Quantifying and Monetizing Renewable Energy Resiliency

Abstract

1. Introduction

2. Materials and Methods

2.1. Estimating the Value of Resiliency from REHS

- p = probability of survival;

- Nsurvived = number of simulated outages that the REHS or diesel generator can meet the critical load; and

- Nsimulated = total number of outages simulated for the given outage duration bin.

- REcoinc = kWh/day of RE generated coincident with demand;

- REnon-coinc = kWh/day of RE generated not coincident with demand; and

- SkWh = kWh size of storage (assuming storage inverter (kW) is ≥critical load).

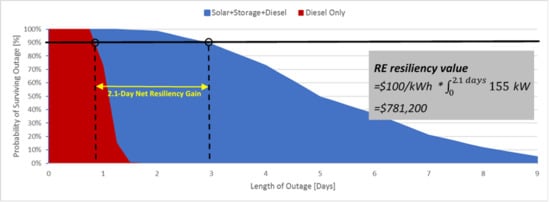

2.2. Monetizing the Value of Resiliency

3. Results

3.1. Value of Resiliency

3.2. Monetization of Resiliency

4. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Olinsky-Paul, T. Solar + Energy Storage = Resilient Power in Vermont. Available online: https://www.cleanegroup.org/solar-energy-storage-resilient-power-in-vermont/ (accessed on 18 February 2018).

- Smith, A.B.; Katz, R.W. US billion-dollar weather and climate disasters: Data sources, trends, accuracy and biases. Nat. Hazards 2013, 67, 387–410. [Google Scholar] [CrossRef]

- Gibbs, L.I.; Holloway, C.F. Hurricane Sandy after Action Report and Recommendations. 2013. Available online: http://www.nyc.gov/html/recovery/downloads/pdf/sandy_aar_5.2.13.pdf (accessed on 18 February 2018).

- Ornstien, C. Why Do Hospital Generators Keep Failing?—ProPublica (WWW Document). 31 October 2012. Available online: https://www.propublica.org/article/why-do-hospitals-generators-keep-failing (accessed on 19 February 2018).

- Electric Service Reliability Reports (WWW Document). 3 October 2017. Available online: http://www3.dps.ny.gov/W/PSCWeb.nsf/All/D82A200687D96D3985257687006F39CA?OpenDocument (accessed on 19 February 2018).

- Office of Inspector General, Department of Homeland Security. FEMA Has No Assurance that Only Designated Recipients Received $6.37 Million in Fuel. 2 November 2015. Available online: https://www.oig.dhs.gov/assets/GrantReports/2016/OIG-16-04-D-Nov15.pdf (accessed on 18 February 2018).

- Mureddu, M.; Damiano, A. A statistical approach for resilience analysis of ESS deployment in RES-based power systems. In Proceedings of the 2017 IEEE 26th International Symposium on Industrial Electronics (ISIE), Edinburgh, UK, 19–21 June 2017; pp. 2069–2074. [Google Scholar]

- Valentine, S.V. Emerging symbiosis: Renewable energy and energy security. Renew. Sustain. Energy Rev. 2011, 15, 4572–4578. [Google Scholar] [CrossRef]

- Esteban, M.; Portugal-Pereira, J. Post-disaster resilience of a 100% renewable energy system in Japan. Energy 2014, 68, 756–764. [Google Scholar] [CrossRef]

- Cox, S.L.; Hotchkiss, E.L.; Bilello, D.E.; Watson, A.C.; Holm, A. Bridging Climate Change Resilience and Mitigation in the Electricity Sector Through Renewable Energy and Energy Efficiency: Emerging Climate Change and Development Topics for Energy Sector Transformation; No. NREL/TP-6A20-67040; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2017. [Google Scholar]

- Qazi, S.; Young, W. Disaster relief management and resilience using photovoltaic energy. In Proceedings of the 2014 International Conference on Collaboration Technologies and Systems (CTS), Minneapolis, MN, USA, 19–23 May 2014; pp. 628–632. [Google Scholar]

- National Academies of Sciences, Engineering, and Medicine. Enhancing the Resilience of the Nation's Electricity System; The National Academies Press: Washington, DC, USA, 2017. [Google Scholar]

- McGranaghan, M.; Clearczyk, M.; Gellings, C. Enhancing Distribution Resiliency—Opportunities for Applying Innovative Technologies; EPRI: Palo Alto, CA, USA, 2013. [Google Scholar]

- The Integrated Grid. A Benefit-Cost Framework; EPRI: Palo Alto, CA, USA, 2015. [Google Scholar]

- Kintner-Meyer, M.C.W.; Homer, J.S.; Balducci, P.J.; Weimar, M.R. Valuation of Electric Power System Services and Technologies; No. PNNL-25633; Pacific Northwest National Lab. (PNNL): Richland, WA, USA, 2017. [Google Scholar]

- Vugrin, E.D.; Castillo, A.R.; Silva-Monroy, C.A. Resilience Metrics for the Electric Power System: A Performance-Based Approach; No. SAND-2017-1493; Sandia National Lab. (SNL-NM): Albuquerque, NM, USA, 2017. [Google Scholar]

- Anderson, K.; Burman, K.; Simpkins, T.; Helson, E.; Lisell, L.; Case, T. New York Solar Smart DG Hub-Resilient Solar Project: Economic and Resiliency Impact of PV and Storage on New York Critical Infrastructure; No. NREL/TP-7A40-66617; National Renewable Energy Laboratory: Golden, CO, USA, 2016. [Google Scholar]

- Marqusee, J.; Schultz, C.; Robyn, D. Power Begins at Home: Assured Energy for US Military Bases; Noblis: Reston, VA, USA, 2017. [Google Scholar]

- Judson, N.; Pina, A.L.; Dydek, E.V.; Van Broekhoven, S.B.; Castillo, A.S. Application of a Resilience Framework to Military Installations: A Methodology for Energy Resilience Business Case Decisions; Massachusetts Institute of Technology Lincoln Laboratory: Lexington, MA, USA, 2016. [Google Scholar]

- Roege, P.E.; Collier, Z.A.; Mancillas, J.; McDonagh, J.; Linkov, I. Metrics for energy resilience. Energy Policy 2014, 72, 249–256. [Google Scholar] [CrossRef]

- Willis, H.H.; Loa, K. Measuring the Resilience of Energy Distribution Systems; RAND Corporation: Santa Monica, CA, USA, 2015. [Google Scholar]

- Grid Modernization: Metrics Analysis (GMLC1.1); Reference Document Version 2.1; Grid Modernization Laboratory Consortium, U.S. Department of Energy: Washington DC, USA, 2017.

- Keogh, M.; Cody, C.; NARUC Grants & Research. Resilience in Regulated Utilities. NARUC, 2013. Available online: https://pubs.naruc.org/pub/536F07E4-2354-D714-5153-7A80198A436D (accessed on 20 March 2018).

- Climate Change and the Electricity Sector: Guide for Climate Change Resiliency Planning, September 2016, U.S. Department of Energy, Office of Energy Policy and Systems Analysis. Available online: https://www.energy.gov/sites/prod/files/2016/10/f33/Climate%20Change%20and%20the%20Electricity%20Sector%20Guide%20for%20Climate%20Change%20Resilience%20Planning%20September%202016_0.pdf (accessed on 20 March 2018).

- Rieger, C. Resilient Control Systems: Practical Metrics Basis for Defining Mission Impact. In Proceedings of the 2014 7th International Symposium on Resilient Control Systems, Denver, CO, USA, 19–21 August 2014. [Google Scholar]

- Industrial Economics, Inc. Assessing the Benefits and Costs of Developing a Microgrid: Model User’s Guide; Industrial Economics, Inc.: Cambridge, MA, USA, 2015. [Google Scholar]

- Stadler, M.; Cardoso, G.; Mashayekh, S.; Forget, T.; DeForest, N.; Agarwal, A.; Schönbein, A. Value streams in microgrids: A literature review. Appl. Energy 2016, 162, 980–989. [Google Scholar] [CrossRef]

- Shivakumar, A.; Welsch, M.; Taliotis, C.; Jakšić, D.; Baričević, T.; Howells, M.; Gupta, S.; Rogner, H. Valuing blackouts and lost leisure: Estimating electricity interruption costs for households across the European Union. Energy Res. Soc. Sci. 2017, 34, 39–48. [Google Scholar] [CrossRef]

- Schroeder, T.; Kuckshinrichs, W. Value of Lost Load: An Efficient Economic Indicator for Power Supply Security? A Literature Review. Front. Energy Res. 2015. [Google Scholar] [CrossRef]

- Coll-Mayor, D.; Pardo, J.; Perez-Donsion, M. Methodology based on the value of lost load for evaluating economical losses due to disturbances in the power quality. Energy Policy 2012, 50, 407–418. [Google Scholar] [CrossRef]

- De Nooij, M.; Koopans, C.; Bijvot, C. The value of supply security: The costs of power interruptions: Economic input for damage reduction and investment in networks. Energy Econ. 2007, 29, 277–295. [Google Scholar] [CrossRef]

- Ghajar, R.; Billinton, R. Economic costs of power interruptions: A consistent model and methodology. Int. J. Electr. Power Energy Syst. 2006, 28, 29–35. [Google Scholar] [CrossRef]

- Kariuki, K.K.; Allan, R.N. Evaluation of reliability worth and value of lost load. Gener. Transm. Distrib. 1996, 143, 171–180. [Google Scholar] [CrossRef]

- Bustos, C.; Watts, D. Novel methodology for microgrids in isolated communities: Electricity cost-coverage trade-off with 3-stage technology mix, dispatch & configuration optimizations. Appl. Energy 2017, 195, 204–221. [Google Scholar]

- Ratha, A.; Iggland, E.; Andersson, G. Value of Lost Load: How much is supply security worth? In Proceedings of the 2013 IEEE Power & Energy Society General, Vancouver, BC, Canada, 21–25 July 2013; pp. 1–5. [Google Scholar]

- Sullivan, M.J.; Schellenberg, J.A.; Blundell, M. Updated Value of Service Reliability Estimates for Electric Utility Customers in the United States; LBNL-6941E; Berkeley Lab: Berkeley, CA, USA, 2015. [Google Scholar]

- Con Edison. Con Edison “Virtual Power Plant” Program Combines Solar and Storage to Improve Grid Resiliency. Available online: https://www.coned.com/en/about-con-edison/media/news/20160613/virtual-power-plant (accessed on 20 March 2018).

- TESLA Powerwall 2. Available online: http://products.greenmountainpower.com/product/tesla-powerwall/ (accessed on 19 February 2018).

- Spencer, S. Out of the Dark. Available online: http://www3.ambest.com/ambv/bestnews/articlecontent.aspx?pc=1009&AltSrc=108&refnum=208627 (accessed on 20 March 2018).

- Spencer, S. Personal Communication; City University of New York: New York, NY, USA, 2012. [Google Scholar]

- Cutler, D.; Olis, D.; Elgqvist, E.; Li, X.; Laws, N.; DiOrio, N.; Walker, A.; Anderson, K. REopt: A Platform for Energy System Integration and Optimization; No. NREL/TP-7A40-70022; National Renewable Energy Laboratory: Golden, CO, USA, 2017. [Google Scholar]

- Hand, M.; Augustine, C.; Feldman, D.; Kurup, P.; Beiter, P.; O’Connor, P. 2017 Annual Technology Baseline (ATB): Cost and Performance Data for Electricity Generation Technologies; National Renewable Energy Laboratory: Golden, CO, USA, 2017. [Google Scholar]

- Lavappa, P.D.; Kneifel, J.D.; O’Rear, E.G. Energy Price Indices and Discount Factors for Life-Cycle Cost Analysis—2017; NIST Interagency/Internal Report (NISTIR) 85-3273-32; National Institute of Standards and Technology: Gaithersburg, MD, USA, 2017. [Google Scholar]

- Webley, K. Hurricane Sandy by the Numbers: A Superstorm’s Statistics, One Month Later. TIME.com. 26 November 2012. Available online: http://nation.time.com/2012/11/26/hurricane-sandy-one-month-later/ (accessed on 19 February 2018).

- Property Valuation and Assessment Data (Condensed Assessed Value Roll). Available online: https://data.cityofnewyork.us/Housing-Development/Property-Valuation-and-Assessment-Data/rgy2-tti8 (accessed on 19 February 2018).

- Lisell, L.; Anderson, K.; Laws, N.; Marr, S.; Lohman, D.; Li, X.; Jimenez, T.; Cutler, D.; Case, T. Quantifying and Monetizing Renewable Energy Resiliency; National Renewable Energy Laboratory: Golden, CO, USA, 2018. [Google Scholar]

- LaCommare, K.H.; Eto, J.H. Understanding the Cost of Power Interruptions to U.S. Electricity Consumers; No. LBNL-55718; Ernest Orlando Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2004. [Google Scholar]

- Manhattan Home Prices & Values. Zillow Home Value Index. Available online: https://www.zillow.com/manhattan-new-york-ny/home-values/ (accessed on 20 March 2018).

- Deru, M.; Field, K.; Studer, D.; Benne, K.; Griffith, B.; Torcellini, P.; Liu, B.; Halverson, M.; Winiarski, D.; Rosenberg, M.; et al. U.S. Department of Energy Commercial Reference Building Models of the National Building Stock; No. NREL/TP-5500-46861; National Renewable Energy Laboratory: Golden, CO, USA, 2011. [Google Scholar]

- Hall, T.M.; Sobel, A.H. On the impact angle of Hurricane Sandy’s New Jersey landfall. Geophys. Res. Lett. 2013. [Google Scholar] [CrossRef]

- Allianz Global Corporate & Specialty. Business Interruption Claims on the Rise: Allianz. 2015. Available online: https://www.insurancejournal.com/news/international/2015/12/10/391437.htm (accessed on 19 February 2018).

- Munich RE. Natural Catastrophe Losses at Their Highest for Four Years. Available online: https://www.munichre.com/en/media-relations/publications/press-releases/2017/2017-01-04-press-release/index.html (accessed on 19 February 2018).

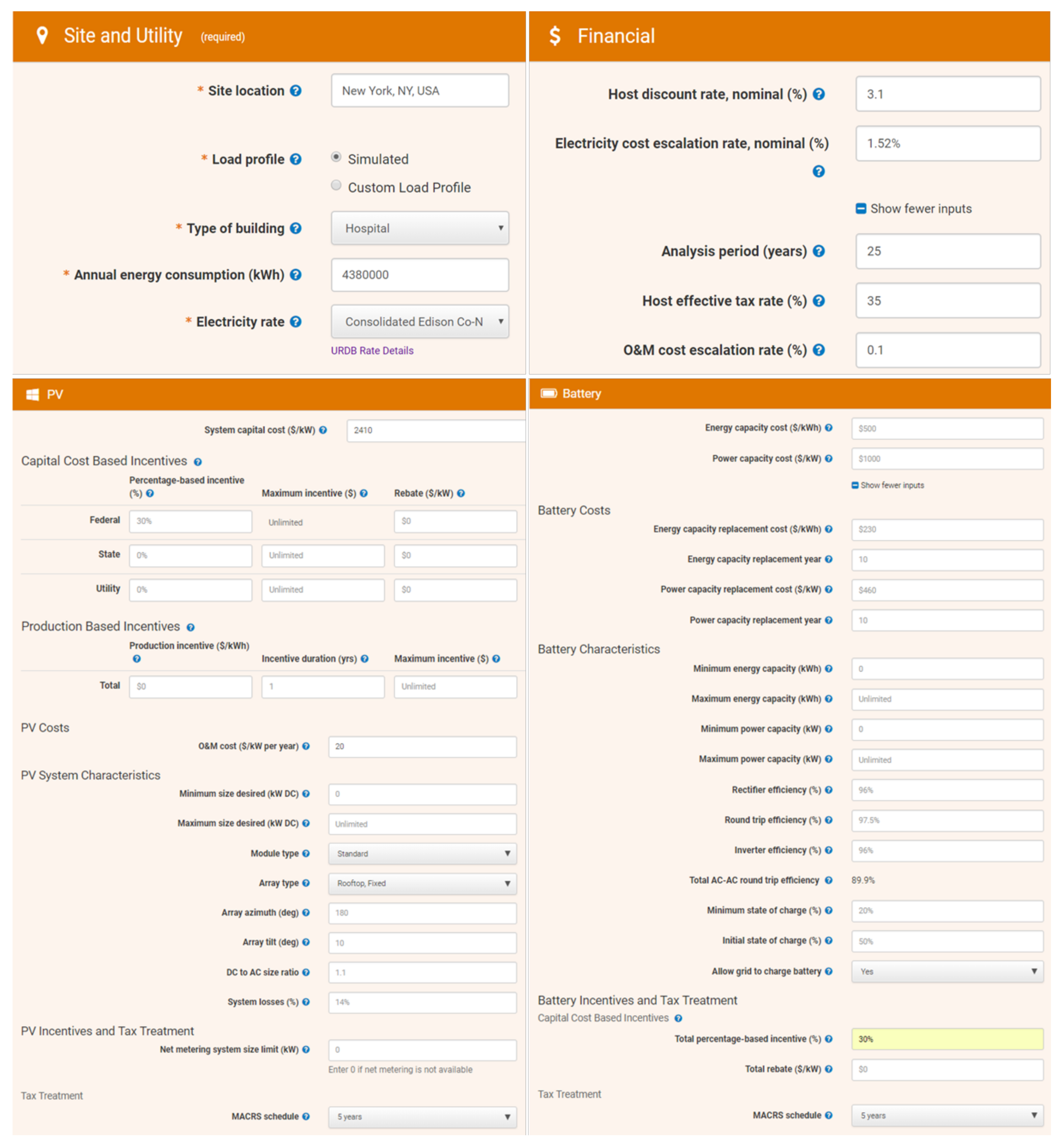

| Item | Value |

|---|---|

| PV installed cost | $2.41/W |

| PV O&M cost | $20/kW/year |

| Battery cost | $1000/kW, $500/kWh |

| Battery replacement cost (year 10) | $460/kW, $230/kWh |

| Discount rate | 3.1% |

| Inflation rate | 0.1% |

| Electricity escalation rate | 1.52% |

| Tax rate | 35% |

| Investment Tax Credit | 30% |

| Depreciation schedule | 5 Yr. MACRS |

| Model Input | System Performance Requirements | |

|---|---|---|

| BI Reduction Levels (%) | Critical Load Supported (%) | Hours of Load Supported |

| 10% | 20% | 4 days (96 h) |

| 25% | 30% | 4 days (96 h) |

| 50% | 50% | 5 days (120 h) |

| 95% | 90% | 8 days (192 h) |

| Simulation Case | Economic Impact (Current Conditions) | Economic Impact (Sea Level Rise) | ||

|---|---|---|---|---|

| BI Reduction Levels (%) | Percent of Revenue from Premium Reduction (%) | Percent of System Capital Cost Offset with BI Premium Reduction (%) | Percent of Revenue from Premium Reduction (%) | Percent of System Capital Cost Offset with BI Premium Reduction (%) |

| Baseline | 0 | 0 | 0 | 0 |

| 10% | 6.7% | 0.5% | 9.2% | 0.7% |

| 25% | 6.7% | 1.3% | 9.1% | 1.7% |

| 50% | 6.7% | 2.3% | 9.2% | 3.1% |

| 95% | 5.8% | 3.2% | 8.0% | 4.4% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anderson, K.; Laws, N.D.; Marr, S.; Lisell, L.; Jimenez, T.; Case, T.; Li, X.; Lohmann, D.; Cutler, D. Quantifying and Monetizing Renewable Energy Resiliency. Sustainability 2018, 10, 933. https://doi.org/10.3390/su10040933

Anderson K, Laws ND, Marr S, Lisell L, Jimenez T, Case T, Li X, Lohmann D, Cutler D. Quantifying and Monetizing Renewable Energy Resiliency. Sustainability. 2018; 10(4):933. https://doi.org/10.3390/su10040933

Chicago/Turabian StyleAnderson, Kate, Nicholas D. Laws, Spencer Marr, Lars Lisell, Tony Jimenez, Tria Case, Xiangkun Li, Dag Lohmann, and Dylan Cutler. 2018. "Quantifying and Monetizing Renewable Energy Resiliency" Sustainability 10, no. 4: 933. https://doi.org/10.3390/su10040933

APA StyleAnderson, K., Laws, N. D., Marr, S., Lisell, L., Jimenez, T., Case, T., Li, X., Lohmann, D., & Cutler, D. (2018). Quantifying and Monetizing Renewable Energy Resiliency. Sustainability, 10(4), 933. https://doi.org/10.3390/su10040933