What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability

Abstract

:1. Introduction

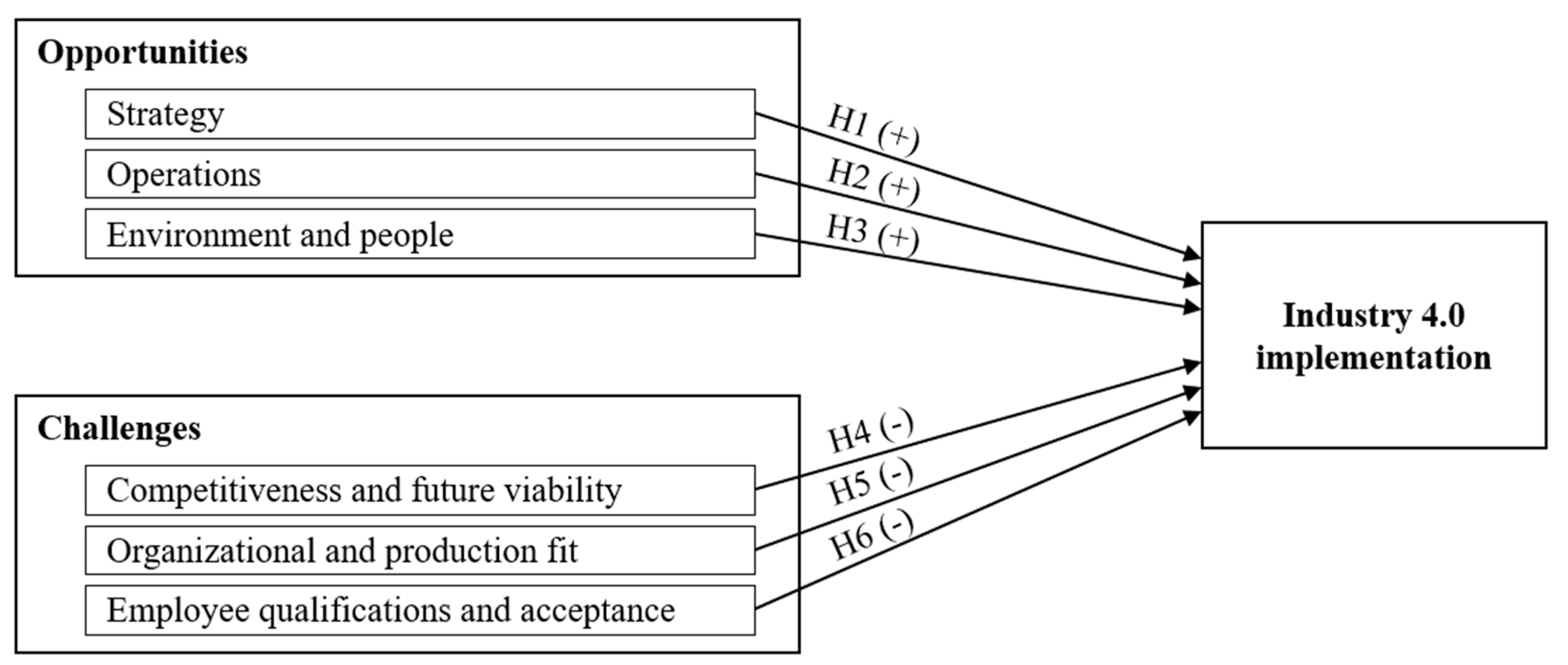

2. Development of Research Model and Hypotheses

2.1. Opportunities of Industry 4.0

2.1.1. Strategy

2.1.2. Operations

2.1.3. Environment and People

2.2. Challenges of the Industrial Internet of Things

2.2.1. Competitiveness and Future Viability

2.2.2. Organizational and Production Fit

2.2.3. Employee Qualifications and Acceptance

3. Methodology

3.1. Data Collection and Sample

3.2. Measures

3.3. Data Analysis

3.4. Validation of the Measurement Model

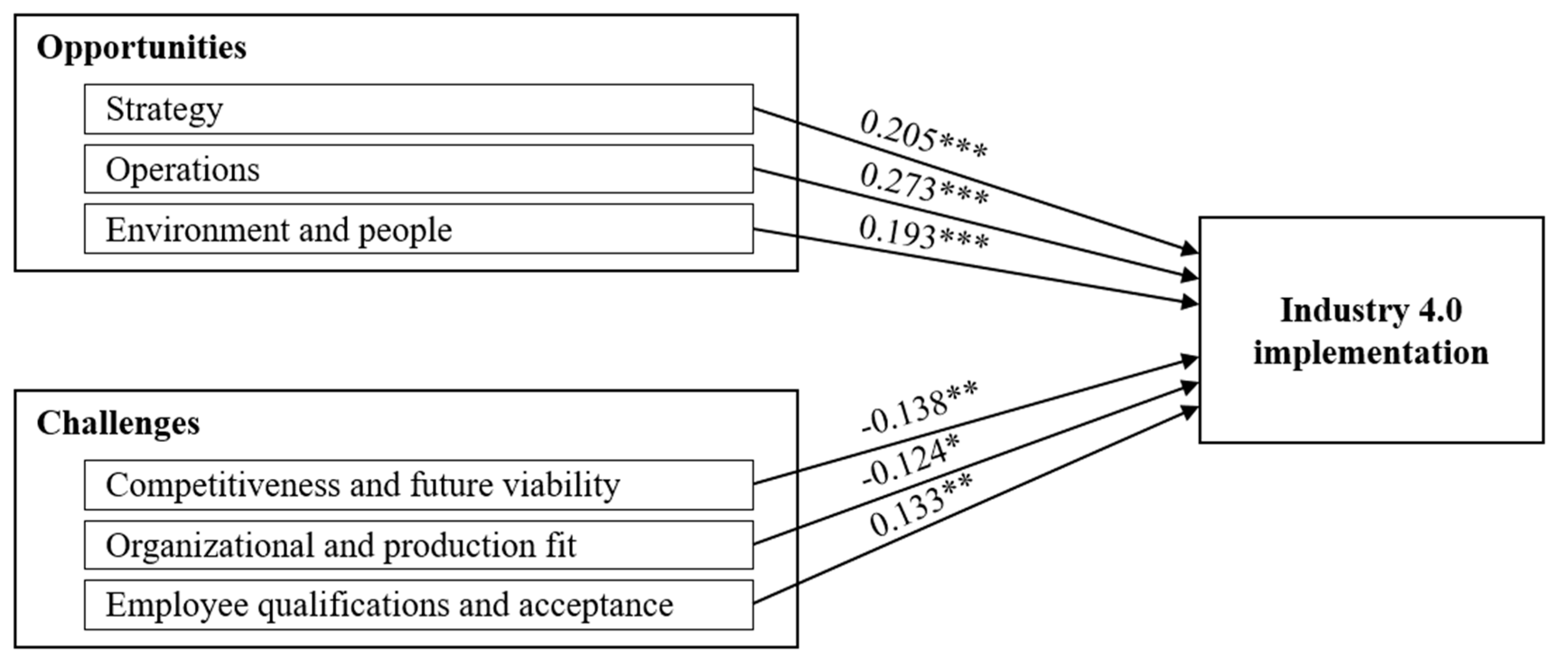

4. Results

4.1. Hypothesis Evaluation

4.2. Multi-Group Analysis

4.2.1. Company Size

4.2.2. Industry Sector

4.2.3. Role towards Industry 4.0

5. Discussion

5.1. Interpretation of the Key Findings

5.2. Concluding Implications for Theory

5.3. Implications for Practice

5.4. Limitations and Suggestions for Future Research

Author Contributions

Conflicts of Interest

Appendix A. Measurement Items of Constructs

| Construct | Item | Description |

|---|---|---|

| Strategy | Str_1 | Industry 4.0 allows us to create new business models. |

| Str_2 | Industry 4.0 allows us to create leading solutions for our customers. | |

| Str_3 | Industry 4.0 allows us to generate solutions that are hard to imitate. | |

| Operations | Op_1 | Industry 4.0 allows decreased costs through interconnection. |

| Op_2 | Industry 4.0 allows increased quality. | |

| Op_3 | Industry 4.0 allows increased traceability. | |

| Op_4 | Industry 4.0 allows decreased non-value-adding effort. | |

| Op_5 | Industry 4.0 allows lowered stocking of goods. | |

| Op_6 | Industry 4.0 allows decreased documentation and administration. | |

| Op_7 | Industry 4.0 allows to increase the flexibility of production. | |

| Op_8 | Industry 4.0 allows increased speed and reactive capabilities. | |

| Op_9 | Industry 4.0 allows increased load balancing. | |

| Op_10 | Industry 4.0 allows reasonable use of machinery data. | |

| Environment and people | Env_1 | Industry 4.0 allows age-appropriate working environments. |

| Env_2 | Industry 4.0 allows a decrease in monotonous and repetitive work. | |

| Env_3 | Industry 4.0 allows decreased waste and environmental impact. | |

| Competitiveness and future viability | Com_1 | Industry 4.0 generates dependence on other enterprises for us. |

| Com_2 | Industry 4.0 makes us replaceable due to standardization. | |

| Com_3 | Industry 4.0 makes us lose value creation of direct customer contact. | |

| Com_4 | Industry 4.0 makes us replaceable due to anonymity. | |

| Com_5 | Industry 4.0 makes us lose our market niche that ensures our success. | |

| Com_6 | Industry 4.0 makes us lose our flexibility, requiring costly solutions. | |

| Com_7 | Industry 4.0 makes us transparent, potentially usable as leverage. | |

| Com_8 | Industry 4.0 generates technological dependence for us. (eliminated) | |

| Organizational and production fit | Org_1 | For us, implementing Industry 4.0 is not reasonable. |

| Org_2 | Customer demands are too individualized to implement Industry 4.0 | |

| Org_3 | We have too little standardization to implement Industry 4.0. | |

| Org_4 | For us, the costs exceed the benefits of Industry 4.0. | |

| Employee qualifications and acceptance | Emp_1 | Our employees do not trust Industry 4.0 technologies. |

| Emp_2 | Our employees fear dependence on Industry 4.0 technologies. | |

| Emp_3 | We expect nonacceptance of Industry 4.0 by employees. | |

| Emp_4 | We expect lack of Industry 4.0 expertise among our employees. | |

| Emp_5 | Our employees fear data transparency due to Industry 4.0. | |

| Implementation | Imp_1 | For our suppliers, Industry 4.0 is relevant for implementation. |

| Imp_2 | For us, Industry 4.0 is relevant for implementation. | |

| Imp_3 | For our customers, Industry 4.0 is relevant for implementation. |

Appendix B. Results of Exploratory Factor Analysis

| Item | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| Str_1 | 0.896 | ||||||

| Str_2 | 0.843 | ||||||

| Str_3 | 0.416 | ||||||

| Op_1 | 0.599 | ||||||

| Op_2 | 0.825 | ||||||

| Op_3 | 0.687 | ||||||

| Op_4 | 0.623 | ||||||

| Op_5 | 0.670 | ||||||

| Op_6 | 0.782 | ||||||

| Op_7 | 0.815 | ||||||

| Op_8 | 0.474 | ||||||

| Op_9 | 0.803 | ||||||

| Op_10 | 0.599 | ||||||

| Env_1 | 0.769 | ||||||

| Env_2 | 0.730 | ||||||

| Env_3 | 0.705 | ||||||

| Com_1 | 0.607 | ||||||

| Com_2 | 0.660 | ||||||

| Com_3 | 0.755 | ||||||

| Com_4 | 0.848 | ||||||

| Com_5 | 0.670 | ||||||

| Com_6 | 0.569 | ||||||

| Com_7 | 0.448 | ||||||

| Com_8 * | 0.315 | 0.329 | |||||

| Org_1 | 0.524 | ||||||

| Org_2 | 0.674 | ||||||

| Org_3 | 0.902 | ||||||

| Org_4 | 0.862 | ||||||

| Emp_1 | 0.726 | ||||||

| Emp_2 | 0.714 | ||||||

| Emp_3 | 0.634 | ||||||

| Emp_4 | 0.629 | ||||||

| Emp_5 | 0.547 | ||||||

| Imp_1 | 0.906 | ||||||

| Imp_2 | 0.840 | ||||||

| Imp_3 | 0.469 |

References

- Arnold, C.; Kiel, D.; Voigt, K.-I. How the Industrial Internet of Things Changes Business Models in Different Manufacturing Industries. Int. J. Innov. Manag. 2016, 20, 1640015. [Google Scholar] [CrossRef]

- Bauer, W.; Hämmerle, M.; Schlund, S.; Vocke, C. Transforming to a Hyper-connected Society and Economy—Towards an “Industry 4.0”. Procedia Manuf. 2015, 3, 417–424. [Google Scholar] [CrossRef]

- Kiel, D.; Müller, J.; Arnold, C.; Voigt, K.-I. Sustainable Industrial Value Creation: Benefits and Challenges of Industry 4.0. Int. J. Innov. Manag. 2017, 21, 1740015. [Google Scholar] [CrossRef]

- Kagermann, H.; Wahlster, W.; Helbig, J. Recommendations for Implementing the Strategic Initiative Industrie 4.0—Final Report of the Industrie 4.0 Working Group; Acatech—National Academy of Science and Engineering: Frankfurt am Main, Germany, 2013. [Google Scholar]

- Kane, G.C.; Palmer, D.; Phillips, A.N.; Kiron, D.; Buckley, N. Achieving Digital Maturity; MIT Sloan Management Review and Deloitte University Press: Boston, MA, USA, 2017. [Google Scholar]

- Wee, D.; Kelly, R.; Cattel, J.; Breunig, M. Industry 4.0—How to Navigate Digitization of the Manufacturing Sector; McKinsey & Company: Dusseldorf, Germany; Berlin, Germany; Munich, Germany, 2015. [Google Scholar]

- Maynard, A.D. Navigating the fourth industrial revolution. Nat. Nanotechnol. 2015, 10, 1005–1006. [Google Scholar] [CrossRef] [PubMed]

- Herrmann, C.; Schmidt, C.; Kurle, D.; Blume, S.; Thiede, S. Sustainability in manufacturing and factories of the future. Int. J. Precis. Eng. Manuf.-Green Technol. 2014, 1, 283–292. [Google Scholar] [CrossRef]

- Elkington, J. Partnerships from cannibals with forks: The triple bottom line of 21st-century business. Environ. Qual. Manag. 1998, 8, 37–51. [Google Scholar] [CrossRef]

- Norman, W.; MacDonald, C.; Arnold, D.G. Getting to the Bottom of “Triple Bottom Line”. Bus. Ethics Q. 2004, 14, 243–262. [Google Scholar] [CrossRef]

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Elkington, J. Towards the Sustainable Corporation. Win-Win-Win Business Strategies for Sustainable Development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- McWilliams, A.; Parhankangas, A.; Coupet, J.; Welch, E.; Barnum, D.T. Strategic Decision Making for the Triple Bottom Line. Bus. Strategy Environ. 2016, 25, 193–204. [Google Scholar] [CrossRef]

- Glavič, P.; Lukman, R. Review of sustainability terms and their definitions. J. Clean. Prod. 2007, 15, 1875–1885. [Google Scholar] [CrossRef]

- Littig, B.; Griessler, E. Social sustainability. A catchword between political pragmatism and social theory. Int. J. Sustain. Dev. 2005, 8, 65–78. [Google Scholar] [CrossRef]

- Beier, G.; Niehoff, S.; Ziems, T.; Xue, B. Sustainability aspects of a digitalized industry—A comparative study from China and Germany. Int. J. Precis. Eng. Manuf.-Green Technol. 2017, 4, 227–234. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How Smart Connected Products Are Transforming Competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How Virtualization, Decentralization and Network Building Change the Manufacturing Landscape: An Industry 4.0 Perspective. Int. J. Mech. Aerosp. Ind. Mechatron. Eng. 2014, 8, 37–44. [Google Scholar]

- Hansen, E.G.; Grosse-Dunker, F.; Reichwald, R. Sustainability innovation cube—A framework to evaluate sustainability-oriented innovations. Int. J. Innov. Manag. 2009, 13, 683–713. [Google Scholar] [CrossRef]

- Kuhl, M.R.; Da Cunha, J.C.; Maçaneiro, M.B.; Cunha, S.K. Relationship between Innovation and Sustainable Performance. Int. J. Innov. Manag. 2016, 20, 1650047. [Google Scholar] [CrossRef]

- Hossain, M.S.; Muhammad, G. Cloud-assisted Industrial Internet of Things (IIoT)—Enabled framework for health monitoring. Comput. Netw. 2016, 101, 192–202. [Google Scholar] [CrossRef]

- Oesterreich, T.D.; Teuteberg, F. Understanding the implications of digitisation and automation in the context of Industry 4.0: A triangulation approach and elements of a research agenda for the construction industry. Comput. Ind. 2016, 83, 121–139. [Google Scholar] [CrossRef]

- Peukert, B.; Benecke, S.; Clavell, J.; Neugebauer, S.; Nissen, N.F.; Uhlmann, E.; Lang, K.-D.; Finkbeiner, M. Addressing Sustainability and Flexibility in Manufacturing via Smart Modular Machine Tool Frames to Support Sustainable Value Creation. Procedia CIRP 2015, 29, 514–519. [Google Scholar] [CrossRef]

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Oettmeier, K.; Hofmann, E. Additive manufacturing technology adoption: An empirical analysis of general and supply chain-related determinants. J. Bus. Econ. 2017, 87, 97–124. [Google Scholar] [CrossRef]

- Saberi, S.; Yusuff, R.M. Advanced manufacturing technology implementation performance: Towards a strategic framework. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Kuala Lumpur, Malaysia, 22–24 January 2011. [Google Scholar]

- Rehage, G.; Bauer, F.; Gausemeier, J.; Jurke, B.; Pruschek, P. Intelligent Manufacturing Operations Planning, Scheduling and Dispatching on the Basis of Virtual Machine Tools. In Digital Product and Process Development; Kovács, G.L., Kochan, D., Eds.; Springer: Berlin, Germany, 2013; pp. 391–400. ISBN 9783642413292. [Google Scholar]

- Rudtsch, V.; Gausemeier, S.; Gesing, J.; Mittag, T.; Peter, S. Pattern-Based Business Model Development for Cyber-Physical Production Systems. Procedia CIRP 2014, 25, 313–319. [Google Scholar] [CrossRef]

- Rogers, E.; Trombley, D. The Benefits and Barriers to Smart Manufacturing. In Proceedings of the 36th Industrial Energy Technology Conference, New Orleans, LA, USA, 20–23 May 2014. [Google Scholar]

- Stock, T.; Seliger, G. Opportunities of Sustainable Manufacturing in Industry 4.0. Procedia CIRP 2016, 40, 536–541. [Google Scholar] [CrossRef]

- Schmidt, R.; Möhring, M.; Härting, R.C.; Reichstein, C.; Neumaier, P.; Jozinović, P. Industry 4.0-potentials for creating smart products: Empirical research results. In Business Information Systems; Abramowicz, W., Ed.; Springer: Cham, Switzerland, 2015; pp. 16–27. ISBN 978-3-319-19027-3. [Google Scholar]

- Schuhmacher, J.; Hummel, V. Decentralized Control of Logistic Processes in Cyber-physical Production Systems at the Example of ESB Logistics Learning Factory. Procedia CIRP 2016, 54, 19–24. [Google Scholar] [CrossRef]

- Hofmann, E.; Rüsch, M. Industry 4.0 and the current status as well as future prospects on logistics. Comput. Ind. 2017, 89, 23–34. [Google Scholar] [CrossRef]

- Zhong, R.Y.; Huang, G.Q.; Lan, S.; Dai, Q.Y.; Chen, X.; Zhang, T. A big data approach for logistics trajectory discovery from RFID-enabled production data. Int. J. Prod. Econ. 2015, 165, 260–272. [Google Scholar] [CrossRef]

- Zhou, W.; Piramuthu, S.; Chu, F.; Chu, C. RFID-enabled flexible warehousing. Decis. Support Syst. 2017, 98, 99–112. [Google Scholar] [CrossRef]

- Arnold, C.; Kiel, D.; Voigt, K.-I. The Driving Role of the Industrial Internet of Things for Strategic Change: The Case of Electronic Engineering Business Models. In Proceedings of the 24th Innovation and Product Development Management Conference (IPDMC), Reykjavik, Iceland, 11–13 June 2017. [Google Scholar]

- Ehret, M.; Wirtz, J. Unlocking value from machines: Business models and the industrial internet of things. J. Mark. Manag. 2017, 33, 111–130. [Google Scholar] [CrossRef]

- Amshoff, B.; Dülme, C.; Echterfeld, J.; Gausemeier, J. Business model patterns for disruptive technologies. Int. J. Innov. Manag. 2015, 19, 1540002. [Google Scholar] [CrossRef]

- Burmeister, C.; Luettgens, D.; Piller, F.T. Business Model Innovation for Industrie 4.0: Why the “Industrial Internet” Mandates a New Perspective on Innovation. Die Unternehmung 2016, 70, 124–152. [Google Scholar] [CrossRef]

- Laudien, S.M.; Spieth, P.; Clauß, T. Digitalization as Driver of Business Model Innovation: An Exploratory Analysis. In Proceedings of the 28th International Society for Professional Innovation Management (ISPIM) Conference, Vienna, Austria, 18–21 June 2017. [Google Scholar]

- Rennung, F.; Luminosu, C.T.; Draghici, A. Service Provision in the Framework of Industry 4.0. Procedia Soc. Behav. Sci. 2016, 221, 372–377. [Google Scholar] [CrossRef]

- Erol, S.; Jäger, A.; Hold, P.; Ott, K.; Sihn, W. Tangible Industry 4.0: A Scenario-Based Approach to Learning for the Future of Production. Procedia CIRP 2016, 54, 13–18. [Google Scholar] [CrossRef]

- Hirsch-Kreinsen, H. Smart production systems. A new type of industrial process innovation. In Proceedings of the 2014 DRUID Society Conference, Copenhagen, Denmark, 16–18 June 2014. [Google Scholar]

- Weyer, S.; Schmitt, M.; Ohmer, M.; Gorecky, D. Towards Industry 4.0-Standardization as the crucial challenge for highly modular, multi-vendor production systems. IFAC PapersOnLine 2015, 48, 579–584. [Google Scholar] [CrossRef]

- Müller, J.; Voigt, K.-I. Industry 4.0—Integration Strategies for Small and Medium-sized Enterprises. In Proceedings of the 26th International Association for Management of Technology (IAMOT) Conference, Vienna, Austria, 14–18 May 2017. [Google Scholar]

- Müller, J.M.; Buliga, O.; Voigt, K.-I. Fortune favors the prepared. How SMEs are approaching business model innovations in Industry 4.0. Technol. Forecast. Soc. 2018, in press. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q. Environmental sustainability and production: Taking the road less travelled. Int. J. Prod. Res. 2017, 1, 1–17. [Google Scholar] [CrossRef]

- Ding, K.; Jiang, P.; Zheng, M. Environmental and Economic Sustainability-Aware Resource Service Scheduling for Industrial Product Service Systems. J. Intell. Manuf. 2015, 1–14. [Google Scholar] [CrossRef]

- Fysikopoulos, A.; Pastras, G.; Alexopoulos, T.; Chryssolouris, G. On a Generalized Approach to Manufacturing Energy Efficiency. Int. J. Adv. Manuf. Technol. 2014, 73, 1437–1452. [Google Scholar] [CrossRef]

- Weinert, N.; Chiotellis, S.; Seliger, G. Methodology for Planning and Operating Energy-Efficient Production Systems. CIRP Ann.-Manuf. Technol. 2011, 60, 41–44. [Google Scholar] [CrossRef]

- Shrouf, F.; Miragliotta, G. Energy Management Based on Internet of Things: Practices and Framework for Adoption in Production Management. J. Clean. Prod. 2015, 100, 235–246. [Google Scholar] [CrossRef]

- Chu, W.S.; Kim, M.S.; Jang, K.H.; Song, J.-H.; Rodriguez, H.; Chun, D.-M.; Cho, Y.T.; Ko, S.H.; Cho, K.-J.; Cha, S.W.; et al. From Design for Manufacturing (DFM) to Manufacturing for Design (MFD) Via Hybrid Manufacturing and Smart Factory: Are view and Perspective of Paradigm Shift. Int. J. Precis. Eng. Manuf.-Green Technol. 2016, 3, 209–222. [Google Scholar] [CrossRef]

- Zhao, W.-B.; Jeong, J.-W.; Noh, S.D.; Yee, J.T. Energy Simulation Framework Integrated with Green Manufacturing-Enabled PLM Information Model. Int. J. Precis. Eng. Manuf.-Green Technol. 2015, 2, 217–224. [Google Scholar] [CrossRef]

- Gabriel, M.; Pessel, E. Industry 4.0 and sustainability impacts: Critical discussion of sustainability aspects with a special focus on future of work and ecological consequences. Int. J. Eng. 2016, 1, 131–136. [Google Scholar]

- Qiu, X.; Luo, H.; Xu, G.; Zhong, R.; Huang, G.Q. Physical assets and service sharing for IoT-enabled Supply Hub in Industrial Park (SHIP). Int. J. Prod. Econ. 2015, 159, 4–15. [Google Scholar] [CrossRef]

- Herman, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the 49th Hawaii International Conference on Systems Sciences (HICSS), Honolulu, Hawaii, 5–8 January 2016. [Google Scholar]

- Müller, J.; Dotzauer, V.; Voigt, K.-I. Industry 4.0 and its Impact on Reshoring Decisions of German Manufacturing Enterprises. In Supply Management Research—Advanced Studies in Supply Management; Bode, C., Bogaschewsky, R., Eßig, M., Lasch, R., Stölzle, W., Eds.; Springer Gabler: Wiesbaden, Germany, 2017; pp. 165–179. ISBN 978-3-658-18631-9. [Google Scholar]

- Meyer, B.; Meyer, M.; Distelkamp, M. Modeling Green Growth and Resource Efficiency New Results. Miner. Econ. 2012, 24, 145–154. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.A.; Yang, S. Service innovation and smart analytics for industry 4.0 and big data environment. Procedia CIRP 2014, 16, 3–8. [Google Scholar] [CrossRef]

- Berman, B. 3-D printing: The new industrial revolution. Bus. Horiz. 2012, 55, 155–162. [Google Scholar] [CrossRef]

- Bonekamp, L.; Sure, M. Consequences of Industry 4.0 on Human Labour and Work Organisation. J. Bus. Media Psychol. 2015, 6, 33–40. [Google Scholar]

- Römer, T.; Bruder, R. User centered design of a cyber-physical support solution for assembly processes. Procedia Manuf. 2015, 3, 456–463. [Google Scholar] [CrossRef]

- Kubicek, B.; Korunka, C. The Present and Future of Work: Some Concluding Remarks and Reflections on Upcoming Trends. In Job Demands in a Changing World of Work; Korunka, C., Kubicek, B., Eds.; Springer: Cham, Switzerland, 2017; pp. 153–162. ISBN 978-3-319-54677-3. [Google Scholar]

- Tesch, J.F.; Brillinger, A.S.; Bilgeri, D. Internet of Things Business Model Innovation and the Stage-Gate Process: An Exploratory Analysis. Int. J. Innov. Manag. 2017, 21, 1740002. [Google Scholar] [CrossRef]

- Leonhardt, F.; Wiedemann, A. Realigning Risk Management in the Light of Industry 4.0; SSRN: Amsterdam, The Netherlands, 2015. [Google Scholar] [CrossRef]

- Dombrowski, U.; Wagner, T. Mental strain as field of action in the 4th industrial revolution. Procedia CIRP 2014, 17, 100–105. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.; Xu, S. Electronic business adoption by European firms: A cross-country assessment of the facilitators and inhibitors. Eur. J. Inf. Syst. 2003, 12, 251–268. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Creating value through business model innovation. MIT Sloan Manag. Rev. 2012, 53, 41–49. [Google Scholar]

- Mitchell, D.; Coles, C. The ultimate competitive advantage of continuing business model innovation. J. Bus. Strategy 2003, 24, 15–21. [Google Scholar] [CrossRef]

- Schneider, S.; Spieth, P. Business Model Innovation: Towards an Integrated Future Research Agenda. Int. J. Innov. Manag. 2013, 17, 1340001. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Voigt, K.-I.; Buliga, O.; Michl, K. Business Model Pioneers—How Innovators Successfully Implement New Business Models; Springer: Cham, Switzerland, 2017; ISBN 978-3-319-38845-8. [Google Scholar]

- Mole, K.F.; Ghobadian, A.; O’Regan, N.; Liu, J. The use and deployment of soft process technologies within UK manufacturing SMEs: An empirical assessment using logit models. J. Small Bus. Manag. 2004, 42, 303–324. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Free Press: New York, NY, USA, 2003; ISBN 978-0743222099. [Google Scholar]

- Meyer, G.G.; Wortmann, J.C.; Szirbik, N.B. Production monitoring and control with intelligent products. Int. J. Prod. Res. 2011, 49, 1303–1317. [Google Scholar] [CrossRef]

- Au, A.K.M.; Enderwick, P. A cognitive model on attitude towards technology adoption. J. Manag. Psychol. 2000, 15, 266–282. [Google Scholar] [CrossRef]

- Bierma, T.; Waterstraat, F. Overcoming Barriers to Pollution Prevention in Small Businesses, Waste Management and Research Center Reports RR-E075; Illinois Department of Natural Resources: Champaign, IL, USA, 2001. [Google Scholar]

- Heinssen, R.K.; Glass, C.R.; Knight, L.A. Assessing computer anxiety: Development and validation of the Computer Anxiety Rating Scale. Comput. Hum. Behav. 1987, 3, 49–59. [Google Scholar] [CrossRef]

- Rodríguez-Ardura, I.; Meseguer-Artola, A. Toward a Longitudinal Model of e-Commerce: Environmental, Technological, and Organizational Drivers of B2C Adoption. Inf. Soc. 2010, 26, 209–227. [Google Scholar] [CrossRef]

- Sila, I. Factors affecting the adoption of B2B e-commerce technologies. Electron. Commer. Res. 2013, 13, 199–236. [Google Scholar] [CrossRef]

- Chau, P.Y.K.; Tam, K.Y. Factors affecting the adoption of open systems: An exploratory study. MIS Q. 1997, 21, 1–24. [Google Scholar] [CrossRef]

- Grover, V. An empirically derived model for the adoption of customer-based interorganizational systems. Decis. Sci. 1993, 24, 603–640. [Google Scholar] [CrossRef]

- Ramdani, B.; Kawalek, P.; Lorenzo, O. Predicting SMEs adoption of enterprise systems. J. Enterp. Inf. Manag. 2009, 22, 10–24. [Google Scholar] [CrossRef]

- Gefen, D. E-commerce: The role of familiarity and trust. Omega 2000, 28, 725–737. [Google Scholar] [CrossRef]

- Bozionelos, N. Socio-economic background and computer use: The role of computer anxiety and computer experience in their relationship. Int. J. Hum.-Comput. Stud. 2004, 61, 725–746. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: Thousand Oaks, CA, USA, 2016; ISBN 9781483377445. [Google Scholar]

- Churchill, G.A. Paradigm for developing better measures of marketing constructs. J. Mark. Res. 1979, 16, 64–73. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modeling. In Modern Methods of Business Research; Marcoulides, G.A., Ed.; Psychology Press: Mahwah, NJ, USA, 1998; pp. 295–336. ISBN 0805830936. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Lohmöller, J.B. Latent Variable Path Modeling with Partial Least Squares; Physica: Heidelberg, Germany, 1989; ISBN 978-3-642-52512-4. [Google Scholar]

- Hair, J.F.; Sarstedt, M.; Pieper, T.M.; Ringle, C.M. The Use of Partial Least Squares Structural Equation Modeling in Strategic Management Research: A Review of Past Practices and Recommendations for Future Applications. Long Range Plan. 2012, 56, 320–340. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. In Advances in International Marketing; Sinkovics, R.R., Ghauri, P.N., Eds.; Emerald: Bingley, UK, 2009; pp. 227–320. ISBN 978-1-84855-468-9. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. Using partial least squares path modeling in advertising research: Basic concepts and recent issues. In Handbook of Research on International Advertising; Okazaki, S., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2012; pp. 252–276. ISBN 978-1-84844-858-2. [Google Scholar]

- Reinartz, W.; Haenlein, M.; Henseler, J. An empirical comparison of the efficacy of covariance-based and variance-based SEM. Int. J. Res. Mark. 2009, 26, 332–344. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.-M. SmartPLS 3, SmartPLS: Hamburg, Germany, 2014.

- Nunnally, J. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978; ISBN 978-0-07047-465-9. [Google Scholar]

- Carmines, E.G.; Zeller, R.A. Reliability and Validity Assessment; Sage: Newbury Park, CA, USA, 1979; ISBN 978-0-8039-1371-4. [Google Scholar]

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to causal modeling: Personal computer adoption and use as an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Duarte, P.A.O.; Raposo, M.L.B. A PLS model to study brand preference: An application to the mobile phone market. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Vinzi, V.E., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 449–485. ISBN 978-3-54032-827-8. [Google Scholar]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Airaksinen, A.; Luomaranta, H.; Alajääskö, P.; Roodhuijzen, A. Statistics on Small and Medium-Sized Enterprises: Dependent and Independent SMEs and Large Enterprises. Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Statistics_on_small_and_%20medium-sized_enterprises (accessed on 7 August 2017).

- Redondo, Y.P.; Fierro, J.C. Importance of company size in long-term orientation of supply function: An empirical research. J. Bus. Ind. Mark. 2007, 22, 236–248. [Google Scholar] [CrossRef]

- Sciascia, S.; Nordqvist, M.; Mazzola, P.; De Massis, A. Family Ownership and R&D Intensity in Small- and Medium-Sized Firms. J. Prod. Innov. Manag. 2015, 32, 349–360. [Google Scholar] [CrossRef]

- Braglia, M.; Petroni, A. Towards a taxonomy of search patterns of manufacturing flexibility in small and medium-sized firms. Omega 2000, 28, 195–213. [Google Scholar] [CrossRef]

- Kapasuwan, S.; Rose, J.; Chiung-Hui, T. The Synergistic Effects of Strategic Flexibility and Technological Resources on Performance of SMEs. J. Small Bus. Entrep. 2007, 20, 257–272. [Google Scholar] [CrossRef]

- Petroni, A.; Bevilacqua, M. Identifying manufacturing flexibility best practices in small and medium enterprises. Int. J. Oper. Prod. Manag. 2002, 22, 929–947. [Google Scholar] [CrossRef]

- Morrison, E.; Milliken, F. Organizational Silence: A Barrier to Change and Development in a Pluralistic World. Acad. Manag. Rev. 2000, 25, 706–725. [Google Scholar] [CrossRef]

- Chesbrough, H. Open innovation: Where we’ve been and where we’re going. Res. Technol. Manag. 2012, 55, 20–27. [Google Scholar] [CrossRef]

- Zhang, Q.; Cheng, L.; Boutaba, R. Cloud computing: State-of-the-art and research challenges. J. Internet Serv. Appl. 2010, 1, 7–18. [Google Scholar] [CrossRef]

- Bulger, M.; Taylor, G.; Schroeder, R. Data-Driven Business Models: Challenges and Opportunities of Big Data; Oxford Internet Institute: Oxford, UK, 2014. [Google Scholar]

- Shim, S.-O.; Park, K.; Choi, S. Innovative Production Scheduling with Customer Satisfaction Based Measurement for the Sustainability of Manufacturing Firms. Sustainability 2017, 9, 2249. [Google Scholar] [CrossRef]

- Bologa, R.; Lupu, A.-R.; Boja, C.; Georgescu, T.M. Sustaining Employability: A Process for Introducing Cloud Computing, Big Data, Social Networks, Mobile Programming and Cybersecurity into Academic Curricula. Sustainability 2017, 9, 2235. [Google Scholar] [CrossRef]

- Gibson, R. Beyond the Pillars: Sustainability assessment as a framework for effective integration of social, economic and ecological considerations in significant decision-making. J. Environ. Assess. Policy Manag. 2006, 8, 259–280. [Google Scholar] [CrossRef]

- Sridhar, K.; Jones, G. The three fundamental criticisms of the Triple Bottom Line approach. An empirical study to link sustainability reports in companies based in the Asia-Pacific region and TBL shortcomings. Asian J. Bus. Ethics 2013, 2, 91–111. [Google Scholar] [CrossRef]

- Lin, K.C.; Shyu, J.Z.; Ding, K. A Cross-Strait Comparison of Innovation Policy under Industry 4.0 and Sustainability Development Transition. Sustainability 2017, 9, 786. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

| Category | Exemplary Literature | Main Contributions |

|---|---|---|

| Strategy | Arnold et al., 2016; Arnold et al., 2017; Brettel et al., 2014; Burmeister et al., 2016; Kagermann et al., 2013; Laudien et al., 2017; Rennung et al., 2016 |

|

| Operations | Erol et al., 2016; Kagermann et al., 2013; Lee et al., 2014; Meyer et al., 2014; Oettmeier and Hofmann, 2017; Rehage et al., 2013; Rogers and Trombley, 2014; Rudtsch et al., 2014; Saberi and Yusuff, 2011; Schmidt et al., 2015; Stock and Seliger, 2016 |

|

| Environment and people | Berman, 2012; Gabriel and Pessel, 2016; Herrmann et al., 2014; Hirsch-Kreinsen, 2014; Kagermann et al., 2013; Kiel et al., 2017; Oettmeier and Hofmann, 2017; Peukert et al., 2015; Stock and Seliger, 2016 |

|

| Category | Exemplary Literature | Main Contributions |

|---|---|---|

| Competitiveness and future viability | Arnold et al., 2016; Brettel et al., 2014; Kiel et al., 2017; Müller et al., 2018; Porter and Heppelmann, 2014 |

|

| Organizational and production fit | Erol et al., 2016; Hermann et al., 2016; Hirsch-Kreinsen, 2014; Müller et al., 2018 |

|

| Employee qualification and acceptance | Bauer et al., 2015; Bonekamp and Sure, 2015; Dombrowski and Wagner, 2014; Erol et al., 2016; Kagermann et al., 2013; Kiel et al., 2017 |

|

| Construct | CR | AVE | Item | Loading | t-Value |

|---|---|---|---|---|---|

| Strategy (Str) | 0.839 | 0.634 | Str_1 | 0.81 | 41.591 |

| Str_2 | 0.83 | 35.066 | |||

| Str_3 | 0.783 | 41.638 | |||

| Operations (Op) | 0.962 | 0.719 | Op_1 | 0.867 | 58.712 |

| Op_2 | 0.836 | 45.788 | |||

| Op_3 | 0.857 | 60.347 | |||

| Op_4 | 0.838 | 51.48 | |||

| Op_5 | 0.846 | 51.287 | |||

| Op_6 | 0.882 | 52.917 | |||

| Op_7 | 0.839 | 42.516 | |||

| Op_8 | 0.777 | 35.62 | |||

| Op_9 | 0.873 | 58.857 | |||

| Op_10 | 0.859 | 61.194 | |||

| Environment and people (Env) | 0.85 | 0.653 | Env_1 | 0.827 | 32.82 |

| Env_2 | 0.763 | 43.28 | |||

| Env_3 | 0.799 | 29.107 | |||

| Competitiveness and future viability (Com) | 0.942 | 0.698 | Com_1 | 0.818 | 39.106 |

| Com_2 | 0.83 | 38.477 | |||

| Com_3 | 0.846 | 43.005 | |||

| Com_4 | 0.796 | 35.251 | |||

| Com_5 | 0.894 | 39.383 | |||

| Com_6 | 0.91 | 59.505 | |||

| Com_7 | 0.744 | 26.928 | |||

| Organizational and production fit (Org) | 0.896 | 0.684 | Org_1 | 0.872 | 56.934 |

| Org_2 | 0.877 | 46.224 | |||

| Org_3 | 0.78 | 42.471 | |||

| Org_4 | 0.773 | 44.786 | |||

| Employee qualifications and acceptance (Emp) | 0.91 | 0.668 | Emp_1 | 0.859 | 44.519 |

| Emp_2 | 0.82 | 33.917 | |||

| Emp_3 | 0.796 | 34.986 | |||

| Emp_4 | 0.783 | 26.809 | |||

| Emp_5 | 0.826 | 40.56 | |||

| Relevance for implementation (Imp) | 0.763 | 0.52 | Imp_1 | 0.632 | 25.814 |

| Imp_2 | 0.779 | 42.427 | |||

| Imp_3 | 0.774 | 33.071 |

| Construct | Str | Op | Env | Com | Org | Emp | Imp |

|---|---|---|---|---|---|---|---|

| Str | |||||||

| Op | 0.723 | ||||||

| Env | 0.697 | 0.698 | |||||

| Com | 0.466 | 0.62 | 0.412 | ||||

| Org | 0.543 | 0.667 | 0.504 | 0.801 | |||

| Emp | 0.579 | 0.712 | 0.484 | 0.556 | 0.658 | ||

| Imp | 0.742 | 0.816 | 0.714 | 0.653 | 0.709 | 0.697 |

| Characteristics | H1 | H2 | H3 | H4 | H5 | H6 |

|---|---|---|---|---|---|---|

| Total sample | + | + | + | + | + | − |

| Large companies | + | + | + | + | + | − |

| SMEs | + | + | + | + | 0 | − |

| Automotive | 0 | + | 0 | 0 | + | − |

| Chemical and plastics | 0 | + | + | 0 | 0 | 0 |

| Electrical engineering | + | + | + | 0 | + | − |

| Mechanical and plant engineering | + | + | + | + | 0 | 0 |

| Steel | 0 | + | + | 0 | + | 0 |

| Providers | + | 0 | + | 0 | 0 | − |

| Users | 0 | + | + | 0 | 0 | − |

| Both | 0 | + | + | + | 0 | − |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Müller, J.M.; Kiel, D.; Voigt, K.-I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. https://doi.org/10.3390/su10010247

Müller JM, Kiel D, Voigt K-I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability. 2018; 10(1):247. https://doi.org/10.3390/su10010247

Chicago/Turabian StyleMüller, Julian Marius, Daniel Kiel, and Kai-Ingo Voigt. 2018. "What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability" Sustainability 10, no. 1: 247. https://doi.org/10.3390/su10010247

APA StyleMüller, J. M., Kiel, D., & Voigt, K.-I. (2018). What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability, 10(1), 247. https://doi.org/10.3390/su10010247