An Empirical Study on Effective Tax Rate and CEO Promotion: Evidence from Local SOEs in China

Abstract

1. Introduction

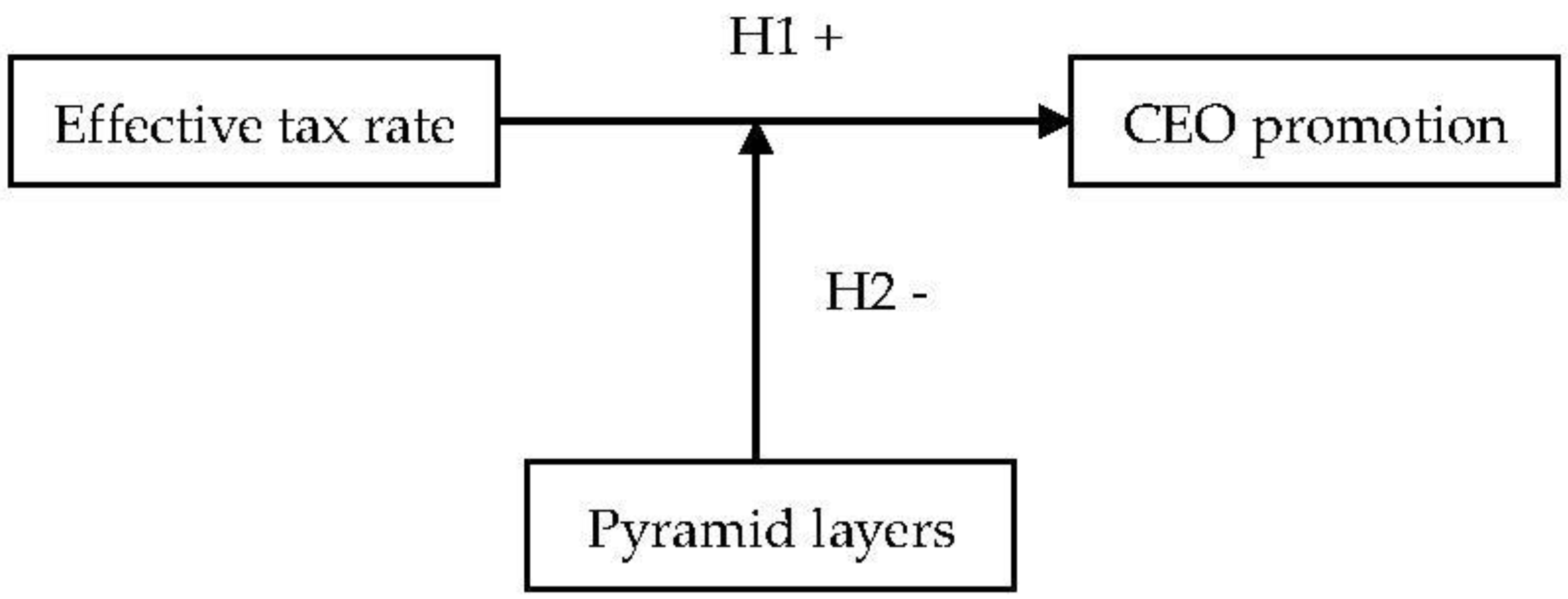

2. Literature Review and Hypotheses Development

3. Data and Methodology

3.1. Data

3.2. Variable Measurements and Model Specification

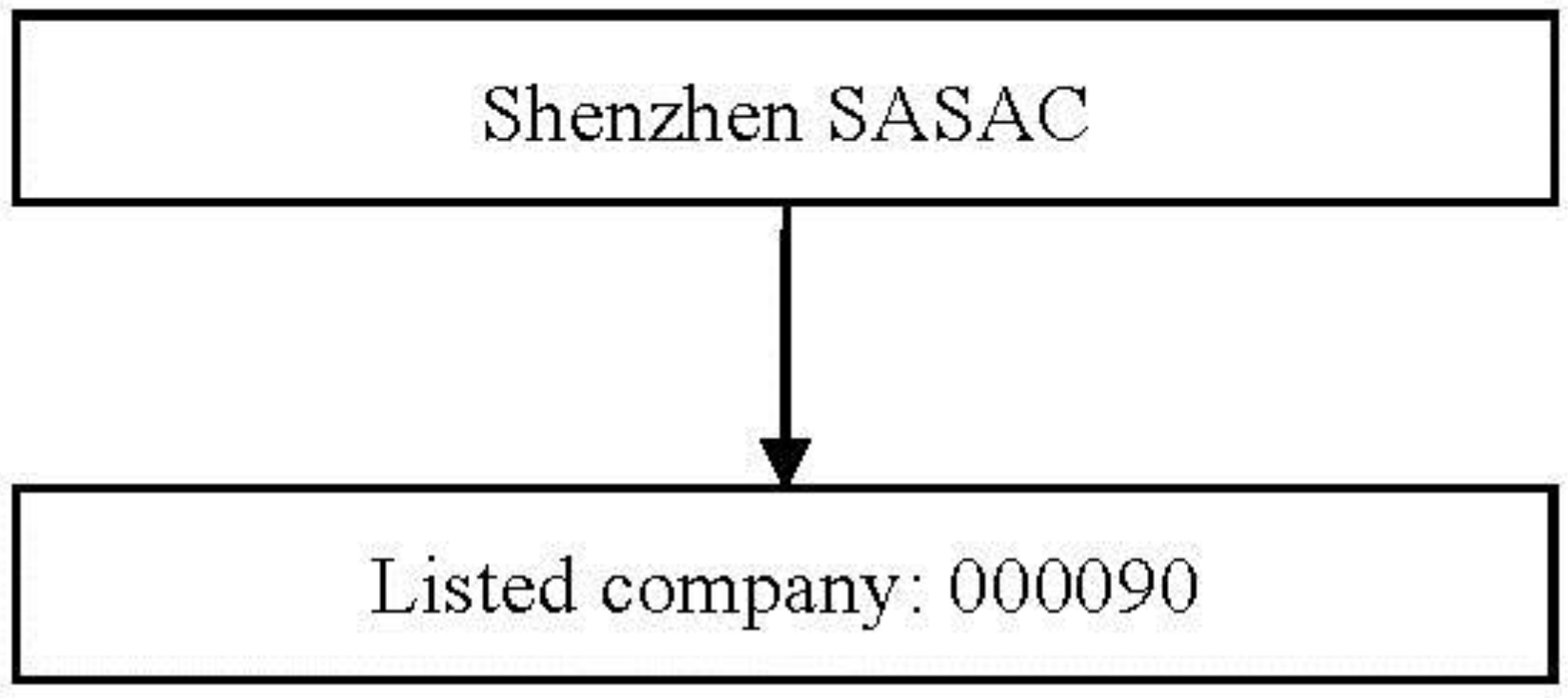

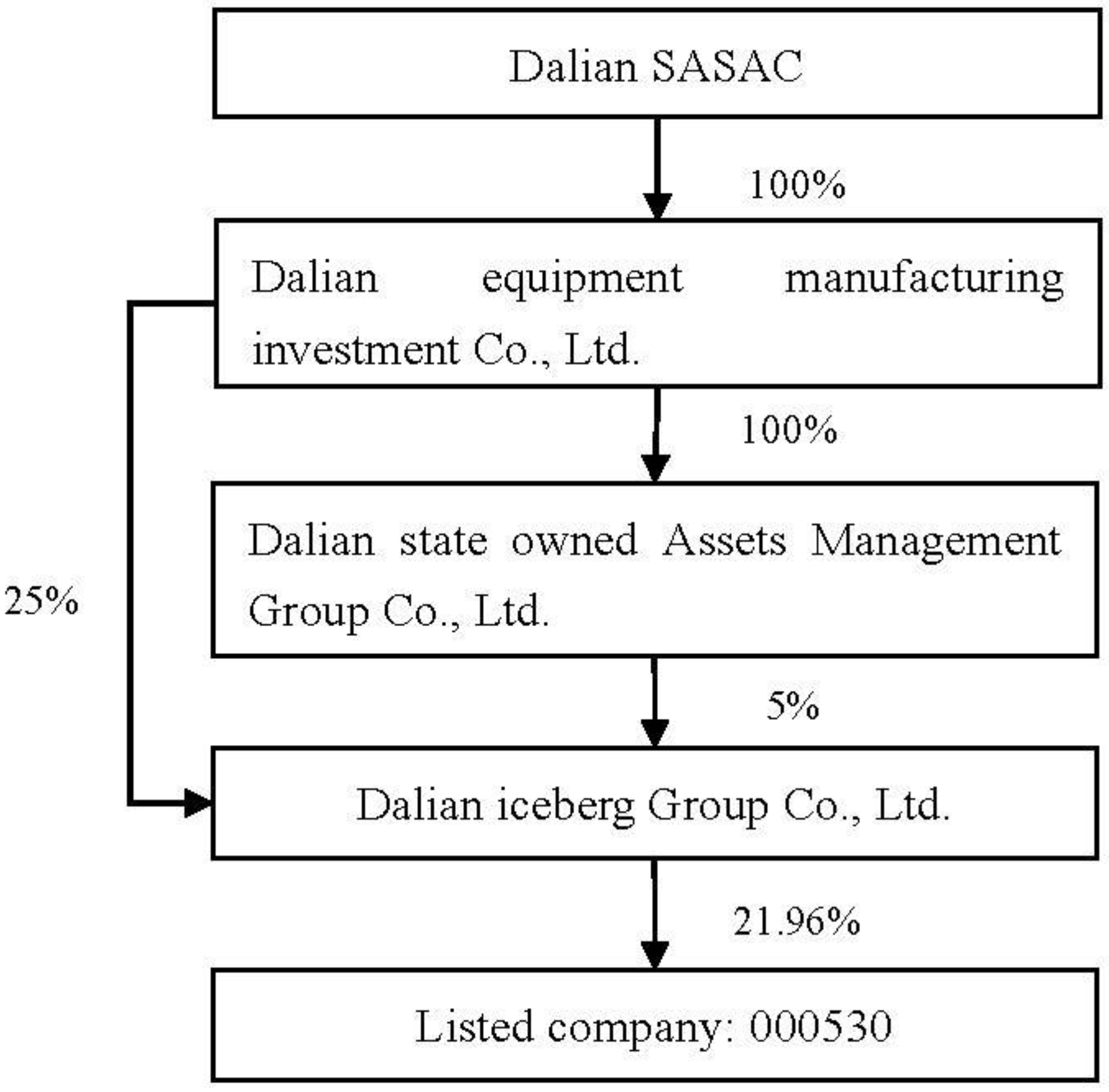

3.2.1. Pyramid Layer

3.2.2. Effective Tax Rate

3.2.3. Model Specification

4. Empirical Results

4.1. Descriptive Summary and Correlation Coefficients

4.2. Regression Results

5. Additional Tests

5.1. Robustness Tests

5.2. The Role of Marketization

6. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A. Variable Definitions

Appendix B. The Importance of Local SOEs

| Year | Type | Local SOE | Central SOE | Private Firm |

|---|---|---|---|---|

| 2004 | Number | 700 | 228 | 426 |

| Asset (billion dollars) | 392.2 | 332.5 | 202.1 | |

| Tax (billion dollars) | 4.0 | 5.6 | 1.0 | |

| 2005 | Number | 683 | 237 | 431 |

| Asset (billion dollars) | 438.1 | 397.8 | 226.8 | |

| Tax (billion dollars) | 4.1 | 6.6 | 1.2 | |

| 2006 | Number | 665 | 262 | 507 |

| Asset (billion dollars) | 622.6 | 2502.8 | 335.6 | |

| Tax (billion dollars) | 5.4 | 14.6 | 1.8 | |

| 2007 | Number | 678 | 273 | 597 |

| Asset (billion dollars) | 847.5 | 4744.4 | 517.4 | |

| Tax (billion dollars) | 8.7 | 39.0 | 3.8 | |

| 2008 | Number | 668 | 294 | 640 |

| Asset (billion dollars) | 1026.5 | 5551.0 | 604.7 | |

| Tax (billion dollars) | 6.6 | 23.8 | 2.4 | |

| 2009 | Number | 661 | 314 | 776 |

| Asset (billion dollars) | 1262.6 | 7065.4 | 795.4 | |

| Tax (billion dollars) | 8.4 | 33.2 | 5.1 | |

| 2010 | Number | 681 | 335 | 1089 |

| Asset (billion dollars) | 1622.4 | 9852.9 | 1185.1 | |

| Tax (billion yuan) | 12.9 | 47.9 | 8.1 |

References

- Marques, R.; Berg, S. Risks, Contracts and Private Sector Participation in Infrastructure. J. Constr. Eng. Manag. 2011, 137, 925–933. [Google Scholar] [CrossRef]

- Pessarossi, P.; Weill, L. Does CEO Turnover Matter in China? Evidence from the Stock Market. J. Econ. Bus. 2012, 70, 27–42. [Google Scholar] [CrossRef]

- Kato, T.; Long, C. CEO Turnover, Firm Performance, and Enterprise Reform in China: Evidence from Micro Data. J. Comp. Econ. 2006, 34, 796–817. [Google Scholar] [CrossRef]

- Chang, E.C.; Wong, S.M.L. Governance with Multiple Objectives: Evidence from Top Executive Turnover in China. J. Corp. Financ. 2009, 15, 230–244. [Google Scholar] [CrossRef]

- Chen, C.; Li, Z.; Su, X.; Yao, Y. Delegation and Sensitivity of CEO Turnover to Firm Performance within Business Groups: Evidence from China. J. Account. Public Policy 2012, 31, 553–574. [Google Scholar] [CrossRef]

- Zimmerman, J.L. Taxes and Firm Size. J. Account. Econ. 1983, 5, 119–149. [Google Scholar] [CrossRef]

- Adhikari, A.; Derashid, C.; Zhang, H. Public Policy, Political Connections, and Effective Tax Rates: Longitudinal Evidence from Malaysia. J. Account. Public Policy 2006, 25, 574–595. [Google Scholar] [CrossRef]

- Bae, K.; Kang, J.; Kim, J. Tunneling or Value Added? Evidence from Mergers by Korean Business Groups. J. Financ. 2002, 57, 2695–2740. [Google Scholar] [CrossRef]

- Bertrand, M.; Mehta, P.; Mullainathan, S. Ferreting out Tunneling: An Application to Indian Business Groups. Q. J. Econ. 2002, 117, 121–148. [Google Scholar] [CrossRef]

- Morck, R.; Yeung, B. Agency Problems in Large Family Business Groups. Entrep. Theory Pract. 2003, 27, 367–382. [Google Scholar] [CrossRef]

- Morck, R.; Wolfenzon, D.; Yeung, B. Corporate Governance, Economic Entrenchment, and Growth. J. Econ. Lit. 2005, 43, 655–720. [Google Scholar] [CrossRef]

- Lin, C.; Ma, Y.; Malatesta, P.; Xuan, Y. Ownership Structure and the Cost of Corporate Borrowing. J. Financ. Econ. 2011, 100, 1–23. [Google Scholar] [CrossRef]

- Fan, J.P.H.; Wong, T.J.; Zhang, T. Institutions and Organizational Structure: The Case of State-owned Corporate Pyramids. J. Law Econ. Organ. 2013, 29, 1217–1252. [Google Scholar] [CrossRef]

- Warner, J.B.; Watts, R.L.; Wruck, K.H. Stock Prices and Top Management Changes. J. Financ. Econ. 1988, 20, 461–492. [Google Scholar] [CrossRef]

- Puffer, S.M.; Weintrop, J.B. Corporate Performance and CEO Turnover: The Role of Performance Expectations. Adm. Sci. Q. 1991, 36, 1–19. [Google Scholar] [CrossRef]

- Farrell, K.A.; Whidbee, D.A. Impact of Firm Performance Expectations on CEO Turnover and Replacement Decisions. J. Account. Econ. 2003, 36, 165–196. [Google Scholar] [CrossRef]

- Boeker, W. Power and Managerial Dismissal: Scapegoating at the Top. Adm. Sci. Q. 1992, 37, 400–421. [Google Scholar] [CrossRef]

- Shen, W.; Cannella, A.A., Jr. Power Dynamics within Top Management and Their Impacts on CEO Dismissal Followed by Inside Succession. Acad. Manag. J. 2002, 45, 1195–1206. [Google Scholar]

- Zhang, Y. The Presence of a Separate COO/President and Its Impact on Strategic Change and CEO Dismissal. Strateg. Manag. J. 2006, 27, 283–300. [Google Scholar] [CrossRef]

- Rizzotti, D.; Frisenna, C.; Mazzone, R. The Impact of Family Owners’ Monitoring on CEO Turnover Decisions and the Role of Trust. J. Manag. Gov. 2017, 21, 599–621. [Google Scholar] [CrossRef]

- Arthaud-Day, M.L.; Dan, R.D. A Changing of the Guard: Executive and Director Turnover Following Corporate Financial Restatements. Acad. Manag. J. 2006, 49, 1119–1136. [Google Scholar] [CrossRef]

- Cowen, A.P.; Marcel, J.J. Damaged Goods: Board Decisions to Dismiss Reputationally Compromised Directors. Acad. Manag. J. 2011, 54, 509–527. [Google Scholar] [CrossRef]

- Wiersema, M.F.; Zhang, Y. CEO Dismissal: The Role of Investment Analysts. Strateg. Manag. J. 2011, 32, 1161–1182. [Google Scholar] [CrossRef]

- Wiersema, M.F.; Zhang, Y. Executive Turnover in the Stock Option Backdating Wave: The Impact of Social Context. Strateg. Manag. J. 2013, 34, 590–609. [Google Scholar] [CrossRef]

- Cao, X.; Pan, X.; Qian, M.; Tian, G.G. Political Capital and CEO Entrenchment: Evidence from CEO Turnover in Chinese Non-SOEs. J. Corp. Financ. 2017, 42, 1–14. [Google Scholar] [CrossRef]

- You, J.X.; Du, G.Q. Are Political Connections a Blessing or Curse? Evidence from CEO Turnover in China. Corp. Gov. Int. Rev. 2012, 20, 179–194. [Google Scholar] [CrossRef]

- Hanlon, M.; Heitzman, S. A Review of Tax Research. J. Account. Econ. 2010, 50, 127–178. [Google Scholar] [CrossRef]

- Tsai, S.-B.; Zhou, J.; Gao, Y.; Wang, J.; Li, G.; Zheng, Y.; Ren, P.; Xu, W. Combining FMEA with DEMATEL Models to Solve Production Process Problems. PLoS ONE 2017, 11, e0167710. [Google Scholar] [CrossRef] [PubMed]

- Liu, W.; Wei, Q.; Huang, S.-Q.; Tsai, S.-B. Doing Good Again? A Multilevel Institutional Perspective on Corporate Environmental Responsibility and Philanthropic Strategy. Int. J. Environ. Res. Public Health 2017, 14, 1283. [Google Scholar] [CrossRef] [PubMed]

- Liu, W.; Shi, H.-B.; Zhang, Z.; Tsai, S.-B.; Zhai, Y.; Chen, Q.; Wang, J. The Development Evaluation of Economic Zones in China. Int. J. Environ. Res. Public Health 2018, 15, 56. [Google Scholar] [CrossRef] [PubMed]

- Lin, F.-H.; Tsai, S.-B.; Lee, Y.-C.; Hsiao, C.-F.; Zhou, J.; Wang, J.; Shang, Z. Empirical research on Kano’s model and customer satisfaction. PLoS ONE 2017, 12, e0183888. [Google Scholar] [CrossRef] [PubMed]

- Peng, C.-H.; Ho, L.-F.; Tsai, S.-B.; Hsiao, Y.-C.; Zhai, Y.; Chen, Q.; Chang, L.-C.; Shang, Z. Applying the Mahalanobis–Taguchi System to Improve Tablet PC Production Processes. Sustainability 2017, 9, 1557. [Google Scholar] [CrossRef]

- Li, H.; Zhang, H.; Tsai, S.-B.; Qiu, A. China’s Insurance Regulatory Reform, Corporate Governance Behavior and Insurers’ Governance Effectiveness. Int. J. Environ. Res. Public Health 2017, 14, 1238. [Google Scholar] [CrossRef] [PubMed]

- Yuan, Y.-H.; Tsai, S.-B.; Dai, C.-Y.; Chen, H.-M.; Chen, W.-F.; Wu, C.-H.; Li, G.; Wang, J. An Empirical Research on Relationships between Subjective Judgement, Technology Acceptance Tendency and Knowledge Transfer. PLoS ONE 2017, 12, e0183994. [Google Scholar] [CrossRef] [PubMed]

- Chang, S.-F.; Chang, J.-C.; Lin, K.-H.; Yu, B.; Lee, Y.-C.; Tsai, S.-B.; Zhou, J.; Wu, C.; Yan, Z.-C. Measuring the service quality of e-commerce and competitive strategies. Int. J. Web Serv. Res. 2014, 11, 96–115. [Google Scholar] [CrossRef]

- Gao, Y.; Tsai, S.-B.; Xue, X.; Ren, T.; Du, X.; Chen, Q.; Wang, J. An Empirical Study on Green Innovation Efficiency in the Green Institutional Environment. Sustainability 2018, 10, 724. [Google Scholar] [CrossRef]

- Chou, C.-C.; Shen, C.-W.; Gao, D.; Gao, Y.; Wang, K.; Tsai, S.-B. Modelling the Dynamic Impacts of High Speed Rail Operation on Regional Public Transport—From the Perspective of Energy Economy. Energies 2018, 11, 1151. [Google Scholar] [CrossRef]

- Chen, Q.; Wang, J.; Yu, J.; Tsai, S.B. An Empirical Research on Marketing Strategies of Different Risk Preference Merchant. Math. Probl. Eng. 2018, 2018, 7947894. [Google Scholar] [CrossRef]

- Chen, Y.; Yu, J.; Li, L.; Li, L.; Li, L.; Zhou, J.; Tsai, S.-B. An Empirical Study of the Impact of the Air Transportation Industry Energy Conservation and Emission Reduction Projects on the Local Economy in China. Int. J. Environ. Res. Public Health 2018, 15, 812. [Google Scholar] [CrossRef] [PubMed]

- Xu, L.; Wu, Q.; Du, P.; Qiao, X.; Tsai, S.-B. Financing Target and Resale Pricing in Reward-Based Crowdfunding. Sustainability 2018, 10, 1297. [Google Scholar] [CrossRef]

- Wu, W.; Huang, X.; Li, Y.; Chu, C.-C. Optimal Quality Strategy and Matching Service on Crowdfunding Platforms. Sustainability 2018, 10, 1053. [Google Scholar] [CrossRef]

- Bai, C.; Xu, L.C. Incentives for CEOs with Multitasks: Evidence from Chinese State-owned Enterprises. J. Comp. Econ. 2005, 33, 517–539. [Google Scholar] [CrossRef]

- Conyon, M.; He, L. CEO Turnover and Firm Performance in China’s Listed Firms; Working Paper; Cornell University ILR School: Ithaca, NY, USA, 2008. [Google Scholar]

| Variable | Obs | Mean | Sd | Min | Max |

|---|---|---|---|---|---|

| Promotion | 3367 | 0.037 | 0.190 | 0 | 1 |

| ETR | 3367 | 0.222 | 0.149 | 0 | 0.743 |

| Layer | 3367 | 2.259 | 0.644 | 1 | 7 |

| ROA | 3367 | 0.038 | 0.048 | −0.182 | 0.192 |

| Size | 3367 | 21.744 | 1.056 | 19.375 | 24.505 |

| No1share | 3367 | 0.406 | 0.155 | 0.102 | 0.759 |

| Dual | 3367 | 0.103 | 0.304 | 0 | 1 |

| Percentage | 3367 | 0.355 | 0.049 | 0.222 | 0.556 |

| CEOshare | 3367 | 0.008 | 0.045 | 0 | 0.391 |

| CEOage | 3367 | 47.793 | 6.095 | 29 | 73 |

| CEOtenure | 3367 | 3.534 | 1.908 | 0.920 | 8.750 |

| ST | 3367 | 0.042 | 0.201 | 0 | 1 |

| Promotion | ETR | Layer | ROA | Size | No1share | Dual | Percentage | CEOshare | CEOage | CEOtenure | ST | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Promotion | 1 | |||||||||||

| ETR | 0.032 * | 1 | ||||||||||

| Layer | 0.011 | −0.038 ** | 1 | |||||||||

| ROA | −0.017 | −0.020 | −0.010 | 1 | ||||||||

| Size | 0.019 | 0.059 *** | −0.037** | 0.251 *** | 1 | |||||||

| No1share | 0.012 | −0.002 | −0.024 | 0.167 *** | 0.184 *** | 1 | ||||||

| Dual | −0.041 ** | −0.000 | −0.009 | −0.016 | −0.083 *** | −0.067 *** | 1 | |||||

| Percentage | −0.004 | −0.033 * | 0.006 | 0.030 * | 0.082 *** | −0.001 | −0.005 | 1 | ||||

| CEOshare | −0.001 | −0.022 | −0.024 | 0.097 *** | 0.019 | −0.128 *** | 0.118 *** | −0.012 | 1 | |||

| CEOage | 0.009 | −0.016 | 0.027 | 0.065 *** | 0.149 *** | 0.061 *** | 0.075 *** | 0.004 | 0.030 * | 1 | ||

| CEOtenure | −0.019 | −0.009 | 0.018 | 0.078 *** | 0.127 *** | −0.148 *** | 0.064 *** | 0.002 | 0.050 *** | 0.194 *** | 1 | |

| ST | 0.029 * | −0.213 *** | 0.033* | −0.301 *** | −0.256 *** | −0.070 *** | 0.089 *** | −0.013 | −0.024 | −0.002 | −0.061 *** | 1 |

| Promotion | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| ROA | −2.132 | −1.862 | −1.982 |

| (1.970) | (2.079) | (2.067) | |

| Size | 0.089 | 0.088 | 0.099 |

| (0.085) | (0.086) | (0.088) | |

| No1share | 0.003 | 0.003 | 0.003 |

| (0.006) | (0.006) | (0.006) | |

| Dual | −1.103 ** | −1.121 ** | −1.116 ** |

| (0.473) | (0.479) | (0.481) | |

| Percentage | −0.870 | −0.723 | −0.654 |

| (1.884) | (1.869) | (1.865) | |

| CEOshare | 0.876 | 1.028 | 1.071 |

| (1.934) | (1.907) | (1.880) | |

| CEOage | 0.009 | 0.009 | 0.010 |

| (0.015) | (0.015) | (0.015) | |

| CEOtenure | −0.063 | −0.062 | −0.061 |

| (0.052) | (0.053) | (0.052) | |

| ST | 0.671 | 0.880 | 0.820 |

| (0.563) | (0.550) | (0.531) | |

| ETR | 1.231 ** | 4.623 ** | |

| (0.593) | (2.008) | ||

| Layer | 0.418 | ||

| (0.257) | |||

| Layer*ETR | −1.530 * | ||

| (0.922) | |||

| Constant | −6.248 *** | −6.468 *** | −7.677 *** |

| (2.153) | (2.192) | (2.418) | |

| Industry | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| N | 3351 | 3351 | 3351 |

| Pseudo R2 | 0.022 | 0.025 | 0.028 |

| Wald Chi2 | 22.08 | 26.71 | 30.94 |

| Promotion | Model 4 | Model 5 | Model 6 |

|---|---|---|---|

| ROA | −1.830 | −1.956 | −1.857 |

| (2.084) | (2.073) | (2.081) | |

| Size | 0.089 | 0.100 | 0.088 |

| (0.086) | (0.088) | (0.087) | |

| No1share | 0.004 | 0.004 | 0.003 |

| (0.007) | (0.007) | (0.006) | |

| Dual | −1.125 ** | −1.119** | −1.121 ** |

| (0.478) | (0.480) | (0.479) | |

| Percentage | −0.703 | −0.640 | −0.735 |

| (1.861) | (1.857) | (1.863) | |

| CEOshare | 1.049 | 1.088 | 1.020 |

| (1.908) | (1.881) | (1.907) | |

| CEOage | 0.009 | 0.010 | 0.009 |

| (0.015) | (0.015) | (0.015) | |

| CEOtenure | −0.061 | −0.060 | −0.062 |

| (0.052) | (0.052) | (0.052) | |

| ST | 0.872 | 0.814 | 0.876 |

| (0.553) | (0.535) | (0.547) | |

| Dividend | −0.002 | −0.001 | |

| (0.007) | (0.007) | ||

| ETR | 1.254 ** | 4.626 ** | 1.219 * |

| (0.592) | (2.009) | (0.678) | |

| Layer | 0.416 | ||

| (0.256) | |||

| Layer*ETR | −1.523 * | ||

| (0.915) | |||

| Separation | −0.002 | ||

| (0.022) | |||

| Separation*ETR | 0.003 | ||

| (0.073) | |||

| Constant | −6.497 *** | −7.695 *** | −6.454 *** |

| (2.195) | (2.422) | (2.207) | |

| Industry | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| N | 3351 | 3351 | 3351 |

| Pseudo R2 | 0.025 | 0.028 | 0.025 |

| Wald Chi2 | 26.95 | 30.94 | 26.85 |

| Promotion | Model 7 | Model 8 |

|---|---|---|

| Index ≥ Median | Index < Median | |

| ROA | −1.874 | −1.544 |

| (3.214) | (3.013) | |

| Size | 0.024 | 0.211 * |

| (0.141) | (0.122) | |

| No1share | −0.003 | 0.012 |

| (0.009) | (0.009) | |

| Dual | −1.293 * | −0.989 |

| (0.779) | (0.652) | |

| Percentage | 0.368 | −2.148 |

| (2.734) | (2.580) | |

| CEOshare | 1.008 | −0.841 |

| (2.157) | (3.497) | |

| CEOage | 0.021 | −0.000 |

| (0.020) | (0.026) | |

| CEOtenure | −0.108 | −0.024 |

| (0.076) | (0.073) | |

| ST | 1.142 | 0.465 |

| (0.800) | (0.643) | |

| ETR | 3.716 | 6.179 ** |

| (2.802) | (2.920) | |

| Layer | 0.170 | 0.873 ** |

| (0.365) | (0.390) | |

| Layer*ETR | −0.906 | −2.567 * |

| (1.255) | (1.314) | |

| Constant | −17.155 *** | −10.319 *** |

| (3.537) | (3.064) | |

| Industry | Yes | Yes |

| Year | Yes | Yes |

| N | 1678 | 1640 |

| Pseudo R2 | 0.058 | 0.065 |

| Wald Chi2 | 569.16 | 45.07 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, K.; Zhang, H.; Tsai, S.-B.; Jiang, J.; Sun, Y.; Wang, J. An Empirical Study on Effective Tax Rate and CEO Promotion: Evidence from Local SOEs in China. Sustainability 2018, 10, 2007. https://doi.org/10.3390/su10062007

Wang K, Zhang H, Tsai S-B, Jiang J, Sun Y, Wang J. An Empirical Study on Effective Tax Rate and CEO Promotion: Evidence from Local SOEs in China. Sustainability. 2018; 10(6):2007. https://doi.org/10.3390/su10062007

Chicago/Turabian StyleWang, Kai, Haomin Zhang, Sang-Bing Tsai, Jin Jiang, Yun Sun, and Jiangtao Wang. 2018. "An Empirical Study on Effective Tax Rate and CEO Promotion: Evidence from Local SOEs in China" Sustainability 10, no. 6: 2007. https://doi.org/10.3390/su10062007

APA StyleWang, K., Zhang, H., Tsai, S.-B., Jiang, J., Sun, Y., & Wang, J. (2018). An Empirical Study on Effective Tax Rate and CEO Promotion: Evidence from Local SOEs in China. Sustainability, 10(6), 2007. https://doi.org/10.3390/su10062007