1. Introduction

Crowdfunding resale, which refers to market sale of crowdfunding products/services after the campaign is successfully achieved and backers are rewarded, can help creators to tap an uncovered market, thus reaping potential profits and obtaining uninterrupted financial support. Moreover, as crowdfunding is now becoming a critical financing source for clean-tech enterprise development, represented by the high proportion of clean-tech campaigns (7.4% on Indiegogo during 2011–2013) [

1], crowdfunding resale can enhance the sustainability of clean-tech business after the success of a crowdfunding campaign, thereby providing effective support for sustainable development. With its prominent advantages in facilitating sustainable development, crowdfunding resale has continuously attracted attention from practitioners, represented by leading platforms’ proposing and advocating resale services. Indiegogo introduced “InDemand,” with the pilot program generating millions of dollars for dozens of participants in just 10 weeks [

2]; “Resale of the Supremes,” initiated by Suning.com, also garnered critical financial support for 61 creators [

3].

As the subsequent activity of crowdfunding, resale is subject to previously funded resources and can have a significant impact on creators’ strategies in the crowdfunding stage. On the one hand, funded capital acts as a financial ceiling for resale: a lower level of funded capital seriously restrains resale capacity, hence the potential resale profit; on the other hand, strategic consideration of resale profit is one of the critical factors that determine creators’ strategies in crowdfunding stage, especially financing target strategy in crowdfunding campaigns of “all or nothing”: with the intention of grabbing more resale profit, creators set a higher financing target to ensure the realization of more funded capital, which exposes creators to more risk of campaign failure. As a result, the joint design of financing target and resale strategy is highly relevant to crowdfunding performance. Moreover, backers’ strategic purchasing behavior in resale affects crowdfunding performances via resale capacity and prices. In view of this, the interplay between the financing target and resale pricing with backers’ strategic purchasing consideration is an interesting topic that deserves exploration.

Extant literature with regard to creators’ crowdfunding strategy mainly focuses on setting financing targets [

4,

5], design of crowdfunding pricing strategy [

4], information revealed when interacting with backers [

6], and promotion via social media [

7], which primarily emphasizes the creators’ strategies in the crowdfunding stage and leaves the post-crowdfunding operations open-ended. Mollick & Kuppswamy [

8] showed that crowdfunding enables most creators to recognize and cultivate market demand, attract resources from various channels, and achieve business development. Neiss, Swart & Best [

9] examined the effectiveness of crowdfunding in improving enterprise performances by comparing indexes of creators’ revenue, funded capital, and the number of employees before and after crowdfunding. The above studies discuss the value of crowdfunding for creators by analyzing creators’ performances after crowdfunding, without considering post-crowdfunding operational strategies and their effect on creators’ strategies and performance in the crowdfunding stage.

Relevant literature regarding revenue management considering consumer strategic purchasing concentrates on the effects of this consumer behavior in traditional operations management [

10], such as leading to firms’ capacity rationing strategy [

11,

12], determining the choice between price commitment and inventory contingent pricing [

13,

14], affecting the price variation [

15,

16], inducing enhancement in product differentiation [

17], and mitigating double marginalization in supply chains [

18]. However, attention has rarely been paid to its effects on crowdfunding. Chen, Zhang & Liu [

19] studied the joint decision of product line and pricing with strategic consumers in the crowdfunding stage, yet did not consider the post-crowdfunding stage. Du, Xu & Qiao et al. [

20] used a genetic algorithm to characterize resale pricing with strategic consumers.

Our paper constructs a dynamic pricing model to study the resale pricing strategy with funded capital constraint, and analyzes the effects of backers’ strategic purchasing on resale pricing and financing target design. The remainder of this paper is organized as follows:

Section 2 characterizes the problem and formulates it into a dynamic pricing model;

Section 3 analyzes the pricing and market conditions of the second stage of resale under various funded capital performances;

Section 4 proposes the expected resale profit function in a multi-parameter portfolio, which is the basis for analyzing resale pricing and profit, as well as the effects of different factors;

Section 5 characterizes how funded capital affects resale prices and explores the effects of backers’ strategic purchasing on resale pricing and profit, as well as creators’ financing target design;

Section 6 makes concluding remarks.

2. Problem Description and Model Formulation

In the context of an “all or nothing” crowdfunding campaign where the creator sets a fundraising goal and keeps nothing unless the goal is achieved [

21], consider a creator who has just achieved a campaign and obtained the funding. After rewarding the backers of the crowdfunding stage, the creator uses the remaining capacity to carry out product resale, which includes two stages. The creator makes the pricing decision at the beginning of the first stage, and adjusts the price in the second stage if there is any leftover capacity. Backers in the resale market choose the timing of purchase or just leave the market empty-handed.

Specifically, the creator sells the crowdfunding product in resale to a market whose volume is normalized to 1. The resale price of the first stage is and the potential adjusted price is , while the unit production cost is . The creator possesses a capacity of units, which falls in the range .

All backers arrive in the market when resale begins. A single backer only needs one unit of product, and leaves the market when he gets the unit or the selling season is over. Backers have heterogeneous product valuations

, which is uniformly distributed in

, where

represents the maximum valuation. To capture demand uncertainty, we also assume

to be a random variable uniformly distributed in

for the creator before

is announced (The success of crowdfunding only verifies that the product is profitable, yet cannot provide much detailed demand information. So we assume the firm knows

, but does not know the exact value of

). After

is given, the true value of

emerges and becomes common knowledge. Backers rationally anticipate the future price, and decide the timing of their purchase based on inter-temporal utility comparison. The extent of strategic purchasing behavior is captured by a homogeneous patience level

, which means backers discount second stage utility to its

proportion in the first stage. The notations used in this paper are summarized in

Table 1.

In summary, the model can be formulated as follows:

The creator maximizes the resale profit by deciding dynamic resale pricing strategy

Backers maximize their utility by choosing purchase timing:

We adopt backward induction to solve the model: the second and first stages are sequentially analyzed. We also use numerical studies to obtain some managerial insights.

3. Analysis of the Second Stage

When the second stage begins, backers’ maximum valuation has already emerged. Based on this, this section studies optimal resale pricing and profit in the second stage under various capacity built with funded capital, and utilizes Propositions 1, 2, and 3 to characterize the results when capacity is high, medium and low, respectively. Moreover, maximum valuation of remaining backers and creator’s remaining capacity are also presented.

Proposition 1. When, the equilibrium outcomes in the second stage of resale under various first stage prices are given as follows:

- (1)

If, then,,,;

- (2)

If, then,,,.

When the creator’s capacity is sufficiently large to cover the whole resale market, the optimal price and profit in the second stage are not affected by capacity constraint. However, there is a threshold for the price in the first stage that counts. In particular, if the price goes beyond the threshold, no one purchases in the first stage, and all backers are driven to the second stage. As a result, neither the first stage price nor backers’ patience level is relevant to the equilibrium outcome of the second stage. On the contrary, if the price is below the threshold, decreasing the first stage price has a pull-down effect on all the indexes of the second stage market outcome, while backers’ higher patience level intuitively provides a drive-up effect.

Proposition 2. When, the equilibrium outcomes in the second stage of resale under various first stage prices are given as follows:

- (1)

If, then,,,;

- (2)

If, then,,,;

- (3)

If, then,,,;

- (4)

If, then,,anddo not exist.

When creator’s capacity cannot cover the whole resale market but is relatively abundant (i.e., ), capacity constraint begins to intervene in the market outcome of the second stage when the first stage price creeps downward sufficiently. To be specific, if the first stage price is just slightly below the threshold determining whether there are backers purchasing in the first stage, capacity constraint does not yet play a role in the second stage outcome. Once it slides down through , which is another threshold, there would be no sufficient capacity left over for the creator to cover the target demand in the second stage. Consequently, a lower capacity in this situation urges the creator to price higher in the second stage, which drives more backers to purchase early and leaves less capacity for the second stage. However, this counter-intuitively benefits the second stage profit, as the increasing of profit margin overwhelms demand loss. Moreover, a higher level of patience impels more backers to purchase in the second stage, thus leaving more capacity, yet does not affect the second-stage price. This is mainly because backer patience only levers the purchase volume in each stage in this capacitated situation, and does not alter the whole demand. If the first-stage price keeps sliding down through the threshold , the capacity would be depleted early in the first stage.

Proposition 3. When, the equilibrium outcomes in the second stage of resale under various prices in the first stage are given as follows:

- (1)

If, then,,,;

- (2)

If, then,,,;

- (3)

If; then,,anddo not exist.

When creator’s capacity is low relative to the resale market, there is no way to cover the creator’s target demand. With the capacity shrinking, the enhancing rationing effect drives up the threshold in the first-stage price beyond which no one purchases in the first stage, as well as the price in the second stage in the case that all backers purchase in the second stage. Nevertheless, it hurts the profit in the second stage due to the effect of sales loss exceeding the effect of profit margin increase.

4. Analysis of the First Stage

After analyzing the second stage of resale, we then study the first-stage pricing and whole resale profit for the creator. In this section, we first utilize Propositions 4, 5, and 6 to verify the creator’s whole resale expected profit function.

Proposition 4. When, the creator’s expected resale profit function under various prices in the first stage are given as follows:

- (1)

If, then;

- (2)

If, then;

- (3)

Ifthen;

- (4)

If, then;

where,,,.

As the creator makes the decision on first-stage price facing demand uncertainty, various ranges of decision-making yield different expected profit function under certain capacity. The outcome exhibits more possibilities with the price level decreasing. When capacity is abundant, if the creator sets too high a price, no one purchases in the first stage whatever the demand is; if the price level is medium, it turns out that no one purchases in the first stage with relatively low demand, and there are sales in both stages with relatively high demand; if the creator proposes a low price, capacity can be depleted early in the first stage with high demand, in addition to the other possibilities mentioned above.

Proposition 5. When, the creator’s expected resale profit function under various prices in the first stage are given as follows:

- (1)

If, then;

- (2)

If, then;

- (3)

If, then;

- (4)

If, then;

where.

Aside from that the second-stage target demand is fully covered as in the case of abundant capacity when no backers purchase in the first stage, a medium level of capacity also yields a chance of high demand such that the creator’s target demand for the second stage cannot be met. Therefore, when the creator prices high in the first stage, either or can occur with medium capacity level while is the only outlet with abundant capacity.

Proposition 6. When, the creator’s expected resale profit function under various prices in the first stage are given as follows:

- (1)

If, then;

- (2)

If, then;

- (3)

If, then;

- (4)

If, then.

Based on the expected resale profit function proposed by Propositions 4, 5, and 6 mentioned above, we can study the optimal pricing in the first stage and optimal resale profit, as well as the effects of various influencing factors. In view of the complexity of the expected resale profit function, we employ numerical analysis to perform further investigations.

5. Numerical Analyses

This section studies the effects of funded capital volume on resale pricing and profit, and the effect of backers’ strategic purchasing on the creator’s financing target strategy. It is easy to check from Propositions 4, 5, and 6 that the expected resale profit is a piece-wise function with respect to the price of the first stage. Moreover, the combination of the “pieces” and the function form of each piece can be extremely complex with different combinations of parameter values, making it difficult to obtain analytical results in a closed form when solving for the optimal price of the first stage. Nevertheless, it is easy to encode price within the support field in the form of chromosomes and use a genetic algorithm to solve for the optimal resale price of the first stage. We then design a relevant genetic algorithm as follows:

- (1)

Encoding: binary encoding is employed for in the range , and the length of the chromosome is determined according to the expected solution accuracy;

- (2)

Generating initial population: each bit of the chromosome is generated to be either 0 or 1 by random selection with each probability being 0.5. Meanwhile, the number of chromosomes is the size of the population, which is a pre-given even value.

- (3)

Decoding and calculating the fitness value: each chromosome is transferred and presented in the decimal mode, and its fitness value is defined as the value of when equals the decimal value of the chromosome.

- (4)

Selection: according to the selection rule, the individual with the worst fitness value is screened out. Meanwhile, the individual with the best fitness value directly enters the new population and replicates itself. Therefore, two seats of the new population are taken. For the rest of the chromosomes, roulette wheel selection is applied to determine the selected chromosomes for the new population.

- (5)

Mating: among the members of the new population, pairs are made randomly.

- (6)

Crossover: pairs in which crossover takes place are randomly chosen with a given probability and the crossover points are also randomly chosen.

- (7)

Mutation: mutation points are randomly generated with a given probability.

After the aforementioned steps, a new generation is obtained. The evolution goes through a given number of generations.

5.1. Optimal Pricing in the First Stage

By exploring the effects of capacity, backer patience level, and unit production cost, this subsection aims to characterize how to optimally price at the beginning of resale under the constraint of funded resources in various circumstances to maximize resale profit as financing for the enterprise’s further developments.

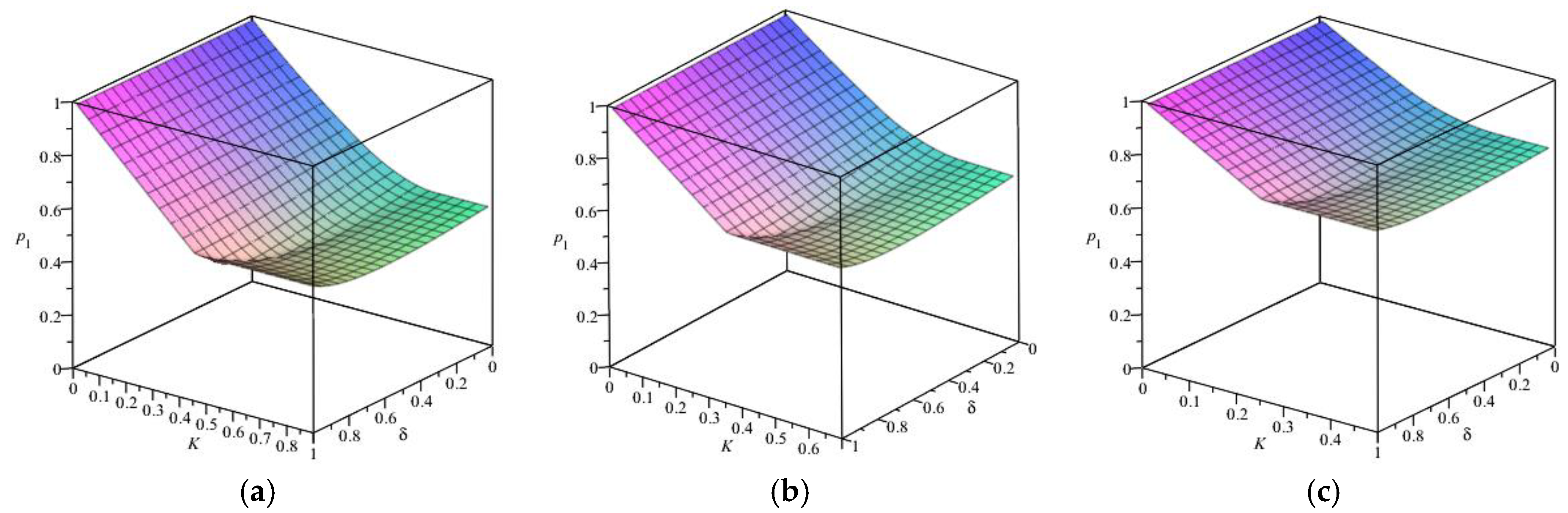

Figure 2 shows that the optimal resale pricing in the first stage intuitively climbs with the increase in unit production cost. There is a threshold in capacity beyond which the price is negatively correlated, and otherwise levels off. This suggests that the rationing effect drives up the price when the creator can only use the limited capacity, which was built with little funding, to target backers with high valuation. Or else, the price does not fluctuate with capacity alteration as the creator can build a high level of capacity that does not ration demand.

With regard to backer patience level, the price makes a U shape with the increasing backer patience level when capacity is beyond the threshold. When backer patience level is at a low level, the creator has to lower the price to attract backers to make early purchases as the patience level rises. When the patience level is sufficiently high, the creator has to price too low to mitigate the effect of rising patience level, which hurts the resale profit. Under this circumstance, the creator should give up fighting with the backers’ strategic purchasing behavior and price high instead. When capacity is below the threshold, the price varies little with respect to changes in the backer patience level, which suggests that little funding suppresses price volatility due to the effect of backer strategic purchasing.

5.2. Optimal Resale Profit

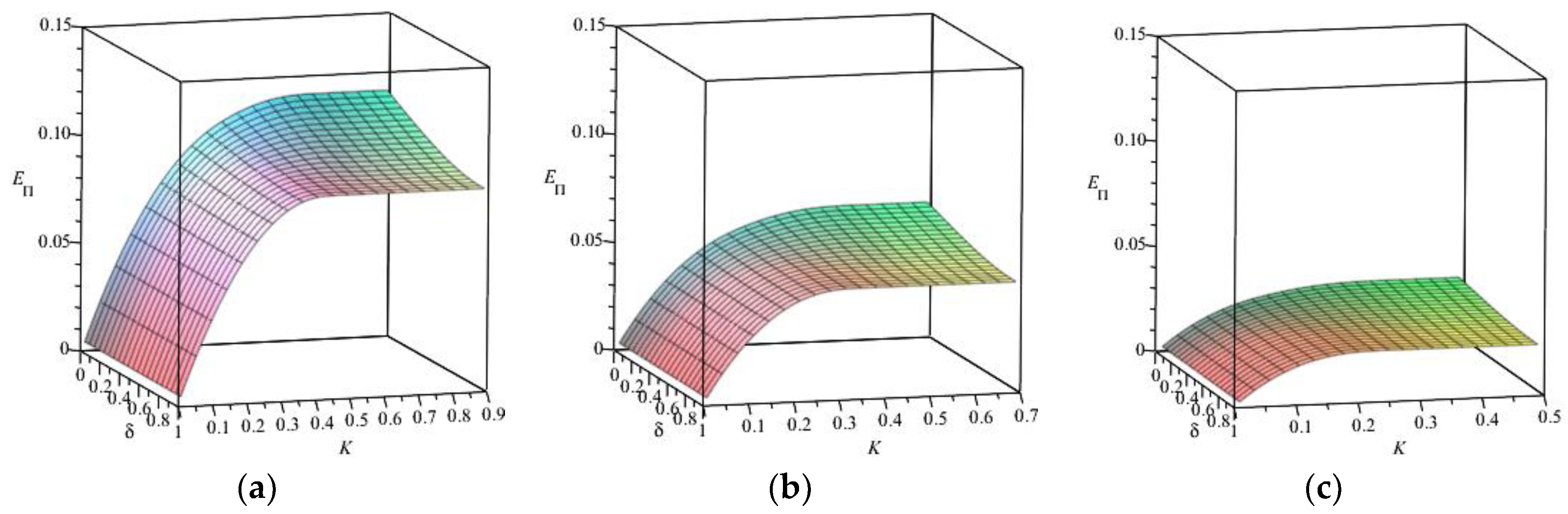

By exploring the effects of capacity, backer patience level, and unit production cost, this subsection evaluates optimal resale profit as a resource for sustainable development under various parameter portfolios, thus providing a reference for financing target design with sustainability considerations in mind.

Figure 3 shows that the optimal resale profit increases when the unit production cost drops. The threshold in capacity also counts in analyzing profit: if a low level of funding leads to a capacity level below the threshold, the optimal resale profit is positively related with capacity, as an increase in capacity can satisfy more demand; on the other hand, a capacity level beyond the threshold does not place constraints on demand, hence the profit. This suggests that there is no need for the creator to go too far in seeking a high capacity level, even if large funding was obtained. In addition, the threshold in capacity creeps downward when either unit production cost or backer patience level rises. This means that the creator does not have to build a large capacity when either of the two parameters is large, thus they can avoid setting a high financing target, which increases the risk of failure in crowdfunding. For instance, “Chu You Ba” is a clean-tech crowdfunding and resale product on Suning. It helps remove oil from dinnerware in a physical manner, thus avoiding the chemical waste from cleaning with detergent. Being aware of the relatively low expected resale profit (they obtained RMB 7566 as a result) possibly due to the high level of backer patience (represented by slow backing dynamics), the creator set a low financing target (RMB 50,000), which barely avoided campaign failure (funded at RMB 68,134 in the crowdfunding stage).

6. Conclusions

This paper builds a two-stage crowdfunding model and uses analytical and numerical studies to explore the effect of funding volume on resale pricing and profit, as well as the effect of backers’ strategic purchasing behavior in resale on the design of financing target in crowdfunding. The results show that large funding helps the creator to build a high level of capacity that satisfies the target demand and does not vary resale prices; low funding only allows a low level of capacity, which pushes up the resale price due to the rationing effect and mitigates price fluctuations due to alterations in backers’ patience. Likewise, the creator can build sufficient capacity that does not put a ceiling on resale profit with large funding. Nevertheless, when either the unit production cost or backer patience level is high, the creator does not have to build a large capacity in the sense of satisfying more resale demand, and accordingly should avoid setting a high financing target incurring the risk of failure in crowdfunding, as a higher level of capacity would not yield a larger expected resale profit.