1. Introduction

Boreal forests constitute a potentially significant carbon sink. A particular benefit of boreal regions is significant carbon storage in the soil. It has been approximated that the amount of soil carbon may exceed the carbon storage in living biomass [

1,

2,

3,

4]. However, living biomass produces the litter resulting in soil carbon accumulation. The rate of carbon storage depends on the rate of biomass production on the site. Biomass production rate, in turn, is related to the amount of living biomass [

2,

5,

6,

7].

In the occurrence of clearcutting and soil preparation, the net release of carbon from the soil to the atmosphere begins [

8,

9,

10,

11]. Correspondingly, maintenance of canopy cover possibly is essential in carbon sequestration.

Human activity related to the sequestration and release of carbon in the atmosphere forms a complex system of industries and disciplines [

12,

13,

14,

15,

16]. Instead of trying to propose some kind of holistic, interdisciplinary optimum, we here discuss microeconomics of carbon sequestration in forestry, focusing on the estate level.

Within the business of forestry, a straightforward policy might appear as a carbon trade system, possibly administered by public agents [

17]. An unbiased carbon trade, however, would incorporate a high initial expense [

18]. Fortunately, it has been recently shown that a carbon rental system is equivalent to the carbon trade system, without much of an initial expense [

18].

In general, the amount of productive biomass is not constant within any forest estate. The canopy cover is also not constant, but rather subject to change over time. A natural reason for the variation in time is that any estate has some variety of stand ages and stand biomass densities. The development of the state of any particular estate can be designed in terms of some sort of dynamic programming [

19].

From the viewpoint of generic instructions, or policy actions, it might be beneficial to reduce the variety of initial estate states by adopting some kind of unifying boundary conditions. A tempting candidate is the normal forest principle [

20]. This principle simply refers to postulating that stand ages are evenly distributed and stand characteristics are uniquely determined by stand age. Such a postulation, even if often departing from reality, simplifies many treatments significantly, producing idealized systems that are stationary in time.

Within the normal forest principle, quantities such as rotation age and average stand trunk volume per area unit become well defined, not only for a single stand but also on the estate level. Correspondingly, microeconomic discussion regarding such quantities becomes simplified. One can even state that the normal forest principle allows for determination of microeconomically optimal rotation age, as well as an expected value of stand volume.

Microeconomically optimal rotation age and expected value of stand volume are not necessarily optimal from the viewpoint of national economics, nor from the viewpoint of carbon sequestration. It has been recently shown that microeconomics often favors solutions with relatively low capitalization [

19,

21,

22]. Low capitalization has adverse effects on volumetric growth rate, as well as litter accumulation rate [

21,

23].

In this paper, our primary interest is the microeconomics of carbon sequestration. We intend to clarify the economic consequences of increment of biomass density, as well as the extension of semiclosed canopy cover, on a real estate level. In terms of rotation forestry, the latter corresponds to extension of rotation age.

First, experimental materials are presented, as well as related computational methods. Then, microeconomic methods, as well as carbon rent formulae are introduced. Third, results are reported, separately for systems with thinnings from above and below. Finally, the outcome is discussed, and a functional carbon sequestration subsidy system is proposed.

2. Materials and Methods

2.1. Empirical Observations

Eleven circular plots of area 314 square meters were taken from typical spots of 11 spruce-dominated forest stands in November 2018 at Vihtari, Eastern Finland. Seven of the stands had experienced only young stand cleaning, whereas four of the stands were previously thinned commercially. Breast-height diameters were recorded, as well as tree species, and a quality class was visually determined for any measured tree.

On measured plots on sites without any previous commercial thinning, the basal area of tree trunks at breast height varied from 32 to 48 m

2/ha, and stem count from 1655 to 2451 per hectare. On measured plots on stands previously thinned commercially, the basal area varied from 29 to 49 m

2/ha, and the stem count from 891 to 955 per hectare. Further details of the experimental stands are reported in earlier papers [

21].

The particular estate is characterized by measurements from the 11 sample plots. However, such a sample does not necessarily represent the entire estate accurately. More importantly, the sampling does not conform to the normal forest principle, with assumptions of constant age distribution and stand characteristics uniquely determined by stand age. In this study, we utilize the normal forest principle in terms of establishing a “normal stand” on the basis of the observations and then approximating the development of this “normal stand” as a function of stand age.

The normal stand is established on the bases of two never-thinned sample plots of medium site fertility and younger range of stand age, among the empirical observations. The two sample plots were combined into one experimental plot of area 628 square meters. Within the representative sample plot, the basal area of acceptable-quality trees was 35.3 m

2/ha, and corresponding stem count 1401 per hectare. The age of the normal stand was 35 years, and dominating tree height 15 m. Measurement results used in the formulation of the normal stand are shown in the

Supplementary Materials.

2.2. Growth Model

For prognostication of further development of the normal stand, some kind of growth model is needed. The growth model of Bollandsås et al. [

21,

22,

24] is adopted, discussing not only growth but also mortality and recruitment. Trees are discussed in diameter classes of 50 mm, and each class is represented by its central tree. Growth is computationally implemented in terms of the probability of a tree to transfer to the next diameter class [

21,

22,

24].

With breast-height diameters being measured for any sample plot, and diameter growth being approximated by the above-mentioned growth model, some kind of technique is needed for determining stem volumes. For any diameter class, the volumetric amount of two assortments, pulpwood and sawlogs, is clarified according to an appendix given by of Rämö and Tahvonen [

25,

26]. In order to discuss financial issues, value growth needs to be addressed, instead of only volumetric growth. The monetary value of the assortment volumes is taken as national stumpage prices from years 2000 to 2011, as given by Rämö and Tahvonen [

25]. Bare land value of 600 Euros/ha is used, corresponding to local circumstances at the time of writing.

Description of stand development until the time of observation in 2018 requires another kind of approach. According to approximation by local professionals, the 2017 annual volume growth rate was 16 m3/ha. Using this growth rate, as well as the 2018 commercial volume estimate 256 m3/ha in an exponential growth function resulted as a stand volume history with a small but finite initial volume.

Possibly the simplest way to approximate financial history is to determine an internal rate of operative return for the period from stand establishment to 2018. In other words, we require

where

R is regeneration expense at regeneration time

,

C is young stand cleaning expense at cleaning time

, and

V is stumpage value of trees at observation time

. In this study, the observation time

corresponds to November 2018, regeneration time is clarified according to known stand age, and young stand cleaning is assumed to have occurred ten years after regeneration. It is assumed that prices and expenses do not evolve in real terms, and thus presently valid expenses can be used in Equation (1). The regeneration expense is taken as 1250 Eur/ha, and young stand cleaning 625 Eur/ha.

It is worth noting that the operative internal rate of return s in Equation (1) does not correspond to capital return rate in the entire activity, as the latter depends on nonoperative capitalization such as bare land value.

2.3. Financial Considerations

In order to determine a momentary capital return rate, we need to discuss the amount of financial resources occupied [

21,

23,

27]. This is done in terms of a financial potential function, defined in terms of capitalization per unit area

K. The momentary capital return rate becomes

where

in the numerator considers value growth, operative expenses, interests and amortizations, but neglects investments and withdrawals. In other words, it is the change of capitalization on an economic profit/loss basis.

K in the denominator gives capitalization on a balance sheet basis, being directly affected by any investment or withdrawal. It is worth noting that timber sales do not enter the numerator of Equation (2): selling trees at market price levels does not change the amount of wealth, it only converts wealth from trees into the form of cash. However, harvesting naturally changes capitalization appearing in the denominator of Equation (2). Harvesting also likely changes the change rate of capitalization occurring after the harvest.

Equation (2) gives a momentary capital return rate, not necessarily sufficient for management considerations. By definition, the expected value capitalization per unit area is

where

is the probability density function of capitalization

K. By change of variables we get

where

a is stand age (or time elapsed since latest regeneration harvesting), and

τ is rotation age. The expected value of the change rate of capitalization is

Correspondingly, the expected momentary rate of relative capital return is

We find from Equation (6) that the expected value of capital return rate within an estate generally evolves in time as the probability density of stand ages evolves. However, Equation (6) can be simplified to be independent of time by adopting the normal forest principle, where stand age probability density is constant [

20]. Besides, constancy of the expected value of capital return rate in time requires that prices and expenses do not evolve in real terms. Then, the expected value of the capital return rate becomes

It has been recently shown that Equation (7) corresponds to the ratio of the partition functions of the change rate of capitalization and capitalization itself [

28]. It also has been recently shown that the maximization of the net present value of future revenues may result in financially devastating consequences [

29]. Momentary capital return rate as given in Equation (2) was introduced in 1860 [

27]; an expected value was mentioned in 1967 [

30,

31], however applications have been introduced only recently [

21,

22,

28,

29].

High capital return rates are gained by an improvement harvesting including diameter-limit cutting to the transition diameter between pulpwood and sawlogs [

21]. It is possible to retain a state of high capital return for decades, implementing further diameter-limit cuttings frequently, provided there is an abundant supply of pulpwood-size stems of an at least semi-shade-tolerant tree species [

21]. In this investigation, however, the focus is in procedures inducing an increment of biomass density on the one hand, and extension of semiclosed canopy cover on the other hand. The former can simply be achieved by applying cutting diameter limits greater than the transition diameter between pulpwood and sawlogs.

In the context of the improvement harvesting, 20% of the stemcount of good-quality trees was removed in all diameter classes due to the establishment of striproads.

The stumpage value is determined in terms of roadside price, deduced by harvesting expense. We here use the roadside prices recently applied by Parkatti et al. [

32], 34.04 Eur/m

3 for spruce pulpwood, and 58.44 Eur/m

3 for sawlogs. We further use the same harvest-expense function as Parkatti et al. [

32], stated to be based on a productivity study of Nurminen et al. [

33], however with one correction. Model parameter C

5 value is taken as 2, instead of 1. With this correction, the expense function corresponds to present local circumstances, including the transfer expense of machinery. In addition to the expense function, we include a fixed harvesting entry expense per hectare. Justification of the latter is that some sites require at least partial pre-harvest cleaning. The entry expense is approximated as 200 Eur/ha. Again, is assumed that prices and expenses do not evolve in time. In other words, the capital return rate is discussed in real terms.

The growth model operates in five-year time steps [

21,

22,

24], as discussed above. Consequently, an eventual harvesting entry may take place every five years. According to recent investigations, it often is favorable to harvest every five years [

21]. However, the fixed harvesting entry cost of 200 Eur/ha restricts low-yield harvesting entries. Numerical investigations indicated that it is not reasonable to harvest if the yield would be less than 20–30 m

2/ha. Such an entry limit is in concert with practices applied in the area. It is worth noting that the maximization of capital return rate within any five-year period does not lead to the maximization of the expected value of capital return rate. The reason is that provided the capital return rate is greater than the accumulated expected value, increased capitalization increases the expected value according to Equation (7).

In addition to high thinnings intended to maximize capital return rate [

21,

22,

28,

29], the consequences of following semi-official silvicultural guidance commonly applied in the area [

34] are discussed. Thinnings are predominantly applied from below, and any rotation is terminated in clearcutting. Clearcutting expenses are lower than thinning harvesting costs, according to Parkatti et al. [

32], stated to be based on a productivity study of Nurminen et al. [

33]. In addition, a 15% clearcutting premium for the roadside price of sawlogs is applied, in accordance with local tradition.

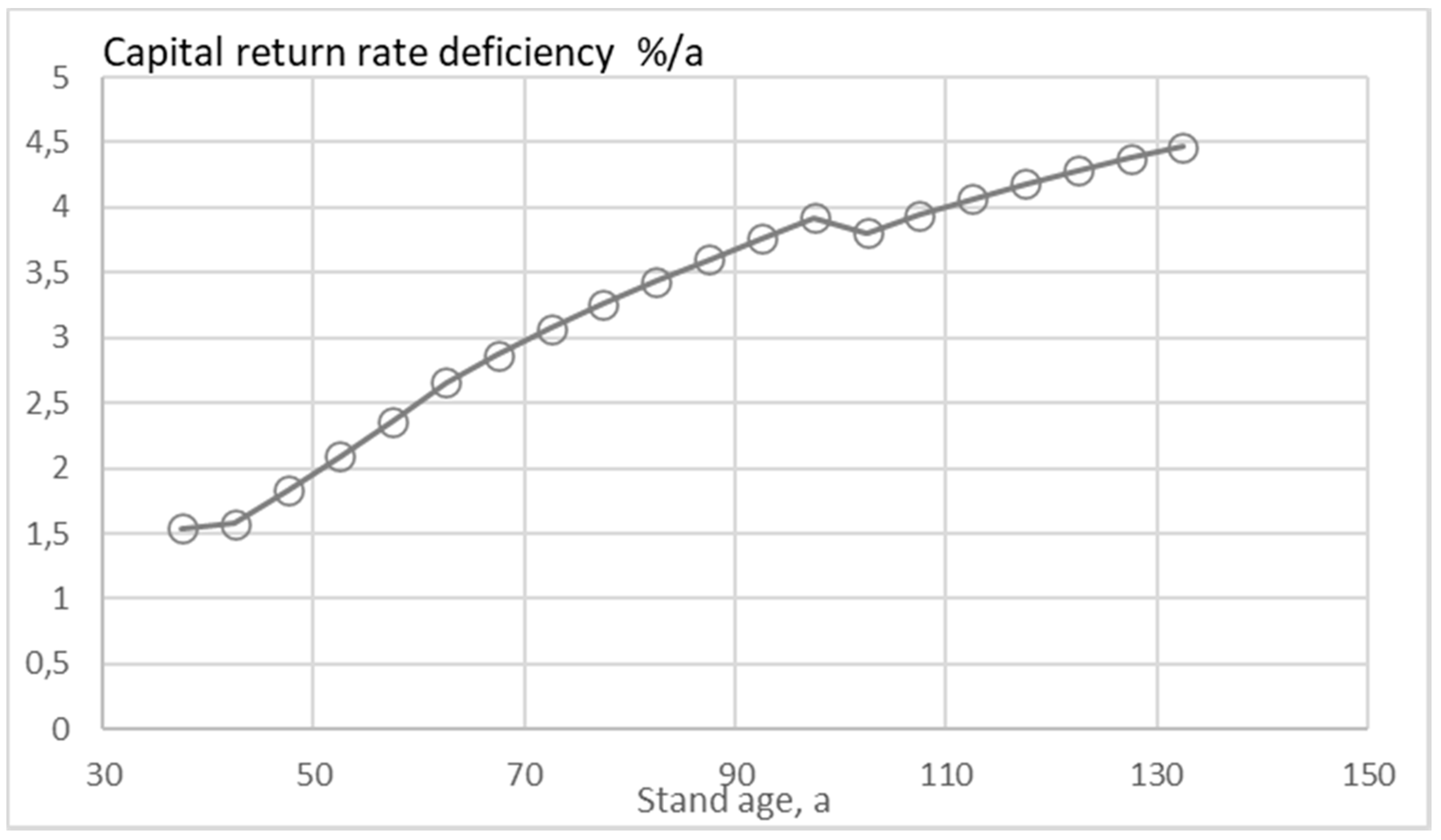

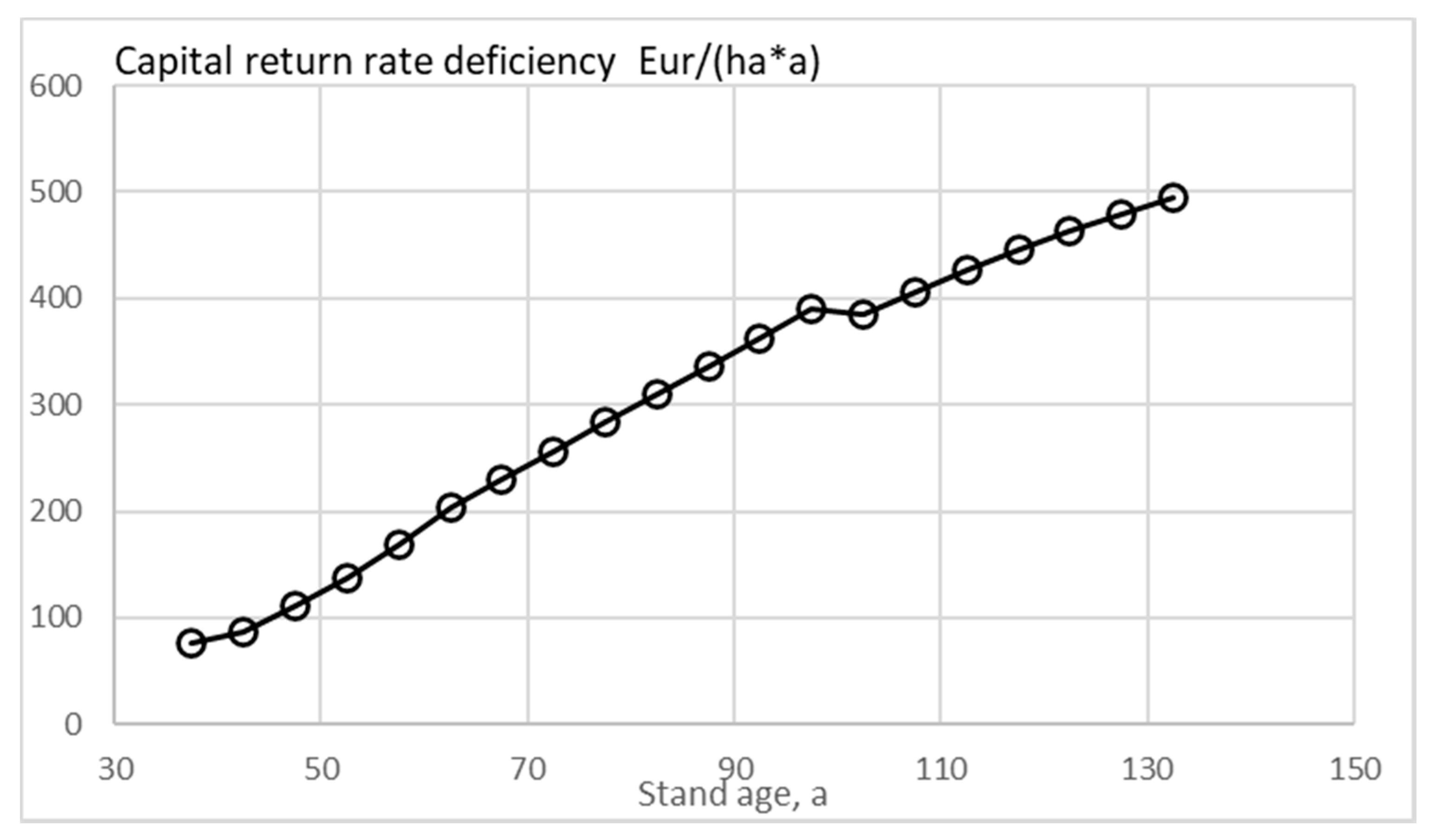

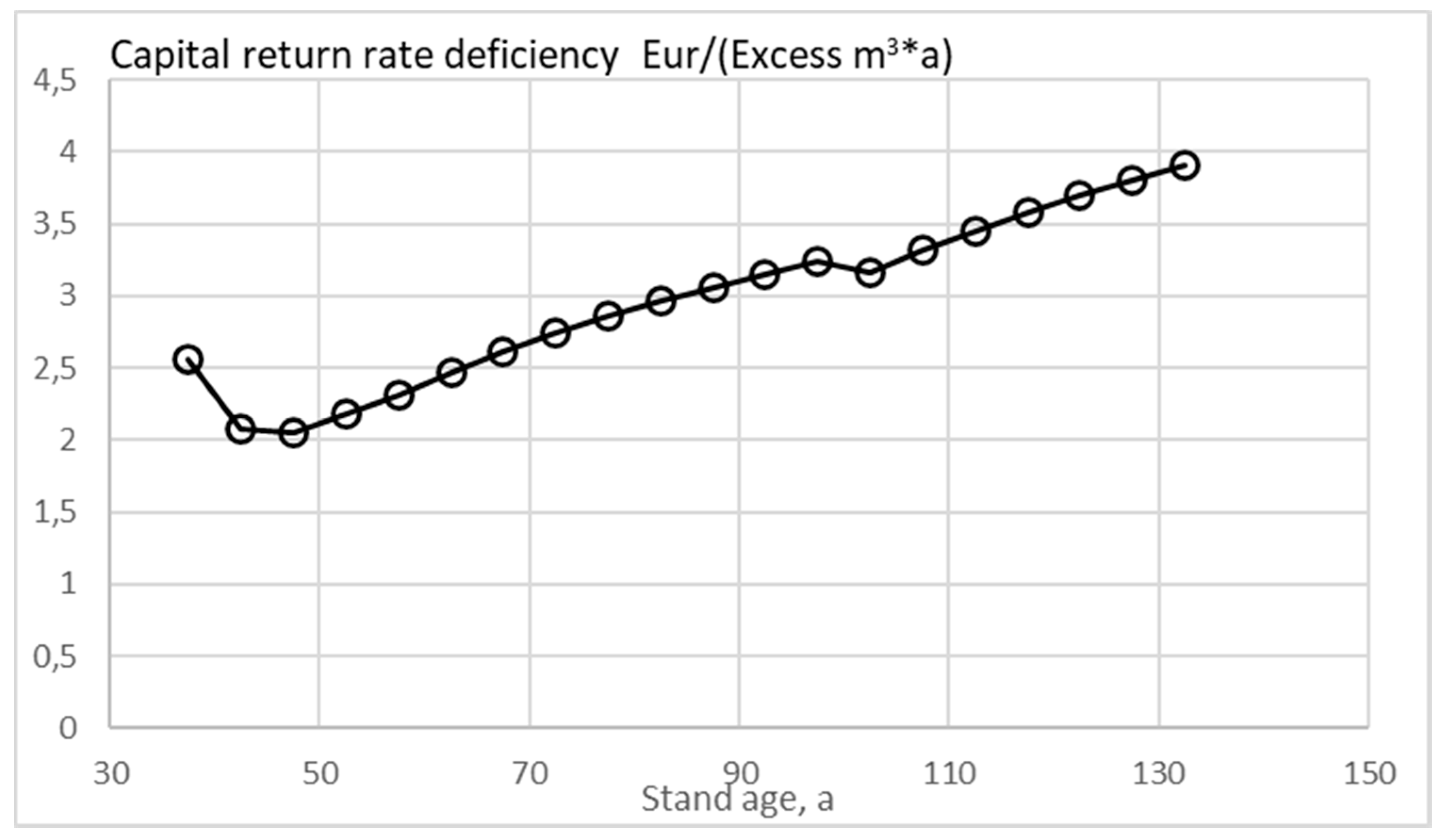

Application of Equation (7) results as an expected value of capital return rate for any treatment schedule investigated. Treatment schedules not corresponding to the most economical one induce some amount of capital return rate deficiency, in terms of percentage per annum. Such deficiency is related either to the amount of timber stock deviating from the optimal timber stock, or the rotation age deviating from the optimal rotation age, or both. In the former case, the deficiency often is due to an excess standing volume, which allows for expressing the deficiency per excess volume unit.

2.4. Carbon Rent Considerations

The last issue in this section of methods regards carbon trade and carbon renting. It is worth noting that carbon prices or rents do not enter the analysis described above in any way. Carbon prices and rents are discussed in order to enable a comparison of the capital return deficiency per excess volume with any hypothetical carbon rent.

It has been recently shown that policies based on carbon rent are equivalent to policies based on carbon sequestration subsidies and taxies [

18]. Unbiased carbon sequestration trade would require a huge initial investment; correspondingly mostly carbon rent procedures are practically feasible [

18]. We will here present a brief derivation of the equivalency of the two principles of subsidies, however adopting boundary conditions possibly less restrictive than those of Lintunen et al. [

18].

Let us establish a carbon sequestration subsidy system at a particular time

τ1. Within a time range up to time

τ2 the total carbon trade compensation is

where

is carbon price at time

t, and

is carbon inventory at time

t. On the other hand, the revenue from carbon rentals is

where

u is the rent rate per carbon unit. Now, in order to establish equivalency between the carbon storage trade and rent, Equations (8) and (9) must become equal. Equality naturally should apply in any possible circumstance. One of the circumstances is that the time change rate of prices, as well as inventories, is zero. In such a case, the latter term of Equation (8) vanishes. Consequently, long-term flow of carbon rents should equal a one-time initial storage purchase payment. If the duration of the rent payments extends towards infinity, the only possibility is that the present value of rent payments forms a contracting series. One possibility of such contracting series is

where

q is a discount rate. The corresponding solution for the carbon rent rate is

One can readily show that Equation (11) applies not only to a steady-state of Equations (8) and (9), but also to any incremental carbon price and inventory.

4. Discussion

Issues related to increment of biomass density on the one hand, and extension of semiclosed canopy cover on the other hand, have been discussed at the estate level, with application to fertile boreal spruce estates.

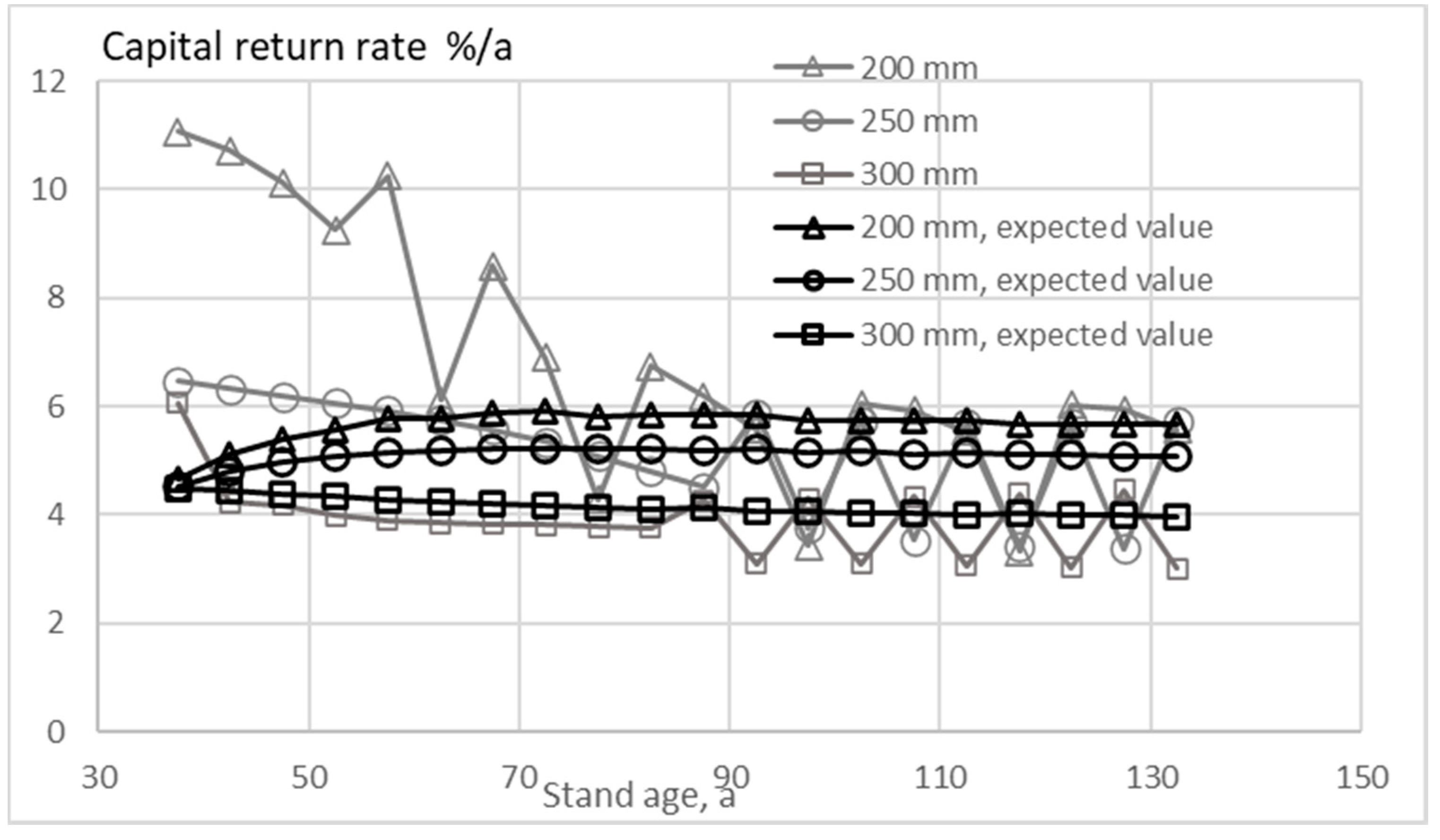

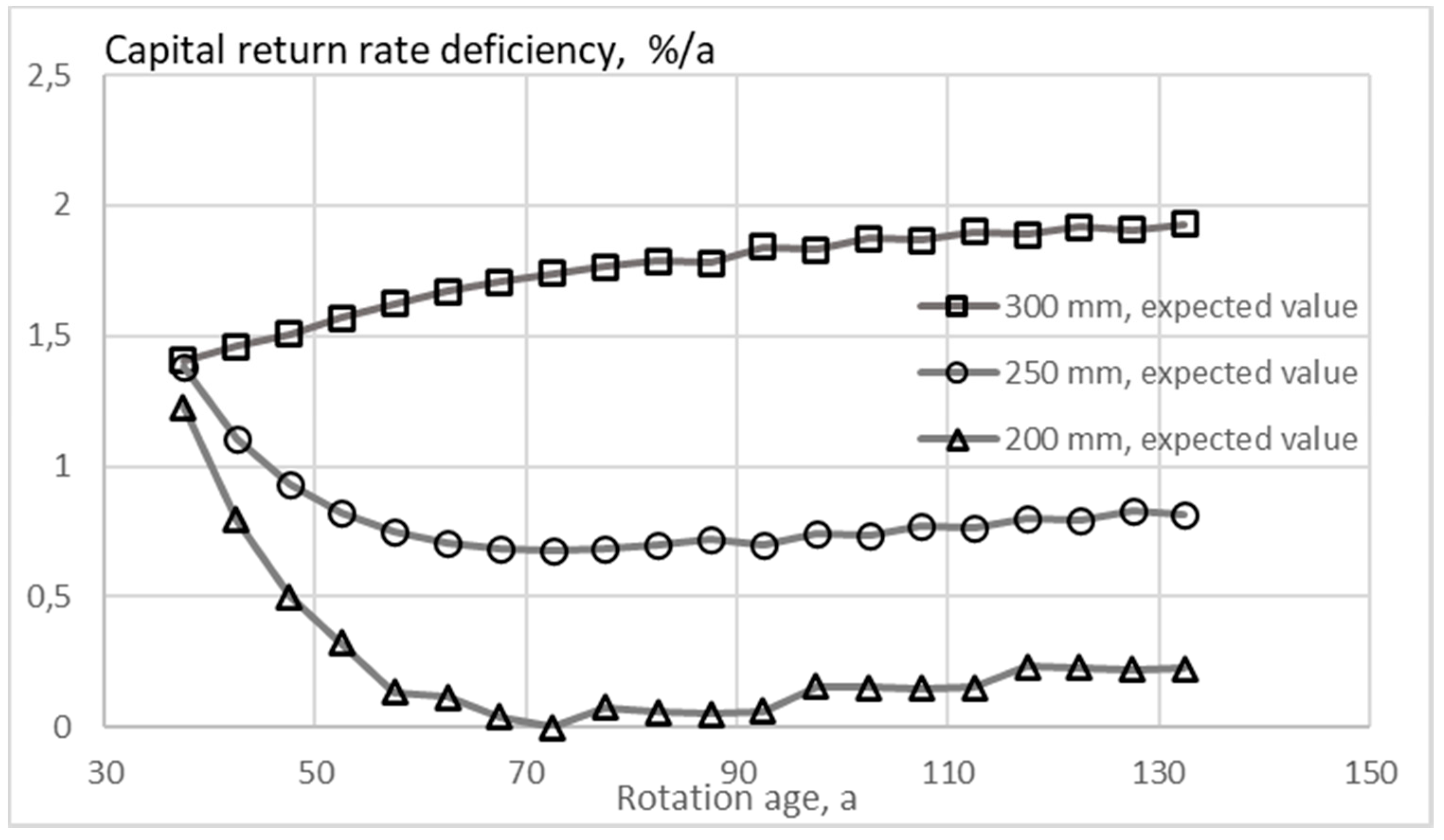

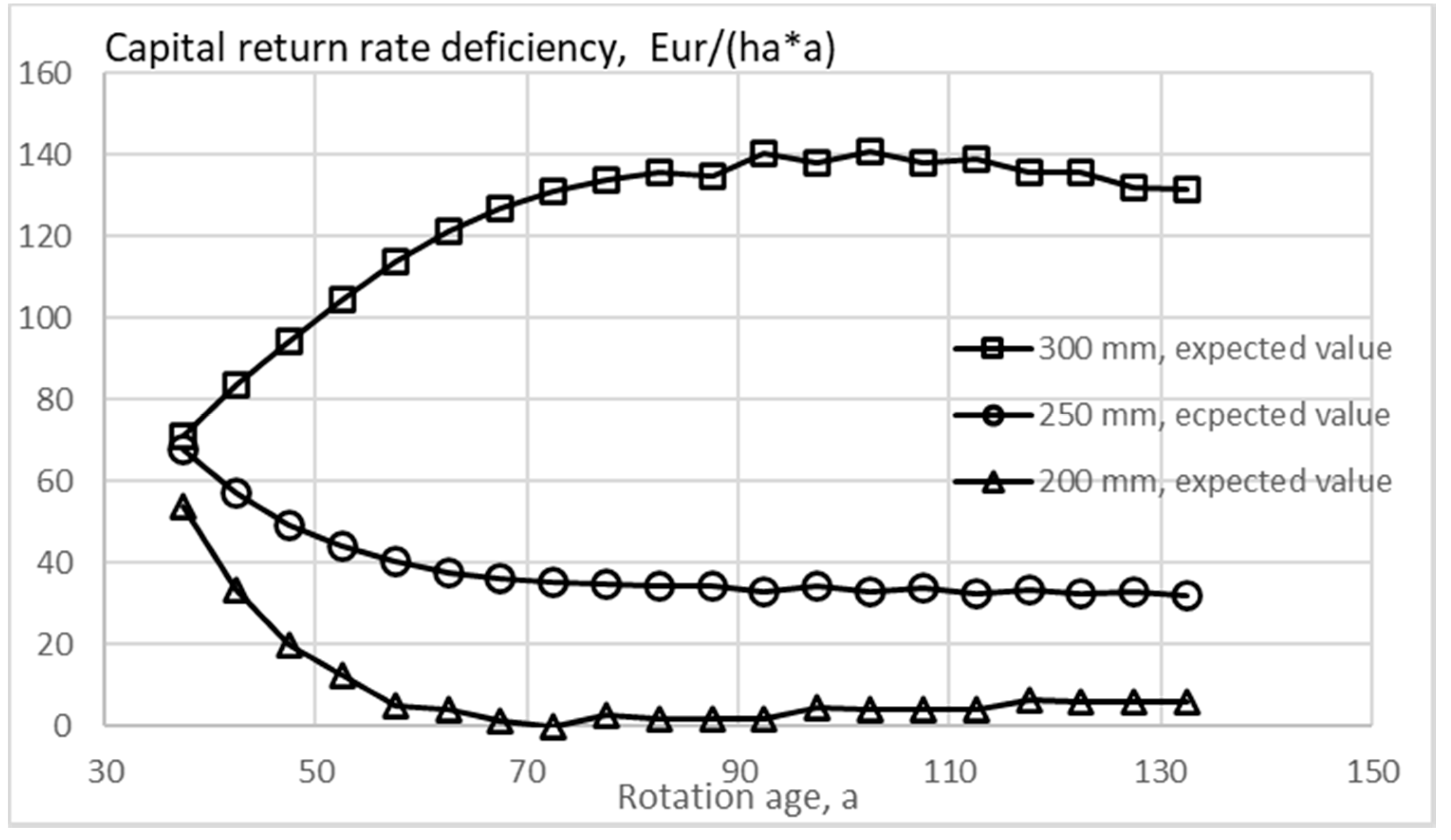

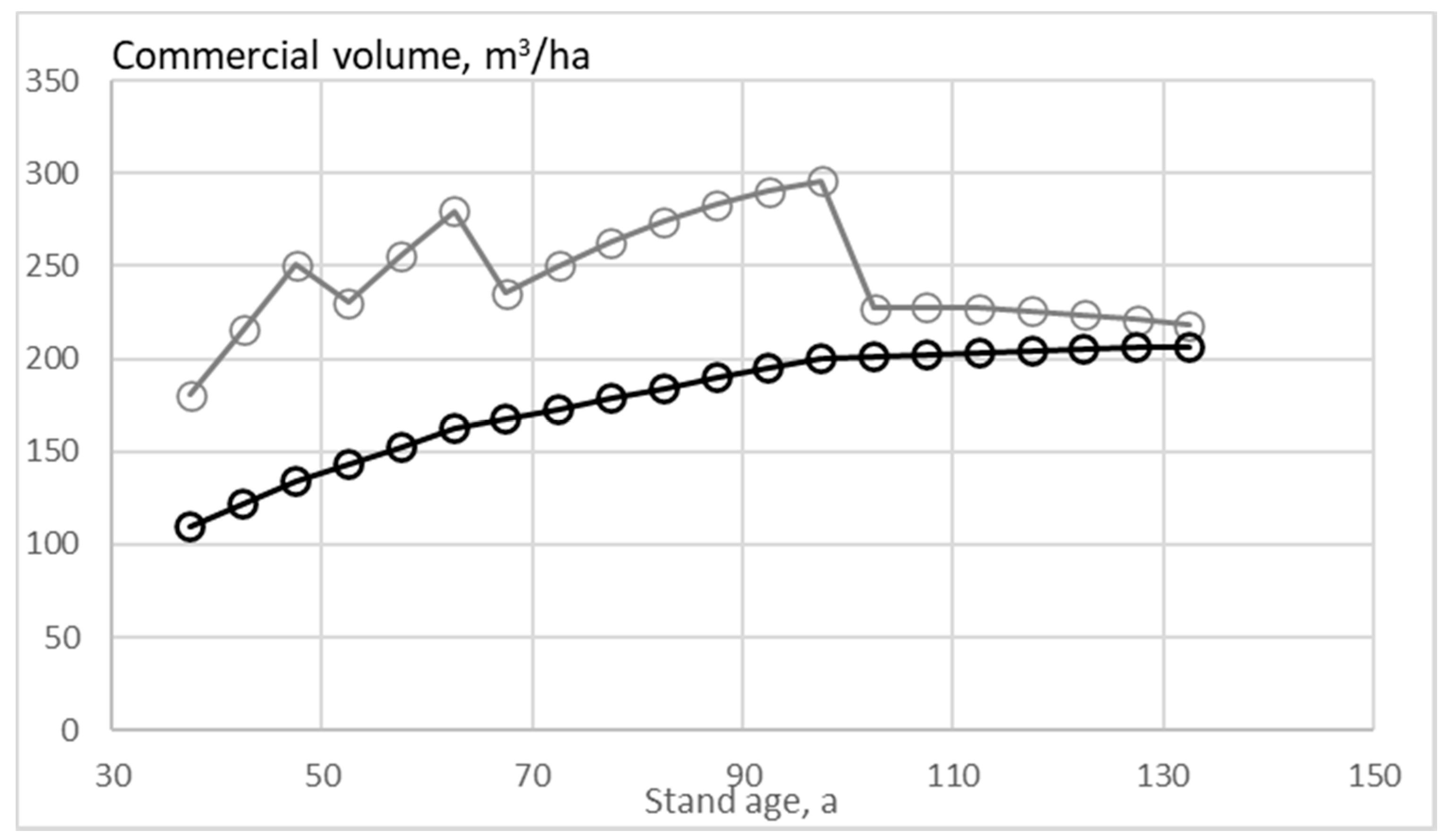

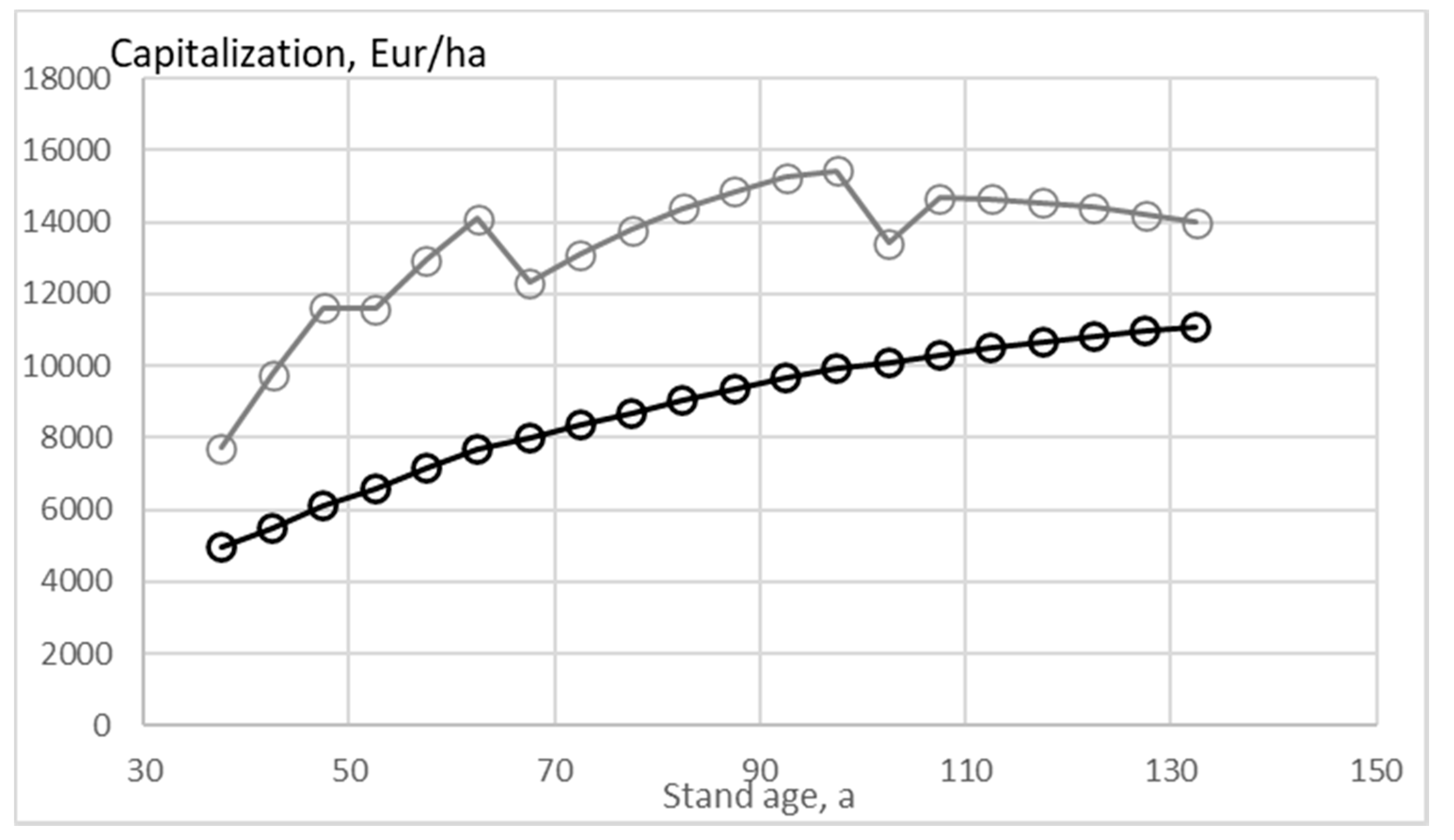

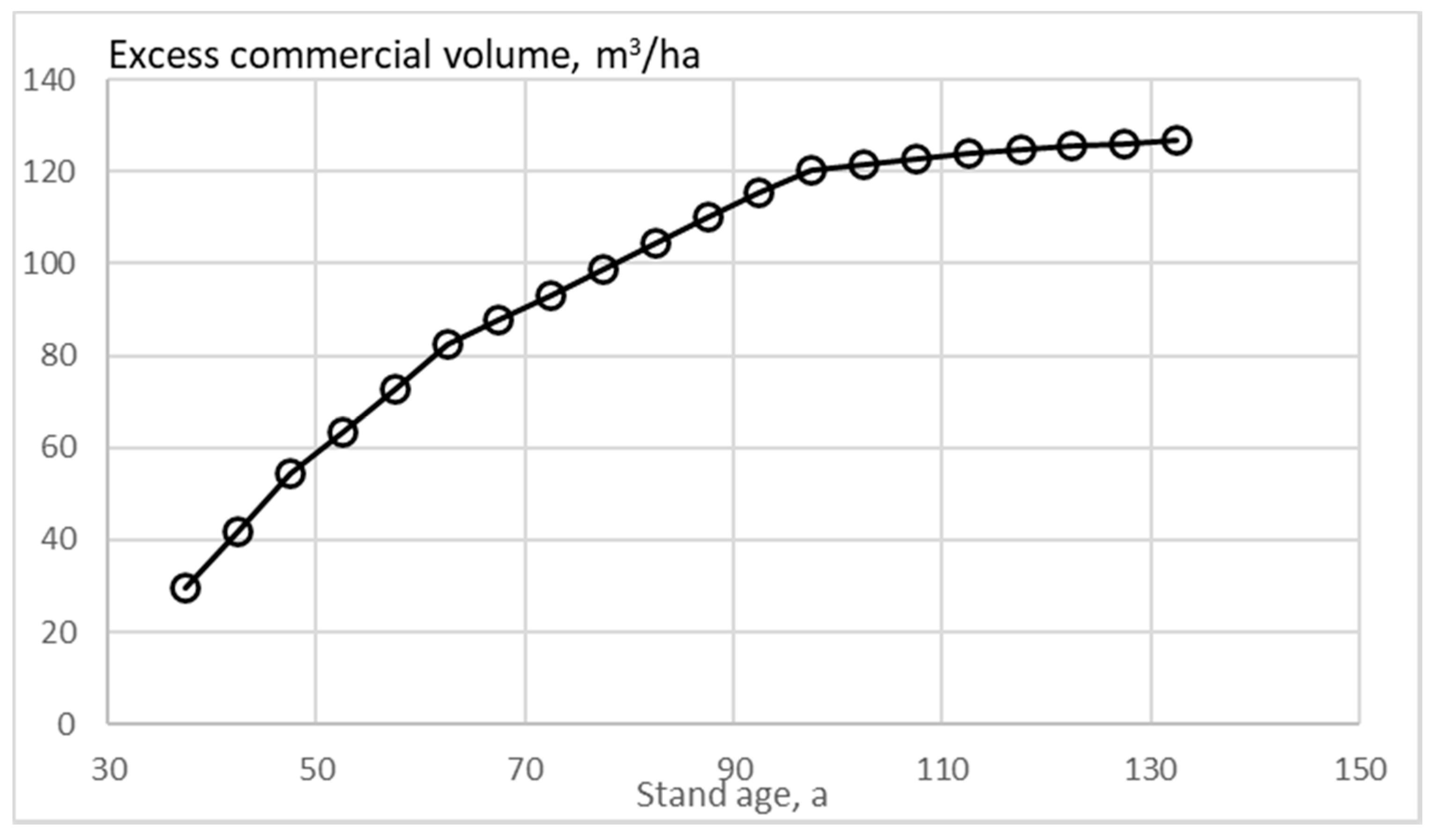

Extending rotations induces a large capital return rate deficiency if thinnings from below are applied (

Figure 9 and

Figure 16). With thinnings from above, the capital return rate is insensitive to rotation age (

Figure 1). However, intensive thinning from above tends to reduce the amount of living biomass, and correspondingly capital return rate deficiency per standing cubic meter may depend on rotation age (

Figure 8).

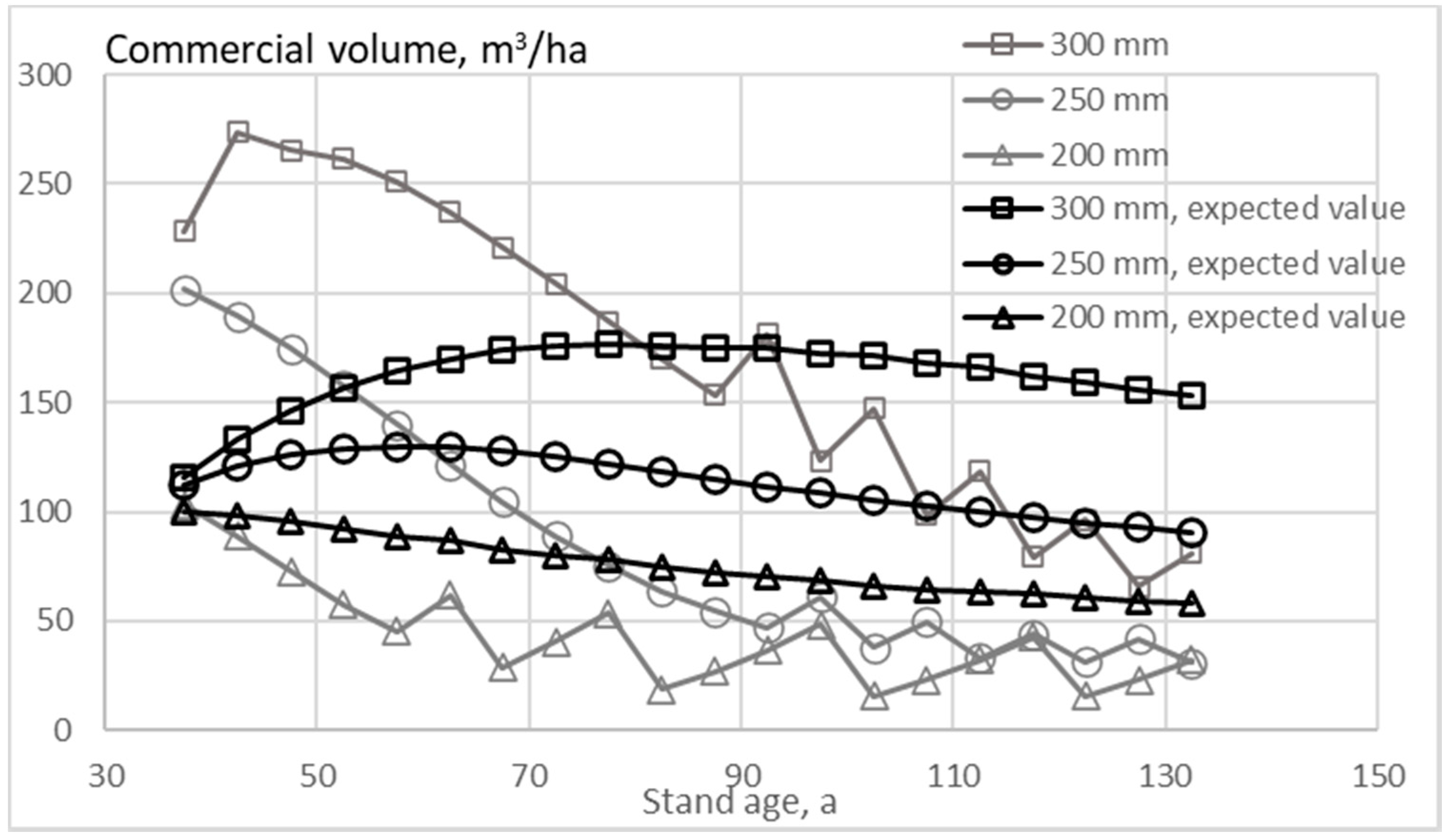

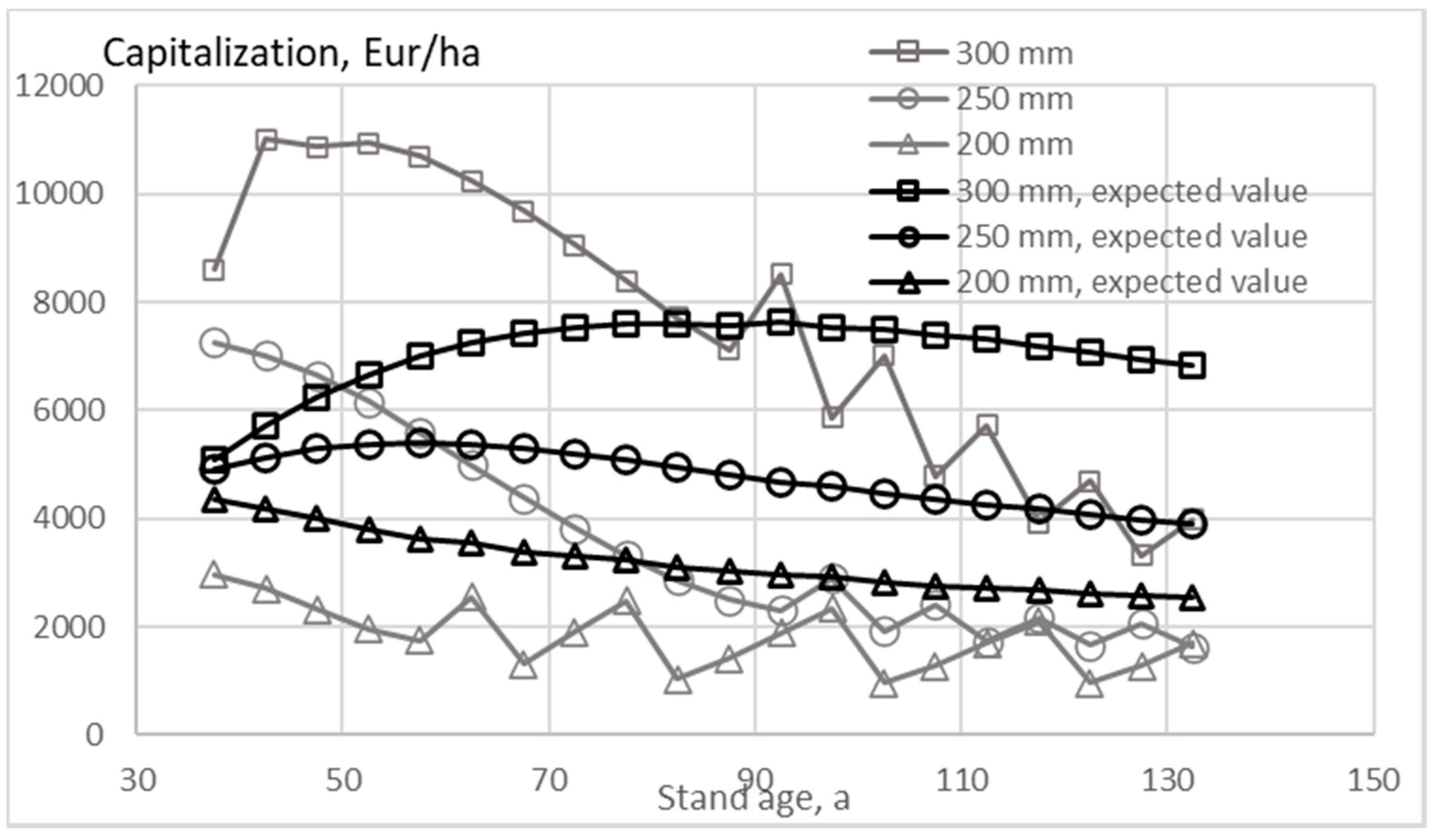

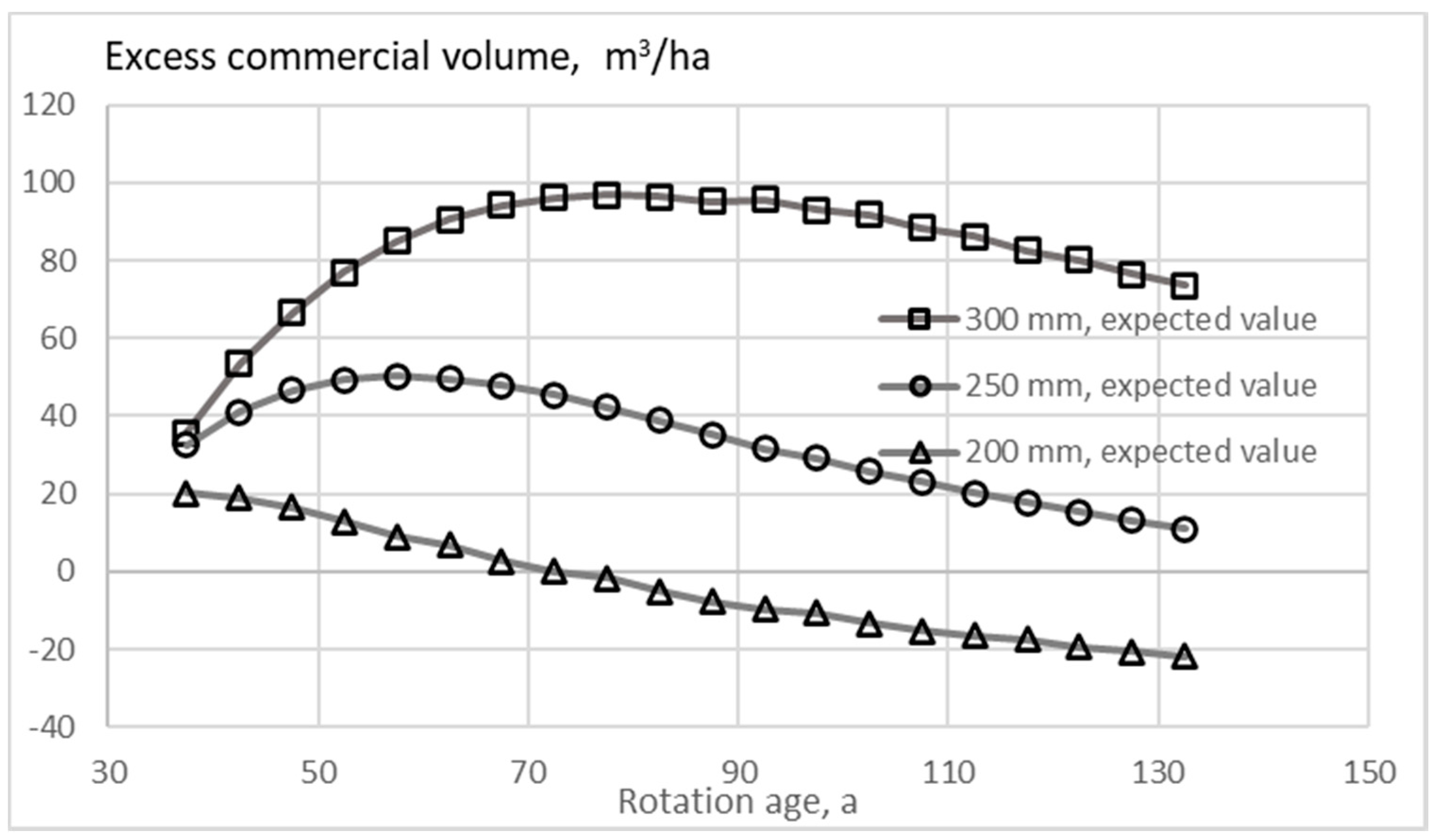

Manipulation of biomass density is possible even if the rotation age is not manipulated. The possibilities for this are particularly pronounced if thinnings are done from above (

Figure 2). It is possible to double the density of living biomass, in comparison to the financially optimal treatment schedule (

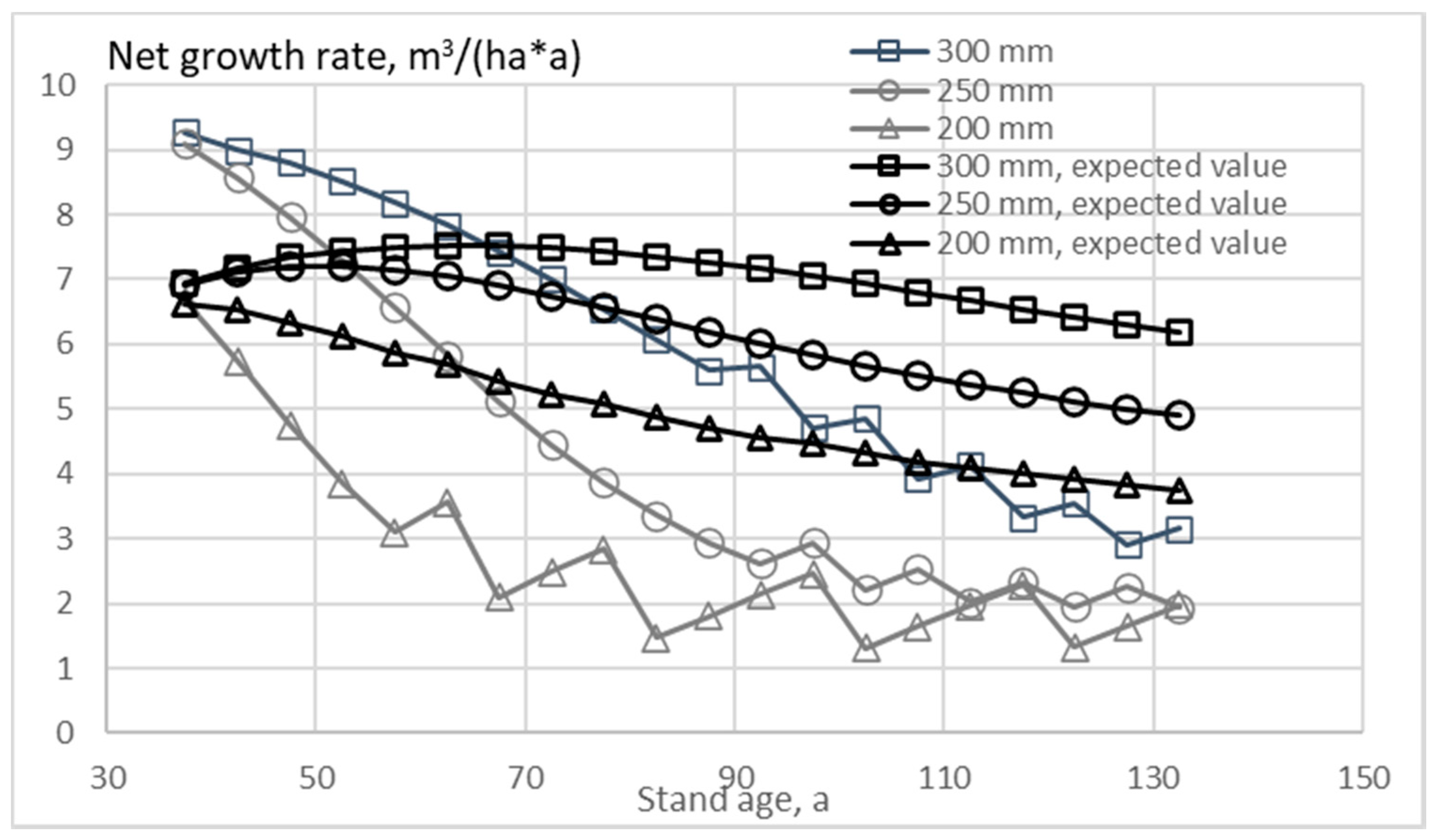

Figure 2), and consequently, growth rate is increased (

Figure 4). However, another consequence is the deficiency in the capital return rate (

Figure 1 and

Figure 5).

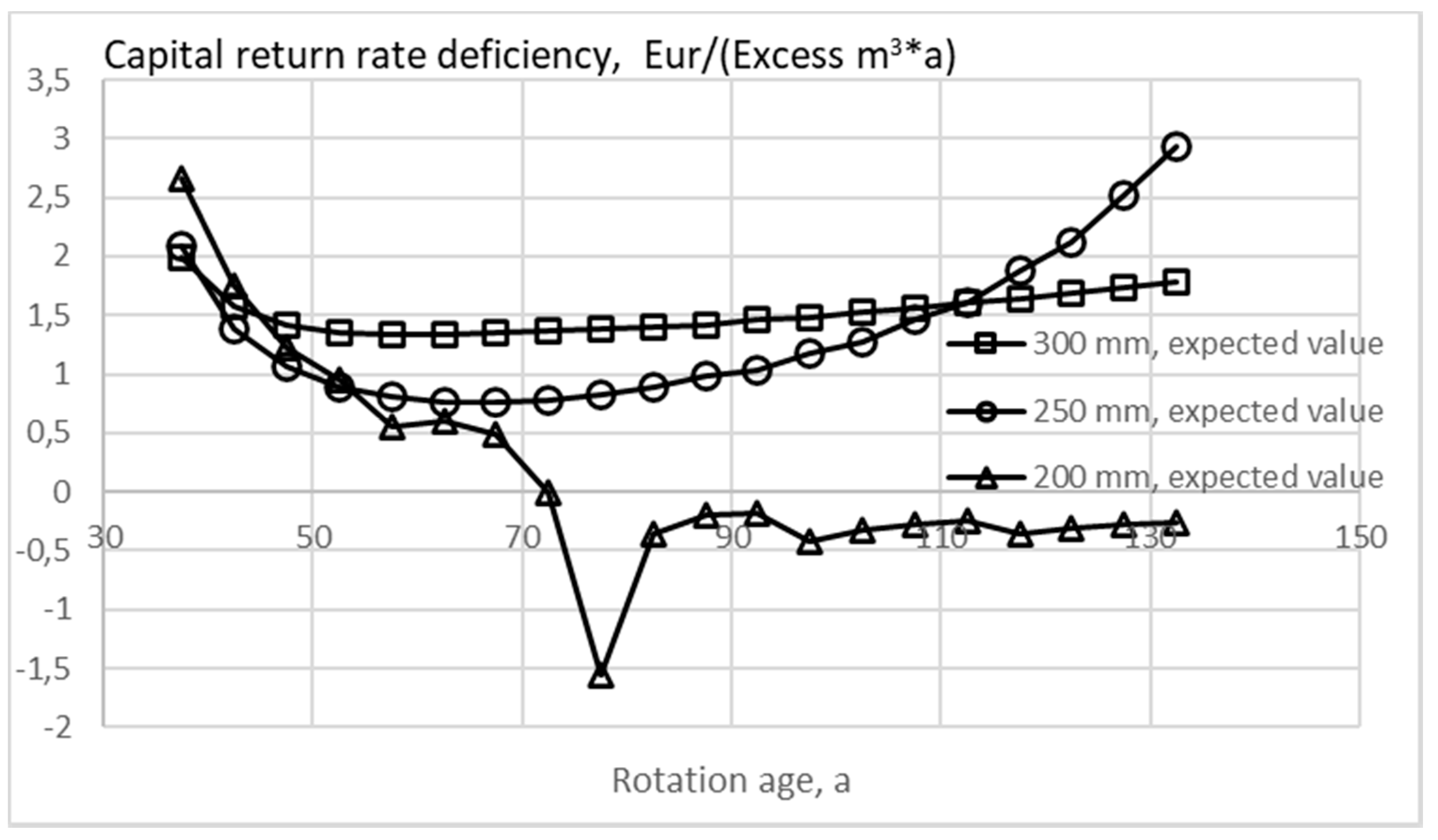

It is possible to allocate the capital return rate deficiency to the excess value of commercial stand volume. With prices applicable at the time of writing, the deficiency per excess volume is in the order of 1.5 Euros per excess standing cubicmeter, if the biomass density is doubled (

Figure 8). With smaller excess volume, the specific deficiency is less (

Figure 2 and

Figure 8).

An applicable carbon rent can be derived from carbon storage market price according to Equation (11). At the time of writing, the market price of carbon dioxide emissions is in the order of 25 Euros per ton. This inserted to Equation (11) together with a 3% discount rate, often applied in Forestry [

35,

36,

37], results as an annual carbon rent of 0.75 Euros per ton of carbon dioxide.

In coarse terms, a cubicmeter of commercial trunk volume in boreal forest stores a ton of carbon dioxide (in living biomass, litter, and soil) [

1,

2,

4,

7,

38,

39]. Correspondingly, considering the prices valid at the time of writing, one might reasonably expect a carbon rent of 0.75 Euros per standing cubicmeter. In comparison to

Figure 8, that is not enough. The deficiency of capital return rate per standing cubicmeter is greater than an appropriate rent. The situation will naturally change if the market price of carbon dioxide emissions changes.

It has recently been shown that a carbon sequestration trade policy is equivalent to a carbon rent policy [

18]. The same treatment, abbreviated and with somewhat less restrictive boundary conditions, is given in Equations (8) to (11) of this paper. There are reasons why any carbon sequestration trade compensation must be proportional to the carbon storage on the estate level [

18]. If it would not be, agents with large carbon inventories initially would suffer heavy and unjustified release taxes. Applying the Equivalency of Equation (10) would thus indicate that also the carbon rent arrangement would be proportional to the total carbon inventory.

As mentioned above, the carbon rent derived from the present carbon dioxide market price (Equation (11)) is not enough to compensate for the capital return deficiency due to increased biomass density. However, there is no particular reason why the carbon rent should be proportional (unlike the carbon trade). If the carbon rent is made nonproportional, the marginal rent may reasonably exceed the capital return rate deficiency.

All the quantitative results in this paper are estate-specific. It is of interest to consider how they would change if the properties of the estate would change. Changing soil fertility, as well as changing temperature sum, would change the values of all time derivatives. Correspondingly, capital return rates, as well as annual capital return deficiencies would change. Greater fertility would result in greater change rates with respect to time and vice versa. Effect of adopting other dominating tree species but Norway spruce on the estate is somewhat more difficult to estimate.

It has recently been proposed that on a national level, sites of low fertility and regions of cool climate are most suitable for carbon sequestration, while regions with high production capacity are best suitable for wood raw material supply [

17]. Consequently one might think that carbon rent derived from present emission prices not being enough to compensate for capital return deficiency on a fertile spruce estate would not necessarily be very detrimental. However, maximizing capital return rate results as low capitalization, and correspondingly as reduced growth (

Figure 1,

Figure 2,

Figure 3 and

Figure 4), which in turn reduces timber supply. Any carbon sequestration subsidy would increase capitalization, growth, and timber supply.

Many of the quantitative results in this paper depend on the market prices of roundwood assortments, bare land, silvicultural and harvesting expenses, carbon emission, as well as the discount rate applied in Equations (10) and (11). Considering eventual changes in the latter two is straightforward in terms of Equations (10) and (11). Changes in the former quantities contribute in a trivial manner if they are proportional. In the case of significant nonproportional changes in prices, most of the Figures of this paper will have to be redrawn.

The growth model applied in this study discusses stem sizes in 50 mm intervals [

24]. The main transition of assortments from pulpwood to sawlogs happens in the diameter class from 200 to 250 mm [

25,

26]. Correspondingly, computations implemented in this paper assume cutting limit diameters 200, 250, and 300 mm. It is not self-evident that the cutting diameter limit best corresponding to the assortment transition is 200 mm. Considering eventual defects in trees, as well as some degree of asymmetry in geometry, a representative diameter limit for utilizing the transition may be greater than 200 mm; 220 mm is used by some practitioners. If the latter cutting diameter limit would be used, nondimensionless quantities, along with their time derivatives, would be subject to change.

The capital return rate in

Figure 1 and

Figure 9 is a dimensionless quantity, not affected by size-scaling. A fourth pair of curves could be drawn in

Figure 2,

Figure 3 and

Figure 4. The capital return rate deficiency in

Figure 5 and

Figure 11 is the time derivative of a dimensionless quantity.

Figure 6 and

Figure 11 might be only slightly affected, provided assortment estimation in [

25,

26] holds. The excess values stand volume in

Figure 7 and

Figure 13 would be reduced, as the base of comparison (in terms of financially optimal stand volume) would be greater. The capital return rate deficiency per excess volume in

Figure 8 and

Figure 16 would be greater, as the excess volume would be reduced.

It might be of interest to try to relate the present results with previous approaches with a focus to large-scale systems. Some investigations claim benefits of intensive forestry with significant harvesting, considering the displacement of nonforest products with forest products [

12,

13]. Other investigators claim displacement factors are not large enough, and consequently minimized harvesting, resulting as large carbon stocks in forests, should be favored [

15,

16]. The present results happen to be in concert with both views. Maximization of capital return rate results in small carbon inventory, as well as a smallish rate of wood production. Carbon stocking, as well as growth rate, can be increased at the expense of capital return deficiency (

Figure 2,

Figure 4, and

Figure 5).

5. Conclusions

Extending rotations induces a large capital return rate deficiency if thinnings from below are applied. With thinnings from above, the capital return rate is insensitive to rotation age.

Manipulation of biomass density is possible even if the rotation age is not manipulated. Maximization of capital return rate results in small carbon inventory, as well as a smallish rate of wood production. Carbon stocking, as well as growth rate, can be increased at the expense of a capital return rate deficiency.

It is possible to allocate the capital return rate deficiency to the excess value of commercial stand volume. However, the deficiency of capital return rate per standing cubicmeter is greater than any appropriate proportional rent, based on present carbon prices. The situation will naturally change if the market price of carbon dioxide emissions changes.

As any proportional the carbon rent derived from the present carbon dioxide market price is not enough to compensate for the capital return rate deficiency, a nonproportional carbon rent is proposed.