How Expensive Is Expensive Enough? Opportunities for Cost Reductions in Offshore Wind Energy Logistics

Abstract

:1. Introduction

- Policy: Our case study indicates that a clear regulatory environment up to at least 2030 is critical for a conducive investment climate to exist. Such an investment climate is necessary in order to enable the needed logistics infrastructure, logistics assets and logistics personnel to be developed by government-owned and private organizations in order to support further offshore wind diffusion in an economical and safe/healthy manner.

- Governance: Our case study shows that necessary research and development (R&D) funding will need to be allocated by governments to proactively ensure logistics innovation support to the technological development of even larger offshore WTGs, yielding a greater nominal output as measured in mega-Watts (MW). This need is further amplified, as the diffusion of offshore wind is about to expand from North Europe to become a globally-applied technology, while OWFs are at the same time moving further out to sea, away from shore and into deeper waters.

- Academic: It is only after the term ‘logistics’ is defined that we may adequately start assembling, qualifying and measuring data and knowledge about this phenomenon. Our case study depicts that the definition of logistics itself may vary greatly depending on many factors, e.g., organizational vantage point and specific life-cycle phase [7] involvement of the individual person involved in offshore wind. For offshore wind, an all-encompassing definition of logistics is challenging to achieve mainly due to the complexity deriving from the many and distinctively different supply chains comprising a complete OWF life-cycle. Each supply chain provides unique frameworks for the respective logistics-related tasks.

- Practitioner: The strong empirical evidence from our case study suggests that logistics may be a somewhat overlooked frontier in the quest for lowering the LCoE of offshore wind. Our case study findings indicate that LCoE models and calculators do not separate out logistics as a stand-alone horizontal cost item throughout the entire OWF life-cycle, where clear levers can be used to impact LCoE in a simple and meaningful manner. Our case study also highlights how different offshore wind organizations do not seem yet to have dedicated logistics departments or competence centers, as in other industries. This prevents proper analysis horizontally across the life-cycle phases of an OWF, stopping synergies within a portfolio of many different OWFs within a single supply chain lead company to be realized. When we contrast this current state of logistical affairs within offshore wind to the latest Council of Supply Chain Management Professionals’ (CSCMP) review [8], it becomes clear that having an organization and singular focus are key contributing factors that have helped drive down U.S. logistics cost across industries as a percentage of gross domestic product (“GDP”).

2. Research Objectives, Key Academic Terms and Case Study Introduction

2.1. Research Objectives

- Logistics is a significant cost driver for offshore wind, as it is for other industries. For logistics in the U.S., as defined by CSCMP across all industries, costs were cut in half over a 20-year period from 15.8% of GDP in 1981 to 8.4% in 2014 [8]. Logistics therefore holds the promise and allure of cost savings due to its sheer relative share of offshore wind LCoE.

- Innovation is generally a path towards the maturing of industries, for example through platform leadership [17]. Furthermore, innovation provides an opportunity for cost reductions in general. Logistics innovation within offshore wind therefore seems relevant to pursue in order to obtain cost savings and to reduce LCoE.

- With a market share of 15.6% of the operating European OWFs by the end of 2015 [3] and a construction/engineering, procurement, construction, and installation (EPCi) track record of 26% of all OWFs built globally [5] (p. 27), WP is the recognized market leader within offshore wind globally. WP seems to be the most interesting case study company to investigate in terms of logistics innovation within offshore wind, as they have the largest portfolio of planned OWFs, OWFs under construction and OWFs already in operation. Only a large market constituency like WP with a correspondingly significant organization and big portfolio of OWFs seems to be able to take advantage of synergies and benefit from economies of scale generating cost savings and LCoE reductions from logistics innovation. A strong organization with strong focus on logistics seems relevant in terms of being able to execute logistics cost savings for offshore wind.

2.2. Levelized Cost of Energy

2.3. Logistics

2.4. Logistics Innovation

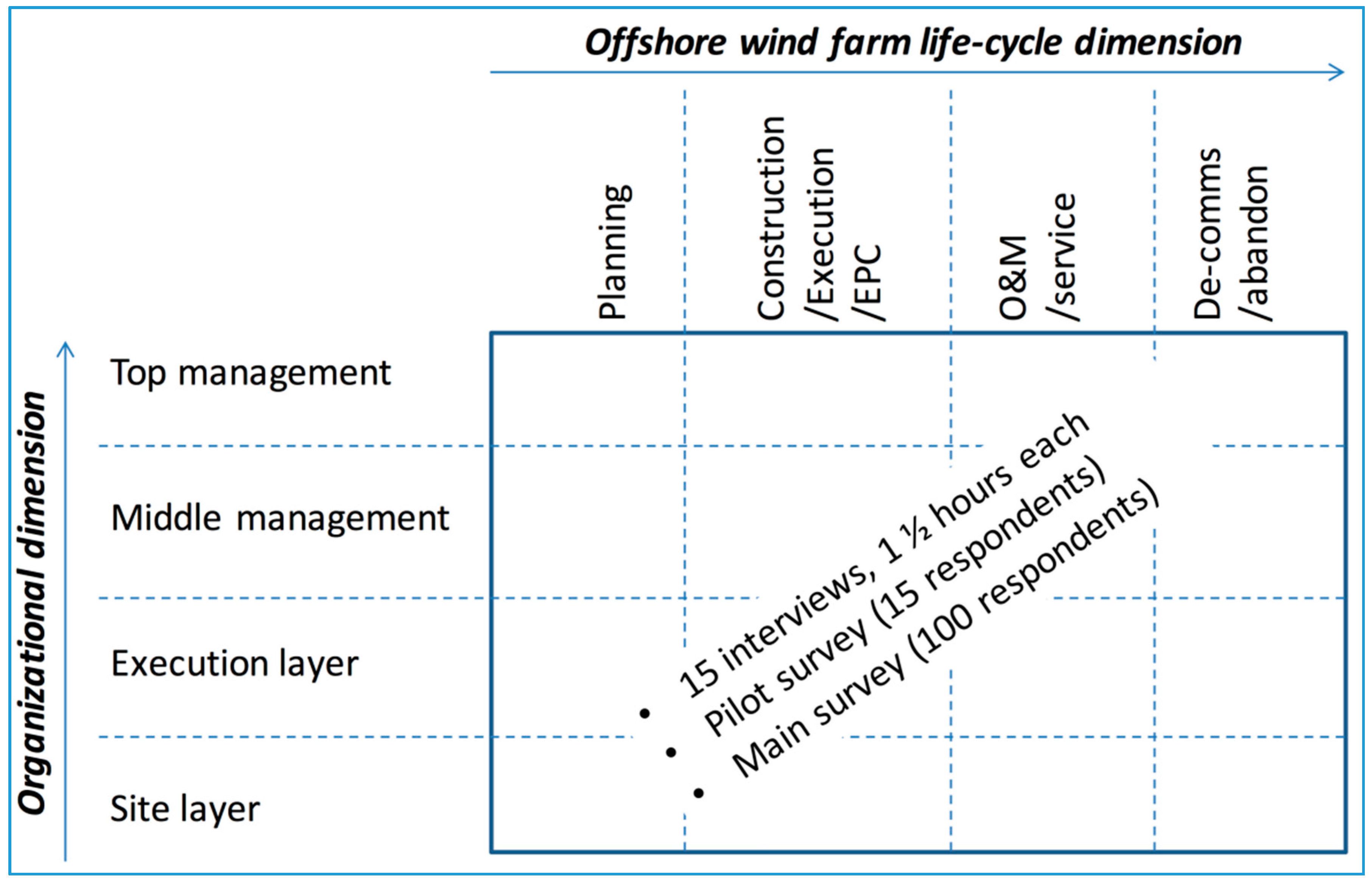

2.5. DONG Energy Wind Power Case Study Introduction

3. Results

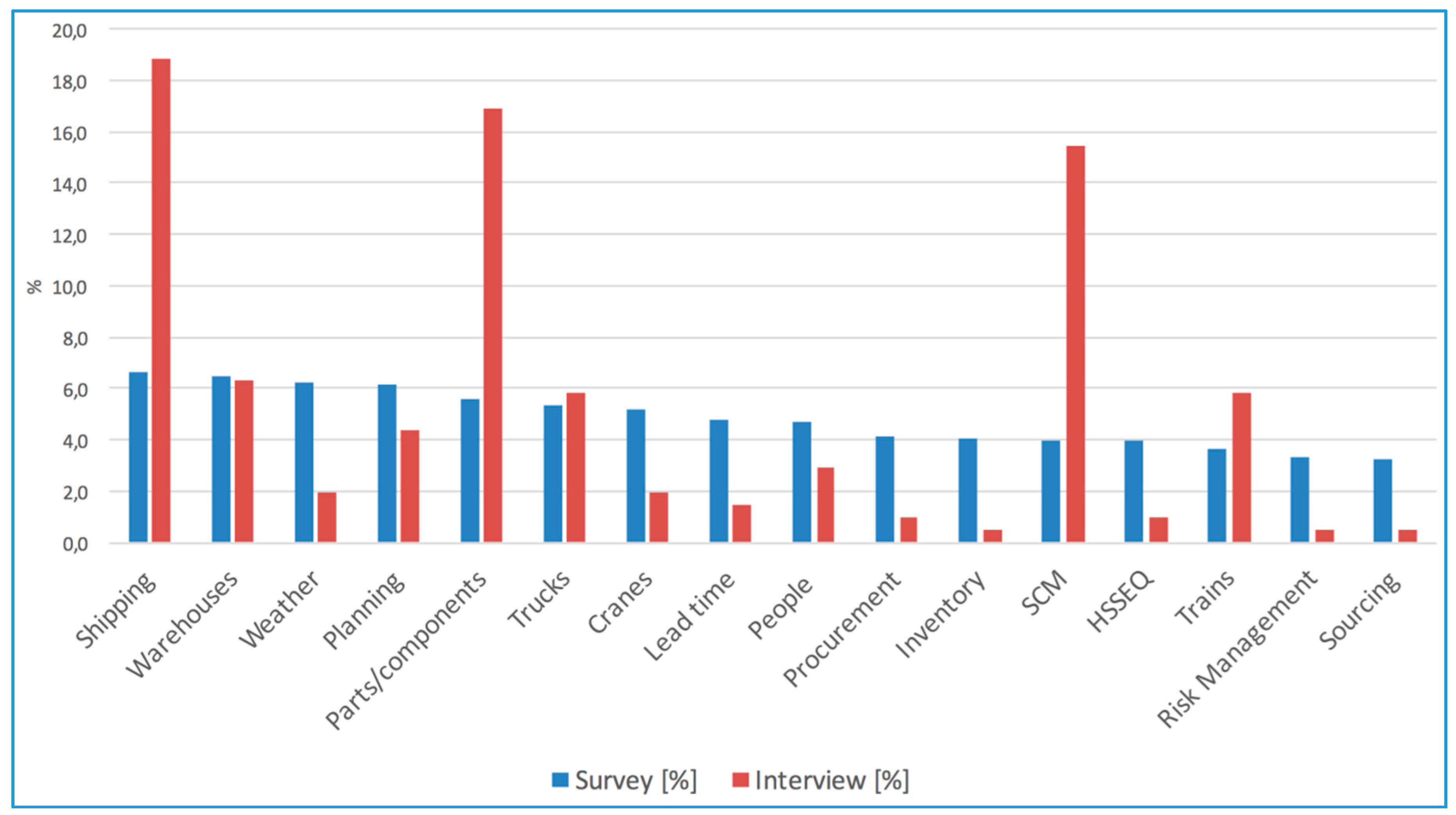

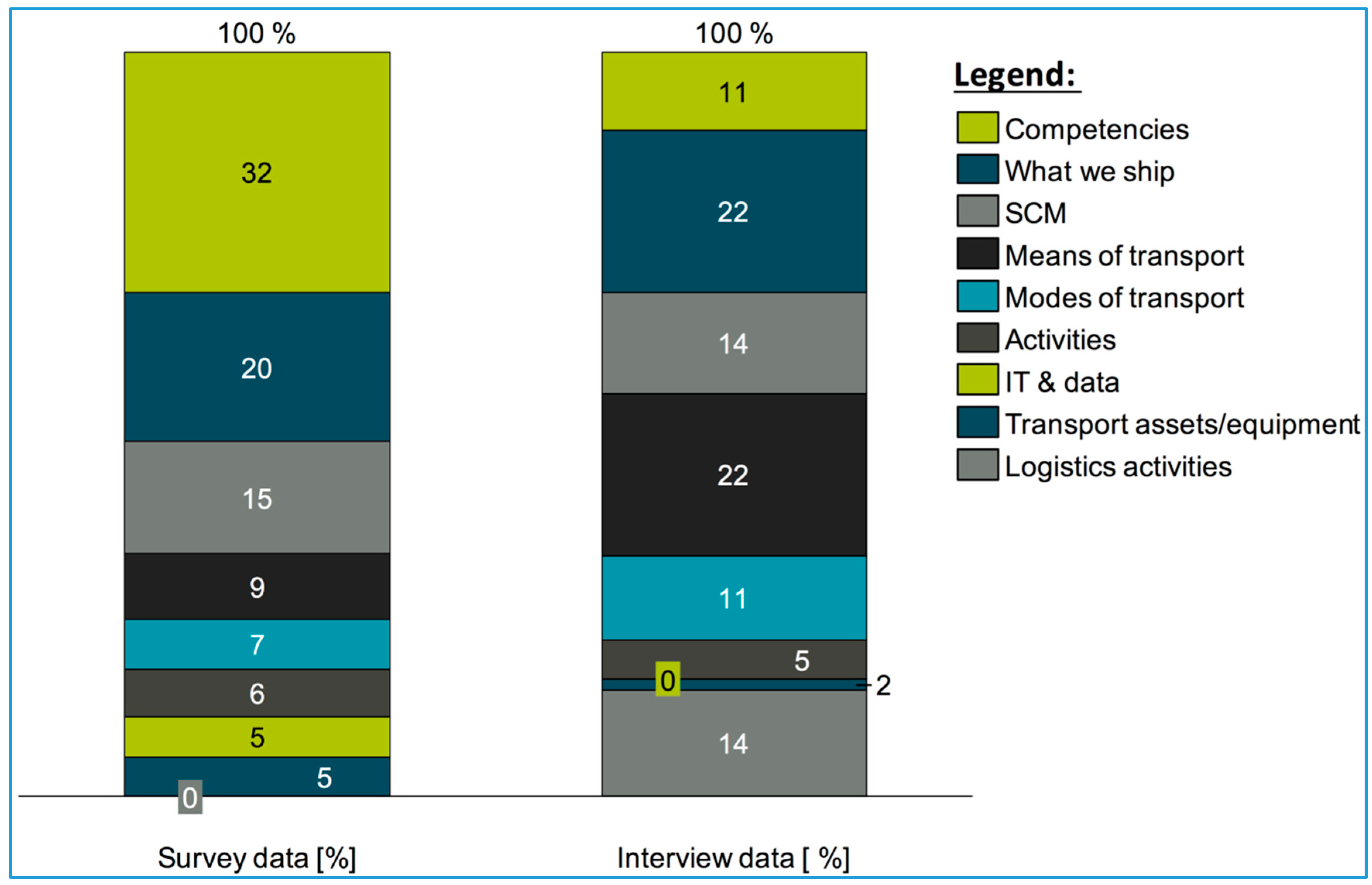

3.1. Definition of Logistics

- The term “shipping” could mean transportation by both vessel and helicopter (mode of transport being sea or air); different types of trucks/ships/boats/vessels/helicopters could be involved (means of transport); and different tasks could be performed (activities such as transporting personnel, performing surveys, preparation, loading, unloading).

- In terms of what we ship, different “parts and components” mentioned by the interviewees included both main WTG and BOP components, but also technicians including their tools, personal protection equipment (PPE), equipment, parts, as well as power to the grid.

- Just like we saw within academia, the definition of “supply chain management” was much wider during the interviews with the WP personnel. Here, the discussions ranged across a wide spectrum: from skills/knowledge (competencies), who is being served within which supply chains (who is the customer of either a single or multiple supply chains), the scale, scope and extent of the different supply chains (beginning and ending points) and the use of key performance indicators and computers (IT and data management).

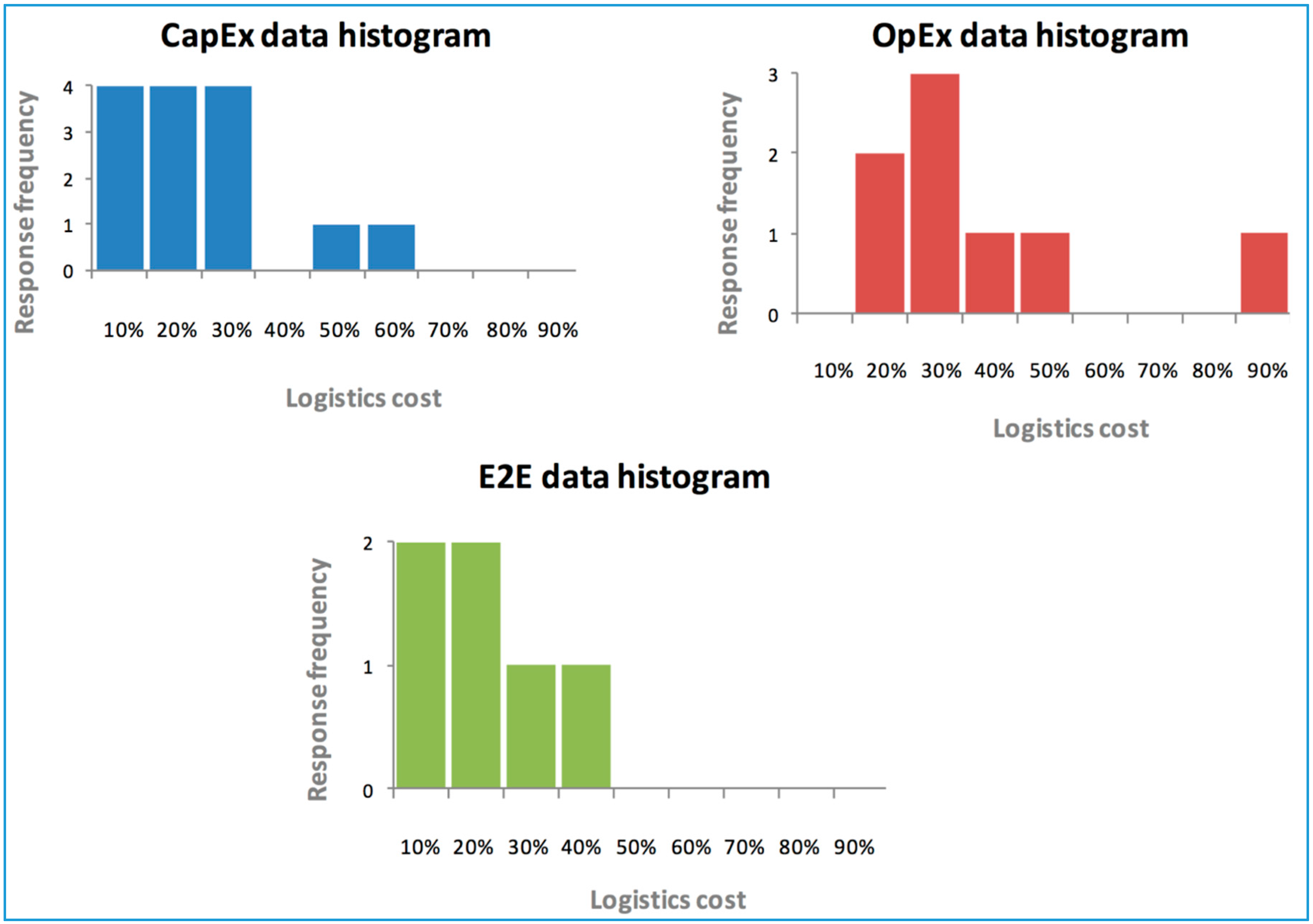

3.2. The cost of Logistics

3.3. Logistics Innovation

3.4. Organizational Implications

- OWFs will move further away from shore. The near shore sites are becoming rarer, which means that OWFs are moving further offshore and into deeper waters. The individual OWFs will be GW-sized, which means that risk management efforts and focused contingency plans will be increased. Each WTG position must produce a greater yield in terms of MW/h, and this, in turn, requires more shore-based personnel to stay offshore for longer periods of time.

- WTG output yield will go through another step-change size increase. The present WTGs yielding 4–8 MW will be replaced by WTGs yielding 10–15 MW by the early 2020s. Towards the end of the 2020s, WTGs yielding 20 MW will be introduced to the market along with floating WTG concepts.

- Offshore wind is rapidly going global. The WTG supply chain is largely global already; however, the BOP supply chain is predominantly European. This means that new key markets, such as China, Japan, South Korea, Taiwan, India and the U.S., will largely depend on a European supply chain for BOP and a largely European experience base in terms of the process of moving land-based WTGs into the ocean.

4. Discussion

- Policy-wise, our work with WP shows that offshore wind is still a fairly young and immature industry with a large dependency on government subsidies to survive and expand diffusion. Up to 2020, the legislative environment is firm in key EU countries and especially the emerging Chinese offshore wind market. A stabile and long-term legislative environment also beyond 2020 is needed to ensure that the necessary investments can be made by shipping/logistics/SCM companies. This is needed to ensure that transportation assets and transport equipment of the necessary size, caliber and the right lifting abilities are in place for the expected advances in technology size and shape. Although downplayed in the interviews, the role of the case study firm’s JV-owned PPP shipping/logistics/SCM subsidiary originally alleviated a significant supply bottleneck at the time of acquisition. Now, the PPP logistics subsidiary has, at a minimum, strengthened the relations between the case study company and the dominant WTG OEM, SWP, with whom the JV subsidiary is jointly owned. In addition, critical shipping/logistics/SCM skills and competencies are now available “in-house” via the JV PPP logistics subsidiary company. Although supposedly run at arm’s length, the availability of both assets, people, competencies, skills and knowledge within the field of logistics seem to go hand-in-hand with the case study company’s ambition to remain in the market leadership role for global offshore wind farm construction and operations. Additional players from the market are, however, needed in order for the industry sector of offshore wind to create the diffusion necessary to reach global renewable energy targets.

- Governance-wise, it is important that necessary government funding is allocated to the area of logistics innovation in order to support the core technological innovation of the WTG products. Only by ensuring proper alignment and due FEED several years in advance can new WTGs and supporting BOP structures be transported and installed to their offshore sites.

- From an academic perspective, strategy alignment is necessary, as well as critical. The task of defining an R&D strategy for logistics within the case study company became more complex when the lack of a common logistics definition along with the inexistent logistics strategy became apparent early in the interviewing process. The strategy hierarchy seemed to be clear with company strategy placed squarely at the top and supported by business unit strategy; in this case, strategy within the offshore wind business unit. WP business unit strategy would ideally be comprised of different supporting pillars of which a logistics or supply chain strategy could expectedly be one such pillar. As defined by Chopra and Meindl [40], alignment of a company’s supply chain strategy to the company strategy is critical to success and company survival. It follows from this argument that the strategy for R&D within the area of logistics should therefore be closely aligned with the overall strategy for logistics. The logistics strategy would be dependent on how logistics itself is defined. Our case study definition category shows that a proposed definition of offshore wind logistics across multiple dimensions should be a step in the right direction for the case study company and also for the offshore wind industry at large. With almost all other offshore wind farm developers and operators applying a single contracting business model, where large contracts are given to, e.g., EPCi companies and/or WTG OEMs, the market is not very transparent to the shipping/logistics/SCM companies trying to serve the global wind energy market. Who is actually the customer demanding the services to be rendered? When is the customer a competitor? Additionally, what alliances and allegiances exist between seemingly straight-forward companies with not so apparent links to sovereign nation states and their national agendas? These questions and the fact that the mere future existence of the wind energy market depends on continued government-sponsored subsidies are factors that may keep some shipping/logistics/SCM companies away from competing in the muddy waters of the global offshore wind industry; or perhaps causes some of the metaphorical blindness referred to by Mintzberg and Lampel [50] in their description of how both practitioners and scientists view this particular “elephant” in the safari of strategy. If the right companies do not enter the offshore wind logistics market place, the much needed professionalization of the supply chain may not happen. This lack of professionalization will be the beginning of a vicious circle that may lead to a lack of industrialization of the wind industry itself and inability to practically lower LCoE, a parameter that in itself is vital for offshore wind industry survival in the long-term without government subsidies; and an important factor for the OWFs already in operation as they start to move closer to their end of life service time [51].

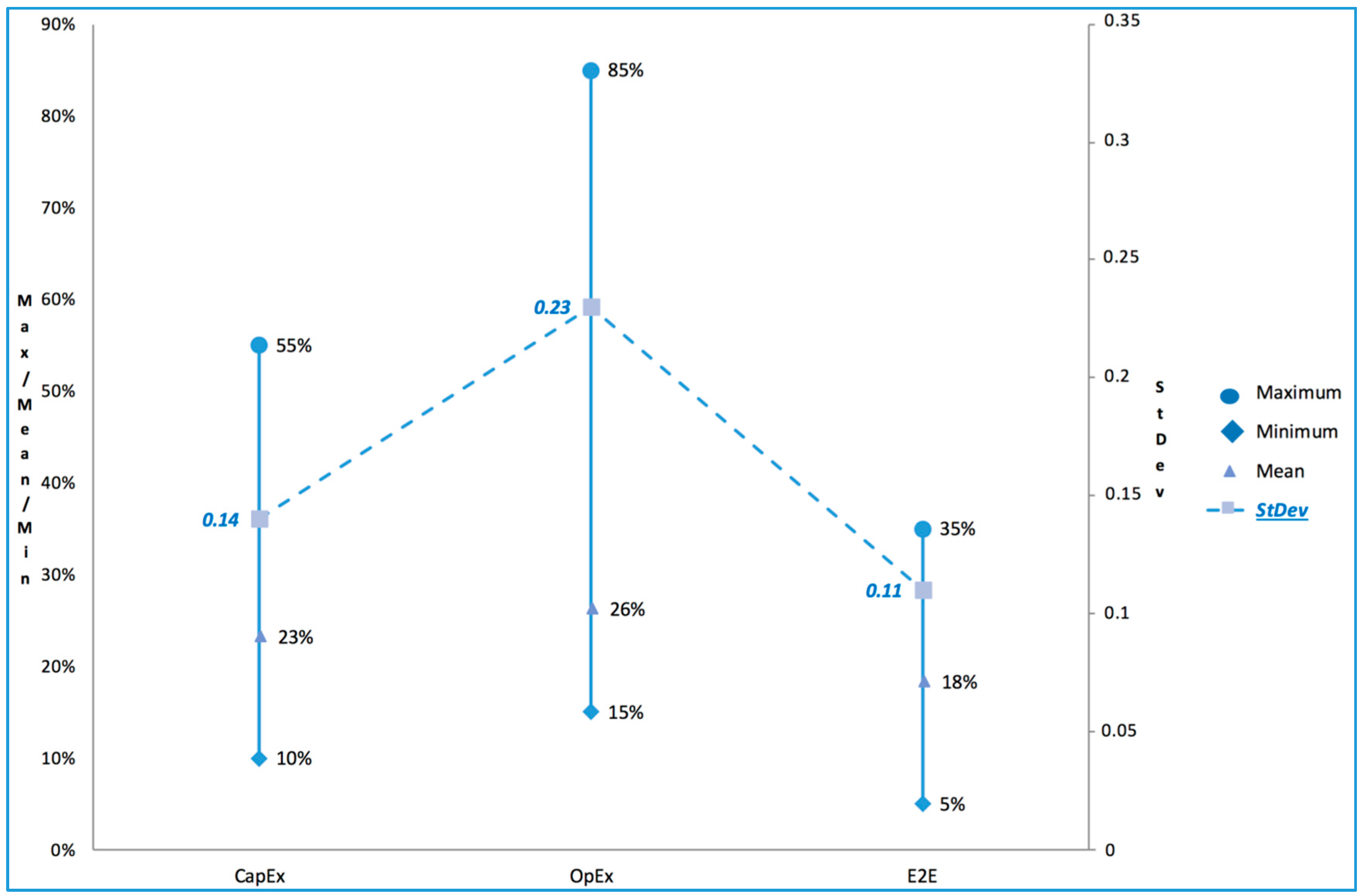

- From a practitioner perspective, our case study findings indicating that logistics is at least 18% of LCoE should point towards the area of logistics being ripe to explore in terms of possible cost reduction exercises. Findings from the U.S. over an extensive period of time reveal that by making logistics a recognized and admirable focus area for a cross-section of all industries with support from academia had brought down logistics costs as a percentage of GDP from 15.8% in 1981 to 8.4% in 2014 [8]. Realizing a 50% reduction in cost is not easy and has taken in excess of 20 years in the U.S. Therefore, the offshore wind industry needs to get organized not only within project life-cycle phases, but also horizontally across the different OWF life-cycle phases and across a portfolio of more OWFs. As the LCoE calculations of respectively Denmark, the U.K. and Germany showed [19,21,29], it is always hard to determine exactly how to measure costs within offshore wind, as it needs to be made very clear from the context or questions asked what, for example, a percentage is related to. Here, the LCoE initiative [24] should be highlighted because it developed a LCoE calculator tool based on the company-specific LCoE calculation models of key offshore wind developers (DONG Energy Wind Power, E.On and Vattenfall), key offshore wind OEMs (Siemens Wind Power and MHI Vestas Offshore Wind) and with input to the initiative from an additional 15 organizations, including several academic institutions, such as Aalborg University and DTU Wind Energy. This LCoE calculator tool [24] takes all wind farm life-cycle stages into consideration, from project idea through site restoration at the end of service life, as it is organized along four main cost dimensions, DevEx, CapEx, OpEx and AbEx. The cost items to be included in the LCoE calculator tool are generic in nature and as such do not allow for a significant further itemized breakdown. However, this model offers a full scope regarding the different supply chains where logistics costs may be incurred throughout the entire OWF project life-cycle. The LCoE calculator tool also considers, for example, production in the construction phase, and as part of production, a large inbound logistics flow is required. None of the country studies accounted or allowed for such an inbound flow. As such, the LCoE calculator tool [24] comes closest to being able to establish a platform able to address the end-to-end logistics costs in a horizontal manner across an OWF project and, thus, also the opportunity to start optimizing across a portfolio or several portfolios of OWFs. The LCoE calculator [24] furthermore addresses the offshore grid connection challenges described earlier by establishing a “point of common coupling” between the onshore grid and the offshore transmission owner, which may be supported by the model. Finally, the terminology used within the Megavind LCoE calculator tool [24] matches almost identically the company-specific terminology we found within our case study company.

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| AAU | Aalborg University |

| AbEx | Abandonment expenditure |

| BOP | Balance of plant (cables, substations, wind turbine foundations) |

| CapEx | Capital expenditure |

| CSCMP | Council of Supply Chain Management Practitioners |

| CSF | Critical success factors |

| CTV | Crew transfer vessel |

| DECC | UK Department of Energy and Climate Change |

| De-comms | Decommissioning, site abandonment at the end of service life |

| DevEx | Development expenditure |

| DTU | Technical University of Denmark |

| E2E | End-to-end |

| EU | European Union |

| EPCi | Engineering, procurement, construction and installation companies |

| EWEA | European Wind Energy Association, now WindEurope |

| FEED | Front-end engineering and design |

| GBP | Great Britain Pounds |

| GW | Giga-Watt |

| GWEC | Global Wind Energy Organization |

| HSSEQ | Health, safety, security, environment and quality |

| I&C | The installation and commissioning life-cycle phase of an offshore wind farm |

| IEA | International Energy Agency |

| IM | Inventory management theory stream |

| IT | Information technology |

| JV | Joint-venture |

| LCoE | Levelized cost of energy |

| MF | Materials flow theory stream |

| MH | Materials handling theory stream |

| MM | Materials management theory stream |

| MW | Mega-Watt |

| MW/h | Mega-Watt hours |

| O&M | Operations and maintenance |

| OEM | Original equipment manufacturer |

| OpEx | Operational expenditure |

| OSS | Offshore (and onshore) sub-station |

| OWF | Offshore wind farm |

| PD | Physical distribution theory stream |

| PPP | Public-private partnership |

| R&D | Research and development |

| SCM | Supply chain management |

| SCI | Supply chain (management) innovation |

| SWP | Siemens Wind Power |

| U.K. | United Kingdom |

| U.S. | United States of America |

| WP | DONG Energy Wind Power |

| WTIV | Wind turbine installation vessel |

| WTG | Wind turbine generator |

References

- Global Wind Energy Council. Global Wind Energy Outlook. 2014. Available online: http://www.gwec.net/wp-content/uploads/2014/10/GWEO2014_WEB.pdf (accessed on 26 November 2015).

- Milborrow, D. Windicator: Global Total Hits 400 GW as China Continues to Push Ahead. 2015. Available online: http://www.windpowermonthly.com/article/1365877/windicator-global-total-hits-400gw-china-continues-push-ahead (accessed on 2 February 2016).

- European Wind Energy Association. The European offshore wind industry key trends and statistics 2015. Available online: http://www.ewea.org/fileadmin/files/library/publications/statistics/EWEA-European-Offshore-Statistics-2015.pdf (accessed on 2 February 2016).

- Navigant Research. A BTM Navigant Wind Report. World Wind Energy Market Update 2015. International Wind Energy Development: 2015–2019; Navigant Research: Chicago, IL, USA, 2015. [Google Scholar]

- DONG Energy. 2015 Annual Report Information (P. 27) about World Leading Construction and Operations of Offshore Wind. Available online: https://assets.dongenergy.com/DONGEnergyDocuments/com/Investor/Annual_Report/2015/dong_energy_annual_report_en.pdf (accessed on 14 February 2016).

- DONG Energy. Shareholder Information. Available online: http://www.dongenergy.com/en/investors/shareholders (accessed on 14 February 2016).

- Poulsen, T.; Rytter, N.G.M.; Chen, G. Global wind turbine shipping & logistics—A research area of the future? In Proceedings of the Conference Proceedings of International Conference on Logistics and Maritime Systems (LogMS) Conference, Singapore, 12–14 September 2013.

- Council of Supply Chain Management Professionals. CSCMP’s Annual State of Logistics Report, Freight Moves the Economy in 2014; National Press Club: Washington, DC, USA, 2015. [Google Scholar]

- Mazzucato, M. The Entrepreneurial State, 2nd ed.; Anthem Press: London, UK, 2014. [Google Scholar]

- Gosden, E. World’s Biggest Offshore Wind Farm to Add £4.2 Billion to Energy Bills. Available online: http://www.telegraph.co.uk/news/earth/energy/windpower/12138194/Worlds-biggest-offshore-wind-farm-to-add-4.2-billion-to-energy-bills.html (accessed on 7 February 2016).

- Shafiee, M.; Dinmohammadi, F. An FMEA-Based Risk Assessment Approach for Wind Turbine Systems: A Comparative Study of Onshore and Offshore. Energies 2014, 7, 619–642. [Google Scholar] [CrossRef]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risk. An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Poulsen, T. Changing strategies in global wind energy shipping, logistics, and supply chain management. In Research in the Decision Sciences for Global Supply Chain Network Innovations; Stentoft, J., Paulraj, A., Vastag, G., Eds.; Pearson Eduction: Old Tappan, NJ, USA, 2015; pp. 83–106. [Google Scholar]

- Lacerda, J.S.; van den Bergh, J.C.J.M. International Diffusion of Renewable Energy Innovations: Lessons from the Lead Markets for Wind Power in China, Germany and USA. Energies 2014, 7, 8236–8263. [Google Scholar] [CrossRef]

- Roehrich, J.; Lewis, M. Procuring complex performance: Implications for exchange governance complexity. Int. J. Oper. Prod. Manag. 2014, 34, 221–241. [Google Scholar]

- Pregger, T.; Lavagno, E.; Labriet, M.; Seljom, P.; Biberacher, M.; Blesl, M.; Trieb, F.; O’Sullivan, M.; Gerboni, R.; Schranz, L.; et al. Resources, capacities and corridors for energy imports to Europe. Int. J. Energy Sect. Manag. 2011, 5, 125–156. [Google Scholar] [CrossRef]

- Cusumano, M.A.; Gawer, A. The elements of platform leadership. IEEE Eng. Manag. Rev. 2003, 31, 8–15. [Google Scholar] [CrossRef]

- Dale, M. A Comparative Analysis of Energy Costs of Photovoltaic, Solar Thermal, and Wind Electricity Generation Technologies. Appl. Sci. 2013, 3, 325–337. [Google Scholar] [CrossRef]

- The Crown Estate. Offshore Wind Cost Reduction Pathways Study. 2012. Available online: http://www.thecrownestate.co.uk/media/5493/ei-offshore-wind-cost-reduction-pathways-study.pdf (accessed on 7 December 2015).

- International Energy Association. Projected Costs of Generating Electricity; Organization for Economic Co-operation and Development: Paris, France, 2005. [Google Scholar]

- Prognos & Ficthner Group. Cost Reduction Potentials of Offshore Wind Power in Germany, Long Version. 2013. Available online: http://www.offshore-stiftung.com/60005/Uploaded/SOW_Download%7cStudy_LongVersion_CostReductionPotentialsofOffshoreWindPowerinGermany.pdf (accessed on 6 December 2015).

- Heptonstall, P.; Gross, R.; Greenacre, P.; Cockerill, T. The cost of offshore wind: Understanding the past and projecting the future. Energy Policy 2012, 41, 815–821. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, W.; Zhao, C.; Yuan, J. The Economics of Wind Power in China and Policy Implications. Energies 2015, 8, 1529–1546. [Google Scholar] [CrossRef]

- Megavind. LCoE Calculator Model. 2015. Available online: http://megavind.windpower.org/download/2452/1500318_documentation_and_guidelinespdf (accessed on 8 December 2015).

- Hasager, C.B.; Madsen, P.H.; Giebel, G.; Réthoré, P.-E.; Hansen, K.S.; Badger, J.; Pena Diaz, A.; Volker, P.; Badger, M.; Karagali, I.; et al. Design tool for offshore wind farm cluster planning. In Proceedings of the EWEA Annual Event and Exhibition, 2015, European Wind Energy Association (EWEA), Paris, France, 17–20 November 2015.

- Gross, R.; Blyth, W.; Heptonstall, P. Risks, revenues and investment in electricity generation: Why policy needs to look beyond costs. Energy Econ. 2010, 32, 796–804. [Google Scholar] [CrossRef]

- Blanco, M.I. The economics of wind energy. Renew. Sustain. Energy Rev. 2009, 13, 1372–1382. [Google Scholar] [CrossRef]

- Shafiee, M. Maintenance logistics organization for offshore wind energy: Current progress and future perspectives. Renew. Energy 2015, 77, 182–193. [Google Scholar] [CrossRef]

- Deloitte. Analysis on The Furthering of Competition in Relation to the Establishment of Large Offshore Wind Farms in Denmark. 2011. Available online: http://www.ens.dk/sites/ens.dk/files/info/news-danish-energy-agency/cheaper-offshore-wind-farms-sight/deloitte_background_report_2_-_analysis_of_competitive_conditions_within_the_offshore_wind_sector.pdf (accessed on 8 December 2015).

- Poulsen, T.; Rytter, N.G.M.; Chen, G. Offshore windfarm shipping and logistics—The Danish Anholt offshore windfarm as a case study. In Proceedings of the 9th EAWE PhD Seminar on Wind Energy in Europe, Uppsala, Sweden, 18–20 September 2013.

- Tudor, F. Historical Evolution of Logistics. Revue Sci. Politiques 2012, 36, 22–32. [Google Scholar]

- Stock, J.R.; Lambert, D.M. Strategic Logistics Management, 4th ed.; Irwin/McGraw-Hill: Chicago, IL, USA, 2001. [Google Scholar]

- Magee, J.F. Guides to Inventory Policy: Functions and Lot Sizes. Harvard Business Rev. 1956, 34, 49–60. [Google Scholar]

- Heskett, J.L.; Glaskowsky, N.A., Jr.; Ivie, R.M. Business Logistics: Physical Distribution and Materials Management; Ronald Press: New York, NY, USA, 1973. [Google Scholar]

- Heskett, J.L. Logistics—Essential to strategy. Harvard Business Rev. 1977, 55, 85–96. [Google Scholar]

- Shapiro, R.D. Get Leverage from Logistics. Harvard Business Rev. 1984, 62, 119–126. [Google Scholar]

- Porter, M.E. Competitive Advantage; Free Press: New York, NY, USA, 1985; Chapter 2. [Google Scholar]

- Shapiro, R.D.; Heskett, J.L. Logistics Strategy; West Publishing: St. Paul, MN, USA, 1985. [Google Scholar]

- Fisher, M.L. What is the right supply chain for your product? Harvard Business Rev. 1997, 75, 105–116. [Google Scholar]

- Chopra, S.; Meindl, P. Supply Chain Management: Strategy, Planning, and Operation, 5th ed.; Pearson Education Limited: Harlow, Essex, UK, 2013. [Google Scholar]

- Hesse, M.; Rodrigue, J.-P. The transport geography of logistics and freight distribution. J. Transp. Geogr. 2004, 12, 171–184. [Google Scholar] [CrossRef]

- Hou, H.; Kataev, M.Y.; Zhang, Z.; Chaudhry, S.; Zhu, H.; Fu, L.; Yu, M. An evolving trajectory—From PD, logistics, SCM to the theory of material flow. J. Manag. Anal. 2015, 2, 138–153. [Google Scholar] [CrossRef]

- Flint, D.J.; Larsson, E. Exploring processes for customer value insights, supply chain learning and innovation: An international study. J. Business Logist. 2008, 29, 257–281. [Google Scholar] [CrossRef]

- Arlbjørn, J.S.; de Haas, H.; Munksgaard, K.B. Exploring supply chain innovation. Logist. Res. 2011, 3, 3–18. [Google Scholar] [CrossRef]

- Grawe, S.J. Logistics innovation: A literature-based conceptual framework. Int. J. Logist. Manag. 2009, 20, 360–377. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Boston, MA, USA, 1934. [Google Scholar]

- Schumpeter, J.A. Capitalism, Socialism, and Democracy; Harper and Brothers: New York, NY, USA, 1942. [Google Scholar]

- Flyvbjerg, B. Five Misunderstandings about Case-Study Research. Qual. Inq. 2006, 12, 219–245. [Google Scholar] [CrossRef]

- Henriksen, L.B. Knowledge management and engineering practices: The case of knowledge management, problem solving and engineering practices. Technovation 2001, 21, 595–603. [Google Scholar] [CrossRef]

- Mintzberg, H.; Lampel, J. Reflecting on the Strategy Process. Sloan Manag. Rev. 1999, 40, 21–30. [Google Scholar]

- Luengo, M.M.; Kolios, A. Failure Mode Identification and End of Life Scenarios of Offshore Wind Turbines: A Review. Energies 2015, 8, 8339–8354. [Google Scholar] [CrossRef]

- Reuters. Goldman Sachs Likely to Keep Stake in DONG After Float—Borsen. 2015. Available online: http://www.reuters.com/article/dongenergy-ipo-goldman-idUSL5N11S0I120150922#sCvzKEwT9OjFV672.97 (accessed on 20 December 2015).

| Organizational Layers | Management and Finance | Development & Consent (D&C) Life-Cycle Phase | Installation & Commissioning (D&C) Life-Cycle Phase | Operations & Maintenance (O&M) Life-Cycle Phase | De-Commissioning (De-Comms) and Site Abandonment Life-Cycle Phase | Full-Time Equivalent (FTE) Employee Count | % of Total |

|---|---|---|---|---|---|---|---|

| Management Board | 4 | 2 | 4 | 2 | 0 | 12 | 0.76% |

| Top management | 6 | 3 | 27 | 11 | 0 | 47 | 2.96% |

| Middle management | 27 | 18 | 38 | 45 | 0 | 128 | 8.06% |

| Operations/execution/analytical | 103 | 60 | 762 | 202 | 0 | 1127 | 70.93% |

| Site | 0 | 0 | 0 | 275 | 0 | 275 | 17.31% |

| FTE count | 140 | 83 | 831 | 535 | 0 | 1589 | - |

| % of total | 8.81% | 5.22% | 52.30% | 33.67% | 0% | - | 100% |

| Shipping | Parts/Components | Supply Chain Management (SCM) |

|---|---|---|

| Transport | Foundations | Delivery |

| Vessel | Turbine | Reduce delivery time |

| Crew transfer vessel (CTV) | Cable | Set-up around transportation |

| Helicopters | Goods/components | Preparation prior to execution |

| Transportation as part of installation | Towers | Coordinate logistics activities |

| Accommodation vessels | Building materials | Aligned flow of components |

| Survey vessels | Spare parts | Installation |

| Other vessels | Equipment | Logistics in operations & maintenance (O&M) |

| Offshore | Suppliers | Transport |

| Transportation with installation vessel | Survey equipment | Starts at production |

| Personnel logistics | Fixed platform | End-to-end (E2E) |

| Execution | Life vests | Between different countries |

| Installation vessel | Tools | Tier one customer |

| Unloading | Onshore activity | Idea to project hand-over |

| Prepare for shipping | Transition assets | Quay side |

| Sailing | Return of faulty component | Build an offshore wind farm (OWF) |

| - | Distribution | Supply |

| - | Technicians | Onshore projects |

| - | Logistics concepts | Knowledge regarding transportation process quality |

| - | Traffic | - |

| ID | 2016 “Must-Win Battles” | CSF |

|---|---|---|

| 1. | Establish preventive maintenance process for balance of plant (BOP) components including foundations/cables/offshore substation | LCoE |

| 2. | Market analysis of future offshore accommodation options as offshore wind farms (OWF) move further from shore into deeper waters | LCoE |

| 3. | Improve present and future crew transfer process to/from any offshore structure to reduce risk of accidents | HSSEQ |

| 4. | Proactively support wind turbine generator (WTG) mega-Watt (MW) yield step-change in terms of logistics to cater for heavier and larger WTG and BOP components | LCoE |

| 5. | Determine if present and future vessels can be used for multiple purposes (e.g., wind turbine installation vessels (WTIVs) for foundations, WTGs, cables, and OSS; crew transfer vessels (CTVs) for surveys) | LCoE |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Poulsen, T.; Hasager, C.B. How Expensive Is Expensive Enough? Opportunities for Cost Reductions in Offshore Wind Energy Logistics. Energies 2016, 9, 437. https://doi.org/10.3390/en9060437

Poulsen T, Hasager CB. How Expensive Is Expensive Enough? Opportunities for Cost Reductions in Offshore Wind Energy Logistics. Energies. 2016; 9(6):437. https://doi.org/10.3390/en9060437

Chicago/Turabian StylePoulsen, Thomas, and Charlotte Bay Hasager. 2016. "How Expensive Is Expensive Enough? Opportunities for Cost Reductions in Offshore Wind Energy Logistics" Energies 9, no. 6: 437. https://doi.org/10.3390/en9060437

APA StylePoulsen, T., & Hasager, C. B. (2016). How Expensive Is Expensive Enough? Opportunities for Cost Reductions in Offshore Wind Energy Logistics. Energies, 9(6), 437. https://doi.org/10.3390/en9060437