Electricity Market Creation in China: Policy Options from Political Economics Perspective

Abstract

1. Introduction

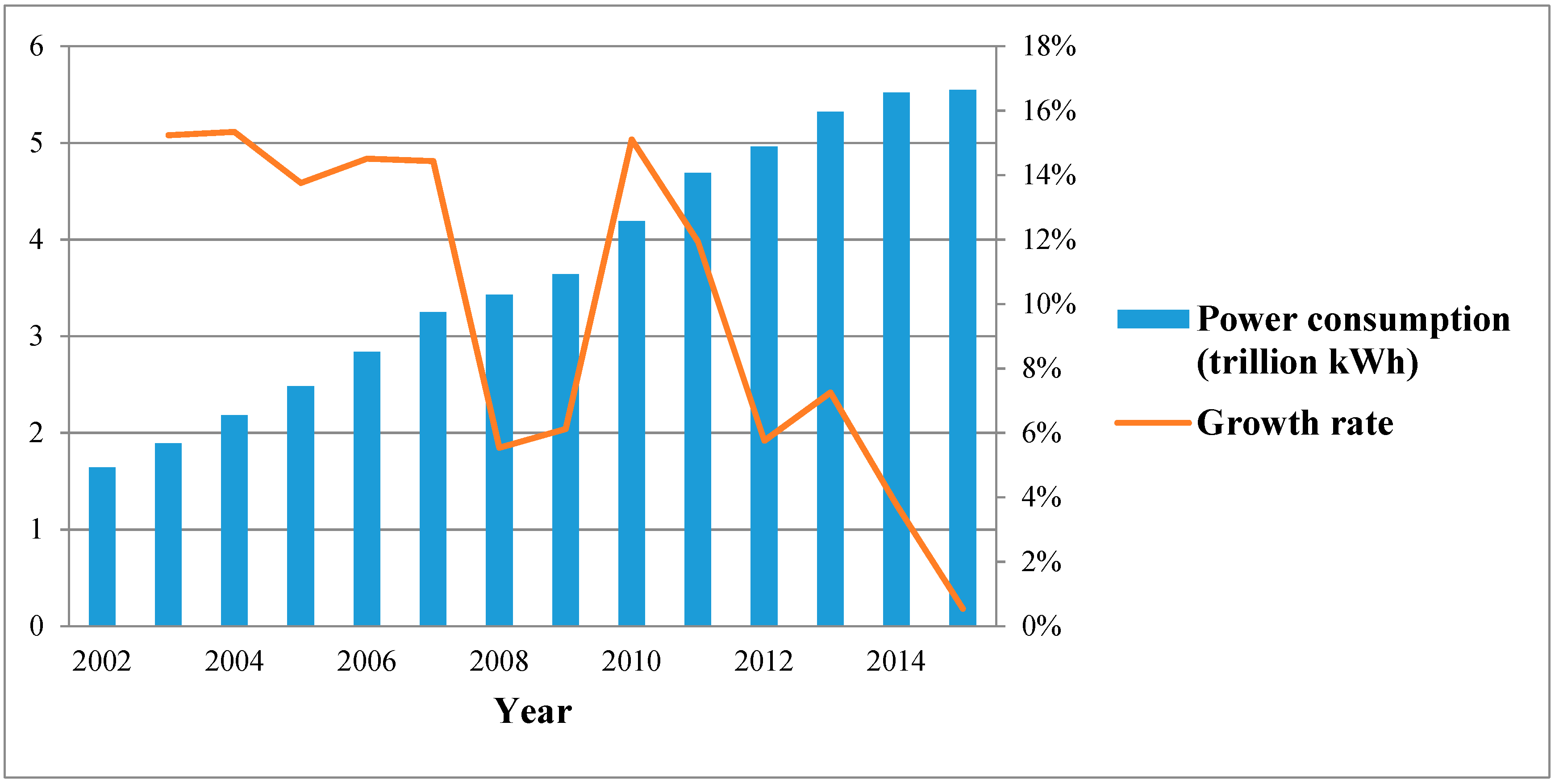

2. The Reforms of the Power Industry in China

2.1. The 2002 Reform of the Power Industry in China

2.2. The Second-Round Reform of the Power Industry in China

3. Market Structure of the 2015 Reform

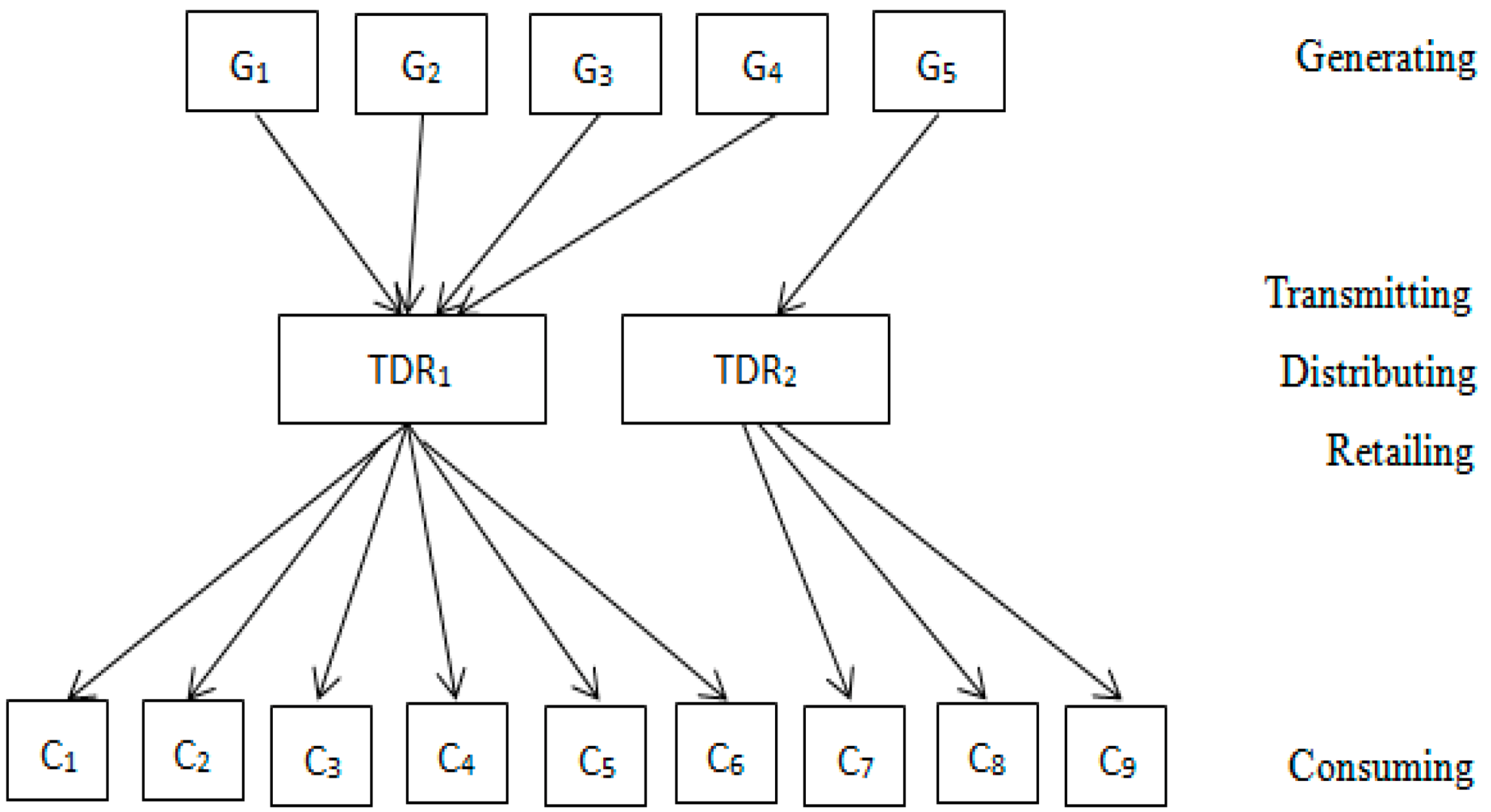

3.1. Schema 1: Integration of Generation and Retail Services while Integrating Transmission and Distribution

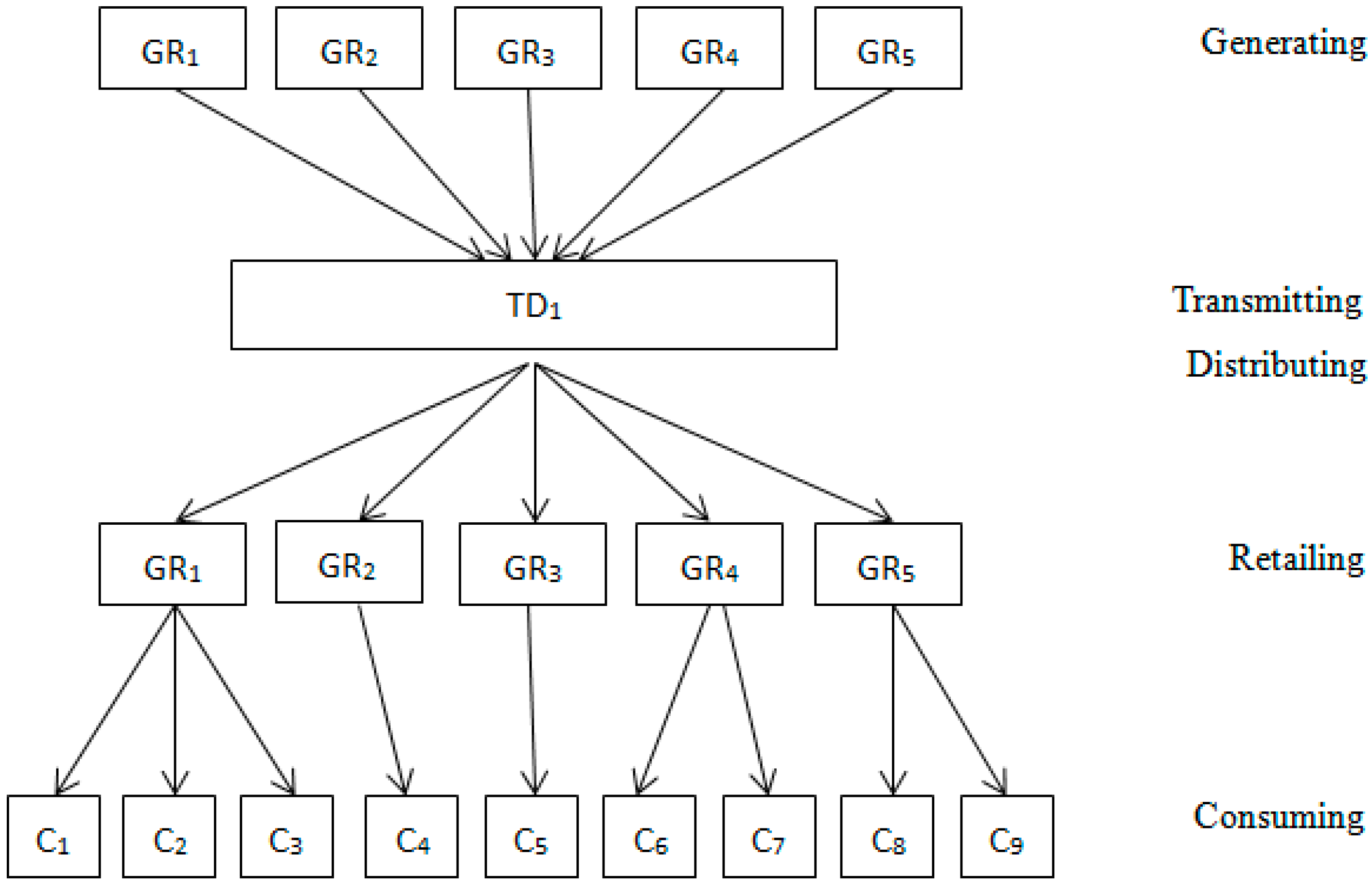

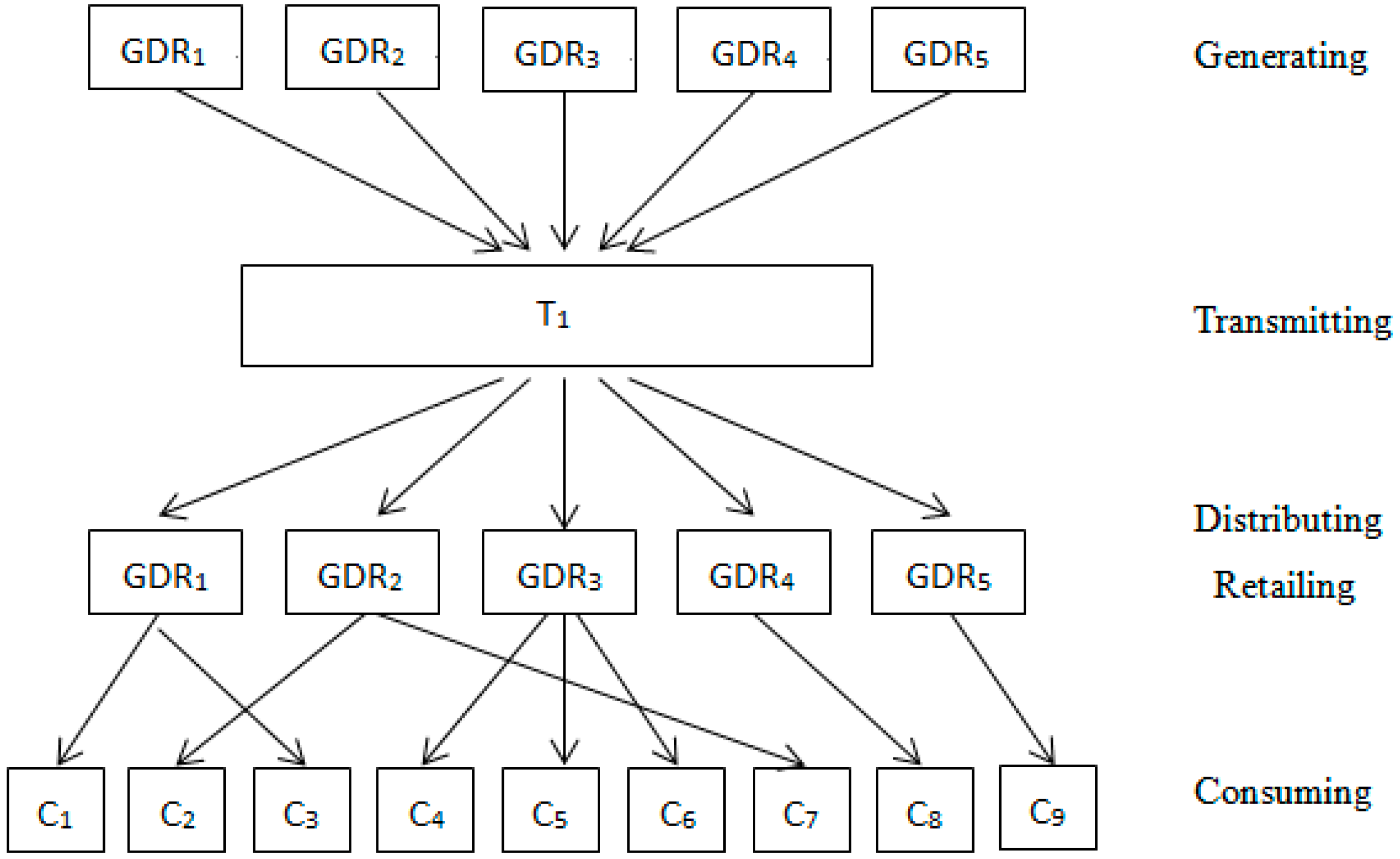

3.2. Schema 2: Integration of Generation, Distribution and Retail Services while Independent of Transmission

4. Pricing Mechanisms

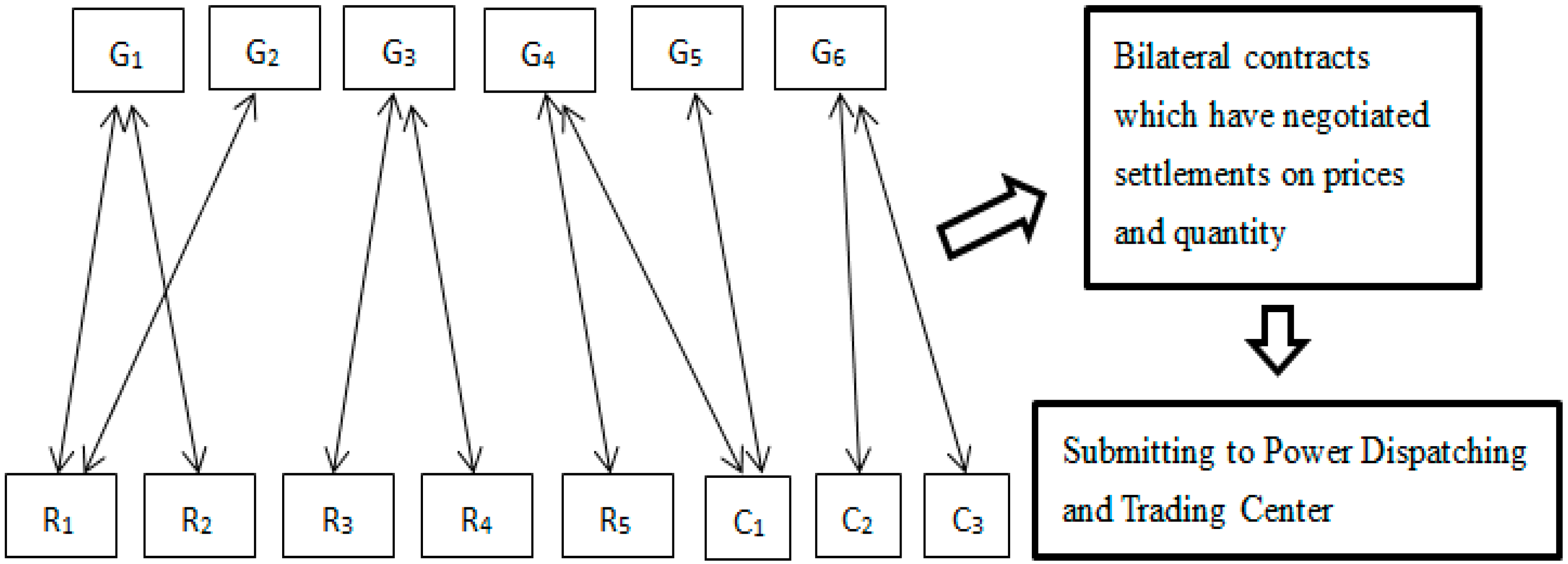

4.1. Pricing Mechanism 1: Bilateral Contracts

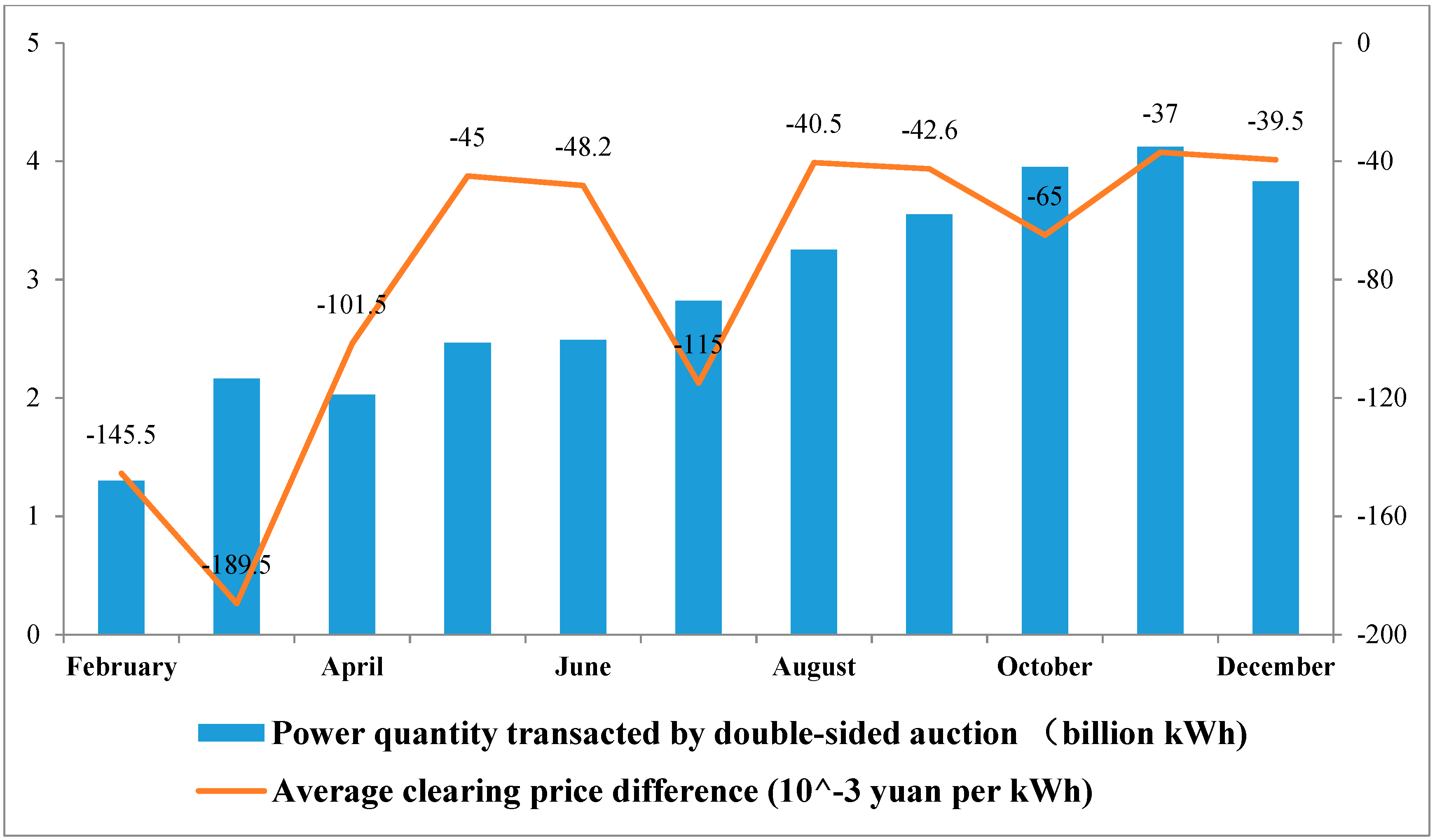

4.2. Pricing Mechanism 2: Double-Sided Auctions

5. Further Discussion

5.1. The Role of Two State-Owned Grid Companies

5.2. The Promotion of Renewable Energy Utilization

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Khalid, S.; Al-Olimat, K.S.; Srivastava, A.K.; Patel, D.; Sankar, S. Electricity markets: An overview and comparative study. Int. J. Energy Sect. Manag. 2011, 5, 169–200. [Google Scholar]

- Nagayama, H.; Kashiwagi, T. Evaluating electricity sector reforms in Argentina: Lessons for developing countries? J. Clean. Prod. 2007, 15, 115–130. [Google Scholar] [CrossRef]

- Ma, C.; He, L. From state monopoly to renewable portfolio: Restructuring China’s electric utility. Energy Policy 2008, 36, 1697–1711. [Google Scholar] [CrossRef]

- Xu, S.; Chen, W. The reform of electricity power sector in the PR of China. Energy Policy 2006, 34, 2455–2465. [Google Scholar] [CrossRef]

- Zhang, S.; Jiao, Y.; Chen, W. Demand-side management (DSM) in the context of China’s on-going power sector reform. Energy Policy 2017, 100, 1–8. [Google Scholar] [CrossRef]

- Min, L.I.; Wang, H. A Brief Analysis of the Electric Power Reform at Home and Abroad. Power Syst. Clean Energy 2017, 8, 44–48. [Google Scholar]

- Quiggin, J. Market-oriented reform in the Australian electricity industry. Econ. Labour Relat. Rev. 2001, 12, 126–150. [Google Scholar] [CrossRef][Green Version]

- Hoven, A.V.D.; Froschauer, K. Limiting regional electricity sector integration and market reform: The cases of France in the EU and Canada in the NAFTA region. Comp. Political Stud. 2004, 37, 1079–1103. [Google Scholar] [CrossRef]

- Ouyang, X.; Sun, C. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2014, 48, 117–126. [Google Scholar] [CrossRef]

- Zhao, X.; Ma, C. Deregulation, vertical unbundling and the performance of China’s large coal-fired power plants. Energy Econ. 2013, 40, 474–483. [Google Scholar] [CrossRef]

- Ming, Z.; Song, X.; Li, L.; Wang, Y.; Yang, W.; Ying, L. China’s large-scale power shortages of 2004 and 2011 after the electricity market reforms of 2002: Explanations and differences. Energy Policy 2013, 61, 610–618. [Google Scholar] [CrossRef]

- Qiang, W.; Qiu, H.N.; Kuang, Y. Market-driven energy pricing necessary to ensure China’s power supply. Energy Policy 2009, 37, 2498–2504. [Google Scholar]

- Wang, B. An imbalanced development of coal and electricity industries in China. Energy Policy 2007, 35, 4959–4968. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, X. China’s electricity market-oriented reform: From an absolute to a relative monopoly. Energy Policy 2012, 51, 143–148. [Google Scholar] [CrossRef]

- Peng, W. Coal sector reform and its implications for the power sector in China. Resour. Policy 2011, 36, 60–71. [Google Scholar] [CrossRef]

- Victor, D.; Heller, T. The Political Economy of Power Sector Reform; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Zang, C. Reform of the Chinese Electric Power Market: Economics and Institutions. Working Papers. 2006. Available online: https://www.researchgate.net/publication/23778377_Reform_of_the_Chinese_Electric_Power_Market_Economics_and_Institutions (accessed on 1 May 2018).

- Lin, B.; Liu, X. Electricity tariff reform and rebound effect of residential electricity consumption in China. Energy 2013, 59, 240–247. [Google Scholar] [CrossRef]

- Sun, C.; Lin, B. Reforming residential electricity tariff in China: Block tariffs pricing approach. Energy Policy 2013, 60, 741–752. [Google Scholar] [CrossRef]

- Zeng, M.; Yang, Y.; Wang, L.; Sun, J. The power industry reform in China 2015: Policies, evaluations and solutions. Renew. Sustain. Energy Rev. 2016, 57, 94–110. [Google Scholar] [CrossRef]

- Ding, N.; Duan, J.; Xue, S.; Zeng, M.; Shen, J. Overall review of peaking power in China: Status quo, barriers and solutions. Renew. Sustain. Energy Rev. 2015, 42, 503–516. [Google Scholar] [CrossRef]

- Liu, M.; Margaritis, D.; Zhang, Y. Market-driven coal prices and state-administered electricity prices in China. Energy Econ. 2013, 40, 167–175. [Google Scholar] [CrossRef]

- Goto, M.; Sueyoshi, T. Electric power market reform in Japan after Fukushima Daiichi nuclear plant disaster: Issues and future direction. Int. J. Energy Sect. Manag. 2015, 9, 336–360. [Google Scholar] [CrossRef]

- Woo, C.K.; Lloyd, D.; Tishler, A. Electricity market reform failures: UK, Norway, Alberta and California. Energy Policy 2003, 31, 1103–1115. [Google Scholar] [CrossRef]

- Totare, N.P.; Pandit, S. Power sector reform in Maharashtra, India. Energy Policy 2010, 38, 7082–7092. [Google Scholar] [CrossRef]

- Filippini, M.; Wetzel, H. The impact of ownership unbundling on cost efficiency: Empirical evidence from the New Zealand electricity distribution sector. Energy Econ. 2014, 45, 412–418. [Google Scholar] [CrossRef]

- Lucas, A.R. Impact of Privatisation and Deregulation of Energy Industries on Canadian Environmental Law and Policy. J. Energy Nat. Resour. Law 2015, 14, 68–75. [Google Scholar] [CrossRef]

- Han, B.; Li, X.L.; Yan, J.H.; Cui, H.; Luo, Z.Q. Research on the Model of Long Term Generation Planning in Power Market Reform. Energy Power Eng. 2017, 9, 525–534. [Google Scholar] [CrossRef]

- Li, Y.Y.; Huang, Y.S.; Chen, J. Research on the Marketing System of Electric Power Company under the Electric Power System Reform. In Proceedings of the International Conference on Economics, Management Engineering and Education Technology, Singapore, 9–11 July 2017. [Google Scholar]

- Prabavathi, M.; Gnanadass, R. Energy bidding strategies for restructured electricity market. Int. J. Electr. Power Energy Syst. 2015, 64, 956–966. [Google Scholar] [CrossRef]

- Wolfram, C.D. Electricity Markets: Should the Rest of the World Adopt the United Kingdom’s Reforms? Regulation 1999, 22, 48–53. [Google Scholar]

- Fang, D.; Wu, J.; Tang, D. A double auction model for competitive generators and large consumers considering power transmission cost. Int. J. Electr. Power Energy Syst. 2012, 43, 880–888. [Google Scholar] [CrossRef]

- Zou, X. Double-sided auction mechanism design in electricity based on maximizing social welfare. Energy Policy 2009, 37, 4231–4239. [Google Scholar] [CrossRef]

- Green, R. Market power mitigation in the UK power market. Utilities Policy 2006, 14, 76–89. [Google Scholar] [CrossRef]

- Thomas, S. The British model in Britain: Failing slowly. Energy Policy 2006, 34, 583–600. [Google Scholar] [CrossRef]

- Faqiry, M.N.; Das, S. Double-Sided Energy Auction in Microgrid: Equilibrium Under Price Anticipation. IEEE Access 2017, 4, 3794–3805. [Google Scholar] [CrossRef]

- Kian, A.R.; Cruz, J.B.; Thomas, R.J. Bidding strategies in oligopolistic dynamic electricity double-sided auctions. IEEE Trans. Power Syst. 2005, 20, 50–58. [Google Scholar] [CrossRef]

- Clements, A.E.; Hurn, A.S.; Li, Z. Strategic Bidding and Rebidding in Electricity Markets. Energy Econ. 2016, 59, 24–36. [Google Scholar] [CrossRef]

- Li, P.; Li, Q.; Wang, L.; Guo, Y.; Kong, X.; Han, D.; Yan, Z.; Song, Y. A stress testing analysis on China’s power market in the future under the new power reform policy. In Proceedings of the 2015 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Brisbane, QLD, Australia, 15–18 November 2016; pp. 1–5. [Google Scholar]

- Zhou, K.; Yang, S. Demand side management in China: The context of China’s power industry reform. Renew. Sustain. Energy Rev. 2015, 47, 954–965. [Google Scholar] [CrossRef]

| Components | Price Maker | Fee Collector |

|---|---|---|

| The transaction price | Decided by the negotiation between generators and large users or between generators and retailers. | Earned by generators. |

| The transmission and distribution price | Dominated by National Development and Reform Commission (NDRC). | Earned by grid companies. |

| The government funds | Dominated by NDRC. | Earned by the government. |

| The electricity price | Sum up the transaction price, the transmission and distribution price, and the government funds. | Paid by large users or consumers. |

| Schema | Representative Country |

|---|---|

| Integration of distribution, transmission, distribution, and retail services | Japan [23], France [8] |

| Integration of generation, distribution and retail services while independent of transmission | UK [24] |

| Integration of distribution and retail services while independent of generation and transmission | India [25], Brazil [2] |

| Integration of generation and retail services while independent of distribution and transmission | New Zealand [26] |

| Integration of transmission and distribution while independent of generation and retail services | Canada [27] |

| Integration of generation and retail while integrating distribution and transmission | Australia [7] |

| Schemas | Advantages | Disadvantages |

|---|---|---|

| Schema 1 Integration of generation and retail services while integrating transmission and distribution. | GR firms can be substantially beneficial due to their advantages in competition. | The distribution section is not open to the private capitals. |

| Customers can gain benefits from the reduction in the electricity price due to the competitive pricing mechanism. | The private capitals without generation assets are difficult to enter into the power exchange market. | |

| The transmission and distribution price become more reasonable and more transparent. | The management and supervision costs are high as the integrating firms should account the business of each section separately. | |

| Schema 2 Integration of generation, distribution and retail services while independent of transmission. | It is able to reduce the protest form grid companies against the reform as they are allowed to enter the retail market. | It is highly likely to create monopolization by the super power companies of integrating generation, distribution and retail services. |

| The distribution efficiency can be improved as the distribution section is open to private capitals. | The costs of separating the distribution section from the transmission section are high. | |

| The form of GDR firms can prevent the power market from excessive competition. | Coordination of the grid planning under this schema is challenging and expensive. |

| Pricing Mechanisms | Advantages | Disadvantages |

|---|---|---|

| Bilateral contracts | 1. The transaction price is generated by bilateral negotiation, which can reflect the relationship between supply and demand. | 1. The deals are determined by the long-term confidential contracts, which are not transparent enough. |

| 2. Bilateral contracts can prevent the electricity price from fluctuating violently as long-term contracts can stabilize the market risk. | 2. The existing integrating firms are so powerful in the market that new generation enterprises and new retail firms find it difficult to participate in the power exchange. | |

| 3. Costs for management and supervision of the power exchange market are high. | ||

| Double-sided auctions | 1. The transaction price is generated from the direct trading by both sides, which can reflect the relationship between supply and demand. | 1. Management and supervision of the transactions by double-sided auctions are difficult and expensive, as different provinces have diverse bidding rules. |

| 2. Retailers have the competitive advantages of their professional skills and auction strategies. | 2. The electricity price may fluctuate violently, and the market is risky as the price reacts sensitively to the market. | |

| 3. Large users without professional bidding strategies are in an unfavorable situation of the power exchange market. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lei, N.; Chen, L.; Sun, C.; Tao, Y. Electricity Market Creation in China: Policy Options from Political Economics Perspective. Sustainability 2018, 10, 1481. https://doi.org/10.3390/su10051481

Lei N, Chen L, Sun C, Tao Y. Electricity Market Creation in China: Policy Options from Political Economics Perspective. Sustainability. 2018; 10(5):1481. https://doi.org/10.3390/su10051481

Chicago/Turabian StyleLei, Ni, Lanyun Chen, Chuanwang Sun, and Yuan Tao. 2018. "Electricity Market Creation in China: Policy Options from Political Economics Perspective" Sustainability 10, no. 5: 1481. https://doi.org/10.3390/su10051481

APA StyleLei, N., Chen, L., Sun, C., & Tao, Y. (2018). Electricity Market Creation in China: Policy Options from Political Economics Perspective. Sustainability, 10(5), 1481. https://doi.org/10.3390/su10051481