Research on Risk Measurement of Supply Chain Emergencies in International Capacity Cooperation

Abstract

:Highlights

- The main hot spots of the risk of international capacity cooperation research have been proposed.

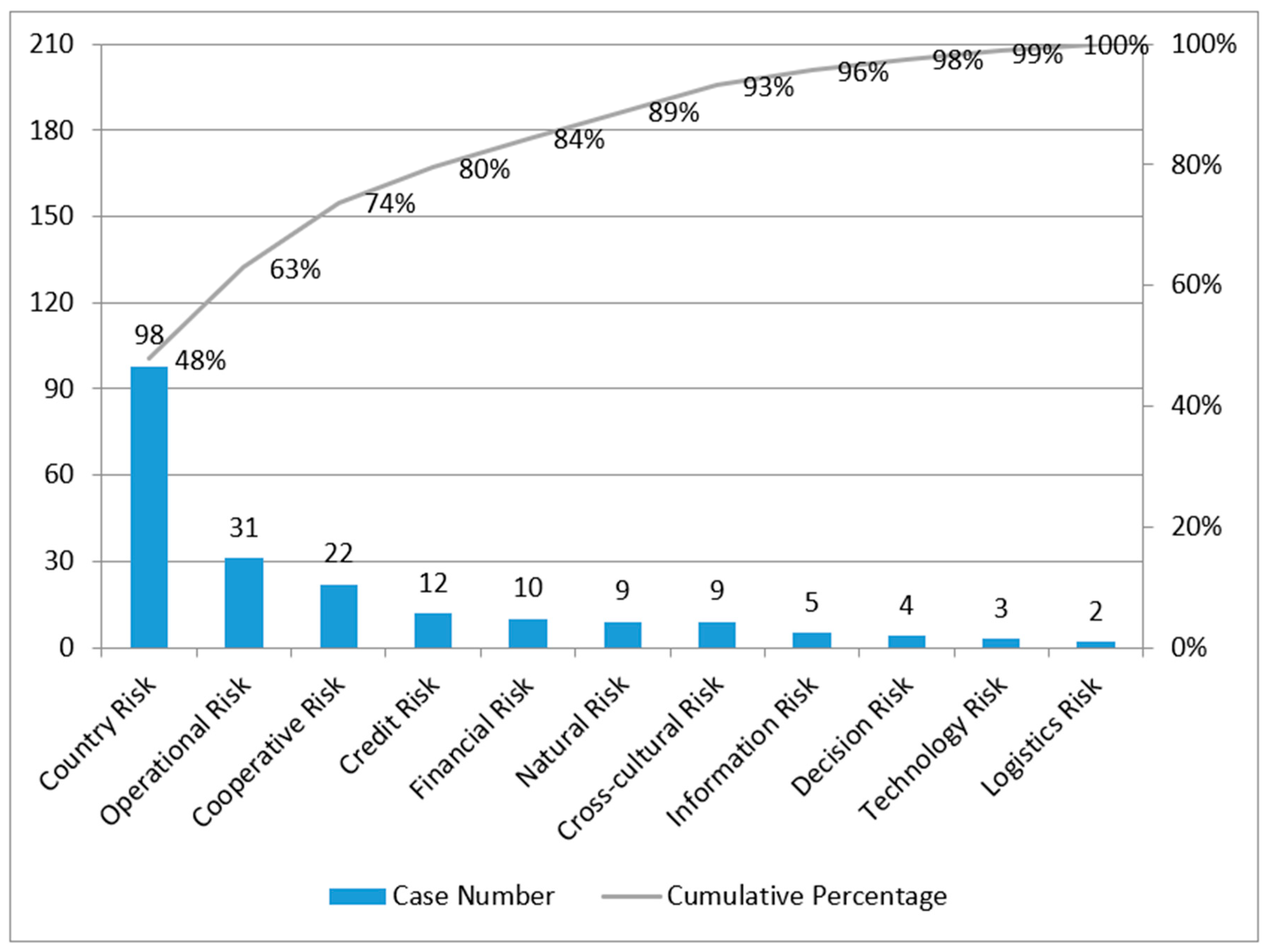

- It was found that country risk is the main cause of supply chain emergencies in international capacity cooperation

- Classification of the risk of international capacity cooperation.

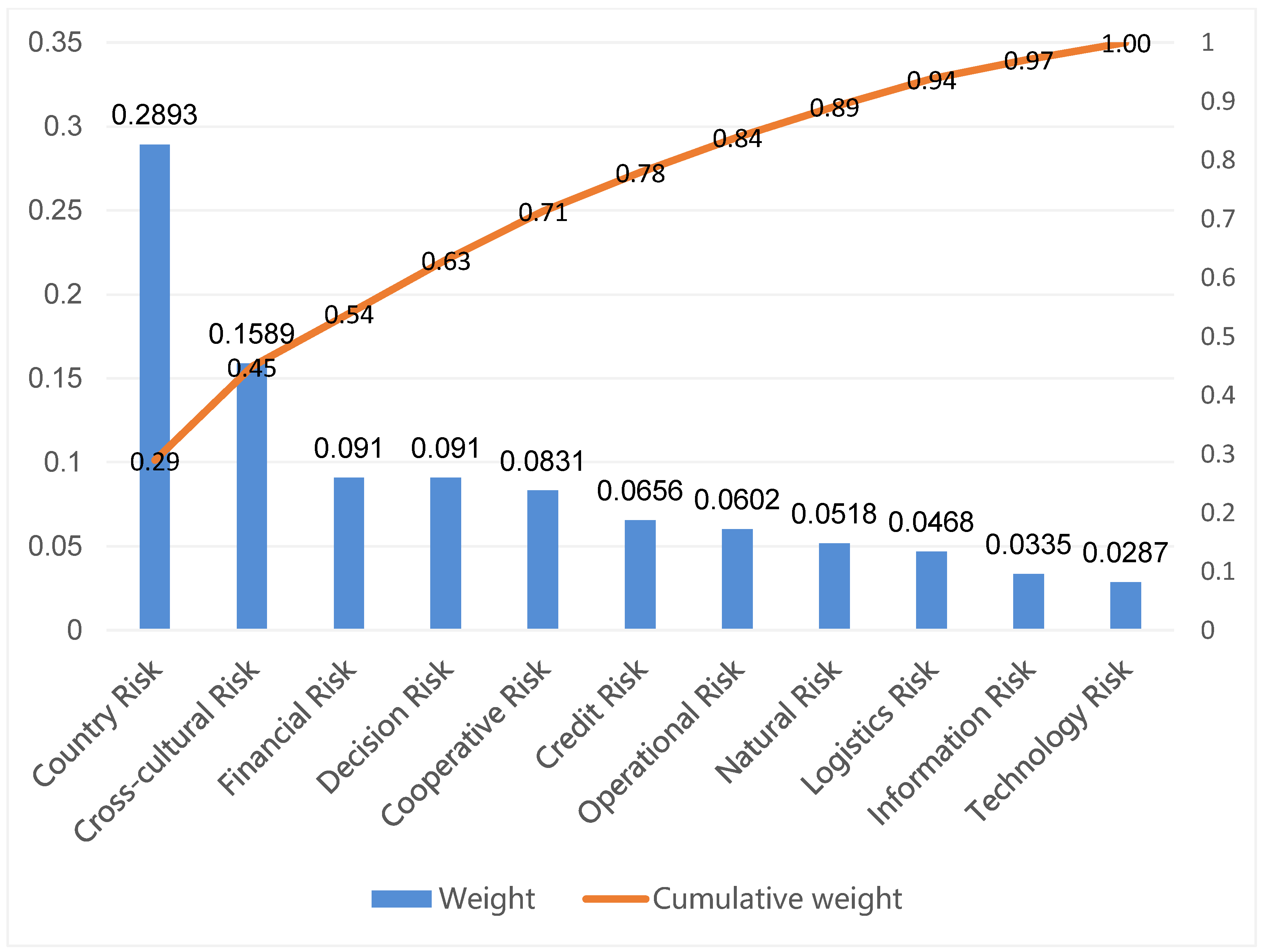

- Using Fuzzy AHP, a measurement model of international capacity cooperation risk is presented.

1. Introduction

2. Literature Review

2.1. International Capacity Cooperation Theory

2.2. Risk Type

2.2.1. Foreign Investment Risk

2.2.2. Industrial Transfer Risk

2.2.3. “Go Global” Risk

2.2.4. Transnational Business Risk

2.2.5. Value Chain Risk

2.2.6. Supply Chain Risk

2.2.7. International Capacity Cooperation Risk

2.3. Risk Measurement

3. Methodology

4. Supply Chain Emergency Risk Types of International Capacity Cooperation

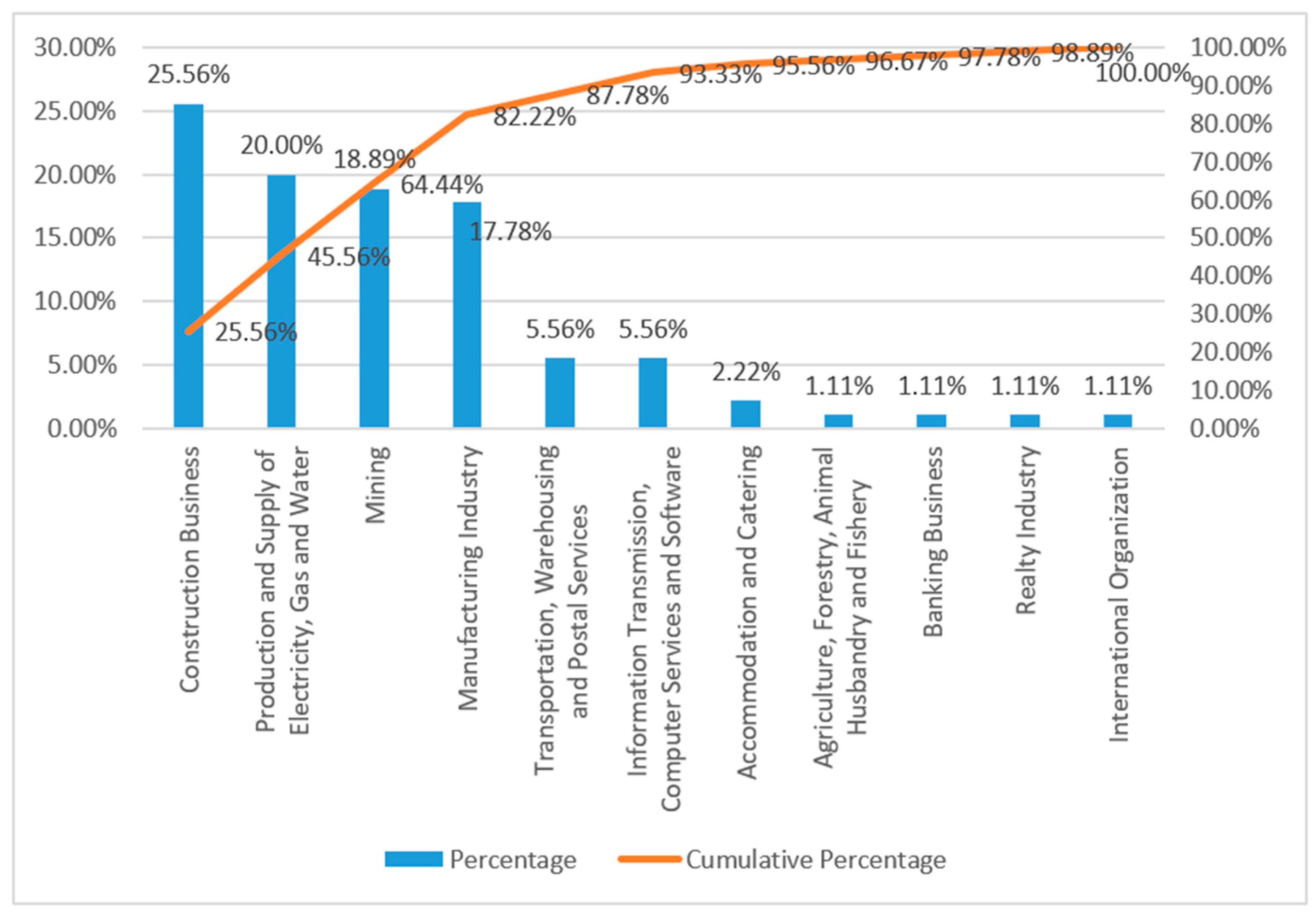

5. Industrial Areas Where Emergencies are Easy to Erupt

6. Risk Measurement and Application Case of International Capacity Cooperation

6.1. Risk Measurement Indexes and Identification

6.2. Evaluation Method and Steps of Index Measurement

6.2.1. Defining the Risk Index Comparison Scale Criteria

6.2.2. Construct a Fuzzy Judgment Matrix

6.2.3. Comprehensive Measure of the Importance of Evaluation Indexes

6.2.4. Compare the Importance of Each Index

6.2.5. Determine the Score ri for Each Index of Each Program

6.3. Measure Analysis and Comprehensive Weight Calculation

6.4. Case Use of Risk Measurement Model

7. Conclusions and Discussion

Author Contributions

Funding

Conflicts of Interest

References

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/xwzx/gnxw/67936.htm (accessed on 25 April 2019).

- Zhou, B.G. The risk prevention and utilization of “go global” of enterprises under the new situation. Int. Econ. Coop. 2016, 11, 47–50. [Google Scholar]

- Tencent News. Available online: https://news.qq.com/a/20110524/000285.htm (accessed on 25 April 2019).

- Sina. Available online: http://finance.sina.com.cn/chanjing/gsnews/20141108/024020764887.shtml (accessed on 25 April 2019).

- Xianjichina. Available online: https://www.xianjichina.com/news/details_81673.html (accessed on 25 April 2019).

- Casson, M.; Lopes, T.D.S. Foreign direct investment in high-risk environments: An historical perspective. Bus. Hist. 2013, 3, 375–404. [Google Scholar] [CrossRef]

- Finance.Ifeng.Com. Available online: https://finance.ifeng.com/a/20180418/16130298_0.shtml (accessed on 10 June 2019).

- ZOL. Available online: http://appnews.zol.com.cn/topic/7019723.html (accessed on 15 July 2019).

- Dunning, J.H. The Eclectic Paradigm of International Production: A Restatement and Some Possible Extensions. J. Int. Bus. Stud. 1987, 11, 9–31. [Google Scholar] [CrossRef]

- Shao, Y.G.; Guo, X.; Yang, N.D. Research on investment risk of foreign direct investment projects based on international production compromise theory. Soft Sci. 2008, 9, 41–44. [Google Scholar]

- Zhao, D.Y.; Liu, S.W. Research on risk prevention and control of international capacity cooperation. Int. Econ. Coop. 2016, 3, 66–70. [Google Scholar]

- Zhang, L.L. The risk and prevention of China’s overseas investment. J. Henan Univ. 1997, 3, 63–66. [Google Scholar]

- Bai, Y. The risk management of foreign investment in Chinese enterprises. Int. Econ. Coop. 2005, 12, 7–11. [Google Scholar]

- Nie, M.H. Risk analysis of foreign direct investment of Chinese enterprises. Econ. Manag. 2009, 31, 52–56. [Google Scholar]

- Zhang, Q. Risk prevention of foreign direct investment of Chinese enterprises in the post-crisis era. China Bus. 2010, 21, 48–49. [Google Scholar]

- Tai, P.; Li, J. Construction of risk prevention system of China’s foreign direct investment under the new system of open economy. Asia-Pac. Econ. 2015, 4, 122–127. [Google Scholar]

- Invest in China. Available online: http://www.fdi.gov.cn/1800000121_35_2022_0_7.html (accessed on 18 April 2019).

- Sun, N.S. Risk response mechanism of externally invested PPP projects under the background of “the Belt and Road”. Res. Rule Law Mod. 2018, 3, 32–40. [Google Scholar]

- Nie, N. China participates in the joint construction of the Belt and Road’s foreign investment risk sources and prevention mechanism. Contemp. Econ. Manag. 2016, 38, 84–90. [Google Scholar]

- Fitzpatrick, M. The Definition and Assessment of Political Risk in International Business: A Review of the Literature. Acad. Manag. Rev. 1983, 2, 249–254. [Google Scholar] [CrossRef]

- Huang, J.K.; Li, M.M.; Ji, J.H. The risk aversion path of undertaking industrial transfer in underdeveloped areas. Mod. Bus. Ind. 2014, 26, 20–21. [Google Scholar]

- Tang, L.Y.; Zhang, Q.Y.; Wang, H.Q. Software industry based on ISM undertaking international industry transfer risk research. Value Eng. 2007, 8, 1–4. [Google Scholar]

- Li, F.S. Research on the national risk of Chinese enterprises’ “go global”. Lat. Am. Study 2006, 6, 51–55. [Google Scholar]

- Liu, H.; Wang, D.Y. Implementation of “go global” strategy and national risk assessment of OFDI: 2008–2009. Int. Trade 2010, 10, 53–56. [Google Scholar]

- Wang, R. The risks faced by Chinese enterprises “go global” and the countermeasures of management and control. Ref. Econ. Res. 2012, 38, 69–75. [Google Scholar]

- Han, Z.H.; Yuan, Y. The risk and countermeasures of “go global” under the background of financial crisis. Macroecon. Manag. 2013, 3, 57–58. [Google Scholar]

- Ye, Y.G. Methods of foreign exchange risk management by transnational corporations. Int. Financ. Res. 1986, 4, 33–35. [Google Scholar]

- Tong, S.; Cheng, J.H. The political risk of transnational operation of resource-based enterprises in China and its avoidance. Int. Trade Issues 2006, 1, 90–95. [Google Scholar]

- Duan, W.J.; Nie, M.; Zhang, X. Research on the risk of Industrial cluster upgrading under global value chain. Sci. Technol. Prog. Countermeas. 2007, 11, 154–158. [Google Scholar]

- Wang, J.G.; Li, B.X. Value chain risk analysis and its countermeasures. Sci. Technol. Manag. 2009, 11, 41–43. [Google Scholar]

- Ma, S.H. How to prevent supply chain risk? Chin. Comput. User 2003, 3, 21. [Google Scholar]

- Ni, Y.L.; Li, H.Y.; Yan, X. Comparison between supply chain risk management and enterprise risk management. Logist. Technol. 2004, 12, 40–42. [Google Scholar]

- Geng, D.M.; Fu, K.J.; Song, H.L. Identification and prevention of supply chain risk of large enterprise groups. Enterp. Econ. 2009, 7, 29–32. [Google Scholar]

- Dong, Q.L. Research on integrated management of supply chain emergencies. Logist. Technol. 2009, 28, 180–184. [Google Scholar]

- Guo, J.L.; Yan, D. A study on the risks and countermeasures of international capacity cooperation under the Belt and Road initiative. Int. Trade 2017, 4, 19–25. [Google Scholar]

- Mei, J.P. National risk and financial choice of international capacity cooperation in the Belt and Road initiative construction. Jiangxi Soc. Sci. 2018, 38, 68–73. [Google Scholar]

- Su, S.B.; Huang, R.H. Attribute hierarchy model based on triangular fuzzy number. Syst. Eng. Theory Pract. 2006, 26, 115–119. [Google Scholar]

- Li, H.; Sun, R.; Lee, W.-J.; Dong, K.; Guo, R. Assessing risk in chinese shale gas investments abroad: Modelling and policy recommendations. Sustainability 2016, 8, 708. [Google Scholar] [CrossRef]

- Leśniak, A.; Kubek, D.; Plebankiewicz, E.; Zima, K.; Belniak, S. Fuzzy AHP application for supporting contractors’ bidding decision. Symmetry 2018, 10, 642. [Google Scholar] [CrossRef]

- Baidu Wenku. Available online: https://wenku.baidu.com/view/25ffbf10876fb84ae45c3b3567ec102de2bddfc0.html (accessed on 5 April 2019).

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/74582.htm (accessed on 6 April 2019).

- Baidu Wenku. Available online: https://baike.baidu.com/item/National risk/10330131?fr=aladdin (accessed on 5 April 2019).

- Sohu. Available online: http://business.sohu.com/20150201/n410510990.shtml (accessed on 6 April 2019).

- MBAlib. Available online: https://wiki.mbalib.com/wiki/%E8%B7%A8%E6%96%87%E5%8C%96%E9%A3%8E%E9%99%A9 (accessed on 5 April 2019).

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/68872.htm (accessed on 6 April 2019).

- Pan, W.R. Supply chain risk identification and evaluation. North. Econ. 2006, 16, 23–24. [Google Scholar]

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/66607.htm (accessed on 6 April 2019).

- Liu, J.P. The cause of formation and prevention of enterprise financial risk. Traffic Enterp. Manag. 2013, 28, 66. [Google Scholar]

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/6841.htm (accessed on 6 April 2019).

- Baidu Wenku. Available online: https://baike.baidu.com/item/Information risk/5780033?fr=aladdin (accessed on 5 April 2019).

- Sohu. Available online: http://www.sohu.com/a/245355268_100240421 (accessed on 8 April 2019).

- Sun, J.Q. Logistics Risk Management; Northeast University of Finance and Economics Press Co., Ltd.: Dalian, China, 2019; p. 11. ISBN 978-7-565-43458-7. [Google Scholar]

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/6664.htm (accessed on 6 April 2019).

- Zhongyi Finance and Economics Website. Available online: http://www.zhongyi9999.com/ask-hot/32229.html (accessed on 5 April 2019).

- Capital Construction Daily. Available online: http://sdjsb.bjd.com.cn/html/2017-06/07/content_139301.htm (accessed on 6 April 2019).

- Li, R.Z. International Financial Law; Wuhan University Press: Wuhan, China, 2011; p. 23. ISBN 978-7-307-09096-5. [Google Scholar]

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/66329.htm (accessed on 6 April 2019).

- MBAlib. Available online: https://doc.mbalib.com/tag/Operational risk (accessed on 6 April 2019).

- China Belt and Road Website. Available online: https://www.yidaiyilu.gov.cn/zchj/zcfg/66488.htm (accessed on 5 April 2019).

- Sina. Available online: http://ishare.iask.sina.com.cn/f/Lnzp1ugOTz.html (accessed on 6 April 2019).

- Li, S.S.; Zhang, G.L. China’s direct investment layout and optimization choice for countries along the Belt and Road: Taking into account investment motivation and risk aversion. Explor. Econ. Probl. 2018, 9, 111–124. [Google Scholar]

- Dong, Q.L.; Yan, B.R. Risk-Crisis Integrated Response of the Network Chain Towards Global Value Chain. China Circ. Econ. 2019, 33, 74–86. [Google Scholar]

| Types of Risk | Risk Meaning | Typical Cases | |

|---|---|---|---|

| External Risks | Natural Risk | Risks due to natural phenomena, physical phenomena and other material phenomena, such as earthquake, flood, fire, wind, disaster, frost, drought, plague, and various plague, etc. [40]. | On 16 April 2016, an earthquake measuring 7.8 on the Richter scale struck off the coast of Ecuador, 654 people were killed, 68 people were missing and more than 16,000 people were injured. On 13 April 2016, the first four units of the Sinclair Hydropower Station project which was built by a Chinese company had just been put into production. Fortunately, after systematic risk investigation, it was safe in the event of a strong earthquake [41]. |

| Country Risk | In international economic activities, the possibility and consequences of losses caused by the sovereign actions of the state, including the risks of economic foundation, solvency, social resilience, political risk and relations with China [42]. | In 2015, the Greek government announced the suspension of the privatization plan of Piraeus Port, saying that it would reassess cooperation with the COSCO Group. Although the Deputy Minister of Shipping of the country later said that the new Greek government respected the agreement reached with the COSCO Group in 2008, it still reflects the great uncertainty of overseas investment [43]. | |

| Cross-cultural Risk | In cross-border economic activities, due to the cultural differences between investment and business entities, the resulting cultural conflicts cannot be resolved reasonably, resulting in the failure of economic cooperation and the failure of mergers and other risk consequences, including the cultural risk of the family, value difference risk, communication risk, religion and customs risk, etc. [44]. | In 2016, Samoan media reported that some of the product descriptions of a Chinese-made baby bath lotion were incorrectly translated in English, making it impossible for local consumers to understand its exact meaning. Subsequently, the Ministry of Commerce, Industry and Labor of Samoa conducted an investigation into the baby body soap, requiring local importers to stop importing the product, and the products already on the shelves to be recalled [45]. | |

| Internal Risks | Cooperative Risk | The uncertainty and consequences of the lack of mutual trust because of the lack of necessary communication between enterprises [46]. | A Chinese engineering company signed a housing construction contract with the relevant departments of Gabon through an intermediary. When the contract did not complete the signing process and the other party’s funds were not in place, the company began construction. Later, because the contract could not be implemented, the company suffered huge losses and there were labor disputes, the incident caused a bad influence [47]. |

| Financial Risk | The possibility and consequences of economic losses suffered by an enterprise in various financial activities, due to various unpredictable and uncontrollable factors, which cause the final financial results obtained by the company to deviate from the expected business objectives within a certain period of time and within a certain range [48]. | After a Chinese enterprise signed the equipment design and installation contract with a Tajikistan company, the capital chain of the Tajikistan party broke, resulting in a long-term shutdown of the project and causing great losses to the Chinese company [49]. | |

| Information Risk | A relatively risky phenomenon of information inaccuracy, lag and other adverse consequences caused by information asymmetry and serious information pollution in the process of sharing information [50]. | A Chinese company acquired an iron mine in western Australia, because of inadequate access to geological data and project information. It was later found that the mine was not hematite, but magnetite. Coupled with the lack of supporting ports, railways and other mine export channels, the project had a huge loss [51]. | |

| Logistics Risk | The possible risks and uncertainties in or after the operation of logistics projects, including logistics timeliness risk, logistics security risk, logistics accuracy risk, logistics cost risk, customs clearance risk and so on [52]. | A Chinese enterprise exported bearings to Russia, because of the difference of customs code, the import tax rate was very different. According to the report of the relevant competitive enterprises, the Russian Customs approved the export products of the Chinese enterprises at a high tax rate, resulting in loss of enterprises and reduction of market share [53]. | |

| Decision Risk | The possibility and consequences that decision-making activities cannot achieve the desired purpose due to the existence of many uncertain factors, such as subject, object and so on [54]. | In 2011, China Overseas Engineering Co., Ltd. participated in the Polish A2 Highway Project, with a total price of 1.3 billion Polish zloty (about 3.049 billion RMB), but the project was already struggling in the past two-thirds of the time limit, with an estimated loss of 395 million US dollars (about 2.545 billion RMB). Eventually, it decided to abandon the project. The Polish Highway Authority filed a claim for 741 million zloty ($271 million) with the Overseas China Commonwealth [55]. | |

| Credit Risk | The risk of breach of contract—the possibility and consequences of the failure or unwillingness of the counterparty to perform the contract, which constitutes a breach of contract and causes losses to the relevant stakeholders [56]. | A Chinese oil equipment exporter trusted too much the commercial credit of a Venezuelan oil company, failed to sign the self-protection clause and delivered the goods lightly. Due to the long-term arrears of about 1 billion yuan, the enterprise bankrupted and was taken over by other enterprises [57]. | |

| Operational Risk | In the course of business operation, because of the complexity and variety of the external environment and the limitation of the cognitive ability and adaptability to the environment, the enterprises may fail in operation or fail to achieve the expected objectives of operation activities. Operational risk refers the possibility and the losses associated with this [58]. | When a Chinese-funded enterprise contracted a project in Cameroon, it signed a subcontract with a Chinese enterprise. The latter subcontracted the civil engineering to individuals, forming a “layer by layer subcontracting”, which led to the general contractor unable to control the construction team. The three parties had disputes over the construction period, project quality and project funds, and then spent more than half a year and bore a large economic loss before rectifying the problem. But as a result, the project could not be completed and delivered on time, which had a negative impact on the outside world [59]. | |

| Technology Risk | The possibility and consequences that the economic benefits of investment projects may deviate from the level predicted or expected by people because of the change of technological factors. Including the risk of technology shortage, technology development risk, technology protection risk, technology use risk, technology acquisition and transfer risk, etc. [60]. | In 2006, because Toyota, GM, Volkswagen, Nissan and other international automobile giants went to Russia for production, Russia no longer urgently needed to introduce foreign automobile enterprises, so it began to choose joint ventures, and Chinese automobile enterprises became the target of “tacit rejection” [53]. | |

| Target Layer | Criterion Layer | Primary Index | Evaluation Reference Content |

|---|---|---|---|

| International Capacity Cooperation Risk | External Risks | Natural Risk R1 | According to the frequency of natural disasters in recent years, judging by the possibility, risk and vulnerability of natural disasters |

| Country Risk R2 | According to the results of country risk rating in CROIC-IWEP, the corresponding risk score is 1–9 | ||

| Cross-cultural Risk R3 | Ethnic culture risk, value difference risk, communication risk, religion and customs risk, and so on | ||

| Internal Risks | Cooperative Risk R4 | The degree of mutual trust of the main partners, the fairness of benefit distribution, the effectiveness of the corresponding risk mechanism, and so on | |

| Financial Risk R5 | Major failure rate of information technology and equipment, capital flow, final product cost, capital flow of main node enterprises, overall coordination ability of core enterprises, etc. | ||

| Information Risk R6 | Coordination of information sharing and intellectual property protection, bullwhip effect intensity, failure degree of data storage and transmission, etc. | ||

| Logistics Risk R7 | Late delivery rate, product damage rate, customs clearance, etc. | ||

| Decision Risk R8 | Market volatility, understanding of the target market, etc. | ||

| Credit Risk R9 | Using the credit rating results, the corresponding risk score is 1–9 | ||

| Operational Risk R10 | The core business capability and structural stability of the main node enterprises, etc. | ||

| Technical Risk R11 | Enterprise technological innovation ability, supplier production flexibility, exclusive supplier, etc. |

| Scale | Explanation |

|---|---|

| 0.5 | Risk Ri is as important as risk Rj |

| 0.6 | Risk Ri is slightly more important than risk Rj |

| 0.7 | Risk Ri is significantly more important than risk Rj |

| 0.8 | Risk Ri is much more important than risk Rj |

| 0.9 | Risk Ri is extremely important than risk Rj |

| 0.1, 0.2, 0.3, 0.4 | If the risk Ri is compared with the risk Rj to obtain a judgment aij, the judgment of the risk Rj compared with the risk Ri is aji = 1–aij |

| R1 | R2 | R3 | |

|---|---|---|---|

| R1 | (0.5, 0.5, 0.5) | (0.3, 0.3, 0.4) (0.3, 0.4, 0.5) (0.2, 0.3, 0.4) | (0.3, 0.3, 0.4) (0.4, 0.5, 0.6) (0.2, 0.3, 0.4) |

| R2 | (0.6, 0.7, 0.7) (0.5, 0.6, 0.7) (0.6, 0.7, 0.8) | (0.5, 0.5, 0.5) | (0.7, 0.7, 0.8) (0.4, 0.5, 0.6) (0.5, 0.6, 0.7) |

| R3 | (0.7, 0.7, 0.6) (0.4, 0.5, 0.6) (0.6, 0.7, 0.8) | (0.2, 0.3, 0.3) (0.4, 0.5, 0.6) (0.3, 0.4, 0.5) | (0.5, 0.5, 0.5) |

| R1 | R2 | R3 | |

|---|---|---|---|

| R1 | (0.500, 0.500, 0.500) | (0.267, 0.333, 0.433) | (0.300, 0.367, 0.467) |

| R2 | (0.567, 0.667, 0.733) | (0.500, 0.500, 0.500) | (0.533, 0.600, 0.700) |

| R3 | (0.567, 0.633, 0.667) | (0.300, 0.400, 0.467) | (0.500, 0.500, 0.500) |

| The Importance of Risk Indexes | Ranked Fuzzy Vector Set |

|---|---|

| I1 | (0.049, 0.069, 0.098) |

| I2 | (0.081, 0.107, 0.138) |

| I3 | (0.070, 0.093, 0.120) |

| Criterion Layer | External Risk | Internal Risk | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Index | R1 | R2 | R3 | R4 | R5 | R6 | R7 | R8 | R9 | R10 | R11 |

| Weight | 0.051 8 | 0.289 3 | 0.158 9 | 0.083 1 | 0.091 0 | 0.033 5 | 0.046 8 | 0.091 0 | 0.065 6 | 0.060 2 | 0.028 7 |

| Risk Type | Project 1 | Project 2 |

|---|---|---|

| Country Risk | 6.0 | 4.0 |

| Cross-cultural Risk | 6.0 | 4.0 |

| Financial Risk | 3.0 | 3.0 |

| Decision Risk | 3.5 | 3.0 |

| Cooperative Risk | 4.0 | 3.5 |

| Credit Risk | 4.5 | 3.5 |

| Operational Risk | 5.0 | 4.0 |

| Natural Risk | 4.0 | 3.0 |

| Logistics Risk | 3.5 | 2.5 |

| Information Risk | 4.5 | 4.0 |

| Technology Risk | 5.0 | 6.0 |

| Total Risk Score | 4.57090 | 3.56335 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, B.-R.; Dong, Q.-L.; Li, Q. Research on Risk Measurement of Supply Chain Emergencies in International Capacity Cooperation. Sustainability 2019, 11, 5184. https://doi.org/10.3390/su11195184

Yan B-R, Dong Q-L, Li Q. Research on Risk Measurement of Supply Chain Emergencies in International Capacity Cooperation. Sustainability. 2019; 11(19):5184. https://doi.org/10.3390/su11195184

Chicago/Turabian StyleYan, Bo-Rui, Qian-Li Dong, and Qian Li. 2019. "Research on Risk Measurement of Supply Chain Emergencies in International Capacity Cooperation" Sustainability 11, no. 19: 5184. https://doi.org/10.3390/su11195184

APA StyleYan, B.-R., Dong, Q.-L., & Li, Q. (2019). Research on Risk Measurement of Supply Chain Emergencies in International Capacity Cooperation. Sustainability, 11(19), 5184. https://doi.org/10.3390/su11195184