Effects of the COVID-19 Pandemic on Logging Contractors in Sweden: A Survey on Personnel Absenteeism, Safety Measures and Economic Impacts

Abstract

:1. Introduction

- Did logging contractors experience a higher absence of personnel during the pandemic, and to what extent did it affect their businesses?

- Did logging contractors take specific measures to ensure a safe working environment and prevent infections in the workplace?

- How has the logging contractors’ financial situation been affected by the pandemic?

2. Materials and Methods

2.1. Sample

2.2. Questionnaire

2.3. Data Collection

2.4. Statistical Analysis

3. Results

3.1. Absence of Personnel

3.2. Safety Measures

3.3. Economic Impacts

3.3.1. Temporary Shutdowns

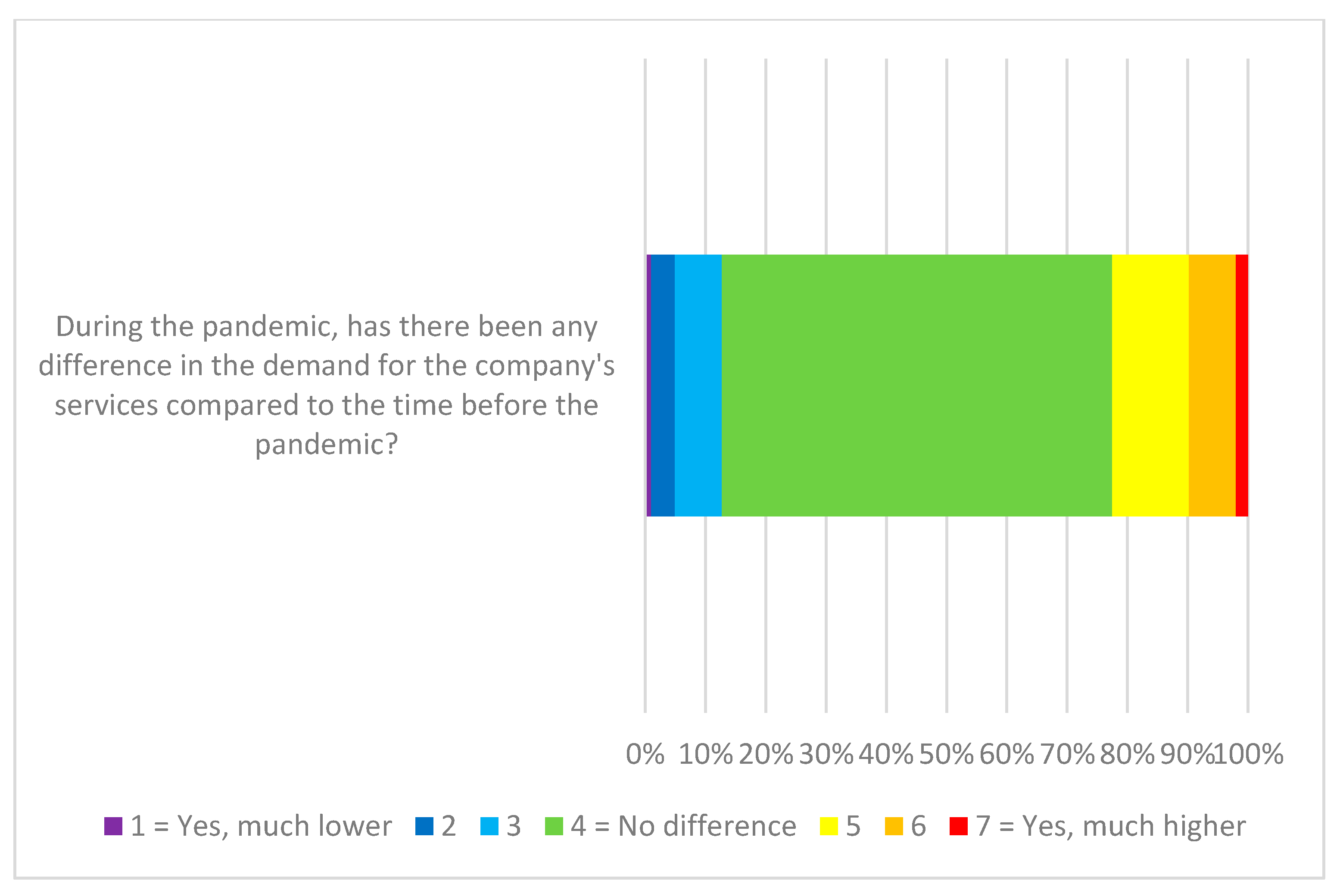

3.3.2. Service Demand

3.3.3. Inflation and Supply Chain Disturbances

3.3.4. Contractors’ Finances

4. Discussion

4.1. Personnel Absenteeism

4.2. Safety Measures

4.3. Economic Impacts

4.4. Strengths and Limitations of the Study

5. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nilsson, P.; Roberge, C.; Dahlgren, J.; Fridman, J. Forest Statistics 2022; Swedish University of Agricultural Sciences: Umeå, Sweden, 2022. [Google Scholar]

- Swedish Forest Industries. Available online: https://www.skogsindustrierna.se/om-skogsindustrin/snabba-fakta/ (accessed on 2 October 2023).

- Ager, B. Skogsbrukets Humanisering Och Rationalisering Från 1900 och Framåt. Ph.D. Thesis, Luleå University of Technology, Luleå, Sweden, 2014. [Google Scholar]

- Häggström, C.; Kawasaki, A.; Lidestav, G. Profiles of forestry contractors and development of the forestry-contracting sector in Sweden. Scand. J. For. Res. 2013, 28, 395–404. [Google Scholar] [CrossRef]

- Roberge, C. Forestry Labour Force in 2017; Swedish Forest Agency: Jönköping, Sweden, 2018. [Google Scholar]

- Kronholm, T.; Larsson, I.; Erlandsson, E. Characterization of forestry contractors’ business models and profitability in Northern Sweden. Scand. J. For. Res. 2021, 36, 491–501. [Google Scholar] [CrossRef]

- Benjaminsson, F.; Kronholm, T.; Erlandsson, E. A framework for characterizing business models applied by forestry service contractors. Scand. J. For. Res. 2019, 34, 779–788. [Google Scholar] [CrossRef]

- Mäkinen, P. Success factors for forestry machine entrepreneurs. J. For. Eng. 1997, 8, 27–35. [Google Scholar]

- Penttinen, M.; Rummukainen, A.; Mikkola, J. Profitability, liquidity and solvency of wood harvesting contractors in Finland. Small-Scale For. 2011, 10, 211–229. [Google Scholar] [CrossRef]

- Eriksson, M. Developing Client-Supplier Alignment in Swedish Wood Supply. Ph.D. Thesis, Swedish University of Agricultural Sciences, Umeå, Sweden, 2016. [Google Scholar]

- Jylhä, P.; Rikkonen, P.; Hamunen, K. Size matters—An analysis of business models and the financial performance of Finnish wood-harvesting companies. Silva Fenn. 2020, 54, 10392. [Google Scholar] [CrossRef]

- Johansson, M.; Erlandsson, E.; Kronholm, T.; Lindroos, O. Key drivers and obstacles for performance among forest harvesting service contractors—A qualitative case study from Sweden. Scand. J. For. Res. 2021, 36, 598–613. [Google Scholar] [CrossRef]

- World Health Organization. WHO Director-General’s Opening Remarks at the Media Briefing on COVID-19—11 March 2020. Available online: https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19---11-march-2020 (accessed on 2 October 2023).

- World Health Organization. WHO Coronavirus (COVID-19) Dashboard. Available online: https://covid19.who.int/ (accessed on 2 October 2023).

- Brodeur, A.; Gray, D.; Islam, A.; Bhuiyam, S. A literature review of the economics of COVID-19. J. Econ. Surv. 2021, 35, 1007–1044. [Google Scholar] [CrossRef] [PubMed]

- Statens Offentliga Utredningar. Sverige under Pandemin: Volym 1 Smittspridning Och Smittskydd; Elanders Sverige AB: Stockholm, Sweden, 2021. [Google Scholar]

- Statens Offentliga Utredningar. Sverige under Pandemin: Volym 1 Samhällets, Företagens Och Enskildas Ekonomi; Elanders Sverige AB: Stockholm, Sweden, 2022. [Google Scholar]

- Statens Offentliga Utredningar. Sverige under Pandemin: Volym 2 Förutsättningar, Vägval Och Utvärdering; Elanders Sverige AB: Stockholm, Sweden, 2022. [Google Scholar]

- Holmen: Bokslutsrapport för 2021. Available online: http://investors.holmen.com/files/press/holmen/202201289626-1.pdf (accessed on 2 October 2023).

- Stora Enso: Stora Enso Oyj Financial Statement Release 28 January. Available online: https://www.storaenso.com/en/newsroom/regulatory-and-investor-releases/2022/1/stora-enso-oyj-financial-statement-release-2021?prid=3d7f1c30e2ef3a7d (accessed on 2 October 2023).

- SCA: Bokslutsrapport 2021. Available online: https://www.sca.com/sv/media/pressmeddelanden/2022/bokslutsrapport-2021/ (accessed on 2 October 2023).

- Bowman, T.; Jeffers, S.; Naka, K. Characteristics and concerns of logging businesses in the southeastern United States: Results from a state-wide survey from Alabama. Forests 2023, 14, 1695. [Google Scholar] [CrossRef]

- English, L.; Pelkki, M.; Montgomery, R.; Tian, N.; Popp, J. Evaluating economic impacts of COVID-19 for Arkansas’ agriculture and forestry sectors in 2020. In Proceeding of the Mid-Continent Regional Science Association Conference, Grand Rapids, MI, USA, 9–10 June 2022. [Google Scholar] [CrossRef]

- Russell, M.B. A summary of COVID-19 pandemic assistance to US forest products companies. For. Prod. J. 2022, 72, 253–257. [Google Scholar] [CrossRef]

- Basnyat, B.; Baral, S.; Tiwari, K.R.; Shrestha, G.K.; Adhikari, B.; Dahal, Y.N. COVID-19 outbreak, timber production, and livelihoods in Nepal. Tribhuvan Univ. J. 2020, 34, 15–32. [Google Scholar] [CrossRef]

- Scott, E.; Hirabayashi, L.; Graham, J.; Hansen-Ruiz, C.; Luschen, K.; Sorensen, J. The impact of COVID-19 on Northeast and Appalachian loggers. J. Agromed. 2022, 27, 329–338. [Google Scholar] [CrossRef] [PubMed]

- Public Health Agency of Sweden: Pandemin Med COVID-19 Går in i en Ny Fas. Available online: https://www.folkhalsomyndigheten.se/nyheter-och-press/nyhetsarkiv/2022/februari/pandemin-med-covid-19-gar-in-i-en-ny-fas/ (accessed on 2 October 2023).

- Gercans, J.; Kons, K.; Kronholm, T. Business success factors of Latvian and Swedish forestry contractors. Int. J. For. Eng. 2022, 33, 262–270. [Google Scholar] [CrossRef]

- Fowler, F. Survey Research Methods; SAGE Publications: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Försäkringskassan: Officiell Statistik om Föräldraförsäkringen. Available online: https://www.forsakringskassan.se/nyhetsarkiv/nyheter-press/2022-01-11-officiell-statistik-om-foraldraforsakringen-2021 (accessed on 2 October 2023).

- Klintö, C. Vabbandet Ökar: “Ny försiktighetskultur”; Svenska Dagbladet: Stockholm, Sweden, 19 October 2022. [Google Scholar]

- Larsson, M.-E. Timkostnaden upp nästan 200 kr på ett år. Skogsentreprenören 2022, 4, 36. [Google Scholar]

- Rummukainen, A.; Brogt, T.; Kastenholz, E. Challenges for forestry contractors—Various structures but mutual problems in Finland, Germany, Poland and Romania. In Issues Affecting Enterprise Development in the Forest Sector in Europe; Niskanen, A., Ed.; University of Joensuu: Joensuu, Finland, 2006; pp. 149–174. [Google Scholar]

- Johansson, F. Branschen överens om gemensam bränsleklausul. Skogsentreprenören 2022, 4, 18. [Google Scholar]

- Erlandsson, E. The impact of industrial context on procurement, management and development of harvesting services: A comparison of two Swedish forest owners associations. Forests 2013, 4, 1171–1198. [Google Scholar] [CrossRef]

- Soirinsuo, J.; Mäkinen, P. Importance of the financial situation for the growth of a forest machine entrepreneur. Scand. J. For. Res. 2009, 24, 264–272. [Google Scholar] [CrossRef]

- Johansson, M.; Erlandsson, E.; Kronholm, T.; Lindroos, O. The need for flexibility in forest harvesting services—A case study on contractors’ workflow variations. Int. J. For. Eng. 2023, 34, 13–25. [Google Scholar] [CrossRef]

| Company Characteristics | Population | Sample |

|---|---|---|

| Net turnover, SEK million | 4.8 | 4.7 |

| Number of employees | 2.8 | 2.8 |

| Region: | ||

| North (Norrland) | 32.7% | 31.7% |

| Central (Svealand) | 30.5% | 31.0% |

| South (Götaland) | 36.8% | 37.3% |

| Safety Measures | Proportion of Respondents (%) |

|---|---|

| Keeping distance to other people | 37 |

| Reduced social contact | 36 |

| Personal hygiene | 30 |

| Disinfection of sticks and handles in the machines | 27 |

| Digital meetings | 12 |

| Work only single shifts or avoid transferring operators between different machines | 10 |

| Commute to work in separate cars | 9 |

| Follow the advice from the Public Health Agency (e.g., stay home in case of symptoms) | 7 |

| Other (e.g., no internships, no staff training) | 6 |

| Service Demand during the Pandemic | Ordinary Logging Contractors (%) | Secondary Logging Contractors (%) |

|---|---|---|

| Lower than before | 15 | 5 |

| No difference | 66 | 58 |

| Higher than before | 19 | 37 |

| Impact Cause | Ordinary Logging Contractors | Secondary Logging Contractors | Total |

|---|---|---|---|

| Fuel price increase | 5.5 * | 4.9 * | 5.4 |

| Disruptions in supply chains | 4.1 | 3.5 | 4.0 |

| Price increase on spare parts, maintenance, and the like | 5.0 * | 4.0 * | 4.8 |

| Financial Indicator | Ordinary Logging Contractors | Secondary Logging Contractors | Total |

|---|---|---|---|

| Financial situation compared to before the pandemic | 3.2 | 3.9 | 3.3 |

| Investments made compared to before the pandemic | 3.9 | 4.2 | 4.0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kronholm, T. Effects of the COVID-19 Pandemic on Logging Contractors in Sweden: A Survey on Personnel Absenteeism, Safety Measures and Economic Impacts. Forests 2023, 14, 2173. https://doi.org/10.3390/f14112173

Kronholm T. Effects of the COVID-19 Pandemic on Logging Contractors in Sweden: A Survey on Personnel Absenteeism, Safety Measures and Economic Impacts. Forests. 2023; 14(11):2173. https://doi.org/10.3390/f14112173

Chicago/Turabian StyleKronholm, Thomas. 2023. "Effects of the COVID-19 Pandemic on Logging Contractors in Sweden: A Survey on Personnel Absenteeism, Safety Measures and Economic Impacts" Forests 14, no. 11: 2173. https://doi.org/10.3390/f14112173

APA StyleKronholm, T. (2023). Effects of the COVID-19 Pandemic on Logging Contractors in Sweden: A Survey on Personnel Absenteeism, Safety Measures and Economic Impacts. Forests, 14(11), 2173. https://doi.org/10.3390/f14112173