4.1. Analysis of Efficiency Based on Windows-SBM and Window-EBM DEA Model

Fiscal and monetary policy as the “big business” inputs, is unable to define its inputs is enough, and macroeconomic policies are theoretically cycle volatility adjustment, and not into the more capacity will be more, especially in the analysis of the impact on the capital market when too much bubble may produce false capital market growth, and therefore not suitable for the scale benefits considered in the model [

14]. The choice of EBM is based on the consideration of the alternative of input factors. From the perspective of the effect efficiency of supply-side reform on the capital market, the effect of lowering taxes is the opposite of the effect of lowering fiscal expenditure and broad money supply. From this perspective, it is very suitable for analysis with EBM model.

In addition, we have some consideration for the choice of non-angle bias input, the maximum amount that can be produced per unit of time with existing plant and equipment, provided that the availability of variable factors of production are not limited. Considering the farthest distance from the front of the Xeon production capacity, the company with efficiency 1 is understood to be operating at full capacity. It is assumed that there is a sufficient input of production factors. Fare (1994) labels this definition of capacity as a strong definition of capacity. He goes on to define a weak definition of capacity which only requires that outputs are bounded, as opposed to insisting on the existence of a maximum, which the Johansen definition requires [

15]. The weak definition is mainly used to analyze whether the ineffective enterprises are fully utilized in terms of input factors compared to effective enterprises. If it must choose one between the two to do topic analysis, we will choose weak capacity. Because fiscal and monetary policies are selected as the input factors of the countries, it is impossible to define whether the input factor is sufficient. The macroeconomic policy is theoretically cyclical volatility adjustment. It is not mean that the greatest input capacity will produce the most output. Especially when analysing the impact of policies on capital markets, excessive investment may generate capital bubbles. This paper chooses EBM based on the consideration of the substitutability of input-output factors and analyzes whether supply-side structural reform can produce efficiency in the capital market. Some input factors need to be reduced for output, and the two input factors that need to be reduced have the opposite effect.

As EBM simultaneously mixes radial and non-radial algorithms and takes the affinity between factors and the weight in efficiency calculation into account, the model is able to compensate for the shortcomings of SBM in the economic sense. We first estimated the weight and index of affinity of each factor in yearly sectional data by using the method proposed by Tone & Tsutsui (2010) [

13] (p. 7), and used these weights to further estimate the efficiency value of the panel data between 2008 and 2016 under the non-oriented EBM model when the window width is 3. As the correlations between factors were insufficiently considered when calculating the index of affinity using the Tone & Tsutsui (2010) method [

13] (p. 8), we re-estimated factor weights and efficiencies using MaxDEA after the estimation method for index of affinity was adjusted, and the results were compared with those obtained from the non-oriented SBM model with the same window width.

The estimation method for index of affinity proposed by Tone & Tsutsui (2010) was adjusted in MaxDEA8.0. On a small scale, the two inputs are highly reliant on each other, and their Pearson’s correlation coefficient is or close to 1, thus the index of affinity should be or close to 1; in a wide distribution scenario, the two inputs are highly substitutable, and the Pearson’s correlation coefficient is or close to −1, thus the index of affinity should be or close to 0. Based on such a relation, the new index of affinity can be defined as S (a,b) = 0.5 + 0.5r(a,b), r(a,b) is the Pearson correlation coefficient between a and b. The new index of affinity conforms to the 4 attributes of the method proposed by Tone & Tsutsui (2010) and overcomes its shortcomings. The adjusted

and

are presentedas [

16] (p. 4):

We use “windows-EBMa” to denote the model before coefficient adjustment and “EBMb” as the model after coefficient adjustment.

We measured the panel data of each DMU with broad money as the input factor from 2008 to 2016, respectively using the SBM model, EBMa model and EBMb model with window width of 3, and found that the EBMb model that fully considered the substitution of factors was more efficient, which was very consistent with common sense. For instance, the efficiencies of China between 2008 and 2016 under the non-oriented SBM model were only somewhere between 0.3 and 0.6. After taking the affinity and weights of factors, all efficiency values have increased. The yearly efficiency values between 2008 and 2016 were between 0.4 and 0.7 when estimated using the Tone & Tsutsui (2010) method, and between 0.8 and 1 after the index of affinity and weights are adjusted. Furthermore, when the affinity of factors was ruled out, the efficiency of China in 2013 was 0.3837, lower than 0.520792 of 2009 and 0.493673 of 2010; when the substitutability of factors was taken into account, the efficiency value of 2013 exceeded those of 2009 and 2010, reaching 0.952685, indicating that the efficiency value increases when the correlation and substitutability of fiscal and monetary policies were sufficiently taken into account while the existing external environment of each DMU’s efficiency remains constant. The efficiency of China from 2010 to 2015 EBMb presents obvious growth. The model efficiency comparison in

Table 4 demonstrates that the DEA is efficient in the United States, Singapore, Switzerland, several of the world’s leading financial centers, according with the actual situation.

We can use the affinity index in EBMb model to compare the substitutability of input factors in different countries. We have for each DMU input and output of 2008 to 2016 years of cross section data calculation, found that China’s inputs as affinity index was 0.017815, lower than Singapore, higher than that of the United States, Switzerland, and high income countries

Table 5. This shows that compared with other countries, China promotion of economic growth and capital markets activity more feasible through policy alternative, Singapore is more appropriate than China.

To test the robustness of the analysis, we choose interest rate instead of broad money as input. This is meaningful in finance theory as a monetary policy that works by adjusting the nominal interest rate volatility to affect the broad money M2, so as to control the money market. We replaced HICs in DMU with Canada, and also used three models to test the effect of fiscal and monetary policies on the efficiency of capital markets. We also found that the model efficiency with substitution of input factors was higher than that without substitution of input factors. DEA efficient is still the United States, Singapore, Switzerland this several major world financial center. The efficiency of China’s value, and efficiency value of the inputs compared to broad money still present growth after 2011, also showing that our analysis method is robust and effective. At the same time, we found that Canada’s efficiency is higher than the average efficiency of high-income countries

Table 6.

We also want to analyze the nominal interest rate as input factor. The data from 2008 to 2016 were taken as the DMU cross-section data, and we found that the input factor affinity index of China was 0.025078, which was the most substitutable of all DMU

Table 7. The robustness of the model is verified again. At the same time, it can be shown that the replacement of interest rate and fiscal expenditure with tax reduction policy in China’s supply-side reform can improve the efficiency effect of the policy on the capital market.

All factors in the model have been calculated using the non-radial algorithm, which derives generally lower efficiency values. As part of the input factors may bear a radial relationship, we introduced the EBM model to compensate for the shortcomings of the non-radial algorithm to re-estimate the efficiencies and interpret the results in a comparison with those obtained from the Windows-SBM model.

We used SPSS to conduct Pearson correlation and reliability tests on

Table 4 and

Table 6, respectively. The results show that the three groups of data in

Table 4 and

Table 6 have significant correlation

Table 8 and

Table 9, and the two groups of data passed the reliability test

Table 10 and

Table 11.

4.2. Analysis of Policy Efficiency

We used the EBMb model again to test the efficiency and affinity cross-reference index of each DMU in each year, that is, we used cross-sectional data from 2008 to 2016.We found that since 2011, the substitution effect between elements and elements with a decreasing affinity index has increased. The cross-sectional data from 2013 to 2015 show that the effect of China’s policies on the capital market is increasing.

As can be seen from

Table 12, the efficiencies on the capital market are not DEA valid except for that of 2015. In combination with

Figure 1, this further reveals that loose monetary policy has led to an upturn of the bonds market, volatile leverages and a fluctuant stock market. Beginning in 2014, China’s central bank imposed an interest rate cap through SLF, guided by a declining interbank rate and a lowering of the repo rate, and officially announced an interest cut in November that year. The extension of the loose period in the first half of 2015 resulted in a continuously bullish bond market. But after the loose period was renewed in August, the stock market became more fluctuant, and the accumulated effect of the loose monetary policy and high leverage ratio gave rise to a “raging” bull market. However, the abrupt changes in the expected looseness in the middle of the year, as well as the continuous deleveraging initiative, caused a plummet of stock market. The cut in interest rate and required reserve ratio (RRR) at the end of August portended a renewal of the loose period; in the meantime, the clearance of share financing that drew to an end in September, helping the stock market gradually recover from its crash. The efficiencies of fiscal and monetary policies of the ensuing year 2016 on the capital market were reduced to the minimum. As such, solely relying on loose monetary policy to inject vitality cannot ensure long-term stable development of the capital market. The supply-side structural reform initiated in 2015 represented a positive signal to reduce financing costs of the firms, strengthen financial support to the real economy, increase corporate competitiveness and reduce their taxation burdens. As indicated by the analysis of this paper, one of the goals of the supply-side reform is to moderate the substitutability and weights of factors pertinent to fiscal and monetary policies, thereby increasing the efficiency of fiscal and monetary policies on the capital market so that better services can be delivered to microeconomy.

4.3. Projection Analysis

Project analysis enables the identification of specific causes to the DEA-invalidity of DMUs, as well as directions towards which improvements can be made. As the windows-EBMb model incorporates the strengths of both radial and non-radial estimations, the input redundancy and output deficiency values are mainly comprised of proportionate movement and slack movement. The original value plus proportionate movement plus slack movement equals to Projection, and proportionate movement plus slack movement equals to value required to be moved, where Projection is at its optimal value. According to the output results of the model, we selected the data of China and respectively obtained the mean value of the next year’s efficiency, slack and projection under each window, yielding the following

Table 13 (U.S. dollar). The specific operations are as follows: the projection is the mean of the corresponding yearly projection values of each factor across various windows; the input redundancy is the mean of the corresponding yearly value required to be moved of each input factor across all windows; and the output deficiency is the mean of the corresponding yearly value required to be moved of each output factor across all windows.

The reductions in fiscal expenditure (I1), total tax revenue (I2) and broad money supply (I3-1) lead to increases in GDP (O1), market value of listed domestic firms (O2) and yearly total value of shares traded (O3), and as the reduction of broad money supply (I3-1) intensifies, the growth of (O2) and (O3) becomes more evident, indicating a significant substitutional effect of fiscal tax policy adjustment to the factor of broad money supply.

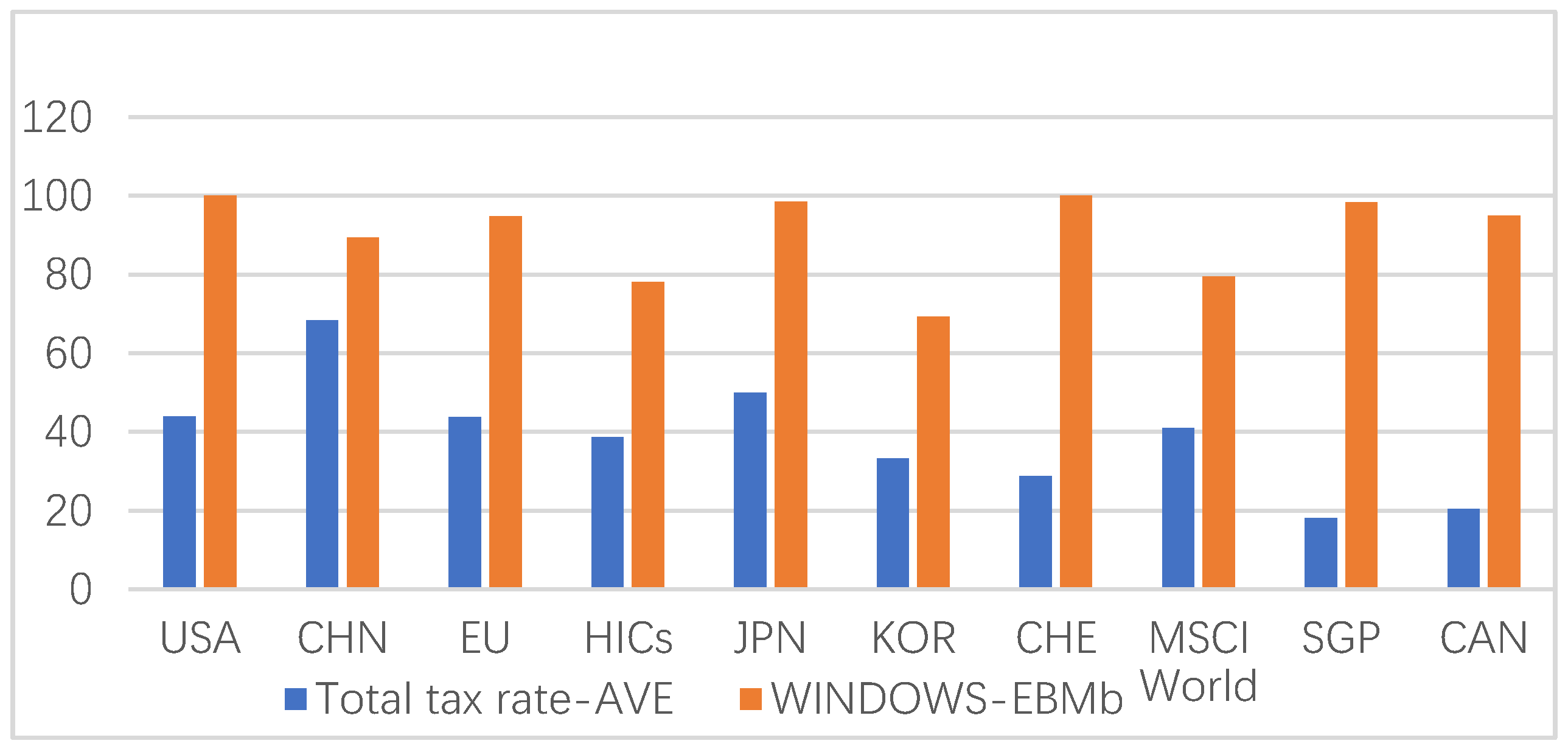

We selected the mean value of the averaged total tax rate of China, a few developed countries, high-income countries and the world between 2013 and 2016, and compared it with those efficiency obtained from the windows-EBMb model during the same period. We converted both sets of data, efficiency and tax rates into percentages as shown in

Figure 2. Total tax rate measures the percentage of the payments against business profit of a firm. The withheld taxes (e.g., personal income tax) or taxes collected or remitted to tax authorities (e.g., VAT, sales tax or commodity or service taxes) are excluded. The total tax rate of China exceeds those of developed countries and the global average by more than half, indicating that Chinese firms are subject to heavier tax burdens; and a positive correlation between total tax rate and efficiency has yet to be made. Lowering the enterprise income tax would play an evident role in stimulating firms’ proactiveness and improving their competence as participants of the capital market. In addition, a cut in enterprise income tax can also be a foundation for reducing excess money supply, thereby allowing the disposable income of firms and their employees to come from the firms themselves, instead of excess money supply, further reducing the risk of inflation. As such, high taxes have not produced any positive effect on improving the activeness of China’s capital market, and there is still great room to deepen supply-side reform; thus presenting an immense space for China’s capital market to gain sustainable development.