) and Dynamic OLS (DOLS) methods | FDI positively influence economic growth |

| Mahembe and Odhiambo [7] | 1980–2012 | Southern African Development Community (SADC) nations | Granger-causality | One-way causal flow from GDP to FDI in the middle-income states Lack of causality in low-income nations |

| Vojtovic, Klimaviciene and Pilinkiene [12] | 1997–2014 | 11 Central and Eastern Europe (CEE) countries | Granger-causality and Vector autoregression (VAR) | FDI Granger-causes GDP |

| Author(s) | Time Span | Database | Empirical Methods | Outcomes |

|---|---|---|---|---|

| Vojtovic, Klimaviciene and Pilinkiene [12] | 1997–2014 | 11 CEECs | Granger-causality and VAR | FDI Granger-causes GDP |

| Comes, et al. [87] | 2010–2016 | 7 CEECs | The method of least squares and the method of least squares with dummy variables | Positive influence of FDI on economic growth |

| Simionescu [88] | 2003–2016 | 8 CEECs | Bayesian bridge regressions | FDI was the most significant driver of economic growth |

| Belaşcu, Popovici and Horobeţ [75] | 1999–2013 | 5 CEE countries | Panel least squares regression | FDI have a positive influence on economic growth |

| Bayar [89] | 2003–2015 | 11 CEECs | Panel causality test | Greenfield and brownfield investments positively impact economic growth, but the effect of greenfield investments was higher |

| Silajdzic and Mehic [90] | 2000–2011 | 10 Central and East European countries | OLS and Granger-causality test | FDI positively influence economic growth |

| Silajdzic and Mehic [91] | 2000–2013 | 10 Central and East European countries | OLS with panel-corrected standard errors - PCSE (fixed-effect) | FDI contribute to economic growth |

| Albulescu [92] | 2005–2012 | 13 CEECs | System-GMM | Direct and portfolio investments impact long-term economic growth |

| Pharjiani [93] | 1995–2012 | 10 CEECs | Ordinary least squares, random effects, fixed effects, first differences estimation | Positive link between FDI and economic growth |

| Sârbu and Carp [94] | 2000–2013 | Romania | OLS and Johansen co-integration | FDI positively influence economic growth |

| Nistor [95] | 1990–2012 | Romania | OLS | FDI inflows positively influence GDP |

| Mehic, et al. [96] | 1998–2007 | Seven southeast European nations | Prais–Winsten regression with panel-corrected standard errors | Positive and statistically significant impact of FDI on economic growth |

| Acaravci and Ozturk [26] | 1994–2008 | 10 transition European countries | ARDL bounds testing approach and the error-correction-based Granger-causality | Causal association amid FDI, export, and economic growth in four states |

| Author(s) | Time Span | Database | Empirical Methods | Outcomes |

|---|---|---|---|---|

| Brada, Drabek, Mendez and Perez [15] | 2005–2009 | 43 home countries and 151 host countries | Poisson pseudo maximum-likelihood (PPML) estimation | Fewer FDI in corrupt nations |

| Dang [112] | 2006–2007 | 60 provinces in Vietnam | Instrumental variable (IV) approach | FDI supports the enhancement of institutions |

| Asamoah, et al. [113] | 1996–2011 | 40 Sub-Saharan African states | GARCH models | Institutional quality rises the stream of FDI |

| Buchanan, Le and Rishi [2] | 1996–2006 | 164 nations | OLS regressions | Positive influence of institutional quality on FDI Institutional quality negatively influences the volatility of FDI |

| Kuzmina, et al. [114] | 1895–1914 | Russia | OLS and IV-2SLS regressions | Greater incidence of illicit payments, alongside burden from governing organizations, enforcement authorities, and criminals diminish FDI |

| Busse and Hefeker [115] | 1984–2003 | 83 developing countries | Panel data fixed-effects and GMM regressions | Government stability, internal and external conflict, corruption and ethnic strains, regulation and order, democratic accountability of government, and quality of bureaucracy are drivers of foreign investment inflows |

| Zakharov [107] | 2004–2013 | 79 Russian regions | Panel data fixed-effects and IV estimation with fixed-effects | Negative association between corruption and the influx of FDI |

| Adams and Opoku [45] | 1980–2011 | 22 sub-Saharan African states | GMM | Regulation–FDI connections positively influence economic growth |

| Wisniewski and Pathan [116] | 1975–2009 | 33 OECD members | Pooled OLS, Fixed-effect panel, Two-way fixed-effect panel | Higher FDI are held by states with presidential systems and long democratic tradition |

| Asiedu and Lien [117] | 1982–2007 | 112 developing countries | GMM | Democracy supports FDI in nations where the portion of natural resources in total exports is reduced, but has a negative influence on FDI in nations where exports are dominated by natural resources |

| Aziz [118] | 1984–2012 | 16 Arab countries | GMM | Institutional quality measures of economic freedom, ease of doing business and international country risk positively influence FDI influxes |

| Egger and Winner [20] | 1995–1999 | 73 developed and less developed nations | Fixed effects, Hausman–Taylor, and between regressions | Corruption is an incentive for FDI |

| Delgado, McCloud and Kumbhakar [40] | 1985–2002 | 60 non-OECD countries | OLS, 2SLS, semiparametric smooth coefficient, nonparametric method of moments models | A 1-point rise in the level of corruption determines a decline of FDI returns between 0.07 and 5.91% |

| Jude and Levieuge [38] | 1984–2009 | 93 developing countries | Panel smooth regression model | FDI positively influence growth beyond a certain threshold of institutional quality |

| Zghidi, Mohamed Sghaier and Abida [43] | 1980–2013 | 4 North African countries | System GMM | The outcome of FDI is more prominent when the economic freedom measure occurs |

| Economou [4] | 1996–2017 | 4 South European states | Random-effects panel data estimations and generalized two-stage least squares (G2SLS) random-effects instrumental variable (IV) regression | Positive influence on FDI related to protection of property rights, government integrity, monetary freedom, and financial freedom |

| Tintin [5] | 1996–2009 | 6 Central and Eastern European nations | Panel data fixed-effects models | Better institutions entice more FDI influxes |

| Uddin, et al. [119] | 1972–2016 | Pakistan | Multivariate OLS regression and VAR system | Democracy rises the inward FDI in the short-run, while a military government has a stronger effect on FDI in the long run |

| Variables | Definitions | Source | Data Availability |

|---|---|---|---|

| Variables concerning sustainable economic growth | |||

| (1) GROWTH | Gross domestic product per capita (current prices, euro per capita) (log values) | Eurostat (nama_10_pc) | 1975–2016 |

| Variables concerning foreign direct investment | |||

| (2) FDI | Foreign direct investment, net inflows (% of GDP) | World Bank (BX.KLT.DINV.WD.GD.ZS) | 1970–2018 |

| Variables concerning poverty | |||

| (3) POV | Individuals at risk of poverty or social exclusion (percentage) | Eurostat (ilc_peps01) | 2003–2016 |

| Variables concerning the inequality of income distribution | |||

| (4) INEQ | Income quintile share ratio as the ratio of total income received by the 20% of the population with the highest income—top quintile) to that received by the 20% of the population with the lowest income—lowest quintile (percentage) | Eurostat (ilc_di11) | 1995–2016 |

| Variables concerning education | |||

| (5) EDU | Pupils and students as the total number of persons who are enrolled in the regular education system in each country. It covers all levels of education from primary education to postgraduate studies, excluding pre-primary education (log values) | Eurostat (educ_ilev) | 1998–2012 |

| Variables towards innovation | |||

| (6) INNOV | The number of patent applications to the European patent office (log values) | Eurostat (pat_ep_ntot) | 1978–2014 |

| Variables concerning transport infrastructure | |||

| (7) TRANSP | The length of motorways, on the territory of the reporting country (km) (logarithmic values) | Eurostat (ttr00002) | 1970–2015 |

| Variables concerning information technology | |||

| (8) IT | Individuals using the Internet (% of population) | World Bank (IT.NET.USER.ZS) | 1960–2017 |

| Variables concerning institutional quality | |||

| (9) CORR | Control of Corruption Estimate captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests (score) | World Bank (Worldwide Governance Indicators) | 1996–2016 |

| (10) GOV_EFF | Government Effectiveness Estimate captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies (score) | World Bank (Worldwide Governance Indicators) | 1996–2016 |

| (11) POL_STAB | Political Stability and Absence of Violence/Terrorism Estimate measures perceptions of the likelihood of political instability and/or politically motivated violence, including terrorism (score) | World Bank (Worldwide Governance Indicators) | 1996–2016 |

| (12) REG_Q | Regulatory Quality Estimate captures perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private-sector development (score) | World Bank (Worldwide Governance Indicators) | 1996–2016 |

| (13) RULE_LAW | Rule of Law Estimate captures perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence (score) | World Bank (Worldwide Governance Indicators) | 1996–2016 |

| (14) VOICE_ACC | Voice and Accountability Estimate captures perceptions of the extent to which a country’s citizens can participate in selecting their government, as well as freedom of expression, freedom of association, and a free media (score) | World Bank (Worldwide Governance Indicators) | 1996–2016 |

| Country-level control variables | |||

| (15) GOV_EXP | General government final consumption expenditure (% of GDP) | World Bank (NE.CON.GOVT.ZS) | 1960–2018 |

| (16) URB | Urban population (percentage of total) | World Bank (SP.URB.TOTL.IN.ZS) | 1960–2016 |

| (17) DCPS | Domestic credit to private sector (percentage of GDP) | World Bank (FS.AST.PRVT.GD.ZS) | 1960–2016 |

| (18) TRADE | Trade is the sum of exports and imports of goods and services measured as a share of gross domestic product (percentage of GDP) | World Bank (NE.TRD.GNFS.ZS) | 1960–2016 |

| Variables | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| (1) GROWTH | 230 | 8310.43 | 4407.87 | 1000.00 | 19600.00 |

| (2) FDI | 209 | 5.39 | 7.07 | −15.99 | 54.84 |

| (3) POV | 125 | 29.39 | 10.22 | 13.30 | 61.30 |

| (4) INEQ | 146 | 5.06 | 1.39 | 3.00 | 8.30 |

| (5) EDU | 160 | 1950.91 | 2353.90 | 237.60 | 9153.10 |

| (6) INNOV | 250 | 58.55 | 86.03 | 0.50 | 609.16 |

| (7) TRANSP | 280 | 422.50 | 364.20 | 0.00 | 1883.90 |

| (8) IT | 263 | 35.55 | 28.75 | 0.00 | 87.24 |

| (9) CORR | 165 | 0.36 | 0.39 | −0.44 | 1.30 |

| (10) GOV_EFF | 165 | 0.64 | 0.39 | −0.36 | 1.19 |

| (11) POL_STAB | 165 | 0.69 | 0.31 | 0.00 | 1.30 |

| (12) REG_Q | 165 | 0.90 | 0.31 | −0.04 | 1.70 |

| (13) RULE_LAW | 165 | 0.60 | 0.41 | −0.26 | 1.37 |

| (14) VOICE_ACC | 165 | 0.83 | 0.25 | 0.30 | 1.20 |

| (15) GOV_EXP | 209 | 18.92 | 1.95 | 12.37 | 25.88 |

| (16) URB | 297 | 62.93 | 7.59 | 49.63 | 75.22 |

| (17) DCPS | 256 | 42.77 | 20.57 | 0.19 | 101.29 |

| (18) TRADE | 271 | 105.27 | 34.63 | 39.14 | 184.55 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| (1) GROWTH | 1 | ||||||||

| (2) FDI | −0.11 | 1 | |||||||

| (3) POV | −0.89*** | 0.13 | 1 | ||||||

| (4) INEQ | −0.33*** | −0.02 | 0.74*** | 1 | |||||

| (5) EDU | −0.23** | −0.03 | 0.23* | −0.08 | 1 | ||||

| (6) INNOV | 0.64*** | −0.04 | −0.41*** | −0.50*** | 0.40*** | 1 | |||

| (7) TRANSP | 0.23*** | 0.01 | −0.23* | −0.46*** | 0.37*** | 0.46*** | 1 | ||

| (8) IT | 0.83*** | −0.04 | −0.62*** | 0.02 | −0.27*** | 0.52*** | 0.09 | 1 | |

| (9) CORR | 0.61*** | −0.01 | −0.62*** | −0.32*** | −0.45*** | 0.27** | −0.02 | 0.40*** | 1 |

| (10) GOV_EFF | 0.72*** | −0.09 | −0.78*** | −0.49*** | −0.50*** | 0.24** | −0.05 | 0.53*** | 0.80*** |

| (11) POL_STAB | 0.55*** | -0.08 | −0.76*** | −0.73*** | −0.19* | 0.35*** | 0.18* | 0.23** | 0.57*** |

| (12) REG_Q | 0.42*** | 0.06 | −0.44*** | −0.11 | −0.32*** | 0.13 | −0.21* | 0.42*** | 0.68*** |

| (13) RULE_LAW | 0.72*** | −0.03 | −0.73*** | −0.38*** | −0.37*** | 0.35*** | −0.12 | 0.56*** | 0.86*** |

| (14) VOICE_ACC | 0.53*** | −0.05 | −0.70*** | −0.46*** | −0.20* | 0.35*** | −0.01 | 0.32*** | 0.84*** |

| (15) GOV_EXP | −0.06 | 0.06 | −0.50*** | −0.56*** | −0.16* | −0.01 | 0.05 | −0.16* | 0.33*** |

| (16) URB | −0.23*** | 0.24*** | 0.18* | 0.22** | −0.08 | −0.02 | −0.21*** | 0.06 | −0.03 |

| (17) DCPS | 0.60*** | 0.03 | −0.09 | 0.13 | −0.47*** | 0.26*** | 0.03 | 0.64*** | 0.34*** |

| (18) TRADE | 0.51*** | 0.14* | −0.48*** | −0.34*** | −0.46*** | 0.29*** | 0.1 | 0.67*** | 0.40*** |

| Variables | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) |

| (10) GOV_EFF | 1 | ||||||||

| (11) POL_STAB | 0.74*** | 1 | |||||||

| (12) REG_Q | 0.70*** | 0.46*** | 1 | ||||||

| (13) RULE_LAW | 0.87*** | 0.65*** | 0.80*** | 1 | |||||

| (14) VOICE_ACC | 0.82*** | 0.73*** | 0.79*** | 0.88*** | 1 | ||||

| (15) GOV_EXP | 0.52*** | 0.51*** | 0.32*** | 0.41*** | 0.44*** | 1 | |||

| (16) URB | 0.12 | −0.09 | 0.44*** | 0.17* | 0.08 | 0.24*** | 1 | ||

| (17) DCPS | 0.34*** | 0.02 | 0.22** | 0.33*** | 0.14† | −0.06 | 0.12† | 1 | |

| (18) TRADE | 0.57*** | 0.42*** | 0.52*** | 0.53*** | 0.45*** | 0.11† | 0.18** | 0.42*** | 1 |

| Variables | (1) | (2) | (3) | (4) | ||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | |

| FDI | −0.00† | −0.00† | −0.01* | −0.01** | −0.00 | −0.00 | −0.01* | −0.01* |

| (−1.78) | (−1.90) | (−2.08) | (−3.26) | (−0.81) | (−0.89) | (−2.07) | (−2.21) | |

| FDI_SQ | 0.00 | 0.00** | 0.00† | 0.00* | ||||

| (1.50) | (2.60) | (1.90) | (2.02) | |||||

| INEQ | 0.07** | 0.06** | 0.08** | 0.07** | ||||

| (2.88) | (2.68) | (3.21) | (2.98) | |||||

| POV | −0.02*** | −0.02*** | −0.02*** | −0.03*** | ||||

| (−10.28) | (−10.83) | (−9.82) | (−15.82) | |||||

| GOV_EXP | 0.02 | 0.01 | 0.01 | 0.00 | −0.01 | −0.01 | −0.01 | −0.01 |

| (1.57) | (1.22) | (1.25) | (0.22) | (−0.36) | (−0.39) | (−0.77) | (−0.66) | |

| URB | −0.02† | −0.01* | −0.03* | −0.01** | −0.01 | −0.02* | −0.01 | −0.02* |

| (−1.76) | (−2.52) | (−2.03) | (−3.12) | (−0.34) | (−2.00) | (−0.91) | (−2.03) | |

| DCPS | 0.00 | 0.00 | 0.00 | 0.00*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (0.68) | (1.26) | (0.65) | (3.91) | (9.00) | (8.95) | (9.05) | (9.08) | |

| TRADE | 0.01*** | 0.01*** | 0.01*** | 0.00** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (8.53) | (7.83) | (8.04) | (3.06) | (9.19) | (9.88) | (8.26) | (9.10) | |

| _cons | 10.31*** | 9.80*** | 10.63*** | 10.03*** | 7.57*** | 8.36*** | 8.37*** | 8.58*** |

| (10.77) | (26.05) | (10.90) | (50.77) | (6.88) | (13.36) | (7.17) | (12.77) | |

| F statistic | 49.64*** | 43.37*** | 64.39*** | 56.87*** | ||||

| R-sq. within | 0.74 | 0.73 | 0.74 | 0.60 | 0.76 | 0.75 | 0.76 | 0.76 |

| Hausman test Prob>chi2 | 0.0266 | 0.0000 | 0.0186 | 0.0945 | ||||

| Obs. | 123.00 | 123.00 | 123.00 | 123.00 | 142.00 | 142.00 | 142.00 | 142.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | (1) | (2) | (3) | (4) | ||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | |

| FDI | −0.00 | −0.00 | −0.00 | −0.00 | 0.00 | −0.00 | 0.00 | −0.00 |

| (−0.16) | (−0.71) | (−0.51) | (−0.68) | (0.23) | (−0.19) | (0.07) | (−0.30) | |

| FDI_SQ | 0.00 | 0.00 | 0.00 | 0.00 | ||||

| (0.50) | (0.41) | (0.04) | (0.27) | |||||

| EDU | −0.77* | 0.03 | −0.78* | 0.02 | ||||

| (−2.15) | (0.35) | (−2.16) | (0.16) | |||||

| INNOV | 0.23*** | 0.21*** | 0.23*** | 0.21*** | ||||

| (7.13) | (7.65) | (7.08) | (7.51) | |||||

| GOV_EXP | −0.04** | −0.03* | −0.04** | −0.04** | −0.02† | −0.02† | −0.02† | −0.02* |

| (−3.03) | (−2.51) | (−3.06) | (−2.61) | (−1.91) | (−1.92) | (−1.89) | (−1.99) | |

| URB | −0.03 | −0.02* | −0.03 | −0.02* | 0.01 | −0.01 | 0.01 | −0.01 |

| (−1.38) | (−2.12) | (−1.45) | (−2.03) | (0.80) | (−1.37) | (0.78) | (−1.13) | |

| DCPS | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (7.53) | (10.25) | (7.47) | (10.14) | (8.06) | (9.15) | (8.03) | (9.03) | |

| TRADE | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (6.80) | (8.60) | (6.62) | (8.42) | (6.28) | (7.04) | (6.21) | (6.86) | |

| _cons | 15.49*** | 9.15*** | 15.73*** | 9.36*** | 6.71*** | 8.07*** | 6.72*** | 8.03*** |

| (5.34) | (9.09) | (5.34) | (8.48) | (6.64) | (15.87) | (6.47) | (14.63) | |

| F statistic | 73.42*** | 62.62*** | 131.10*** | 111.67*** | ||||

| R-sq. within | 0.76 | 0.75 | 0.76 | 0.75 | 0.83 | 0.83 | 0.83 | 0.83 |

| Hausman test Prob>chi2 | 0.0142 | 0.0521 | 0.0100 | 0.0472 | ||||

| Obs. | 154.00 | 154.00 | 154.00 | 154.00 | 177.00 | 177.00 | 177.00 | 177.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | (1) | (2) | (3) | (4) | ||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | |

| FDI | −0.00 | −0.00 | −0.00 | −0.01 | −0.00 | −0.00 | −0.00 | 0.00 |

| (−0.82) | (−1.22) | (−0.70) | (−1.13) | (−0.01) | (−0.08) | (−0.00) | (0.14) | |

| FDI_SQ | 0.00 | 0.00 | −0.00 | −0.00 | ||||

| (0.35) | (0.59) | (−0.00) | (−0.19) | |||||

| TRANSP | 0.29*** | 0.12*** | 0.29*** | 0.12*** | ||||

| (5.45) | (3.60) | (5.34) | (3.40) | |||||

| IT | 0.01*** | 0.01*** | 0.01*** | 0.01*** | ||||

| (16.14) | (15.96) | (15.91) | (15.84) | |||||

| GOV_EXP | −0.06*** | −0.05*** | −0.06*** | −0.05*** | −0.05*** | −0.04*** | −0.05*** | −0.04*** |

| (−5.09) | (−4.05) | (−5.08) | (−4.03) | (−5.97) | (−5.44) | (−5.90) | (−5.51) | |

| URB | −0.06*** | −0.02* | −0.06*** | −0.02* | −0.03** | −0.02** | −0.03** | −0.02** |

| (−3.74) | (−2.33) | (−3.74) | (−2.34) | (−3.32) | (−3.14) | (−3.21) | (−3.07) | |

| DCPS | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.00*** | 0.00*** | 0.00*** | 0.00*** |

| (9.46) | (10.43) | (9.43) | (10.40) | (3.82) | (3.97) | (3.80) | (3.92) | |

| TRADE | 0.01*** | 0.01*** | 0.01*** | 0.01*** | −0.00 | 0.00 | −0.00 | 0.00 |

| (9.07) | (10.64) | (8.88) | (10.39) | (−0.02) | (0.46) | (−0.01) | (0.38) | |

| _cons | 10.70*** | 9.00*** | 10.76*** | 9.04*** | 10.95*** | 10.35*** | 10.95*** | 10.42*** |

| (11.21) | (13.85) | (11.05) | (14.00) | (17.83) | (20.86) | (17.04) | (19.60) | |

| F statistic | 123.35*** | 105.21*** | 306.61*** | 261.38*** | ||||

| R-sq. within | 0.81 | 0.80 | 0.81 | 0.80 | 0.91 | 0.91 | 0.91 | 0.91 |

| Hausman test Prob>chi2 | 0.0006 | 0.0011 | 0.1073 | 0.2950 | ||||

| Obs. | 189.00 | 189.00 | 189.00 | 189.00 | 201.00 | 201.00 | 201.00 | 201.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | |

| FDI | −0.00 | −0.00† | −0.01* | −0.01** | −0.00 | −0.00 | −0.01† | −0.01** | −0.00 | −0.00† | −0.01* | −0.01* |

| (−1.49) | (−1.83) | (−2.24) | (−3.04) | (−0.76) | (−1.14) | (−1.84) | (−2.70) | (−1.65) | (−1.73) | (−2.21) | (−2.42) | |

| FDI_SQ | 0.00† | 0.00* | 0.00† | 0.00* | 0.00† | 0.00† | ||||||

| (1.78) | (2.50) | (1.67) | (2.45) | (1.68) | (1.86) | |||||||

| CORR | 0.48*** | 0.38*** | 0.48*** | 0.40*** | ||||||||

| (4.56) | (4.40) | (4.59) | (4.69) | |||||||||

| GOV_EFF | 0.54*** | 0.48*** | 0.54*** | 0.50*** | ||||||||

| (4.55) | (5.00) | (4.53) | (5.12) | |||||||||

| POL_STAB | −0.02 | 0.11 | −0.03 | 0.09 | ||||||||

| (−0.22) | (1.20) | (−0.29) | (0.98) | |||||||||

| GOV_EXP | −0.03* | −0.04** | −0.04** | −0.04** | −0.03* | −0.04** | −0.04* | −0.05*** | −0.04** | −0.03* | −0.05** | −0.04** |

| (−2.42) | (−2.70) | (−2.73) | (−3.16) | (−2.21) | (−3.25) | (−2.51) | (−3.56) | (−2.72) | (−2.23) | (−3.01) | (−2.58) | |

| URB | 0.03 | −0.01† | 0.02 | −0.01 | 0.02 | −0.01† | 0.02 | −0.01 | −0.00 | −0.01† | −0.01 | −0.01† |

| (1.64) | (−1.83) | (1.18) | (−1.61) | (1.39) | (−1.85) | (0.94) | (−1.63) | (−0.28) | (−1.94) | (−0.70) | (−1.80) | |

| DCPS | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (9.10) | (8.36) | (9.17) | (8.64) | (8.64) | (8.54) | (8.70) | (8.74) | (8.56) | (8.36) | (8.61) | (8.50) | |

| TRADE | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (8.44) | (8.57) | (7.65) | (7.77) | (7.94) | (7.58) | (7.20) | (6.89) | (7.83) | (8.94) | (7.07) | (8.19) | |

| _cons | 6.46*** | 8.95*** | 7.08*** | 9.09*** | 6.60*** | 9.06*** | 7.20*** | 9.17*** | 8.76*** | 8.95*** | 9.41*** | 9.15*** |

| (5.48) | (20.46) | (5.80) | (19.59) | (5.64) | (18.82) | (5.92) | (17.44) | (7.27) | (17.86) | (7.47) | (16.62) | |

| F statistic | 62.17*** | 54.54*** | 62.11*** | 54.30*** | 51.42*** | 45.02*** | ||||||

| R-sq. within | 0.72 | 0.71 | 0.72 | 0.72 | 0.72 | 0.71 | 0.72 | 0.72 | 0.68 | 0.67 | 0.68 | 0.68 |

| Hausman test Prob>chi2 | 0.0000 | 0.0004 | 0.0008 | 0.0121 | 0.0001 | 0.0015 | ||||||

| Obs. | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | |

| FDI | −0.00 | −0.00 | −0.01† | −0.01** | −0.00† | −0.00† | −0.01† | −0.01** | −0.00 | −0.00† | −0.01* | −0.01** |

| (−1.24) | (−1.62) | (−1.68) | (−2.79) | (−1.68) | (−1.91) | (−1.96) | (−3.18) | (−1.38) | (−1.70) | (−2.21) | (−2.91) | |

| FDI_SQ | 0.00 | 0.00* | 0.00 | 0.00** | 0.00† | 0.00* | ||||||

| (1.29) | (2.32) | (1.39) | (2.59) | (1.79) | (2.41) | |||||||

| REG_Q | 0.88*** | 0.65*** | 0.87*** | 0.68*** | ||||||||

| (8.86) | (6.89) | (8.73) | (7.30) | |||||||||

| RULE_LAW | 0.87*** | 0.67*** | 0.86*** | 0.67*** | ||||||||

| (8.22) | (7.89) | (8.12) | (8.22) | |||||||||

| VOICE_ACC | 0.62** | 0.38** | 0.63** | 0.44** | ||||||||

| (3.08) | (2.73) | (3.14) | (3.07) | |||||||||

| GOV_EXP | −0.02 | −0.04** | −0.02† | −0.04** | −0.04** | −0.05*** | −0.04** | −0.05*** | −0.03* | −0.04** | −0.04** | −0.05*** |

| (−1.45) | (−3.02) | (−1.69) | (−3.27) | (−3.09) | (−4.12) | (−3.31) | (−4.33) | (−2.31) | (−2.87) | (−2.62) | (−3.33) | |

| URB | 0.03* | −0.02* | 0.03† | −0.02* | 0.04** | −0.01* | 0.03* | −0.01** | 0.04† | −0.01 | 0.03 | −0.01 |

| (2.26) | (−2.21) | (1.83) | (−1.98) | (2.62) | (−2.52) | (2.17) | (−2.86) | (1.83) | (−1.49) | (1.49) | (−1.21) | |

| DCPS | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (8.10) | (8.38) | (8.15) | (8.49) | (6.37) | (7.07) | (6.43) | (7.12) | (8.46) | (8.47) | (8.52) | (8.65) | |

| TRADE | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** | 0.01*** |

| (11.92) | (10.55) | (11.03) | (9.95) | (7.65) | (7.16) | (7.03) | (6.39) | (8.75) | (9.03) | (8.02) | (8.23) | |

| _cons | 5.15*** | 8.74*** | 5.59*** | 8.79*** | 5.89*** | 9.40*** | 6.36*** | 9.59*** | 5.35*** | 8.73*** | 5.95*** | 8.82*** |

| (5.11) | (16.37) | (5.27) | (15.23) | (5.84) | (23.20) | (6.00) | (24.78) | (3.45) | (16.67) | (3.78) | (15.41) | |

| F statistic | 92.07*** | 79.51*** | 86.42*** | 74.83*** | 56.32*** | 49.47*** | ||||||

| R-sq. within | 0.79 | 0.77 | 0.79 | 0.78 | 0.78 | 0.76 | 0.78 | 0.77 | 0.70 | 0.69 | 0.70 | 0.70 |

| Hausman testProb>chi2 | 0.0000 | 0.0002 | 0.0000 | 0.0000 | 0.0002 | 0.0062 | ||||||

| Obs. | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | Level | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Individual Intercept | Individual Intercept and Trend | ||||||||

| LLC | IPS | ADF | PP | LLC | Breitung | IPS | ADF | PP | |

| (1) GROWTH | −6.89148*** | −2.83747** | 42.1514** | 58.4211*** | 0.15541 | 3.17011 | 3.01311 | 6.73929 | 6.39581 |

| (2) FDI | −5.13076*** | −4.58253*** | 60.6361*** | 56.5393*** | −3.87191*** | −3.2594*** | −3.62251*** | 50.3541*** | 56.1099*** |

| (3) POV | −6.30543*** | −3.14041*** | 50.1233*** | 54.6683*** | −6.45945*** | −2.33002** | −2.18696* | 46.6079** | 43.2553** |

| (4) INEQ | −14.2876*** | −5.9795*** | 68.0805*** | 73.5803*** | −13.3524*** | −2.57474** | −5.04005*** | 67.067*** | 103.905*** |

| (5) EDU | −14.2876*** | −5.9795*** | 68.0805*** | 73.5803*** | −3.96935*** | 3.58804 | 0.23805 | 26.7064 | 38.9658* |

| (6) INNOV | −4.17114*** | −0.5406 | 40.3984** | 29.4974 | −2.45073** | −1.68113* | −5.10344*** | 64.2222*** | 92.981*** |

| (7) TRANSP | 0.16593 | 4.22876 | 6.54 | 6.06803 | −0.71733 | 0.48229 | 0.15573 | 18.54 | 17.4855 |

| (8) IT | 2.38744 | 6.07589 | 2.12261 | 2.14089 | −0.22001 | −0.13088 | 0.75325 | 15.7589 | 12.7974 |

| (9) CORR | 0.09776 | 0.63304 | 18.3063 | 19.7321 | −0.94174 | −0.23127 | −0.7865 | 26.3428 | 33.0795† |

| (10) GOV_EFF | −2.08343* | −2.51437** | 42.9291** | 54.336*** | −2.83903** | −1.23925 | −1.9375* | 35.1402* | 42.4099** |

| (11) POL_STAB | −6.14953*** | −4.35309*** | 55.5461*** | 58.6936*** | −2.90664** | −0.53716 | −0.39607 | 22.4669 | 44.5648** |

| (12) REG_Q | −1.54727† | 0.1684 | 24.2968 | 18.8836 | −3.49729*** | 0.06775 | −1.13672 | 25.5891 | 26.3469 |

| (13) RULE_LAW | −0.63316 | 0.33652 | 23.3193 | 28.4594 | −2.75257** | −0.76952 | −2.86205** | 41.8436** | 64.9622*** |

| (14) VOICE_ACC | 0.95339 | −0.01605 | 30.1553 | 20.4843 | −2.76689** | 1.17876 | −1.59179† | 31.3506† | 26.7416 |

| (15) GOV_EXP | −3.28222*** | −3.0214** | 45.7265** | 46.235** | −4.47912*** | −1.52291† | −3.49884*** | 48.2018** | 36.4402* |

| (16) URB | 2.34336 | 2.73388 | 19.8265 | 43.537** | −2.42386** | −3.03075** | 0.44016 | 23.0641 | 7.86373 |

| (17) DCPS | −3.17298*** | −1.36901† | 33.1668† | 15.3335 | 2.36018 | 1.14294 | 1.30803 | 10.6243 | 6.93452 |

| (18) TRADE | −0.57095 | 1.36231 | 12.4385 | 12.6113 | −2.17451* | −3.09165** | −2.91162** | 43.1445** | 37.8771* |

| Variables | First Difference | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Individual Intercept | Individual Intercept and Trend | ||||||||

| LLC | IPS | ADF | PP | LLC | Breitung | IPS | ADF | PP | |

| (1) ∆GROWTH | −10.0412*** | −7.1558*** | 91.0021*** | 81.29*** | −11.2039*** | −6.56351*** | −7.06473*** | 85.2992*** | 88.9451*** |

| (2) ∆FDI | −12.6609*** | −12.4626*** | 156.28*** | 452.106*** | −9.6859*** | −5.18914*** | −9.20536*** | 108.654*** | 154.953*** |

| (3) ∆POV | −5.32266*** | −3.19925*** | 47.048** | 52.9729*** | −4.40028*** | −1.41804† | −0.20066 | 24.1753 | 25.6106 |

| (4) ∆INEQ | −15.3118*** | −11.1358*** | 124.86*** | 138.282*** | −11.078*** | −1.97373* | −4.45331*** | 79.4281*** | 121.825*** |

| (5) ∆EDU | −2.61974** | −0.87694 | 30.1715 | 35.3114* | −3.47777*** | −0.0883 | −0.39812 | 29.8188 | 37.1392* |

| (6) ∆INNOV | −14.9716*** | −16.306*** | 214.13*** | 389.426*** | −14.4802*** | −7.34945*** | −17.1801*** | 210.228*** | 528.752*** |

| (7) ∆TRANSP | −10.5123*** | −10.3428*** | 127.778*** | 127.185*** | −8.72964*** | −8.15695*** | −8.93238*** | 104.849*** | 114.023*** |

| (8) ∆IT | −5.79754*** | −5.57405*** | 72.5568*** | 85.062*** | −5.04762*** | −5.30682*** | −3.84183*** | 53.1043*** | 59.786*** |

| (9) ∆CORR | −8.05233*** | −7.09242*** | 86.6963*** | 95.5046*** | −5.96343*** | −1.90304* | −4.0105*** | 54.3082*** | 85.6108*** |

| (10) ∆GOV_EFF | −12.8263*** | −10.5067*** | 123.252*** | 129.783*** | −11.0076*** | −4.84495*** | −8.46448*** | 94.4206*** | 121.1*** |

| (11) ∆POL_STAB | −10.09*** | −8.19166*** | 98.6169*** | 125.865*** | −8.98325*** | −3.30695*** | −6.80943*** | 82.317*** | 146.228*** |

| (12) ∆REG_Q | −8.07981*** | −7.17869*** | 88.8002*** | 96.2212*** | −9.70664*** | −2.96341** | −6.76272*** | 77.9188*** | 94.6873*** |

| (13) ∆RULE_LAW | −8.40469*** | −8.13053*** | 96.3068*** | 122.676*** | −8.32379*** | 0.5883 | −5.85384*** | 69.9895*** | 85.7716*** |

| (14) ∆VOICE_ACC | −9.90439*** | −8.19117*** | 99.3145*** | 130.447*** | −10.1777*** | −4.93672*** | −7.52055*** | 84.7466*** | 123.706*** |

| (15) ∆GOV_EXP | −11.3765*** | −9.19058*** | 113.171*** | 341.109*** | −8.91053*** | −7.43709*** | −7.01183*** | 82.334*** | 114.625*** |

| (16) ∆URB | 3.37016 | −0.68492 | 50.8643*** | 46.8744** | 1.10092 | −1.93539* | −3.49968*** | 59.7389*** | 87.0832*** |

| (17) ∆DCPS | −5.83659*** | −6.26303*** | 81.0564*** | 84.8147*** | −4.11108*** | 2.08777 | −4.16056*** | 61.1824*** | 64.09*** |

| (18) ∆TRADE | −12.5416*** | −10.9456*** | 141.017*** | 166.151*** | −10.6513*** | −8.69885*** | −8.84618*** | 104.826*** | 129.987*** |

| Models | Co-integration Test Null Hypothesis: No Co-integration | Individual Intercept | Individual Intercept and Individual Trend | No Intercept or Trend | ||||

|---|---|---|---|---|---|---|---|---|

| Statistic | Weighted Statistic | Statistic | Weighted Statistic | Statistic | Weighted Statistic | |||

| (1) | GROWTH FDI CORR | Panel v-Statistic | −1.7076 | −1.5416 | 2.558375** | 2.358355** | −2.5585 | −2.5629 |

| Panel rho-Statistic | 1.7729 | 1.6675 | 2.9389 | 2.5653 | 0.6379 | 1.0724 | ||

| Panel PP-Statistic | 0.8394 | 0.6747 | 2.4321 | 1.5509 | −0.0228 | 0.6954 | ||

| Panel ADF-Statistic | −0.1785 | −0.2901 | 0.0185 | −0.1417 | −0.1750 | 0.6009 | ||

| Group rho-Statistic | 3.2381 | 3.3607 | 2.0779 | |||||

| Group PP-Statistic | 1.4325 | 1.2245 | 0.5920 | |||||

| Group ADF-Statistic | −0.0656 | −0.3940 | 0.0036 | |||||

| (2) | GROWTH FDI GOV_EFF | Panel v-Statistic | −2.0410 | −1.8150 | 5.601757*** | 3.009423** | −2.5340 | −2.5525 |

| Panel rho-Statistic | 1.6788 | 1.4922 | 2.3794 | 2.1078 | −0.0905 | 0.4903 | ||

| Panel PP-Statistic | 0.4617 | 0.3585 | 1.4419 | 0.7355 | −1.2721 | −0.8283 | ||

| Panel ADF-Statistic | 0.2270 | −0.0464 | 0.7036 | 0.2789 | −1.337236† | −0.8235 | ||

| Group rho-Statistic | 2.6590 | 3.1500 | 0.5467 | |||||

| Group PP-Statistic | 1.0769 | 1.5894 | −2.457101** | |||||

| Group ADF-Statistic | 0.3420 | 0.8662 | −2.806141** | |||||

| (3) | GROWTH FDI POL_STAB | Panel v-Statistic | −1.9435 | −1.7911 | 4.109299*** | 3.148275*** | −2.5467 | −2.5509 |

| Panel rho-Statistic | 1.6581 | 1.4842 | 2.8441 | 2.5303 | 0.7844 | 0.4696 | ||

| Panel PP-Statistic | 0.8934 | 0.4409 | 1.6648 | 0.8465 | 0.2732 | −0.6228 | ||

| Panel ADF-Statistic | 0.8873 | 0.3311 | 1.3484 | 0.5390 | 0.2050 | −0.7181 | ||

| Group rho-Statistic | 2.8741 | 3.5536 | 1.1195 | |||||

| Group PP-Statistic | 1.2001 | 1.5957 | −1.88605* | |||||

| Group ADF-Statistic | 0.9912 | 0.9094 | −2.142891* | |||||

| (4) | GROWTH FDI REG_Q | Panel v-Statistic | −1.9322 | −1.7904 | 3.827421*** | 3.100601** | −2.5047 | −2.5344 |

| Panel rho-Statistic | 1.7994 | 1.8637 | 2.4795 | 2.2650 | 0.0694 | 0.7520 | ||

| Panel PP-Statistic | 0.4580 | 0.6717 | 1.5360 | 0.8376 | −1.295661† | 0.0573 | ||

| Panel ADF-Statistic | 0.4554 | 0.3683 | 0.1285 | −0.1233 | −0.3046 | 1.0050 | ||

| Group rho-Statistic | 3.3447 | 3.4405 | 0.9909 | |||||

| Group PP-Statistic | 1.6631 | 1.8083 | −1.1041 | |||||

| Group ADF-Statistic | 0.8479 | 0.7101 | −1.1348 | |||||

| (5) | GROWTH FDI RULE_LAW | Panel v-Statistic | −1.2978 | −1.0993 | 1.394589† | 1.1297 | −2.5529 | −2.5564 |

| Panel rho-Statistic | 0.7354 | 0.7656 | 3.1147 | 2.8597 | −1.794843* | −0.9406 | ||

| Panel PP-Statistic | −1.568443† | −1.415265† | 2.8852 | 2.0077 | −3.816753*** | −3.156792*** | ||

| Panel ADF-Statistic | −1.430085† | −1.2416 | 2.3909 | 1.3439 | −2.534433** | −2.537426** | ||

| Group rho-Statistic | 2.0371 | 4.1321 | 0.3189 | |||||

| Group PP-Statistic | −1.338549† | 2.5739 | −3.770538*** | |||||

| Group ADF-Statistic | −0.9832 | 1.6086 | −2.018076* | |||||

| (6) | GROWTH FDI VOICE_ACC | Panel v-Statistic | −2.1255 | −1.9365 | 3.894971*** | 2.947807** | −2.4596 | −2.5230 |

| Panel rho-Statistic | 1.6990 | 1.6716 | 3.1083 | 2.9776 | 1.0982 | 1.8708 | ||

| Panel PP-Statistic | −0.5114 | −0.3768 | 2.7915 | 2.3235 | 0.7232 | 2.1639 | ||

| Panel ADF-Statistic | −0.3276 | 0.1174 | 2.4500 | 2.1509 | 0.0742 | 1.9391 | ||

| Group rho-Statistic | 3.0075 | 3.9313 | 1.5779 | |||||

| Group PP-Statistic | 0.0575 | 3.0209 | −0.5654 | |||||

| Group ADF-Statistic | 0.9403 | 2.4051 | −2.599532** | |||||

| Models | ||||||

|---|---|---|---|---|---|---|

| Null Hypothesis: No Co-Integration | (1) GROWTH FDI ORR | (2) GROWTH FDI GOV_EFF | (3) GROWTH FDI POL_STAB | (4) GROWTH FDI REG_Q | (5) GROWTH FDI RULE_LAW | (6) GROWTH FDI VOICE_ACC |

| ADF (t-Statistic) | −3.457081*** | −3.51358*** | −2.678418** | −1.799285* | −2.957034** | −0.688062 |

| Residual Variance | 0.010128 | 0.010301 | 0.010336 | 0.009971 | 0.009585 | 0.010323 |

| HAC Variance | 0.021366 | 0.022058 | 0.022258 | 0.022209 | 0.016184 | 0.023863 |

| Models | Hypothesized No. of CE(s) | Fisher Stat. (From Trace Test) | Fisher Stat. (From Max-Eigen Test) | |

|---|---|---|---|---|

| (1) | GROWTH FDI CORR | None | 135.8*** | 116.9*** |

| At most 1 | 46.99** | 39.7* | ||

| At most 2 | 37.73* | 37.73* | ||

| (2) | GROWTH FDI GOV_EFF | None | 126.7*** | 106*** |

| At most 1 | 49.74*** | 35.41* | ||

| At most 2 | 49.92*** | 49.92*** | ||

| (3) | GROWTH FDI POL_STAB | None | 124.5*** | 100.8*** |

| At most 1 | 50.92*** | 34.92* | ||

| At most 2 | 53.41*** | 53.41*** | ||

| (4) | GROWTH FDI REG_Q | None | 110.9*** | 89.26*** |

| At most 1 | 44.86** | 31.7† | ||

| At most 2 | 50.2*** | 50.2*** | ||

| (5) | GROWTH FDI RULE_LAW | None | 102.9*** | 81.13*** |

| At most 1 | 44.29** | 33.34† | ||

| At most 2 | 44.31** | 44.31** | ||

| (6) | GROWTH FDI VOICE_ACC | None | 100.6*** | 62.01*** |

| At most 1 | 61.64*** | 39.13* | ||

| At most 2 | 66.19*** | 66.19*** | ||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FMOLS | DOLS | FMOLS | DOLS | FMOLS | DOLS | FMOLS | DOLS | FMOLS | DOLS | FMOLS | DOLS | |

| FDI | −0.01* (−2.55) | −0.01** (−2.77) | 0.00 (−0.93) | 0.00 (−0.69) | −0.01** (−3.28) | −0.01 (−1.63) | −0.01† (−1.92) | −0.01 (−1.21) | 0.00 (−1.00) | −0.01 (−0.95) | −0.01** (−3.16) | −0.01 (−1.58) |

| CORR | 0.46* (2.31) | 0.35 (1.46) | ||||||||||

| GOV_EFF | 1.05*** (4.71) | 0.91** (3.29) | ||||||||||

| POL_STAB | −0.30 (−1.40) | −0.04 (−0.15) | ||||||||||

| REG_Q | 0.74*** (3.61) | 0.70** (2.73) | ||||||||||

| RULE_LAW | 1.45*** (7.49) | 1.29*** (5.99) | ||||||||||

| VOICE_ACC | −0.33 (−1.48) | −0.08 (−0.24) | ||||||||||

| R-squared | 0.63 | 0.73 | 0.68 | 0.74 | 0.63 | 0.70 | 0.67 | 0.73 | 0.77 | 0.82 | 0.64 | 0.69 |

| Adjusted R-squared | 0.60 | 0.65 | 0.65 | 0.67 | 0.59 | 0.61 | 0.64 | 0.65 | 0.75 | 0.77 | 0.60 | 0.61 |

| S.E. of regression | 0.28 | 0.26 | 0.26 | 0.25 | 0.28 | 0.27 | 0.26 | 0.26 | 0.22 | 0.21 | 0.27 | 0.27 |

| Long-run variance | 0.15 | 0.10 | 0.13 | 0.09 | 0.15 | 0.12 | 0.14 | 0.10 | 0.09 | 0.06 | 0.15 | 0.12 |

| Mean dependent var | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 | 9.14 |

| S.D. dependent var | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 | 0.44 |

| Sum squared resid | 10.76 | 7.85 | 9.39 | 7.48 | 10.87 | 8.81 | 9.73 | 7.80 | 6.69 | 5.23 | 10.59 | 8.87 |

| Models | Excluded | Short-Run (or Weak) Granger-Causality | Long-Run Granger-Causality | ||

|---|---|---|---|---|---|

| Dependent Variables | |||||

| (1) | ∆GROWTH | ∆FDI | ∆CORR | ECT | |

| ∆GROWTH | 1.6978 | 2.3258 | −0.124502*** | ||

| ∆FDI | 12.34713** | 0.5063 | −10.96881*** | ||

| ∆CORR | 2.8356 | 3.0597 | −0.001809 | ||

| (2) | ∆GROWTH | ∆FDI | ∆GOV_EFF | ECT | |

| ∆GROWTH | 1.8875 | 1.0458 | −0.174456*** | ||

| ∆FDI | 11.45159** | 1.1969 | −9.440169** | ||

| ∆GOV_EFF | 7.444163* | 0.4843 | 0.046016 | ||

| (3) | ∆GROWTH | ∆FDI | ∆POL_STAB | ECT | |

| ∆GROWTH | 2.1091 | 1.4481 | −0.140034*** | ||

| ∆FDI | 8.041205* | 2.8072 | −8.335268** | ||

| ∆POL_STAB | 0.2664 | 1.2736 | −0.026861 | ||

| (4) | ∆GROWTH | ∆FDI | ∆REG_Q | ECT | |

| ∆GROWTH | 1.1953 | 10.78608** | −0.103463*** | ||

| ∆FDI | 12.49779** | 3.7957 | −7.632315*** | ||

| ∆REG_Q | 1.1073 | 3.1275 | 0.005832 | ||

| (5) | ∆GROWTH | ∆FDI | ∆RULE_LAW | ECT | |

| ∆GROWTH | 1.3339 | 4.764213† | −0.157890*** | ||

| ∆FDI | 11.30389** | 0.8344 | −8.213606** | ||

| ∆RULE_LAW | 0.5774 | 1.6971 | −0.001021 | ||

| (6) | ∆GROWTH | ∆FDI | ∆VOICE_ACC | ECT | |

| ∆GROWTH | 1.7856 | 2.5089 | −0.139026*** | ||

| ∆FDI | 10.69032** | 0.9557 | −6.247867* | ||

| ∆VOICE_ACC | 3.2408 | 4.73479† | 0.012596 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gherghina, Ș.C.; Simionescu, L.N.; Hudea, O.S. Exploring Foreign Direct Investment–Economic Growth Nexus—Empirical Evidence from Central and Eastern European Countries. Sustainability 2019, 11, 5421. https://doi.org/10.3390/su11195421

Gherghina ȘC, Simionescu LN, Hudea OS. Exploring Foreign Direct Investment–Economic Growth Nexus—Empirical Evidence from Central and Eastern European Countries. Sustainability. 2019; 11(19):5421. https://doi.org/10.3390/su11195421

Chicago/Turabian StyleGherghina, Ștefan Cristian, Liliana Nicoleta Simionescu, and Oana Simona Hudea. 2019. "Exploring Foreign Direct Investment–Economic Growth Nexus—Empirical Evidence from Central and Eastern European Countries" Sustainability 11, no. 19: 5421. https://doi.org/10.3390/su11195421

APA StyleGherghina, Ș. C., Simionescu, L. N., & Hudea, O. S. (2019). Exploring Foreign Direct Investment–Economic Growth Nexus—Empirical Evidence from Central and Eastern European Countries. Sustainability, 11(19), 5421. https://doi.org/10.3390/su11195421