Abstract

Private investment in China, as a developing country, is an important source of financing for Chinese SMEs (Small and Medium-Size Enterprises) and has played a major role in the development of the real economy. However, in 2016, the growth rate of private investment in China dropped from 10.18% to 3.17%, which had a significant impact on the real economy. At the same time, China’s real estate market has developed rapidly, attracting a large number of capital inflows. The relationship between real estate development and private investment in China is worth considering. This study first, theoretically analyzes the influence mechanism of real estate industry on private investment, pointing out that within a modest development range, the development of real estate industry can promote private investment through the industrial linkage, urbanization, and balance sheet effects, but when real estate is overdeveloped, it has an inhibitory effect on private investment through vampire effect, raising costs and reducing demand effect. In other words, real estate has different effects on private investment in different developmental periods. Therefore, there is a non-linear relationship between the two variables. Second, the relevant provincial panel data of 31 provinces in mainland China from 2003 to 2015 were selected. Using the dynamic panel system Generalized Method of Moments (GMM), this study estimated the correlation between real estate development and private investment. The empirical results showed that the development of the real estate industry has a significant impact on the level of private investment; the two showing an “inverted U-shaped” relationship. At present, in some provinces in China, the real estate industry has exceeded the inverted U-shaped threshold. To boost the vitality of private investment in promoting real economic growth, the development of the real estate industry should be restricted, and house prices should be properly regulated.

1. Introduction

Since the reform and opening up, China’s Non-Public Economy has been gradually applauded. After the establishment of a socialist market economy, the private economy has experienced rapid growth, and accordingly, private investment has developed with renewed vigor. Relevant data show that in recent years, the private economy has created about 60% of Gross Domestic Product (GDP) and about 80% of social employment and has become an important foundation for stabilizing China’s economy. The role of private investment in economic growth has also drawn the attention of government departments. The 13th Five-year Plan explicitly states that private enterprises should be required to set foot in more areas by law to stimulate the vitality and creativity of the non-public economy. Until 2016, private investment accounted for more than 60% of the total social investment in fixed assets, far exceeding public investment. Compared with public investment, private investment is characterized by high economic efficiency and strong competition, which can release tremendous vitality in stimulating consumption, expanding employment and stimulating the national economy. Although public investment can effectively boost demand in the short term and guarantee normal economic growth, some scholars point out that in the long run, the proper growth of private investment is the fundamental guarantee of high-level economic development [1].

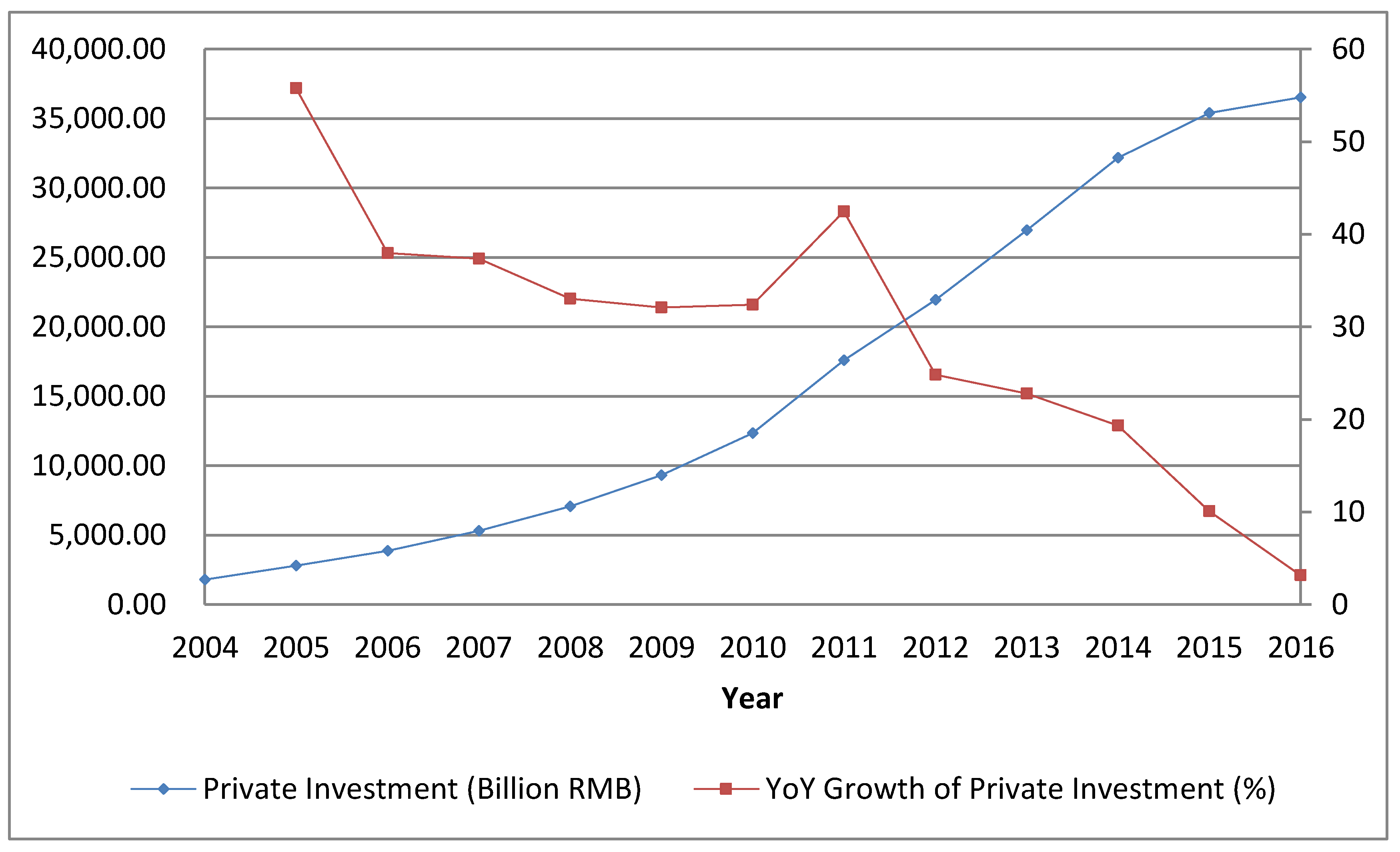

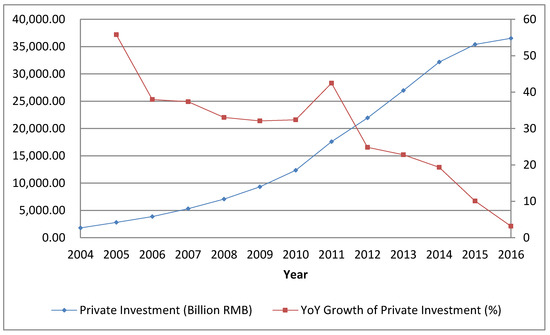

However, since 2012, the growth rate of private investment in China has been declining and, in 2016 it turned into a serious “stalling” problem. As shown in Figure 1, the year-on-year (YoY) growth of private investment remained above 30% until 2011 and maintained a steady high-speed growth. Then it declined from 2012 to 2015 but remained above 10%. However, in 2016 the growth rate dropped to 3.17%, showing a steep decline, which attracted wide spread attention of relevant departments and scholars.

Figure 1.

The amount of private investment in China and its year-on-year (YoY) growth. Source: Wind Databases.

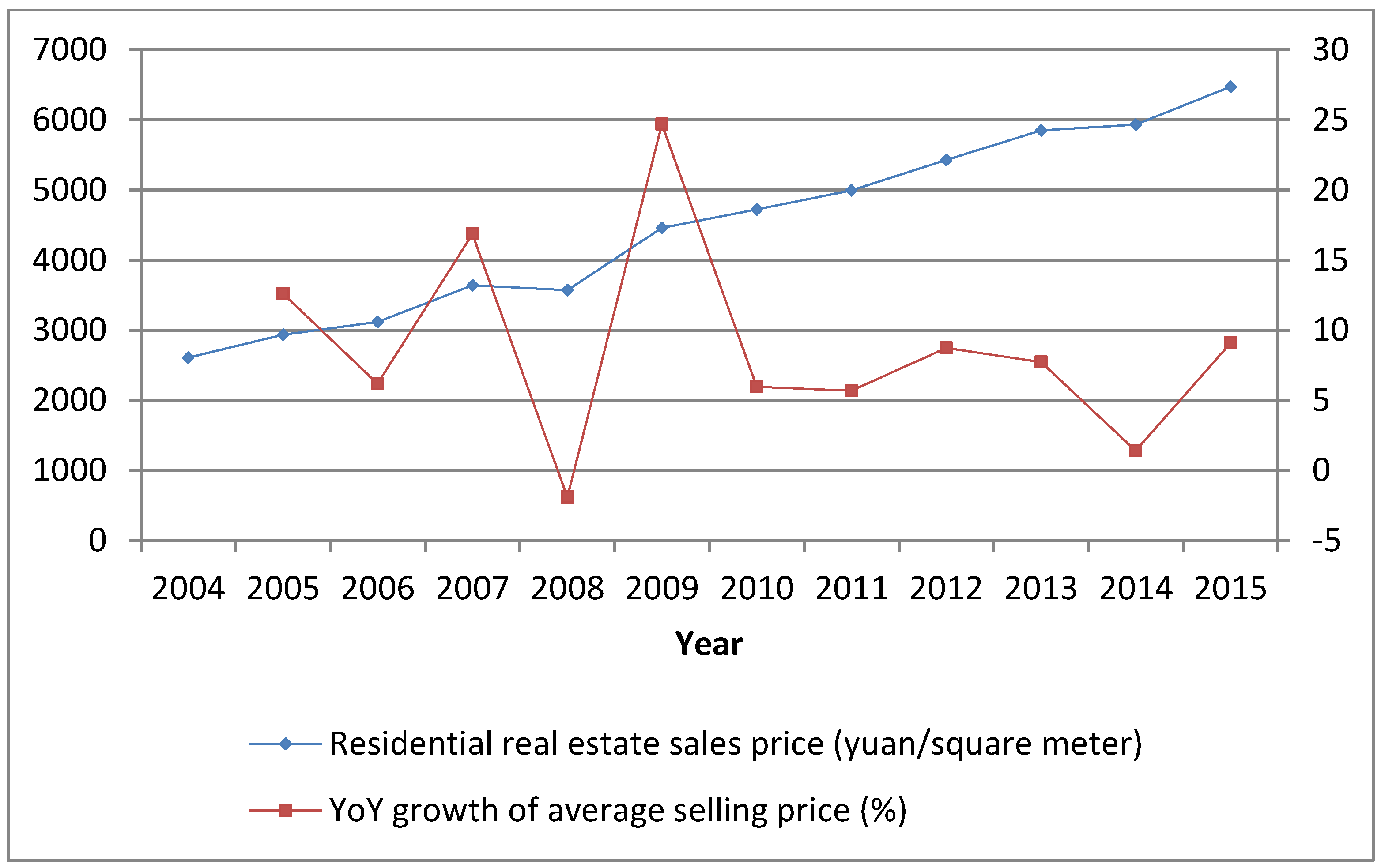

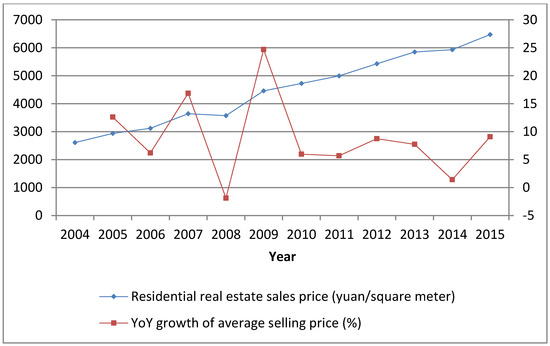

In sharp contrast to the stalling of private investment, China’s real estate industry has been developing at a high level. Since the 1990s, the expansion of urbanization in China has led to the fast-growth of the real estate industry [2]. The real estate market reform in 1998 contributed to the booming development of the real estate industry. In 2000, China’s residential real estate sales were 322.86 billion yuan, while in 2015 they rose to 7.28 trillion yuan, with an average annual growth rate of 23.1%, much higher than that of GDP over the same period. The average sales price of residential real estate also increased from 1948 yuan per square meter in 2000 to 6473 yuan per square meter in 2015, with an average annual growth rate of 8.3%. As shown in Figure 2, with the exception of 2008, when it was influenced by the financial crisis, and 2014, when it was affected by high inventory, the year-on-year growth of house prices remained above 5%, indicating that China’s real estate industry has been in a state of rapid development.

Figure 2.

Average selling prices of residential housing in China and YoY growth. Source: National Bureau of Statistics of China.

Excluding 2008 and 2014, we observe that before 2012, the trend of house prices in China is basically in line with that of private investment, both of which have been growing steadily and the growth rate of private investment is relatively high. However, after 2012, private investment seems to have crossed the inflection point, and its growth rate has been declining year by year. At the same time, house prices have maintained a relatively steady growth rate, and the two have shown opposite trends of development. The development of real estate involves many industries, and its price factors are also very complex, making real estate development and private investment relevant to each other to a certain degree. Thus, what is the relationship between the development of China’s real estate industry and private investment? How do we quantify the correlation between the two variables? Research on these issues has great theoretical and practical significance.

This paper proceeds as follows: Section 2 provides a literature review on private investment and real estate. Section 3 expounds the mechanism of real estate development influencing private investment. Section 4 introduces the methodologies for investigating the relationship between private investment and real estate. Section 5 discusses the findings, and conclusions are drawn in Section 6.

2. Literature Review

Private investment is crucial for developing countries. Stiglitz and Weiss (1981) [3] pointed out that when there is information asymmetry in the market, commercial banks are reluctant to lend to SMEs (Small and Medium-Size Enterprises) for the sake of financial security. Therefore, of the loans issued by commercial banks, SMEs received very little money, which has led to the emergence of private investment. SMEs, especially in developing countries, are finding it more difficult to obtain loans from the banking system because of financial constraints and distortions in financial policies. To meet its financing and development needs, SMEs will inevitably turn to the private financial market for funding (Isaksson) [4]. Germidis (1990) [5] pointed out that because of the advantages of being highly efficient, flexible, and convenient, the private financial market can effectively solve the problems of SME financing, and it is, therefore, a common practice and is rapidly developing in developing countries.

Public investment and private investment are the two major components of domestic investment in fixed assets investment. Thus, the relationship between the two has been a research area of great interest. In the study of public investment and private investment, Keynesian economics believed that the increase in public spending will lead to an increase in interest rates, which will have a crowding-out effect on private investment. But there are many differing opinions on the empirical side. Nazmi and Ramirez (2010) [6], Khalifa (1998) [7], and Pradhan et al. (1990) [8], respectively, obtained empirical evidence that public investment has a crowding-out effect on private investment. Analogously, Dash thought that public investment has a marked crowding-out effect on private investment, and the crowding-out effect is more evident in the long run than in the short term [9]. However, some scholars hold the opposite view. Nieh and Ho (2007) [10] used the annual data of 23 OECD countries to examine the crowding-out effect of the expansion of government expenditure on private spending, and the internal inter-temporal substitution elasticity indicated that government expenditures have no crowding-out effect on private investment. While Wang (2005) [11] found that government spending on education and healthcare has a positive effect on private investment, while spending on capital and infrastructure has a crowding-out effect on private investment. Makuyana’s (2016) [12] research showed that both public investment and private investment can promote economic growth, but the empirical results indicated that private investment plays a more significant role.

With respect to the influencing factors of private investment, McKinnon (1973) [13] and Shaw (1973) [14] found that financial deepening (M2/GDP) has a very significant impact on private investment. Gans (2001) [15] pointed out the important role of price formulation, indicating that reasonable capital prices are important for developing private investment and promoting private investment participants to participate in infrastructure investment. Ghura and Goodwin (2000) [16] believed that real GDP growth, increase in public investment, and financial deepening will all contribute to the growth of private investment, while world interest rates, and domestic loans to government agencies as a share of GDP, are both negatively correlated to private investment. Herzer’s (2012) [17] research showed that foreign aid has a crowding-out effect on domestic private investment. Through the above literature, it can be observed that relevant scholars have carried out in-depth research on the factors affecting private investment, but few scholars have conducted research from the perspective of housing prices.

In response to the dramatic decline of private investment in China in 2016, some scholars point out that one of the reasons for it is that asset bubbles, represented by rising housing prices, have caused private capital to seek higher returns and have fled from manufacturing industries into the capital market or the real estate market, resulting in private investment swarming into a fictitious economy while bypassing the real one [18,19,20].

Real estate, a key factor in the growth of private investment, is attracting more and more attention regarding its relationship with private investment. Gerdesmeier et al. (2010) [21] found that entering the real estate industry in the form of investment has a profound impact on real estate development, and the scale of investment changes can be used to predict the rise and fall of real estate. Private investment is an important source of real estate investment [22]. Based on this, some scholars have studied the impact of private investment on housing prices [23,24,25], while another group of scholars studied the effect of house prices on investment. Barot and Yang (2002) [26] used the error correction model to compare and analyze the relationship between house prices and investment in Sweden and the United Kingdom. Research by Hui and Yu (2012) [27] showed that house prices in Hong Kong are closely linked to investment needs. Studies by Han and Lu (2017) [28] showed that the rise in house prices has a negative net effect on business investments, thus impeding economic growth. With respect to stimulating private investment, Luo and Wang (2013) [29] believed that the real estate investment should be controlled and private investment in high-tech industries should be encouraged.

It can be concluded from the above literature that the impact of public investment on private investment and their roles in economic growth are hot topics in the study of private investment. With regard to the contributing factors in private investment, the existing research has not explored it from the perspective of real estate. In the relationship between private investment and real estate, many studies have focused on the impact of private investment on housing prices. There is not much research on the impact of real estate on private investment. As a developing country, private investment is an important source of SME funds in China, the growth rate of which has huge impact on the real economy. In addition, the real estate industry is the pillar industry in China’s national economy, which plays a leading role in economic development. What impact will it have on private investment? What is the quantitative relationship between these two variables? The answer to this question not only fills theoretical gaps but also plays a guiding role in the healthy development of the real economy. Thus, it is of great theoretical and practical significance.

3. Theoretical Mechanism

Since the 1990s, the development of the real estate industry has played an important role in the growth of China’s economy and investment (Zhang, 2002) [30]. However, by 2012, with its financial character being increasingly evident, the real estate industry’s positive effect on the real economy is weakening. Because of its special nature, as previously mentioned, the real estate industry has had a series of extremely complicated effects on the development of private investment.

3.1. Positive Effects

Moderately developed real estate has a positive impact on private investment through the industrial linkage, urbanization and balance sheet effects, whose specific mechanism is as follows.

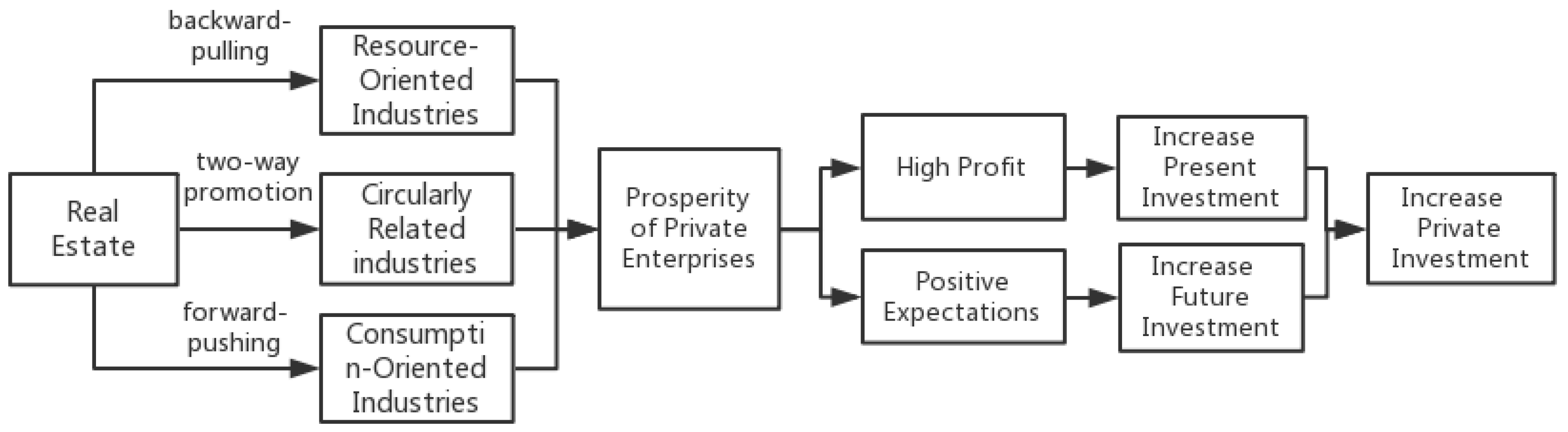

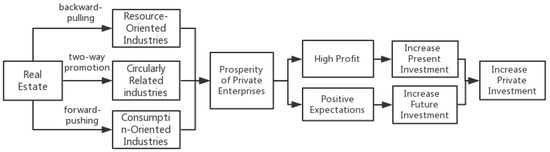

3.1.1. Industrial Linkage Effect

As an important industry of the national economy, the real estate industry has the characteristics of long industrial chain, high correlation, and strong driving force [31,32]. Related research shows that for each additional 100 million yuan of residential investment in China, the investment of 23 related industries will increase by 147.9 million yuan accordingly [33]. The real estate industry plays a backward-pulling role in driving resource-oriented industries, such as manufacturing and plays a forward-pushing role in promoting consumption-oriented industries, such as the textile industry. It also has a two-way promotion effect on circularly related industries, such as the financial and insurance industries, and construction industries. The prosperity of such industries can attract an active private economy and, thus, lead to competitive investment. Entrepreneurs need to raise sufficient funds to occupy as much market share as possible. Therefore, privately-owned enterprises in all industries may raise funds through direct financing, such as issuing stocks and bonds, or indirect financing, such as credit, thus, broadening the private investment channels and encouraging private investment into the real economy.

In addition to attracting private investment directly, the prosperity of the real economy can raise the confidence index of entrepreneurs and enable entrepreneurs and investors to have positive psychological expectations. This expectation often causes investors to underestimate the investment risk, as a result of which they tend to continue to increase their investment in the future. Thus, private investment will be boosted in the short time even though overcapacity might emerge in the long run.

The specific mechanism of action can be represented in Figure 3.

Figure 3.

Industrial linkage effect.

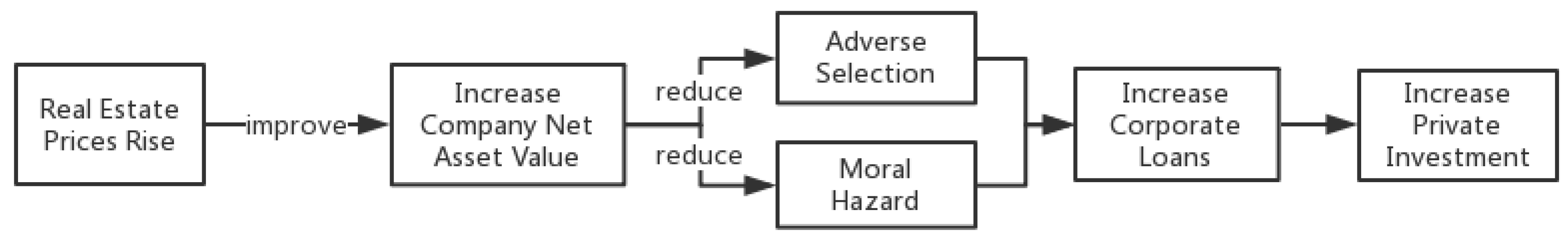

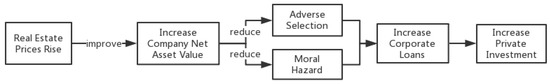

3.1.2. Balance Sheet Effect

The balance sheet effect is based on “credit perspective” [34], emphasizing the impact of the balance sheet on a firm’s ability to raise funds under the condition of information asymmetry. Information asymmetry exists between borrowers and lenders in imperfectly competitive financial markets, leading to the adverse selection of lenders (which means that lenders tend not to lend money to borrowers) and the moral hazard of borrowers (which means that borrowers invest borrowed money in high-risk projects). In this regard, borrowers usually use mortgage or guarantee of assets to improve their credit score. Real estate is an important asset of an enterprise and one of the important mortgages of a bank loan, whose value is closely related to the maximum loan amount of the enterprise. When the price of real estate rises, the net asset value of the company’s balance sheet will increase accordingly. On the one hand, this means that the value of borrower’s collateral will increase, thereby reducing the adverse selection of financial institutions, such as banks. On the other hand, this means that the equity invested by the business owners will increase and their willingness to invest in high-risk projects is reduced, thus reducing the corporate moral hazard. Ultimately, the monetary amount of loans available to the enterprise will increase and the investment expenditure will increase correspondingly. Private enterprises increase investment in fixed assets, meaning private investment will go up.

The specific mechanism of action can be represented in Figure 4.

Figure 4.

Balance sheet effect.

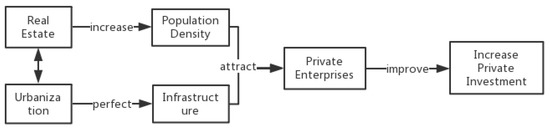

3.1.3. Urbanization Effect

The real estate industry can exert influence on urbanization from two aspects [35]. First, it can affect the speed of urbanization by absorbing the influx of migrants. The attraction of the transient population in the real estate market stems from two aspects. First, it meets the residents’ living needs, which is also the basic level that must be guaranteed for urbanization. Second, it stimulates employment. According to the analysis of Section 3.1.1, the development of the real estate market will drive the development of many industries, thus providing many jobs.

Furthermore, it can influence the scale of urbanization through market expectations and the amplification effect of credit (according to Section 3.1.2). The real estate market’s expectations and credit levels directly affect its equilibrium price, and the price changes eventually lead to the speed of urbanization.

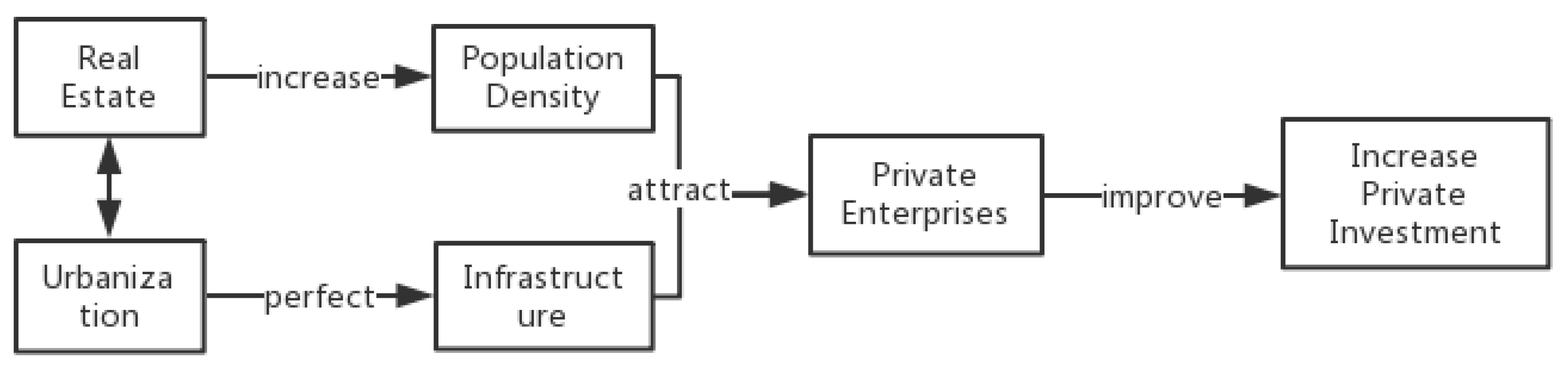

Real estate development and urbanization complement each other. First, they attract population inflows so as to increase population density. Second, they speed up improvements in supporting infrastructure in the surrounding areas such as medical care, education, and transportation. Dense population and perfect infrastructure are both crucial factors in attracting private enterprises: Dense population not only brings a broad market demand, but also provides sufficient labor force, and a sound infrastructure can reduce the operating costs of enterprises. Therefore, the development of the real estate industry can indirectly attract privately-run business circles and relevant service industries. These enterprises need to absorb a large amount of private funds in their own development, as a result of which private investment is increased.

The specific mechanism of action can be represented in Figure 5.

Figure 5.

Urbanization effect.

3.2. Negative Effects

When real estate is over-developed, it will have a negative impact on private investment through vampire effect, raising costs and reducing demand effect, whose specific mechanism is as follows.

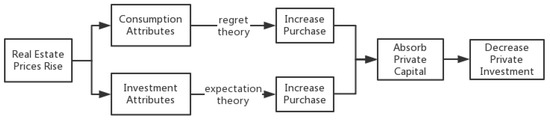

3.2.1. The Vampire Effect on Real Economy

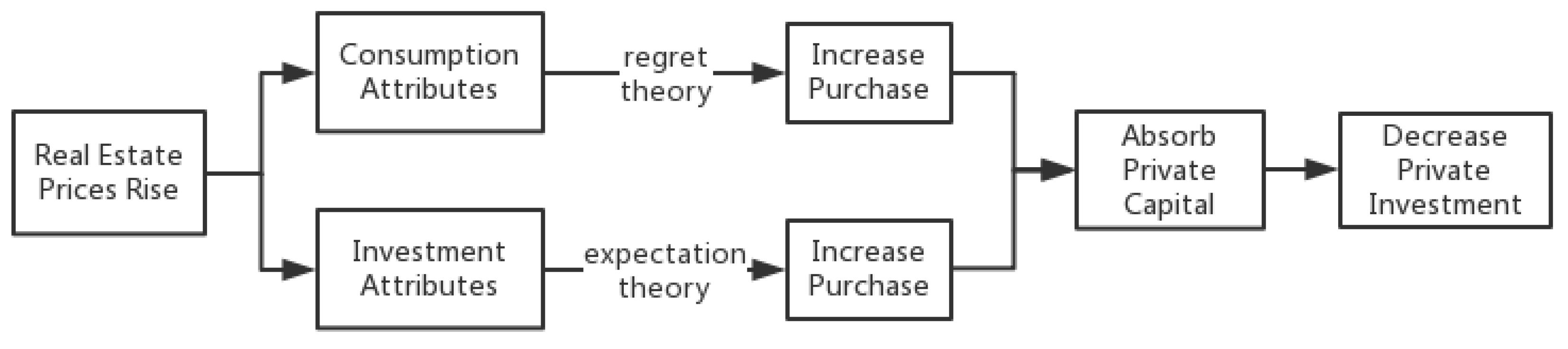

Real estate has the dual attributes of consumption and investment [36]. On the one hand, like consumer goods, the demand for normal goods will decline when their prices rise according to the demand and supply model of neoclassical economics. However, considering consumers’ subjective expectations, the situation will be different. When consumers observe sharp increases in house prices and expect those prices will rise beyond their purchasing power in the future, they will choose to buy before they cannot afford them. On the other hand, rising house prices have attracted a great deal of personal speculation [37,38]. As an investment product, excess profits in real estate have resulted in investors’ expectation of high yields. Investors hope to earn the difference in the future, so they invest in real estate in the current period. The declining profits and rising risks in real economy cause private capital to transfer from the real sector to the real estate industry, which has helped to further boost house prices. In this way, the real estate industry continuously retains private capital. However, this part of capital self-circulates in the fictitious economy, distorting the capital allocation and doing no good to the transformation and expansion of manufacturing industry and the upgrading of the service industry in the real economy. It is no longer of the significance that effective private investment should have been

The specific mechanism of action can be represented in Figure 6.

Figure 6.

The vampire effect on the real economy.

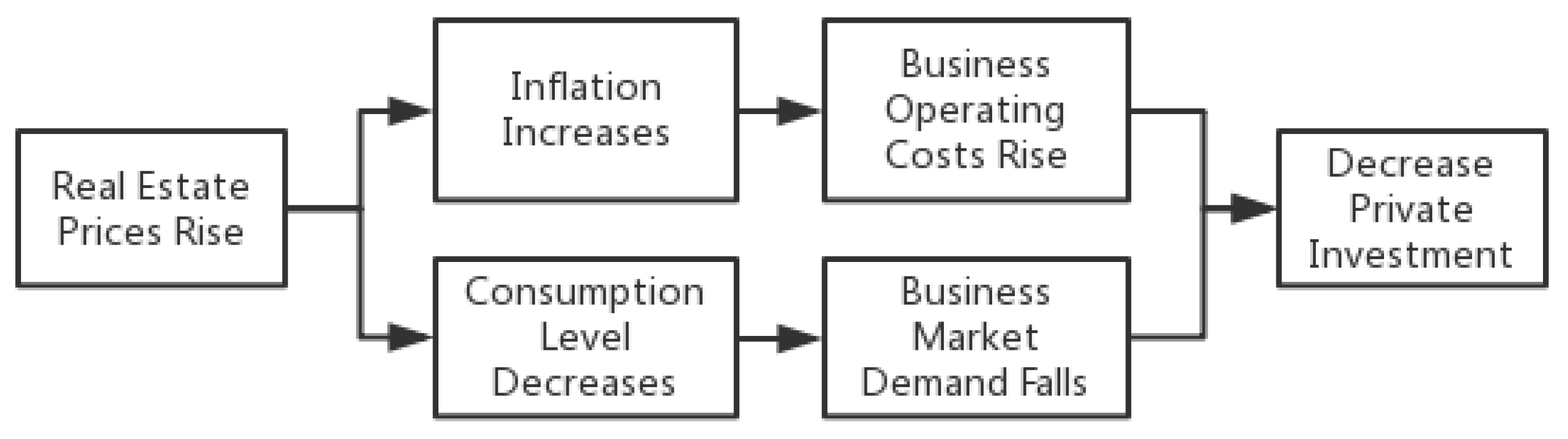

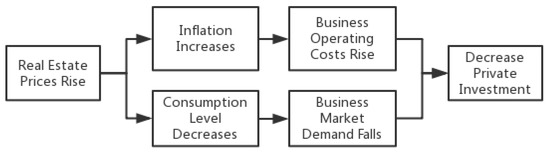

3.2.2. Cost-Increasing and Demand-Reducing Effect

On the one hand, rising real estate prices have a significant positive impact on inflation [39], which indirectly increases enterprises’ procurement costs and labor costs. To stabilize house prices, the government may adopt tightened monetary policies, thus indirectly raising the financing cost of private enterprises. On the other hand, the real estate industry attracts a large amount of private capital, thereby lowering household consumption level [40] and leading to insufficient effective demand and a shrunken effective market. Under the dual pressures of high costs and low demand, the enthusiasm for private investment is further dampened.

The specific mechanism can be represented in Figure 7.

Figure 7.

To increase costs and reduce demand effect.

4. Methodology

There are many indicators to measure the development of real estate, such as investment in real estate development, real estate added value, and housing price. Because of the overlap between real estate development investment and private investment, it is inappropriate to study the relationship between the two. As for the added value of real estate, though it can measure the contribution of real estate to GDP growth in the current year, it cannot reflect the impact of real estate on upstream and downstream industries (Wang, 2010) [41], or the real estate industry’s relevance to the whole real economy. Therefore, this paper selected house prices to measure the development of the real estate industry, because house prices can not only represent the rate of return of real estate industry but also reflect enterprises’ factor costs in the real economy. Given the overlap between private investment and real estate investment, the two are not completely independent. Therefore, this paper excludes investment in real estate development from the private investment data to test the impact of house prices on private investment in non-real estate fields, to improve the validity and accuracy of the empirical results.

According to the theoretical analysis in Section 3, moderately developed real estate has a positive impact on private investment, while over-developed real estate has a negative impact on private investment, so quadratic term should be added to the model. According to the existing research by Li et al. (2008) [42], the level of urbanization is a crucial factor in investment areas. The areas with high urbanization usually have sound infrastructure and services, where investment is more likely to achieve economies of scale. This paper uses the proportion of non-agricultural population in the total population at the end of the year in the area to measure the level of urbanization. In addition, the level of nationalization in a region can affect the vitality of private investment. Therefore, we should add urbanization level and nationalization level as control variables in the model. Because of the tendency that previous private investment may have had on the current private investment, this article selects dynamic panel data to construct model.

The specific methodology model is as follows:

where is private investment in non-real estate field (below referred to as private investment); is private investment lagging for j period(s) (j = 1, 2, 3); is housing price while is square of housing price; is nationalization level and is urbanization level; is individual effects among different provinces and is disturbance term.

Since the explanatory variables and are related to disturbance term, the model has endogenous problems. Therefore, it needs to be amended by the instrumental variable. Under the assumption of spherical disturbance, 2SLS estimation is the most effective method. However, Generalized Method of Moments (GMM) estimation is more effective if the disturbance has heteroscedasticity or autocorrelation. There are two main approaches of GMM estimation of dynamic panel data. One is differential GMM (Arellano and Bond, 1991) and the other is system GMM (Blundell and Bond, 1998). Since differential GMM is prone to weak instrumental variables and other issues, this paper uses the system GMM to estimate.

The instrumental variables used in the instrumental variable method need to meet the two conditions of relativity and exogeneity, according to which, this paper chooses two variables, cost of per unit housing and unit-price of land purchase, as the instrumental variables to amend the above model.

The definition and calculation method of variables in this model are shown in Table 1.

Table 1.

Variables of system Generalized Method of Moments (GMM) estimates model.

5. Empirical Analysis

5.1. Data

This paper selected provincial panel data from 31 provinces in mainland China from 2003 to 2015. The raw data was downloaded from the Yearbook and the National Bureau of Statistics website. In particular, private investment data were collected from the China Statistical Yearbook on Fixed Assets, and the remaining data were from the National Bureau of Statistics in China (http://www.stats.gov.cn/). Due to the absence of the China Statistical Yearbook on Fixed Assets in 2014, relevant data on private investment in 2013 came from the Statistical Yearbooks, Statistical Yearbooks on Fixed Assets, and Statistical Communique on National Economic and Social Development of various provinces. A very few which were missing data were supplemented with average growth rates.

It is noteworthy that in 2011, the statistical caliber of China’s fixed assets investment has undergone significant changes: In addition to real estate investment and rural individual investment, the statistical starting point for investment in fixed assets increased from 500,000 yuan to 5 million yuan. Accordingly, this paper re-analyzes the data of private investment from 2003 to 2010 to increase accuracy. First, the data on investment in fixed assets (excluding farmers) below 5 million yuan in 31 provinces from 2003 to 2010 were obtained from the National Bureau of Statistics. Then the above data were multiplied by the ratio of private investment to the fixed assets investment (excluding farm) in each province in each year to get an estimated value of private investment below 5 million yuan per year in each province. Finally, data below 5 million yuan from 2003 to 2010 were excluded from the private investment to obtain private investment data that unified caliber.

5.2. Descriptive Statistics

The statistical software used in this paper isStata14.0MP (StataCorp LP, College Station, Texas 77845 USA). Descriptive statistics of variables are as follows.

As can be seen from Table 2, the mean of the explained variable, i.e., private investment, is about 36,200 billion, and its within standard deviation (which is 3.97 × 107) is greater than its between standard deviation (which is 3.10 × 107), indicating that the dispersion of private investment with time is greater than that with space. That is, despite the large differences in private investment in different provinces in China, the difference in private investment over time is greater than that between provinces. This shows that in general, China’s private investment experienced rapid growth during the sample period. However, the case of explanation variable, i.e., house prices, is the opposite. The between standard deviation of house price (which is 2491) is greater than the within standard deviation of it (which is 1974). This shows that although China’s housing prices have grown at a great rate over time, its degree of change is still smaller than the difference in housing prices between Chinese provinces. That is to say, there are serious housing price imbalances across China. In terms of the control variables, the average level of nationalization is about 0.42, indicating that in general, the sales value of industry of private enterprises in China has exceeded that of state-owned enterprises, showing the greater vitality of private enterprises. The between standard deviation of urbanization is smaller than its between standard deviation, indicating that the urbanization process in China is relatively flat over time, but the regional differences are obvious.

Table 2.

Descriptive statistics of variables.

The Pearson correlation coefficient between variables is shown in Table 3.

Table 3.

Pearson correlation coefficient between variables.

As can be seen from Table 3, there is a positive correlation between private investment and housing prices, but it is not significant, with a correlation coefficient of 0.1604. The correlation coefficient between private investment and the square of housing prices is not significant, either. This shows that the relationship between real estate and private investment cannot be characterized by a simple linear relationship between the two. In terms of control variables, private investment is significantly negatively related to the level of nationalization. The higher the degree of nationalization, the stronger inhibitory effect it has on private investment. The level of urbanization shows a significantly positive correlation to private investment. As the level of urbanization increases, the agglomeration effect of private capital increases, thereby promoting the development of private investment.

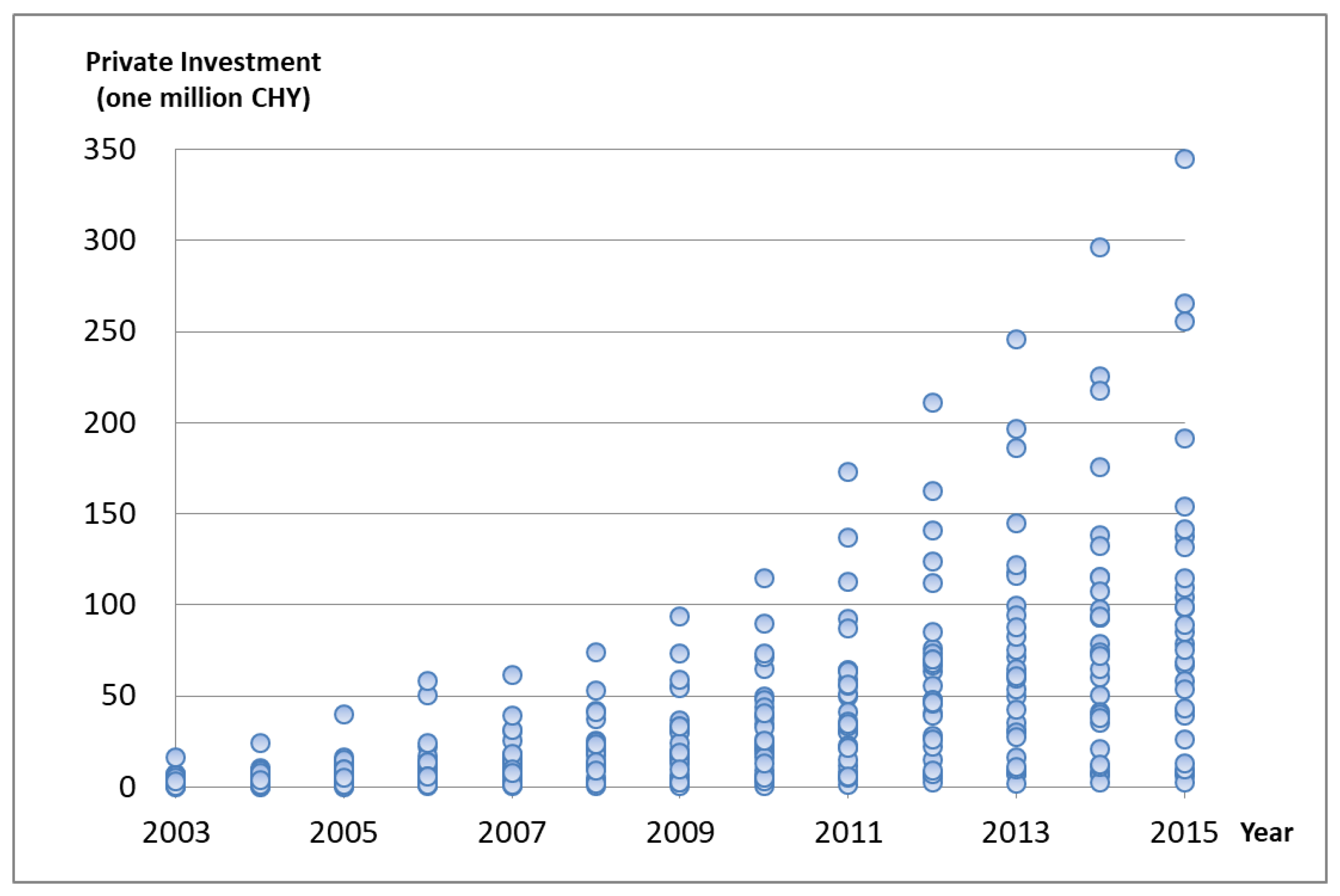

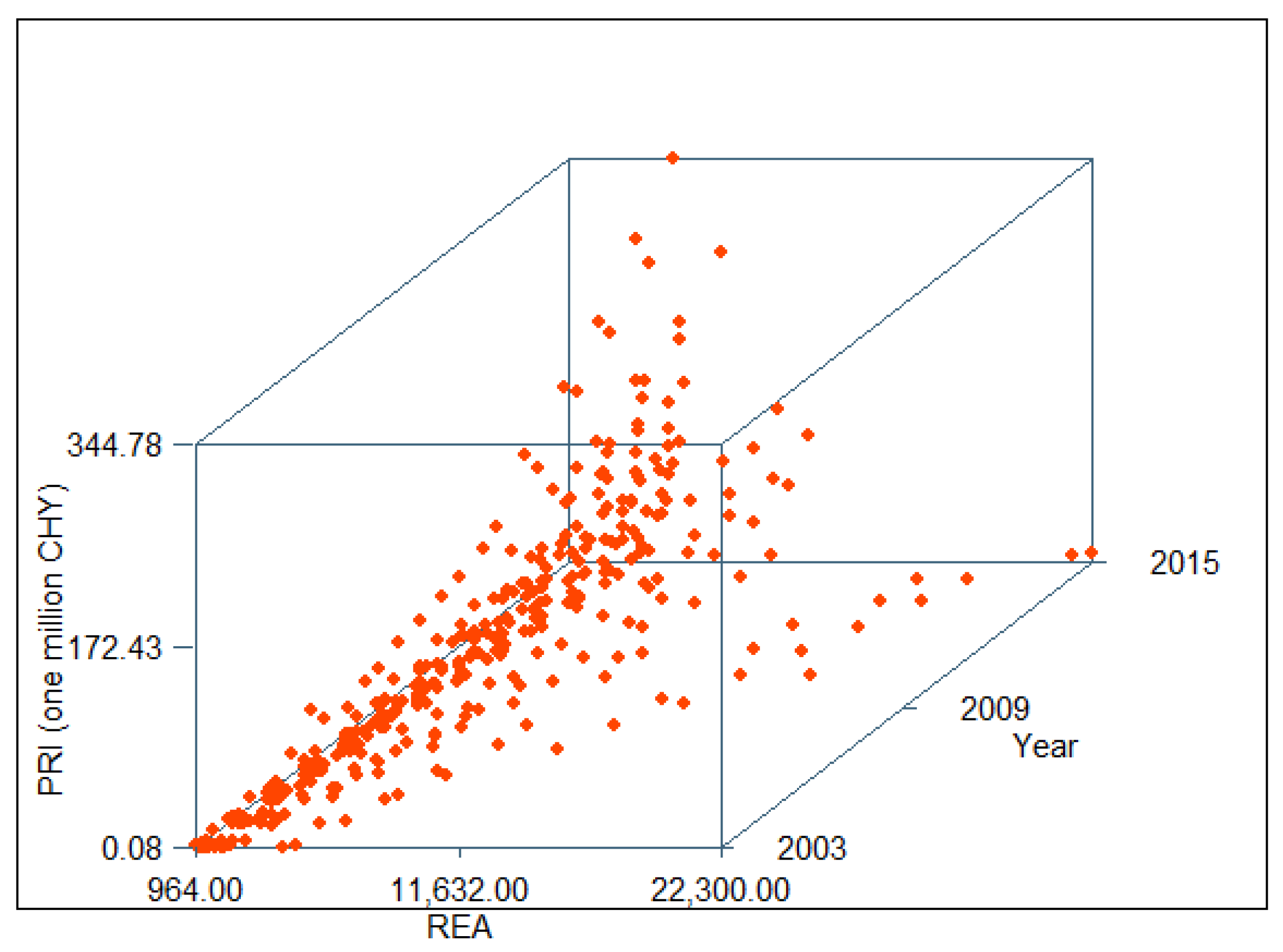

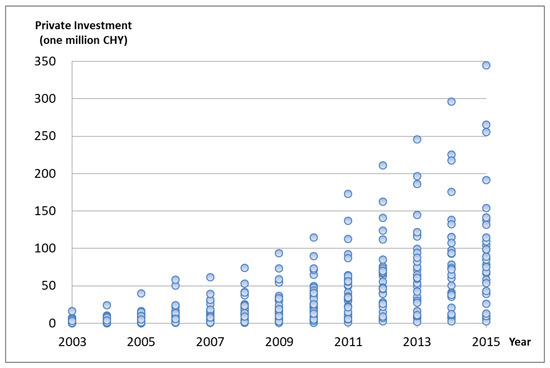

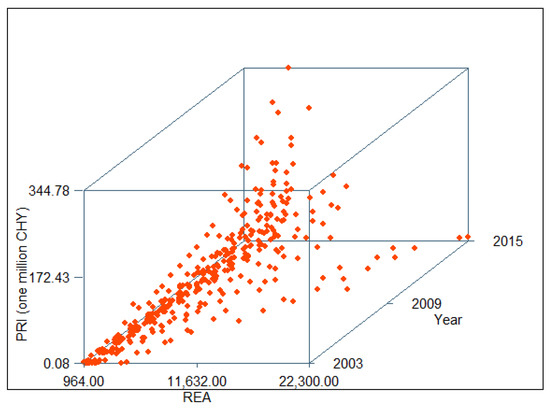

Figure 8 and Figure 9 more clearly demonstrate the level of private investment in various provinces each year as well as the relationship between private investment and housing prices.

Figure 8.

Scatter plot of private investment.

Figure 9.

Scatter plot of private investment against house prices.

Figure 8 shows that from 2003 to 2015, the private investment in China is in general rising and developing rapidly. In 2009, private investment in all provinces was less than 100 million yuan. After that, it has experienced rapid development, and in 2015, private investment in some provinces has exceeded 300 million yuan. At this time, China’s private capital shows strong vigor.

It can be seen from Figure 9 that in the early stage, the sample scatters were mostly concentrated in the bottom left area with low level of private investment and housing prices. This distribution indicates that in the early days when China’s housing prices were relatively low, most provinces had inactive private investment. Over time, house prices and private investment have experienced an upward trend. In the later period, the development trend of the two has gradually differentiated. Especially in 2015, the development level of private investment in some provinces is relatively high, but their house prices are still maintained at a low level. However, provinces with higher housing prices maintain a low level of private investment. Intuitively, in the period of low housing prices, private investment has a positive correlation with house prices; when house prices are too high, the two have a negative correlation. However, the specific relationship between real estate development and private investment needs to be further verified.

5.3. System GMM Estimation

First, a Hausman test was run, and a p-value of 0.0000 was obtained, which rejected the exogenous hypothesis at the 1% significance level. It indicates that variables are endogenous, and the instrumental variable should be adopted. As a robustness test, control variables were added to the model one by one to perform dynamic panel system GMM estimation. The estimated results are as follows.

As shown in Table 4, all variables are significant at the 5% confidence level, and the signs of the coefficient estimates in three models are the same, which indicates that the estimation results are robust. The Wald test results are significant at the 1% confidence level, indicating that the model fits well. The test results of Arellano-Bond test and Sargan test indicate that the instrumental variables passed the over-identification test and the validity test, that is, all instrumental variables were valid.

Table 4.

System GMM estimation results.

5.4. Empirical Result

According to the third regression result shown in Table 4, the specific quantitative model between private investment and housing price is:

Among them, the coefficient of housing price is positive, and the coefficient of its square term is negative, both of which are significant at 1% significance level, indicating a significant inverted U-shaped relationship between real estate development and private investment.

Get PRI derivative of REA:

Making the derivative above equal to 0 generates the maximum value of the inverted U-shaped curve and the corresponding housing prices. The calculated result shows that the housing price at the top of the curve is 15,687 yuan. According to quantitative analysis of China’s housing prices and private investment, we can see that in the rising range of the curve, that is, when the house price is below 15,687 yuan, the development of the real estate market in China can promote the improvement of private investment. This shows that within a certain period of economic development in China, the development of the real estate market can better activate the private investment market, greatly stimulating the development of other industries and making the capital market more prosperous, thus, to reduce private enterprises’ financing costs, increase the rate of return on private investment, and encourage private capital to flow into the real economy. However, in the falling range of the inverted U-shaped curve, the development of real estate will inhibit private investment. One possible reason is that the excessive profits of real estate attract a large amount of private capital to the real estate field. On the one hand, interception of private investment has raised the financing cost of real economy. On the other hand, it has reduced the level of aggregate demand because residents will reduce unnecessary consumption while ensuring daily consumption so as to dampen down the vitality of private investment. Taking house prices in China (reference Appendix A Table A1) into account, most regions in the years from 2003 to 2015 are in the rising range of the inverted U-shaped curve, that is, the development of real estate can further improve the level of private investment, but the driving speed has slowed down. However, some regions such as Beijing, Shanghai have been in the descending range of the inverted U-shaped curve since 2013, and their house prices are still rising further. According to a survey conducted by the Inspectorate of the State Council, from January 2016 to April 2016, nearly 80% of private capital in Beijing has been invested in the real estate sector. These funds are speculative in nature and have little effect on promoting the real economy. Private investment has broken away from the real economy, and house prices need to be regulated.

In terms of controlling variables, the coefficient of nationalization level is −2.9 × 107, and is significant at 1% significance level, indicating that nationalization has a certain inhibitory effect on private investment. Public investment has a crowding-out effect, and the expansion of investment by state-owned enterprises will have an important impact on a country’s private economy. At the same time, the high degree of nationalization indirectly represents the role of the local government in leading the market. Therefore, deepening market reforms and broadening the scope of private investment can be an effective way to enhance private investment. It is worth noting that the coefficient of urbanization level is −1.74 × 107 and is significant at a significance level of 1%, indicating that there is an obviously negative correlation between urbanization level and private investment in recent years, which is inconsistent with the expectation. This may be because the level of urbanization in China is closely related to the local economy, and the level of urbanization in developed and developing regions is quite different. The level of urbanization in developed regions is relatively high, and private investment in those regions started earlier. At the same time, private investment in those regions has approached saturation after years of development. It can be seen that areas with lower levels of urbanization have greater investment potential.

6. Conclusions

Based on the provincial panel data of 31 provinces in mainland China from 2003 to 2015, this paper conducts an in-depth study of the relationship between real estate development and private investment. First, the paper analyzed the mechanism of real estate investment affecting private investment in theory, pointing out that the development of real estate industry not only promotes private investment through the industrial linkage, urbanization, and balance sheet effects but also has an inhibitory effect on private investment through the vampire effect, raising costs and reducing demand effect. Therefore, there is a non-linear relationship between the two variables. We then used the dynamic panel system GMM to conduct empirical research on housing prices and private investment. The main conclusions are drawn as follows:

- (1)

- The development of real estate has a significant impact on private investment.

- (2)

- The relationship between real estate development and private investment is not a simple linear relationship, but a significant inverted U-shaped relationship. At a moderate level (when the housing price is lower than 15,687 yuan), the development of real estate industry can effectively promote private investment, while in the case of over-development (when the housing price is higher than 15,687 yuan), it can have an inhibitory effect on private investment.

- (3)

- At present, most regions in China are in the uprising phase of inverted U-shape. Housing price increases can further attract private investment, but the effect gradually declines. However, some regions such as Beijing and Shanghai are already in the down phase of inverted U-shape. The development of real estate has created an obstacle to private investment.

At present, China’s financial system is still not perfect. Because of the asymmetric information and the low credit rating of SMEs, it is difficult for SMEs to obtain loans from the banking sector. Private investment, as an important financing channel for Chinese SMEs, has played a significant role in the development of SMEs and is crucial to the healthy operation of the Chinese real economy. In recent years, the decline in the growth rate of private investment has attracted the attention of government departments and scholars. This paper finds that the overheating of real estate industry is an important reason for the stalling of private investment. Although the real estate industry has revealed the characteristics of the fictitious economy, its influence on the economy and people’s livelihood is profound on account of its numerous related industries. Therefore, the regulation of real estate should lay emphasis on stability—not only curbing real estate bubble but also preventing radical changes, thus directing private investment from real estate to the real economy gradually and restoring the vitality of private investment so that it can better serve the real economy and promote the healthy development of economy in China. Specifically, for the control of housing prices, this paper proposes the following measures.

- (1)

- On the supply side, the Chinese government should promote the construction of affordable housing and low-rent housing, to expand housing supply.

Affordable housing and low-rent housing are a means for the government to guarantee housing for low-income and middle-income residents and are substitutes for commercial housing. For the construction of affordable housing and low-rent housing, the government should provide corresponding preferential policies and increase the supervision of housing construction to ensure the quality of housing and the construction of public infrastructure.

- (2)

- On the demand side, property tax needs to be levied to curb excess demand.

Property tax is the tax on the real estate retention link. On the one hand, the introduction of property tax can increase the cost of housing for speculators, forcing them to leave the real estate market, thereby curbing excess demand. On the other hand, it can provide local governments with long-term stable income, reverse the short-term behavior of government, and provide them with a good public service.

- (3)

- Reform the performance appraisal system of local governments.

Housing issues are related to social stability and harmony. The assessment system of the “only GDP theory” of local governments should be changed, and the people’s livelihood indicators in real estate development should be included in the performance evaluation system. On the one hand, it is necessary to have the assessment criteria for the construction of affordable housing. On the other hand, the housing price-to-income ratio and the rate of increase in housing prices are stable assessment criteria for housing prices.

Author Contributions

Conceptualization, J.L. and J.J.; Data curation, H.G.; Formal analysis, J.J.; Funding acquisition, J.L.; Investigation, J.J.; Methodology, J.J. and H.G.; Project administration, J.L. and J.J.; Resources, J.L.; Software, H.G.; Supervision, J.J.; Validation, J.L., J.J. and H.G.; Visualization, H.G. and L.C.; Writing—original draft, H.G.; Writing—review and editing, L.C.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Housing prices of 31 provinces in China (2003~2015).

Table A1.

Housing prices of 31 provinces in China (2003~2015).

| Province | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beijing | 4456 | 4747 | 6162 | 7375 | 10,661 | 11,648 | 13,224 | 17,151 | 15,518 | 16,553 | 17,854 | 18,499 | 22,300 |

| Tianjin | 2393 | 2950 | 3987 | 4649 | 5576 | 5598 | 6605 | 7940 | 8548 | 8010 | 8390 | 8828 | 9931 |

| Hebei | 1343 | 1486 | 1777 | 2028 | 2505 | 2743 | 3210 | 3442 | 3767 | 4142 | 4640 | 4988 | 5530 |

| Shanxi | 1263 | 1574 | 1876 | 1806 | 2052 | 2253 | 2552 | 3338 | 3231 | 3691 | 4211 | 4462 | 4742 |

| Neimenggu | 1077 | 1225 | 1402 | 1627 | 2015 | 2265 | 2649 | 2983 | 3341 | 3656 | 3863 | 3833 | 3939 |

| Liaoning | 2131 | 2316 | 2652 | 2884 | 3355 | 3575 | 3872 | 4303 | 4543 | 4717 | 4918 | 5107 | 5486 |

| Jilin | 1447 | 1758 | 1756 | 1858 | 2192 | 2399 | 2788 | 3495 | 4161 | 3875 | 4228 | 4810 | 5213 |

| Heilongjiang | 1622 | 1693 | 1873 | 2035 | 2354 | 2642 | 3067 | 3492 | 3683 | 3726 | 4435 | 4517 | 4818 |

| Shanghai | 4989 | 5761 | 6698 | 7039 | 8253 | 8115 | 12,364 | 14,290 | 13,566 | 13,870 | 16,192 | 16,415 | 21,501 |

| Jiangsu | 2017 | 2418 | 3146 | 3375 | 3834 | 3802 | 4805 | 5592 | 6145 | 6423 | 6650 | 6783 | 7177 |

| Zhejiang | 2451 | 2786 | 3973 | 4510 | 5623 | 6144 | 7890 | 9332 | 9801 | 10,680 | 11,016 | 10,586 | 10,755 |

| Anhui | 1346 | 1571 | 2065 | 2153 | 2505 | 2808 | 3235 | 3899 | 4371 | 4495 | 4776 | 5017 | 5067 |

| Fujian | 2053 | 2297 | 2801 | 3656 | 4476 | 4498 | 5366 | 6077 | 7452 | 8366 | 8618 | 8843 | 8565 |

| Jiangxi | 964 | 1011 | 1336 | 1591 | 1998 | 2022 | 2517 | 2959 | 3822 | 4381 | 4905 | 4971 | 5107 |

| Shandong | 1624 | 1886 | 2295 | 2400 | 2799 | 2851 | 3390 | 3809 | 4299 | 4557 | 4797 | 5029 | 5290 |

| Henan | 1289 | 1443 | 1659 | 1843 | 2081 | 2138 | 2501 | 2856 | 3123 | 3511 | 3835 | 3909 | 4317 |

| Hubei | 1452 | 1599 | 2164 | 2422 | 2937 | 2898 | 3413 | 3506 | 4142 | 4668 | 4847 | 5085 | 5663 |

| Hunan | 1188 | 1248 | 1405 | 1655 | 2068 | 2113 | 2532 | 3014 | 3524 | 3670 | 3908 | 3830 | 3974 |

| Guangdong | 2994 | 3298 | 4149 | 4589 | 5682 | 5723 | 6360 | 7004 | 7561 | 7668 | 8466 | 8526 | 9495 |

| Guangxi | 1699 | 1886 | 1825 | 1973 | 2386 | 2634 | 3133 | 3382 | 3554 | 3910 | 4219 | 4442 | 4587 |

| Hainan | 2017 | 2380 | 2855 | 3735 | 4095 | 5441 | 6291 | 8800 | 9083 | 7811 | 8633 | 9262 | 9226 |

| Chongqing | 1324 | 1573 | 1901 | 2081 | 2588 | 2640 | 3266 | 4040 | 4492 | 4805 | 5239 | 5094 | 5012 |

| Sichuan | 1229 | 1351 | 1688 | 2123 | 2753 | 3067 | 3434 | 3985 | 4595 | 4959 | 5086 | 5092 | 5034 |

| Guizhou | 1143 | 1181 | 1308 | 1584 | 1899 | 2122 | 2642 | 3142 | 3490 | 3695 | 3735 | 3694 | 3629 |

| Yunnan | 1775 | 1860 | 2001 | 2191 | 2296 | 2441 | 2723 | 2893 | 3388 | 3861 | 4176 | 4451 | 4800 |

| Xizang | 1745 | 2748 | 1506 | 1687 | 2662 | 3103 | 2392 | 2761 | 3312 | 2982 | 3883 | 5323 | 3605 |

| Shanxi | 1390 | 1598 | 1930 | 2297 | 2487 | 2821 | 3113 | 3668 | 4705 | 4803 | 4991 | 4823 | 5082 |

| Gansu | 1175 | 1601 | 1739 | 1703 | 2146 | 1851 | 2396 | 2938 | 3130 | 3376 | 3684 | 4234 | 4613 |

| Qinghai | 1342 | 1415 | 1681 | 1840 | 2206 | 2384 | 2442 | 2894 | 3090 | 3692 | 3957 | 4294 | 4241 |

| Ningxia | 1515 | 1665 | 1765 | 1869 | 1958 | 2215 | 2824 | 3107 | 3389 | 3621 | 3917 | 3747 | 4010 |

| Xinjiang | 1487 | 1325 | 1509 | 1684 | 1960 | 2100 | 2466 | 2872 | 3287 | 3594 | 3949 | 4057 | 4176 |

References and Note

- Chao, H.J.; Ren, B.P. Economic transformation, growth of private investment and transition of public investment: An empirical analysis of the investment promotion of China’s rapid economic growth. Econ. Sci. 2008, 2, 5–15. [Google Scholar]

- Xu, X.C.; Jia, H.; Li, J. On the role played by real estate in the growth of China’s national economy. Soc. Sci. China 2015, 1, 84–101204. [Google Scholar]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Isaksson, A. The Importance of Informal Finance in Kenyan Manufacturing; Industrial Development Organization Working Paper; Industrial Development Organization: Vienna, Austria, 2002. [Google Scholar]

- Germidis, D. Interlinking the formal and informal financial sectors in developing countries. Sav. Dev. 1990, 14, 5–22. [Google Scholar]

- Nazmi, N.; Ramirez, M.D. Public and private investment and economic growth in mexico. Contemp. Econ. Policy 2010, 15, 65–75. [Google Scholar] [CrossRef]

- Khalifa, H.G. Public investment and private capital formation in a vector error-correction model of growth. Appl. Econ. 1998, 30, 837–844. [Google Scholar]

- Pradhan, B.K.; Ratha, D.K.; Sarma, A. Complementarity between public and private investment in India. J. Dev. Econ. 1990, 33, 101–116. [Google Scholar] [CrossRef]

- Dash, P. The impact of public investment on private investment: Evidence from india. Vikalpa J. Decis. Makers 2016, 41, 288–307. [Google Scholar] [CrossRef]

- Nieh, C.C.; Ho, T.W. Does the expansionary government spending crowd out the private consumption? Cointegration analysis in panel data. Q. Rev. Econ. Financ. 2007, 46, 133–148. [Google Scholar] [CrossRef]

- Wang, B.T. Effects of government expenditure on private investment: Canadian empirical evidence. Empir. Econ. 2005, 30, 493–504. [Google Scholar] [CrossRef]

- Makuyana, G.; Odhiambo, N.M. Public and private investment and economic growth: A review. J. Account. Manag. 2016, 6, 25–42. [Google Scholar]

- McKinnon, R.I. Money and Capital in Economic Development; The Brookings Institution: Washington, DC, USA, 1973. [Google Scholar]

- Shaw, E.S. Financial Deepening in Economic Development; Oxford University Press: New York, NY, USA, 1973. [Google Scholar]

- Gans, J.S. Regulating Private Infrastructure Investment: Optimal Pricing for Access to Essential Facilities. J. Regul. Econ. 2001, 20, 167–189. [Google Scholar] [CrossRef]

- Ghura, D.; Goodwin, B. Determinants of private investment: A cross-regional empirical investigation. Appl. Econ. 2000, 32, 1819–1829. [Google Scholar] [CrossRef]

- Herzer, D.; Grimm, M. Does foreign aid increase private investment? Evidence from panel cointegration. Appl. Econ. 2012, 44, 2537–2550. [Google Scholar] [CrossRef]

- Xu, X.Y.; Xie, J.; Li, L.H. Research on causes and countermeasures of the decline of private investment in China. Public Financ. Res. 2017, 7, 49–59. [Google Scholar]

- Wu, G.; Gao, L. From the real economy to the virtual economy and from the virtual economy to the real economy. China Financ. 2017, 6, 76–77. [Google Scholar]

- Liu, L.F. Current investment situation and strategic choice. Macroeconomics, 2017. [Google Scholar]

- Gerdesmeier, D.; Reimers, H.E.; Roffia, B. Asset Price Misalignments and the Role of Money and Credit *. Int. Financ. 2010, 13, 377–407. [Google Scholar] [CrossRef]

- Benefield, J.D.; Anderson, R.I.; Zumpano, L.V. Performance differences in property-type diversified versus specialized real estate investment trusts (REITs). Rev. Financ. Econ. 2009, 18, 70–79. [Google Scholar] [CrossRef]

- Longstaff, F.A. The subprime credit crisis and contagion in financial markets. J. Financ. Econ. 2010, 97, 436–450. [Google Scholar] [CrossRef]

- Beryl, Y.C.; John, R.N.; Caroline, E.W.G. The mortgage foreclosure rage: A behavioral perspective. J. Econ. Behav. Stud. 2012, 4, 635–648. [Google Scholar]

- Gennaioli, N.; Shleifer, A.; Vishny, R.W. A model of shadow banking. J. Financ. 2013, 68, 1331–1363. [Google Scholar] [CrossRef]

- Barot, B.; Yang, Z. House Prices and Housing Investment in Sweden and the UK: Econometric Analysis for the Period 1970–1998. Rev. Urban Reg. Dev. Stud. 2002, 14, 189–216. [Google Scholar] [CrossRef]

- Hui, E.C.M.; Yu, K.H. Assisted homeownership, investment and their roles in private property price dynamics in Hong Kong. Habitat Int. 2012, 36, 219–225. [Google Scholar] [CrossRef]

- Han, L.; Lu, M. Housing prices and investment: An assessment of China’s inland-favoring land supply policies. J. Asia Pac. Econ. 2017, 22, 106–121. [Google Scholar] [CrossRef]

- Luo, J.; Wang, Y. Private investment, technological innovation and economic growth. J. Zhongnan Univ. Econ. Law 2013, 4, 5762. [Google Scholar]

- Zhang, H.Y. Prospects of real estate industry for the beginning of 21 century. China Ind. Econ. 2002, 6, 22–26. [Google Scholar]

- Wang, G.J.; Liu, S.X. The driving effects on real estate to the correlative industries. Econ. Res. J. 2004, 8, 38–47. [Google Scholar]

- Liang, Y.F.; Gao, T.M.; He, S.P. An empirical analysis of harmonious development between the real estate industry and the national economy in transitional China. Soc. Sci. China 2006, 3, 74–84,205–206. [Google Scholar]

- Cao, Z.L. General Theory of Real Estate Economics; Peking University Press: Beijing, China, 2003. [Google Scholar]

- Bernanke, B.S.; Gertler, M. Inside the Black Box: The Credit Channel of Monetary Policy Transmission. J. Econ. Perspect. 1995, 9, 27–48. [Google Scholar] [CrossRef]

- Zhu, Z.R.; Zang, B. Mechanism and coordinated development of real estate market promoting the construction of urbanization. Chin. J. Popul. Resour. Environ. 2016, 9, 116–122. [Google Scholar]

- Chen, M.C.; Chang, C.O.; Yang, C.Y.; Hsieh, B.M. Investment Demand and Housing Prices in an Emerging Economy. J. Real Estate Res. 2012, 34, 345–374. [Google Scholar]

- Liu, F.; Matsuno, S.; Malekian, R.; Yu, J.; Li, Z. A Vector Auto Regression Model Applied to Real Estate Development Investment: A Statistic Analysis. Sustainability 2016, 8, 1082. [Google Scholar] [CrossRef]

- Lei, W.; Qian, H. Consumer investment preferences and the Chinese real estate market. Int. J. Hous. Mark. Anal. 2013, 6, 231–243. [Google Scholar]

- Zhang, H.; Yang, F. Exploration on interactive relationships among housing prices, investments in real estate development and inflation. Econ. Probl. 2013, 1, 49–52,96. [Google Scholar]

- Zhou, D.M.; Ai, F.; Hu, X.W. The plundering effect of China’s real estate industry on the real economy: Based on the dynamic and random simulation analysis of multiple sectors in the general equilibrium model. Contemp. Econ. Res. 2016, 11, 62–72,97. [Google Scholar]

- Wang, T. Research on the status of Chinese real estate in the national economy. China Real Estate Financ. 2010, 1, 19–24. [Google Scholar]

- Li, J.T.; Tang, M.L. Regional differences and affecting factors of the private investment in China. Econ. Geogr. 2008, 1, 6–1028. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).