The Impact of High-Speed Rail on Housing Prices: Evidence from China’s Prefecture-Level Cities

Abstract

1. Introduction

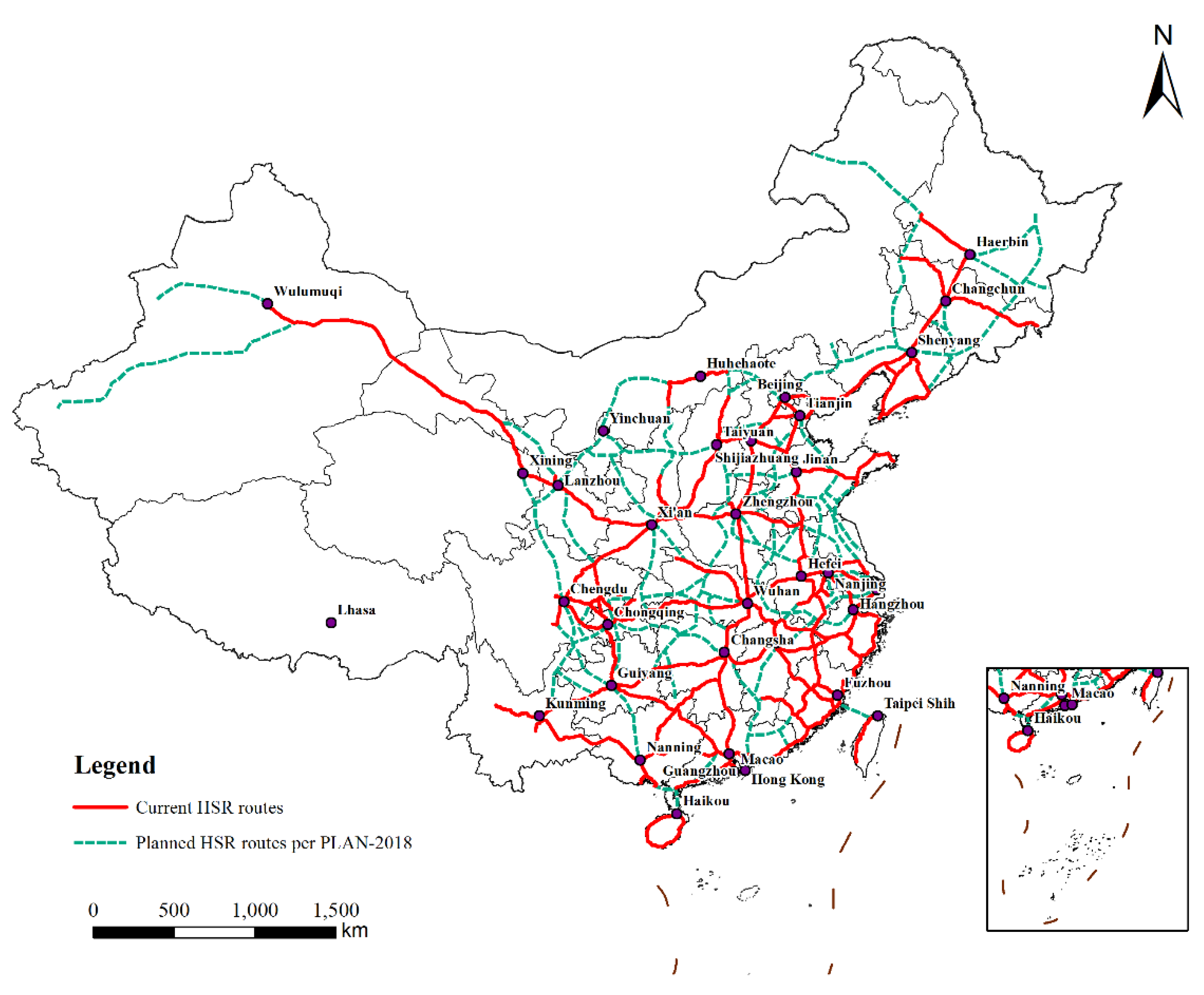

2. Theoretical Analysis of the Effect of HSR on Housing Prices

2.1. Direct and Indirect Impact of HSR on Housing Prices

2.2. City Size Heterogeneity Analysis

2.3. Regional Heterogeneity Analysis

3. Methodology and Data

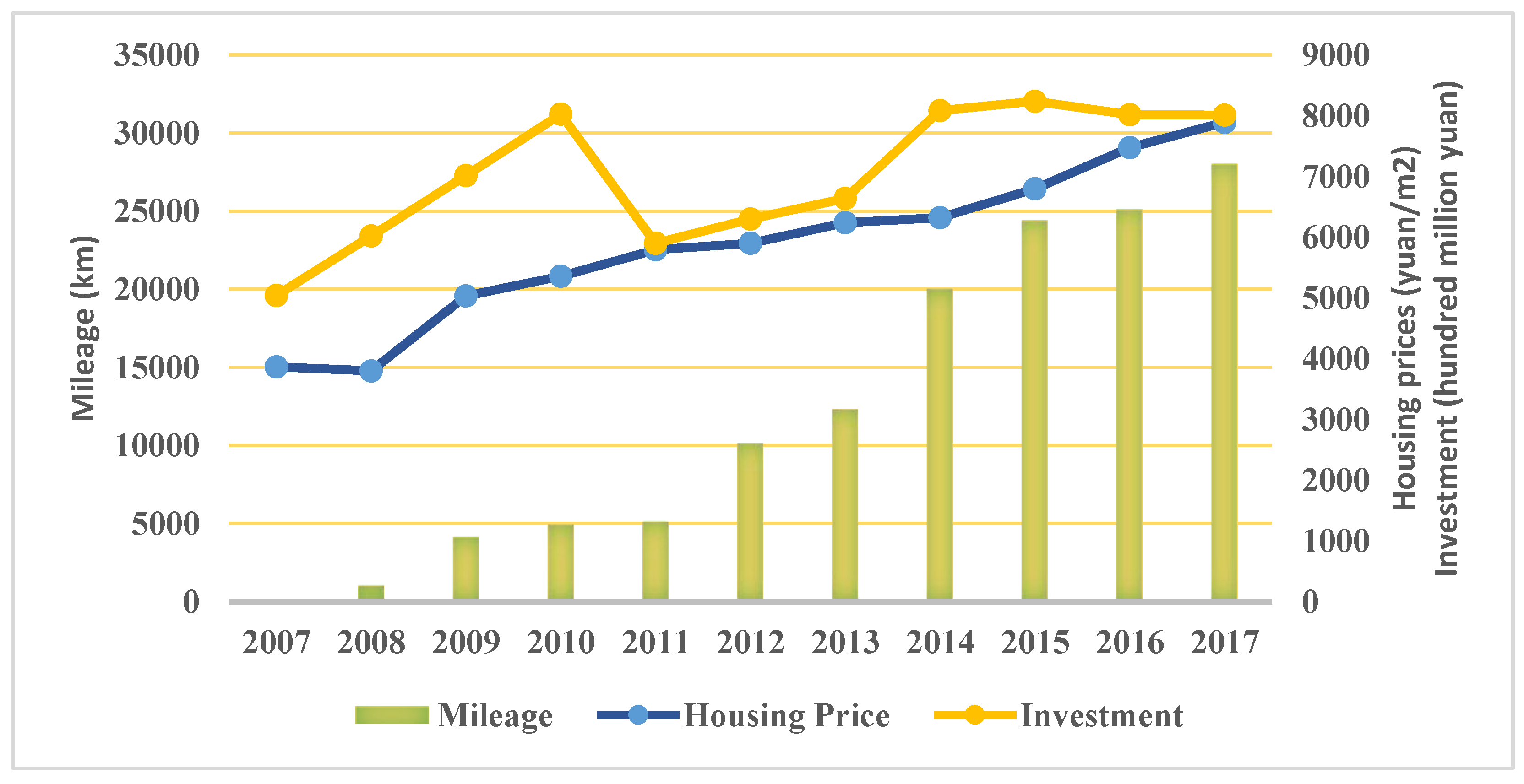

3.1. Data Model

3.2. Variable Description

- (1)

- The economic growth level is measured by gross domestic product (GDP) per capita. The GDP per capita reflects the level of urban economic development. Mayer’s [38] review study also pointed out that GDP is an important factor affecting housing prices. The higher the city’s GDP is, the more developed the city’s economy is, which promotes the increase in real estate prices [29]. Therefore, the impact of economic growth level on housing prices is expected to be positive.

- (2)

- Population level is measured by the total population at year-end. The urban population level reflects the impact of city scale on housing prices. On the one hand, a higher level of population means a larger market. The increase in population leads to a “centripetal force effect” and an increase in housing demand [37], thereby raising housing prices. On the other hand, the operation of HSR can increase city accessibility and reduce commuting costs between cities. It can lead to the flow of people or factors from large cities with a higher population level to small and medium-sized cities [39]. Therefore, the impact of population level on housing prices is expected to be positive.

- (3)

- Education level is measured by collections of public libraries per 100 persons. As people pay more and more attention to education, the level of urban education becomes an important factor affecting residents’ choices of housing. In China, parents attach great importance to the education of their children, and it is very common to compete for school district houses. Therefore, the coefficient of education level is expected to be positive [40].

- (4)

- Medical level is measured by the number of beds in hospitals and health centers. As people pay more attention to health, the level of urban medical care plays an increasingly important role in peoples’ choice of location. The medical level is an important indicator of the level of public services in the region and an important factor in attracting population. Good medical standards became an important factor in raising housing prices.

- (5)

- Investment in fixed assets is measured by total investment in fixed assets. Investment not only causes the accumulation of material but also has a certain impact on housing prices [41]. On the one hand, the increase in fixed-asset investment may lead to an increase in supply, thereby reducing housing prices. On the other hand, an increase in fixed-asset investment may lead to the agglomeration of labor, resulting in an increase in demand, thereby raising housing prices. Therefore, the direction of the impact of investment in fixed assets on housing prices is uncertain.

3.3. Determination of HSR Operation Time Point and Sample Selection

3.3.1. Determination of HSR Operation Time Point

3.3.2. Sample Selection

4. Empirical Analysis

4.1. The Effect of HSR on Housing Prices

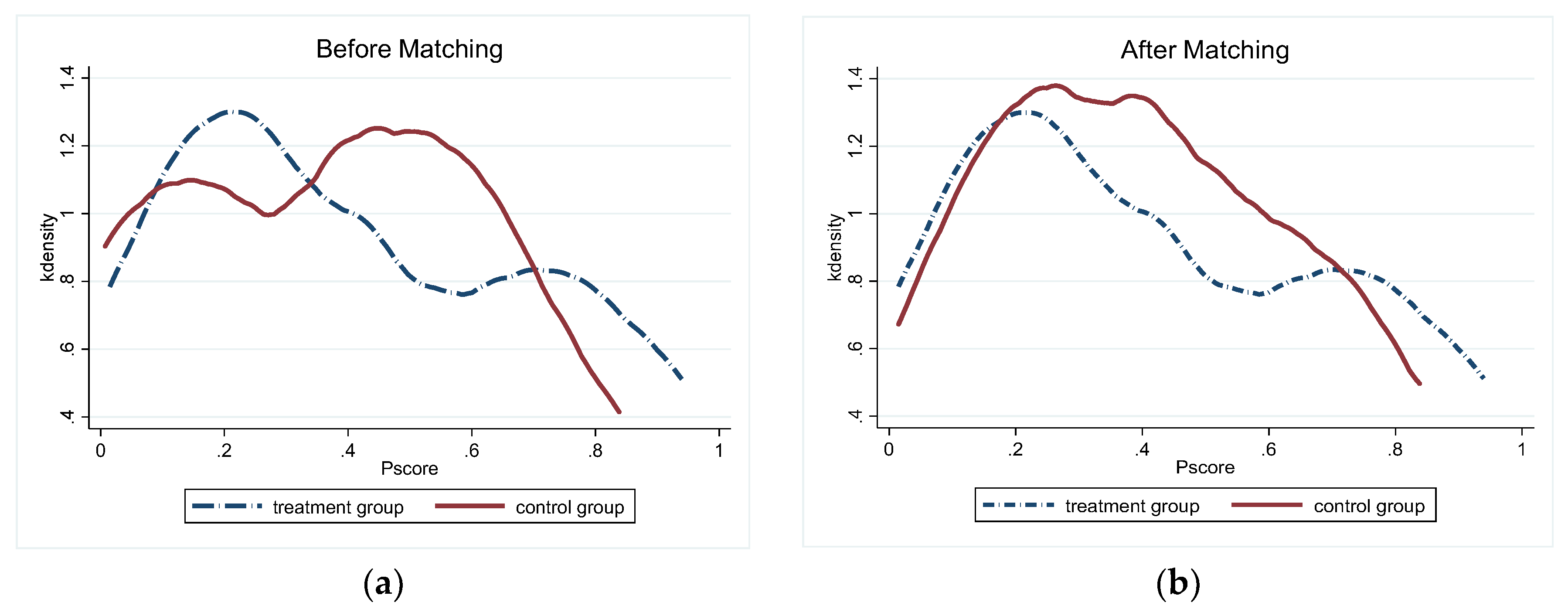

4.2. Test Based on the PSM-DID Model

4.3. City Size Heterogeneity Analysis

4.4. Regional Heterogeneity Analysis

5. Mechanism Test

6. Robustness Test

6.1. Change Time Window Test

6.2. Placebo Test

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- NRA. China’s High-Speed Rail Information. Available online: http://www.nra.gov.cn/xwzx/zlzx/hytj/201904/P020190426367686178375.pdf (accessed on 21 November 2016).

- NDRC. Mid-to-Long Term Railway Network Plan. Available online: http://www.nra.gov.cn/jgzf/flfg/gfx_wj/zt/other/201607/t20160721_26055.shtml (accessed on 18 December 2018).

- Wang, S.; Yang, Z.; Liu, H. Impact of urban economic openness on real estate prices: Evidence from thirty-five cities in China. China Econ. Rev. 2011, 22, 42–54. [Google Scholar] [CrossRef]

- Jia, S.; Zhou, C.; Qin, C. No difference in effect of high-speed rail on regional economic growth based on match effect perspective. Transport. Res. Part A Policy Pract. 2017, 106, 144–157. [Google Scholar] [CrossRef]

- Chen, Z.; Xue, J.; Rose, A.Z.; Haynes, K.E. The impact of high-speed rail investment on economic and environmental change in china: A dynamic CGE analysis. Transport. Res. Part A Policy Pract. 2016, 92, 232–245. [Google Scholar] [CrossRef]

- Shaw, S.L.; Fang, Z.; Lu, S. Impacts of high speed rail on railroad network regional accessibility in China. J. Transp. Geogr. 2014, 40, 112–122. [Google Scholar] [CrossRef]

- Vickerman, R. High-speed rail and regional development: The case of intermediate stations. J. Transp. Geogr. 2015, 42, 157–165. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E. China’s bullet trains facilitate market integration and mitigate the cost of mega city growth. Proc. Natl. Acad. Sci. USA 2013, 110, E1248–E1253. [Google Scholar] [CrossRef] [PubMed]

- Tierney, S. High-speed rail, the knowledge economy and the next growth wave. J. Transp. Geogr. 2012, 22, 285–287. [Google Scholar] [CrossRef]

- Dong, Y.M.; Zhu, Y.M. Study on the employment effect of the construction of high speed railway—Evidence from 285 cities of China based on PSM-DID method. Econ. Mana. J. 2016, 38, 26–44. [Google Scholar]

- Willigers, J.; Wee, B.V. High-speed rail and office location choices. J. Transp. Geogr. 2011, 19, 745–754. [Google Scholar] [CrossRef]

- Hiramatsu, T. Unequal regional impacts of high speed rail on the tourism industry: A simulation analysis of the effects of Kyushu Shinkansen. Transprtation 2016, 45, 1–25. [Google Scholar] [CrossRef]

- Yun, Z.; Xue-Mei, I. Estimation model of knowledge spillover based on accessibility—Analysis of effect of high speed railway network. Soft. Sci. 2015, 29, 55–58. [Google Scholar]

- Geng, B.; Bao, H.; Ying, L. A study of the effect of a high-speed rail station on spatial variations in housing price based on the hedonic model. Habitat Int. 2015, 49, 333–339. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Impact of high speed rail on housing values: An observation from the Beijing–Shanghai line. J. Transp. Geogr. 2015, 43, 91–100. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Polit. Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Minghong, Z.; Qingyuan, Z.; Ruobing, L. A study of the nonlinear and heterogeneity influence of high-speed railway on the real estate prices. Contemp. Financ. Econ. 2017, 9, 3–13. [Google Scholar]

- Lvhua, W.; Yongxue, L.; Liang, M. Potential Impacts of China 2030 High-Speed Rail Network on Ground Transportation Regional accessibility. Sustainability 2018, 10, 1270. [Google Scholar] [CrossRef]

- Hou, Q.; Li, S.-M. Transport infrastructure development and changing spatial accessibility in the Greater Pearl River Delta, China, 1990–2020. J. Transp. Geogr. 2011, 19, 1350–1360. [Google Scholar] [CrossRef]

- Chandra, S.; Vadali, S. Evaluating accessibility impacts of the proposed America 2050 high-speed rail corridor for the Appalachian Region. J. Transp. Geogr. 2014, 37, 28–46. [Google Scholar] [CrossRef]

- Ke, X.; Chen, H.; Hong, Y. Do China’s high-speed-rail projects promote local economy?—New evidence from a panel data approach. China Econ. Rev. 2017, 44, 203–226. [Google Scholar] [CrossRef]

- Shao, S.; Tian, Z.; Yang, L. High speed rail and urban service industry agglomeration: Evidence from China’s Yangtze River Delta region. J. Transp. Geogr. 2017, 64, 174–183. [Google Scholar] [CrossRef]

- Abadie, A. Semiparametric difference-in-differences estimators. Rev. Econ. Stud. 2005, 72, 1–19. [Google Scholar] [CrossRef]

- Dong, Y.M.; Zhu, Y.M. Can high-speed rail construction reshape the layout of China’s economic space—Based on the perspective of regional heterogeneity of employment, wage and economic Growth. China Indust. Econ. 2016, 10, 92–108. [Google Scholar]

- Guirao, B.; Campa, J.L.; Casado-Sanz, N. Labour mobility between cities and metropolitan integration: The role of high speed rail commuting in Spain. Cities 2018, 78, 140–154. [Google Scholar] [CrossRef]

- Määttänen, N.; Terviö, M. Income distribution and housing prices: An assignment model approach. J. Econ. Theory 2014, 151, 381–410. [Google Scholar] [CrossRef]

- Wang, X.; Hui, E.C.; Sun, J. Population migration, urbanization and housing prices: Evidence from the cities in China. Habitat Int. 2017, 66, 49–56. [Google Scholar] [CrossRef]

- Rubin, Z.; Felsenstein, D. Supply side constraints in the Israeli housing market the impact of state owned land. Land Use Policy 2017, 65, 266–276. [Google Scholar] [CrossRef]

- Xie, D.; Lin, X. The effect of urban scale, economic growth to urban housing price. Econ. Geogr. 2014, 34, 70–77. [Google Scholar]

- Huang, X.B.; Liang, Q.P.; Chen, Z.N.; Liu, S. The Study of the Space Effect of Intercity Rail to Housing Price: A Case of Study on Guangzhou-Zhuhai Intercity Railway. Mod. Urban Res. 2015, 6, 26–31. (In Chinese) [Google Scholar]

- Youn, H. The effects regional characteristics of housing environment in Seoul upon housing prices. J. Korea Real Estate Anal. Assoc. 2013, 19, 235–253. [Google Scholar]

- Choi, C.; Jung, H. Does an economically active population matter in housing prices? Appl. Econ. Lett. 2017, 24, 1061–1064. [Google Scholar] [CrossRef]

- Blundell, R.; Dias, M.C. Evaluation methods for non-experimental data. Fiscal. Stud. 2000, 21, 427–468. [Google Scholar] [CrossRef]

- Heckman, J. The common structure of statistical models of truncation, sample selection and limited dependent variables. Ann. Econ. Soc. Meas. 1976, 5, 475–492. [Google Scholar]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propoensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Baier, S.L.; Bergstrand, J.H. Estimating the effects of free trade agreements on international trade flows using matching econometrics. J. Int. Econ. 2009, 77, 63–76. [Google Scholar] [CrossRef]

- Lin, Y.; Ma, Z.; Zhao, K. The impact of population migration on urban housing prices: Evidence from China’s major cities. Sustainability 2018, 10, 3169. [Google Scholar] [CrossRef]

- Mayer, C.J. Housing bubbles: A survey. Soc. Sci. Elect. Pub. 2011, 3, 559–577. [Google Scholar] [CrossRef]

- Hall, P. Magic carpets and seamless webs: Opportunities and constraints for highspeed trains in Europe. Built. Environ. 2009, 35, 59–69. [Google Scholar] [CrossRef]

- Wen, H.; Xiao, Y.; Zhang, L. School district, education quality, and housing price: Evidence from a natural experiment in Hangzhou, China. Cities 2017, 66, 72–80. [Google Scholar] [CrossRef]

- Han, L.; Ming, L.U. Housing prices and investment: An assessment of China’s inland-favoring land supply policies. J. Asia. Pac. Econ. 2017, 22, 1–16. [Google Scholar] [CrossRef]

- Krakstad, S.O.; Oust, A. Are house prices in the Norwegian capital too high? Int. J. Hous. Mark. Anal. 2015, 8, 152–168. [Google Scholar] [CrossRef]

- Li, Z.F.; Zhang, H. Cost-push or demand-pull: What is driving the housing prices in China? Chin. J. Manag. Sci. 2015, 23, 143–150. [Google Scholar]

- Heckman, J.J.; Ichimura, H.; Todd, P. Matching as an econometric evaluation estimator. Rev. Econ. Stud. 1998, 65, 261–294. [Google Scholar] [CrossRef]

- Abadie, A.; Imbens, G.W. On the failure of the bootstrap for matching estimators. Econometrica 2008, 76, 1537–1557. [Google Scholar]

- Zhang, Y.; Peng, Y.; Ma, C.; Bo, S. Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 2017, 100, 18–28. [Google Scholar] [CrossRef]

- CSC. The Notice on Adjusting the Standard of City Size Division. Available online: http://www.gov.cn/zhe ngce/content/2014–11/20/content_9225.htm (accessed on 19 January 2016).

- NBS. The China Urban Area Division Standard. Available online: http://www.stats.gov.cn/tjsj/zxfb/201405 /t20140527_558611.html (accessed on 11 February 2016).

- Baron, R.M.; Kenny, D.A. The Moderator-mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Bond, A.S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ Stud. 1991, 58, 277–297. [Google Scholar]

- Wu, W.; Liang, Y.; Wu, D. Evaluating the impact of China’s rail network expansions on local accessibility: A market potential approach. Sustainability 2006, 8, 512–613. [Google Scholar] [CrossRef]

| Variable | Definition | Mean | SD | Minimum | Maximum |

|---|---|---|---|---|---|

| HOUPR | The average sales price of commercial housing | 4847.139 | 3894.481 | 901 | 45,146.500 |

| CITY | Whether or not HSR services exist (yes = 1 and no = 0) | 0.365 | 0.482 | 0 | 1 |

| GDP | GDP per capita | 43,202.240 | 32,974.840 | 3602 | 256,877 |

| PEO | Total population at year-end | 422.953 | 283.620 | 16.520 | 1446 |

| EDU | Collections of public libraries per 100 persons | 82.006 | 120.627 | 2.300 | 2187.390 |

| MED | Number of beds of hospitals and health centers | 15,848.070 | 16,141.380 | 1279 | 126,838 |

| INVEST | Total investment in fixed assets | 1492.436 | 3867.747 | 17.125 | 130,143 |

| Variable | lnHOUPR | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| 0.1186 *** (0.0579) | 0.1137 *** (0.0506) | 0.1240 *** (0.0481) | 0.1688 *** (0.0466) | 0.1465 *** (0.0434) | 0.1511 *** (0.0434) | |

| lnGDP | 0.3055 *** (0.0225) | 0.3183 *** (0.0222) | 0.2674 *** (0.0231) | 0.2342 *** (0.0200) | 0.2145 *** (0.0219) | |

| lnPEO | 0.1558 *** (0.0129) | 0.1679 *** (0.0129) | 0.0431 *** (0.0163) | 0. 0272 * (0.0175) | ||

| lnEDU | 0.1170 *** (0.0186) | 0.0842 *** (0.0174) | 0.0775 * (0.0169) | |||

| lnMED | 0.1951 *** (0.0177) | 0.1750 *** (0.0187) | ||||

| lnINVEST | 0.0484 *** (0.0173) | |||||

| Observation | 1332 | 1332 | 1332 | 1332 | 1332 | 1332 |

| Adjusted R2 | 0.3627 | 0.5000 | 0.5490 | 0.5678 | 0.6059 | 0.6076 |

| Variable | Mean Control | Mean Treated | Diff | |t| | P > |t| |

|---|---|---|---|---|---|

| lnHOUPR | 8.023 | 8.316 | 0.293 | 4.49 | 0.0003 *** |

| lnGDP | 10.375 | 10.340 | −0.035 | 0.43 | 0.5727 |

| lnPEO | 5.590 | 5.527 | −0.063 | 0.74 | 0.8703 |

| lnEDU | 4.152 | 4.148 | −0.003 | 0.06 | 0.8029 |

| lnMED | 9.177 | 9.142 | −0.035 | 0.43 | 0.6726 |

| lnINVEST | 6.500 | 6.483 | −0.016 | 0.22 | 0.8265 |

| Outcome Var. | lnHOUPR | Standard Error | |t| | P > |t| |

|---|---|---|---|---|

| Before | ||||

| Control Treated | 8.023 8.316 | |||

| Diff (T−C) | 0.293 | 0.061 | 4.82 | 0.000 *** |

| After | ||||

| Control | 8.201 | |||

| Treated | 8.729 | |||

| Diff (T−C) | 0.528 | 0.059 | 8.95 | 0.000 *** |

| Diff-in-Diff | 0.235 | 0.085 | 2.78 | 0.006 *** |

| lnHOUPR | ||

|---|---|---|

| Large Cities | Small and Medium-Sized Cities | |

| 0.133 | 0.120 | |

| Standard Error | 0.166 | 0.036 |

| |t| | 0.800 | 3.320 |

| P > |t| | 0.427 | 0.001 *** |

| Adjusted R2 | 0.408 | 0.337 |

| lnHOUPR | ||

|---|---|---|

| Eastern Region | Central and Western Regions | |

| Diff-in-Diff | 0.079 | 0.183 |

| Standard Error | 0.051 | 0.058 |

| |t| | 1.56 | 3.16 |

| P > |t| | 0.120 | 0.002 *** |

| Adjusted R2 | 0.241 | 0.296 |

| Variable | lnHOUPR | lnEM | lnHOUPR |

|---|---|---|---|

| 0.1187 *** (0.0579) | 0.0795 *** (0.0385) | 0.0303 (0.0372) | |

| lnEM | 0.1101 *** (0.0647) | ||

| Observation | 1332 | 1332 | 1332 |

| Adjusted R2 | 0.3627 | 0.3618 | 0.7136 |

| Variable | lnHOUPR | lnSAV | lnHOUPR |

|---|---|---|---|

| 0.1187 *** (0.0579) | 0.1543 *** (0.0752) | 0.0289 (0.0362) | |

| lnSAV | 0.5813 *** (0.0327) | ||

| Observation | 1332 | 1332 | 1332 |

| Adjusted R2 | 0.3627 | 0.3658 | 0.7264 |

| lnHOUPR | ||||

|---|---|---|---|---|

| One Year | Two Years | Three Years | Four Years | |

| 0.0741 * | 0.0721 * | 0.1046 *** | 0.1510 *** | |

| Standard Error | 0.0687 | 0.0606 | 0.0495 | 0.0434 |

| |t| | 1.0800 | 1.1900 | 2.1100 | 3.4800 |

| P > |t| | 0.2820 | 0.2350 | 0.0350 | 0.0010 |

| Adjusted R2 | 0.5869 | 0.5334 | 0.5750 | 0.6076 |

| Variable | lnHOUPR | |||||

|---|---|---|---|---|---|---|

| 2009 | 2010 | 2011 | ||||

| 0.0148 (0.0917) | 0.0266 (0.0633) | 0.0057 (0.0767) | 0.0251 (0.0559) | −0.0147 (0.0765) | 0.0061 (0.0572) | |

| lnGDP | 0.1888 *** (0.0258) | 0.1784 *** (0.0256) | 0.1949 *** (0.0274) | |||

| lnPEO | −0.0464 ** (0.0263) | −0.0078 (0.0206) | 0.0303 * (0.0208) | |||

| lnEDU | 0.0544 *** (0.0227) | 0.0702 *** (0.0220) | 0.0754 *** (0.0228) | |||

| lnMED | 0.2277 *** (0.0253) | 0.2142 *** (0.0230) | 0.1849 *** (0.0231) | |||

| lnINVEST | 0.0761 *** (0.0220) | 0.0520 *** (0.0203) | 0.0590 *** (0.0536) | |||

| Observation | 740 | 740 | 740 | |||

| Adjusted R2 | 0.2922 | 0.5644 | 0.3416 | 0.5823 | 0.2974 | 0.5564 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, R.; Ye, L.; Chen, L. The Impact of High-Speed Rail on Housing Prices: Evidence from China’s Prefecture-Level Cities. Sustainability 2019, 11, 3681. https://doi.org/10.3390/su11133681

Wang R, Ye L, Chen L. The Impact of High-Speed Rail on Housing Prices: Evidence from China’s Prefecture-Level Cities. Sustainability. 2019; 11(13):3681. https://doi.org/10.3390/su11133681

Chicago/Turabian StyleWang, Rong, Li Ye, and Liwen Chen. 2019. "The Impact of High-Speed Rail on Housing Prices: Evidence from China’s Prefecture-Level Cities" Sustainability 11, no. 13: 3681. https://doi.org/10.3390/su11133681

APA StyleWang, R., Ye, L., & Chen, L. (2019). The Impact of High-Speed Rail on Housing Prices: Evidence from China’s Prefecture-Level Cities. Sustainability, 11(13), 3681. https://doi.org/10.3390/su11133681