Unsupervised Profiling of Operator Macro-Behaviour in the Italian Ancillary Service Market via Stability-Driven k-Means

Abstract

1. Introduction

- Utilizing a Stability-Driven Clustering Framework as an unsupervised clustering methodology, to ensure that the identified groupings of production units are consistent and not artefacts of random seed selection.

- Constructing an up-to-date dataset using capacity-normalized cross-market features.

- Empirical taxonomy of bidding behaviours under recent market conditions (2022–2024) and interpreting each cluster with unit technology and ownership.

- Covering the NORD, as the country’s largest market area, representing about two-thirds of national demand and hosting most of the large thermal and hydro plants that dominate MSD participation.

- Insights into market design and transparency by comparing cluster profiles, shedding light on the diversity of bidding strategies and highlighting potential inefficiencies or opacities in the current market structure.

2. Italian Electricity Market

3. Data Collection

3.1. Market Variables: MGP, MI, and MSD

- SCOPE, describing the type of service (AS, GR1, GR2, GR3, GR4), distinguishing whether the unit is starting up or increasing output in steps (Table 2).

- ADJ_PRICE, a corrected price applied by Terna to ensure compliance with market constraints.

3.2. Production Units’ Selection and Features

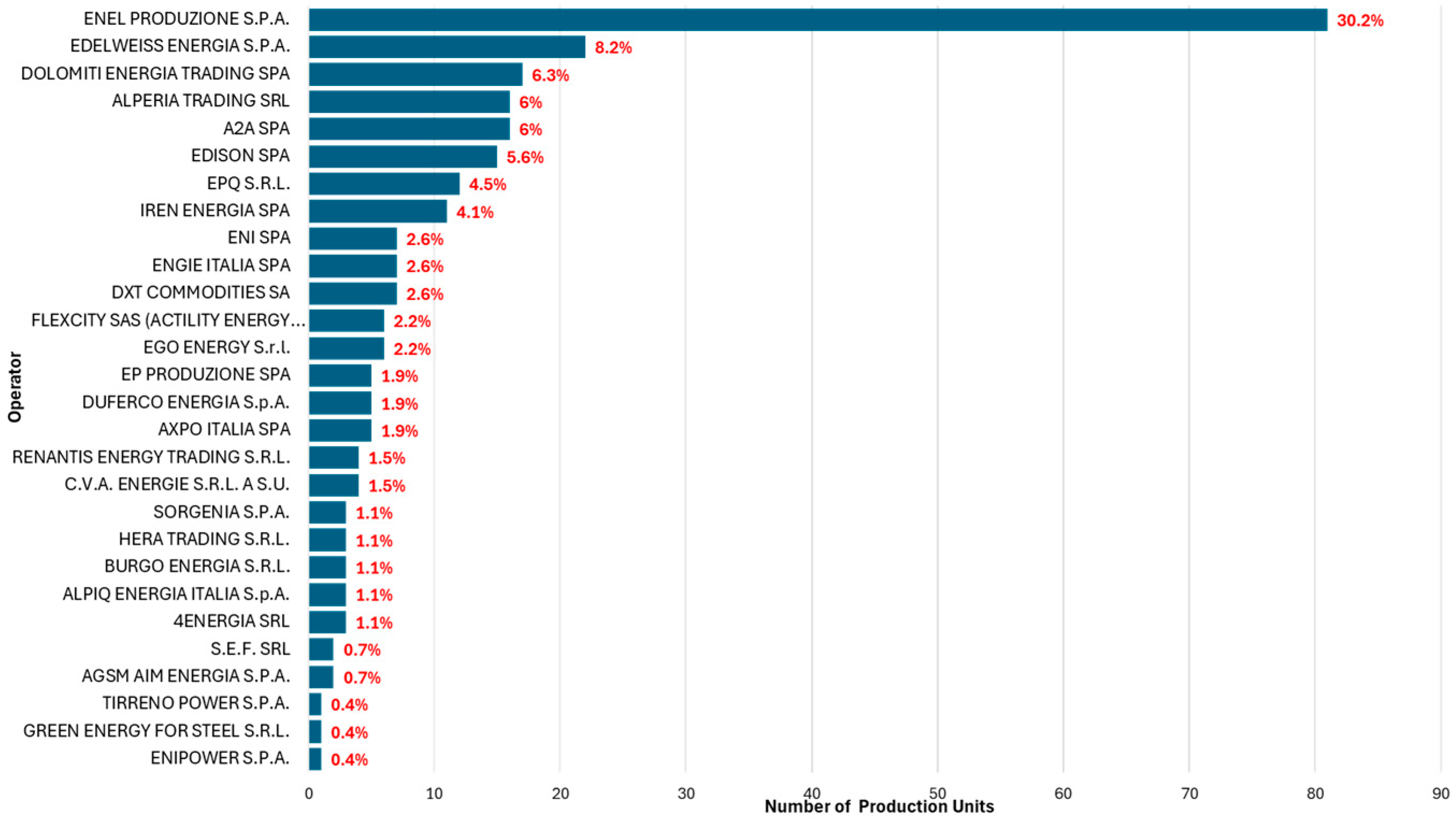

3.2.1. Selection of Units

3.2.2. Structural Characteristics

3.2.3. Customized Indicators

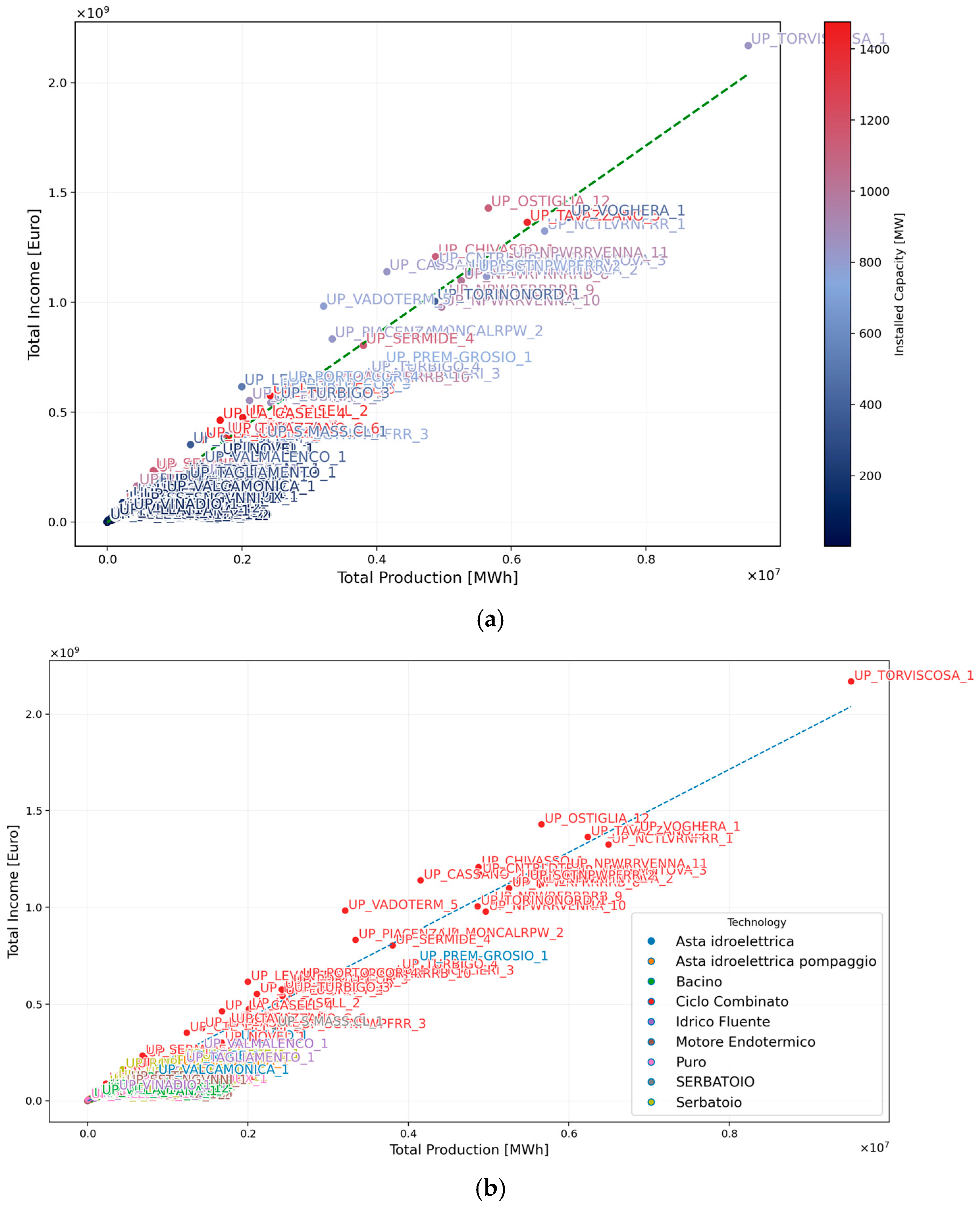

- PROD_TOTAL (Total production): Total electricity delivered ([MWh]) during the reference period, summing accepted bids.

- REV_MGP (Revenue MGP): Income from accepted MGP “OFF” bids, i.e.,

- REV_MI (Revenue MI): Income from accepted MI “OFF” bids.

- EXP_MI (Expenditure MI): Costs associated with MI “BID” offers.

- REV_MSD (Revenue MSD): Gains from accepted MSD “OFF” bids, i.e.,

- EXP_MSD (Expenditure MSD): Costs linked to accepted MSD “BID” offers.

- EOH: Equivalent Operating Hours measured in hours [h] and indicates how many full-load hours the unit effectively produced.

3.2.4. Technology and Operator Profiles

- = total net energy produced by unit over the period [MWh];

- = Installed capacity of unit [MW].

4. Clustering Methodology

4.1. Problem Setup

4.2. Gap Statistics with the 1-SE Rule

4.3. Bootstrap Stability via Adjusted Rand Index

4.4. Final Decision Rule and Visualization

5. Results and Discussion

5.1. Choosing the Number of Clusters with Gap Statistic and Bootstrap Stability

5.2. Selected Clusters’ Features

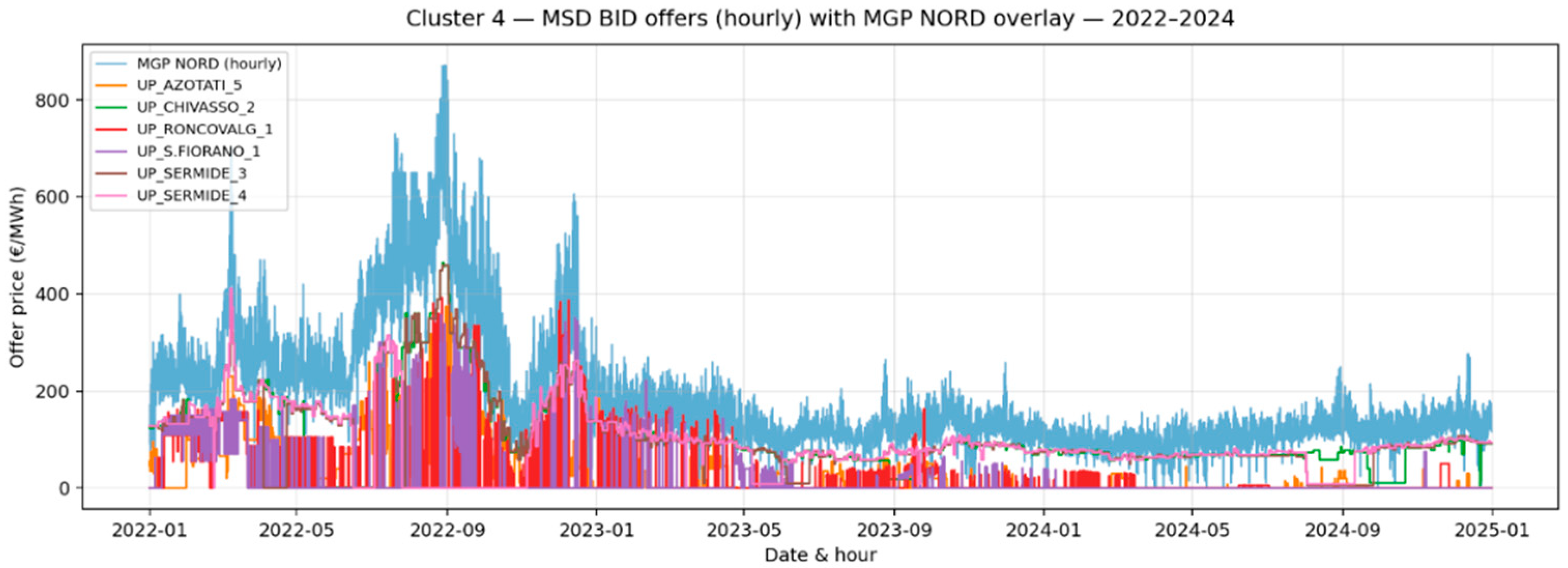

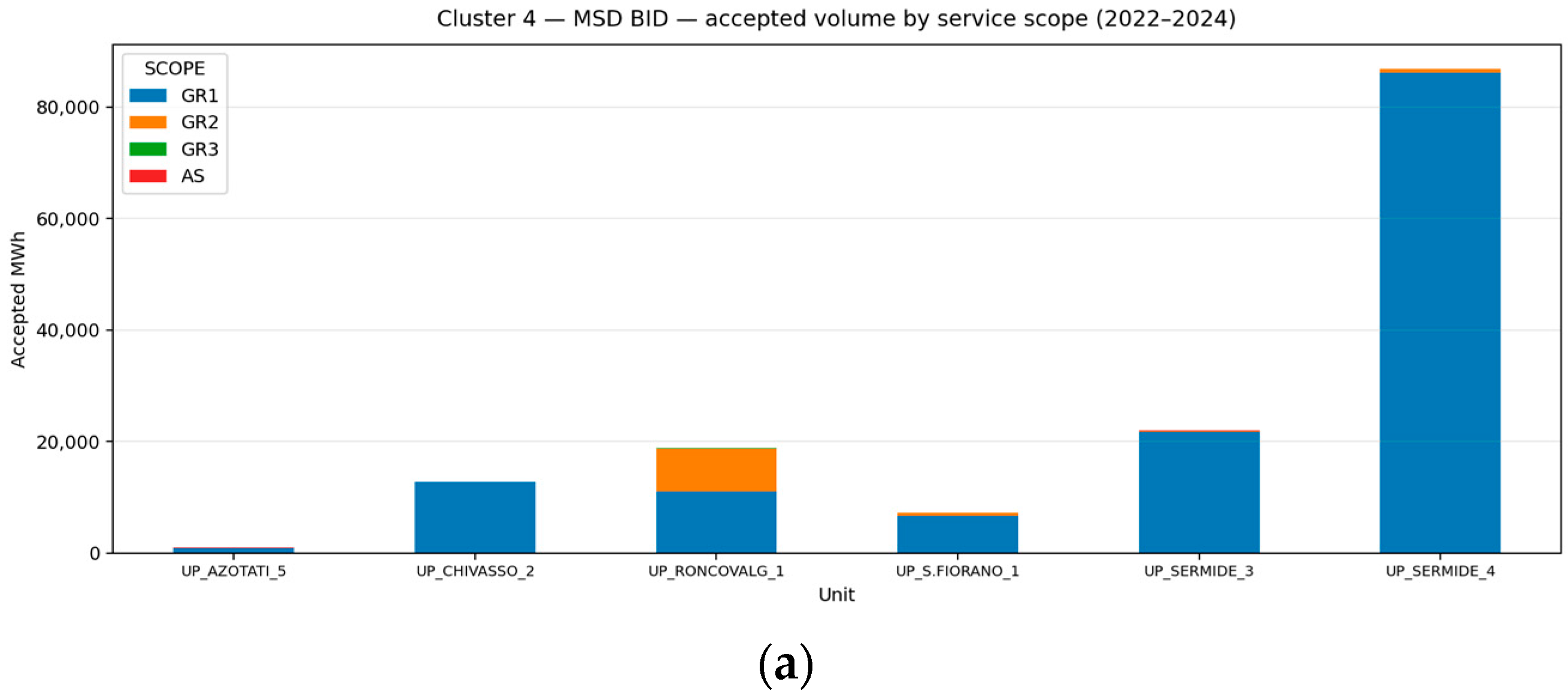

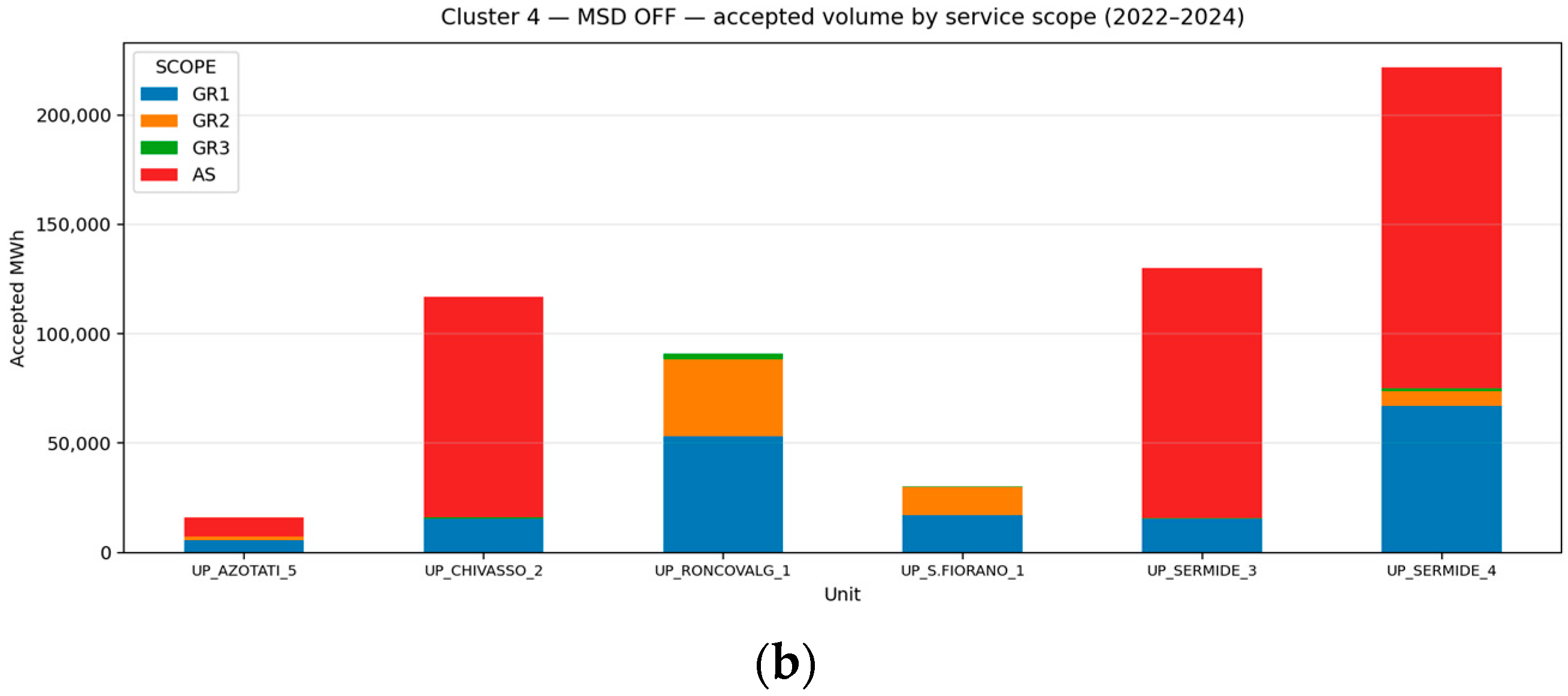

- Cluster 4: mixes pumped-storage hydro with large CCGTs and shows a distinctive energy-market posture with strong price tracking in OFF and defensive BID during scarcity periods.

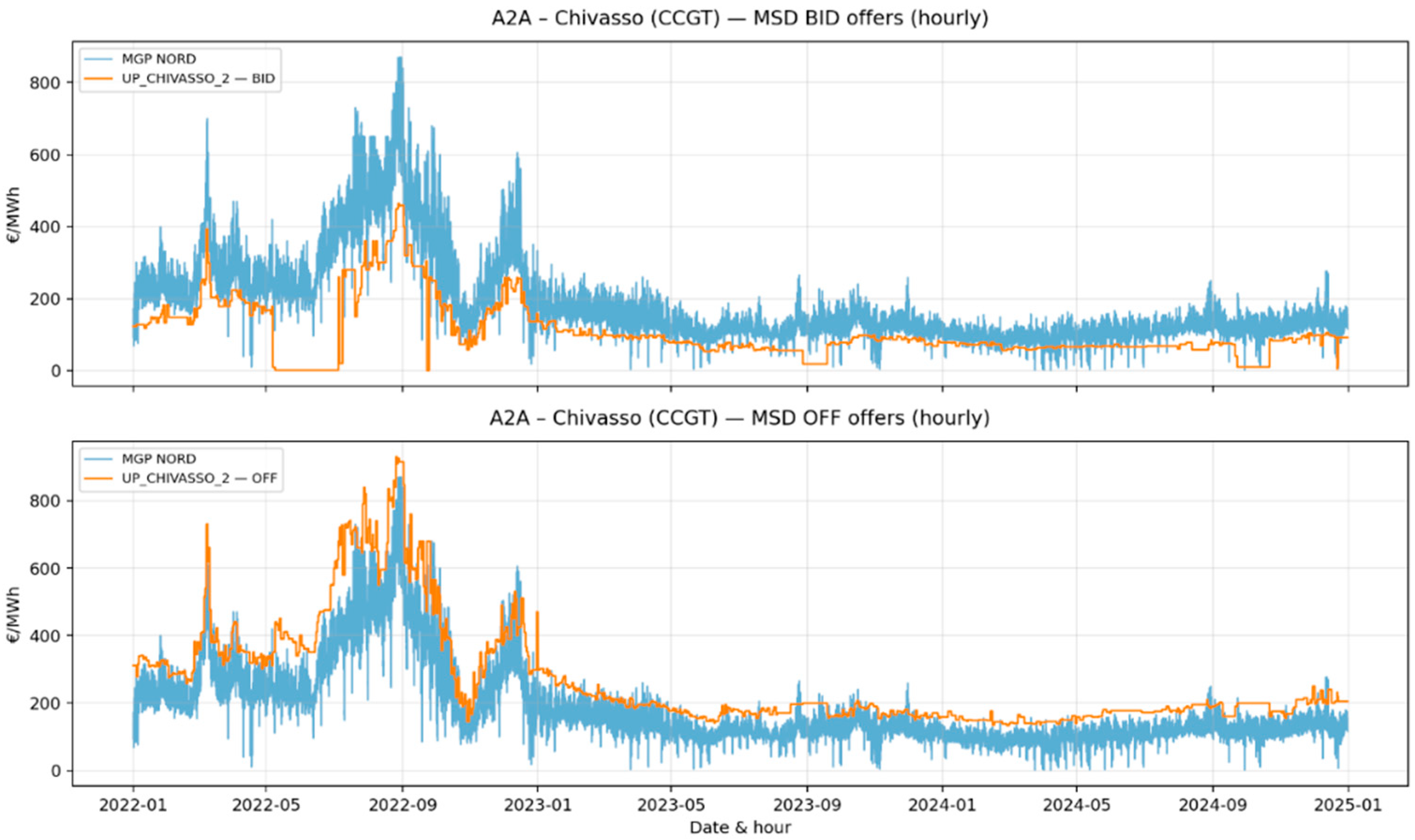

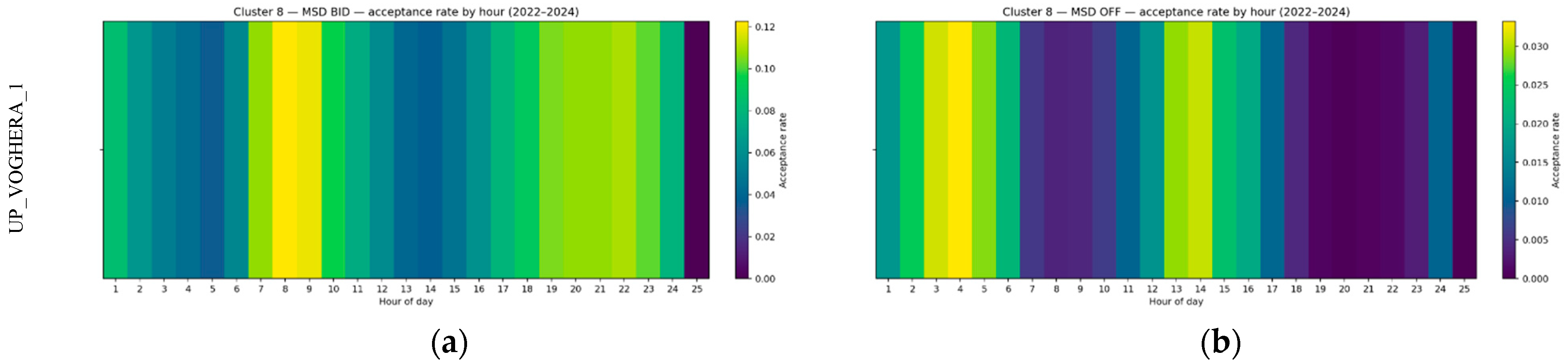

- Cluster 8: collapses to a single ENGIE CCGT at Voghera, a stable, near-baseload unit that reveals clean MSD pricing rules and sharp asymmetry between downward and upward actions.

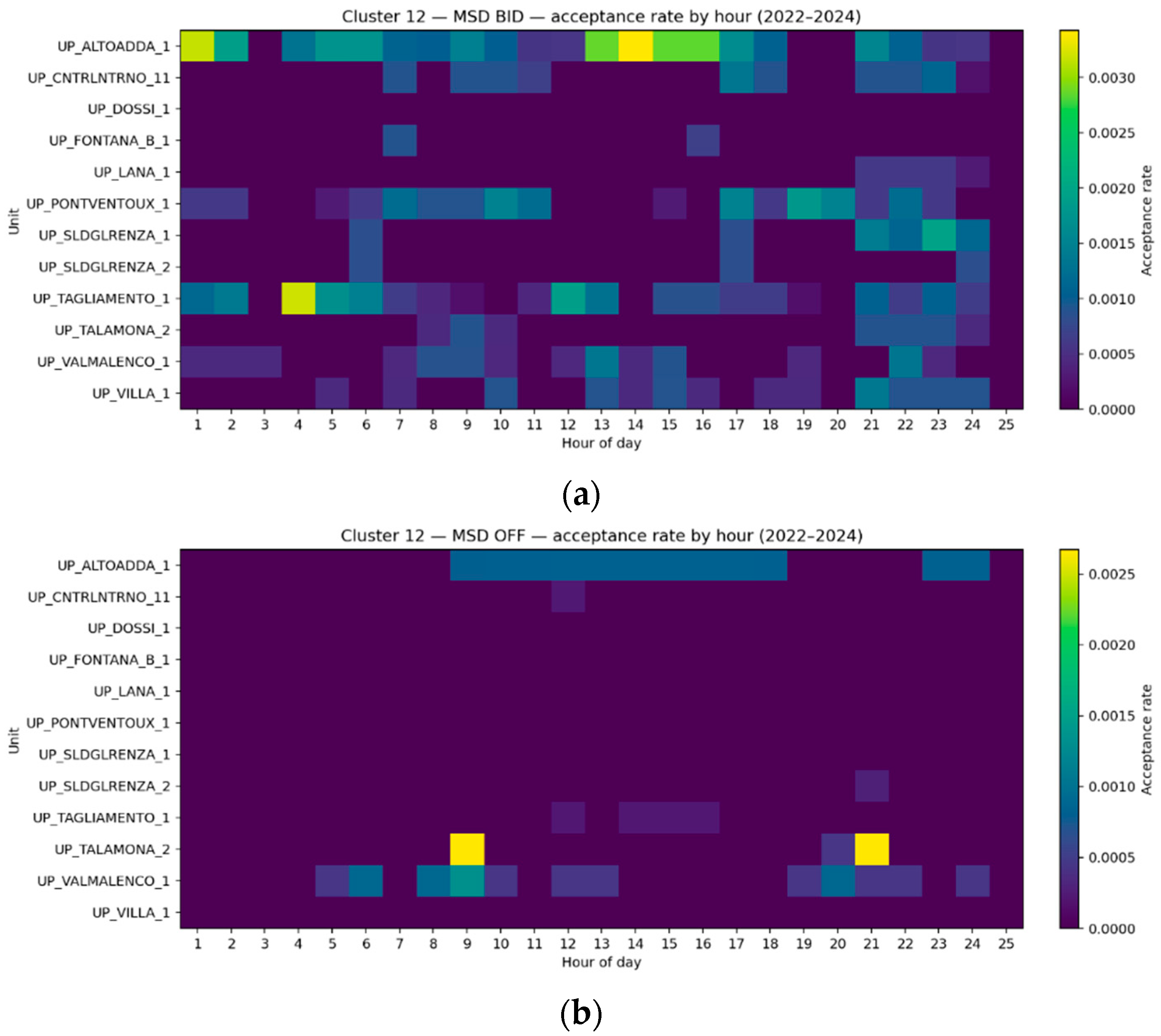

- Cluster 12: aggregates reservoir and pumped-storage hydro with low EOH and persistent OFF premia (i.e., extra amounts added on top of a benchmark price) aligned with water-value management.

5.2.1. Cluster 4

5.2.2. Cluster 8

5.2.3. Cluster 12

6. Conclusions and Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Supplementary Results

| K | GAP | S_K | WK | MEDIAN_ARI | Q25_ARI | Q75_ARI |

|---|---|---|---|---|---|---|

| 2 | 1.2321 | 0.0316 | 643.3810 | 0.9202 | 0.8441 | 0.9601 |

| 3 | 1.3376 | 0.0347 | 515.4605 | 0.5588 | 0.5158 | 0.7495 |

| 4 | 1.4762 | 0.0317 | 409.2592 | 0.8296 | 0.6744 | 0.9439 |

| 5 | 1.5795 | 0.0338 | 339.2602 | 0.8492 | 0.7251 | 0.9195 |

| 6 | 1.7120 | 0.0333 | 277.4403 | 0.9237 | 0.8563 | 0.9586 |

| 7 | 1.7806 | 0.0339 | 241.7871 | 0.7052 | 0.6486 | 0.7667 |

| 8 | 1.8792 | 0.0387 | 208.6044 | 0.7466 | 0.6307 | 0.8392 |

| 9 | 1.9647 | 0.0347 | 180.3132 | 0.5375 | 0.4770 | 0.7431 |

| 10 | 2.0611 | 0.0293 | 156.9004 | 0.7643 | 0.7059 | 0.8346 |

| 11 | 2.1136 | 0.0366 | 141.6342 | 0.7913 | 0.6940 | 0.8561 |

| 12 | 2.1647 | 0.0403 | 129.1525 | 0.8358 | 0.7785 | 0.8739 |

| 13 | 2.2105 | 0.0340 | 117.9699 | 0.8675 | 0.7976 | 0.9164 |

| 14 | 2.2412 | 0.0318 | 110.3891 | 0.8572 | 0.8000 | 0.9103 |

| 15 | 2.2411 | 0.0379 | 106.4304 | 0.7673 | 0.7427 | 0.8147 |

| 16 | 2.2741 | 0.0400 | 99.6839 | 0.7997 | 0.6986 | 0.8315 |

| 17 | 2.3202 | 0.0369 | 91.8462 | 0.8139 | 0.7444 | 0.8860 |

| 18 | 2.3321 | 0.0397 | 87.3546 | 0.7494 | 0.6579 | 0.8553 |

| 19 | 2.3719 | 0.0378 | 80.9728 | 0.7320 | 0.5675 | 0.8188 |

| 20 | 2.3997 | 0.0365 | 76.9286 | 0.6882 | 0.5885 | 0.7756 |

| 21 | 2.4192 | 0.0370 | 72.5618 | 0.6242 | 0.5823 | 0.7045 |

| 22 | 2.4555 | 0.0352 | 67.2887 | 0.6084 | 0.5716 | 0.7123 |

| 23 | 2.4839 | 0.0352 | 64.1359 | 0.5708 | 0.5100 | 0.6761 |

| 24 | 2.5371 | 0.0392 | 59.0476 | 0.6568 | 0.5950 | 0.6962 |

| 25 | 2.5569 | 0.0354 | 56.4049 | 0.6713 | 0.6047 | 0.7096 |

| 26 | 2.5710 | 0.0422 | 53.9180 | 0.6908 | 0.5914 | 0.7389 |

| 27 | 2.6204 | 0.0440 | 49.7231 | 0.6617 | 0.5886 | 0.7371 |

| 28 | 2.6430 | 0.0396 | 47.2299 | 0.7080 | 0.6107 | 0.7866 |

| 29 | 2.6827 | 0.0416 | 44.3146 | 0.6364 | 0.5910 | 0.7025 |

| 30 | 2.7144 | 0.0421 | 41.8684 | 0.6916 | 0.6304 | 0.7970 |

| CLUSTER | UNIT_REFERENCE |

|---|---|

| C0 | UP_BORGO_TRE_1, UP_CAORIA_1, UP_CAVILLA_1, UP_CLHRCSLGNO_1, UP_CNTRLDTRNL_1, UP_LASA_ME_1, UP_NOCE_1, UP_NOVE_1, UP_RETE_2_1, UP_SANGIACOMO_1, UP_SCTNPWPFRR_2, UP_TURBIGO_3, UP_VALCAMONICA_1, UP_VERZUOLO_2 |

| C1 | UP_ANDONNO_C_1, UP_CASTELDEL_1, UP_CHIEVOLIS_2, UP_CMPLCCIOLI_2, UP_DEVERO_3, UP_FADALTO_1, UP_FUSINA_T_3, UP_FUSINA_T_4, UP_GEROLA_1, UP_LEVANTE_3, UP_MONCALIERI_3, UP_NPWRFRRRRB_10, UP_PANTANO_D_1, UP_PELOS_1, UP_PONTE_1, UP_PORTO_COR_3, UP_PORTO_COR_4, UP_ROVESCA_1, UP_S.FLORI.A_1, UP_S.MASS.CL_1, UP_SCTNPWPFRR_3, UP_SFLORIANO_2, UP_SOSPIROLO_1, UP_SSTSNGVNNI_1, UP_VINADIO_1. |

| C2 | UP_CETSERVOLA_1, UP_CURON_ME_1, UP_GRESSONEY_1, UP_MAEN_5, UP_VALPELLIN_1 |

| C3 | UP_NCTLVRNFRR_1, UP_OSTIGLIA_12, UP_VADOTERM_5 |

| C4 | UP_AZOTATI_5; UP_CHIVASSO_2; UP_RONCOVALG_1; UP_S.FIORANO_1; UP_SERMIDE_3; UP_SERMIDE_4. |

| C5 | UP_ACTV_1, UP_BARGI_CEN_1, UP_CARONA_1, UP_CHIESE_1, UP_CNTRLDCGNR_46, UP_DUINO_1, UP_EDOLO_1, UP_ETQCHIOTAS_1, UP_ETQ_ROVINA_1, UP_GARGNANO_1, UP_LA_CASELL_1, UP_LA_CASELL_2, UP_LA_CASELL_3, UP_LA_CASELL_4, UP_M._CIAPEL_1, UP_MASOCORON_1, UP_MONFALCO_1, UP_MONFALCO_2, UP_OSTIGLIA_3, UP_PERRERES_1, UP_RIVADEL_3, UP_SOVERZENE_2, UP_SSTSNGVNN2_1, UP_TAVAZZANO_C_6, UP_TELESSIO_1, UP_ULTIMO_1, UP_VAL_NOANA_1 |

| C6 | UP_GRAVEDONA_1; UP_S.PANCRAZ_1; UP_SOVERZENE_1 |

| C7 | UP_MOLINE_1; UP_NOVEL_1; UP_TORINONORD_1; UP_TORVISCOSA_1 |

| C8 | UP_VOGHERA_1 |

| C9 | UP_ARSIE_1; UP_BATTIGGIO_1; UP_BRUNICO_M_1; UP_CENCENIGH_1; UP_LAPPAGO_1; UP_LIRO_1; UP_ROSONE_1; UP_SND_ALBAN_1; UP_SND_CAMPO_1 |

| C10 | UP_CASSANO_2, UP_CHIVASSO_1, UP_CTE_DEL_M_2, UP_LEINI_1, UP_MONCALRPW_2, UP_NPWRFRRRRB_8, UP_NPWRFRRRRB_9, UP_NPWRMNTOVA_2, UP_NPWRMNTOVA_3, UP_NPWRRVENNA_10, UP_NPWRRVENNA_11, UP_PIACENZA_4, UP_TAVAZZANO_5, UP_TURBIGO_4. |

| C11 | UP_MORASCO_1; UP_SFRNGNRZNE_2; UP_VENAUS_1 |

| C12 | UP_ALTOADDA_1; UP_CNTRLNTRNO_11; UP_DOSSI_1; UP_FONTANA_B_1; UP_LANA_1; UP_PONTVENTOUX_1; UP_PREM-GROSIO_1; UP_SLDGLRENZA_1; UP_SLDGLRENZA_2; UP_TAGLIAMENTO_1; UP_TALAMONA_2; UP_VALMALENCO_1; UP_VILLA_1 |

| CLUSTER | COMPOSITION (TECH/EXAMPLES) | UTILIZATION (EOH) | MSD SIGNATURE | NOTES |

|---|---|---|---|---|

| C0 | Mixed CCGT/ICE (AGSM/HERA/Sorgenia/SEF/Iren/Burgo) + dispatchable hydro (ENEL/Dolomiti/Alperia/Edison). | High–very high (~6–10.7 k h). | Selective; a few thermos with strong OFF (e.g., CLHRCSLGNO_1, VERZUOLO_2); some with both BID/OFF (CNTRLDTRNL_1, SCTNPWPFRR_2). | Balanced “MGP workhorses” with targeted MSD, not MSD-specialists. |

| C1 | Mostly dispatchable hydro (ENEL/Alperia/Dolomiti) + some CCGT (Moncalieri/Porto Corsini/Levante) + two Fusina coal. | Mid (~3–7 k h). | Low overall; pockets of BID (PORTO_COR_3–4, MONCALIERI_3). | “Baseline producers”: scheduled output, occasional ancillary actions. |

| C2 | Hydro-dominated (CVA reservoirs + Alperia RoR) + one CCGT (self-producer). | Mid–high (≈2.6–8.4 k h). | Minimal/sporadic. | Energy-oriented assets using MI for fine-tuning; not MSD providers. |

| C3 | Large CCGTs (EP/Tirreno Power etc.). | Mid–high (≈4–8 k h). | Around average (no extreme MSD). | “MI-arbitrageurs”: agile downward flexibility Via MI, MSD secondary. |

| C4 | Peaking mix: ENEL pumped-storage (RONCOVALG_1, S.FIORANO_1) + A2A/Edison CCGTs (CHIVASSO_2, SERMIDE_3–4, AZOTATI_5). | Low (hundreds–few thousand h). | Very high: BID extreme; OFF high-frequent redispatch both ways. | Flexibility monetizers in the MSD (pumped-storage + peaking CCGTs). |

| C5 | Pumped-storage/reservoir hydro (ENEL and others) + peaking CCGT/coal + some small reservoirs. | Low (many <1.5 k h; some small hydro 1–3 k h). | Strong OFF (upward); BID slightly below avg. | “Ancillary-driven peaks”: earn mainly via MSD OFF activations. |

| C6 | Three dispatchable hydro: GRAVEDONA_1 (RoR), S.PANCRAZ_1, SOVERZENE_1. | High (well above avg). | Slightly below avg. | “Very active hydro”: sustained output + systematic intraday upward offers. |

| C7 | One small reservoir hydro (MOLINE_1) + three CCGTs (NOVEL_1, TORINONORD_1, TORVISCOSA_1). | Very high. | Slightly below avg. | “Energy-market maximizers”: long running hours, intraday optimization; MSD limited. |

| C8 | Singleton ENGIE CCGT VOGHERA_1. | Very high (~18 k h). | High BID (frequent downward redispatch) + notable OFF. | Baseload CCGT flexing around schedule Via MSD (especially downward). |

| C9 | Nine dispatchable hydro (mix RoR/reservoir; ENEL/A2A/Edison/Alperia/IREN). | High (~6.3–9.7 k h). | Regular OFF and BID acceptances. | “Baseload hydro with flexibility”: steady energy + non-trivial MSD services. |

| C10 | Fleet of large CCGTs (ENI/A2A/EP/IREN/ENGIE). | High (centroid z ≈ +0.86). | Below avg BID/OFF. | “Workhorse CCGTs”: continuous operation, MI for adjustments, limited MSD. |

| C11 | ENEL reservoirs: MORASCO_1, SFRNGNRZNE_2, VENAUS_1. | Low (~1.1–1.5 k h). | High OFF, BID also +. | Reservoir hydro peakers: flexibility revenues dominate over energy volume. |

| C12 | Hydro mix with two pumped-storage (ALTOADDA_1, PONTVENTOUX_1) + reservoirs/RoR. | Low; income low. | Very high OFF (largest + among features); BID~neutral. | “Flex-hydro”: limited annual energy, strong value in upward MSD redispatch. |

References

- Lei, X.; Zhong, J.; Chen, Y.; Shao, Z.; Jian, L. Grid Integration of Electric Vehicles within Electricity and Carbon Markets: A Comprehensive Overview. eTransportation 2025, 25, 100435. [Google Scholar] [CrossRef]

- Wang, B.; Xu, X.; Li, G.; Fan, H.; Qiao, N.; Chen, H.; Liu, D.; Ma, T. A study of electricity sales offer strategies applicable to the participation of multi-energy generators in short-and medium-term markets. Sustain. Energy Grids Netw. 2024, 40, 101553. [Google Scholar] [CrossRef]

- GME—Gestore dei Mercati Energetici. Available online: https://www.mercatoelettrico.org/EN/ (accessed on 20 August 2025).

- Cheng, L.; Huang, P.; Zou, T.; Zhang, M.; Peng, P.; Lu, W. Evolutionary game-theoretical approaches for long-term strategic bidding among diverse stakeholders in large-scale and local power markets: Basic concept, modelling review, and future vision. Int. J. Electr. Power Energy Syst. 2025, 166, 110589. [Google Scholar] [CrossRef]

- Huang, C.; Li, K.; Zhang, N. Strategic joint bidding and pricing of load aggregators in day-ahead demand response market. Appl. Energy 2025, 377, 124552. [Google Scholar] [CrossRef]

- Sousa, V.; Algarvio, H. Strategic Bidding to Increase the Market Value of Variable Renewable Generators in Electricity Markets. Energies 2025, 18, 1586. [Google Scholar] [CrossRef]

- Roldan-Fernandez, J.M.; Serrano-Gonzalez, J.; Gonzalez-Rodriguez, A.G.; Burgos-Payan, M.; Riquelme-Santos, J.M. The effect of hydropower bidding strategy on the iberian day-ahead electricity market. Energy Strateg. Rev. 2024, 55, 101517. [Google Scholar] [CrossRef]

- Andreotti, D.; Spiller, M.; Scrocca, A.; Bovera, F.; Rancilio, G. Modeling and Analysis of BESS Operations in Electricity Markets: Prediction and Strategies for Day-Ahead and Continuous Intra-Day Markets. Sustainability 2024, 16, 7940. [Google Scholar] [CrossRef]

- Jiang, Y.; Dong, J.; Huang, H. Optimal bidding strategy for the price-maker virtual power plant in the day-ahead market based on multi-agent twin delayed deep deterministic policy gradient algorithm. Energy 2024, 306, 132388. [Google Scholar] [CrossRef]

- Innocenti, P. Statistical Models and Algorithms for the Analysis of the Electricity Market and the Economic Dispatch Service. Master’s Thesis, Politecnico di Milano, Milan, Italy, 2020. [Google Scholar]

- Marchionni, V. TAJIVE: A New Tool for Integrative Analysis of Multidimensional Data. Application to the Italian Energy Market. Master’s Thesis, Politecnico di Milano, Milan, Italy, 2019. [Google Scholar]

- Bovera, F.; Blaco, A.; Rancilio, G.; Delfanti, M. Assessing the accuracy of different machine learning classification algorithms in forecasting results of Italian ancillary services market. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–5. [Google Scholar]

- Pasotti, A. Prediction and Interpretation of Bids in the Italian Electricity Market for Ancillary Services. Master’s Thesis, Politecnico di Milano, Milan, Italy, 2020. [Google Scholar]

- Imani, M.H.; Bompard, E.; Colella, P.; Huang, T. Data analytics in the electricity market: A systematic literature review. Energy Syst. 2023, 16, 1–35. [Google Scholar] [CrossRef]

- Huang, L.; Shan, M.; Weng, L.; Meng, L. Graph Convolutional Spectral Clustering for Electricity Market Data Clustering. Appl. Sci. 2024, 14, 5263. [Google Scholar] [CrossRef]

- Imani, M.H.; Andani, M.T.; Andani, H.T. Clustering of electricity price: An application to the Italian electricity market. In Proceedings of the 2023 IEEE Texas Power and Energy Conference (TPEC), College Station, TX, USA, 13–14 February 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar]

- Shahcheraghian, A.; Ilinca, A.; Sommerfeldt, N. K-means and agglomerative clustering for source-load mapping in distributed district heating planning. Energy Convers. Manag. X 2025, 25, 100860. [Google Scholar] [CrossRef]

- Jalooli, A.; Marefat, A. Cluster stability-driven optimization for enhanced routing in heterogeneous vehicular networks. Veh. Commun. 2024, 47, 100745. [Google Scholar] [CrossRef]

- Chang, A.; Tang, T.M.; Zikry, T.M.; Allen, G.I. Unsupervised Machine Learning for Scientific Discovery: Workflow and Best Practices. arXiv 2025, arXiv:2506.04553. [Google Scholar] [CrossRef]

- Imani, M.H.; Bompard, E.; Colella, P.; Huang, T. Predictive methods of electricity price: An application to the Italian electricity market. In Proceedings of the 2020 IEEE International Conference on Environment and Electrical Engineering and 2020 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Madrid, Spain, 9–12 June 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–6. [Google Scholar]

- Imani, M.H.; Bompard, E.; Colella, P.; Huang, T. Impacts of the COVID-19 pandemic on the Italian electricity demand and markets. CSEE J. Power Energy Syst. 2022, 9, 824–827. [Google Scholar]

- Il Mercato per il Servizio di Dispacciamento. Available online: https://www.rse-web.it/wp-content/uploads/2024/03/05_MSD-MB.pdf (accessed on 26 July 2025).

- Il Mercato Europeo del Gas Nell’inverno ‘24/’25. Available online: www.mercatoelettrico.org/Portals/0/Documents/Newsletter/20250117Newsletter.pdf (accessed on 26 July 2025).

- Relazione 2022 Incentivo per la Riduzione dei Costi di Dispacciamento. Available online: https://download.terna.it/terna/Relazione_2022_costi_di_dispacciamento_8db9a8865e2ab99.pdf (accessed on 12 July 2025).

- Rapporto Mensile sul Sistema Elettrico Novembre. 2024. Available online: https://download.terna.it/terna/Rapporto_Mensile_Novembre_24_8dd2029e68c7c67.pdf (accessed on 22 July 2025).

- Petrolio: Da Mercato Globale a Mercato Frammentato? Available online: https://www.mercatoelettrico.org/Portals/0/Documents/Newsletter/20230117Newsletter.pdf (accessed on 24 July 2025).

- Il Mercato del Giorno Prima (MGP). Available online: www.rse-web.it/wp-content/uploads/2024/02/02_MGP.pdf (accessed on 17 July 2025).

- Hosseini Imani, M. Empirical Analysis of Inter-Zonal Congestion in the Italian Electricity Market Using Multinomial Logistic Regression. Energies 2024, 17, 5901. [Google Scholar] [CrossRef]

- Context Analysis and Business Model. Available online: https://reports.gruppoacea.it/2022/en/sustainability/corporate-identity/group-profile/context-analysis-and-business-model (accessed on 22 July 2025).

- Approvazione Delle Modifiche, Predisposte da Terna s.p.a., al Progetto Pilota per la Partecipazione di Unità Virtuali Miste al Mercato per il Servizio di Dispacciamento (msd), ai Sensi Della Deliberazione Dell’autorità 300/2017/r/ee. Available online: https://www.arera.it/fileadmin/allegati/docs/23/366-23.pdf (accessed on 25 June 2025).

- Price Records in European Energy Markets After the Russian Invasion of Ukraine. Available online: https://aleasoft.com/price-records-european-energy-markets-russian-invasion-ukraine (accessed on 21 June 2025).

- Regolamento Recante le Modalità per la Creazione, Qualificazione e Gestione di Unita’ Virtuali Abilitate Miste (Uvam) al Mercato dei Servizi di Dispacciamento-Regolamento msd Uvam. Available online: https://www.terna.it/DesktopModules/AdactoBackend/API/directdownload/get?file=Regolamento_UVAM_MSD_8d803bd91884d36.pdf (accessed on 21 June 2025).

- ENTSO-E. Available online: https://www.entsoe.eu/ (accessed on 22 July 2025).

- UP Rilevanti Inferiori a 100MW. Available online: https://download.terna.it/terna/0000/0216/19.XLS (accessed on 1 August 2025).

- Qualità del Servizio di Trasmissione—Elenco dei Siti di Utenti Consumatori ed Utenti Produttori Direttamente Connessi Alla rete di Trasmissione Nazionale al 31.12.2021. 2021. Available online: https://download.terna.it/terna/PUNTI DI CONNESSIONE DIR CONNESSI RTN UFFICIALE al 31.12.2021_8da34c53fa3fb41.pdf (accessed on 16 July 2025).

- Colbalchini, R. Development of a Visualization and Analysis Tool for Public Domain Data of the Italian Electric Power Market. Master’s Thesis, Politecnico di Milano, Milan, Italy, 2014. [Google Scholar]

- Vannoni, A. Flexible Heat and Power Generation: Market Opportunities for Combined Cycle Gas Turbines and Heat Pumps Coupling. Master’s Thesis, Università Degli Studi di Genova, Genoa, Italy, 2022. [Google Scholar]

- Database NORD Italy. Available online: https://prod-dcd-datasets-public-files-eu-west-1.s3.eu-west-1.amazonaws.com/67579c18-90db-4cff-b83a-47bd3a6fc3d1 (accessed on 1 August 2025).

- Sagala, N.T.M.; Gunawan, A.A.S. Discovering the optimal number of crime cluster using elbow, silhouette, gap statistics, and nbclust methods. ComTech Comput. Math. Eng. Appl. 2022, 13, 1–10. [Google Scholar] [CrossRef]

- Yang, J.; Lee, J.-Y.; Choi, M.; Joo, Y. A new approach to determine the optimal number of clusters based on the gap statistic. In Proceedings of the International Conference on Machine Learning for Networking, Paris, France, 3–5 December 2019; Springer Nature: Cham, Switzerland, 2019; pp. 227–239. [Google Scholar]

- Khan, I.K.; Daud, H.; Zainuddin, N.; Sokkalingam, R. Standardizing reference data in gap statistic for selection optimal number of cluster in K-means algorithm. Alexandria Eng. J. 2025, 118, 246–260. [Google Scholar] [CrossRef]

- Yu, H.; Chapman, B.; Di Florio, A.; Eischen, E.; Gotz, D.; Jacob, M.; Blair, R.H. Bootstrapping estimates of stability for clusters, observations and model selection. Comput. Stat. 2019, 34, 349–372. [Google Scholar] [CrossRef]

- Gana Dresen, I.M.; Boes, T.; Huesing, J.; Neuhaeuser, M.; Joeckel, K.-H. New resampling method for evaluating stability of clusters. BMC Bioinform. 2008, 9, 42. [Google Scholar] [CrossRef] [PubMed]

- Mucha, H.-J.; Bartel, H.-G. Validation of k-means clustering: Why is bootstrapping better than subsampling. Arch. Data Sci. Ser. A 2017, 2, 1–14. [Google Scholar]

- Ydroelectric Power Plant on the Adda River—Alta Valtellina. Available online: https://www.salvettigraneroli.com/en/news/hydroelectric-power-plant-on-the-adda-river-alta-valtellina/?rootAlbumId=-1&=1188===&article-detail=4696 (accessed on 25 August 2025).

| VARIABLE | DESCRIPTION |

|---|---|

| DATE | Calendar date of the bid (YYYYMMDD). |

| HOUR | Hour of the bid (1 = 00:00–00:59). |

| UNIT_REFERENCE | Unique code identifying the Production Unit (PU). |

| OPERATOR | Company owning the PU, or “Bilateral” for private agreements (MGP only). |

| PURPOSE | Direction of the bid: “OFF” (sell/inject energy) or “BID” (buy/decrease injection). |

| STATUS | Indicates whether the bid was accepted (ACC) or rejected (REJ). |

| QUANTITY | Amount of energy offered [MWh]. |

| ADJ_QUANTITY | Quantity corrected by the TSO for system security [MWh]. |

| AWARDED_QTY | Final amount of energy remunerated after acceptance [MWh]. |

| PRICE | Initial bid price [€/MWh]. |

| AWARDED_PRICE | Remunerated price for accepted bids [€/MWh]. |

| GRID_POINT_ID | Identifier of the exchange point (Grid Supply Point). |

| SCOPE | DEFINITION | OFF (UPWARD) | BID (DOWNWARD) | DEPENDENCY |

|---|---|---|---|---|

| AS | Minimum/Shut-down block | Start from off and inject at minimum stable output | Shut-down request: reduce injection to zero | Base block; GR steps can be stacked above it |

| GR1 | Step 1 | First increment while online | First decrement while online | First step; no prior GR needed |

| GR2 | Step 2 | Second increment | Second decrement | Only if GR1 accepted |

| GR3 | Step 3 | Third increment | Third decrement | Only if GR2 accepted |

| GR4 | Step 4 | Fourth increment | Fourth decrement | Only if GR3 accepted |

| FEATURES | DESCRIPTION |

|---|---|

| ENERGY SOURCE | Hydro dispatchable (Idroelettrica dispacciabile), Hydro pumped-storage (Idroelettrica da pompaggio), Thermal (Termoelettrica), Renewable (Rinnovabile) |

| TECHNOLOGY | For hydro plants—Bacino (reservoir), Serbatoio (artificial reservoir), Puro (pure run-of-river), Asta Idroelettrica (river stretch). For thermal—Ciclo combinato (combined cycle CCGT) or Tradizionale (steam). For renewable—Idrico fluente (run-of-river without reservoir), onshore vs. offshore wind. |

| INSTALLED CAPACITY | Nominal production capacity [MW]. |

| GRID VOLTAGE | Voltage level of the transmission connection [V]. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hosseini Imani, M.; Khalili Param, A. Unsupervised Profiling of Operator Macro-Behaviour in the Italian Ancillary Service Market via Stability-Driven k-Means. Energies 2025, 18, 5446. https://doi.org/10.3390/en18205446

Hosseini Imani M, Khalili Param A. Unsupervised Profiling of Operator Macro-Behaviour in the Italian Ancillary Service Market via Stability-Driven k-Means. Energies. 2025; 18(20):5446. https://doi.org/10.3390/en18205446

Chicago/Turabian StyleHosseini Imani, Mahmood, and Atefeh Khalili Param. 2025. "Unsupervised Profiling of Operator Macro-Behaviour in the Italian Ancillary Service Market via Stability-Driven k-Means" Energies 18, no. 20: 5446. https://doi.org/10.3390/en18205446

APA StyleHosseini Imani, M., & Khalili Param, A. (2025). Unsupervised Profiling of Operator Macro-Behaviour in the Italian Ancillary Service Market via Stability-Driven k-Means. Energies, 18(20), 5446. https://doi.org/10.3390/en18205446