Optimal Residential Battery Storage Sizing Under ToU Tariffs and Dynamic Electricity Pricing

Abstract

1. Introduction

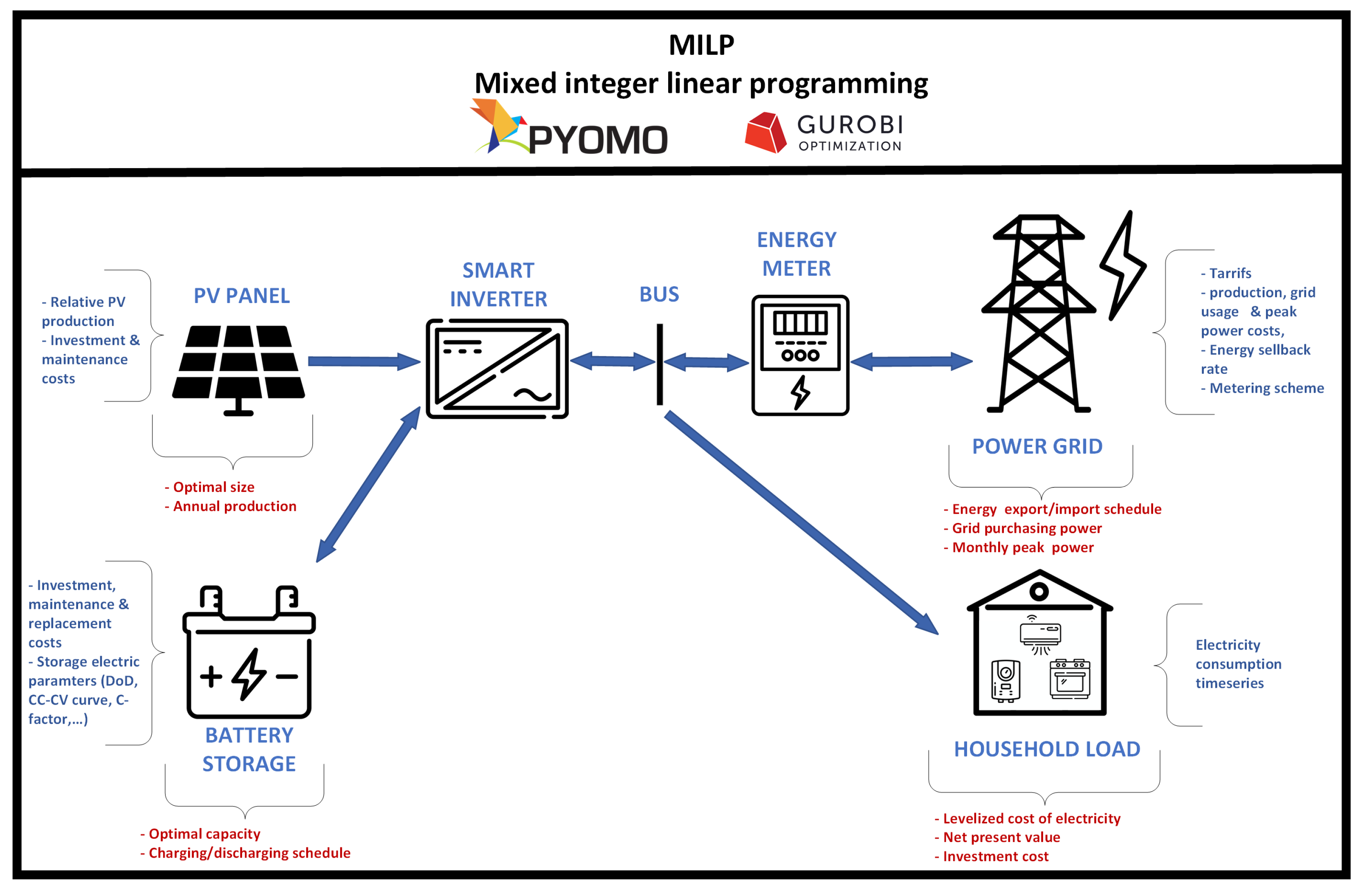

2. Mathematical Model

- The model can run on a centralized smart home management unit, which computes the optimal operation plan and sends setpoints to the smart inverter.

- Alternatively, the smart inverter’s onboard processing unit can execute the model directly if equipped with sufficient computational resources and real-time data inputs.

2.1. Objective Function

- Power supply investment decision variables: PV plant investment (, ), BSS; investment (, ), grid connection purchase power ()

- Consumer power supply variables: PV plant production (), BSS operation (, , , ), grid supply and associated costs (, , ).

2.2. Investment and Loan Costs

2.3. Maintenance and Replacement Costs

2.4. Energy Costs and Profits

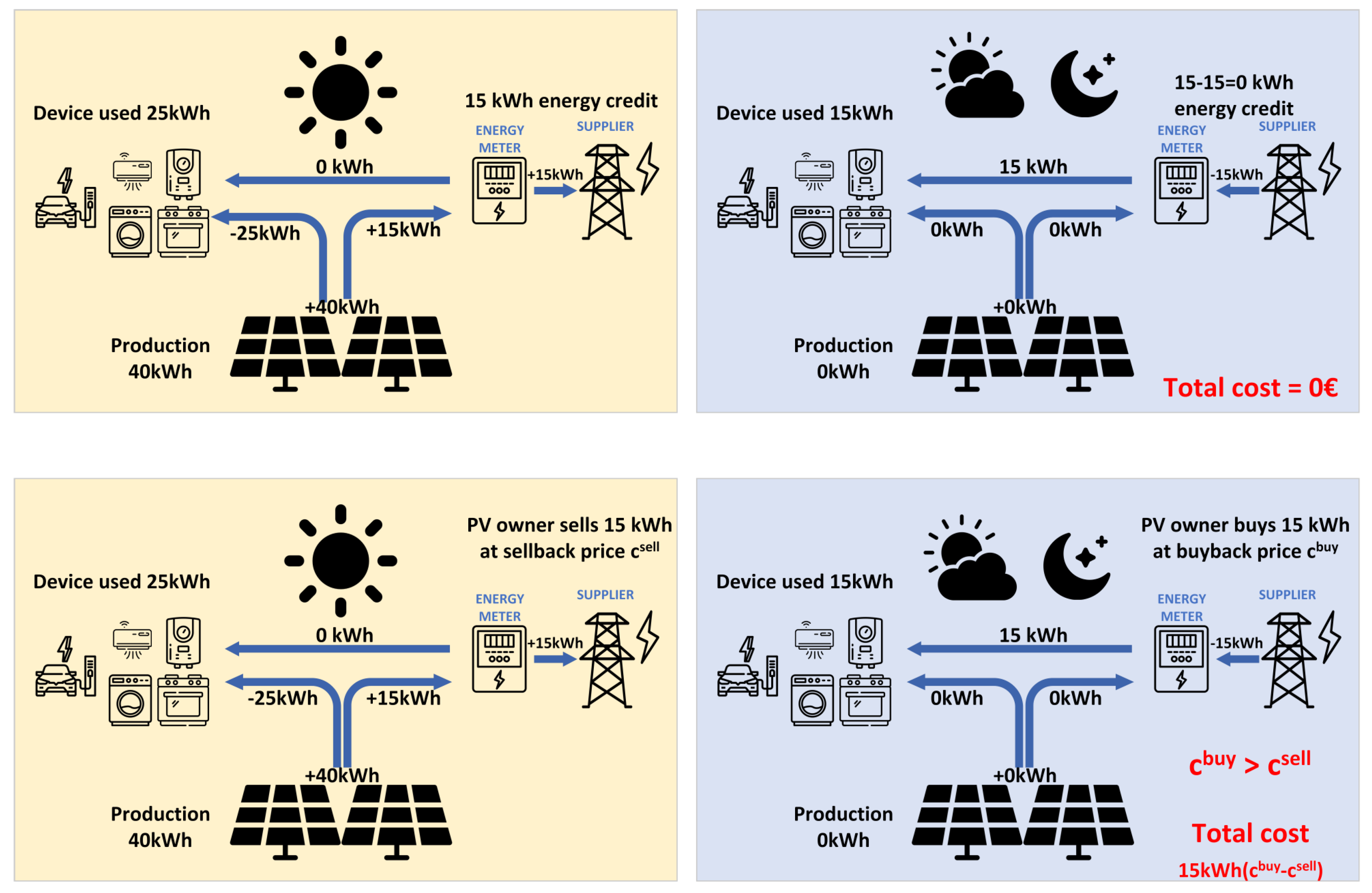

- Monthly net metering/billing: Under a pure monthly net metering compensation mechanism, any excess electricity produced by a PV system that is delivered to the grid is credited at the same retail rate that the customer would pay for electricity consumption. This means that for every kilowatt-hour (kWh) exported, the consumer receives a full kWh credit that can offset future electricity consumption from the grid. In Croatia, suppliers use a less common approach that combines both net metering and net billing simultaneously. Consumers receive full retail credits (net metering) for the portion of exported electricity equal to the amount of monthly imported electricity, but after this threshold is reached, any further excess energy is compensated at the lower rate (currently 80% of the energy retail rate [26]).

- 15 min interval net billing: Under the 15 min net billing compensation mechanism, excess electricity exported to the grid is compensated at a lower rate, rather than the full retail price. The customer is then billed separately for the electricity consumed from the grid at the standard retail rate. This often results in lower financial benefits compared to monthly net metering.

2.5. Battery Storage and PV Plant Operation

3. Case Study

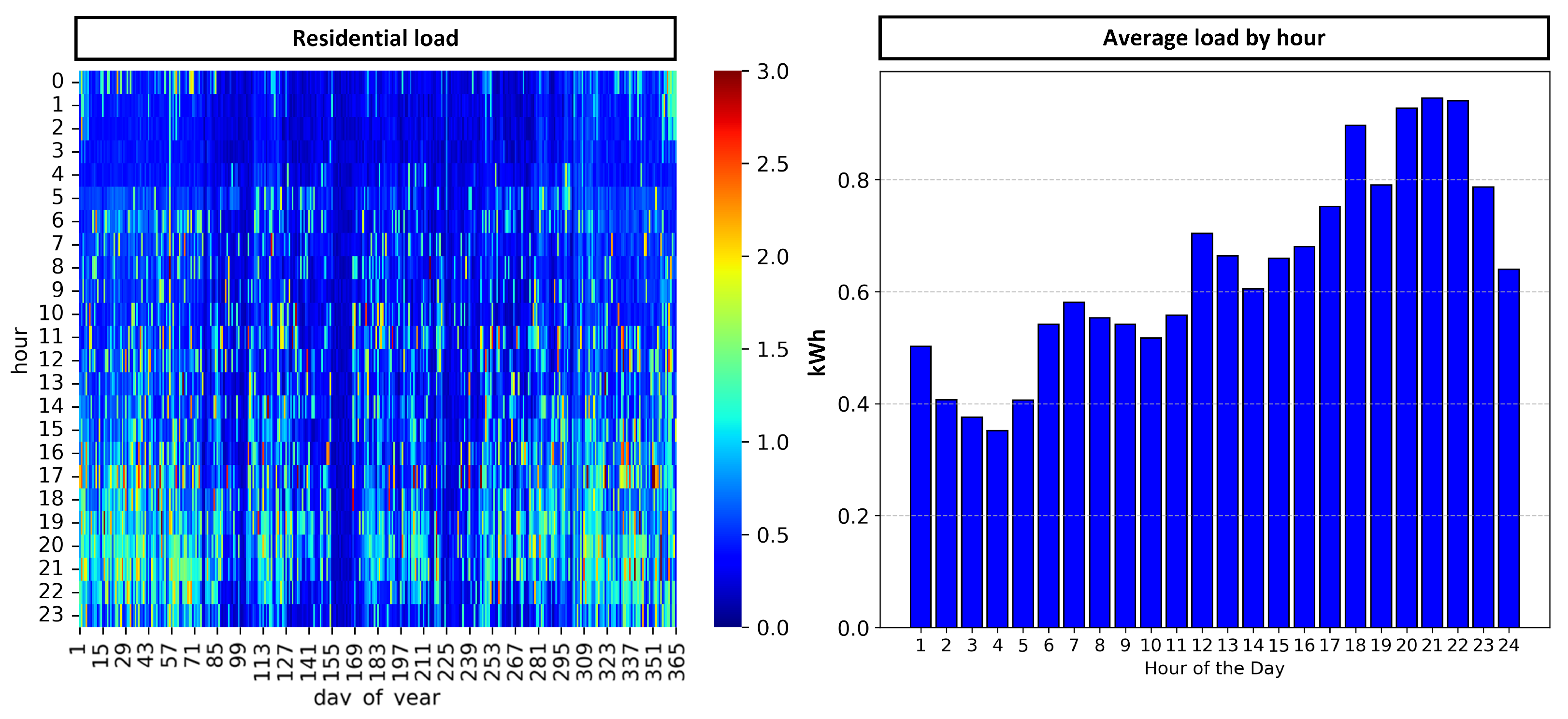

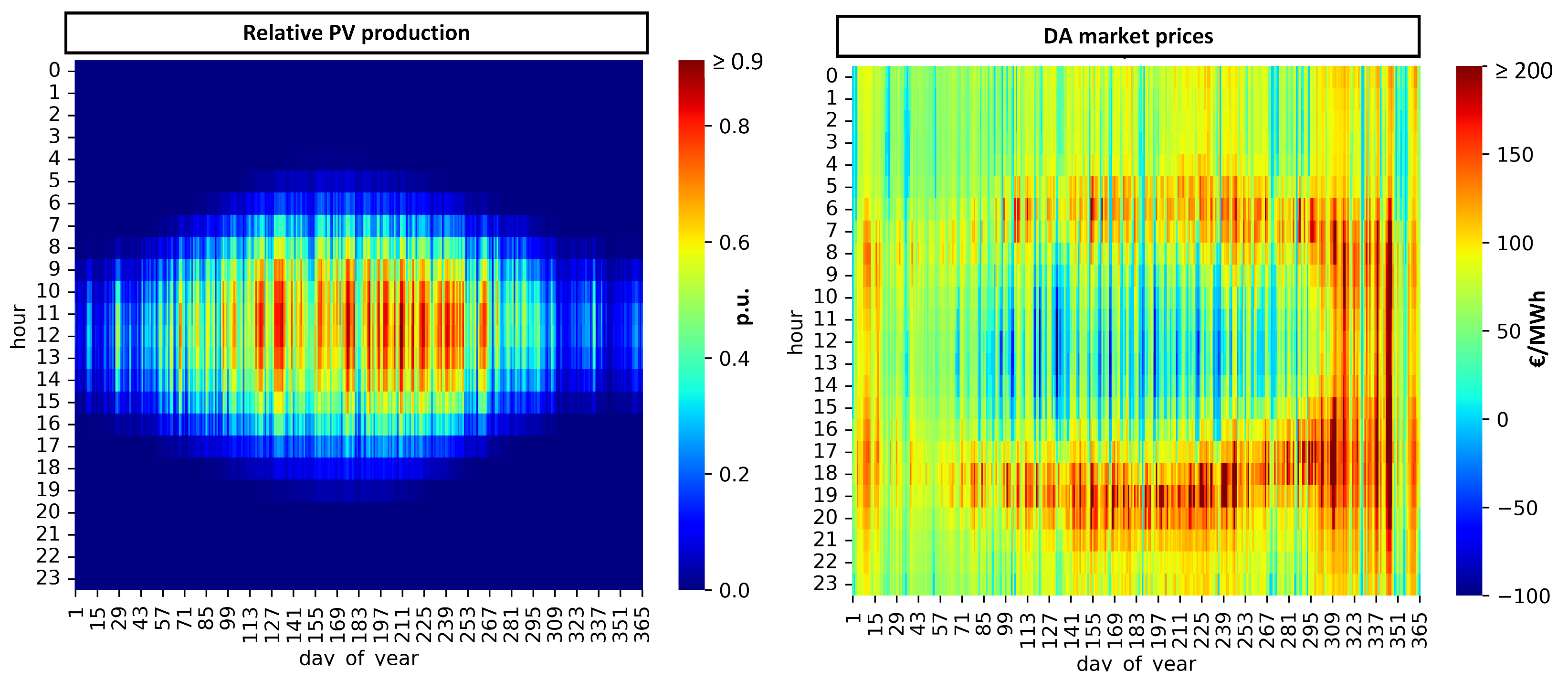

3.1. Input Data Description

3.2. Numerical Results and Discussion

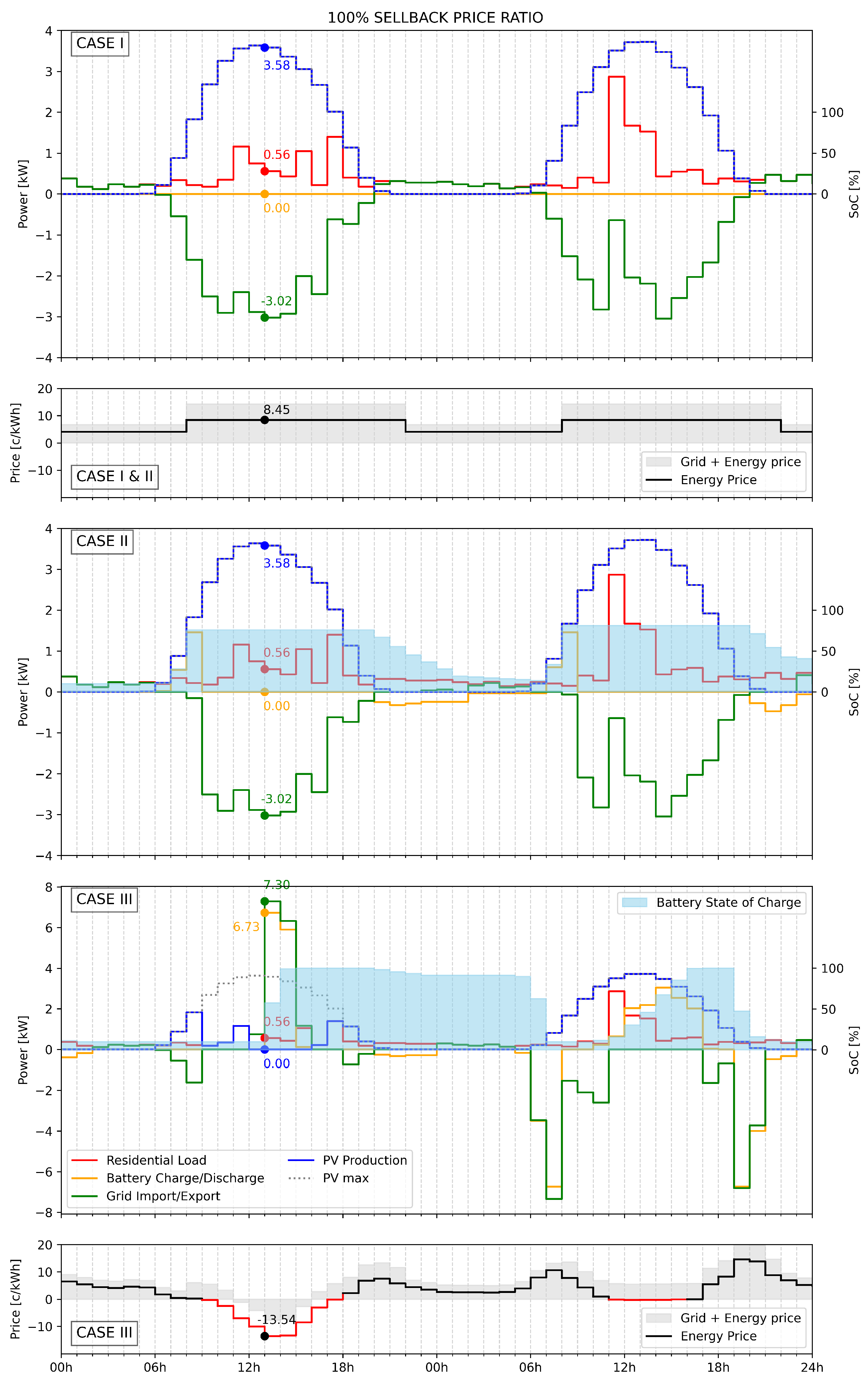

- CASE I—involves a monthly net metering/billing scheme with ToU tariff prices that is currently used in most residential grid-connected PV systems in Croatia;

- CASE II—involves a 15 min net billing scheme with ToU tariff prices that is usually used for industrial grid-connected PV prosumers in Croatia;

- CASE III—involves a 15 min net billing scheme with dynamic day-ahead market prices.

- Limiting the output of the PV system to avoid exporting energy at a loss;

- Utilizing BSS to store surplus energy for later use or sale when market conditions are more favorable.

- Energy purchased at negative/low prices can be stored and later sold during peak price periods, creating an arbitrage opportunity. With the increase in the relative sellback price (), the profit from arbitrage opportunity increases.

- A larger BSS capacity allows for greater energy manipulation, potentially increasing income through strategic buying and selling.

- The ability to store more energy provides a buffer against price volatility on a daily basis and enhances system flexibility to handle/market PV production surplus.

- The average DA market prices are higher than the current regulated ToU tariff prices in Croatia;

- The analysis assumes that the consumer load pattern remains unchanged under the dynamic pricing tariff, similar to the load pattern observed under the ToU tariff.

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| Sets | |

| Set of all optimization problem variables | |

| T | Time instances set |

| M | Month set |

| Y | Lifetime year set |

| L | Loan payback period year set |

| Time instance duration | |

| Parameters | |

| Load at time step t | |

| Total annual load | |

| Total energy demand on annual basis | |

| d | Discount rate |

| PV plant variable costs per kW installed | |

| BSS variable costs per kWh | |

| Grid connection variable cost per kW contracted | |

| f | Portion of total investment financed through a loan |

| Energy surplus price to energy production price ratio | |

| Energy production costs in high tariff | |

| Energy production costs in low tariff | |

| Grid usage costs in high tariff | |

| Grid usage costs in low tariff | |

| RES support tax price | |

| Value-added tax | |

| Grid peak power costs | |

| r | Fixed annual growth rate |

| PV plant maintenance costs | |

| BSS maintenance costs | |

| k | Loan interest rate |

| Battery replacement costs | |

| z | BSS battery replacement year |

| PV plant maximum install power | |

| Relative PV plant production at time step t | |

| Initial BSS state of charge | |

| Maximum BSS energy capacity | |

| Charging efficiency | |

| Discharging efficiency | |

| Inverter efficiency | |

| BSS depth of discharge limit | |

| BSS maximum charging–discharging power | |

| Variations in BSS charging penalty | |

| Variables | |

| BSS maximum charging power at time step t | |

| Optimal PV plant install power | |

| PV plant power production at time step t | |

| BSS C factor | |

| Optimal BSS energy capacity | |

| BSS binary investment decision variable | |

| PV plant binary investment decision variable | |

| Binary variable indicating net energy surplus/deficit for month m at high tariff | |

| Binary variable indicating net energy surplus/deficit for month m at low tariff | |

| BSS energy state at time step t | |

| BSS charging power at time step t | |

| BSS discharging power at time step t | |

| BSS charging ramp rate power at time step t | |

| Power imported from grid at time step t | |

| Power exported to grid at time step t | |

| Total exported and imported grid power at time step t | |

| Monthly grid peak power at month m | |

| Grid connection purchase power | |

| Net energy at high tariff for month m | |

| Net energy at low tariff for month m | |

| Total energy exported to grid at high tariff for month m | |

| Total energy imported from grid at high tariff for month m | |

| Total energy exported to grid at low tariff for month m | |

| Total energy imported from grid at low tariff for month m | |

| Total net present cost | |

| Investment costs | |

| Total electric energy costs for the considered period | |

| Present value of total electric energy costs (energy + grid usage + peak power costs) | |

| Total maintenance cost | |

| Present value of total equipment maintenance costs | |

| PV plant maintenance cost | |

| BSS maintenance cost | |

| Battery replacement cost | |

| The electric energy cost for month m | |

| Present value of loan costs | |

| Annuity cost for loan | |

| Annual variations in the BSS charging cost | |

| Variations in the BSS charging total cost |

References

- Zhang, N.; Leibowicz, B.D.; Hanasusanto, G.A. Optimal Residential Battery Storage Operations Using Robust Data-Driven Dynamic Programming. IEEE Trans. Smart Grid 2020, 11, 1771–1780. [Google Scholar] [CrossRef]

- Mohamed, A.A.R.; Best, R.J.; Liu, X.; Morrow, D.J. Residential Battery Energy Storage Sizing and Profitability in the Presence of PV and EV. In Proceedings of the 2021 IEEE Madrid PowerTech, Madrid, Spain, 28 June–2 July 2021; pp. 1–6. [Google Scholar] [CrossRef]

- World Bank. Economic Analysis of Battery Energy Storage Systems; Technical Report; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Nottrott, A.; Kleissl, J.; Washom, B. Energy dispatch schedule optimization and cost benefit analysis for grid-connected, photovoltaic-battery storage systems. Renew. Energy 2013, 55, 230–240. [Google Scholar] [CrossRef]

- Guidara, I.; Tina, G.M.; Souissi, A.; Chaabene, M. Techno-economic adequacy for PV-Battery sizing of a residential grid-connected installation. In Proceedings of the 2020 11th International Renewable Energy Congress (IREC), Hammamet, Tunisia, 29–31 October 2020; pp. 1–5. [Google Scholar] [CrossRef]

- Shabani, M.; Dahlquist, E.; Wallin, F.; Yan, J. Techno-economic impacts of battery performance models and control strategies on optimal design of a grid-connected PV system. Energy Convers. Manag. 2021, 245, 114617. [Google Scholar] [CrossRef]

- Pan, X.; Khezri, R.; Mahmoudi, A.; Muyeen, S. Optimal planning of solar PV and battery storage with energy management systems for Time-of-Use and flat electricity tariffs. IET Renew. Power Gener. 2022, 16, 1206–1219. [Google Scholar] [CrossRef]

- Li, J. Optimal sizing of grid-connected photovoltaic battery systems for residential houses in Australia. Renew. Energy 2019, 136, 1245–1254. [Google Scholar] [CrossRef]

- Akram, U.; Khalid, M.; Shafiq, S. Optimal sizing of a wind/solar/battery hybrid grid-connected microgrid system. IET Renew. Power Gener. 2018, 12, 72–80. [Google Scholar] [CrossRef]

- Khalilpour, R.; Vassallo, A. Planning and operation scheduling of PV-battery systems: A novel methodology. Renew. Sustain. Energy Rev. 2016, 53, 194–208. [Google Scholar] [CrossRef]

- Gitizadeh, M.; Fakharzadegan, H. Battery capacity determination with respect to optimized energy dispatch schedule in grid-connected photovoltaic (PV) systems. Energy 2014, 65, 665–674. [Google Scholar] [CrossRef]

- Ru, Y.; Kleissl, J.; Martinez, S. Storage Size Determination for Grid-Connected Photovoltaic Systems. IEEE Trans. Sustain. Energy 2013, 4, 68–81. [Google Scholar] [CrossRef]

- Aghamohamadi, M.; Mahmoudi, A.; Haque, M.H. Two-Stage Robust Sizing and Operation Co-Optimization for Residential PV–Battery Systems Considering the Uncertainty of PV Generation and Load. IEEE Trans. Ind. Inform. 2021, 17, 1005–1017. [Google Scholar] [CrossRef]

- Zhou, L.; Zhang, Y.; Lin, X.; Li, C.; Cai, Z.; Yang, P. Optimal Sizing of PV and BESS for a Smart Household Considering Different Price Mechanisms. IEEE Access 2018, 6, 41050–41059. [Google Scholar] [CrossRef]

- Yen, M.Y.C.; Tan, W.S.; Ng, W.L.; Wu, Y.K. Solar and Battery Sizing for Maximum Savings Implementation in Malaysia’s Buildings. In Proceedings of the 2021 IEEE International Future Energy Electronics Conference (IFEEC), Taipei, Taiwan, 16–19 November 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Chang, H.; Jing, F.L.; Hou, Y.L.; Chen, L.Q.; Yang, Y.J.; Liu, T.Y.; Wei, C.L.; Zhai, B.Q.; Hou, C.Y. Development of a Mathematical Model to Size the Photovoltaic and Storage Battery Based on the Energy Demand Pattern of the House. Front. Energy Res. 2022, 10, 945180. [Google Scholar] [CrossRef]

- Parray, M.T.; Martinsen, T. Multi-year analysis for optimal behind-the-meter battery storage sizing and scheduling: A Norwegian case study. J. Energy Storage 2025, 110, 115304. [Google Scholar] [CrossRef]

- Hiesl, A.; Ramsebner, J.; Haas, R. Economic viability of decentralised battery storage systems for single-family buildings up to cross-building utilisation. Smart Energy 2024, 16, 100160. [Google Scholar] [CrossRef]

- Bucciarelli, L.L. The effect of day-to-day correlation in solar radiation on the probability of loss-of-power in a stand-alone photovoltaic energy system. Solar Energy 1986, 36, 11–14. [Google Scholar] [CrossRef]

- Bucciarelli, L.L. Estimating loss-of-power probabilities of stand-alone photovoltaic solar energy systems. Solar Energy 1984, 32, 205–209. [Google Scholar] [CrossRef]

- Ofry, E.; Braunstein, A. The loss of power supply probability as a technique for designing stand-alone solar electrical (photovoltaic) systems. IEEE Trans. Power Appar. Syst. 1983, 5, 1171–1175. [Google Scholar] [CrossRef]

- Egido, M.; Lorenzo, E. The sizing of stand alone PV-system: A review and a proposed new method. Sol. Energy Mater. Sol. Cells 1992, 26, 51–69. [Google Scholar] [CrossRef]

- Hafiz, F.; Lubkeman, D.; Husain, I.; Fajri, P. Energy Storage Management Strategy Based on Dynamic Programming and Optimal Sizing of PV Panel-Storage Capacity for a Residential System. In Proceedings of the 2018 IEEE/PES Transmission and Distribution Conference and Exposition (T&D), Denver, CO, USA, 16–19 April 2018; pp. 1–9. [Google Scholar] [CrossRef]

- Mahmood, M.; Chowdhury, P.; Yeassin, R.; Hasan, M.; Ahmad, T.; Chowdhury, N.U.R. Impacts of digitalization on smart grids, renewable energy, and demand response: An updated review of current applications. Energy Convers. Manag. X 2024, 24, 100790. [Google Scholar] [CrossRef]

- Balogun, O.A.; Sun, Y.; Gbadega, P.A. Coordination of smart inverter-enabled distributed energy resources for optimal PV-BESS integration and voltage stability in modern power distribution networks: A systematic review and bibliometric analysis. e-Prime Adv. Electr. Eng. Electron. Energy 2024, 10, 100800. [Google Scholar] [CrossRef]

- Clean Energy for EU Islands Secretariat. Net Metering and Net Billing in Croatia: What It Means for the Promotion of RES Electricity. 2025. Available online: https://clean-energy-islands.ec.europa.eu/ (accessed on 20 February 2025).

- Vagropoulos, S.I.; Bakirtzis, A.G. Optimal Bidding Strategy for Electric Vehicle Aggregators in Electricity Markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Hart, W.E.; Watson, J.P.; Woodruff, D.L. Pyomo: Modeling and solving mathematical programs in Python. Math. Program. Comput. 2011, 3, 219–260. [Google Scholar] [CrossRef]

- Gurobi Optimization, LLC. Gurobi Optimizer Reference Manual. Gurobi Optimization, LLC. 2024. Available online: https://docs.gurobi.com/projects/optimizer/en/current/index.html (accessed on 15 January 2025).

- HEP Operator Distribucijskog Sustava d.o.o. (HEP ODS). Tariff Rates (Prices) for Households. 2025. Available online: https://www.hep.hr/ods/korisnici/kucanstvo/tarifne-stavke-cijene/160# (accessed on 19 February 2025).

- Croatian Energy Regulatory Agency (HERA). Annual Report for 2022. 2023. Available online: https://www.hera.hr/en/html/annual_reports.html (accessed on 18 February 2025).

- Cole, W.; Karmakar, A. Cost Projections for Utility-Scale Battery Storage: 2023 Update; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2023. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jakus, D.; Novaković, J.; Vasilj, J.; Jolevski, D. Optimal Residential Battery Storage Sizing Under ToU Tariffs and Dynamic Electricity Pricing. Energies 2025, 18, 2391. https://doi.org/10.3390/en18092391

Jakus D, Novaković J, Vasilj J, Jolevski D. Optimal Residential Battery Storage Sizing Under ToU Tariffs and Dynamic Electricity Pricing. Energies. 2025; 18(9):2391. https://doi.org/10.3390/en18092391

Chicago/Turabian StyleJakus, Damir, Joško Novaković, Josip Vasilj, and Danijel Jolevski. 2025. "Optimal Residential Battery Storage Sizing Under ToU Tariffs and Dynamic Electricity Pricing" Energies 18, no. 9: 2391. https://doi.org/10.3390/en18092391

APA StyleJakus, D., Novaković, J., Vasilj, J., & Jolevski, D. (2025). Optimal Residential Battery Storage Sizing Under ToU Tariffs and Dynamic Electricity Pricing. Energies, 18(9), 2391. https://doi.org/10.3390/en18092391