Redundancy Identification and Optimization Scheme of Branches for Sustainable Operation of Commercial Banks

Abstract

1. Introduction

2. Literature Review

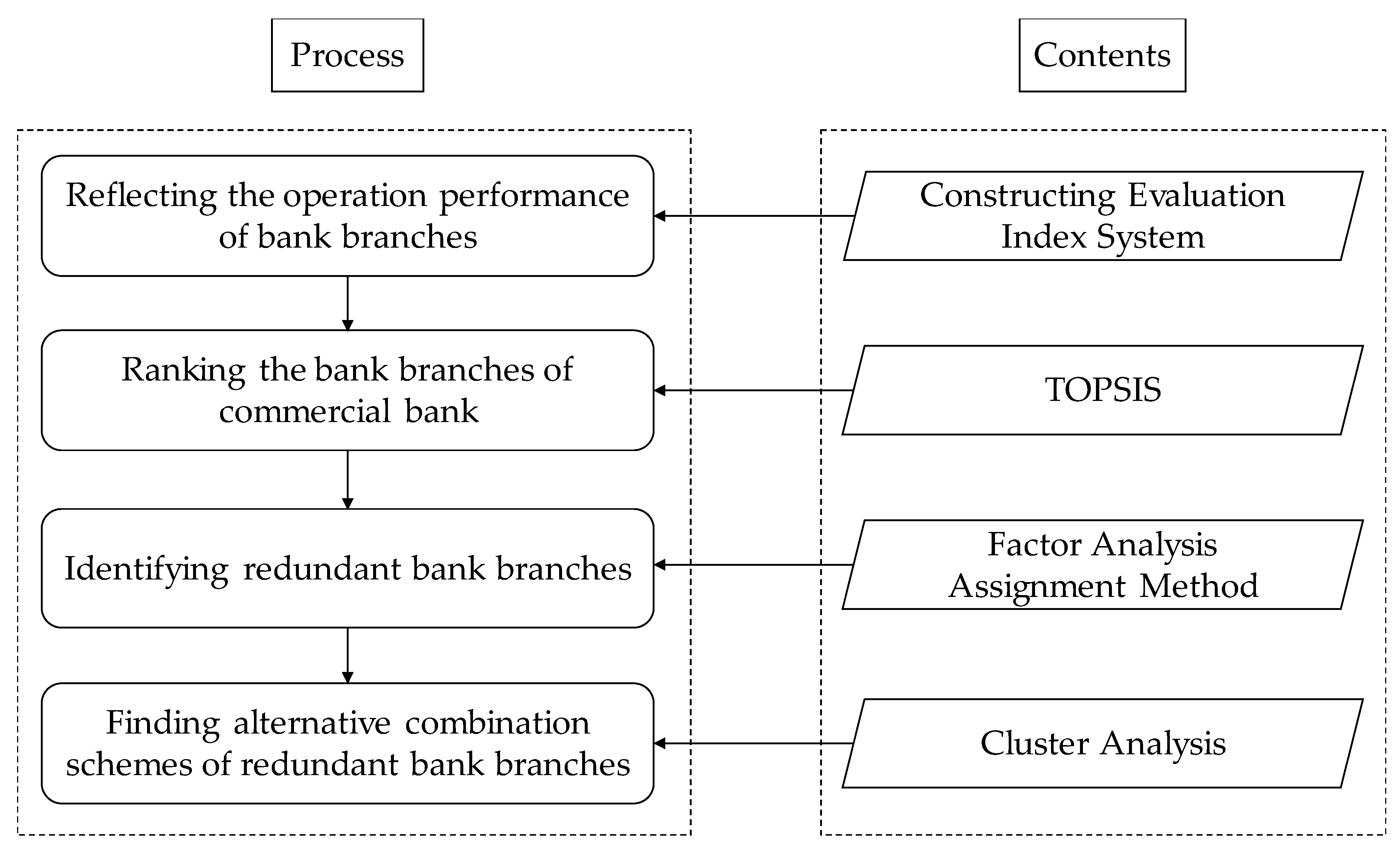

3. Materials and Methods

3.1. Constructing the Evaluation Index System

3.2. TOPSIS

3.3. Factor Analysis

3.4. Assignment Method

3.5. Cluster Analysis

4. Results and Discussion

4.1. Case Study

4.2. Employing TOPSIS to Judge the Ranking of Bank Branches

4.3. Using Factor Analysis and Assignment Method to Identify Redundant Bank Branches

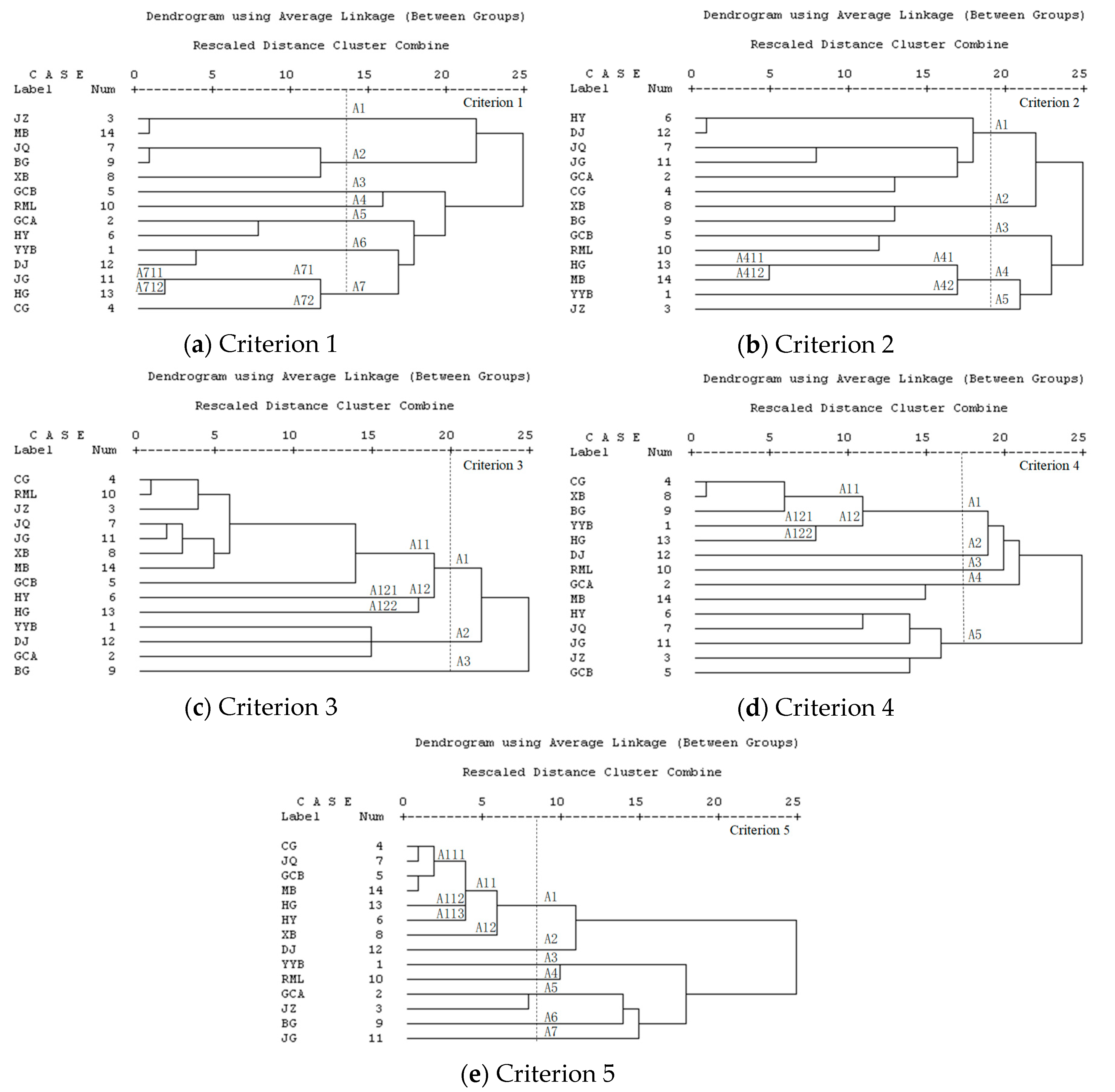

4.4. Using Cluster Analysis to Find Alternative Combinations of Redundant Bank Branches

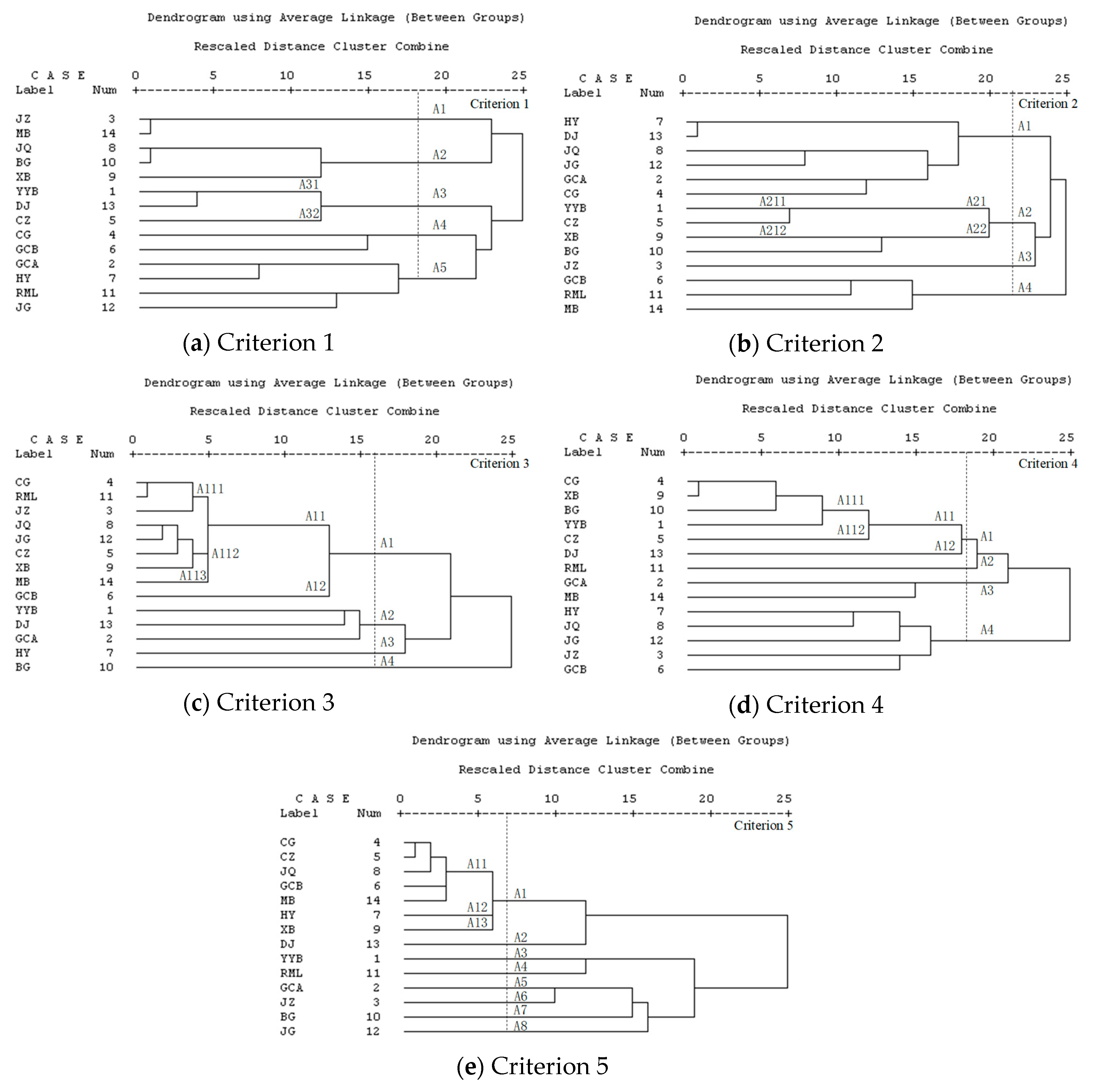

4.4.1. Verifying the Redundancy of the CZ Bank Branch

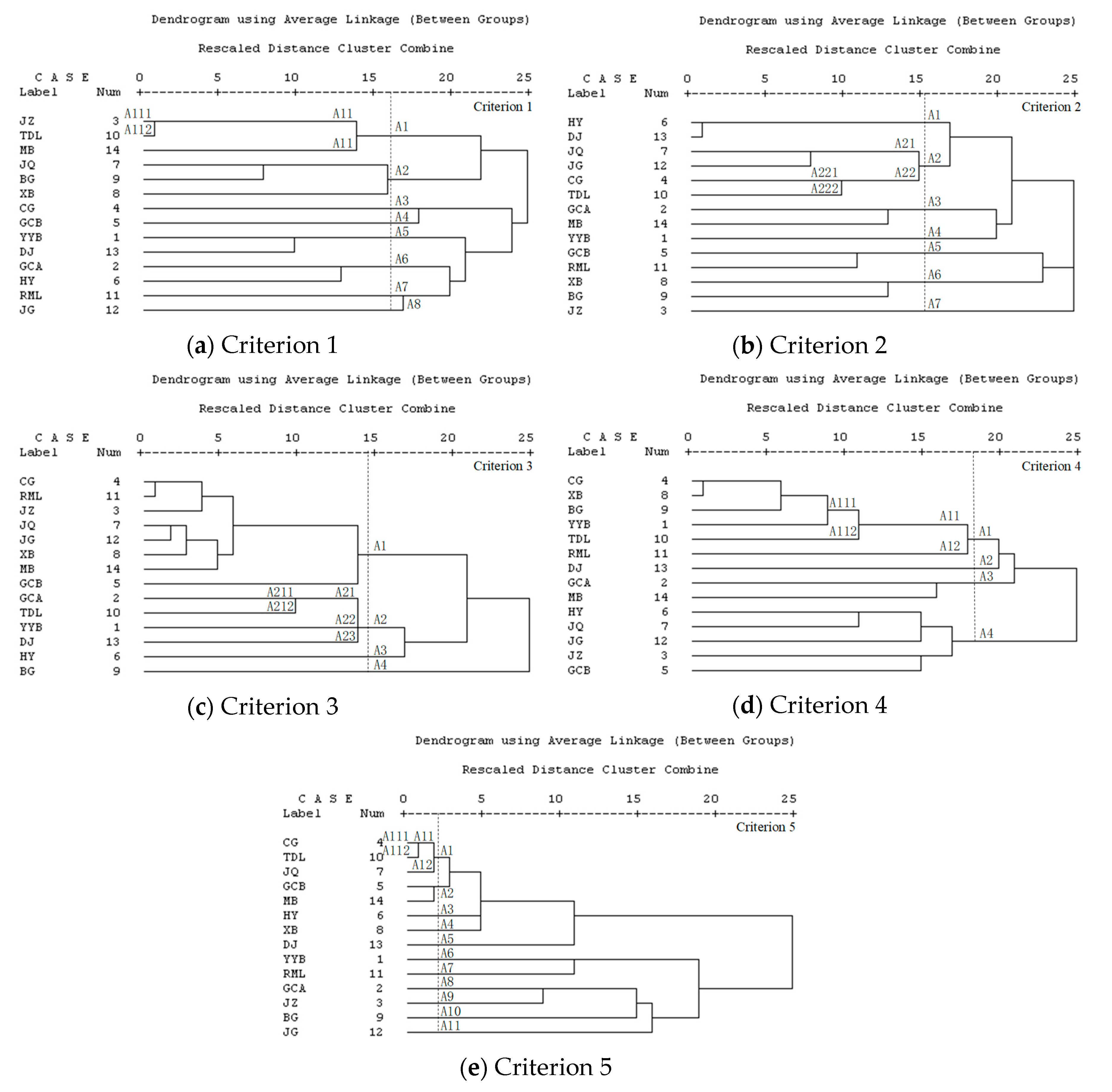

4.4.2. Verifying the Redundancy of the TDL Bank Branch

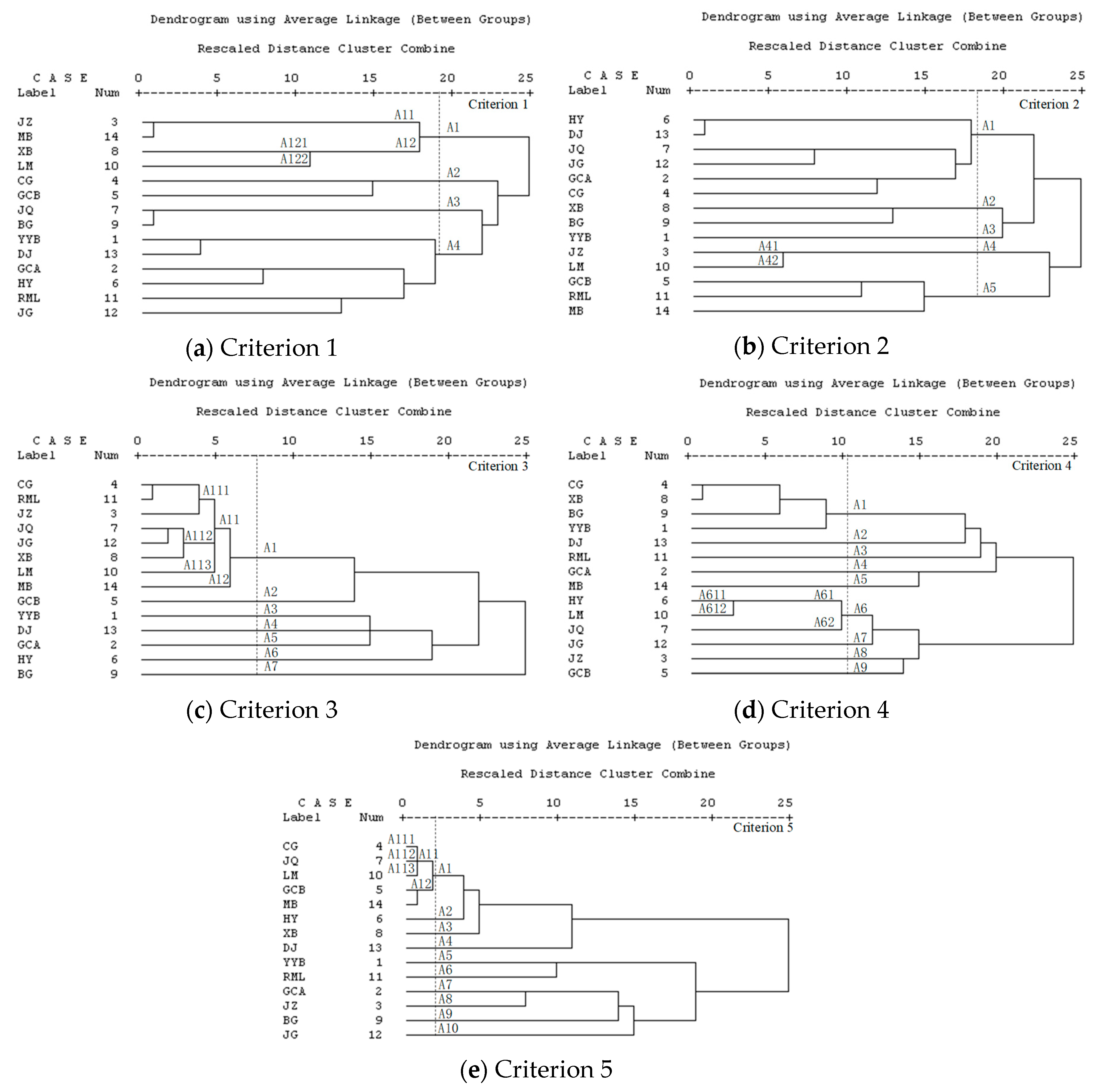

4.4.3. Verifying the Redundancy of the LM Bank Branch

4.4.4. Verifying the Redundancy of the HG Bank Branch

4.5. Comparison and Verification

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Cabello, J.G. A Decision Model for Bank Branch Site Selection: Define Branch Success and do not Deviate. Socio-Econ. Plan. Sci. 2017, 15, 1–10. [Google Scholar] [CrossRef]

- Maqbool, S.; Zameer, M.N. Corporate Social Responsibility and Financial Performance: An Empirical Analysis of Indian Banks. Future Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Cornett, M.M.; Erhemjamts, O.; Tehranian, H. Greed or Good Deeds: An Examination of the Relation Between Corporate Social Responsibility and the Financial Performance of U.S. Commercial Banks Around the Financial Crisis. J. Bank. Financ. 2016, 70, 137–159. [Google Scholar] [CrossRef]

- Yeung, G.; He, C.F.; Liu, H. Centralization and Marginalization: The Chinese Banking Industry in Reform. Appl. Geogr. 2012, 32, 854–867. [Google Scholar] [CrossRef]

- Ye, J.J.; Zhang, A.Y.; Dong, Y. Banking Reform and Industry Structure: Evidence from China. J. Bank. Financ. 2019, 104, 70–84. [Google Scholar] [CrossRef]

- Berger, A.N.; Hasan, I.; Zhou, M.M. Bank Ownership and Efficiency in China: What will Happen in the World’s Largest Nation? J. Bank. Financ. 2009, 33, 113–130. [Google Scholar] [CrossRef]

- Chen, Z.F.; Matousek, R.; Wanke, P. Chinese Bank Efficiency during the Global Financial Crisis: A Combined Approach Using Satisficing DEA and Support Vector Machines. N. Am. J. Econ. Financ. 2018, 43, 71–86. [Google Scholar] [CrossRef]

- Tan, Y. The Impacts of Risk and Competition on Bank Profitability in China. J. Int. Financ. Mark. Inst. Money 2016, 40, 85–110. [Google Scholar] [CrossRef]

- Tan, Y.; Floros, C. Risk, Capital and Efficiency in Chinese Banking. J. Int. Financ. Mark. Inst. Money 2013, 26, 378–393. [Google Scholar] [CrossRef]

- Lin, X.C.; Zhang, Y. Bank Ownership Reform and Bank Performance in China. J. Bank. Financ. 2009, 33, 20–29. [Google Scholar] [CrossRef]

- Li, L.; McMurray, A.; Sy, M.; Xue, J.J. Corporate Ownership, Efficiency and Performance under State Capitalism: Evidence from China. J. Policy Model. 2018, 40, 747–766. [Google Scholar] [CrossRef]

- Guan, F.Y.; Liu, C.Z.; Xie, F.M.; Chen, H.Y. Evaluation of the Competitiveness of China’s Commercial Banks on the G-CAMELS Evaluation System. Sustainability 2019, 11, 1791. [Google Scholar] [CrossRef]

- Masood, O.; Sergi, B.S. China’s Banking System, Market Structure, and Competitive Conditions. Front. Econ. China 2011, 6, 22–35. [Google Scholar] [CrossRef]

- Xie, L.; Zhang, M.; Song, X.Y.; Tong, L.J. Does Internal Competition Shape Bank Lending Behavior? Evidence from a Chinese Bank. Pac. Basin Financ. J. 2019, 55, 169–181. [Google Scholar] [CrossRef]

- Yip, A.W.H.; Bocken, N.M.P. Sustainable Business Model Archetypes for the Banking Industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Ramnarain, T.D.; Pillay, M.T. Designing Sustainable Banking Services: The Case of Mauritian Banks. Procedia-Soc. Behav. Sci. 2016, 224, 483–490. [Google Scholar] [CrossRef]

- Hong, T.L.; Cheong, C.B.; Rizal, H.S. Service Innovation in Malaysian Banking Industry towards Sustainable Competitive Advantage through Environmentally and Socially Practices. Procedia-Soc. Behav. Sci. 2016, 224, 52–59. [Google Scholar] [CrossRef]

- Shah, A.A.; Wu, D.S.; Korotkov, V. Are Sustainable Banks Efficient and Productive? A Data Envelopment Analysis and the Malmquist Productivity Index Analysis. Sustainability 2019, 11, 2398. [Google Scholar] [CrossRef]

- Lin, J.; Chang, H.Y. Business Sustainability Performance Evaluation for Taiwanese Banks—A Hybrid Multiple-Criteria Decision-Making Approach. Sustainability 2019, 11, 2236. [Google Scholar] [CrossRef]

- Yu, Y.T.; Huang, J.H.; Shao, Y.M. The Sustainability Performance of Chinese Banks: A New Network Data Envelopment Analysis Approach and Panel Regression. Sustainability 2019, 11, 1622. [Google Scholar] [CrossRef]

- Liang, L.W.; Chang, H.Y.; Shao, H.L. Does Sustainability Make Banks More Cost Efficient? Glob. Financ. J. 2018, 38, 13–23. [Google Scholar] [CrossRef]

- Miliotis, P.; Dimopoulou, M.; Giannikos, I. A Hierarchical Location Model for Locating Bank Branches in a Competitive Environment. Int. Trans. Oper. Res. 2002, 9, 549–565. [Google Scholar] [CrossRef]

- Cinar, N. A Decision Support Model for Bank Branch Location Selection. World Acad. Sci. Eng. Technol. 2009, 60, 126–131. [Google Scholar]

- Rahgan, S.; Mirzazadeh, A. A New Method in the Location Problem using Fuzzy Evidential Reasoning. Res. J. Appl. Sci. Eng. Technol. 2012, 4, 4636–4645. [Google Scholar]

- Zainab, L.; Zahra, N.A.; Mostafa, K. Locating the Bank Branches using a Hybrid Method. Technol. J. Eng. Appl. Sci. 2014, 4, 124–134. [Google Scholar]

- Bilginol, K.; Denli, H.H.; Seker, D.Z. Ordinary Least Squares Regression Method Approach for Site Selection of Automated Teller Machines(ATMs). Procedia Environ. Sci. 2015, 26, 66–69. [Google Scholar] [CrossRef]

- Chen, W. Research on the Setting of Commercial Bank Outlets—Based on Hotelling Model. Soc. Sci. Yunnan 2013, 5, 73–77. (In Chinese) [Google Scholar]

- Lv, Y.B.; Zhou, X.P.; Yi, Y.Y. Research on the Geographical Layout and the Economic Effect of the Commercial Banks in China Based on the Information of Financial License. Stud. Int. Financ. 2017, 6, 54–64. (In Chinese) [Google Scholar]

- Morrison, P.S.; O’Brien, R. Bank Branch Closures in New Zealand: The Application of a Spatial Interaction Model. Appl. Geogr. 2001, 21, 301–330. [Google Scholar] [CrossRef]

- Zhang, H.R.; Song, X.; Long, Y.; Xia, T.Q.; Fang, K.; Zheng, J.Q.; Huang, D.; Shibasaki, R.; Liang, Y.T. Mobile Phone GPS Data in Urban Bicycle-sharing: Layout Optimization and Emissions Reduction Analysis. Appl. Energy 2019, 242, 138–147. [Google Scholar] [CrossRef]

- Zhao, L.J.; Xie, Y.J.; Wang, J.J.; Xu, X. A Performance Assessment and Adjustment Program for Air Quality Monitoring Networks in Shanghai. Atmos. Environ. 2015, 122, 382–392. [Google Scholar] [CrossRef]

- Wang, C.C.; Zhao, L.J.; Sun, W.J.; Xue, J.; Xie, Y.J. Identifying Redundant Monitoring Stations in an Air Quality Monitoring Network. Atmos. Environ. 2018, 190, 256–268. [Google Scholar] [CrossRef]

- Liu, J.P.; Zhang, T.X.; Zhu, J.; Ma, T.N. Allocation Optimization of Electric Vehicle Charging Station (EVCS) Considering with Charging Satisfaction and Distributed Renewables Integration. Energy 2018, 164, 560–574. [Google Scholar] [CrossRef]

- Yu, S.C. The Planning System of Charging Network. In Proceedings of the 4th International Conference on Energy Science and Applied Technology (ESAT), Chongqing, China, 29–30 December 2018. [Google Scholar]

- Basar, A.; Kabak, Ö.; Topçu, Y.İ. Identifying the Criteria and Their Priorities for Locating Bank Branches in Turkey. In Proceedings of the ISAHP, International Journal of the Analytic Hierarchy Process, Washington, DC, USA, 29 June–2 July 2014. [Google Scholar]

- Li, H.Z. Research Methodology for Management, 1st ed.; Xi’an Jiaotong University Press: Xi’an, China, 2000; pp. 218–225. (In Chinese) [Google Scholar]

| Evaluation Index Code | Evaluation Index Name | Nature of Evaluation Index |

|---|---|---|

| Criterion 1 | deposit | Benefit indicator |

| Criterion 2 | loan | Benefit indicator |

| Criterion 3 | number of vouchers | Benefit indicator |

| Criterion 4 | maintenance, establishment, and modification of customer information | Benefit indicator |

| Criterion 5 | number of counter transactions | Benefit indicator |

| Bank Branch | Abbreviation |

|---|---|

| Ying Ye Bu | YYB |

| Gao Chao | GCA |

| Jiu Zhou | JZ |

| Cheng Guan | CG |

| Che Zhan | CZ |

| Guang Chang | GCB |

| He Ying | HY |

| Jia Qi | JQ |

| Xi Ba | XB |

| Bei Guan | BG |

| Tian Dang Lu | TDL |

| Lian Meng | LM |

| Ren Min Lu | RML |

| Ji Guang | JG |

| Ding Jun | DJ |

| Han Gang | HG |

| Mao Bao | MB |

| Ranking | Bank Branch | |||

|---|---|---|---|---|

| 1 | YYB | 0.046390 | 21.297830 | 0.002173 |

| 2 | MB | 0.005075 | 21.327441 | 0.000501 |

| 3 | JQ | 0.003679 | 21.328585 | 0.000463 |

| 4 | JZ | 0.006873 | 21.326524 | 0.000370 |

| 5 | LM | 0.003858 | 21.327842 | 0.000322 |

| 6 | GCB | 0.006287 | 21.326140 | 0.000295 |

| 7 | DJ | 0.004423 | 21.327493 | 0.000238 |

| 8 | HY | 0.004129 | 21.328011 | 0.000207 |

| 9 | JG | 0.003371 | 21.328663 | 0.000206 |

| 10 | CZ | 0.004180 | 21.328905 | 0.000196 |

| 11 | HG | 0.009885 | 21.323746 | 0.000194 |

| 12 | CG | 0.007883 | 21.325246 | 0.000181 |

| 13 | TDL | 0.002286 | 21.329364 | 0.000172 |

| 14 | GCA | 0.001896 | 21.329726 | 0.000158 |

| 15 | RML | 0.010698 | 21.323314 | 0.000117 |

| 16 | BG | 0.004392 | 21.328213 | 0.000107 |

| 17 | XB | 0.002488 | 21.329250 | 0.000089 |

| Bank Branch | Criterion 1 | Criterion 2 | Criterion 3 | Criterion 4 | Criterion 5 | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F1 | F2 | F3 | F4 | F5 | F6 | F7 | F8 | F1 | F2 | F3 | F4 | F5 | F6 | F7 | F1 | F2 | F3 | F1 | F2 | F3 | F4 | F5 | F6 | F1 | F2 | F3 | |

| YYB | 0.102 | 0.204 | 0.211 | −0.174 | 0.753 | −0.009 | 0.145 | 0.159 | −0.076 | 0.142 | −0.245 | 0.772 | 0.213 | 0.002 | 0.092 | 0.224 | 0.756 | 0.069 | 0.734 | 0.187 | −0.047 | −0.113 | 0.166 | 0.127 | 0.019 | 0.104 | 0.823 |

| GCA | 0.000 | 0.124 | 0.089 | 0.727 | 0.022 | 0.041 | −0.066 | −0.004 | 0.189 | 0.130 | 0.352 | 0.007 | −0.171 | −0.211 | 0.642 | 0.130 | 0.824 | 0.021 | 0.004 | 0.071 | −0.159 | 0.133 | 0.879 | −0.072 | −0.366 | 0.636 | 0.187 |

| JZ | 0.810 | −0.090 | −0.194 | −0.082 | −0.120 | 0.015 | 0.030 | 0.158 | −0.186 | 0.121 | 0.004 | 0.045 | −0.772 | 0.121 | 0.133 | 0.844 | 0.191 | 0.077 | −0.174 | 0.692 | 0.272 | −0.065 | 0.013 | 0.083 | −0.452 | 0.651 | 0.264 |

| CG | −0.172 | 0.074 | 0.627 | −0.287 | −0.030 | 0.080 | 0.079 | −0.005 | 0.770 | 0.012 | 0.205 | 0.193 | 0.030 | 0.002 | 0.097 | 0.860 | 0.243 | 0.101 | 0.836 | −0.102 | 0.173 | 0.267 | −0.142 | −0.048 | 0.933 | −0.067 | −0.011 |

| CZ | 0.090 | 0.125 | 0.068 | −0.598 | 0.329 | −0.134 | −0.104 | −0.260 | −0.664 | 0.004 | 0.050 | 0.369 | 0.011 | −0.032 | 0.113 | 0.836 | 0.318 | 0.168 | 0.430 | −0.172 | 0.314 | 0.056 | 0.158 | 0.305 | 0.924 | −0.131 | 0.049 |

| GCB | 0.103 | −0.041 | 0.115 | −0.033 | −0.025 | 0.054 | 0.852 | 0.107 | 0.031 | 0.059 | −0.284 | −0.729 | 0.208 | −0.079 | 0.135 | 0.617 | 0.087 | 0.246 | −0.027 | 0.676 | −0.234 | −0.067 | 0.141 | −0.215 | 0.830 | −0.357 | −0.011 |

| HY | 0.102 | 0.096 | 0.003 | 0.466 | 0.321 | −0.628 | 0.025 | −0.030 | −0.073 | −0.006 | 0.072 | 0.012 | 0.017 | 0.850 | −0.071 | 0.278 | 0.483 | 0.484 | −0.744 | 0.117 | 0.063 | 0.064 | −0.054 | −0.096 | 0.808 | −0.080 | 0.077 |

| JQ | 0.124 | 0.779 | −0.041 | 0.104 | 0.042 | −0.026 | 0.213 | 0.059 | 0.109 | 0.227 | 0.642 | −0.268 | 0.184 | 0.197 | −0.078 | 0.881 | 0.227 | 0.134 | −0.448 | 0.277 | 0.127 | −0.069 | 0.474 | 0.361 | 0.904 | −0.098 | 0.017 |

| XB | −0.065 | 0.277 | −0.296 | 0.078 | −0.021 | 0.716 | 0.056 | −0.024 | −0.007 | −0.057 | −0.180 | −0.023 | 0.131 | 0.260 | 0.710 | 0.825 | 0.092 | 0.269 | 0.597 | −0.138 | 0.194 | 0.073 | −0.134 | −0.325 | 0.801 | −0.023 | 0.062 |

| BG | −0.043 | 0.733 | 0.033 | −0.051 | −0.060 | 0.082 | −0.382 | 0.059 | −0.286 | −0.673 | −0.168 | 0.046 | 0.157 | −0.034 | 0.271 | 0.095 | 0.030 | 0.853 | 0.563 | 0.029 | 0.044 | 0.451 | −0.117 | −0.071 | 0.115 | 0.554 | 0.435 |

| TDL | 0.785 | 0.298 | 0.094 | 0.073 | 0.033 | 0.011 | 0.101 | −0.251 | 0.561 | 0.052 | 0.011 | −0.063 | 0.146 | 0.042 | 0.116 | 0.326 | 0.802 | 0.049 | 0.321 | 0.451 | 0.417 | 0.485 | −0.153 | −0.005 | 0.872 | 0.192 | 0.072 |

| LM | 0.241 | −0.156 | 0.200 | 0.293 | 0.094 | 0.647 | −0.022 | −0.027 | −0.467 | 0.393 | 0.226 | 0.016 | −0.333 | −0.167 | 0.236 | 0.794 | 0.290 | 0.284 | −0.761 | 0.249 | −0.226 | −0.216 | −0.001 | 0.038 | 0.904 | 0.030 | −0.017 |

| RML | −0.063 | 0.148 | 0.056 | 0.121 | 0.052 | −0.070 | 0.127 | 0.853 | −0.015 | 0.217 | −0.752 | −0.162 | −0.078 | −0.030 | −0.047 | 0.863 | 0.206 | 0.140 | 0.002 | 0.067 | 0.812 | −0.041 | −0.115 | 0.037 | 0.125 | 0.053 | 0.827 |

| JG | 0.085 | 0.017 | 0.707 | 0.119 | −0.018 | −0.107 | −0.013 | 0.105 | 0.042 | 0.067 | 0.320 | 0.066 | 0.654 | 0.081 | 0.236 | 0.902 | 0.200 | 0.085 | −0.394 | 0.288 | −0.354 | 0.345 | −0.351 | 0.247 | 0.138 | 0.787 | −0.144 |

| DJ | −0.180 | −0.194 | −0.099 | 0.072 | 0.750 | −0.047 | −0.164 | −0.030 | 0.292 | −0.108 | 0.089 | 0.061 | −0.101 | 0.705 | 0.276 | 0.136 | 0.683 | 0.422 | 0.106 | −0.092 | 0.036 | 0.084 | −0.055 | 0.779 | 0.605 | 0.306 | 0.195 |

| HG | −0.096 | −0.158 | 0.595 | 0.325 | 0.235 | −0.033 | 0.121 | −0.090 | −0.047 | 0.634 | −0.164 | 0.250 | −0.187 | −0.006 | 0.039 | 0.361 | 0.190 | 0.598 | 0.619 | 0.054 | −0.254 | −0.010 | −0.145 | 0.277 | 0.765 | −0.245 | 0.188 |

| MB | 0.428 | −0.155 | 0.031 | −0.067 | 0.110 | 0.183 | −0.458 | 0.502 | −0.080 | 0.764 | −0.050 | −0.098 | 0.230 | −0.106 | 0.143 | 0.840 | 0.202 | 0.121 | 0.041 | −0.165 | −0.084 | 0.805 | 0.191 | 0.109 | 0.880 | −0.126 | −0.041 |

| Eigenvalue | 1.975 | 1.824 | 1.528 | 1.412 | 1.357 | 1.275 | 1.106 | 1.009 | 2.357 | 1.847 | 1.690 | 1.358 | 1.276 | 1.218 | 1.080 | 9.119 | 1.940 | 1.153 | 4.504 | 1.545 | 1.415 | 1.292 | 1.188 | 1.028 | 8.366 | 2.511 | 1.249 |

| Variance (%) | 11.616 | 10.730 | 8.990 | 8.307 | 7.980 | 7.499 | 6.503 | 5.937 | 13.864 | 10.867 | 9.943 | 7.989 | 7.509 | 7.167 | 6.356 | 53.644 | 11.413 | 6.785 | 26.495 | 9.086 | 8.322 | 7.602 | 6.986 | 6.048 | 49.210 | 14.771 | 7.348 |

| Cumulative variance (%) | 11.616 | 22.347 | 31.337 | 39.643 | 47.623 | 55.122 | 61.625 | 67.562 | 13.864 | 24.732 | 34.675 | 42.664 | 50.172 | 57.340 | 63.695 | 53.644 | 65.056 | 71.841 | 26.495 | 35.581 | 43.903 | 51.505 | 58.491 | 64.539 | 49.210 | 63.980 | 71.328 |

| Bank Branch | Criterion 1 | Criterion 2 | Criterion 3 | Criterion 4 | Criterion 5 | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F1 | F2 | F3 | F4 | F5 | F6 | F7 | F8 | F1 | F2 | F3 | F4 | F5 | F6 | F7 | F1 | F2 | F3 | F1 | F2 | F3 | F4 | F5 | F6 | F1 | F2 | F3 | |

| YYB | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| GCA | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 |

| JZ | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| CG | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| CZ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| GCB | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| HY | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| JQ | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| XB | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BG | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| TDL | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| LM | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| RML | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 |

| JG | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| DJ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| HG | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| MB | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Bank Branch | Criterion 1 | Criterion 2 | Criterion 3 | Criterion 4 | Criterion 5 | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F1 | F2 | F3 | F4 | F5 | F6 | F7 | F8 | F1 | F2 | F3 | F4 | F5 | F6 | F7 | F1 | F2 | F3 | F1 | F2 | F3 | F4 | F5 | F6 | F1 | F2 | F3 | |

| YYB | 0.288 | 0.087 | 0.134 | 0.741 | 0.150 | 0.146 | −0.210 | 0.169 | −0.291 | 0.130 | 0.021 | 0.833 | 0.010 | 0.168 | 0.097 | 0.235 | 0.815 | −0.062 | 0.663 | 0.363 | 0.017 | 0.062 | −0.173 | 0.201 | −0.010 | 0.066 | 0.835 |

| GCA | 0.015 | −0.036 | 0.029 | −0.016 | 0.097 | 0.013 | 0.945 | 0.032 | 0.218 | 0.272 | −0.202 | 0.056 | 0.394 | −0.310 | 0.540 | 0.139 | 0.809 | −0.016 | −0.061 | 0.864 | 0.095 | −0.127 | 0.171 | −0.075 | −0.412 | 0.609 | 0.200 |

| JZ | 0.063 | 0.797 | 0.079 | −0.174 | −0.123 | 0.203 | −0.112 | −0.142 | −0.032 | 0.052 | 0.083 | 0.086 | −0.181 | −0.862 | 0.061 | 0.848 | 0.194 | 0.060 | −0.177 | 0.076 | 0.490 | 0.586 | 0.002 | 0.014 | −0.487 | 0.620 | 0.276 |

| CG | 0.015 | −0.036 | −0.001 | 0.050 | 0.010 | 0.096 | 0.024 | 0.936 | 0.074 | 0.019 | 0.101 | 0.010 | 0.893 | 0.181 | 0.002 | 0.865 | 0.217 | 0.109 | 0.873 | −0.084 | −0.101 | 0.036 | 0.108 | 0.019 | 0.922 | −0.048 | 0.011 |

| GCB | 0.019 | −0.028 | −0.069 | −0.024 | 0.106 | 0.884 | 0.026 | 0.122 | −0.279 | 0.204 | −0.038 | −0.755 | −0.012 | 0.281 | 0.145 | 0.639 | 0.150 | 0.127 | 0.001 | 0.099 | 0.860 | −0.073 | −0.114 | −0.103 | 0.839 | −0.308 | −0.020 |

| HY | 0.231 | 0.014 | 0.751 | 0.215 | −0.053 | 0.039 | 0.326 | −0.188 | 0.072 | −0.019 | 0.848 | 0.069 | −0.097 | 0.013 | −0.029 | 0.305 | 0.534 | 0.397 | −0.700 | −0.199 | 0.175 | 0.022 | 0.081 | −0.162 | 0.834 | −0.035 | 0.082 |

| JQ | 0.863 | −0.022 | 0.044 | −0.015 | 0.026 | 0.123 | 0.005 | −0.052 | 0.757 | 0.261 | 0.160 | −0.146 | −0.048 | 0.065 | −0.049 | 0.886 | 0.229 | 0.051 | −0.540 | 0.399 | 0.229 | 0.191 | −0.030 | 0.314 | 0.902 | −0.059 | 0.024 |

| XB | 0.241 | 0.041 | −0.774 | 0.004 | −0.170 | 0.068 | 0.174 | −0.143 | −0.060 | −0.088 | 0.186 | −0.041 | −0.031 | 0.062 | 0.782 | 0.839 | 0.086 | 0.240 | 0.732 | −0.153 | −0.015 | 0.062 | −0.036 | −0.187 | 0.822 | −0.009 | 0.100 |

| BG | 0.640 | −0.004 | −0.210 | −0.026 | 0.073 | −0.464 | 0.047 | 0.128 | −0.086 | −0.696 | −0.097 | 0.036 | −0.302 | 0.156 | 0.368 | 0.133 | 0.084 | 0.929 | 0.672 | −0.096 | 0.090 | −0.107 | 0.238 | 0.099 | 0.090 | 0.554 | 0.448 |

| RML | 0.131 | 0.150 | −0.106 | 0.129 | 0.762 | 0.124 | 0.133 | −0.207 | −0.680 | 0.312 | 0.026 | −0.061 | −0.314 | −0.019 | −0.007 | 0.871 | 0.195 | 0.105 | 0.086 | −0.122 | −0.176 | 0.862 | −0.027 | −0.007 | 0.130 | 0.065 | 0.814 |

| JG | −0.042 | −0.118 | 0.235 | −0.077 | 0.703 | −0.010 | −0.010 | 0.220 | 0.463 | 0.150 | 0.048 | 0.200 | −0.079 | 0.527 | 0.327 | 0.911 | 0.178 | 0.052 | −0.328 | −0.369 | 0.405 | −0.128 | 0.431 | 0.248 | 0.120 | 0.823 | −0.150 |

| DJ | −0.244 | −0.098 | 0.040 | 0.800 | −0.070 | −0.140 | 0.143 | −0.066 | 0.061 | −0.073 | 0.735 | −0.039 | 0.321 | −0.105 | 0.250 | 0.159 | 0.711 | 0.385 | 0.102 | −0.054 | −0.087 | −0.006 | 0.049 | 0.899 | 0.601 | 0.330 | 0.207 |

| MB | −0.095 | 0.802 | −0.120 | 0.149 | 0.156 | −0.270 | 0.069 | 0.092 | −0.002 | 0.802 | −0.131 | 0.000 | −0.103 | 0.076 | 0.129 | 0.857 | 0.210 | 0.058 | 0.132 | 0.181 | −0.143 | 0.002 | 0.899 | 0.017 | 0.886 | −0.085 | −0.034 |

| Eigenvalue | 1.703 | 1.545 | 1.370 | 1.304 | 1.196 | 1.095 | 0.993 | 0.859 | 1.977 | 1.604 | 1.370 | 1.302 | 1.229 | 1.073 | 1.031 | 6.904 | 1.684 | 0.994 | 3.303 | 1.397 | 1.307 | 1.174 | 1.097 | 0.929 | 5.461 | 2.419 | 1.183 |

| Variance (%) | 13.102 | 11.887 | 10.539 | 10.032 | 9.200 | 8.421 | 7.641 | 6.611 | 15.208 | 12.337 | 10.542 | 10.014 | 9.450 | 8.251 | 7.928 | 53.104 | 12.953 | 7.647 | 25.404 | 10.745 | 10.057 | 9.033 | 8.440 | 7.143 | 42.007 | 18.607 | 9.096 |

| Cumulative Variance (%) | 13.102 | 24.990 | 35.528 | 45.561 | 54.761 | 63.181 | 70.823 | 77.434 | 15.208 | 27.546 | 38.088 | 48.102 | 57.552 | 65.804 | 73.732 | 53.104 | 66.057 | 73.704 | 25.404 | 36.149 | 46.205 | 55.238 | 63.678 | 70.821 | 42.007 | 60.614 | 69.710 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, J.; Zhu, D.; Zhao, L.; Wang, C.; Li, H. Redundancy Identification and Optimization Scheme of Branches for Sustainable Operation of Commercial Banks. Sustainability 2019, 11, 4111. https://doi.org/10.3390/su11154111

Xue J, Zhu D, Zhao L, Wang C, Li H. Redundancy Identification and Optimization Scheme of Branches for Sustainable Operation of Commercial Banks. Sustainability. 2019; 11(15):4111. https://doi.org/10.3390/su11154111

Chicago/Turabian StyleXue, Jian, Di Zhu, Laijun Zhao, Chenchen Wang, and Hongyang Li. 2019. "Redundancy Identification and Optimization Scheme of Branches for Sustainable Operation of Commercial Banks" Sustainability 11, no. 15: 4111. https://doi.org/10.3390/su11154111

APA StyleXue, J., Zhu, D., Zhao, L., Wang, C., & Li, H. (2019). Redundancy Identification and Optimization Scheme of Branches for Sustainable Operation of Commercial Banks. Sustainability, 11(15), 4111. https://doi.org/10.3390/su11154111