Do Overnight Returns Truly Measure Firm-Specific Investor Sentiment in the KOSPI Market?

Abstract

1. Introduction

2. Literature Review

3. Methodology

4. Empirical Data

5. Results and Discussion

5.1. Overnight Returns and Individual Stock Returns

5.2. Individual Stock Returns by Firm Characteristics and Overnight Returns

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Branch, W.A.; Evans, G.W. Asset return dynamics and learning. Rev. Financ. Stud. 2010, 23, 1651–1680. [Google Scholar] [CrossRef]

- Devault, L.; Sias, R.; Starks, L. Sentiment metrics and investor demand. J. Financ. 2019, 74, 985–1024. [Google Scholar] [CrossRef]

- Kothari, S.P.; Lewellen, J.; Warner, J.B. Stock returns, aggregate earnings surprises, and behavioral finance. J. Financ. Econ. 2006, 79, 537–568. [Google Scholar] [CrossRef]

- Ryu, D. What types of investors generate the two-phase phenomenon? Phys. A Stat. Mech. Appl. 2013, 392, 5939–5946. [Google Scholar] [CrossRef]

- Shim, H.; Kim, H.; Kim, J.Y.; Ryu, D. Weather and stock market volatility: The case of a leading emerging market. Appl. Econ. Lett. 2015, 22, 987–992. [Google Scholar] [CrossRef]

- Shim, H.; Kim, M.H.; Ryu, D. Effects of intraday weather changes on asset returns and volatilities. Proc. Rij. Fac. Econ. J. Econ. Bus. 2017, 35, 301–330. [Google Scholar] [CrossRef]

- Yang, H.; Ahn, H.-J.; Kim, M.H.; Ryu, D. Information asymmetry and investor trading behavior around bond rating change announcements. Emerg. Mark. Rev. 2017, 32, 38–51. [Google Scholar] [CrossRef]

- Hwang, B.-H. Country-specific sentiment and security prices. J. Financ. Econ. 2011, 100, 382–401. [Google Scholar] [CrossRef]

- Li, X.; Luo, D. Investor sentiment, limited arbitrage, and the cash holding effect. Rev. Financ. 2016, 21, 2141–2168. [Google Scholar]

- Yu, J.; Yuan, Y. Investor sentiment and the mean-variance relation. J. Financ. Econ. 2011, 100, 367–381. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Investor sentiment and the cross-section of stock returns. J. Financ. 2006, 61, 1645–1680. [Google Scholar] [CrossRef]

- Berger, D.; Turtle, H.J. Sentiment bubbles. J. Financ. Mark. 2015, 23, 59–74. [Google Scholar] [CrossRef]

- Huang, D.; Jiang, F.; Tu, J.; Zhou, G. Investor sentiment aligned: A powerful predictor of stock returns. Rev. Financ. Stud. 2015, 28, 791–837. [Google Scholar] [CrossRef]

- Kim, J.S.; Ryu, D.; Seo, S.W. Investor sentiment and return predictability of disagreement. J. Bank. Financ. 2014, 42, 166–178. [Google Scholar] [CrossRef]

- Stambaugh, R.F.; Yu, J.; Yuan, Y. The long of it: Odds that investor sentiment spuriously predicts anomaly returns. J. Financ. Econ. 2014, 114, 613–619. [Google Scholar] [CrossRef]

- Kim, D.; Na, H. Investor sentiment, anomalies, and macroeconomic conditions. Asia Pac. J. Financ. Stud. 2018, 47, 751–804. [Google Scholar] [CrossRef]

- Yang, C.; Zhou, L. Investor trading behavior, investor sentiment and asset prices. N. Am. J. Econ. Financ. 2015, 34, 42–62. [Google Scholar] [CrossRef]

- Yang, C.; Zhou, L. Individual stock crowded trades, individual stock investor sentiment and excess returns. N. Am. J. Econ. Financ. 2016, 38, 39–53. [Google Scholar] [CrossRef]

- Yang, C.; Yang, J. Individual stock cash inflow-outflow imbalance, individual stock investor sentiment and excess returns. Emerg. Mark. Financ. Trade 2019. [Google Scholar] [CrossRef]

- Ryu, D.; Kim, H.; Yang, H. Investor sentiment, trading behavior and stock returns. Appl. Econ. Lett. 2017, 24, 826–830. [Google Scholar] [CrossRef]

- Yang, H.; Ryu, D.; Ryu, D. Investor sentiment, asset returns and firm characteristics: Evidence from the Korean stock market. Invest. Anal. J. 2017, 46, 132–147. [Google Scholar] [CrossRef]

- Seok, S.I.; Cho, H.; Ryu, D. Firm-specific investor sentiment and the stock market response to earnings news. North Am. J. Econ. Financ. 2019, 48, 221–240. [Google Scholar] [CrossRef]

- Kim, K.; Ryu, D.; Yang, H. Investor sentiment, stock returns, and analyst recommendation changes: The KOSPI stock market. Invest. Anal. J. 2019. [Google Scholar] [CrossRef]

- Chung, C.Y.; Cho, S.J.; Ryu, D.; Ryu, D. Institutional blockholders and corporate social responsibility. Asian Bus. Manag. 2019. [Google Scholar] [CrossRef]

- Lee, J.; Ryu, D. How does FX liquidity affect the relationship between foreign ownership and stock liquidity? Emerg. Mark. Rev. 2019, 39, 101–119. [Google Scholar] [CrossRef]

- Chun, D.; Cho, H.; Ryu, D. Macroeconomic structural changes in a leading emerging market: The effects of the Asian financial crisis. Rom. J. Econ. Forecast. 2018, 21, 22–42. [Google Scholar]

- Chung, C.Y.; Kang, S.; Ryu, D. Does institutional monitoring matter? Evidence from insider trading by information risk level. Invest. Anal. J. 2018, 47, 48–64. [Google Scholar] [CrossRef]

- Lee, J.; Ryu, D.; Kutan, A.M. Monetary policy announcements, communication, and stock market liquidity. Aust. Econ. Pap. 2016, 55, 227–250. [Google Scholar] [CrossRef]

- Ryu, D.; Ryu, D.; Hwang, J.H. Corporate social responsibility, market competition, and shareholder wealth. Invest. Anal. J. 2016, 45, 16–30. [Google Scholar] [CrossRef]

- Ryu, D.; Ryu, D.; Hwang, J.H. Corporate governance, product-market competition, and stock returns: Evidence from the Korean market. Asian Bus. Manag. 2017, 16, 50–91. [Google Scholar] [CrossRef]

- Aboody, D.; Even-Tov, O.; Lehavy, R.; Trueman, B. Overnight Returns and Firm-Specific Investor Sentiment. J. Financ. Quant. Anal. 2018, 53, 485–505. [Google Scholar] [CrossRef]

- Kim, J.S.; Ryu, D.; Seo, S.W. Corporate vulnerability index as a fear gauge? Exploring the contagion effect between U.S. and Korean markets. J. Deriv. 2015, 23, 73–88. [Google Scholar] [CrossRef]

- Kim, J.S.; Ryu, D. Effect of the subprime mortgage crisis on a leading emerging market. Invest. Anal. J. 2015, 44, 20–42. [Google Scholar] [CrossRef]

- Park, Y.J.; Kutan, A.M.; Ryu, D. The impacts of overseas market shocks on the CDS-option basis. N. Am. J. Econ. Financ. 2019, 47, 622–636. [Google Scholar] [CrossRef]

- Song, W.; Park, S.Y.; Ryu, D. Dynamic conditional relationships between developed and emerging markets. Phys. A Stat. Mech. Appl. 2018, 507, 534–543. [Google Scholar] [CrossRef]

- Song, W.; Ryu, D.; Webb, R.I. Overseas market shocks and VKOSPI dynamics: A Markov-switching approach. Financ. Res. Lett. 2016, 16, 275–282. [Google Scholar] [CrossRef]

- Song, W.; Ryu, D.; Webb, R.I. Volatility dynamics under an endogenous Markov-switching framework: A cross-market approach. Quant. Financ. 2018, 18, 1559–1571. [Google Scholar] [CrossRef]

- Barberis, N.; Shleifer, A.; Vishny, R. A model of investor sentiment. J. Financ. Econ. 1998, 49, 307–343. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Kyle, A.S. Smart money, noise trading and stock price behaviour. Rev. Econ. Stud. 1993, 60, 1–34. [Google Scholar] [CrossRef]

- Lee, C.M.C.; Shleifer, A.; Thaler, R.H. Investor sentiment and the closed-end fund puzzle. J. Financ. 1991, 46, 75–109. [Google Scholar] [CrossRef]

- Ben-Rephael, A.; Kandel, S.; Wohl, A. Measuring investor sentiment with mutual fund flows. J. Financ. Econ. 2012, 104, 363–382. [Google Scholar] [CrossRef]

- Fisher, K.L.; Statman, M. Consumer confidence and stock returns. J. Portf. Manag. 2003, 30, 115–127. [Google Scholar] [CrossRef]

- Schmeling, M. Investor sentiment and stock returns: Some international evidence. J. Empir. Financ. 2009, 16, 394–408. [Google Scholar] [CrossRef]

- Yang, C.; Zhang, R. Does mixed-frequency investor sentiment impact stock returns? Based on the empirical study of MIDAS regression model. Appl. Econ. 2014, 46, 966–972. [Google Scholar] [CrossRef]

- Baker, M.; Stein, J.C. Market liquidity as a sentiment indicator. J. Financ. Mark. 2004, 7, 271–299. [Google Scholar] [CrossRef]

- Dorn, D. Does sentiment drive the retail demand for IPOs? J. Financ. Quant. Anal. 2009, 44, 85–108. [Google Scholar] [CrossRef]

- Da, Z.; Engelberg, J.; Gao, P. The sum of all FEARS investor sentiment and asset prices. Rev. Financ. Stud. 2014, 28, 1–32. [Google Scholar] [CrossRef]

- Liao, T.L.; Huang, C.J.; Wu, C.Y. Do fund managers herd to counter investor sentiment? J. Bus. Res. 2011, 64, 207–212. [Google Scholar] [CrossRef]

- Bathia, D.; Bredin, D. An examination of investor sentiment effect on G7 stock market returns. Eur. J. Financ. 2013, 19, 909–937. [Google Scholar] [CrossRef]

- Corredor, P.; Ferrer, E.; Santamaria, R. Investor sentiment effect in stock markets: Stock characteristics or country-specific factors? Int. Rev. Econ. Financ. 2013, 27, 572–591. [Google Scholar] [CrossRef]

- Gao, B.; Yang, C. Forecasting stock index futures returns with mixed-frequency sentiment. Int. Rev. Econ. Financ. 2017, 49, 69–83. [Google Scholar] [CrossRef]

- Mangee, N. New evidence on psychology and stock returns. J. Behav. Financ. 2017, 18, 417–426. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J.; Yuan, Y. Global, local, and contagious investor sentiment. J. Financ. Econ. 2012, 104, 272–287. [Google Scholar] [CrossRef]

- Brzeszczynski, J.; Gajdka, J.; Kutan, A.M. Investor response to public news, sentiment and institutional trading in emerging markets: A review. Int. Rev. Econ. Financ. 2015, 40, 338–352. [Google Scholar] [CrossRef]

- Chen, H.K.; Lien, C.T. Market reaction to macroeconomic news: The role of investor sentiment. Asia Pac. J. Financ. Stud. 2017, 46, 853–875. [Google Scholar] [CrossRef]

- Seok, S.I.; Cho, H.; Ryu, D. Firm-specific investor sentiment and daily stock returns. North Am. J. Econ. Financ. 2019. [Google Scholar] [CrossRef]

- Yang, H.; Ryu, D.; Ryu, D. Market reform and efficiency: The case of KOSPI200 options. Emerg. Mark. Financ. Trade 2018, 54, 2687–2697. [Google Scholar] [CrossRef]

- Carhart, M.M. On persistence in mutual fund performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Shen, J.; Yu, J.; Zhao, S. Investor sentiment and economic forces. J. Monet. Econ. 2017, 86, 1–21. [Google Scholar] [CrossRef]

- Choi, H.-S.; Ryu, D.; Yang, H. International transmission of risk factor movements: The case of developed markets. Invest. Anal. J. 2018, 47, 111–126. [Google Scholar] [CrossRef]

- Ryu, D.; Yang, H. The directional information content of options volumes. J. Futures Mark. 2018, 38, 1533–1548. [Google Scholar] [CrossRef]

- Yang, H.; Choi, H.-S.; Ryu, D. Option market characteristics and price monotonicity violations. J. Futures Mark. 2017, 37, 473–498. [Google Scholar] [CrossRef]

| N | Mean | SD | Min | Max | |

|---|---|---|---|---|---|

| Panel A. Stock Returns and Sentiment for Individual Firms (Daily Data) | |||||

| Return (%) | 1,562,909 | 0.08 | 3.17 | −30.00 | 30.00 |

| Overnight (%) | 1,562,909 | 0.07 | 1.83 | −30.00 | 30.00 |

| Panel B. Firm Characteristics (Quarterly Data) | |||||

| Ln (ME) | 25,493 | 25.56 | 1.69 | 21.70 | 31.73 |

| IVOL (%) | 25,493 | 2.49 | 1.25 | 0.52 | 9.68 |

| E/BE | 25,493 | 0.02 | 0.05 | −0.61 | 0.79 |

| BE/ME | 25,493 | 1.62 | 1.38 | −15.11 | 13.25 |

| D/E | 25,493 | 1.19 | 1.60 | −12.31 | 39.12 |

| INST | 25,493 | 0.22 | 0.23 | 0.00 | 0.97 |

| Panel A. Fama–MacBeth Regression | ||||||||||

| t+1 | t+2 | t+3 | t+4 | t+5 | ||||||

| Intercept | 0.0000 | −0.0001 | 0.0004 | 0.0002 ** | 0.0004 | 0.0002 *** | 0.0004 | 0.0002 *** | 0.0004 | 0.0003 *** |

| (−0.19) | (−0.85) | (1.50) | (2.79) | (1.64) | (3.26) | (1.64) | (3.39) | (1.68) | (3.54) | |

| Overnight | 0.6280 *** | 0.5268 *** | 0.0438 *** | 0.0368 *** | 0.0188 * | 0.0116 *** | −0.0043 | −0.0032 | −0.0184 ** | −0.0068 *** |

| (46.64) | (18.29) | (4.43) | (9.07) | (1.97) | (3.38) | (−0.42) | (−1.38) | (−2.47) | (−3.58) | |

| MKT | 0.7540 *** | 0.9340 *** | 0.9344 *** | 0.9344 *** | 0.9347 *** | |||||

| (60.71) | (120.29) | (131.90) | (129.70) | (127.52) | ||||||

| SMB | 0.5895 *** | 0.7139 *** | 0.7139 *** | 0.7152 *** | 0.7154 *** | |||||

| (44.98) | (46.21) | (47.08) | (46.48) | (45.80) | ||||||

| HML | 0.1456 ** | 0.1917 *** | 0.1930 *** | 0.1938 *** | 0.1934 *** | |||||

| (2.23) | (3.00) | (3.04) | (3.04) | (3.06) | ||||||

| UMD | −0.0136 | −0.0357 ** | −0.0342 * | −0.0352 * | −0.0351 * | |||||

| (−0.62) | (−2.15) | (−2.05) | (−2.11) | (−2.10) | ||||||

| Adj R2 | 0.1260 | 0.2052 | 0.0011 | 0.1230 | 0.0007 | 0.1226 | 0.0006 | 0.1225 | 0.0004 | 0.1225 |

| Panel B. Long–Short Return | ||||||||||

| Return | 0.0162 *** | 0.0009 *** | 0.0004 *** | 0.0002 ** | 0.0001 * | |||||

| (120.05) | (8.88) | (4.79) | (2.08) | (1.66) | ||||||

| Alpha | 0.0158 *** | 0.0005 *** | 0.0000 | −0.0002 ** | −0.0002 *** | |||||

| (118.91) | (5.64) | (0.27) | (−2.15) | (−2.64) | ||||||

| Decile | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Overnight | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

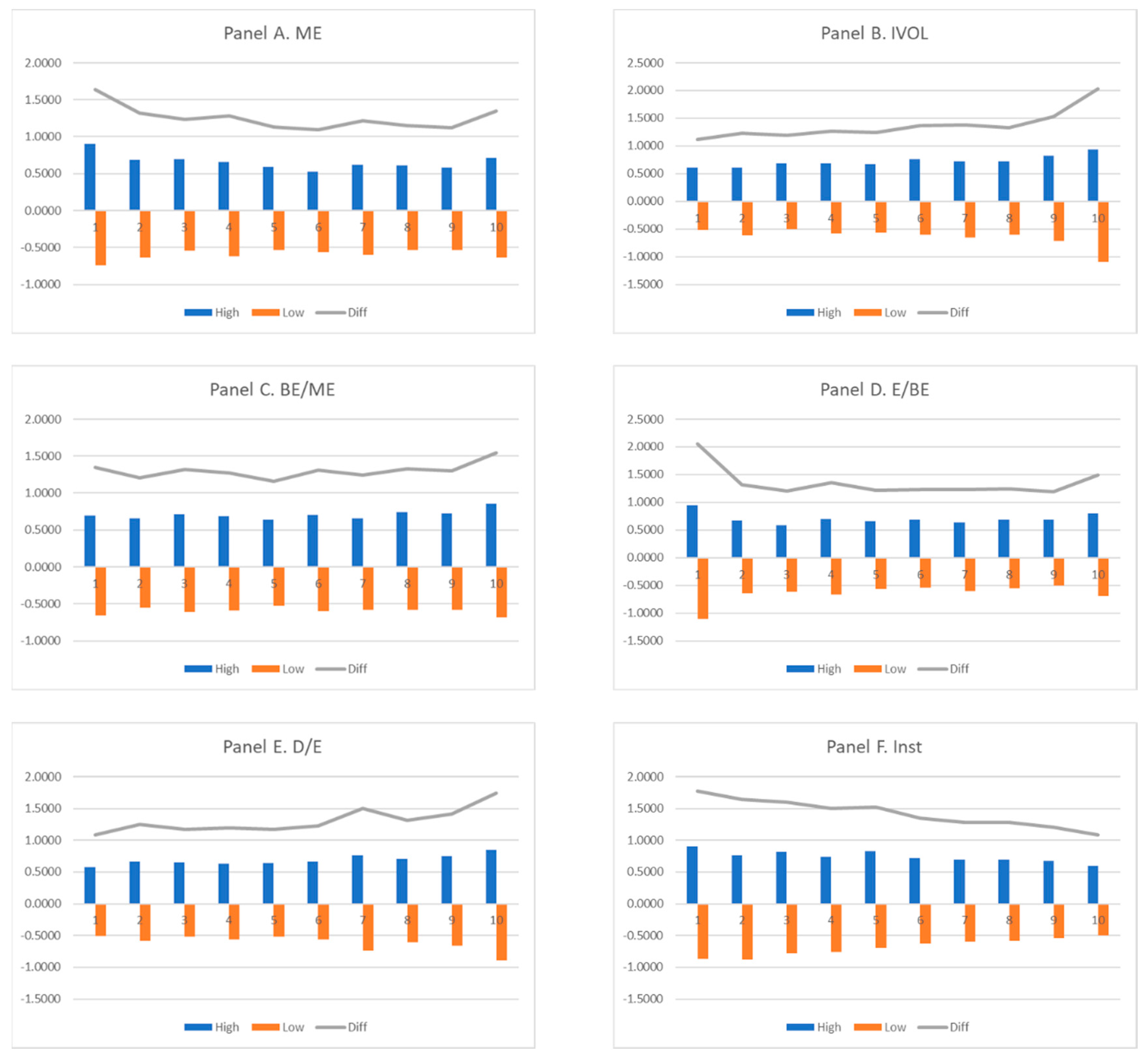

| ME | High (%) | 0.897 | 0.685 | 0.690 | 0.661 | 0.594 | 0.530 | 0.616 | 0.612 | 0.586 | 0.712 |

| Low (%) | −0.739 | −0.636 | −0.542 | −0.624 | −0.537 | −0.561 | −0.604 | −0.534 | −0.538 | −0.641 | |

| Difference (%) | 1.640 | 1.320 | 1.230 | 1.280 | 1.130 | 1.090 | 1.220 | 1.150 | 1.120 | 1.350 | |

| IVOL | High (%) | 0.604 | 0.613 | 0.681 | 0.681 | 0.672 | 0.761 | 0.724 | 0.722 | 0.819 | 0.938 |

| Low (%) | −0.513 | −0.620 | −0.506 | −0.585 | −0.564 | −0.606 | −0.652 | −0.608 | −0.714 | −1.090 | |

| Difference (%) | 1.120 | 1.230 | 1.190 | 1.270 | 1.240 | 1.370 | 1.380 | 1.330 | 1.530 | 2.030 | |

| BE/ME | High (%) | 0.698 | 0.659 | 0.713 | 0.681 | 0.635 | 0.705 | 0.655 | 0.745 | 0.720 | 0.858 |

| Low (%) | −0.655 | −0.555 | −0.607 | −0.592 | −0.529 | −0.604 | −0.581 | −0.586 | −0.585 | −0.685 | |

| Difference (%) | 1.350 | 1.210 | 1.320 | 1.270 | 1.160 | 1.310 | 1.240 | 1.330 | 1.300 | 1.540 | |

| E/BE | High (%) | 0.946 | 0.673 | 0.588 | 0.693 | 0.655 | 0.684 | 0.629 | 0.687 | 0.681 | 0.798 |

| Low (%) | −1.100 | −0.644 | −0.617 | −0.669 | −0.568 | −0.544 | −0.599 | −0.555 | −0.507 | −0.688 | |

| Difference (%) | 2.050 | 1.320 | 1.200 | 1.360 | 1.220 | 1.230 | 1.230 | 1.240 | 1.190 | 1.490 | |

| D/E | High (%) | 0.575 | 0.665 | 0.652 | 0.631 | 0.644 | 0.667 | 0.764 | 0.703 | 0.749 | 0.850 |

| Low (%) | −0.506 | −0.587 | −0.523 | −0.562 | −0.525 | −0.567 | −0.734 | −0.606 | −0.664 | −0.895 | |

| Difference (%) | 1.080 | 1.250 | 1.170 | 1.190 | 1.170 | 1.230 | 1.500 | 1.310 | 1.410 | 1.740 | |

| Inst | High (%) | 0.899 | 0.760 | 0.819 | 0.736 | 0.830 | 0.718 | 0.691 | 0.691 | 0.670 | 0.593 |

| Low (%) | −0.872 | −0.877 | −0.782 | −0.764 | −0.690 | −0.629 | −0.591 | −0.589 | −0.542 | −0.496 | |

| Difference (%) | 1.770 | 1.640 | 1.600 | 1.500 | 1.520 | 1.350 | 1.280 | 1.280 | 1.210 | 1.090 | |

| Sentiment | Sentiment with Carhart’s Four Factors | |||||

|---|---|---|---|---|---|---|

| High | Low | Diff | High | Low | Diff | |

| ME | 0.8311 *** | 0.7350 *** | 0.0993 *** | 0.1853 *** | 0.5782 *** | −0.3878 *** |

| (42.31) | (30.88) | (2.95) | (12.96) | (25.26) | (−11.71) | |

| IVOL | 0.7969 *** | 0.8648 *** | −0.0810 ** | 0.4155 *** | 0.1485 *** | 0.2575 *** |

| (36.36) | (45.01) | (−2.39) | (21.10) | (11.49) | (8.31) | |

| BE/ME | 0.8666 *** | 0.8303 *** | 0.0353 | 0.5416 *** | 0.1840 *** | 0.3542 *** |

| (39.71) | (42.33) | (1.14) | (27.12) | (13.72) | (12.78) | |

| E/BE | 0.8330 *** | 0.7924 *** | 0.0511 * | 0.3529 *** | 0.4010 *** | −0.0377 |

| (44.05) | (35.38) | (1.69) | (23.72) | (19.63) | (−1.41) | |

| D/E | 0.8406 *** | 0.8993 *** | −0.0661 ** | 0.3226 *** | 0.3416 *** | −0.0241 |

| (40.47) | (47.51) | (−2.19) | (18.64) | (22.97) | (−0.96) | |

| INST | 0.8422 *** | 0.7963 *** | 0.0622 * | 0.2050 *** | 0.4998 *** | −0.2816 *** |

| (44.34) | (33.51) | (1.80) | (16.16) | (22.34) | (−8.59) | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Seok, S.I.; Cho, H.; Park, C.; Ryu, D. Do Overnight Returns Truly Measure Firm-Specific Investor Sentiment in the KOSPI Market? Sustainability 2019, 11, 3718. https://doi.org/10.3390/su11133718

Seok SI, Cho H, Park C, Ryu D. Do Overnight Returns Truly Measure Firm-Specific Investor Sentiment in the KOSPI Market? Sustainability. 2019; 11(13):3718. https://doi.org/10.3390/su11133718

Chicago/Turabian StyleSeok, Sang Ik, Hoon Cho, Chanhi Park, and Doojin Ryu. 2019. "Do Overnight Returns Truly Measure Firm-Specific Investor Sentiment in the KOSPI Market?" Sustainability 11, no. 13: 3718. https://doi.org/10.3390/su11133718

APA StyleSeok, S. I., Cho, H., Park, C., & Ryu, D. (2019). Do Overnight Returns Truly Measure Firm-Specific Investor Sentiment in the KOSPI Market? Sustainability, 11(13), 3718. https://doi.org/10.3390/su11133718