Joint Pricing and Product Carbon Footprint Decisions and Coordination of Supply Chain with Cap-and-Trade Regulation

Abstract

1. Introduction

- (1)

- How do the manufacturer and the retailer make optimal product carbon footprint and pricing decisions under the carbon cap and trade regulation?

- (2)

- What effects does the cap-and-trade regulation have on the product carbon footprint, selling price, consumer demand and the profit of the supply chain system?

- (3)

- How does the manufacturer design coordinating contract (such as the wholesale price and fixed fee in the two-part tariff) to ensure the retailer to cooperate based on the change of the carbon cap and the carbon trading price?

- (4)

- For the government, what policies and measures are also implemented to encourage the manufacturer to invest in low-carbon technology under cap-and-trade regulation, and then to reduce the product carbon footprint more effectively.

2. Literature Review

3. Models and Decision Analysis

3.1. Problem Statement and Assumption

- (1)

- The manufacturer produces the product with unit cost and sells it at wholesale price to the retailer, which is a decision variable of the manufacturer.

- (2)

- Under cap-and-trade regulation, the manufacturer is allocated a predetermined emission quota (hereinafter referred to as the carbon cap, which is similar to the studies of Hua et al. [7], Benjaafar et al. [8], Zhou et al. [16] and Xu et al. [21]), and the carbon trading price in an outside market is denoted by . If the actual emissions exceed the carbon cap , the manufacturer needs to buy carbon permits. Conversely, if the emissions are less than the carbon cap , the manufacturer can sell the extra carbon permits. We assume that is traded quantity of carbon emissions: if , it means that the manufacturer can sell units of carbon credit; if , it means that the manufacturer need to buy units of carbon credit; and if , it means that the manufacturer neither buys nor sells any carbon emission credits.

- (3)

- If the manufacturer carries out investment in low-carbon technology, the initial carbon footprint of the product can be reduced to with an investment cost , which is similar to the study of Yalabik and Fairchild [28], where represents the cost factor related to low-carbon technology, is the product carbon footprint, which is decision-making variable for the manufacturer.

- (4)

3.2. The Centralized Decision-Making Model

- (a)

- If the initial carbon footprint () and carbon trading price () satisfy any of the following two conditions, the optimal product carbon footprint will decrease with increasing carbon trading price:

- (b)

- If the initial carbon footprint () and carbon trading price () satisfy, respectively, and , the optimal product carbon footprint will increase with increasing carbon trading price.

- (a)

- If the initial carbon footprint () and carbon trading price () satisfy any of the following two conditions, the optimal selling price will increase with increasing carbon trading price:

- (b)

- If the initial carbon footprint () and carbon trading price () satisfy, respectively, and , the optimal selling price will decrease with increasing carbon trading price,

3.3. The Decentralized Decision-Making Model

- (a)

- If the initial carbon footprint () and carbon trading price () satisfy any of the following two conditions, then the optimal product carbon footprint will decrease with increasing carbon trading price:

- (b)

- If the initial carbon footprint () and carbon trading price () satisfy, respectively, and , then the optimal product carbon footprint will increase with increasing carbon trading price,

- (a)

- If the initial carbon footprint () and carbon trading price () satisfy any of the following two conditions, then the optimal sales price will increase with increasing carbon trading price:

- (b)

- If the initial carbon footprint () and carbon trading price () satisfy, respectively, and , then the optimal selling price will decrease with increasing carbon trading price,

3.4. The Comparative Analysis of Models

- (a)

- When the initial carbon footprint () and carbon trading price () satisfy any of the following three conditions, regardless of the manufacturer and retailer taking centralized or decentralized decision-making, the optimal product carbon footprint will decrease with increasing carbon trading price:

- (b)

- When the initial carbon footprint () and carbon trading price () satisfy, respectively, and , if the manufacturer and retailer take centralized decision-making, the optimal product carbon footprint will decrease with increasing carbon trading price; and, if the manufacturer and the retailer take decentralized decision-making, the optimal product carbon footprint will increase with increasing carbon trading price.

- (c)

- When the initial carbon footprint () and carbon trading price () satisfy, respectively, and , if the manufacturer and the retailer take centralized decision-making, the optimal product carbon footprint will increase with increasing carbon trading price; and, if the manufacturer and retailer take decentralized decision-making, the optimal product carbon footprint will decrease with increasing carbon trading price.

- (d)

- When the initial carbon footprint () and carbon trading price () satisfy, respectively, and , regardless of the manufacturer and retailer taking centralized or decentralized decision-making, the optimal product carbon footprint will increase with increasing carbon trading price.

- (a)

- When the initial carbon footprint () and carbon trading price () satisfy any of the following two conditions, regardless of the manufacturer and retailer taking centralized or decentralized decision-making, the optimal selling price of the product will increase with increasing carbon trading price:

- (b)

- When the initial carbon footprint () and carbon trading price () satisfy any of the following two conditions, if the manufacturer and retailer take centralized decision-making, the optimal selling price of the product will decrease with increasing carbon trading price; and if the manufacturer and retailer take decentralized decision-making, then the optimal selling price of the product will increase with increasing carbon trading price.

- (c)

- When the initial carbon footprint () and carbon trading price () are satisfied, respectively, and , regardless of the manufacturer and retailer taking centralized or decentralized decision-making, the optimal selling price of the product will decrease with increasing carbon trading price.

3.5. The Design of Coordinating Mechanism

4. Numerical Examples

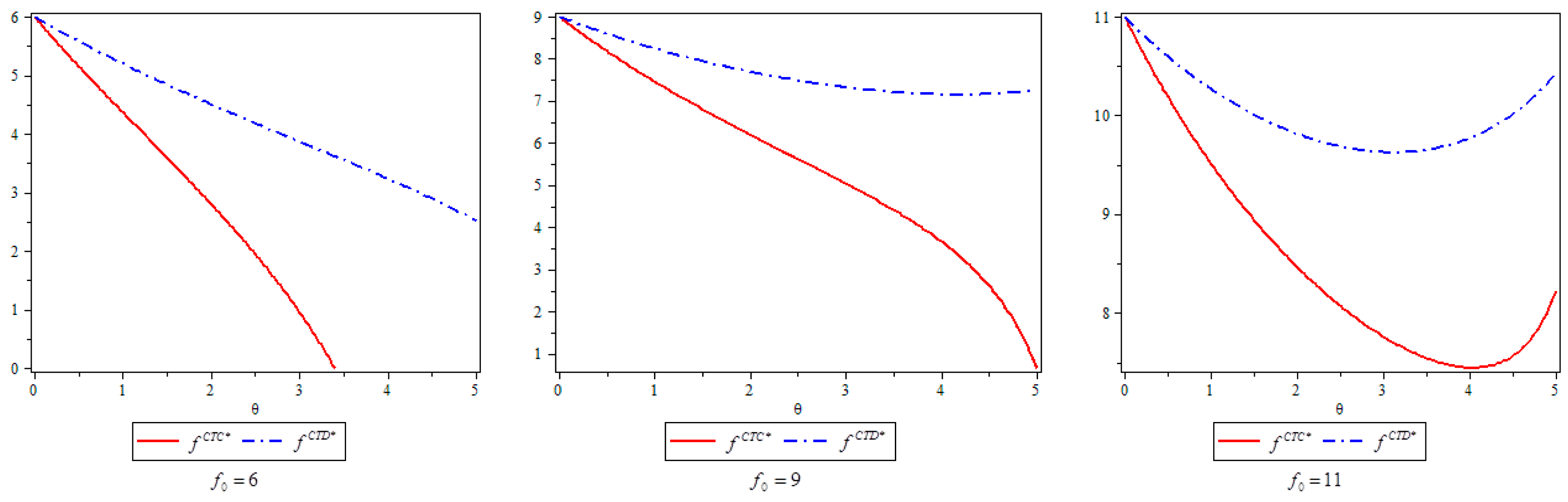

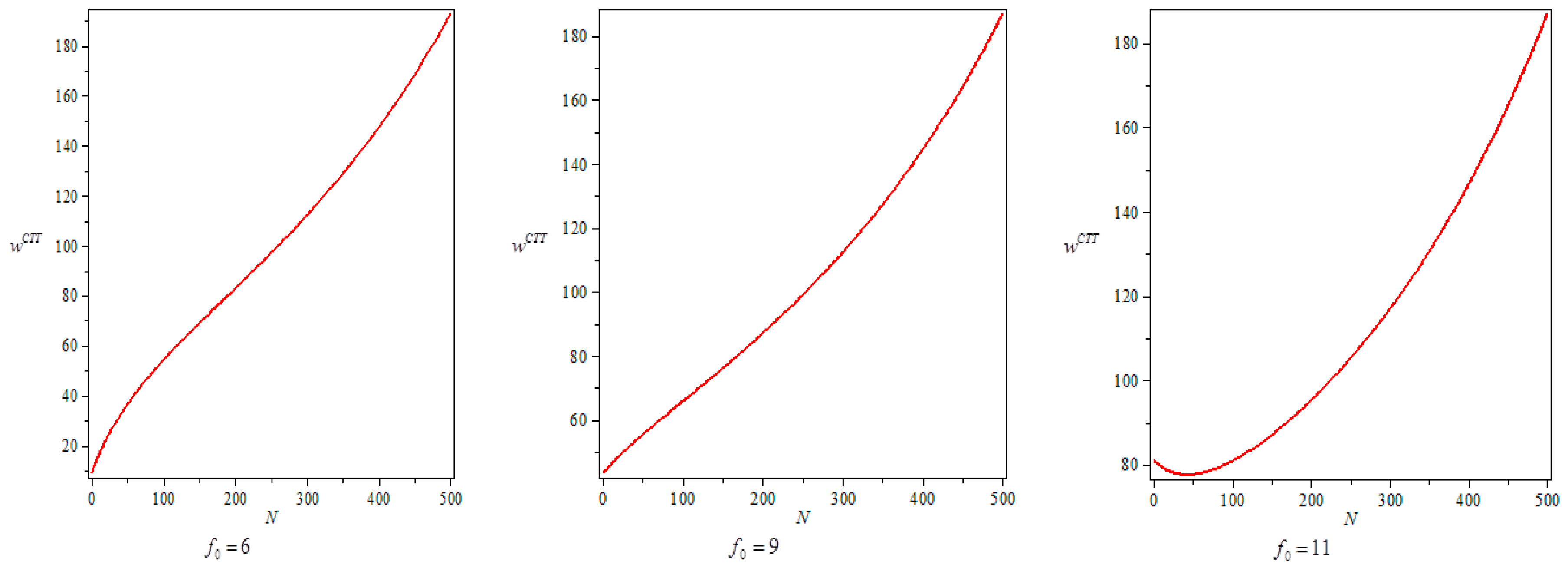

4.1. The Effects of Carbon Trading Price on Product Carbon Footprint

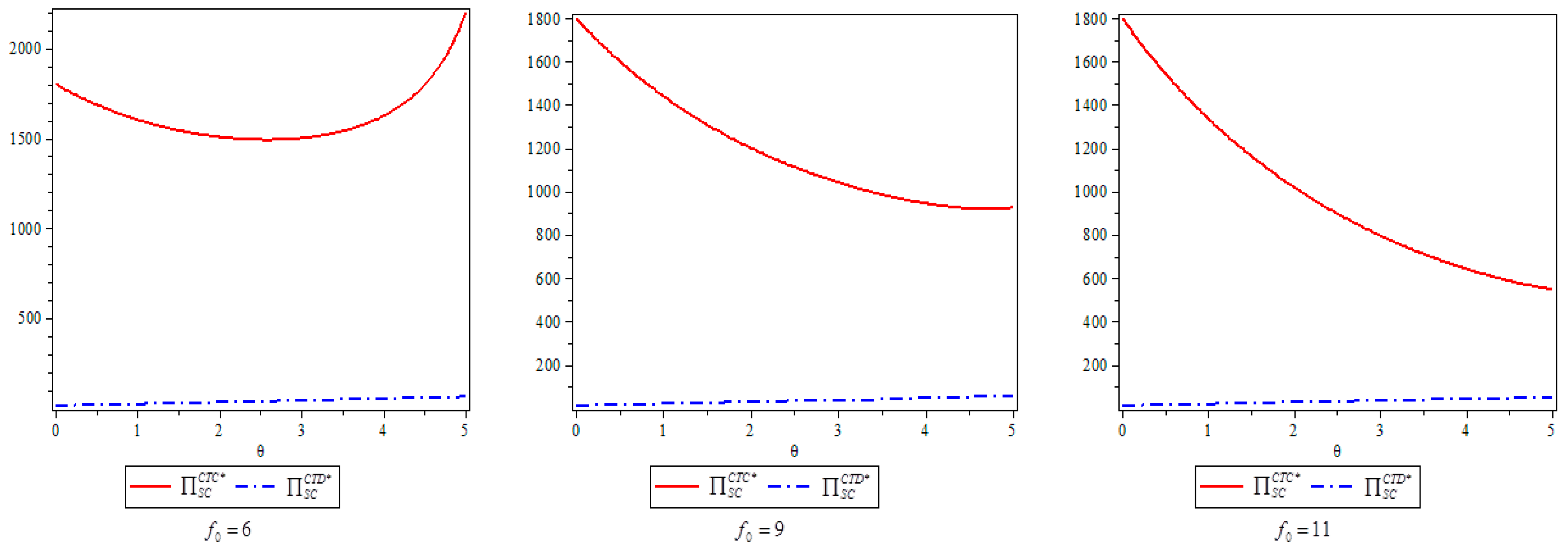

4.2. The Effects of Carbon Trading Price on Selling Price

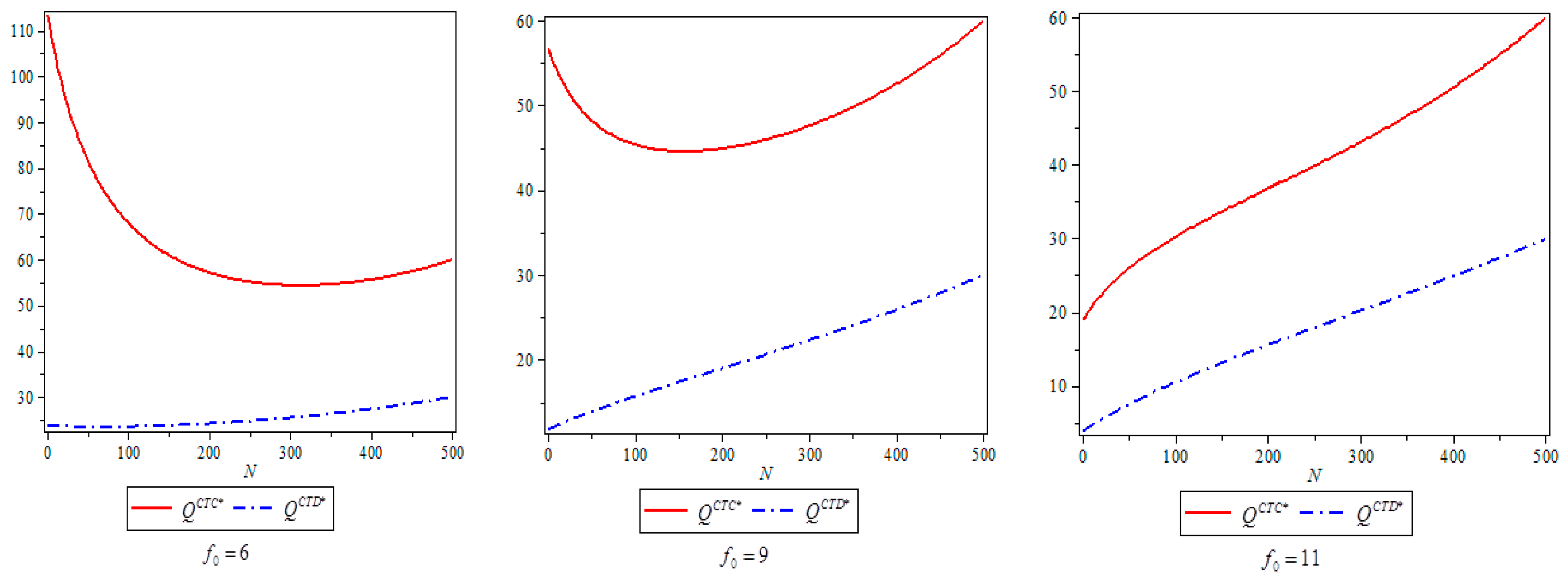

4.3. The Effects of Carbon Trading Price on Consumer Demand

4.4. The Effects of Carbon Trading Price on Supply Chain Profits

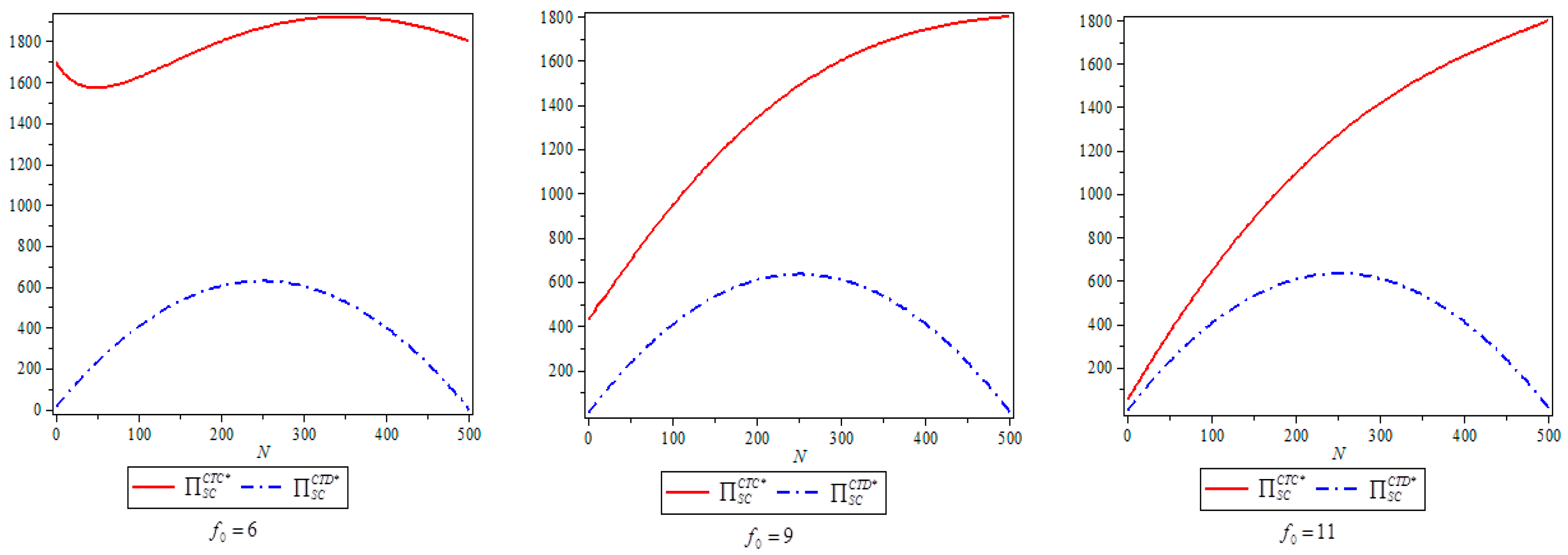

4.5. The Effects of Carbon Trading Price on the Coordination Mechanism

4.6. The Effects of Carbon Cap on Product Carbon Footprint

- (1)

- For the product with small initial carbon footprint (), whether it is centralized or decentralized, with the increasing of carbon trading price, the government should cut down the carbon cap to impel the manufacturer to reduce the product carbon footprint.

- (2)

- For the product with large initial carbon footprint (), with the decreasing of the carbon trading price, if the manufacturers and retailer take the centralized decision-making, the government should cut the carbon cap to impel the manufacturer to reduce the product carbon footprint. However, if the manufacturer and retailer take the decentralized decision-making, the government should first cut and then increase the carbon cap to motivate the manufacturer to reduce the product carbon footprint.

- (3)

- For the product with great initial carbon footprint (), whether it is centralized or decentralized, with the increasing of the carbon trading price, the government should first cut and then increase the carbon cap to motivate the manufacturer to reduce the product carbon footprint.

4.7. The Effects of Carbon Cap on Selling Price

4.8. The Effects of Carbon Cap on Consumer Demand

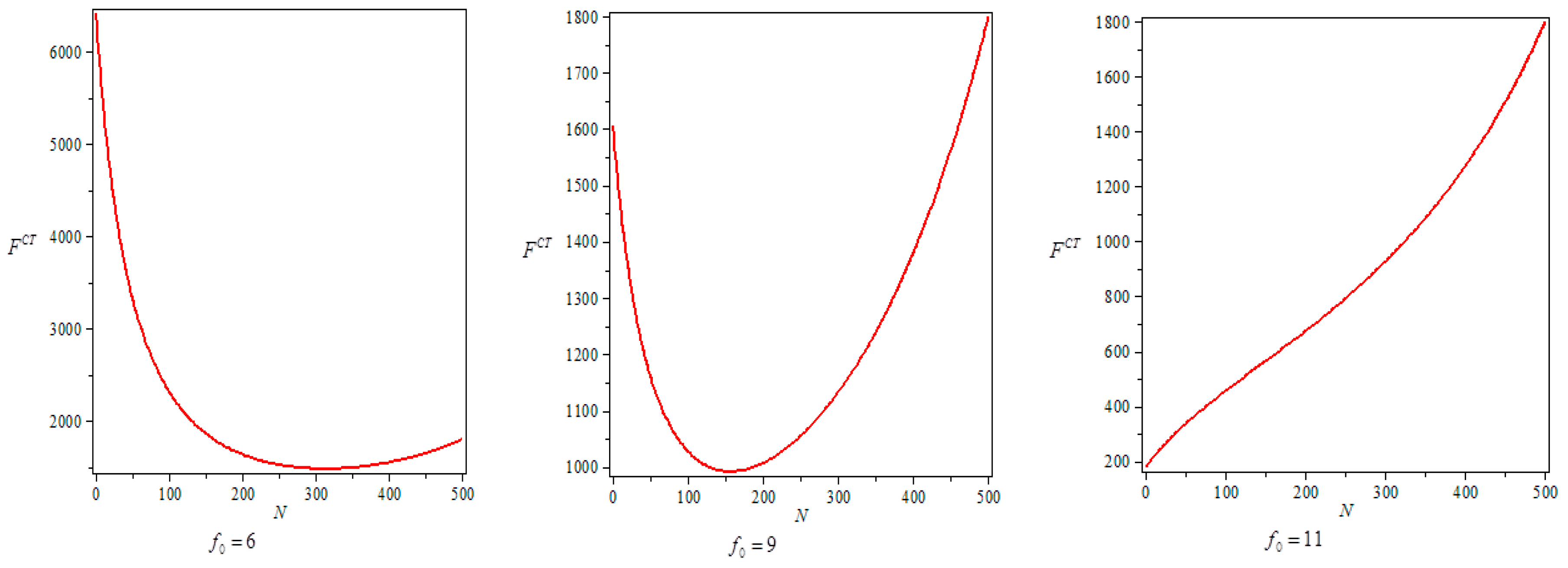

4.9. The Effects of Carbon Cap on the Profits of the Supply Chain

4.10. The Effects of Carbon Cap Price on the Coordination Mechanism

5. Conclusions and Future Research

- (1)

- Under cap-and-trade regulation, when the initial carbon footprint of the product is relatively small, regardless of the manufacturer and retailer taking the centralized or decentralized decision-making, the product carbon footprint decreases with the rising of carbon trading price, and also decreases with the decreasing of the carbon cap. The selling price first increases and then decreases with the increasing of carbon trading price, and also first increases and then decreases with the decreasing of the carbon cap.

- (2)

- Under cap-and-trade regulation, when the initial carbon footprint of the product is relatively large, if the manufacturer and retailer take centralized decision-making, then the product carbon footprint decreases with the increasing of carbon trading price, and also decreases with the decreasing of the carbon cap, the selling price first increases and then decreases with the increasing of carbon trading price, and also first increases and then decreases with the decreasing of the carbon cap; and if the manufacturer and retailer take the centralized decision-making, then the product carbon footprint first decreases and then increases with the increasing of carbon trading price, and also first decreases and then increases with the decreasing of the carbon cap, the selling price increases with the increasing of carbon trading price, and also first increases and then decreases with the decreasing of the carbon cap.

- (3)

- Under cap-and-trade regulation, when the initial carbon footprint of the product is large, regardless of the manufacturer and retailer taking the centralized or decentralized decision-making, the product carbon footprint first decreases and then increases with the increasing of carbon trading price, and also first decreases and then increases with the decreasing of the carbon cap; and the selling price increases with the increasing of carbon trading price, and also increases with the decreasing of the carbon cap.

- (4)

- Under cap-and-trade regulation, when the initial carbon footprint of the product is relatively small, the manufacturer’s wholesale price first increases and then decreases with the increasing of carbon trading price, and also decreases with the decrease of the carbon cap, and the fixed fee first decreases and then increases with the increasing of carbon trading price, and also first decreases and then increases with the decreasing of the carbon cap; and when the initial carbon footprint of the product is relatively large, the manufacturer’s wholesale price increases with the increasing of carbon trading price, and also first decreases and then increases with the decreasing of the carbon cap, and the fixed fee decreases with the increasing of carbon trading price, and also decreases with the decreasing of the carbon cap, then the contract can solve the “double marginalization” problem and coordinate the supply chain system.

- (1)

- For the product with small initial carbon footprint, the increasing of carbon trading price may inspire the manufacturer to reduce the product carbon footprint, but, if the carbon trading price is low, then the government can encourage the manufacturer to reduce their carbon footprint by reducing the carbon cap.

- (2)

- For the product with large initial carbon footprint, in the centralized decision-making, the increasing of carbon trading price may inspire the manufacturer to reduce the product carbon footprint. Contrary, if carbon trading price is low, then the government can motivate the manufacturer to reduce their carbon footprint by reducing the carbon cap. In the decentralized decision-making, the increasing of carbon trading price cannot inspire the manufacturer to reduce the product carbon footprint, and then the government can first decrease and then increase the carbon cap to inspire the manufacturer to reduce the product carbon footprint.

- (3)

- For the product with great initial carbon footprint, such as some high energy consumption, high-emission product, the increaseof carbon trading price cannot promote the manufacturer to reduce product carbon footprint. Therefore, if the carbon trading price increases, the government should first decrease and then increase the carbon cap to motivate the manufacturer to reduce the product carbon footprint.

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

References

- Anger, N. Emission trading beyond Europe: Linking schemes in a Post-Kyoto World. Energy Econ. 2006, 30, 2028–2049. [Google Scholar] [CrossRef]

- Whitesell, W. Carbon taxes, cap-and-trade administration, and US legislation. Clim. Policy 2007, 7, 457–462. [Google Scholar] [CrossRef]

- He, L.; Zhao, D.; Xia, L. Game theoretic analysis of carbon emission abatement in fashion supply chains considering vertical incentives and channel structures. Sustainability 2015, 7, 4280–4309. [Google Scholar] [CrossRef]

- Goulder, L.; Hafstead, M.; Dworsky, M. Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. J. Environ. Econ. Manag. 2010, 60, 161–181. [Google Scholar] [CrossRef]

- The National Development and Reform Commission of China (NDRC). The Notice on Implementing Pilot Cap-and-Trade Schemes; NDRC: Beijing, China, 2011.

- Ye, B.; Jiang, J.; Miao, L.; Li, J.; Peng, Y. Innovative carbon allowance allocation policy for the Shenzhen emission trading scheme in China. Sustainability 2016, 8, 3. [Google Scholar] [CrossRef]

- Hua, G.; Cheng, T.C.E.; Wang, S. Managing carbon footprints in inventory management. Int. J. Prod. Econ. 2011, 132, 178–185. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Chen, X.; Benjaafar, S.; Elomri, A. The carbon constrained EOQ. Oper. Res. Lett. 2013, 41, 172–179. [Google Scholar] [CrossRef]

- He, P.; Zhang, W.; Xu, X. Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. J. Clean. Prod. 2015, 103, 241–248. [Google Scholar] [CrossRef]

- Dong, C.W.; Shen, B.; Chow, P.S.; Yang, L.; Ng, C.T. Sustainability investment under cap-and-trade regulation. Ann. Oper. Res. 2016, 240, 509–531. [Google Scholar] [CrossRef]

- Song, J.; Leng, M. Analysis of the single-period problem under carbon emissions policies. In Handbook of Newsvendor Problems; Springer: New York, NY, USA, 2012; pp. 297–313. [Google Scholar]

- Jaber, M.; Glock, C.; Ahmed, S. Supply chain coordination with emissions reduction incentives. Int. J. Prod. Res. 2013, 51, 69–82. [Google Scholar] [CrossRef]

- Zhang, B.; Xu, L. Multi-item production planning with carbon cap and trade mechanism. Int. J. Prod. Econ. 2013, 144, 118–127. [Google Scholar] [CrossRef]

- Du, S.; Ma, F.; Fu, Z. Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Ann. Oper. Res. 2015, 228, 135–149. [Google Scholar] [CrossRef]

- Zhou, M.; Pan, Y.; Chen, Z. Environmental resource planning under cap-and-trade: Models for optimization. J. Clean. Prod. 2016, 112, 1582–1590. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; He, P. Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 2015, 66, 248–257. [Google Scholar] [CrossRef]

- Zheng, Y.; Liao, H.; Yang, X. Stochastic pricing and order model with transportation mode selection for low-carbon retailers. Sustainability 2016, 8, 48. [Google Scholar] [CrossRef]

- Du, S.; Tang, W.; Song, M. Low-carbon production with low-carbon premium in cap-and-trade regulation. J. Clean. Prod. 2016, 134, 652–662. [Google Scholar] [CrossRef]

- Xu, J.; Chen, Y.; Bai, Q. A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J. Clean. Prod. 2016, 135, 42–56. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Seifert, J.; Uhrig-Homburg, M.; Wagner, M. Dynamic behavior of CO2 spot prices. J. Environ. Econ. Manag. 2008, 56, 180–194. [Google Scholar] [CrossRef]

- Aatola, P.; Ollikainen, M.; Toppinen, A. Impact of the carbon price on the integrating European electricity market. Energy Policy. 2013, 61, 1236–1251. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, A.; Tan, W. The impact of China’s carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Policy 2015, 86, 176–185. [Google Scholar] [CrossRef]

- Trappey, A.; Trappey, C.; Hsiao, C. System dynamics modelling of product carbon footprint life cycles for collaborative green supply chains. Int. J. Comput. Integr. Manuf. 2012, 25, 934–945. [Google Scholar] [CrossRef]

- Jensen, J.K. Product carbon footprint developments and gaps. Int. J. Phys. Distrib. Logist. Manag. 2012, 42, 338–354. [Google Scholar] [CrossRef]

- Arıkan, E.; Jammernegg, W. The single period inventory model under dual sourcing and product carbon footprint constraint. Int. J. Prod. Econ. 2014, 157, 15–23. [Google Scholar] [CrossRef]

- Yalabik, B.; Fairchild, R. Customer, regulatory, and competitive pressure as drivers of environmental innovation. Int. J. Prod. Econ. 2011, 131, 519–527. [Google Scholar] [CrossRef]

- Goyal, M.; Netessine, S. Strategic technology choice and capacity investment under demand uncertainty. Manag. Sci. 2007, 53, 192–207. [Google Scholar] [CrossRef]

- Daskalakis, G.; Psychoyios, D.; Markellos, R. Modeling CO2 emission allowance prices and derivatives: Evidence from the European trading scheme. J. Bank. Financ. 2009, 33, 1230–1241. [Google Scholar] [CrossRef]

- Zhang, Y.; Wei, Y. An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect. Appl. Energy 2010, 87, 1804–1814. [Google Scholar] [CrossRef]

- Kumar, R.S.; Choudhary, A.; Irfan Babu, S.A.K.; Kumar, S.K.; Goswami, A.; Tiwari, M.K. Designing multi-period supply chain network considering risk and emission: A multi-objective approach. Ann. Oper. Res. 2017, 250, 427–461. [Google Scholar] [CrossRef]

- Fera, M.; Fruggiero, F.; Lambiase, A.; Macchiaroli, R.; Miranda, S. The role of uncertainty in supply chains under dynamic modeling. Int. J. Ind. Eng. Comput. 2017, 8, 119–140. [Google Scholar] [CrossRef]

- Martino, G.; Fera, M.; Iannone, R.; Miranda, S. Supply chain risk assessment in the fashion retail industry: An analytic network process approach. Int. J. Appl. Eng. Res. 2017, 12, 140–154. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, Y.; Xiong, Z.; Luo, Q. Joint Pricing and Product Carbon Footprint Decisions and Coordination of Supply Chain with Cap-and-Trade Regulation. Sustainability 2018, 10, 481. https://doi.org/10.3390/su10020481

Cheng Y, Xiong Z, Luo Q. Joint Pricing and Product Carbon Footprint Decisions and Coordination of Supply Chain with Cap-and-Trade Regulation. Sustainability. 2018; 10(2):481. https://doi.org/10.3390/su10020481

Chicago/Turabian StyleCheng, Yonghong, Zhongkai Xiong, and Qinglin Luo. 2018. "Joint Pricing and Product Carbon Footprint Decisions and Coordination of Supply Chain with Cap-and-Trade Regulation" Sustainability 10, no. 2: 481. https://doi.org/10.3390/su10020481

APA StyleCheng, Y., Xiong, Z., & Luo, Q. (2018). Joint Pricing and Product Carbon Footprint Decisions and Coordination of Supply Chain with Cap-and-Trade Regulation. Sustainability, 10(2), 481. https://doi.org/10.3390/su10020481