1. Introduction

In 2010, Greenpeace launched a successful campaign against Nestlé’s use of palm oil, particularly in its Kit Kat-brand chocolate bars. Members of the palm oil supply chain remember the campaign well and continue to refer to it almost a decade later. Among numerous iconic images, Greenpeace posted a YouTube video featuring an office worker opening a Kit Kat bar to find severed orangutan fingers inside. Within weeks, Nestlé committed to tracing its palm oil supply chain. A flurry of brand-based activism focused on retailers and manufacturers, particularly in Europe, ensued [

1].

Given this history, it might seem surprising that Nestlé’s membership in the Roundtable on Sustainable Palm Oil (RSPO) was suspended in late June 2018. The RSPO, an organization that monitors and certifies palm oil production according to set of sustainability criteria, has been a common recourse for firms hedging against palm oil’s reputational risks, despite perceptions that its requirements are too weak [

1,

2]. While, in a press release, Benjamin Ware [

3], Nestlé’s head of responsible sourcing, argued that “there are fundamental differences in the theory of change that Nestlé and RSPO are employing to realise the ambition of a wholly sustainable palm oil industry.” The release contended that, nevertheless, Nestlé “believe[d] in achieving traceability to plantations and transforming supply chain practices through interventionist activities […] to embed the true cost of sustainable production into supply chain procurement practices,” in contrast to the RSPO’s certification approach [

3]. In the event, the firm made a quick about-face, achieving reinstatment on 16 July 2018. Ware then asserted that the firm would focus “on increasing [supply chain] traceability primarily through segregated RSPO palm oil,” adding that “this builds on Nestlé’s ongoing activities to achieve a traceable and responsibly sourced palm oil supply chain“ (quoted in [

4]).

Nestlé’s statement highlights a key debate in transnational sustainability efforts. Organizations like the RSPO, Marine Stewardship Council (MSC), Forest Stewardship Council (FSC), Bonsucro, and the Round Table on Responsible Soy (RTRS) use private standards to affect prices, production costs, or market access in an attempt to internalize environmental externalities [

5]. Following Noor et al. [

6] and Tipper et al. [

7], we can identify two approaches such private standards use: offsetting, in which a firm receives credit for supporting a positive action, even if that action is not within its own supply chain; and insetting, in which a firm engages directly with its own suppliers across the supply chain, supporting, for example, community development in agricultural areas. In an offset market, externalities are internalized through Coasian [

8] bargaining over tradeable credits, whereas in inset markets, firms internalize externalities in the costs of sourcing goods in a given value chain, the approach endorsed in Nestlé’s above statement. Many of the diverse private environmental governance approaches Rueda et al. [

9] identify, such as investments at product origins, retailer standards, roundtables, codes of conduct, and third-party certification, could in principle employ either offsetting or insetting approaches.

Using a case study of the RSPO, a prominent example of a private standard in which offsetting and insetting are institutionalized side-by-side, we outline tensions between the two strategies. We select the RSPO for analysis both because of its structure and because its mandatory Annual Communication of Progress (ACOPs) reports provide an excellent repository of perspectives on the standard from across the value chain [

10]. This allows us to see very clearly how support for insetting or offsetting plays out in the organization. We begin by outlining how improved information and monitoring technologies can transform commodity markets by making it possible to differentiate commodities using previously unmeasured environmental and social impacts. In other words, only after the negative impacts of consumption are more readily knowable can buyers be motivated to try to avoid the worst offenders, adding new elements of reputational risk to commodity purchases. Drawing on a range of sources, we then demonstrate that, despite the costs of traceability required for insetting and the fact that on-the-ground requirements are generally the same for all RSPO certifications, RSPO members facing reputational risks show a preference for insetting over offsetting. We conclude with a discussion of the challenges insetting can pose for private standards and suggest that new governance strategies may help address these risks.

2. Private Standards and Asymmetric Information

For either offsetting or insetting to internalize externalities, firms must be able to signal positive behavior to consumers [

11]. In a classic analysis of the used car market, however, Akerlof [

12] demonstrated that asymmetric information makes it difficult for firms acting more responsibly than others intheir industries to demonstrate their credibility. Adopting an American slang term for a used car that breaks down frequently after purchase, Akerlof [

12] called this the “market for lemons” problem. The used car dealership, he explained, has much more information about the quality of a car than the buyer, but the buyer has no way of distinguishing honest from dishonest dealers, precisely because the buyer has insufficient information to detect deception. Like the office worker in Greenpeace’s video who opens his Kit Kat to find a nasty surprise, over the past few years Nestlé has been forced to acknowledge both labor and human rights concerns and continued environmental damage in its supply chain, as the activists bringing these problems to light note they continue despite RSPO certification [

13,

14].

Whether these firms were innocently or deliberately unaware of their supply chain impacts, recent improvements in monitoring technologies make it accepting or feigning ignorance an increasingly risky strategy. With some civil society organizations calling for palm oil boycotts [

15], with some firms following suit [

16]. the palm oil supply chain, like supply chains involving other goods with negative social and environmental impacts, can begin to look like a string of used-car transactions, with each step in the chain needing to ascertain the production conditions in the previous step and demonstrate their credibility to customers. As a result, what was once an undifferentiated commodity market can become a market for lemons.

Private standards can be an attractive way to mitigate asymmetric information problems and thus escape markets for lemons [

17,

18,

19,

20]. Using reputable private standards, firms upstream in the supply chain can signal responsible behavior, while downstream firms can avoid buying reputational lemons. For private standards to mitigate asymmetric information problems, however, their members must impose high costs on firms attempting to use the label for greenwashing purposes [

11], turning reputation into an excludable benefit and differentiating certified firms from the industry as a whole [

21]. Even these efforts, however, may be insufficient signals. Cerri et al. [

22] find evidence that more environmentally conscious consumers can be less persuaded by ecolabels, and there is a growing movement to promote meta-labels to police lemons amongst ecolabels themselves [

23].

These considerations should affect firms’ incentives to opt for insetting or offsetting. As Rueda et al. [

9] point out, a range of factors are likely to affect firms’ preferences for one or another private environmental governance instrument. They identify several key considerations at the level of the supply chain as a whole: the degree of civil society pressure, the costs of more sustainable practices, the geographic extent of feasible production areas, and the visibility of raw materials in the final product. In addition, they identify several factors that are more firm specific: the institutional environment in sourcing locations, the firm’s supply chain control, and brand recognition. While the first set of factors will affect all firms in a given value chain, the second are likely to vary from firm to firm, leading to different preferences for governance instruments depending on firms’ supply chain position [

18]. If firms’ primary motivation to adopt private standards is escaping a market for lemons, then they are likely to prefer insetting to offsetting. If the standard is not sufficiently credible, furthermore, larger firms could opt for their own insetting approaches, as Nestlé’s statement hints [

24,

25].

Offsetting and insetting therefore reflect two very different market visions. Offsetting imagines a market where prices reflect true marginal social costs, so commodities can be treated unproblematically. Insetting separates off a section of the market with more responsible production practices. In principle either approach could be adopted nearly universally, if adherence became obligatory to achieve sales [

25]. To the degree that insetting imposes transaction costs related to traceability, however, it may undermine the standard’s scalability [

26], and in the absence of regulation a two-tiered market could form [

10].

3. Private Standards Amid Cheap Information

Over the past two decades, improvements in mapping, monitoring, and data storage and transfer technologies have strengthened non-state actors’ capacity to engage in informational politics, a trend likely to continue for some time [

27]. In the oil palm context, for example, Global Forest Watch [

28] provides a user-friendly interface for forest change and wildfire monitoring, which can be applied to a range of applications, such as monitoring risky mills. The Stockholm Environment Institute and Global Canopy’s [

29] Trase system aggregates land-use and import-export data to track commodities from (often sub-national) sources through firms to consumers. The Zoological Society of London’s [

30] Sustainability and Transparency Toolkit scovers several large firms involved in timber, paper, and palm oil production, grading their supply chain transparency. Supply Change, managed by Forest Trends [

31], tracks supply chain commitments of firms operating in value chains with deforestation risks.

These technologies allow advocacy groups to promote “public transparency” [

18] as a way of making individual consumer-facing firms like retailers and consumer goods manufacturers accountable for activities in their supply chain [

32,

33]. “The days of going unnoticed as a ‘black sheep’ are over,” the Malaysian Palm Oil Association’s RSPO Executive Board representative observed in 2015 [

34], acknowledging the significance of campaigns targeting leading firms downstream in the supply chain [

32,

33,

35,

36]. Evidence suggests these tactics can lead to changes in firm management structures that, in turn, can also make firms subject to further claims [

37] and more susceptible to change when challenged [

38].

As these technologies develop and are deployed, they can transform undifferentiated commodity markets into markets where not only physical characteristics but, also, social and environmental characteristics, matter to customers. These new sources of relatively cheap information add reputational risk to procurement decisions, turning once undifferentiated markets for commodities into markets for reputational lemons. Firms could respond to these challenges either by supporting offsetting, providing material support to incentivize the transformation of the production base as a whole, or insetting, differentiating themselves by improving their own supply chains. Because insetting requires acquiring and tracking detailed information, as well as comprehensive and effective supply chain governance, it can require substantial investments in data tracking and management, even in conditions of informational plenty [

26,

39]. Conversely, one of offsetting’s benefits is its relatively low barrier to entry - at least for the firms purchasing offsets.

Firms’ motivations to support the diffusion and institutionalization of either insetting or offsetting will depend on relative costs and benefits, which, in turn, depend on the commodity in question and each firm’s position in the supply chain [

18,

26]. Auld ([

40], p. 47) argues that if firms receive net benefits from being certified, there may be incentives for them to increase the difficulty of acceding to a standard, retaining the ecolabel’s market benefits. For these firms, a primary goal will be to ensure the standard’s benefits accrue only to members who adhere to rigorous, credibly enforced, requirements [

21,

41,

42]. In the extreme, a firm might even maintain its own exclusive standard, if it could do so sufficiently credibly to escape the market for lemons, particularly if either brand recognition is low or if the raw material is readily recognizable in the final product [

9].

4. Materials and Methods

Our analysis of insetting and offsetting in the RSPO draws on several sources. The first are publicly available RSPO documents, including documents intended to support members in understanding and implementing the standard, news items, historical summaries, and minutes of meetings of the General Assembly (GA), the RSPO’s primary governing entity. We supplement these with secondary materials from news, academic, and policy literature, as well as experiences from attendance at three RSPO conferences in Europe and two in Asia, to develop a qualitative understanding of the primary internal debates at the RSPO. Our third source of data comes from the RSPO website, as well as past versions of the website available from the Internet Archive. We use the Internet Archive to find documents and posts with information on total potential certified production and the share of production on the RSPO’s offset market, as compared to insetting production, reconstructing these data on either a monthly or annual basis, depending on data frequency, using linear interpolation to fill in missing observations. Our fourth data source is the GreenPalm website [

43], which provides data on transactions in the RSPO’s offset (Book & Claim or B&C) market. We downloaded all B&C members and their annual credit purchases, as well as transacted volumes and prices as of the end of the B&C market in 2016.

Our fifth, and most important, source comes from submissions of Annual Communications of Progress (ACOPs), surveys reporting activities related to sustainably certified palm oil that affiliate and ordinary RSPO members are required to submit on an annual basis. While multiple failures to submit reports can result in suspension or expulsion, there still are some problems with non-submittal [

44]. While this raises some concerns about potential selection effects, it is nevertheless the case that the vast majority of required submitters do, in fact, submit. In any case, we can presume that firms that do not bother to submit ACOPs are not particularly active in the organization. Since 2012, the ACOPs have included an item asking members to discuss challenges they have encountered in their sustainable palm oil activities, and members take the opportunity this affords to address concerns they have with standard, as well as to report challenges they have encountered more broadly. Specifically, the prompt asked “What significant economic, social or environmental obstacles have you encountered in the production, procurement, use and/or promotion of CSPO and what efforts did you make to mitigate or resolve them?” The prompt was slightly different in 2012, just asking for challenges, but, as can be seen in the results, responses were similar across years, which suggests respondents interpreted the meaning of the item in much the same way over time.

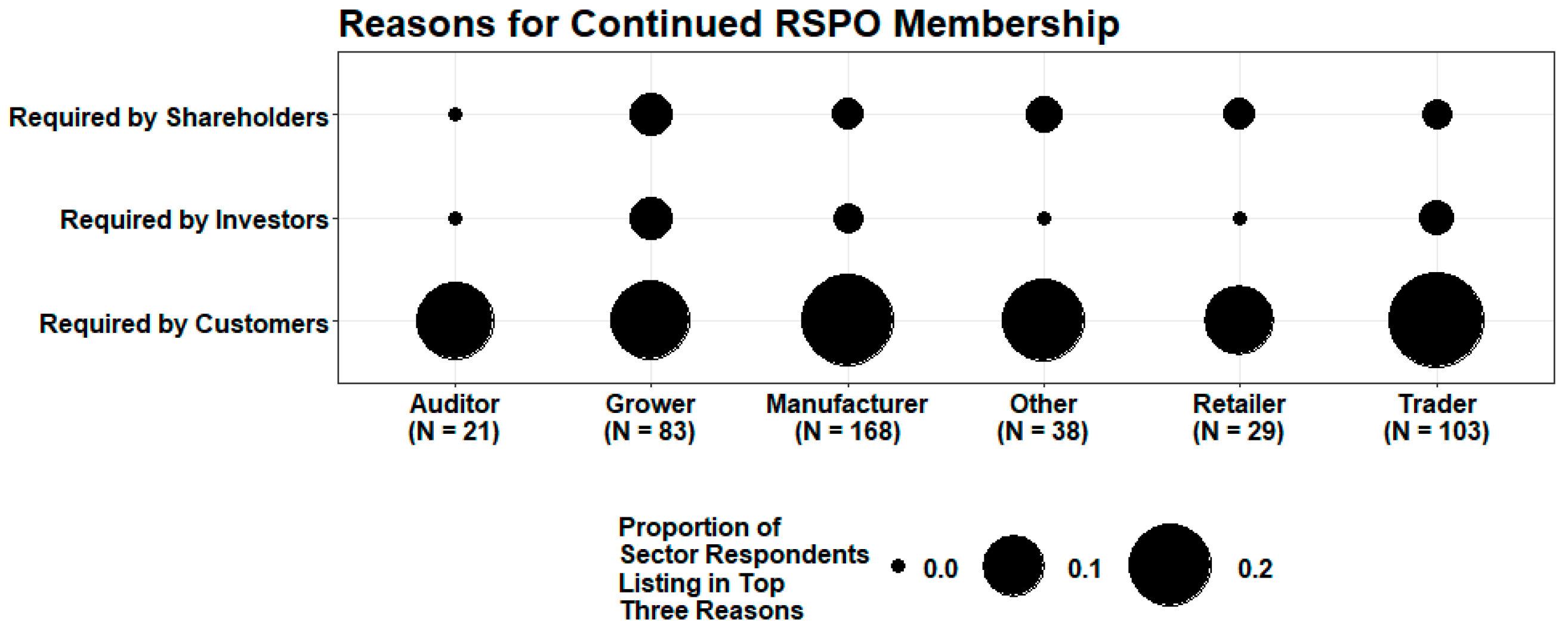

Finally, we use two items from a survey of RSPO members, conducted online in English, Bahasa Indonesia, Spanish, Chinese, and Japanese, in collaboration with the RSPO secretariat, between 09 July and 16 August 2019. Invitations to respond to the survey were shared with representatives of RSPO members through social media, the RSPO website, and RSPO’s membership email lists. Respondents were entered into a drawing for one of five $100 gift cards as an incentive. The survey received 650 responses, with 405 (approximately 10% of the RSPO membership) of the respondents answering the first item we use, which asked respondents to rank the top three reasons that their organizations continued to be RSPO members from a list of 17 possible reasons, with the option to suggest others. We consider only the proportion of respondents listing items associated with power in the supply chain in this analysis. For the second item, which asked respondents if they had helped train suppliers in an RSPO-related issue in the past year, we consider all respondents who completed at least 70% of the survey.

Responses to this item provide a valuable and broadly representative insiders’ perspective on the sustainable palm oil supply chain, but they are not easily used. We start with data first reported by Gallemore et al. [

25], who used a custom-coded R script to download and extract this item from the ACOP reports for 2012 through 2015. We augment their data by adding the 2016 ACOP reports more recently posted to the RSPO website [

41], resulting in a total of 4,200 reports. Because these responses are entered as free text, it is necessary to qualitatively code them in order to use them for analysis. For consistency with previous data, we use the coding scheme reported in the methods appendix of Gallemore et al. [

25], applying the scheme to the 2016 reports. Abbreviated definitions of the codes are found in

Table 1. Fuller definitions and coding examples are found in Gallemore et al. [

25].

5. Results: Offsetting and Insetting at the RSPO

Created in the early 2000s, the RSPO’s membership now numbers in the thousands. The organization has a strong focus on brand and supply-chain management [

43], supported by on-the-ground production standards outlined in the Principles and Criteria (P&Cs) established by its members. It also manages systems for certifying that palm oil used in products was produced in accordance with the P&Cs. While field-level implementation is expected to be uniform, allowing for variances outlined in national interpretations of the P&Cs, downstream firms can make traceability claims ranging from identifying an individual mill on the high end to an offset mechanism originally called Book & Claim (B&C)—now RSPO Credits—on the low end (

Table 2). Debates about the RSPO’s rigor involve both on-the-ground requirements and traceability expectations.

In effect, the RSPO operates two standards. As the organization’s website puts it, “One [is] to ensure that palm oil is produced sustainably […]; the other [is] to ensure the integrity of the trade in sustainable palm oil” [

44,

45]. The P&Cs’ on-the-ground requirements address what the standard is intended to do. The traceability standards, on the other hand, address how reputations can be protected and risks mitigated. The RSPO’s various supply chain tiers make it an ideal case for studying the tension between offsetting and insetting. Often, private standards with some degree of rigor fully embody either offsetting or insetting. The FSC, for example, certifies wood from the production site to the final user, tracking timber across the supply chain, only allowing offsets within a single organization’s supply chain [

46]. Offsetting, on the other hand, is dominant in voluntary carbon standards like the Verified Carbon Standard and the American Carbon Registry, where credits are used to allow firms to demonstrate efforts to reduce greenhouse gas emissions [

47]. In the RSPO, offsetting, in the form of B&C/RSPO Credits, exists alongside insetting, exemplified in the higher traceability tiers. While Bonsucro and the RTRS operate similar systems to the RSPO [

15], these initiatives are relatively new and lack an accessible database similar to the ACOP reports.

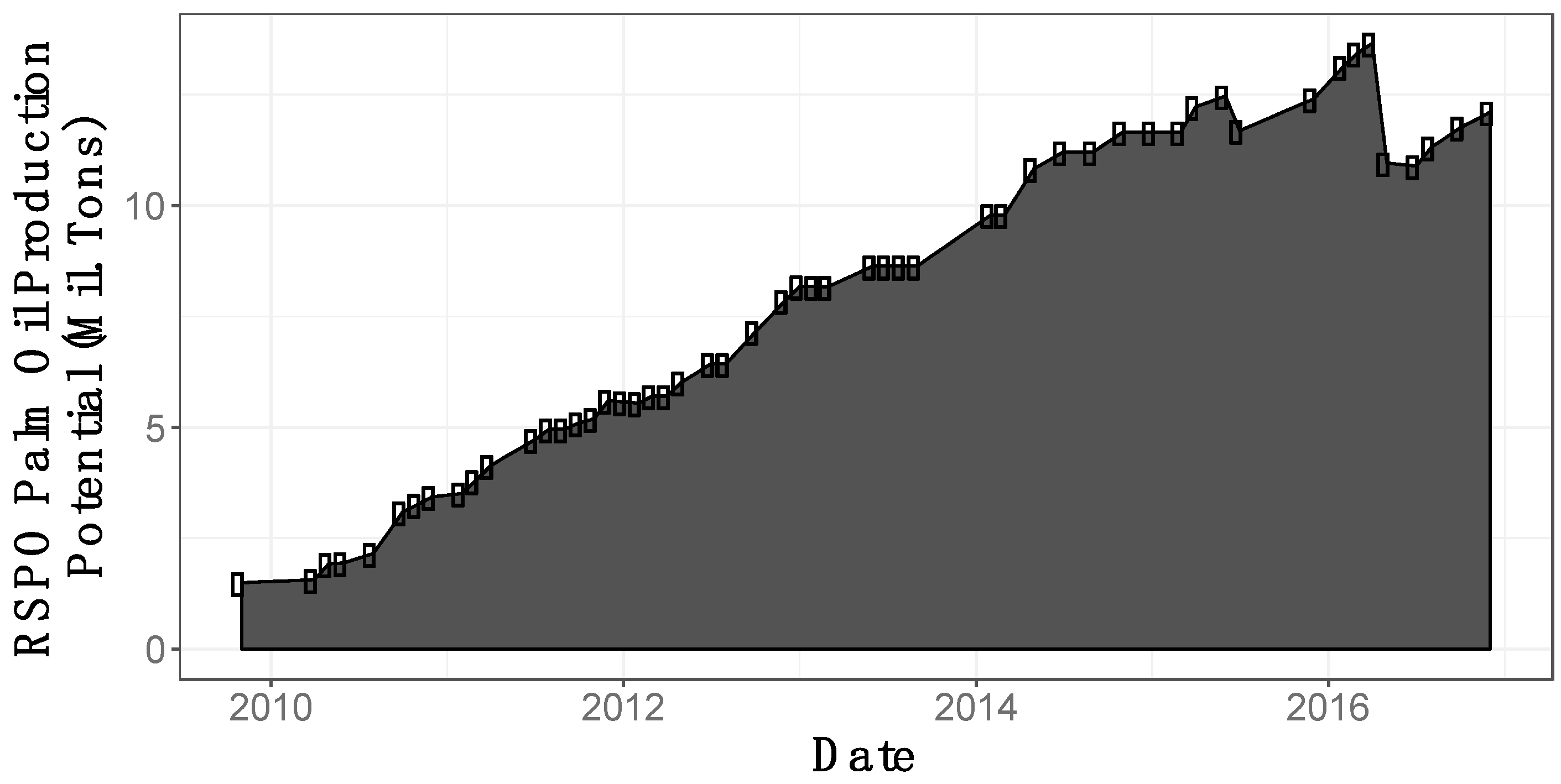

The RSPO has experienced massive increases in certified area and production capacity, particularly in the past decade (

Figure 1). All certified production must meet the P&C requirements, regardless of supply chain tier. Indeed, the only situation in which minimum on-the-ground requirements differ is when a grower is certified under RSPO NEXT, which has, as yet, not been widely adopted. From an offsetting perspective, most RSPO-certified palm oil is the same. Nevertheless, there are strong pressures motivating insetting. At least some consumers, for example, are willing to pay meaningful premiums for higher traceability tiers [

48], and several firms note in the ACOPs that their choices are based on customer demands.

Differences in consumer interest and the costs involved in building, maintaining, and monitoring separate, traceable supply chains [

17,

45] required for insetting are reflected in considerable differences in price and availability across the supply chain tiers, commonly noted in the ACOP reports. As one firm observed in 2016, “Premiums for MB [mass balance] and SG [segregated] materials are not transparent […] and differs [sic] from supplier to supplier with a considerable cost difference.” Another, in 2015, reported that “The most significant challenge we have faced is the availability of competitively priced physical supplies [that is, not B&C] of CSPO [certified sustainable palm oil].”

While a number of firms report either shifting suppliers or working with existing suppliers to support their own certification as part of their insetting strategies, such moves are not always an option. As one member complained in 2016, “We have a number of suppliers who have no plans on becoming RSPO certified as our volumes that we take from them are not large enough.” Members using low volumes of palm oil often repeat this concern. Other firms report responding to challenges in acquiring or affording more traceable oil by temporarily or permanently moving down to lower tiers, particularly to mass balance or B&C/RSPO Credits, while some move away from palm oil altogether. Some, finally, combine strategies, as was the case for one manufacturer, who reported in 2016 that their “3rd party suppliers of finished products are not all engaged with RSPO standard, making it very difficult for us to comply [with] 100% CSPO from physical supply chains. We mitigate [this] by engaging (and even switching to) new suppliers which are committed to RSPO, developing products without palm oil and by mitigating this situation with the buy[ing]/redemption of Green Palm [B&C] certificates.”

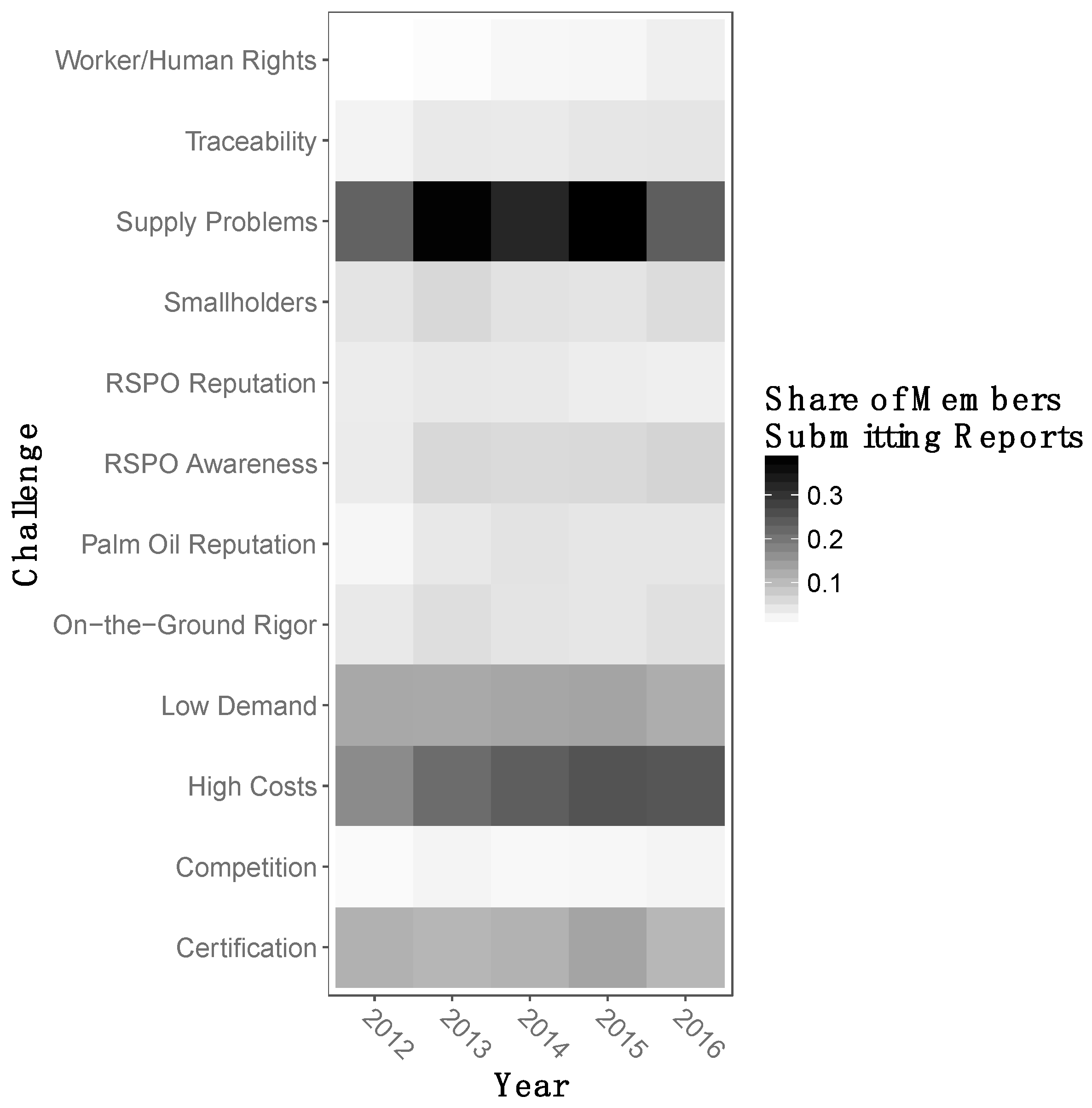

These challenges are not isolated instances but are in fact reported quite widely in the ACOPs.

Figure 2 presents the proportion of reports mentioning each of the challenges outlined in

Table 1. At their peaks, nearly 40% of ACOPs mentioned some form of supply chain challenge, and around one-third addressed high costs. Other concerns, such as the difficulty of the certification process itself, low demand for and awareness of certified palm oil, and the challenges smallholders face in achieving certification, have remained stable over time. A few other concerns, however, have steadily grown, though they are still rarely raised. Particularly notable are references to worker and human rights, coming in the wake of a powerful exposé of labor conditions on some RSPO-certified plantations in 2016 [

13], leading to renewed interest in insetting emphasizing social protections.

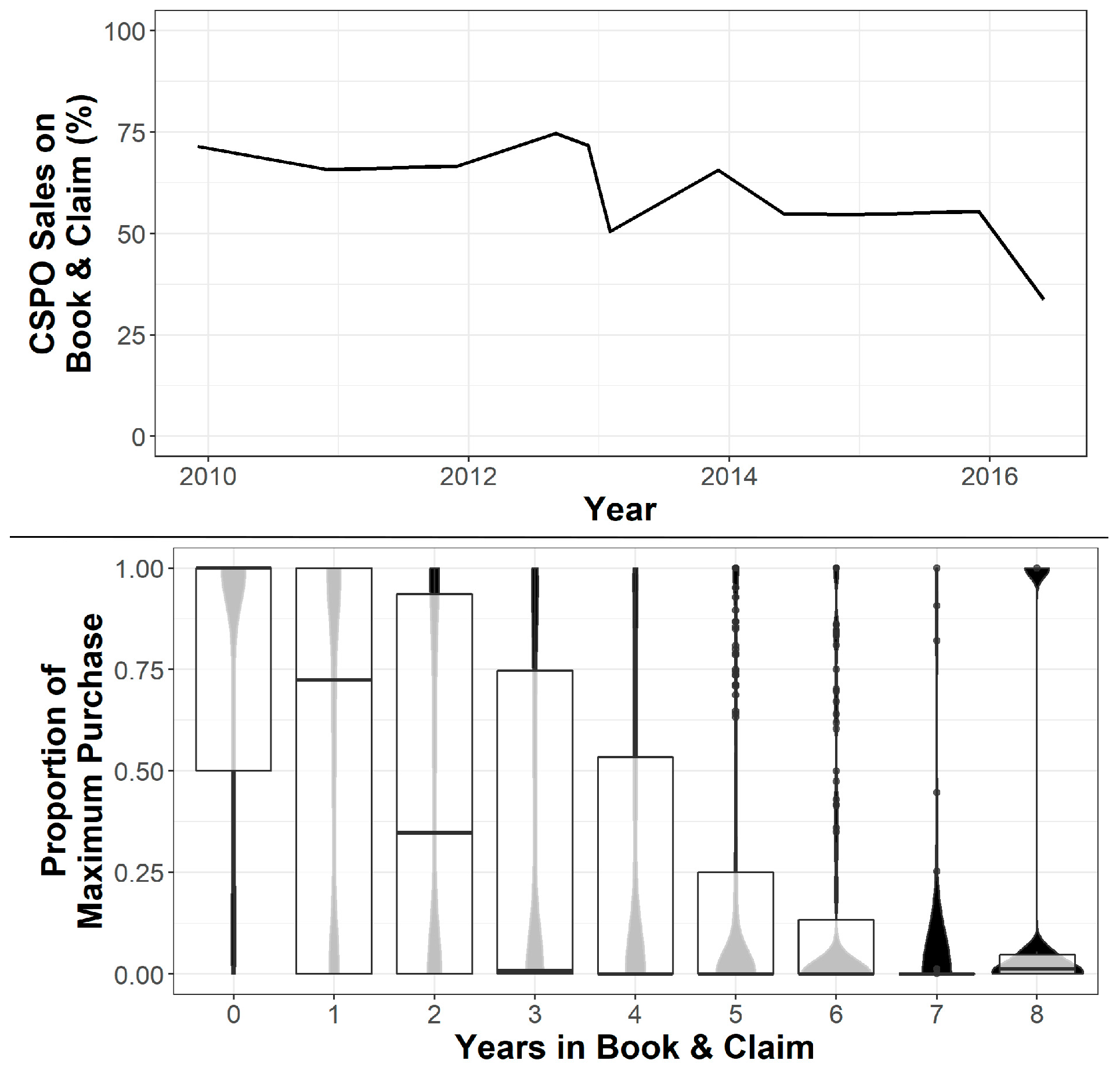

Despite the considerable challenges involved, firms are generally moving toward insetting. The top part of

Figure 3 presents the change in proportion of certified palm oil sold via B&C in the years leading up to its transition to RSPO Credits. While B&C made up about 70% of sales by volume in 2010, its share fell to less than half that by mid-2016. Evidence from firms’ activity on the B&C market suggests it is used to transition to higher supply chain tiers. The bottom of

Figure 3 plots the share of firms’ maximum annual certified sustainable palm oil credit purchase on B&C against the number of years since they either became B&C members or made their first purchase, whichever came first. With very few exceptions, firms start with their largest purchases on B&C in their first few years, transitioning toward zero over the next several years.

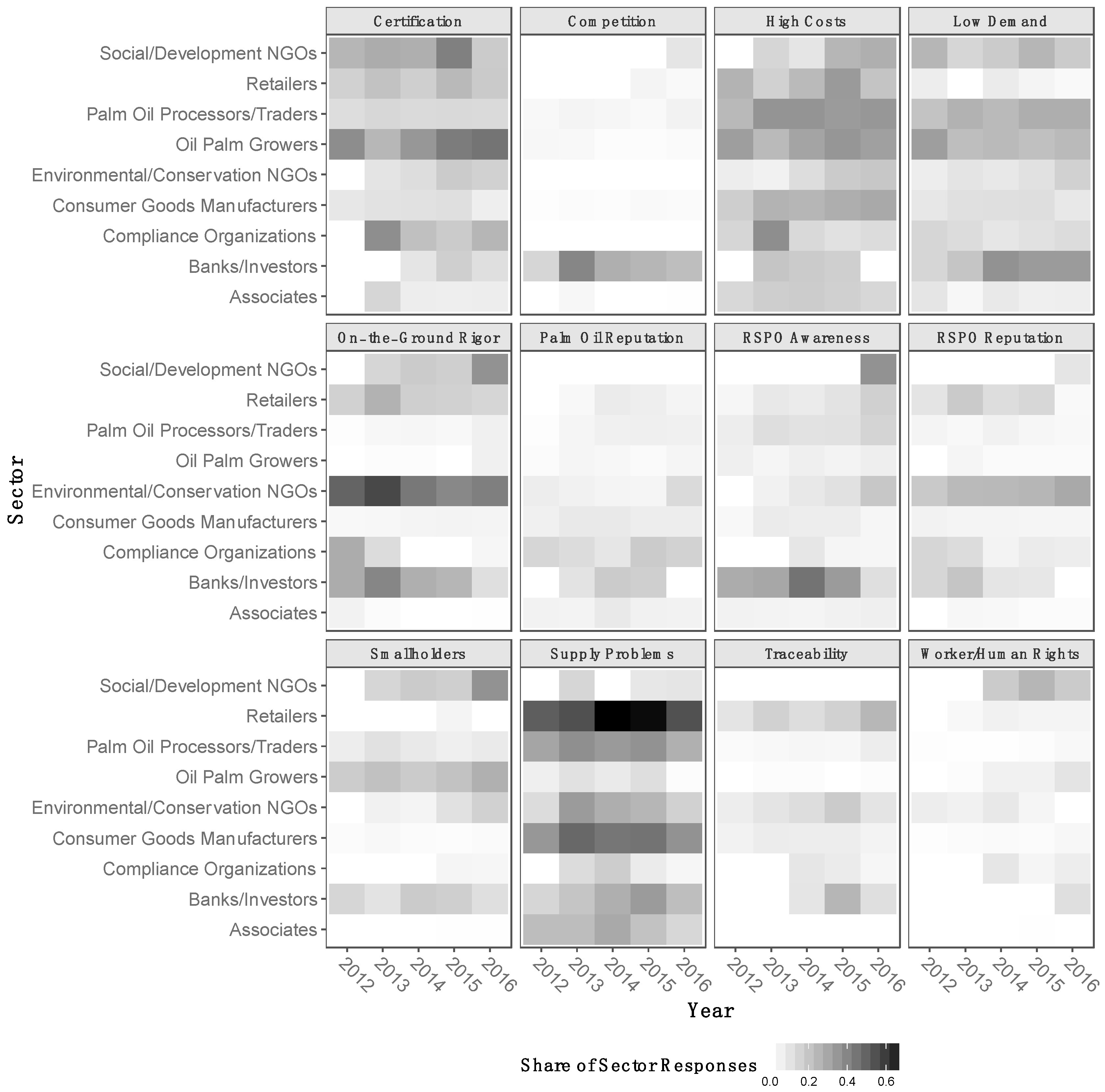

To understand the forces driving this process, it is helpful to look at the challenges noted in the ACOP reports, disaggregated by members’ supply chain sectors (

Figure 4). Growers, processors and traders, and the social/development NGOs tend to be more likely than downstream members to raise concerns about the difficulty of certification, the high costs of maintaining the standard, and low demand that makes it difficult to pass those costs on to consumers, issues that might be more effectively addressed with offsetting approaches. Consumer-facing firms, particularly retailers, conversely, are more likely to raise concerns about the standard’s degree of on-the-ground rigor, the need for improved traceability, and the brand reputation of the RSPO as a whole, concerns associated with insetting. Indeed, downstream firms sometimes sound quite similar to environmental NGOs. One environmental NGO, for example, argued in 2016 that “people ask ‘how do we know that the plantations and companies are doing what they say they are?’” The same year, a manufacturer observed, “Customers are requiring more and more information in terms of traceability and transparency within supply chains. […] It is difficult under the mass balance route to ensure that all aspects in terms of social and environmental requirements are fully compliant with RSPO expectations, without independent verifications of all parts of the supply chain taking place.”

Like smaller firms, upstream members can find themselves squeezed by these demands. In 2016, one palm oil processor and trader complained of having problems “balancing our production based on customers’ demand which requires traceable oil only instead of RSPO Mass Balance/Segregated products.” The same year, a manufacturer expressed a common sentiment among users of either relatively low volumes or diverse palm oil sources: “The complexity of our supply arrangements combined with relatively small volumes across a diverse range of ingredients continues to be a barrier to switching to segregated supply.” These members are not the only ones facing supply chain challenges.

Figure 4 demonstrates that retailers and manufacturers consistently report supply chain challenges at the highest rates, though these rates were notably lower in 2016, potentially reflecting increased availability in higher tiers as both upstream and downstream members exit the offset market. An additional problem is that the infrastructure required for segregating certified palm oil from uncertified can be locally unavailable. One member noted in 2013, for example, that “infrastructure and demand needed to secure segregated and IP [identity preserved] sources in the U.S. are lacking.” Another reported in 2015 that “availability of physically sustainable materials within certain geographies is very challenging due to the lack of development in these supply chains.”

That RSPO members as a whole gravitate toward insetting may reflect the fact that only insetting truly admits escape from the reputational risks arising from the market for lemons. One processor/trader reported in 2016, for example, that they were dealing with “customers who are not at all disposed to turn to sustainable sources” but that “part of them are more interested in traceability of palm oil.” Other members are concerned that the very existence of offsetting threatens insetting. In 2016, another processor and trader, repeating a refrain from earlier ACOPs, claimed that “competition from other schemes (i.e., ISCC [International Sustainability and Carbon Certification]) and B&C [are] hampering physical transformation.” Interestingly, ISCC is focused on traceability and is an RSPO competitor, so this member is equating offsetting with a separate standard.

Following Oosterveer [

49], we might think of insetting and offsetting as different modes of “programming” the global production network for palm oil, determining which actors are to be included in or excluded from sustainable value chains. Despite the additional transaction and segregation costs associated with increased traceability [

49], RSPO members are gravitating toward insetting, despite the cost and flexibility advantages of offsetting noted in the ACOPs. We can explain this pattern by considering the power of downstream firms, particularly retailers, in the palm oil supply chain, and the fact that downstream firms are more likely to call for increases in the standard’s rigor [

25]. These firms have higher brand exposure and tend to be more susceptible to activist pressure, two factors that motivate insetting.

Figure 5 presents the proportion of respondents to a 2019 survey of RSPO members who were asked to list up to three top reasons why they continued to be RSPO members. While members reported a diverse range of motivations for continued membership, customer requirements were listed as a top motivation consistently across the supply chain. Indeed, out of 18 options, customer requirements were the most frequently listed by all sectors except for retailers, who were more likely to report being motivated to increase the uptake of certified sustainable palm oil than being motivated by customers. Some downstream firms also conduct training to support their suppliers, and 13% of the survey respondents in the processor/trader, manufacturer, and retailer sectors reported providing RSPO-related training to supply chain members within the previous year.

A second important dimension of power in the sustainable palm oil supply chain, hinted at above, has to do with firm size. Large and small consumer goods manufacturers, despite operating in the same supply chain sector, can have very different experiences. While some smaller manufacturers may find certification useful for reaching more upscale, niche markets, others find compliance challenging, as it is difficult or impossible, as some of the above quotations suggest, for them to influence the market alone. As discussed above, insetting is not a likely option for smaller firms like these, given that certification itself is at times a challenge.

6. Discussion and Conclusions

While interest in insetting may be good news for internalizing externalities in firms’ supply chains, it may not be the best news for internalizing externalities across the industry as a whole. For smaller firms or firms using smaller or more diverse types of palm oil, insetting is difficult. Smallholders, similarly, face barriers to certification, let alone to traceability [

50], a fact noted often by growers and social/development NGOs in their ACOPs and acknowledged in the RSPO’s more positive stance toward smallholder offsets. While for smallholders and other growers market exit may not be particularly attractive, leading them to opt to remain uncertified, there is evidence from the ACOPs that some consumer goods manufacturers may turn toward palm oil alternatives. While likely substitutes for palm oil in food risk even greater environmental damage [

51,

52,

53], they have the advantage of allowing firms to escape a particularly closely observed market for lemons. The Nestlé case may represent another path, where large firms combine certification with supply chain transparency efforts managed in house. These approaches, too, have their drawbacks. As Larsen et al. [

50] point out, similar approaches can potentially be anti-democratic, even neo-colonial, as downstream firms come to be seen to dictate production practices.

While traceability commitments appear more common in the palm oil than in other sectors [

54], insetting is found in many markets. Even in the voluntary carbon market, once synonymous with offsetting, organizations like the Gold Standard [

55] and the International Carbon Reduction and Offset Alliance [

56] have made prominent statements noting that offsets are not often accepted on ethical grounds, leading firms to inset more emissions reductions within their own supply chains. Given the strong pressures favoring insetting for larger and recognizably branded firms, alongside its attendant costs, are private standards like the RSPO at risk of creating market separation [

25], in which a small number of producers escape the market for lemons but the standard fails to reach a tipping point required to cover the entire industry?

It is possible that the growing attention to jurisdictional certification efforts, and their confluence with zero deforestation commitments, might be a way of bringing offsetting and insetting’s advantages together [

57,

58]. Jurisdictional certification approaches, which bring together local government policy tools and market-based certification, are currently being built in a few regions with high production of deforestation-linked commodities [

50]. Under this model, private sector firms take on an insetting role, providing purchase guarantees, supporting contracts for smallholders, and other incentives for sustainability, while the government helps support improved practices through regulation and policy [

6,

50]. While clearly facilitating insetting, jurisdictional approaches might also provide opportunities for an offsetting model. Already the RSPO clearly differentiates credits produced by smallholders from other credits, allowing for price differentiation. Other certification standards could adopt similar approaches. Furthermore, firms’ support for smallholder certification in jurisdictional contexts could be reframed and charitable giving or a form of corporate social responsibility. Such actions need not target only smallholders in the firms’ own supply chains. While no longer using the language of offsets, this approach could still be a way of internalizing externalities without respect to direct purchasing connections. In either case, the move toward jurisdictional certification can be an opportunity to rethink the division between insetting and offsetting and look for hybrid means to internalize externalities