6.3. Revenue

Electricity sales are a unique way that charging points can raise revenue. The daily charger usage costs contribute to 80% of EV charging [

34]. Thus, the electricity demands, cost of electricity, and price for EV drivers are required parameters in calculations. These parameters change dynamically. For instance, the electricity purchase cost rises 5.2% annually [

2]. The price for EV drivers to recharge will rise simultaneously. Thus, this project assumes that the gap between electricity cost and the price is the same.

A total annual profit of around 200 GBP is achievable when “selling” electricity at a profit of 0.04 GBP per kWh [

37]. But the price of recharging varies by region, type of charger, car brand, etc. Pod Point rapid chargers cost 23 p/kWh at Lidl and 24 p/kWh at Tesco [

38]. According to Tesla, EV owners are charged at 26.4 p per kWh [

38].

Current types of charging stations include Level 1, Level 2, and DC fast chargers (DCFC) [

24]. There are three types of charger in the U.K.—slow chargers, fast chargers, and rapid chargers. The features and parameters of these chargers are displayed in

Table 8.

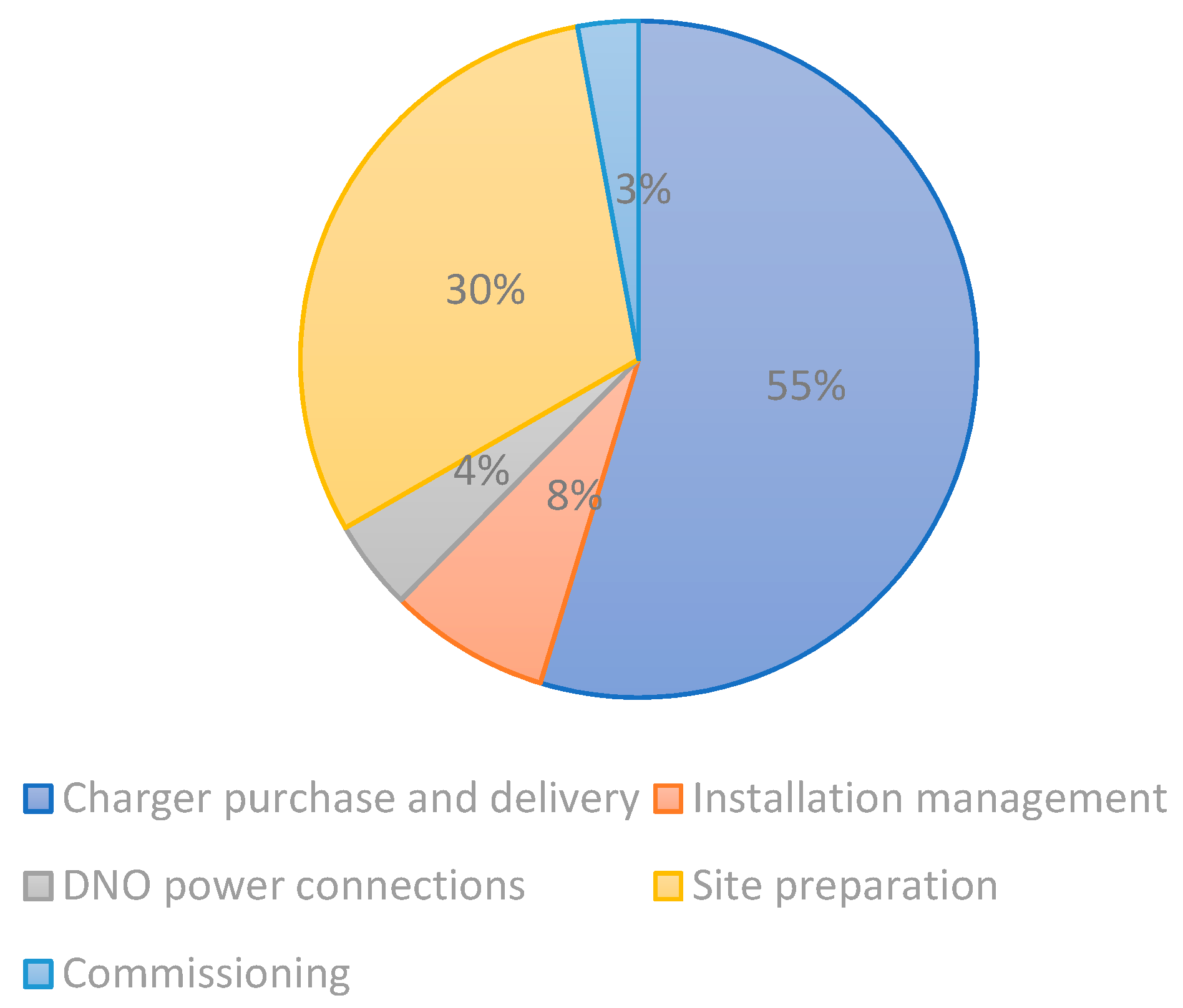

The parameters are related to how much it costs per charger per year. There is little literature about the relationship between EV owners and the number of chargers in one charging station. This paper assumes that one PCS in the rural area typically provides two chargers. The CAPEX and OPEX can be estimated in the following section.

To summarise, the electricity purchase cost is 0.172 GBP per kWh, and sales price is 0.264 GBP per kWh, which is applied in cost-effective analysis combined with electricity demands.

The parameters and equation in

Section 3 and

Section 6 will be applied in this part. Based on

Table 7, this project firstly calculates the CAPEX of the charging station.

As is assumed in the end of

Section 6.3, there are two chargers in this station. Thus, the amount of CAPEX can be easily calculated (

Table 9). This number is less likely to influence the following analysis once a PCS has been installed.

6.4. Electricity Usage Forecast

OPEX is highly related to the number of existing EVs according to Equation (1). The unique variable in

Table 10 is Ed. To demonstrate the method for dealing with OPEX, this project predicts the electricity demands of County Durham in

Table 11.

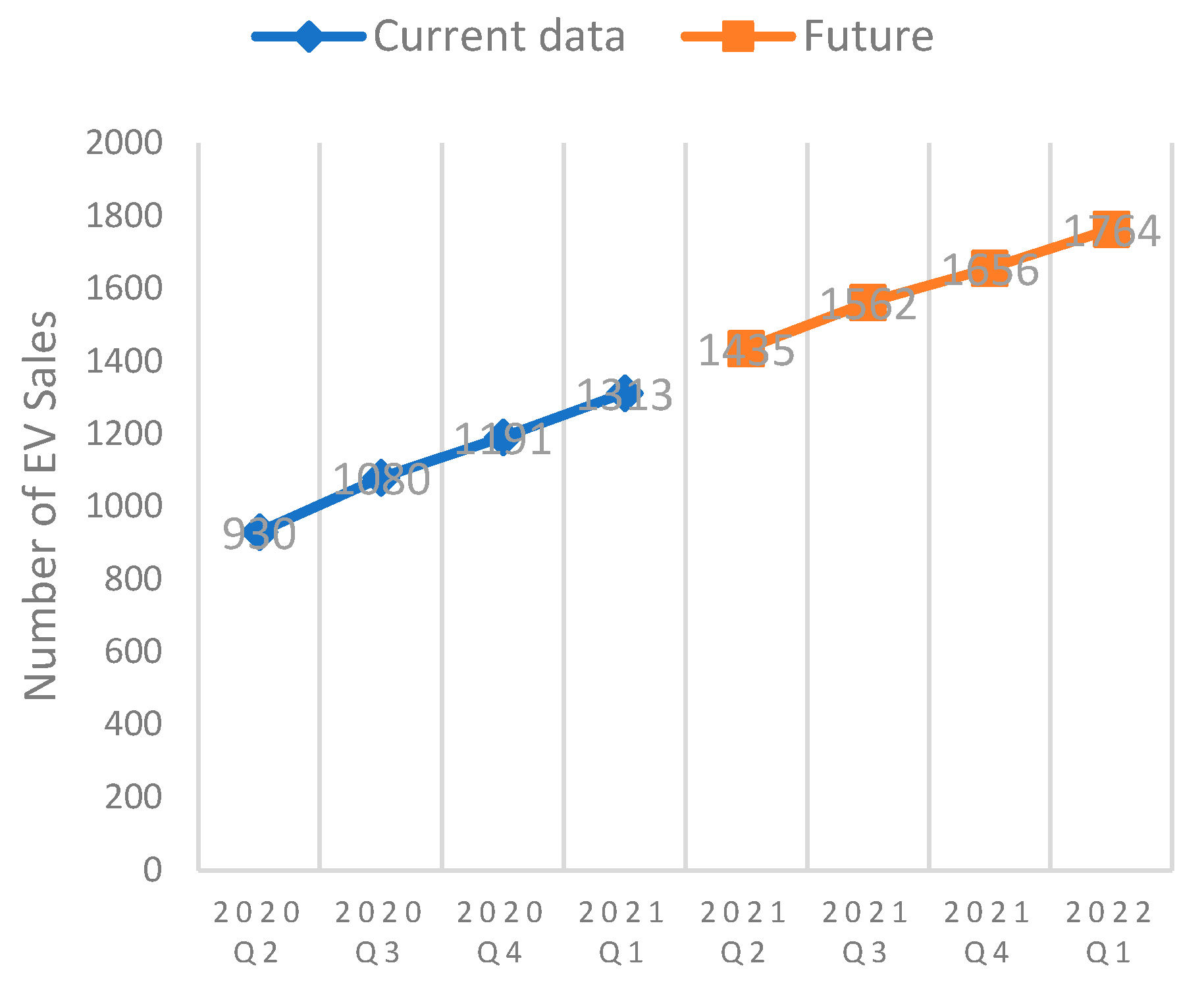

Before calculating Ed, this paper applies linear programming in an Ev forecast. Judging from the statistical information in

Table 2, the number of licensed vehicles experienced an increasing trend.

To accurately forecast electricity demands in the next four quarters, this paper uses ten groups of EVs, which have not been shown in

Table 11, with the help of the ‘FORECAST’ function in Excel. The numbers in the second line are presented. The reason that this paper predicts future EVs is to estimate payback time. Through this method, future data can be addressed. The trend of Ed and Ev can be seen in

Figure 8 and

Figure 9.

However, not all groups of data have a constant growing tendency. For example,

Figure 10 shows that the number of licensed vehicles in the Isles of Scilly increases and decreases during this period, but it moderately begins to rise from 2020. So, this project chooses to make the prediction based on the latest data from quarter 1 2020 to quarter 1 2021.

The more recent data is shown in the first quarter of 2021. This paper selects the first quarter in the following years to represent the corresponding Ev of this year. The selected data are printed in yellow in

Table 12. After refining and simplifying the tables, this section finally collects Ev in

Table 13.

Combining Equation (1) and

Table 12, Ed in the rural areas can be calculated, as is shown in

Table 13. This paper predicts the data of the next thirty-two quarters because the further a prediction is made, the more error it has. This project selected eight numbers from those thirty-two prediction numbers to prevent the error from influencing the accuracy and dependency in the following calculations.

After calculating the Ed, all columns in

Table 14 have a definite value. This paper displays some of the data that are used in the following research.

6.5. Revenue Calculation

Filling the column with values completes

Table 10. Then, the OPEX of the next eight years have their own value.

Table 15 lists the detailed data of OPEX in County Durham in the first year.

Based on the results, in the next few years in County Durham, investors do not need to spend money on CAPEX, but the OPEX will change as time goes by due to the dynamic variable Ed.

The revenue also needs the data of Ed. Ed plus price for EV drivers equals total revenue. The net revenue can then be calculated by minimising the CAPEX and OPEX.

As is shown in

Table 16, for the whole eight years the net income for the PCS is negative, meaning no profit was made from this charging point during this period.

To observe dynamic changes, the data were inputted into line graphs.

As shown in

Figure 11a, the cost has a more dramatic increase trend compared to that of revenue. The

Figure 11b shows how net revenue change in years. The revenue cannot cover its cost, and the gap between cost and revenue is growing, which means this PCS cannot make a profit if investors do not adjust in time. The actual cost-effectiveness of setting up charging infrastructures is very poor. It is necessary to identify the reasons why there is no rising tendency in net revenue.

6.6. Reasons and Solutions

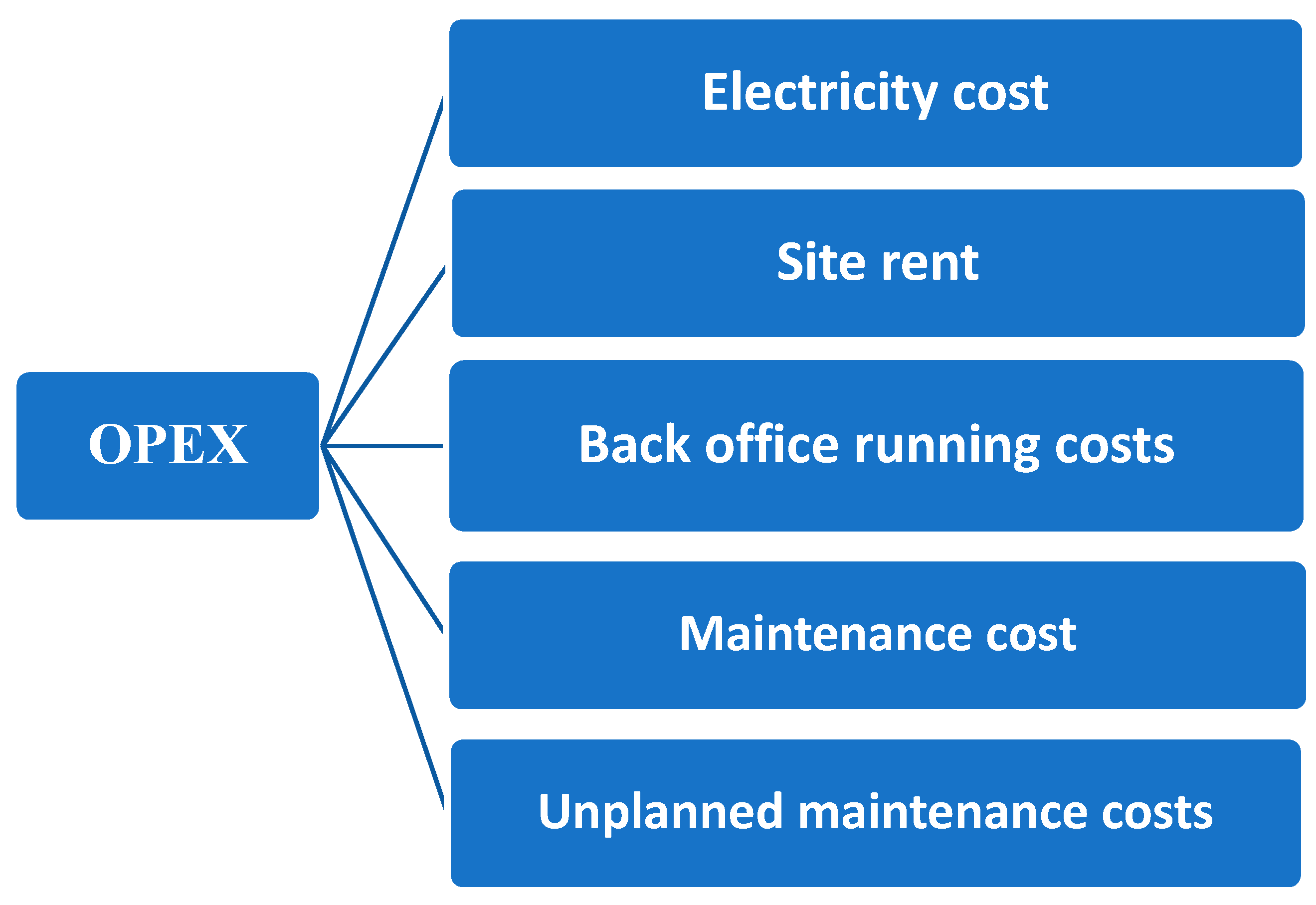

OPEX plays a vital role in the increase of total cost once installation has been completed. Thus, the factors that influence the speed of increase feed into OPEX. The factors are listed below.

The unchangeable factors in

Table 17 are ‘Site rent’ and ‘Electricity cost’. There is no change in site rent, except that other bodies can fund PCS. Furthermore, businesses are unable to boost Ed—the unique variable in electricity cost. The cost of electricity purchase is a national standard measured by the government.

The last three elements are related to the number of chargers. Therefore, reducing the number of chargers is an available method to slow down the speed of total OPEX. Moreover, CAPEX declines at the same time. After changing one factor, this paper analyses the effectiveness of one charger in County Durham.

Table 18 lists the details of novel OPEX, and

Table 18 updates its cost and revenue in County Durham. However, the net revenue remains the same, negative.

During these eight years, the total cost in PCS with one charger still outnumbers that of revenue. Nevertheless, there is an apparent minimal decrease trend closing to the end of the year. It means the speed of increase in revenue exceeds that of cost. With the ever-decreasing gap between cost and revenue, charging stations in County Durham will profit in the following years.

It is a fact that can be seen in

Table 19 and

Figure 12 that the decreasing trend gradually slows down.

It seems that the investment in rural PCS is likely to pay back after eight years. However, the lifespan of payback is long for investors who cannot afford this tremendous loss. It is essential to seek other methods of boosting net revenue.

As we mentioned before, profit is related to electricity demands.

The decision variables used in our model are as follows:

| x | Year |

| OPEX in this year |

| Revenue in this year |

| Annual net revenue |

Both Equations (2) and (3) share the same variable—

Ed. The total amount of site rent, back office running costs, maintenance costs, and unplanned maintenance costs is 1274.50 GBP. Equation (3) minus Equation (2) equals annual revenue.

When f″(x) is a positive value, there is no loss in that year. If f″(x) remains negative, the net revenue will not be positive anymore.

The minimal number of chargers is one. Currently, the cost cannot be cut by reducing the number of chargers. Fortunately, there is one last parameter that has not been changed—the profit gap. If investors plan to make a profit as soon as possible, they can bill EV drivers more in electricity price.

For instance, this paper assumes that investors increase rates from 0.264 GBP per kWh to 0.50 GBP per kWh. It can easily be predicted that the trend of total revenue is sharper than before.

As is shown in

Table 20, the PCS in County Durham starts to make a profit in year 6.

Figure 13 shows that the total revenue covers the total cost and rises dramatically in the following years.

Based on the data in

Table 21, the internal rate of return (IRR) can be calculated in Excel. The IRR in

Table 22 is 27%, which means it will earn a 27% compound annual growth rate. The IRR is positively related to revenue, once the CAPEX is confirmed. There is no standard for PCS to have a certain IRR. The businesses can opt to adjust parameters and compare them to select the highest one.

The different levels of sales price correspond to different levels of IRR shown in

Table 22. The IRR shares positive relationships with the sales price. The precondition is that the electricity demands do not impact sales price. The private investors can compare the IRR of different rural PCS and go for the most profitable one.

The sales price of 0.50 GBP per kWh cannot guarantee that all rural PCS are able to pay back in these eight years. Equation (4) can be applied to calculate how many electricity demands it needs. The first parameter in Equation (4) switches to 0.328.

When f″(x) exceeds 0, it requires Ed to achieve 3770.71. It means the annual revenue of this PCS can cover the OPEX when its electricity demands reach 3770 during these eight years. There is no standard or reference timeline for investors to pay back the fund. This section suggests two ways to shorten the payback period. One is reducing the cost where possible and another one is raising the price for EV drivers. As for cost-saving, it has a bottom line since the necessity of management and hardware. The conditions of PCS are the basement of future development and running. On the contrary, there is no maximum for charging electricity, but, the high price of recharging for EV drivers is likely to negatively impact electricity demands, public reputation, and EV development, etc. Even though the price for EV drivers doubled and it ignores the CAPEX, there are still 30 rural regions that cannot make any profit during these eight years due to insufficient electricity demands. The 30 rural regions include North Devon, Scarborough, Rutland, Redcar and Cleveland, the Isles of Scilly and others.

Figure 14 shows that the regions with insufficient

Ed account for 22% of PCS in all rural regions. Predictably, those PCS with not enough

Ed will suffer from consistent losses over eight years.

Meanwhile, the PCS with sufficient Ed may still make losses for many years. Compared with those regions with insufficient Ed, they just have a capability of recovering costs.

This paper highly recommends that investors consider cost-reduction first because rising prices may raise complaints among EV drivers. If there is little effect in making profits, then the business begins to manage the price according to the revenue they want to produce.

6.7. Payback Period

There are 138 groups of data regarding current vehicle numbers and predictions. It is difficult to calculate them one by one but this paper calculates how much electricity demand they need in those eight years to cover the cost. In other words, the latest payback period is eight years.

With the assistance of Equations (2) and (3), this paper accumulates those eight groups of data to list an equation of total cost.

The decision variables used in our model are as follows:

| x | Year |

| Total OPEX of 8 years |

| F′ | Total revenue of 8 years |

When the gap between F and F′ is 3650–CAPEX, the PCS eventually covers all the costs with sufficient revenue. Then this equation could be:

After simplifying Equation (7), the results should be the integer:

This point represents that the total cost of PCS equals that of total revenue. After calculating the amount of Ed, this project accumulates 138 groups of Ed to select those regions whose payback times are less than 8 years.

Forty-six regions can reach this line.

As shown in

Figure 15, one-third of PCS in rural areas can pay back what they invest from 2021 to 2028, according to the sequences of total electricity demands. Those regions include Wiltshire, Glasgow City, Northumberland, and Central Bedfordshire, etc. The eight years’ payback period is a bottom line in this project. Spirit (n.d.) suggests that the payback period is typically five to eight years [

39]. If these rural PCS are unable to reach this bottom line, the risk of it is high for investors. The cost-effectiveness of most investments in rural PCS is relatively low.

6.8. Summary

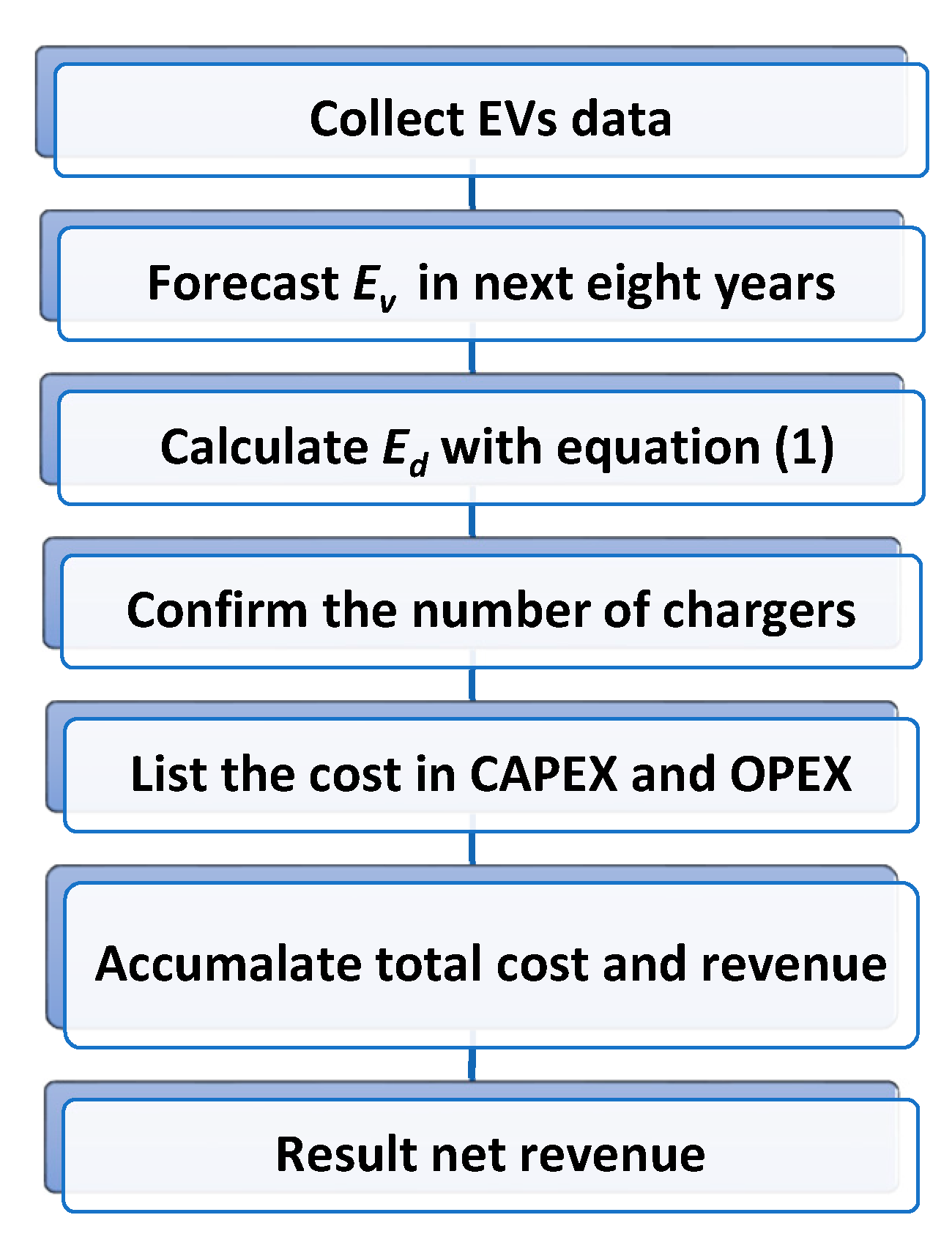

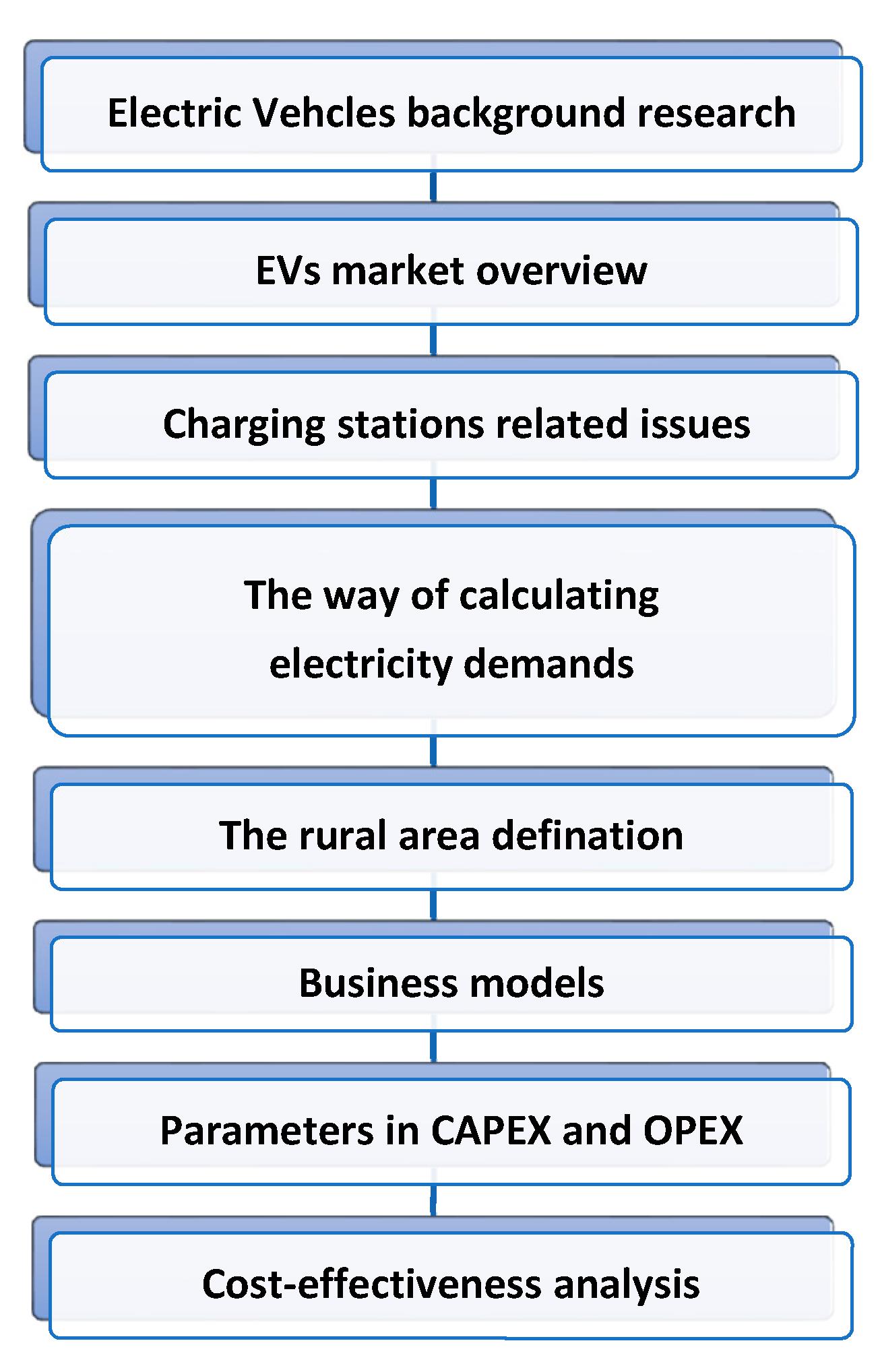

In this chapter, the parameters and methodology mentioned are applied. The calculation of Ed is elaborated in

Section 3, but the prediction of Ev is completed in this section. The U.K. government’s data of licensed EVs strongly supports the prediction in this project. Enough statistical support can make the forecast more accurate. Mostly Ev experienced a moderate increase from 2011 to 2020, and fluctuations were seen in a few regions. Linear programming is a reasonable choice because the regulation can be easily spotted through the trends inside. However, the prediction is a mathematical result that cannot symbolise the authentic statistic. Based on the average car range, average electricity consumption per kilometre as well as the predicted Ev directly contribute to the Ed data from 2022 to 2028. The equations in this model are highly relative. Due to the closing relationship among equations, the results are more accurate and dependable with low error. Moreover, the cost-effectiveness analysis process is displayed in the flow chart below.

Through the process in

Figure 16, net revenue can be calculated step by step. After calculating OPEX each year, this project has to add CAPEX in the first year and accumulate one by one. In other words, the total cost of a particular year contains CAPEX and all previous OPEX. The way of accumulating revenue is the same. Then, the total accumulated cost in that year minus that of revenue equals to current net revenue. The net revenue results in the tables mean how much net revenue the PCS gains or loses that year. If this result turns the negative number into a positive number, it means that this PCS starts to make a profit. However, the results show that there is no profit. The elements that influence the changes in net revenue have been identified in this project. Thus, two parts can be adjusted by investors.

Figure 17 displays how this project works in case the net revenue remains negative during this period. Firstly, a dramatic decrease occurs in net revenue, meaning the revenue of PCS cannot cover its cost every year. On the contrary, the net revenue starts to climb, representing that the revenue of PCS is able to cover its annual cost, even if it is negative. This process can help investors gradually boost the revenue of PCS. Reducing the number of chargers to the minimum can cut the CAPEX and basement of OPEX, which directly decreases the total cost of PCS. However, it can slow down the growth rate of the total cost.

If there is a slight improvement in profit-making, it is reasonable for the business to speed up the growth rate of total revenue by raising the price. The rising price for EV drivers may bring other issues to PCS. As is suggested in

Figure 16, the price could be changed more than once. So, investors have opportunities to change the price depending on the facts. For example, managers can slightly adjust the price at the beginning. Based on the evaluation of the growth rate in net revenue, another price adjustment could be considered. Before investing in PCS in rural areas, the business could estimate the revenue in the following years. This project gives an accessible model for evaluation. It is available for businesses to forecast their financial situation with this model. For managers running their PCS, the model can help them predict how many years they need to pay back, what they invest in or how much they can raise the electricity price. Meanwhile, for investors or companies who plan to install a PCS in rural areas, this analysis process references how many chargers they need, what a reasonable price is, and the possible payback period. Using line charts in this model shows the trend and compares cost and revenue in a one-time line. For example, the point where the total cost meets total revenue represents when this PCS turns loss into net profit. A gap exists after putting two lines into one chart: the value of net revenue. This paper uses two colours, blue and orange, to distinguish them. If an orange line is on top of the blue one, the PCS will make a profit.

This project assumes the same conditions—charger numbers, CAPEX, special electricity price. Once the charger number is confirmed, the only variable is Ed, as presented in Equation (7).

So long as this model presumes the latest payback time is eight years, the minimal total electricity demands of a PCS comes out. This number could be called the ‘electricity demands threshold’. In other words, if its total electricity demands reach this ‘threshold’, the PCS will pay back before 2028.

Investors can adjust this threshold. For instance, if businesses plan to pay back investments in five years, it changes the eight into five based on the Equations (5) and (6):

| x | Year |

| Total OPEX of 5 years |

| Total revenue of 5 years |

The other parameters remain the same. The gap between Equations (8) and (9) equals the value of CAPEX. However, this ‘threshold’ cannot be changed by random. The lower the ‘threshold’ is, the less likely the charging stations can pay back their investments. Moreover, the purpose of the ‘threshold’ is to examine whether the PCS pays back in time.

Even though this model improves the cost and price, most rural PCS are less likely to gain any net profit before 2028.