1. Introduction

In the 2000s, mid-sized shipping companies operated tramp during the super cycle and large shipping companies invested indiscriminately in shipping assets. Before the Global Financial Crisis of 2008, the shipping cycle was booming. At that time, most shipping companies lacked foresight and secured bigger fleets, rather than preparing for the recession. As a result, many shipping companies faced bankruptcy and court receivership during the maritime slump after 2008. Thus, large companies are not free from investment mistakes [

1,

2].

For some ship owners, sale and purchase (S&P) of ships is a more important source of revenue than shipping operations. Notably, Stopford [

3] pointed out that “Shipowners have two jobs. One is to operate ships, a worthy task but not one that brings riches. The other is to be in the right place at the right time, to rake in the money at the peak of a cycle.” Nevertheless, most shipping companies are concentrating on profit growth through cargo transportation contracts and their sustainable growth plans have met limited success. As shipbuilding takes time, the order to delivery cycle can be long. Second-hand ships can be picked up directly from the second-hand ship market. Using S&P, shipowners attempt to make more money. Therefore, it is worthwhile to achieve sustainable growth in the shipping market, which is marked by high volatility, by participating in high value-added S&P activities. Because S&P of ships is a professional service industry that arranges transactions based on expertise of shipping, shipbuilding, finance, and legal fields, it might be seen as a knowledge industry with value add that can produce advanced information by predicting the entire shipping market based on basic transaction information. Therefore, the potential impact of S&P business development on the shipping industry is significant. S&P business can form a large market by itself and can contribute to the development of ship investment finance, ship management, ship insurance, maritime law, shipping, and shipbuilding [

4]. Major shipping companies in Europe and Japan have increased the value add in shipping by not only conducting freight transportation, but also performing maritime knowledge services, such as finance, ship valuation, S&P of ships, chartering, maritime arbitration, insurance, and consulting. In the global shipping industry, the freight transportation market has been growing continuously, but since the 2000s, large-scale capital has been injected into the shipping market, and the second-hand ship market has expanded. Historically, the shipowners and shipping companies in the United Kingdom, Greece, and Japan have been the leading players in the S&P market. Recently, the S&P business, in particular, has emerged as a key source of competitive power in the maritime market, where freight transportation is changing rapidly. Furthermore, it is becoming more difficult to predict the shipping cycle. Therefore, S&P business has also been developed in advanced shipping countries, such as in Greece, the United Kingdom, and Singapore. As a representative example, the Singapore government has been expending much effort on increasing the breadth and depth of other maritime auxiliary services such as value-added services by capitalizing or leveraging its leading status in S&P activities [

5]. In Greece, which owns the largest portion of fleets, S&P has been the flagship business of the shipping industry for a long time [

6].

As mentioned above, strengthening S&P capacity has become a fundamental requirement for ensuring sustainable growth and corporate competitiveness in the modern shipping market. However, there is lack of research related to S&P and its priority when shipping companies attempt to implement ship acquisition through S&P activities. To fill this gap, this paper aims to examine shipping companies’ priorities when they undertake S&P activities. An empirical analysis is conducted on the priority factors considered during the decision making on acquiring second-hand ships. By doing so, this study seeks to help shipowners by analyzing the factors and its implications that are important for the acquisition of ships and asset investment in the Korean shipping industry. The priority of introducing second-hand ships was analyzed by using the fuzzy analytic hierarchy process (AHP) method after conducting interviews with shipping experts and administering questionnaires to shipping company employees. After the selection of preemptive evaluation factors by asking an expert group to answer a questionnaire, it presents directions for securing second-hand ships by analyzing the importance of, and preference for, the various factors selected. This paper is structured as follows. The next section reviews the relevant studies and the third section explains the methodology. The empirical analysis is shown in the fourth section. Finally, the fifth section provides a discussion of the results and presents the concluding remarks.

2. Literature Review

Various scholars have divided the shipping markets into freight, second-hand ships, newbuilding, and demolition markets [

3,

7,

8,

9]. The second-hand ship market is distinct from the newbuilding and the demolition markets as an auxiliary market, in the sense that it does not change the number of vessels or the transport capacity offered by the market [

3,

10]. Although the second-hand ship market is closely related to the newbuilding market, its features are quite different in terms of the availability of ships from the contract date and the method of transferring a ship’s ownership [

3]. The notable characteristics of this market is that ships worth billions of dollars are traded like generic commodities. In this market, both the buyers and sellers are shipowners. Generally, the administrative procedures are analogous to those involved in real property, in the use of a standard contract, such as the Norwegian Sales Form [

3]. The value of second-hand ships depends on the freight rates, age, inflation, and expectations. Hence, accurately determining the optimal time for trading can be of critical importance [

11].

As mentioned earlier, the second-hand ship market is different from the other markets, which provide flexibility in the expansion or reduction of transport capacity as their main function. The purpose of the second-hand ship market is to effectively reallocate ships among operators. Besides, the second-hand ship market may increase the efficiency of the markets for transport services. Therefore, the second-hand ship market fosters efficient use of capital equipment in the shipping industry and contributes to moderating the transport costs in world trade. According to Strandenes [

8], the second-hand ship market facilitates entry into shipping since potential operators may easily be able to buy an existing ship and promptly enter the transport market. On the other hand, shipowners can reallocate their fleet in line with changes in fluctuating demand or have the flexibility to shift to new markets. Further, not only shipowners operate ships, but also speculators who do not have expertise in shipping and who want to participate in S&P for the purpose of asset management, can enter the market. Their activities contribute to the functioning of the second-hand ship market by increasing its liquidity.

The characteristics of the second-hand ship market depend on the types of ships traded [

12]. In general, the S&P of bulk carriers, especially dry bulk ships, is the leading activity of this industry. In 2017, a record 93.1 million deadweight tonnage (DWT) was sold on the second-hand ship market. Bulk carriers accounted for 50% of this volume, with strong investor interest, led by Greeks, whilst bulker and values increased [

11]. The bulk carrier market varies from the small-sized Handysize and Supramax to the large-sized Capesize. There is a large variety of market participants because there are almost no barriers to entry into the market; thus, it has a wide distribution of small- and large-scale shipowners. There are various known shippers in this market (e.g., Vale, Rio Tinto, and other large-scale mining companies handling iron ore and coal, as well as small- and mid-sized grain handling companies). Market entry and exit is very liberal, and transactions are focused on profit margins. In addition, there are relatively few political risks, compared to those associated with oil tankers [

4]. Through these activities in the market, the shipowners seek to construct a rational fleet portfolio in order to appropriately hedge financial and operating risks arising from the ship’s ownership and operations.

The ship acquisitions of shipping companies by S&P activities are connected to the price of the second-hand ship. Therefore, a significant body of literature has explored the determinants of the value of second-hand ships. Most researchers adopt a business perspective focusing on the ship size (e.g., Handysize, Aframax, and Suezmax) or a market environment perspective focused on the change in the number of orders and delivery of ships, fleets, and throughput of major freight categories [

13,

14]. Merikas et al. [

15] introduced the variable of the price ratio of second-hand ship and new shipbuilding as a decision-making tool and main determinant, in accordance with the theory of finance. Amir and Nomikos [

16] argued that freight should be recognized as a priority factor because the prices of second-hand ships and newbuilding change according to freight volatility in the shipping industry. In addition, there are studies on the acquisition of ships from various other perspectives [

17,

18]. Among them, research that provides rational criteria for decision making has been carried out regularly. In addition, it has also examined the effects of the volatility in the shipping industry and the limitations of information power in the decision-making, based on market sentiment. Besides, a considerable body of literature exists in regard to shipping companies’ S&P strategy, such as S&P timing and ship price prediction. Alizadeh and Nomikos [

16] established the existence of a long-term cointegrating relationship between ship price and earnings and used this relationship as a barometer of S&P timing decisions in the dry bulk shipping sector. In their results, S&P strategies based on earnings–price ratios were significant, especially in the market for larger ships, due to higher volatility in the second-hand ship market. Tsolakis et al. [

13] provided an econometric analysis of second-hand ship prices for reducing the risk of S&P activity. They argued that analysis at a separated level is needed because the factors affecting second-hand ship prices have different impacts on different ship types. Therefore, this paper has analyzed S&P activities of dry bulk ship that lead the second-hand ship market and have been studied through previous research.

However, there is a lack of research that incorporate the various factors to be considered when shipping companies carry out S&P activities for ship acquisition. Some extant studies have explored the second-hand ship markets [

14,

19,

20,

21], the economic life cycles of ships [

6], the econometric perspective of the shipping market, the demolition market of second-hand ships [

7], and the price of second-hand ships [

11,

18,

22]. In the aforementioned studies on the timing and decision of S&P activities [

10,

23,

24,

25], the focus is on the three main perspectives—business, market environment, and policy.

4. Findings

A good decision-making model needs to allow uncertainty because fuzziness is a common characteristic of many decision-making problems [

42]. Shipping companies’ S&P activities are typical multi-criteria decision-making problems owing to the uncertainty prevailing in the shipping market [

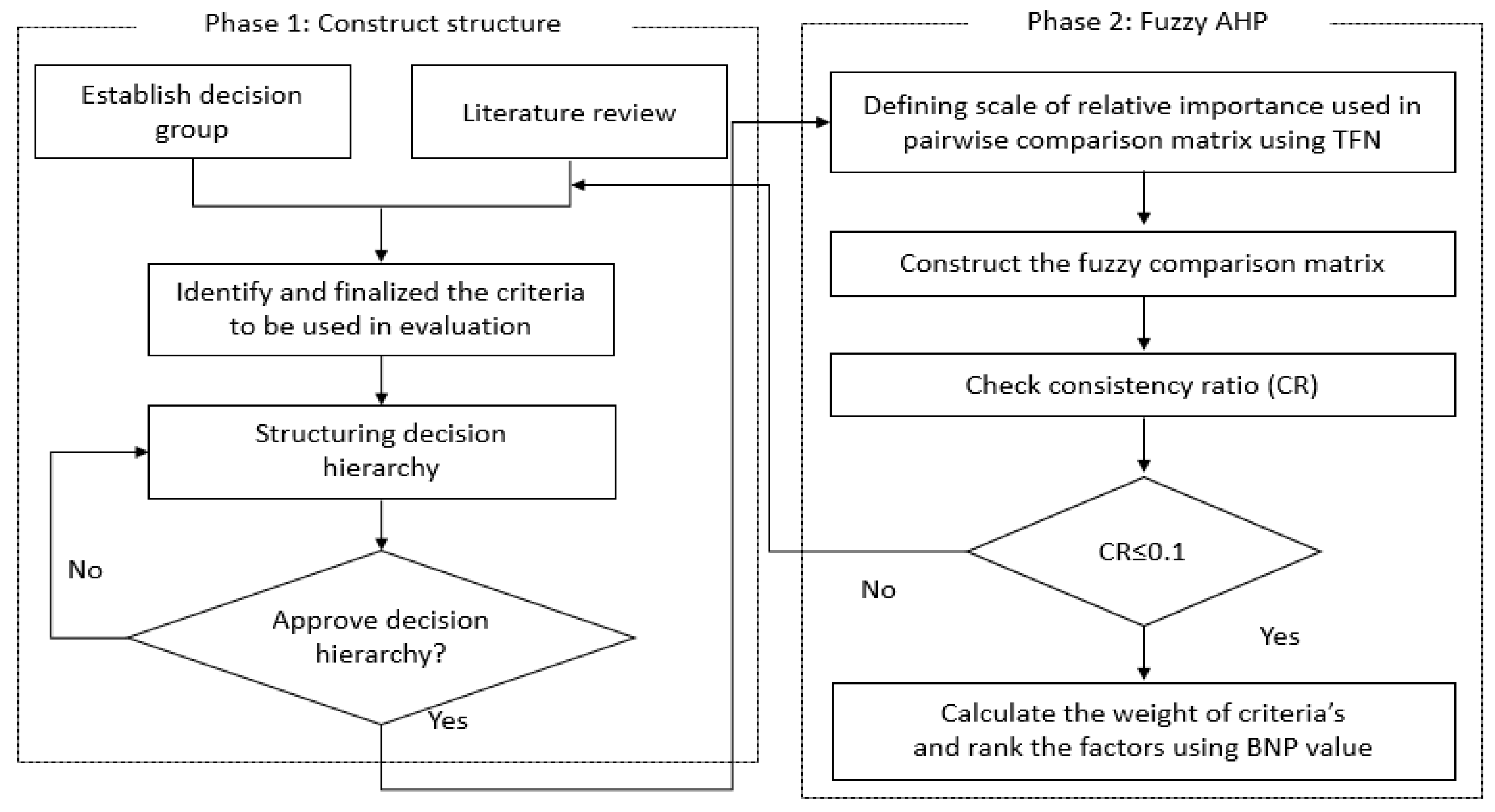

43]. Therefore, in this section, the fuzzy AHP approach is utilized to identify the priority factors when shipping companies acquire ships for sustainable growth by S&P activities. The structure of the analysis is shown in

Figure 2.

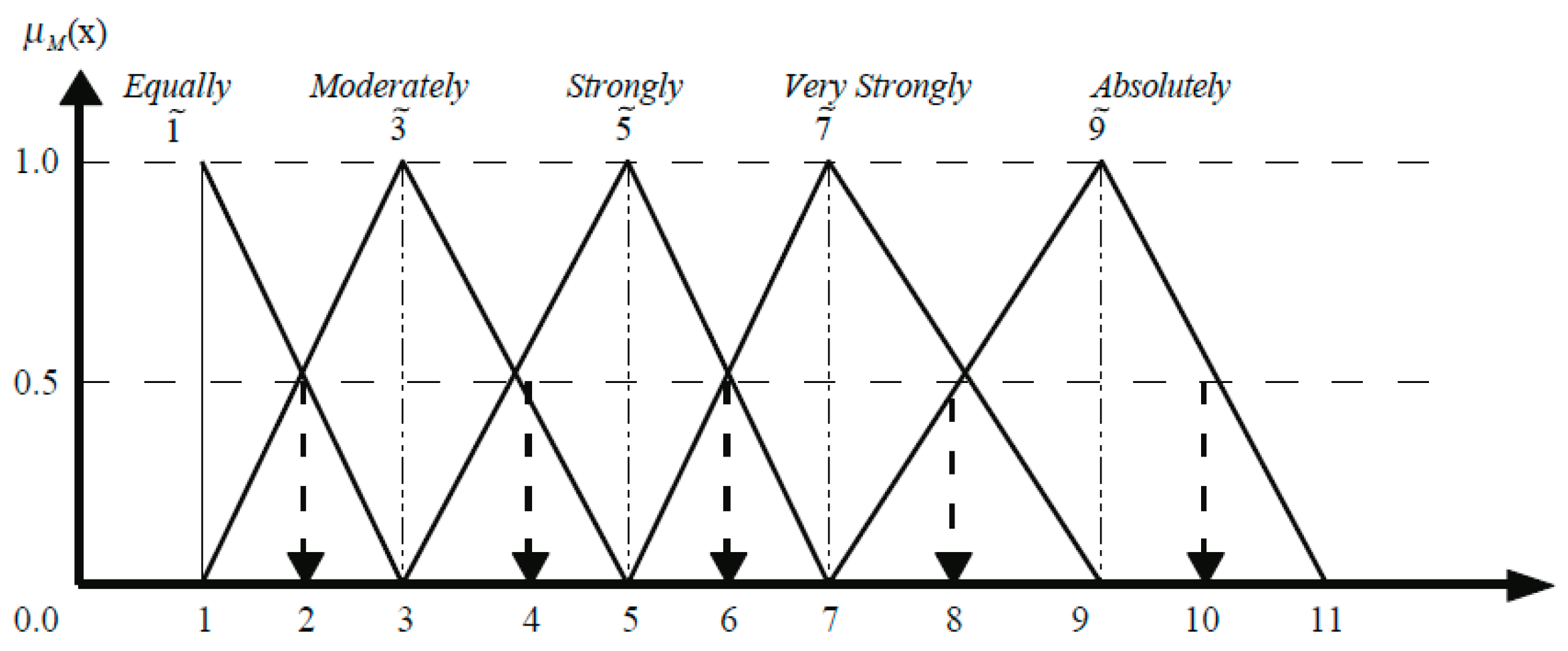

Respondents were asked to construct pairwise comparisons of the three major criteria and twelve sub-criteria by using linguistic variables. The CR of all matrices is less than 0.1, indicating that these matrices are sufficiently consistent. Then, the linguistic expressions were transformed into TFNs and a fuzzy evaluation matrix was established (see

Table 1). Using the geometric mean, the pairwise comparison matrices of the criteria and sub-criteria are established. The results from the computations using the pairwise comparison matrices are shown in

Table 5,

Table 6,

Table 7 and

Table 8.

The next step is to obtain a fuzzy weighted evaluation matrix. By the calculated criteria weight, the weighted evaluation matrix is established using Equations (9) and (10). The results are shown in

Table 9 and

Table 10. This study explored the priorities during S&P activities in shipping companies. The second level of hierarchy (main criteria) included business, market environment and policy criteria. The results of the business criterion (M

1) suggest that financial status and funding (B

1) is the most important factor, followed by ship types and size (B

3), strengthening market influence (B

2), and old ship replacement fleet management (B

4). In other words, it is shown that the decision making for ship acquisition is based on internal factors when making investment decisions, as well as on the ship type and size and the possibility of future participation in the market. The results of the market environment criterion (M

2) suggest that fleet and throughput fluctuations (E

2) are the most important factors, followed by oil price and freight rate change (E

4), second-hand ship market fluctuation (E

3), and international situation change (E

1), in that order. This means that factors, such as the direct demand of the shipping market and the fleet/freight are taken into consideration when shipping companies determine ship acquisition. The results of the policy criterion (M

3) suggest that investment support of policy finance institutions (P

2) is the most important factor, followed by shipping tax benefits (P

1), changes in domestic and overseas ship regulations (P

3), and ship registry (P

4). It can be seen from the long recession that shipping companies are very sensitive to government investment support or tax benefits. Finally, the results of the priority importance of the sub-criteria (

Table 10) are as follows. The results in

Table 10 suggest that investment support of policy financial institutions (P

2) is the most important factor, followed by fleet and throughput fluctuations (E

2), financial status and funding (B

1), and oil price and freight rate change (E

4).

5. Concluding Remarks

Although there is a considerable body of literature on the shipping industry using AHP [

44,

45], few studies applied AHP in S&P activities. Therefore, the academic contribution made by uncovering the importance of S&P for shipping companies’ sustainable growth using fuzzy AHP is broadly recognized. Although the previous literature has mainly analyzed determinants of the value of second-hand ships, research on the priority factors during acquisition by directly linking the shipping companies’ S&P activities is still limited. This study contributes to filling this gap by investigating the priority factors that shipping companies consider when they participate in S&P activities for sustainable growth through ship acquisition via fuzzy AHP. To the best of our knowledge, this research is the first exploration covering Korean shipping companies’ ship acquisition by S&P activities. This study may be able to contribute to a better understanding of the role of S&P in shipping companies and provide stakeholders with valuable insights. It also seems to complement previous academic research that focused on a business perspective criterion (M

1), such as the ship size [

13,

15] and market environment perspective criteria (M

2), such as the change in the number of orders and ships delivered [

22], and fleets and throughput [

40].

This research analyzed the factors that are important for the acquisition of a ship and sustainable growth in the Korean shipping industry and has the following notable implications. Derived from the results of fuzzy AHP, a business criterion, such as financial status and funding (B1), is the most important; it has a relative importance value of 0.343. It is followed by the market environment criteria (0.299), such as fleet and throughput fluctuations (E2) and oil price and freight rate change (E4). The five top-ranked factors in the fuzzy AHP results include two factors under business criteria (B1 and B3), two factors under market environment criteria (E2 and E4), and one factor under policy criterion (P2). These results might help to decide the direction of decision making for ship investment. First, as the criteria in business (M1) are considered to be the most important factors in the analysis for S&P, the more complex and difficult the problem, the more the number of analytical and rational factors that need to be decided. In other words, it would be valuable to consider the most reasonable ship investment factors, such as profitability review, financial status of the company, funding ability, and future market forecast (B1). For the business perspective criteria (M1), ship companies have a method to perform professional internal analysis in detail. If necessary, the shipping company may collaborate with external agencies and use a professional analysis tool, such as simulation, to predict the future before making an investment. In order to succeed in the shipping business, the managers in shipping companies might need to invest assets in forecasts so that they can accurately recognize market changes.

The findings indicate that ship types and sizes (B

3) are important. It is empirically recognized that different ship types and sizes in the second-hand market lead to S&P activities and higher ship prices [

6,

13,

16,

20,

22,

44]. Further, this paper may supplement the existing study of Fan and Luo [

46]. They argued that both fleets and throughput changes can increase the probability of ship investment to improve shipping companies’ profitability. This paper’s analysis found that the fleet/throughput fluctuations (E

2) were an important factor in shipping companies’ S&P activity. In general, a shipping company reallocates its fleet and throughput to (1) reduce financial risks; (2) respond to changes in market share; and (3) maintain market profitability capacity. This study found that oil price and freight rate change (E

4) in S&P activities was another important factor. According to Beenstock and Vergottis [

40], an anticipated increase in fuel prices leads to expected shortages in the freight market, and this causes an increase in freight rates. The trade-off between oil prices and freight rates affects the profitability of shipowners. In other words, when shipping companies decide on S&P activities, the fleet/throughput fluctuations (E

2) reflecting the direct demand of the shipping market and oil price/freight rates (E

4) affecting the profitability of the ship should be considered. Because the most important part is investment support of policy financial institutions (P

2), the government and financial policy institutions should provide investment support measures for these S&P activities. Especially, the S&P business of Korean shipping companies is at its infancy. Since most of the international S&P activities are dominated by foreign shipping companies, the S&P scale and demand of the Korean shipping industry is not accurately understood. For this reason, there are still a large number of shipping companies that mainly focus on ship operating income. Therefore, brokerage firms specializing in S&P business are still operating on a small scale, and considerable time is needed to secure international competitiveness [

4]. Therefore, it would be valuable to refer to the work of Haralambides and Yang [

47]. They suggest that the government should foster a more proactive shipping policy, marked by financial support for shipping companies, and maintenance of related laws and systems. Although, existing research was not focused on financial status and funding (B

1) for S&P, surprisingly, this paper has found that these factors have a high priority when shipping companies conduct S&P activities for the acquisition of second-hand ships. Because Korean brokerage companies, specializing in S&P business, are still operating on a small scale, and considerable time is needed to secure international competitiveness as mentioned above, the Korean government and related ministries should seek laws, systems, and financial support for shipping companies. To benchmark research, and in order to activate Korean S&P business, the development of related laws and systems is indispensable. Further, the policy support system should be able to install the financial status and funding (B

1) of Korean shipping companies. In addition, to achieve sustainable growth, a basic plan of public-private partnership should be laid out and the development plan should be systematically promoted.

Despite the superiority of this study over previous ones, it contains some limitations. It has been difficult for decision makers involved in the acquisition of ships to obtain reliable and consistent data on their decision making and judgment. Especially, in terms of tramp companies, the information is very limited because there are many small and non-listed companies. Therefore, it will be necessary to obtain more accurate results by securing a variety of objective data through more in-depth interviews and surveys. Decisions about S&P investments are made on the basis of management policies. However, most of the surveys were performed at the staff level. In the future, it will be meaningful to explore how executives make different judgments by interviewing a wider range of personnel. This research has shown that decision making to secure ships by shipping companies is influenced not only by business criteria but also by market environment criteria. However, the analysis of this research did not yield results that demonstrated reasonable performance on the basis of the crucial factors involved in the decision. Therefore, it is not enough to present objective problems of shipping companies and to suggest reasonable alternatives. In order to compensate for this, it will be necessary to study additional internal and external factors of the shipping market through statistical analysis, in conjunction with the analysis of this study.