1. Introduction

The current automobile industry is undergoing structural changes because of its convergence with cutting-edge information and communication technologies—such as artificial intelligence and the Internet of Things, along with big data—in order to produce next-generation automobiles. To achieve sustainable competitiveness and maximize operational efficiency, the importance of the supply chain has been further emphasized [

1]. The systematic management of the supply chain requires activities such as demand forecasting, production planning and scheduling, procurement, inventory management, and logistics to be managed at an integrated supply chain level, rather than an individual company level [

2].

Over the last three decades, studies on supply chain management have traditionally focused on a cooperative supply chain and analyzed the effects of cooperation within the supply chain on the performance improvement. Such research has covered transaction cost theory, resource-based theory, knowledge-based theory, and game theory [

1] for case studies on Toyota, Hewlett Packard Enterprise, and Walmart among others [

3,

4,

5]. In addition, studies on the establishment of an efficient and sustainable supply chain have been actively conducted [

6,

7,

8,

9].

Most of the extant literature has examined the supply chain in its simplest form and identified the relationship between the buyer–supplier partnership and the supply chain performance. Nevertheless, they are limited in their evaluation of supply chain performance using the efficiency and effectiveness of individual companies. The measurement of supply chain performance must be holistically conducted, rather than being focused on the individual level. This is because in conditions where a conflict of interests arises between supply chain players, an efficient operation for one player may lead to an inefficient operation for another player in the supply chain. This would ultimately hamper the efficiency of the entire supply chain [

10]. Therefore, to assess the supply chain performance, the nature of and interactions within the supply chain network all need to be taken into consideration in order to adjust and integrate the performance of supply chain players [

11].

The automobile industry in Korea has a top-down (vertical) structure, where automakers exercise power over partners, which is unlike that in the U.S., where automobile suppliers have grown independently [

12]. Hyundai and Kia Motors occupied over 80% of the domestic automobile market, and it leads to a heightened awareness that large conglomerates’ opportunistic practices for short-term interests pose serious threats to the survival of small- and medium-sized enterprises (SMEs). As an alternative to this status quo, policies on win–win cooperation that seek to promote mid- to long-term (sustainable) relationship and mutual growth of automakers and partners have been put forward [

13].

The present study aims to empirically analyze the effects of improved competitiveness of the partners (through win–win cooperation) on the efficiency of the total supply chain. The Hyundai Motor Company has provided financial and technological assistance to its partners, leading them to actively participate in the quality improvement process. However, without integrating the supply chain, such policies are likely to cause inefficiency in the overall supply chain. We hypothesized that an efficient partner with high profitability might maintain quality only to the minimum requirement, and thereby disrupt the supply chain performance. This hypothesis was tested through a three-tier supply chain of partners, subsidiaries, and parent companies in the automobile industry. The rest of the paper is organized as follows.

Section 2 examines the literature on supply chain management in the automobile industry.

Section 3 describes the data envelopment analysis (DEA) model that we build.

Section 4 presents data and criteria for variable selection, and summarizes the results from two DEA models that we use to evaluate the efficiency of partners and supply chains, respectively.

Section 5 applies the Mann–Whitney U test and the Tobit regression model to the DEA results, and discusses the relationship between these two efficiency scores.

Section 6 concludes the paper and suggests future directions.

2. Literature Review

Owing to unstable demand and excessive supply, automakers have faced immense competitive pressure. In light of the increasing need for sustainable supply chain management that allows an optimized material flow, various studies have been conducted on performance evaluation and benchmarking of supply chains [

14].

The supply chain is a complex network in which multiple companies interact with one another in a business process. The evaluation of its performance can be defined as a process that measures its efficiency [

15]. The most commonly used method to analyze supply chain efficiency is DEA, a non-parametric approach that estimates the relative efficiency of decision-making units (DMU) with multiple inputs and outputs [

16]. DEA, unlike a typical supply chain optimization model, has an advantage—it does not require unrealistic prior consumption for variables [

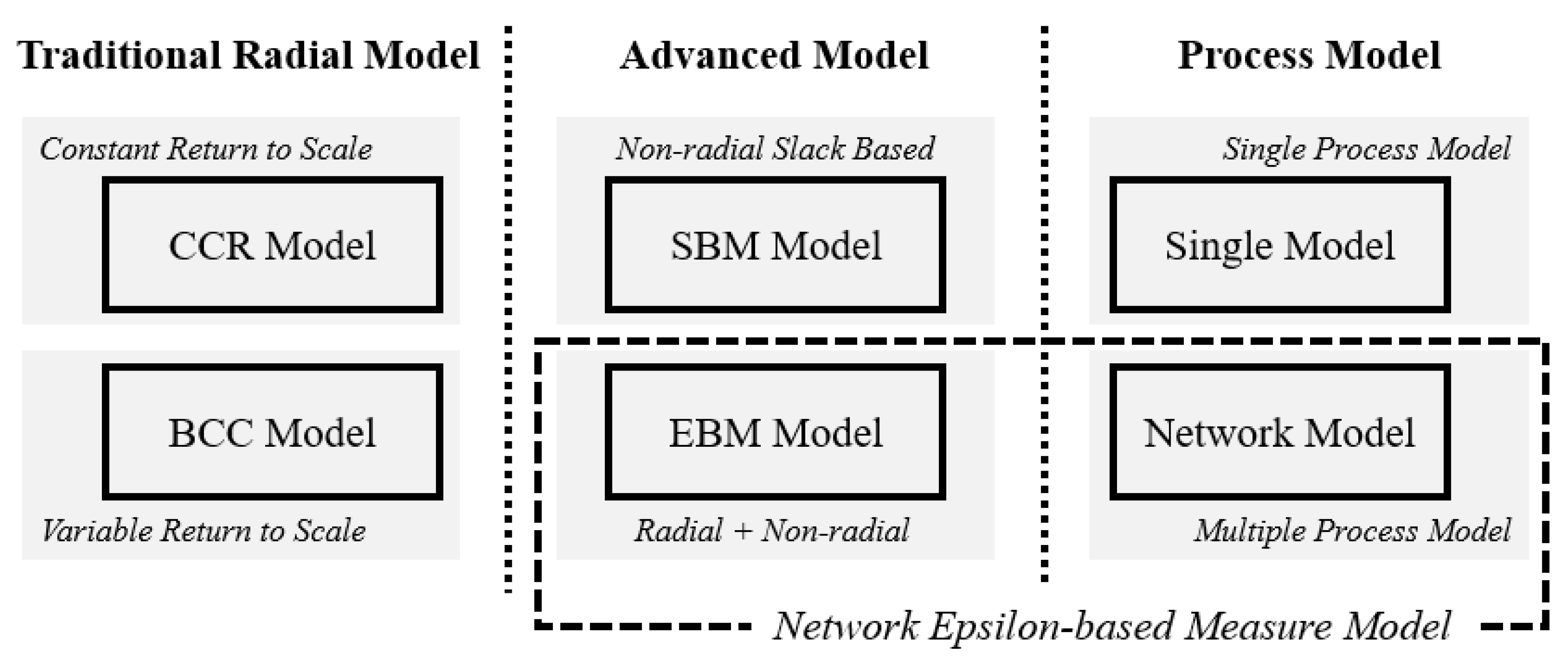

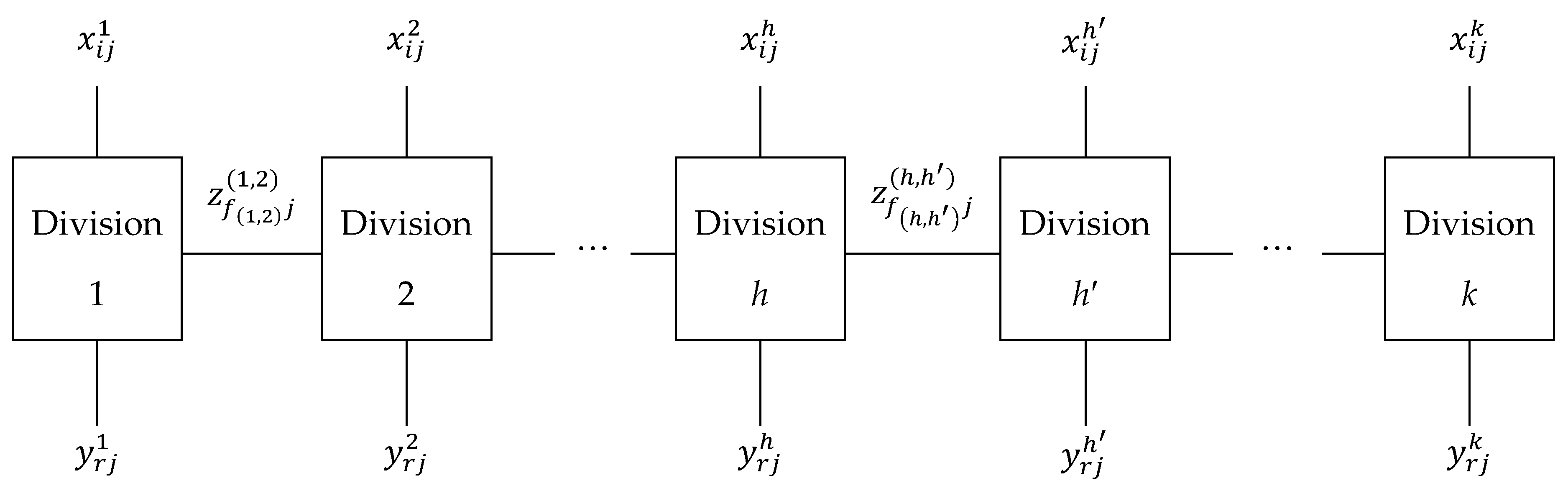

17]. However, traditional DEA models, such as Charnes–Cooper–Rhodes (CCR) and Banker–Charnes–Cooper (BCC) models, treat the production process of the DMU as a black box and have been criticized for not clearly identifying the relationship between inputs and outputs. To address this limitation, a network DEA model was developed to divide the production process of the DMU into multiple processes between the divisions and then calculate the efficiency of the entire networked system [

18]. The network DEA model can deal with processes in various forms, including serial, parallel, mixed, hierarchical, and dynamic systems [

19]. It can be also extended to hybrid models by combining it with other decision-making methods, such as analytic hierarchy process (AHP), stochastic programming, goal programming, and neural networks. Thus, the network DEA model is used in the banking, aviation, transport, manufacturing, and sports industries; furthermore, the scope of its application continues to gradually expand [

20].

In the automobile industry, studies that utilize DEA for supply chain management have primarily evaluated the efficiency of auto parts manufacturers in relation to supplier selection. Zeydan et al. [

21] used a fuzzy AHP on trunk panel manufacturers to obtain qualitative variables that were then converted into quantitative variables. These were designated as the outputs of the DEA model to measure the efficiency of suppliers and exclude inefficient suppliers. Ha and Krishnan [

22] operated a supplier portfolio by conducting a cluster analysis based on qualitative and quantitative factors obtained from AHP, neural networks, and DEA in order to select competitive suppliers among automatic transmission manufacturers. Çelebi and Bayraktar [

23] employed neural networks to process incomplete supplier data of a local auto assembly plant that imports components from overseas suppliers to establish evaluation criteria shared by all the DMUs. They applied DEA to form a partnership with suppliers classified as efficient DMUs to improve operational efficiency.

Several studies have identified the cause of the differences in efficiency of automobile suppliers. Talluri et al. [

24] estimated the efficiency of 150 primary suppliers for three major automakers in the U.S.—GM, Ford, and Chrysler—and categorized them into three groups of high, medium, and low according to their efficiency scores. Then, they utilized a Kruskal–Wallis test to detect between-group differences in cost, quality, on-time delivery, flexibility, and innovation variables. The most efficient and least efficient groups showed a significant difference only in cost, indicating that efficient suppliers were successful in cost reduction. Manello et al. [

25] examined changes in the total factor productivity of numerous companies in the Italian automobile supply chain over a four-year period after the financial crisis. They used a bootstrapped Malmquist index and reported that firms concentrating on their core business were more efficient than the others. Moreover, in contrast with SMEs, large conglomerates were located near the efficient frontier, which hindered them from benefiting from catching-up effects (emulating other companies), and thus allowed productivity improvement only by technological innovation.

Meanwhile, some studies have discussed a correlation between the supplier–automaker relationship and the supply chain efficiency. Saranga [

14] investigated the Indian automobile industry; the author described a case in which a small-scale manufacturer at a low level of the supply chain had to make advanced payments for raw materials and receive after-payment for supplied components. Owing to this difficult financing environment, instead of using automated equipment, the manufacturing process was undertaken manually, which caused inefficiency in the operation of automobile suppliers. The study further suggested that, to ensure an efficient supply chain, automakers at high levels of the supply chain must provide those suppliers with financial and technological support, as well as long-term supply contracts. This would affect the cost reduction and quality improvement of the automobile supply chain. Sadjadi and Bayati [

26] applied game theory to the relationship between raw material producers and auto parts manufacturers in a three-tier supply chain (raw material producers, auto parts manufacturers, and automakers). They computed supply chain efficiency in a cooperative game, where all suppliers made efforts to promote overall efficiency, and then in a non-cooperative game, where a leader maximized its efficiency and a follower made decisions sequentially, taking the efficiency of the leader as a fixed value (Stackelberg model). The results showed that the optimal efficiency of the cooperative game was greater than or equivalent to that of the non-cooperative game.

In supply chain management, decision-making by individual entities affects not only those entities, but also their counterparts, which ultimately determines the efficiency of the total supply chain. However, most previous studies on automobile supply chain have mainly focused on the individual suppliers. In addition, many studies have examined the two-tier supply chain comprising automobile suppliers and automakers. Few studies have considered a three-tier or higher supply chain. Thus, this study sets a three-tier supply chain comprising partners, subsidiaries, and parent companies. The individual and overall efficiencies of the supply chain are analyzed to verify the impact of individual entities on the supply chain.

6. Conclusions

The main purpose of this study was to identify the impact of the partner efficiency on the overall supply chain efficiency. Under the assumption that a supply contract that specifies the unit price and quantity is signed between automakers and partners, an input-oriented CCR model was used to measure the efficiency of the individual partner, while an output-oriented NEBM model was used to measure the efficiency of the overall supply chain. Then, the relationship between the partner efficiency and the supply chain efficiency was analyzed using the Mann–Whitney U test and the Tobit regression model.

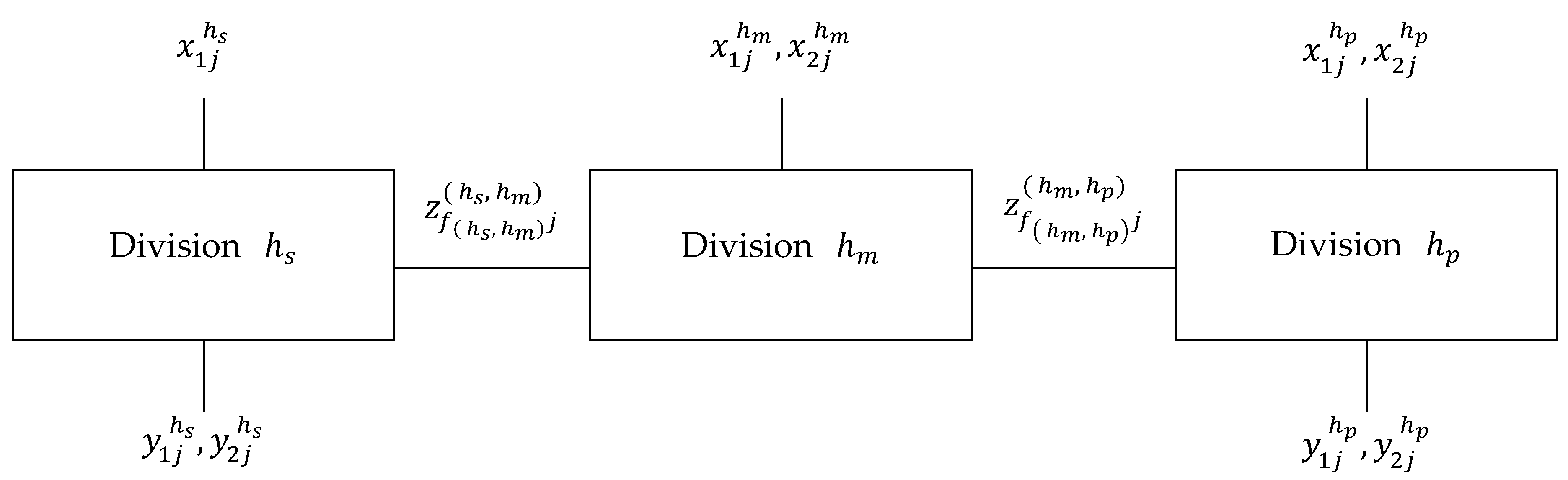

In the first phase, two types of DEA models were used. The CCR model was applied to assess the competitiveness of the individual partner. The inputs comprised the number of employees, operating cost, and fixed assets, while the output was the total gross sales. According to the results, only two of the 139 partners were identified as efficient DMUs. The CCR efficiency scores are low in general, and 63% of all partners (88 of 139) have a CCR efficiency score below the average. The NEBM model was applied to a three-tier supply chain comprising partners, subsidiaries, and parent companies. The inputs and outputs of the partners (non-affiliates of the Hyundai Motor Group) were selected based on the vendor selection criteria. The input of the partners was price, whereas the outputs were quality and delivery performance. The inputs of the subsidiaries and parent companies were the number of employees and operating cost, while the outputs were the total gross sales and export sales. The intermediate measure was material flow. The result of the NEBM model reveals that none of the 540 supply chains was located at the efficient frontier. As only the supply chains with all divisions being efficient have an NEBM efficiency score of 1, the NEBM model has higher discriminatory power than the NCCR model. In addition, the NEBM model was suitable for measuring the efficiency of a complex supply chain as its similarity to the NSBM or NCCR models increased according to the dispersion of data. It evaluated efficiency using both radial and non-radial measures.

Under a circumstance in which the unit price, quantity, quality standards, and other details are set, we suppose that partners would maintain quality only to the minimum requirement to reduce the production cost. However, as the quality of components corresponds to the output of the supply chain, a hypothesis was established—the partner efficiency at cost reduction would have a negative impact on the overall supply chain efficiency. This hypothesis was verified through non-parametric and parametric methods.

In the second phase, the Mann–Whitney U test and the Tobit regression model were used. Two groups were created: a supply chain with partners achieving a CCR efficiency score of 1 and a supply chain without such partners. Then, the Mann–Whitney U test was conducted to verify the difference in the distribution of the NEBM efficiency scores between the two groups. The Tobit regression analysis was also conducted to identify the causal relationship between the CCR efficiency score and the NEBM efficiency score. The supply chain comprising the partners with a CCR efficiency score of 1 was less efficient than the supply chain without such partners. That is, the more efficient the partner, the less efficient the total supply chain would be.

This finding implied a conflict of interests within a supply chain consisting of independent companies and therefore supported similar studies reporting the lower performance of a supply chain under non-cooperative assumption [

10,

26]. Moreover, the quality score of efficient partners was not higher than that of inefficient partners, which is consistent with previous studies demonstrating that efficient suppliers focus on cost reduction, not on quality improvement [

24].

In contrast to the results reported here, a previous study claimed that automakers’ financial and technical support to partners would reduce supply chain inefficiency [

14]. This discrepancy could be explained by differences in the industry environment. In the Indian automobile industry, manual labor was a poor substitute for automated equipment, while manufacturing processes in the Korean automobile industry were mostly automated to eliminate such inefficiencies.

The Hyundai Motor Company has increasingly pursued win–win cooperation with its partners because of political pressure and labor-management conflicts. Thus, its business strategy aims to increase its partners’ competitiveness and ultimately enhance the quality competitiveness of its finished vehicles. However, as our study reveals, the efficient operation of partners impairs the efficiency of the total supply chain. This suggests that the effects of quality improvement on the partners are lower than the support provided by the Hyundai Motor Company. Considering our findings, the automobile industry must review its partner management system (performance measurement and incentive systems) to establish a truly efficient supply chain. From a managerial point of view, this could give managers a deeper insight on designing and implementing supply chain integration. This approach also leads policymakers to a more realistic assessment for developing evaluation criteria in the automobile industry.

Even though this study utilized sharper efficiency estimates of a three-tier supply chain by applying the NEBM model, it has some limitations. In evaluating suppliers within the supply chain, a wider criterion can be adopted, while we only examined the key indices because of limited data. This would involve intangible factors such as information sharing, technological innovation, and partnership, aside from price, quality, and delivery performance. In addition, potential risks always exist in the supply chain, including the demand, production and logistics risks, and such risks may lead to data uncertainties. Thus, in future studies, methods such as fuzzy model can be used to deal with uncertainties and establish an efficient supply chain.