Are the World-Leading Primary Silver Mines Exhausting?

Abstract

:1. Introduction

2. Materials

3. Methods

4. Results and Discussion

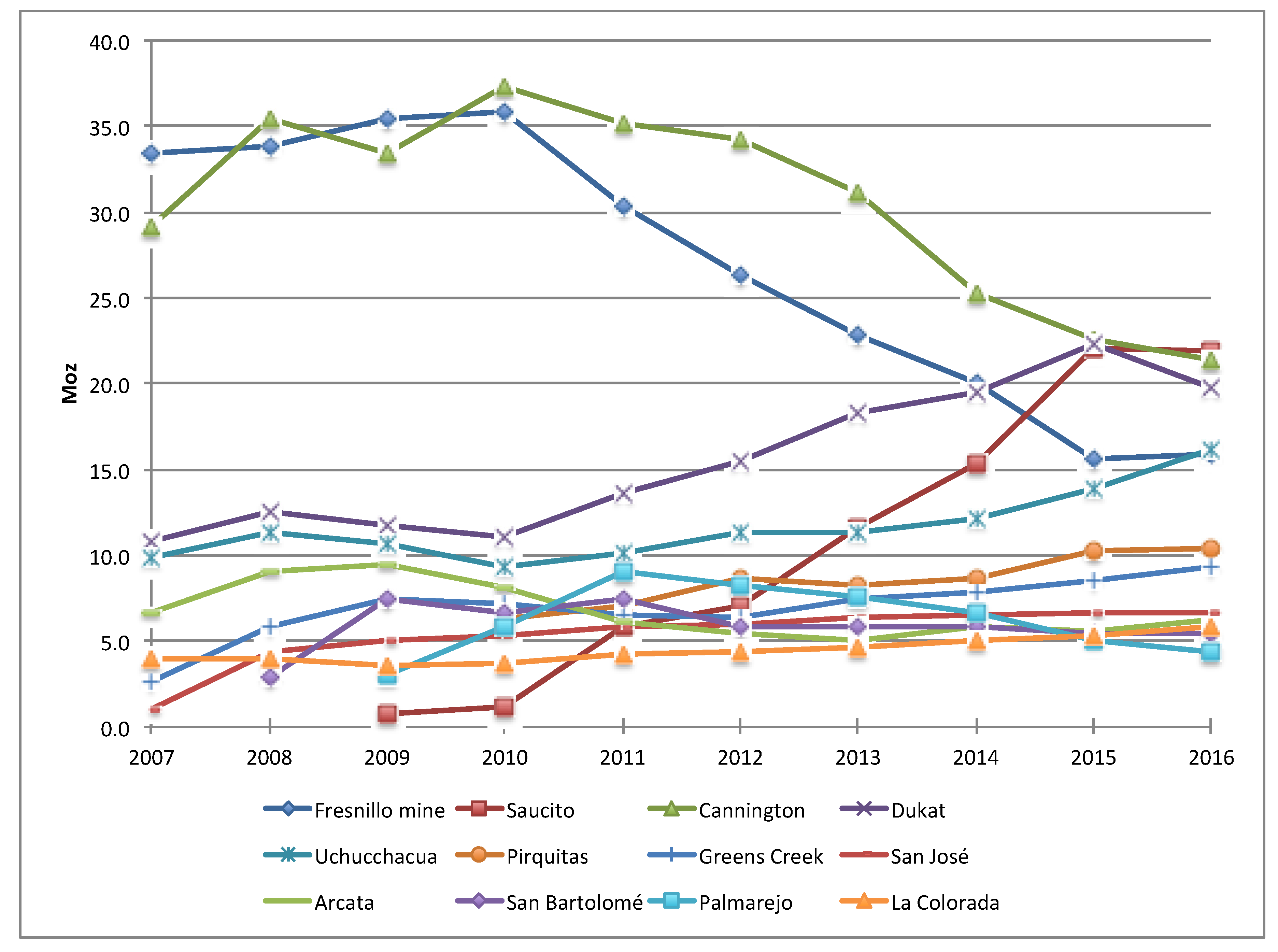

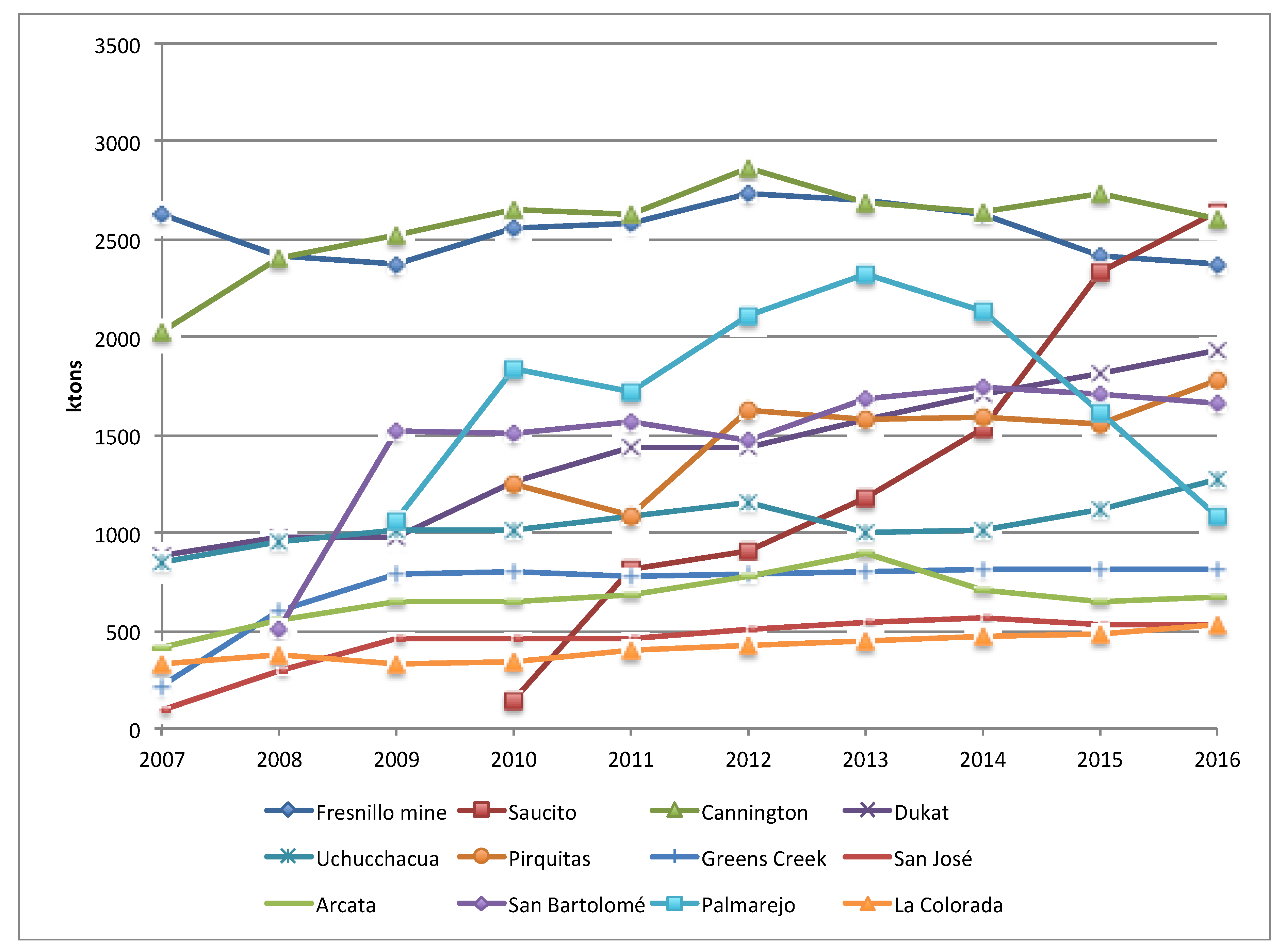

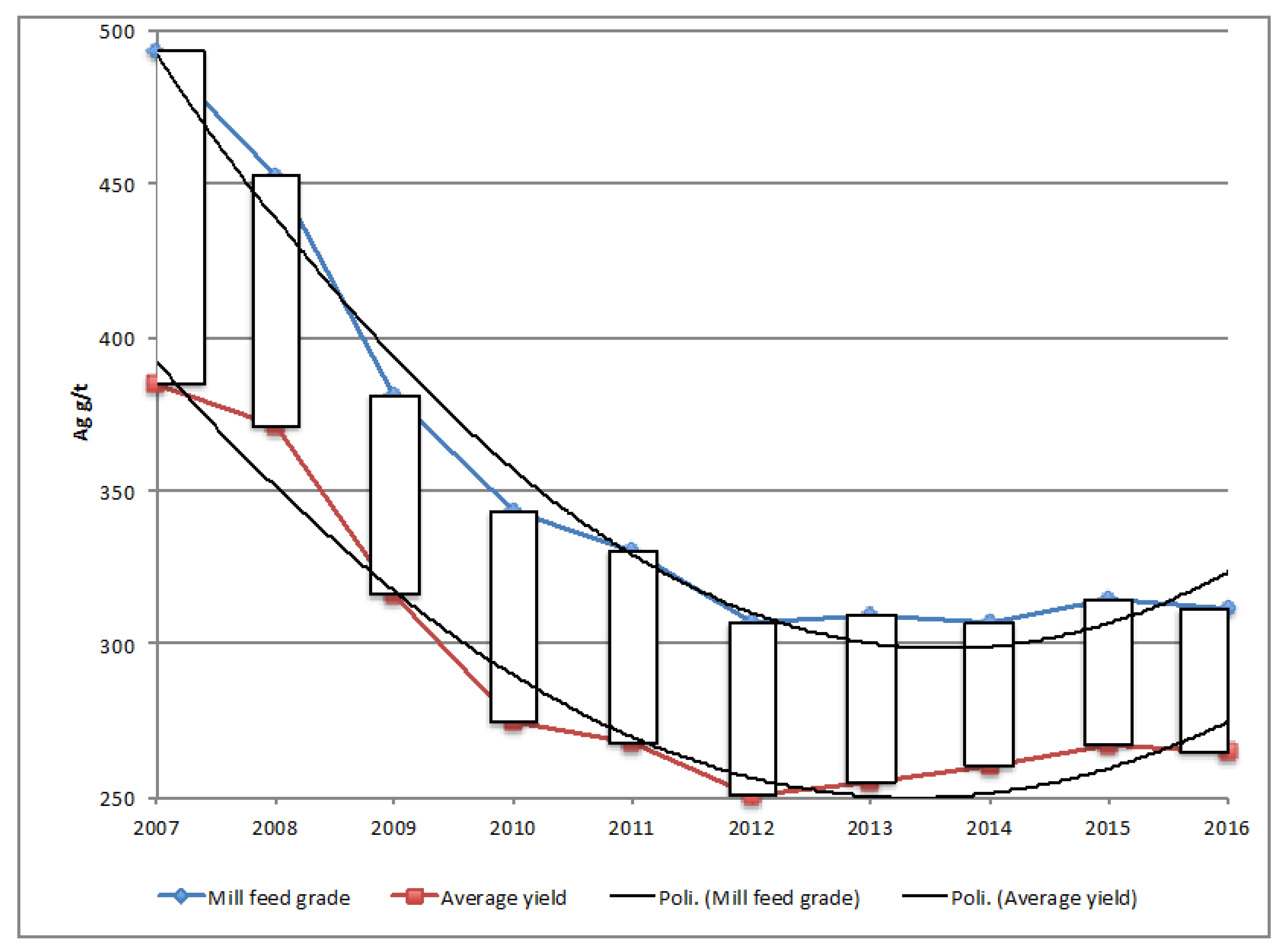

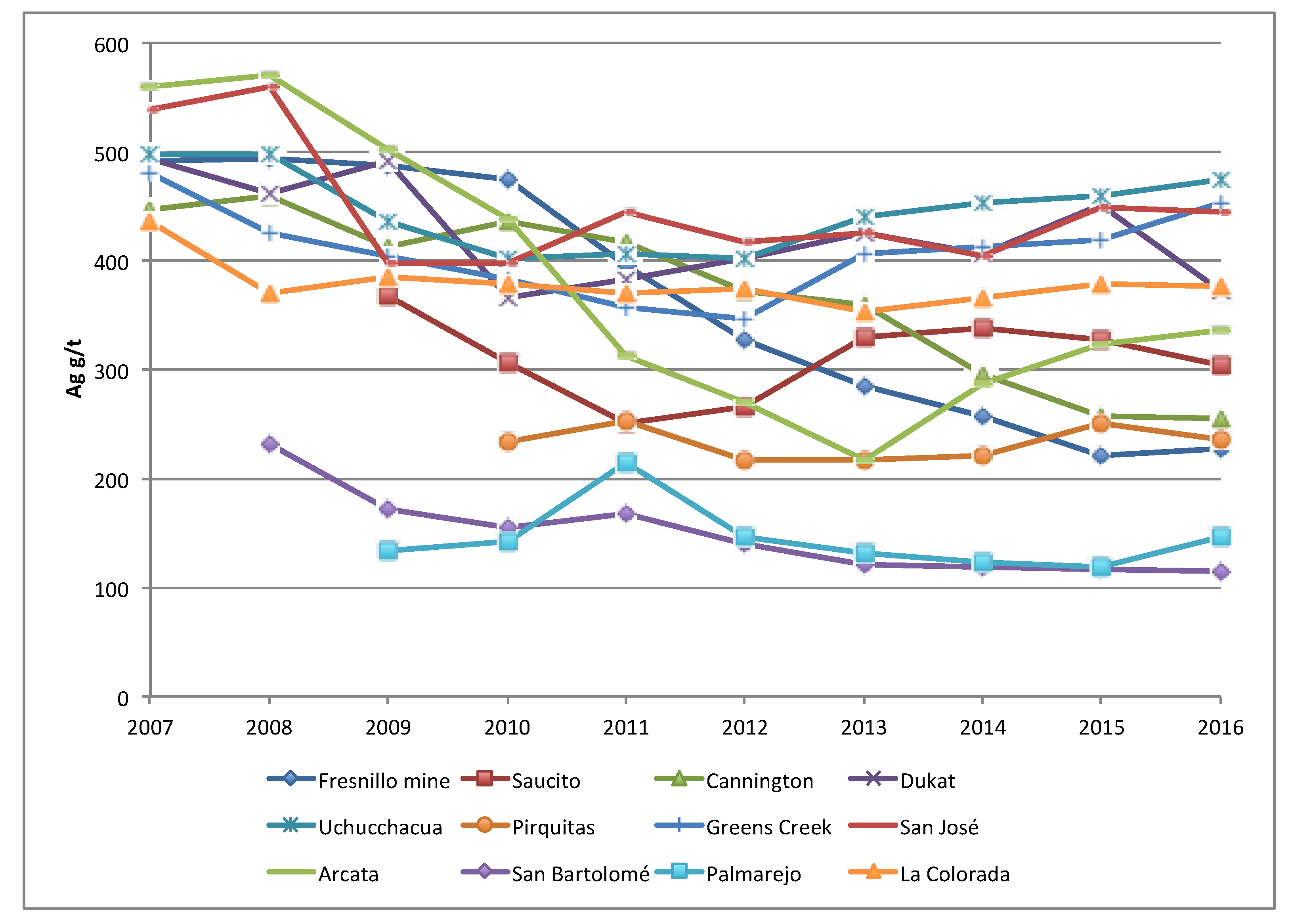

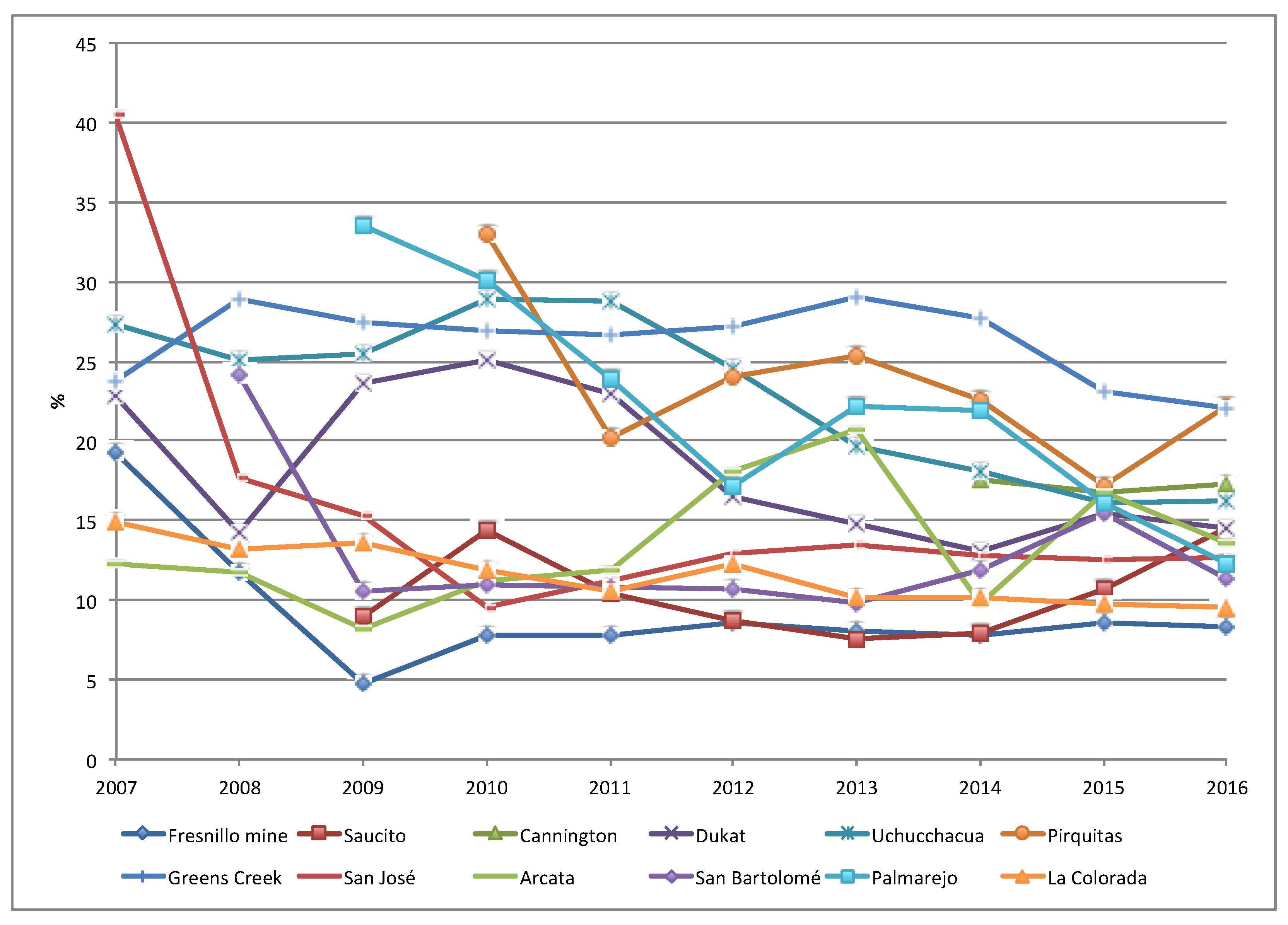

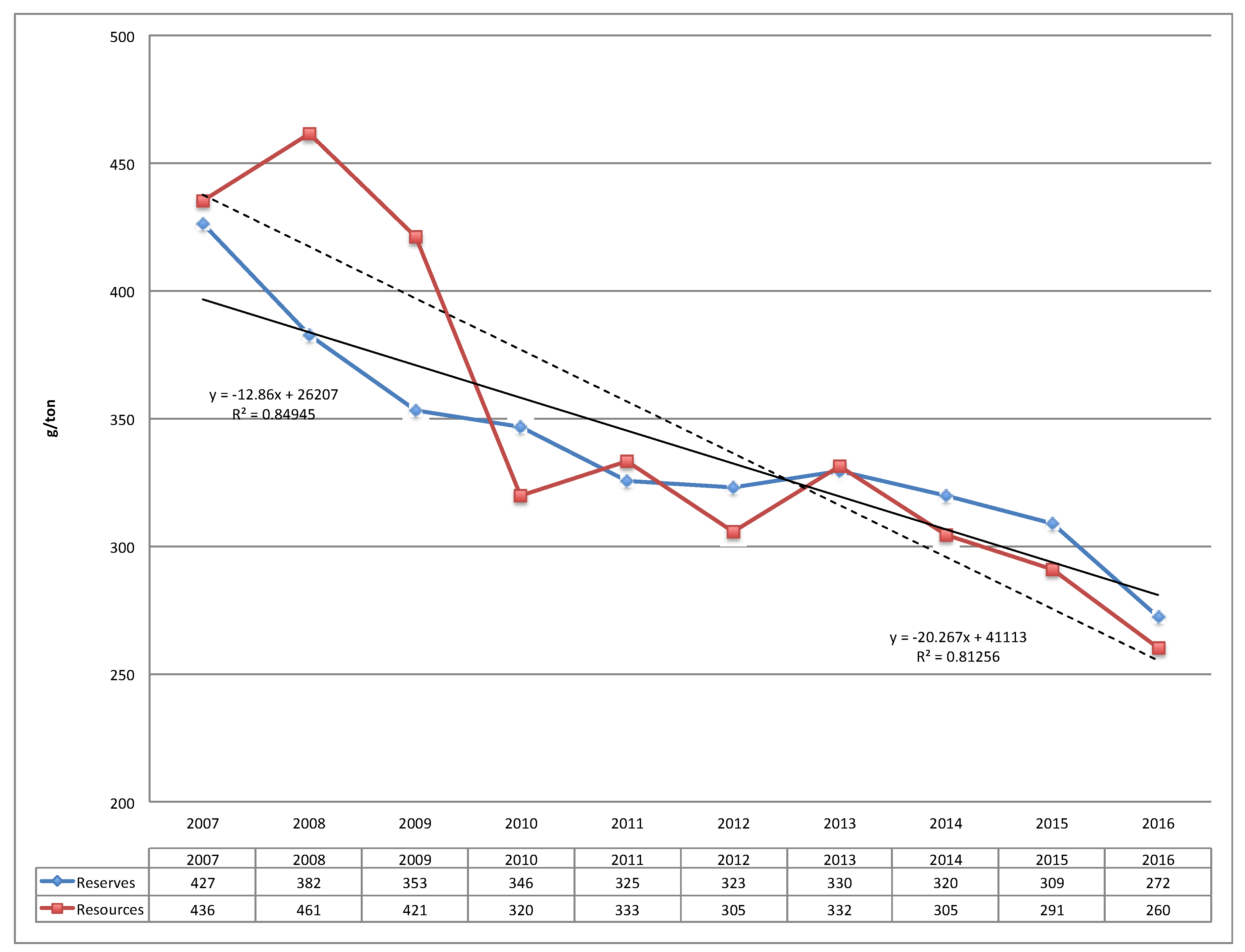

4.1. Production Statistics

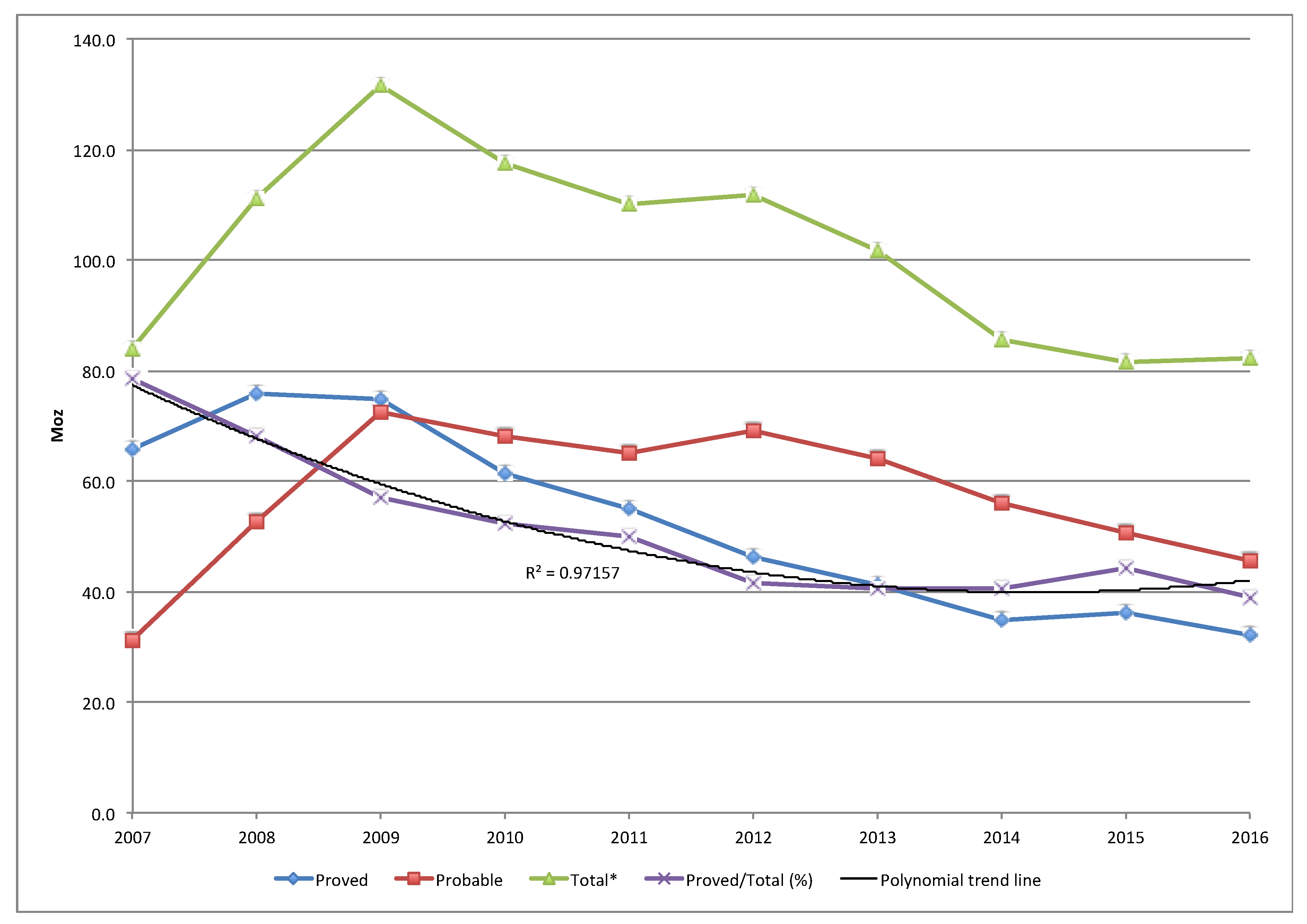

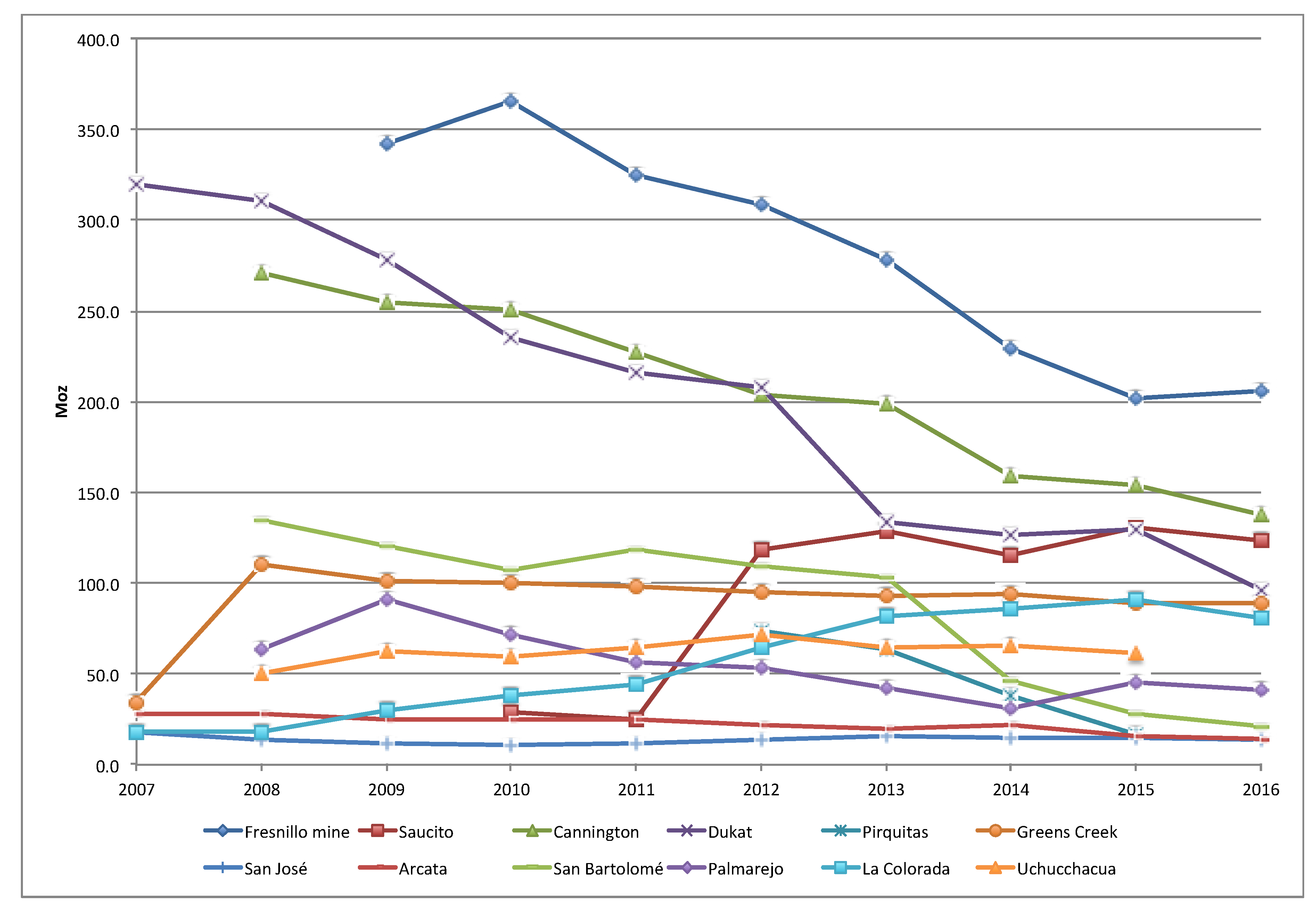

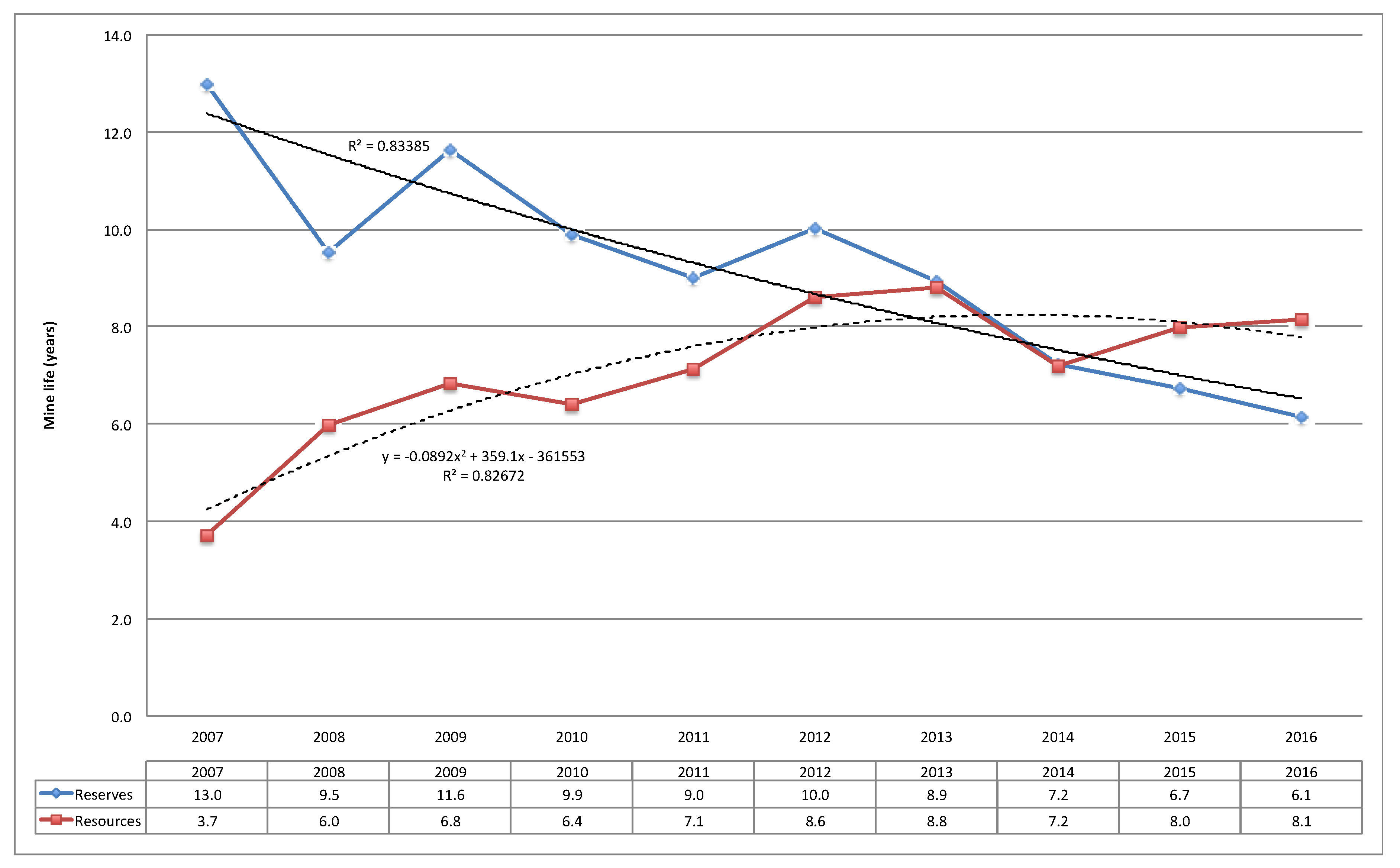

4.2. Resources and Reserves

5. Conclusions

- Silver is one of the rarest metals in nature and one of the most important for many hi-tech applications.

- Investigating the production of primary silver gives to us a good idea of the past and, possibly, future availability of this metal in those primary deposits that virtually have the highest silver ore grades on the earth.

- Until now, no scientific publication has yet been issued to investigate these topics.

- This paper is based on the analysis of primary silver mining statistics of a highly significant sample consisting of twelve of the world’s top fifteen largest primary silver mining sites.

- The findings of our study are that the primary silver mining grade of these twelve big production sites has, gradually and significantly, decreased.

- What is the whole situation about silver reserves and ore grade of the world mines?

- What are the real mining extraction costs of silver?

- Is it true that many mining companies are in economic losses situations?

- What are the historical variations in the extraction costs of the largest silver mines in the world?

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Glossary of Some Technical Terms

| Oz | one troy ounce, equivalent to 31.1035 g; Moz is million ounce; |

| t | tonne (metric ton), equal to 1.1023 short tons, or 2205 pounds; |

| t/d | metric tonnes per day; |

| g/t Ag | grams of silver per tonne of rock; |

| Ore grade | the percentage of silver contained in the extracted mineral; |

| Average yield (in oz/t) | the percentage of silver that is actually produced from the extracted material, due to the specific mining technology of a site. |

References

- Gsodam, P.; Lassnig, M.; Kreuzeder, A.; Mrotzek, M. The Austrian silver cycle: A material flow analysis. Resour. Conserv. Recycl. 2014, 88, 76–84. [Google Scholar] [CrossRef]

- Butterman, W.C.; Hilliard, H.E. Silver. USGS (U.S. Geological Survey); Open-File Report 2004–1251; 2005; Reston (Virginia). Available online: https://pubs.usgs.gov/of/2004/1251/2004-1251.pdf (accessed on 8 March 2018).

- Grandell, L.; Lehtila, A.; Kivinen, M.; Koljonen, T.; Kihlman, S.; Lauri, L.S. Role of critical metals in the future markets of clean energy technologies. Renew. Energ. 2016, 95, 53–62. [Google Scholar] [CrossRef]

- The Silver Institute. World Silver Survey. 2017. Available online: https://www.silverinstitute.org/site/publications/World_Silver_Survey_2017.pdf (accessed on 22 February 2018).

- Sverdrup, H.; Ragnarsdottir, K.V.; Koca, D. Investigating the sustainability of the global silver supply, reserves, stocks in society and market price using different approaches. Resour. Conserv. Recycl. 2014, 83, 121–140. [Google Scholar] [CrossRef]

- The Silver Institute. World Silver Survey. 2016. Available online: https://www.silverinstitute.org/site/publications/World_Silver_Survey_2016.pdf (accessed on 16 February 2018).

- Fresnillo plc. What We Do. Available online: http://www.fresnilloplc.com/what-we-do/mines-in-operation/fresnillo/ (accessed on 22 January 2018).

- Laznicka, P. Giant metallic deposits—A century of progress. Ore Geol. Rev. 2014, 62, 259–314. [Google Scholar] [CrossRef]

- Fresnillo plc. Production Reports. Available online: http://www.fresnilloplc.com/investor-relations/reports-and-presentations/?year=2017 (accessed on 19 February 2018).

- Fresnillo plc. Reports and Presentations. Available online: http://www.fresnilloplc.com/investor-relations/reports-and-presentations/ (accessed on 19 February 2018).

- Polymetal International plc. Annual Reports & Accounts. Available online: http://www.polymetal-international.com/ investors-and-media/annual-reports.aspx?sc_lang=en (accessed on 22 February 2018).

- South32 Ltd. Annual Reports. Available online: https://www.south32.net/investors-media/reports-and-presentations (accessed on 25 February 2018).

- BHP Billiton plc. Annual Reports. Available online: http://www.bhp.com/media-and-insights/reports-and-presenta-tions (accessed on 8 February 2018).

- BHP Billiton plc. Quarterly Production Reports—June. Available online: http://www.bhp.com/media-and-insights/ reports-and-presentations (accessed on 22 February 2018).

- St. Angelo, S. The Silver Chart Report. SRSrocco Report, 2015. Available online: https://srsroccoreport.com/the- silver-chart-report (accessed on 22 February 2018).

- Compañía de Minas Buenaventura S.A.A. Annual Reports. Available online: http://www.buenaventura.com/annual_reports (accessed on 10 February 2018).

- Silver Standard Resources Mining Inc. Silver Standard Reports—Fourth Quarter and Year-End Results. Available online: http://ir.ssrmining.com/investors/investor-kit-download-library/default.aspx (accessed on 22 February 2018).

- Hecla Mining Company. Greens Creek. Available online: http://www.hecla-mining.com/greens-creek/ (accessed on 18 February 2018).

- Hecla Mining Company. Annual Reports. Available online: http://ir.hecla-mining.com/CustomPage/Index?KeyGenPage=315096 (accessed on 5 February 2018).

- Hochschild Mining plc. San Jose—Argentina. Available online: http://www.hochschildmining.com/en/our_operations/current_operations/argentina/san_jose (accessed on 11 February 2018).

- Hochschild Mining plc. Arcata—Peru. Available online: http://www.hochschildmining.com/en/our_operations/current_operations/peru/arcata (accessed on 18 February 2018).

- Hochschild Mining plc. Annual Reports & Accounts. Available online: http://www.hocplc.com/en/investors/results (accessed on 22 February 2018).

- Hochschild Mining plc. Preliminary Results for the Twelve Months Ended 31 December 2016. Available online: http://www.hocplc.com/en/investors/results/financial?year=2017 (accessed on 5 February 2018).

- McEwen Mining Inc. Annual Report. Available online: http://www.mcewenmining.com/Operations/Reserves-and-Resources/default.aspx (accessed on 2 February 2018).

- Coeur Mining Inc. San Bartolomé, Bolivia. Available online: http://www.coeur.com/mines-projects/mines/san-bartolomé-bolivia#.WP-GlhQ1WEY (accessed on 5 February 2018).

- Coeur Mining Inc. Palmarejo, Mexico. Available online: http://www.coeur.com/mines-projects/mines/palmarejo-mexico#.WP-KDRQ1WEY (accessed on 7 February 2018).

- Coeur Mining Inc. Annual Reports. Available online: http://investors.coeur.com/GenPage.aspx?IID=4349317&GKP=1073749603 (accessed on 18 February 2018).

- Coeur Mining Inc. News Release. Available online: http://investors.coeur.com/news.aspx?IID=4349317&Year=2017&mode=0 (accessed on 8 February 2018).

- Pan American Silver Corp. La Colorada—Highlights. Available online: https://www.panamericansilver.com/operations-projects/mexico/la-colorada (accessed on 11 February 2018).

- Pan American Silver Corp. Annual Reports. Available online: https://www.panamericansilver.com/investors/reports/ annual-reports (accessed on 22 February 2018).

- JORC. Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves—The JORC Code—2012 Edition. Available online: http://www.jorc.org/docs/JORC_code_2012.pdf (accessed on 22 March 2018).

- Krzemień, A.; Riesgo Fernández, P.; Suárez Sánchez, A.; Álvarez, I.D. Beyond the pan-european standard for reporting of exploration results, mineral resources and reserves. Resour. Policy 2016, 49, 81–91. [Google Scholar] [CrossRef]

- Njowa, G.; Clay, A.N.; C. Musingwini, C. A perspective on global harmonisation of major national mineral asset valuation codes. Resour. Policy 2014, 39, 1–14. [Google Scholar] [CrossRef]

- Ragnarsdottir, K.V.; Sverdrup, H.; Koca, D. Assessing long-term sustainability of global supply of natural resources and materials. In Sustainable Development—Energy, Engineering and Technologies—Manufacturing and Environment; Ghenai, C., Ed.; Intech Publishers: London, UK, 2012; ISBN 9789535101659. [Google Scholar]

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Silver production | 97.5 | 119.2 | 127.9 | 138.0 | 141.5 | 139.5 | 140.3 | 138.6 | 143.3 | 143.6 |

| Ore processed | 7438 | 9078 | 11,692 | 14,472 | 15,254 | 16,806 | 17,414 | 17,560 | 17,788 | 17,901 |

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Mill feed grade | 493 | 453 | 381 | 343 | 331 | 307 | 309 | 307 | 314 | 312 |

| Average yield | 384 | 371 | 316 | 274 | 268 | 251 | 255 | 261 | 267 | 265 |

| Recovery rate | 77.9% | 82.0% | 83.1% | 80.0% | 81.0% | 81.7% | 82.3% | 84.9% | 85.0% | 84.9% |

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Proved | 65.7 | 75.7 | 74.8 | 61.2 | 54.9 | 46.4 | 41.1 | 34.7 | 36.0 | 32.0 |

| Probable | 31.2 | 52.6 | 72.6 | 68.2 | 65.2 | 69.1 | 64.1 | 55.9 | 50.5 | 45.7 |

| Total * | 83.7 | 111.2 | 131.4 | 117.5 | 110.1 | 111.9 | 101.9 | 85.6 | 81.4 | 82.2 |

| Proved/Total (%) | 78.4 | 68.1 | 56.9 | 52.1 | 49.9 | 41.5 | 40.4 | 40.6 | 44.3 | 38.9 |

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Measured | 134.5 | 135.2 | 140.0 | 79.7 | 79.1 | 75.3 | 80.6 | 95.2 | 74.8 | 68.5 |

| Indicated | 67.2 | 50.2 | 100.0 | 72.1 | 62.5 | 75.7 | 67.1 | 63.2 | 55.0 | 53.5 |

| Inferred | 15.4 | 40.4 | 85.6 | 85.3 | 111.9 | 96.3 | 91.3 | 103.0 | 79.0 | 81.1 |

| Measured + Indicated | 201.7 | 160.3 | 197.4 | 133.0 | 124.4 | 135.1 | 125.8 | 119.5 | 103.5 | 109.5 |

| Total * | 235.0 | 166.3 | 242.0 | 190.6 | 204.6 | 204.0 | 201.9 | 201.9 | 162.7 | 183.3 |

| Measured/Total (%) | 57.2 | 81.3 | 57.8 | 41.8 | 38.7 | 36.9 | 39.9 | 47.1 | 46.0 | 37.4 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ruberti, M.; Massari, S. Are the World-Leading Primary Silver Mines Exhausting? Sustainability 2018, 10, 2619. https://doi.org/10.3390/su10082619

Ruberti M, Massari S. Are the World-Leading Primary Silver Mines Exhausting? Sustainability. 2018; 10(8):2619. https://doi.org/10.3390/su10082619

Chicago/Turabian StyleRuberti, Marcello, and Stefania Massari. 2018. "Are the World-Leading Primary Silver Mines Exhausting?" Sustainability 10, no. 8: 2619. https://doi.org/10.3390/su10082619

APA StyleRuberti, M., & Massari, S. (2018). Are the World-Leading Primary Silver Mines Exhausting? Sustainability, 10(8), 2619. https://doi.org/10.3390/su10082619