A Comprehensive Analysis of the Economic Implications, Challenges, and Opportunities of Electric Vehicle Adoption in Indonesia

Abstract

1. Introduction

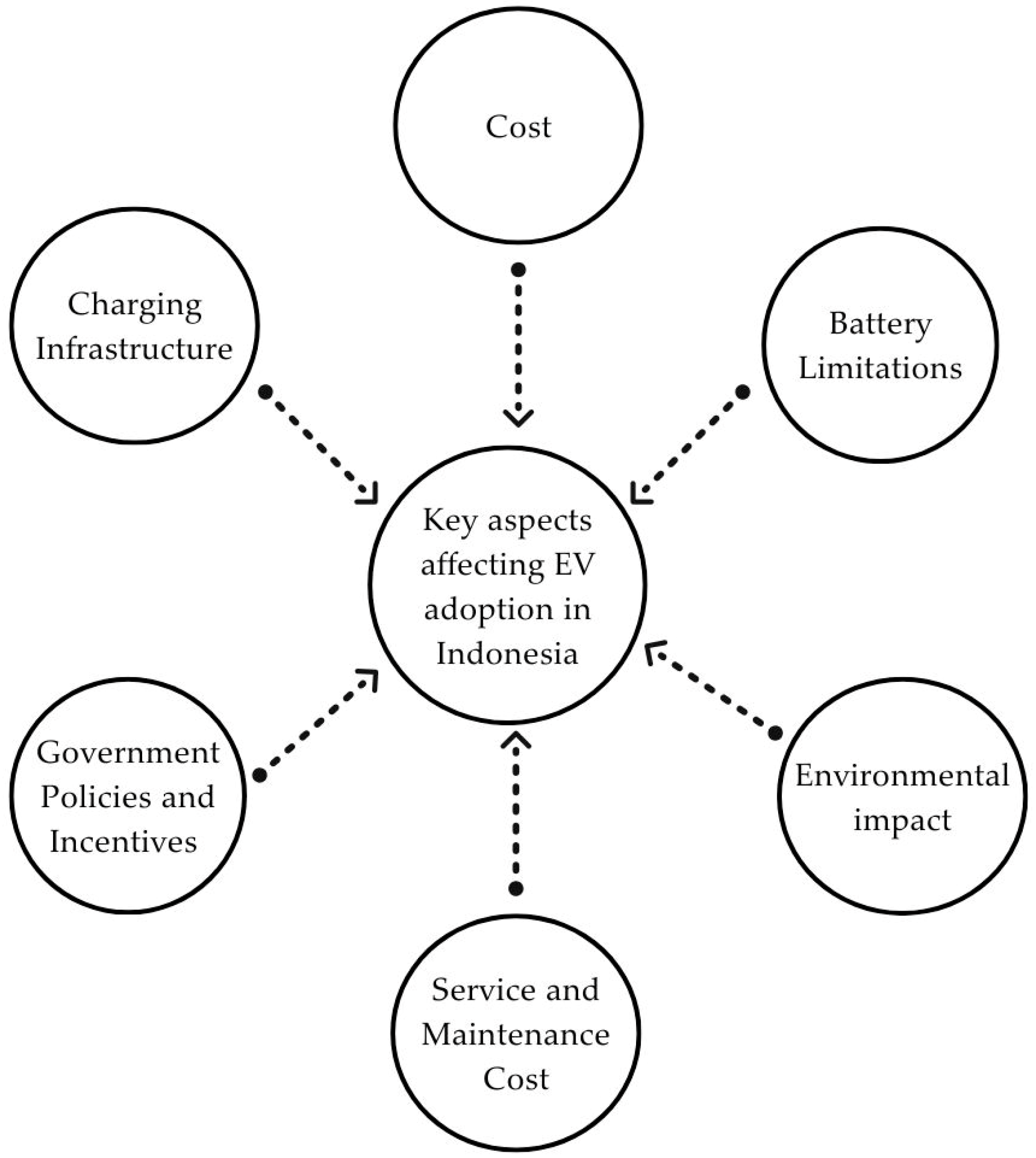

2. Review on Electric Vehicle Adoption in Indonesia

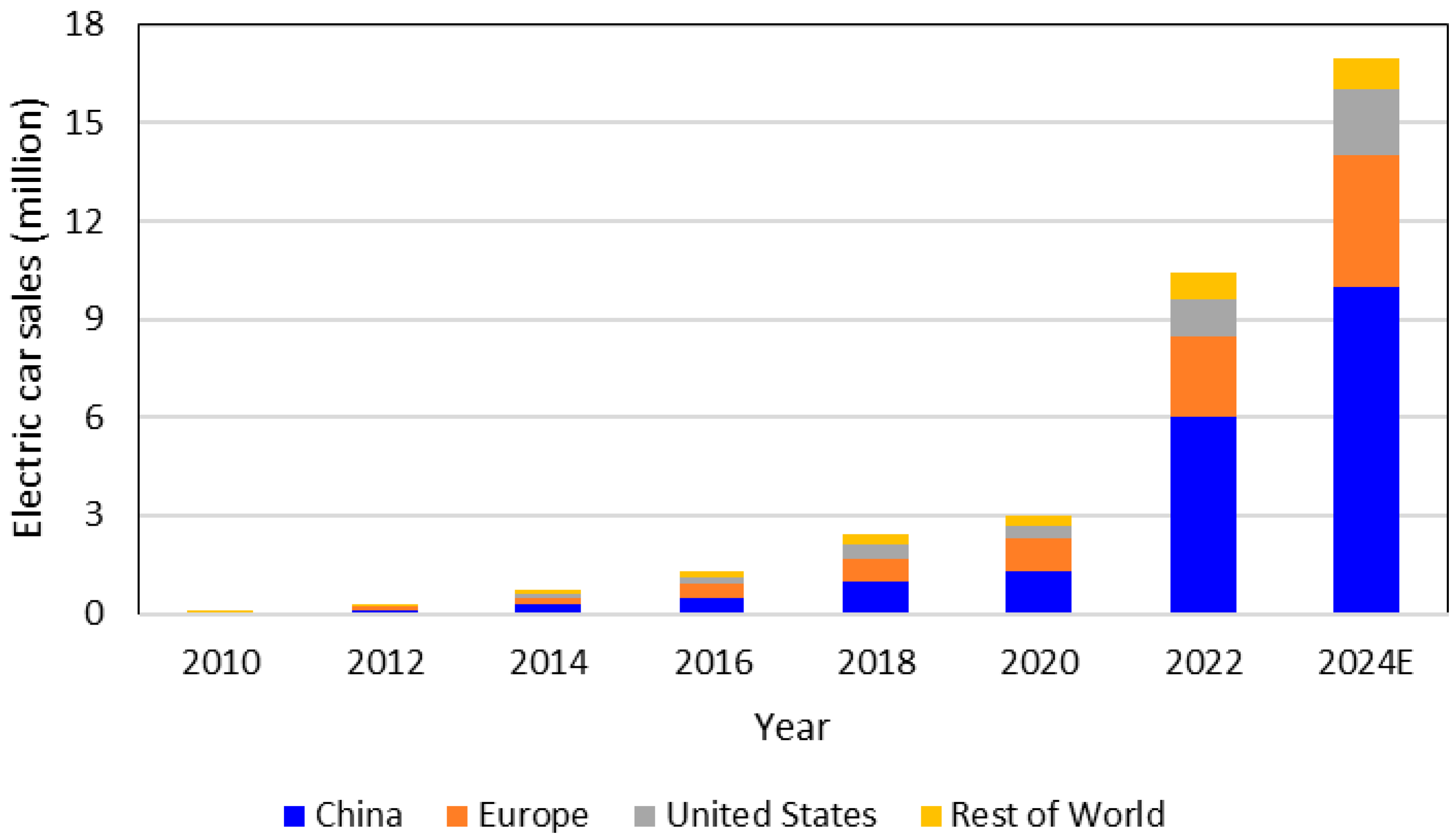

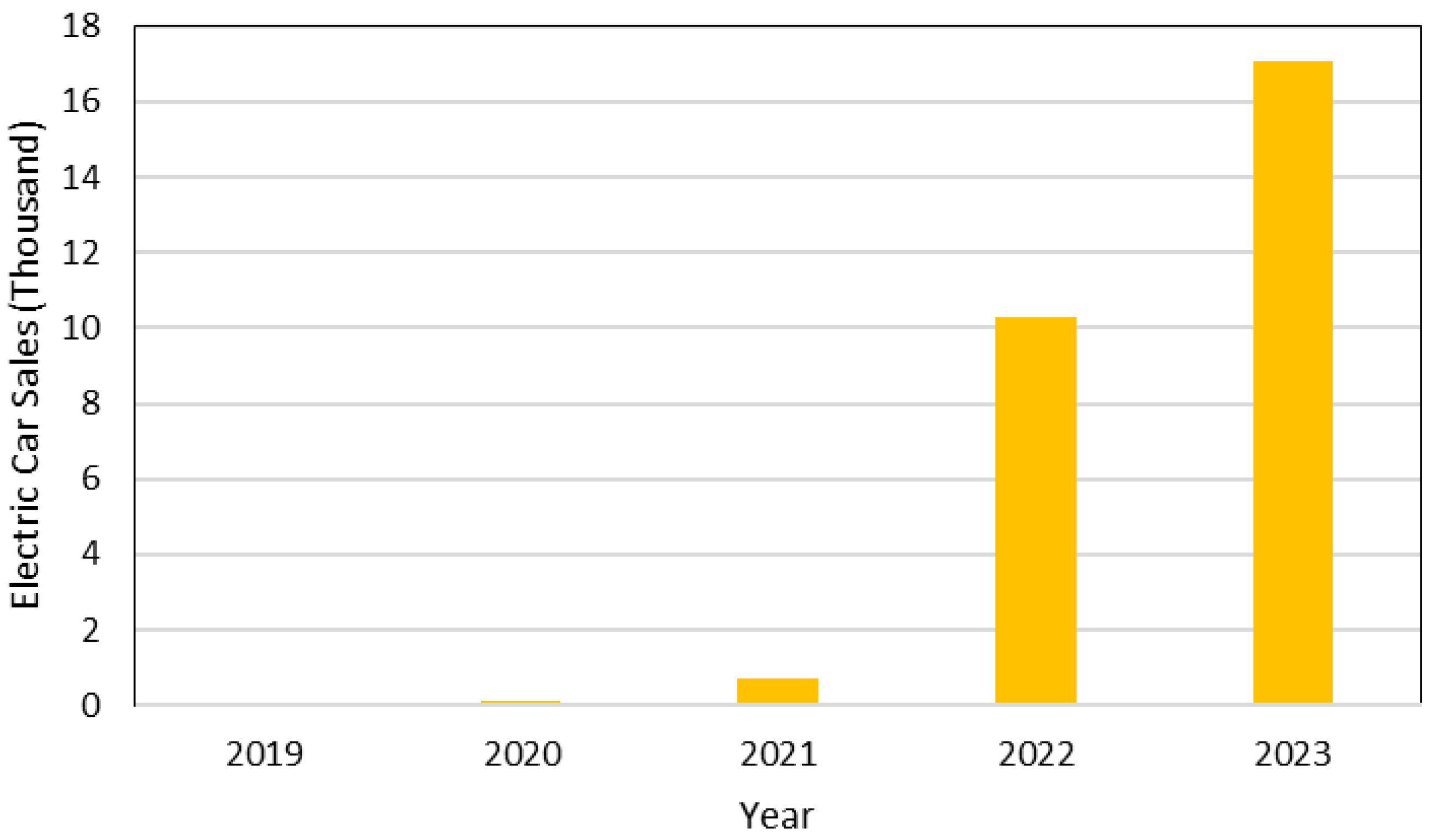

2.1. Electric Vehicle’s Market

2.2. Indonesia’s EV Regulatory Framework and Incentives

2.3. EV Charging Infrastructure in Indonesia

2.4. EV Maintenance Services in Indonesia

2.5. Integration of EVs in Indonesia’s Public Transportation

2.6. Study on Customer Preferences for Electric Vehicles

3. Results and Discussion

3.1. Vehicle User’s Perspective

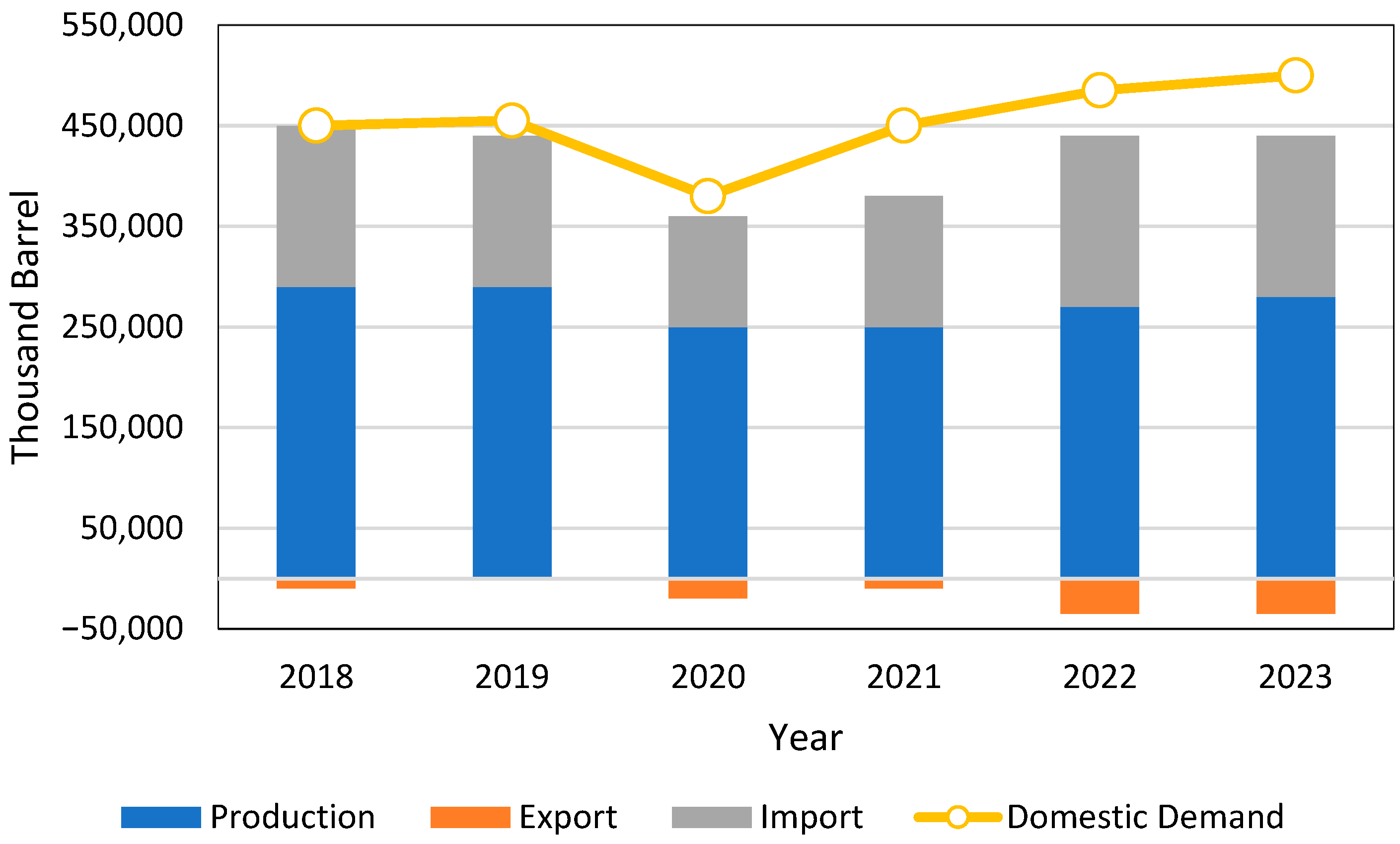

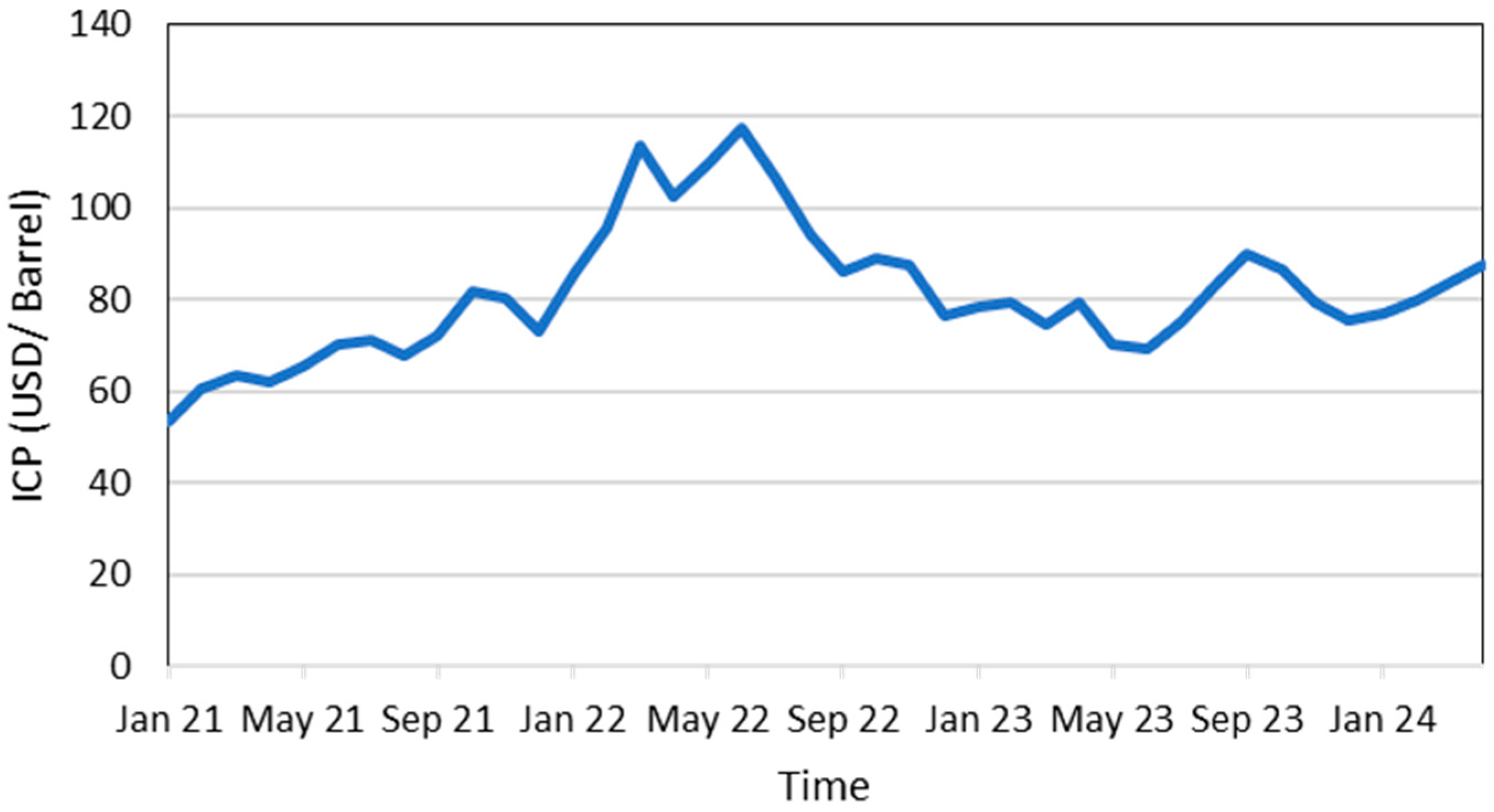

3.1.1. Economic Implication for Vehicle Users in Adopting Electric Vehicles

3.1.2. Challenges in Adoption of Electric Vehicles

3.1.3. Opportunities for Vehicle Users in Adopting Electric Vehicles

3.2. Industries’ Perspective

3.2.1. Economic Implication for Industries in Adopting Electric Vehicles

3.2.2. Challenges in the Adoption of Electric Vehicles

3.2.3. Opportunities for Industries in Adopting Electric Vehicles

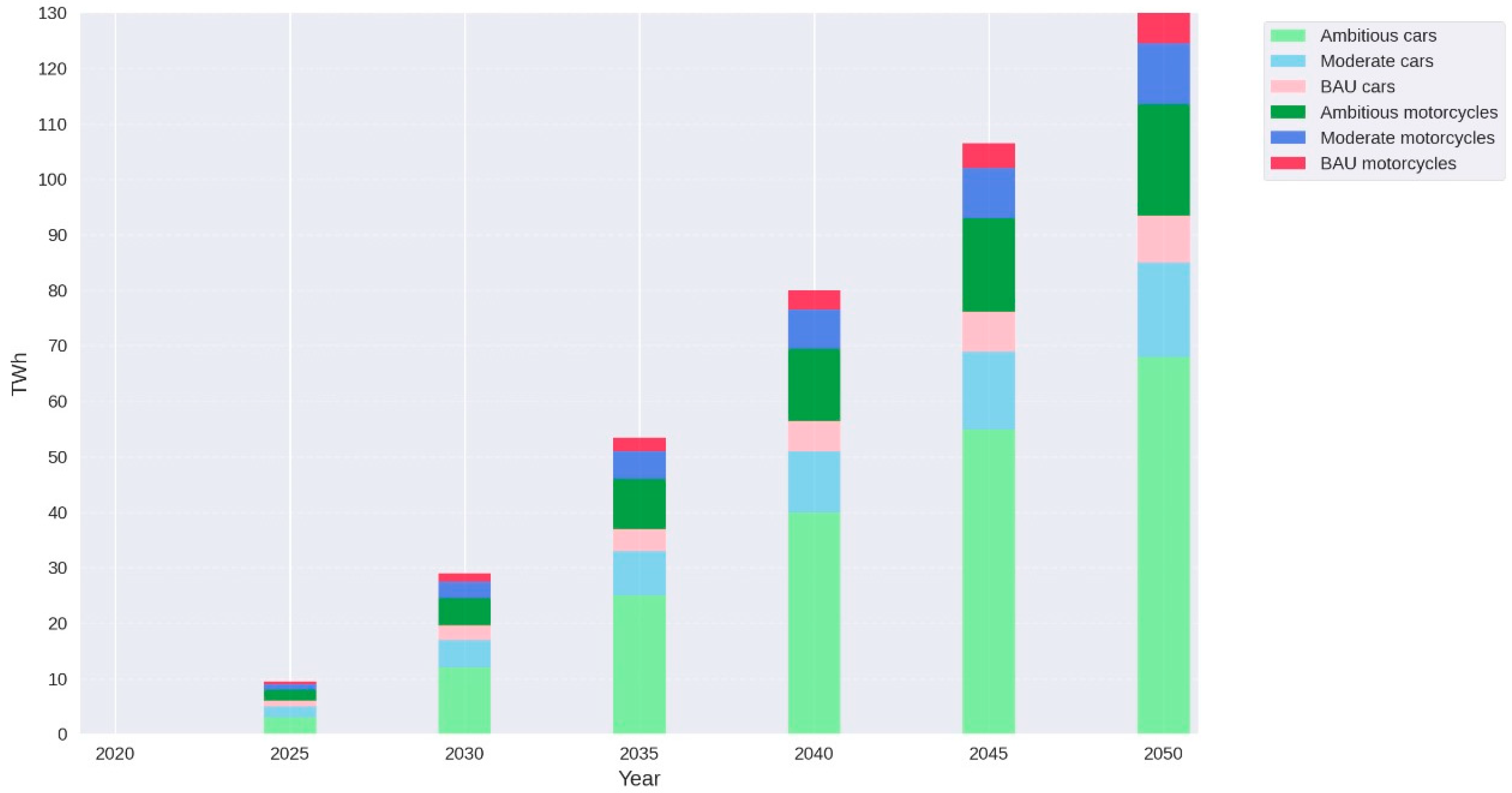

3.3. Government’s Perspective

3.3.1. Economic Implications for Governments in Adopting Electric Vehicles

3.3.2. Opportunities for Government in Adopting Electric Vehicles

4. Conclusions and Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Foreign Direct Investment Plan and Realization

| Company | Country | Investment Plan (in Billion USD) | Project Plan | Collaboration | Realization | Source |

| LG Energy Solution-Hyundai Motor Company (Karawang, West Java, Indonesia) | South Korea | 9.8 | An electric vehicle battery cell project integrating mining, smelting, refining, precursor, and cathode industries (Buli, Halmahera) | PT Indonesia Asahan Aluminium (Persero), PT Aneka Tambang Tbk, PT Pertamina (Persero), PT Perusahaan Listrik Negara (PLN), PT Indonesia Battery Corporation (IBC) | First Phase: USD 1.1 billion investment by PT HLI

Green Power in a production facility at Karawang New Industry City (KNIC).

Capacity: 10 GWh, producing 32.6 million battery cells for approximately

150,000 units. The inauguration was held in July 2024. Second Phase: USD 2 billion investment, construction ongoing, with commercial production beginning in March 2025. Capacity: 20 GWh. | [80,81] |

| PT Ningbo Contemporary Brunp Lygend Co., Ltd. (CBL), a subsidiary of Contemporary Amperex Technology Co. (CATL) (Morowali, Central Sulawesi, Indonesia) | China | 6 | A nickel mine (joint venture with PT ANTAM) and further nickel downstream processing in refining, precursor, cathode, battery cells, and recycling stages | PT Indonesia Battery Corporation (IBC), PT Sumberdaya Arindo (a subsidiary of PT Aneka Tambang Tbk.) | Signed a Conditional Share Purchase Agreement (CSPA) on January 16, 2023, to invest the initial USD 420 million. This agreement involves the transfer of 49% of Antam’Fs shares in its subsidiary, PT Sumberdaya Arindo (SDA), for the joint project with CBL. | [82] |

| Ford-Zhejiang Huayou Cobalt (Halmahera, North Maluku, Indonesia) | United States-China | 4.5 | High-pressure acid leaching (HPAL) plant in Pomalaa in Southeast Sulawesi | PT Kolaka Nickel Indonesia (KNI), PT Vale Indonesia (INCO) | The HPAL plant was constructed in November 2022 and is expected to start production in 2026, producing 120 kilotons of mixed hydroxide precipitate (MHP) annually. | [83] |

| PT BYD Motor Indonesia (BYD) (Subang, West Java, Indonesia) | China | 0.74 | An electric vehicle factory in Subang Smartpolitan Industrial Zone, designed to produce 150,000 EVs per year. | PT Suryacipta Swadaya | The construction of the factory is expected to be completed by the end of 2025, with production likely to begin in 2026. | [84,85] |

References

- Mathy, S.; Menanteau, P.; Criqui, P. After the Paris Agreement: Measuring the Global Decarbonization Wedges from National Energy Scenarios. Ecol. Econ. 2018, 150, 273–289. [Google Scholar] [CrossRef]

- Kanugrahan, S.P.; Hakam, D.F.; Nugraha, H. Techno-Economic Analysis of Indonesia Power Generation Expansion to Achieve Economic Sustainability and Net Zero Carbon. Sustainability 2022, 14, 9038. [Google Scholar] [CrossRef]

- Huang, Y.; Zhang, Y.; Deng, F.; Zhao, D.; Wu, R. Impacts of Built-Environment on Carbon Dioxide Emissions from Traffic: A Systematic Literature Review. Int. J. Environ. Res. Public Health 2022, 19, 16898. [Google Scholar] [CrossRef]

- Kene, R.; Olwal, T.; Van Wyk, B.J. Sustainable Electric Vehicle Transportation. Sustainability 2021, 13, 12379. [Google Scholar] [CrossRef]

- Alanazi, F. Electric Vehicles: Benefits, Challenges, and Potential Solutions for Widespread Adaptation. Appl. Sci. 2023, 13, 6016. [Google Scholar] [CrossRef]

- Kumar, M.; Panda, K.P.; Naayagi, R.T.; Thakur, R.; Panda, G. Comprehensive Review of Electric Vehicle Technology and Its Impacts: Detailed Investigation of Charging Infrastructure, Power Management, and Control Techniques. Appl. Sci. 2023, 13, 8919. [Google Scholar] [CrossRef]

- Pirmana, V.; Alisjahbana, A.S.; Yusuf, A.A.; Hoekstra, R.; Tukker, A. Economic and Environmental Impact of Electric Vehicles Production in Indonesia. Clean Technol. Environ. Policy 2023, 25, 1871–1885. [Google Scholar] [CrossRef]

- IEA. Global EV Outlook 2024. Available online: https://iea.blob.core.windows.net/assets/a9e3544b-0b12-4e15-b407-65f5c8ce1b5f/GlobalEVOutlook2024.pdf (accessed on 8 December 2024).

- Llanos, C. What Is the Electric Vehicle (EV) Boom? Available online: https://www.jpmorgan.com/insights/investing/investment-strategy/what-is-the-electric-vehicle-boom (accessed on 8 December 2024).

- Yang, Z.; Slowik, P.; Lutsey, N.; Searle, S. Principles for Effective Electric Vehicle Incentive Design; The International Council on Clean Transport: Washington, DC, USA, 2016. [Google Scholar]

- Pambudi, I.; Juwono, V. Electric Vehicles in Indonesia: Public Policy, Impact, and Challenges. Asian J. Soc. Humanit. 2023, 2, 1631–1644. [Google Scholar] [CrossRef]

- MEMR. EV Program Overcomes Gasoline Imports, Official Says. Available online: https://www.esdm.go.id/en/media-center/news-archives/tren-kendaraan-listrik-ke-depan-telah-disiapkan-sejak-dini (accessed on 8 December 2024).

- Maghfiroh, M.F.N.; Pandyaswargo, A.H.; Onoda, H. Current Readiness Status of Electric Vehicles in Indonesia: Multistakeholder Perceptions. Sustainability 2021, 13, 13177. [Google Scholar] [CrossRef]

- Pandyaswargo, A.H.; Wibowo, A.D.; Maghfiroh, M.F.N.; Rezqita, A.; Onoda, H. The Emerging Electric Vehicle and Battery Industry in Indonesia: Actions around the Nickel Ore Export Ban and a SWOT Analysis. Batteries 2021, 7, 80. [Google Scholar] [CrossRef]

- Mah, S. Electric Vehicle (EV) Sales Expected to See Sharp Growth across ASEAN-6 Markets: EY-Parthenon Study. Available online: https://www.ey.com/en_sg/newsroom/2023/12/electric-vehicle-sales-expected-to-see-sharp-growth-across-asean-6-markets-ey-parthenon-study (accessed on 10 December 2024).

- US-ABC. EV Market Landscape. Available online: https://www.usasean.org/article/ev-market-landscape (accessed on 11 December 2024).

- Ganbold, S. Market Share of Electric Vehicle (EV) Sales in Southeast Asia as of 3rd Quarter of 2022, by Leading Country. Available online: https://www.statista.com/statistics/1360566/sea-ev-market-share/ (accessed on 10 December 2024).

- GAIKINDO. Penjualan Mobil Domestik Melambat Sepanjang 2023. Available online: https://www.gaikindo.or.id/penjualan-mobil-domestik-melambat-sepanjang-2023/ (accessed on 9 December 2024).

- DFSK. DFSK Series E1. Available online: https://www.dfskmotors.co.id/id/cars/e1 (accessed on 8 December 2024).

- FEA. Mobil Listrik Termahal Mercy di RI, EQS Edition One Cuma Ada 12 Unit. Available online: https://www.cnnindonesia.com/otomotif/20231110120755-603-1022448/mobil-listrik-termahal-mercy-di-ri-eqs-edition-one-cuma-ada-12-unit (accessed on 8 December 2024).

- PLN. PLN Terus Genjot Penambahan Charging Station Kendaraan Listrik di Berbagai Daerah. Available online: https://web.pln.co.id/media/siaran-pers/2024/08/pln-terus-genjot-penambahan-charging-station-kendaraan-listrik-di-berbagai-daerah (accessed on 10 December 2024).

- PLN. Electric Vehicle Digital Solution. Available online: https://lights.iconpln.co.id/storage/product/20240701_105235-product-24-20240612%20EV%20Services.pdf (accessed on 17 February 2025).

- Wuling. Mengenal Apa Itu SPKLU Hingga Perbedaan Dengan SPLU. Available online: https://wuling.id/id/blog/lifestyle/pemilik-mobil-listrik-wajib-tahu-spklu-stasiun-pengisian-kendaraan-listrik-umum (accessed on 17 February 2025).

- Kompas. Pemerintah Proyeksikan Bangun 63.000 SPKLU Untuk 1 Juta EV Hingga 2030. Available online: https://money.kompas.com/read/2025/02/18/123000326/pemerintah-proyeksikan-bangun-63.000-spklu-untuk-1-juta-ev-hingga-2030 (accessed on 17 February 2025).

- Bisnis. Pertamina Patra Niaga Operasikan 25 Battery Swapping Station. Available online: https://ekonomi.bisnis.com/read/20240110/44/1731020/pertamina-patra-niaga-operasikan-25-battery-swapping-station (accessed on 17 February 2025).

- PLN. Electric Vehicle Services. Available online: https://lights.iconpln.co.id/product/YAga2R9e (accessed on 17 February 2025).

- Hyundai. Perawatan Berkala. Available online: https://www.hyundai.com/id/id/hyundai-hadir-untukmu/hyundai-jaga/maintenance/maintenance (accessed on 18 February 2025).

- Wuling. Wajib Tahu! Ragam Service Mobil, Biaya, Dan Jarak Waktu. Available online: https://wuling.id/id/blog/lifestyle/wajib-tahu-ragam-service-mobil-biaya-dan-jarak-waktu (accessed on 18 February 2025).

- BYD. Servis. Available online: https://byd.arista-group.co.id/servis/ (accessed on 18 February 2025).

- GAIKINDO. Dokter Mobil Indonesia Hadirkan Servis Khusus Listrik Dan Hybrid. Available online: https://www.gaikindo.or.id/dokter-mobil-indonesia-hadirkan-servis-khusus-listrik-dan-hybrid/ (accessed on 18 February 2025).

- Kompas. Transjakarta Akan Operasikan 10.000 Bus Listrik Hingga Tahun 2030 Demi Tekan Emisi Karbon. Available online: https://megapolitan.kompas.com/read/2022/09/02/18154711/transjakarta-akan-operasikan-10000-bus-listrik-hingga-tahun-2030-demi (accessed on 18 February 2025).

- Kompas. Merintis Langit Biru Dari Bus Transjakarta. Available online: https://www.kompas.id/baca/riset/2021/01/22/merintis-langit-biru-dari-bus-transjakarta (accessed on 18 February 2025).

- BPK RI. Transjakarta Resmi Operasikan 100 Unit Bus Listrik Berjenis Lowdeck Di Tahun 2023 Dalam Rangka Peningkatan Layanan Angkutan Umum. 2023. Available online: https://jakarta.bpk.go.id/wp-content/uploads/2023/12/TranJ-operasikan-Bus-Listrik.wil_pdf (accessed on 18 February 2025).

- Detik. Warga Minta Rute Bus Listrik Surabaya Ditambah, Alasannya Nyaman-Tepat Waktu. Available online: https://www.detik.com/jatim/berita/d-7722218/warga-minta-rute-bus-listrik-surabaya-ditambah-alasannya-nyaman-tepat-waktu (accessed on 18 February 2025).

- Detik. Bus Listrik Akan Beroperasi Di Bali Dengan Jalur Khusus Seperti TransJakarta. Available online: https://www.detik.com/bali/bisnis/d-7408961/bus-listrik-akan-beroperasi-di-bali-dengan-jalur-khusus-seperti-transjakarta (accessed on 18 February 2025).

- Interport. Interport Participates in the Launch of 60 Electric Buses for Medan’s BRT Mass Transportation Project. Available online: https://interport.co.id/interport-participates-in-the-launch-of-60-electric-buses-for-medans-brt-mass-transportation-project/ (accessed on 18 February 2025).

- Kompas. Hingga Akhir 2023, Gojek Targetkan Punya 5.000 Kendaraan Listrik. Available online: https://www.kompas.com/properti/read/2023/05/30/180000621/hingga-akhir-2023-gojek-targetkan-punya-5000-kendaraan-listrik (accessed on 18 February 2025).

- Grab. Grab Dan Pemerintah Indonesia Melaju Bersama Untuk Wujudkan Roadmap Ekosistem Kendaraan Listrik. Available online: https://www.grab.com/id/press/tech-product/grab-dan-pemerintah-indonesia-melaju-bersama-untuk-wujudkan-roadmap-ekosistem-kendaraan-listrik/ (accessed on 18 February 2025).

- Kompas. Punya 200 Armada EV, Ini Deretan Mobil Listrik Yang Dipakai Bluebird. Available online: https://otomotif.kompas.com/read/2024/07/31/172100115/punya-200-armada-ev-ini-deretan-mobil-listrik-yang-dipakai-bluebird (accessed on 18 February 2025).

- Suyanto, A.M.A.; Pasaribu, W.S. Analysis of Indonesian Society’s Preferences for the Presence of Electric Vehicles. J. Prof. Bus. Rev. 2023, 8, e03324. [Google Scholar] [CrossRef]

- PWC. Indonesia Electric Vehicle Consumer Survey 2023; Indonesia. Available online: https://www.pwc.com/id/en/publications/automotive/indonesia-electric-vehicle-consumer-survey-2023.pdf (accessed on 9 December 2024).

- Insights, S. Electric Vehicles in Indonesia. Available online: https://standard-insights.com/electric-vehicles-in-indonesia/#download (accessed on 9 December 2024).

- Haryadi, F.N.; Asi Simaremare, A.; Rohmatul, S.R.; Hakam, D.F.; Mangunkusumo, K.G.H. Investigating the Impact of Key Factors on Electric/Electric-Vehicle Charging Station Adoption in Indonesia. Int. J. Energy Econ. Policy 2023, 13, 434–442. [Google Scholar] [CrossRef]

- Hakam, D.F.; Jumayla, S. Electric Vehicle Adoption in Indonesia: Lesson Learned from Developed and Developing Countries. Sustain. Futures 2024, 8, 100348. [Google Scholar] [CrossRef]

- Armenta-Déu, C.; Cattin, E. Real Driving Range in Electric Vehicles: Influence on Fuel Consumption and Carbon Emissions. World Electr. Veh. J. 2021, 12, 166. [Google Scholar] [CrossRef]

- Atmo, G.U. Energy Transition in Indonesia and Future Mobility. Available online: https://www.gaikindo.or.id/wp-content/uploads/2023/08/02.-EBTKE_Seminar-GIIAS_18-Augt_2023_0818-GAIKINDO-R2.pdf (accessed on 11 December 2024).

- Sidabutar, V.T.P. Kajian pengembangan kendaraan listrik di Indonesia: Prospek dan hambatannya. J. Paradig. Ekon. 2020, 15, 21–38. [Google Scholar] [CrossRef]

- Sasongko, T.W.; Ciptomulyono, U.; Wirjodirdjo, B.; Prastawa, A. Identification of Electric Vehicle Adoption and Production Factors Based on an Ecosystem Perspective in Indonesia. Cogent Bus. Manag. 2024, 11, 2332497. [Google Scholar] [CrossRef]

- Shree, V.; Edeh, F.O.; Sin, L.G.; Pandey, R.; Tiwari, S.; Onukele, A.; Gupta, H.K.; Farzan, K.A.; Tiwari, G.; Ayu Triana, A.A.; et al. EV Markets: A Comparative Analysis between India, Nigeria, and Indonesia. Int. J. Account. Financ. Asia Pac. 2024, 7, 14–32. [Google Scholar] [CrossRef]

- Umah, A. Ini lho Alasan Mobil Listrik Masih Mahal di RI. Available online: https://www.cnbcindonesia.com/news/20210921093008-4-277837/ini-lho-alasan-mobil-listrik-masih-mahal-di-ri (accessed on 10 December 2024).

- Candra, C.S. Evaluation of Barriers to Electric Vehicle Adoption in Indonesia through Grey Ordinal Priority Approach. Int. J. Grey Syst. 2022, 2, 38–56. [Google Scholar] [CrossRef]

- Pelletier, S.; Jabali, O.; Laporte, G. Battery Electric Vehicles for Goods Distribution: A Survey of Vehicle Technology, Market Penetration, Incentives and Practices. Available online: https://www.cirrelt.ca/DocumentsTravail/CIRRELT-2014-43.pdf (accessed on 19 May 2016).

- Putra, Y.R.P.; Sudiarno, A.; Sholihah, M.; Wikarta, A.; Pranaditya, I.M.I.S.; Saputra, Y.A. Comparative Economic Study of Electric Cars in Indonesia. E3S Web Conf. 2024, 517, 05016. [Google Scholar] [CrossRef]

- Cyrill, M. Indonesia Market Prospects for EV Sales and Manufacturing. Available online: https://www.aseanbriefing.com/news/indonesia-market-prospects-for-electric-vehicles-sales-manufacturing-investments/ (accessed on 8 December 2024).

- Humana International. EV Battery Production in Indonesia. Available online: https://humanainternational.com/ev-battery-production-in-indonesia/ (accessed on 8 December 2024).

- Nurdifa, A.R. Di Depan Pejabat Asean, Bahlil Klaim Investasi Ekosistem EV Tembus Rp630 Triliun Artikel Ini Telah Tayang Di Bisnis.Com Dengan Judul “Di Depan Pejabat Asean, Bahlil Klaim Investasi Ekosistem EV Tembus Rp630 Triliun. Available online: https://ekonomi.bisnis.com/read/20230902/257/1690798/di-depan-pejabat-asean-bahlil-klaim-investasi-ekosistem-ev-tembus-rp630-triliun (accessed on 9 December 2024).

- Tempo. BASF Batalkan Investasi Rp42,72 Triliun, Kementerian ESDM: Baru Pernyataan Pers. 2024. Available online: https://www.tempo.co/ekonomi/basf-batalkan-investasi-rp42-72-triliun-kementerian-esdm-baru-pernyataan-pers-45592 (accessed on 9 December 2024).

- Tempo. Profil Tesla yang Batal Investasi di Indonesia karena Gunakan Tenaga Listrik Berbasis Fosil. Available online: https://www.tempo.co/ekonomi/profil-tesla-yang-batal-investasi-di-indonesia-karena-gunakan-tenaga-listrik-berbasis-fosil-12417 (accessed on 9 December 2024).

- BKPM. Mundurnya BASF Di Proyek Sonic Bay Tidak Menurunkan Minat Investasi Hilirisasi Di Indonesia. Available online: https://www.bkpm.go.id/id/info/siaran-pers/mundurnya-basf-di-proyek-sonic-bay-tidak-menurunkan-minat-investasi-hilirisasi-di-indonesia (accessed on 12 December 2024).

- Antara. Bahlil: Pembangunan Pabrik Baterai EV Tunjukkan Komitmen Hilirisasi. Available online: https://www.antaranews.com/berita/3727824/bahlil-pembangunan-pabrik-baterai-ev-tunjukkan-komitmen-hilirisasi?utm (accessed on 10 December 2024).

- Vale. Indonesia Growth Project. Available online: https://vale.com/in/indonesia-growth-projects (accessed on 13 December 2024).

- VOI Development of Battery Electric Vehicles Contributing to Absorb Thousands of Worker. Available online: https://voi.id/en/economy/287531 (accessed on 11 December 2024).

- Amiruddin, A.; Dargaville, R.; Liebman, A.; Gawler, R. Integration of Electric Vehicles and Renewable Energy in Indonesia’s Electrical Grid. Energies 2024, 17, 2037. [Google Scholar] [CrossRef]

- PLN. PLN Gunakan REC untuk Seluruh SPKLU, Pengguna EV Tak Perlu Ragu Listriknya 100% Energi Bersih. Available online: https://web.pln.co.id/cms/media/siaran-pers/2023/12/pln-gunakan-rec-untuk-seluruh-spklu-pengguna-ev-tak-perlu-ragu-listriknya-100-energi-bersih/ (accessed on 9 December 2024).

- Pramana, P.A.A.; Hakam, D.F.; Tambunan, H.B.; Tofani, K.M.; Mangunkusumo, K.G.H. How Are Consumer Perspectives of PV Rooftops and New Business Initiatives in Indonesia’s Energy Transition? Sustainability 2024, 16, 1590. [Google Scholar] [CrossRef]

- IESR. The Role of EV in Decarbonizing Road Transport Sector in Indonesia. Available online: https://www.climate-transparency.org/wp-content/uploads/2020/07/Final_The-Role-of-EV-in-Decarbonizing-Road-Transport-Sector-in-Indonesia_Compressed-Version.pdf (accessed on 9 December 2024).

- Huda, M.; Aziz, M.; Tokimatsu, K. The Future of Electric Vehicles to Grid Integration in Indonesia. Energy Procedia 2019, 158, 4592–4597. [Google Scholar] [CrossRef]

- Tambunan, H.B.; Hakam, D.F.; Prahastono, I.; Pharmatrisanti, A.; Purnomoadi, A.P.; Aisyah, S.; Wicaksono, Y.; Sandy, I.G.R. The Challenges and Opportunities of Renewable Energy Source (RES) Penetration in Indonesia: Case Study of Java-Bali Power System. Energies 2020, 13, 5903. [Google Scholar] [CrossRef]

- PLN. PT PLN Persero Annual Report 2022. Available online: https://web.pln.co.id/statics/uploads/2023/06/Laporan-Tahunan-2022_Final_3005_Med-Res.pdf (accessed on 10 December 2024).

- Darmoyono, I. Study on Challenges and Opportunities for Electric Vehicle Development for Land-Based Public Transport Sector in Cities of Indonesia. Available online: https://repository.unescap.org/bitstream/handle/20.500.12870/6777/ESCAP-2024-WP-Study-Challenges-Opportunities-Electric-Vehicle-Development-Land-based-Public-Transport-Sector-Indonesia.pdf (accessed on 12 December 2024).

- Utama, S.; Redrup, O. How to Seize Opportunities across Southeast Asia’s EV Value Chain. 2024. Available online: https://www.ey.com/en_vn/insights/strategy/how-to-seize-opportunities-across-southeast-asias-ev-value-chain#:~:text=To%20succeed%20in%20the%20region’s,synergies%20within%20the%20value%20chain (accessed on 12 December 2024).

- ACVentures. Indonesia’s Electric Vehicle Outlook: Supercharging Tomorrow’s Mobility. Available online: https://acv.vc/wp-content/uploads/2023/07/Report-Indonesias-Electric-Vehicle-Outlook-Supercharging-Tomorrows-Mobility_NEW.pdf (accessed on 14 December 2024).

- MEMR. Potensi Menjanjikan, Nikel RI Bakal Laris Manis Pikat Investor. Available online: https://www.esdm.go.id/id/media-center/arsip-berita/potensi-menjanjikan-nikel-ri-bakal-laris-manis-pikat-investor- (accessed on 14 December 2024).

- BPS. [Seri 2010] Laju Pertumbuhan PDB Seri 2010 (Persen), 2024. Available online: https://www.bps.go.id/id/statistics-table/2/MTA0IzI=/pertumbuhan-ekonomi--triwulan-i-2024.html (accessed on 10 December 2024).

- GAIKINDO. Jika Mobil Hybrid Mendapat Insentif, GAIKINDO Yakin Penjualan Meningkat. Available online: https://www.gaikindo.or.id/jika-mobil-hybrid-mendapat-insentif-gaikindo-yakin-penjualan-meningkat/ (accessed on 10 December 2024).

- Setiawan, V.N. Warga RI Pakai Mobil Listrik, Impor BBM Turun 30 Juta Barel. Available online: https://www.cnbcindonesia.com/news/20220912142110-4-371360/warga-ri-pakai-mobil-listrik-impor-bbm-turun-30-juta-barel (accessed on 8 December 2024).

- MEMR. Handbook of Energy & Economic Statistics of Indonesia 2023. Available online: https://esdm.go.id/assets/media/content/content-handbook-of-energy-and-economic-statistics-of-indonesia-2023.pdf (accessed on 12 December 2024).

- Suraharta, I.M.; Djajasinga, N.D.; Wicaksono, M.B.A.; Akbar, R.A.; Priono, N.J.; Yusuf, M.A.; Gugat, R.M.D. Electric Vehicle Policy: The Main Pillar of Indonesia’s Future Energy Security. Int. J. Sci. Soc. 2022, 4, 142–156. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook 2023. Available online: https://iea.blob.core.windows.net/assets/86ede39e-4436-42d7-ba2a-edf61467e070/WorldEnergyOutlook2023.pdf (accessed on 12 December 2024).

- MSS Beranda Tentang Kami Produk Hukum Berita & Artikel Informasi & Layanan Publik Presiden Jokowi Resmikan Ekosistem Kendaraan Listrik Dan Pabrik Sel Baterai Listrik Pertama Dan Terbesar Di Asia Tenggara. Available online: https://www.setneg.go.id/baca/index/presiden_jokowi_resmikan_ekosistem_kendaraan_listrik_dan_pabrik_sel_baterai_listrik_pertama_dan_terbesar_di_asia_tenggara (accessed on 14 December 2024).

- Tempo Hyundai LG Indonesia Produksi Sel Baterai April 2024, Pasok 150 Ribu Kendaraan Listrik. Available online: https://www.tempo.co/ekonomi/hyundai-lg-indonesia-produksi-sel-baterai-april-2024-pasok-150-ribu-kendaraan-listrik--79319 (accessed on 10 December 2024).

- Setiawan, V.N. Deal! Pabrikan Baterai EV China CBL Investasi Rp 6 T di RI. 2023. Available online: https://www.cnbcindonesia.com/news/20231222101527-4-499487/deal-pabrikan-baterai-ev-china-cbl-investasi-rp-6-t-di-ri (accessed on 11 December 2024).

- Wahyudi, N.A. Huayou Beberkan Progres Proyek Nikel Rp67,5 Triliun Bareng Vale & Ford. Available online: https://ekonomi.bisnis.com/read/20240304/44/1746331/huayou-beberkan-progres-proyek-nikel-rp675-triliun-bareng-vale-ford (accessed on 13 December 2024).

- Rayanti, D. Apa Kabar Pabrik BYD di Indonesia, Kapan Mulai Ngebul? Available online: https://oto.detik.com/mobil-listrik/d-7670944/apa-kabar-pabrik-byd-di-indonesia-kapan-mulai-ngebul (accessed on 11 December 2024).

- Tempo. BYD akan Investasi di RI Senilai Rp 11,7 Triliun, Bakal Hadirkan Banyak Kendaraan Listrik Plug-in Hybrid. Available online: https://www.tempo.co/ekonomi/byd-akan-investasi-di-ri-senilai-rp-11-7-triliun-bakal-hadirkan-banyak-kendaraan-listrik-plug-in-hybrid-359389 (accessed on 14 December 2024).

| Category | Electric Cars | Conventional Cars |

|---|---|---|

| Energy Consumption | 0.123 kWh/km | 0.083 liter/km |

| 0.44 MJ/km | 2.46 MJ/km | |

| Cost of Energy | IDR 178/km | IDR 747/km |

| Emission | 108 g CO2/km | 178 g CO2/km |

| Description | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Total Power Plants (unit) | 6545 | 6723 | 6677 | 6760 | 6928 |

| Number of Customers (mio) | 71,917,397 | 75,705,614 | 79,000,033 | 82,543,980 | 85,636,198 |

| Power Capacity (MW) | 57,822 | 62,833 | 63,336 | 64,553 | 69,040 |

| Electricity Production (GWh) | 267,085 | 278,941 | 274,851 | 289,471 | 308,002 |

| Category | Estimated Indonesia Market Size ($B, 2030) |

|---|---|

| Cell manufacturing and battery management system | 3–4.5 |

| Auto R&D and manufacturing | 12.5–15 |

| Vehicle sales and dealership | 1–2 |

| Charging infrastructure | 2–3 |

| Service maintenance and battery recycling | 0.5–1.5 |

| Activities | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| Number of Electric Cars (cumulative) | 500 | 93,875 | 187,250 | 280,625 | 374,000 | 738,200 | 1,102,400 | 1,466,600 | 1,830,800 | 2,195,000 |

| Number of Electric Motorcycles (cumulative) | 200,000 | 3,098,250 | 5,996,500 | 8,894,750 | 11,793,000 | 12,034,800 | 12,276,600 | 12,518,400 | 12,760,200 | 13,002,000 |

| Energy Savings (MBOE) | 0.25 | 4.37 | 8.49 | 12.62 | 16.74 | 19.35 | 22.19 | 24.57 | 27.18 | 29.79 |

| Emission Reduction (MtonCO2-e) | 0.1 | 1.2 | 2.3 | 3.4 | 4.5 | 5.1 | 5.6 | 6.1 | 6.7 | 7.2 |

| Electric Cars Roadmap | Notes | Electric Motorcycle Roadmap | Notes | |

|---|---|---|---|---|

| Annual mileage | 18,000 km | Annual mileage | 8000 km | |

| Total vehicles by 2030 | 2,195,000 unit | Total vehicles by 2030 | 13,002,000 unit | |

| Energy Savings 2030 | 13.96 MBOE | Energy Savings 2030 | 15.83 MBOE | |

| Emission Reduction 2030 | 2.79 Mton CO2 | Emission Reduction 2030 | 4.44 Mton CO2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Damanik, N.; Saraswani, R.; Hakam, D.F.; Mentari, D.M. A Comprehensive Analysis of the Economic Implications, Challenges, and Opportunities of Electric Vehicle Adoption in Indonesia. Energies 2025, 18, 1384. https://doi.org/10.3390/en18061384

Damanik N, Saraswani R, Hakam DF, Mentari DM. A Comprehensive Analysis of the Economic Implications, Challenges, and Opportunities of Electric Vehicle Adoption in Indonesia. Energies. 2025; 18(6):1384. https://doi.org/10.3390/en18061384

Chicago/Turabian StyleDamanik, Natalina, Risa Saraswani, Dzikri Firmansyah Hakam, and Dea Mardha Mentari. 2025. "A Comprehensive Analysis of the Economic Implications, Challenges, and Opportunities of Electric Vehicle Adoption in Indonesia" Energies 18, no. 6: 1384. https://doi.org/10.3390/en18061384

APA StyleDamanik, N., Saraswani, R., Hakam, D. F., & Mentari, D. M. (2025). A Comprehensive Analysis of the Economic Implications, Challenges, and Opportunities of Electric Vehicle Adoption in Indonesia. Energies, 18(6), 1384. https://doi.org/10.3390/en18061384