Sustainable Emerging Country Agro-Food Supply Chains: Fresh Vegetable Price Formation Mechanisms in Rural China

Abstract

1. Introduction

2. Literature Review

3. Research Method

3.1. The Price Conduction Model of the Fresh and Raw Vegetable Supply Chain

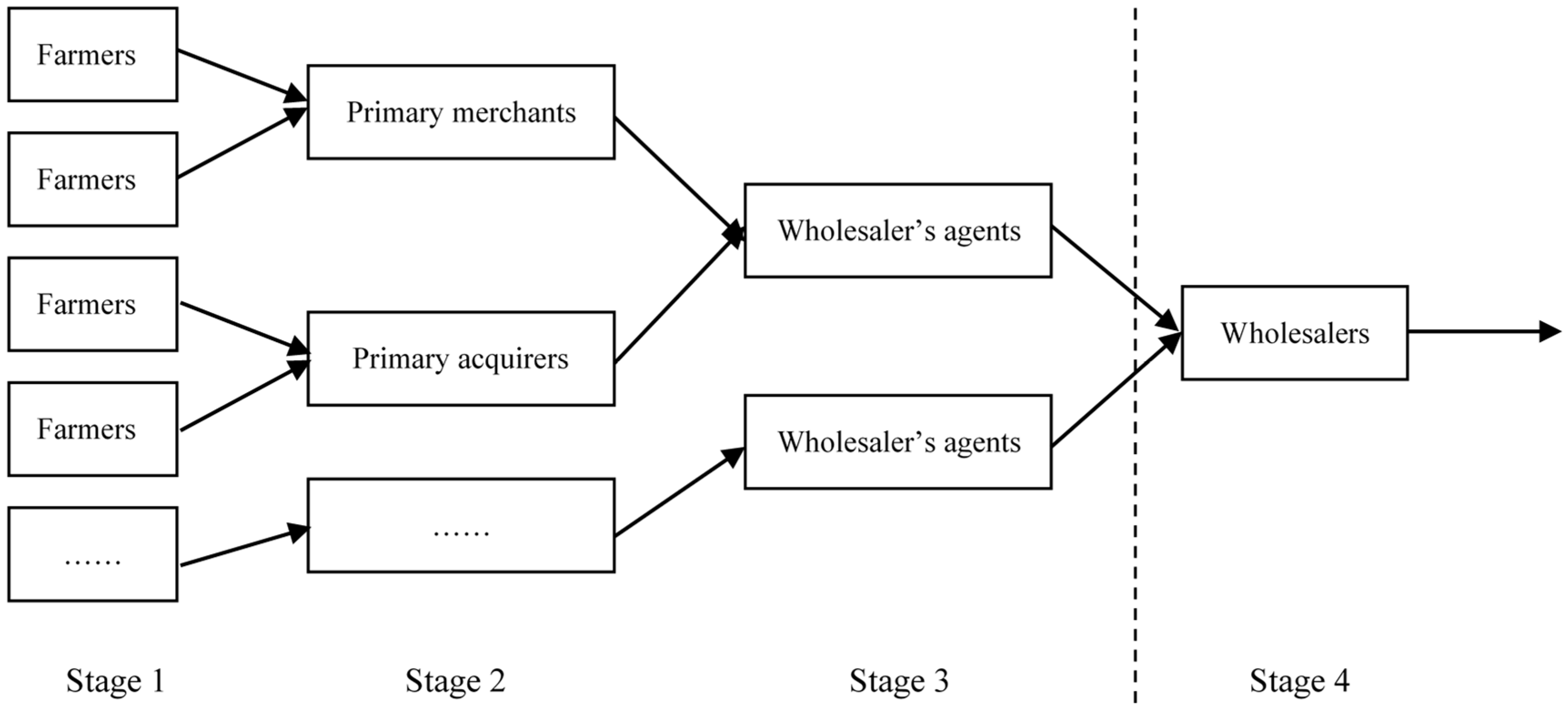

3.1.1. The Price Conduction Model of the Upstream Supply Chain

- (1)

- Wholesalers inform secondary merchants regarding the demand quantity. The secondary merchants inform the primary merchants to buy vegetables. However, the task of each primary merchant is different, depending on demand. For example, if the wholesalers have a high demand and time pressures, they will try to seek other buyers, in addition to their own designated buyers;

- (2)

- The first-level merchants will deliver the vegetables to the warehouses of secondary merchants on completion of procurement. The secondary merchants will do the sorting and packaging and sell the vegetables to wholesalers, who will in turn transport and sell the vegetables. The wholesalers also set the selling price and the price offered to secondary merchants. The price is usually the same across a single region;

- (3)

- Wholesalers pay the secondary merchants, who in turn pay the primary merchants; the latter in turn pay the producers; and

- (4)

- The transaction ends.

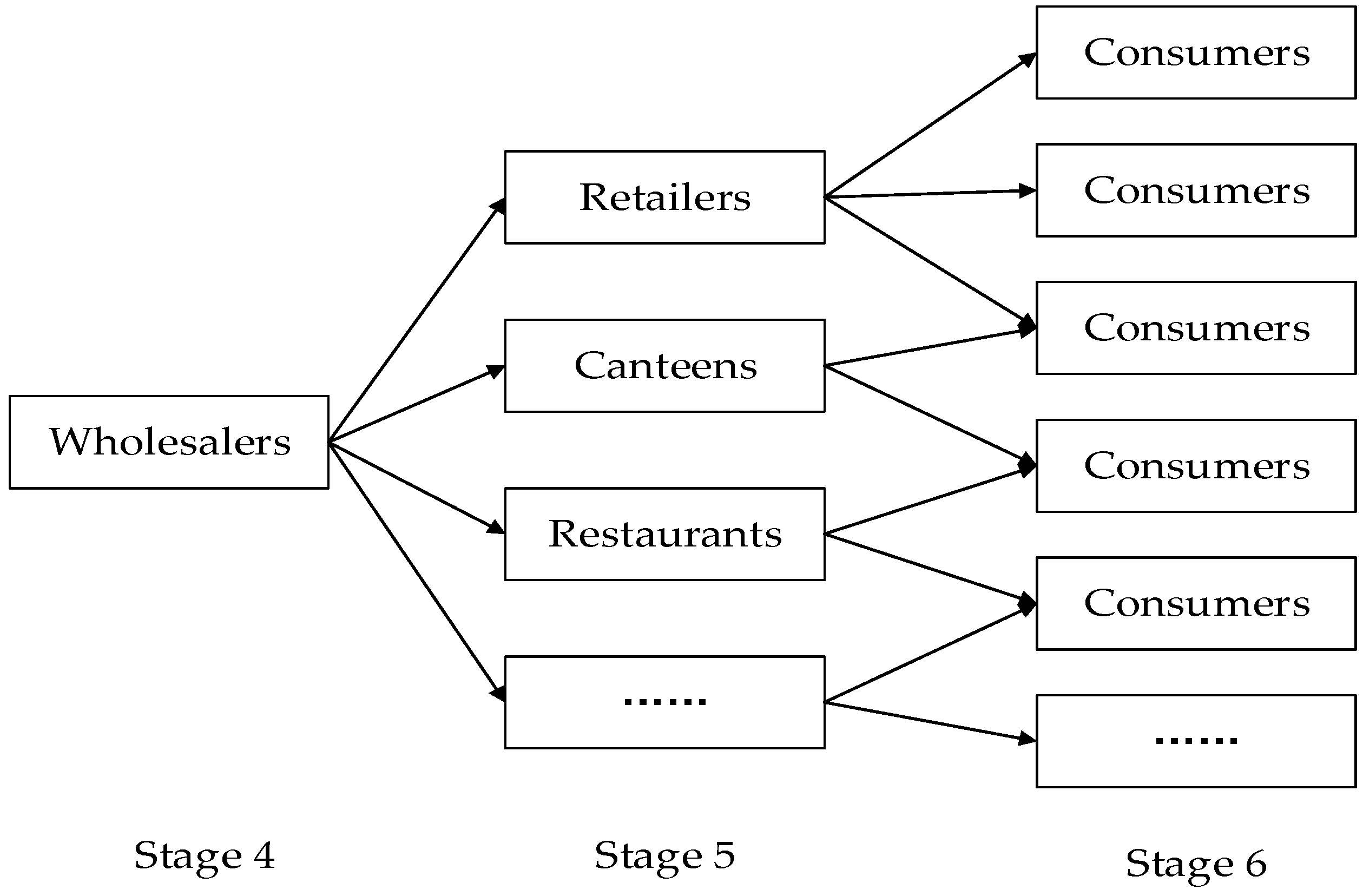

3.1.2. The Price Conduction Model of the Downstream Supply Chain

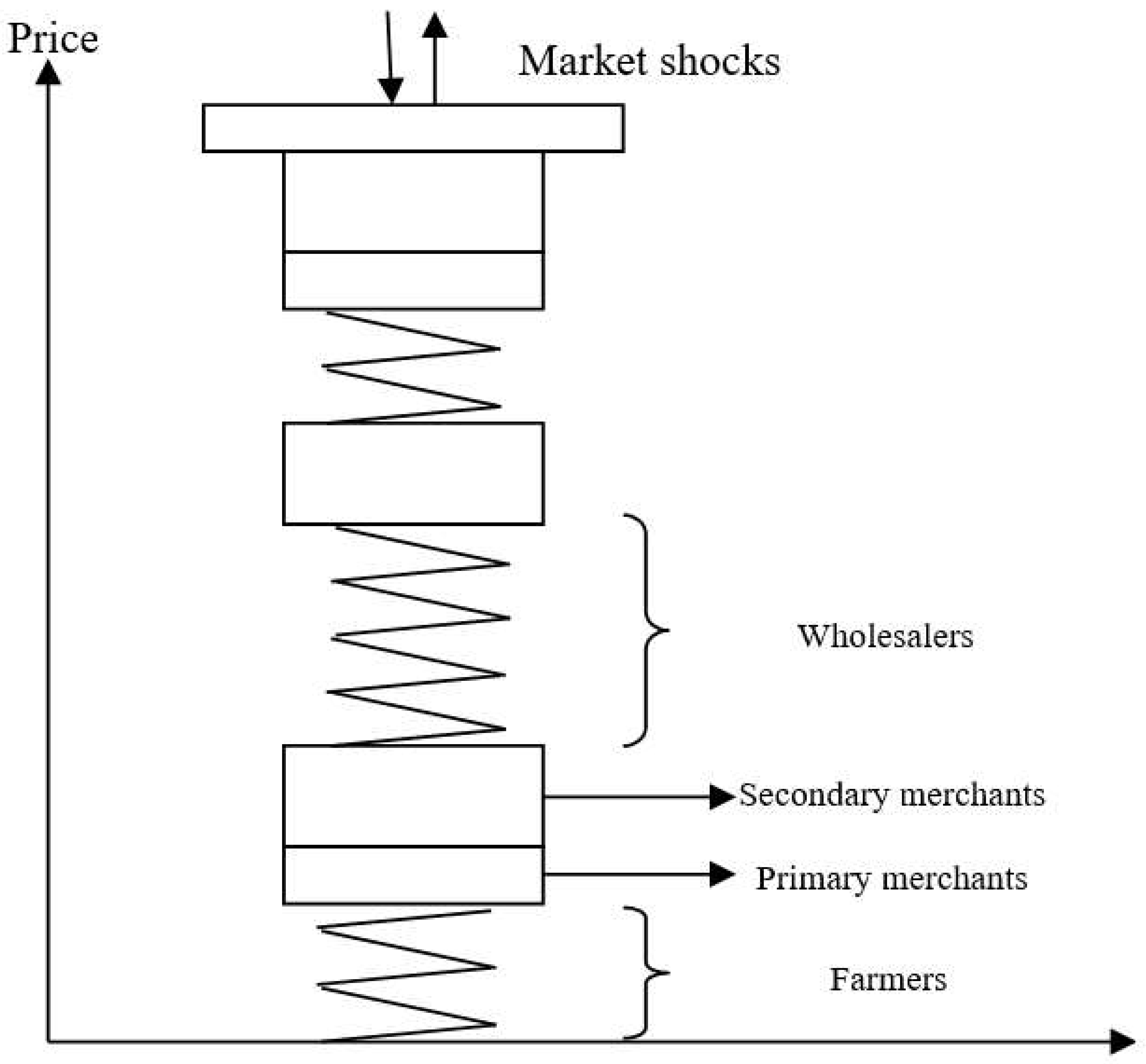

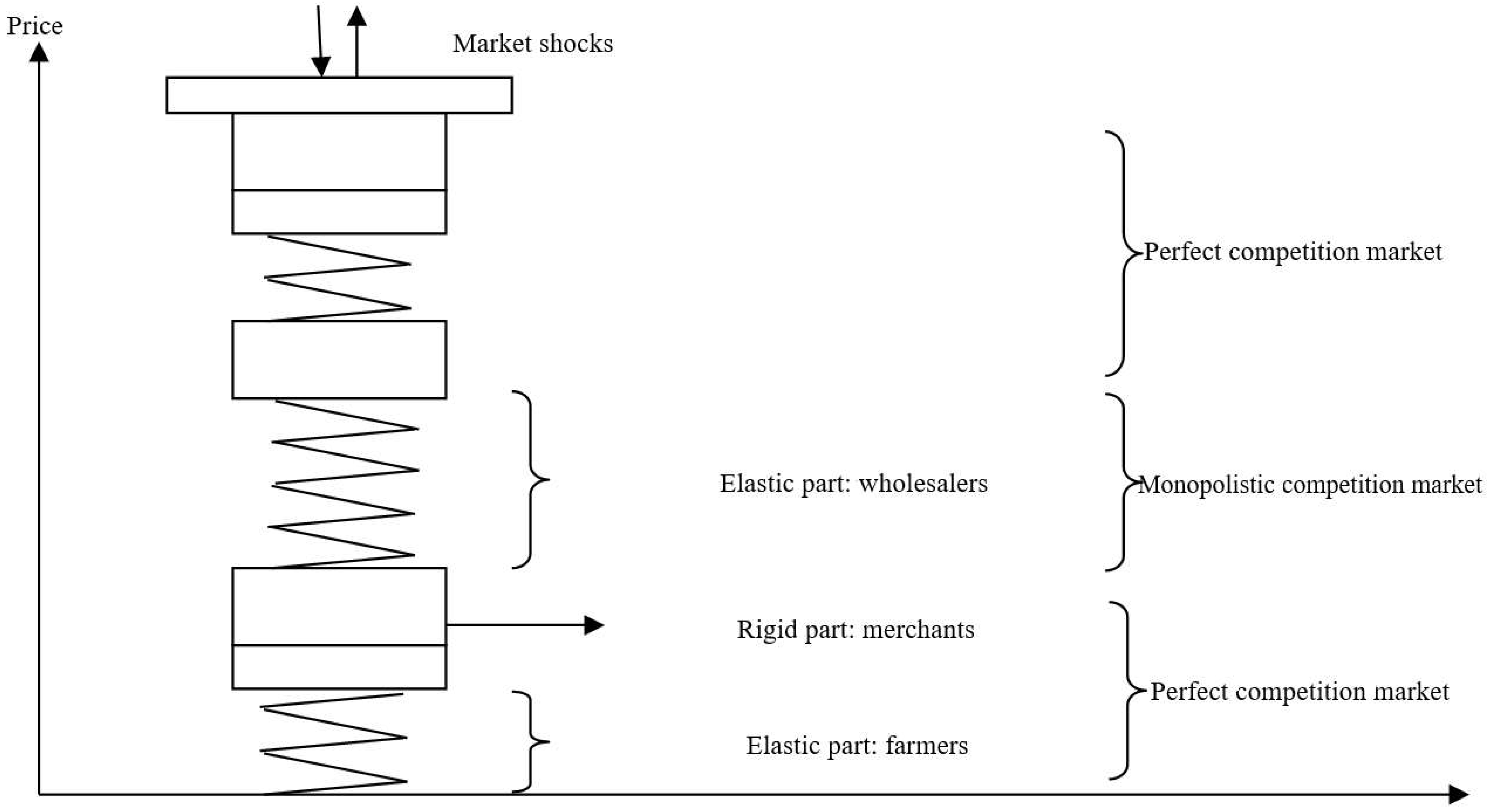

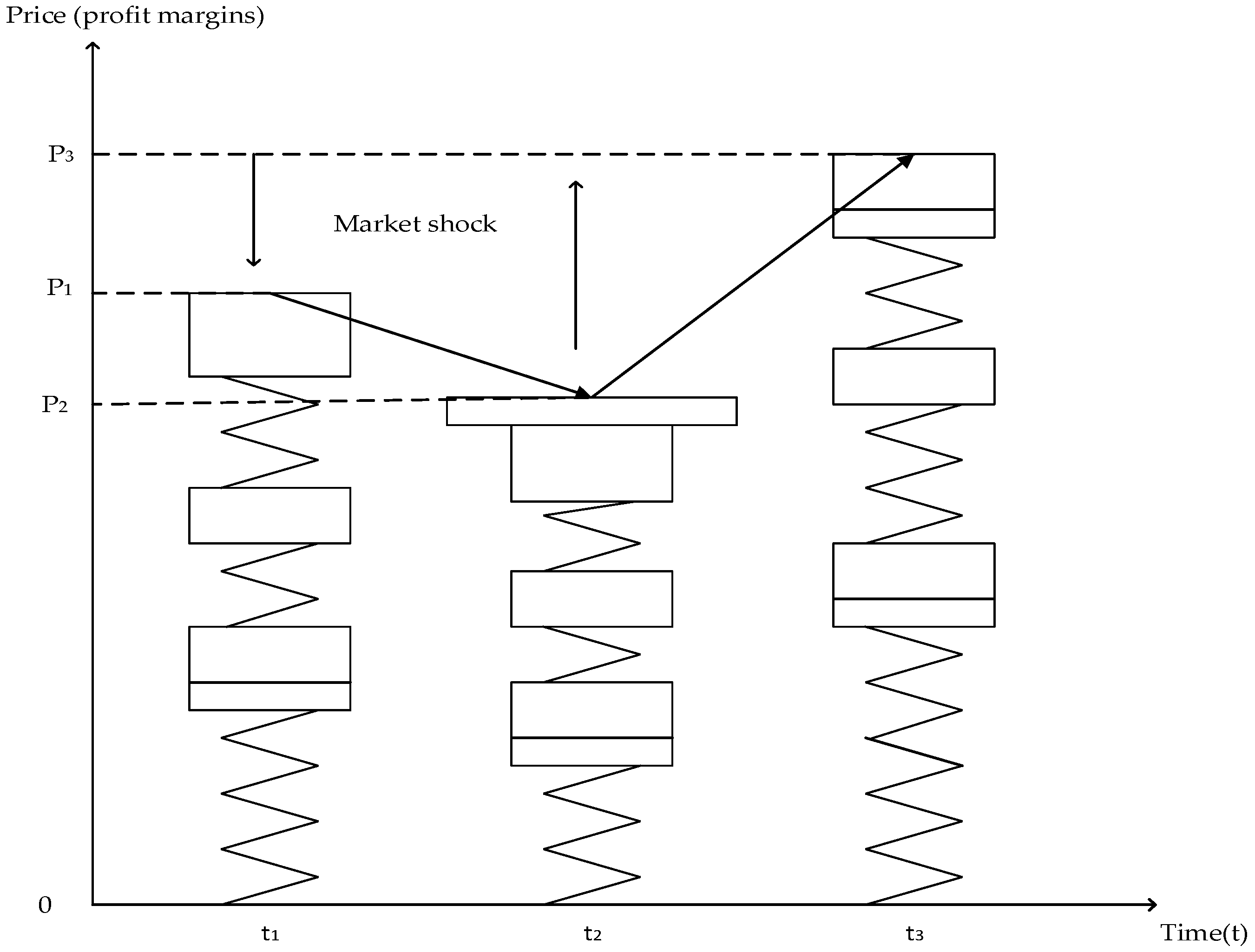

3.2. Elastic Model of Supply Chain Price Conduction of Fresh and Raw Vegetables

3.2.1. Elastic Model of Price Conduction

3.2.2. Generalized Correction of the Model

4. Empirical Analysis

4.1. Descriptive Analysis of Data

4.2. Stationarity Test

4.3. Co-Integration Test

4.4. Value at Risk (VAR) and the Determination of Lag Order

4.5. Granger Causality Analysis

5. Discussions on Findings

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Assefa, T.T.; Meuwissen, M.P.M.; Oude Lansink, A.G.J.M. Literature Review on Price Volatility Transmission in Food Supply Chains, the Role of Contextual Factors and the CAP’s Market Measures; ULYSSES Project, EU 7th Framework Programme, Project 312182 KBBE. 2012.1. 4-05; ULYSSES: Wageningen, The Netherlands, 2013; pp. 1–30. [Google Scholar]

- Schnepf, R. Farm-to-Food Price Dynamics; Congressional Research Service Report, 40621; Congressional Research Service: Washington, DC, USA, 2013. Available online: www.crs.gov (accessed on 2 May 2019).

- People’s Republic of China, Ministry of Agriculture. China Agricultural Statistics. 2017. Available online: http://www.moa.gov.cn (accessed on 2 May 2019).

- Vavra, P.; Goodwin, B.K. Analysis of Price Transmission Along the Food Chain; OECD Food, Agriculture and Fisheries Paper No. 3.; OECD Publishing: Paris, France, 2005. [Google Scholar]

- Best, S.; Mamic, I. Global Agri-Food Chains: Employment and Social Issues in Fresh Fruit and Vegetables; (No. 994299953402676); International Labour Organization: Geneva, Switzerland, 2008. [Google Scholar] [CrossRef]

- He, L.Y.; Chen, S.P. Multifractal detrended cross-correlation analysis of agricultural futures markets. Chaos Solitons Fractals 2011, 44, 355–361. [Google Scholar] [CrossRef]

- Réquillart, V.; Simioni, M.; Varela Irimia, X.L. Imperfect competition in the fresh tomato industry. In Proceedings of the 12th Congress of the European Association of Agricultural Economists—EAAE 2008, Ghent, Belgium, 26–29 August 2008. [Google Scholar]

- Liu, T.L.; Wang, Y.Q. Analysis of vegetable supply chain and price fluctuation. China Logist. Purch. 2011, 2011, 52–53. [Google Scholar]

- Xu, S. Construction of China agriculture monitoring and early-warning system (CAMES). In Proceedings of the 2013 World Agricultural Outlook Conference; Springer-Verlag: Berlin/Heidelberg, Germany, 2014; pp. 1–13. [Google Scholar]

- Bakucs, Z.; Fałkowski, J.; Fertő, I. Does market structure influence price transmission in the agro-food sector? A meta-analysis perspective. J. Agric. Econ. 2014, 65, 1–25. [Google Scholar] [CrossRef]

- Beckert, J. Where do prices come from? Sociological approaches to price formation. Socio-Econ. Rev. 2011, 9, 757–786. [Google Scholar] [CrossRef]

- Xu, L.; Zhang, Q.; Xu, S. Analysis of price rise in vegetables in China since 2009. Food Nutr. 2012, 18, 39–44. [Google Scholar]

- Xiao, X.; Li, C. The price characteristics, problems and solutions of vegetables in China. Res. Agric. Mod. 2016, 37, 948–955. [Google Scholar]

- Ling, L. Study on Fluctuation Characteristics and Conduction Mechanism of Vegetable Price in China. Ph.D. Thesis, Shandong Agricultural University, Taian, China, 2017. [Google Scholar]

- Cutts, M.; Kirsten, J. Asymmetric price transmission and market concentration: An investigation into four South African agro-food industries. S. Afr. J. Econ. 2006, 74, 323–333. [Google Scholar] [CrossRef]

- Beatty, T.; Snyder, S. Regional fresh fruit and vegetable price indices using supermarket scanner data. In Proceedings of the Aaea & Waea Joint Meeting, San Francisco, CA, USA, 26–28 July 2015; Agricultural and Applied Economics Association: Milwaukee, WI, USA; Western Agricultural Economics Association: Milwaukee, WI, USA, 2015. [Google Scholar]

- Song, C.; Xu, J.; Zhang, S. Research on vegetable price fluctuation and vertical transmission mechanism—Based on the analysis of VAR and VECH models. J. Agrotech. Econ. 2013, 2013, 10–21. [Google Scholar]

- Busse, S.; Brümmer, B.; Ihle, R. Price formation in the German biodiesel supply chain: A Markov-switching vector error-correction modeling approach. Agric. Econ. 2012, 43, 545–560. [Google Scholar] [CrossRef]

- Xie, H.; Wang, B. An empirical analysis of the impact of agricultural product price fluctuations on China’s grain yield. Sustainability 2017, 9, 906. [Google Scholar] [CrossRef]

- Shi-hong, Z. Analysis on the cause of rising and fluctuating of vegetable prices. Enterp. Econ. 2012, 31, 100–103. [Google Scholar]

- Luo, C.; Zhao Wang, Z.; Zhai, Q. Vegetable price fluctuation and its endogenous factors—An empirical analysis based on PVAR model. J. Agrotech. Econ. 2013, 2013, 22–30. [Google Scholar]

- Ward, R.W. Asymmetry in retail, wholesale, and shipping point pricing for fresh vegetables. Am. J. Agric. Econ. 1982, 64, 205–212. [Google Scholar] [CrossRef]

- Li, S. The internal causes and Countermeasures of vegetables selling cheap and expensive. Theory Reform 2014, 2011, 84–86. [Google Scholar]

- Downey, W.D. The challenge of food and agri products supply chains. In Proceedings of the 2nd International Conference on Chain Management in Agri and Food Business, WAU Department of Management Studies, Wageningen, The Netherlands, 24–27 March 1996. [Google Scholar]

- Li, Z.; Xu, S.; Cui, L.; Zhang, J. Prediction research based on dynamic chaotic neural network—Taking potato time series price as an example. Syst. Eng. Theory Pract. 2015, 35, 2083–2091. [Google Scholar]

- Xu, S.; Li, Z.; Cui, L.; Dong, X.; Kong, F.; Li, G. Price transmission in China’s swine industry with an application of MCM. J. Integr. Agric. 2012, 11, 2097–2106. [Google Scholar] [CrossRef]

- Gu, G.; Fang, C. Research on domestic transmission path and asymmetry of agricultural product price fluctuation. J. Agrotech. Econ. 2011, 2011, 12–20. [Google Scholar]

- Willett, L.S.; Hansmire, M.R.; Bernard, J.C. Asymmetric price response behavior of Red Delicious apples. Agribusiness 1997, 13, 649–658. [Google Scholar] [CrossRef]

- Ben-Kaabia, M.; Gil, J.M. Asymmetric price transmission in the Spanish lamb sector. Eur. Rev. Agric. Econ. 2007, 34, 53–80. [Google Scholar] [CrossRef]

- Meyer, J.; von Cramon-Taubadel, S. Asymmetric price transmission, a survey. J. Agric. Econ. 2004, 55, 581–611. [Google Scholar] [CrossRef]

- Blažková, I.; Syrovátka, P. Price formation and transmission along the food commodity chain. Acta Univ. Agric. Silvic. Mendel. Brun. 2013, 60, 31–36. [Google Scholar] [CrossRef]

- Edet, G.E.; Akpan, S.B.; Patrick, I.M.V. Assessment of price transmission and market integration of pawpaw and leafy telfairia in Akwa Ibom State, Nigeria. Am. J. Exp. Agric. 2014, 4, 1367–1384. [Google Scholar] [CrossRef]

- Qi, C.; Fu, M. Research on the influence factors of fresh agricultural products pricing. Price Theory Pract. 2016, 2016, 109–112. [Google Scholar]

- Zhao, A.; Zhao, Y.; Wang, C. Research on vegetable price change and transmission mechanism between wholesale and retail markets. Chin. Agric. Sci. Bull. 2011, 2011, 253–260. [Google Scholar]

- Zheng, Y. Measurement and upgrading strategies of fresh vegetables circulation efficiency based on Industrial Chain Perspective. Agric. Econ. 2017, 2017, 139–140. [Google Scholar]

- Fałkowski, J. Price transmission and market power in a transition context: Evidence from the Polish fluid milk sector. Post-Communist Econ. 2010, 22, 513–529. [Google Scholar] [CrossRef]

- Renting, H.; Wiskerke, J.S.C. New Emerging Roles for Public Institutions and Civil Society in the Promotion of Sustainable Local Agro-Food Systems. 2010. Available online: https://library.wur.nl/WebQuery/wurpubs/fulltext/146104 (accessed on 4 May 2019).

- Zhou, H. An Analysis on Optional Behaviors and Causal Factors of Vegetable Households’ Selling Pattern. Master’s Thesis, Nanjing Agricultural University, Nanjing, China, 2007. [Google Scholar]

- Cao, Y. Study on the fluctuation of terminal price in the value chain of agricultural industry. Stat. Decis. 2015, 7, 88–91. [Google Scholar]

- Cao, Y.; Zhao, L. The influence of agricultural product price fluctuation on Farmers’ income. Spec. Zone Econ. 2014, 3, 156–157. [Google Scholar]

- Bunte, F. Pricing and performance in agri-food supply chains. In Quantifying the Agri-Food Supply Chain; Ondersteijn, C.J.M., Wijnands, J.H.M., Huirne, R.B.M., van Kooten, O., Eds.; Springer: Dordrecht, The Netherlands, 2006; pp. 37–45. [Google Scholar]

- Guillen, J.; Franquesa, R. Price transmission and volatility along the Spanish fresh fish market chain. New Medit 2015, 14, 4–11. [Google Scholar]

- Chopra, S.; Meindl, P. Supply Chain Management: Strategy, Planning & Operation, 6th ed.; Pearson Publications: New York, NY, USA, 2018. [Google Scholar]

| Variable | Name | Mean | Standard Deviation | Minimum | Maximum | Sample Size |

|---|---|---|---|---|---|---|

| Procurement price | Pricely | 2.622 | 0.837 | 1.74 | 4.82 | 78 |

| Wholesale price | Pricebj | 3.027 | 0.934 | 2 | 5.25 | 78 |

| Variable | Mean | Standard Deviation | Standard Deviation Coefficient |

|---|---|---|---|

| Procurement price | 2.622 | 0.837 | 0.319 |

| Wholesale price | 3.027 | 0.934 | 0.309 |

| Variable | Horizontal Variable | First order Difference | Result | ||

|---|---|---|---|---|---|

| ADF | t * | ADF | t *** | ||

| Pricebj | −1.5209 | −4.0817 | −6.7064 | −4.0833 | I (1) |

| Pricely | −2.5455 | −4.0817 | −9.6573 | −4.0834 | I (1) |

| Variable | ADF | t *** | Result |

|---|---|---|---|

| pricebj | −5.5217 | −4.0850 | I (0) |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −128.0675 | NA | 0.115278 | 3.515338 | 3.577610 | 3.540179 |

| 1 | 8.747078 | 262.5361 | 0.003183 | −0.074245 | 0.112571 * | 0.000278 * |

| 2 | 10.81702 | 3.860168 | 0.003355 | −0.022082 | 0.289278 | 0.102124 |

| 3 | 18.48179 | 13.87944 * | 0.003040 * | −0.121129 * | 0.314775 | 0.052758 |

| 4 | 20.02998 | 2.719789 | 0.003253 | −0.054864 | 0.505584 | 0.168705 |

| Null Hypothesis | F-Statistic | Probability |

|---|---|---|

| PRICELY does not Granger Cause PRICEBJ | 2.14345 | 0.1028 |

| PRICEBJ does not Granger Cause PRICELY | 5.17398 | 0.0028 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, Y.; Mohiuddin, M. Sustainable Emerging Country Agro-Food Supply Chains: Fresh Vegetable Price Formation Mechanisms in Rural China. Sustainability 2019, 11, 2814. https://doi.org/10.3390/su11102814

Cao Y, Mohiuddin M. Sustainable Emerging Country Agro-Food Supply Chains: Fresh Vegetable Price Formation Mechanisms in Rural China. Sustainability. 2019; 11(10):2814. https://doi.org/10.3390/su11102814

Chicago/Turabian StyleCao, Yuliang, and Muhammad Mohiuddin. 2019. "Sustainable Emerging Country Agro-Food Supply Chains: Fresh Vegetable Price Formation Mechanisms in Rural China" Sustainability 11, no. 10: 2814. https://doi.org/10.3390/su11102814

APA StyleCao, Y., & Mohiuddin, M. (2019). Sustainable Emerging Country Agro-Food Supply Chains: Fresh Vegetable Price Formation Mechanisms in Rural China. Sustainability, 11(10), 2814. https://doi.org/10.3390/su11102814