Analyzing New Quality Productive Forces in New Energy Vehicle Companies Based on a New Multi-Criteria Decision Analysis Model

Abstract

1. Introduction

- (1)

- It is the first to study the issue of NQPF evaluation in the NEV industry.

- (2)

- It proposes the IDOCRIW-PROBID model, which addresses the shortcomings of traditional entropy weight and TOPSIS methods.

- (3)

- It introduces obstacle degree analysis into the MCDA model, providing more comprehensive references for industry policy formulation and company strategy adjustments.

2. Research Methods

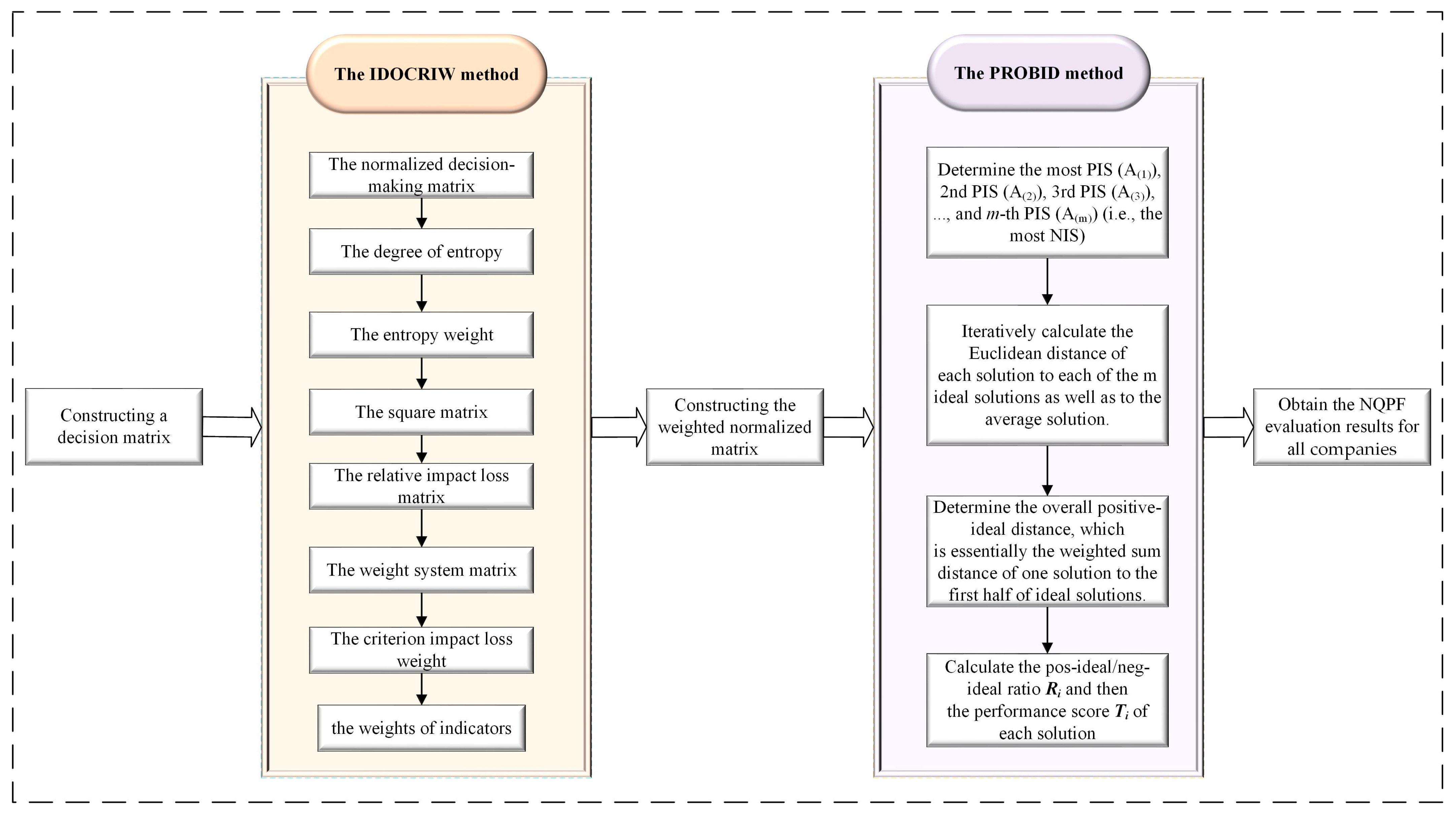

2.1. A New MCDA Model for Evaluating NQPF

2.1.1. Weight Calculation Based on IDOCRIW

2.1.2. Calculating NQPF Based on PROBID

2.2. Obstacle Degree Model

3. Case Study

3.1. Case Introduction

3.2. Case Calculation

4. Results Analysis

4.1. Model Comparison Analysis

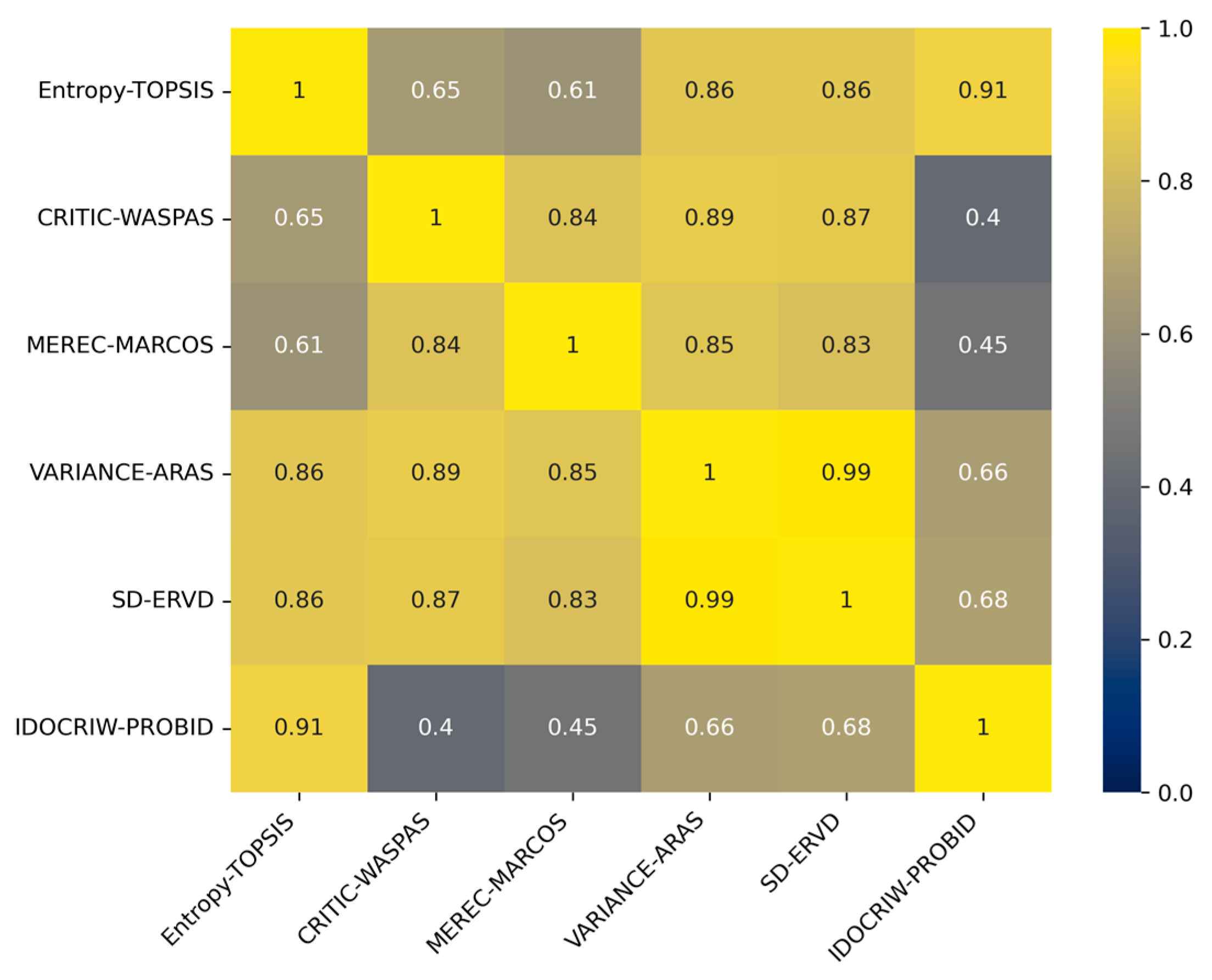

4.1.1. Reliability Analysis of the Model

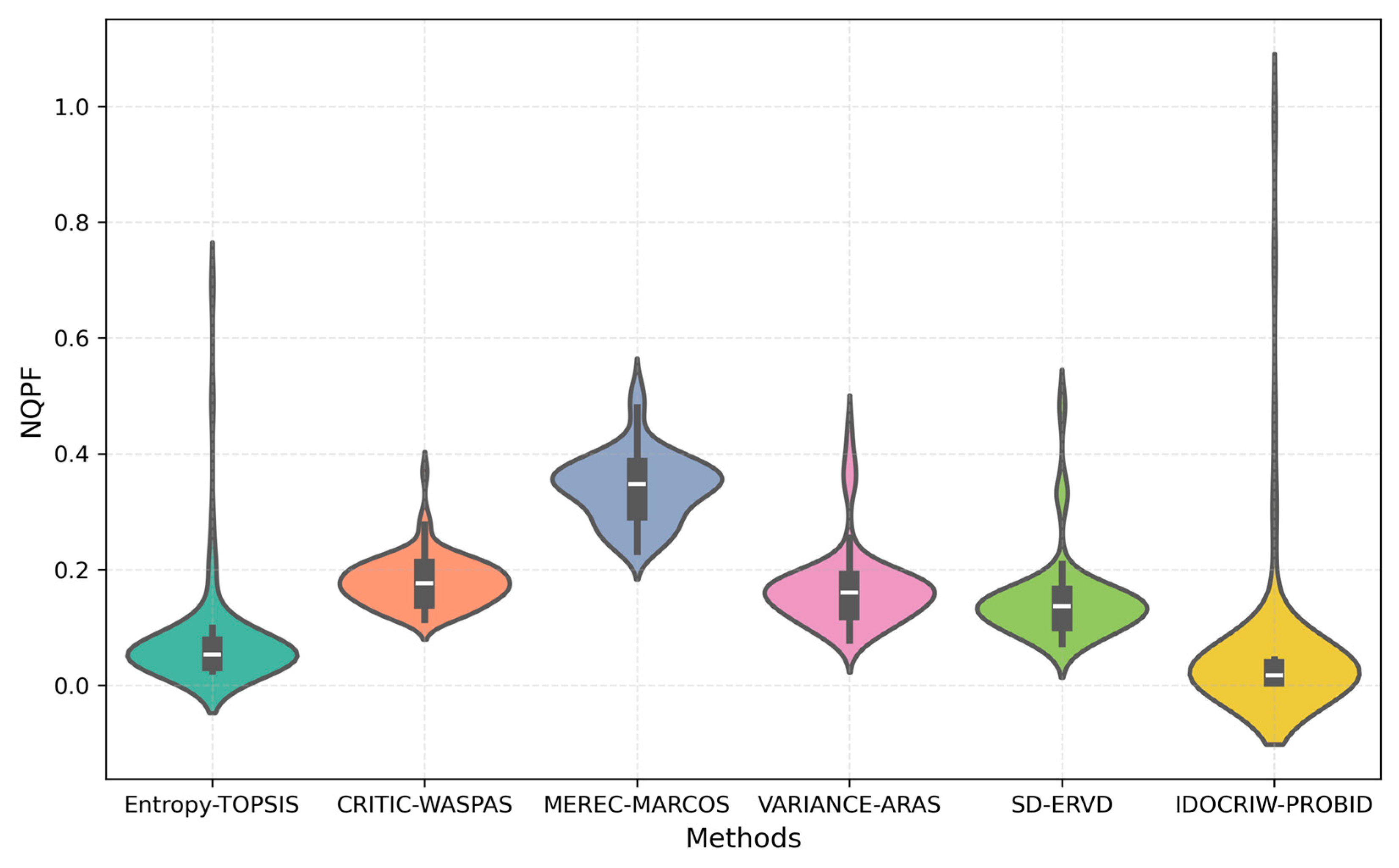

4.1.2. Superiority Analysis of the Model

4.2. Analysis of NQPF Levels

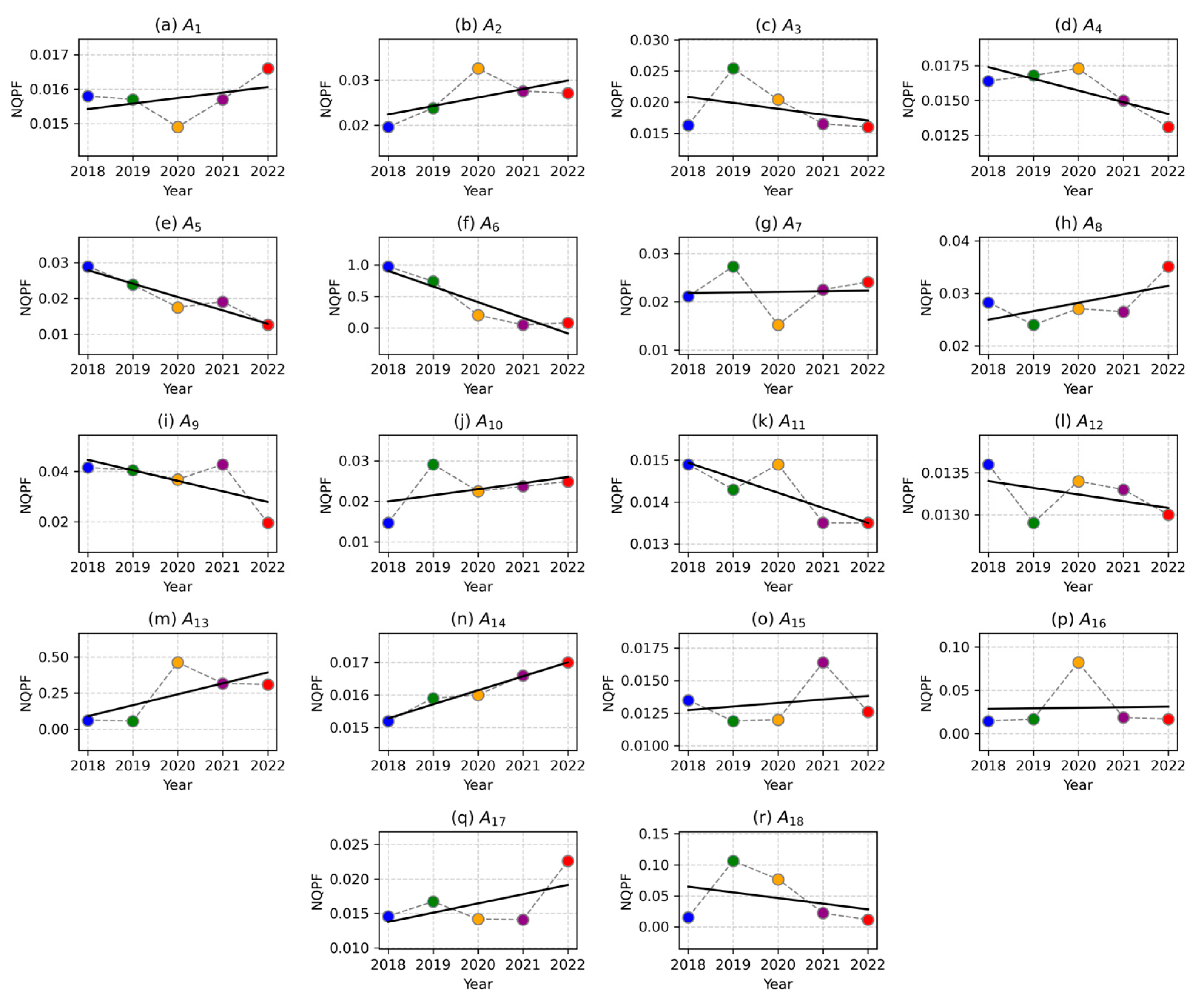

4.2.1. Descriptive Statistical Analysis

4.2.2. Regression Analysis

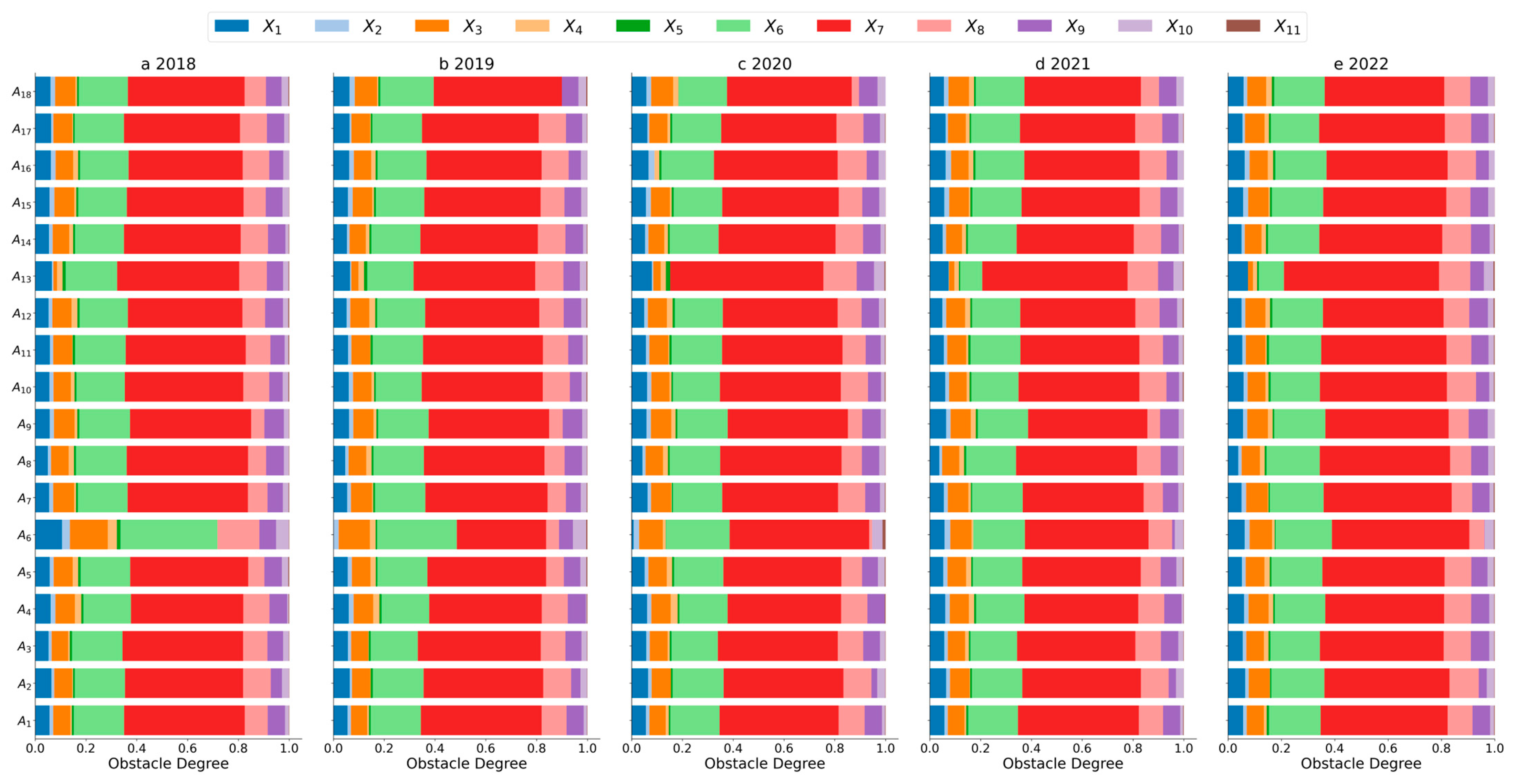

4.3. Analysis of NQPF Obstacle Factors

5. Conclusions and Recommendations

5.1. Conclusions

- (1)

- The proposed IDOCRIW-PROBID model demonstrates reliability and superiority. The correlation between the evaluation results of the IDOCRIW-PROBID model and traditional models (such as Entropy-TOPSIS) reached 0.91, indicating the high reliability and accuracy of the model in assessing the NQPF of NEV companies. The model can effectively distinguish differences in productivity levels among companies and shows high sensitivity in identifying subtle changes and performance variations.

- (2)

- The development level of NQPF in Chinese NEV companies is suboptimal. From 2018 to 2022, the overall NQPF level of NEV companies showed a downward trend, and the disparity among companies gradually narrowed. This reflects insufficient investment in technological innovation, asset utilization, and talent acquisition across the industry, especially in terms of direct R&D investment, R&D depreciation, and leasing costs, which have become major obstacles to improving productivity.

- (3)

- The lack of hard technology is a primary obstacle to the development of NQPF in Chinese NEV companies. During the study period, the high obstacle degrees of X6, X7, and X8 indicated low levels of investment in these key R&D inputs, which severely affected companies’ technological innovation capabilities and asset utilization efficiency. The insufficient investment in these critical areas has become a long-term challenge for NEV companies.

5.2. Recommendations

- (1)

- Increase R&D investment and optimize fund allocation. NEV companies should increase their R&D funding, especially in key areas such as R&D depreciation, R&D leasing, and other critical fields, to ensure the sustainability of technological innovation. At the same time, companies should strengthen their fine management of R&D funds, rationally allocate R&D expenses, and improve fund utilization efficiency.

- (2)

- Strengthen technological innovation capabilities and improve R&D efficiency. Technological innovation is a key driver for improving NQPF. Companies should, while maintaining their current R&D investment, further improve the efficiency of R&D activities. By optimizing the management of R&D assets and reducing unnecessary leasing costs, companies can enhance the utilization efficiency of R&D depreciation and leasing expenses, maximizing the benefits of R&D activities.

- (3)

- Improve asset management and enhance resource utilization efficiency. Companies should focus on improving their overall asset utilization efficiency, especially in the rational allocation of R&D funds and resource optimization. Strengthening technology transfer and the industrial application of innovative outcomes will help boost productivity. Furthermore, optimizing the management of R&D depreciation and leasing expenses will enhance companies’ ability to allocate R&D resources, reducing financial waste.

- (4)

- Improve talent recruitment and training mechanisms. Although companies have made some improvements in the proportion of highly educated personnel, the overall allocation of R&D talent still needs optimization. Companies should further enhance their talent recruitment and training mechanisms to improve the overall quality and innovative capabilities of their R&D teams, providing more high-quality human resources to support technological innovation.

- (5)

- Government support and policy guidance. The government should continue to encourage NEV companies to increase R&D investment through policy support, particularly by offering appropriate tax incentives or subsidies for R&D leasing and depreciation costs. Additionally, the government should promote the establishment of a comprehensive technological innovation ecosystem, facilitating collaboration between companies and research institutions to drive technology transfer and the industrialization of outcomes. Furthermore, the government should offer talent recruitment policy support to help companies better attract and retain high-end R&D talent.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Martyushev, N.V.; Malozyomov, B.V.; Kukartsev, V.V.; Gozbenko, V.E.; Konyukhov, V.Y.; Mikhalev, A.S.; Tynchenko, Y.A. Determination of the reliability of urban electric transport running autonomously through diagnostic parameters. World Electr. Veh. J. 2023, 14, 334. [Google Scholar] [CrossRef]

- Wang, S. Exploring the sustainability of China’s new energy vehicle development: Fresh evidence from population symbiosis. Sustainability 2022, 14, 10796. [Google Scholar] [CrossRef]

- Zhou, W.; Xu, L. On New Quality Productivity: Connotative Characteristics and Important Focus. Reform 2023, 10, 1–13. [Google Scholar]

- Xie, F.; Jiang, N.; Kuang, X. Towards an accurate understanding of ‘new quality productive forces’. Econ. Political Stud. 2024, 1–15. [Google Scholar] [CrossRef]

- Lu, J.; Guo, Z.; Wang, Y. Levels of development of new quality productivity, regional differences and paths to enhancement. J. Chongqing Univ. 2024, 30, 1–17. [Google Scholar]

- Zeng, P.; Qin, Y.; Zhou, L. Measurement and spatiotemporal pattern of new quality productive forces level in Chinese cities. Prog. Geogr. 2024, 43, 1102–1117. [Google Scholar]

- Luo, G.; Song, X. The Production Mechanisms, Spatial and Temporal Characteristics, and Regional Differences of Agricultural New Quality Productivity in China. Chin. J. Agric. Resour. Reg. Plan. 2024, 1–14. Available online: https://link.cnki.net/urlid/11.3513.s.20240624.1845.020 (accessed on 24 September 2024).

- Deng, Z.; Wu, H.; Yang, D. Accelerating the Development of New Quality Productive Forces in the Industrial Field: History, Characteristics, and Pathways. J. Beijing Univ. Technol. 2024, 24, 107–117. [Google Scholar]

- Liu, Y.; He, Z. Synergistic Industrial Agglomeration, New Quality Productive Forces and High-quality Development of the Manufacturing Industry. Int. Rev. Econ. Financ. 2024, 94, 103373. [Google Scholar] [CrossRef]

- Yang, L.H.; Ye, F.F.; Wang, Y.M.; Huang, Y.; Hu, H. An ensemble model for efficiency evaluation of enterprise performance based on evidential reasoning approach. J. Intell. Fuzzy Syst. 2023, 45, 2477–2495. [Google Scholar] [CrossRef]

- Quan, C.; Yu, S.; Cheng, X.; Liu, F. Comprehensive efficiency evaluation of social responsibility of Chinese listed logistics enterprises based on DEA-Malmquist model. Oper. Manag. Res. 2022, 15, 1383–1398. [Google Scholar] [CrossRef]

- Xu, X.; He, D.; Wang, T.; Chen, X.; Zhou, Y. Technological innovation efficiency of listed carbon capture companies in China: Based on the dual dimensions of legal policy and technology. Energies 2023, 16, 1118. [Google Scholar] [CrossRef]

- Dong, J.; Liu, D.; Liu, Y.; Huo, H.; Dou, X.; Bao, A. Trading performance evaluation for traditional power generation group based on an integrated matter-element extension cloud model. Energy Rep. 2021, 7, 3074–3089. [Google Scholar] [CrossRef]

- Liang, X.; Chen, T.; Ye, M.; Lin, H.; Li, Z. A hybrid fuzzy BWM-VIKOR MCDM to evaluate the service level of bike-sharing companies: A case study from Chengdu, China. J. Clean. Prod. 2021, 298, 126759. [Google Scholar] [CrossRef]

- Mohammed, A.; Jabbour, A.B.L.D.S.; Diabat, A. COVID-19 pandemic disruption: A matter of building companies’ internal and external resilience. Int. J. Prod. Res. 2023, 61, 2716–2737. [Google Scholar] [CrossRef]

- Sun, P.; Cui, T.; Qi, S. MADM framework based on 2-tuple linguistic neutrosophic sets and its application to comprehensive evaluation of corporate cultural competitiveness. J. Intell. Fuzzy Syst. 2023, 45, 7921–7937. [Google Scholar] [CrossRef]

- Guo, C.; Wang, Y.; Yuan, S.; Li, Z. A Novel Hybrid Multiple Attribute Decision Making Framework for Enterprise Green Marketing Performance Management Evaluation Based on the Triangular Fuzzy Neutrosophic Sets. IEEE Access 2023, 11, 142676–142688. [Google Scholar] [CrossRef]

- Lin, L.; Gu, T.; Shi, Y. The Influence of New Quality Productive Forces on High-Quality Agricultural Development in China: Mechanisms and Empirical Testing. Agriculture 2024, 14, 1022. [Google Scholar] [CrossRef]

- López-Parra, P.; Alvarez, P.A.; León-Castro, E.; Velázquez-Cázares, M.; Muñoz-Palma, M. A Bibliometric Analysis of Robustness and MCDA. In Soft Computing and Fuzzy Methodologies in Innovation Management and Sustainability; Springer International Publishing: Cham, Switzerland, 2022; pp. 249–274. [Google Scholar]

- Bhaskar, A.S.; Khan, A. Comparative analysis of hybrid MCDM methods in material selection for dental applications. Expert Syst. Appl. 2022, 209, 118268. [Google Scholar] [CrossRef]

- Wu, Q.; Liu, X.; Zhou, L.; Qin, J.; Rezaei, J. An analytical framework for the best–worst method. Omega 2024, 123, 102974. [Google Scholar] [CrossRef]

- Zeng, F.; Sun, H. Spatial Network Analysis of Coupling Coordination between Digital Financial Inclusion and Common Prosperity in the Yangtze River Delta Urban Agglomeration. Mathematics 2024, 12, 1285. [Google Scholar] [CrossRef]

- Pamučar, D.; Stević, Ž.; Sremac, S. A new model for determining weight coefficients of criteria in MCDM models: Full consistency method (FUCOM). Symmetry 2018, 10, 393. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Podvezko, V. Integrated determination of objective criteria weights in MCDM. Int. J. Inf. Technol. Decis. Mak. 2016, 15, 267–283. [Google Scholar] [CrossRef]

- Zhang, X.; Lv, M.; Yuan, X. Research on cloud-CRITIC-PDR method for hybrid multi-criteria decision making. J. Intell. Fuzzy Syst. 2023, 45, 8789–8803. [Google Scholar] [CrossRef]

- Keshavarz-Ghorabaee, M.; Amiri, M.; Zavadskas, E.K.; Turskis, Z.; Antucheviciene, J. Determination of objective weights using a new method based on the removal effects of criteria (MEREC). Symmetry 2021, 13, 525. [Google Scholar] [CrossRef]

- Sałabun, W.; Wątróbski, J.; Shekhovtsov, A. Are MCDA methods benchmarkable? A comparative study of TOPSIS, VIKOR, COPRAS, and PROMETHEE II methods. Symmetry 2020, 12, 1549. [Google Scholar] [CrossRef]

- Alao, M.A.; Popoola, O.M.; Ayodele, T.R. Selection of waste-to-energy technology for distributed generation using IDOCRIW-Weighted TOPSIS method: A case study of the City of Johannesburg, South Africa. Renew. Energy 2021, 178, 162–183. [Google Scholar] [CrossRef]

- Ayan, B.; Abacıoğlu, S.; Basilio, M.P. A comprehensive review of the novel weighting methods for multi-criteria decision-making. Information 2023, 14, 285. [Google Scholar] [CrossRef]

- Luo, Y.; Zhang, X.; Qin, Y.; Yang, Z.; Liang, Y. Tourism attraction selection with sentiment analysis of online reviews based on probabilistic linguistic term sets and the IDOCRIW-COCOSO model. Int. J. Fuzzy Syst. 2021, 23, 295–308. [Google Scholar] [CrossRef]

- Ciardiello, F.; Genovese, A. A comparison between TOPSIS and SAW methods. Ann. Oper. Res. 2023, 325, 967–994. [Google Scholar] [CrossRef]

- Ünvan, Y.A.; Ergenç, C. Financial performance analysis with the fuzzy COPRAS and entropy-COPRAS approaches. Comput. Econ. 2022, 59, 1577–1605. [Google Scholar] [CrossRef]

- Su, J.; Sun, Y. An improved TOPSIS model based on cumulative prospect theory: Application to ESG performance evaluation of state-owned mining enterprises. Sustainability 2023, 15, 10046. [Google Scholar] [CrossRef]

- Palas, M.R.; Islam, M.R.; Roy, P.; Razzaque, M.A.; Alsanad, A.; AlQahtani, S.A.; Hassan, M.M. Multi-criteria handover mobility management in 5G cellular network. Comput. Commun. 2021, 174, 81–91. [Google Scholar] [CrossRef]

- Mufazzal, S.; Muzakkir, S.M. A new multi-criterion decision making (MCDM) method based on proximity indexed value for minimizing rank reversals. Comput. Ind. Eng. 2018, 119, 427–438. [Google Scholar] [CrossRef]

- Wang, Z.; Rangaiah, G.P.; Wang, X. Preference ranking on the basis of ideal-average distance method for multi-criteria decision-making. Ind. Eng. Chem. Res. 2021, 60, 11216–11230. [Google Scholar] [CrossRef]

- Chun, Y.; Zhang, J.; Han, Y. Green development level assessment and obstacle analysis of China’s coal-resource-based regions. Heliyon 2023, 9, e22495. [Google Scholar] [CrossRef]

- Song, J.; Zhang, J.; Pan, Y. Research on the Impact of ESG Development on New Quality Productive Forces of Enterprises—Empirical Evidence from Chinese A-share Listed Companies. Contemp. Econ. Manag. 2024, 46, 1–11. [Google Scholar]

- Shi, D.; Sun, G. Data Elements and New Quality Productive Forces: A Perspective from Total Factor Productivity of Enterprises. Econ. Theory Bus. Manag. 2024, 44, 12. [Google Scholar]

- Li, B. Research on the Influence of Government Subsidy on New Quality Productive Forces of Grain Enterprises—Empirical Evidence from Listed Companies in China. Econ. Insights-Trends Chall. 2024, 3, 45–72. [Google Scholar] [CrossRef]

- Wang, J.; Mo, L.; Ma, Z. Evaluation of port competitiveness along China’s “Belt and Road” based on the entropy-TOPSIS method. Sci. Rep. 2023, 13, 15717. [Google Scholar] [CrossRef]

- Sampath, V.K.; Radhakrishnan, N. Prioritization of Sub-Watersheds Susceptible to Soil Erosion using Different Combinations of Objective Weighting and MCDM Techniques in an Ungauged River Basin. Water Resour. Manag. 2024, 38, 3447–3469. [Google Scholar] [CrossRef]

- Simic, V.; Gokasar, I.; Deveci, M.; Švadlenka, L. Mitigating climate change effects of urban transportation using a type-2 neutrosophic MEREC-MARCOS model. IEEE Trans. Eng. Manag. 2022, 71, 3233–3249. [Google Scholar] [CrossRef]

- Seikh, M.R.; Chatterjee, P. Determination of best renewable energy sources in India using SWARA-ARAS in confidence level based interval-valued Fermatean fuzzy environment. Appl. Soft Comput. 2024, 155, 111495. [Google Scholar] [CrossRef]

- Shyur, H.J.; Yin, L.; Shih, H.S.; Cheng, C.B. A multiple criteria decision making method based on relative value distances. Found. Comput. Decis. Sci. 2015, 40, 299–315. [Google Scholar] [CrossRef]

| Target Layer | Criterion Layer | Index Layer | Calculation Formula | Property |

|---|---|---|---|---|

| Labor | Live Labor | R&D Personnel Salary Ratio (X1) | (R&D Expenses − Salary Compensation)/Operating Income | + |

| R&D Personnel Proportion (X2) | Number of R&D Personnel/Total Number of Employees | + | ||

| High-Education Personnel Proportion (X3) | Number of Personnel with Bachelor’s Degree or Higher/Total Number of Employees | + | ||

| Materialized Labor | Fixed Asset Ratio (X4) | Fixed Assets/Total Assets | + | |

| Manufacturing Expense Ratio (X5) | (Net Cash Flow from Operating Activities + Fixed Asset Depreciation + Intangible Asset Amortization + Provision for Impairment − Cash Paid for Goods and Services − Wages Paid to Employees)/(Net Cash Flow from Operating Activities + Fixed Asset Depreciation + Intangible Asset Amortization + Provision for Impairment) | + | ||

| Production Tools | Hard Technology | R&D Depreciation & Amortization Ratio (X6) | (R&D Expenses − Depreciation & Amortization)/Operating Income | + |

| R&D Leasing Fee Ratio (X7) | (R&D Expenses − Leasing Fee)/Operating Income | + | ||

| R&D Direct Investment Ratio (X8) | (R&D Expenses − Direct Investment)/Operating Income | + | ||

| Soft Technology | Intangible Asset Ratio (X9) | Intangible Assets/Total Assets | + | |

| Total Asset Turnover Ratio (X10) | Operating Income/Average Total Assets | + | ||

| Equity Multiplier (X11) | Total Assets/Shareholders’ Equity | - |

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | X10 | X11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.069 | 0.020 | 0.066 | 0.016 | 0.007 | 0.184 | 0.482 | 0.083 | 0.046 | 0.024 | 0.003 | |

| 0.056 | 0.069 | 0.075 | 0.109 | 0.109 | 0.066 | 0.059 | 0.080 | 0.102 | 0.080 | 0.196 | |

| 0.058 | 0.020 | 0.074 | 0.026 | 0.012 | 0.180 | 0.424 | 0.099 | 0.069 | 0.029 | 0.009 |

| Companies | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| A1 | 0.0158 | 0.0157 | 0.0149 | 0.0157 | 0.0166 |

| A2 | 0.0196 | 0.0238 | 0.0326 | 0.0276 | 0.0271 |

| A3 | 0.0163 | 0.0254 | 0.0204 | 0.0165 | 0.0160 |

| A4 | 0.0164 | 0.0168 | 0.0173 | 0.0150 | 0.0131 |

| A5 | 0.0289 | 0.0238 | 0.0175 | 0.0191 | 0.0126 |

| A6 | 0.9767 | 0.7387 | 0.2028 | 0.0445 | 0.0779 |

| A7 | 0.0211 | 0.0273 | 0.0152 | 0.0225 | 0.0241 |

| A8 | 0.0283 | 0.0240 | 0.0271 | 0.0265 | 0.0351 |

| A9 | 0.0416 | 0.0405 | 0.0368 | 0.0428 | 0.0195 |

| A10 | 0.0147 | 0.0291 | 0.0225 | 0.0237 | 0.0249 |

| A11 | 0.0149 | 0.0143 | 0.0149 | 0.0135 | 0.0135 |

| A12 | 0.0136 | 0.0129 | 0.0134 | 0.0133 | 0.0130 |

| A13 | 0.0611 | 0.0562 | 0.4628 | 0.3171 | 0.3096 |

| A14 | 0.0152 | 0.0159 | 0.0160 | 0.0166 | 0.0170 |

| A15 | 0.0135 | 0.0119 | 0.0120 | 0.0164 | 0.0126 |

| A16 | 0.0145 | 0.0167 | 0.0822 | 0.0187 | 0.0168 |

| A17 | 0.0146 | 0.0148 | 0.0142 | 0.0141 | 0.0226 |

| A18 | 0.0153 | 0.1062 | 0.0767 | 0.0222 | 0.0116 |

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| count | 18 | 18 | 18 | 18 | 18 |

| mean | 0.0746 | 0.0674 | 0.0611 | 0.0381 | 0.038 |

| std | 0.2255 | 0.169 | 0.1103 | 0.0702 | 0.0695 |

| min | 0.0135 | 0.0119 | 0.012 | 0.0133 | 0.0116 |

| 25% | 0.0148 | 0.0158 | 0.015 | 0.0159 | 0.0132 |

| 50% | 0.0161 | 0.0238 | 0.019 | 0.0189 | 0.0169 |

| 75% | 0.0265 | 0.0286 | 0.0357 | 0.0258 | 0.0247 |

| max | 0.9767 | 0.7387 | 0.4628 | 0.3171 | 0.3096 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hua, G.; Zeng, F.; Sun, H. Analyzing New Quality Productive Forces in New Energy Vehicle Companies Based on a New Multi-Criteria Decision Analysis Model. World Electr. Veh. J. 2024, 15, 503. https://doi.org/10.3390/wevj15110503

Hua G, Zeng F, Sun H. Analyzing New Quality Productive Forces in New Energy Vehicle Companies Based on a New Multi-Criteria Decision Analysis Model. World Electric Vehicle Journal. 2024; 15(11):503. https://doi.org/10.3390/wevj15110503

Chicago/Turabian StyleHua, Guozhen, Fanlong Zeng, and Huaping Sun. 2024. "Analyzing New Quality Productive Forces in New Energy Vehicle Companies Based on a New Multi-Criteria Decision Analysis Model" World Electric Vehicle Journal 15, no. 11: 503. https://doi.org/10.3390/wevj15110503

APA StyleHua, G., Zeng, F., & Sun, H. (2024). Analyzing New Quality Productive Forces in New Energy Vehicle Companies Based on a New Multi-Criteria Decision Analysis Model. World Electric Vehicle Journal, 15(11), 503. https://doi.org/10.3390/wevj15110503