Abstract

In 2020, a survey was conducted of timberland investment professionals. The focus of the survey was collecting and examining transaction cost data within the timberland investment space. The data collected were generally lacking in the public domain, as well as academic literature, yet it provides insight into the significant costs that are involved in timberland investing. The survey revealed that the U.S. South and the Pacific Northwest have significant differences in investor expectations for transaction costs. The objective of the current study was to explore the differences in transaction costs for the two regions and to uncover the relationships between (1) timberland transaction costs; (2) investment interest; and (3) prior experience in owning, investing, or managing timberland in either region. The findings of this work confirmed that transaction costs were a statistically significant predictor of investor interest in the U.S. South and the Pacific Northwest. The findings also showed that prior ownership, investment, or management experience in either region were a statistically significant predictor of investor interest in the U.S. South and the Pacific Northwest. Furthermore, this work explores factors that appear to rationalize the high investor interest in the Pacific Northwest, despite investor expectations of much higher transaction costs associated with timberland acquisition within this region.

1. Introduction

Transaction costs have been a part of the human experience for centuries [1]. They have been associated with processes that allow for the exchange of goods and services among individuals and organizations. They reflect the effort and energy (and a significant portion of the ultimate financial and economic cost) involved in much of our daily economic activities. Transaction costs are so ubiquitous in the human experience that they are hardly given any recognition or methodical attention. Coase [2,3] changed all of that and is generally credited with bringing academic attention to transaction costs in the mid-20th century, as he developed the concept and the early framework where transaction costs could be systematically studied and better understood. Shortly before Coase’s seminal 1937 paper, Hicks [4] attempted to describe what he called “frictions” that delay or even prevent some transactions from occurring. Hicks pointed out that some people had “…the preference for holding money rather than capital goods. For capital will ordinarily yield a positive rate of return, which money does not”. Since capital goods can produce superior returns to the rate of interest gained from holding “barren money”, Hicks was looking for a reason that would explain the reluctance of individuals to invest their funds into projects that would yield a superior return. The reason, he discovered, was the friction (later coined transaction costs) associated with the purchase of capital goods.

Both Coase and Hicks’ works are relevant in economics and capital markets today. Investments in various opportunities, whether financial or real-asset instruments, are encumbered by transaction costs [5,6]. Real assets, such as timberland, often require a multi-million-dollar capital investment. Those investments have only increased over time. For example, both private and public market entities recently (by a 2022 estimate) invested more than USD 88 billion in timberlands in the U.S. alone [7,8]. This type of real asset investing involves a multifaceted due diligence approach to examine the asset under consideration, as well as potential future returns. This pre-acquisition assessment process requires extensive amounts of resources and energy (i.e., transaction costs) to successfully complete the exchange of investment funds for timberlands [9]. In this manuscript, a closer look will be given to the timberland transaction costs for two specific regions: the U.S. South and the Pacific Northwest. These two regions have incurred the most investor interest and investment activity across the entire timberland investment space over the last few decades [9,10]. The U.S. South timberland region is defined here as the states of North Carolina, South Carolina, Georgia, Florida, Tennessee, Alabama, Mississippi, Louisiana, Arkansas, Oklahoma, and Texas. The Pacific Northwest timberland region is defined here as the states of Washington, Oregon, Idaho, Montana, and the northern part of California. This study will examine the regional demand for timberland assets in these regions, the land area that has been exchanged in the two regions, as well as the total returns for the underlying timberland assets that were purchased or sold.

1.1. Means of Investing in U.S. Timberland

Individuals, as well as organizations, can invest in the U.S. timberland asset class in four different ways [11]: (1) purchasing timberland directly; (2) investing through a timberland investment management organization (TIMO) as their management fiduciary; (3) purchasing securities of a forestry real estate investment trust (REIT); and (4), purchasing futures contracts in lumber commodities. This manuscript will discuss the first three of these as they are most relevant to the study of transaction costs in timberland investment.

Some examples of large timberland investments by individuals or family investors include John Malone, the largest shareholder in Liberty Media, who owns over 405,000 hectares of timberland in Maine and New Hampshire. Peter Buck, founding partner of Subway restaurants, owns nearly 500,200 hectares of timberland in rural Maine. Thomas Peterffy, founder of Interactive Brokers, owns more than 235,000 hectares of timberland in Northern Florida. The Ford family owns approximately 235,000 hectares of timberland, mostly located in the Pacific Northwest [12]. The details of private transactions involving these land acquisitions are rare and often opaque with no requirement of public reporting. The financial terms of purchases, sales, and associated transaction costs of these deals are generally unavailable. This type of timberland investing more often occurs on a much smaller scale among affluent individuals or by way of consortium investing. This type of investing is not the focus of this study.

Although it is more common for private individual investors (as well as a few ultra-wealthy individuals) to invest in timberland directly, institutional investors have not commonly utilized this ownership and management strategy to any significant extent. Institutional investors more often rely on independent advisors, such as TIMOs, to source and complete deals, manage properties, and eventually sell those assets on their behalf [13]. The private-equity timberland investment sector is led by several large TIMOs [7]. Institutional timberland investors who utilize these investment management organizations, in general, do not have the professional expertise on staff and are not interested in conducting the day-to-day management activities associated with industrial timberlands.

The public timberland investment sector in the U.S. is represented by three major REITs. Together, Weyerhaeuser, Rayonier, and PotlatchDeltic own or manage more than six million hectares of timberland [14]. The associated stocks and the exchange-traded funds that incorporate them are not strictly a “pure play” on timberland. Weyerhaeuser and PotlatchDeltic both own lumber conversion operations that make them more of a vertically integrated organization than Rayonier. However, Rayonier also operates a seedling nursery and a beekeeping business on its properties [15]. The performance of REITs can be tracked using several indexes, such as the Forisk Timber REIT (FTR) index [16] and the Hoya Capital Timber REIT index [17].

In this study, relationships were tested between investor interest in the U.S. South and the Pacific Northwest with the explanatory variables of transaction costs and prior experience operating in those regions. The NCREIF Timberland Index (NTI) (NCREIF: National Council of Real Estate Investment Fiduciaries) was used to compare results from the 2020 Timberland Transaction Cost Survey [9] with investor behavior in the timberland investing space. Attention was directed to total timberland returns during the period of 2014–2019, as that was the focus of this Timberland Transaction Cost Survey.

1.2. Investing in the U.S. South vs. the Pacific Northwest

Regarding investments in timberland, there are several important differences between the two timberland regions. The first relates to the total forested area available for investment in the two regions. The U.S. South has more than 73.6 million hectares of private timberland that could be considered available for investment; however, the Pacific Northwest has less than about 13.9 million hectares of private timberland available for investment [18]. Whether these forested areas are of sufficient quality or productivity that would capture investor interest is unknown, but they represent an estimated catalog of all private timberland areas capable of being bought or sold within the two regions. The second major distinction between these two timberland investment regions relates to their regulatory systems. In the Pacific Northwest, timberland management is subject to a greater level of state and local regulatory oversight than similar activities in the U.S. South [19]. This additional amount of oversight can influence total management and administrative costs and can affect net revenues derived from timberland ownership. A third major distinction between these two regions relates to regional topography. The Pacific Northwest contains a significant amount of steep ground on which forests grow, and thus is characterized by much more variable topography than the U.S. South. In general, this leads to more limited (and expensive) infrastructure that is required to access rural land, and with respect to both logging and road building, there are more slope instability issues, and higher risks of soil erosion and surface water sedimentation issues here, in general, than in the U.S. South. These complications introduce other regional differences, such as the more expensive logging technology that is needed in the Pacific Northwest, and greater hauling logistic and cost issues. The last major distinction between these two regions relates to the level of intensity in plantation management. Timberland owners in the U.S. South have benefitted from more advances in plantation management and genetic breeding of seedling stock than landowners in the Pacific Northwest [20,21]. These advancements have resulted in lower input costs (e.g., land, labor, and productivity), higher multi-rotational yields per hectare, and lower rotational ages for many product groups (e.g., pulp, chip-and-saw, and sawlog rotations) [22].

These important differences between the two U.S. regions impact the extent that pre-sale or pre-purchase (depending on perspective) due-diligence work is required. For example, the need to investigate more complicated regulations, which may affect allowable annual wood removals, will add transaction cost expenses. The need to investigate slope instability issues, as well as road conditions and road life-cycle durability, may also add significant transaction cost expenses. In addition, the need to gather the necessary legal documents to understand access issues related to remote properties can be expensive.

The remainder of this manuscript is organized as follows. The next section introduces the material and methods used to conduct this study. Then, the results of the analysis are presented, with a focus on transaction costs and hypothesis testing using survey results from a 2020 Timberland Transaction Cost Survey, focusing on the U.S. South and the Pacific Northwest. A synthesis of the results is provided with an interpretation of findings using the NCREIF NTI and regional log price indices; limitations of this study are presented, and finally, a summary of the key findings is given.

2. Materials and Methods

Data for transaction costs were derived from the 2020 Timberland Transaction Cost Survey [9]. Data for total timberland transactions in the U.S. South and the Pacific Northwest were obtained from TimberMart-South [23]. Data for regional forest product revenues that combined log price indices from the U.S. South and the Pacific Northwest were obtained from Forest2Market, a timberland data intelligence firm based in Charlotte, North Carolina [24]. Data regarding housing starts were obtained from the U.S. Census Bureau [25].

One issue with investing in timberland, a non-publicly traded asset, is the lack of readily available data like pro forma, appraisals, or property compatibles. To overcome this deficit, the NTI, a commercially available information service that collects information from a large and changing collection of privately held timberlands, provides a measure of investment performance. The returns from private timberland investors were obtained from NCREIF and presented on a quarterly basis. As of 2022, the NTI consisted of approximately 5.4 million hectares of timberland with a market value that exceeded $23 billion USD.

The 2020 Timberland Transaction Cost Survey was made available to 650 timberland investment professionals [9]. The sample frame included participants from three major timberland investment conferences that were held at different locations: (1) The World Forestry Center: Who Will Own the Forest (WWOF), 17–19 September 2019, Portland, OR, U.S.; (2) Arena International Events Group: The Alternative Investment Forum (AIF), 16–17 October 2019, London, U.K.; and (3) The University of Georgia’s Timberland Investment Conference, 20–22 March 2019, Amelia Island, FL, U.S. The survey consisted of 50 questions that were designed to investigate: (1) the total cost of individual timberland transaction components; (2) the participants’ familiarity with timberland transactions—both by timberland estate size and estate location; (3) the participants’ views of expected timberland transaction costs by estate size and estate location; and (4) the ultimate impact of timberland transaction costs on timberland investing. A total of 102 responses were received from the survey participants, which corresponded to a response rate of 15.7%.

Hypothesis Testing

Three main hypotheses about timberland investing in the Pacific Northwest and the U.S. South are being examined in this work:

H1.

Investment interest in one region is not affected by investment interest in the other region.

H2.

Investment interest in one region is not affected by an investor’s existing ownership or investment experience in the same region.

H3.

Investment interest in either region is not affected by the transaction costs incurred either in the same region or the other region.

To test these three hypotheses, this work utilized ordinal logistic regression (OLR) on answers to questions received in the 2020 Timberland Transaction Cost Survey. The goodness-of-fit test using the Chi-squared statistic was performed on the relationships between how survey participants responded to a series of independent questions. OLR is an extension of logistic regression where the response variable has ranked multiple values. Following Fagerland and Hosmer as decribed by Lee [26], the proportional odds logistic model is defined as follows. Y denotes a variable with c-ordered categorical response levels. Note that X denotes the vector of explanatory variables. Ordinal logistic regression models are used to describe the relationship between Y and X using c-1 logit equations (c = 3, for the 3 categories of Y) represented by the following:

These equations relate a specific set of intercepts (α’s), as well as regression coefficients (β’s), to the probability of response categories. In this case, of proportional odds logistic regression, each of the logit equations compares the probabilities of obtaining a response to Y of an explanatory variable X.

In the case of this study, the response variable, Y, is timberland investment interest in either the Pacific Northwest or the U.S. South in ordered categories “low”, “average”, or “high”. The explanatory variable X is one of several variables utilized from questions posed in the 2020 Timberland Transaction Cost Survey. These variables include (1) investment interest in either region, the U.S. South or Pacific Northwest; (2) investment, ownership, or management in either region; or (3) transaction cost perception in either region.

The questions utilized from the 2020 Timberland Transaction Cost Survey that were analyzed to address the hypotheses posed in this work were:

- In which U.S. regions do you invest, own, operate, or manage other’s timberland?

- Please rank by priority the region in the U.S. in which you are trying to invest capital in timberlands.

- Please rank by timberland region in the U.S. by the total transaction costs each requires to invest capital.

Answers to Question 1 were used as the dependent variable, and Questions 2 and 3 were used as the explanatory variables. The OLR test statistic is based on the probability of obtaining a Chi-squared value that is greater than the one computed if there is no statistically significant relationship between answers. This test was conducted with a threshold at the 0.05 significance level.

Survey question responses were analyzed with JMP Pro 17 software (version 17.1.0, SAS Institute Inc., Cary, NC, USA). This analysis is used for the sake of comparison between responses between survey questions. Specifically, can the response to an ordinal question help predict how an individual might respond to another ordinal question in the survey [27]? To further explore the differences between the U.S. South and Pacific Northwest, historical transaction data, timberland revenue streams, and total timberland returns were also examined to investigate timberland investor sentiment and behavior.

3. Results and Discussion

3.1. Timberland Transaction Data

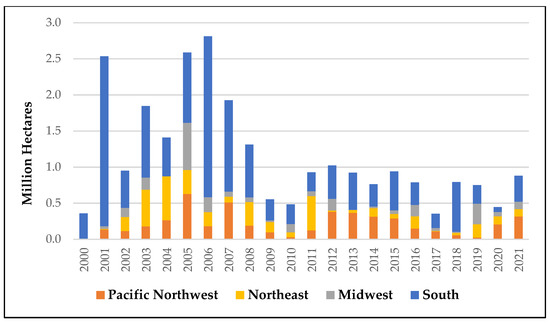

The number of hectares transacted in the U.S. from 2000 through 2021 is shown in Figure 1 and Table 1. In that period, approximately 14.5 million hectares of timberland transactions occurred in the U.S. South, and approximately 4.6 million hectares of timberland transactions occurred in the Pacific Northwest [23]. These areas represented in these exhibits account for more than 68% of the total timberland transacted across the entire U.S. during this period. The transactions in these two regions also represent nearly 66 billion dollars (USD) in timberland investment. The total investment value of both regions represents 75% of the estimated USD 88 billion timberland capital invested throughout the entire U.S. in that period [28]. One aspect of timberland availability that may have significant implications for transaction costs is dead deal costs. Dead deal costs involve the entire range of due diligence transaction costs for a timberland property that is not successfully executed [9]. In regions where less timberland is available for purchase and the markets are more competitive, like the Pacific Northwest, there is a higher probability of dead deal costs. These costs only add additional transaction costs for investors. The concept and implications for dead deals will be discussed in more detail in the conclusions.

Figure 1.

Total transaction area by U.S. region 2000–2021.

Table 1.

Total transaction hectares by U.S. region 2000–2021.

3.2. 2020 Timberland Transaction Cost Survey Results

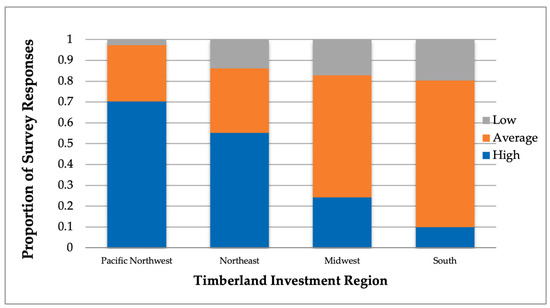

One of the questions posed in the 2020 Timberland Transaction Cost Survey was: “Please rank the U.S. timberland by the total transaction costs each requires to invest capital”. The Pacific Northwest ranked the highest for transaction costs among all of the U.S. timberland regions (Figure 2). Nearly 70% of respondents ranked this region as “high” in terms of transaction costs. This result differs dramatically from the less than 10% of survey respondents that ranked the U.S. South as having “high” transaction costs.

Figure 2.

Reported transaction costs by U.S. timberland region.

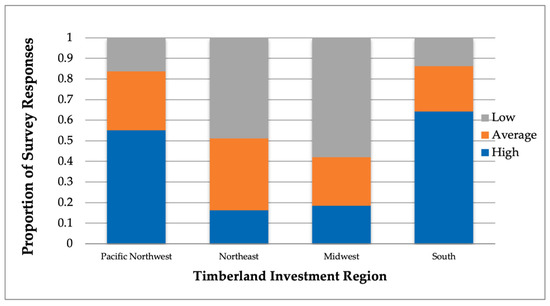

Survey participants were also asked: “In what U.S. region(s) are you attempting to place your timberland capital?” The responses (Figure 3) indicated that 63% of respondents regarded the U.S. South as their “highest” investment priority, whereas 55% of those that responded said that the Pacific Northwest was their “highest” investment priority. The other U.S. regions included in the survey were the U.S. Midwest (which includes the states of Ohio, Michigan, Minnesota, Wisconsin, Missouri, Iowa, Illinois, Indiana, West Virginia, and Kentucky) and Northeast (which includes the states of Virginia, Maryland, Pennsylvania, New York, New Jersey, Rhode Island, Massachusetts, Vermont, New Hampshire, Connecticut, and Maine), and they accounted for only 6% investor interest, respectively. It is important to note that responses to the investment interest by regional categories were not mutually exclusive with this survey question. The statistics are based on the total responses received for each region.

Since most respondents perceive transaction costs as “high” in the Pacific Northwest and “low” in the U.S. South, the high interest reported for both regions in our survey (Figure 3) would seem to indicate that investors are not sensitive to the difference in regional transaction costs. In other words, investors seem to have a comparable investment interest in the U.S. South and the Pacific Northwest (Figure 3). How can this be if transaction costs are viewed as so much higher in the Pacific Northwest (Figure 2)? The conflict in these findings will be explored in much greater detail later in this manuscript.

Figure 3.

Reported investor interest by U.S. timberland region.

3.3. Hypotheses Testing Results

Table 2 displays the summary results of all three OLR hypotheses testing. The hypothesis testing mosaic plots and contingency table results of each OLR goodness-of-fit test are shown in Figure 4, Figure 5, Figure 6, Figure 7, Figure 8, Figure 9, Figure 10 and Figure 11 and Table 3, Table 4, Table 5, Table 6, Table 7, Table 8, Table 9 and Table 10. Note that in Table 2 (as well as several other figures and tables), PNW has been abbreviated for Pacific Northwest.

Table 2.

Summary of hypothesis testing using the Ordinal Logistic Regression model.

Table 2.

Summary of hypothesis testing using the Ordinal Logistic Regression model.

| Hypothesis | Response Variable | Explanatory Variable | Chi-Squared Test Statistic | Prob> ChiSq | Result |

|---|---|---|---|---|---|

| H1: Investment interest in one region is not affected by investment interest in the other region. | PNW Investment Interest | U.S. South Investment Interest | 13.494 | 0.009 * | Reject H1 |

| U.S. South Investment Interest | PNW Investment Interest | 13.494 | 0.009 * | ||

| H2: Investment interest in one region is not affected by an investor’s existing ownership or investment experience in the same region. | PNW Investment Interest | Investment Ownership or Mgmt. in Either Region | 27.090 | <0.0001 * | Reject H2 |

| U.S. South Investment Interest | Investment Ownership or Mgmt. in Either Region | 10.169 | 0.006 * | ||

| H3: Investment interest in either region is not affected by the transaction costs incurred either in the same region or the other region. | PNW Investment Interest | PNW Transaction Costs | 0.806 | 0.6682 | Reject H3 |

| PNW Investment Interest | U.S. South Transaction Costs | 11.814 | 0.018 * | ||

| U.S. South Investment Interest | PNW Transaction Costs | 3.245 | 0.1974 | ||

| U.S. South Investment Interest | U.S. South Transaction Costs | 10.037 | 0.039 * |

* Statistically significant at the 0.05 threshold. PNW is abbreviated for Pacific Northwest.

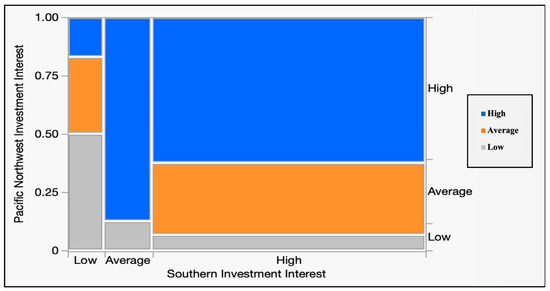

As detailed in Table 2, each null hypothesis that was tested was able to be rejected using the goodness-of-fit testing methodology. Examining the test results of H1, if a survey respondent reported that their timberland investment interest in the U.S. South was high, there was a significant reduction in their reported investment interest in the Pacific Northwest. This was found to be a statistically different response from those whose investment interest in the U.S. South was average or low (Figure 4). Similarly, examining the test results of H2, when a survey respondent reported experience in owning, investing, or managing timberland in the U.S. South, those individuals were more interested in investing future capital in this region rather than in the Pacific Northwest. Conversely, if a respondent reported experience owning, investing, or managing timberland in the Pacific Northwest, those individuals were more interested in investing future capital in this region rather than in the U.S. South. These results indicated that there are statistically significant differences in regional investment interest based on past experiences (Figure 10 and Figure 11). Lastly, examining the test results of H3, when a survey participant reported the belief that timberland transaction costs in the U.S. South were low or medium, their investment interest in the U.S. South was higher. The investment interest of this same group of participants was also higher for timberland in Pacific Northwest, but to a lesser degree. Surprisingly, that test result was not found to be statistically significant for those participants who believe that regional transaction costs in the Pacific Northwest are high. Investment interest in both regions was relatively high for both investment regions—no matter the investor’s views on high regional transaction costs. This can be seen in Figure 6 and Figure 8. This test result supports what was reported earlier and shown in Figure 2 and Figure 3, that investors do not seem to be discouraged from investing in the Pacific Northwest—regardless of the high transaction costs. Rationalizations for this investor behavior are presented further on in this manuscript.

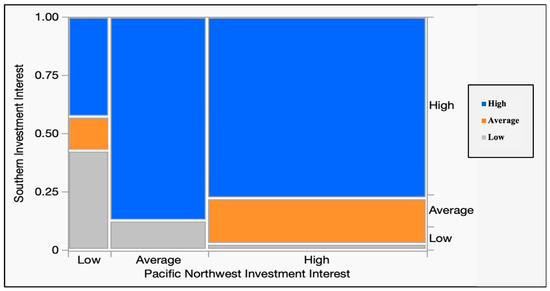

In Figure 4, the graph shows the Pacific Northwest investment interest (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their investment interest in the other region—in this case, the U.S. South. These responses were also categorized as “high”, “average”, and “low”. As Figure 4 illustrates, a “high” investment interest in the U.S. South does not coincide with a respondent’s “high” investment interest in the Pacific Northwest.

Figure 4.

Mosaic plot showing the survey proportion of the Pacific Northwest investment interest by those with U.S. South investment interest.

Similarly, in Figure 5, the dependent variable is on the y-axis. In this case, it is investment interest in the U.S. South. As Figure 5 illustrates, there is a higher investment interest in the U.S. South if a respondent reported a “high” investment interest in the Pacific Northwest.

Figure 5.

Mosaic plot showing the survey proportion of U.S. South investment interest by the Pacific Northwest investment interest.

Table 3 provides the contingency table results of the OLR of Pacific Northwest investment interest to investment interest in the U.S. South (Figure 4 and Figure 5).

Table 3.

Contingency table showing survey responses for the Pacific Northwest investment interest by U.S. South investment interest.

Table 3.

Contingency table showing survey responses for the Pacific Northwest investment interest by U.S. South investment interest.

| Pacific Northwest Investment Interest | Total Responses | |||

|---|---|---|---|---|

| U.S. South Investment Interest | Low | Average | High | |

| High | 3 | 2 | 1 | 6 |

| Average | 1 | 0 | 7 | 8 |

| Low | 3 | 14 | 28 | 45 |

| Total | 7 | 16 | 36 | 59 |

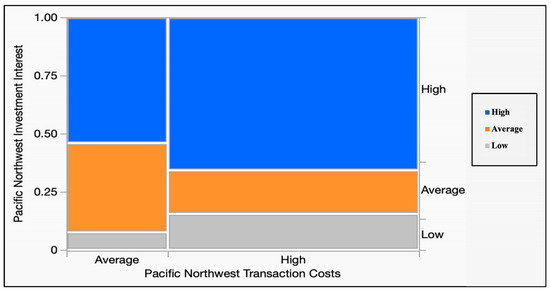

Figure 6 shows the Pacific Northwest investment interest (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their perception of timberland transaction costs in the Pacific Northwest. These responses were also categorized as “high”, “average”, and “low”. As Figure 6 illustrates, a perception of “high” transaction costs in the Pacific Northwest does not seem to diminish a “high” investment interest in the Pacific Northwest. This result will be discussed further in the conclusion section. Note in Figure 6 that none of the responses received in the survey categorized transaction costs in the Pacific Northwest as “low”.

Figure 6.

Mosaic plot showing the survey proportion of the Pacific Northwest investment interest by U.S. South transaction costs.

Table 4 provides the contingency table results of the OLR of Pacific Northwest investment interest to transaction costs in that timberland region (Figure 6).

Table 4.

Contingency table showing survey responses for U.S. South investment interest by U.S. South transaction costs.

Table 4.

Contingency table showing survey responses for U.S. South investment interest by U.S. South transaction costs.

| Pacific Northwest Investment Interest | Total Responses | |||

|---|---|---|---|---|

| Pacific Northwest Transaction Costs | Low | Average | High | |

| High | 6 | 11 | 26 | 43 |

| Average | 1 | 5 | 10 | 16 |

| Low | 0 | 0 | 0 | 0 |

| Total | 7 | 16 | 36 | 59 |

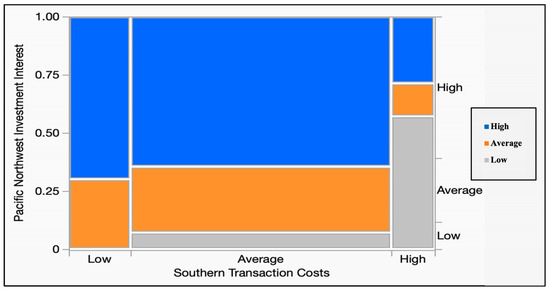

Figure 7 shows the investment interest in the Pacific Northwest (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their perception of timberland transaction costs in the U.S. South. These responses were also categorized as “high”, “average”, and “low”. As Figure 7 illustrates, a perception of “average” or “low” transaction costs in the U.S. South corresponds with a high investment interest in the Pacific Northwest that is about even. However, if there is a perception of “high” transaction costs in the U.S. South, then the investment interest in the Pacific Norwest is significantly lower.

Figure 7.

Mosaic plot showing the survey proportion of the Pacific Northwest investment interest by U.S. South transaction costs.

Table 5 provides the contingency table results of the OLR of Pacific Northwest investment interest to transaction costs in the U.S. South (Figure 7).

Table 5.

Contingency table showing survey responses for the Pacific Northwest investment interest by U.S. South transaction costs.

Table 5.

Contingency table showing survey responses for the Pacific Northwest investment interest by U.S. South transaction costs.

| Pacific Northwest Investment Interest | Total Responses | |||

|---|---|---|---|---|

| U.S. South Transaction Costs | Low | Average | High | |

| High | 4 | 1 | 2 | 7 |

| Average | 3 | 12 | 27 | 42 |

| Low | 0 | 3 | 7 | 10 |

| Total | 7 | 16 | 36 | 59 |

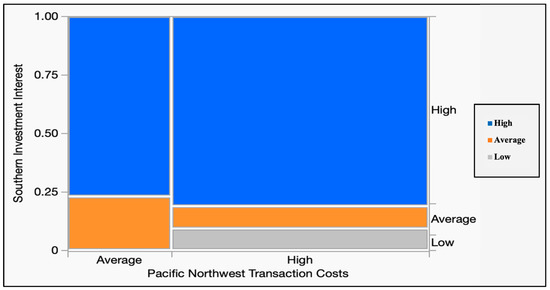

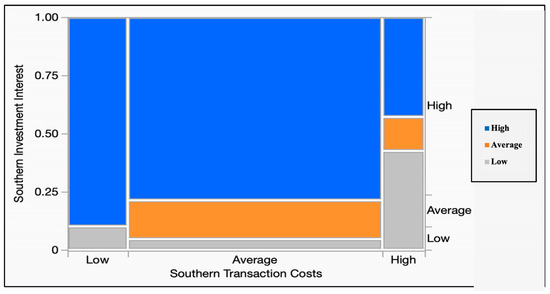

Figure 8 shows the investment interest in the U.S. South (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their perception of timberland transaction costs in the Pacific Northwest. As Figure 8 illustrates, the perception of “high” and “average” transaction costs in the Pacific Northwest corresponds with a high investment interest in the U.S. South.

Figure 8.

Mosaic plot showing the survey proportion of U.S. South investment interest by the Pacific Northwest transaction costs.

Table 6 provides the contingency table results of the OLR of Pacific Northwest transaction costs to investment interest in the U.S. South (Figure 8).

Table 6.

Contingency table showing survey responses for U.S. South investment interest by the Pacific Northwest transaction costs.

Table 6.

Contingency table showing survey responses for U.S. South investment interest by the Pacific Northwest transaction costs.

| U.S. South Investment Interest | Total Responses | |||

|---|---|---|---|---|

| Pacific Northwest Transaction Costs | Low | Average | High | |

| High | 0 | 3 | 10 | 13 |

| Average | 3 | 3 | 26 | 32 |

| Total | 3 | 6 | 36 | 45 |

Figure 9 shows the investment interest in the U.S. South (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their perception of timberland transaction costs in the U.S. South. As Figure 9 illustrates, a perception of “average” or “low” transaction costs in the U.S. South corresponds with a high investment interest in the region. However, if there is a perception of “high” transaction costs in the U.S. South, then the investment interest in the U.S. South is significantly lowered.

Figure 9.

Mosaic plot showing the survey proportion of the U.S. South investment interest by U.S. South transaction costs.

Table 7 provides the contingency table results of the OLR of the U.S. South transaction costs to investment interest in that timberland region (Figure 9).

Table 7.

Contingency table showing survey responses for U.S. South investment interest U.S. South by transaction costs.

Table 7.

Contingency table showing survey responses for U.S. South investment interest U.S. South by transaction costs.

| U.S. South Investment Interest | Total Responses | |||

|---|---|---|---|---|

| U.S. South Transaction Costs | Low | Average | High | |

| High | 3 | 1 | 3 | 7 |

| Average | 2 | 7 | 33 | 42 |

| Low | 1 | 0 | 9 | 10 |

| Total | 6 | 8 | 45 | 59 |

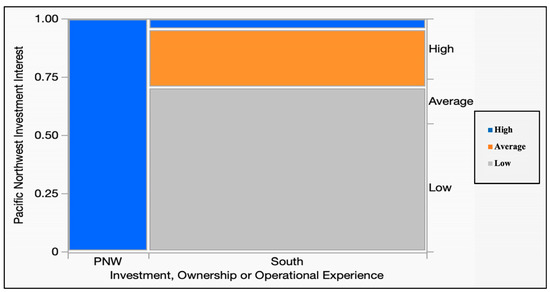

Figure 10 shows the Pacific Northwest investment interest (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their investment and ownership of operational experience in the U.S. South. Figure 10 illustrates a strong regional investment interest according to how respondents reported their experience in the U.S. South. Those with experience in the U.S. South did not have much interest in investing in the Pacific Northwest. However, all respondents that had experience in the Pacific Northwest had a high interest there for future timberland investing.

Figure 10.

Mosaic plot showing the survey proportion of the Pacific Northwest investment interest by investment, ownership, or operation experience in either region.

Table 8 provides the contingency table results of the OLR of the investment interest in the Pacific Northwest to investment, ownership, or operational experience in either timberland region (Figure 10).

Table 8.

Contingency table showing survey responses for the Pacific Northwest investment interest by investment, ownership, or operation experience in the two regions.

Table 8.

Contingency table showing survey responses for the Pacific Northwest investment interest by investment, ownership, or operation experience in the two regions.

| Pacific Northwest Investment Interest | Total Responses | |||

|---|---|---|---|---|

| Investment, Ownership or Operational Experience in the Two Regions | Low | Average | High | |

| PNW | 0 | 0 | 7 | 7 |

| South | 17 | 6 | 1 | 24 |

| Total | 17 | 6 | 8 | 31 |

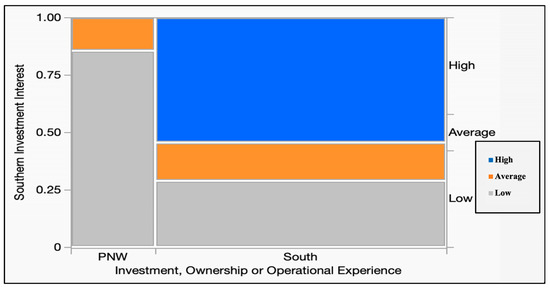

Figure 11 shows the U.S. South investment interest (dependent variable) on the y-axis by the proportion of responses in categories “high”, “average”, and “low”. The independent variable is shown on the x-axis, and it is also categorized by how survey respondents reported their investment and ownership of operational experience in the Pacific Northwest. Figure 11 illustrates a strong regional investment interest according to how respondents reported their experience in the U.S. South. Those with experience in the U.S. South have a much higher interest in investing back in that region. However, those respondents that had experience in the Pacific Northwest had a low interest in investing in the U.S. South.

Figure 11.

Mosaic plot showing the survey proportion of U.S. South investment interest by investment, ownership, or operation experience in the either region.

Table 9 provides the contingency table results of the OLR of the investment interest in the U.S. South to investment, ownership, or operational experience in either timberland region (Figure 10).

Table 9.

Contingency table showing survey responses for U.S. South investment interest by investment, ownership, or operation experience in the two regions.

Table 9.

Contingency table showing survey responses for U.S. South investment interest by investment, ownership, or operation experience in the two regions.

| U.S. South Investment Interest | Total Responses | |||

|---|---|---|---|---|

| Investment, Ownership or Operational Experience in the Two Regions | Low | Average | High | |

| PNW | 6 | 1 | 0 | 7 |

| South | 7 | 4 | 13 | 24 |

| Total | 13 | 5 | 13 | 31 |

Two of the results of hypothesis testing were somewhat confounding, as can be seen in Figure 4 and Figure 8 above. Investment interest in the Pacific Northwest did not seem to be reduced by the high transaction cost expectations of timberland investors. This result is counterintuitive. Similarly, investment interest in the U.S. South did not seem to be affected by transaction cost beliefs that were held in the Pacific Northwest. So, low transaction cost expectations in the U.S. South did not seem to decrease investment interest in the Pacific Northwest. One would expect that if transaction costs were a significant factor in timberland acquisitions, these relative transaction costs would have a noticeable effect on investors’ interests and behavior.

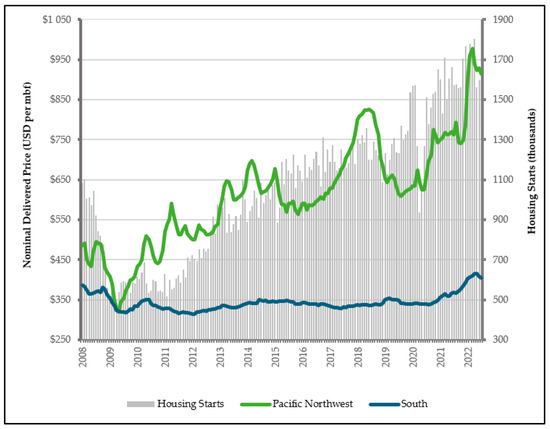

To examine this apparent dissonance between high transaction costs in the Pacific Northwest and continued high investor interest, data were collected for relative log prices from the two timberland regions (the Pacific Northwest and the U.S. South) using data from Forest2Market. According to Forest2Market, it uses only completed transaction data for log sales in its log price index. It collects and compiles these data from dimension mills, TIMOs, and REITs. The Forest2Market log price index includes all logs purchased and sold into the domestic sawmilling and export markets. In the Pacific Northwest, the index includes all log-quality grades (#2 and #3 sawlog) and conifer species transacted with its contributors in Washington, Idaho, Montana, Oregon, and Northern California. In the U.S. South, the index includes logs graded as sawlog and chip-and-saw from its contributors in Virginia, N. Carolina, S. Carolina, Georgia, N. Florida, Alabama, Mississippi, Oklahoma, and southeastern Texas. These regions align very closely with the regions defined in the 2020 Transaction Cost Survey.

The results of graphing these two series can be seen in Figure 12. Log price indices are shown here in nominal (not inflation-adjusted) terms. As can be seen in this graph, U.S. South log prices have not kept pace with Pacific Northwest prices since the great financial crisis of 2009. Figure 12 shows a long-term divergence of log prices between the two regions. Since log revenues constitute a large proportion of total timberland revenues from timberland investments in these regions, this has major implications for investment return expectations.

Figure 12.

Monthly Sawlog delivered prices U.S. South and Pacific Northwest and U.S. total housing starts (Source: Forest2Market. Used with permission).

3.4. Regional Timberland Return Comparisons

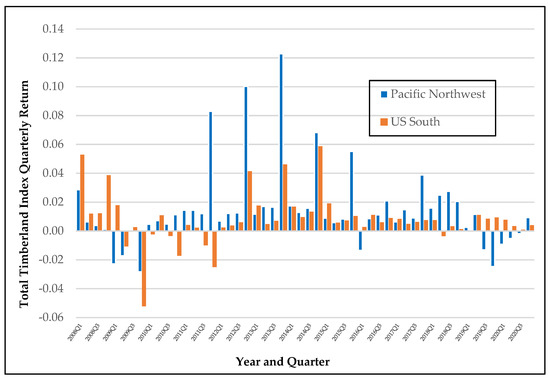

To explore the effects that these regionally divergent log revenues have on total timberland returns, the NECRIF–NTI index was utilized. The NTI provides a subscription-based service that collects return data from its contributors and distributes it to its clients. This data includes anonymous and regionally based investment returns of privately held timberland. NCREIF is an acknowledged leader in private timberland return information [29]. The NTI uses a mix of reported timberland sales, periodic appraisals, and asset purchases. It tracks a large pool of timberland properties that have been acquired solely as real-asset investments. Quarterly return data from the NTI is provided below in Figure 13 and Table 10. Return intervals in Table 10 are based upon the following intervals: 3 years (2016–2018), 5 years (2015–2019), and 7 years (2014–2019). As can be observed below, there is a large divergence between the quarterly returns in Figure 13, as well as the annualized returns that are shown in Table 10. This corresponds with what was exhibited in the log price index information from Forest2Market earlier in the manuscript.

Figure 13.

Quarterly timberland returns of the NCREIF-NTI by investment region (Source: NCREIF).

Table 10.

Annualized NCREIF–NTI returns by timberland investment region.

Table 10.

Annualized NCREIF–NTI returns by timberland investment region.

| Timberland Region | Annualized Returns with Corresponding Standard Deviations (S.D.) | |||||

|---|---|---|---|---|---|---|

| 2016 until 2018 | 2015 until 2019 | 2014 until 2020 | ||||

| 3-Year | S.D. | 5-Year | S.D. | 7-Year | S.D. | |

| U.S. South | 2.16% | 1.24% | 2.75% | 1.15% | 3.61% | 3.07% |

| Pacific Northwest | 6.28% | 3.30% | 4.82% | 4.75% | 4.98% | 5.31% |

Examining the data collected in this manuscript for both timberland regions, several differences are found between the two. Figure 13 shows a wide divergence in the market price paid for delivered logs from the U.S. South versus the Pacific Northwest. The Pacific Northwest market log prices far surpassed those being paid for a similar delivered product in the U.S. South. The reasons for this price premium can be explained by two prevailing factors. First of all, there was a robust export market for logs delivered to Asia that developed on the West Coast of North America after the Global Financial Crisis of 2007–2008. This export market had a large impact on log prices in the Pacific Northwest, but it did not have a similar effect on log prices in the U.S. South. Secondly, total housing starts in the Pacific Northwest were less impacted by regional housing starts in the U.S. South. The reduction of 408,000 annual (seasonally adjusted) regional housing starts in the Pacific Northwest from 2004 to 2009 was far less than the reduction of approximately 718,000 annual (seasonally adjusted) regional starts in the U.S. South that occurred during that same period. The U.S. South was suffering a more depressed regional housing market than the Pacific Northwest [25]. This loss of lumber demand in the U.S. South, along with limited substitution in export market demand, led to a steep decline in log revenues for timberland property owners in the U.S. South. Also, as Busby and Binkley noted in a recent professional opinion piece [30], log prices in the U.S. South have had a hard time recovering from the Global Financial Crisis lows. According to the authors, this is due to an increase in timber inventory that has surpassed the regional mill capacity. Since log revenues constitute the principal revenue drivers for timberland investing, this has created significant differences in the annual incomes and total returns to investors. As Table 10 shows, annualized returns in the Pacific Northwest have outperformed annualized returns in the U.S. South in every period from 2008 through 2022. These data include all of the revenues received by timber landowners, as well as the change in property value, whether received or estimated.

4. Conclusions

There is a statistically significant relationship between investors’ future timberland investment interest in one region, whether it is the U.S. South or Pacific Northwest, when compared with the future timberland investment interest in the other. Simply put, the two regions are not independent of one another, and the degree of interest in one region is a determining factor in the degree of interest in the other. Furthermore, there is also a statistically significant relationship between those that invest, own or operate timberland in one of the two regions, and the investment interest shown in either timberland region. In other words, those investors that invest, own, or operate in the U.S. South have a much higher interest in further investments in the U.S. South and less interest in investing in the Pacific Northwest. Conversely, investors that invest, own, or operate in the Pacific Northwest have a much higher interest in further investments in the Pacific Northwest and less interest in investing in the U.S. South. This result shows regional preferences that have significant implications for timberland investment participation in the future. Lastly, there is a statistically significant relationship between future investment interest and perceived transaction costs in the Pacific Northwest and in the U.S. South. This means that those investors who view the U.S. South as having low transaction costs are much more likely to invest in this region. However, it was found that other investors were willing to invest more capital in the Pacific Northwest despite the high transaction costs that seem to be prevalent in this region.

What makes investors so interested in the Pacific Northwest? Figure 12 shows the significant differences in realized log prices between the two regions from 2008 until 2022. Since log revenues are a primary factor driving timberland returns, this chart is telling. One can also see from examining Table 10, historical annual returns in the Pacific Northwest have been substantially higher than the U.S. South in the period 2014 until 2020. In fact, if the period from 2008 until 2020 is examined, timberland annualized returns in the Pacific Northwest almost doubled the returns in the U.S. South (5.92%. vs. 3.15%, respectively). Timberland investors, it seems, are willing to incur much higher transaction costs if the corresponding investment returns seem to justify those higher costs. The transaction cost in the U.S. South may be relatively lower than in the Pacific Northwest, but the total annual returns have also been significantly lower in the U.S. South. Higher transaction costs in the Pacific Northwest, instead of being a barrier to investment, may just be considered a normal business cost to participate in a more historically lucrative region for timberland investment.

There is one important note about the NCREIF–NTI reported timberland returns: calculations for these property returns are based on the reported purchase price and terminal price (or appraised annual price) of timberland. These calculations explicitly exclude management fees. Management fees are fees collected by timberland management companies for their property management services. It is unclear how most management entities (TIMOs and REITS) treat timberland transaction costs and management fees in their return calculations. It was discovered in the 2020 Timberland Transaction Cost Survey that as much as 30% of timberland managers did not include transactions in the cost basis for a timberland investment [9]. Another survey finding showed that less than 8% of responding investors capitalized dead deal costs into their successful timberland acquisitions [9]. Dead deal costs have the ability to increase transaction costs by almost one order of magnitude (or 10×). This is because the probability of a successful closing in timberland deals averages about 10%, according to anecdotal evidence, as well as personal acquisition experience. By not accounting for these costs, timberland investors and their managers may be severely underestimating the effects that these transactional cost expenses have on total timberland returns. Accounting for these factors may prove to be problematic for calculating total timberland property returns.

Limitations of this study include a lack of time series (or case study) data showing investors’ expectations for timberland transaction costs over a period of time. Time series data about timberland transaction costs could provide better insight into timberland investor sentiment and investment activities and change. Since regional investment interest and inter-regional transaction costs fluctuate with changing market conditions, having this collection of time series surveys would be useful and instructive. Moreover, expanding international timberland transaction cost databases to include (intra-country) regional comparisons would help to provide the relative magnitudes of these costs for timberland researchers as well as investors. Future surveys could be tailored explicitly for these purposes. For example, contrasting transaction costs in South Australia or Queensland to those in the U.S. South and Pacific Northwest would provide more clarity and transparency to investors. Finally, the creation of a more comprehensive transaction cost database that incorporates those costs from other real assets investments should be commissioned. As institutional investors attempt to place an increasing amount of capital into real assets, providing these types of cross-sector (and cross-country) regional investment databases could prove timely, informative, and rewarding for reseachers as well as investors. Transaction costs are an important cost of real asset investing. Real assets are more illiquid and complex in nature than many traditional financial assets; therefore, the transaction costs can be opaque and ambiguous to real asset investors. More comprehensive and wide-ranging studies of these transaction costs should be encouraged and funded in the future.

Author Contributions

A.H. and J.S. conceptualized the project and developed the methodology. All authors contributed to the writing—review and editing. J.S., B.M. and P.B. supervised the project and acquired the funding. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the United States Department of Agriculture Food and Agricultural Sciences National Needs Graduate Grants Program (NIFA grant 2015–10780).

Data Availability Statement

The majority of data contained in this study is related to the 2020 Timberland Transaction Cost Survey and can be made available, with special permission, from the corresponding author. Some of the data presented in this study was made available to the authors from non-public, for-profit sources. The data are not publicly available due to fees that must be colleted from the consulting firm.

Acknowledgments

The authors would also like to thank the late John ‘Harold’ H. Mulherin III. We were sad to hear of your passing, and our condolences to your family. Thank you for your insight and notion to apply transaction cost analysis to timberland investing.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hardt, Ł. A history of transaction cost economics and its recent developments. Erasmus J. Phils. Econ. 2009, 2, 29–51. [Google Scholar] [CrossRef]

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Coase, R.H. The problem of social cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Hicks, J. A suggestion for simplifying the theory of money. Economica 1935, 2, 1–19. [Google Scholar] [CrossRef]

- Amihud, Y.; Mendelson, H. Transaction costs and asset management. In Global Asset Management: Strategies, Risks, Processes, and Technologies; Pinedo, M., Walter, I., Eds.; Palgrave Macmillan: London, UK, 2013; pp. 414–432. [Google Scholar]

- Allen, D.W.; Lueck, D. A transaction cost primer on farm organization. Can. J. Agric. Econ. 2000, 48, 643–652. [Google Scholar] [CrossRef]

- Mei, B. Timberland investments in the United States: A review and prospects. For. Pol. Econ. 2019, 109, 101998. [Google Scholar] [CrossRef]

- Evens, T. (TimberLink LLC., Johns Creek, GA, USA). Unpublished raw data. 2022. [Google Scholar]

- Hiegel, A.; Siry, J.; Bettinger, P.; Mei, B. Timberland transaction costs: Survey results and insights. J. For. Bus. Res. 2022, 1, 21–50. [Google Scholar]

- Chudy, R.P.; Cubbage, F.W. Research trends: Forest investments as a financial asset class. For. Policy Econ. 2020, 119, 102273. [Google Scholar] [CrossRef] [PubMed]

- Chambers, D.R.; Anson, M.J.P.; Black, K.H.; Kazemi, H.B. Alternative Investments: CAIA Level 1, 4th ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2020; p. 928. [Google Scholar]

- The Land Report. 2022. Available online: https://landreport.com (accessed on 17 October 2022).

- Zhang, D.; Butler, B.J.; Nagubadi, R.V. Institutional timberland ownership in the US South: Magnitude, location, dynamics, and management. J. For. 2012, 110, 355–361. [Google Scholar] [CrossRef]

- Baral, S.; Mei, B. Development and performance of timber REITs in the United States: A review and some prospects. Can. J. For. Res. 2022, 47, 226–233. [Google Scholar] [CrossRef]

- Rayonier. 2022. Available online: www.rayonier.com (accessed on 5 August 2022).

- Forisk Consulting. 2022. Available online: https://forisk.com/resources/timber-reit-weekly-summary/ (accessed on 11 July 2022).

- Hoya Capital. 2022. Available online: https://www.hoyacapital.com/reit-sector/timber (accessed on 11 July 2022).

- Forest2Market. A New Report Details Regional Timberland Ownership and Class Profiles. 2019. Available online: www.forest2market.com (accessed on 3 November 2022).

- Kelly, E.C.; Crandall, M.S. State-level forestry policies across the US: Discourses reflecting the tension between private property rights and public trust resources. For. Pol. Econ. 2022, 141, 102757. [Google Scholar] [CrossRef]

- Rauscher, H.M.; Johnsen, K. Southern Forest Science: Past, Present, and Future, General Technical Report, SRS-75; Southern Research Station: Asheville, NC, USA, 2004; United States Forest Service. [Google Scholar]

- Talbert, C.; Marshall, D. Plantation productivity in the Douglas-fir region under intensive silvicultural practices: Results from research and operations. J. For. 2005, 103, 65–70. [Google Scholar]

- Binkley, C.S.; Aronow, M.E.; Washburn, C.L.; New, D. Global Perspectives on intensely managed plantations: Implications for the Pacific Northwest. J. For. 2005, 103, 61–64. [Google Scholar]

- Baldwin, S. Large US Timberland Transactions-Annual Summary (2015–2021); TimberMart-South: Athens, Greece, 2022; Unpublished raw database. [Google Scholar]

- Kessinger, J. (Forest2Market, Charlotte, NC, USA). Unpublished raw data. 2022. [Google Scholar]

- US Census Bureau, U.S. Department of Commerce. 2022. Available online: https://www.census.gov/construction/nrc/historical_data/index.html (accessed on 17 December 2022).

- Lee, H.Y. Goodness-of-fit tests for a proportional odds model. J. Korean Data Info. Sci. Soc. 2013, 24, 1465–1475. [Google Scholar] [CrossRef][Green Version]

- Heeringa, S.G.; West, B.T.; Berglund, P.A. Applied Survey Data Analysis, 2nd ed.; Chapman and Hall/CRC press: New York, NY, USA, 2017; 568p. [Google Scholar]

- Lyddan, C. (Fastmarkets RISI, Boston, MA, USA). Unpublished raw data. 2022. [Google Scholar]

- Mei, B. Investment returns of US commercial timberland: Insights into index construction methods and results. Can. J. For. Res. 2017, 47, 226–233. [Google Scholar] [CrossRef]

- Busby, G.; Binkley, C.S. Explaining the Disconnect between Lumber and Timber Prices. Nuveen Natural Capital Opinion Piece. 2021. Available online: https://documents.nuveen.com/Documents/Nuveen/Default.aspx?uniqueId=834a79b4-cbaf-4139-87ec-cf723a693f13 (accessed on 17 March 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).