Moderating the Role of Firm Size in Sustainable Performance Improvement through Sustainable Supply Chain Management

Abstract

:1. Introduction

2. Theoretical Background

2.1. SSCM Development

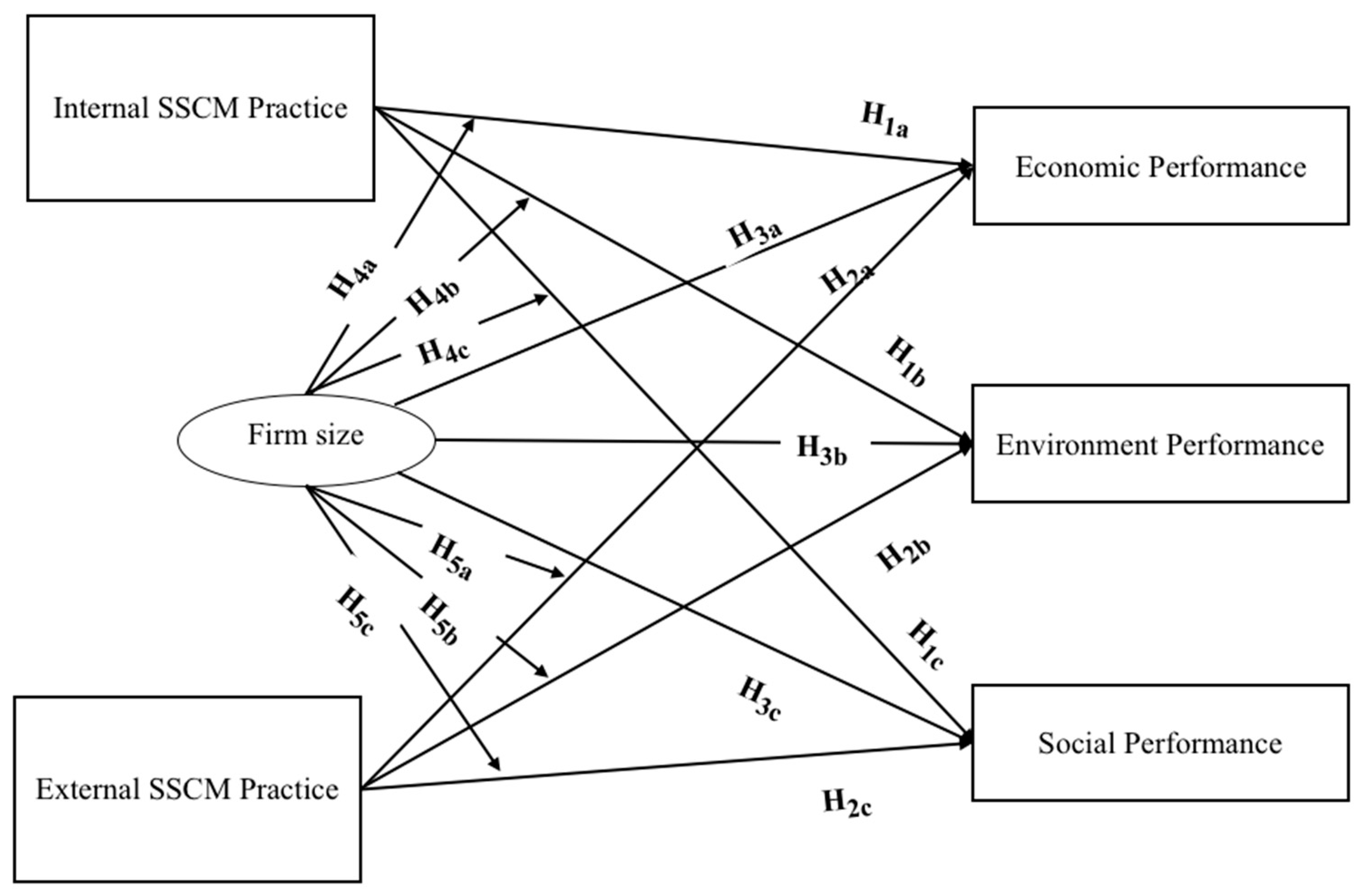

2.2. SSCM Practice and Sustainable Performance

2.3. Firm Size and Sustainable Performance

2.4. Moderating the Effect of Firm Size

3. Method

3.1. Survey Questionnaire and Measures

3.2. Data

3.3. Exploratory Factor Analysis

4. Analysis and Results

5. Discussion and Prospects

5.1. SSCM Practices and Sustainable Performance

5.2. Moderating Effect of Firm Size

5.3. Managerial Implications

5.4. Research Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logis. Manag. 2008, 38, 360–387. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business, Conscientious Commerce; New Society Publishers: Gabriola Island, BC, Canada, 1998. [Google Scholar]

- Wu, T.; Wu, Y.C.J.; Chen, Y.J.; Goh, M. Aligning supply chain strategy with corporate environmental strategy: A contingency approach. Int. J. Prod. Econ. 2014, 147, 220–229. [Google Scholar] [CrossRef]

- Soosay, C.; Fearne, A.; Varsei, M. Extending Sustainable Practices Beyond Organizations to Supply Chains. In Linking Local and Global Sustainability; Springer: Dordrecht, The Netherlands, 2014; pp. 71–90. [Google Scholar]

- Yang, C.S.; Lu, C.S.; Haider, J.J.; Marlow, P.B. The effect of green supply chain management on green performance and firm competitiveness in the context of container shipping in Taiwan. Transp. Res. Part E Logis. Transp. Rev. 2013, 55, 55–73. [Google Scholar] [CrossRef]

- Chandran, V.G.R.; Rasiah, R. Firm size, technological capability, exports and economic performance: The case of electronics industry in Malaysia. J. Bus. Econ. Manag. 2013, 14, 741–757. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Ramos, T.R.P.; Gomes, M.I.; Barbosa-Póvoa, A.P. Planning a sustainable reverse logistics system: Balancing costs with environmental and social concerns. Omega 2014, 48, 60–74. [Google Scholar] [CrossRef]

- Hsu, C.H.; Chang, A.Y.; Luo, W. Identifying key performance factors for sustainability development of SMEs—Integrating QFD and fuzzy MADM methods. J. Clean. Prod. 2017, 161, 629–645. [Google Scholar] [CrossRef]

- Fera, M.; Fruggiero, F.; Lambiase, A.; Macchiaroli, R.; Miranda, S. The role of uncertainty in supply chains under dynamic modeling. Int. J. Ind. Eng. Comput. 2017, 8, 119–140. [Google Scholar] [CrossRef]

- Nagel, M.H. Environmental supply-chain management versus green procurement in the scope of a business and leadership perspective. In Proceedings of the IEEE International Symposium on Electronics and the Environment, San Francisco, CA, USA, 10 May 2000; pp. 219–224. [Google Scholar]

- Gimenez, C.; Sierra, V. Sustainable supply chains: Governance mechanisms to greening suppliers. J. Bus. Ethics 2013, 116, 189–203. [Google Scholar] [CrossRef]

- Wang, J.; Yue, H. Food safety pre-warning system based on data mining for a sustainable food supply chain. Food Control. 2017, 73, 223–229. [Google Scholar] [CrossRef]

- Linton, J.D.; Klassen, R.; Jayaraman, V. Sustainable supply chains: An introduction. J. Oper. Manag. 2007, 25, 1075–1082. [Google Scholar] [CrossRef]

- Das, D. Development and validation of a scale for measuring Sustainable Supply Chain Management practices and performance. J. Clean. Prod. 2017, 164, 1344–1362. [Google Scholar] [CrossRef]

- Mefford, R.N. Offshoring, Lean Production, and a Sustainable Global Supply Chain. Eur. J. Int. Manag. 2010, 4, 303–315. [Google Scholar] [CrossRef]

- Lu, T.P.; Chang, S.N.; Chen, Y.K. Identifying and Analyzing the Critical Element Model of Sustainability Supply Chain Management. 2013. Available online: http://ir.lib.ntut.edu.tw/wSite/ct?ctNode=449&mp=ntut&xItem=50976 (accessed on 18 May 2018).

- Pourhejazy, P.; Kwon, O. The New Generation of Operations Research Methods in Supply Chain Optimization: A Review. Sustainability 2016, 8, 1033. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Environmental sustainability in the service industry of transportation and logistics service providers: Systematic literature review and research directions. Transp. Res. Part D Transp. Environ. 2017, 53, 454–470. [Google Scholar] [CrossRef]

- Sila, I.; Ebrahimpour, M.; Birkholz, C. Quality in supply chains: An empirical analysis. Supply Chain Manag. 2006, 11, 491–502. [Google Scholar] [CrossRef]

- Pagell, M.; Yang, C.L.; Krumwiede, D.W.; Sheu, C. Does the Competitive Environment Influence the Efficacy of Investments in Environmental Management? J. Supply Chain Manag. 2004, 40, 30–39. [Google Scholar] [CrossRef]

- Ramus, C.A.; Steger, U. The roles of supervisory support behaviors and environmental policy in employee “ecoinitiatives” at leading-edge European companies. Acad. Manag. J. 2000, 43, 605–626. [Google Scholar]

- Devaraj, S.; Krajewski, L.; Wei, J.C. Impact of eBusiness technologies on operational performance: The role of production information integration in the supply chain. J. Oper. Manag. 2007, 25, 1199–1216. [Google Scholar] [CrossRef]

- Hanna, M.D.; Newman, W.R.; Johnson, P. Linking operational and environmental improvement through employee involvement. Int. J. Oper. Prod. Manag. 2013, 20, 148–165. [Google Scholar] [CrossRef]

- Gopalakrishnan, K.; Yusuf, Y.Y.; Musa, A.; Abubakar, T.; Ambursa, H.M. Sustainable supply chain management: A case study of British Aerospace (BAe) Systems. Int. J. Prod. Econ. 2012, 140, 193–203. [Google Scholar] [CrossRef]

- Kaynak, H.; Hartley, J.L. A replication and extension of quality management into the supply chain. J. Oper. Manag. 2008, 26, 468–489. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K.H. Initiatives and outcomes of green supply chain management implementation by Chinese manufacturers. J. Environ. Manag. 2007, 85, 179–189. [Google Scholar] [CrossRef] [PubMed]

- Lo S, M. Effects of supply chain position on the motivation and practices of firms going green. Int. J. Oper. Prod. Manag. 2013, 34, 93–114. [Google Scholar]

- Droge, C.; Vickery, S.K.; Jacobs, M.A. Does supply chain integration mediate the relationships between product/process strategy and service performance? An empirical study. Int. J. Prod. Econ. 2012, 137, 250–262. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. Green supply chain management in China. In Proceedings of the Photonics Technologies for Robotics, Automation, and Manufacturing. International Society for Optics and Photonics, Providence, RI, USA, 27 February2004; pp. 147–154. [Google Scholar]

- Fairfield, P.M.; Whisenant, J.S.; Yohn, T.L. Accrued Earnings and Growth: Implications for Future Profitability and Market Mispricing. Account. Rev. 2003, 78, 353–371. [Google Scholar] [CrossRef]

- Huo, B.; Zhao, X.; Zhou, H. The Effects of Competitive Environment on Supply Chain Information Sharing and Performance: An Empirical Study in China. Prod. Oper. Manag. 2014, 23, 552–569. [Google Scholar] [CrossRef]

- Wong, C.W.Y.; Wong, C.Y.; Boon-Itt, S. The combined effects of internal and external supply chain integration on product innovation. Int. J. Prod. Econ. 2013, 146, 566–574. [Google Scholar] [CrossRef]

- Zailani, S. Effects of Information, Material and Financial Flows on Supply Chain Performance: A Study of Manufacturing Companies in Malaysia. Int. J. Manag. 2012, 29, 293–313. [Google Scholar]

- Barcellos, J.O.J.; Abicht, A.D.M.; Brandão, F.S.; Collares, F.C. Consumer perception of Brazilian traced beef. Rev. Bras. Zootec. 2012, 41, 771–774. [Google Scholar] [CrossRef]

- Golicic, S.L.; Smith, C.D. A Meta-Analysis of Environmentally Sustainable Supply Chain Management Practices and Firm Performance. J. Supply Chain Manag. 2013, 49, 78–95. [Google Scholar] [CrossRef]

- Minagawa, T.; Trott, P.; Hoecht, A. Counterfeit, imitation, reverse engineering and learning: Reflections from Chinese manufacturing firms. R D Manag. 2007, 37, 455–467. [Google Scholar] [CrossRef]

- Legge, J.M. The Economics of Industrial Innovation. Rev. Political Econ. 2000, 12, 249–256. [Google Scholar]

- Chung, K.H.; Wright, P.; Kedia, B. Corporate governance and market valuation of capital and R&D investments. Rev. Financ. Econ. 2003, 12, 161–172. [Google Scholar]

- Carr, A.S.; Pearson, J.N. Strategically managed buyer–supplier relationships and performance outcomes. J. Oper. Manag. 1999, 17, 497–519. [Google Scholar] [CrossRef]

- Vanpoucke, E.; Vereecke, A.; Wetzels, M. Developing supplier integration capabilities for sustainable competitive advantage: A dynamic capabilities approach. J. Oper. Manag. 2014, 32, 446–461. [Google Scholar] [CrossRef]

- Sharma, G. Do SMEs need to strategize? Bus. Strateg. 2013, 12, 186–194. [Google Scholar] [CrossRef]

- Spence, L.J. CSR and Small Business in a European Policy Context: The Five “C”s of CSR and Small Business Research Agenda 2007. Bus. Soc. Rev. 2010, 112, 533–552. [Google Scholar] [CrossRef]

- Ullah, I.; Narain, R.; Singh, A. Supply Chain Management Practices in SMEs of India: Some Managerial Lessons from Large Enterprises. Int. Res. J. Eng. Technol. 2015, 2, 1176–1196. [Google Scholar]

- Wagner, B.A.; Fillis, I.; Johansson, U. E-business and e-supply strategy in small and medium sized businesses (SMEs). Supply Chain Manag. 2003, 8, 343–354. [Google Scholar] [CrossRef]

- Fawcett, S.E.; Wallin, C.; Allred, C.; Magnan, G. Supply chain information-sharing: Benchmarking a proven path. Benchmarking 2009, 16, 222–246. [Google Scholar] [CrossRef]

- Jabbour, C.J.C. Environmental training and environmental management maturity of Brazilian companies with ISO14001: Empirical evidence. J. Clean. Prod. 2015, 96, 331–338. [Google Scholar] [CrossRef]

- Li, Y.H.; Huang, J.W. The moderating role of relational bonding in green supply chain practices and performance. J. Purch. Supply Manag. 2017, 23, 290–299. [Google Scholar] [CrossRef]

- Teixeira, A.A.; Jabbour, C.J.C.; Latan, H. Green training and green supply chain management: Evidence from Brazilian firms. J. Clean. Prod. 2016, 116, 170–176. [Google Scholar] [CrossRef]

- Busse, C.; Schleper, M.C.; Niu, M.; Wagner, S.M. Supplier development for sustainability: Contextual barriers in global supply chains. Int. J. Phys. Distrib. Logis. Manag. 2016, 46, 442–468. [Google Scholar] [CrossRef]

- Luthra, S.; Govindan, K.; Mangla, S.K. Structural model for sustainable consumption and production adoption—A grey-DEMATEL based approach. Resour. Conserv. Recycl. 2017, 125, 198–207. [Google Scholar] [CrossRef]

- Loucks, E.S.; Martens, M.L.; Cho, C.H. Engaging small and medium sized businesses in sustainability. Sustain. Account. Manag. Policy J. 2010, 1, 178–200. [Google Scholar] [CrossRef]

- Wen, H.; Tan, J. Low-Carbon Strategy with Chinese SMEs. Energy Procedia 2011, 5, 613–618. [Google Scholar]

| Firm Size | Small | Mid | Large |

|---|---|---|---|

| Number (%) | 45 (25) | 64 (36) | 69 (39) |

| SSCM | F1 | F2 |

|---|---|---|

| Salary and compensation system | 0.812 | 0.314 |

| Information technology management | 0.762 | 0.530 |

| Employee participation | 0.747 | 0.531 |

| Total quality management | 0.742 | 0.113 |

| Innovation ability | 0.715 | 0.278 |

| Ecological design | 0.701 | 0.491 |

| Sustainable development strategy | 0.663 | 0.591 |

| Share information with suppliers and distributors | 0.246 | 0.894 |

| External supervision mechanism | 0.281 | 0.891 |

| Supplier environmentally assessment | 0.308 | 0.876 |

| Product recovery | 0.361 | 0.830 |

| Green purchase | 0.569 | 0.648 |

| Product traceability | 0.585 | 0.616 |

| Eigenvalue | 7.161 | 5.930 |

| Cumulative variance | 42.122 | 77.002 |

| Variables | Mean | S.D. | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|---|

| 1.Internal SSCM practices | 18.90 | 5.08 | 0.728 | ||||

| 2.External SSCM practices | 18.66 | 7.38 | 0.102 | 0.751 | |||

| 3.Economic performance | 16.08 | 3.40 | 0.347 | −0.311 | 0.409 | ||

| 4.Environmental performance | 16.00 | 3.46 | 0.215 | 0.259 | 0.308 | 0.419 | |

| 5.Social performance | 16.40 | 3.38 | 0.221 | 0.310 | 0.318 | 0.212 | 0.413 |

| Variable | Economic Performance | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Firm age | 0.08 | 0.08 | 0.09 | 0.07 | 0.04 | −0.09 |

| Industry type | −0.07 | −0.06 | −0.05 | −0.06 | −0.04 | −0.05 |

| Internal SSCM practices | −0.11 * | −0.10 | −0.08 | −0.10 | −0.04 | |

| External SSCM practices | 0.19 ** | 0.14 * | 0.15 * | 0.17 ** | 0.17 ** | |

| Firm size | 0.22 *** | 0.19 ** | 0.17 ** | 0.18 ** | ||

| Internal SSCM practices * Small enterprises | −0.09 | |||||

| External SSCM practices * Small enterprises | 0.14 * | |||||

| Internal SSCM practices * Mid-sized enterprises | −0.06 | |||||

| External SSCM practices * Mid-sized enterprises | 0.15 ** | |||||

| Internal SSCM practices * Large enterprises | −0.13 * | |||||

| External SSCM practices * Large enterprises | 0.16 ** | |||||

| R2 | 0.01 | 0.19 | 0.25 | 0.33 | 0.29 | 0.37 |

| ΔR2 | 0.01 | 0.18 | 0.24 | 0.32 | 0.28 | 0.36 |

| F | 1.06 | 11.60 *** | 12.84 *** | 13.78 *** | 14.14 *** | 12.60 *** |

| ΔF | 1.06 | 10.54 | 11.78 | 12.72 | 13.08 | 11.54 |

| Variable | Environmental Performance | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Firm age | −0.12 | −0.01 | −0.01 | −0.02 | −0.02 | −0.02 |

| Industry type | 0.07 | −0.01 | −0.01 | −0.02 | −0.01 | −0.02 |

| Internal SSCM Practices | 0.41 ** | 0.32 ** | 0.20 ** | 0.43 ** | 0.61 *** | |

| External SSCM Practices | 0.89 *** | 0.91 *** | 1.07 *** | 0.85 *** | 0.87 *** | |

| Firm size | 0.11 ** | 0.10 ** | 0.12 ** | 0.13 ** | ||

| Internal SSCM Practices *Small enterprises | 0.24 ** | |||||

| External SSCM Practices *Small enterprises | 0.29 ** | |||||

| Internal SSCM Practices *Mid-sized enterprises | 0.39 ** | |||||

| External SSCM Practices *Mid-sized enterprises | 0.49 ** | |||||

| Internal SSCM Practices *Large enterprises | 0.76 *** | |||||

| External SSCM Practices *Large enterprises | 0.63 *** | |||||

| R2 | 0.05 | 0.86 | 0.86 | 0.88 | 0.88 | 0.89 |

| ΔR2 | 0.05 | 0.81 | 0.81 | 0.83 | 0.83 | 0.84 |

| F | 2.30 | 10.78 *** | 10.81 *** | 14.96 *** | 16.03 *** | 17.37 *** |

| ΔF | 2.30 | 8.48 | 8.51 | 12.66 | 13.73 | 15.07 |

| Variable | Social Performance | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Firm age | 0.11 | 0.06 | 0.01 | 0.04 | 0.05 | 0.04 |

| Industry type | −0.04 | −0.01 | −0.03 | −0.02 | −0.03 | −0.02 |

| Internal SSCM Practices | 0.48 *** | 0.43 *** | 0.65 *** | 0.28 *** | 0.35 *** | |

| External SSCM Practices | 0.47 *** | 0.48 *** | 0.25 *** | 0.56 *** | 0.61 *** | |

| Firm size | 0.11 ** | 0.10 ** | 0.14 *** | 0.19 *** | ||

| Internal SSCM Practices *Small enterprises | 0.41 ** | |||||

| External SSCM Practices *Small enterprises | 0.31 ** | |||||

| Internal SSCM Practices *Mid-sized enterprises | 0.43 ** | |||||

| External SSCM Practices *Mid-sized enterprises | 0.41 ** | |||||

| Internal SSCM Practices *Large enterprises | 0.66 *** | |||||

| External SSCM Practices *Large enterprises | 0.91 *** | |||||

| R2 | 0.07 | 0.83 | 0.84 | 0.87 | 0.85 | 0.86 |

| ΔR2 | 0.07 | 0.76 | 0.77 | 0.80 | 0.78 | 0.79 |

| F | 4.54 | 10.90 *** | 11.34 *** | 15.29 *** | 15.81 *** | 18.22 *** |

| ΔF | 4.54 | 6.36 | 6.80 | 10.84 | 11.27 | 13.68 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Zhang, Y.; Goh, M. Moderating the Role of Firm Size in Sustainable Performance Improvement through Sustainable Supply Chain Management. Sustainability 2018, 10, 1654. https://doi.org/10.3390/su10051654

Wang J, Zhang Y, Goh M. Moderating the Role of Firm Size in Sustainable Performance Improvement through Sustainable Supply Chain Management. Sustainability. 2018; 10(5):1654. https://doi.org/10.3390/su10051654

Chicago/Turabian StyleWang, Jing, Yuchen Zhang, and Mark Goh. 2018. "Moderating the Role of Firm Size in Sustainable Performance Improvement through Sustainable Supply Chain Management" Sustainability 10, no. 5: 1654. https://doi.org/10.3390/su10051654

APA StyleWang, J., Zhang, Y., & Goh, M. (2018). Moderating the Role of Firm Size in Sustainable Performance Improvement through Sustainable Supply Chain Management. Sustainability, 10(5), 1654. https://doi.org/10.3390/su10051654