Unpacking Artificial Intelligence’s Role in the Energy Transition: The Mediating and Moderating Roles of Knowledge Production and Financial Development

Abstract

1. Introduction

- (a)

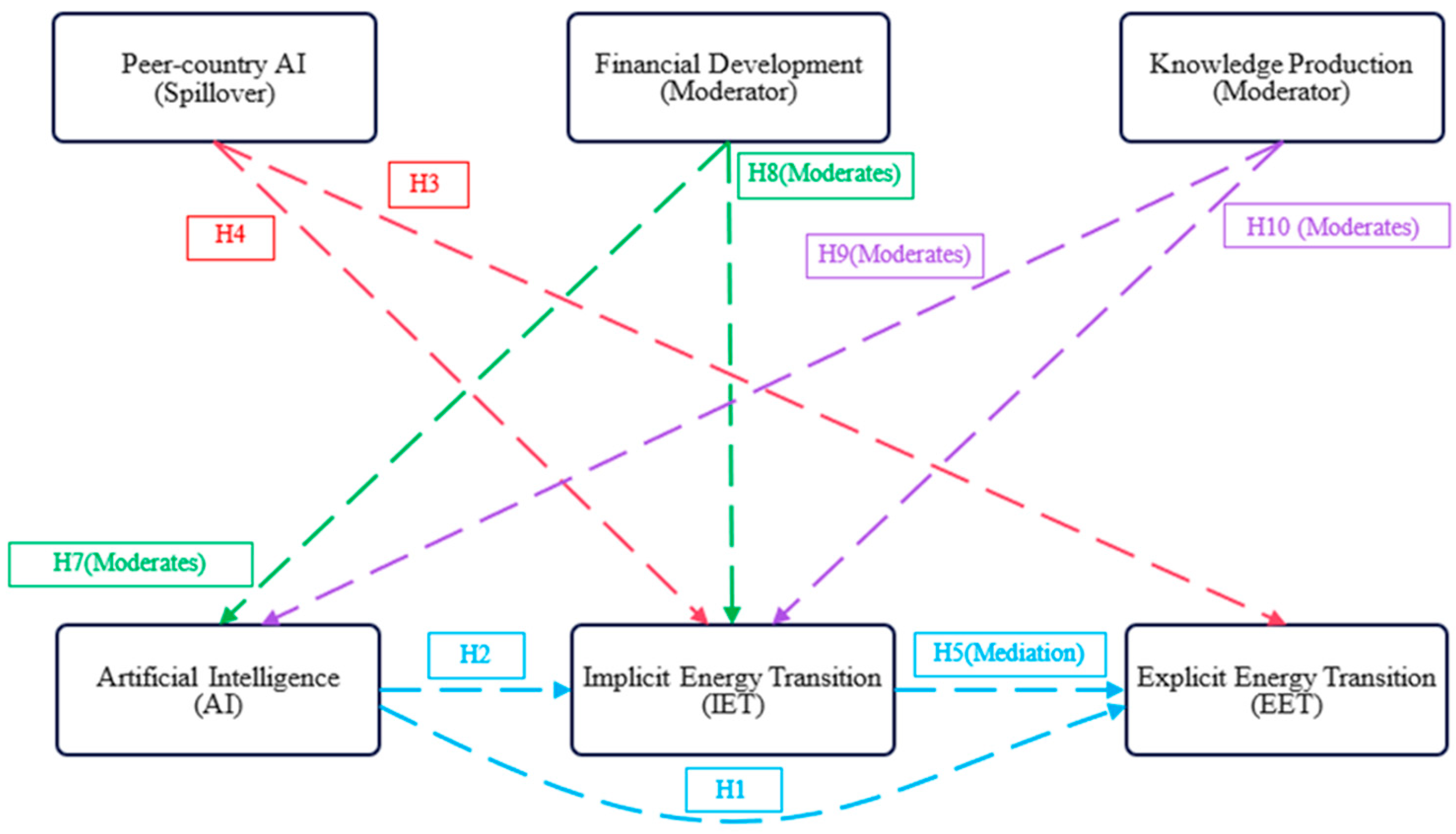

- To evaluate the direct impact of artificial intelligence on both explicit and implicit energy transitions in BRICS nations.

- (b)

- To investigate the cross-country spillover effects of artificial intelligence on domestic energy transitions.

- (c)

- To examine the mediating role of implicit energy transition in the relationship between AI and explicit energy transition.

- (d)

- To assess the moderating influence of financial development and knowledge production on the AI–energy transition nexus.

Novelty and Contribution of Study

2. Theoretical and Literature Review

2.1. Theoretical Review

2.2. Literature Review

| Author(s) | Period | Nation(s) | Method(s) | Finding(s) |

|---|---|---|---|---|

| Artificial Intelligence and Energy Transition | ||||

| [8] | Undefined | Global | AIEM | AI ↑ ET |

| [20] | 2006–2022 | 469 publications | Bibliometric analysis | AI ↑ ET |

| [4] | Undefined | Undefined | Machine learning | AI → ET |

| [3] | 2015–2022 | 15 emerging nations | Baron and Kenny’s approach | AI ↑ ET |

| [14] | 2005–2019 | BRICS nations | Two-way fixed effects regression | AI ↑ ET |

| [21] | 2018–2021 | U.S. | Benchmark regression | AI ↑ ET |

| Financial Development and Energy Transition | ||||

| [9] | 2000–2020 | 32 EU and ASEAN nations | FMOLS | FD ↑ ET |

| [22] | 1995–2022 | BRICS | Fixed Effect Model | FD ↑ ET |

| [23] | 2000–2021 | Developing markets | panel quantile regression | FD ↑ ET |

| [10] | 1990–2019 | 7 emerging nations | Fixed Effects and Random Effects | FD ↓ ET |

| [24] | 1996–2019 | 119 nations | panel ARDL | FD ↓ ET |

| [25] | 2006–2019 | Africa | GMM | FD ↑↓ ET |

| Human Capital, Economic Growth, and Energy Transition | ||||

| [11] | 1996–2019 | 134 countries | SGMM | HC and EG ↑↓ ET |

| [13] | 1995–2018 | 8 Asian nations | FMOLS | HC and EG ↑ ET |

| [26] | 1990–2021 | Emerging nations | Panel Quantile Regression | HC and EG ↑ ET |

| [27] | Undefined | SAARC nations | PCSE | HC and EG ↑ ET |

| [28] | 1980–2015 | OECD nations | FMOLS | HC and EG ↑ ET |

| Technological Innovation, Globalization, and Energy Transition | ||||

| [29] | 1985–2018 | G7 countries | CUP-FM and CUP-BC | TI and GLO ↑ ET |

| [30] | 1995–2020 | UK | bootstrap rolling window approach | TI and FIG ↑ ET |

| [31] | 1997–2021 | MENA economies | DOLS | TI and GLO ↑ ET |

| [32] | Not defined | Global analysis | SWOT analysis | TI and GLO ↑ ET |

2.3. Hypothesis Formulation

3. Data and Method

3.1. Data

| Role | Variables | Dimension | Index Interpretation | Sources |

|---|---|---|---|---|

| Dependent Variables | Explicit Energy Transition (EET) | Energy–Environment | Ratio of non-fossil generation to total generation | [33] |

| Energy–Environment-Society | Share of population with clean cooking fuels | |||

| Energy–Environment–Technology | Share of GDP spent on R&D | |||

| Energy–Environment–Technology | Patent-based measure of clean energy innovation | |||

| Implicit Energy Transition (IET) | Energy–Environment–Society | Average energy consumption per capita | [33] | |

| Energy–Environment–Economy | Energy use per unit of GDP | |||

| Energy–Environment–Politics | Electricity imports/consumption ratio | |||

| Energy–Environment–Politics | Modern renewables’ share in final consumption | |||

| Energy–Environment–Economy | CO2 emissions per unit of energy supply | |||

| Moderating Variables | Knowledge Production (KP) | Number of papers published, the number of papers cited, and the citation count | [33] | |

| Financial Development (FD) | Domestic credit to private sector by banks (% of GDP) | [34] | ||

| Control Variables | Human Capital (HC) | Index | [35] | |

| Economic Growth (EG) | GDP per capita (constant 2015 US$) | [34] | ||

| Financial Globalization (FIG) | Index | [36] | ||

| Technological Innovations (TI) | Patents Resident | [33] | ||

| Urbanization (UB) | Urban population growth (annual %) | [34] | ||

| Economic Risk (ER) | Index | [37] |

3.2. Empirical Model

3.2.1. Benchmark Regression Model

3.2.2. Mediating Effect Model

3.2.3. Moderating Effect

4. Results

4.1. Descriptive Statistics

4.2. Baseline Regression Results

4.3. Robustness Check

4.4. Spillover Effects of Artificial Intelligence (AI)

5. Conclusions and Policy Recommendations

5.1. Conclusions

5.2. Policy Recommendations

- (a)

- Phase AI Integration through Efficiency Pathways: Given AI’s strong direct effects on both explicit and implicit energy transitions—and its full mediation via efficiency gains—governments should adopt a phased approach to AI deployment in energy systems. In the short term, pilot AI-enabled smartgrid and demand-response projects (e.g., China’s New Generation Smart Substation and India’s Green Energy Corridor) can demonstrate tangible efficiency improvements. Over the medium to long term, mandatory connections to a national AI-powered energy-management platform, coupled with dedicated R&D funding for grid optimization algorithms, will ensure AI investments translate into sustained renewable integration and loss reductions.

- (b)

- Strengthen Implicit Transition via Human Capital and Knowledge Production: Our results show that human capital and patenting intensity are critical for behind-the-meter improvements. BRICS governments should bolster technical and vocational training in energy technologies and incentivize clean-tech patenting through R&D tax credits and innovation vouchers. Establishing joint research centers and patent pools focused on energy-efficiency solutions will magnify AI’s impact on system optimization and drive the positive demonstration effects that, in turn, promote visible shifts in energy mixes.

- (c)

- Reform Financial Systems to Mobilize Green Capital: Deep financial markets have shown a crowding-out effect on green investments unless steered by policy. Mandating a minimum green-loan quota for commercial banks and expanding green bond markets will redirect capital from legacy fossil sectors toward renewables. Further, harmonizing BRICS-wide standards for sustainable finance—such as unified taxonomy and reporting rules—can leverage financial globalization to amplify explicit transition without diluting AI’s green potential.

- (d)

- Leverage Urbanization and Regulatory Stringency: Denser urban centers facilitate pilot green infrastructure and district-level efficiency upgrades. Urban planning should integrate renewables and microgrids into new developments, while environmental regulations—already shown to be robust levers—must be tightened to enforce higher efficiency benchmarks and renewable-energy quotas for utilities. Coordinated urban energy policies will harness demographic trends for rapid deployment of clean technologies.

- (e)

- Deepen Cross-Border Cooperation and Demonstration Spillovers: To counteract negative AI and growth spillovers, BRICS should create formal joint R&D consortia, shared data-governance protocols, and talent-exchange programs. Demonstration projects—such as cross-country pilot grids—can accelerate learning and reduce competitive resource drains. Aligning AI standards and IP regimes across the bloc will enable faster technology diffusion and turn initial “beggar-thy-neighbor” dynamics into sustained, bloc-wide advancement.

- (f)

- Differentiate Strategies by National Conditions: Countries with advanced AI infrastructure (China, India) should pioneer large-scale smart-grid demonstrations and open-source AI toolkits, while those with structural constraints (South Africa, Brazil) ought to focus first on off-grid renewables and microgrid interconnections to alleviate energy poverty. Developed members can support these tailored pathways through targeted grants, technical assistance, and co-investment vehicles.

- (g)

- Transition to Knowledge-Driven Green Development: Moving beyond resource dependence, governments must establish ecological red-lines and channel incentives toward low-carbon circular-economy projects. Prioritizing AI ethics and algorithmic transparency in energy allocation will ensure that smart energy systems serve all communities equitably. International green-technology platforms—facilitating real-time data sharing and joint patent licensing—can accelerate the shift toward knowledge-intensive, clean-energy industries.

5.3. Limitation and Future Direction

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wang, Z.; Danish; Zhang, B.; Wang, B. The moderating role of corruption between economic growth and CO2 emissions: Evidence from BRICS economies. Energy 2018, 148, 506–513. [Google Scholar] [CrossRef]

- Yadav, A.; Gyamfi, B.A.; Asongu, S.A.; Behera, D.K. The role of green finance and governance effectiveness in the impact of renewable energy investment on CO2 emissions in BRICS economies. J. Environ. Manag. 2024, 358, 120906. [Google Scholar] [CrossRef]

- Omri, A.; Hamza, F.; Slimani, S. The Role of Green Finance in Driving Artificial Intelligence and Renewable Energy for Sustainable Development. Sustain. Dev. 2025, in press. [Google Scholar] [CrossRef]

- Talaat, F.M.; Kabeel, A.; Shaban, W.M. The role of utilizing artificial intelligence and renewable energy in reaching sustainable development goals. Renew. Energy 2024, 235, 121311. [Google Scholar] [CrossRef]

- Zhang, X.; Khan, K.; Shao, X.; Oprean-Stan, C.; Zhang, Q. The rising role of artificial intelligence in renewable energy development in China. Energy Econ. 2024, 132, 107489. [Google Scholar] [CrossRef]

- Hannan, M.; Al-Shetwi, A.Q.; Ker, P.J.; Begum, R.; Mansor, M.; Rahman, S.; Dong, Z.; Tiong, S.; Mahlia, T.I.; Muttaqi, K. Impact of renewable energy utilization and artificial intelligence in achieving sustainable development goals. Energy Rep. 2021, 7, 5359–5373. [Google Scholar] [CrossRef]

- Zhao, C.; Dong, K.; Wang, K.; Nepal, R. How does artificial intelligence promote renewable energy development? The role of climate finance. Energy Econ. 2024, 133, 107493. [Google Scholar] [CrossRef]

- Chen, C.; Hu, Y.; Karuppiah, M.; Kumar, P.M. Artificial intelligence on economic evaluation of energy efficiency and renewable energy technologies. Sustain. Energy Technol. Assess. 2021, 47, 101358. [Google Scholar] [CrossRef]

- Horky, F.; Fidrmuc, J. Financial development and renewable energy adoption in EU and ASEAN countries. Energy Econ. 2024, 131, 107368. [Google Scholar] [CrossRef]

- Deka, A.; Özdeşer, H.; Seraj, M. The impact of oil prices, financial development and economic growth on renewable energy use. Int. J. Energy Sect. Manag. 2023, 18, 351–368. [Google Scholar] [CrossRef]

- Achuo, E.; Kakeu, P.; Asongu, S. Financial development, human capital and energy transition: A global comparative analysis. Int. J. Energy Sect. Manag. 2024, 19, 59–80. [Google Scholar] [CrossRef]

- Yang, Z.; Zhan, J. Examining the multiple impacts of renewable energy development on redefined energy security in China: A panel quantile regression approach. Renew. Energy 2024, 221, 119778. [Google Scholar] [CrossRef]

- Azam, M.; Khan, F.; Ozturk, I.; Noor, S.; Yien, L.C.; Bah, M.M. Effects of Renewable Energy Consumption on Human Development: Empirical Evidence from Asian Countries. J. Asian Afr. Stud. 2023, 60, 420–441. [Google Scholar] [CrossRef]

- Zhang, W.; Zhang, Y.; Lan, X.; Song, M. “Green BRICS”: How artificial intelligence can build the explicit structure and implicit order of energy transition. Energy Econ. 2025, 149, 108713. [Google Scholar] [CrossRef]

- Schumpeter, J. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Rogers, E. Diffusion of Innovations, 5th ed.; The Free Press: New York, NY, USA, 2003. [Google Scholar]

- Anton, S.G.; Nucu, A.E.A. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Ashraf, M.S.; Mingxing, L.; Zhiqiang, M.; Ashraf, R.U.; Usman, M.; Khan, I. Adaptation to globalization in renewable energy sources: Environmental implications of financial development and human capital in China. Front. Environ. Sci. 2023, 10, 1060559. [Google Scholar] [CrossRef]

- Athari, S.A. The impact of financial development and technological innovations on renewable energy consumption: Do the roles of economic openness and financial stability matter in BRICS economies? Geol. J. 2024, 59, 288–300. [Google Scholar] [CrossRef]

- Yan, Z.; Jiang, L.; Huang, X.; Zhang, L.; Zhou, X. Intelligent urbanism with artificial intelligence in shaping tomorrow’s smart cities: Current developments, trends, and future directions. J. Cloud Comput. 2023, 12, 179. [Google Scholar] [CrossRef]

- Xiao, G.; Yang, D.; Xu, L.; Li, J.; Jiang, Z. The Application of Artificial Intelligence Technology in Shipping: A Bibliometric Review. J. Mar. Sci. Eng. 2024, 12, 624. [Google Scholar] [CrossRef]

- Yadav, A.; Bekun, F.V.; Ozturk, I.; Ferreira, P.J.S.; Karalinc, T. Unravelling the role of financial development in shaping renewable energy consumption patterns: Insights from BRICS countries. Energy Strat. Rev. 2024, 54, 101434. [Google Scholar] [CrossRef]

- Athari, S.A. Global economic policy uncertainty and renewable energy demand: Does environmental policy stringency matter? Evidence from OECD economies. J. Clean. Prod. 2024, 450, 141865. [Google Scholar] [CrossRef]

- Wang, Q.; Cheng, X.; Pata, U.K.; Li, R.; Kartal, M.T. Intermediating effect of mineral resources on renewable energy amidst globalization, financial development, and technological progress: Evidence from globe based on income-groups. Resour. Policy 2024, 90, 104798. [Google Scholar] [CrossRef]

- Horvey, S.S.; Odei-Mensah, J.; Moloi, T.; Bokpin, G.A. Digital economy, financial development and energy transition in Africa: Exploring for synergies and nonlinearities. Appl. Energy 2024, 376, 124297. [Google Scholar] [CrossRef]

- Jin, D.; Zafar, M.W. Fostering green progress: The dual influence of natural resource rent and human capital on emerging economy energy transition. Nat. Resour. Forum 2025, 49, 656–676. [Google Scholar] [CrossRef]

- Roy, S. Do Human Capital and Renewable Energy Consumption Matter for the EKC Hypothesis in the Case of SAARC Countries? Energy Res. Lett. 2025, 6, 138286. [Google Scholar] [CrossRef]

- Alvarado, R.; Deng, Q.; Tillaguango, B.; Méndez, P.; Bravo, D.; Chamba, J.; Alvarado-Lopez, M.; Ahmad, M. Do economic development and human capital decrease non-renewable energy consumption? Evidence for OECD countries. Energy 2021, 215, 119147. [Google Scholar] [CrossRef]

- Ahmed, Z.; Ahmad, M.; Murshed, M.; Shah, M.I.; Mahmood, H.; Abbas, S. How do green energy technology investments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sustainability in the G7 countries? Gondwana Res. 2022, 112, 105–115. [Google Scholar] [CrossRef]

- Ramzan, M.; Razi, U.; Quddoos, M.U.; Adebayo, T.S. Do green innovation and financial globalization contribute to the ecological sustainability and energy transition in the United Kingdom? Policy insights from a bootstrap rolling window approach. Sustain. Dev. 2022, 31, 393–414. [Google Scholar] [CrossRef]

- Alariqi, M.; Long, W.; Singh, P.R.; Al-Barakani, A.; Muazu, A. Modelling dynamic links among energy transition, technological level and economic development from the perspective of economic globalisation: Evidence from MENA economies. Energy Rep. 2023, 9, 3920–3931. [Google Scholar] [CrossRef]

- Chatzinikolaou, D.; Vlados, C.M. New Globalization and Energy Transition: Insights from Recent Global Developments. Societies 2024, 14, 166. [Google Scholar] [CrossRef]

- OWD. Our World in Data. 2024. Available online: https://ourworldindata.org/ (accessed on 28 July 2021).

- WDI. World Development Indicator. 2024. Available online: https://data.worldbank.org (accessed on 1 April 2024).

- PWT 10.01. Penn World Table version 10.01. 2025. Available online: https://www.rug.nl/ggdc/productivity/pwt/?lang=en (accessed on 6 June 2025).

- ETH Zurich. KOF Globalisation Index. 2023. Available online: https://kof.ethz.ch/en/forecasts-and-indicators/indicators/kof-globalisation-index.html (accessed on 23 October 2023).

- PRS Group. PRS Group Data of Country Risk; Obtained from the PRS Group via E−Mail (2022); PRS Group: Mount Pleasant, SC, USA, 2022. [Google Scholar]

- Şerban, A.C.; Lytras, M.D. Artificial Intelligence for Smart Renewable Energy Sector in Europe—Smart Energy Infrastructures for Next Generation Smart Cities. IEEE Access 2020, 8, 77364–77377. [Google Scholar] [CrossRef]

- Charfeddine, L.; Hussain, B.; Kahia, M. Analysis of the Impact of Information and Communication Technology, Digitalization, Renewable Energy and Financial Development on Environmental Sustainability. Renew. Sustain. Energy Rev. 2024, 201, 114609. [Google Scholar] [CrossRef]

- Olanrewaju, V.O.; Adebayo, T.S.; Uzun, B. Navigating the impact of ESG sustainability uncertainty on fossil fuel prices: Evidence from wavelet cross-quantile regression. Appl. Econ. 2025, 5, 1–17. [Google Scholar] [CrossRef]

- Acemoglu, D.; Akcigit, U.; Hanley, D.; Kerr, W. Transition to Clean Technology. J. Political Econ. 2016, 124, 52–104. [Google Scholar] [CrossRef]

- Popp, D.; Hascic, I.; Medhi, N. Technology and the diffusion of renewable energy. Energy Econ. 2011, 33, 648–662. [Google Scholar] [CrossRef]

- Fang, W.; Liu, Z.; Putra, A.R.S. Role of research and development in green economic growth through renewable energy development: Empirical evidence from South Asia. Renew. Energy 2022, 194, 1142–1152. [Google Scholar] [CrossRef]

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| EET | 80 | 0.343 | 0.272 | 0.059 | 0.919 |

| IET | 80 | 0.299 | 0.134 | 0.130 | 0.705 |

| AI | 80 | 10.084 | 1.858 | 6.023 | 14.857 |

| FD | 80 | 81.861 | 41.108 | 25.923 | 179.104 |

| KP | 80 | 0.177 | 0.238 | 0.027 | 0.979 |

| EG | 80 | 8.578 | 0.721 | 6.854 | 9.266 |

| UB | 80 | 1.804 | 1.070 | −0.320 | 3.882 |

| HC | 80 | 2.636 | 0.452 | 1.857 | 3.434 |

| FIG | 80 | 50.195 | 6.602 | 36.747 | 62.090 |

| TI | 80 | 9.511 | 2.203 | 6.295 | 14.148 |

| EET | IET | AI | FD | KP | EG | UB | HC | FIG | TI | |

|---|---|---|---|---|---|---|---|---|---|---|

| EET | 1 | 0.5769 | 0.0495 | −0.5271 | −0.1207 | 0.3449 | −0.4668 | 0.1665 | −0.1594 | −0.0871 |

| IET | 0.5769 | 1 | 0.6369 | −0.6493 | 0.6696 | −0.1937 | −0.3053 | −0.052 | −0.5088 | 0.0124 |

| AI | 0.0495 | 0.6369 | 1 | −0.1173 | 0.8708 | −0.5642 | 0.3526 | −0.4796 | −0.7204 | 0.1447 |

| FD | −0.5271 | −0.6493 | −0.1173 | 1 | −0.2736 | 0.2551 | 0.5559 | −0.0844 | 0.2204 | 0.214 |

| KP | −0.1207 | 0.6696 | 0.8708 | −0.2736 | 1 | −0.7356 | 0.3158 | −0.5456 | −0.6997 | 0.1187 |

| EG | 0.3449 | −0.1937 | −0.5642 | 0.2551 | −0.7356 | 1 | −0.5184 | 0.7749 | 0.6828 | 0.1397 |

| UB | −0.4668 | −0.3053 | 0.3526 | 0.5559 | 0.3158 | −0.5184 | 1 | −0.7507 | −0.3935 | 0.1984 |

| HC | 0.1665 | −0.052 | −0.4796 | −0.0844 | −0.5456 | 0.7749 | −0.7507 | 1 | 0.6822 | 0.0931 |

| FIG | −0.1594 | −0.5088 | −0.7204 | 0.2204 | −0.6997 | 0.6828 | −0.3935 | 0.6822 | 1 | 0.172 |

| TI | −0.0871 | 0.0124 | 0.1447 | 0.214 | 0.1187 | 0.1397 | 0.1984 | 0.0931 | 0.172 | 1 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

|---|---|---|---|---|---|---|---|

| Variable | EET | IET | EET | EET | IET | EET | IET |

| AI | 0.0657 *** (4.4029) | 0.1987 *** (7.0553) | −0.0306 ** (−2.2832) | 0.0422 ** (2.0470) | 0.1048 ** (2.9968) | −0.0248 * (−1.9698) | 0.0098 (1.3572) |

| EG | 0.0423 (0.4308) | 0.3103 ** (2.6209) | −0.1081 (−1.3047) | 0.0694 (0.6101) | 0.5518 *** (3.8690) | −0.1091 (−1.1392) | 0.0402 (1.0102) |

| UB | 0.0085 (0.4200) | 0.0149 (0.5677) | 0.0013 (0.1067) | −0.0156 (−1.1626) | −0.0228 (−0.9343) | −0.0003 (−0.0257) | 0.0040 (0.4949) |

| HC | 0.0856 (1.3470) | 0.5105 *** (7.0642) | −0.1619 ** (−2.5219) | 0.0093 (0.1544) | 0.4459 *** (5.4718) | −0.1374 * (−1.7492) | 0.0991 ** (2.7293) |

| FIG | 0.0048 ** (2.9226) | −0.0023 (−0.9928) | 0.0059 *** (5.1501) | 0.0047 ** (2.7911) | 0.0001 (0.0627) | 0.0065 *** (5.1380) | 0.0015 ** (2.1131) |

| TI | −0.0188 (−0.6543) | −0.0766 ** (−2.5691) | 0.0183 (0.7224) | −0.0014 (−0.0515) | −0.0657 ** (−2.1159) | 0.0194 (0.6803) | −0.0078 (−0.6440) |

| IET | 0.4848 *** (8.2962) | ||||||

| FD | −0.0021 *** (−5.4684) | −0.0035 *** (−4.8816) | |||||

| AI*FD | −0.0000 (−0.1695) | −0.0005 ** (−2.4665) | |||||

| KP | 0.0700 (0.5086) | 0.3468 *** (3.6825) | |||||

| AI*KP | 0.0433 * (1.7310) | 0.0570 *** (3.7030) | |||||

| CONS | −0.9840 (−1.4012) | −4.8967 *** (−6.1669) | 1.3898 * (1.9867) | −0.7243 (−0.9208) | −5.7250 *** (−6.0347) | 1.3529 (1.6570) | −0.4961 (−1.4397) |

| N | 80 | 80 | 80 | 80 | 80 | 80 | 80 |

| R2 | 0.99 | 0.94 | 0.99 | 0.99 | 0.96 | 0.99 | 0.99 |

| id FE | YES | YES | YES | YES | YES | YES | YES |

| year FE | YES | YES | YES | YES | YES | YES | YES |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Replace and Add Control Variables | AI and Controls Lag One Period | |||||

| Variable | EET | IET | EET | EET | IET | EET |

| AI | 0.1131 *** (4.5493) | 0.2051 *** (5.3548) | 0.0179 (1.1006) | |||

| EG | −0.2819 * (−1.7091) | 0.1470 (0.7741) | −0.3501 ** (−2.5473) | |||

| UB1 | 0.0123 ** (2.1487) | −0.0003 (−0.0449) | 0.0124 ** (2.7065) | |||

| HC | 0.0336 (0.4870) | 0.4958 *** (5.1027) | −0.1965 ** (−2.7742) | |||

| FIG | 0.0029 (1.4042) | −0.0016 (−0.6538) | 0.0036 ** (2.2586) | |||

| TI | 0.0004 (0.0138) | −0.0490 (−1.6125) | 0.0231 (1.0777) | |||

| ER | 0.0056 ** (3.1489) | 0.0073 ** (2.2606) | 0.0022 ** (2.3810) | |||

| IET | 0.4641 *** (8.7953) | 0.4698 *** (7.7861) | ||||

| L.AI | 0.0488 ** (2.6748) | 0.1980 *** (5.3693) | −0.0442 ** (−2.7756) | |||

| L.EG | 0.0585 (0.5112) | 0.3855 ** (2.7542) | −0.1226 (−1.2589) | |||

| L.UB | 0.0130 (0.5986) | 0.0134 (0.4392) | 0.0067 (0.4620) | |||

| L.HC | −0.0033 (−0.0394) | 0.5276 *** (5.0661) | −0.2512 ** (−3.4074) | |||

| L.FIG | 0.0021 (1.3959) | −0.0022 (−0.8523) | 0.0032 ** (2.3910) | |||

| L.TI | −0.0222 (−0.6947) | −0.0905 ** (−2.5607) | 0.0203 (0.7079) | |||

| CONS | 0.4269 | −4.0364 *** | 2.3004 ** | −0.5573 | −5.4164 *** | 1.9873 ** |

| N | 80 | 80 | 80 | 75 | 75 | 75 |

| R2 | 0.9948 | 0.94 | 0.99 | 0.99 | 0.93 | 0.99 |

| id FE | YES | YES | YES | YES | YES | YES |

| year FE | YES | YES | YES | YES | YES | YES |

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Variable | EETj | IETj | EETj |

| −0.0160 *** (−4.6363) | −0.0511 *** (−6.8569) | −0.0064 (−1.3588) | |

| EG | −0.0513 ** (−2.5963) | −0.0871 ** (−2.7688) | −0.0351 * (−1.7040) |

| UB | −0.0060 (−1.3692) | −0.0053 (−0.7457) | −0.0050 (−1.1884) |

| HC | −0.0270 (−1.3758) | −0.1317 *** (−6.9579) | −0.0024 (−0.1223) |

| FIG | −0.0006 (−1.4078) | 0.0005 (0.8832) | −0.0007 * (−1.6906) |

| TI | 0.0140 ** (2.8305) | 0.0205 ** (2.6087) | 0.0102 * (1.9368) |

| 0.1868 ** (2.9069) | |||

| CONS | 0.7367 *** (4.5581) | 1.6900 *** (8.0575) | 0.4209 ** (2.2382) |

| N | 80 | 80 | 80 |

| R2 | 0.998 | 0.9772 | 0.9982 |

| id FE | YES | YES | YES |

| year FE | YES | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Essed, A.; Iyiola, K.; Alzubi, A. Unpacking Artificial Intelligence’s Role in the Energy Transition: The Mediating and Moderating Roles of Knowledge Production and Financial Development. Energies 2025, 18, 4512. https://doi.org/10.3390/en18174512

Essed A, Iyiola K, Alzubi A. Unpacking Artificial Intelligence’s Role in the Energy Transition: The Mediating and Moderating Roles of Knowledge Production and Financial Development. Energies. 2025; 18(17):4512. https://doi.org/10.3390/en18174512

Chicago/Turabian StyleEssed, Abdulmonaem, Kolawole Iyiola, and Ahmad Alzubi. 2025. "Unpacking Artificial Intelligence’s Role in the Energy Transition: The Mediating and Moderating Roles of Knowledge Production and Financial Development" Energies 18, no. 17: 4512. https://doi.org/10.3390/en18174512

APA StyleEssed, A., Iyiola, K., & Alzubi, A. (2025). Unpacking Artificial Intelligence’s Role in the Energy Transition: The Mediating and Moderating Roles of Knowledge Production and Financial Development. Energies, 18(17), 4512. https://doi.org/10.3390/en18174512