1. Introduction

The rapid electrification of transportation is reshaping power systems worldwide, creating both challenges and opportunities for grid management. Vehicle-to-Grid (V2G) technology, which enables bidirectional energy flow between electric vehicles (EVs) and the grid, has emerged as a promising solution for enhancing grid flexibility, integrating renewable energy sources, and generating new revenue streams for EV owners and operators.

Turkey, as a signatory to the Paris Agreement, has committed to achieving net-zero carbon emissions by 2053 [

1]. To support this goal, the country has increased investments in renewable energy and energy efficiency. According to the National Energy Plan published by the Ministry of Energy and Natural Resources (MENR), as shown in

Table 1, electricity demand in Turkey is expected to rise from approximately 330 TWh in 2023 to over 510 TWh by 2035 [

2]. This growth, driven by electrification across multiple sectors and expanding renewable generation, highlights the need for flexible and decentralized balancing mechanisms.

In Turkey, frequency control and ancillary services are managed by the national transmission system operator, TEİAŞ (Turkish Electricity Transmission Corporation). One of the key balancing mechanisms is the manual Frequency Restoration Reserve (mFRR), which activates during power imbalances by dispatching committed reserves [

3]. Participating resources are compensated based on their availability and response. Currently, only the mFRR is commercially active in Turkey, with participation limited to units with a minimum capacity of 10 MW and no established aggregator model. Automatic frequency reserves (aFRR) and primary control (FCR) remain under regulatory development, with limited pilot testing underway [

4]. A summary of the technical requirements for balancing services in Turkey is presented in

Table 2.

Although the current mFRR market structure favors large-scale units, recent developments in virtual power plant (VPP) models and aggregator regulations suggest that smaller and distributed resources, such as EVs, may gain access in the near future [

5]. The market framework is evolving to accommodate distributed flexibility, paving the way for innovative solutions such as V2G integration. Although Turkey’s mFRR market is still under development, the general trend in ancillary service prices suggests increasing interest in capacity-based revenue models. However, publicly available data on reserve capacity pricing remain limited (

Table 3) [

6,

7]. Estimated based on analog markets (Nordics, Germany) and the Turkish market size and demand volatility.

Vehicle-to-Grid (V2G) technology enables bidirectional energy flow between EVs and the power grid, allowing EVs to act as mobile storage assets that can provide ancillary services such as frequency regulation, peak shaving, and energy arbitrage [

8,

9]. V2G can enhance grid flexibility, support renewable energy integration, and create new value streams for vehicle owners and operators [

10]. In the Turkish context, V2G remains in the early stages of development, with no commercial-scale deployments as of 2025. However, domestic electric vehicle manufacturing is advancing rapidly. As Turkey’s EV production accelerates, TOGG’s models—particularly the T10X—are positioned to compete with international V2G-capable vehicles in terms of battery capacity and range. While bidirectional charging is not yet commercially available, TOGG has indicated plans to incorporate this functionality into future models. Therefore, TOGG vehicles are expected to support V2G functionality in future versions, as part of ongoing developments in EV interoperability and smart charging capabilities. As the national EV stock grows and smart charging infrastructure expands—particularly through initiatives like the Trugo charging network—the technical foundation for V2G is likely to strengthen. In this evolving environment, shared electric fleets operated by municipalities or cooperatives could play a pioneering role by aggregating capacity for flexible grid services.

Table 4 compares the specifications of TOGG vehicles with selected international V2G-capable models [

11,

12].

Research Purpose and Objectives:

The purpose of this study is to assess the viability of a V2G-enabled cities’ electric vehicle fleet participating in Turkey’s mFRR market. Through an LCC–based approach, the study aims to explore how such systems could contribute to grid flexibility while generating financial returns for local stakeholders such as municipalities or housing cooperatives. Specific objectives include:

Estimating the revenue potential from frequency regulation using aggregated EV capacity.

Calculating the income potential from vehicle sharing/rental within a cooperative or public fleet.

Quantifying the capital and operational costs, including EV procurement, charging infrastructure, and system software.

Evaluating cost-effectiveness across different operational models (internal vs. outsourced management; leasing vs. ownership).

The study addresses two primary research questions:

Under what economic and technical conditions can a V2G-enabled EV fleet be feasibly implemented and operated in Turkey’s frequency regulation market?

How sensitive are these outcomes to key variables such as mFRR pricing, EV utilization rates, and implementation models (municipal vs. third-party aggregator)?

The study’s methodological flow and core assumptions are summarized in

Figure 1, which provides a visual overview of the modeled interactions between cost components, operational scenarios, and V2G revenue streams.

The study is framed around a pilot-scale case involving a fleet of five EVs equipped with V2G capabilities, operated either by a housing cooperative or municipality. It uses Turkish market conditions for electricity pricing, vehicle leasing/purchase, and grid service revenues. The geographical context is based on Bartın, representing a typical mid-sized Turkish city transitioning toward clean energy solutions. Assumptions include:

Availability of mFRR participation for aggregated distributed resources in the near future, pending regulatory reforms.

Constant power delivery capacity from EVs during grid service windows (weekday daytime hours).

Average monthly data are used for costs and revenues; battery degradation, incentives, and taxation are excluded from the baseline model but considered in the discussion and sensitivity framing.

Aim and Policy Relevance of the Study:

The aim of this study is to develop a realistic and adaptable framework for evaluating the technical and economic feasibility of integrating a V2G-enabled electric vehicle fleet in cities into Turkey’s frequency regulation market. By modeling both cost and revenue components under current and anticipated regulatory conditions, the study seeks to provide actionable insights for decision-makers evaluating flexible grid support options.

The findings are intended to support policymakers, local governments, housing cooperatives, and private energy stakeholders by:

Demonstrating the potential economic value of EV fleets when used as distributed energy resources,

Highlighting the conditions under which V2G participation becomes cost-effective,

Identifying regulatory gaps and investment risks that may hinder implementation.

By grounding the analysis in Turkish market conditions and stakeholder needs, this work aims to contribute to the strategic planning of distributed energy resources (DERs) and encourage further innovation in electric mobility, energy flexibility, and grid modernization.

This work establishes for the first time a contextual basis and research motivation for economic modeling taking into account the cost-effectiveness of integrating electric vehicle fleets in cities for V2G technologies. By reviewing the policy development framework and comparative experience for a given geographical destination of Turkey. The presented research, therefore, fills a gap in the literature on the subject in the following areas: (1) Vehicle-to-Grid (V2G); (2) energy costs and energy efficiency; (3) innovative solutions and electromobility; (4) encouraging discussion and further research in the area of opportunities for energy efficiency in Smart Cities.

The structure of the paper is as follows.

Section 1 contains a broad description of the introduction to the research problem presented in the article, along with a review of the literature on the research topic which was carried out.

Section 2 describes the research methodology used to assess the technical and economic viability of integrating fleets of Vehicle-to-Grid (V2G)-enabled electric vehicle (EV) technology into the Turkish manual frequency restoration reserve (mFRR) market. In

Section 3, the results of the research are presented.

Section 4 provides a discussion of the presented research and future perspectives in this research area.

Section 5 presents conclusions and policy implications of the presented considerations.

2. Literature Review

A growing body of research has explored the economic, environmental, and technical implications of integrating EVs into shared mobility systems and grid-balancing frameworks through V2G technology. At the same time, they are a tool that smart cities can use to manage electricity effectively on the road to implementing electromobility in vehicle fleets.

Caggiani et al. [

13] conducted a case study at the Polytechnic University of Bari in Italy, where they modeled a V2G-enabled car-sharing system designed to both meet mobility demand and maximize surplus electricity sales. Their results showed that optimized charging and discharging schedules could significantly improve profitability, although trade-offs emerged between grid services and user availability.

Corinaldesi, Lettner, and Auer [

14] evaluated the economic feasibility of shared e-mobility within residential buildings. By simulating integrated systems with solar panels, battery storage, and EVs, their model showed that shared EV systems could reduce total costs by up to 29% compared to private ownership. However, savings were unevenly distributed among tenants due to variations in driving and consumption behavior.

Fachrizal et al. [

15] analyzed the impact of different EV charging strategies on load balancing in cities powered by wind and solar energy. Their findings emphasized that V2G operation outperformed both opportunistic and smart charging by enhancing grid load matching, particularly under a 70% wind/30% solar supply mix. The study also highlighted that EVs could match the performance of stationary storage solutions under certain conditions.

Yassine et al. [

16] investigated BlueLA, a low-emission EV car-sharing initiative in California focused on underserved communities. The study found that each shared EV delayed or replaced the purchase of up to 16 private vehicles, resulting in a 34% reduction in vehicle kilometers traveled (VKT) and a 48% reduction in GHG emissions. The authors concluded that EV sharing programs can support both climate goals and social equity.

Amatuni et al. [

17] performed a life cycle analysis (LCA) of car-sharing systems in the Netherlands, San Francisco, and Calgary. Their study showed that GHG emissions reductions ranged from 7% to 18% depending on location, mainly due to reduced private car ownership. However, emissions from shared vehicle use and modal shifts partially offset these gains.

Jia et al. [

18] conducted an LCC analysis of a 60-EV car-sharing operation in China, incorporating vehicle procurement, maintenance, charging, and parking costs. The study identified several key sensitivity factors affecting economic viability, including electricity prices, rental rates, and government subsidies.

Noel et al. [

19] compiled findings from 227 expert interviews across the Nordic countries to identify major barriers to V2G adoption. Their study highlighted widespread skepticism around economic returns, regulatory uncertainty, public hesitation, and integration complexity. Experts emphasized that while V2G offers technical promise, commercial scaling remains limited.

Pearre, N.S. and Ribberink [

20] reviewed V2X implementation challenges across Germany, the Netherlands, the UK, and the U.S. They found that although frequency regulation offers short-term revenue, saturation in reserve markets has driven down prices. Moreover, high charger costs and lack of utility incentives continue to slow deployment. Their work suggests that car-sharing models may serve as an ideal starting point for scalable V2G or V2X systems.

To sum up, in all the above-mentioned studies, the role of V2G technology as one of the key elements of the system architecture is emphasized. However, there is no technical and economic assessment in the area of cost-effectiveness of integrating fleets of electric vehicles (EVs) supporting V2G technology based on LCC in a scenario model.

While the existing literature provides substantial insights into the techno-economic potential of V2G systems in mature markets such as Europe, North America, and China, limited research has yet explored their techno-economic feasibility in emerging EV markets such as Turkey, where regulatory frameworks, cost structures, and usage patterns differ from those in more mature settings. This study addresses that gap by adapting internationally established LCC and revenue modeling methodologies to Turkey’s specific regulatory, economic, and infrastructural conditions. In contrast to prior studies, which typically assume developed aggregator frameworks and liberalized grid markets, this research accounts for Turkey’s transitional energy landscape—including incomplete market access, evolving ancillary service regulations, and localized electricity pricing. Furthermore, by modeling shared V2G-enabled fleets under prospective mFRR market participation, the study offers a novel scenario-based assessment grounded in local cost structures, fleet dynamics, and climate-adjusted energy usage. In doing so, it builds upon the methodological foundation of Jia et al. [

18] and responds to policy challenges highlighted by Pearre and Ribberink [

20], extending their applicability to a market characterized by rapid electrification but nascent regulatory maturity. This contribution advances the discourse on V2G deployment pathways in emerging economies and supports the design of locally adapted pilot strategies and policy frameworks where the development of the identified technologies can be key to the success of fleet electromobility.

3. Research Methodology

This study applies a mixed-methods modeling framework to evaluate the techno-economic feasibility of a V2G-enabled EV fleet in Turkey’s evolving mFRR market. The methodology integrates an LCC model with scenario-based revenue analysis to capture both expenditure and income streams under different operational configurations. Data were sourced from a combination of technical specifications, market reports, expert interviews, and modeled assumptions, supplemented by proxy data from European analog markets where Turkish figures were unavailable. Quantitative analysis was conducted using Microsoft Excel for financial modeling and MATLAB R2025a for scenario simulations and sensitivity testing, ensuring transparency and replicability of the results.

3.1. Life Cycle Cost (LCC) Analysis

To assess the economic viability of integrating a V2G-enabled electric vehicle fleet into Turkey’s frequency regulation market, this study adopts an LCC modeling approach. LCC accounts for all investment and operational expenditures over the system’s lifetime while incorporating potential revenue streams such as vehicle rental and ancillary service income (mFRR participation).

The LCC is computed as the net present value (NPV) over a 10-year period, using the equation:

where:

N—project lifetime (10 years assumed),

r—discount rate (set at 8% in line with Turkish energy sector investment standards),

Costs—EV procurement/leasing, charging infrastructure, electricity, software/system development, and maintenance,

Revenues—rental income, frequency regulation payments, and potential solar charging arbitrage.

This method enables scenario comparison under different business models, including:

Internal vs. outsourced operation,

Leasing vs. ownership,

With or without frequency regulation participation,

Low vs. high utilization.

3.2. Data Sources and Methodology

This study is based on a combination of technical specifications, market observations, expert judgment, and modeled assumptions to estimate the life cycle costs and revenue potential of a V2G-enabled EV fleet operating in Turkey.

Technical and Market Data:

EV and charger specifications were sourced from publicly available documentation for TOGG T10X models and comparable V2G-capable vehicles in the European market [

11,

21].

Charging performance and battery behavior assumptions were guided by WLTP data and third-party efficiency testing, with adjustments for Turkish climate and terrain conditions [

22,

23].

Electricity pricing reflects 2024 residential and commercial tariff averages published by EPDK (Energy Market Regulatory Authority) and includes time-of-use (ToU) assumptions (off-peak and peak periods) [

24].

Vehicle leasing costs were estimated based on dealership quotes obtained in June 2025 from TOGG and other EV brands operating in Turkey.

Software development costs were estimated using benchmarking interviews with software developers working on EV backend systems in Ankara and Istanbul.

International Benchmarks and Modeled Inputs:

Since mFRR market participation rules and prices are not yet publicly available from TEİAŞ, estimates were derived from analog markets (Sweden, Germany, and Finland). The capacity price for mFRR was modeled at USD 50/kW-year, corresponding to the median Nordic value in 2023–2024. To validate cost and operational assumptions, informal interviews were conducted with:

An EV fleet operator in Bartın, involved in municipal transport electrification.

A representative from a housing cooperative in Eskişehir that had previously investigated solar-charger integration and carpooling infrastructure.

A software engineer with experience working on V2G telemetry and aggregator platforms, who provided input on integration costs and data availability challenges in Turkey.

All interviews were unrecorded and conducted via phone or email. Qualitative insights were used to shape operational modeling parameters such as driving patterns, fleet downtime, preferred charging hours, and likely digital system outsourcing models.

Quantitative Modeling Tools:

Data analysis and scenario modeling were conducted using Microsoft Excel and MATLAB, with inflation adjustments, NPV calculations, and revenue modeling based on yearly and monthly time steps.

Sensitivity analyses were performed by varying parameters such as electricity prices, V2G availability, vehicle utilization rates, and reserve capacity prices.

Where Turkey-specific data were unavailable, the study adopted a “proxy modeling approach”, substituting with the most relevant European analogs and applying correction factors for inflation, regulation stage, and climate-related efficiency effects.

All cost and revenue models, including sensitivity analyses, were developed using Microsoft Excel and MATLAB. Scenario assumptions, model equations, and parameter values are fully documented to enable replicability and can be shared upon request for academic or policy research purposes.

3.3. Scenario Definition

The core parameters used in the cost and revenue modeling are summarized in

Table 5, including electricity tariffs, vehicle characteristics, digital system costs, and projected mFRR income assumptions.

Based on the parameters summarized in

Table 5, this study develops and compares three operational scenarios to systematically assess the financial and operational implications of V2G integration within the Turkish context. The three scenarios—outlined in

Table 6—vary in terms of ownership, frequency market participation, and utilization level.

This study models a pilot-scale fleet of five EVs, totaling 110 kW of bidirectional capacity, which is well below the current 10 MW minimum bid size required for participation in Turkey’s mFRR market. It is assumed that, in future regulatory frameworks, these small-scale resources would be aggregated via an approved aggregator or integrated into a larger Virtual Power Plant (VPP) alongside other distributed energy resources (DERs).

The 5-EV fleet analyzed here is therefore representative of a single node within a broader aggregated portfolio, rather than an independent market participant. This approach aligns with developments in European markets, where distributed V2G fleets are aggregated to meet minimum bid requirements while maintaining local operational control. By modeling the smallest viable operational unit, this study provides insights into the economics of local fleet management while assuming that total capacity would be scaled up through aggregation to satisfy national market rules, as illustrated in

Figure 2.

In 2024, Turkey’s Energy Market Regulatory Authority (EMRA) launched regulatory sandbox trials exploring Virtual Power Plant (VPP) models and distributed flexibility services. These initiatives align with the European Union’s Clean Energy Package, which requires member states to enable aggregator participation in ancillary service markets. While no formal roadmap has been published, these steps indicate that Turkey is moving toward integrating smaller distributed resources into mFRR and related balancing mechanisms. Therefore, the assumption of aggregator-based participation is considered realistic for the study horizon.

All scenarios assume:

Charging infrastructure installed at a central location

Charging occurs primarily at off-peak hours (to minimize electricity costs)

Vehicles available for grid services during typical business hours (8:00–17:00)

Scenario 1: Base Case—Internal leasing, no mFRR

No ancillary service revenue. Only leasing cost, charging, software, and O&M.

Scenario 2: V2G+ Case—Internal leasing with mFRR income

Same as base, but includes mFRR revenue

Scenario 3: High-Utilization Case—Ownership, high rental income

EVs are purchased, not leased. High rental income and mFRR included.

where;

I—Initial capital cost (charging infrastructure, purchase or leasing setup fees),

L—Leasing cost (only in lease-based scenarios) (L is not used in High-Use because vehicles are purchased (included in I)),

E—Annual electricity/charging cost,

O&M—Operations and maintenance,

S—Software/platform costs (if custom-built or leased),

H—Rental income,

F—Frequency regulation income,

Rv—Residual value of vehicles and chargers,

r—Discount rate,

N—Analysis period (10 years).

3.4. Limitations

This study is subject to the following limitations:

Aggregator Frameworks: As of 2025, Turkey does not yet allow small-scale consumers (housing cooperatives) to directly participate in frequency regulation markets. The analysis assumes this regulatory barrier will be lifted through market reform or pilot program exemptions.

Battery Degradation: Battery degradation due to V2G cycling was not explicitly modeled in the quantitative LCC framework. However, recent studies indicate that repeated charge–discharge cycles associated with frequency regulation can accelerate battery aging by 8–12% over a 10-year horizon [

25,

26]. Based on replacement cost data for EV battery packs, this corresponds to an additional expense of approximately USD 500–USD 800 per vehicle per year for the modeled TOGG fleet. While this factor does not fundamentally change the ranking of the scenarios, it would delay the break-even point of the High Utilization case by approximately 1–2 years. Based on literature values for lithium-ion battery cycling under V2G conditions [

25,

27,

28], degradation is estimated to add approximately USD 25,000–USD 40,000 in cumulative replacement and performance loss costs over the 10-year project horizon for a five-vehicle fleet. While this value is not included in the baseline LCC equations, it is discussed in

Section 4 to illustrate its potential impact on economic outcomes.

Solar PV Integration: Not included but noted as an optional extension in sensitivity analysis.

Key input parameters and economic modeling assumptions used throughout the analysis are summarized in

Table 7, including the project lifetime, discount rate, and inflation assumptions used in LCC calculations.

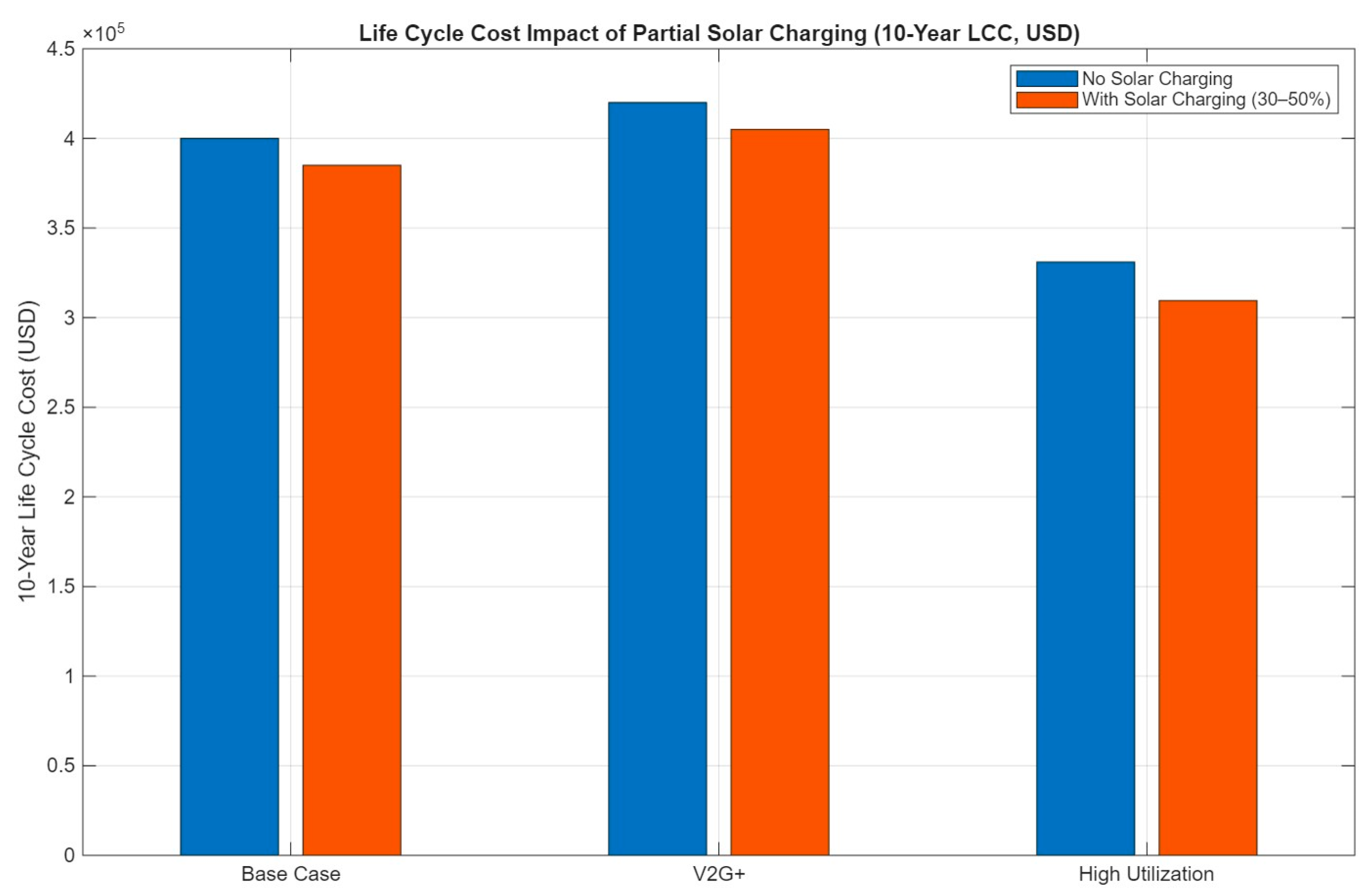

While the base scenarios assume grid-only charging, a supplemental case was modeled to evaluate the impact of partial solar-powered charging on life cycle cost. Under Turkey’s YEK-G (Renewable Energy Guarantee of Origin) and net metering regime, on-site solar generation can legally offset commercial energy consumption, especially if aggregated under a cooperative or municipal structure.

Scenario Assumptions:

30% and 50% of the total annual EV energy demand is met by a rooftop PV system.

Levelized cost of solar electricity: USD 0.035/kWh (based on 2024 CAPEX and OPEX benchmarks for small-scale PV in Turkey).

Grid electricity offset: USD 0.095/kWh (2024 average C&I off-peak tariff).

No battery storage assumed; charging aligned with daytime solar production.

Impact on LCC:

Substituting 30–50% of EV charging with solar energy reduces annual electricity costs by up to USD 165–USD 275 per fleet (5 vehicles), depending on the solar share. This corresponds to a 12–20% reduction in annual charging cost, with cumulative impact reaching up to USD 2000 in total LCC savings over 10 years.

This also increases the system’s energy autonomy, enhances grid resilience, and reduces upstream transmission losses. If dynamic tariffs or feed-in incentives are adopted, additional economic value may accrue.

3.5. Charging Cost Calculation

Charging costs for the EV fleet are calculated using a linear model based on annual mileage, energy consumption per kilometer, and average electricity tariffs. The methodology is adapted from Jia et al. [

18], incorporating charging efficiency losses and the specific conditions of the Turkish electricity market.

where;

L—annual charging cost per vehicle (USD),

x—energy consumption per km (kWh/km),

s—monthly driving distance (km),

p—electricity price (USD/kWh),

η—charging efficiency.

While the nominal energy consumption is assumed to be 0.21 kWh/km, real-world charging typically incurs approximately 10% losses due to heat, cabling, and inverter inefficiencies. This study adopts a real-world adjusted consumption rate of 0.23 kWh/km to reflect these losses—particularly relevant during winter months and peak charging periods. Notably, energy use per kilometer can increase by around 15% during winter due to cabin heating and reduced battery efficiency. Based on Turkish regional climate data, a seasonal adjustment factor of +0.03 kWh/km is applied from November through March. The main input values used for charging cost estimation are summarized in

Table 8.

To charge five EVs simultaneously at 22 kW each, the system must support a combined 110 kW load. This would typically require upgrading the site’s grid connection and electrical protection capacity.

A 200A main fuse is recommended to support a total capacity of up to 138 kW, offering a 28 kW margin for other facility loads (lighting, HVAC).

With this margin, the system could technically support six EVs at 22 kW, reaching 132 kW total charging capacity, while still maintaining minimal operational headroom (6 kW).

The cost of upgrading grid connection infrastructure (e.g., main panel, cabling, and utility demand-based charges) is not included in the baseline LCC model, as these expenses are highly site-specific and can vary widely depending on local grid conditions and DSO regulations. However, based on regional utility cost data, such upgrades are expected to range between USD 8000–USD 10,000 for a five-EV fleet. Incorporating these costs would increase the initial capital expenditure and delay the break-even point by approximately 6–10 months. This factor is discussed further in

Section 4 to provide context for practical implementation planning.

3.6. Sensitivity Analysis

To assess the robustness of the LCC results under uncertain future conditions, a sensitivity analysis was conducted. This analysis evaluates how variations in key parameters—including the discount rate, electricity price escalation, mFRR capacity price, and monthly vehicle mileage—influence the system’s overall cost-effectiveness. The tested parameter ranges are summarized in

Table 9.

In addition to these core parameters, a supplemental sensitivity case was developed to evaluate the impact of partial solar-powered charging (30–50% substitution of grid electricity), given its growing relevance under Turkey’s net metering regime. This extension enables comparison of both financial and technical synergies between V2G operation and distributed PV generation.

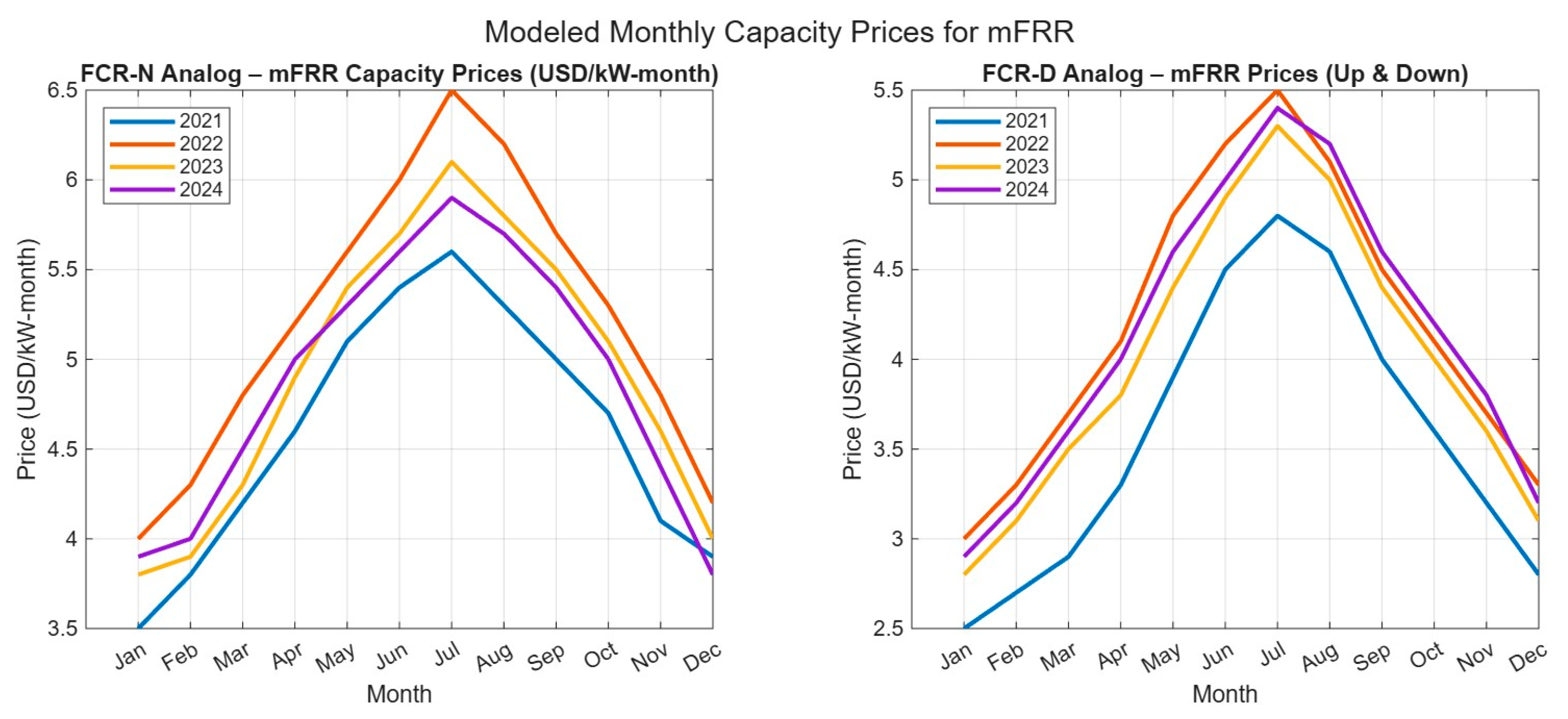

3.7. Frequency Regulation Revenues (mFRR)

Since Turkey’s mFRR market is in an early development stage with no published pricing data, analogous European balancing products were used to model potential revenues. The Nordic markets—particularly Sweden’s FCR-N and FCR-D services—were selected as proxies because their market structures closely align with the design principles outlined by TEİAŞ for Turkey’s upcoming frequency reserve mechanisms. Both regions employ capacity-based remuneration with standardized bid increments and strict state-of-charge management, making them more comparable than alternative European markets such as the UK or Spain, where energy-based settlement is dominant. Additionally, the Nordic region provides a mature dataset with transparent historical capacity prices, enabling robust modeling of revenue potential for small-scale aggregators in Turkey.

In Turkey, the manual Frequency Restoration Reserve (mFRR) market offers a potential revenue stream for distributed energy resources (DERs), including V2G-capable EV fleets. While current regulations limit participation to licensed generators, it is assumed in this study that aggregator models will soon be introduced, enabling EVs to provide grid services collectively.

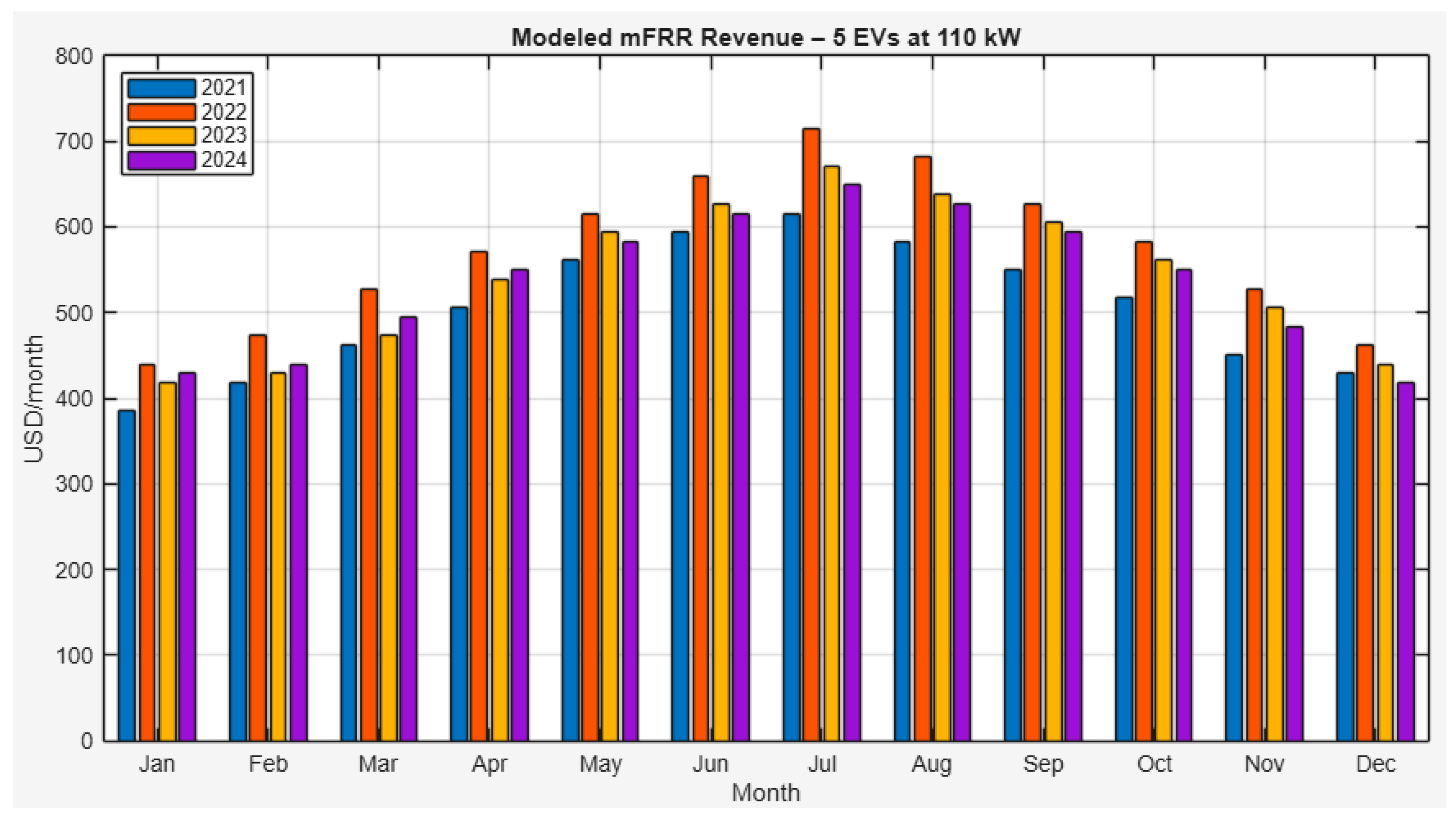

To estimate mFRR revenues, this study models a fleet of five electric vehicles, each capable of delivering 22 kW bidirectional power, for a total aggregated capacity of 110 kW. This meets the minimum market entry threshold for reserve capacity products and reflects a realistic deployment scale for a housing cooperative or municipal fleet.

Battery Recovery Constraints:

Although TEİAŞ has not yet published detailed recovery curve protocols for mFRR resources, international counterparts such as Svenska Kraftnät restrict recharge or “ramp-down” rates to 20–34% of dispatched power, depending on the product (FCR-N or FCR-D). To protect battery health and prevent rapid cycling, this study assumes that V2G operation is managed within a 30–70% state-of-charge (SOC) range, which reflects practices in other worldwide pilot projects [

27,

28]. This range ensures the battery is neither fully depleted nor fully saturated during frequency response, reducing the risk of NEM (Normal Energy Management) or AEM (Automatic Energy Management) events.

Revenue Modeling:

The modeled mFRR capacity price is set at USD 50/kW-year, based on analog markets in Sweden, Finland, and Germany (see

Table 3). This includes only capacity availability payment and excludes real-time energy dispatch or performance bonuses.

Annual Gross Revenue = 110 kW × 50 USD/kW-year = USD 5500/year

A 20% aggregator fee is applied to cover costs for dispatch management, regulatory compliance, and data telemetry services:

Net Annual Revenue = 5500 × (1 − 0.20) = USD 4400/year

The modeled mFRR capacity price is set at USD 50/kW-year, in line with comparable Nordic and German markets. This results in an annual gross income of USD 5500 for a 110 kW aggregated V2G fleet. After applying a 20% aggregator service fee, the net annual revenue retained by the fleet operator is USD 4400. Assumptions and calculations are detailed in

Table 10.

To model frequency regulation revenues in the Turkish context, analogs from Nordic capacity markets (such as Sweden and Finland) were used as a reference [

3].

Figure 3 presents monthly modeled capacity prices for mFRR in Turkey, with the left panel reflecting standby-type remuneration (similar to Sweden’s FCR-N), and the right panel capturing performance-based income patterns (analogous to FCR-D up/down services). Based on these values,

Figure 4 estimates the corresponding monthly revenues for a V2G-enabled EV fleet participating in mFRR with an aggregated capacity of 110 kW (five vehicles at 22 kW each).

These estimates provide a conservative baseline for evaluating V2G business models in Turkey, assuming successful aggregator-based participation and comparable reserve pricing behavior to European markets.

4. Results

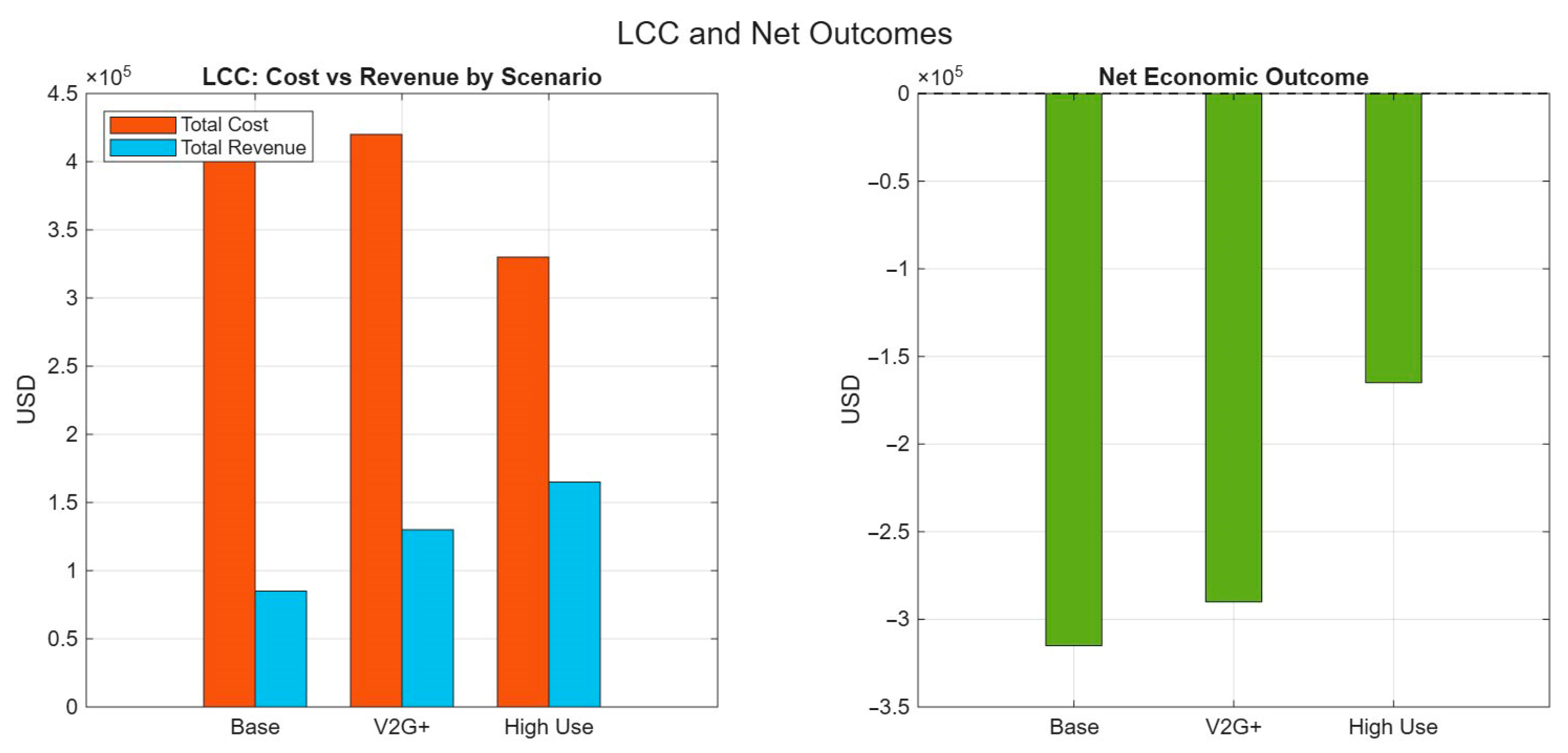

The results of the analysis present a comprehensive evaluation of the financial and operational implications of deploying a V2G-enabled EV fleet in Turkey’s mFRR market. The outcomes are organized to reflect the structure of the methodology: first, by comparing the three modeled scenarios (Baseline, V2G+, and High Utilization); second, by examining the breakdown of LCC across different cost and revenue categories; third, by analyzing annual cash flow patterns over the 10-year horizon; and finally, by conducting sensitivity assessments to test the robustness of the findings under varying market and technical conditions. Together, these results provide both a quantitative and qualitative foundation for assessing the feasibility of V2G integration within the Turkish energy and transport context.

4.1. Overview of Scenario Outcomes

The comparative analysis of the three operational scenarios reveals marked differences in financial performance, primarily driven by variations in ownership structure, utilization intensity, and participation in frequency regulation markets. As summarized in

Table 11, the High Utilization scenario—featuring EV ownership combined with V2G market participation and enhanced rental activity—yields the most favorable economic outcomes. It achieves the lowest total LCC and highest net annual income, making it the only scenario to approach financial break-even within the 10-year project horizon.

Assumptions include 5 EVs, 1150 km/month per vehicle, real-world charging losses, USD 0.095/kWh electricity price, a USD 50/kW-year mFRR capacity payment, and a 20% aggregator fee.

4.2. LCC Breakdown by Scenario

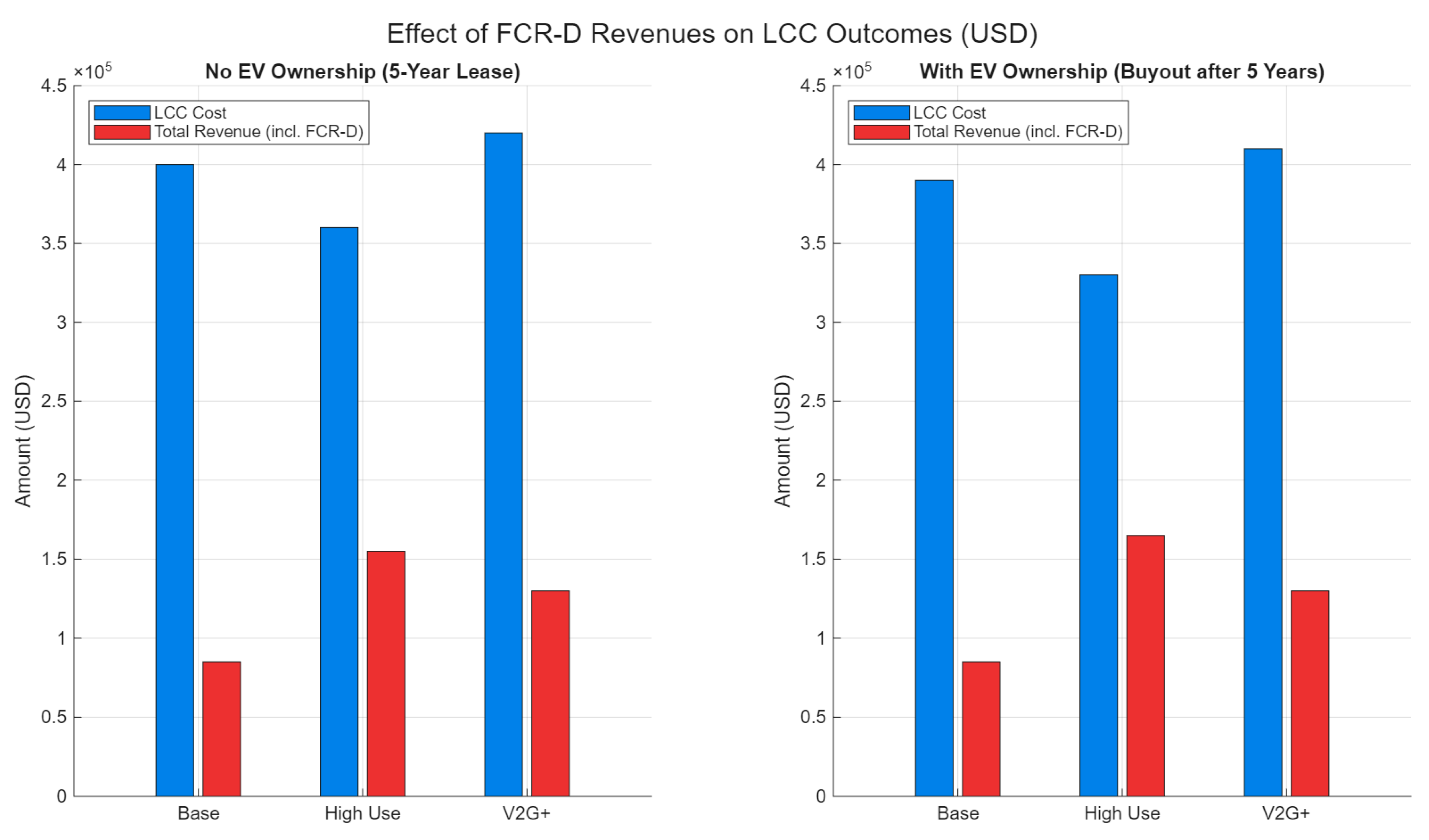

Figure 5 presents the total 10-year LCC, revenue, and net economic outcome for each scenario. Although all configurations result in a net loss under current conditions, the High Utilization scenario demonstrates a significantly improved financial profile due to increased rental income and the elimination of leasing costs.

Figure 6 illustrates the impact of FCR-D analog revenues on the net economic outcome of each scenario. Even under this improved market structure, neither the Base Case nor V2G+ scenarios achieve break-even without additional revenue streams or policy incentives. However, ownership models consistently outperform leasing-based configurations.

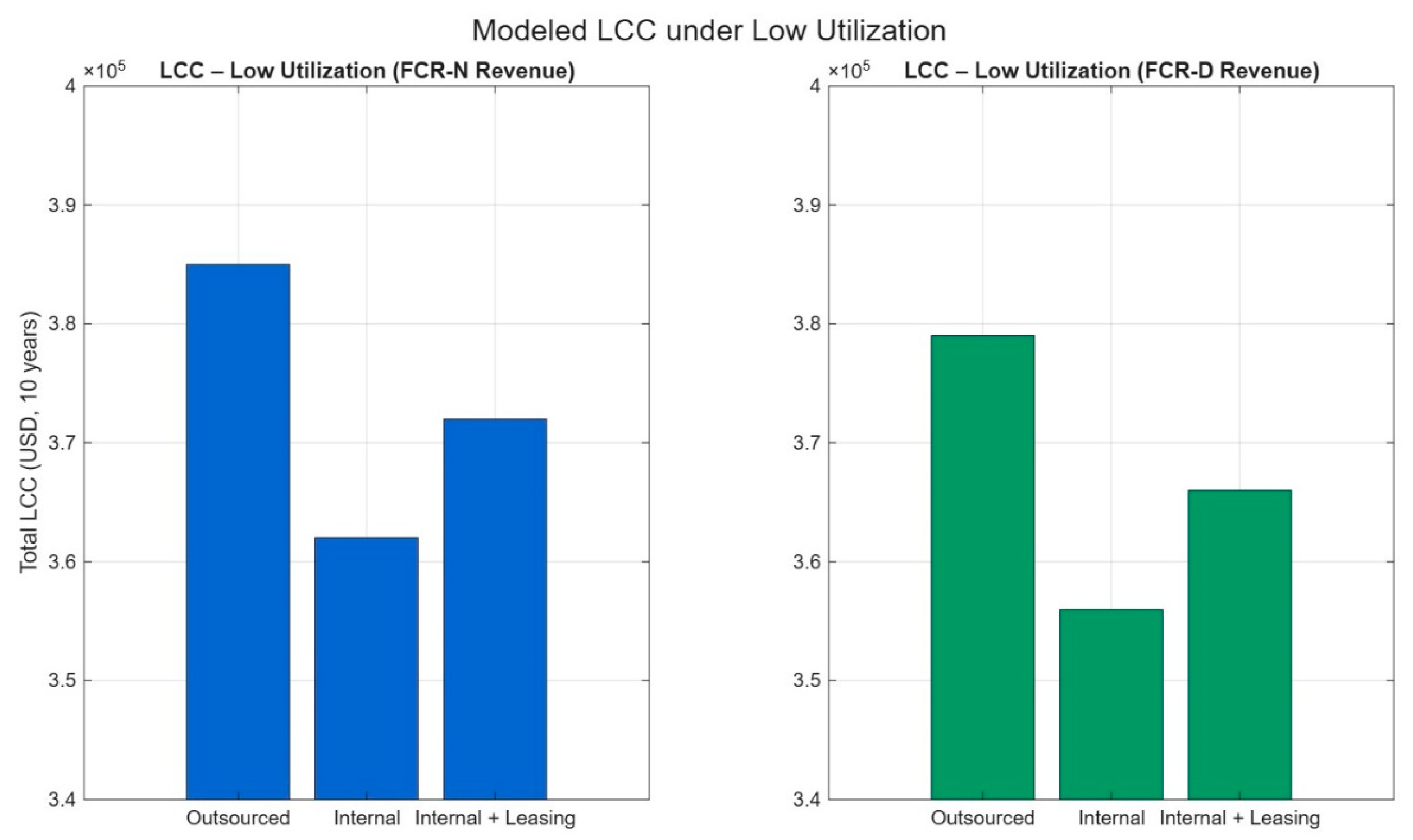

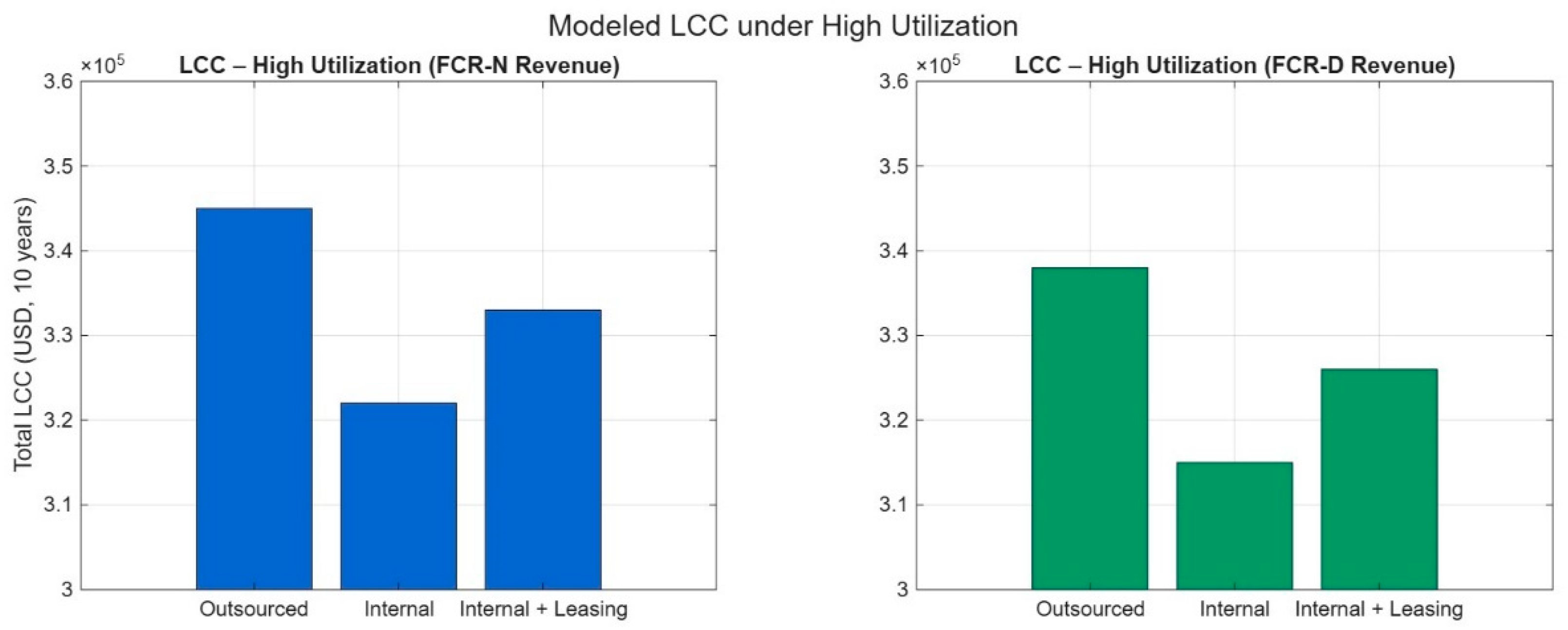

Figure 7 demonstrates the adverse effect of reduced rental utilization on LCC across all scenarios. Even with participation in high-value FCR-D markets, low fleet utilization significantly worsens financial outcomes.

In contrast,

Figure 8 shows that high utilization rates significantly enhance the economic viability of all models—especially under dynamic, performance-based mFRR pricing.

4.3. Annual Net Cash Flow Comparison

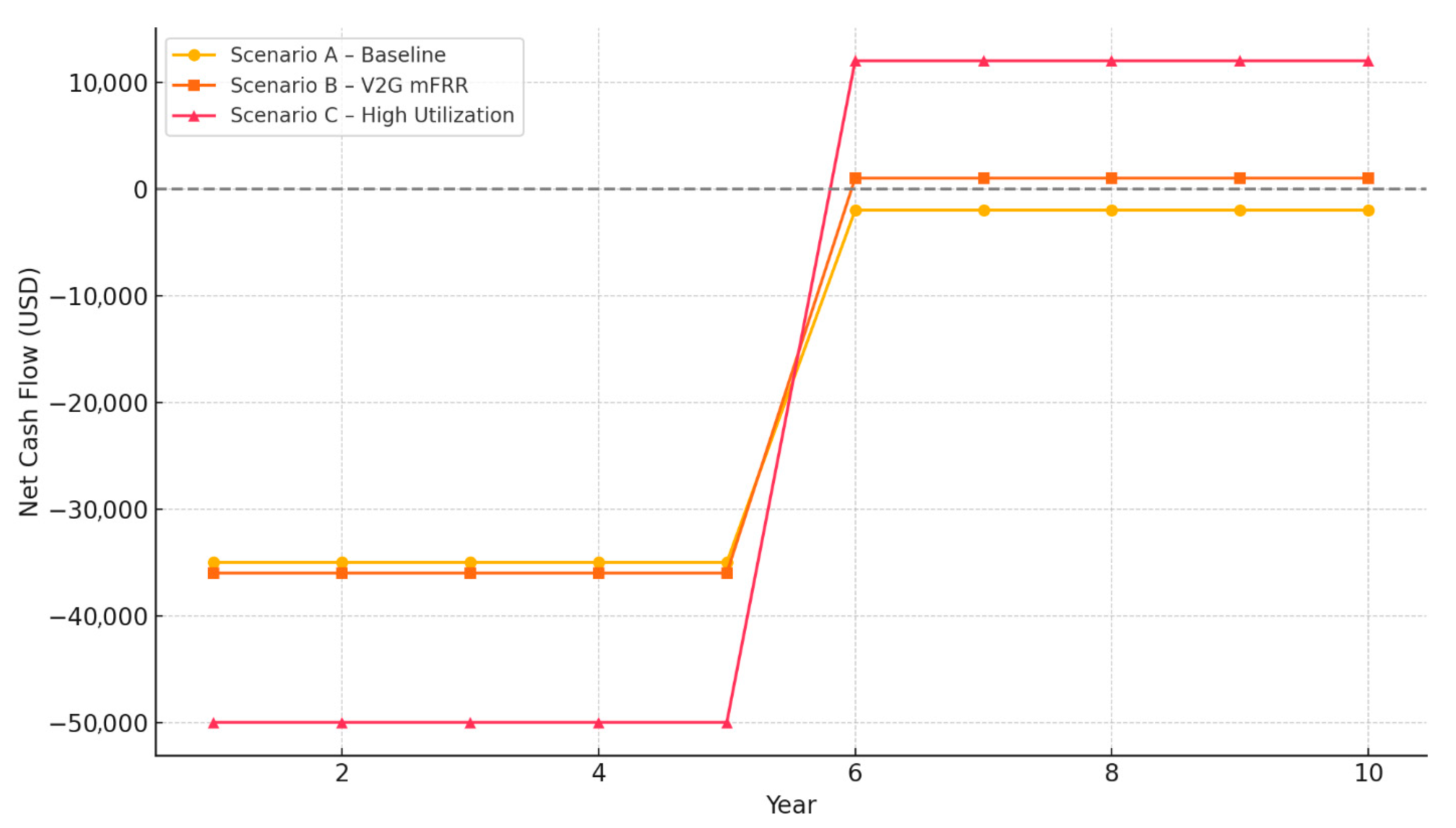

Annual cash flow projections over the 10-year project horizon are shown in

Figure 9. The Base Case remains in continuous deficit, whereas the V2G+ scenario shows modest improvement. Only the High Utilization model enters positive cash flow territory, doing so by year 7.

Annual net cash flow trends can be summarized as follows:

The Base Case remains in deficit throughout the horizon.

The V2G+ scenario partially closes the gap through frequency service income.

The High Utilization scenario crosses into net positive territory around year 7.

4.4. Sensitivity Analysis

As defined in

Section 3.6, the sensitivity analysis examines both core economic parameters (discount rate, electricity price, mFRR capacity price, and utilization) as well as an extended case incorporating partial solar charging. The results presented here reflect these dimensions, highlighting their influence on long-term life cycle cost and revenue performance.

Figure 10 demonstrates the LCC savings achieved by supplementing grid charging with 30–50% solar energy. This hybrid approach reduces total LCC by up to USD 21,500 over the 10-year project period, underscoring the potential synergy between V2G and rooftop PV generation.

The system’s overall financial outcomes are also shaped by shifts in electricity prices, capital expenditure, and market remuneration. As summarized in

Table 12, the High Utilization scenario emerges as the most cost-sensitive configuration, particularly in response to increased EV purchase prices (+15%, leading to a USD 7000 rise in CAPEX). Conversely, higher mFRR capacity prices (+50%) enhance projected revenues, particularly for the V2G+ and High Utilization cases. Changes in electricity prices (+25%) exert a more modest impact, increasing total costs by around USD 2200 across all scenarios. All impacts are calculated relative to baseline values over the 10-year analysis period.

Overall, the findings highlight four central insights into the economic feasibility of V2G-enabled EV fleets in Turkey’s emerging mFRR market. First, grid participation through V2G consistently improves cost-effectiveness relative to non-participation, particularly in low- and moderate-utilization scenarios where ancillary service income offsets operating costs. Second, fleet ownership combined with high utilization provides the most favorable outcome: the High Utilization scenario achieves the lowest LCC, generates over USD 12,000 in annual income, and approaches financial break-even within seven years. Third, aggregator models are indispensable under current regulations but also reduce profitability; a 20% fee significantly diminishes retained earnings. Finally, while regulatory barriers presently prevent small-scale fleet participation in balancing markets, the modeled outcomes suggest that both technical and economic readiness exist for pilot-scale V2G deployments in Turkey, provided that aggregator-based access mechanisms are introduced.

5. Discussion

The comparative outcomes across the three modeled scenarios reveal that fleet ownership paired with high utilization generates significantly better financial performance than leasing-based models. As shown in

Table 11, the High Utilization scenario achieved a 12% lower LCC than the Base Case over the 10-year horizon, primarily due to avoided leasing fees and higher rental income streams. In contrast, the V2G+ scenario only partially offset costs, as the USD 4400 annual net revenue from mFRR participation was insufficient to cover the fixed costs of leasing and digital system operation. Sensitivity analysis further highlighted that variations in mFRR pricing and EV capital expenditure were the most influential factors affecting economic viability. For instance, a 50% increase in capacity price improved total revenue by USD 2750 over 10 years, while a 15% rise in EV purchase cost increased capital expenses by USD 7000. These findings indicate that policy interventions such as aggregator fee reduction or targeted EV purchase incentives could directly improve the break-even timeline for municipal or cooperative fleets.

The results of this study indicate that V2G technology holds substantial technical and economic promise for Turkey, especially when coupled with shared EV fleets and revenue from frequency regulation markets. While the modeling shows potential viability, various structural, regulatory, and technical limitations currently hinder large-scale implementation. This discussion reflects on the study’s findings within the context of Turkey’s energy and transportation landscape and highlights both emerging opportunities and prevailing barriers.

Turkey’s growing renewable energy capacity—surpassing 55 GW in 2024 and expected to account for 65% of electricity generation by 2035—makes system flexibility a critical need. Provinces such as Konya, Şanlıurfa, and Karaman are increasingly solar-dominated, resulting in variable generation profiles. Distributed V2G-enabled EV fleets can serve as mobile, fast-response resources that help balance these fluctuations, particularly in low-voltage urban networks.

In parallel, domestic EV manufacturing has begun scaling. TOGG’s T10X, Turkey’s flagship electric car, exceeded 20,000 units sold in its first 18 months. The rollout is supported by a growing national charging network under the “Trugo” brand. Although V2G functionality is not yet available, TOGG’s publicly stated R&D roadmap references bidirectional energy transfer and ISO 15118 [

29] communication standards as a medium-term goal, suggesting future readiness.

At the municipal level, several cities—including İstanbul, İzmir, and Eskişehir—are proactively deploying electric buses and light e-mobility fleets. İstanbul’s centralized EV charging infrastructure for public service vehicles is especially well positioned to act as a pilot testbed for aggregated V2G services. These developments, while fragmented, represent promising starting points for real-world demonstrations.

Despite these strengths, Turkey lacks a regulatory and market framework to support V2G implementation. TEİAŞ’s current ancillary services rules prohibit direct market access for distributed energy resources, including EVs. Participation in the mFRR market is restricted to licensed generators and system operators, leaving no legal pathway for aggregators or fleet operators to contribute reserve capacity. This prevents EVs from monetizing their flexibility, even if technically capable.

Infrastructure constraints also remain. While Zorlu Energy (ZES) and Sharz.net continue expanding Turkey’s EV charging network, V2G-capable chargers are nearly absent in the installed base. Furthermore, EV battery warranties currently do not address V2G cycling, leaving owners uncertain about degradation risks and coverage. These technical and contractual uncertainties dampen user confidence in enabling bidirectional power flow. The financial outcomes presented here assume that V2G operation occurs within a controlled SOC window (30–70%), which helps limit degradation but cannot fully prevent it. If degradation costs are incorporated, as estimated in

Section 3.4, the total LCC would rise by approximately USD 25,000–USD 40,000 over 10 years for the five-vehicle fleet. This reinforces the importance of advanced thermal management strategies [

30] and optimized dispatch algorithms [

26] to minimize cycling stress and extend battery life.

Recent advances in high-power battery thermal management and energy dispatch strategies can further refine the assumptions made in this study. For instance, Qi et al. [

25] and Qi et al. [

30] propose advanced cooling architectures such as interwound cooling belts and multi-U micro-channel plates, which are designed to maintain uniform temperature distribution and extend lithium-ion cell lifespans under frequent charge–discharge cycles. These technologies could mitigate degradation risks associated with V2G operations, particularly in high-frequency regulation markets. Additionally, Zhang et al. [

26] present a real-time global optimization framework for dynamic charging and discharging scheduling, which could enhance the efficiency and responsiveness of aggregator-based V2G fleets. While our model adopts a simplified SOC window (30–70%) to represent safe operating limits, future work could integrate such advanced thermal management and scheduling strategies to capture battery performance and economic outcomes with higher fidelity.

Revenue mechanisms present another gap. TEİAŞ has yet to define a compensation structure for behind-the-meter flexibility or distributed capacity aggregation. Without dynamic pricing, dispatch signals, or auction-based bidding opportunities, EVs offering grid services receive no compensation—leaving business models speculative rather than bankable.

To address these gaps, policy reform and pilot deployment are essential. EMRA (EPDK) could establish an aggregator certification framework, enabling new actors to bundle EVs and flexible loads for participation in balancing markets. This would align with the EU’s Clean Energy Package and parallel the 2024 EPDK sandbox trials, which explore VPP models. Simultaneously, national funding bodies like TÜBİTAK could support pilot projects under existing programs (e.g., 1505 or 1007). A demonstration in Bursa or Eskişehir using TOGG vehicles for both municipal fleet operations and frequency services could accelerate commercial learning while supporting domestic industry.

On the tariff side, bi-directional net metering could be piloted in collaboration with DSOs like EnerjiSA. Turkey’s YEK-G scheme already tracks renewable energy inputs at the prosumer level; a modified version could account for EV discharge events, enabling compensation for mobile storage assets.

In comparison with Nordic countries—where EV adoption is more mature, and the mFRR market is transparent and standardized—Turkey’s V2G ecosystem remains in a pre-commercial stage. However, Turkey enjoys some key advantages: a strong national EV manufacturer, centralized grid governance, and rapid EV market growth (over 70,000 units sold by mid-2025). With the right regulatory adjustments and targeted public investment, Turkey could leapfrog into a V2G-enabled future, unlocking new value streams for clean mobility and grid flexibility.

Another avenue is to benchmark Turkey’s regulatory and technical readiness against comparable and more mature markets.

Table 13 provides a high-level comparison of V2G aggregator readiness across Turkey, selected EU member states, and pilot markets in the MENA region. This comparison highlights the significant regulatory and technical gaps that Turkey must address to enable widespread V2G adoption, including the absence of a legal definition for aggregators, limited deployment of bidirectional charging infrastructure, and a lack of standardized market access pathways for distributed resources.

6. Conclusions and Policy Implications

This study assessed the technical and economic feasibility of integrating a small EV fleet with V2G capabilities into Turkey’s manual Frequency Restoration Reserve (mFRR) market. Using LCC analysis and scenario modeling over a 10-year horizon, the findings suggest that while V2G offers long-term potential, immediate deployment is constrained by market structures, regulatory gaps, and economic uncertainties.

The analysis reveals that V2G participation improves financial performance compared to baseline EV operation, particularly under high-utilization ownership scenarios. However, under current Turkish market conditions, V2G does not guarantee profitability without external support or favorable pricing. Revenue contributions from mFRR capacity payments and moderate carsharing activity form the core of income potential, while energy arbitrage remains a speculative but promising addition. Sensitivity analysis confirms that financial outcomes are strongly influenced by aggregator fees, EV utilization rates, and reserve market pricing—emphasizing the need for targeted optimization strategies.

Although Turkey’s domestic EV sector, led by TOGG, is progressing rapidly, the institutional and regulatory framework remains unprepared to accommodate distributed flexibility resources. Technical standards such as ISO 15118, which are critical for bidirectional energy communication, are not yet widely adopted. Aggregator models have not been defined in legislation, and there are currently no mechanisms that allow behind-the-meter assets like EVs to participate in grid services or frequency reserves.

To address these challenges, a range of policy measures should be considered. First, legal recognition and operational rules for aggregators are necessary to enable distributed participation in ancillary markets. Second, pilot programs funded by national institutions such as TEİAŞ or TÜBİTAK can help validate business models and demonstrate real-world feasibility. Third, standardization and local certification for V2G-compatible devices will be essential to ensure interoperability and trust in the ecosystem. Financial incentives—such as net metering, tax reductions, or micro-payments for grid participation—could enhance early adoption and stimulate user interest. Finally, municipalities and housing cooperatives are well positioned to serve as early adopters, combining carsharing and grid-balancing functionality in localized pilot environments.

Turkey now stands at a pivotal point in its energy transition and transport electrification pathway. With the right regulatory reforms, strategic investments, and cross-sector collaboration, the country can become a regional frontrunner in integrating EVs into balancing markets. This study offers a modeled proof-of-concept, but further research—especially using operational data from domestic pilot projects—is necessary to refine projections and support practical implementation at scale.

Building on the findings of this study, several areas warrant further research to support the strategic integration of V2G technology in Turkey. One promising direction involves simulating multi-node aggregator models, where V2G-capable electric vehicles are deployed across multiple sites—such as cooperative housing complexes, municipal depots, or mixed-use charging hubs. These simulations can account for regional variation in tariffs, solar potential, usage patterns, and distribution grid constraints. By modeling the coordination of power flows and reserve contributions across nodes, such studies would offer valuable insights into aggregator-level optimization, revenue-sharing mechanisms, and system-level grid support.

Finally, further exploration is needed into the role of TOGG as a vertically integrated aggregator. With proprietary control over vehicle hardware, charging infrastructure (via the Trugo network), and software platforms, TOGG is well positioned to lead domestic V2G innovation. Future research could evaluate TOGG’s technical compatibility with bidirectional charging protocols, business models for fleet aggregation, and its potential to partner with municipalities, cooperatives, or utilities as a turnkey V2G solution provider.

In summary, although the presented considerations are not exhaustive, the authors believe that further, broader research in this research area, as described above, may determine the future development of vehicle fleet electrification. Therefore, a thorough and interdisciplinary approach to analysis encompassing all elements of the system upon which the electromobility process will develop, is undoubtedly crucial. Thanks to this, the electrification of corporate vehicle fleets has the potential to become a key step towards sustainable transport and the decarbonization of the automotive sector, particularly in developing countries such as Turkey.