A Study on the Price Transmission Mechanism of Environmental Benefits for Green Electricity in the Carbon Market and Green Certificate Markets: A Case Study of the East China Power Grid

Abstract

:1. Introduction

2. Domestic and International Research Status

2.1. Green Electricity Pricing Mechanism

2.2. The Operational Mechanisms of the Carbon Trading and Green Certificate Markets

2.3. The Interactions and Price Signal Transmission Between the Carbon Trading, Green Certificate, and Green Electricity Markets

3. Analysis of the Impact of the Carbon Market and Green Certificate Market on Green Electricity Prices

3.1. Methodology

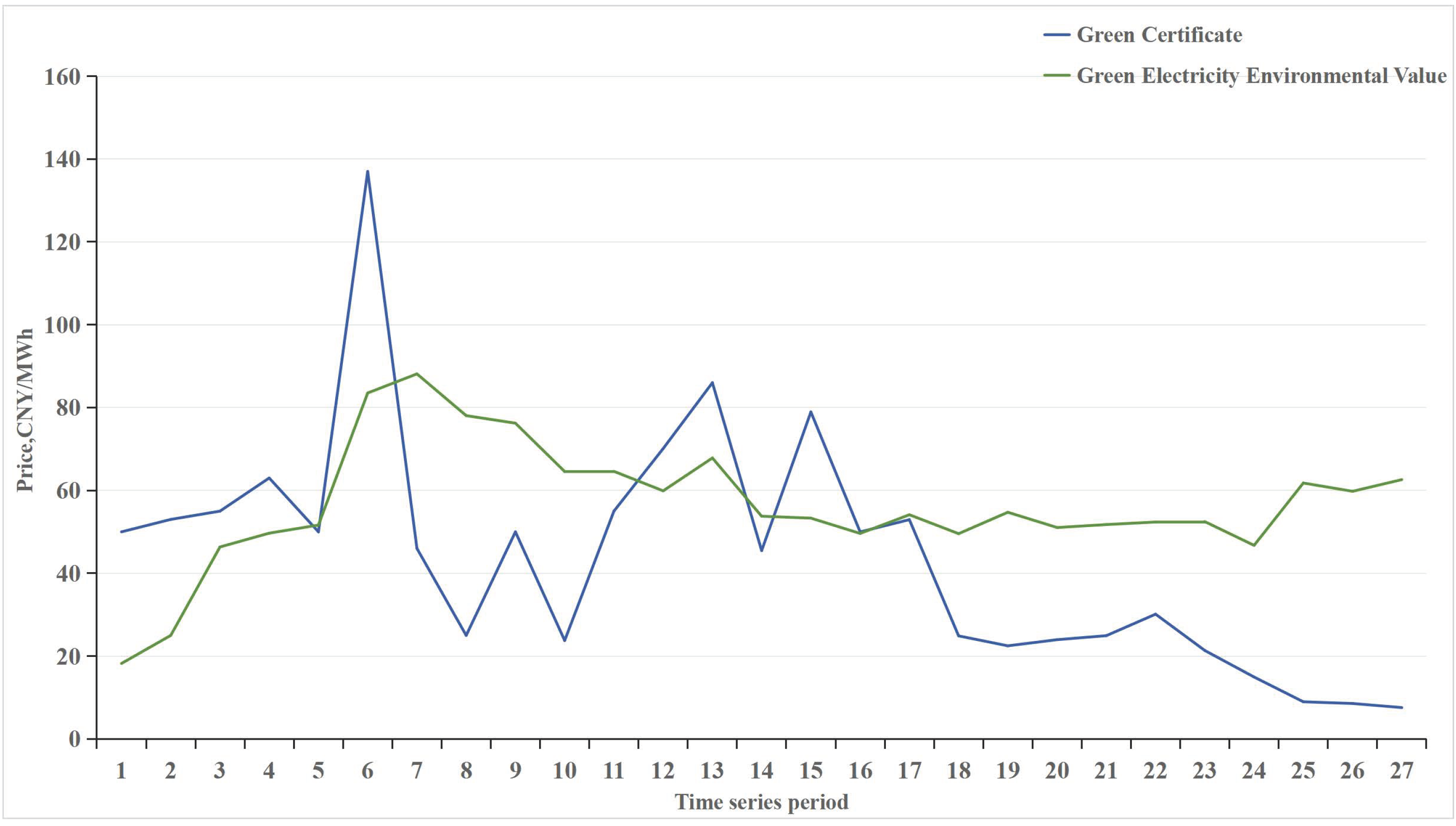

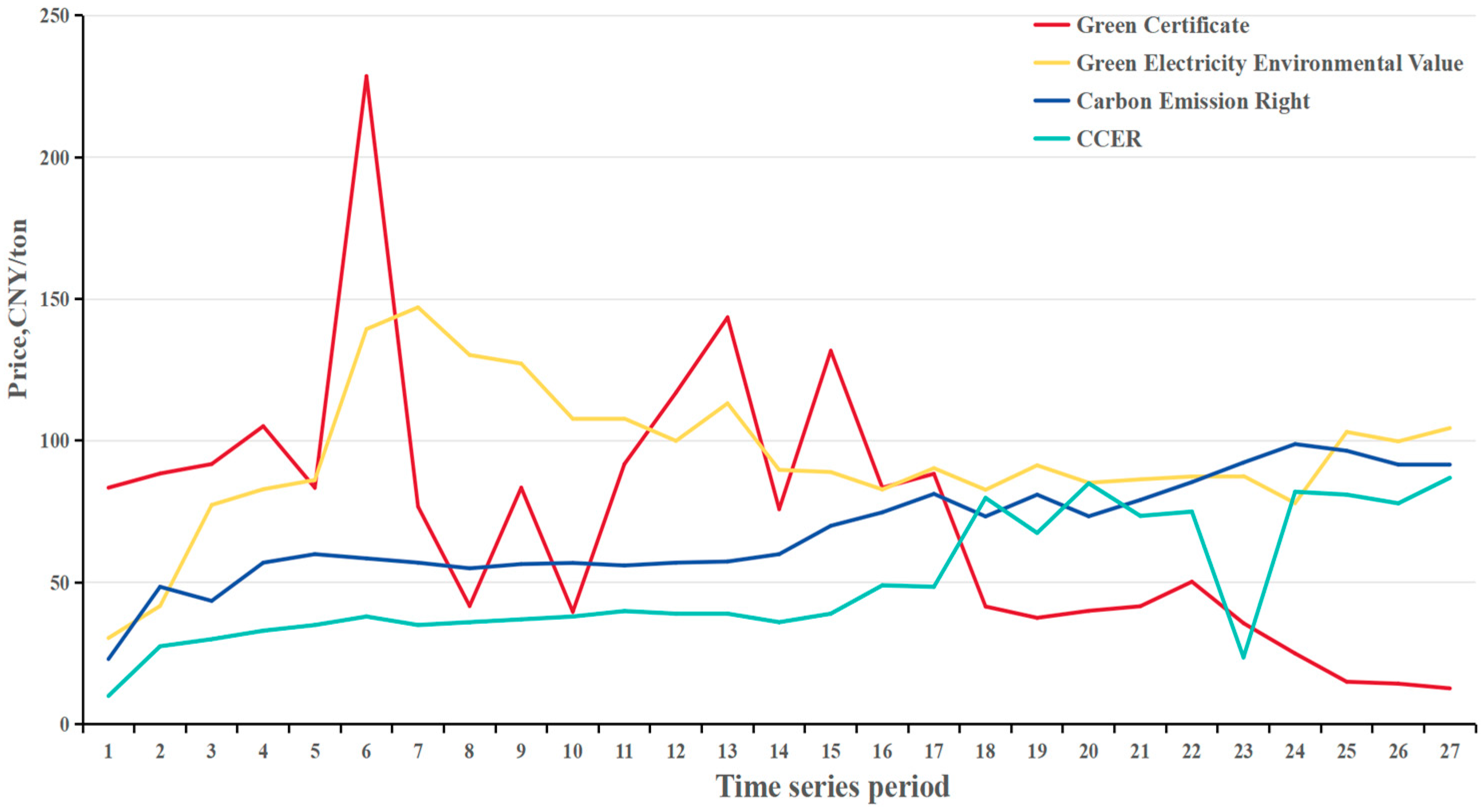

3.2. Data Analysis

3.3. Correlation Analysis

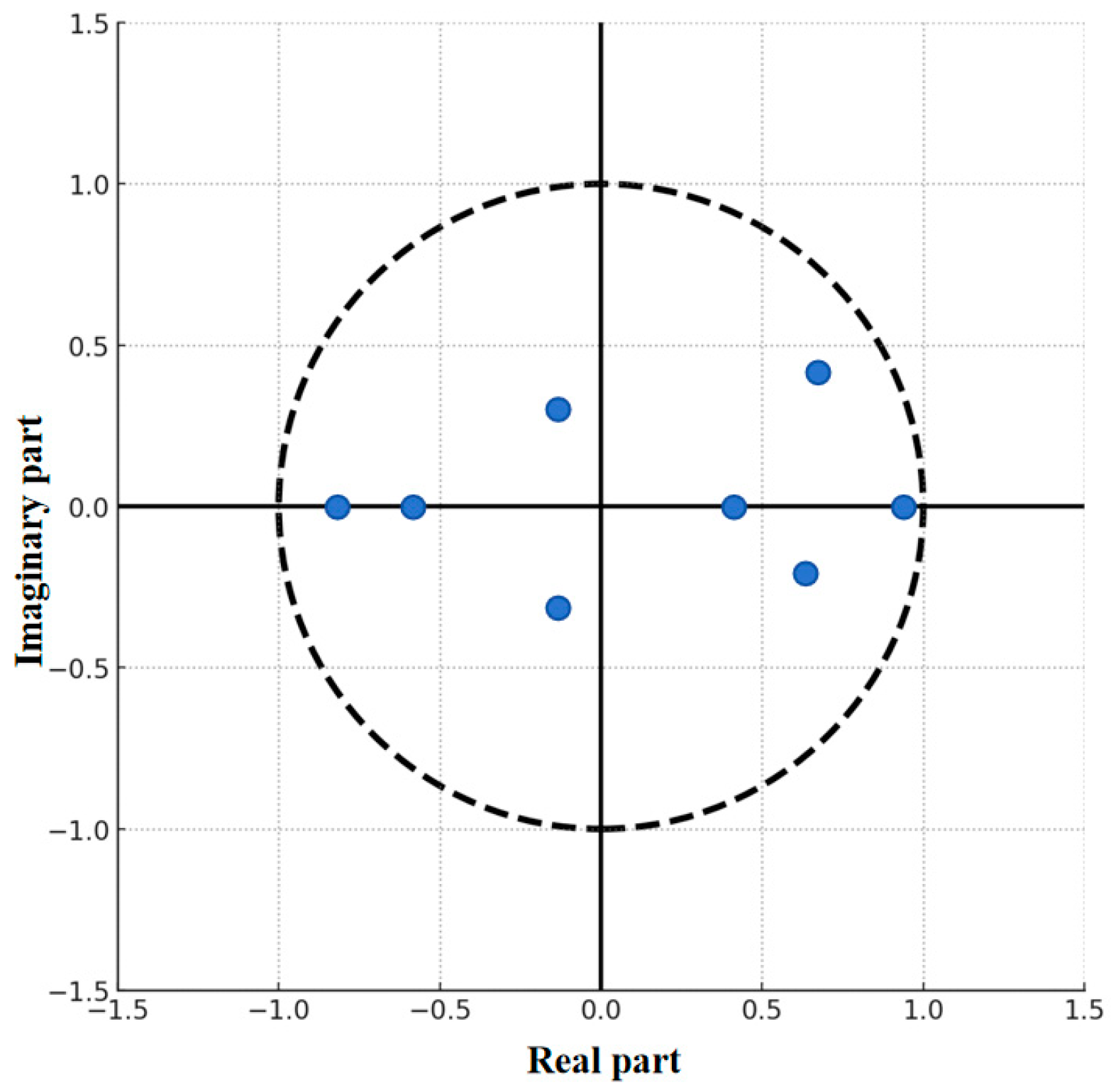

3.4. Calculation of Lag Coefficient Matrix

4. Granger Causality Test

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bigerna, S.; Bollino, C.A.; Polinori, P. The Question of Sustainability of Green Electricity Policy Intervention. Sustainability 2014, 6, 5378–5400. [Google Scholar] [CrossRef]

- Yuan, J.; Wang, L.; Li, Y. Carbon emission reduction dynamic decision-making in the electricity supply chain with different carbon emission allowance principles. Energy 2024, 312, 133563. [Google Scholar] [CrossRef]

- Zhang, C.; Lin, B. Impact of introducing Chinese certified emission reduction scheme to the carbon market: Promoting renewable energy. Renew. Energy 2024, 222, 119887. [Google Scholar] [CrossRef]

- Liu, D.; Jiang, Y.; Pen, C.; Jian, J.; Zheng, J. Can green certificates substitute for renewable electricity subsidies? A Chinese experience. Renew. Energy 2024, 222, 119861. [Google Scholar] [CrossRef]

- Shang, N.; Chen, Z.; Leng, Y. Mutual Recognition Mechanism and Key Technologies of Typical Environmental Interest Products in Power and Carbon Markets. Zhongguo Dianji Gongcheng Xuebao Proc. Chin. Soc. Electr. Eng. 2024, 44, 2558–2577. [Google Scholar]

- Sun, Q.; Zhang, C.; Li, C.; You, P.; Gao, X.; Zhao, Q.; Xu, Z.; Liu, S.; Li, Y. Cost and Price Level Forecasting of the Power System under the ‘Carbon Peak and Carbon Neutrality’ Goals. China Electr. Power 2023, 56, 9–16. (In Chinese) [Google Scholar]

- Li, J.; Zou, N.; Li, W.; Wu, J.; Zhang, M. Analysis of Regional Green Certificates, Carbon Emission Rights, and Electricity Joint Trading Taking into Account Demand Flexibility. Grid Technol. 2023, 47, 3164–3176. (In Chinese) [Google Scholar]

- Bo, H. Enhancing the ‘Green’ Content in Power Trading. Electr. Power Equip. Manag. 2024, 17, 1. (In Chinese) [Google Scholar]

- He, J.; Liu, Q.; Zhao, W. Market-oriented trading system considering renewable energy under the goal of carbon peak and neutrality. J. Sci. Technol. Eng. 2021, 21, 15476–15484. [Google Scholar]

- Zhao, W.; Cao, Y.; Miao, B.; Wang, K.; Wei, Y.-M. Impacts of shifting China’s final energy consumption to electricity on CO2 emission reduction. Energy Econ. 2018, 71, 359–369. [Google Scholar] [CrossRef]

- Gabbasa, M.; Sopian, K.; Yaakob, Z.; Zonooz, M.F.; Fudholi, A.; Asim, N. Review of the energy supply status for sustainable development in the Organization of Islamic Conference. Renew. Sustain. Energy Rev. 2013, 28, 18–28. [Google Scholar] [CrossRef]

- Cheng, R.; Zhang, Y.; Li, L.; Ding, M.; Deng, W.; Chen, H.; Lin, J. Research Progress in the Power Market Construction for High Proportion Renewable Energy Integration. China Eng. Sci. 2023, 25, 89–99. (In Chinese) [Google Scholar]

- Wang, X.; Long, R.; Chen, H.; Wang, Y.; Shi, Y.; Yang, S.; Wu, M. How to promote the trading in China’s green electricity market? Based on environmental perceptions, renewable portfolio standard and subsidies. Renew. Energy 2024, 222, 119784. [Google Scholar] [CrossRef]

- Schusser, S.; Jaraitė, J. Explaining the interplay of three markets: Green certificates, carbon emissions and electricity. Energy Econ. 2018, 71, 1–13. [Google Scholar] [CrossRef]

- Guo, F.; Gomes, L.; Ma, L.; Tian, Z.; Vale, Z.; Pang, S. Optimizing battery storage for sustainable energy communities: A multi-scenario analysis. Sustain. Cities Soc. 2025, 118, 106030. [Google Scholar] [CrossRef]

- Zhang, C. Analysis of the Total Quota Setting and the Risk Transmission Mechanism of the CCER Market in the Carbon Trading Market. Econ. Res. Guide 2019, 9, 154–155. (In Chinese) [Google Scholar]

- Chen, Y.; Liang, Y. Study on the Impact of Carbon Trading Pilot Policies on Regional Carbon Intensity. Hainan Financ. 2023, 6, 13–25. (In Chinese) [Google Scholar]

- Hao, X.; Sun, W.; Zhang, X. How does a scarcer allowance remake the carbon market? An evolutionary game analysis from the perspective of stakeholders. Energy 2023, 280, 128150. [Google Scholar] [CrossRef]

- Kamalinia, S.; Shahidehpour, M.; Wu, L. Sustainable resource planning in energy markets. Appl. Energy 2014, 133, 112–120. [Google Scholar] [CrossRef]

- Shang, N.; Chen, Z.; Lu, Z.; Leng, Y. Interaction Mechanism and Coordination Mechanism of Power Market, Carbon Market, and Green Certificate Market. Power Grid Technol. 2023, 47, 142–154. (In Chinese) [Google Scholar]

- Gireesh, S.; Sumala, T. Renewable energy certificate markets in India—A review. Renew. Sustain. Energy Rev. 2013, 26, 702–716. [Google Scholar]

- Hulshof, D.; Jepma, C.; Mulder, M. Performance of markets for European renewable energy certificates. Energy Policy 2019, 128, 697–710. [Google Scholar] [CrossRef]

- Li, X.; Liu, Z.; Yang, D.; Wang, D. Evaluation of Power Market Efficiency and Carbon Market Price Design—Based on the Estimation of Transmission Rates from the Perspective of Power-Carbon Market Interaction. China Ind. Econ. 2022, 1, 132–150. (In Chinese) [Google Scholar]

- Wang, Q.; Tan, Z.; Tan, Q.; Pu, L. Research on the Pricing Mechanism of Green Electricity Certificates in China. Price Theory Pract. 2018, 1, 74–77. (In Chinese) [Google Scholar]

- Christoph, B.; Gunnar, L.; Robert, C.P.; Eva, S.; Elmarm, K.; Ottmar, E. Complementing carbon prices with technology policies to keep climate targets within reach. Nat. Clim. Change 2015, 5, 235–239. [Google Scholar]

- Lu, C.; Tong, Q.; Liu, X.M. The impacts of carbon tax and complementary policies on Chinese economy. Energy Policy 2010, 38, 7278–7285. [Google Scholar] [CrossRef]

- Fan, H.; Pan, F.; Zhang, W.; Chen, J. Research on China’s Green Electricity Certificate Trading Mechanism under the ‘Dual Carbon’ Goals. China Energy 2022, 44, 29–32. (In Chinese) [Google Scholar]

- Chen, W.; Jiang, Y. Interactive Optimization of Day-Ahead Electricity Market Trading Coupled with Carbon, Green Certificate, and Consumption Markets. Power Grid Technol. 2024, 48, 1967–1979. (In Chinese) [Google Scholar]

- Li, J.; Hu, Y.; Chi, Y.; Liu, D.; Yang, S.; Gao, Z.; Chen, Y. Analysis on the synergy between markets of electricity, carbon, and tradable green certificates in China. Energy 2024, 302, 131808. [Google Scholar] [CrossRef]

- Chang, X.; Wu, Z.; Wang, J.; Zhang, X.; Zhou, M.; Yu, T.; Wang, Y. The coupling effect of carbon emission trading and tradable green certificates under electricity marketization in China. Renew. Sustain. Energy Rev. 2023, 187, 113750. [Google Scholar] [CrossRef]

- Zhang, X.; Guo, X.; Zhang, X. Assessing the policy synergy among power, carbon emissions trading and tradable green certificate market mechanisms on strategic GENCOs in China. Energy 2023, 278, 127833. [Google Scholar] [CrossRef]

- Zhong, L.; Pan, F.; Yang, Y.; Feng, L.; Yang, X.; Wang, W.; Zhang, C. Research on the Impact Mechanism of Green Electricity Trading on Carbon Market Subject Behavior Decision making from the Perspective of Carbon Measurement. Electr. Meas. Instrum. 2025, 62, 68–79. (In Chinese) [Google Scholar]

- Zhou, R.; Zhao, Y.; Hu, F.; Huang, C. Green electricity market-carbon market linkage trading based on improved electric carbon metering. J. Electr. Power Syst. Autom. 2019, 36, 105–115. (In Chinese) [Google Scholar]

- Jiang, Y.; Wu, Z. Regression analysis of influencing factors of carbon emission trading price in China. Environ. Sustain. Dev. 2019, 46, 77–83. (In Chinese) [Google Scholar]

- Li, J.; Zou, N.; LI, W.; Wu, J.; Zhang, M. Analysis of joint trading of regional green certificates, carbon emission permits and electricity with demand flexibility. Power Grid Technol. 2019, 47, 3164–3176. (In Chinese) [Google Scholar]

- Wei, Q.; An, G.; Tu, Y. The Interactive Mechanism and Empirical Study of Carbon Trading Market and Green Electricity Policy. China Soft Sci. 2023, 5, 198–206. (In Chinese) [Google Scholar]

- Zou, X.; Wei, Y. Research on multi-scale electrocarbon-green certificate coupling market trading based on System Dynamics. Electr. Power Sci. Eng. 2023, 39, 32–44. (In Chinese) [Google Scholar]

- Liu, L.; Feng, T.; Cui, M.; Zhong, C. Impact mechanism and effect of green power trading on power market. China’s Popul. Resour. Environ. 2024, 34, 76–90. (In Chinese) [Google Scholar]

- Huang, A.; Wang, L.; Zeng, M.; Zhu, J. Research on trading decision Behavior of power generation enterprises under the coupling of carbon-electric-green certificate market. Electr. Power Sci. Eng. 2024, 40, 1–13. (In Chinese) [Google Scholar]

- Wang, H.; Feng, T.; Cui, M.; Zhong, C. Analysis of coupling effect between green hydrogen trading market and electricity market under carbon trading policy. South. Energy Constr. 2023, 10, 32–46. (In Chinese) [Google Scholar]

- Guo, R.; Shi, Y.; Sun, L.; Cui, M.; Zha, D.; Feng, T. Current Status, Problems, and Countermeasures of Typical Environmental Rights Trading Products. South. Energy Constr. 2025, 12, 181–194. (In Chinese) [Google Scholar]

| Region | Market Participants | Carbon Market Mechanism | Carbon Offset Mechanism | Pricing Mechanism | Green Electricity Market Mechanism | Price Transmission Relationship Between Markets |

|---|---|---|---|---|---|---|

| European Union (EU ETS) | Power, industry, and aviation | Auction-based quota allocation | Carbon credits are not allowed to offset surrender quotas | Carbon quota prices are determined by market supply and demand, with significant price volatility | Voluntary market transactions; green certificate prices are determined by market supply and demand; physical electricity and green certificates are traded separately | The carbon market and the green electricity market are relatively independent. Carbon prices mainly drive emission reduction costs, while green electricity premiums are more driven by corporate voluntary carbon neutrality and demand, with weaker transmission |

| California, USA (CCTP) | Power, cement, steel, etc. | A combination of auction and free allocation | Carbon offsetting is allowed (such as forestry carbon sinks), accounting for 8% | Carbon quota prices are determined by market supply and demand, with significant price volatility | Green electricity prices are determined by market supply and demand. Some states have subsidies or tax incentives | State-level RPS (Renewable Portfolio Standard) promotes green certificate demand. The impact of carbon prices on green electricity prices is relatively small |

| China (GBC) | Power (with plans to gradually include steel, building materials, aviation, and eight other major industries in the future) | Mainly free allocation, gradually introducing auction mechanisms | CCER can be used to offset carbon emission quotas, with a maximum offset ratio of 5% | Carbon quota prices are determined by a combination of government guidance and market bidding, with relatively lower prices | Certificate-electricity separation or certificate-electricity integration trading; only one transaction is allowed, and prices are determined by bilateral negotiation, listing trading, or centralized bidding | In the initial stage of the carbon market, only the power industry is included. There is potential competition between green certificates and CCER. If policies clearly define mutual recognition rules (such as allowing green certificates to offset quotas), the transmission effect will be significantly enhanced |

| Papers | Research Method | Dataset | Research Content | Research Limitation |

|---|---|---|---|---|

| [33,34] | Game model | Data on China’s electricity market and carbon market | The interaction between carbon market and green electricity market is studied. | The complexity of the behavior of market participants and the incomplete competition of the market are not fully considered and are also mainly based on static analysis. |

| [35,36] | Regression model and static analysis | Relevant data of China’s carbon emission trading market and green certificate market | The price fluctuation and mutual influence of carbon market and green certificate market are analyzed. | The research is mainly based on static analysis and does not deeply explore the dynamic changes of market mechanism, ignoring the delay effect and lag factors in the market. |

| [37,38,39,40] | System dynamics model | Carbon market, electricity market, and green certificate market transaction data | The coupling mechanism of electricity market, carbon market, and green certificate market is analyzed, and the complex interaction between the markets is simulated by a model. | The system dynamics model relies on a large number of assumptions and parameter settings, and it is easy to ignore the influence of some market factors. |

| This paper | VAR model + Granger causality test | Carbon markets, green certificates, and green electricity data 2021–2024 | The complex interaction and price transfer mechanism of green electricity market, carbon market, and green certificate market are revealed, including lag effect and causality. | The VAR model cannot capture causality directly and relies on lag selection. In order to make up for the deficiency, this paper discusses the causality between variables through Granger causality test. |

| Variable Name | Maximum | Minimum | Mean | Standard Deviation | Median | Variance | Kurtosis | Skewness | Coefficient of Variation (CV) |

|---|---|---|---|---|---|---|---|---|---|

| Green Certificate | 228.638 | 12.65 | 72.88 | 47.368 | 76.769 | 2243.694 | 3.178 | 1.362 | 0.65 |

| Carbon Emission Rights | 98.83 | 23 | 67.966 | 18.186 | 60 | 330.73 | −0.082 | −0.151 | 0.268 |

| CCER | 86.94 | 10 | 49.712 | 22.349 | 39 | 499.494 | −1.145 | 0.446 | 0.45 |

| Green Electricity Environmental Value | 147.079 | 30.424 | 94.412 | 25.063 | 89.736 | 628.172 | 1.472 | −0.246 | 0.265 |

| Variable | T (Statistic) | P (p-Value) | Critical Values | ||

|---|---|---|---|---|---|

| 1% | 5% | 10% | |||

| Green Certificate | −0.728 | 0.839 | −3.724 | −2.986 | −2.633 |

| Carbon Emission Rights | −2.396 | 0.143 | −3.711 | −2.981 | −2.63 |

| CCER | 1.083 | 0.995 * | −3.809 | −3.022 | −2.651 |

| Green Electricity Environmental Value | −3.292 | 0.015 ** | −3.833 | −3.031 | −2.656 |

| Variable | T (Statistic) | P (p-Value) | Critical Values | ||

|---|---|---|---|---|---|

| 1% | 5% | 10% | |||

| Green Certificate | −2.8818 | 0.0475 ** | −3.964 | −3.085 | −2.682 |

| Carbon Emission Rights | −4.0709 | 0.0011 *** | −3.809 | −3.022 | −2.651 |

| CCER | −2.037 | 0.0474 ** | −3.964 | −3.085 | −2.682 |

| Green Electricity Environmental Value | −2.8733 | 0.0485 ** | −3.833 | −3.031 | −2.656 |

| Lag Order | Log L | AIC | SC | HQ | FPE |

|---|---|---|---|---|---|

| 0 | −475.66 | 24.179 | 24.371 | 24.236 | 31,681,256,194.491 |

| 1 | −399.396 | 20.91 | 21.877 * | 21.188 | 1,228,540,973.541 |

| 2 | −363.402 | 20.601 | 22.356 | 21.087 | 1,012,511,536.871 * |

| 3 | −331.227 | 20.584 | 23.137 | 21.261 | 1,461,698,948.426 |

| 4 | −289.62 | 19.746 * | 23.103 | 20.59 * | 2,009,909,138.106 |

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

|---|---|---|---|---|

| Constant | −0.2399 | 0.1088 | −2.205 | 0.027 * |

| L1. Green Certificate | 1.7132 | 0.4534 | 3.778 | 0.000 * |

| L1. Green Electricity Environmental Value | −1.6404 | 0.3020 | −5.432 | 0.000 * |

| L1. Carbon Emission Rights | 0.2810 | 0.3904 | 0.720 | 0.472 |

| L1. CCER | 0.4353 | 0.4003 | 1.088 | 0.277 |

| L2. Green Certificate | 1.1394 | 0.6257 | 1.821 | 0.069 |

| L2. Green Electricity Environmental Value | 0.1583 | 0.5119 | 0.309 | 0.757 |

| L2. Carbon Emission Rights | 0.5939 | 0.3493 | 1.700 | 0.089 |

| L2. CCER | 0.8000 | 0.5220 | 1.533 | 0.125 |

| L3. Green Certificate | 1.0091 | 0.4835 | 2.087 | 0.037 * |

| L3. Green Electricity Environmental Value | 0.0676 | 0.4301 | 0.157 | 0.875 |

| L3. Carbon Emission Rights | 0.8914 | 0.3148 | 2.832 | 0.005 * |

| L3. CCER | 0.4601 | 0.5003 | 0.920 | 0.358 |

| L4. Green Certificate | −0.1406 | 0.2078 | −0.677 | 0.499 |

| L4. Green Electricity Environmental Value | 0.7676 | 0.3553 | 2.161 | 0.031 * |

| L4. Carbon Emission Rights | 0.8113 | 0.4392 | 1.847 | 0.065 |

| L4. CCER | 1.0120 | 0.6071 | 1.667 | 0.096 |

| Green Certificate | Carbon Emission Rights | CCER | Green Electricity Environmental Value | |

|---|---|---|---|---|

| L1. Green Certificate | 0.0795 | 0.0019 | −0.0415 | 0.4403 |

| L1. Carbon Emission Rights | 0.5112 | −0.5884 | 0.6386 | 0.6470 |

| L1. CCER | 0.1119 | 0.0123 | −0.8840 | 0.3217 |

| L1. Green Electricity Environmental Value | −4.3648 | −0.2348 | 0.1662 | −1.6404 |

| L2. Green Certificate | 0.3856 | 0.1868 | −0.4829 | 0.2928 |

| L2. Carbon Emission Rights | 1.4427 | 0.1692 | 1.3065 | 1.3676 |

| L2. CCER | 1.9611 | 0.0972 | −0.7505 | 0.5912 |

| L2. Green Electricity Environmental Value | −2.1222 | −0.4324 | 1.1673 | 0.1583 |

| L3. Green Certificate | 0.9133 | 0.1399 | −0.5680 | 0.2593 |

| L3. Carbon Emission Rights | 2.9814 | 0.0059 | 1.8557 | 2.0524 |

| L3. CCER | 1.9171 | 0.2114 | −0.4502 | 0.3400 |

| L3. Green Electricity Environmental Value | −1.6027 | 0.1940 | 0.2328 | 0.0676 |

| L4. Green Certificate | 0.0913 | 0.0616 | −0.1521 | −0.0361 |

| L4. Carbon Emission Rights | 5.4118 | −0.4292 | −0.1952 | 1.8680 |

| L4. CCER | 3.0084 | 0.0261 | 0.1276 | 0.7478 |

| L4. Green Electricity Environmental Value | 1.6656 | 0.2344 | −1.0439 | 0.7675 |

| Green Certificate | Carbon Emission Rights | CCER | Green Electricity Environmental Value | |

|---|---|---|---|---|

| CCER | 0.2773 | 0.1908 | −0.2669 | 0.2097 |

| Carbon Emission Rights | 0.4099 | −0.4632 | 0.4919 | 0.6222 |

| Green Electricity Environmental Value | −0.2545 | −0.1313 | 0.0713 | −0.0678 |

| Green Certificate | 0.0582 | 0.2146 | −0.1698 | 0.1003 |

| Lag Order (Lag) | AIC | F-Test | p-Value | Chi-Square Test Chi2 | p-Value | Likelihood Ratio Test Chi2 | p-Value | F Test for Parameters | p-Value |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 14.015 | 0.2845 | 0.5989 | 0.3217 | 0.5706 | 0.3197 | 0.5718 | 0.2845 | 0.5989 |

| 2 | 13.242 | 0.2277 | 0.7984 | 0.5691 | 0.7523 | 0.5628 | 0.7547 | 0.2277 | 0.7984 |

| 3 | 13.602 | 0.1646 | 0.9187 | 0.6973 | 0.8738 | 0.6874 | 0.8762 | 0.1646 | 0.9187 |

| 4 | 13.657 | 0.6821 | 0.6158 | 4.4826 | 0.3446 | 4.0954 | 0.3933 | 0.6821 | 0.6158 |

| 5 | 13.204 | 0.9540 | 0.0485 | 9.5402 | 0.0894 | 7.9248 | 0.1604 | 0.9540 | 0.0485 |

| Lag Order (Lag) | AIC | F-Test | p-Value | Chi-Square Test Chi2 | p-Value | Likelihood Ratio Test Chi2 | p-Value | F Test for Parameters | p-Value |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 9.548 | 0.0332 | 0.8571 | 0.0375 | 0.8465 | 0.0375 | 0.8465 | 0.0332 | 0.8571 |

| 2 | 9.563 | 0.3205 | 0.7295 | 0.8012 | 0.6699 | 0.7886 | 0.6741 | 0.3205 | 0.7295 |

| 3 | 9.832 | 0.5535 | 0.6527 | 2.3444 | 0.5041 | 2.2368 | 0.5247 | 0.5535 | 0.6527 |

| 4 | 9.483 | 1.3951 | 0.2861 | 9.1676 | 0.0570 | 7.7157 | 0.1026 | 1.3951 | 0.2861 |

| 5 | 9.310 | 1.5501 | 0.2526 | 15.5014 | 0.0084 | 11.7334 | 0.0386 | 1.5501 | 0.2526 |

| Lag Order (Lag) | AIC | F-Test | p-Value | Chi-Square Test Chi2 | p-Value | Likelihood Ratio Test Chi2 | p-Value | F Test for Parameters | p-Value |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 12.278 | 0.0123 | 0.9127 | 0.0139 | 0.9061 | 0.0139 | 0.9062 | 0.0123 | 0.9127 |

| 2 | 12.289 | 2.1888 | 0.1382 | 5.4721 | 0.0648 | 4.9484 | 0.0842 | 2.1888 | 0.1382 |

| 3 | 12.457 | 1.0335 | 0.4028 | 4.3772 | 0.2235 | 4.0208 | 0.2592 | 1.0335 | 0.4028 |

| 4 | 12.371 | 0.8507 | 0.5165 | 5.5901 | 0.2319 | 5.0040 | 0.2869 | 0.8507 | 0.5165 |

| 5 | 12.086 | 1.2385 | 0.3551 | 12.3847 | 0.0299 | 9.8245 | 0.0804 | 1.2385 | 0.3551 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, X.; Huang, H.; Guo, B.; Song, L.; Yang, Y.; Li, Q.; Qian, F. A Study on the Price Transmission Mechanism of Environmental Benefits for Green Electricity in the Carbon Market and Green Certificate Markets: A Case Study of the East China Power Grid. Energies 2025, 18, 2235. https://doi.org/10.3390/en18092235

Wu X, Huang H, Guo B, Song L, Yang Y, Li Q, Qian F. A Study on the Price Transmission Mechanism of Environmental Benefits for Green Electricity in the Carbon Market and Green Certificate Markets: A Case Study of the East China Power Grid. Energies. 2025; 18(9):2235. https://doi.org/10.3390/en18092235

Chicago/Turabian StyleWu, Xinhong, Hao Huang, Bin Guo, Lifei Song, Yongwen Yang, Qifen Li, and Fanyue Qian. 2025. "A Study on the Price Transmission Mechanism of Environmental Benefits for Green Electricity in the Carbon Market and Green Certificate Markets: A Case Study of the East China Power Grid" Energies 18, no. 9: 2235. https://doi.org/10.3390/en18092235

APA StyleWu, X., Huang, H., Guo, B., Song, L., Yang, Y., Li, Q., & Qian, F. (2025). A Study on the Price Transmission Mechanism of Environmental Benefits for Green Electricity in the Carbon Market and Green Certificate Markets: A Case Study of the East China Power Grid. Energies, 18(9), 2235. https://doi.org/10.3390/en18092235