1. Introduction

Energy return on energy invested (EROEI) represents one of the major characteristics of energy sources. The higher it is, the more energy is free to fuel human economic activities. On the other hand, its decline indicates that a proportionately higher share of obtained energy from a given source has to be used in the energy extraction process instead of powering other economic activities. This usually means a higher price of a given energy source and more extensive use of capital during the production process itself. The Meta-analysis performed by Hall and colleagues points out to rapidly declining EROEI of major fossil fuels, with renewables having only a fraction of EROEI previously bestowed by high-quality fossil fuels century ago [

1,

2]. The ongoing transition to renewable energy sources thus might have serious long-term economic consequences.

EROEI is a means of quantitative evaluation of the quality of various fuels by reckoning the ratio between the energy provided by a particular fuel to society (

) and the energy needed for its capturing and distribution of this energy (

) [

2].

EROEI of fossil fuels declined sharply from the values of around 100:1 to a more recent 18:1 [

1,

2]. From the renewable energy sources, only the Hydropower has EROEI comparable to early fossil fuels, but its extensibility is limited, probably to not more than 80% above its current capacity [

3]. Modern renewables (Solar PV and Wind power) generally have lower EROEI than Fossil fuels, except imported oil and gas, which seems to be comparable with Wind power [

1,

2].

This problem of low EROEI values was very well summed by Pickard [

4]: “In summation, as the Age of Fossil Fuels draws to a close, it appears that mankind may be facing an obligatory change to renewable fuel sources without having done due diligence to learn, whether, as envisioned, those renewable sources can possibly suffice.”

This problem remains mostly unaddressed in purely economic modelling (notable and rare exceptions are Refs. [

5,

6]), which treats the surrounding environment as an unfortunate externality. Analysis of historical data repeatedly reveals that economic growth, expressed in the form of growth of the real gross domestic product (GDP), goes hand in hand with rising energy consumption and all natural resources in general [

7,

8,

9,

10]. Professor Steve Keen [

11] pointed out recently: “The abiding weakness of all schools of economics, ever since the Classicals—including today’s Neoclassical and Post Keynesian schools, which are normally at pains to point out how superior one is to the other—is this failure to acknowledge the key role of energy in production”. This blindness is in stark contrast to the modelling approach of System Dynamics, which thoroughly takes into consideration various relationships between an economy and its environment and the accumulation of non-renewable and renewable resources, single products, and its sinks (such as released greenhouse gases or waste disposal costs) during model development. The influential work Limits of Growth relates to existing pollution problems to finite availability of non-renewable natural resources. It points out that this type of issue will negatively influence the value of economic indicators such as economic growth [

12]. Although the study was accepted only by ecological economists, Graham Turner compared the study scenario with real-world data and figured out that the study was extraordinarily accurate [

13]. Moreover, Bardi stressed that not all critics of the study really comprehended the original study and thus their criticism is not as relevant as it could be [

14].

Since 1972, many models have used the system dynamics approach, illustrating the problems of resource depletion and climate change caused by continuing economic growth [

15,

16,

17,

18]. However, these models failed to change the economic theory in any appreciable way, even though they represented empirical facts in the relevant fields of science. Takuro Uehara et al. [

19] summarized the problem concisely: “While system dynamicists may not rely heavily on economic theory because of the seemingly unrealistic assumptions employed, economists are indifferent to models that seem to disregard economic theory”.

An example of such a system dynamics model which omits economic interpretation of the problem altogether is the SET model developed by Sgouridis et al. [

3] and World Limits Model developed by by Capellán-Pérez et al. [

20] (more elaborated economy sector is currently being added to the model under the MEDEAS EU project). Selected existing models with feedback structures are presented in

Appendix A.

The model presented in this study called EENGM, Energy Extended Neoclassical Growth Model, aims to bridge this gap through the adoption of a standard, Solow-Swan model of economic growth translated into a system dynamics format. Representation of the model in system dynamics format enables its easy extension with the energy sector based on the main stocks, variables and feedbacks identified in the empirical literature focused on the energy-economy nexus. With this novel approach identified by Radzicki [

21], EENGM explores the implications of declining EROEI for economic development while overcoming the limitations of the previously mentioned models.

The remainder of the paper is structured as follows. The introductory section is followed by the description of applied methods. The third section presents the existing model that represents the main modelling starting point, an outline of the model structure and its parametrization, the basic model behaviour, and finally a sensitivity analysis. After a discussion of the acquired outcomes, the paper concludes.

2. Materials and Methods

This study analyzes the existing representative models developed by means of the system dynamics methodology, which copes with the issues of resource depletion and climate change. The analysis focuses on the common models’ assumptions and conclusions as well as on the form of production functions used—see the

Appendix A. These findings are then used in the next step, which comprise the selection of a representative model of economic development, its conversion into the system dynamics format, and its extension with the energy sector, comprised of selected important feedback and stocks, to represent the ongoing energy transition. Detailed description of the method used for the EENGM development is the main subject of our previous work, presented in the article

Adding Feedbacks and Non-Linearity to the Neoclassical Growth Model: A New Realm for System Dynamics Applications [

22]. The energy transition currently only mildly influences economic growth, but has the potential to play a decisive role in the future. Can the current rate of economic growth be maintained with the currently available renewable energy sources technology? For how long can the current stock of fossil fuels support economic growth? The Energy-extended Neoclassical Growth Model (EENGM) presented in this paper is intended to help to answer these questions. The EENGM respects the rule of thumb stating that a model should be “as simple as possible”. The model is thus relatively easily understandable, analysable and interpretable, which complies with the rule that a model should be “mind sized” [

23]. In this form, it should convey to readers selected challenges that the economic growth process faces in the 21st century.

Figure 1 is a simplification representing the development of EENGM.

We have presented the research gap in the introduction.

Section 2.1 and

Section 2.2 take a look at the following element, Identification of the main Energy-Economy feedbacks.

Section 2.4 is focused on their implementation into the model, which also covers the parameter settings. Calibration is the content of

Appendix B, with sensitivity analysis along with analysis of the results being described in

Section 4. The model was implemented in the software Stella, Version 9.1.3 (run under operating systems Windows 10, 8.1 and 7).

2.1. Relation of Economic Growth and Energy Consumption

It has been repeatedly proven that economic growth expressed in the form of growth of the real GDP is closely related to intensified energy consumption and escalated usage of natural resources in general. An example is the economy of the US, where, from 1949 to 2009, the correlation between GDP growth and energy consumption growth was equal to 0.934 [

8]. Smil obtained a similar result for the economy of Japan [

9]. Brown et al. [

7] analysed the data for 220 nations over a 24-year-long period (1980–2003) and found a strong correlation between the per capita energy use and the per capita GDP. An explanation for this phenomenon is the augmentation of human labour with capital. Most capital goods that are currently used are in one way or another dependent on various inputs of energy, be it from gasoline or electricity, to be usable in the production process. Human labour has mostly been reduced to the role of operating capital or serving as a sensory input in supervisory and decision-making roles [

24]. From that viewpoint, fossil fuels were the enablers of the Industrial Revolution and the subsequent continuing economic growth. Stern pointed out that as the scarcity of energy grows, a strong constraint on the growth of the economy can be experienced [

25]. However, the abundance of energy has a much reduced effect on economic growth. This is also the conclusion of a study of 200 years of data for the Swedish economy [

25]. Hamilton [

26] further pointed out that 80% of recessions experienced since 1970 in the US have a close connection to oil price shocks.

The bell-shaped extraction curve is known as the Hubbert curve and describes the extraction rate of specific non-renewable resources during a certain period. It is a result of interactions between a growing economic system and a finite resource base upon which it is dependent.

Real resource extraction curves are deformed in many ways, marked by many different real-world events, but they usually remain similar to the model case. The Hubbert curve can be used to model the extraction of non-renewable resources, including predictions of peak extraction, but it should be used with extreme caution. Hubbert employed it in 1956, when he estimated the total recoverable reserves of conventional crude oil for the lower 48 US states to be somewhere between 150 and 200 billion barrels. According to that range, he placed peak crude oil production in the lower 48 US states between 1965 and 1970 [

27]. In 1970, the region experienced a peak in crude oil extraction, proving the first successful application of Hubbert’s model. There is no breath-taking precision in this; the peak was predicted in 1956 and placed within a 5-year range, roughly 10 or so years before it happened. Still, we should not forget that, at that time, it was a rather heretical prophecy. Adam Brandt thoroughly tested the Hubbert curve in his work. He tested sets of 139 oil extraction curves from local, regional, and national examples to explore the validity of Hubbert’s model. The results of his work were, in general, favourable for Hubbert’s model [

28]. Recently, Patzek and Croft used multi-Hubbert cycle analysis to predict that the peak of global coal extraction is imminent [

29]. Ugo Bardi noted that even renewable resources, when extracted beyond their regenerative abilities, tend to have bell-shaped extraction curves. He presented cases of wood extraction in 19th-century Ireland and the recent case of Atlantic cod [

30].

The important conclusion from the Hubbert model is not that non-renewable resources should have symmetrical, bell-shaped curves but that the extraction of resources tends to rise along with a growing economy; however, later this process is reversed when the ultimate limit of scarcity is approached. It is important to note that this occurs only in free-market conditions. In other cases, resource extraction curves can have different shapes, for example under rare political conditions, like those in Russia, where we can see a second peak for the oil extraction curve after the dismantling of the USSR.

To model the non-renewable resource price, we adopt an approach proposed by Reynolds. In his paper, he created a model of resource exploration in which the total reserves of the resource base are unknown during searching for resources and their extraction. His model reveals a specific behavioural pattern in which several years of increasing production simultaneously with lowering prices and costs is followed by a sudden and intense price rise with a significant decrease of production. The availability of technology that can cut costs and increase the reserve base supports a longer increase in production and decline in prices and costs. However, his model suggests that in spite of better technology, we can experience a rapid increase in price as long as the pace of technological innovation is smaller than the growth of demand. He proposed a ‘U’-shaped price curve as a model of non-renewable resource price curve development [

31].

2.2. EROEI

The concept itself has been presented as part of the introduction; some important notes and caveats follow. The Relationship in Equation (1) is seemingly straightforward, but in reality, various studies adopt different system boundaries, which leads to different results obtained for the same fuels, caused by variability in the denominator [

2]. The wider the system boundaries selected, the lower EROEI tends to be, as more energy inputs are accounted for. Fortunately, there are efforts to push the common framework for calculations, so this issue should no longer cause confusion.

It is important to note that there are a few important caveats. Studies focused on modern renewables adopting wider boundaries, including even necessary back-ups in the form of batteries to counter intermittency of these energy sources, usually come with much lower EROEI values then presented in the table above. One example study by Ferroni and Hopkirk came to the conclusion that Solar PV is an energy sink based on the analysis of Solar PV installations placed in Switzerland and Germany [

32]. Pedro Prieto and Charles Hall also came to a much lower number for solar PV, analysing the comprehensive available data for the case of Spain. According to their conclusion, the EROEI of solar PV installations in Spain is only around 2.45:1 [

33,

34].

EENGM simulation results depend critically on the EROEI of renewable technology. Hall et al. reported mean values of 18:1 for the EROEI of wind power and 10:1 for solar PV [

2]. Pickard noted that these estimates have to be downsized dramatically when one considers the systemic EROEI of the whole energy sector composed solely from renewables, as it will need: “(1) a radically strengthened long distance transmission backbone that serves to average generation over continent-sized areas; and (2) an ancillary infrastructure of massive electricity storage to finesse the remaining supply fluctuations inherent to solar-derived electricity” [

4]. The study by Weißbach et al. reported a buffered EROEI (accounting for battery storage) of 3.9 for solar PV and 9 for wind power, producing an average of 6.45 [

35]. Considering this renewable energy aggregate, we would have to scale down its EROEI further, as solar PV has greater potential for total installed capacity. This consideration still leaves out the reduction necessary to account for the long-distance transmission backbone mentioned by Pickard. Capellán-Peréz et al. reported an EROEI of the whole energy sector running solely on renewable energy sources with a necessary battery backup equal to 3 [

36]. For this reason, we ran a model sensitivity analysis predominantly for the EROEI ranging from 3 to 7 or up to 15 in two instances.

Despite these low values reported in the literature, it is important to not forget that technology itself is still evolving. The concept used to show the progression in the development of a certain energy source is the experience curve. The experience curve shows reductions in the price of a unit of installed capacity relative to its cumulative installed capacity. It reflects the learning ratio, which is the reduction achieved in the price of the installed capacity unit per doubling of the installed cumulative capacity. In other words, the experience curve depicts economies of scale without considering other possible influences, for example changes in the prices of the raw materials used in the production of any given renewable energy source. The experience curve for the solar PV price shows a historic learning rate of 22% in the years 1976–2003. The Renewable Energy Agency reported that, on average, the doubling of the cumulative installed capacity of onshore wind between 1983 and 2014 resulted in a 7% reduction in the weighted average installed costs [

37].

A rising load factor is also reported, which will further contribute to the rising EROEI for onshore wind power (from 20% in 1983 to 27% in 2014). This is due to higher hub heights and larger rotor diameters, which helped to increase the load factor despite the fact that, in some countries, lower-quality wind sites were used for the development of new projects [

37].

2.3. Concept of Sustainability Adopted for the EENGM

Our perception of sustainability or sustainable economic development has to be clarified here, as these concepts have become widely overused and potentially vacuous words. Richard Heinberg postulates five axioms of sustainability [

38]. For the model at hand, mainly his second and fourth axioms are crucial, as they are also quantifiable, which is necessary for the model. The second axiom states that population growth and/or growth in the rates of resource consumption cannot be sustained. The fourth builds on the previous one, stating that a sustainable economy has to be closely connected with the declining rate of non-renewable resources usage. Moreover, this rate must be equal to or exceed the rate of depletion. For an economy to be considered sustainable, it must also fulfil the requirements of the remaining three axioms [

38].

Aforementioned second and fourth axioms together form model behaviour named sustainability strategy (SUS). Once It is adopted by the model, population growth stops, and all the energy sector investment is redirected to renewable energy generating technology immediately. The model default behaviour is called business as usual (BAU). Populations grow according to the UN predictions, and energy investment is allocated reversely to the energy generating technology prices while BAU is active.

2.4. Feedback Structure of the Current Models

The system dynamics paradigm has been proved to be a suitable tool for modelling economic systems. Various models using the framework of system dynamics have been presented in the scientific literature. While the fundamental works were already being published in the 1970s [

39] or the 1980s [

17], only recent research on simulation methods, tools, and related software applications have enabled the development of sophisticated models. The rationale for using the system dynamics method for constructing the EENGM has already been explained by Ref. [

22]. Eight of the most relevant feedback structure models [

3,

15,

17,

18,

40,

41,

42] are chronologically ordered and listed in

Appendix A—Feedback structure models. The description also contains the main drawbacks and weak points, as the development of the EENGM model is partially based on their mitigation.

2.5. Description of the EENGM

The EENGM model builds on the Neoclassical economic model and extends it by the implementation of several blocks or sectors that enable the development of a meaningful energy sector to be used in simulation. Besides the aforementioned typical sectors (technology sector, general-purpose capital goods sector, and population), the production process sector is significantly extended and comprises the influence of energy availability on capital usability in production. Moreover, the endogenous savings rate is included and it is influenced by the total capital amount and the availability of energy resources for its operation. Similarly, the energy sector is elaborated and structured. It comprises a renewable energy source and a non-renewable energy source. The latter is cheap and plentiful at the onset of the simulation. Nevertheless, its price grows due to a decline in its limited reserves. The former is associated with a high price, which decreases with respect to the cumulative installed capacity. The mechanism that divides the investment between two aforementioned energy sources and redistributes energy capital investment is also included. All variables can be found in the file with the model attached to this manuscript as a

Supplementary File.

Below, the main variables of the model are summarized. As it is important to comprehend the limitations of the model, selected significant omitted variables are presented:

Endogenous variables: macroeconomic product, consumption, savings/investment, capital, demand for energy sources, representation of EROEI, extraction and depletion of fossil fuels, renewable energy sources, and the role of energy in the creation of the macroeconomic product.

Exogenous variables: population, factor productivity and technology.

Omitted elements: atmosphere, emissions of CO2 and natural resources of a non-energy nature.

The simulation period for the model is 1965–2065. The model recreates behaviour for 50 years (see

Figure A1,

Figure A2 and

Figure A3 in

Appendix B—Model calibration). This forecast is the main topic of this paper.

The assumptions associated with the model are the following:

Energy as a necessary production factor—the maximal product potential can be verified in this switch-

off state. The product

Q is expressed by the energy-dependent Cobb–Douglas production function where

K represents the capital stock,

L stands for the population stock, and the technological progress is

A. Energy (

stands for the energy supplied by the energy sector an

is the amount of energy needed to fully operate the capital) is needed to use capital stock in production (Equation (2)):

where

is the capital elasticity in production. Subscript

t denotes the explicit time-dependence of the model, which is computed in discrete time steps where each simulation year represents one time step of the model. Structure of the model, basic behaviour, model equations, or model-simplifying assumptions, can be found in

Section 2.4 and our previous work [

22].

An endogenous savings rate—the system can respond to the increased need for investment in the energy sector. There are two types of investment—into general, energy-using capital and into energy sector capital.

where

Ic corresponds to Capital Investment in the scheme below and

Ie to

Energy Sector Available Investment. The total investment fraction

is given by

where

corresponds to

Initial Capital Investment Fraction,

to

Marginal Return on Capital and

to Normal Return on Capital. Calibration corresponds to a third Kaldor’s fact, in which the capital/output ratio is roughly constant (around two in our case, which corresponds to also to the value reached in DICE model). Investment is then separated into energy and general-purpose capital investment, determined by the

Energy Capital Investment Fraction variable. It is the transition function based on the ratio of the

. This corresponds to the total investment dedicated to the energy sector; thus, it is clear that when there is less than 85% of total capital operated, all investment assets are redirected to the energy sector alone.

A starting quantity of the non-renewable source, calibrated to represent the fossil fuels and the uranium ore reserves at the same time (TOE). This represents the stock, from which the energy necessary for production to operate capital stock is extracted.

Fossil Fuels Extraction Capital represents the capacity, the amount of resources which can be extracted from available stocks of fossil fuels in 1 year, and it depreciates with a constant rate. The price of fossil fuels,

Added TOE capacity price grows with declining amount of

Fossil Fuels Reserves. The model uses the following version of the Equation [

42]:

where

is resource price,

is the initial resource stock,

stands for current reserves and

is the resource coefficient. The model uses the value of −0.78 which corresponds to a six-times higher price than initial this roughly corresponds to historical oil price movements. Reynolds, in his research, concluded that the resource price during the exhaustion phase slowly grows to the levels seen during the start of the extraction [

31].

The parameter settings for the renewable energy source. The lifetime of the capital used for its generation, the load factor (the percentage of the amount of time when the energy source operates on the level of its maximum performance), and the fall in the cost of capital used for the renewable energy generation by doubling its installed capacity (the so-called learning curve).

The initial cost of the renewable energy source (1989$).

Ayres–Warr’s hypothesis. When explaining economic growth, the part that cannot be explained by a change in the amount of labour or capital employed in production is automatically attributed to the technological progress, but in fact it is a residual error caused by the exclusion of other variables from the statistical model. The aforementioned authors showed that it was a failure to factor in the useful work, which, in other words, means the increased efficiency of capital in the transformation of energy resources into useful work. By activating this assumption, the exogenous growth of the technological factor is limited in the model. This corresponds to an observation that, in several processes, we are already approaching the thermodynamic limits (e.g., combustion engine efficiency).

3. Results

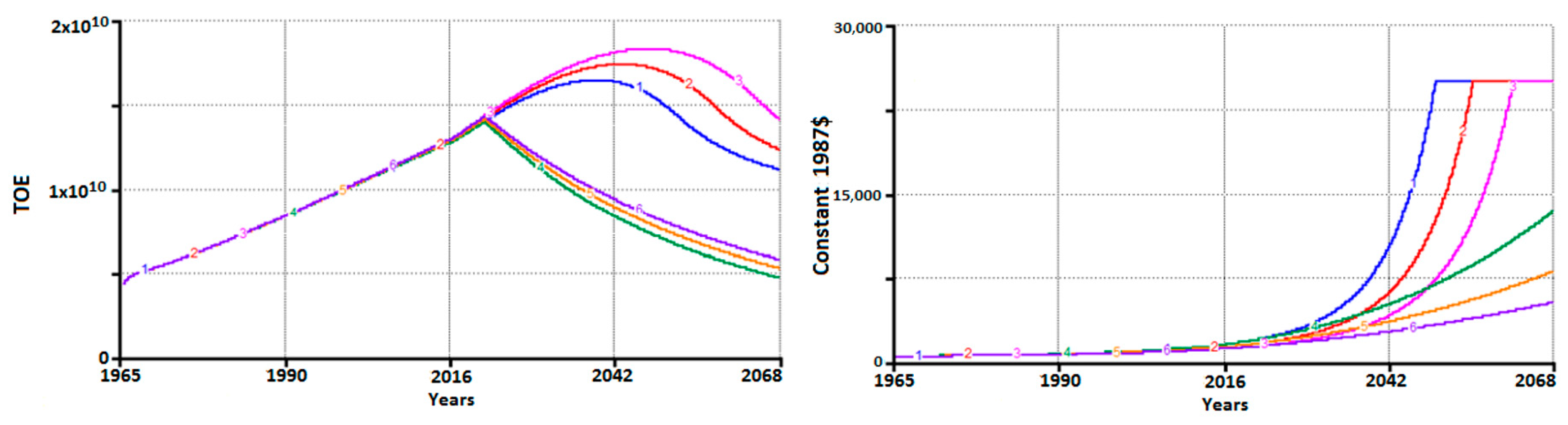

The results are divided between the two aforementioned scenarios,

business as usual (BAU) and the

sustainability strategy (SUS). Although the EENGM comprises many variables, the development of the gross domestic product, discretionary consumption per capita and investment comprise

Figure 2, with fossil fuel extraction and consumption, EROEI development, and total investment rate also being selected to represent the simulation results in the following figures. The values of the other variables can be found in the model itself, which is attached to this study as a

Supplementary File.

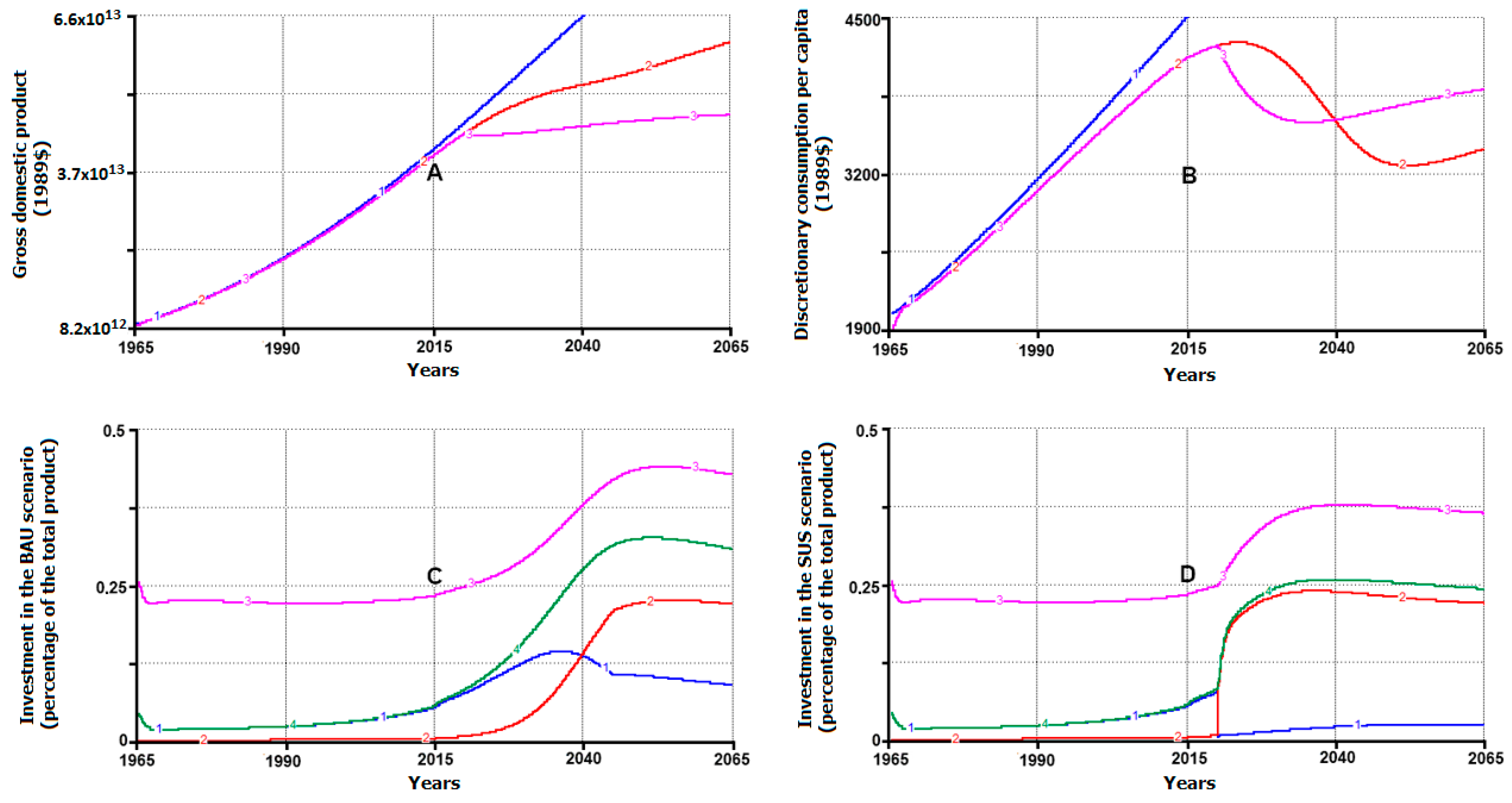

The GDP in both scenarios differs sharply from the historical trend line, which can be considered a simple trend extrapolation when the GDP growth is not constrained by energy scarcity and other environmental limits. This is caused in part by the aforementioned saturation of the technological factor and the shift of the investment flow predominantly into the energy sector, which can cause capital shortages in other economic sectors. The worse performance of the SUS scenario is due predominantly to the population being capped at the level of 7.75 billion people, as demanded by the SUS scenario definition, so the small observed GDP growth comes solely from meagre general capital increases. The BAU scenario reaches a much higher total product, but the capital/product ratio falls to 1.54, referring to the higher labour intensity of the product (the average value in the simulation start year is over 1.9; the SUS scenario reaches the value of 1.7), pointing out a significant paradigm shift in the production process relying more on human labour.

The differences in the discretionary consumption are more pronounced than those in the case of the GDP, as both scenarios fail to reach the current levels in the final simulation years. The SUS scenario has slightly higher total cumulative consumption per capita, the main difference being the timing. The adoption of the SUS scenario means lower per-capita consumption in the first two decades of transition but significantly higher consumption towards the end of the simulation period. The observed divergence between the historical trend line and the model’s projected consumption in the pre-2018 period is caused by the omission of energy sector investments in the historical trend.

The SUS scenario involves a significantly smaller investment rate than the BAU scenario thanks to the early massive investment in renewable technology at a time when fossil fuels are still relatively cheap. In the later years, the system is confronted with less efficient fossil fuel capital (employed in extracting and processing lower-grade resources, like tar sands and deep-sea oil deposits) and the necessity to invest in immature renewable energy source technology. In the case of the SUS scenario, the investment rate is on the level of 34% of total GDP, and in the final years of the simulation it declines to 33%, while the BAU scenario reaches the 38% mark.

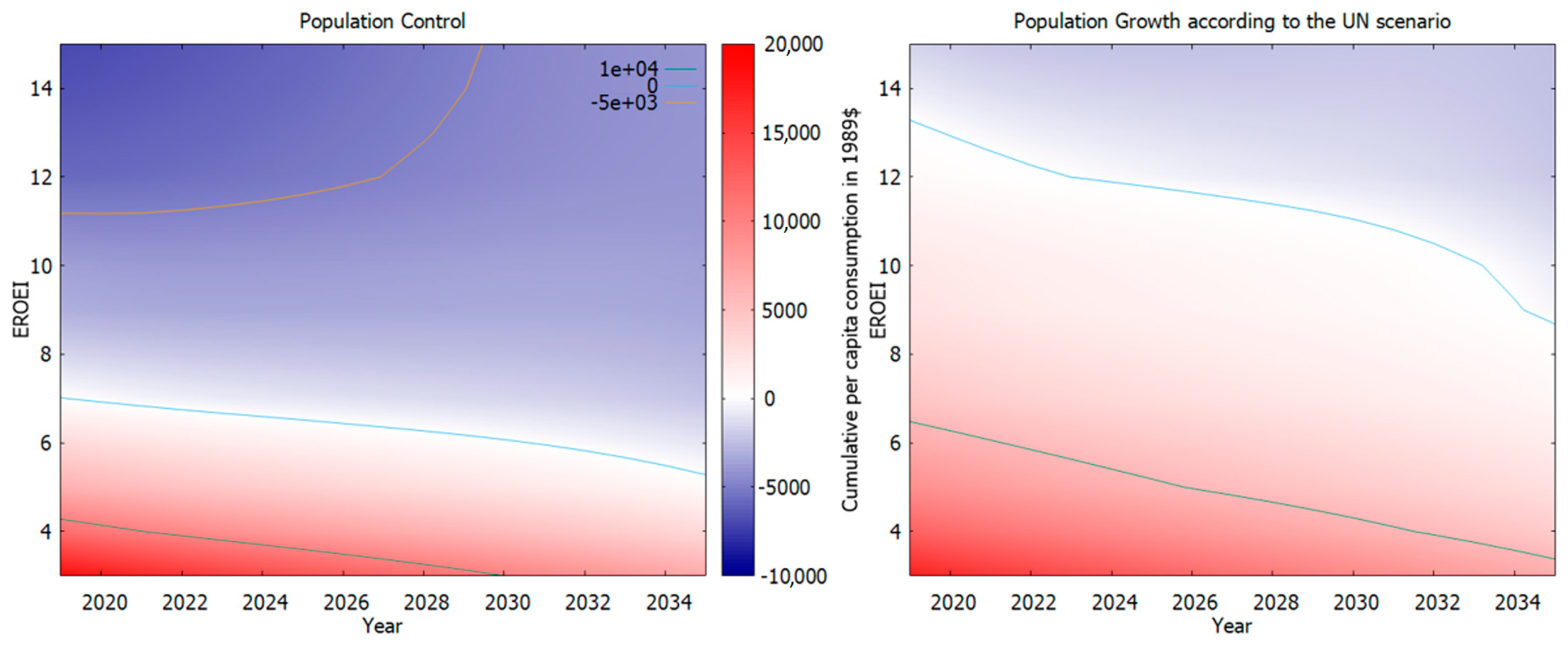

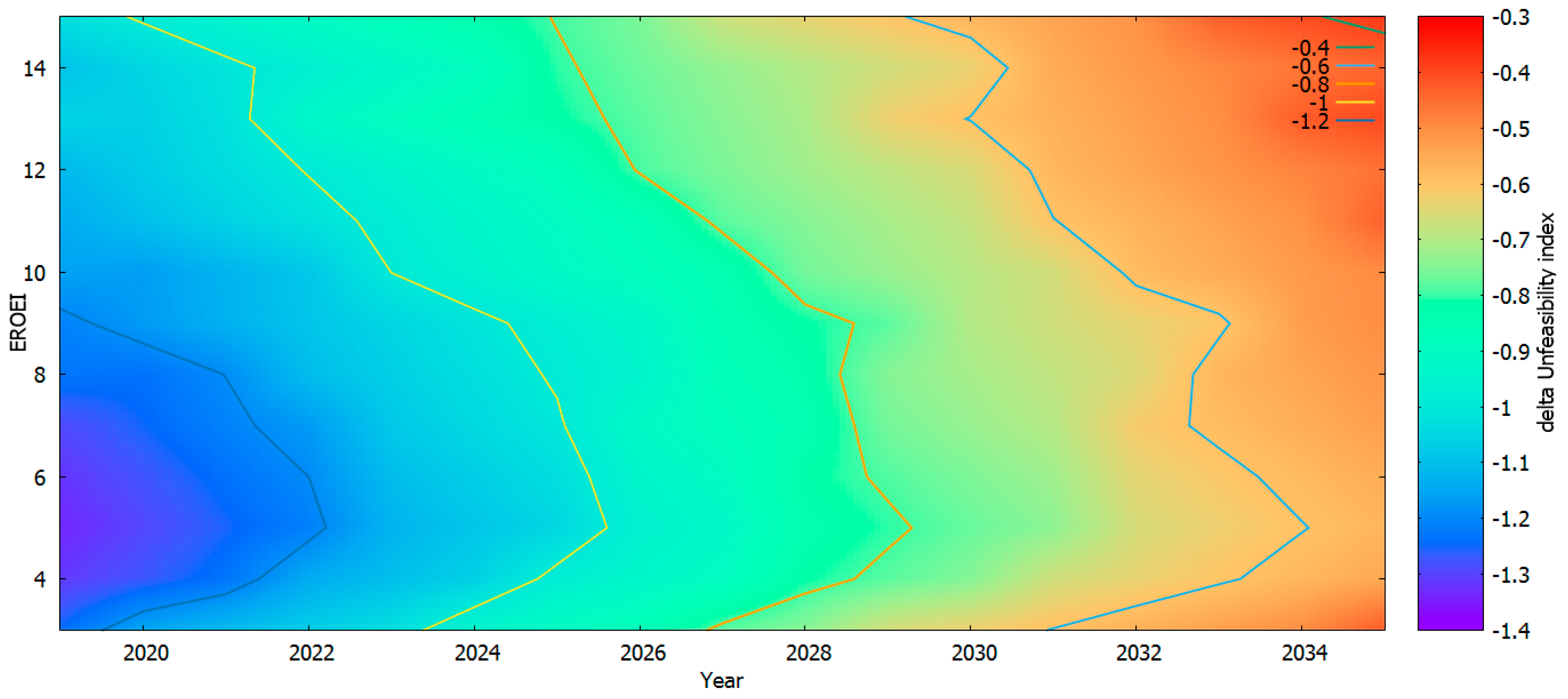

We have elaborated more detailed sensitivity analysis for the expected economic performance of the system. One of the ways in which we can evaluate it is the cumulative per-capita disposable income, being a simple proxy variable for the quality of life. Variables used for this sensitivity analysis were EROEI (in the relatively wide range of 3–15) and a year in which the SUS scenario strategy could be adopted by the system. The results are displayed in

Figure 3. The SUS scenario is further varied by population, which is in the first analysis kept constant since 2019 (left side of the

Figure 3) as suggested by Heinberg and exactly the same as in the BAU scenario (population growth according to the UN projections) in the second.

Colours represent different outcomes of the decision to adopt the SUS strategy or do nothing, which corresponds to the BAU scenario. Red colour represents the situation in which it is still economically more advantageous for the system to not change its behaviour/strategy, which produces higher cumulative per-capita consumption. This changes on the level of EROEI 7 and higher, where even early adoption of the SUS development scenario outperforms BAU. There is a saddle point at the EROEIL = 9, where regardless of the SUS year adoption, BAU is outperformed by roughly the same value of per-capita cumulative consumption. In a case of very favourable EROEIL = 12–15, which unfortunately does not correspond to the currently available renewable technology quality (but still might be reachable in the future), the SUS development scenario outperforms BAU by the highest margin if adopted early on.

The SUS development scenario, as defined by Heinberg, demands an immediate cap on population growth. As desirable as it might be from the viewpoint of overall ecosystem degradation, it is not realistic. Therefore, the right half of the chart includes the same analysis, but for the population growing exactly by the same rate like in the BAU scenario. Here we can see that for the majority of values, the BAU scenario performs better than the SUS. This is given by the fact that a system with a constant population does not require the same general-purpose stock capital investments as a growing population does to have its ends meet. This leaves relatively more investment to be allocated for the energy sector accompanied with relatively higher cumulative per-capita consumption at the same time.

It is necessary to point out that in all cases, SUS strategy adoption leads to a better economic performance in the final simulation years. The sacrifices necessary to kick-start transition to renewable energy are significant. The results could change in favour of the SUS development scenario with a longer time horizon. However, even the current model simulation period mightily overcomes the typical planning horizon of most governments. So, in this case, even without the use of discounting of future consumption, we are running into a problem that basically, as many noted, the end of the world is free while the will of the people to curb their current income is limited at best.

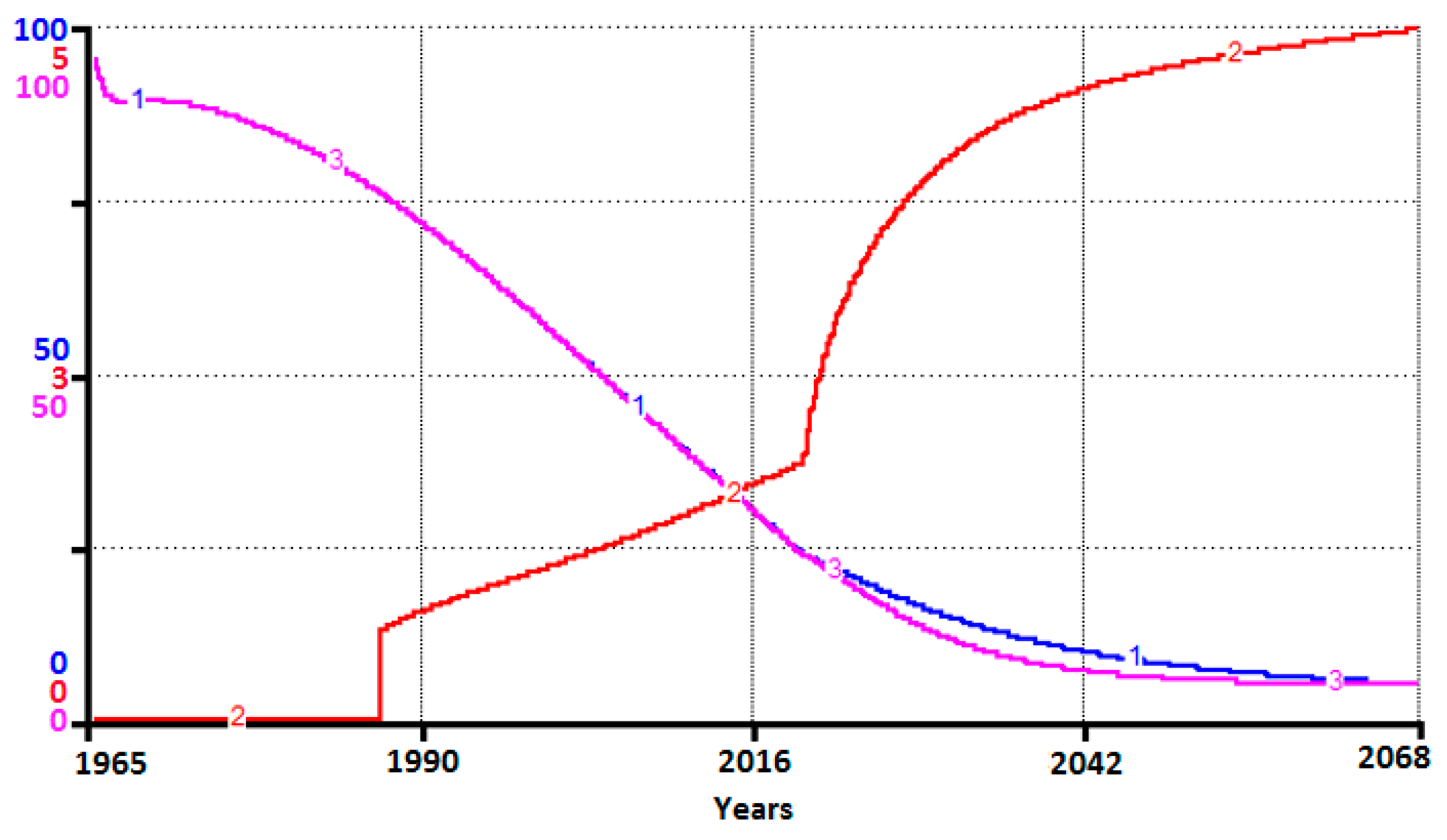

Figure 4 illustrates the concept of EROEI in the model. The EROEI for the fossil fuel aggregate declines from historically observed values of 100:1 to 4:1, while the EROEI for renewables increases with cumulative investment in technology to the upper level of 5:1.

It is also important to note that, in the final year of the BAU scenario, renewable energy technology is used to generate 52.6% of the energy consumed, while, for the SUS scenario, it is 83.4%.

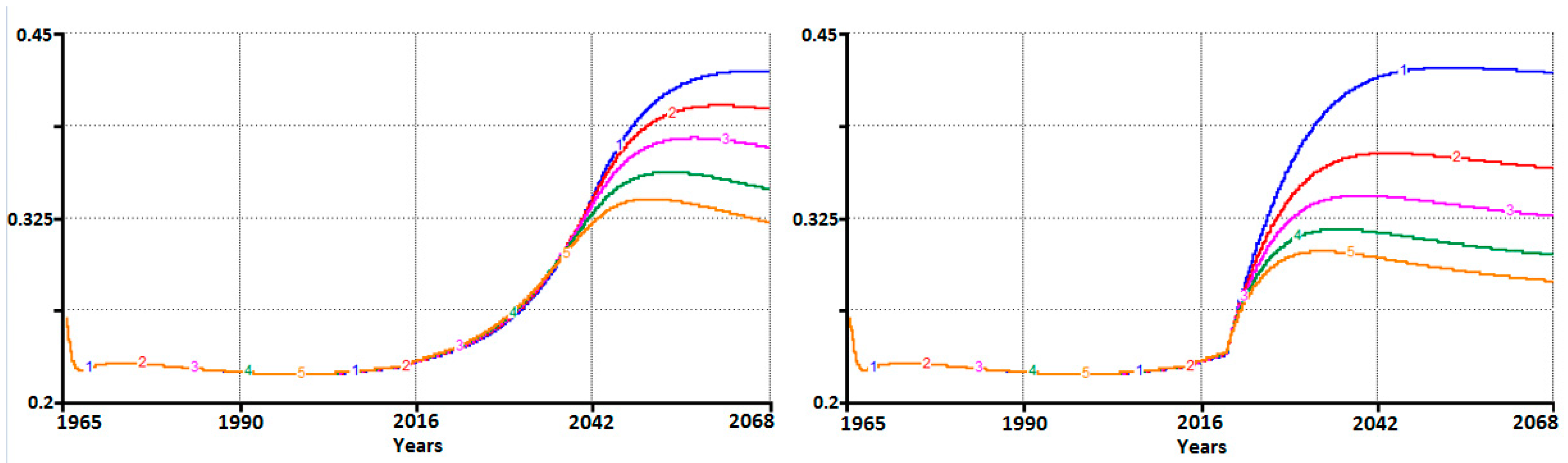

For the model sensitivity analysis (varied EROEI

L, limit EROEI of renewable energy technology, reachable by newly installed capacity towards the end of simulation), we chose the investment rate fraction, displayed in

Figure 5, as it clearly captures the difficulty connected with the energy transition, since only the rest of the GDP can be used for consumption purposes. An investment rate sensitivity analysis was performed for the following renewable resources harnessing capital parameters (see

Table 1).

It is clearly visible from

Figure 5 that, for EROEI

L = 3, the investment share is almost equal for the two scenarios, surpassing the 40% mark. The SUS scenario performs significantly better for the renewable energy technology EROEI of 4 and higher, offering a 4% smaller investment fraction on average. The SUS scenario thus manages the transition with significantly smaller investment shares, but the economy has to endure them for longer.

Since the EENGM lacks climate representation, it is also important to emphasize that the SUS strategy leads to cumulative fossil fuel consumption of only 746 BTOE compared with 1040 BTOE for the BAU scenario (note: The starting amount of fossil fuels’ aggregate reserves is 1280 BTOE). The price cap is reached in the year 2045 in the case of the BAU scenario, while it is never an issue for the SUS scenario.

Figure 6 captures how uncertainty about ultimate recoverable fossil fuels reserve changes the timing of the extraction peak, which is postponed slightly over a decade by the considerable increase in the reserves (+25% added to the initial reserves amount) with a similar change in the price dynamics.

Connecting preceding results regarding the investment rate and the absolute amount of used fossil fuels aggregate, we have performed an analysis capturing the feasibility of various model development pathways. For the purpose of the EENGM evaluation, we have defined the Unfeasibility index (UFI) as a sum of the two values. The first corresponds to the maximum energy sector investment rate necessary for certain model development path viability and the second to the amount of fossil fuel aggregate used up during its energy sector operation. The scenario with the highest investment rate observed in the data (which corresponds to 32%) for this analysis will receive 1 and if it also has the highest amount of fossil fuel aggregate used (roughly 500 BTOE is used up in 2019 with another 780 BTOE remaining in the ground), it will receive the total UFI = 2, which is the maximum UFI value. It is important to note that in that case, BAU cumulative emissions are equal to roughly 1220 BTCO

2, accounting for other CO

2 sources (e.g., cement). This can be directly compared with various studies presenting the remaining carbon budget, which we do in the discussion section. The scenario with the lowest energy sector investment rate (14%) and the lowest fossil fuel aggregate used at the same time have the unfeasibility index equal to 0.

Figure 7 shows the result expressed as the reduction of UFI stemming from the SUS development strategy adoption in any given year.

It is clearly visible that the highest potential reduction in the feasibility index has the EROEIL = 5, but adoption of the SUS decreases the UFI index significantly at all times. However, with passing time, it is harder and harder to steer the system off from more difficult paths, in which the population has to face an economic squeeze in the form of necessary high investments into the energy sector along with the changing climate, posing a grave threat when combined. The window of opportunity to steer the system off the difficult paths starts to close after the year 2031 for most EROEIL values used in this analysis.

4. Discussion

The EENGM is a model developed in the style of the “mind-sized” models. The model is thus relatively well suited to conveying to readers the main qualitative features of energy transition modelling within the common economic framework. The presented novel extension of the Neoclassical model of economic growth created new dynamics in the model where future economic performance is related to the quality of the available energy technology and past investment allocation decisions in the energy sector. Explicit representation of the fossil fuel stock along with the renewable energy technology parameters, installed capacity, and labor stock represent the limitation of the Cobb-Douglas production function. While the substitutability of the factors of production remains, realistic values of the production function parameters are clearly restricted by the stock dynamics in the model, which represent the contribution of the system dynamics approach to economic modelling. EENGM itself turns out to provide results similar to those generated by the more complex models. Its high level of aggregation is thus a drawback and a strong point at the same time. The following discussion starts with the main model limitations.

Various relatively new renewable energy source technologies are aggregated into one with averaged parameters. It is nothing more than a simplistic assumption. The attempts to implement a renewable energy mix in the model were defeated by the fact that, in the real world, investment in renewable energy resources is not driven just by their prices; many other factors are at play. In the case of hydropower, the main factor is usually a political decision about dam placement [

42]. Decisions about investment in wind power can be influenced by aesthetical concerns regarding damage to natural scenery. The model could not simulate all the various concerns considered during the decision process, and for that reason, there is only one abstract renewable energy source. This, of course, limits the model’s significance, as the total EROEI of the whole renewable energy mix will be influenced by its composition. Hydropower has high EROEI values, but it is seriously limited by its total scalability. Wind power has a higher EROEI than solar power but a flattening price learning curve at the same time. All these factors could change the model results and elaborate on the true scale of the economic burden that the energy transition constitutes.

The EENGM omits a few well-known feedbacks. There is no representation of the CO

2 emissions and the atmosphere capability of storing carbon and the consequent global warming. This would probably create a need to phase out fossil fuel energy resources faster in the BAU scenario, and it could decrease the GDP growth even further. At least the total quantity of the fossil fuel aggregate is monitored, which gives a certain idea about the total emissions produced. The worst case BAU scenario (EROEIL = 3) produces 1218.75 BTCO

2 from the energy sector alone, while the best case SUS scenario (immediate SUS strategy adoption, EROEIL = 15) produces 671.25 BTOCO

2. Rogelj et al. report that the remaining carbon budget is in line with global warming not exceeding 1.5 °C, compared to the preindustrial levels which are around 600 BTCO

2 [

43]. Since the model does not account for other sources of CO

2 outside of the energy sector, even an extremely radical program, which the SUS strategy indeed is, fails to remain within this carbon budget by a wide margin.

Another omitted feedback is represented by the need to replace the energy end-use capital stock, which is responsible for the production of the economic goods. This need could arise in the case of a fast fossil fuel phase-out or as an inevitability in the case of a rapidly declining fossil fuel extraction curve. Grubler emphasized the importance of energy end-use capital stock for energy transition. This capital stock is many times bigger than the energy-generating capital stock, so its role in energy transition could be considerable, as it might be necessary to change its composition alongside the changing energy-generating capital. It means that lock-in of the energy supply may be created by the energy-using equipment stock. Grubler further presented a figure for the total global annual energy investment, which amounts to US

$0.3–3.5 trillion and surpasses the energy supply side investment of US

$0.7 to 1.0 trillion (annual figures in 2005 constant dollars) [

44]. The inclusion of this feedback could influence the model results negatively, as the amount of investment needed in various scenarios could rise significantly, thus making those scenarios unfeasible.

Lastly, Population is an exogenous variable in the model, based on the UN population predictions. It is clear that in a case when only the low EROEI (EROEI

L = 3–5) technology is available, per-capita energy consumption will drop to very low levels towards the end of the EENGM simulation period. Smil presented the relationship between per capita energy availability and infant mortality rate, the average per capita food availability and life expectancy at birth, with all three variables increasing and growing in a non-linear fashion with the energy consumption [

9]. Population levels in certain model scenarios could be adversely affected with this feedback present in the model.

To summarize, the above-presented omitted variables and missing feedbacks together could significantly influence the model results adversely; its results can thus be viewed as best-case scenarios.

The comparison with other models is not straightforward, as they usually employ different sets of assumptions. Compared with the standard run of the legendary limits to the growth model, the model results are a little more optimistic. The LTG model’s industrial output and services per capita peaked and declined shortly before the year 2020 [

45]. The current model does not predict a decline in per-capita discretionary consumption before the year 2029 for the BAU scenario. In the SUS scenario, the peak in per-capita consumption is immediate, but, during the final years of the simulation, it returns close to the peak levels. The LTG considered a more comprehensive set of environmental feedback but suffered from an even greater aggregation of the main variables.

In the MEDEAS model, the global economy falls into a lasting recession shortly after 2025 and the per-capita GDP levels drop below the levels obtained in 1995; results that are relatively similar to those obtained by the EENGM simulation. In both scenarios simulated in the MEDEAS model, the per-capita GDP falls below 5000 constant 1995

$, while in the EENGM it stays above 6000 constant 1989

$. Unfortunately, the investment and consumption shares in the GDP are not reported, so the comparison is narrowed to these two variables. We also consider the per-capita GDP to be a poor indicator of affluence, as the investment share in the GDP is expected to rise considerably during the energy transition. It seems that the MEDEAS results point out even greater economic hardship to be expected during the energy transition. This difference can also account for the lower EROEI of 3 used by the authors [

46].

A similar approach was selected recently also by Victor et al. to develop their EETRAP model. EETRAP is a mathematical model with a macroeconomic framework which is used for building the EROI metric and the energy characteristics of renewable generation. EETRAP was used for simulation analysis to test how renewable investment will be affected by varied EROI of renewables. Authors conclude that the renewable investment rate by 2050 is significantly larger than the current energy investment rate and crowds out investment into general purpose capital and can cause a prolonged recession.

In comparison with the EENGM, our results are significantly worse in terms of the size of the investment rate. In the worst-case scenario of the EETRAP model, the investment rate for renewables peaks at 17%, while the authors used the energy system EROEI of 3 (slowly declining to this value with increasing penetration of renewables) [

47]. In the EENGM, the investment rate for renewables plateaus at the level of 32% (with EROEI

L = 3) in the BAU scenario and 27% for the SUS scenario. Unfortunately, the overall investment, and thus also the savings rate, is not reported for the EETRAP; a direct comparison is therefore impossible. The difference between the EENGM and the EETRAP lies at least partly in the more aggressive pricing function for the non-renewable resource extraction capital (capped at 25,000 1989

$ per added TOE of incremental extraction capacity).

After seeing all the EENGM results, knowing its inherent limitations, what course of action does it suggest? One of the model lessons is that the price signals (for non-renewable resources) should not be trusted, or used solely as the primary decision factor guiding energy policy while being compared with the alternative technologies. When used in this way in the EENGM BAU scenario, investment into renewable energy technology is postponed for too long, creating a situation with a very high energy sector investment rate (assuming the lower renewable energy technology EROEI values, which are in accord with currently reported values in the literature [

35,

46]). This is in line with previous work of Reynolds and Hirsch [

31,

48]. In reality, we should also account for the feedback between supply and demand, which could create oscillations in the resource price when the excessively high price could temporarily decrease demand. The EROEI of a given technology in question and its probable trajectory should have higher weight than price alone. It is clear that the development of high EROEI renewable energy technology should have maximum support; otherwise we can expect steadily declining standards of living, measured as per-capita consumption (without even accounting for decreasing utility of further degrading natural environment). Unfortunately, no amount of investment guarantees the actual existence of the high-EROEI technology, without which considerable economic adjustments are unavoidable.

Further research could focus mainly on model extensions to include the previously identified omitted feedback and their consequences for model dynamics. Energy resources could be disaggregated to individual fuels, for example, coal, oil, and natural gas in the case of fossil fuels and hydropower, wind power, and solar power in the case of renewables. A second step should follow—making the energy end-use capital dependent on a certain composition of the energy mix. With the rapidly changing energy mix, energy end-use capital also has to be replaced faster to be able to use the new energy mix composition. Since every energy source has a different CO2 emission profile, the model should also be extended with a module containing various atmospheric stocks and flows to represent CO2 accumulation and consecutive temperature and weather changes with associated possible disruption to the economic process in the form of a damage function.