Exploring the Future Energy Value of Long-Duration Energy Storage

Abstract

1. Introduction

2. Literature Review

3. Methods

3.1. Price-Taker Modeling to Assess Storage Arbitrage Value

3.2. Simulated Future Price Time Series

3.3. Infrastructure and Storage System Scenarios

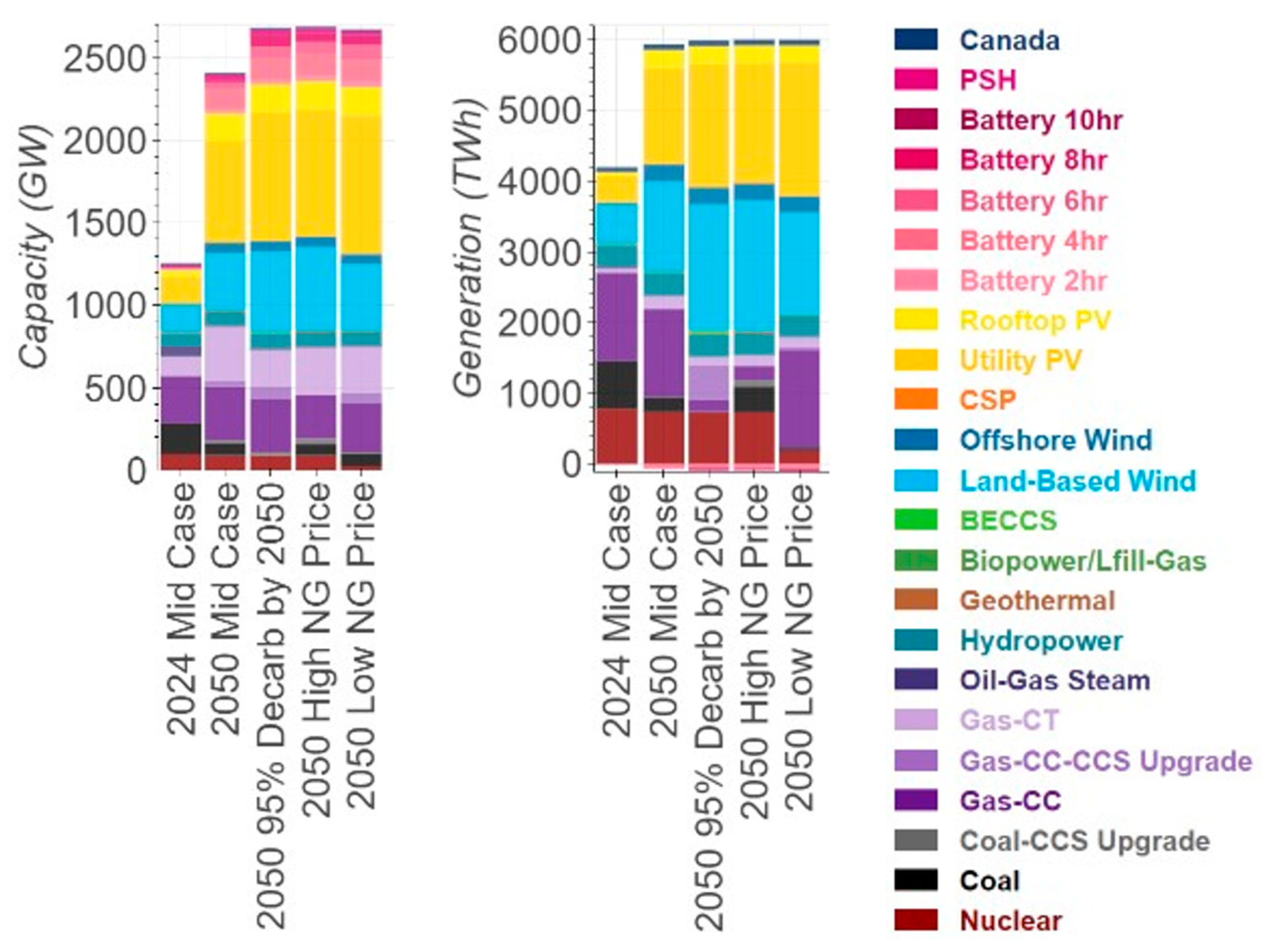

- The 2024 Mid Case provides a baseline for comparison and represents the current U.S. electricity system as described in the 2022 Standard Scenarios report [39].

- The 2050 Mid Case represents a future year under the default ReEDS assumptions in the 2022 Standard Scenarios report. It provides a baseline for comparing future infrastructures in a future year. As shown in Figure 1, this scenario has substantially greater deployment of wind, solar, and battery technologies, and the generation mix is a balance of wind, solar, natural gas, and nuclear electricity.

- The 2050 95% Decarb by 2050 scenario uses the 2050 infrastructure for a scenario that requires 95% zero-carbon electricity by 2050. This scenario was chosen to represent a deep decarbonization scenario with shares of low/zero-carbon technologies above those in the Mid Case. It also includes a substantive contribution of natural gas generation with carbon capture and sequestration (CCS).

- The 2050 High NG Price scenario uses natural gas prices based on the EIA AEO2022 Low Oil and Gas Resource case [46]. It represents a market-driven way to achieve a low-carbon electricity system compared to the policy-driven representation of the 95% Decarb by 2050 scenario. It has slightly higher contributions of wind and solar compared to the 95% Decarb scenario but also has the second-highest coal usage among the five scenarios.

- The 2050 Low NG Price scenario uses natural gas prices based on the EIA AEO2022 High Oil and Gas Resource case. It was chosen to incorporate a future with higher natural gas usage, although it still uses substantive quantities of wind and solar generation and displaces some nuclear with low-cost natural gas.

3.4. Key Metrics of Interest

4. Results and Discussion

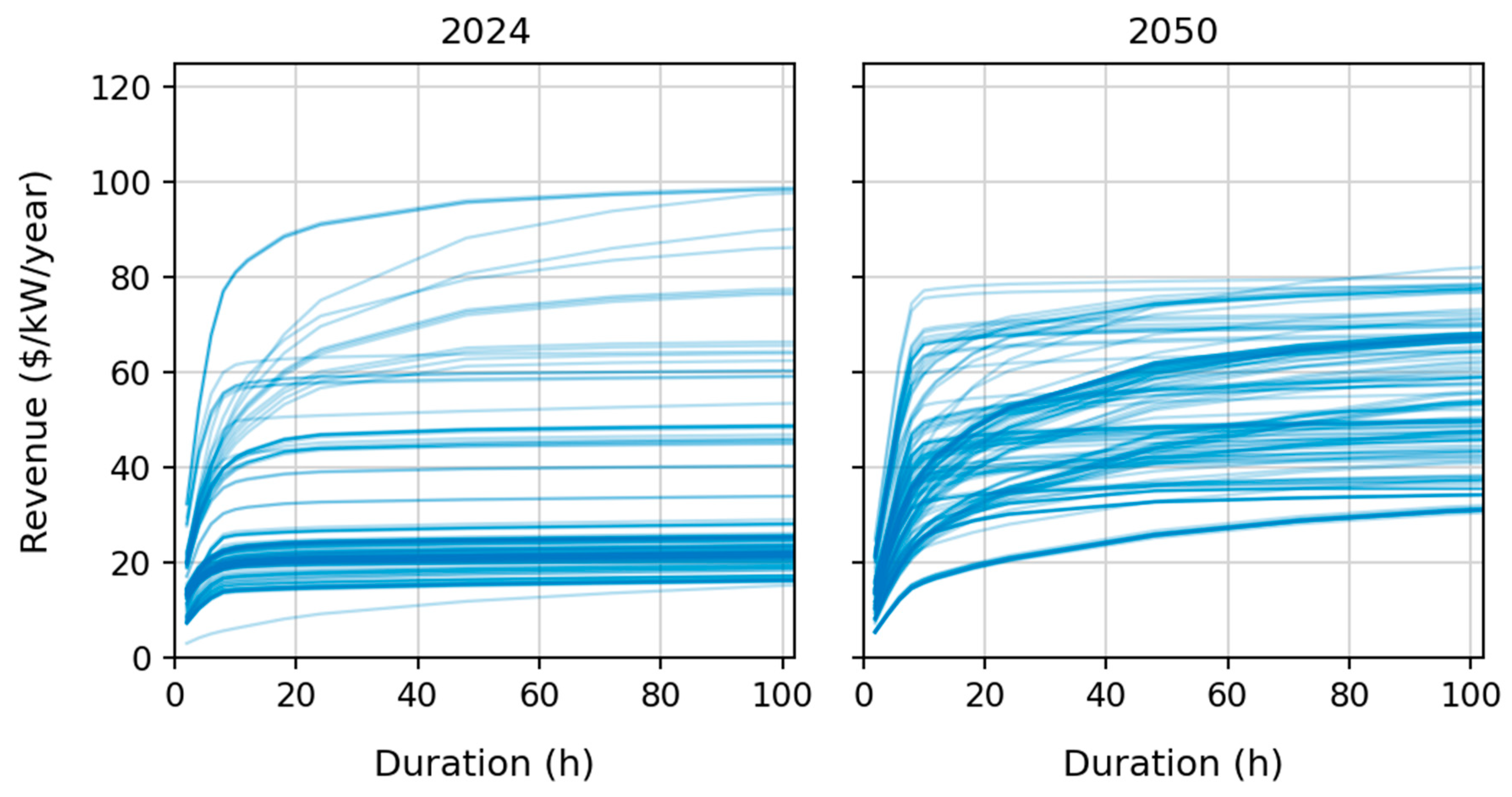

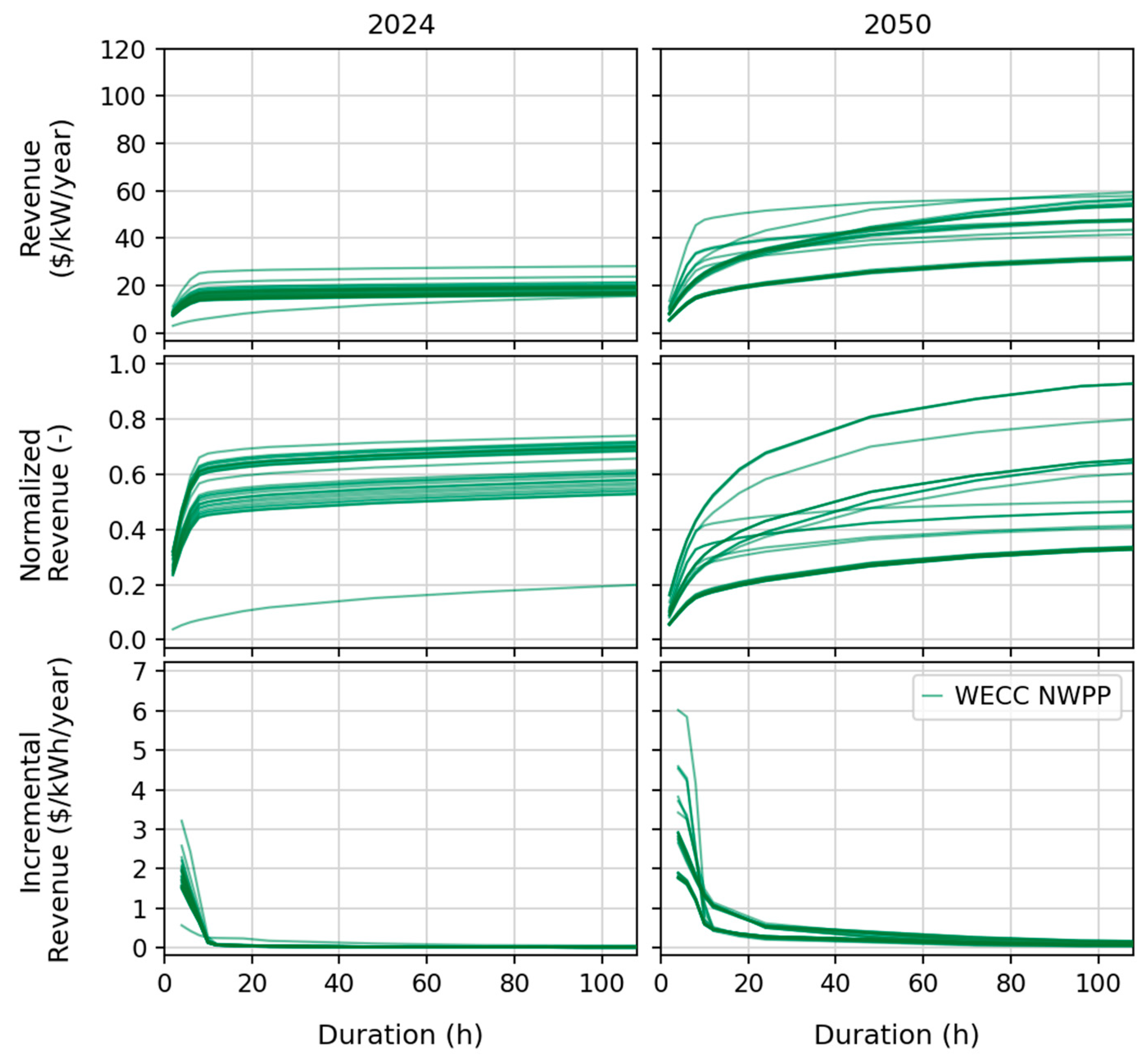

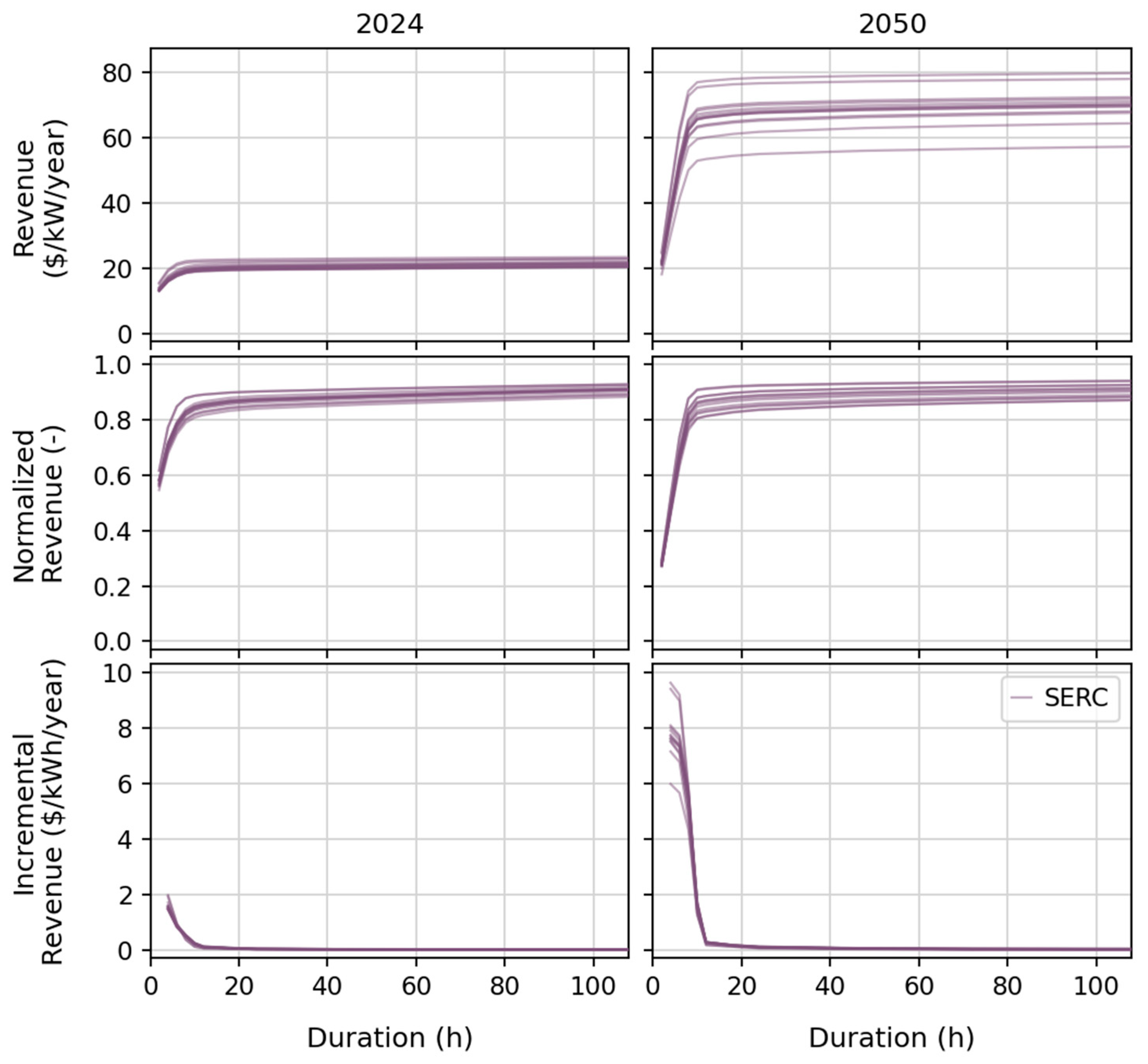

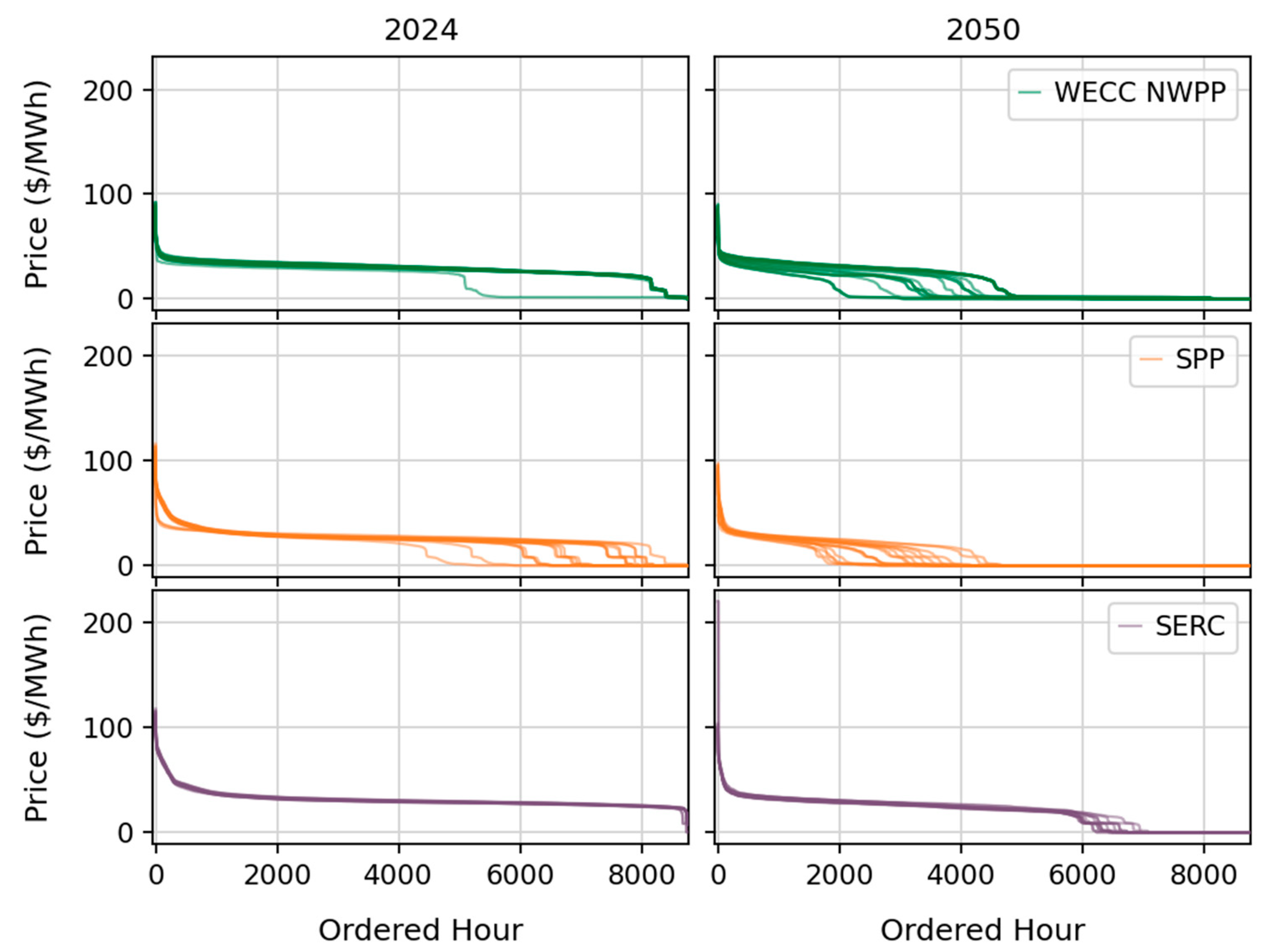

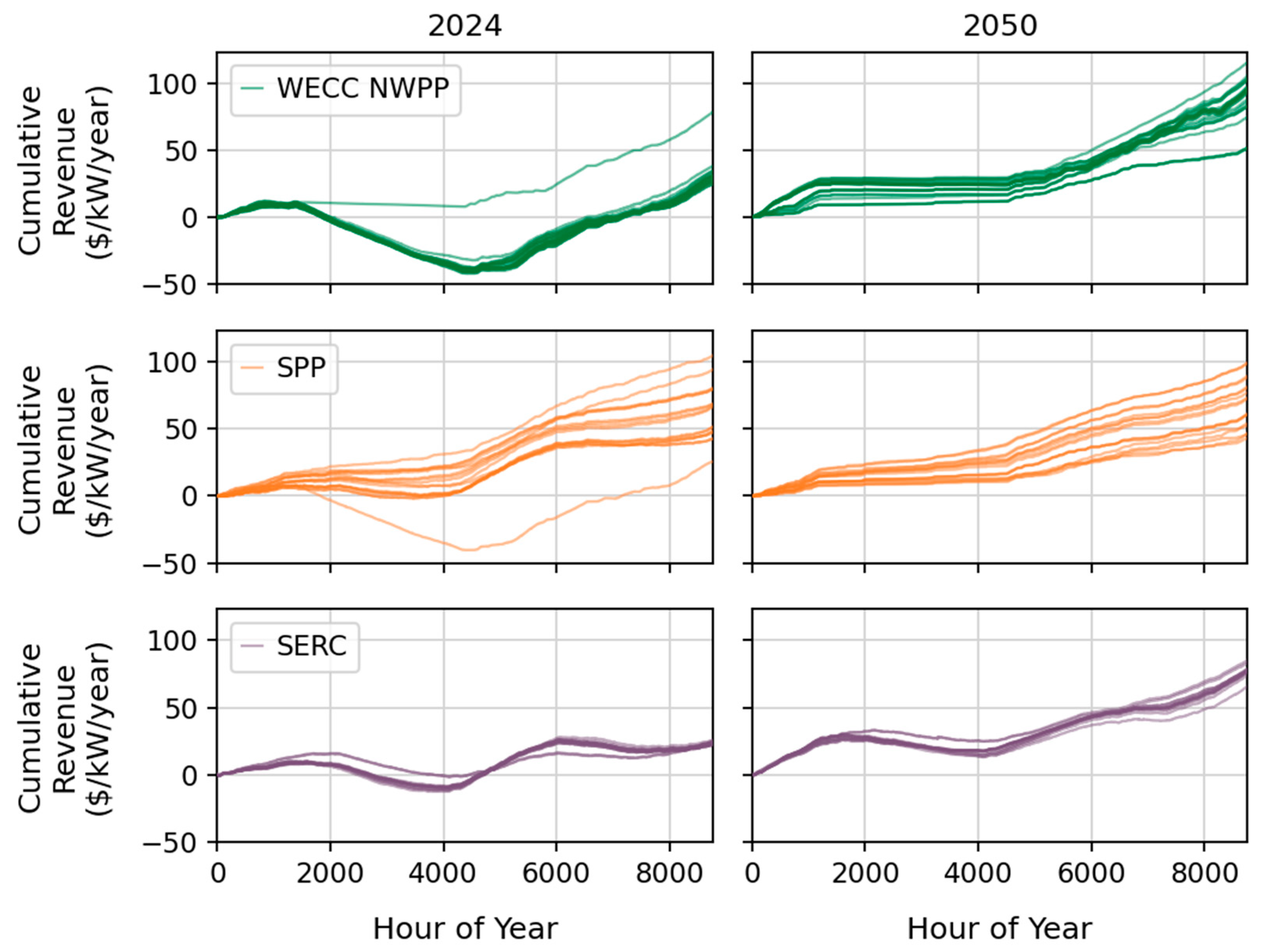

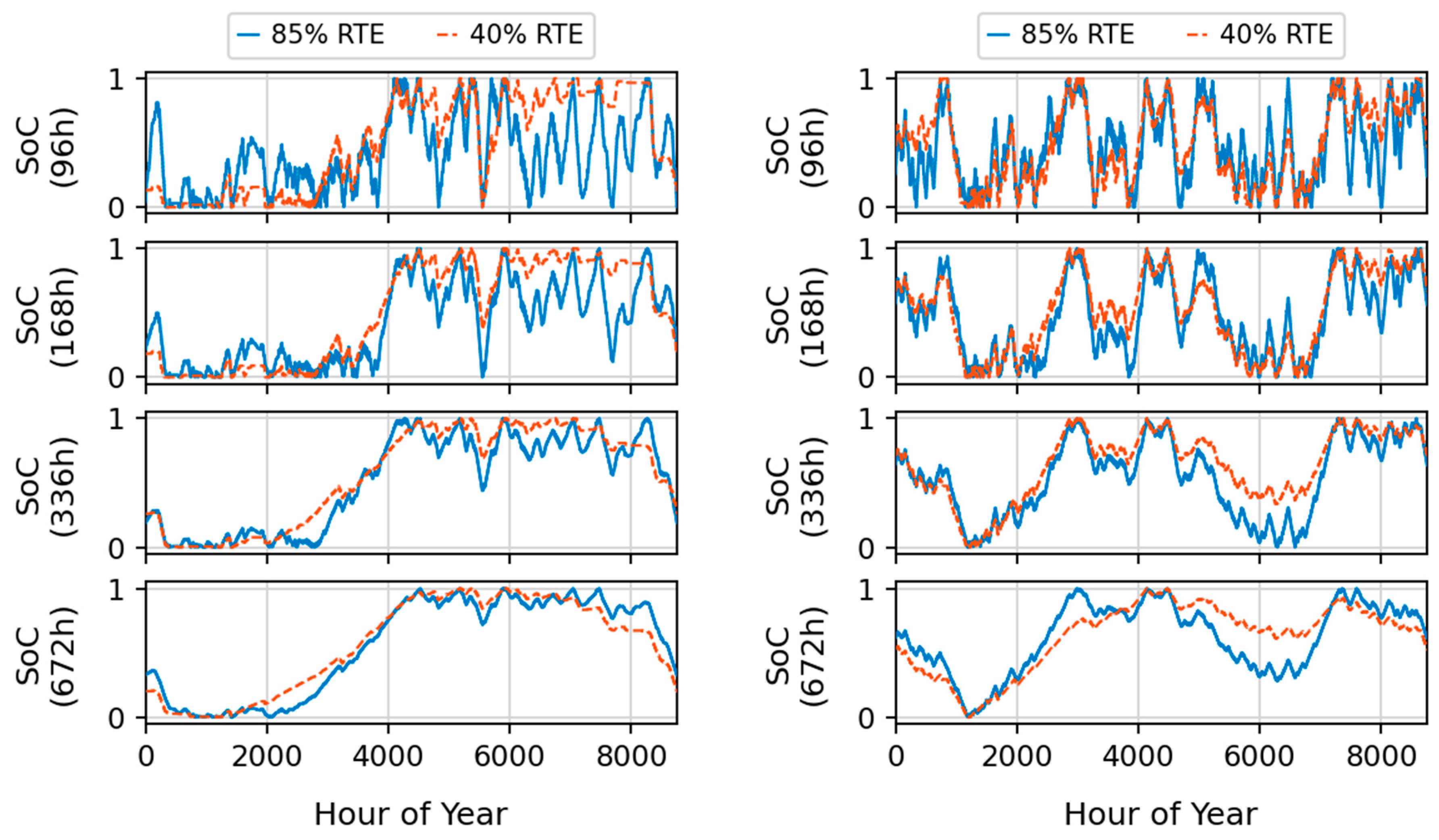

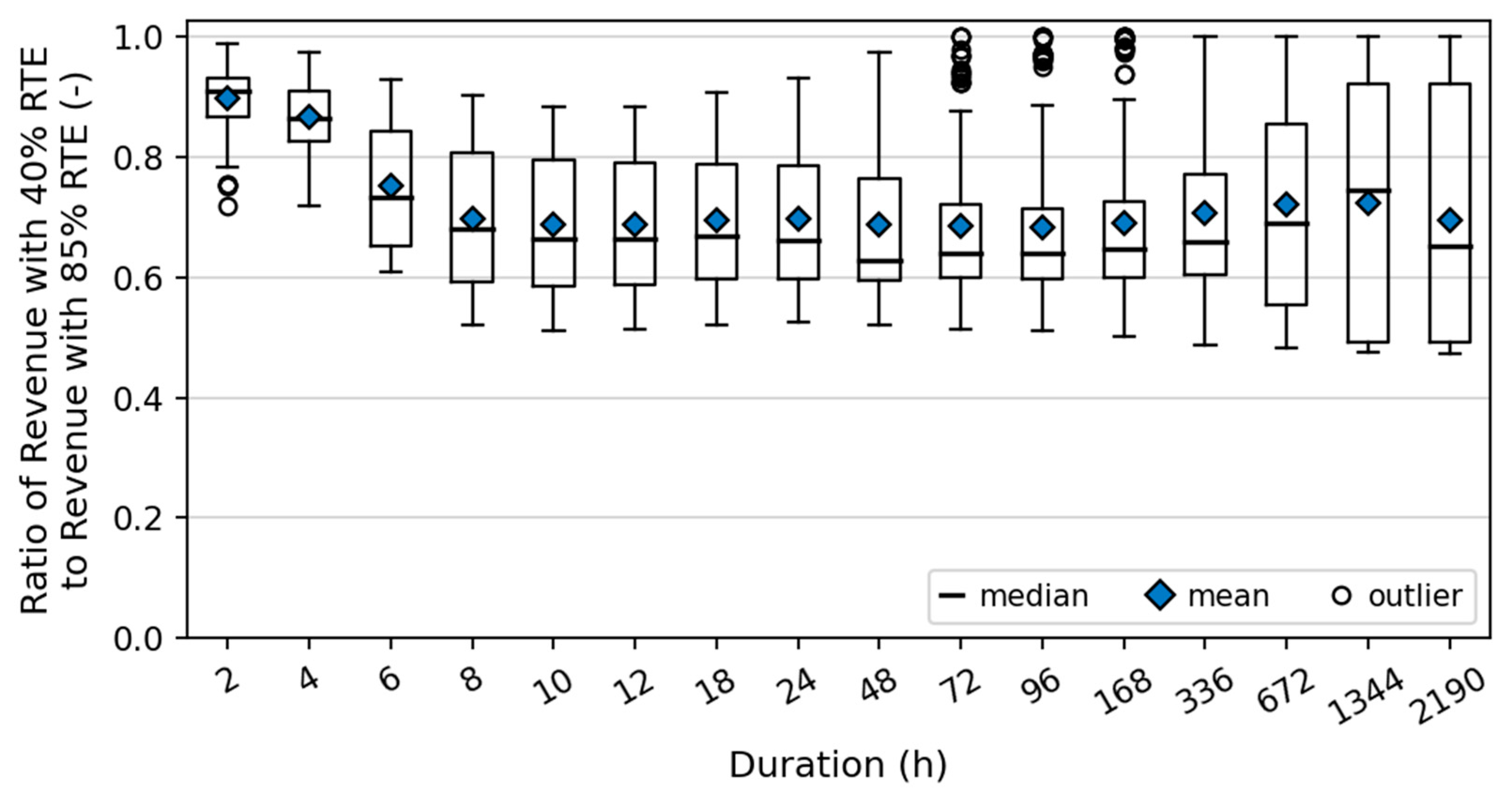

4.1. Arbitrage Revenue Relationships

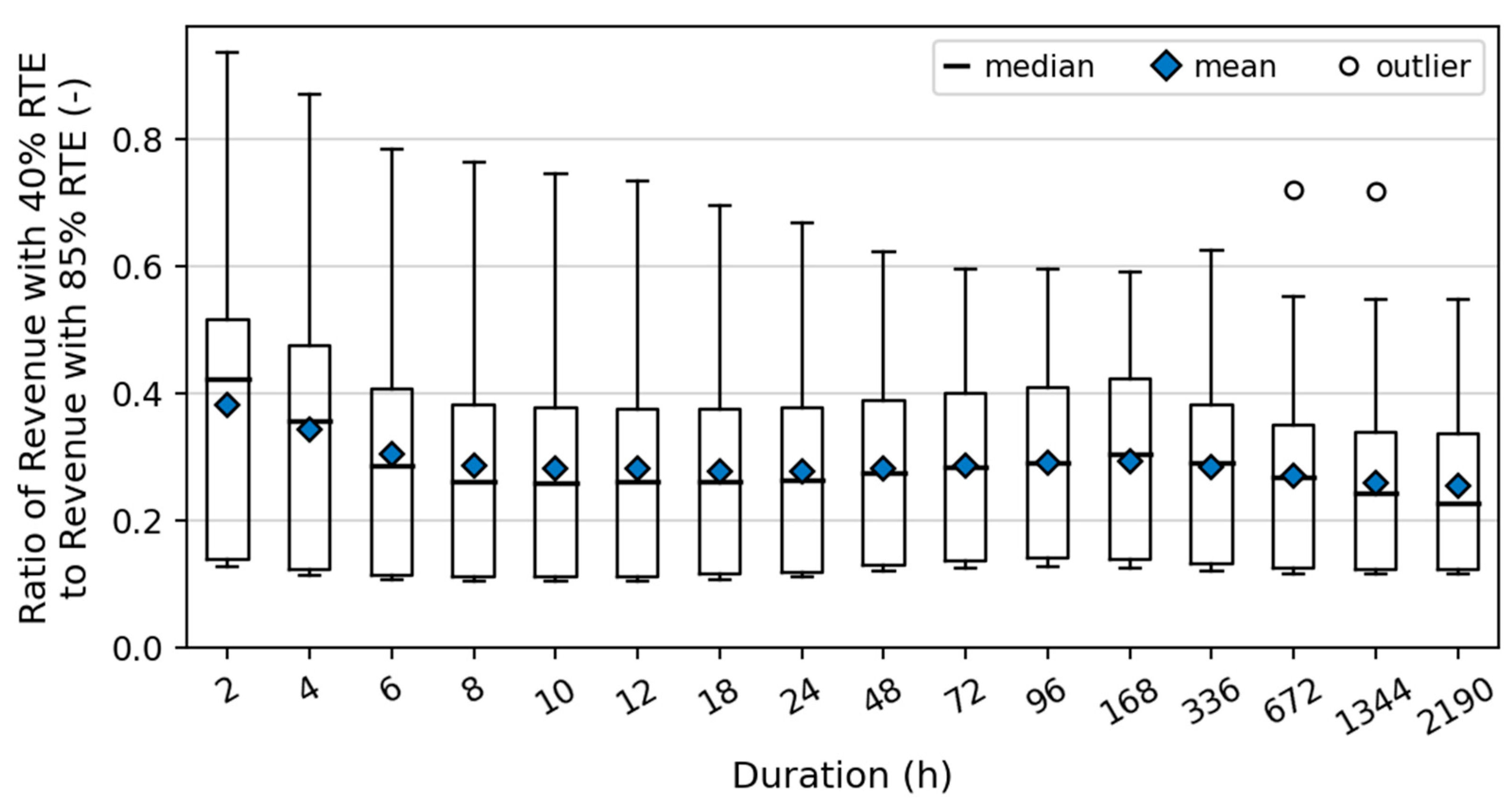

4.2. LDES Operation

4.3. The Effects of Alternative Electricity Futures

4.4. Limitations

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- McPherson, M.; Tahseen, S. Deploying storage assets to facilitate variable renewable energy integration: The impacts of grid flexibility, renewable penetration, and market structure. Energy 2018, 145, 856–870. [Google Scholar] [CrossRef]

- Battery Storage in the United States: An Update on Market Trends; Technical Report; U.S. Energy Information Administration: Washington, DC, USA, 2021. Available online: https://www.eia.gov/analysis/studies/electricity/batterystorage/archive/2021/pdf/battery_storage_2021.pdf (accessed on 21 March 2025).

- Denholm, P.; Cole, W.; Frazier, A.W.; Podkaminer, K.; Blair, N. The Four Phases of Storage Deployment: A Framework for the Expanding Role of Storage in the U.S. Power System; Technical Report NREL/TP-6A20-77480; National Renewable Energy Laboratory: Golden, CO, USA, 2021. Available online: https://www.nrel.gov/docs/fy21osti/77480.pdf (accessed on 21 March 2025).

- Zhao, D.; Jafari, M.; Botterud, A.; Sakti, A. Strategic energy storage investments: A case study of the CAISO electricity market. Appl. Energy 2022, 325, 119909. [Google Scholar] [CrossRef]

- Figgener, J.; Stenzel, P.; Kairies, K.-P.; Linßen, J.; Haberschusz, D.; Wessels, O.; Robinius, M.; Stolten, D.; Sauer, D.U. The development of stationary battery storage systems in Germany—Status 2020. J. Energy Storage 2021, 33, 101982. [Google Scholar] [CrossRef]

- Carden, K.; Wintermantel, N. Energy Storage Capacity Value on the CAISO System; Astrape Consulting: Hoover, AL, USA, 2019; Available online: https://www.astrape.com/wp-content/uploads/2024/01/2019-20-IRP-Astrape-Battery-ELCC-Analysis.pdf (accessed on 3 April 2024).

- Parks, K. Declining Capacity Credit for Energy Storage and Demand Response with Increased Penetration. IEEE Trans. Power Syst. 2019, 34, 4542–4546. [Google Scholar] [CrossRef]

- Frazier, A.W.; Cole, W.; Denholm, P.; Machen, S.; Gates, N.; Blair, N. Storage Futures Study: Economic Potential of Diurnal Storage in the U.S. Power Sector; Technical Report NREL/TP-6A20-77449; National Renewable Energy Laboratory: Golden, CO, USA, 2021. Available online: https://www.nrel.gov/docs/fy21osti/77449.pdf (accessed on 3 April 2024).

- Denholm, P.; Nunemaker, J.; Gagnon, P.; Cole, W. The potential for battery energy storage to provide peaking capacity in the United States. Renew. Energy 2020, 151, 1269–1277. [Google Scholar] [CrossRef]

- Hjalmarsson, J.; Thomas, K.; Boström, C. Service stacking using energy storage systems for grid applications—A review. J. Energy Storage 2023, 60, 106639. [Google Scholar] [CrossRef]

- McGrath, G. Electricity Monthly Update with Data for April 2023. Energy Information Administration. Available online: https://www.eia.gov/electricity/monthly/update/archive/june2023/ (accessed on 28 July 2023).

- Hoos, J.; Lohmeyer, T.; Graham, J. The Case for Battery Storage in PJM. 23 January 2025. Available online: https://auroraer.com/webinar/battery-storage-in-pjm/ (accessed on 21 March 2025).

- Munoz, J.; Liu, A.; Hunt, E.; Pharande, S. The Case for Battery Storage in MISO: Market Reforms and Opportunities. 11 February 2025. Available online: https://auroraer.com/webinar/flexible-energy-add-on-in-miso/ (accessed on 21 March 2025).

- Cole, W.; Karmakar, A. Cost Projections for Utility-Scale Battery Storage: 2023 Update; Technical Report NREL/TP-6A40-85332; National Renewable Energy Laboratory: Golden, CO, USA, 2023. Available online: https://www.nrel.gov/docs/fy23osti/85332.pdf (accessed on 3 April 2024).

- Shan, R.; Reagan, J.; Castellanos, S.; Kurtz, S.; Kittner, N. Evaluating emerging long-duration energy storage technologies. Renew. Sustain. Energy Rev. 2022, 159, 112240. [Google Scholar] [CrossRef]

- Hunter, C.A.; Penev, M.M.; Reznicek, E.P.; Eichman, J.; Rustagi, N.; Baldwin, S.F. Techno-economic analysis of long-duration energy storage and flexible power generation technologies to support high-variable renewable energy grids. Joule 2021, 5, 2077–2101. [Google Scholar] [CrossRef]

- Amir, M.; Deshmukh, R.G.; Khalid, H.M.; Said, Z.; Raza, A.; Muyeen, S.M.; Nizami, A.-S.; Elavarasan, R.M.; Saidur, R.; Sopian, K. Energy storage technologies: An integrated survey of developments, global economical/environmental effects, optimal scheduling model, and sustainable adaption policies. J. Energy Storage 2023, 72, 108694. [Google Scholar] [CrossRef]

- Smdani, G.; Islam, M.R.; Yahaya, A.N.A.; Safie, S.I.B. Performance Evaluation of Advanced Energy Storage Systems: A Review. Energy Environ. 2023, 34, 1094–1141. [Google Scholar] [CrossRef]

- Sepulveda, N.A.; Jenkins, J.D.; Edington, A.; Mallapragada, D.S.; Lester, R.K. The design space for long-duration energy storage in decarbonized power systems. Nat. Energy 2021, 6, 506–516. [Google Scholar] [CrossRef]

- Jenkins, J.D.; Sepulveda, N.A. Long-duration energy storage: A blueprint for research and innovation. Joule 2021, 5, 2241–2246. [Google Scholar] [CrossRef]

- Albertus, P.; Manser, J.S.; Litzelman, S. Long-Duration Electricity Storage Applications, Economics, and Technologies. Joule 2020, 4, 21–32. [Google Scholar] [CrossRef]

- McNamara, J.W.; DeAngelis, V.; Byrne, R.H.; Benson, A.; Chalamala, B.R.; Masiello, R. Long-duration energy storage in a decarbonized future: Policy gaps, needs, and opportunities. MRS Energy Sustain. 2022, 9, 142–170. [Google Scholar] [CrossRef]

- Guerra, O.J. Beyond short-duration energy storage. Nat. Energy 2021, 6, 460–461. [Google Scholar] [CrossRef]

- Peng, P.; Jiang, H.Z.H.; Collins, S.; Furukawa, H.; Long, J.R.; Breunig, H. Long Duration Energy Storage Using Hydrogen in Metal–Organic Frameworks: Opportunities and Challenges. ACS Energy Lett. 2024, 9, 2727–2735. [Google Scholar] [CrossRef]

- Hunt, J.D.; Zakeri, B.; Jurasz, J.; Tong, W.; Dąbek, P.B.; Brandão, R.; Patro, E.R.; Đurin, B.; Filho, W.L.; Wada, Y.; et al. Underground Gravity Energy Storage: A Solution for Long-Term Energy Storage. Energies 2023, 16, 825. [Google Scholar] [CrossRef]

- Vecchi, A.; Sciacovelli, A. Long-duration thermo-mechanical energy storage—Present and future techno-economic competitiveness. Appl. Energy 2023, 334, 120628. [Google Scholar] [CrossRef]

- Cole, W.; Denholm, P.; Carag, V.; Frazier, W. The peaking potential of long-duration energy storage in the United States power system. J. Energy Storage 2023, 62, 106932. [Google Scholar] [CrossRef]

- Twitchell, J.; DeSomber, K.; Bhatnagar, D. Defining long duration energy storage. J. Energy Storage 2023, 60, 105787. [Google Scholar] [CrossRef]

- Denholm, P.; Cole, W.; Blair, N. Moving Beyond 4-Hour Li-Ion Batteries: Challenges and Opportunities for Long(er)-Duration Energy Storage; Technical Report NREL/TP-6A40-85878; National Renewable Energy Laboratory: Golden, CO, USA, 2023. Available online: https://www.nrel.gov/docs/fy23osti/85878.pdf (accessed on 3 April 2024).

- Jafari, M.; Botterud, A.; Sakti, A. Estimating revenues from offshore wind-storage systems: The importance of advanced battery models. Appl. Energy 2020, 276, 115417. [Google Scholar] [CrossRef]

- Scott, K.; Hendrickson, S.; Ryan, N.; Dawson, A.; Kort, K.; Shrager, B.; Siberry, V.; Spitsen, P.; Babinec, S.; Balducci, P.; et al. Pathways to Commercial Liftoff: Long Duration Energy Storage; Department of Energy: Washington, DC, USA, 2023. Available online: https://liftoff.energy.gov/wp-content/uploads/2023/03/20230320-Liftoff-LDES-vPUB.pdf (accessed on 25 March 2023).

- Conlon, T.; Waite, M.; Modi, V. Assessing new transmission and energy storage in achieving increasing renewable generation targets in a regional grid. Appl. Energy 2019, 250, 1085–1098. [Google Scholar] [CrossRef]

- Sánchez-Pérez, P.A.; Staadecker, M.; Szinai, J.; Kurtz, S.; Hidalgo-Gonzalez, P. Effect of modeled time horizon on quantifying the need for long-duration storage. Appl. Energy 2022, 317, 119022. [Google Scholar] [CrossRef]

- Staadecker, M.; Szinai, J.; Sánchez-Pérez, P.A.; Kurtz, S.; Hidalgo-Gonzalez, P. The value of long-duration energy storage under various grid conditions in a zero-emissions future. Nat. Commun. 2024, 15, 9501. [Google Scholar] [CrossRef]

- Dowling, J.A.; Dowling, J.A.; Rinaldi, K.Z.; Ruggles, T.H.; Davis, S.J.; Yuan, M.; Tong, F.; Lewis, N.S.; Caldeira, K. Role of Long-Duration Energy Storage in Variable Renewable Electricity Systems. Joule 2020, 4, 1907–1928. [Google Scholar] [CrossRef]

- Cárdenas, B.; Swinfen-Styles, L.; Rouse, J.; Garvey, S.D. Short-, Medium-, and Long-Duration Energy Storage in a 100% Renewable Electricity Grid: A UK Case Study. Energies 2021, 14, 8524. [Google Scholar] [CrossRef]

- Giovanniello, M.A.; Wu, X.-Y. Hybrid lithium-ion battery and hydrogen energy storage systems for a wind-supplied microgrid. Appl. Energy 2023, 345, 121311. [Google Scholar] [CrossRef]

- Fernandez, G.; Jose, O.; Koleva, M.; Eichman, J.; Townsend, A. RODeO (Revenue Operation and Device Optimization Model) [SWR 20-67]; National Renewable Energy Laboratory: Golden, CO, USA, 2020. [Google Scholar] [CrossRef]

- Gagnon, P.; Brown, M.; Steinberg, D.; Brown, P. 2022 Standard Scenarios Report: A U.S. Electricity Sector Outlook; Technical Report NREL/TP-6A40-84327; National Renewable Energy Laboratory: Golden, CO, USA, 2022. [Google Scholar]

- Jorgenson, J.; Frazier, A.W.; Denholm, P.; Blair, N. Storage Futures Study: Grid Operational Impacts of Widespread Storage Deployment; Technical Report NREL/TP-6A40-80688; National Renewable Energy Laboratory: Golden, CO, USA, 2022. Available online: https://www.nrel.gov/docs/fy22osti/80688.pdf (accessed on 3 April 2024).

- U.S. Department of Energy. Solar Futures Study; DOE/GO-102021-5621; U.S. Department of Energy Office of Energy Efficiency and Renewable Energy: Washington, DC, USA, 2021. Available online: https://www.energy.gov/sites/default/files/2021-09/Solar%20Futures%20Study.pdf (accessed on 3 April 2024).

- Murphy, C.; Mai, T.; Sun, Y.; Jadun, P.; Muratori, M.; Nelson, B.; Jones, R. Electrification Futures Study: Scenarios of Power System Evolution and Infrastructure Development for the United States; Technical Report NREL/TP-6A20-72330; National Renewable Energy Laboratory: Golden, CO, USA, 2021. Available online: https://www.nrel.gov/docs/fy21osti/72330.pdf (accessed on 3 April 2024).

- Murphy, C.; Cole, W.; Bistline, J.; Bragg-Sitton, S.; Dixon, B.; Eschmann, E.; Ho, J.; Kwon, A.; Martin, L.; Namovicz, C.; et al. Nuclear Power’s Future Role in a Decarbonized U.S. Electricity System; Technical Report NREL/TP-6A20-84451; National Renewable Energy Laboratory: Golden, CO, USA, 2023. Available online: https://www.nrel.gov/docs/fy23osti/84451.pdf (accessed on 3 April 2024).

- Gagnon, P.; Cowiestoll, B.; Schwarz, M. Cambium 2022 Scenario Descriptions and Documentation; Technical Report NREL/TP-6A40-84916; National Renewable Energy Laboratory: Golden, CO, USA, 2023. Available online: https://www.nrel.gov/docs/fy23osti/84916.pdf (accessed on 1 March 2023).

- Gagnon, P.; Perez, P.A.S.; Obika, K.; Schwarz, M.; Morris, J.; Gu, J.; Eisenman, J. Cambium 2023 Scenario Descriptions and Documentation; Technical Report NREL/TP-6A40-88507; National Renewable Energy Laboratory: Golden, CO, USA, 2024. Available online: https://www.nrel.gov/docs/fy24osti/88507.pdf (accessed on 3 April 2024).

- U.S. Energy Information Administration. Annual Energy Outlook 2022. Available online: https://www.eia.gov/outlooks/aeo/ (accessed on 3 March 2023).

- Mirletz, B.; Vimmerstedt, L.; Akar, S.; Avery, G.; Stright, D.; Akindipe, D.; Augustine, C.; Beiter, P.; Cohen, S.; Cole, W.; et al. Annual Technology Baseline: The 2023 Electricity Update. July 2023. Available online: https://www.osti.gov/biblio/1992829 (accessed on 3 April 2024).

- Maestre, V.M.; Ortiz, A.; Ortiz, I. Challenges and prospects of renewable hydrogen-based strategies for full decarbonization of stationary power applications. Renew. Sustain. Energy Rev. 2021, 152, 111628. [Google Scholar] [CrossRef]

- Sakti, A.; Gallagher, K.G.; Sepulveda, N.; Uckun, C.; Vergara, C.; de Sisternes, F.J.; Dees, D.W.; Botterud, A. Enhanced representations of lithium-ion batteries in power systems models and their effect on the valuation of energy arbitrage applications. J. Power Sources 2017, 342, 279–291. [Google Scholar] [CrossRef]

- Sioshansi, R.; Denholm, P.; Jenkin, T.; Weiss, J. Estimating the value of electricity storage in PJM: Arbitrage and some welfare effects. Energy Econ. 2009, 31, 269–277. [Google Scholar] [CrossRef]

- Walawalkar, R.; Apt, J.; Mancini, R. Economics of electric energy storage for energy arbitrage and regulation in New York. Energy Policy 2007, 35, 2558–2568. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schleifer, A.H.; Cohen, S.M.; Cole, W.; Denholm, P.; Blair, N. Exploring the Future Energy Value of Long-Duration Energy Storage. Energies 2025, 18, 1751. https://doi.org/10.3390/en18071751

Schleifer AH, Cohen SM, Cole W, Denholm P, Blair N. Exploring the Future Energy Value of Long-Duration Energy Storage. Energies. 2025; 18(7):1751. https://doi.org/10.3390/en18071751

Chicago/Turabian StyleSchleifer, Anna H., Stuart M. Cohen, Wesley Cole, Paul Denholm, and Nate Blair. 2025. "Exploring the Future Energy Value of Long-Duration Energy Storage" Energies 18, no. 7: 1751. https://doi.org/10.3390/en18071751

APA StyleSchleifer, A. H., Cohen, S. M., Cole, W., Denholm, P., & Blair, N. (2025). Exploring the Future Energy Value of Long-Duration Energy Storage. Energies, 18(7), 1751. https://doi.org/10.3390/en18071751