How Does Carbon Trading Impact China’s Forest Carbon Sequestration Potential and Carbon Leakage?

Abstract

1. Introduction

2. Theoretical and Framework Analysis

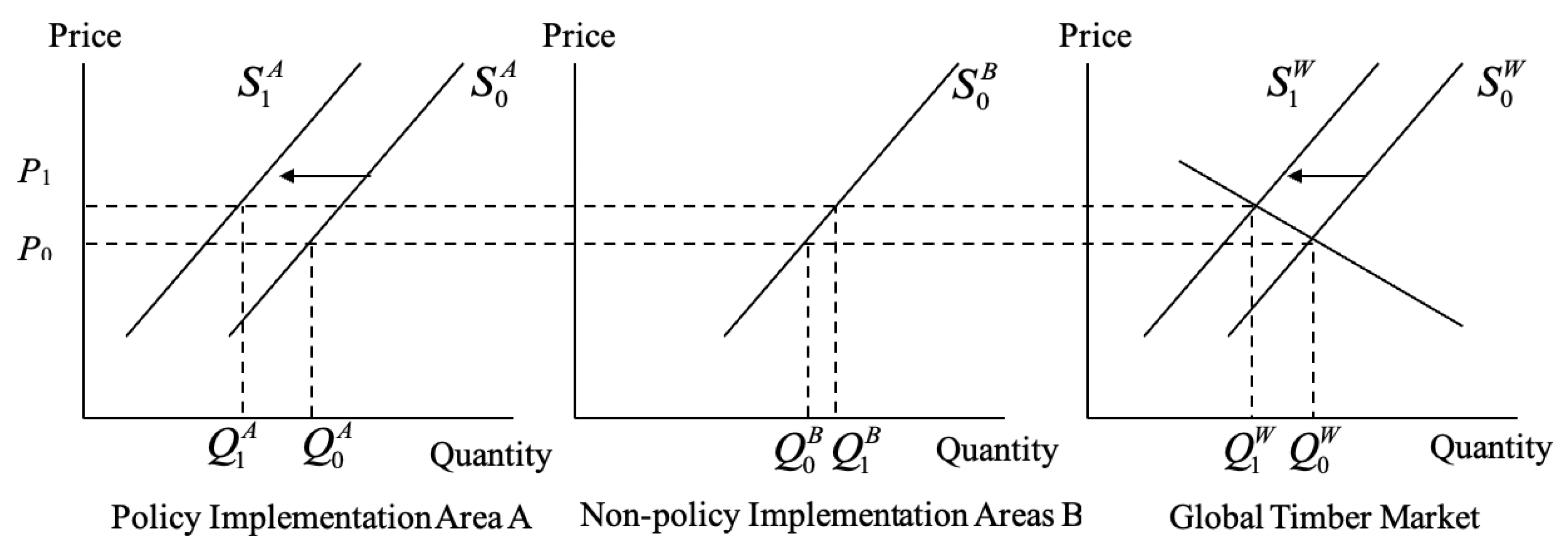

2.1. Economic Analysis of Carbon Leakage

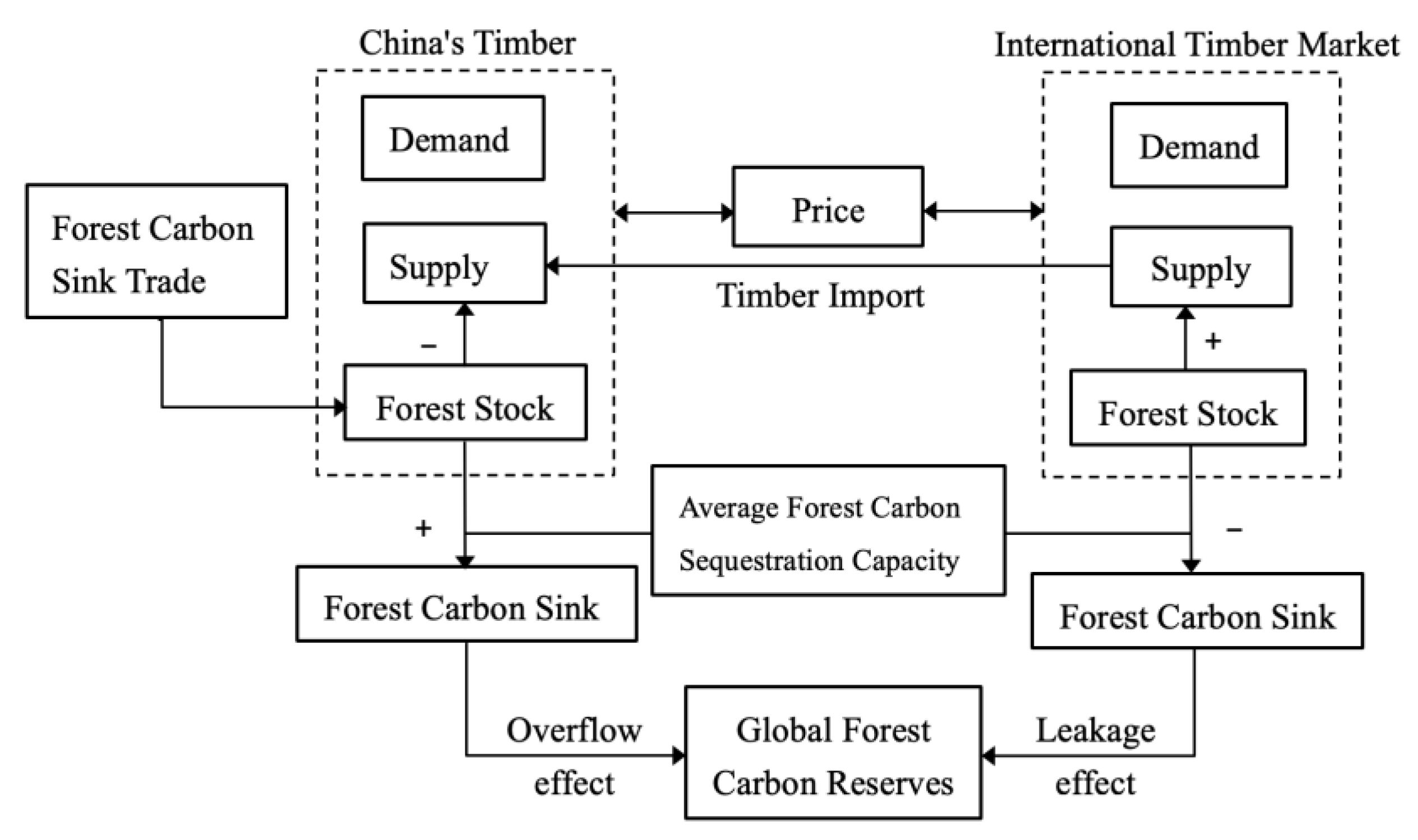

2.2. Framework

3. Methodology and Materials

3.1. GFPM

3.2. Data

3.3. Calculation of Forest Carbon Stocks

4. Results

4.1. Forest Carbon Leakage

4.2. Alternative Scenarios

4.3. Forest Carbon Sink Potential Prediction

4.4. Timber Market Prediction

4.5. Forest Carbon Leakage Effect

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Michetti, M.; Rosa, R. Afforestation and Timber Management Compliance Strategies in Climate Policy. A Computable General Equilibrium Analysis. Ecol. Econ. 2011, 77, 139–148. [Google Scholar] [CrossRef]

- Richards, K.R.; Stokes, C.A. Review of Forest Carbon Sequestration Cost Studies: A Dozen Years of Research. Clim. Chang. 2004, 63, 1–48. [Google Scholar] [CrossRef]

- Kindermann, G.; Obersteiner, M.; Sohngen, B.; Sathaye, J.; Andrasko, K.; Rametsteiner, E.; Schlamadinger, B.; Wunder, S.; Beach, R. Global cost estimates of reducing carbon emissions through avoided deforestation. Proc. Natl. Acad. Sci. USA 2008, 105, 10302–10307. [Google Scholar] [CrossRef]

- Tong, X.; Brandt, M.; Yue, Y.; Ciais, P.; Jepsen, M.R.; Penuelas, J.; Wigneron, J.-P.; Xiao, X.; Song, X.-P.; Horion, H.S.; et al. Forest management in southern China generates short term extensive carbon sequestration. Nat. Commun. 2020, 11, 129. [Google Scholar] [CrossRef] [PubMed]

- Cai, W.; He, N.; Li, M.; Xu, L.; Wang, L.; Zhu, J.; Zeng, N.; Yan, P.; Si, G.; Zhang, X.; et al. Carbon sequestration of Chinese forests from 2010 to 2060: Spatiotemporal dynamics and its regulatory strategies. Sci. Bull. 2022, 67, 836–843. [Google Scholar] [CrossRef] [PubMed]

- Murray, B.C.; Mccarl, B.A.; Lee, H.C. Estimating Leakage from Forest Carbon Sequestration Programs. Land Econ. 2003, 80, 109–124. [Google Scholar] [CrossRef]

- Nepal, P.; Ince, P.J.; Skog, K.E.; Chang, S.J. Forest carbon benefits, costs and leakage effects of carbon reserve scenarios in the United States. J. For. Econ. 2013, 19, 286–306. [Google Scholar] [CrossRef]

- Gan, J.; Mccarl, B.A. Measuring transnational leakage of forest conservation. Ecol. Econ. 2007, 64, 423–432. [Google Scholar] [CrossRef]

- Sohngen, B.; Brown, S. Measuring leakage from carbon projects in open economies: A stop timber harvesting project in Bolivia as a case study. Can. J. For. Res. 2004, 34, 829–839. [Google Scholar] [CrossRef]

- Sun, B.; Sohngen, B. Set-asides for carbon sequestration: Implications for permanence and leakage. Clim. Chang. 2009, 96, 409–419. [Google Scholar] [CrossRef]

- Hu, X.; Shi, G.; Hodges, D.G. International Market Leakage from China’s Forestry Policies. Forests 2014, 5, 2613–2625. [Google Scholar] [CrossRef]

- Sedjo, R.; Solomon, A. Climate and Forests. In Greenhouse Warming: Abatement and Adaptation; Crosson, P., Darmstadter, J., Easterling, W., Rosenberg, N., Eds.; Resources for the Future Press: Washington, DC, USA; Routkedge: London, UK, 1989; pp. 110–119. [Google Scholar]

- Sohngen, B.; Mendelsohn, R. An Optimal Control Model of Forest Carbon Sequestration. Am. J. Agric. Econ. 2003, 85, 448–457. [Google Scholar] [CrossRef]

- Xu, D.; Zhang, X.Q.; Shi, Z. Mitigation Potential for Carbon Sequestration through Forestry Activities in Southern and Eastern China. Mitig. Adapt. Strateg. Glob. Chang. 2001, 6, 213–232. [Google Scholar] [CrossRef]

- Liu, S.N.; Tao, Z.; Lin, Y.W.; Yang, S. The spatial distribution of forest carbon sinks and sources in China. Chin. Sci. Bull. 2012, 57, 1699–1707. [Google Scholar] [CrossRef]

- Xu, B.; Guo, Z.D.; Piao, S.L.; Fang, J.Y. Biomass carbon stocks in China’s forests between 2000 and 2050: A prediction based on forest biomass-age relationships. Sci. China-Life Sci. 2010, 8, 776–783. [Google Scholar] [CrossRef]

- Ke, S.F.; Zhang, Z.; Wang, Y.M. China’s forest carbon sinks and mitigation potential from carbon sequestration trading perspective. Ecol. Indic. 2023, 148, 110054. [Google Scholar] [CrossRef]

- Yu, Z.; Ciais, P.; Piao, S.; Houghton, R.A.; Lu, C.; Tian, H.; Agathokleous, E.; Kattel, G.R.; Sitch, S.; Goll, D.; et al. Forest expansion dominates China’s land carbon sink since 1980. Nat. Commun. 2022, 13, 5374. [Google Scholar] [CrossRef] [PubMed]

- Canadell, J.G.; Quere, C.L.; Raupach, M.R.; Field, C.B.; Buitenhuis, E.T.; Ciais, P.; Conway, T.J.; Gillett, N.P.; Houghton, R.A.; Marland, G.; et al. Contributions to accelerating atmospheric CO2 growth from economic activity, carbon intensity, and efficiency of natural sinks. Proc. Natl. Acad. Sci. USA 2007, 104, 18866–18870. [Google Scholar] [CrossRef] [PubMed]

- Jiang, X.; Huang, Z.H. Analysis of China’s forestry carbon sink potential under the New Economic Normal. Chin. Rural. Econ. 2016, 11, 57–67. (In Chinese) [Google Scholar]

- Gren, I.M.; Zeleke, A.A. Policy design for forest carbon sequestration: A review of the literature. Forest Policy Econ. 2016, 70, 128–136. [Google Scholar] [CrossRef]

- Liu, Z.; Deng, Z.; He, G.; Wang, H.L.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Zhang, P.; Yin, G.Z.; Duan, M.S. Distortion effects of emissions trading system on intra-sector competition and carbon leakage: A case study of China. Energy Policy 2020, 137, 111126. [Google Scholar] [CrossRef]

- Henders, S.; Ostwald, M. Forest carbon leakage quantification methods and their suitability for assessing leakage in REDD. Forests 2012, 3, 33–58. [Google Scholar] [CrossRef]

- Sohngen, B.; Mendelsohn, R.; Sedjo, R. Forest Management, Conservation, and Global Timber Markets. Am. J. Agric. Econ. 1999, 81, 1–13. [Google Scholar] [CrossRef]

- Bosello, F.; Parrado, R.; Rosa, R. The Economic and Environmental Effects of an EU Ban on Illegal Logging Imports. Insights from a CGE Assessment. Environ. Dev. Econ. 2013, 18, 184–206. [Google Scholar] [CrossRef]

- Tian, X.; Sohngen, B.; Baker, J.; Ohrel, S.; Fawcett, A.A. Will U.S. Forests Continue to Be a Carbon Sink? Land Econ. 2018, 94, 97–113. [Google Scholar] [CrossRef] [PubMed]

- Buongiorno, J.; Zhu, S. Consequences of carbon offset payments for the global forest sector. J. For. Econ. 2013, 19, 384–401. [Google Scholar] [CrossRef]

- Ince, P.J.; Kramp, A.D.; Skog, K.E.; Yoo, D.I.; Sample, V.A. Modeling future U.S. forest sector market and trade impacts of expansion in wood energy consumption. J. For. Econ. 2011, 17, 142–156. [Google Scholar] [CrossRef]

- Johnston, C.M.T.; Radeloff, V.C. Global mitigation potential of carbon stored in harvested wood products. Proc. Natl. Acad. Sci. USA. 2019, 116, 14526–14531. [Google Scholar] [CrossRef] [PubMed]

- Nepal, P.; Prestemon, J.P.; Joyce, L.A.; Skog, K.E. Global forest products markets and forest sector carbon impacts of projected sea level rise. Glob. Environ. Chang. 2022, 77, 102611. [Google Scholar] [CrossRef]

- Buongiorno, J. Modeling some long-term implications of CO2 fertilization for global forests and forest industries. For. Ecosyst. 2015, 2, 1–13. [Google Scholar] [CrossRef]

- Nepal, P.; Ince, P.J.; Skog, K.E.; Chang, S.J. Projection of US forest sector carbon sequestration under US and global timber market and wood energy consumption scenarios, 2010–2060. Biomass Bioenerg. 2012, 45, 251–264. [Google Scholar] [CrossRef]

- Nepal, P.; Joseph, B.; Craig, M.T.J.; Jeffrey, P.; Guo, J.G. Global forest products trade model. In International Trade in Forest Products: Lumber Trade Disputes, Models and Examples; CABI: Wallingford, UK, 2021; pp. 110–141. [Google Scholar]

- Daigneault, A.; Baker, J.S.; Guo, J.; Lauri, P.; Favero, A.; Forsell, N.; Johnston, C.; Ohrel, S.B.; Sohngen, B.L. How the future of the global forest sink depends on timber demand, forest management, and carbon policies. Glob. Environ. Chang.-Hum. Policy Dimens. 2022, 76, 102582. [Google Scholar] [CrossRef]

- Buongiorno, J.; Zhu, S.S. Technical change in forest sector models: The global forest products model approach. Scand. J. Forest Res. 2015, 30, 30–48. [Google Scholar] [CrossRef]

- Lin, B.; Ge, J. Valued forest carbon sinks: How much emissions abatement costs could be reduced in China. J. Clean. Prod. 2019, 224, 455–464. [Google Scholar] [CrossRef]

- Buongiorno, J.; Zhu, S.; Zhang, D.; Turner, J.; Tomberlin, D. The Global Forest Products Model (GFPM): Structure, Estimation, Applications; Academic Press: Cambridge, MA, USA, 2003. [Google Scholar]

- Pan, W.; Kim, M.K.; Ning, Z.; Yang, H. Carbon leakage in energy/forest sectors and climate policy implications using meta-analysis. For. Policy Econ. 2020, 115, 102161. [Google Scholar] [CrossRef]

- Wilson, R.; Luckow, P.; Biewald, B.; Ackerman, F.; Hausman, E. 2015 Carbon Dioxide Price Forecast; Synapse Energy Economics, Inc.: Cambridge, UK, 2015. [Google Scholar]

- Zhu, Z.; Shen, Y.Q.; Wu, W.G. Household optimal forest management decision and carbon supply: Case from Zhejiang and Jiangxi Provinces. Acta Ecol. Sin. 2013, 33, 2577–2585. (In Chinese) [Google Scholar]

- Shen, Y.Q.; Zeng, C.; Wang, C.J.; Xu, X.Y.; Zeng, C. Impact of Carbon Sequestration Subsidy and Carbon Tax Policy on Forestry Economy——Based on CGE Model. J. Nat. Resour. 2015, 9, 560–568. (In Chinese) [Google Scholar]

- Zhang, Y.; Li, X.G.; Wen, Y.L. Forest carbon sequestration potential in China under background of carbon emission peak and carbon neutralization. J. Beijing For. Univ. 2022, 44, 38–47. [Google Scholar]

- Bowditch, E.; Santopuoli, G.; Binder, F.; del Río, M.; La Porta, N.; Kluvankova, T.; Lesinski, J.; Motta, R.; Pach, M.; Panzacchi, P.; et al. What is Climate-Smart Forestry? A definition from a multinational collaborative process focused on mountain regions of Europe. Ecosyst. Serv. 2020, 43, 101113. [Google Scholar] [CrossRef]

- Zhang, B.; Lan, K.; Harris, T.B.; Ashton, M.S.; Yao, Y. Climate-smart forestry through innovative wood products and commercial afforestation and reforestation on marginal land. Proc. Natl. Acad. Sci. USA 2023, 120, e2221840120. [Google Scholar] [CrossRef] [PubMed]

| Variables | Scenarios | 2020 | 2025 | 2030 | Total Increment | Mean Annual Increment |

|---|---|---|---|---|---|---|

| Forest Stock | Basic | 177.4 | 200.3 | 223.6 | 59.2 | 4.5 |

| CEA | 177.5 | 200.6 | 224.1 | 59.8 | 4.6 | |

| LFCSP | 177.6 | 201.2 | 225.4 | 61.1 | 4.7 | |

| HFCSP | 177.8 | 202.2 | 227.8 | 63.9 | 4.9 | |

| Carbon Storage | Basic | 7863.5 | 8875.2 | 9906.9 | 2624.9 | 201.9 |

| CEA | 7866.4 | 8888.0 | 9932.1 | 2650.1 | 203.9 | |

| LFCSP | 7871.4 | 8914.8 | 9990.8 | 2708.8 | 208.3 | |

| HFCSP | 7880.3 | 8958.7 | 10,096.0 | 2813.9 | 216.5 |

| Region/Country | CEA | LFCSP | HFCSP | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2025 | 2030 | 2020 | 2025 | 2030 | 2020 | 2025 | 2030 | |

| Africa | 0.20 | 0.17 | 0.15 | 0.38 | 0.74 | 0.68 | 0.47 | 1.23 | 1.67 |

| North America | 0.19 | 0.13 | 0.29 | 0.28 | 0.64 | 1.27 | 1.42 | 3.28 | 6.17 |

| South America | 0.07 | 0.21 | 0.21 | 0.59 | 0.96 | 1.34 | 0.81 | 3.12 | 3.67 |

| Asia (excluding China) | −3.86 | −4.07 | −3.91 | −10.65 | −15.36 | −16.14 | −21.79 | −33.98 | −41.54 |

| China | −3.92 | −4.34 | −4.99 | −10.71 | −15.78 | −18.31 | −22.44 | −35.97 | −45.78 |

| Oceania | 1.42 | 1.39 | 1.22 | 2.05 | 5.13 | 4.66 | 2.16 | 7.88 | 9.40 |

| Europe | 0.18 | 0.19 | 0.32 | 0.24 | 0.67 | 1.08 | 1.29 | 3.38 | 4.79 |

| Global (excluding China) | 2.12 | 2.35 | 3.27 | 3.62 | 8.56 | 11.20 | 6.79 | 20.86 | 29.95 |

| Global | −1.80 | −1.98 | −1.73 | −7.10 | −7.22 | −7.10 | −15.65 | −15.11 | −15.83 |

| Region/Country | CEA | LFCSP | HFCSP | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2025 | 2030 | 2020 | 2025 | 2030 | 2020 | 2025 | 2030 | |

| Equatorial Guinea | 4.33 | 4.68 | 4.94 | 8.62 | 16.95 | 17.66 | 8.62 | 29.14 | 34.05 |

| Gambia | 0.99 | 1.01 | 0.96 | 1.28 | 3.68 | 3.52 | 1.28 | 5 | 6.85 |

| Nigeria | 10.67 | 7.88 | 5.82 | 17 | 46.39 | 36.93 | 17 | 46.4 | 79.34 |

| Zambia | 1.8 | 2.52 | 2.73 | 1.83 | 4.98 | 8.57 | 1.83 | 4.99 | 8.59 |

| Canada | 0 | 0 | 0 | 0 | 0.01 | 25.51 | 158.93 | 433.68 | 741.42 |

| Japan | 0 | 0 | 0 | 0 | 0.01 | 16.75 | 30.76 | 83.95 | 143.52 |

| New Zealand | 120.81 | 109.28 | 94.76 | 154.2 | 417.58 | 349.68 | 154.2 | 587.3 | 686.66 |

| Papua New Guinea | 18.03 | 19.57 | 20.85 | 48.5 | 72.59 | 77.8 | 48.5 | 151.28 | 150.11 |

| Solomon Islands | 4.45 | 13.38 | 13.35 | 4.45 | 30.53 | 49.72 | 4.46 | 30.54 | 84.03 |

| Belgium | 0 | 0 | 0.01 | 0 | 9.08 | 20.25 | 19.65 | 53.61 | 91.66 |

| Germany | 0 | 0 | 0 | 0 | 0 | 0 | 13.95 | 38.05 | 65.06 |

| Roumania | 0 | 0 | 0 | 0 | 0 | 0 | 3.82 | 10.41 | 17.81 |

| Sweden | 0 | 0 | 0 | 0 | 0 | 0 | 0.42 | 1.14 | 1.96 |

| Swiss | 0 | 0 | 0 | 0 | 0 | 0 | 1.73 | 4.71 | 8.06 |

| England | 0 | 0 | 0 | 0 | 0 | 0 | 0.38 | 0.33 | 0.24 |

| Other countries | 0.028 | 0.068 | 0.096 | 0.034 | 0.085 | 0.12 | 0.042 | 0.101 | 0.147 |

| Global | 161.36 | 159 | 144.38 | 236.22 | 602.66 | 607.59 | 465.95 | 1481.54 | 2120.83 |

| Region/Country | CEA | LFCSP | HFCSP | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Forest Stock Volume | Forest Carbon Storge | Leakage Effect | Forest Stock Volume | Forest Carbon Storge | Leakage Effect | Forest Stock Volume | Forest Carbon Storge | Leakage Effect | |

| Africa | −14.4 | −9.7 | 6.6% | −37.6 | −25.3 | 5.4% | −55 | −37.0 | 3.7% |

| North America | −16.7 | −8.5 | 5.8% | −33.7 | −17.2 | 3.7% | −164.6 | −83.8 | 8.3% |

| South America | −8.4 | −4.4 | 3.0% | −56.2 | −29.2 | 6.3% | −124 | −64.5 | 6.4% |

| China | 332.8 | 147.5 | —— | 1051.5 | 466.0 | —— | 2288.2 | 1014.0 | —— |

| Asia (excluding China) | −9.7 | −6.0 | 4.1% | −14.2 | −8.8 | 1.9% | −77.4 | −48.1 | 4.7% |

| Oceania | −101.5 | −83.9 | 56.9% | −244.5 | −202.1 | 43.4% | −322.2 | −266.3 | 26.3% |

| Europe | −15.2 | −7.8 | 5.3% | −30.3 | −15.5 | 3.3% | −167.9 | −86.0 | 8.5% |

| Global (excluding China) | −165.9 | −120.3 | 81.5% | −416.5 | −298.1 | 64.0% | −911.1 | −585.7 | 57.8% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qiao, D.; Zhang, Z.; Li, H. How Does Carbon Trading Impact China’s Forest Carbon Sequestration Potential and Carbon Leakage? Forests 2024, 15, 497. https://doi.org/10.3390/f15030497

Qiao D, Zhang Z, Li H. How Does Carbon Trading Impact China’s Forest Carbon Sequestration Potential and Carbon Leakage? Forests. 2024; 15(3):497. https://doi.org/10.3390/f15030497

Chicago/Turabian StyleQiao, Dan, Zhao Zhang, and Hongxun Li. 2024. "How Does Carbon Trading Impact China’s Forest Carbon Sequestration Potential and Carbon Leakage?" Forests 15, no. 3: 497. https://doi.org/10.3390/f15030497

APA StyleQiao, D., Zhang, Z., & Li, H. (2024). How Does Carbon Trading Impact China’s Forest Carbon Sequestration Potential and Carbon Leakage? Forests, 15(3), 497. https://doi.org/10.3390/f15030497