Abstract

In the context of actively and steadily implementing the “dual carbon” strategy, two competing electric vehicle manufacturers (manufacturers m1 and m2) were selected as research objects to construct two different leasing strategy models for electric vehicle manufacturers, namely, m1 provided a unit rental electric vehicle strategy and m2 provided a fixed rental electric vehicle strategy. We studied the optimal car rental strategy and pricing of the two manufacturers under the situation of m2 providing and not providing rental service efforts, and the influence of relevant factors on the optimal decision are explored. It shows that the price of electric vehicles rented by consumers per unit increases with the combined effect of the coefficient of rental service effort and the marginal cost of the rental service effort, while the price of fixed rental electric vehicles decreases with the combined effect of both. When the unit rental preference coefficient is large, the unit rental of electric vehicles will give m1 maximum profit. When the rental service effort coefficient is high, m2 is the most profitable. The efforts to provide leasing services of m2 increase their own interests to a certain extent. The greater the effort coefficient of leasing services, the smaller the marginal cost of leasing services, and the optimal social welfare reaches the maximum. The conclusion of the article can provide relevant leasing insights for electric vehicle manufacturers and also provide certain theoretical guidance for promoting electric vehicle leasing service strategies.

1. Introduction

In recent years, the new forces of automobile manufacturing have accelerated the development of the automobile industry to be green and low-carbon, and the competition in the domestic high-end automobile market has become increasingly fierce. The promotion of electric vehicles will become an important way for countries to solve decentralized carbon emissions and achieve emission reduction commitments, and it will also help related enterprises to achieve a tough battle to reduce costs and increase efficiency. Under the pressure of competition, car leasing has gradually become a hot issue of common concern for automobile manufacturers and automobile circulation enterprises. As people’s shopping patterns change, modern consumers have different priorities, and their attitudes towards car ownership are changing. Car leasing provides a cost-effective solution for customers and is a key part of the market. As a new transportation service industry in China, car leasing not only plays an important role in the traditional transportation industry and the automobile industry, but it is also an important mode of transportation to meet people’s personalized travel needs and ensure major social activities. For electric vehicle rental providers, leasing will be a quick and easy solution to monetize a large number of rental cars. According to the Subscription Mode scheme released by NIO, subscribers can also receive full insurance, maintenance and flexible battery upgrades for battery swapping services in addition to using vehicles. Under the vehicle-electric separation mode of electric vehicles, users have the right to use only by paying the battery rental fee when purchasing a car. This mode can reduce the threshold for the use of electric vehicles, greatly reduce the price of vehicles and reducing the purchase cost of users’ cars. As the world’s largest electric vehicle market, China’s electric vehicle business model and leasing service strategy can provide some reference for the development of electric vehicle-related industries. Therefore, it is of great significance to explore the leasing strategy and future development ideas of the battery swapping mode to promote the steady and sustainable development of China’s electric vehicle industry.

Based on this, this article not only considers the optimal leasing strategy of electric vehicle manufacturers but also focuses on the optimal car leasing price and leasing service level of the two manufacturers under the scenario of m2 providing and not providing rental service efforts, and to a certain extent, it enriches the research on electric vehicle leasing strategies and pricing decisions under the background of ‘double carbon’. In view of the above background, this paper mainly solves the following problems: First, the optimal equilibrium solution of electric vehicle manufacturers under different leasing strategies? Second, how do electric vehicle manufacturers m1 and m2 make decisions to maximize profits? Third, under which leasing strategy do consumers benefit the most? Therefore, the main academic contributions of this paper are as follows: Firstly, different from previous research, we study two different leasing strategies of electric vehicle manufacturers from reality, namely, the unit leasing electric vehicle strategy provided by m1 and the fixed leasing electric vehicle strategy provided by m2. Secondly, the optimal decisions of two manufacturers under the scenario of m2 with and without leasing service effort are studied. In addition, the insights provided by this paper can help electric vehicle manufacturers to determine the best electric vehicle rental strategy and pricing.

2. Literature Review

At present, the relevant literature on electric vehicle decision-making research at home and abroad mainly focuses on the pricing decision-making and leasing operation strategy of electric vehicle manufacturers.

2.1. Research on the Pricing Decision of Electric Vehicle Manufacturers

Regarding the pricing decision of electric vehicle manufacturers, Shao et al. [1] discussed the non-cooperative game model of electric vehicle manufacturers and fuel vehicle manufacturers in the electric vehicle market under monopoly and duopoly structures, and they obtained the optimal pricing of manufacturers under subsidies and price discounts. Xiong et al. [2] studied the optimal pricing model of two electric vehicle manufacturers with different technical levels but alternative products, and showed that under different government subsidies, electric vehicle manufacturers will adopt different pricing strategies according to the market competition environment and subsidy input. Fan et al. [3] explored the pricing strategies of domestic and imported electric vehicle manufacturers and the setting of government subsidy policies and tariff policies by constructing an evolutionary game model. Zhu et al. [4] investigated the supply chain composed of electric vehicle manufacturers that can produce power batteries and cannot produce batteries, and they explored the optimal wholesale price of batteries under wholesale competition and a cooperation strategy and the optimal strategy choice of electric vehicle manufacturers under different strategies according to the asymmetric Nash negotiation. Considering consumers’ low-carbon preference and price competition, Lu et al. [5] constructed the pricing strategy and emission reduction decision model of manufacturers producing fuel vehicles and electric vehicles and manufacturers only producing electric vehicles under the double-points policy. The results show that the policy can reduce the price of electric vehicles and increase the profits of manufacturers. Zheng et al. [6] constructed a three-stage game model of electric vehicle suppliers and manufacturers on the investment level, supplier production competition and manufacturer production competition under the double-point policy considering the subsidy, and they explained that the combination of the subsidy policy and double-point policy with an inverse spillover rate change can realize the healthy development of the electric vehicle industry. Wang et al. [7] designed a charging system for electric vehicle manufacturers that combines mobile charging and fixed charging. The results show that the mobile charging system is more favorable than the fixed charging system in some cases. Lu et al. [8] designed a coordination contract for three different supply chains of two electric vehicle manufacturers and one automobile dealer under the influence of automobile price, low carbon preference and endurance factors, and pointed out that the increase in the above factors can promote manufacturers to improve the level of emission reduction efforts and endurance efforts. Xu et al. [9] constructed a decision analysis model of a tripartite game from the perspective of electric vehicle manufacturers and battery swapping station investors. Zou et al. [10] constructed a decentralized charging strategy to achieve consensus benefits, while fully considering the trade-offs between personal interests, transformer interests and power generation interests. Moghaddam et al. [11] provided a new dynamic pricing model for electric vehicle charging stations to transfer electric vehicle loads during the evening peak hours and to achieve the best use of electric energy resources by encouraging electric vehicle users to charge uniformly in different charging stations. Subramanian et al. [12] confirmed a two-tier optimization model to minimize the cost of electric vehicle users and maintain the interests of enterprise system operators in the face of soaring prices. Raz et al. [13] mainly studied the government ‘s incentive mechanism design for electric vehicles and analyzed the government’s ability to coordinate pricing and supply through rebates and subsidies. Shao et al. [1] established a non-cooperative game strategy model for electric vehicle manufacturers, gasoline vehicle manufacturers and governments by considering the automobile market under monopoly and duopoly structures and studied manufacturing under subsidy plans and price discount plans.

It is found that the close cooperation between the battery-swapping vehicle manufacturer and the station investor can reduce the profit of the charging vehicle manufacturer. The level of investment and construction when they do not cooperate will be affected by the profit-sharing ratio of the manufacturer in the battery-swapping mode.

2.2. Research on the Operation Strategy of Electric Vehicle Leasing

Research on the operation strategy of electric vehicle leasing: Huang et al. [14] analyzed the evolutionary game model and concluded that electric vehicle time-sharing leasing not only allows consumers to contact and understand electric vehicles more, but it also solves the short-term sales problem of automobile manufacturers. In order to improve the flexibility and personalized innovation of car sharing lease operation, Ren et al. [15] combined the Internet of Vehicles and blockchain technology, and they set up a car rental alliance among car renters, rental service platforms and rental vehicle providers which can reduce market transaction costs and access thresholds. Qi et al. [16] studied the decentralized decision-making and centralized decision-making models of electric vehicle manufacturers, leasing companies and governments under the conditions that the demand rate of the electric vehicle market is random and the rental price is dependent. The research shows that in decentralized decision making, it is difficult to achieve supply chain system coordination, and the joint contract parameters under centralized decision making can achieve Pareto optimality. Zhang et al. [17] established a stochastic dynamic programming function model of electric vehicle customer behavior on rental price, and they solved the model by two approximate algorithms and obtained the relevant conclusions: electric vehicle rental companies use the opportunity cost of leasing as important textual research for capacity allocation decisions. The total revenue of the leasing company under a reasonable subsidy strategy will increase with the increase in subsidies. Lu et al. [18] discussed the impact of consumers’ average battery leasing time and cost-sharing ratio on the profits of both parties and the level of battery swapping technology under the background of new energy electric vehicle battery swapping mode and the difference in the supply chain structure of three different power structures in the battery swapping mode. Wan et al. [19] used the optimal stopping theory to characterize the optimal choice behavior of consumers between electric vehicle travel modes. The study shows that the existence condition of the electric vehicle merger effect is related to the service rate and service time stability of the time-sharing rental. By dividing the quality of the car into performance quality and environmental quality, Liu et al. [20] constructed the sales model, pure time-sharing leasing model and mixed model of the product line strategy model of the electric vehicle manufacturers on their own platform and a third-party platform; it exhibits that the competition and merger effect between products of the same brand is the key to affecting the product line strategy of the time-sharing leasing model. Wan et al. [21] constructed an evolutionary game model of government subsidies and manufacturer’s business model decision making considering three factors of policy and technology revealing that electric vehicle subsidies change the manufacturer’s business model decision making by affecting two basic dimensions, and the merger effect brought by the transformation will promote the manufacturer to adopt the time-sharing leasing model. Sun et al. [22] studied the optimal leasing strategy of a battery energy storage system based on the usage share and constructed a battery leasing pricing model. Hoogland et al. [23] analyzed several important factors that affect consumers’ choice of electric vehicle product leasing or purchase, and they provided powerful suggestions for consumers and enterprises on electric vehicle leasing and purchasing. Huang et al. [24] and Kuo et al. [25] discussed the relationship between the total profit and cost variables of the rental and sale mode of electric vehicle products, and they pointed out that at the end of the rental period of electric vehicles, electric vehicle companies should weigh the cost factors such as product durability and residual value to evaluate their electric vehicle rental services. Zhu et al. [4] investigated the decision-making problem of a supply chain system composed of electric vehicle manufacturers who can produce power batteries and those who cannot. Based on the asymmetric Nash negotiation, the optimal wholesale price of power batteries under a wholesale competition and cooperation strategy and the optimal strategy selection of electric vehicle manufacturers under different strategies were explored.

2.3. The Discussion Section

Different from the above literature, we not only consider the optimal leasing strategy of electric vehicle manufacturers but also focus on the optimal car leasing price and rental service level of the two manufacturers under the situation of m2 providing and not providing rental service efforts. To a certain extent, it enriches the research on electric vehicle leasing strategies and pricing decisions under the background of double carbon. The main contributions of this paper are as follows: (1) Different from previous research, we study two different leasing strategies of electric vehicle manufacturers from reality, namely, the unit leasing electric vehicle strategy provided by m1 and the fixed leasing electric vehicle strategy provided by m2. (2) The optimal decisions of two manufacturers under the scenario of m2 with and without leasing service effort are studied. (3) In addition, the insights provided by this paper can help electric vehicle manufacturers determine the best electric vehicle rental strategy and pricing in the context of dual carbon.

3. Model Construction and Solution Analysis

This section mainly constructs two theoretical models to explain the leasing strategy of electric vehicle manufacturers, that is, the best unit leasing strategy of m1 and the best fixed leasing strategy of m2 under the efforts of the manufacturer m2 to provide and not to provide leasing services. At the same time, the optimal pricing and leasing service effort level of electric vehicle manufacturers are studied.

3.1. Model Description and Basic Assumptions

This paper considers the existence of two competing electric vehicle manufacturers (m1 and m2) in a duopoly market. They produce and lease electric vehicles with the battery-swapping mode and provide consumers with the strategy of unit leasing and fixed leasing of electric vehicles, respectively. Manufacturer m1 provides consumers with the price of unit leasing electric vehicle of p1, and m2 provides consumers with the price of fixed leasing electric vehicle of p2. Both of them will strive to maximize their own interests in order to increase sales and obtain greater benefits. Due to the prevalence of the unit rental mode in the current automobile market, m2 will strive to improve the service level h for fixed rental consumers in order to enhance their competitiveness, that is, to provide consumers with post-rental battery upgrades, vehicle health management testing and consumer on-demand flexible battery swapping and other services. In view of this, this paper explores the optimal decision-making and pricing problems of m1 that provides unit leasing electric vehicles and m2 that provides fixed leasing electric vehicles under m2’s efforts to provide and not provide leasing services. Table 1 gives the specific model symbols and meanings involved in this paper.

Table 1.

Notation and definition.

The basic assumptions of this article are as follows: (1) It is assumed that in the duopoly competition market, electric vehicles produced by electric vehicle manufacturers m1 and m2 are only provided to consumers in the form of unit leases and fixed leases. (2) This article mainly studies the optimal leasing strategy and leasing service level, so it omits the manufacturer’s research on the wholesale price of electric vehicles. (3) According to the studies by Lu et al. [18] and Wu et al. [26], we assume that the utility obtained by heterogeneous consumers for electric vehicles provided by unit leasing m1 and fixed leasing m2’s electric vehicles are u1 and u2, where the random variable v is the consumers’ valuation of the electric vehicle, and v obeys the uniform distribution on [0, 1]. The rental price will have a negative impact on the utility u, but the consumers’ leasing preference coefficient θ (0 < θ < 1), the leasing service coefficient α and the rental service effort level h will have a positive impact on the utility. (4) We assume that the marginal cost of the manufacturer m2’s efforts to provide rental services is β (0 < β < 1).

3.2. Basic Model: Do Not Provide Leasing Service Effort

In this section, we consider the competition between m1 and m2 when m2 does not provide leasing service efforts in the electric vehicle market. Through the behavior of consumers, it can be seen that there are three choices for consumers: (1) electric vehicles provided by unit leasing m1; (2) fixed leasing m2 electric vehicles provided to consumers; (3) hold a conservative wait-and-see attitude. According to references [18,26], the utility functions that satisfy the above consumer choice are as follows:

Equation (1) shows that the utility obtained by consumers when they choose to lease the electric vehicle provided by m1 is affected by the valuation v, the lease preference coefficient θ, the times of leases n and the lease price p1. In Equation (2), the consumer utility of the fixed leasing depends on the size of v and p2. Through the above utility function, it is easy to know that when u1 − u2 > 0 and both u1 and u2 are greater than 0, consumers are more willing to lease electric vehicles provided by m1; otherwise, when u1 − u2 < 0, consumers prefer fixed leasing electric vehicles. According to the different behavior choices of heterogeneous consumers and the non-negative demand, we will assume that , and it is easy to derive the demand function of consumers’ unit and fixed leasing electric vehicles:

Therefore, the profits of electric vehicle m1 and m2 are as follows:

In Formulas (6) and (7), m1 and m2 determine their optimal rental prices with the goal of maximizing their own profits. Because , π1 is a concave function of p1, and there is a unique maximum value. Similarly, , so π2 has a unique maximum. The Nash equilibrium simultaneous equation is used to obtain the optimal rental price:

Then the optimal equilibrium solution condition is . Substituting the optimal rental price into Equations (4) and (5), the optimal consumer demand and the optimal profit of the two manufacturers are as follows:

Theorem 1.

In the basic model when m2does not provide leasing service efforts, only when the inequality is established can the optimal solution that meets the interests of the two manufacturers and the requirements of the basic model be obtained, and the optimal equilibrium solution is given by Equations (8)–(10).

The Proof of Theorem 1.

In Equations (6) and (7), m1 and m2 determine their optimal leasing prices with the goal of maximizing their own profits. Because , π1 is a concave function of p1, and there is a unique maximum value. Similarly, , so π2 has a unique maximum value. By using the Nash equilibrium simultaneous equation, the optimal rental price and the condition for obtaining the optimal equilibrium solution are obtained, and Theorem 1 is proved. □

Theorem 1 shows that only when the consumers’ leasing preference coefficient θ is in a certain threshold interval (i.e., ), the electric vehicle manufacturer can attract more leasing consumers to participate in the leasing activities, and the equilibrium solution of the optimal unit and fixed leasing price exists. m1 and m2 can obtain the optimal profit when m2 does not provide leasing service efforts.

Under the basic model, the optimal consumer surplus of consumers with unit and fixed leasing of electric vehicles are as follows:

Then, the optimal total social welfare in the basic model is as follows:

3.3. Expanded Model: Rental Service Effort

In the extended model, m2 will provide leasing service efforts to consumers of fixed-leasing electric vehicles. The decision variables in the model include the price of unit and fixed leasing electric vehicles and the level of leasing service efforts. At this time, the utility functions obtained by consumers from leasing are as follows:

In order to meet the different choice behaviors of heterogeneous consumers and the non-negative conditions of consumer demand, it is assumed that , and when , the electric vehicle demand function provided by the consumer unit and fixed leasing are as follows:

Under the extended model, the profit functions obtained by manufacturers providing unit and fixed leasing are as follows:

Similar to most studies, this paper assumes that the cost of m2 providing leasing service effort is a quadratic function of leasing service effort level h, and it is , where β is the marginal cost of leasing service effort. Because , is a concave function of with a unique maximum. The Hessian matrix of Equation (19) is , its first-order order principal sub-formula is , at the same time, the second-order order principal sub-formula is , and it has an optimal solution. Therefore, according to the non-negative consumer demand and Hessian negative definiteness, the conditions for obtaining the optimal solution under the extended model are as follows: and .

Theorem 2.

When m2 provides the leasing service effort, when the inequalities andare satisfied at the same time, m1and m2can obtain the optimal Nash equilibrium solution. Otherwise, although the equilibrium results can be obtained, there is no optimal solution that meets the requirements. The optimal equilibrium solution is as follows:

Proof of Theorem 2.

Similar to the proof of Theorem 1, when and meet the conditions , the optimal equilibrium solution can be obtained by using game theory, and then, Theorem 2 is proven. □

Theorem 2 shows that when m2 provides the leasing service effort, the consumers’ leasing preference coefficient θ satisfies , and when the marginal cost of the rental service effort paid by m2 is , the electric vehicle manufacturers m1 and m2 can obtain the optimal Nash equilibrium solution.

Through calculation, the optimal consumer surplus and total social welfare of consumers under this model are as follows, which satisfies , , , .

4. Comparative Analysis of Different Leasing Strategies

The previous chapter provides an analysis of the optimal equilibrium solution of the electric vehicle manufacturer. In this section, we further study the optimal leasing price, optimal consumer demand, and optimal profit under different leasing strategies under the basic and extended models. The comparative analysis also analyzes the impact of important factors (leasing service effort coefficient α, leasing service effort marginal cost β and consumer leasing preference coefficient θ) on the optimal decision variables. Because the factors considered according to the actual situation are more complicated to establish the model, based on the research background of the article and the actual data analysis and calculation of market research and literature [19], we set the following parameters: c1 = 0.8, c2 = 0.65, α~[0.2, 0.4], β~[0.5, 0.7], θ~[0.4, 0.4], N~[24, 96]. At the same time, we use the Matlab 2023 calculation tool and Origin 2023b data drawing analysis tool for the example analysis. The comparative analysis of the best equilibrium solutions for electric vehicle manufacturers. is shown in Table 2.

Table 2.

Comparative analysis of the best equilibrium solutions for electric vehicle manufacturers.

4.1. A Comparative Analysis of the Single Factor of θ on the Change of Optimal Decision Variables

This section explores the impact of a single factor for θ on the optimal equilibrium solution, consumer surplus and social welfare in the basic and extended models.

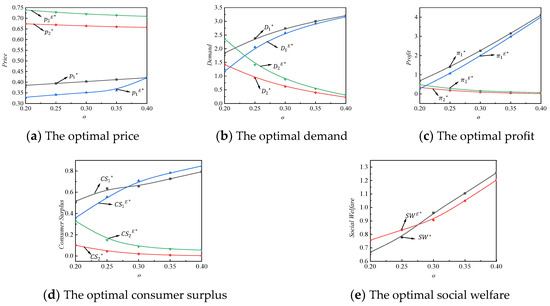

Through the comparative analysis of the optimal decision variables of different strategy models under the influence of θ in Figure 1, the following inferences and analysis are obtained.

Figure 1.

The impact of θ on optimal decision variables

Corollary 1.

When , the comparative analysis of the optimal decision variables is as follows:

- (a)

- The optimal price: ;

- (b)

- The optimal demand: when θ~(0, 0.21], ; when θ~(0.21, 0.225], ; when θ~(0.225, 0.25], ; when θ~(0.25, 0.4], ;

- (c)

- The optimal profit: when θ~(0, 0.225], ; when θ~(0.225, 0.4], ;

- (d)

- The optimal consumer surplus: when θ~(0, 0.275], ; when θ~(0.275, 0.4], ;

- (e)

- The optimal social welfare: when θ~(0, 0.275], ; when θ~(0.275, 0.4], .

Proof of Corollary 1.

According to Theorem 1, the optimal leasing price of basic model is , and when , the optimal demand of consumers is derived as , and the optimal profits of the two manufacturers are . Through Theorem 2, when m2 provides the rental service effort, when and are satisfied at the same time, the manufacturers m1 and m2 can obtain the Nash equilibrium solution. Therefore, the optimal equilibrium solution in the above different models is analyzed, and the relationship between the optimal prices is , and then, Corollary 1(a) is proved. The comparison of optimal demand: when θ~(0, 0.21], ; when θ~(0.21, 0.225], ; when θ~(0.225, 0.25], ; when θ~(0.25, 0.4], ; therefore, Corollary 1(b) can be proven. The optimal profit comparison analysis is as follows: when θ~(0, 0.225], ; when θ~(0.225, 0.4], ; Corollary 1(c) is proven. Comparing the optimal consumer surplus seen in the model: when θ~(0, 0.275], ; when θ~(0.275, 0.4], ; Corollary 1(d) is easy to prove. Similarly, the optimal social welfare in Corollary 1(e) can be proven. □

In Corollary 1(a), when , the optimal price shows that whether m2 provides the leasing service effort or not, the price of the consumer unit leasing the electric vehicle is less than the price of the fixed leasing. When m2 provides leasing service efforts, due to the cost, in order to balance the income, m2 will increase the fixed leasing price, and at this time, the fixed leasing cost is the largest. In the two models, consumers can obtain greater benefits by choosing unit leasing. The optimal demand of consumers in the optimal demand of Corollary 1(b) is closely related to consumer’s unit leasing preference coefficient θ and the leasing price. When θ~(0, 0.225], the consumer unit leasing coefficient has less impact on consumer choice. When m2 does not provide rental service efforts, consumers mainly choose unit leasing electric vehicles based on the leasing price. When m2 provides leasing service efforts, more consumers will choose fixed leasing under higher leasing service levels, so more consumers will prefer fixed leasing electric vehicles under m2’s leasing service efforts. When the leasing coefficient θ~(0.25, 0.4], the consumer unit leasing coefficient has a greater impact on its choice. Regardless of whether m2 provides leasing services or not, the larger unit leasing preference coefficient will encourage more consumers to choose unit leasing electric vehicles. Therefore, when the unit leasing coefficient is small, the demand of consumers is mainly determined by the leasing price and the level of leasing service effort; when the unit leasing coefficient is large, consumers will be more inclined to unit leasing electric vehicles. The optimal profit of Corollary 1(c) shows that when the unit leasing coefficient is small, the profit of consumers is determined by the leasing price, the level of leasing service effort and the demand; when the unit leasing coefficient is large, the unit leasing will bring the maximum profit to m1. The optimal consumer surplus in Corollary 1(d) explains that when the unit leasing coefficient is small, when consumers do not provide leasing service efforts in m2, the unit leasing electric vehicle obtains greater benefits. However, when the unit leasing coefficient is large, consumers will gain a lot in choosing unit leasing electric vehicles under any circumstances. The optimal social welfare in Corollary 1(e) explores that when θ is small and θ~(0, 0.275], m2’s efforts to provide leasing services will increase the welfare of the whole society; when θ~(0.275, 0.4], the larger unit leasing coefficient will encourage more consumers to choose independently. At this time, regardless of whether the manufacturer has improved the level of leasing service efforts, social welfare will increase with the increase in the unit leasing coefficient.

Corollary 2.

When , the monotonicity analysis of the optimal decision variable is as follows.

- (a)

- The optimal price: ; ; ; ;

- (b)

- The optimal demand: ; ; ; ;

- (c)

- The optimal profit: ; ; ; .

The Proof of Corollary 2.

Corollary 2 can be proved by a method similar to Corollary 1. Therefore, the specific proof process is omitted here. □

In Corollary 2, when , the monotonicity analysis of the optimal decision variable with respect to θ is as follows: Due to and , it can be seen that under m2 providing and not providing leasing service efforts, the price of the consumer unit leasing the electric vehicle will increase with the unit leasing coefficient, but the price of the consumer fixed leasing the electric vehicle will decrease with the increase in the unit leasing coefficient in Corollary 2(a). Combined with and in Corollary 2(b), that is, the demand of consumers for unit leasing electric vehicles increases monotonically with the unit leasing coefficient, and the monotonicity of the price in Corollary 2(a) with respect to θ can be well understood. At this time, when the demand increases steadily, the manufacturer can obtain greater profits by real-time markup. Similarly, Corollary 2(c) shows that under a certain threshold, the optimal profit of m1 increases with the unit leasing coefficient, while the optimal profit of m2 decreases with the unit leasing coefficient.

4.2. Comparative Analysis of Optimal Decision Variables under the Influence of α and β

Similarly, in this section, we mainly investigate the influence of the leasing service effort coefficient α and the marginal cost of the rental service effort β on the optimal equilibrium solution, consumer surplus and social welfare in the decision-making model.

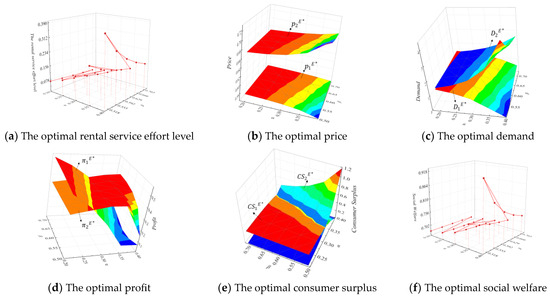

Figure 2a depicts the impact of leasing service effort coefficient α and leasing service effort marginal cost β on the optimal rental service effort level. The optimal leasing service effort level increases with the increase in leasing service effort coefficient and decreases with the leasing service effort marginal cost. In general, the optimal rental service effort level is increasing under the two factors of α and β. When the leasing service effort coefficient α = 0.4 and the marginal cost of rental service effort β = 0.5, the leasing service effort level provided by m2 reaches the maximum. At this time, consumers can better obtain services such as post-rent battery upgrades, vehicle health management inspections and consumers’ on-demand use of flexible battery swaps provided by m2.

Figure 2.

The impact of α and β on optimal decision variables.

From the above analysis, the optimal leasing service effort level shows an increasing trend under the two factors of α and β. When α and β are at a general level, the leasing service effort level provided by m2 reaches the maximum value. At this time, the profit of the combined manufacturer m2 is higher, and the profitability is stronger than that of the manufacturer m1. Although the leasing price provided by the manufacturer m2 is slightly higher at this time, based on the fact that consumers can better obtain services such as post-rent battery upgrades, vehicle health management inspections and consumers’ on-demand use of flexible battery swaps provided by m2, more and more consumers will lease the vehicles of m2. Thus, the demand on m2 is larger, and m2 will be more competitive in the electric vehicle market.

Figure 2b shows that when m2 provides leasing service efforts, the price of electric vehicles leased by consumers per unit increases with the influence of α and β, while the price of fixed leasing electric vehicles decreases with the increase in α and β. In general, the price of fixed leasing electric vehicles in the extended model is always higher than the unit leasing price. This is consistent with the reality that since m2 provides leasing services at a certain cost, it will correspondingly increase the fixed leasing price in order to increase its revenue.

Figure 2c reflects that the demand of consumers for unit leasing electric vehicles decreases with the influence of α and β, while the demand for fixed leasing electric vehicles increases with the increase in α and β. Because m2 provides leasing service efforts, consumers obtain greater benefits than unit leasing in the fixed leasing process. At this time, consumers’ demand for fixed leasing electric vehicles is higher than that of unit leasing.

Figure 2d shows that the optimal profits of m1 and m2 decrease with the increase in α and β. The profit of m1 fluctuates greatly under the influence of α and β, and the profit of m2 is less affected by α and β. When the leasing service effort coefficient of m2 is small, that is α~(0.2, 0.3), the optimal profit of m2 is less than m1 regardless of the marginal cost of the input. When the leasing service effort coefficient takes the equilibrium value α = 0.3, the optimal profit of the two manufacturers is equal. When the leasing service effort coefficient is large, that is α~(0.3, 0.4), m2 is the most profitable. It fully shows that m2’s efforts to provide leasing services have increased its own interests to a certain extent, and at the same time, they have a certain impact on the profits of their rival m1.

Figure 2e points out that after m2 provides the leasing service effort, the consumer surplus of the unit leasing electric vehicle decreases with the influence of α and β. On the contrary, the consumer surplus of the fixed leasing electric vehicle increases under the combined influence of α and β, and the greater the leasing service effort coefficient, the greater the optimal consumer surplus. Therefore, the greater the coefficient of leasing effort provided by m2, the more consumers will choose fixed leasing electric vehicles.

In Figure 2f, the optimal social welfare increases with the increase in the leasing service effort coefficient and decreases with the increase in the marginal cost of the leasing service effort. In general, the optimal social welfare shows an increasing trend under the influence of α and β. When m2 provides the leasing service effort, the greater the leasing service effort coefficient, the smaller the marginal cost of leasing service effort, and the optimal social welfare reaches the maximum value.

5. Conclusions

The paper takes two competing electric vehicle manufacturers (m1 and m2) as the research object and analyzes two different leasing strategies of electric vehicle manufacturers under the background of double carbon: the unit leasing electric vehicle strategy provided by m1 and the fixed leasing electric vehicle strategy provided by m2. The main contributions of this paper are as follows: (1) Different from previous research, we study two different leasing strategies of electric vehicle manufacturers from reality, namely, the unit leasing electric vehicle strategy provided by m1 and the fixed leasing electric vehicle strategy provided by m2. (2) The optimal decisions of two manufacturers under the scenario of m2 with and without leasing service effort are studied. (3) In addition, the insights provided by this paper can help electric vehicle manufacturers determine the best electric vehicle rental strategy and pricing in the context of dual carbon. At the same time, the optimal car rental strategy and pricing problem of the two manufacturers under the situation of m2 providing and not providing rental service efforts are explored. The research results provide the following insights.

(1) Price: The price of electric vehicles leased by consumers will increase with the increase in the unit rental preference coefficient, but the price of electric vehicles rented by consumers will decrease with the increase in the unit leasing preference coefficient. When m2 provides rental service efforts, the price of electric vehicles leased by consumers increases with the influence of α and β, while the price of fixed rental electric vehicles decreases with the increase in α and β. In general, the price of fixed rental electric vehicles in the extended model is always higher than the unit rental price. Regardless of whether m2 provides leasing services or not, the price of electric vehicles leased by consumers is less than the price of fixed leasing.

(2) Demand: The optimal demand of consumers is closely related to the consumer’s unit leasing preference coefficient θ, leasing service effort coefficient α, leasing service effort marginal cost β and rental price. When θ is small, the demand of consumers is mainly determined by the rental price and the level of leasing service effort. When θ is large, consumers will be more inclined to rent electric vehicles. The demand for electric vehicles leased by consumers decreases with the influence of α and β, while the demand for fixed leasing electric vehicles increases with the increase in α and β. Because m2 provides leasing service efforts, consumers obtain greater benefits than unit leasing in the fixed leasing process. At this time, consumers’ demand for fixed leasing electric vehicles is higher than that of unit leasing.

(3) Profit: When the unit rental preference coefficient is small, the consumer’s profit is determined by the rental price, the rental service effort level and the demand; when the unit rental preference coefficient is large, the unit rental electric vehicle will bring the maximum profit to m1. The optimal profits of m1 and m2 decrease with the increase in α and β. The profit of m1 fluctuates greatly under the influence of α and β, and the profit of m2 is less affected by α and β. When the rental service effort coefficient of m2 is small, the optimal profit of m2 is less than m1 regardless of the marginal cost of input. When the leasing service effort coefficient takes the equilibrium value, the optimal profits of the two manufacturers are evenly matched. When the rental service effort coefficient is large, m2 is the most profitable. The efforts of m2 to provide leasing services have increased its own interests to a certain extent, and at the same time, they have had a certain impact on the profits of competitor m1.

(4) Consumer surplus: When the unit leasing preference coefficient is small, and consumers are not provided rental service efforts in m2, the unit rental electric vehicle gains more benefits; when m2 provides leasing service efforts, consumers’ fixed leasing electric vehicles are more profitable. However, when the unit leasing coefficient is large, consumers will gain a lot in choosing unit leasing electric vehicles under any circumstances. After m2 provides leasing service efforts, the consumer surplus of selecting unit leasing electric vehicles decreases with the influence of α and β; on the contrary, the consumer surplus of selecting fixed leasing electric vehicles increases under the combined influence of α and β, and the greater the leasing service effort coefficient, the greater the optimal consumer surplus. Therefore, the greater the coefficient of leasing effort provided by m2, the more consumers will be attracted to choose leasing rental electric vehicles.

(5) Social welfare: When the unit leasing preference coefficient is small, m2’s efforts to provide leasing services will increase the welfare of the whole society; when the unit leasing preference coefficient is large, more consumers will choose independently. At this time, regardless of whether the manufacturer has improved the level of leasing service efforts, social welfare will increase with the increase in the unit leasing coefficient. When m2 provides the level of rental service effort, the greater the coefficient of rental service effort, the smaller the marginal cost of rental service effort, and the optimal social welfare reaches the maximum value.

In summary, this research provides the following main insights and inspirations for electric vehicle manufacturers, consumers and governments: (1) m1: when the consumer unit leasing preference coefficient is large, m1 will obtain greater profits. (2) m2: when the leasing service effort coefficient is large, m2 is the most profitable. (3) Consumers: When m2 does not provide rental service efforts, consumers mainly choose to lease electric vehicles according to the rental price. When m2 provides leasing service efforts, more consumers will favor fixed leasing electric vehicles at a higher level of rental service. (4) Government: when the consumer unit rental preference coefficient is small, the government should encourage m2 to actively provide rental services to increase the welfare of the whole society; when m2 provides the level of leasing service effort, the government should call on m2 to increase the coefficient of leasing service effort and reduce the marginal cost of the leasing service effort to achieve better social welfare.

To some extent, this study can provide leasing insights for electric vehicle manufacturers and also provide new ideas for promoting the development of the electric vehicle industry. However, this paper only studies the leasing service strategy of electric vehicle manufacturers and does not involve the optimal leasing decision of the supply chain system composed of manufacturers and suppliers. Additionally, the problems studied in this paper assume that the electric vehicle market has complete or perfect information and assume that consumers are completely rational. At the same time, it is a future research direction to study the online and offline dual-channel electric vehicle leasing problem between electric vehicle manufacturers and retailers in the electric vehicle market with incomplete information and uncertain consumer demand, as well as the overall cooperative leasing decision of the electric vehicle supply chain composed of electric vehicle manufacturers, battery suppliers and electric vehicle retailers.

Author Contributions

Conceptualization, D.W.; methodology, D.W.; software, D.W.; validation, D.W.; formal analysis, D.W.; investigation, D.W.; resources, D.W.; data curation, D.W. and J.L.; writing—original draft preparation, D.W.; writing—review and editing, D.W.; visualization, D.W.; supervision, D.W. and J.L.; project administration, D.W. and J.L.; funding acquisition, D.W. and J.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Natural Science Foundation of China grant number [71872076].

Data Availability Statement

Research data can be found at https://www.nio.cn/ and http://www.miit.gov.cn/index.html (accessed on 19 November 2023).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Shao, L.; Yang, J.; Zhang, M. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 2017, 262, 1181–1195. [Google Scholar] [CrossRef]

- Xiong, Y.Q.; Li, X.L.; Huang, T.T. Research on new energy vehicle manufacturers pricing decision basis for different subsidy bodies. Chin. J. Manag. Sci. 2020, 28, 139–147. [Google Scholar]

- Fan, Z.; Cao, Y.; Huang, C.; Li, Y. Pricing strategies of domestic and imported electric vehicle manufacturers and the design of government subsidy and tariff policies. Transp. Res. Part E Logist. Transp. Rev. 2020, 143, 102093. [Google Scholar] [CrossRef]

- Zhu, M.P.; Liu, Z.X.; Li, J.B.; Zhu, S.X. Electric vehicle battery capacity allocation and recycling with downstream competition. Eur. J. Oper. Res. 2020, 283, 365–379. [Google Scholar] [CrossRef]

- Lu, C.; Wang, Q.Q.; Zhao, M.Y.; Yan, J. Research on Competitive Pricing and Emission Reduction Strategies of Automobile Manufacturers under the “Double Points” Policy. Chin. J. Manag. Sci. 2022, 30, 65–76. [Google Scholar]

- Zheng, J.C.; Zhao, H.; Li, Z.G. Research on research and development subsidies for the new energy vehicle industry under the dual point policy. Sci. Res. Manag. 2019, 40, 126–133. [Google Scholar]

- Wang, C.; Lin, X.; He, F.; Shen, M.Z.-J.; Li, M. Hybrid of fixed and mobile charging systems for electric vehicles: System design and analysis. Transp. Res. Part C Emerg. Technol. 2021, 126, 103–168. [Google Scholar] [CrossRef]

- Lu, C.; Wang, Q.Q.; Chen, Q. Coordination of Automobile Supply Chain Considering Price, Emission Reduction, and Range under the “Double Points” Policy. Syst. Eng. Theory Pract. 2021, 41, 2595–2608. [Google Scholar]

- Xu, S.X.; Xie, B.; Qin, W.; Cheng, H.B. Pricing and Investment Strategies for Electric Vehicle Charging and Exchange Modes. J. Transp. Syst. Eng. Inf. Technol. 2021, 21, 184–189. [Google Scholar]

- Zou, S.; Hiskens, I.; Ma, Z. Consensus-based coordination of electric vehicle charging considering transformer hierarchy. Control. Eng. Pract. 2018, 80, 138–145. [Google Scholar] [CrossRef]

- Moghaddam, Z.; Ahmad, I.; Habibi, D.; Masoum, M.A.S. A Coordinated Dynamic Pricing Model for Electric Vehicle Charging Stations. IEEE Trans. Transp. Electrif. 2019, 5, 226–238. [Google Scholar] [CrossRef]

- Subramanian, V.; Das, T.K. A two-layer model for dynamic pricing of electricity and optimal charging of electric vehicles under price spikes. Energy 2018, 10, 2–20. [Google Scholar] [CrossRef]

- Raz, G.; Ovchinnikov, A. Coordinating Pricing and Supply of Public Interest Goods Using Government Rebates and Subsidies. IEEE Trans. Eng. Manag. 2015, 62, 65–79. [Google Scholar] [CrossRef]

- Huang, Y.X.; Pu, Y.J. Research on the evolutionary game model of the new energy vehicle rental market competition. Chin. J. Manag. Sci. 2018, 26, 79–85. [Google Scholar]

- Ren, P.; Xu, J.J.; Wang, Y.; Ma, X. Research and Implementation of Car Rental Alliance Based on Blockchain and Internet of Vehicles. J. Appl. Sci. Electron. Inf. Eng. 2019, 37, 852–858. [Google Scholar]

- Qi, Z.Q.; Jing, Y.G.; An, G.F.; Qin, K.D. Tripartite Coordination Contract for New Energy Vehicle Rental System with Price Dependent Demand Rate. J. Syst. Ang Manag. 2020, 29, 1189–1196. [Google Scholar]

- Zhang, L.F.; Mu, Y.P. Capacity Allocation Policy for Car Rental Systems with Customer Behavior Consideration. Oper. Res. Manag. Sci. 2020, 29, 171–178. [Google Scholar]

- Lu, Z.P.; Yao, Y.F.; Lu, C.Y. Research on Pricing Strategies for New Energy Electric Vehicle Exchange Models under Differential Supply Chain Structure. Syst. Eng. 2022, 40, 28–37. [Google Scholar]

- Wan, M.Y.; Liu, J.; Cheng, Y.S. Analysis of consumer travel mode choices in car-sharing. J. Manag. Sci. China 2022, 25, 33–48. [Google Scholar]

- Liu, J.; Wan, M.Y.; Zhou, H.; Lang, W.F. Manufacturers Strategies on Per-Use Rental Adoption and Product Line. Oper. Res. Manag. Sci. 2022, 31, 228–233. [Google Scholar]

- Wan, M.Y.; Liu, J.; Zhang, Z.J.; Luo, C.L. EV Manufacturers Per-Use Rental Adoption Strategy-An Evolutionary Analysis Framework Based on Comparison of Business Model. Chin. J. Manag. Sci. 2023, 31, 31–39. [Google Scholar]

- Sun, L.; Qiu, J.; Han, X.; Yin, X.; Dong, Z. Per-use-share rental strategy of distributed BESS in joint energy and frequency control ancillary services markets. Appl. Energy 2020, 277, 115–189. [Google Scholar] [CrossRef]

- Hoogland, K.; Chakraborty, D.; Hardman, S. To purchase or lease: Investigating the finance decision of plug-in electric vehicle owners in California. Environ. Res. Commun. 2022, 4, 232–235. [Google Scholar] [CrossRef]

- Huang, Y.; Qian, L.; Soopramanien, D.; Tyfield, D. Buy, lease, or share? Consumer preferences for innovative business models in the market for electric vehicles. Technol. Forecast. Soc. Chang. 2021, 166, 120–163. [Google Scholar] [CrossRef]

- Kuo, T.C.; Chiu, M.C.; Hsu, C.W.; Tseng, M.L. Supporting sustainable product service systems: A product selling and leasing design model. Resour. Conserv. Recycl. 2019, 146, 384–394. [Google Scholar] [CrossRef]

- Wu, D.D.; Li, J.Z. Optimal decision analysis of new energy vehicle production pricing under battery-swapping VS charging mode. Ind. Eng. Manag. 2023, 28, 94–106. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).