Economic Impacts of Increased U.S. Exports of Natural Gas: An Energy System Perspective

Abstract

:1. Introduction

2. Relevant Literature

3. Modeling Methodology

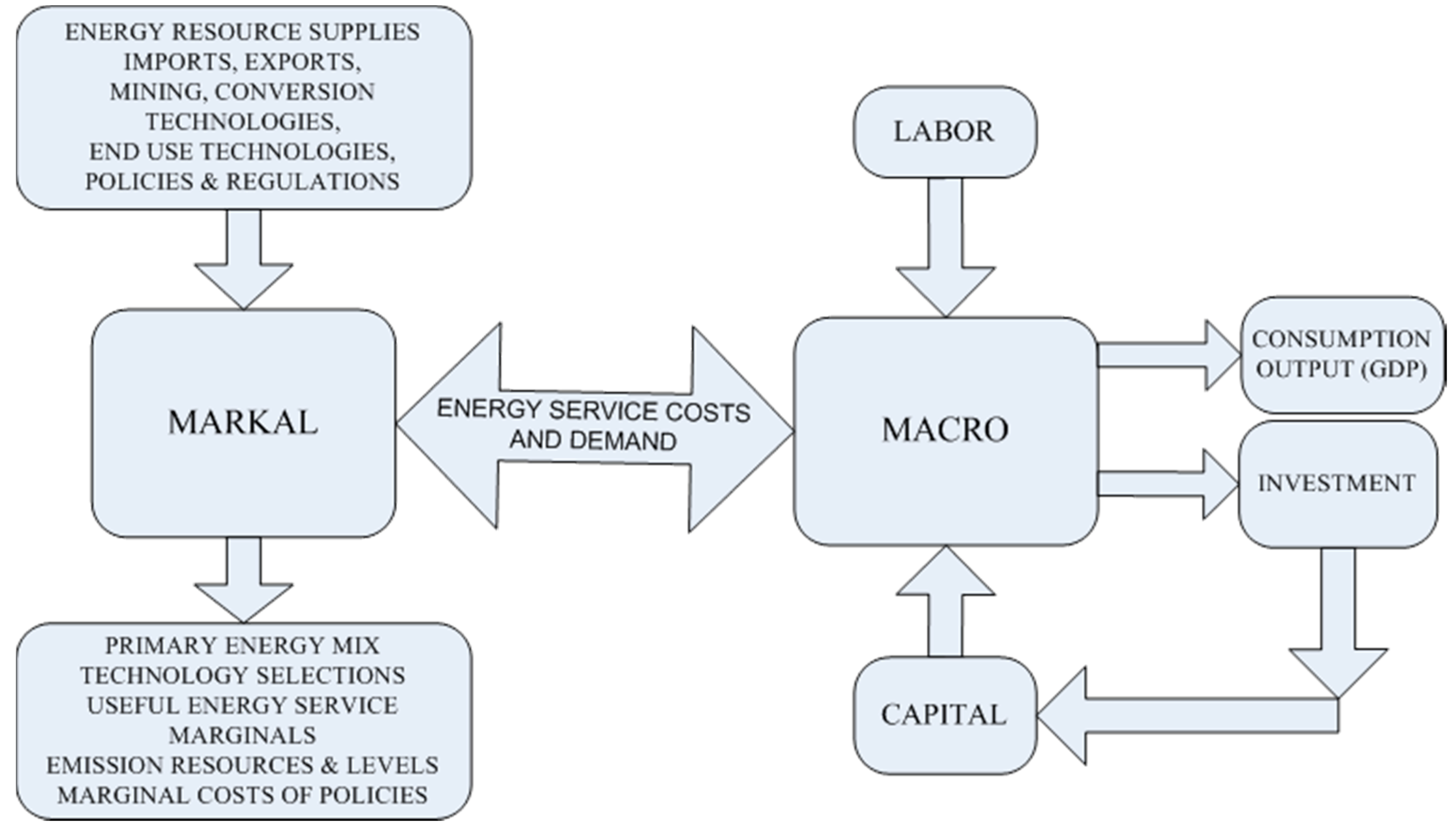

3.1. U.S. MARket ALlocation-Macro Model

3.2. Model Modifications

- supply-chain of biomass was introduced including land rents from the global trade analysis project (GTAP) model. Essentially, we captured the land rents as a result of increasing the amounts of specific biofuels demanded in that model and used those land rent responses for constructing land supply curves to be used in MARKAL;

- the biochemical conversion technologies in MARKAL were updated to the latest and most reliable available in the literature at the time of model development;

- biomass thermochemical conversion technologies were added to the model. All these changes are detailed in previous work [24];

- new data on natural gas supply was introduced to reflect the increased supply of shale gas;

- the transportation sector compressed natural gas (CNG) use has been restructured.

3.3. Macro Linkage

3.4. Model Key Parameters

4. Results

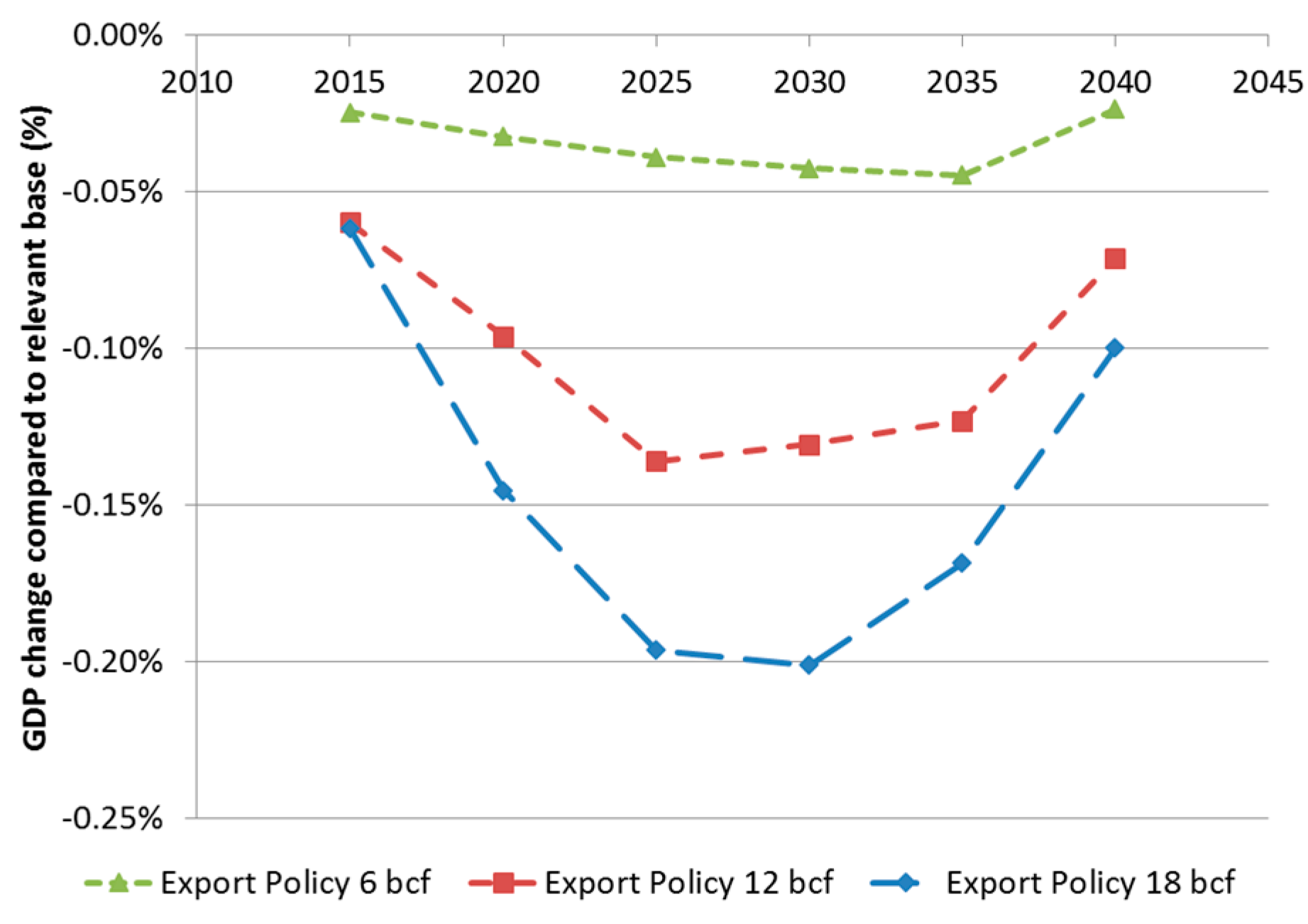

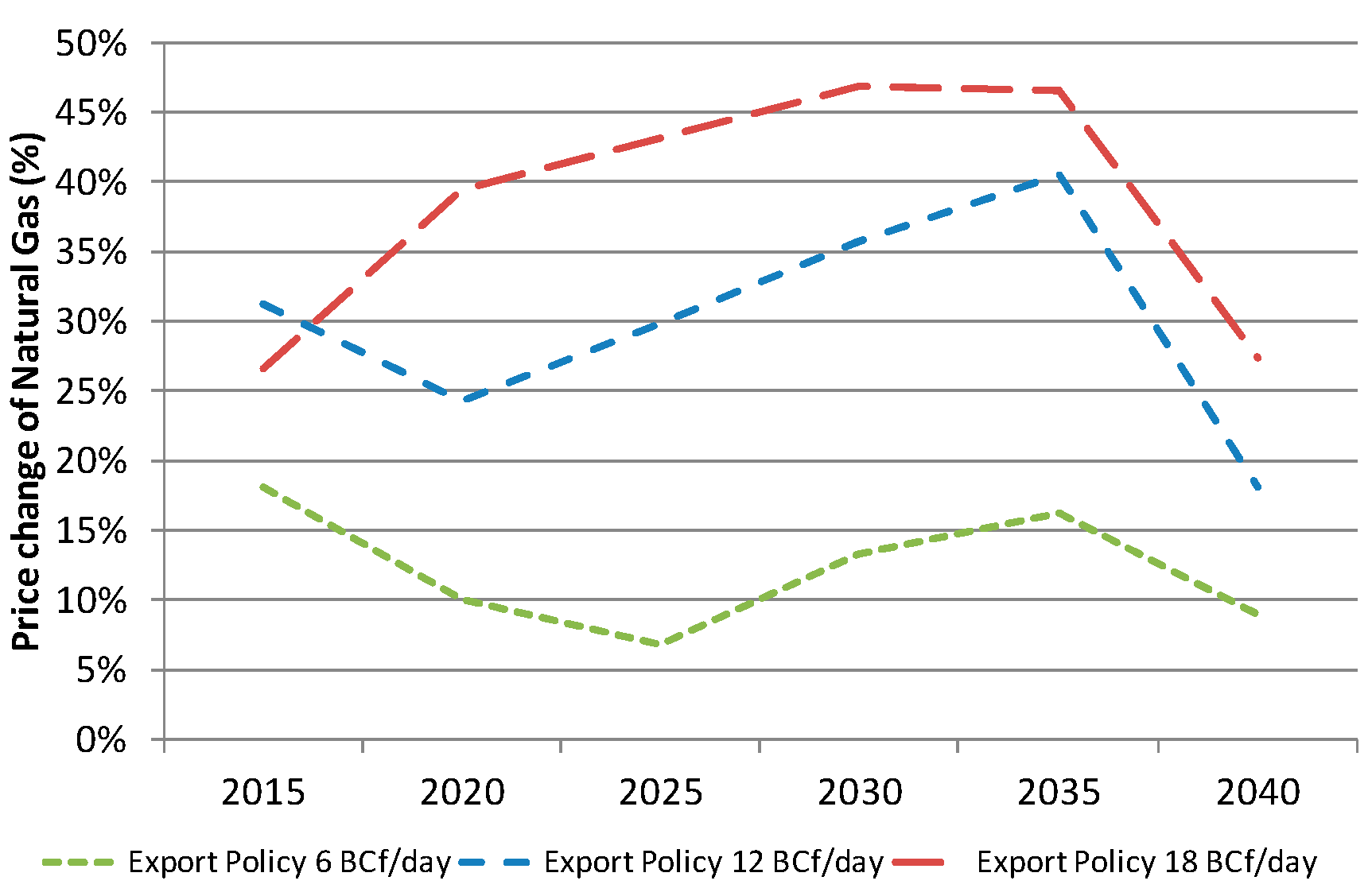

4.1. Gross Domestic Product Impacts

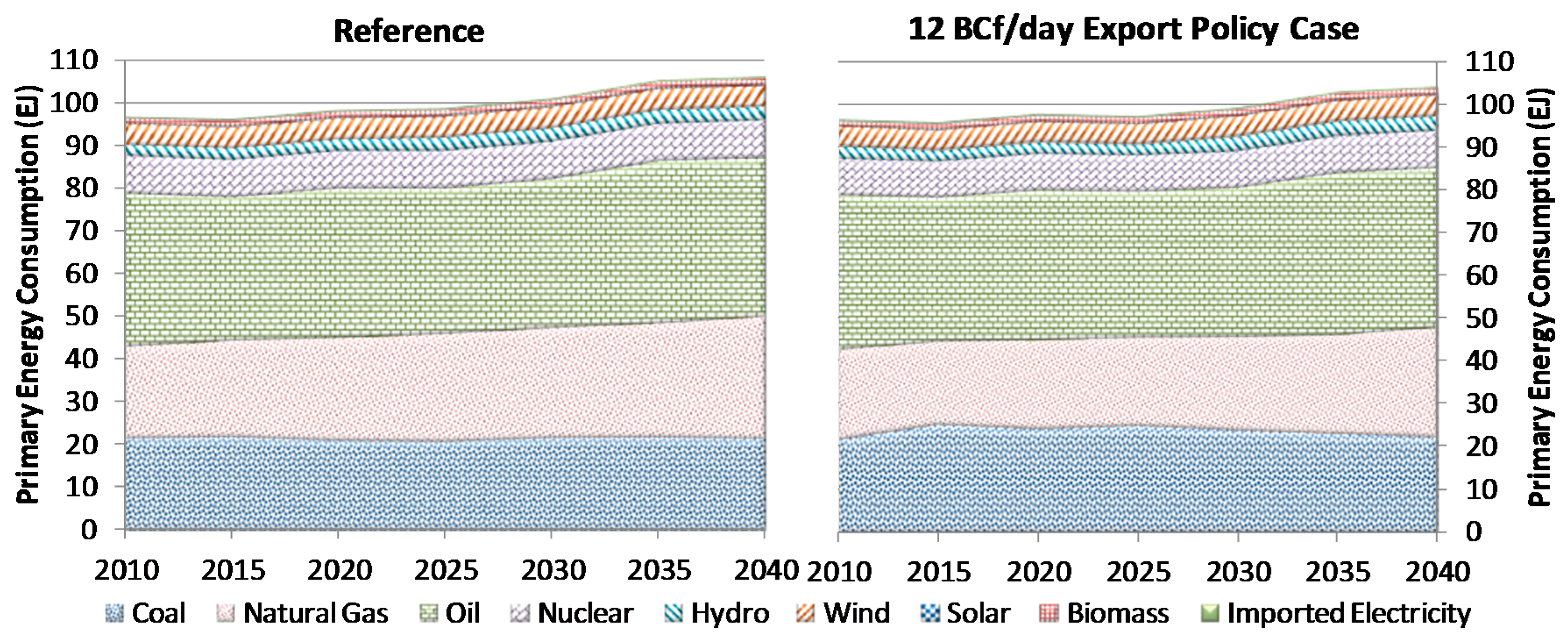

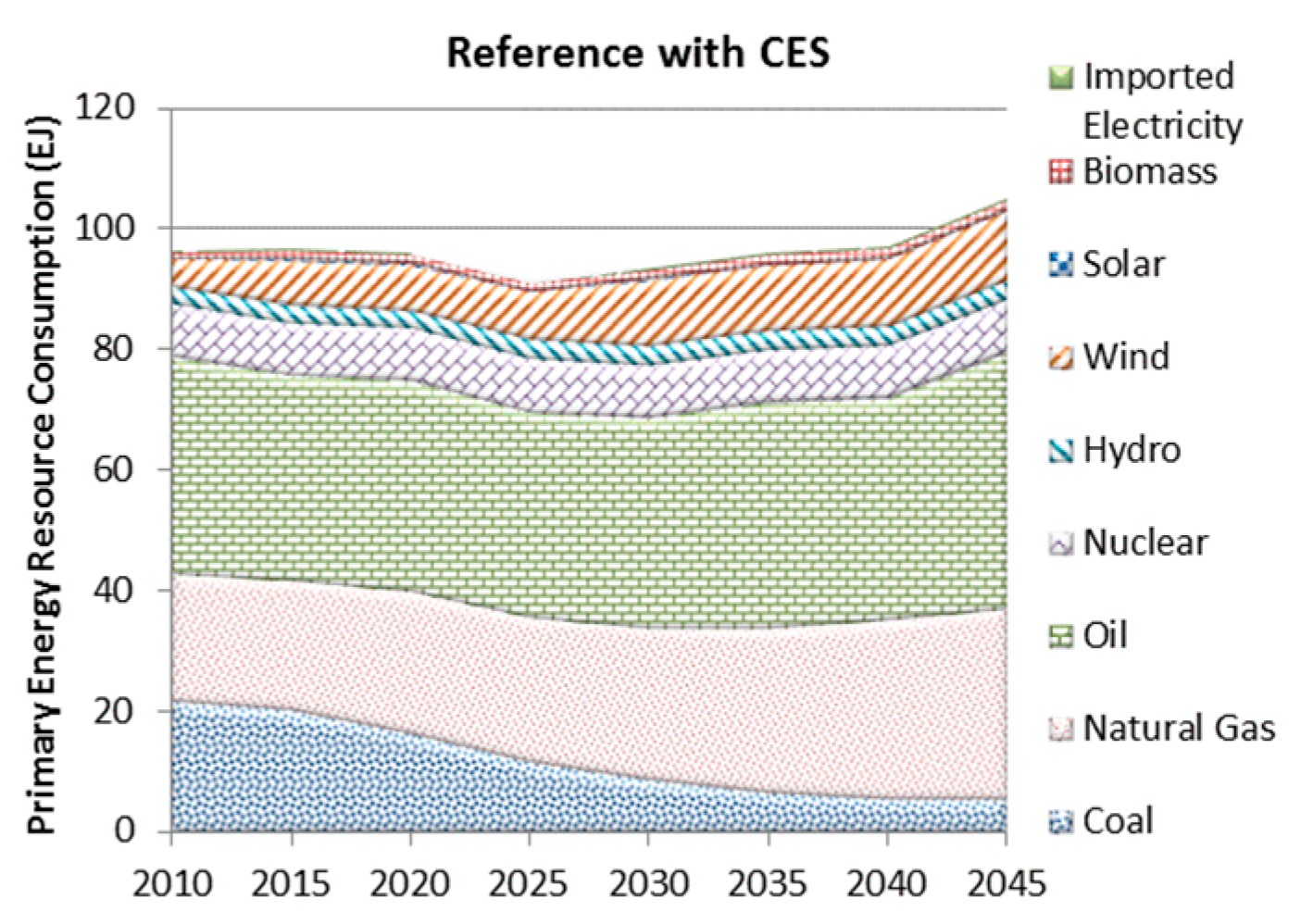

4.2. Energy Resource Mix

- (1)

- the domestic energy share for natural gas falls from 25% to 22%;

- (2)

- domestic use of coal increases from 21% to 23%;

- (3)

- the fraction of oil in total consumption increases from 36% to 37%;

- (4)

- there are small increases in nuclear and renewables (hydro, solar, wind, and biomass) as response to increased level of natural gas exports. The directions of all these changes correspond to prior expectations.

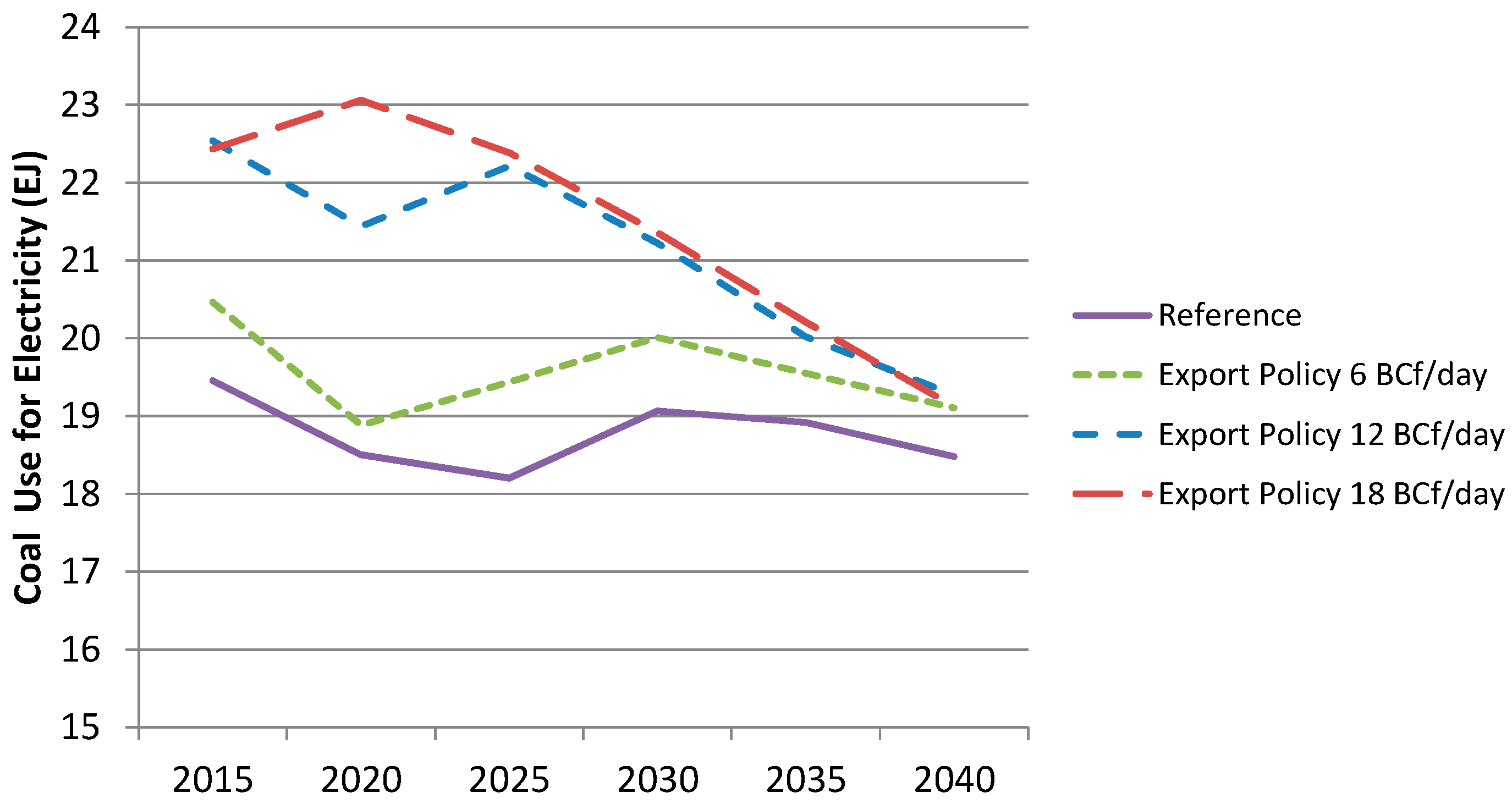

4.3. Electricity Sector Impacts

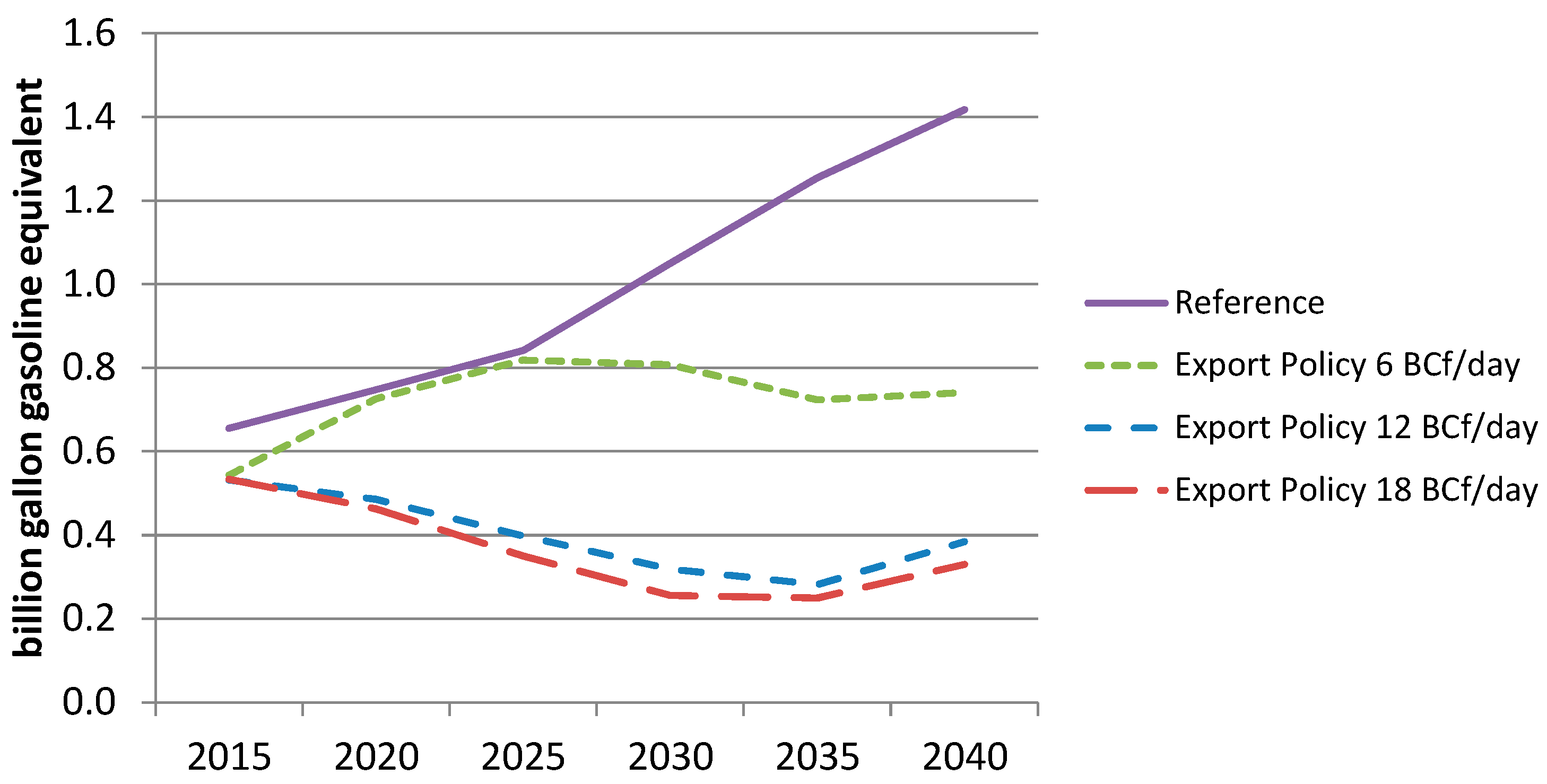

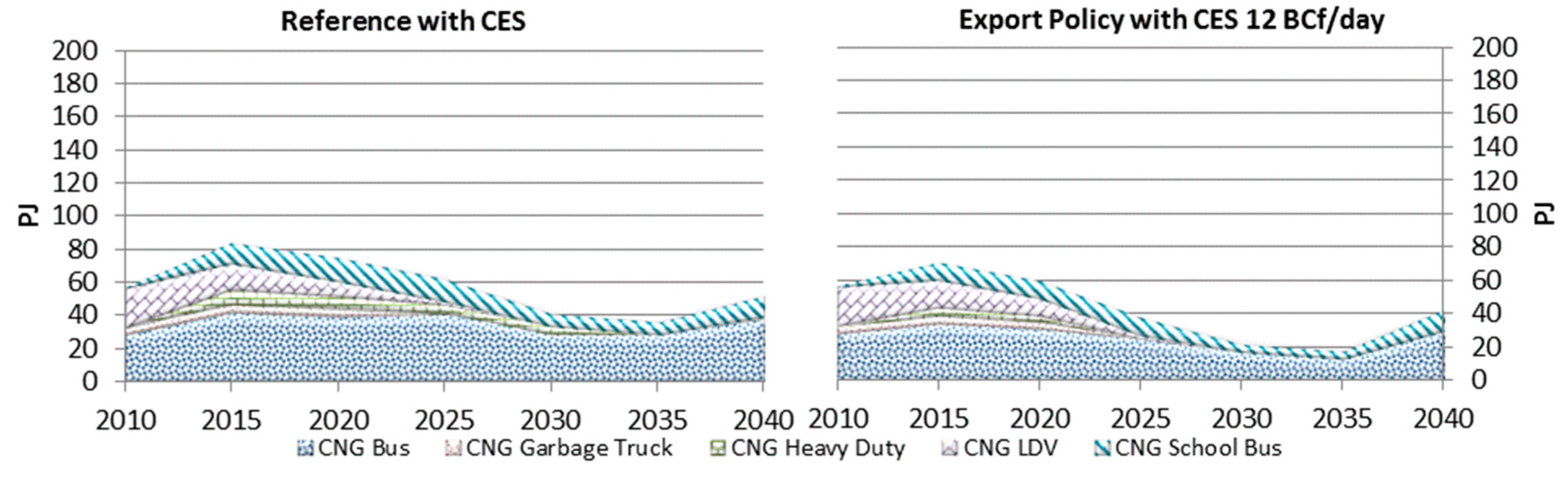

4.4. Transport Sector

4.5. Other Sectors

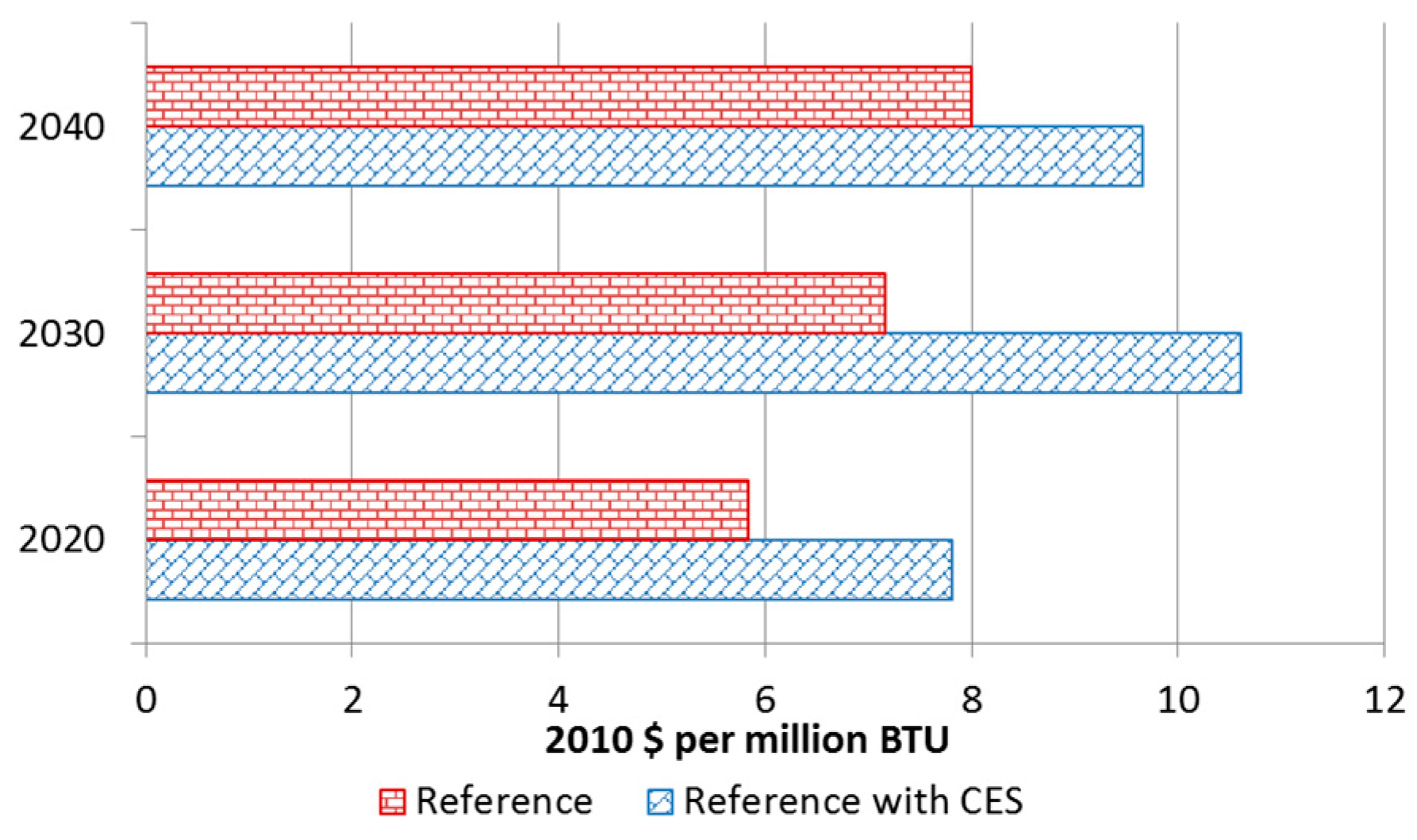

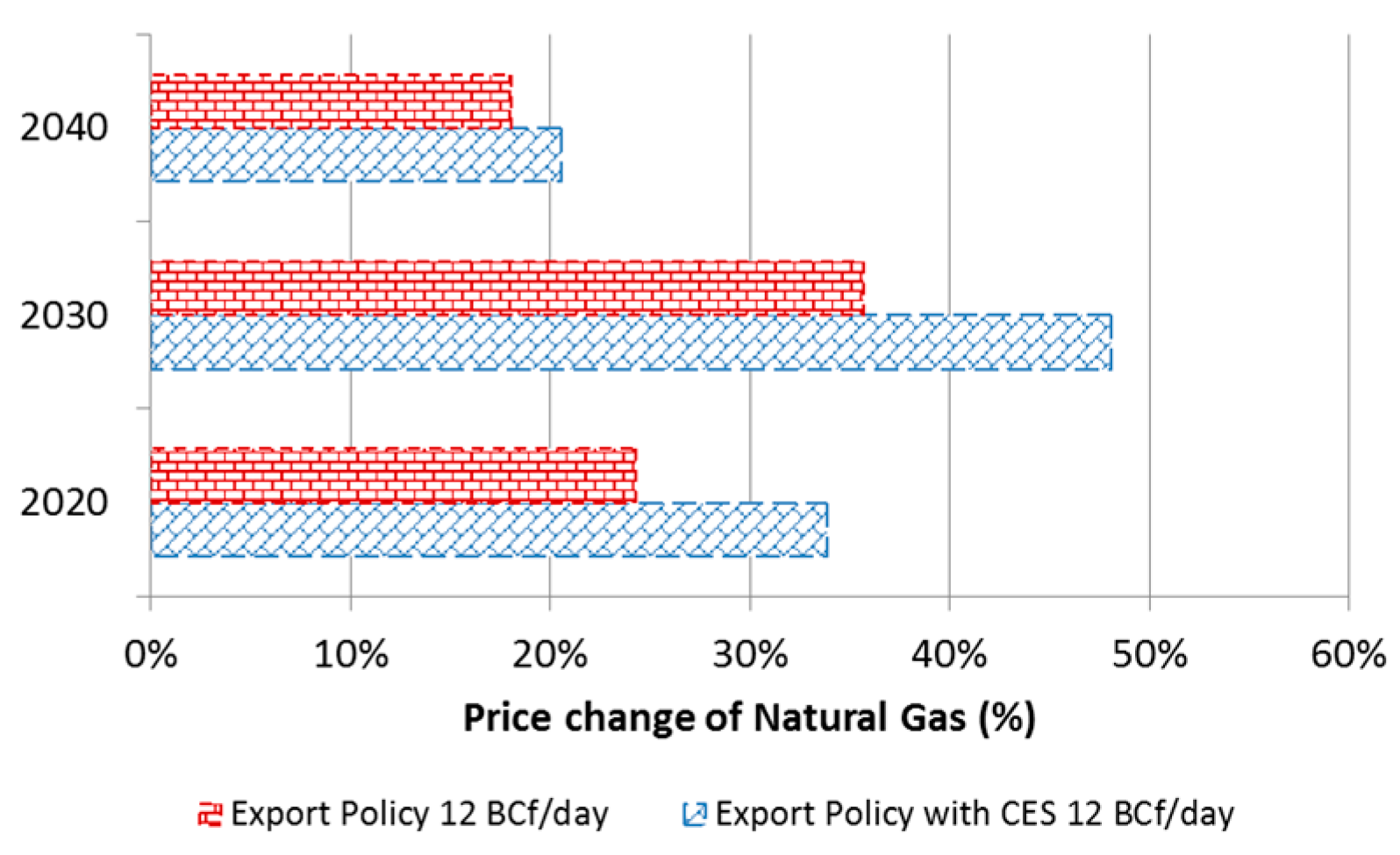

4.6. Results with Clean Energy Standard Included in Reference Case

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Energy Information Administration. Effect of Increased Natural Gas Exports on Domestic Energy Markets; U.S. Department of Energy: Washington, DC, USA, 2012.

- Kypreos, S. Assessment of CO2 reduction policies for Switzerland. Int. J. Glob. Energy Issues 1999, 12, 233–243. [Google Scholar] [CrossRef]

- Morris, S.C.; Goldstein, G.A.; Fthenakis, V.M. NEMS and MARKAL-Macro models for energy-environmental-economic analysis: A comparison of the electricity and carbon reduction projections. Environ. Model. Assess. 2002, 7, 207–216. [Google Scholar] [CrossRef]

- Morales, K.E.L.S.-R. Response from a MARKAL technology model to the EMF scenario assumptions. Energy Econ. 2004, 26, 655–674. [Google Scholar] [CrossRef]

- Chen, W. The costs of mitigating carbon emissions in China: Findings from China MARKAL-Macro modeling. Energy Policy 2005, 33, 885–896. [Google Scholar] [CrossRef]

- Chen, W.; Wu, Z.; He, J.; Gao, P.; Xu, S. Carbon emission control strategies for China: A comparative study with partial and general equilibrium versions of the China MARKAL model. Energy 2007, 32, 59–72. [Google Scholar] [CrossRef]

- Contaldi, M.; Gracceva, F.; Tosato, G. Evaluation of green-certificates policies using the MARKAL-Macro-Italy model. Energy Policy 2007, 35, 797–808. [Google Scholar] [CrossRef]

- Strachan, N.; Kannan, R. Hybrid modelling of long-term carbon reduction scenarios for the UK. Energy Econ. 2008, 30, 2947–2963. [Google Scholar] [CrossRef]

- Strachan, N.; Pye, S.; Kannan, R. The iterative contribution and relevance of modelling to UK energy policy. Energy Policy 2009, 37, 850–860. [Google Scholar] [CrossRef]

- Ko, F.-K.; Huang, C.-B.; Tseng, P.-Y.; Lin, C.-H.; Zheng, B.-Y.; Chiu, H.-M. Long-term CO2 emissions reduction target and scenarios of power sector in Taiwan. Energy Policy 2010, 38, 288–300. [Google Scholar] [CrossRef]

- NERA Economic Consulting. Macroeconomic Impacts of LNG Exports from the United States; National Economic Research Associates: Washington, DC, USA, 2012. [Google Scholar]

- Trading Economics. Available online: http://www.tradingeconomics.com/united-states/gdp (accessed on 1 January 2014).

- Gülen, G.; Browning, J.; Ikonnikova, S.; Tinker, S.W. Well economics across ten tiers in low and high Btu (British thermal unit) areas, Barnett Shale, Texas. Energy 2013, 60, 302–315. [Google Scholar] [CrossRef]

- Weijermars, R. US shale gas production outlook based on well roll-out rate scenarios. Appl. Energy 2014, 124, 283–297. [Google Scholar] [CrossRef]

- Loulou, R.; Goldstein, G.; Noble, K. Documentation for the MARKAL Family of Models. Available online: http://www.etsap.org (accessed on 1 January 2014).

- Johnson, T.L.; DeCarolis, J.F.; Shay, C.L.; Loughlin, D.H.; Gage, C.L.; Vijay, S. MARKAL Scenario Analysis of Technology Options for the Electric Sector: The Impact on Air Quality; U.S. Environmental Protection Agency: Washington, DC, USA, 2006.

- Sauthoff, A.; Meier, P.; Holloway, T. Assessment of Biodiesel Scenarios for Midwest Freight Transport Emission Reduction; CFIRE 02-10; National Center for Freight and Infrastructure Research and Education: Madison, WI, USA, 2010. [Google Scholar]

- Schafer, A.; Jacoby, H. Vehicle technology under CO2 constraint: A general equilibrium analysis. Energy Policy 2006, 34, 975–985. [Google Scholar] [CrossRef]

- Hu, M.; Hobbs, B. Analysis of multi-pollutant policies for the US power sector under technology and policy uncertainty using MARKAL. Energy 2010, 35, 5430–5442. [Google Scholar] [CrossRef]

- Department of Energy, U.S. Annual Energy Outlook 2010 with Projections to 2035; U.S. Department of Energy, Energy Information Administrator, Office of Integrated Analysis and Forecasting: Washington, DC, USA, 2010.

- Duprey, R.L. Compilation of Air Pollutant Emission Factors; U.S. Environmental Protection Agency, Office of Air Quality Planning and Standards: Raleigh, NC, USA, 1995.

- Burnham, A.; Wang, M.; Wu, Y. Development and Applications of GREET 2.7—The Transportation Vehicle-Cycle Model; Argonne National Laboratory, Energy Systems Division: Argonne, France, 2006. [Google Scholar]

- Shay, C.; DeCarolis, J.; Loughlin, D.; Gage, C.; Yeh, S.; Vijay, S.; Wright, E.L. EPA U.S. National MARKAL Database Documentation; EPA-600/R-06/057; EPA: Washington, DC, USA, 2006. [Google Scholar]

- Sarica, K.; Tyner, W.E. Analysis of US renewable fuels policies using a Modified MARKAL model. Renew. Energy 2013, 50, 701–709. [Google Scholar] [CrossRef]

- Taheripour, F.; Tyner, W.E. Global Land Use Changes and Consequent CO2 Emissions due to US Cellulosic Biofuel Program: A Preliminary Analysis; Purdue University: West Lafayette, IN, USA, 2011. [Google Scholar]

- Tyner, W.E.; Taheripour, F.; Zhuang, Q.; Birur, D.; Baldos, U. Land Use Changes and Consequent CO2 Emissions Due to US Corn Ethanol Production: A Comprehensive Analysis; Purdue University Department of Agricultural Economics: West Lafayette, IN, USA, 2011. [Google Scholar]

- The MIT Energy Initiative. The Future of Natural Gas—An Interdisciplinary MIT Study; MIT: Cambridge, MA, USA, 2011; Volume 2011. [Google Scholar]

- Department of Transportation, U.S. Available online: http://www.ntdprogram.gov/ntdprogram/pubs/dt/2011/excel/DataTables.htm (accessed on 31 December 2013).

- Department of Education, U.S. Available online: http://nces.ed.gov/ccd/elsi/tableGenerator.aspx (accessed on 1 February 2014).

- Waste and Recycling News. Available online: http://www.wasterecyclingnews.com/article/99999999/DATA/307199975/hauling-disposal-ranking-2010 (accessed on 1 June 2013).

- Department of Commerce, U.S. 2002 Economic Census—Vehicle Inventory and Use Survey; EC02TV-US; US Census Bureau: Washington, DC, USA, 2004.

- Johnson, C. Business Case for Compressed Natural Gas in Municipal Fleets; NREL/TP-7A2-47919; National Renewable Energy Laboratory: Washington, DC, USA, 2010.

- Messner, S.; Schrattenholzer, L. MESSAGE-Macro: Linking an energy supply model with a macro economic model and solving itinteractively. Energy 2000, 25, 267–282. [Google Scholar] [CrossRef]

- Gillingham, K.; Palmer, K. Bridging the Energy Efficiency Gap: Insights for Policy from Economic Theory and Empirical Analysis; Oxford University Press: Oxford, UK, 2013. [Google Scholar]

| Energy Service Demands | Average Growth | ||

|---|---|---|---|

| 2010–2020 | 2020–2030 | 2030–2045 | |

| Commercial | |||

| Cooking | 1.16% | 1.30% | 1.23% |

| Lighting | 1.36% | 1.27% | 1.24% |

| Miscellaneous use of fuels—Diesel | −0.66% | −0.20% | −0.98% |

| Miscellaneous use of fuels—Electricity | 2.46% | 2.22% | 2.28% |

| Miscellaneous use of fuels—Liquefied Petroleum Gas | 0.34% | 0.40% | 0.54% |

| Miscellaneous use of fuels—Natural gas | 0.53% | 1.42% | 0.98% |

| Miscellaneous use of fuels—Low Sulphur Residual Fuel Oil | −0.58% | 0.13% | 0.74% |

| Office Equipment | 1.80% | 1.34% | 1.80% |

| Refrigeration | 1.36% | 1.27% | 1.24% |

| Cooling | 2.11% | 1.74% | 1.48% |

| Heating | 1.06% | 1.01% | 1.03% |

| Ventilation | 1.36% | 1.27% | 1.24% |

| Water heating | 1.36% | 1.27% | 1.24% |

| Industry | |||

| Chemical | 0.26% | −0.97% | −0.38% |

| Food | 1.92% | 1.61% | 1.67% |

| Primary metals | 2.80% | −1.90% | −0.61% |

| Non-Metallic | 2.19% | 0.49% | 0.59% |

| Paper | 1.33% | 0.48% | 0.61% |

| Transport vehicles | 0.28% | 2.82% | 1.93% |

| Aggregate Non-Manufacturing | −0.09% | −0.51% | −0.22% |

| Other Sector | 2.99% | 1.31% | 1.65% |

| Residential | |||

| Freezing | 1.40% | 0.99% | 1.14% |

| Lighting | 1.93% | 1.42% | 1.03% |

| Refrigeration | 1.29% | 1.61% | 1.30% |

| Cooling | 1.70% | 0.58% | 0.50% |

| Heating | 1.04% | 1.00% | 0.80% |

| Water Heating | 0.83% | 1.14% | 0.74% |

| Other Appliances—Electricity | 1.62% | 0.27% | −0.10% |

| Other Appliances—Natural Gas | 0.47% | −0.19% | −0.56% |

| Transportation | |||

| Air | 1.61% | 0.98% | 1.35% |

| Bus | 1.16% | 1.09% | 1.12% |

| Truck | 1.93% | 1.42% | 1.34% |

| High duty vehicle | 2.33% | 1.82% | 1.75% |

| Light duty vehicle | 1.83% | 1.83% | 0.69% |

| Offroad diesel | 0.16% | 0.16% | 0.16% |

| Offroad gasoline | 0.18% | 0.18% | 0.18% |

| Rail—Freight | 1.34% | 0.74% | 0.63% |

| Rail passenger | 1.52% | 1.15% | 1.24% |

| Shipping | 1.00% | 0.75% | 0.67% |

| Energy Source | Reference | 6 BCF/Day | 12 BCF/Day | 18 BCF/Day |

|---|---|---|---|---|

| Coal | 20.7% | 21.6% | 22.3% | 22.6% |

| Natural gas | 25.2% | 23.8% | 22.5% | 22.0% |

| Oil | 36.1% | 36.4% | 36.8% | 37.0% |

| Nuclear | 8.3% | 8.4% | 8.5% | 8.5% |

| Renewables | 9.3% | 9.4% | 9.5% | 9.6% |

| Electricity imports | 0.3% | 0.3% | 0.3% | 0.3% |

| Sector | Primary Metals | Non-Metallic | Paper | Chemical |

|---|---|---|---|---|

| 6 BCF/day | −1.4% | −2.2% | −0.8% | −1.8% |

| 12 BCF/day | −3.0% | −3.1% | −2.0% | −2.4% |

| 18 BCF/day | −4.0% | −3.5% | −2.8% | −3.8% |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sarıca, K.; Tyner, W.E. Economic Impacts of Increased U.S. Exports of Natural Gas: An Energy System Perspective. Energies 2016, 9, 401. https://doi.org/10.3390/en9060401

Sarıca K, Tyner WE. Economic Impacts of Increased U.S. Exports of Natural Gas: An Energy System Perspective. Energies. 2016; 9(6):401. https://doi.org/10.3390/en9060401

Chicago/Turabian StyleSarıca, Kemal, and Wallace E. Tyner. 2016. "Economic Impacts of Increased U.S. Exports of Natural Gas: An Energy System Perspective" Energies 9, no. 6: 401. https://doi.org/10.3390/en9060401

APA StyleSarıca, K., & Tyner, W. E. (2016). Economic Impacts of Increased U.S. Exports of Natural Gas: An Energy System Perspective. Energies, 9(6), 401. https://doi.org/10.3390/en9060401