Selecting the House-of-Quality-Based Energy Investment Policies for the Sustainable Emerging Economies

Abstract

1. Introduction

2. Literature Review

3. Proposed Model

4. Analysis of Results

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. IT2 and Linguistic Term Sets under the Hesitancy

Appendix B. Methodology

Appendix C. Tables

| C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|

| C1 | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) | ((0.28,0.43,0.43,0.58;1,1), (0.33,0.43,0.43,0.53;0.90,0.90)) | ((0.50,0.65,0.65,0.78;1,1), (0.55,0.65,0.65,0.73;0.90,0.90)) |

| C2 | ((0.50,0.65,0.65,0.78;1,1), (0.55,0.65,0.65,0.73;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.28,0.43,0.43,0.58;1,1), (0.33,0.43,0.43,0.53;0.90,0.90)) | ((0.35,0.50,0.50,0.65;1,1), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) |

| C3 | ((0.35,0.50,0.50,0.65;1,1), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.35,0.50,0.50,0.65;1,1), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.28,0.43,0.43,0.58;1,1), (0.33,0.43,0.43,0.53;0.90,0.90)) |

| C4 | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) | ((0.58,0.73,0.73,0.85;1,1), (0.63,0.73,0.73,0.80;0.90,0.90)) | ((0.50,0.65,0.65,0.78;1,1), (0.55,0.65,0.65,0.73;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) |

| C5 | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) | ((0.43,0.58,0.58,0.73;1,1), (0.48,0.58,0.58,0.68;0.90,0.90)) | ((0.35,0.50,0.50,0.65;1,1), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.28,0.43,0.43,0.58;1,1), (0.33,0.43,0.43,0.53;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) |

| C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|

| C1 | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) | ((0.09,0.14,0.14,0.19;1,1), (0.10,0.14,0.14,0.17;0.90,0.90)) | ((0.16,0.21,0.21,0.25;1,1), (0.18,0.21,0.21,0.23;0.90,0.90)) |

| C2 | ((0.16,0.21,0.21,0.25;1,1), (0.18,0.21,0.21,0.23;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.09,0.14,0.14,0.19;1,1), (0.10,0.14,0.14,0.17;0.90,0.90)) | ((0.11,0.16,0.16,0.21;1,1), (0.13,0.16,0.16,0.19;0.90,0.90)) | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) |

| C3 | ((0.11,0.16,0.16,0.21;1,1), (0.13,0.16,0.16,0.19;0.90,0.90)) | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.11,0.16,0.16,0.21;1,1), (0.13,0.16,0.16,0.19;0.90,0.90)) | ((0.09,0.14,0.14,0.19;1,1), (0.10,0.14,0.14,0.17;0.90,0.90)) |

| C4 | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) | ((0.19,0.23,0.23,0.27;1,1), (0.20,0.23,0.23,0.26;0.90,0.90)) | ((0.16,0.21,0.21,0.26;1,1), (0.18,0.21,0.21,0.24;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) |

| C5 | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) | ((0.14,0.19,0.19,0.23;1,1), (0.15,0.19,0.19,0.22;0.90,0.90)) | ((0.11,0.16,0.16,0.21;1,1), (0.13,0.16,0.16,0.19;0.90,0.90)) | ((0.09,0.14,0.14,0.19;1,1), (0.10,0.14,0.14,0.17;0.90,0.90)) | ((0,0,0,0;1,1), (0,0,0,0;0.90,0.90)) |

| C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|

| C1 | ((0.13,0.38,0.38,1.62;1,1), (0.18,0.38,0.38,0.88;0.90,0.90)) | ((0.26,0.55,0.55,1.87;1,1), (0.33,0.55,0.55,1.09;0.90,0.90)) | ((0.24,0.51,0.51,1.74;1,1), (0.30,0.51,0.51,1.02;0.90,0.90)) | ((0.18,0.44,0.44,1.58;1,1), (0.24,0.44,0.44,0.90;0.90,0.90)) | ((0.26,0.54,0.54,1.79;1,1), (0.33,0.54,0.54,1.05;0.90,0.90)) |

| C2 | ((0.26,0.55,0.55,1.79;1,1), (0.33,0.55,0.55,1.05;0.90,0.90)) | ((0.13,0.39,0.39,1.65;1,1), (0.19,0.39,0.39,0.89;0.90,0.90)) | ((0.20,0.47,0.47,1.68;1,1), (0.26,0.47,0.47,0.97;0.90,0.90)) | ((0.19,0.45,0.45,1.56;1,1), (0.25,0.45,0.45,0.90;0.90,0.90)) | ((0.24,0.52,0.52,1.75;1,1), (0.31,0.52,0.52,1.02;0.90,0.90)) |

| C3 | ((0.22,0.49,0.49,1.70;1,1), (0.28,0.49,0.49,0.99;0.90,0.90)) | ((0.24,0.52,0.52,1.78;1,1), (0.31,0.52,0.52,1.04;0.90,0.90)) | ((0.10,0.33,0.33,1.47;1,1), (0.15,0.33,0.33,0.79;0.90,0.90)) | ((0.19,0.43,0.43,1.51;1,1), (0.24,0.43,0.43,0.87;0.90,0.90)) | ((0.19,0.46,0.46,1.66;1,1), (0.25,0.46,0.46,0.95;0.90,0.90)) |

| C4 | ((0.27,0.58,0.58,1.95;1,1), (0.34,0.58,0.58,1.14;0.90,0.90)) | ((0.32,0.64,0.64,2.05;1,1), (0.39,0.64,0.64,1.21;0.90,0.90)) | ((0.28,0.57,0.57,1.90;1,1), (0.34,0.57,0.57,1.11;0.90,0.90)) | ((0.11,0.35,0.35,1.54;1,1), (0.17,0.35,0.35,0.83;0.90,0.90)) | ((0.26,0.57,0.57,1.92;1,1), (0.34,0.57,0.57,1.12;0.90,0.90)) |

| C5 | ((0.24,0.52,0.52,1.75;1,1), (0.30,0.52,0.52,1.02;0.90,0.90)) | ((0.25,0.533,0.53,1.81;1,1), (0.31,0.53,0.53,1.06;0.90,0.90)) | ((0.21,0.47,0.47,1.67;1,1), (0.27,0.47,0.47,0.97;0.90,0.90)) | ((0.17,0.42,0.42,1.52;1,1), (0.23,0.42,0.42,0.87;0.90,0.90)) | ((0.11,0.35,0.35,1.53;1,1), (0.17,0.35,0.35,0.82;0.90,0.90)) |

| A1 | A2 | A3 | A4 | A5 | |

|---|---|---|---|---|---|

| C1 | ((0.70,0.87,0.87,0.97;1,1), (0.78,0.87,0.87,0.92;0.90,0.90)) | ((0.6,0.85,0.85,0.75;1,1), (0.7,0.8,0.8,0.88;0.90,0.90)) | ((0.6,0.80,0.80,0.95;1,1), (0.7,0.8,0.8,0.88;0.90,0.90)) | ((0.40,0.60,0.60,0.80;1,1), (0.50,0.60,0.60,0.70;0.90,0.90)) | ((0.5,0.7,0.7,0.87;1,1), (0.6,0.7,0.7,0.78;0.90,0.90)) |

| C2 | ((0.5,0.7,0.7,0.90;1,1), (0.6,0.7,0.7,0.80;0.90,0.90)) | ((0.40,0.75,0.75,0.65;1,1), (0.50,0.60,0.60,0.70;0.90,0.90) | ((0.30,0.50,0.50,0.70;1.00,1.00), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.30,0.50,0.50,0.70;1.00,1.00), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.70,0.90,0.90,1.00;1,1), (0.80,0.90,0.90,0.95;0.90,0.90)) |

| C3 | ((0.70,0.87,0.87,0.97;1,1), (0.78,0.87,0.87,0.92;0.90,0.90)) | ((0.40,0.75,0.75,0.83;1,1), (0.50,0.60,0.60,0.70;0.90,0.90) | ((0.30,0.50,0.50,0.70;1.00,1.00), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.20,0.40,0.40,0.60;1.00,1.00), (0.30,0.40,0.40,0.50;0.90,0.90)) | ((0.40,0.60,0.60,0.80;1,1), (0.50,0.60,0.60,0.70;0.90,0.90)) |

| C4 | ((0.80,0.95,0.95,1.00;1.00,1.00), (0.88,0.95,0.95,0.98;0.90,0.90)) | ((0.40,0.75,0.75,0.83;1,1), (0.50,0.60,0.60,0.70;0.90,0.90) | ((0.40,0.60,0.60,0.80;1,1), (0.50,0.60,0.60,0.70;0.90,0.90)) | ((0.50,0.70,0.70,0.90;1,1), (0.60,0.70,0.70,0.80;0.90,0.90) | ((0.70,0.87,0.87,0.97;1,1), (0.78,0.87,0.87,0.92;0.90,0.90)) |

| C5 | ((0.30,0.50,0.50,0.70;1.00,1.00), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.30,0.75,0.75,0.70;1.00,1.00), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.30,0.50,0.50,0.70;1.00,1.00), (0.40,0.50,0.50,0.60;0.90,0.90)) | ((0.20,0.40,0.40,0.60;1.00,1.00), (0.30,0.40,0.40,0.50;0.90,0.90)) | ((0.70,0.87,0.87,0.97;1,1), (0.78,0.87,0.87,0.92;0.90,0.90)) |

References

- Prahalad, C.K.; Ramaswamy, V. Co–opting Customer Competence. Harv. Bus. Rev. 2000, 78, 79–90. [Google Scholar]

- Ple, L. Managing Multichannel Coordination in Retail Banking: The Influence of Customer Participation. Int. J. Bank Mark. 2006, 24, 327–345. [Google Scholar] [CrossRef]

- Kenneth, R.E.; Arnold, T.J.; Grant, J.A. Combining Service and Sales at the Point of Customer Contact. J. Serv. Res. 1999, 2, 34–49. [Google Scholar]

- Nambisan, S. Designing Virtual Customer Environments for New Product Development: Toward A Theory. Acad. Manag. Rev. 2002, 27, 392–413. [Google Scholar] [CrossRef]

- Trott, P.; Hoecht, A.; Özdemir, S. New Service Development: Insights from An Explorative Study into the Turkish Retail Banking Sector. Innovation 2007, 9, 276–291. [Google Scholar]

- Popoff, A.; Millet, D. Sustainable Life Cycle Design Using Constraint Satisfaction Problems and Quality Function Deployment. Procedia CIRP 2017, 61, 75–80. [Google Scholar] [CrossRef]

- Chen, L.H.; Ko, W.C.; Yeh, F.T. Approach Based on Fuzzy Goal Programing and Quality Function Deployment for New Product Planning. Eur. J. Oper. Res. 2017, 259, 654–663. [Google Scholar] [CrossRef]

- Wu, T.; Liu, X.; Liu, F. An interval type-2 fuzzy TOPSIS model for large scale group decision making problems with social network information. Inf. Sci. 2018, 432, 392–410. [Google Scholar] [CrossRef]

- Wall, R.; Grafakos, S.; Gianoli, A.; Stavropoulos, S. Which policy instruments attract foreign direct investments in renewable energy? Clim. Policy 2019, 19, 59–72. [Google Scholar] [CrossRef]

- Masud, M.H.; Ananno, A.A.; Arefin, A.M.; Ahamed, R.; Das, P.; Joardder, M.U. Perspective of biomass energy conversion in Bangladesh. Clean Technol. Environ. Policy 2019, 21, 1–13. [Google Scholar] [CrossRef]

- Levieux, L.I.; Inthamoussou, F.A.; De Battista, H. Power dispatch assessment of a wind farm and a hydropower plant: A case study in Argentina. Energy Convers. Manag. 2019, 180, 391–400. [Google Scholar] [CrossRef]

- Cetin, T.H.; Kanoglu, M.; Yanikomer, N. Cryogenic energy storage powered by geothermal energy. Geothermics 2019, 77, 34–40. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From Nonrenewable to Renewable Energy and Its Impact on Economic Growth: The role of Research & Development Expenditures in Asia–Pacific Economic Cooperation Countries. J. Clean. Prod. 2019, 212, 1166–1178. [Google Scholar]

- Liang, Y.; Yu, B.; Wang, L. Costs and benefits of renewable energy development in China’s power industry. Renew. Energy 2019, 131, 700–712. [Google Scholar] [CrossRef]

- Ko, W.C. Construction of House of Quality for New Product Planning: A 2-Tuple Fuzzy Linguistic Approach. Comput. Ind. 2015, 73, 117–127. [Google Scholar] [CrossRef]

- Hansen, K.; Mathiesen, B.V.; Skov, I.R. Full energy system transition towards 100% renewable energy in Germany in 2050. Renew. Sustain. Energy Rev. 2019, 102, 1–13. [Google Scholar] [CrossRef]

- Garver, M.S. Improving the House of Quality with Maximum Difference Scaling. Int. J. Qual. Reliab. Manag. 2012, 29, 576–594. [Google Scholar] [CrossRef]

- Dinçer, H.; Yüksel, S.; Pınarbaşı, F. SERVQUAL-Based Evaluation of Service Quality of Energy Companies in Turkey: Strategic Policies for Sustainable Economic Development. In The Circular Economy and Its Implications on Sustainability and the Green Supply Chain; IGI Global: Hershey, PA, USA, 2019; pp. 142–167. [Google Scholar]

- Dinçer, H.; Yuksel, S. IT2-based Fuzzy Hybrid Decision Making Approach to Soft Computing. IEEE Access 2019, 7, 15932–15944. [Google Scholar] [CrossRef]

- Keček, D.; Mikulić, D.; Lovrinčević, Ž. Deployment of renewable energy: Economic effects on the Croatian economy. Energy Policy 2019, 126, 402–410. [Google Scholar] [CrossRef]

- Chuang, M.T.; Chang, S.Y.; Hsiao, T.C.; Lu, Y.R.; Yang, T.Y. Analyzing major renewable energy sources and power stability in Taiwan by 2030. Energy Policy 2019, 125, 293–306. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Does electricity price matter for innovation in renewable energy technologies in China? Energy Econ. 2019, 78, 259–266. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Z.; Zhong, Z. CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew. Energy 2019, 131, 208–216. [Google Scholar] [CrossRef]

- Adiano, C.; Aleda, V.R. Beyond the House of Quality: Dynamic QFD. Benchmarking Qual. Manag. Technol. 1994, 1, 25–37. [Google Scholar] [CrossRef]

- Wu, Q. Fuzzy Measurable House of Quality and Quality Function Deployment for Fuzzy Regression Estimation Problem. Expert Syst. Appl. 2011, 38, 14398–14406. [Google Scholar] [CrossRef]

- Li, Y.L.; Huang, M.; Chin, K.S.; Luo, X.G.; Han, Y. Integrating Preference Analysis and Balanced Scorecard to Product Planning House of Quality. Comput. Ind. Eng. 2011, 60, 256–268. [Google Scholar] [CrossRef]

- Yazdani, M.; Zarate, P.; Coulibaly, A.; Zavadskas, E.K. A Group Decision Making Support System in Logistics and Supply Chain Management. Expert Syst. Appl. 2017, 88, 376–392. [Google Scholar] [CrossRef]

- Wu, W.Y.; Qomariyah, A.; Sa, N.T.T.; Liao, Y. The Integration between Service Value and Service Recovery in the Hospitality Industry: An Application of QFD and ANP. Int. J. Hosp. Manag. 2018, 75, 48–57. [Google Scholar] [CrossRef]

- Lin, T.; Ekanayake, A.; Gaweshan, L.S.; Hasan, Z.A. Ergonomics Product Development of over Bed Table for Bedridden Patients. Comput. Aided Des. Appl. 2016, 13, 538–548. [Google Scholar] [CrossRef]

- Adinyira, E.; Kwofie, T.E.; Quarcoo, F. Stakeholder Requirements for Building Energy Efficiency in Mass Housing Delivery: The House of Quality Approach. Environ. Dev. Sustain. 2017, 20, 1–17. [Google Scholar] [CrossRef]

- Seow, Y.; Goffin, N.; Rahimifard, S.; Woolley, E.A. Design for Energy Minimization Approach to Reduce Energy Consumption during the Manufacturing Phase. Energy 2016, 109, 894–905. [Google Scholar] [CrossRef]

- Campisi, D.; Gitto, S.; Morea, D. An evaluation of energy and economic efficiency in residential buildings sector: A multi-criteria analisys on an Italian case study. Int. J. Energy Econ. Policy 2018, 8, 185–196. [Google Scholar]

- Dinçer, H.; Yüksel, S.; Martínez, L. Balanced scorecard–based Analysis about European Energy Investment Policies: A hybrid hesitant fuzzy decision–making approach with Quality Function Deployment. Expert Syst. Appl. 2019, 115, 152–171. [Google Scholar] [CrossRef]

- Abdullah, L.; Zulkifli, N. Integration of fuzzy AHP and interval type-2 fuzzy DEMATEL: An application to human resource management. Expert Syst. Appl. 2015, 42, 4397–4409. [Google Scholar] [CrossRef]

- Hosseini, M.B.; Tarokh, M.J. Type-2 fuzzy set extension of DEMATEL method combined with perceptual computing for decision making. J. Ind. Eng. Int. 2013, 9, 10. [Google Scholar] [CrossRef]

- Abdullah, L.; Zulkifli, N. A new DEMATEL method based on interval type-2 fuzzy sets for developing causal relationship of knowledge management criteria. Neural Comput. Appl. 2018, 1–17. [Google Scholar] [CrossRef]

- Najib, L.; Ab Ghani, A.T.; Abdullah, L.; Ahmad, M.F. An Application of Coastal Erosion Decision Problem Using Interval Type-2 Fuzzy Dematel Method. J. Sustain. Sci. Manag. 2017, 12, 204–217. [Google Scholar]

- Dinçer, H.; Yüksel, S.; Korsakienė, R.; Raišienė, A.G.; Bilan, Y. IT2 Hybrid Decision-Making Approach to Performance Measurement of Internationalized Firms in the Baltic States. Sustainability 2019, 11, 296. [Google Scholar] [CrossRef]

- Tooranloo, H.S.; Azadi, M.H.; Sayyahpoor, A. Analyzing factors affecting implementation success of sustainable human resource management (SHRM) using a hybrid approach of FAHP and Type-2 fuzzy DEMATEL. J. Clean. Prod. 2017, 162, 1252–1265. [Google Scholar] [CrossRef]

- Yüksel, S.; Dinçer, H.; Meral, Y. Financial Analysis of International Energy Trade: A Strategic Outlook for EU-15. Energies 2019, 12, 431. [Google Scholar] [CrossRef]

- Liao, T.W. Two interval type 2 fuzzy TOPSIS material selection methods. Mater. Des. 2015, 88, 1088–1099. [Google Scholar] [CrossRef]

- Dymova, L.; Sevastjanov, P.; Tikhonenko, A. An interval type-2 fuzzy extension of the TOPSIS method using alpha cuts. Knowl.-Based Syst. 2015, 83, 116–127. [Google Scholar] [CrossRef]

- Sang, X.; Liu, X. An analytical solution to the TOPSIS model with interval type-2 fuzzy sets. Soft Comput. 2016, 20, 1213–1230. [Google Scholar] [CrossRef]

- Zamri, N.; Abdullah, L. A new qualitative evaluation for an integrated interval type-2 fuzzy TOPSIS and MCGP. In Recent Advances on Soft Computing and Data Mining; Springer: Cham, Switzerland, 2014; pp. 79–88. [Google Scholar]

- Abdullah, L.; Kamal, C.R.A.C. A New Integrating SAW-TOPSIS Based on Interval Type-2 Fuzzy Sets for Decision Making; IOS Press: Amsterdam, The Netherlands, 2016; pp. 45–50. [Google Scholar]

- Yoon, K.; Hwang, C.L. TOPSIS (Technique for Order Preference by Similarity to Ideal Solution)—A Multiple Attribute Decision Making, w: MULTIPLE Attribute Decision Making-Methods and Applications, a State-of-the-at Survey; Springer: Berlin, Germany, 1981. [Google Scholar]

- Finn, A. Investigating the non-linear effects of e-service quality dimensions on customer satisfaction. J. Retail. Consum. Serv. 2011, 18, 27–37. [Google Scholar] [CrossRef]

- Gil, I.; Berenguer, G.; Cervera, A. The roles of service encounters, service value, and job satisfaction in achieving customer satisfaction in business relationships. Ind. Mark. Manag. 2008, 37, 921–939. [Google Scholar] [CrossRef]

- Yoon, C. Antecedents of customer satisfaction with online banking in China: The effects of experience. Comput. Hum. Behav. 2010, 26, 1296–1304. [Google Scholar] [CrossRef]

- Jones, C. Developing a scorecard for service quality. Manag. Serv. 2004, 48, 8–13. [Google Scholar]

- Grigoroudis, E.; Siskos, Y. A survey of customer satisfaction barometers: Some results from the transportation–communications sector. Eur. J. Oper. Res. 2004, 152, 334–353. [Google Scholar] [CrossRef]

- Bei, L.T.; Shang, C.F. Building marketing strategies for state-owned enterprises against private ones based on the perspectives of customer satisfaction and service quality. J. Retail. Consum. Serv. 2006, 13, 1–13. [Google Scholar] [CrossRef]

- Vivekanandana, L.; Jayasenab, S. Facilities offered by the Banks and Expectations of IT Savvy Banking Customers. Procedia Soc. Behav. Sci. 2012, 40, 576–583. [Google Scholar] [CrossRef]

- Matos, C.R.; Carneiro, J.F.; Silva, P.P. Overview of Large-Scale Underground Energy Storage Technologies for Integration of Renewable Energies and Criteria for Reservoir Identification. J. Energy Storage 2019, 21, 241–258. [Google Scholar] [CrossRef]

- Baykasoglu, A.; Gölcük, İ. Development of an interval type-2 fuzzy sets based hierarchical MADM model by combining DEMATEL and TOPSIS. Expert Syst. Appl. 2017, 70, 37–51. [Google Scholar] [CrossRef]

- Chen, S.M.; Lee, L.W. Fuzzy multiple attributes group decision–making based on the interval type-2 TOPSIS method. Expert Syst. Appl. 2010, 37, 2790–2798. [Google Scholar] [CrossRef]

- Nesticò, A.; Sica, F. The sustainability of urban renewal projects: A model for economic multi-criteria analysis. J. Prop. Investig. Financ. 2017, 35, 397–409. [Google Scholar] [CrossRef]

- Joseph, M.; Stone, G. An empirical evaluation of US bank customer perceptions of the impact of technology on service delivery in the banking sector. Int. J. Retail Distrib. Manag. 2003, 31, 190–202. [Google Scholar] [CrossRef]

- Celik, M.; Cebi, S.; Kahraman, C.; Er, I.D. An integrated fuzzy QFD model proposal on routing of shipping investment decisions in crude oil tanker market. Expert Syst. Appl. 2009, 36, 6227–6235. [Google Scholar] [CrossRef]

- Dror, S.; Barad, M. House of Strategy (HOS): From strategic objectives to competitive priorities. Int. J. Prod. Res. 2006, 44, 3879–3895. [Google Scholar] [CrossRef]

- Chen, C.T. Extensions of the TOPSIS for group decision-making under fuzzy environment. Fuzzy Sets Syst. 2000, 114, 1–9. [Google Scholar] [CrossRef]

- Hsieh, T.Y.; Lu, S.T.; Tzeng, G.H. Fuzzy MCDM approach for planning and design tenders selection in public office buildings. Int. J. Proj. Manag. 2004, 22, 573–584. [Google Scholar] [CrossRef]

- Erdogan, S.; Sayin, C. Selection of the most suitable Alternative fuel depending on the fuel characteristics and price by the hybrid MCDM method. Sustainability 2018, 10, 1583. [Google Scholar] [CrossRef]

- Ball, D.; Simões Coelho, P.; Machás, A. The role of communication and trust in explaining customer loyalty: An extension to the ECSI model. Eur. J. Mark. 2004, 38, 1272–1293. [Google Scholar] [CrossRef]

- Ford, W.Z. Customer expectations for interactions with service providers: Relationship versus encounter orientation and personalized service communication. J. Appl. Commun. Res. 2001, 29, 1–29. [Google Scholar] [CrossRef]

- Ntanos, S.; Kyriakopoulos, G.; Chalikias, M.; Arabatzis, G.; Skordoulis, M. Public perceptions and willingness to pay for renewable energy: A case study from Greece. Sustainability 2018, 10, 687. [Google Scholar] [CrossRef]

- Ntanos, S.; Kyriakopoulos, G.; Chalikias, M.; Arabatzis, G.; Skordoulis, M.; Galatsidas, S.; Drosos, D. A social assessment of the usage of renewable energy sources and its contribution to life quality: The case of an Attica urban area in Greece. Sustainability 2018, 10, 1414. [Google Scholar] [CrossRef]

- Tsili, M.; Papathanassiou, S. A review of grid code technical requirements for wind farms. IET Renew. Power Gener. 2009, 3, 308–332. [Google Scholar] [CrossRef]

- Kondziella, H.; Bruckner, T. Flexibility requirements of renewable energy based electricity systems-a review of research results and methodologies. Renew. Sustain. Energy Rev. 2016, 53, 10–22. [Google Scholar] [CrossRef]

- Yam, F.K.; Hassan, Z. Innovative advances in LED technology. Microelectron. J. 2005, 36, 129–137. [Google Scholar] [CrossRef]

- Finch, B.J. Customer expectations in online auction environments: An exploratory study of customer feedback and risk. J. Oper. Manag. 2007, 25, 985–997. [Google Scholar] [CrossRef]

- Bevan, N. Quality in use: Meeting user needs for quality. J. Syst. Softw. 1999, 49, 89–96. [Google Scholar] [CrossRef]

- Olsina, L.; Lafuente, G.; Rossi, G. Specifying quality characteristics and attributes for websites. In Web Engineering; Springer: Berlin, Germany, 2001; pp. 266–278. [Google Scholar]

| Criteria | Definition | Supported Literature |

|---|---|---|

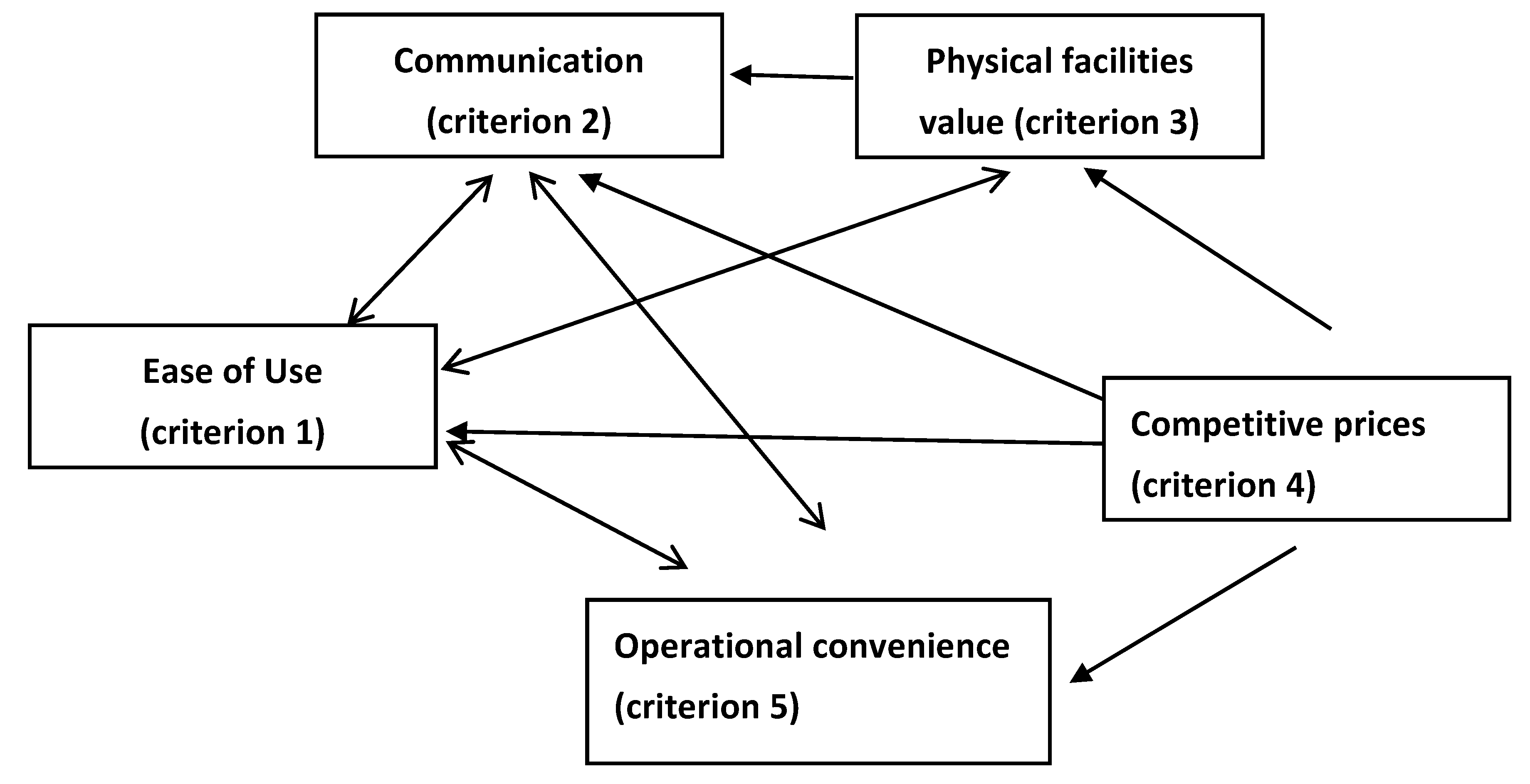

| Ease of Use (Criterion 1) | Increase in the speed of the energy transferring | [47,48] |

| Communication (Criterion 2) | Continuous assistance with customer support | [49,50] |

| Physical facilities (Criterion 3) | Facilities for accessing the energy sources | [51] |

| Competitive prices (Criterion 4) | Dynamic pricing in global energy market | [50,52] |

| Operational convenience (Criterion 5) | Providing the infrastructure for the sustainable energy | [53] |

| Factors | Definition | Supported Literature |

|---|---|---|

| Functionality (Alternative 1) | Ease of transaction in the energy sources | [33] |

| Interaction (Alternative 2) | Considering the customers in the service design | [30,31] |

| Equipment (Alternative 3) | High-tech tools in the energy investments | [33] |

| Efficiency (Alternative 4) | Decreasing the costs of energy services | [13,21,32] |

| Capacity (Alternative 5) | Increase of potential with research and development | [22,54] |

| Linguistic Scales | Interval Type 2 Fuzzy Numbers |

|---|---|

| Very very low (VVL) | ((0,0.1,0.1,0.2;1,1), (0.05,0.1,0.1,0.15;0.9,0.9)) |

| Very low (VL) | ((0.1,0.2,0.2,0.35;1,1), (0.15,0.2,0.2,0.3;0.9,0.9)) |

| Low (L) | ((0.2,0.35,0.35,0.5;1,1), (0.25,0.35,0.35,0.45;0.9,0.9)) |

| Medium (M) | ((0.35,0.5,0.5,0.65;1,1), (0.4,0.5,0.5,0.6;0.9,0.9)) |

| High (H) | ((0.5,0.65,0.65,0.8;1,1), (0.55,0.65,0.65,0.75;0.9,0.9)) |

| Very high (VH) | ((0.65,0.8,0.8,0.9;1,1), (0.7,0.8,0.8,0.85;0.9,0.9)) |

| Very very high (VVH) | ((0.8,0.9,0.9,1;1,1), (0.85,0.9,0.9,0.95;0.9,0.9)) |

| Criteria Set | Ease of Use (Criterion 1) | Communication (Criterion 2) | Physical Facilities (Criterion 3) | Competitive Prices (Criterion 4) | Operational Convenience (Criterion 5) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | |

| Ease of Use (Criterion 1) | - | - | - | M | H | H | M | H | M | L | M | M | M | H | VH |

| Communication (Criterion 2) | M | VH | VH | - | - | - | M | L | M | L | M | H | M | H | H |

| Physical facilities (Criterion 3) | H | M | L | M | H | H | - | - | - | L | M | H | M | L | L |

| Competitive prices (Criterion 4) | H | H | M | H | VH | VH | H | - | - | - | M | H | M | ||

| Operational convenience (Criterion 5) | M | H | H | M | H | H | M | M | M | L | L | M | - | - | - |

| Criteria Set | Ease of Use (Criterion 1) | Communication (Criterion 2) | Physical Facilities (Criterion 3) | Competitive Prices (Criterion 4) | Operational Convenience (Criterion 5) |

|---|---|---|---|---|---|

| Ease of Use (Criterion 1) | 0.53 | 0.71 | 0.65 | 0.57 | 0.69 |

| Communication (Criterion 2) | 0.69 | 0.54 | 0.61 | 0.58 | 0.66 |

| Physical facilities (Criterion 3) | 0.63 | 0.67 | 0.47 | 0.56 | 0.60 |

| Competitive prices (Criterion 4) | 0.74 | 0.80 | 0.72 | 0.50 | 0.73 |

| Operational convenience (Criterion 5) | 0.66 | 0.68 | 0.61 | 0.55 | 0.50 |

| Linguistic Scales | Interval Type 2 Fuzzy Numbers |

|---|---|

| Very Poor (VP) | ((0,0,0,0.1;1,1), (0,0,0,0.05;0.9,0.9)) |

| Poor (P) | ((0,0.1,0.1,0.3;1,1), (0.05,0.1,0.1,0.2;0.9,0.9)) |

| Medium Poor (MP) | ((0.1,0.3,0.3,0.5;1,1), (0.2,0.3,0.3,0.4;0.9,0.9)) |

| Fair (F) | ((0.3,0.5,0.5,0.7;1,1), (0.4,0.5,0.5,0.6;0.9,0.9)) |

| Good (G) | ((0.5,0.7,0.7,0.9;1,1), (0.6,0.7,0.7,0.8;0.9,0.9)) |

| Very Good (VG) | ((0.7,0.9,0.9,1;1,1), (0.8,0.9,0.9,0.95;0.9,0.9)) |

| Best (B) | ((0.9,1,1,1;1,1), (0.95,1,1,1;0.9,0.9)) |

| Criteria/ Alternatives | Functionality (Alternative 1) | Interaction (Alternative 2) | Equipment (Alternative 3) | Efficiency (Alternative 4) | Capacity (Alternative 5) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | DM1 | DM2 | DM3 | |

| Ease of Use (Criterion 1) | VG | G | B | G | VG | VG | G | VG | G | F | G | G | F | G | VG |

| Communication (Criterion 2) | G | G | G | F | G | F | F | F | F | F | F | F | VG | VG | VG |

| Physical facilities (Criterion 3) | G | B | VG | F | G | G | F | F | F | MP | F | F | F | G | G |

| Competitive prices (Criterion 4) | VG | B | VG | F | G | G | F | G | G | G | G | G | G | VG | B |

| Operational convenience (Criterion 5) | F | F | F | F | F | F | F | G | G | FL | F | F | G | B | VG |

| Criteria/ Alternatives | Functionality (Alternative 1) | Interaction (Alternative 2) | Equipment (Alternative 3) | Efficiency (Alternative 4) | Capacity (Alternative 5) |

|---|---|---|---|---|---|

| Ease of Use (Criterion 1) | 8.86 | 8.46 | 8.45 | 7.27 | 7.86 |

| Communication (Criterion 2) | 7.87 | 7.49 | 6.67 | 6.67 | 9.03 |

| Physical facilities (Criterion 3) | 8.86 | 7.58 | 6.67 | 6.07 | 7.27 |

| Competitive prices (Criterion 4) | 9.36 | 7.58 | 7.27 | 7.87 | 8.86 |

| Operational convenience (Criterion 5) | 6.67 | 7.15 | 6.67 | 6.07 | 8.86 |

| Criteria/ Alternatives | Functionality (Alternative 1) | Interaction (Alternative 2) | Equipment (Alternative 3) | Efficiency (Alternative 4) | Capacity (Alternative 5) |

|---|---|---|---|---|---|

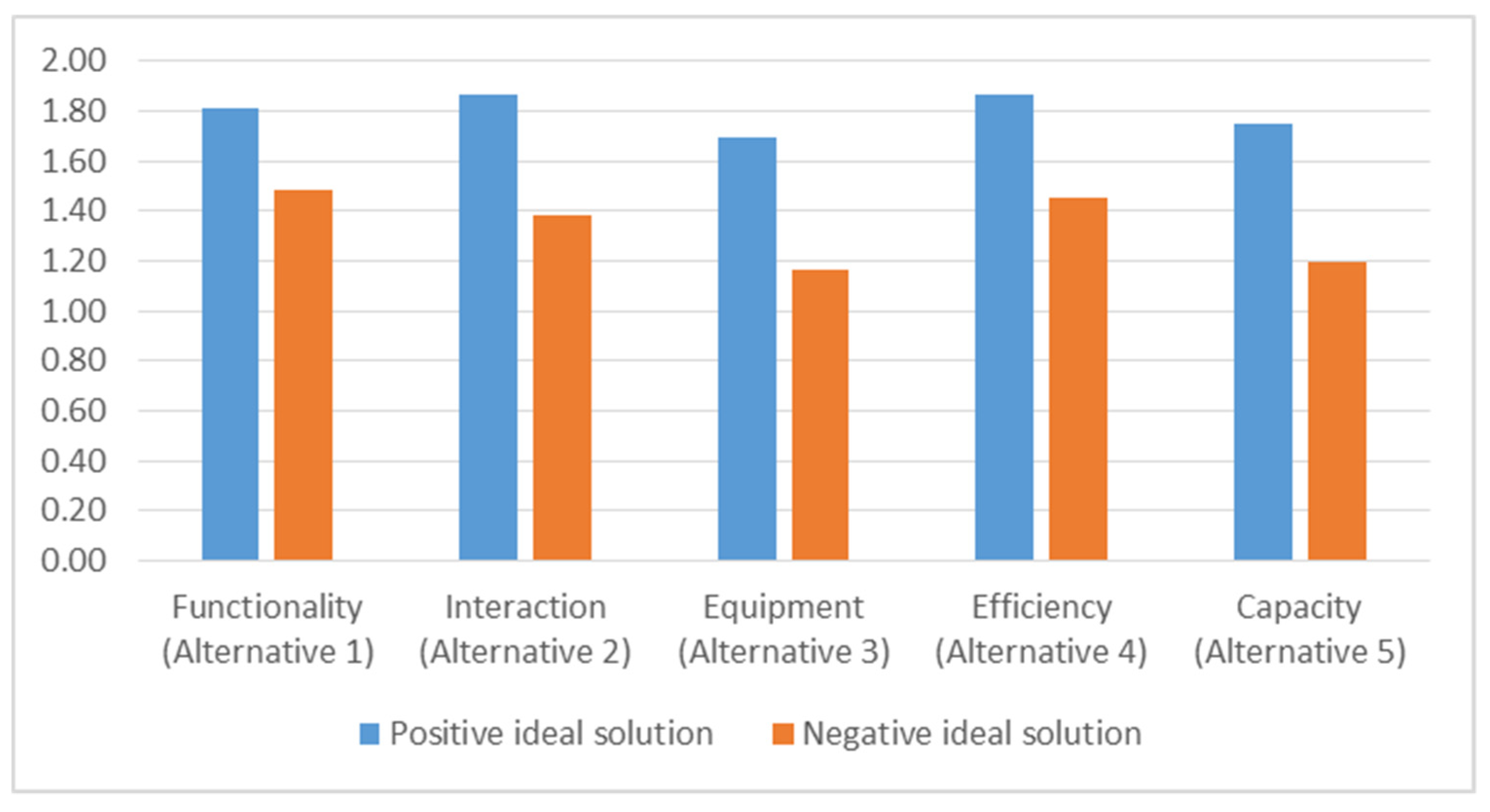

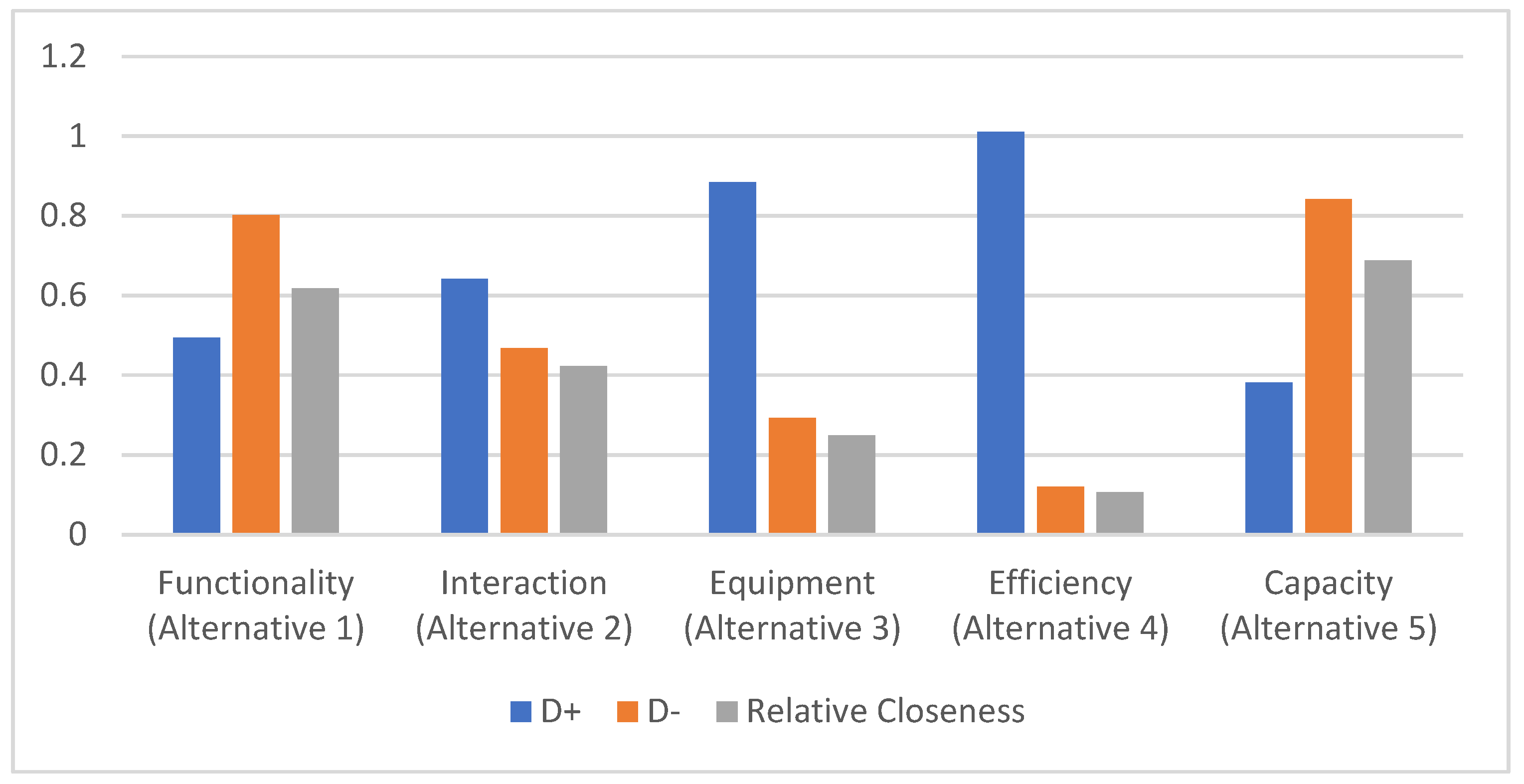

| Ease of Use (Criterion 1) | 1.81 | 1.73 | 1.73 | 1.49 | 1.61 |

| Communication (Criterion 2) | 1.63 | 1.55 | 1.38 | 1.38 | 1.87 |

| Physical facilities (Criterion 3) | 1.70 | 1.45 | 1.28 | 1.16 | 1.39 |

| Competitive prices (Criterion 4) | 1.87 | 1.51 | 1.45 | 1.57 | 1.77 |

| Operational convenience (Criterion 5) | 1.32 | 1.41 | 1.32 | 1.20 | 1.75 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tang, Z.; Dinçer, H. Selecting the House-of-Quality-Based Energy Investment Policies for the Sustainable Emerging Economies. Sustainability 2019, 11, 3514. https://doi.org/10.3390/su11133514

Tang Z, Dinçer H. Selecting the House-of-Quality-Based Energy Investment Policies for the Sustainable Emerging Economies. Sustainability. 2019; 11(13):3514. https://doi.org/10.3390/su11133514

Chicago/Turabian StyleTang, Ziyuan, and Hasan Dinçer. 2019. "Selecting the House-of-Quality-Based Energy Investment Policies for the Sustainable Emerging Economies" Sustainability 11, no. 13: 3514. https://doi.org/10.3390/su11133514

APA StyleTang, Z., & Dinçer, H. (2019). Selecting the House-of-Quality-Based Energy Investment Policies for the Sustainable Emerging Economies. Sustainability, 11(13), 3514. https://doi.org/10.3390/su11133514